Amazon's Melania Documentary Box Office Collapse: Why Theatrical Release Failed

Introduction: A $75 Million Lesson in Misaligned Strategy

Amazon Studios made a bold bet in early 2026. They acquired the rights to a documentary about former First Lady Melania Trump, then spent an eye-watering

The results? Catastrophic.

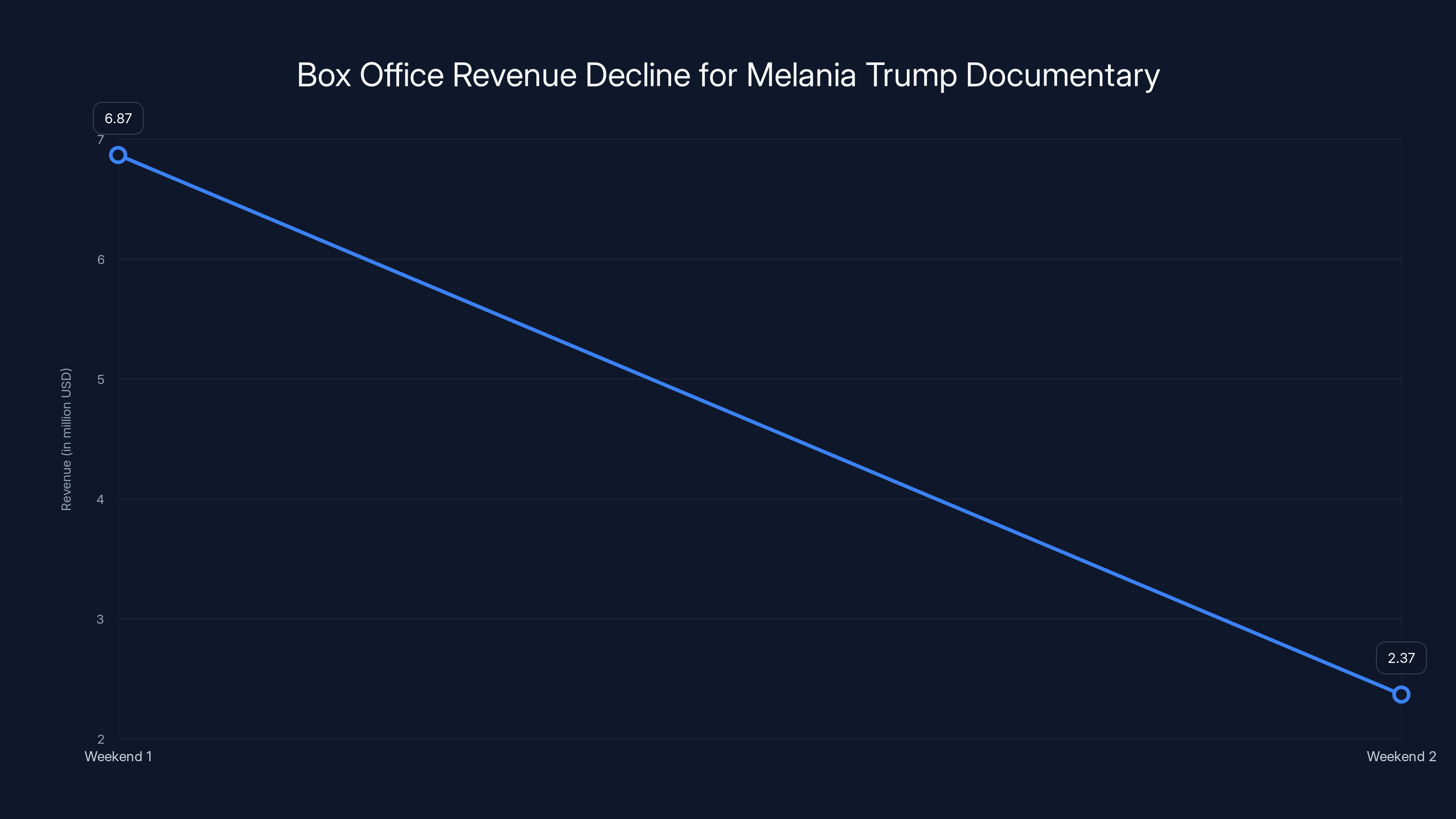

After a better-than-expected opening weekend that generated headlines about strong audience interest, the documentary collapsed in its second weekend. Box office revenue plummeted 67% to just

But here's what makes this story interesting to tech and media insiders. This wasn't just a case of a film underperforming. This was a case of a streaming giant fundamentally misunderstanding its own audience, overestimating the power of marketing spend, and making a strategic bet that contradicted everything we know about how streaming companies should operate.

