Introduction: When the Sales Playbook Becomes a Liability

The traditional B2B sales process—the one that has dominated enterprise software sales for nearly two decades—is no longer fit for purpose. What once worked like clockwork now feels antique to modern buyers. The multi-touch sales cycle, the qualification gauntlet, the "discovery call," the demo theater, the proposal dance—these mechanisms are increasingly becoming friction points rather than conversion tools.

Consider this real-world scenario: A prospect does their own research. They watch product demonstrations on YouTube. They compare pricing across three competitors. They consult with industry peers. They read documentation thoroughly. By the time they initiate contact with your sales team, they've completed approximately 70% of their buying journey independently. Yet many sales organizations respond by launching into their standard qualification process as if the prospect knows nothing about the solution.

This disconnect represents a fundamental misalignment between modern buyer expectations and legacy sales infrastructure. The information asymmetry that sales organizations once leveraged—knowing things prospects didn't—has evaporated. Today's B2B buyers are better informed than ever before. They understand the problem they're solving. They've identified potential solutions. They've validated whether a product fits their technical requirements. What they need from sales at this point isn't education; it's transactional efficiency.

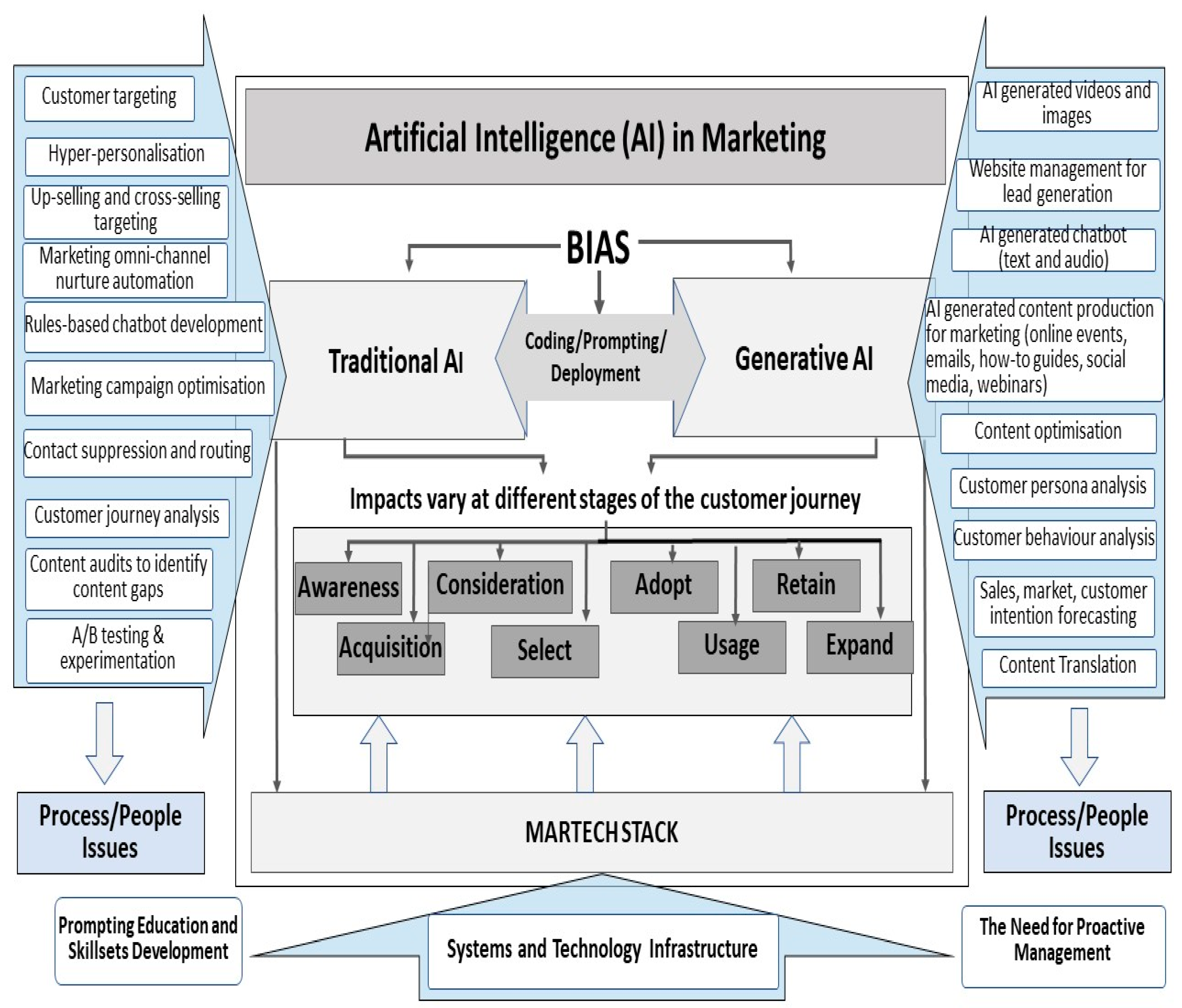

The emergence of artificial intelligence is not creating this problem—it's simply accelerating and exposing it. AI can respond to prospect questions in seconds, answer technical inquiries with precision, qualify opportunities without bias, and even draft contracts. More importantly, AI can do these things at exactly the moment prospects need them, without forcing prospects through unnecessary procedural hoops.

This fundamental shift represents more than a technology adoption challenge. It's a complete reimagining of what sales organizations must do to remain relevant. The question isn't whether AI will transform sales. It's whether your organization will evolve faster than your competition or watch market share migrate to companies that have already made the transition.

The implications stretch across the entire go-to-market function: sales rep roles, training programs, compensation structures, management practices, hiring criteria, and strategic planning. Every assumption underlying current sales processes is now open for reconsideration. Understanding this transformation—and acting decisively on it—has become table stakes for survival.

The 2021 Sales Process: Why It Worked Then (And Why It Fails Now)

The Historical Context: Why Traditional Sales Processes Emerged

The sales methodology that dominated the 2010s evolved to address a specific problem: information scarcity. In the era before ubiquitous internet access, before SaaS democratized software, before YouTube tutorials and public documentation became standard, buyers genuinely needed vendors to educate them. A prospect considering enterprise software in 2005 had limited options for learning what a product could do. They couldn't watch a 10-minute demo online. They couldn't read detailed case studies from industry peers. They couldn't access pricing pages (many companies kept pricing private). They couldn't evaluate integration capabilities through public APIs.

This information scarcity created enormous power imbalances. Vendors controlled the narrative. Sales representatives held privileged knowledge. Demonstrations were theatrical events that showcased cherry-picked functionality. Pricing was a secret negotiated behind closed doors. Under these conditions, a lengthy sales process made sense. It gave vendors time to shape perception, manage expectations, and extract maximum contract value.

The consultative selling methodology—built around discovery conversations, needs analysis, and custom solution design—emerged as a response to this environment. It worked remarkably well. Sales teams could uncover pain points that prospects hadn't consciously articulated. Vendors could position solutions to address those specific pain points. The process created switching costs through familiarity and relationship-building. Multi-year contracts were the natural outcome.

How Buyer Behavior Has Shifted

Everything has changed. Modern B2B buyers operate under completely different conditions.

Product research has become self-service and abundant. A prospect interested in enterprise resource planning can access hundreds of YouTube videos demonstrating competing platforms. They can read feature comparisons on review sites. They can examine API documentation. They can analyze pricing structures. They can contact peer companies directly through LinkedIn to ask implementation questions. They have access to more information about software solutions than most sales representatives possessed 15 years ago.

