14 Game-Changing Ag Tech & Food Tech Startups Leading the Industry [2025]

Every year, the agriculture and food technology space explodes with innovation. Startups are solving problems that have plagued farmers for centuries, disrupting supply chains, and rethinking how we produce food at scale. But with thousands of companies claiming to revolutionize agriculture, how do you know which ones actually matter?

TechCrunch's Startup Battlefield competition attracts thousands of applicants annually. From that pool, we select the top 200 most promising startups across various categories. While only 20 make it to the main stage for the Startup Battlefield Cup and the $100,000 grand prize, the remaining 180 are equally impressive in their respective niches.

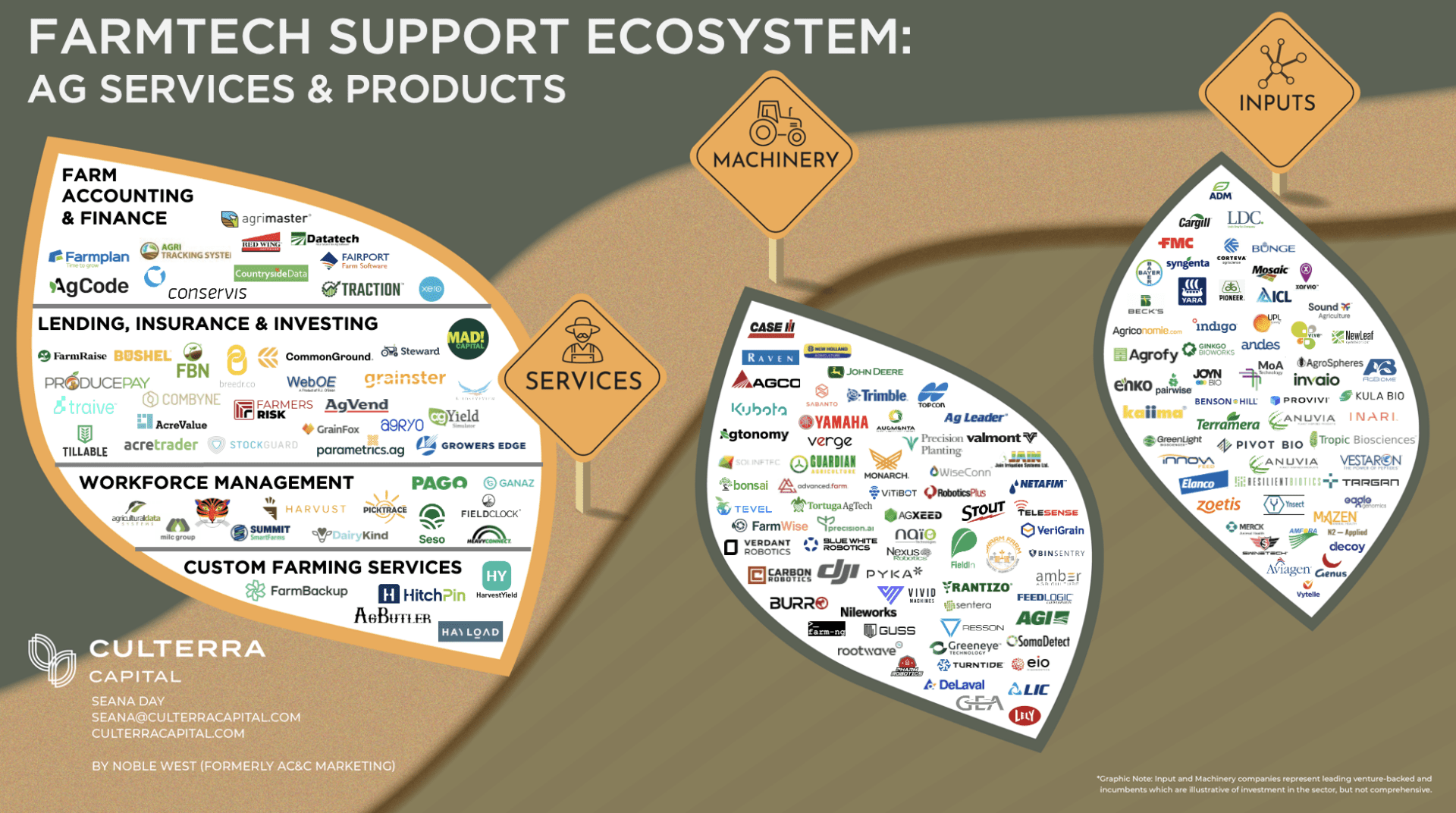

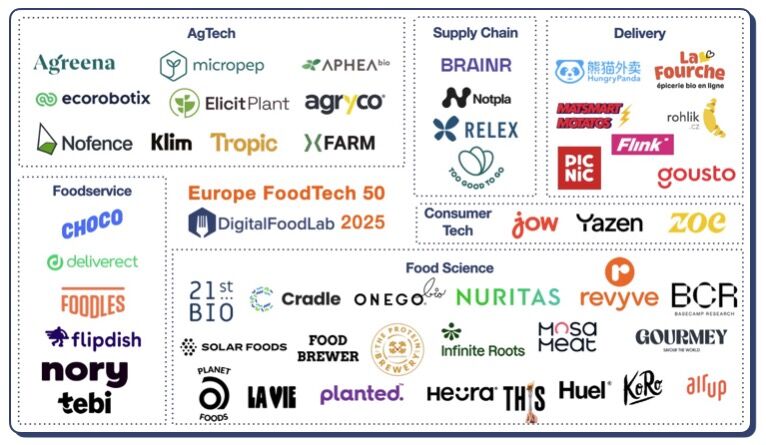

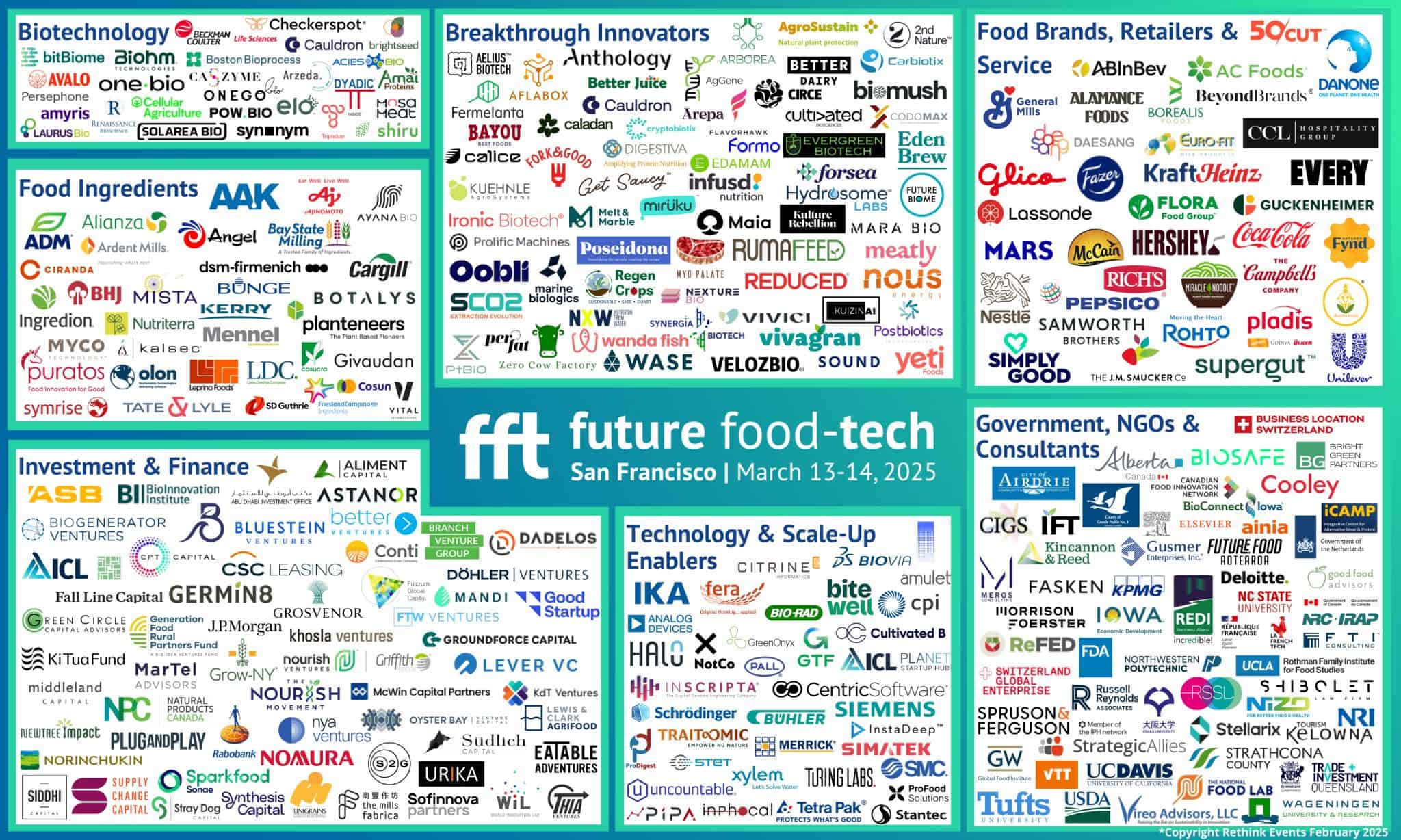

This year's agtech and food tech cohort is particularly strong. We're seeing a convergence of artificial intelligence, robotics, satellite imagery, and precision fermentation creating an unprecedented wave of innovation. Companies are no longer just optimizing existing processes. They're reimagining entire systems, from soil health to food preparation to waste reduction.