The Melania documentary collapse reveals something deeper about the intersection of technology, media, and politics in 2025. It shows how companies can miscalculate cultural moments, how big budgets don't guarantee success, and how the theatrical model might be inherently wrong for certain content categories. It also raises questions about whether Amazon's decision to pursue theatrical distribution for a niche, politically-charged documentary made any strategic sense at all.

This article breaks down exactly what went wrong, why theatrical failed, what this means for streaming's theatrical ambitions, and what Amazon's next move might be. We'll examine the economics, the audience dynamics, the competitive landscape, and the fundamental mismatch between content type and distribution channel that doomed this project from the start.

Amazon's

TL; DR

- **Amazon spent 40M acquisition +13.5M at the box office

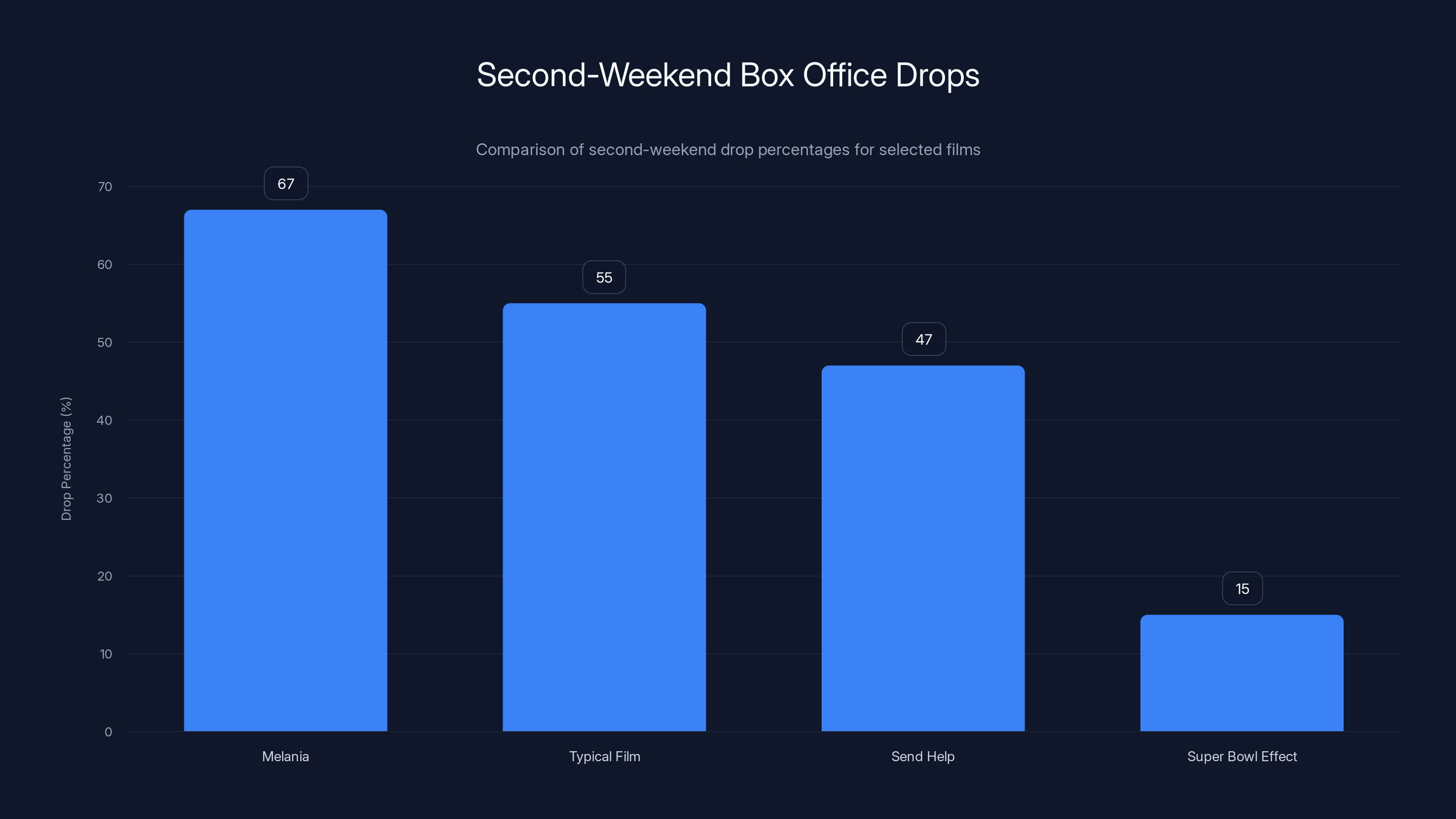

- Second-weekend collapse was severe: The film dropped 67% in its second weekend, falling from third to ninth place on box office charts

- Theatrical wasn't the right channel: Documentary audiences, especially for niche political content, prefer streaming over theater trips