Buyer sophistication has increased dramatically. Today's B2B purchasers aren't novices stumbling through unfamiliar territory. They're experienced operators who've implemented software before. They understand technical requirements. They know what questions to ask. They've built business cases for similar projects. They understand TCO (total cost of ownership), implementation timelines, and integration complexity. They don't need vendors to educate them on what they don't know—they need vendors to answer specific questions they've identified.

Decision-making timelines have compressed. In the traditional sales environment, a typical deal cycle lasted 3-4 months (or longer). Prospects moved slowly because they had limited information and needed time to coordinate stakeholders, build business cases, and secure approvals. Modern organizations move faster. They've got proven procurement processes. Stakeholder alignment happens more quickly because everyone has already done independent research. Budget cycles have tightened. Speed increasingly becomes a competitive advantage. Organizations that can transact quickly capture market share from companies that insist on lengthy evaluation periods.

The reference model has become decentralized. Previously, prospects relied on vendor-provided references. Sales teams handpicked happy customers and coached them on messaging before reference calls. Today, prospects bypass vendor-provided references entirely, instead finding authentic peer feedback through online reviews, LinkedIn communities, industry forums, and direct outreach. They trust peer recommendations over vendor claims. This democratization of social proof fundamentally shifts sales dynamics.

Where the Traditional Process Still Fails

The 2021 sales playbook was optimized for a specific problem: educating uninformed buyers about unfamiliar solutions. This optimization creates systematic failures when applied to informed buyers. Consider the specific failure modes:

Qualification Theater: The traditional process assumes prospects need qualification before they deserve attention. Sales representatives deploy discovery conversations supposedly to understand buyer readiness, budget authority, timeline, and need. In reality, most prospects have already qualified themselves. They've determined they have budget. They understand their timeline. They've confirmed they have authority or know how to secure it. Forcing them through qualification feels patronizing and wastes their time.

Deferred Responsiveness: The traditional sales process assumes prospects will accept delays. A prospect reaches out with a question; the inquiry sits for hours or days before receiving a response. In the traditional model, this was acceptable. Prospects expected delays. They built them into their timelines. Modern buyers find this unacceptable. When they have a question, they want an answer immediately. Delays signal indifference or organizational dysfunction.

Forced Conversation Requirements: The traditional model insists that every interaction move toward a conversation—a discovery call, a qualification call, a demo, a contract review. Countless prospects don't want conversations. They want answers. They want information. They want to review documentation. They want to execute. Forcing a phone call into transactions that don't require human interaction creates friction without providing value.

Standardized Processes for Non-Standard Situations: The traditional model applies the same process to every prospect, regardless of their situation. A prospect who's been evaluating a solution for six months goes through the same qualification process as someone just beginning research. A buyer ready to execute goes through the same sales cycle as a prospect still in exploratory phases. This one-size-fits-all approach optimizes for average cases while failing dramatically for outliers.

Handoff Failures: As deals progress, the traditional sales process involves multiple handoffs—from SDR to AE, from AE to sales engineer, from sales to implementation. Each handoff introduces context loss. New team members lack the relationship history. They don't understand the prospect's specific situation. They restart conversations. They re-ask questions. They force prospects to re-educate them on context they've already provided. These handoffs create moments of vulnerability where deals die.

The Fundamental Shift: Information Abundance and Buyer Control

How Buyer Research Has Transformed

The transformation in how prospects conduct research represents perhaps the most significant shift in B2B sales dynamics. This isn't merely about more information being available—it's about the nature of that information and the control buyers exert over discovery.

Consider the research journey for a prospect evaluating a new content automation platform. Twenty years ago, they would contact 3-4 vendors, request information, wait for printed materials to arrive, set up demo appointments, attend those demos, request references, speak with references over the phone, request proposals, wait for written proposals, review with internal stakeholders, negotiate terms, and finally make a decision. The timeline typically extended 8-12 weeks. The vendor controlled the pacing, the presentation of information, and the demonstration methodology.

Today's research journey looks different. The same prospect visits the vendor's website and learns about core capabilities from public documentation. They watch product demos on YouTube, often created by current customers showing real workflows. They read comparison articles on sites like G2 and Capterra, seeing how the product stacks up against alternatives. They search for implementation case studies, finding detailed examples of how similar organizations deployed the solution. They access pricing information directly from the website (or infer it from public sources). They might join the vendor's public Slack community and ask implementation questions to current users. They review the product's roadmap on a public board. They access API documentation and technical architecture diagrams. They read recent security audit reports.

This research happens entirely without vendor involvement. The prospect may never contact a sales representative until they've completed 70-80% of their evaluation. When they finally reach out, they typically have very specific questions—not about basic capabilities (they understand those), but about implementation details, specific integrations, data migration pathways, pricing for their exact use case, or timeline expectations.

The Asymmetry of Modern B2B Purchase Behavior

The shift creates a peculiar asymmetry. Buyers are tremendously well-informed about products themselves, yet they often need tactical assistance with implementation planning, integration architecture, and organizational change management. They don't need vendor salespeople to tell them whether a product has value—they've already determined that. They need specialists who can help them succeed with implementation.

This asymmetry invalidates the traditional sales process. The consultative selling methodology assumes the vendor's primary value is helping prospects understand their own problems and positioning the solution as the answer. But when prospects have already done this work, consultative selling feels condescending. They already understand their problems. They've already determined which vendor solutions might address those problems. They've already validated fit. What they now need is execution support, not problem discovery.

Yet many sales organizations continue deploying consultative selling methodology long after its utility has passed. An AE with decades of success in asking probing discovery questions meets a prospect who has no interest in being discovered. The conversation becomes uncomfortable. The prospect experiences it as the salesperson not listening, not understanding their situation, or wasting their time. The salesperson experiences it as a prospect unwilling to engage properly. Both are actually responding rationally to a methodology that no longer matches market conditions.

Why Traditional Sales Methodologies Fail Informed Buyers

The traditional sales stack—from MEDDIC qualification frameworks to the Challenger Sale methodology to consultative selling—all assume a specific buyer profile: someone early in their research journey, potentially unaware of specific vendors, needing education about the problem and solution space, and requiring a trusted advisor to guide them toward the right choice.

That buyer profile still exists, but it represents an increasingly small segment of the B2B purchase population. For the majority of modern B2B purchases, especially in the small-to-medium business segment, buyers have done substantial research and qualification before any human engagement. These buyers don't need discovery conversations. They need rapid response to specific questions. They need to see how implementation works in their specific context. They need pricing transparency. They need to transact quickly.

Applying discovery-focused sales methodologies to this buyer segment is like having a concierge service insist on writing you a biography before hailing you a taxi. The service is technically excellent, but it's solving a problem you don't have. It creates frustration rather than delight. It signals that the organization doesn't understand what you actually need.

The Buyer Journey Has Fundamentally Changed (And Sales Hasn't Caught Up)

The 70% Rule: Why Initial Vendor Contact No Longer Marks the Beginning

McKinsey research consistently shows that B2B buyers are approximately 70% through their decision process before meaningfully engaging with vendor sales teams. This statistic has been remarkably consistent across industries and purchase sizes, suggesting it reflects something fundamental about how modern purchasing works rather than a temporary market phenomenon.

What does 70% completion actually mean? At this point, the prospect has typically:

- Identified the problem they need to solve and quantified its business impact

- Researched solution categories and identified which approach aligns with their architecture

- Identified specific vendors that appear capable of addressing their needs

- Conducted preliminary capability assessment by reviewing public documentation, case studies, and demos

- Performed informal reference checks by talking to peers, reading reviews, and accessing community feedback

- Estimated budget allocation and validated that solutions are within acceptable price ranges

- Assessed organizational readiness including timeline, resources, and stakeholder alignment

- Narrowed the field to 2-3 vendors actually worth detailed evaluation

This 70% statistic has profound implications for sales strategy. It means that approximately 70% of the buying process happens without vendor involvement. The sales team's opportunity to influence the decision has dramatically narrowed. Instead of shaping perception from the beginning, sales is playing a role in perhaps 30% of the decision process—and often in the least important part (the final transaction mechanics).