What makes these startups special isn't just the technology. It's the problems they're tackling. Agriculture accounts for roughly 10% of U.S. greenhouse gas emissions. Food waste reaches astronomical levels every year. Farmers struggle with labor shortages, unpredictable weather patterns, and rising input costs. These startups aren't just building cool tech. They're addressing genuine pain points that impact billions of people globally.

In this guide, we'll walk through 14 of the most noteworthy agtech and food tech startups selected for the Startup Battlefield 200. We'll explore what each company does, why their approach matters, and what problems they're solving. Whether you're an investor, farmer, or someone curious about the future of food, you'll see why these companies are positioned to reshape how we grow, process, and deliver food.

TL; DR

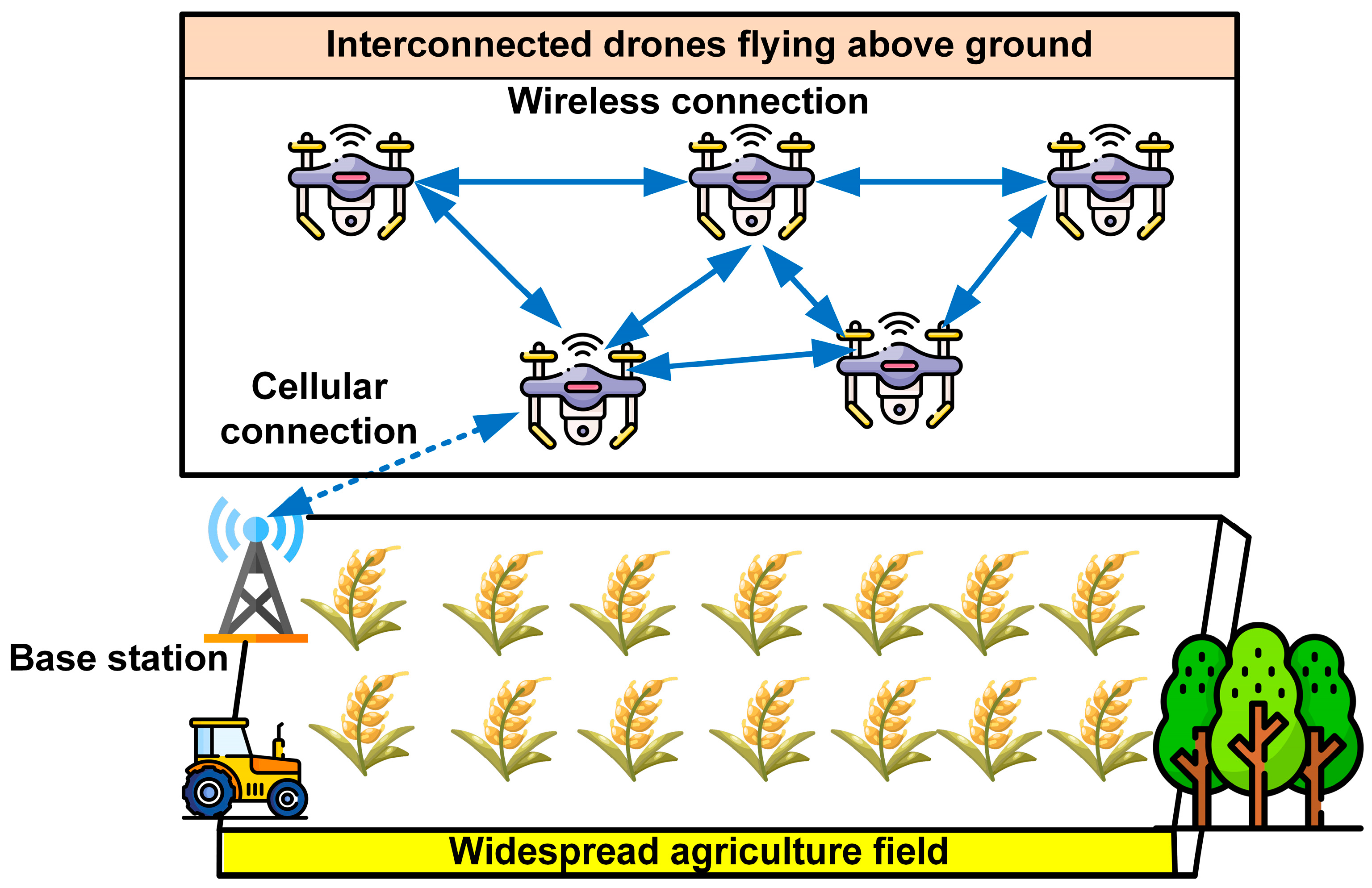

- AI-powered monitoring is transforming farm management through satellite imagery, IoT sensors, and real-time analytics

- Robotics and automation are addressing labor shortages while improving precision in farming and food preparation

- Precision fermentation and biotech solutions offer sustainable alternatives to traditional agricultural practices

- Waste-to-value innovations are converting agricultural byproducts into valuable commodities like edible fats and biodegradable polymers

- Sustainability focus is central to these startups, with emphasis on reducing water usage, eliminating pesticides, and minimizing environmental impact