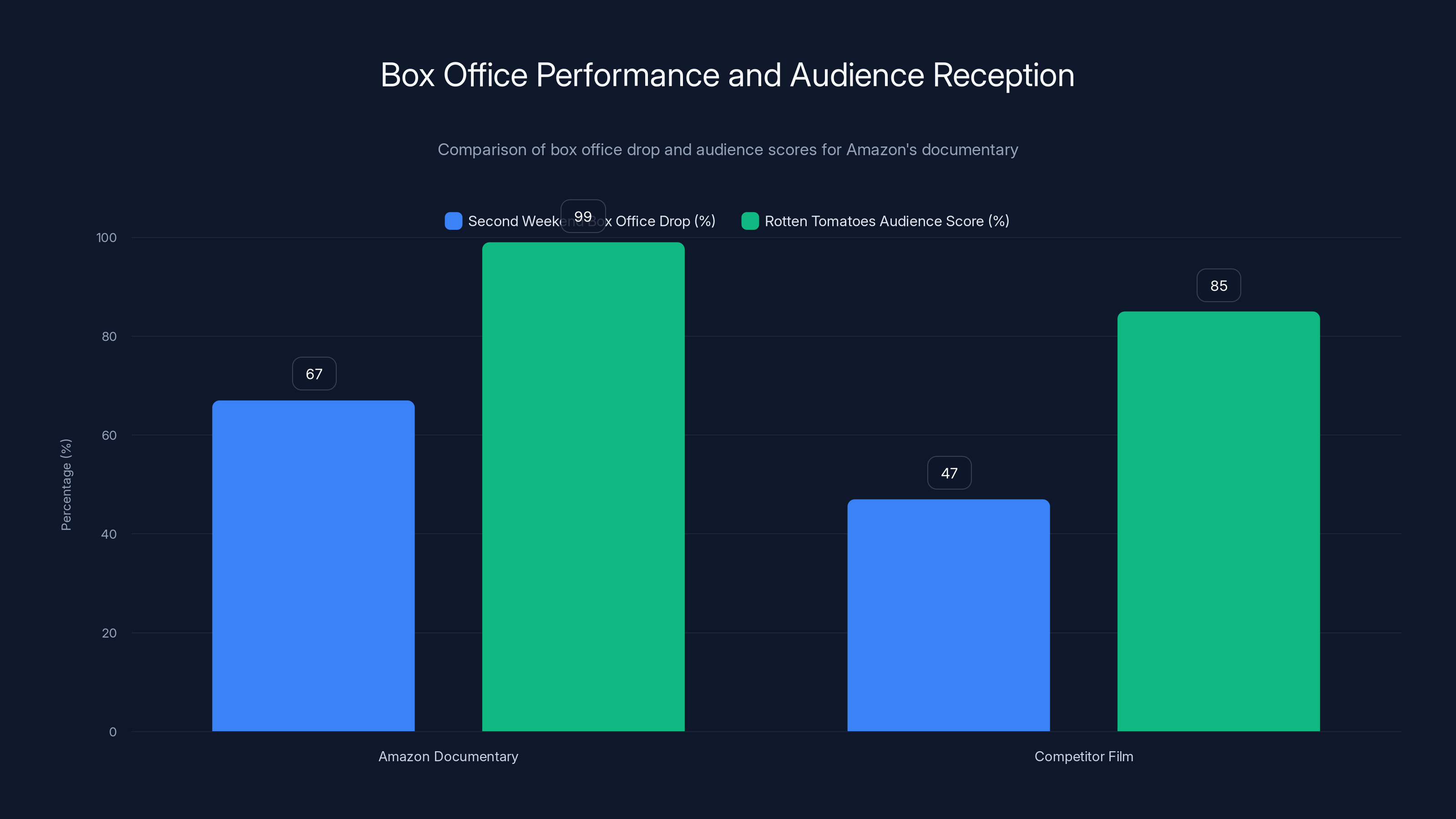

- Super Bowl weekend timing hurt: Box office slowed for all films, but competitors like "Send Help" only declined 47% compared to Melania's 67%