For technical buyers and operations teams, the percentage is often higher. Technical professionals conduct more thorough research before engagement. They review technical documentation, test API functionality through sandboxes, validate integrations against their architecture requirements, and assess security postures before speaking with sales. Technical buyers often complete 80-85% of their evaluation independently.

The Inverse Relationship: Information Abundance and Sales Engagement

As information availability has increased, the necessary duration of vendor-led sales engagement has decreased. This creates an inverse relationship: companies with more detailed public documentation, transparent pricing, accessible demos, and active user communities actually need shorter sales cycles. The prospect needs less time with sales because they have better mechanisms for self-education.

Yet most sales organizations haven't adjusted. They maintain the same length sales cycles regardless of buyer sophistication. This creates a mismatch. The more information a prospect can access independently, the more frustrating a lengthy sales process becomes. The sales team isn't providing value through education; they're imposing delays on a process the prospect is trying to accelerate.

Conversely, organizations that have restructured around this reality—providing comprehensive documentation, transparent pricing, self-service evaluation opportunities, and rapid response to specific questions—report significantly shorter sales cycles. But they've also typically restructured their compensation models, team structures, and success metrics to match. Short sales cycles don't mean shorter seller productivity; they mean different kinds of productivity.

The Role Compression: Where Sales Actually Matters Now

With 70% of the buying journey happening before sales engagement, the remaining 30% has become extraordinarily compressed. That final 30% includes:

- Clarifying specific implementation details that aren't covered in documentation

- Addressing unique architecture or compliance requirements specific to the prospect's situation

- Negotiating pricing and contract terms specific to the prospect's volume or commitment level

- Validating integration pathways for systems critical to the prospect's operations

- Understanding change management and organizational adoption strategies for implementation

- Ensuring stakeholder alignment around vendor selection and implementation commitment

- Executing the transaction and transitioning to implementation

These remaining activities require human judgment and expertise. But they don't require the lengthy relationship-building and educational investment that traditional sales processes assume. A knowledgeable specialist can often address these items in a few conversations rather than a 3-4 month sales cycle.

Sales organizations that have restructured around this reality—deploying specialized expertise only when needed, responding rapidly to initial inquiries, focusing on transaction facilitation rather than buyer education—report several advantages: longer hours of specialist time applied to fewer deals (higher quality conversations), faster deal cycles (transactions happen when prospects are ready), higher win rates against competitors still running longer sales processes, and more satisfied customers (who experience responsive, competent service from the beginning).

The Case for AI-Powered Sales Response

Why AI Becomes Essential in Rapid-Response Sales Environments

When a prospect reaches out to your organization with a question, the speed of response carries outsized importance. In traditional sales environments, response timing mattered less. Prospects expected delays. They planned evaluation timelines around vendor response rates. A response within 2-3 business days was considered acceptable.

In modern sales environments, this response timeline is problematic. Prospects don't operate on 2-3 business day schedules. They operate on their own timelines, which often include evening and weekend research. They expect information immediately. When they have a question, they want an answer now, not in 48 hours.

Human sales teams cannot provide 24/7 response across all inquiries. Even organizations with round-the-clock SDR coverage can't respond to every inquiry within minutes. There are natural constraints: people sleep, people take days off, people focus on complex deals and can't respond to every inbound inquiry immediately.

Artificial intelligence removes these constraints. An AI system trained on product documentation, frequently asked questions, pricing information, and implementation guidelines can respond to 80-95% of inbound inquiries immediately, accurately, and helpfully. This responsiveness doesn't replicate human sales conversations; it replaces the information-gathering phase entirely.

Consider the experience differential. A prospect submits a question at 8 PM on a Thursday evening. Traditional sales process: the inquiry sits in an inbox until Friday morning when an SDR reviews it. The SDR reads the inquiry, determines it's a product question, forwards it to a product specialist. The specialist responds sometime Friday afternoon. Total response time: 18+ hours. Prospect experience: slow, bureaucratic, impersonal.

AI-powered response: the inquiry is answered at 8:03 PM Thursday evening with a precise, informed response addressing the specific question. Prospect experience: responsive, knowledgeable, efficient. The prospect gets the information they need to move forward in their evaluation immediately.

What AI Can Effectively Handle (And What It Can't)

AI excels at certain categories of sales interactions:

Product Questions: "Does your platform support SAML integration?" "What's your data storage model for international customers?" "How many users does the enterprise plan support?" These are factual questions about product capabilities. AI trained on technical documentation can answer these with 90%+ accuracy.

Pricing Inquiries: "What does your Pro plan cost?" "Are there volume discounts for organizations with 500+ users?" "What's included in your support tier?" Pricing questions are straightforward. AI can provide pricing information instantly.

Implementation Timelines: "How long does implementation typically take?" "Do you provide implementation services or do customers implement internally?" "What resources do we need to allocate for deployment?" AI can provide standard implementation timelines and resource requirements based on organization size and complexity.

Capability Validation: "Can your platform integrate with our ERP system?" "Do you support real-time data synchronization?" "Can we customize reports for our specific KPIs?" AI can assess whether standard capabilities address these needs or whether specialist consultation is required.

Qualification Assessment: "Is this product suitable for organizations with our team size?" "Does this platform work for distributed teams?" "Is this appropriate for our industry vertical?" AI can quickly assess whether the prospect fits the target customer profile.

AI struggles with certain categories:

Complex Strategic Decisions: When a prospect is trying to decide between fundamentally different architectural approaches, they need human expertise. Should they build a custom solution or implement an off-the-shelf platform? Should they invest in one comprehensive system or integrate multiple best-of-breed tools? These decisions require judgment about trade-offs.

Relationship-Building and High-Stakes Negotiations: Enterprise deals involving executive-level decisions, significant budget allocations, and long-term partnership frameworks require human judgment and relationship expertise. AI can facilitate these conversations, but shouldn't lead them.

Consultative Problem-Solving: When a prospect needs help understanding their own operational challenges—how they should restructure workflows, what business processes need reimagining, how they should approach organizational change—they need human expertise and judgment.

Unique Situations and Edge Cases: When a prospect's requirements fall outside standard parameters, they need human judgment. If they're trying to implement across 30 international markets with varying data residency requirements, that requires specialized expertise beyond what general AI training provides.

The sweet spot for AI-powered sales response is the high-volume, straightforward category of questions. These represent perhaps 60-80% of inbound sales inquiries in most B2B organizations—exactly the category that humans least enjoy handling and that represent poor utilization of specialist expertise.

The Economics of AI-Powered Initial Response

Deploying AI to handle initial prospect responses has compelling economics. Consider a typical B2B software company:

- 500 inbound inquiries per month from prospects and leads

- 80% are straightforward product, pricing, or basic capability questions (400 inquiries)

- 20% are complex and require human expertise (100 inquiries)

- Current process: One SDR spends approximately 40 hours per month responding to these inquiries (assuming 6 minutes per response on average)

- SDR cost: 5,000 per month in fully-loaded cost)

- Cost per response: Approximately $12.50 per inquiry

With AI-powered initial response:

- AI handles 80% of routine inquiries (400 inquiries) instantly and cost-effectively

- Human SDRs focus on the remaining 20% (100 complex inquiries) plus following up with AI-qualified prospects when human expertise is genuinely valuable

- SDR time allocation: Approximately 20 hours per month on actual human-required activities

- Freed capacity: 20 hours per month available for higher-value activities (relationship building, complex deal support, customer success, etc.)