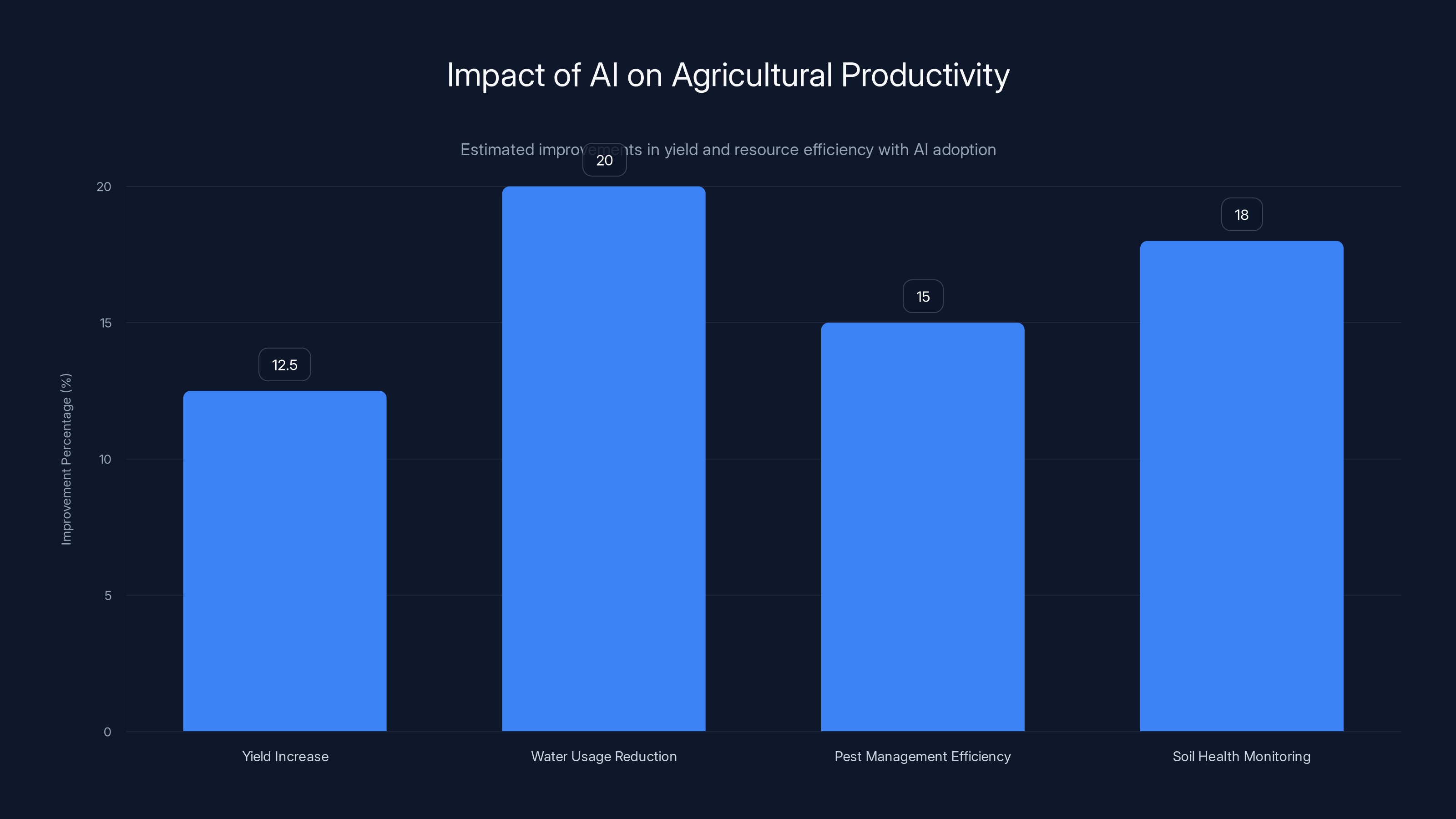

AI adoption in agriculture can lead to an estimated 12.5% increase in yields and up to 20% reduction in water usage, showcasing its potential to enhance productivity and resource efficiency. (Estimated data)

The Shift Toward AI-Powered Agriculture

The agriculture industry has been slow to embrace digital transformation. For decades, farming relied on intuition, experience, and trial-and-error. A farmer might look at their crops and make decisions based on what they've always done. But that approach doesn't scale in a world facing climate volatility, growing populations, and rising input costs.

Artificial intelligence changes this equation entirely. Instead of guessing, farmers can now have real data. They can understand exactly what their soil needs, when their crops are stressed, where disease is spreading, and how to optimize every input.

This shift is happening right now. Companies in this year's cohort are leading the charge.

Instacrops: Real-Time Farm Intelligence

Instacrops combines AI, IoT sensors, and satellite imagery to monitor and optimize farming fields in real time. The company is a Y Combinator graduate, which already signals serious backing and validation.

Here's what makes Instacrops different. Traditional farm monitoring requires farmers to manually walk fields, observe conditions, and make decisions. Instacrops automates this entire process. Sensors track soil moisture, temperature, and nutrient levels. Satellite imagery provides a bird's-eye view of crop health across entire fields. AI agents analyze this data and recommend specific actions: irrigation scheduling, fertilization timing, pest management interventions.

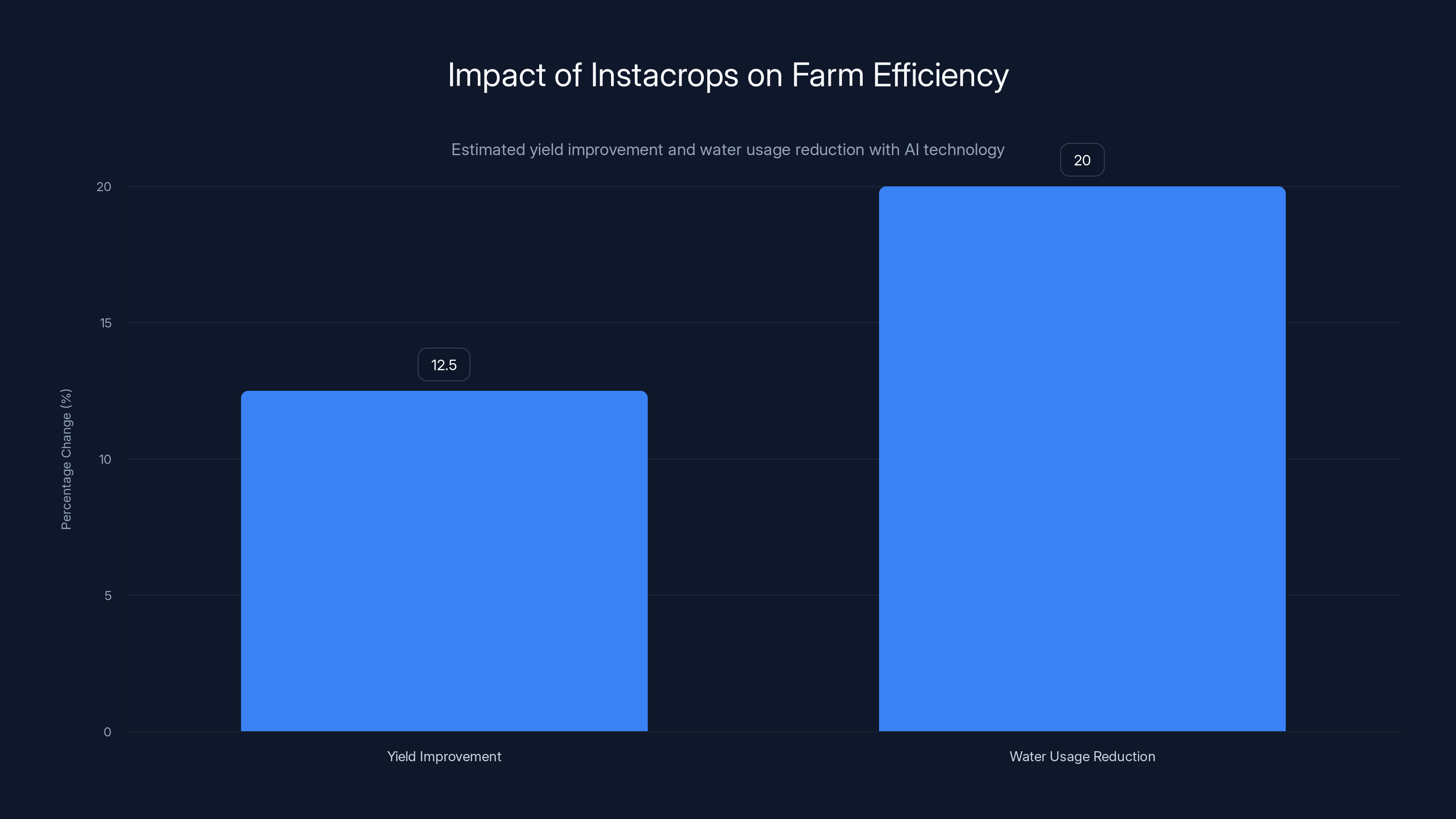

The results are measurable. Farms using Instacrops report yield improvements of 10-15% while reducing water usage by up to 20%. For a farmer managing hundreds or thousands of acres, those percentages translate directly to revenue impact.

What's particularly clever is the focus on water efficiency. In many regions, water is the limiting factor for crop production. By optimizing irrigation timing based on actual soil moisture rather than calendar-based schedules, farms reduce waste significantly. Over a growing season, this compounds into serious savings.