The financial impact: organizations reduce response time for 80% of inquiries from hours to seconds while deploying human expertise only where it actually provides value. This improves customer experience while simultaneously reducing per-inquiry cost and freeing human capacity for higher-value activities.

The relationship impact is equally significant. When humans finally engage with prospects, it's because the prospect has complex needs or because the organization has determined human expertise will accelerate a deal. These interactions start from a position of informed engagement rather than basic information gathering. The specialist already understands the prospect's situation (through earlier AI conversations) and can focus on adding value through expertise and problem-solving rather than repeating basic information.

How AI Agents Transform the Sales Response Function

The Technical Infrastructure for AI Sales Agents

Modern AI sales agents operate on a foundation of large language models fine-tuned on company-specific data. These models are trained on:

- Product documentation (technical specifications, feature descriptions, capability matrices)

- Frequently asked questions (historical inquiries and their answers)

- Pricing structure and packaging (plan definitions, pricing tiers, volume discount structures)

- Implementation playbooks (standard timelines, resource requirements, deployment methodologies)

- Integration libraries (technical details on how the platform connects with other systems)

- Compliance and security information (certifications, data protection practices, compliance frameworks)

- Case studies and use cases (examples of how customers implement the solution across different industries and use cases)

When a prospect submits an inquiry, the AI agent:

- Parses the incoming inquiry to understand what the prospect is asking

- Retrieves relevant information from its training data

- Generates a contextually appropriate response addressing the specific question

- Assesses whether human expertise is required (routing to specialist if the question exceeds the AI's confidence level)

- Records the interaction for future reference and improvement

This infrastructure is remarkably effective because it grounds AI responses in company-specific information rather than generic large language models. An AI trained only on general knowledge might provide a plausible-sounding answer to a product question that's actually incorrect. An AI trained specifically on company documentation provides accurate information because it's directly referencing authoritative sources.

The system continuously improves as it encounters new questions. When a prospect asks a question that the AI isn't confident answering, the inquiry is escalated to a human specialist. That specialist's response is recorded and becomes part of the training data. Over time, the AI handles an increasing percentage of inquiries without human involvement.

Implementation Patterns for Enterprise Organizations

Large enterprises typically deploy AI sales agents in a phased approach:

Phase 1: Structured Inquiry Handling (Weeks 1-4) The AI agent is deployed to handle the highest-volume, most straightforward inquiries. Organizations typically focus on:

- Basic product questions (capabilities, features, limitations)

- Pricing inquiries

- Implementation timeline questions

- Integration capability questions

At this stage, human SDRs handle everything else. As the AI proves itself on these straightforward cases, confidence increases.

Phase 2: Qualification and Lead Routing (Weeks 5-12) Once the system reliably handles basic inquiries, it's expanded to include preliminary qualification. The AI assesses:

- Organization size and whether it matches target customer profile

- Industry and vertical appropriateness

- Geographic requirements and support coverage

- Estimated opportunity size based on typical customer metrics

Preliminary qualified prospects are automatically routed to appropriate specialists. Disqualified prospects (those outside target markets, too small, wrong geography) receive a response explaining why they're not a fit, often with referrals to partners who might better serve their needs. This reduces human time spent on obviously poor fits while improving experience for prospects who are genuine opportunities.

Phase 3: Conversation Continuation and Context Preservation (Weeks 13+) As the AI gains sophistication, it begins participating in multi-message conversations with prospects. A prospect's first message is answered by AI. Their follow-up question (which refines their original question) is also answered by AI, using context from the initial exchange. This reduces back-and-forth while providing increasingly personalized responses.

Throughout this progression, the system continuously learns. Questions that initially required human escalation become routine over time. The organization gradually discovers which inquiry categories represent the highest-value opportunities for AI (routine, high-volume questions) and where human expertise still provides the greatest value.

The Customer Experience of AI-Powered Sales Interactions

When implemented effectively, AI-powered sales response creates superior customer experience compared to traditional processes. The prospect perceives:

- Immediate response to their inquiries (seconds vs. hours)

- Knowledgeable answers from someone (something) that clearly understands the product

- Relevant information directly addressing their specific question (not generic responses)

- Professional tone that matches company standards

- Efficient transactions moving toward signing without unnecessary delays

These perceptions align with modern buyer expectations. Prospects increasingly expect organizations to respond immediately through various channels. They expect answers to be informed and specific. They value efficiency over traditional rapport-building. An AI system delivering against these expectations creates positive brand perception.

Crucially, when human specialists eventually engage, the prospect has already had several interactions with the organization and has been guided by AI toward the most relevant specialists. The human specialist enters the conversation with context: they know what questions the prospect has asked, what concerns they've raised, and what information they've already reviewed. This context allows the specialist to focus on adding value rather than repeating information.

The Economics and ROI of Sales Transformation

Measuring the Impact on Deal Velocity

Organizations that successfully implement AI-powered sales response typically see measurable improvements in deal velocity. Traditional metrics used to measure this:

Sales Cycle Length: Average duration from initial contact to close.

- Typical baseline: 60-90 days for small-to-medium deals, 120-180 days for enterprise deals

- Post-AI implementation: 20-30% reduction (48-63 days for SMB, 90-135 days for enterprise)

- Driver: Rapid initial response and elimination of qualification delays

Time to First Meaningful Conversation: Duration from initial prospect inquiry to substantive discussion with appropriate specialist.

- Typical baseline: 2-3 business days

- Post-AI implementation: 4-8 hours (same business day)

- Driver: AI screening and qualification reduces time before human engagement is valuable

Response Rate to Initial Inquiry: Percentage of prospects who respond after initial outreach.

- Typical baseline: 15-25% (with 2-3 day response delays, many prospects move to other vendors)

- Post-AI implementation: 35-45%

- Driver: Rapid response prevents prospect abandonment while they're actively researching

Conversion Rate from Inquiry to Sales Conversation: Percentage of inbound inquiries that convert to a conversation with an appropriate specialist.

- Typical baseline: 20-30%

- Post-AI implementation: 40-55%

- Driver: Better qualification and routing ensure prospects get connected with relevant specialists

These improvements compound. A 30% reduction in sales cycle length dramatically impacts revenue. If an organization closes 100 deals per year with a 90-day average cycle, a 30% reduction to 63 days means they can complete approximately 140 deals in the same time period (assuming consistent pipeline input). That's a 40% increase in annual revenue from the same sales organization.

Impact on Sales Specialist Efficiency and Capacity

AI-powered response systems fundamentally alter how salespeople spend their time. Rather than frontloading sales cycles with basic information gathering, salespeople focus on higher-value activities:

Time Reallocation Example:

Traditional Sales Model (per deal, 90-day cycle):

- Discovery conversations: 8 hours

- Qualification and assessment: 4 hours

- Demo and presentation: 4 hours

- Proposal development and negotiation: 8 hours

- Administration and CRM data entry: 4 hours

- Total: 28 hours per deal

AI-Enhanced Sales Model (per deal, 60-day cycle):

- AI handles initial discovery and qualification: 0 hours (human)

- Focused consultation on specific challenges: 3 hours

- Demo (typically pre-recorded, reviewed on their own time): 0 hours

- Proposal development and negotiation: 6 hours

- Specialist expertise consultation (if needed): 2 hours

- Administration and CRM data entry: 2 hours

- Total: 13 hours per deal

This 50%+ reduction in hours per deal doesn't mean salespeople are underutilized. Rather, they can handle more deals with the same time investment. An AE handling 4-5 deals per quarter under the traditional model can handle 8-10 deals per quarter under the AI-enhanced model (assuming consistent pipeline). This translates to significantly higher revenue per salesperson.

However, it also means the job itself changes fundamentally. Less time is spent building relationships over multiple interactions. More time is spent solving specific problems and facilitating transactions. Some salespeople thrive in this environment; others find it less satisfying. Successful implementations require honest conversations with sales teams about whether they prefer transaction facilitation or relationship-based selling, and staffing accordingly.

Impact on Win Rate and Customer Satisfaction

Counterintuitive to what one might expect, AI-powered sales response typically improves win rates and customer satisfaction despite reducing human interaction.

Why Win Rates Improve:

-

Faster response eliminates competitor engagement: When your organization responds in minutes and competitors respond in days, prospects move forward with you while still evaluating others. First-mover advantage matters.

-

Better qualification improves close rate: AI-powered routing ensures specialists only engage with qualified prospects. Time spent on obviously poor fits disappears. Specialists focus exclusively on prospects likely to buy.

-

Consistent quality of early interactions: Every prospect's first interaction with your organization is professionally handled and informed. There's no variance based on which SDR happened to receive the inquiry or how that SDR was having their day.

-

Clear expectations set immediately: Prospects understand what the product does (and doesn't do) from the first interaction. This eliminates surprise and disappointment later in the sales process.

Why Customer Satisfaction Improves:

Postpurchase satisfaction correlates strongly with quality of presale experience. Customers who encountered responsive, knowledgeable, efficient service during the evaluation phase perceive the vendor as competent and customer-focused. This carries forward into implementation and ongoing relationships.

Additionally, customers who've had efficient sales experiences are more likely to be satisfied during implementation. They perceive the vendor's team as capable and responsive. They attribute implementation challenges to complexity rather than incompetence. They're more likely to renew and expand.

Why Organizations Resist Sales Transformation

The Institutional Inertia of Proven Playbooks

Organizations resist change in sales processes not because the case for change is weak, but because change is hard. Sales methodologies represent institutional knowledge, compensation structures, hiring criteria, and team identity. Changing them creates organizational turbulence.

Consider an organization that's built its entire culture around consultative selling. The organization hires for consultative selling aptitude. It trains salespeople in consultative selling methodology. It compensates people based on relationship development metrics. It promotes people who excel at consultative selling. Suddenly, consultative selling is no longer the primary value proposition. It's now just one component of the sales process, and a smaller one than before. This represents an identity crisis.

The salespeople hired under the old model may not excel under the new model. The star performer who excels at relationship building over 90-day sales cycles might struggle with 45-day transaction cycles requiring specialist expertise. This creates anxiety about job security and competence.

Leadership worries about execution risk. Changing sales processes mid-cycle is inherently risky. There's a period where performance likely dips—staff are learning new processes, new systems aren't fully optimized, message clarity hasn't fully propagated to market. Revenue is sensitive. Dips create pressure to revert to proven playbooks. Successfully navigating this transition valley requires executive commitment to a multi-quarter improvement timeline.

Compensation Model Misalignment

Traditional sales compensation models are predicated on relationship-based, lengthy sales cycles. Salespeople are compensated for deal size and occasionally for cycle length. As cycle length decreases, compensation typically decreases (fewer deals per salesperson per year, lower compensation per deal). This creates explicit financial incentive to maintain lengthy sales processes.

Under AI-enhanced processes, deals should move faster. But if compensation is based on traditional metrics, this creates a scenario where salespeople are financially harmed by achieving better outcomes. This is obviously unsustainable—no organization can successfully transform sales if doing so financially penalizes the sales team.

Successful transformations require compensation model redesign. This typically involves:

- Higher deal velocity targets: Commission-able metrics shift from cycle length to deal count

- Quality metrics integration: Revenue retention metrics and customer satisfaction scores influence compensation

- Specialist expertise compensation: Consultation and strategic selling activities are compensated explicitly

- Transition support: During transition periods, protections on earnings prevent financial cliffs

Designing and implementing new compensation models is complex. It typically requires human resources involvement, finance review, and careful communication to prevent turnover among high performers who fear financial impact. Many organizations avoid this complexity and implicitly preserve the old process to maintain compensation structure alignment.

Technical Skepticism About AI Reliability

Sales leadership often expresses legitimate skepticism about whether AI systems can actually deliver accurate information without human oversight. This skepticism is grounded in real examples of AI providing incorrect information with confidence.

A prospect asks a specific technical question. The AI provides an answer. The prospect, trusting the response, uses it to plan implementation. Later, the prospect discovers the answer was incorrect. The prospect's trust in the vendor is damaged. They may consider switching vendors. This scenario terrifies sales leadership.

This skepticism is valid, which is why successful AI implementations don't launch with the assumption that AI will handle everything perfectly. They launch with systematic quality assurance:

-

Confidence thresholding: AI only answers questions it's highly confident about (confidence > 95%). Lower-confidence inquiries are automatically escalated to humans.

-

Response review: For a period of time, human specialists review all AI responses before they're sent to prospects. This catches errors. It also identifies areas where the AI's training data needs improvement.

-

Systematic testing: The organization tests the AI system against a library of known questions with known correct answers. This quantifies accuracy and identifies gaps.

-

Iterative improvement: The AI system is continuously improved based on real-world usage. Questions that were initially escalated to humans can eventually be handled by AI once training data is sufficient.

Despite these quality assurance practices, some sales leaders remain skeptical. They've seen technology implementations disappoint before. Overcoming this skepticism requires demonstration—showing that the AI system actually performs well, that accuracy improves over time, and that customer impacts are positive.

Change Fatigue and Implementation Capacity

Most mature organizations are managing multiple simultaneous changes: CRM system implementations, sales methodology updates, territory restructuring, compensation model changes, new hire onboarding. Asking the organization to simultaneously transform sales processes with AI feels like one change too many.

This is a legitimate concern. Implementation capacity is real and finite. Organizations that attempt to change too many things simultaneously typically execute none of them well. The practical response is often to sequence transformations rather than attempting them in parallel. If the organization is in the midst of a CRM implementation, adding sales process transformation is typically suboptimal timing. Better to sequence: complete CRM implementation, allow the organization to reach steady state, then implement sales transformation.

However, this sequencing decision often becomes a permanent deferral. "We'll implement sales transformation next year" becomes an ongoing pattern. The competitive advantage of being an early implementer erodes as more competitors also implement. Eventually, the organization is implementing not because it provides competitive advantage, but because it's table stakes to remain competitive.

The New Sales Process: Architecture and Implementation

The Three-Tier Sales Structure

Organizations successfully managing the sales transformation typically structure sales into three tiers, each optimized for different value delivery:

Tier 1: AI-Powered Initial Response (24/7, Automated)

The first tier handles initial prospect contact, whether that's through website chat, email, form submission, or other inbound channels. This tier provides:

- Immediate response to any inquiry

- Accurate information about product capabilities and pricing

- Preliminary qualification assessment

- Routing to appropriate human specialists when valuable

- FAQ and self-service information

This tier operates entirely through AI systems. Response time is seconds. Availability is 24/7/365. Cost per interaction is minimal (fractions of a cent).

The primary goal at this tier is not to sell but to serve. Prospects receive the information they need to continue their evaluation efficiently. The secondary goal is qualification—moving obviously poor fits to lower-effort interactions (like referrals to partners) while routing strong prospects to specialized expertise.

Tier 2: Specialist Consultation (Business Hours, Human-Driven)

The second tier engages when AI has determined that human expertise provides value. This tier delivers:

- Deep expertise in specific domains (technical implementation, complex integrations, industry-specific use cases)

- Consultative problem-solving for non-standard requirements

- Technical architecture assistance

- Contract negotiation and terms customization

- Relationship continuity through implementation

Specialists at this tier focus on high-value conversations. They don't answer basic product questions (that's handled by Tier 1). They don't go through generic qualification (that's been done by Tier 1). They engage when they can add specific expertise the prospect actually needs.