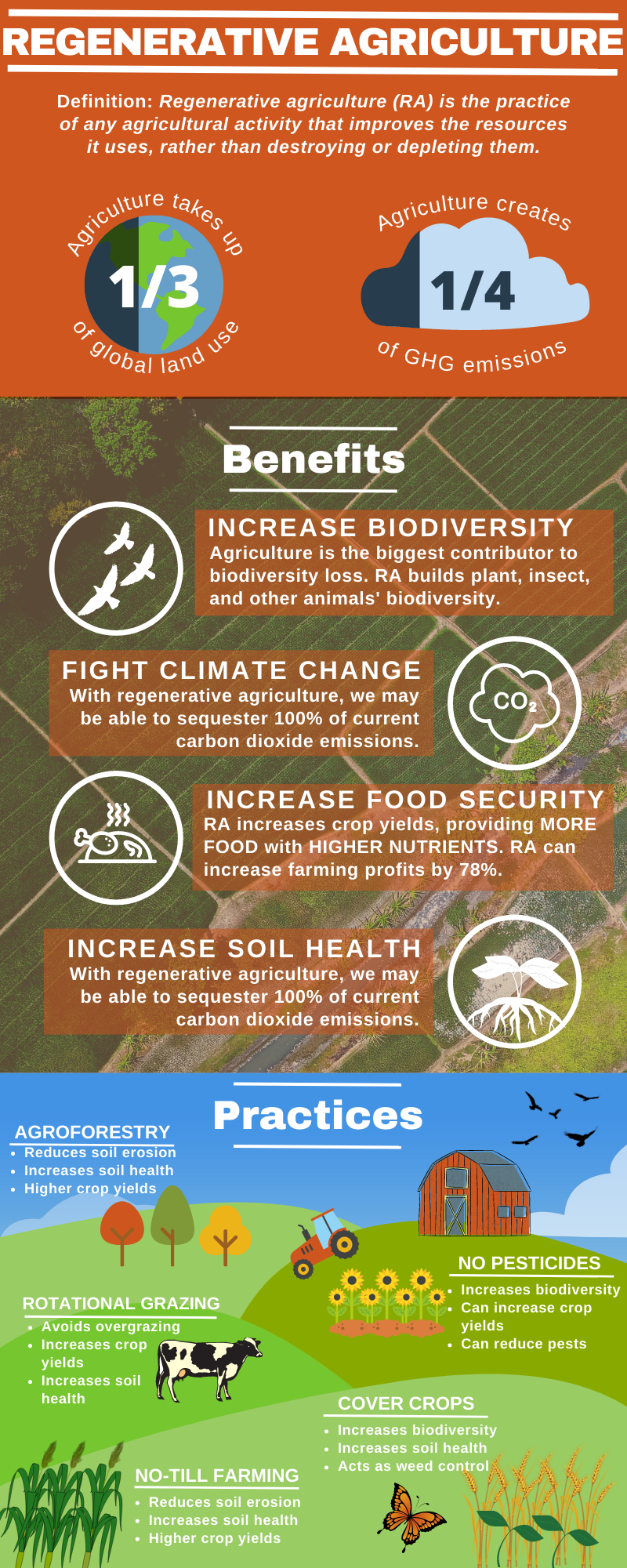

Genesis: Soil Intelligence for Regenerative Agriculture

Genesis offers something different. Instead of monitoring the current season, Genesis helps farms understand their soil as a strategic asset.

The company has built one of the most comprehensive soil data databases available. They combine raw soil analysis with AI models that help agricultural businesses make decisions about land management and crop selection. Their pitch centers on regenerative agriculture, which has become increasingly important to both farmers and buyers concerned about soil health and carbon sequestration.

Here's why this matters. Regenerative practices like cover cropping, reduced tillage, and diverse rotations improve long-term soil health. But they require understanding your specific soil conditions. Genesis takes the guesswork out. They analyze your soil, compare it to thousands of other samples, and recommend practices that will genuinely improve yields while building soil health.

The business model is straightforward: farmers and agricultural companies pay for soil analysis and strategic insights. Genesis makes money per acre analyzed. As sustainability becomes increasingly central to food supply chains, demand for this kind of data-driven guidance only increases.

Clave AI agents can potentially increase sales by 5-10% through tailored promotions, with variations based on local market conditions. Estimated data.

Robotics and Automation in Food Production

Labor is the agriculture industry's biggest headache. Finding reliable workers for seasonal harvests has become increasingly difficult. Wages are rising. Workers are scarce. Mechanization and automation have become economic necessities rather than nice-to-haves.

But automation in farming and food production is tricky. Crops are fragile. Every plant is slightly different. Conditions change daily. This is why robotics in agriculture requires sophisticated sensors, AI, and mechanical engineering.

Several startups in this cohort are tackling this challenge from different angles.

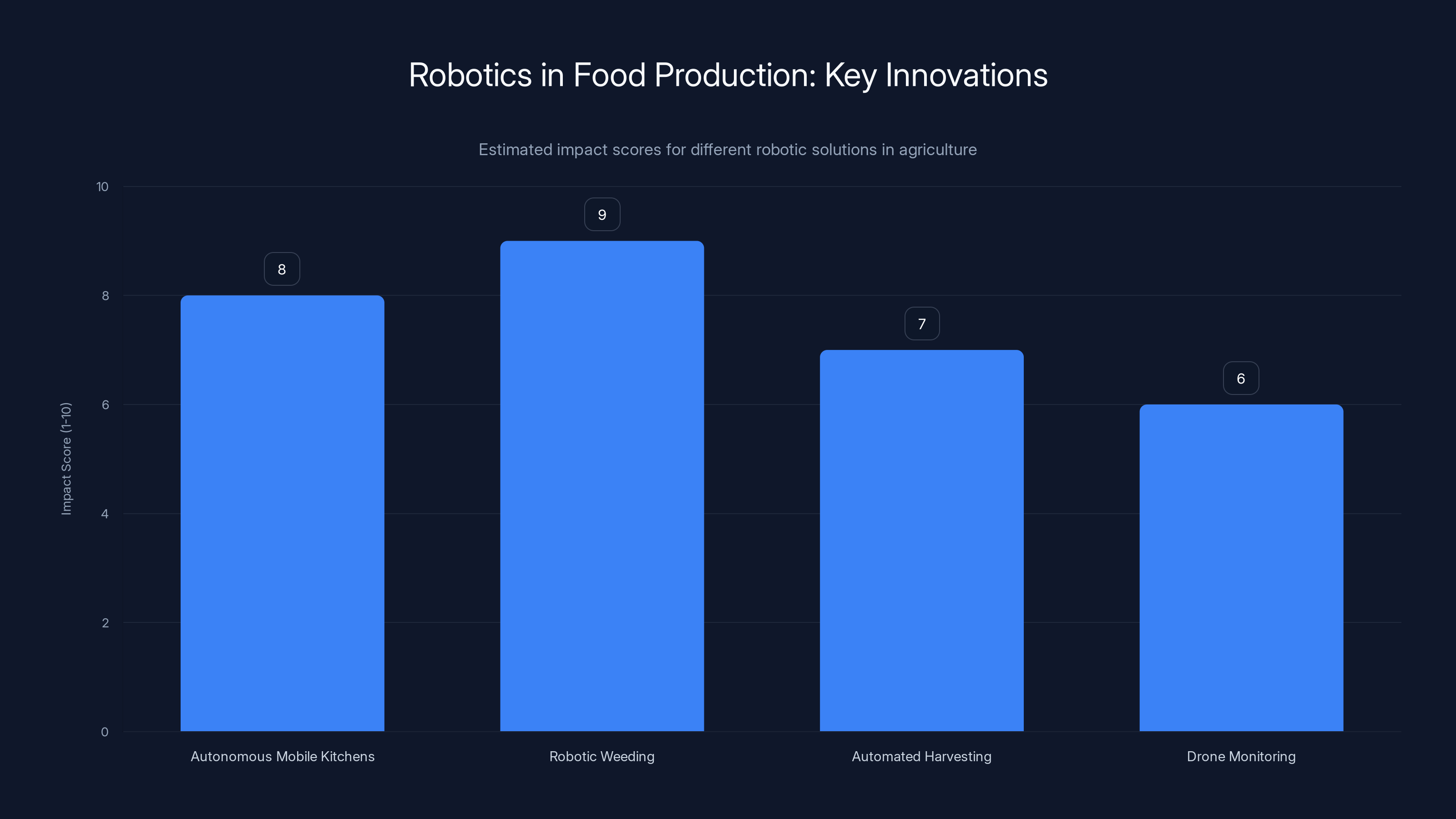

Shin Starr Robotics: Autonomous Mobile Kitchens

Shin Starr Robotics builds autonomous kitchens that prepare food while traveling to delivery destinations. It's an unconventional approach, but it's genuinely clever.

Imagine this: a truck leaves a central hub with raw ingredients. While driving to customer locations, the onboard autonomous kitchen cooks meals. The truck arrives at the destination with fresh, restaurant-quality Korean BBQ ready to serve. Temperature is perfect. Nothing has cooled down. Timing is optimized.

This solves multiple problems simultaneously. It eliminates the time lag between cooking and delivery, which typically results in food quality degradation. It allows restaurants to operate without massive kitchen facilities. It opens up new business models where food is prepared on demand, en route.

The engineering challenges are substantial. A moving truck is unstable compared to a stationary kitchen. Managing heat, safety, and food handling in motion requires serious innovation. But if executed well, this model could reshape food delivery economics.

Tensorfield Agriculture: Robotic Weeding Without Pesticides

Tensorfield uses AI-powered robotics to identify and eliminate weeds without chemical herbicides. The mechanism is elegantly simple but technologically complex: the robot identifies young weeds, then injects them with superheated vegetable oil.

This approach works on dense crop beds like carrots, spinach, and lettuce, where traditional herbicides can't be used without damaging the crop. The robot can identify weeds when they're just sprouting, before they consume significant nutrients or water. By eliminating weeds at this stage, overall crop yields improve without adding chemical inputs.

The market for chemical-free weed management is enormous. Organic farmers command premium prices but face yield pressures from weed competition. Conventional farmers are under increasing pressure to reduce chemical inputs. Tensorfield's solution addresses both markets.