This tier typically operates business hours, though organizations increasingly offer extended hours for important prospects or deals. Staffing is optimized for utilization. Rather than each person covering a geographic territory or customer segment, people specialize in specific functional domains (integrations expertise, specific industry expertise, change management expertise) and work with appropriate prospects across the organization's customer base.

Tier 3: Executive Relationship Management (Strategic Deals)

The third tier engages for significant deals, strategic partnerships, or situations requiring executive judgment. This tier involves:

- Executive-to-executive relationship building

- Strategic partnership discussions

- Large contract negotiations

- Custom implementation planning

- Post-sale executive sponsorship and success planning

This tier is staffed by the most senior salespeople and is reserved for the organization's most important deals. These opportunities receive the full resources and attention of senior expertise.

Implementation Sequencing and Timeline

Successful implementations typically follow a structured timeline:

Month 1-2: Design and Preparation

- Audit current sales process, identifying high-volume/routine inquiry categories

- Inventory product documentation, pricing information, and FAQ content

- Design AI system architecture and integration with existing tools

- Prepare team communication and change management strategy

Month 3-4: Limited Pilot

- Deploy AI system to handle a subset of inbound inquiries (typically Tier 1: basic product questions)

- Implement quality assurance process with human review of all AI responses

- Gather feedback from both customers and sales team

- Measure accuracy, response time, and customer satisfaction

Month 5-6: Expansion and Refinement

- Expand AI to handle additional inquiry categories (pricing, implementation timelines, integration questions)

- Reduce human review from 100% to sampling (review 10-20% of interactions)

- Implement training updates for sales team on new workflow

- Measure impact on deal velocity and customer satisfaction

Month 7-8: Qualification Integration

- Deploy preliminary qualification capabilities

- Implement automated routing to appropriate specialists

- Restructure Tier 2 specialist teams for domain specialization

- Update compensation models to reflect new process

Month 9-12: Optimization and Scaling

- Refine AI training based on real-world usage

- Scale specialized Tier 2 teams based on demand

- Implement continuous improvement cycles for AI accuracy

- Measure full impact on revenue and customer satisfaction

This timeline assumes a well-resourced implementation. Lean organizations might extend this to 6-9 months. Complex organizations (multiple business units, legacy systems) might extend to 12-18 months.

Metrics and Success Indicators

Effective transformation requires clear metrics demonstrating progress and value. Key metrics typically include:

Response Time Metrics:

- Time to first response (target: <5 minutes for AI, <4 hours for Tier 2)

- Percentage of inquiries answered within first response (target: 60-80%)

- Customer satisfaction with response timing (target: >85%)

Efficiency Metrics:

- Average deal cycle length (target: 20-30% reduction)

- Hours per deal (target: 40-50% reduction)

- Number of deals per salesperson (target: 25-40% increase)

- Cost per opportunity qualified (target: 30-50% reduction)

Quality Metrics:

- AI response accuracy (target: >95%)

- Customer satisfaction with AI responses (target: >80%)

- Win rate against competitors (target: maintain or improve)

- Customer satisfaction post-sale (target: maintain or improve)

Revenue Metrics:

- Annual recurring revenue per salesperson (target: 25-50% increase)

- Win rate by deal stage (target: improve qualification to conversion rates)

- Customer lifetime value (target: improve through faster implementation)

- Time to first revenue (target: reduce by 20-30%)

Organizations that establish these metrics upfront and track them throughout implementation create accountability. Metrics that show improvement justify continued investment and help overcome skepticism. Metrics that show challenges identify areas needing refinement.

Competitive Dynamics: Who's Winning This Transformation and Why

Early Mover Advantages

Organizations implementing sales transformation early gain several competitive advantages that persist even after late movers also implement:

Market Share Capture During Transition: Prospects researching vendors during your early-mover phase experience dramatically better service than your competitors still running traditional processes. This creates preference and increases win rates. These initial customers become reference customers and case studies that help with future selling. Late movers can't capture this share—it's already taken.

Brand Positioning as Modern and Responsive: Early movers are perceived as innovative and customer-focused. Late movers are perceived as following trend. In technology markets, perception of innovation drives purchasing decisions. Customers prefer vendors seen as forward-thinking.

Talent Attraction and Retention: Salespeople interested in technology transformation, in working with AI tools, in higher-velocity deal environments are attracted to early-mover organizations. These tend to be higher-engagement, more ambitious salespeople. As the transformation matures, it becomes easier to attract and retain top talent.

Operational Learnings: Early movers learn how to structure Tier 2 specialist teams, how to train AI systems, how to compensate teams effectively. Late movers benefit from published best practices and consultants, but lack the custom learnings from operating this model.

Cost Structure Advantage: As early movers optimize AI systems, cost per transaction decreases. By the time late movers implement, technology is mature and cost-effective. But early movers have achieved cost advantages earlier and can reinvest those savings into growth or profitability.

Competitive Vulnerability for Traditional Sales Models

Organizations clinging to traditional sales processes increasingly find themselves at competitive disadvantage:

-

Longer sales cycles mean slower growth: In fast-moving markets, faster is better. A 90-day sales cycle loses deals to a 60-day cycle because prospects move forward with the first vendor while still evaluating the second.

-

Inefficient resource utilization: Traditional models require larger sales teams to handle the same volume of business compared to AI-enhanced models. This creates structural cost disadvantage.

-

Perception of outdated operations: Prospects experience slow response times, multiple handoffs, and generic questioning as signs of unsophisticated operations. This damages brand perception.

-

Difficulty attracting top talent: High-performing salespeople increasingly seek roles in modern, technology-enabled environments. Traditional sales models have increasing difficulty attracting and retaining ambitious salespeople.

The Inversion of Competitive Advantage

Traditionally, large enterprises had sales advantage over smaller competitors. They had resources to field larger teams, implement sophisticated processes, invest in training. This advantage is inverting. Smaller, more agile organizations are implementing sales transformation faster. They're experiencing competitive advantage through superior customer experience. Larger organizations, burdened by institutional inertia and change management complexity, are falling behind.

This creates a peculiar dynamic: smaller, younger organizations with less sales legacy are surpassing larger organizations in sales effectiveness. The historical correlation between organization size and sales capability is weakening.

Beyond Sales: How This Transformation Cascades Through Organizations

Implications for Customer Success and Implementation Teams

When sales cycles compress from 90 days to 60 days (or faster), implementation timelines face pressure to compress proportionally. Customers expect faster time-to-value. They're less willing to accept 4-6 month implementation timelines post-sale.

This creates pressure on implementation and customer success teams. Faster sales cycles mean more parallel implementations. More implementations mean resource constraints. Organizations have two options: hire additional implementation resources (expensive) or optimize implementation processes.

Successful organizations optimize: they shift from custom implementations toward configuration-based implementation, from extensive training toward self-service training, from dedicated implementation managers toward task-based implementation coordinators. This mirrors what sales transformation has done—removing unnecessary touches and focusing humans on high-value interactions where expertise genuinely matters.

Sales transformation that doesn't cascade into customer success transformation creates a customer experience cliff: excellent sales experience followed by slow, resource-constrained implementation. Smart organizations ensure customer success infrastructure scales alongside sales transformation.

Implications for Product and Competitive Positioning

When customers need less vendor support for basic sales and are expecting faster implementations, product becomes more important. Customers making faster decisions have less time for vendors to convince them. More relies on product inherent capability and ease of use.

This creates pressure on product teams to:

- Improve product accessibility: Product should be self-onboardable for straightforward use cases

- Reduce implementation complexity: Customers expect faster deployments; product should be designed with this in mind

- Enhance self-serve capabilities: Product should enable customers to achieve value without extensive customization

- Improve documentation and help systems: Customers are more self-sufficient; product help should be comprehensive

Organizations with products designed for ease of use and fast time-to-value have significant advantage in environments where customers are impatient. Traditional products requiring extensive customization and implementation become increasingly uncompetitive.