The capital requirements are significant. Building reliable agricultural robots isn't cheap. But if the technology works at scale and cost drops, this could become the default approach for high-value crops where herbicide residues are undesirable.

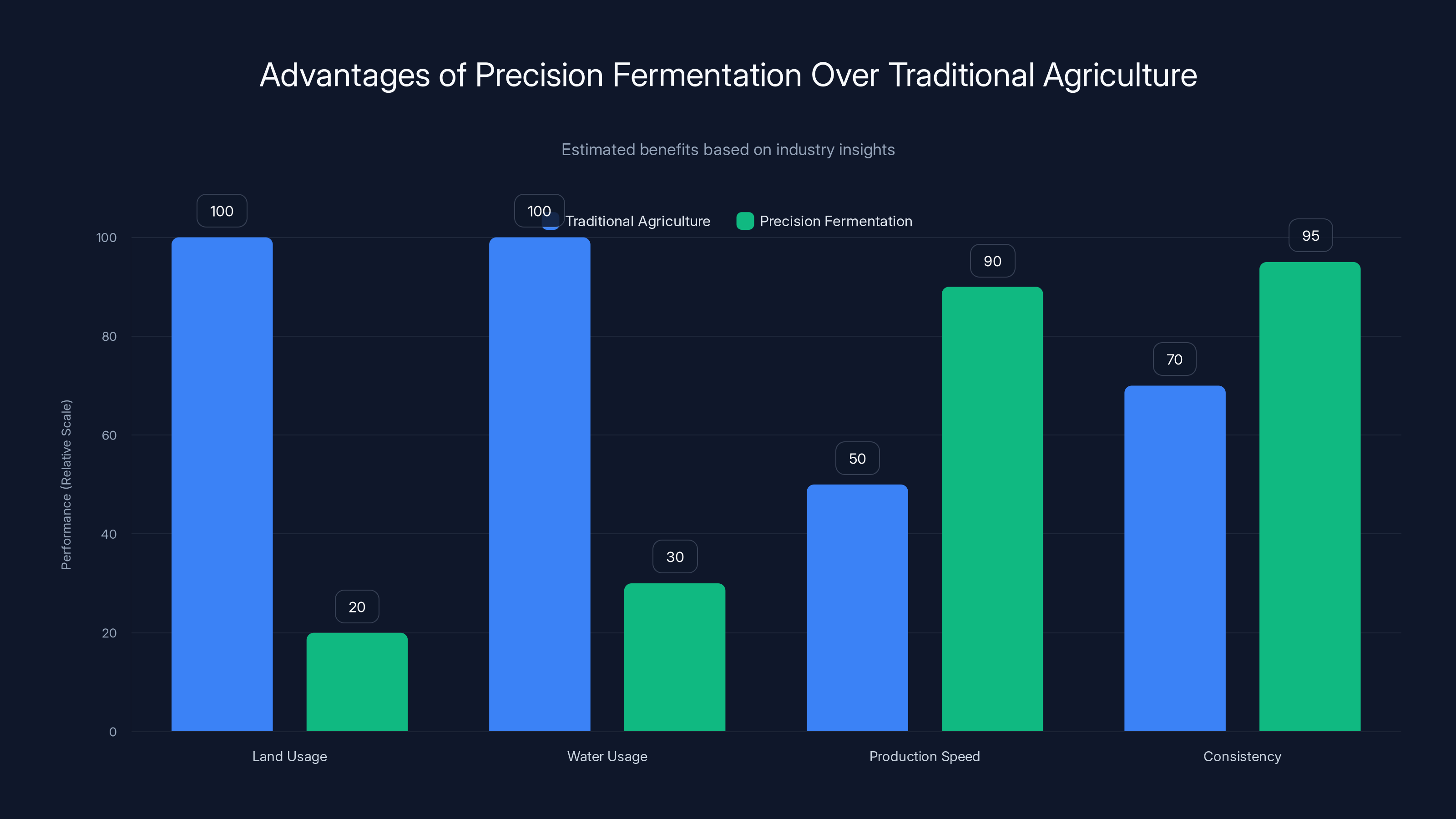

Precision Fermentation and Biotech Innovation

One of the most interesting trends in food technology is precision fermentation. Instead of growing crops or raising animals, companies use microorganisms to produce specific proteins, fats, and other compounds.

This approach offers several advantages. It's faster than conventional agriculture. It uses less land and water. It produces consistent, predictable results. And as technology improves and costs drop, it becomes competitive with traditional production methods.

Verley: Lab-Grown Dairy Proteins

Verley manufactures bioidentical dairy proteins using precision fermentation. The protein is chemically identical to milk protein but produced in bioreactors rather than from cows.

Why does this matter? Dairy farming is resource-intensive. A cow requires feed, water, land, and ongoing care. Scaling milk production means scaling all these inputs. Climate change, water scarcity, and land availability create real constraints.

Verley's approach is different. By fermenting the right microorganisms, they produce dairy protein that's indistinguishable from the real thing. This dairy protein can be used in yogurt, cheese, milk, and countless other products. From the consumer perspective, it's identical. From the producer's perspective, it offers better economics and sustainability.

The regulatory pathway is clear. The FDA has already approved precision fermentation as a food production method. Market adoption is accelerating. As cost curves improve, this becomes increasingly competitive with traditional dairy.

The business model is B2B. Verley sells dairy protein to food manufacturers. As manufacturers incorporate this into products, consumer adoption happens naturally without requiring anyone to change their behavior.

Äio: Converting Waste Into Valuable Fats

Äio has developed a method to produce edible fat from agricultural waste using a proprietary yeast strain. The process is beautifully simple in concept but complex in execution.

Agricultural waste is abundant and currently underutilized. Sawdust, crop residues, and other byproducts are typically burned, buried, or left to decompose. But these materials contain significant energy and carbon that could be converted into useful compounds.

Äio's yeast converts this waste into edible fat suitable for food and cosmetics applications. The fat is nutritionally comparable to conventional cooking oils. But instead of requiring oil crops like soybeans or palm, production happens from waste streams.

This is valuable for several reasons. It creates additional revenue streams for agricultural operations. It reduces waste disposal costs. It decreases pressure on land dedicated to oil crops. And it produces food-grade output from inputs that currently have minimal value.

The challenge is scale and cost. Fermentation at scale requires substantial infrastructure. But the trajectory is clear. As volumes increase, unit economics improve. This model has already worked in other precision fermentation applications, and there's no reason it won't work here.

Unibaio: Biodegradable Polymers From Shrimp Waste

Unibaio develops biodegradable polymers derived from shrimp waste. These microparticles deliver agrochemicals more efficiently than traditional methods and degrade naturally in soil.

Agrochemical delivery is typically crude. A farmer applies fertilizer or pesticide, and a significant percentage is lost to runoff or degradation. Unibaio's polymer-encapsulated approach keeps chemicals available to plants longer and reduces environmental loss.

Moreover, the base material is shrimp waste, a byproduct of seafood processing. By converting waste into valuable agricultural inputs, Unibaio creates a closed-loop system. Shrimp farmers benefit from additional revenue. Agricultural operations get better inputs. Environmental impact decreases.

The startup claims applicability across over 35 crops. That's substantial market coverage. If adoption accelerates, this becomes infrastructure-level technology that food producers depend on.

Farms using Instacrops report an average yield improvement of 12.5% and a reduction in water usage by 20%. Estimated data based on reported ranges.

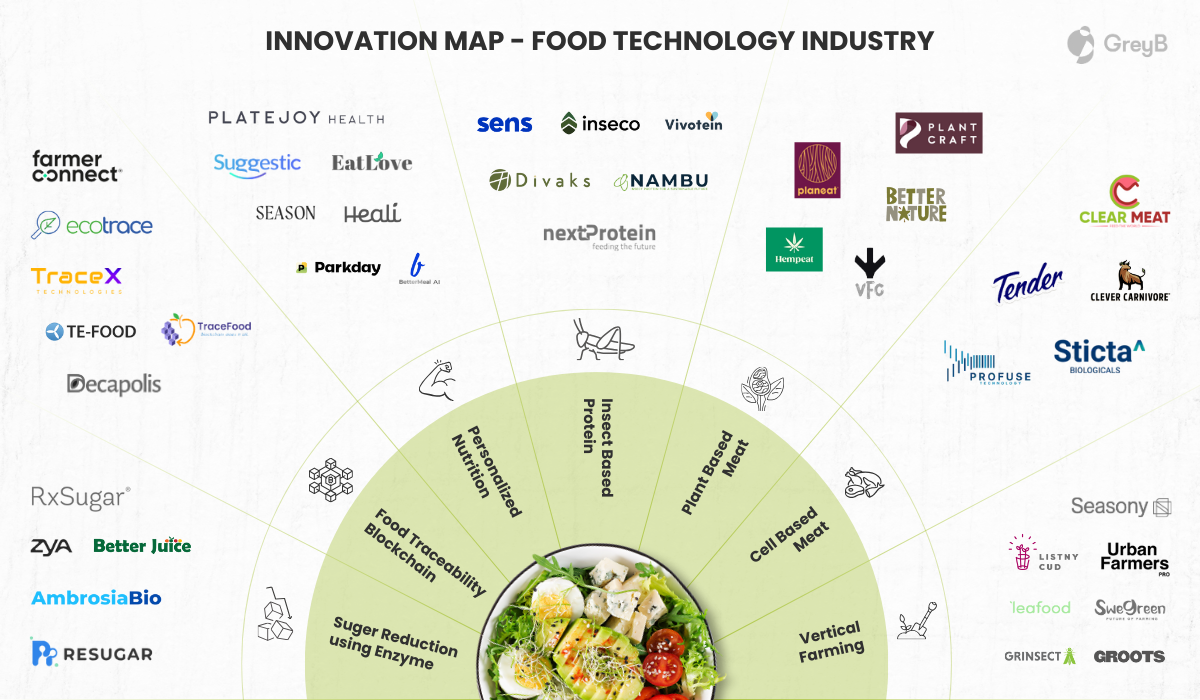

AI and Diagnostics for Aquaculture

Aquaculture is one of the fastest-growing protein production systems globally. Fish and shrimp farming now produce more protein than wild fisheries in many regions. But aquaculture faces serious challenges, particularly disease management in high-density farming environments.

Diseases spread rapidly in concentrated aquaculture systems. A single sick fish can devastate an entire facility. Early detection is critical, but current diagnostic methods are slow and require expert knowledge.

Several startups are leveraging AI and sensor technology to change this.

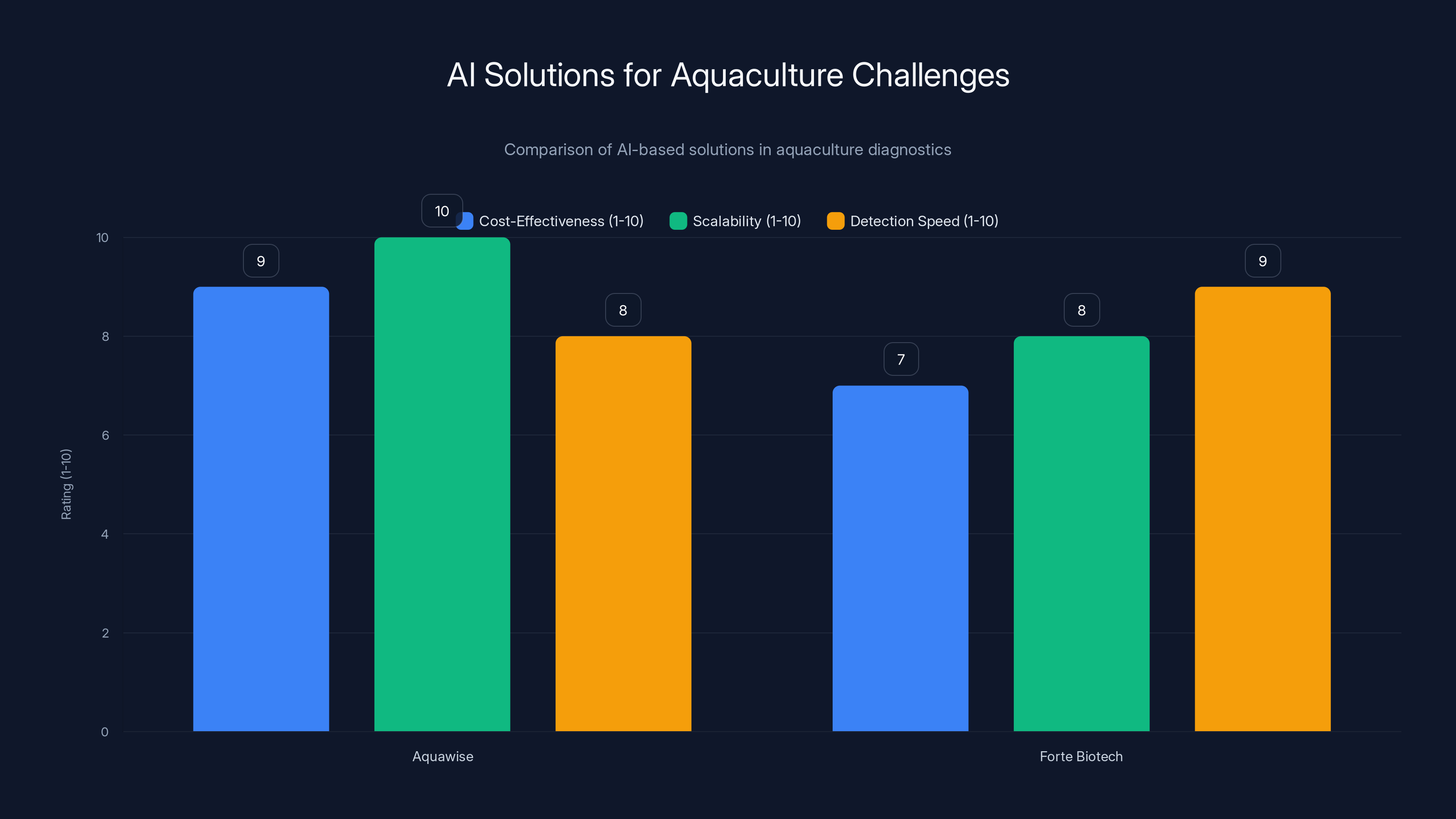

Aquawise: AI-Powered Water Quality Monitoring

Aquawise provides AI-powered water quality monitoring for shrimp and fish farms using satellite imagery. This is an interesting approach because it eliminates the need for expensive in-situ sensors in every tank or pond.

Satellite imagery captures detailed information about water characteristics: color, temperature, algal growth patterns, and other indicators of water quality. Aquawise's AI analyzes this data to infer water quality metrics in real time. The system then provides predictive analytics, alerting farmers to problems before they become catastrophic.

This approach is cost-effective and scalable. A farm with dozens of ponds or hundreds of tanks can monitor all of them with minimal infrastructure. The satellite data already exists; Aquawise just interprets it intelligently.

The business model is straightforward: subscription access to monitoring platform and alerts. For aquaculture operators, this is a significant cost reduction compared to deploying hundreds of individual sensors while providing better coverage.

Forte Biotech: Pathogen Detection in Shrimp

Forte Biotech developed a patented technology to test for diseases in shrimp farms. The company partnered with the National University of Singapore to develop this capability.

Diseases like white spot syndrome virus and other pathogens devastate shrimp farming. Early detection allows farmers to isolate affected areas and prevent spread. But current testing is time-consuming and requires expertise.

Forte's technology enables rapid, on-site disease detection without requiring expert diagnosticians. A farm worker can run a test, get results quickly, and take action. This democratizes disease management and dramatically improves response times.

The market is substantial. Global shrimp farming generates tens of billions in annual revenue. Disease losses exceed hundreds of millions annually. A test that prevents even a fraction of these losses pays for itself multiple times over.

Fonte's partnership with NUS signals serious scientific credibility. Government backing for aquaculture innovation is increasing globally, which benefits companies with this kind of institutional partnership.

Data and Intelligence Platforms for Restaurants

Food tech isn't just about production. Restaurant operations, supply chains, and consumer preferences generate massive data sets. Startups are building platforms that help restaurants, franchises, and food service operations make better decisions.

Clave: AI Agents for Restaurant Data Analysis

Clave offers AI agents that help fast-food restaurant franchises interact with their data more effectively. Specifically, Clave analyzes historical and real-time store data to help franchise restaurants develop promotions that increase sales.

Here's the problem Clave solves. Franchise restaurants operate within corporate guidelines but need to respond to local market conditions. A promotion that works in Miami might not work in Minneapolis. A manager might not have the analytical expertise to test different strategies efficiently.

Clave's AI agents analyze store performance data, identify patterns, and recommend specific promotions. The system considers seasonality, local competition, inventory levels, and historical performance. The recommendation isn't generic; it's tailored to that specific franchise location.

For franchise operators, this means higher sales without requiring an in-house data scientist. For corporate operators, this means franchise locations perform better and generate higher royalties. It's a win-win.