Implications for Marketing and Content Strategy

As buyers spend 70% of their journey researching independently, content becomes more important. Buyers need information accessible before sales engagement. This shifts marketing strategy from lead generation (pushing qualified prospects toward sales) to demand generation (attracting and educating prospects throughout their research journey).

Successful organizations shift toward:

- Comprehensive documentation and knowledge bases: Publicly accessible, detailed, searchable information about how the product works

- User communities and peer networks: Prospect access to existing customers sharing experiences and best practices

- Educational content and tutorials: Videos, guides, and interactive content helping prospects understand solution options

- Transparent pricing and packaging: Pricing information publicly accessible rather than hidden

- Active social communities: Prospects observing how existing customers use the product and sharing experiences

Traditional marketing focused on generating leads for sales to chase becomes less critical. Marketing that educates prospects during their independent research becomes more valuable.

The Skills Gap: What Sales Organizations Need to Develop

The Shift from Hunter to Architect

Traditional sales culture celebrates the "hunter"—the aggressive, relationship-focused seller who pursues deals persistently, builds relationships, overcomes objections, and closes business. This archetype succeeded when sales involved persuading prospects who weren't already convinced. It's less effective in environments where prospects have already sold themselves and need specialized expertise.

The new environment rewards a different archetype: the architect. Rather than hunting, architects design solutions. Rather than persuading, they advise. Rather than chasing, they serve. Rather than handling objections to moving faster, they solve implementation problems. This requires different skills:

- Domain expertise: Deep understanding of specific industries, use cases, or implementation challenges

- Problem-solving: Ability to understand complex requirements and design solutions addressing them

- Technical fluency: Understanding technical architecture, integration points, data flows

- Consultative wisdom: Ability to advise customers on approaches and trade-offs

- Project facilitation: Ability to coordinate multiple stakeholders and drive toward solutions

Organizations successfully navigating this transition are deliberately developing these skills. They're hiring people with domain expertise even if they lack pure sales background. They're training existing salespeople in technical and consultative skills. They're creating career paths allowing people to develop specialized expertise over time.

They're also accepting that some people successful under the old model won't be successful under the new model. Individuals who thrive on aggressive persuasion and competitive closing may find specialist advisory work less satisfying. Organizations make space for this reality rather than trying to force transformation on people fundamentally misaligned with new approaches.

The Investment in Continuous Learning

Under traditional sales models, salespeople typically completed onboarding and thereafter relied on product training updates and sales methodology coaching. The pace of change was relatively slow. A salesperson could develop expertise in a product and maintain it with periodic refreshes.

Under AI-enhanced, specialist-focused models, continuous learning becomes essential. Specialists need deeper expertise. They need to stay current with product evolution. They need to understand new integrations, new use cases, new industries. They need domain expertise that itself evolves.

Successful organizations invest in continuous learning infrastructure: regular technical training, industry certification programs, conference attendance, community participation, knowledge-sharing forums. This represents significant ongoing investment but creates competitive advantage. Specialists with deeper expertise close deals faster, achieve higher win rates, and retain customers better.

The Importance of Systems and Process Thinking

Traditional sales culture emphasizes individual heroics: the top individual performer carrying multiple large deals, the person whose relationships prevent customer defection. This culture works when success depends on individual effort.

Under AI-enhanced processes, system effectiveness becomes more important than individual heroics. A system that reliably routes prospects to appropriate specialists, that responds quickly, that maintains context across multiple interactions, that seamlessly escalates complex situations creates consistent results. Individual heroics can't overcome system failures.

Successful organizations shift culture toward:

- Process documentation: Capturing how things work so knowledge doesn't reside only in individual heads

- Handoff discipline: Ensuring context and responsibility are clearly transferred between team members

- Data integrity: Maintaining accurate, updated CRM data as foundation for process reliability

- Metrics orientation: Measuring system performance and identifying bottlenecks

- Continuous improvement: Regularly analyzing data and refining processes

This shift often meets resistance from high-performing individuals who've succeeded through personal relationships and unique approaches. Helping these individuals understand they're more impactful through systematic leverage than personal heroics is part of cultural transformation.

Alternative Solutions for Sales Transformation

While AI agents represent one approach to modernizing sales processes, several alternative and complementary approaches merit consideration:

Workflow Automation Platforms for Sales Process Optimization

Beyond AI-powered agents, workflow automation platforms like Runable provide structured approaches to sales process modernization. These platforms enable organizations to automate repetitive sales tasks, create intelligent routing workflows, and build interactive tools that guide prospects through evaluation without requiring live human interaction.

For example, Runable's automation capabilities allow organizations to:

- Automate lead routing based on specified criteria (geography, company size, use case)

- Build automated nurture sequences that deliver relevant information at the right time

- Create interactive comparison tools helping prospects evaluate options

- Automate contract generation based on specified terms and parameters

- Build custom sales documentation automatically tailored to prospect profiles

These automation approaches complement AI agents. While AI agents handle natural language conversations, workflow automation tools handle structured, predictable processes. Organizations often benefit from both: AI agents for flexible, conversational interactions, and workflow automation for structured, repetitive processes.

Sales Engagement Platforms for Orchestrated Outreach

Sales engagement platforms like Outreach and Salesloft provide structured frameworks for orchestrating outreach campaigns, managing prospecting efforts, and scaling sales activities. These platforms don't replace sales processes but enhance them by providing systematic approaches to prospecting, nurturing, and engagement timing.

Sales Enablement and Knowledge Management Systems

Platforms like Seismic and Highspot focus on equipping salespeople with the information, content, and tools they need to sell effectively. By centralizing product knowledge, competitive intelligence, case studies, and sales collateral, these platforms improve sales effectiveness. Organizations using these systems report shorter ramp times for new salespeople and improved win rates among experienced salespeople.

CRM Evolution and Data-Driven Sales Insights

Modern CRM systems (Salesforce, HubSpot, Microsoft Dynamics) increasingly incorporate AI-powered analytics, forecasting, and recommendations. These systems identify high-probability opportunities, recommend next actions, and provide visibility into pipeline health. While not replacing sales processes, they provide intelligence enabling better sales decisions.

Sales Coaching and Methodology Training

Certainly, AI implementation isn't the only approach to improving sales effectiveness. Enhanced coaching, updated sales methodologies (moving from MEDDIC toward frameworks better suited to informed buyers), and increased investment in sales development can also drive improvement. Many organizations benefit from combination approaches: improved methodology and coaching alongside AI-powered initial response and workflow automation.

The optimal approach depends on specific organizational context: current sales maturity, available resources, competitive dynamics, and product/service complexity. Most successful organizations employ multiple approaches simultaneously—improving fundamentals while also implementing AI and automation that address specific pain points.

Implementation Roadmap: From Planning to Execution

Assessing Organizational Readiness

Before investing in sales transformation, organizations should honestly assess their readiness:

Cultural Readiness: Does leadership genuinely support change, or is it lip service? Have previous change initiatives succeeded or failed? Do salespeople generally embrace new tools or resist them? Is the organization willing to restructure teams and redefine roles?

Technical Readiness: Does the organization have IT resources to support new systems? Is the CRM data sufficiently clean and organized to support AI training? Are there existing integrations that need to be maintained? How complex is the IT environment?

Financial Readiness: Is the organization willing to invest in a multi-quarter transformation that may show decreased performance during transition? Do expected returns justify the investment? Is revenue dependent on specific salespeople, or is it more distributed?

Market Readiness: Are customers experiencing pain with current sales processes? Would faster sales cycles be valuable in the market? Are competitors already implementing transformations?