The scale potential is enormous. There are hundreds of thousands of franchise restaurants globally. If even a small percentage adopt Clave, the TAM is huge. And franchise operators are accustomed to adopting corporate-approved software, so distribution is relatively straightforward.

Aquawise excels in cost-effectiveness and scalability due to its use of satellite imagery, while Forte Biotech leads in detection speed with its patented pathogen detection technology. Estimated data.

Sustainability and Circular Economy Solutions

Sustainability has moved from marketing buzzword to fundamental business requirement. Investors, corporate buyers, and consumers increasingly prioritize environmental impact. Several startups in this cohort are building circular economy solutions.

Kadeya: Eliminating Single-Use Beverage Containers

Kadeya operates beverage vending stations for offices that use reusable bottles. Customers use the station, then return the bottle to be cleaned and reused.

This is beautifully simple. Instead of offices stocking fridges with plastic-bottled beverages, employees use reusable bottles and the Kadeya system. The company provides the bottles, the beverages, and the cleaning and restocking infrastructure.

The environmental impact is substantial. A typical office might go through hundreds of single-use bottles annually. Eliminating this waste is significant. But Kadeya also reduces total cost for the office, which is why adoption makes economic sense.

The business model is recurring revenue: offices pay a subscription fee for the service. The startup handles all logistics. Revenue grows as customer count increases and office utilization increases.

This isn't revolutionary technology, but it's elegant problem-solving. It takes something undesirable (waste), redirects it through a system that reduces environmental impact, and creates a profitable business in the process.

Kadeya represents a broader trend in food and beverage tech: making sustainable choices the default option rather than requiring active consumer choice. When the convenient option is also the sustainable option, adoption skyrockets.

Emerging Sensor Technology and Multisensory Robotics

One of the most futuristic areas of innovation is digitizing senses that humans have always relied on. Touch, smell, taste, and hearing are beginning to be captured by sensors and AI systems.

MUI-Robotics: Digital Smell Detection

MUI-Robotics develops AI scent detection for robots. The company is essentially digitizing smell, which has profound implications for robotics and quality control.

Smell is powerful but hard to systematize. Experienced food quality inspectors can identify defects through smell that instruments can't capture. But training humans is slow, and scaling human inspection is expensive.

MUI-Robotics' approach uses sophisticated sensors and AI to detect and classify odors. Applications span food production, chemical manufacturing, environmental monitoring, and medical diagnostics. A robot equipped with this capability can inspect food for spoilage, detect gas leaks, or identify contamination.

This is genuinely pioneering work. Most food and manufacturing companies rely on visual inspection and laboratory testing. Adding olfactory capability opens entirely new possibilities for quality control and safety.

The regulatory pathway for this technology is still emerging, but the fundamental capability has enormous potential. As artificial senses become more sophisticated, robots become more capable and more useful.

Estimated data shows that robotic weeding and autonomous mobile kitchens have the highest potential impact on food production, with scores of 9 and 8 respectively.

Plant Health Diagnostics and Precision Agriculture Inputs

Crop health monitoring is foundational to modern agriculture. But current approaches are fragmented. Different tests for different diseases. Multiple platforms. Lots of friction.

Credo Sense: Portable Plant Diagnostics

Credo Sense offers an AI-powered portable plant diagnostic system that measures crop health across a broad spectrum of conditions. The innovation is integrating multiple diagnostic capabilities into a single, low-power, portable device.

Farmers currently face a fragmented diagnostic landscape. One test for fungal diseases, another for nutrient deficiencies, another for insect damage. Different devices, different expertise required, different interpretations.

Credo Sense consolidates this. A farmer can run a single test and understand multiple aspects of plant health. The AI interprets the data and provides actionable recommendations.

The device is portable and low-power, meaning it can be used in the field without requiring laboratory infrastructure. Results are available quickly, enabling rapid response.

For farmers managing large acreages, the convenience and speed of consolidated diagnostics is valuable. It enables more frequent monitoring and faster intervention.

Greeny Solutions: Controlled Environment Agriculture

Indoor farming is increasingly viable as technology improves and energy costs become more predictable. However, managing controlled environments is complex. Temperature, humidity, nutrients, light, and carbon dioxide all require precise control.

Greeny Solutions offers AI-powered software and IoT tools for indoor commercial farming. The system automates nutrient dosing, climate control, and disease monitoring, with the goal of increasing yields while reducing resource consumption.

Indoor farming has several inherent advantages over field agriculture. Water usage is dramatically lower because water recirculates. Pesticide usage is minimal because insects can't access plants. Yields per square foot are much higher. Growing seasons aren't constrained by outdoor weather.

The challenge is cost and operational complexity. Every input must be precisely managed. Environmental conditions must be constantly monitored and adjusted. Greeny's automation software reduces the burden significantly.

For high-value crops like leafy greens, herbs, and specialty produce, indoor farming economics already work. As Greeny's technology reduces operational costs further, the addressable market expands.

The business model is software-as-a-service for indoor farming facilities. As the number of commercial indoor farms grows, so does Greeny's revenue.

Precision fermentation significantly reduces land and water usage while increasing production speed and consistency compared to traditional agriculture. Estimated data.

Why These Startups Matter

These fourteen startups represent different approaches to similar problems: producing more food with fewer resources while reducing environmental impact. Some use AI and sensors. Some use robotics. Some use biotech. Some build software platforms.

But they share common characteristics. They're addressing real problems with significant economic impact. They're leveraging emerging technology in practical ways. They're solving problems at scale, not just niche applications.

Moreover, these startups benefit from a favorable macro environment. Agriculture globally faces increasing pressure to be more productive and more sustainable simultaneously. Climate change is making farming less predictable. Labor is becoming scarcer. Input costs are rising. Food demand is increasing as global population grows and incomes rise in developing countries.

These pressures create urgency and willingness to adopt new solutions. A technology that saves a farmer 20% on water or increases yields by 15% isn't interesting; it's essential.

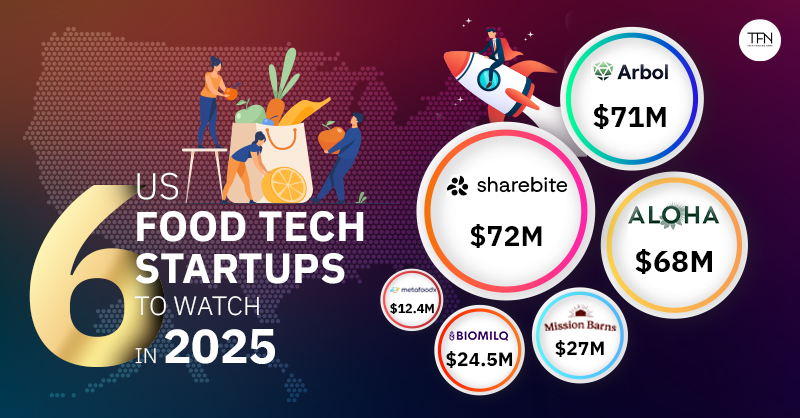

Investment Trends in Ag Tech and Food Tech

Funding in agtech and food tech has evolved significantly. Early-stage VC funding peaked around 2021, then contracted as investors became more focused on profitability and path to revenue. But institutional interest remains strong.

Global agriculture generates roughly

We're seeing geographic expansion as well. Traditionally, agtech funding concentrated in California, the Midwest, and parts of Europe. Now, significant innovation is happening in Brazil, India, Southeast Asia, and Africa, where agriculture is central to economic development and climate is increasingly variable.

The winners in this space will likely be companies that:

- Solve problems worth significant money to solve

- Build defensible technology that's difficult to copy

- Create network effects or switching costs once adopted

- Expand into adjacent markets as they mature

- Achieve profitability before capital runs out

Many of these startups have these characteristics. Whether they execute successfully remains to be seen. But the potential is clear.

The Future of Food Production

Looking forward, expect convergence across multiple technologies. AI will become more sophisticated at analyzing agricultural data. Robotics will become more capable and cost-effective. Precision fermentation will expand beyond proteins into fats, vitamins, and other compounds. Satellite and drone imagery will become higher resolution and cheaper to access.

The next decade will see agriculture become substantially more data-driven and automated. Labor requirements will decline in developed countries while output increases. Supply chains will become more traceable and verifiable, driven by consumer demand and regulatory requirements.

Sustainability won't be optional. Regulations will increasingly restrict practices that degrade soil, contaminate water, or contribute disproportionately to climate change. Technologies that make farming more sustainable will become mandatory, not optional.

The startups featured here are positioned at the leading edge of these shifts. They're not just building companies; they're building the infrastructure for how humanity will produce food in a resource-constrained, climate-challenged world.

What to Expect From These Startups

For investors, the key question is execution. Agtech and food tech have high failure rates. Technology that works in controlled environments often fails in real-world conditions. Farmer adoption is slower than expected. Regulatory requirements are more complex than anticipated.

But the payoff for successful execution is enormous. A company that genuinely solves a $10 billion problem globally has unlimited scaling potential.

For entrepreneurs in adjacent spaces, these startups serve as proof that sophisticated technology can create value in agriculture and food. If you've been hesitant about building in this space, the increasing sophistication and funding should be encouraging.

For farmers and food production companies, the message is clear: the tools and solutions that will define competitive advantage are being built right now. Early adoption creates learning advantages. Late adopters will be forced to adopt quickly once the benefits become undeniable.

The next five years will be fascinating to watch. These startups will either achieve meaningful scale and validation, or they'll run out of capital and fail. Either outcome will teach valuable lessons about what works in food tech and agtech.

FAQ

What types of problems are agtech startups solving?

Modern agtech startups address multiple layers of the agricultural ecosystem. At the production level, they're solving problems like crop health monitoring, pest management, irrigation optimization, and yield prediction. At the processing and distribution level, they're tackling food safety, supply chain transparency, and waste reduction. At the business level, they're helping farms and restaurants operate more efficiently through data analytics and automation. The most successful startups solve problems worth significant money to solve, where existing solutions are expensive, slow, or ineffective.

How does AI improve agricultural productivity?

AI enables agriculture to shift from reactive to predictive decision-making. Instead of a farmer discovering a problem after it's already harmed crops, AI systems detect early warning signs and recommend interventions before damage occurs. AI analyzes vast amounts of data from sensors, satellites, and historical records to identify patterns humans can't detect. For example, an AI system might notice subtle changes in soil moisture and recommend irrigation timing that increases yields by 10-15% while reducing water usage. This combination of improved outcomes and resource efficiency is why AI adoption in agriculture is accelerating.

What is precision fermentation and why does it matter for food production?

Precision fermentation uses microorganisms in controlled bioreactors to produce specific proteins, fats, vitamins, and other compounds. Unlike traditional agriculture or animal farming, fermentation is fast, scalable, and requires minimal land and water. A dairy protein produced through fermentation is chemically identical to milk protein but can be manufactured in weeks rather than waiting for cows to mature. This matters because conventional agriculture faces constraints: limited arable land, water scarcity, climate variability, and labor availability. Precision fermentation offers an alternative path to producing food products that sidesteps many of these constraints.

How are robots being used in agriculture and food production?

Robots in agriculture perform tasks that are labor-intensive, repetitive, or require precision. Weeding robots identify young weeds and eliminate them without damaging crops. Harvesting robots pick ripe fruit without bruising. Autonomous kitchens prepare food while traveling. The common thread is automation of tasks that are difficult to scale with human labor due to cost, availability, or consistency challenges. As robotics becomes more capable and costs decrease, adoption will accelerate in areas where labor is expensive or scarce.

What makes a successful agtech startup?

Successful agtech startups typically combine several factors: a genuine understanding of agricultural problems from first-hand experience, technology that solves problems worth significant money to solve, a path to profitability before capital runs out, and a team capable of executing in a regulated industry with long sales cycles. They also tend to focus initially on high-value crops or operations where ROI justifies adoption costs, then expand to broader markets as technology matures and costs decline. Most importantly, they recognize that agriculture moves slowly. Convincing a farmer to change practices requires demonstrating results consistently over multiple seasons, not just impressive technical capabilities.

How is satellite imagery being used in agriculture?

Satellite imagery provides a bird's-eye view of crop conditions across entire fields or regions. AI systems analyze imagery to detect diseases, water stress, nutrient deficiencies, and pest pressure. Multispectral and hyperspectral satellites capture wavelengths invisible to human eyes, revealing plant health conditions. This data, combined with ground-based sensors and historical records, enables predictive analytics. For example, a farm can identify which fields are likely to experience yield stress weeks before symptoms become visible, allowing preventive action. Satellite data is becoming cheaper and higher resolution, making it increasingly practical for routine farm monitoring.

What regulatory challenges do agtech and food tech startups face?

Food production is heavily regulated for good reason: food safety is non-negotiable. Agtech startups must navigate regulations around pesticide alternatives, animal welfare (for aquaculture), genetic modification, and food additives. Different countries have different requirements, making global expansion complex. Precision fermentation, for example, must prove safety through extensive testing before regulatory approval. Robotics in food preparation must meet food safety standards. Satellite-based monitoring faces privacy questions in some jurisdictions. Companies that understand regulatory pathways early and build compliance into their technology from the start succeed; those that ignore regulations typically fail expensively.

How long does it take for agtech innovations to reach widespread adoption?

Agtech adoption timelines are longer than most software industries. A typical adoption curve spans 5-10 years from initial pilot to meaningful market penetration. This is because farmers are conservative, rightfully skeptical of new approaches until they see consistent results, and constrained by capital budgets. A technology must prove itself across multiple growing seasons and geographic conditions. However, economic pressure accelerates adoption. A technology that increases profits by 20% gets adopted much faster than one that improves sustainability slightly. Similarly, technologies addressing acute problems (like disease detection in aquaculture where losses are catastrophic) see faster adoption than incremental improvements.

What is the market size for agtech and food tech?

The global agricultural industry generates roughly

How do these startups handle data security and farmer privacy?

Agriculture is increasingly data-driven, which creates new questions about data ownership and security. Farmers are understandably protective of their data because it reveals operational details and profitability metrics. Successful agtech startups address this by being transparent about data usage, offering strong security, and often allowing farmers to maintain ownership of their data. Some startups use data across customers to improve their algorithms while keeping individual farm data confidential. Others focus on on-premise solutions where data never leaves the farm. As agriculture becomes more data-centric, data security and privacy will become increasingly important competitive differentiators.

What emerging technologies should we watch in agtech?

Beyond current innovations like AI and robotics, several technologies are emerging. Blockchain is being explored for supply chain transparency and food traceability. Advanced biotechnology like CRISPR is enabling faster crop improvement. Internet of Things sensors are becoming smaller, cheaper, and more capable. Vertical farming and controlled environment agriculture are scaling. Synthetic biology is expanding precision fermentation applications beyond proteins. Drones with advanced sensors are becoming standard tools. Quantum computing may enable new crop modeling capabilities. Most exciting is the convergence of these technologies: AI-powered robots using satellite imagery and sensor data in controlled environments will likely define the most productive agriculture in coming decades.

Final Thoughts

The agtech and food tech startups featured in this year's TechCrunch Startup Battlefield represent the future of food production. They're not perfect solutions to complex problems. But they're meaningful steps forward in making agriculture more productive, more sustainable, and more resilient.

For investors, these startups represent genuine opportunities in a massive market facing structural challenges. For entrepreneurs, they demonstrate that sophisticated technology can create value in agriculture despite long adoption timelines and regulatory complexity. For farmers and food companies, they show that the tools to improve productivity and sustainability are available now, not years away.

The companies that execute successfully will scale into billions of dollars in market value. The lessons from failures will guide the next generation of agtech innovation. Either way, this cohort is pushing the industry forward in meaningful ways.

If you're interested in food systems, sustainability, automation, or emerging technology, the work happening in agtech and food tech deserves serious attention. These startups are literally shaping how humanity will feed itself in the coming decades.

Key Takeaways

- AI and satellite monitoring are transforming farm decision-making from reactive to predictive, enabling yield increases of 10-15% while reducing water usage by up to 20%

- Robotics and automation are solving agriculture's labor shortage crisis while improving precision in weeding, harvesting, and food preparation across multiple scales

- Precision fermentation enables production of dairy proteins, edible fats, and biotech solutions without requiring traditional agriculture, using waste streams and microorganisms

- Aquaculture technology innovations like AI water quality monitoring and rapid disease detection are protecting high-density farming operations from catastrophic losses

- The convergence of AI, robotics, biotech, and IoT sensors is creating unprecedented opportunity for startups solving the trillion-dollar challenge of sustainable, productive food systems

Related Articles

- Hasselblad X2D II: The Ultimate Medium-Format Camera [2025]

- Aflac Data Breach: 22.6 Million Exposed [2025]

- Best Headphones [2025]: 30 Models Tested, 4 Worth Your Money

- VPN Innovations That Surprised Everyone in 2025

- Pluribus Season 2: Everything You Need to Know [2025]

- Best Streaming Services 2026: Complete Guide & Comparison

![14 Game-Changing AgTech & Food Tech Startups [2025]](https://tryrunable.com/blog/14-game-changing-agtech-food-tech-startups-2025/image-1-1766588751976.jpg)