Organizations scoring high on these dimensions are good candidates for transformation. Organizations scoring low should perhaps address foundational issues before attempting transformation.

Phased Implementation Approach

Successful implementations follow phased approaches:

Phase 1: Quick Win (Weeks 1-8) Identify and implement a low-risk improvement providing immediate value. This might be: deploying AI to handle basic product questions via website chat, implementing a sales engagement automation for prospecting, or creating a self-serve comparison tool helping prospects evaluate options. The goal is proving that change is possible and generating internal enthusiasm.

Phase 2: Core Transformation (Weeks 9-20) Implement the central transformation initiative: AI-powered initial response and specialist routing, sales process restructuring, team reallocation. This is the most complex phase, involving significant change management and process disruption. But it's also where the largest benefits are captured.

Phase 3: Scaling and Optimization (Weeks 21-52) Refine what's working, discontinue what isn't, and scale successful approaches. This phase involves increasing AI sophistication, optimizing specialist team structures, improving handoff processes, and fine-tuning compensation models.

Phase 4: Continuous Improvement (Ongoing) Establish processes ensuring continuous improvement: regularly analyzing metrics, updating AI training, refining processes, and adapting to market changes. Transformation isn't a destination; it's an ongoing process.

Change Management and Communication Strategy

Successful transformations invest heavily in change management:

Transparent Communication: Regular, honest communication about what's changing, why it's changing, and what it means for different roles. Information vacuum gets filled by rumors and speculation. Transparent communication prevents this.

Stakeholder Engagement: Involving affected parties in planning transformation (rather than imposing it) increases buy-in. Salespeople involved in designing their new role are more invested in success than those told their role is changing.

Training and Development: Providing comprehensive training on new tools, processes, and approaches. People don't resist change because they're obstinate; they resist because they're uncertain. Training reduces uncertainty.

Support Structures: Providing coaching, mentoring, and resources helping people succeed in their new roles. New roles are difficult. Support structures accelerate success.

Recognition and Reinforcement: Recognizing and rewarding people successfully adapting to new approaches. Culture change happens when organization visibly values new behaviors.

Transition Support: Providing financial and professional support for people who determine new roles don't match their preferences. Some good salespeople will opt out. Helping them transition (to other roles or organizations) maintains goodwill and prevents sabotage.

The Future of Sales: Toward Fully Autonomous Transactions

The Progression: From Human-Controlled to AI-Augmented to Autonomous

Sales transformation isn't stopping at AI-assisted response and specialist consultation. The trajectory continues toward increasingly autonomous systems:

Stage 1: Current State (AI-Assisted): Humans make all decisions; AI assists by handling routine tasks and providing information.

Stage 2: Near Term (AI-Augmented): AI handles more complex decisions (complex qualification, solution design recommendations) while humans review and adjust. Humans remain in control; AI is the primary decision-maker in many situations.

Stage 3: Medium Term (Partially Autonomous): Straightforward deals (below certain complexity or value thresholds) execute entirely through AI with human oversight. More complex deals require human involvement. The system automatically routes deals appropriately.

Stage 4: Long Term (Fully Autonomous Transactions): Organizations implement fully automated transaction processes for standard deals—from initial inquiry through contract signature—with no human involvement required. All customer interaction happens through AI. Humans provide strategic guidance and complex deal management.

The timeline for this progression varies by organization and industry. Straightforward software with clear use cases might reach full autonomy in 3-5 years. Complex enterprise software requiring significant customization might take 10+ years. Some use cases may never fully automate—they may remain human-driven indefinitely.

Emerging Challenges in Fully Autonomous Systems

As systems become more autonomous, new challenges emerge:

Trust and Relationship Building: Enterprise buyers often prefer relationships with vendors. A fully autonomous system might technically close deals more efficiently but damage long-term relationships and customer perception. Organizations need to balance efficiency with relationship value.

Edge Cases and Exceptions: Real business situations are messy. They don't always fit standard parameters. Fully autonomous systems may fail catastrophically on edge cases. Organizations need monitoring systems that flag unusual situations for human review.

Ethical and Transparency Concerns: As systems become more autonomous, questions of transparency and explainability become more acute. Customers may reasonably want to understand how decisions were made and by whom. Black-box autonomous decision-making may create legal or ethical concerns.

Competitive Dynamics: As more organizations deploy autonomous systems, questions of fairness arise. Should large enterprises be able to automate more aggressively than smaller competitors? Do autonomous systems create barriers to entry? How do you compete against an autonomous competitor when you maintain human-centric processes?

The Human Element: What Remains Irreplaceable

Even in scenarios of advanced automation, human expertise and judgment remain valuable:

Strategic Problem-Solving: Helping customers think through complex strategic questions—how to restructure operations, which initiatives to prioritize, how to approach organizational change—requires human judgment and wisdom.

Executive Relationship Building: Sponsorship from executive-level relationships remains valuable in enterprise deals. Fully autonomous systems are unlikely to fully replace this.

Customization and Unique Solutions: When customers have non-standard requirements, designing custom solutions requires human expertise and creativity.

Empathy and Support During Difficulty: When implementations encounter challenges or customers face adoption difficulties, human support with empathy and personal attention remains valuable.

The question isn't whether humans will become irrelevant in sales. It's whether humans will focus on high-value activities (complex problem solving, executive relationships, custom solutions) and leave routine activities to automation.

Key Takeaways and Conclusions

The traditional sales process that dominated the 2010s—built for a world of information scarcity and uninformed buyers—is fundamentally misaligned with modern market conditions. Buyers are more informed. They research independently. They expect rapid response. They want to transact efficiently. Traditional sales processes built around lengthy relationship-building and buyer education create friction in this environment.

AI-powered sales agents and automated response systems address this misalignment by enabling organizations to:

- Respond immediately to prospect inquiries (seconds rather than days)

- Provide accurate information from a product perspective

- Qualify opportunities automatically, routing appropriate prospects to specialists

- Facilitate transactions for straightforward deals without unnecessary complexity

This isn't simply a technology adoption challenge. It's a fundamental reimagining of sales organization structure, roles, and culture. Successful transformations require:

- Sales restructuring toward specialist expertise and away from generalist account management

- Compensation redesign aligning incentives with shorter cycles and higher transaction volumes

- Culture shift from hunter-based to architect-based sales

- Skill development in domain expertise and consultative problem-solving

- Process discipline emphasizing system effectiveness over individual heroics

Organizations successfully navigating this transformation experience measurable benefits: shorter sales cycles (20-30% reduction), higher salesperson productivity (25-50% increase in revenue per rep), better customer experience (faster response, informed interactions, efficient transactions), improved win rates against competitors still using traditional approaches, and better-positioned organizations for market shifts ahead.

Organizations resisting or delaying transformation face increasing competitive pressure. As more competitors implement modern sales processes, traditional approaches become increasingly disadvantageous. First-mover advantage isn't permanent—late movers can catch up—but every quarter of delay increases the gap and makes catching up harder.

The transformation isn't optional; it's inevitable. The question for leadership is not whether sales processes will transform but whether your organization will lead or follow that transformation.

FAQ

What exactly is meant by "the death of the 2021 sales process"?

The traditional sales process that dominated the 2010s was built around lengthy relationship-building, extensive qualification cycles, consultative problem-solving, and vendor-controlled information flow. This process was optimized for an environment where vendors controlled information and buyers needed education. That environment has fundamentally changed. Buyers now research independently, are largely self-educated, and expect rapid response. Traditional processes that made sense in 2015 create friction in 2025, making them obsolete for many types of deals. The "death" refers to this functional obsolescence—the approach still technically works but increasingly poorly compared to modern alternatives.

How has buyer research behavior fundamentally changed?