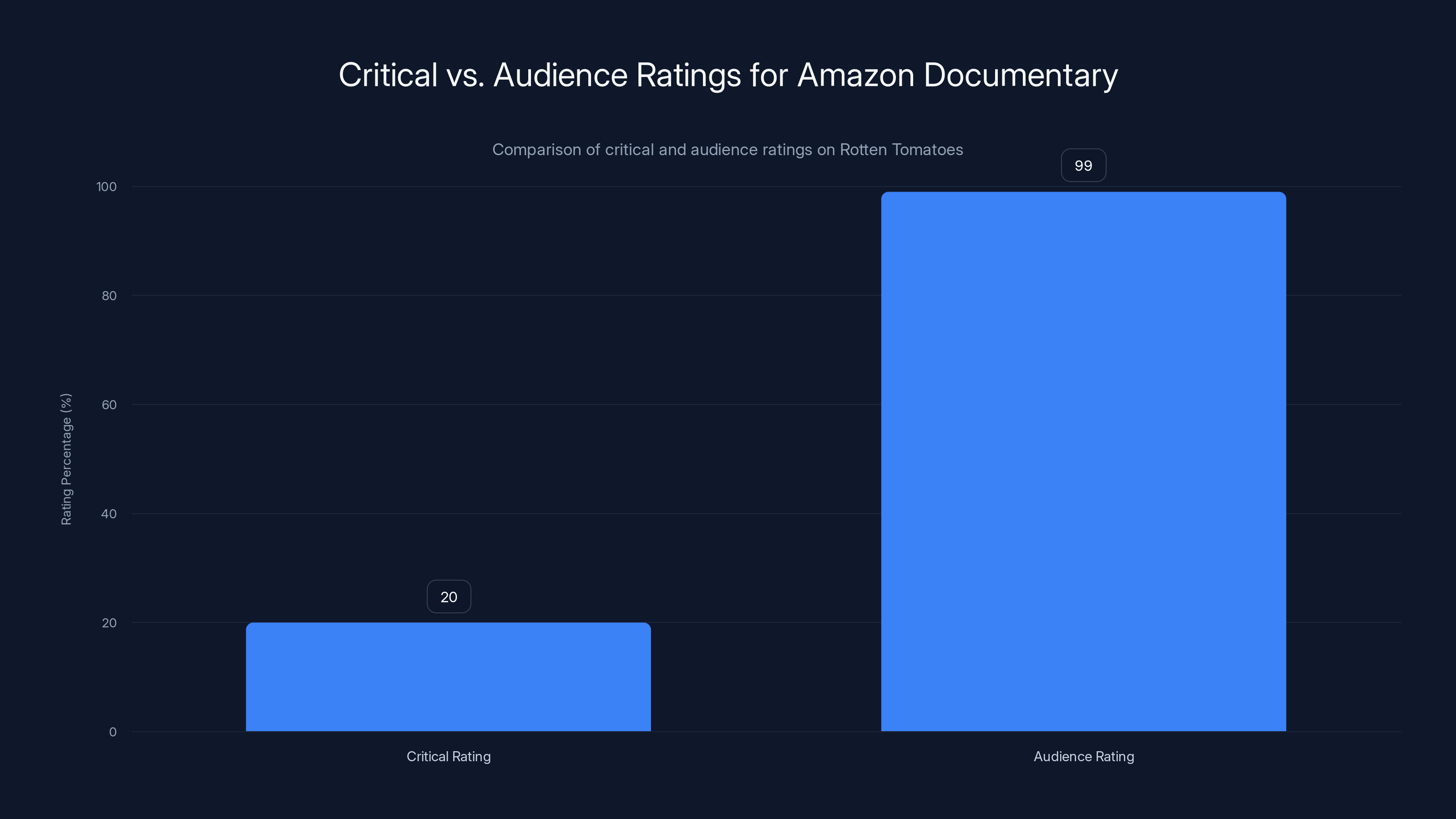

- Critical vs. audience disconnect: The film received universal critical panning but somehow achieved a 99% Rotten Tomatoes audience score (so unusual the site issued a statement)

- Streaming would have been better: Releasing directly to Prime Video would have maximized the addressable audience without the overhead costs of theatrical distribution

- Bottom line: This represents a fundamental strategic misalignment between content type, distribution channel, and target audience

The $75 Million Acquisition: When Deep Pockets Make Bad Decisions

Understanding Amazon's Acquisition Strategy

Amazon's approach to content acquisition has always been different from traditional studios. While major Hollywood producers develop projects over years, Amazon tends to acquire completed projects or films in post-production, then leverages its massive resources to market and distribute them. This strategy worked brilliantly for documentaries like "All or Nothing" sports series and various prestige films that found audiences on Prime Video.

But acquiring a Melania Trump documentary for $40 million—even in a politically charged election year—showed questionable judgment. The premise was simple: controversial political figure, current events relevance, existing media interest. Amazon executives likely calculated that the inherent controversy would drive awareness and curiosity, translating to both theatrical tickets and subsequent streaming viewers.

What they miscalculated was the fundamental truth about documentary audiences. People interested in political documentaries in 2025 don't necessarily want to leave their homes, buy tickets, find a theater, and sit through two hours. They want immediate, accessible, on-demand content they can watch at their own pace, pause for discussion, and revisit segments. The theatrical release requirement added friction where there should have been ease.

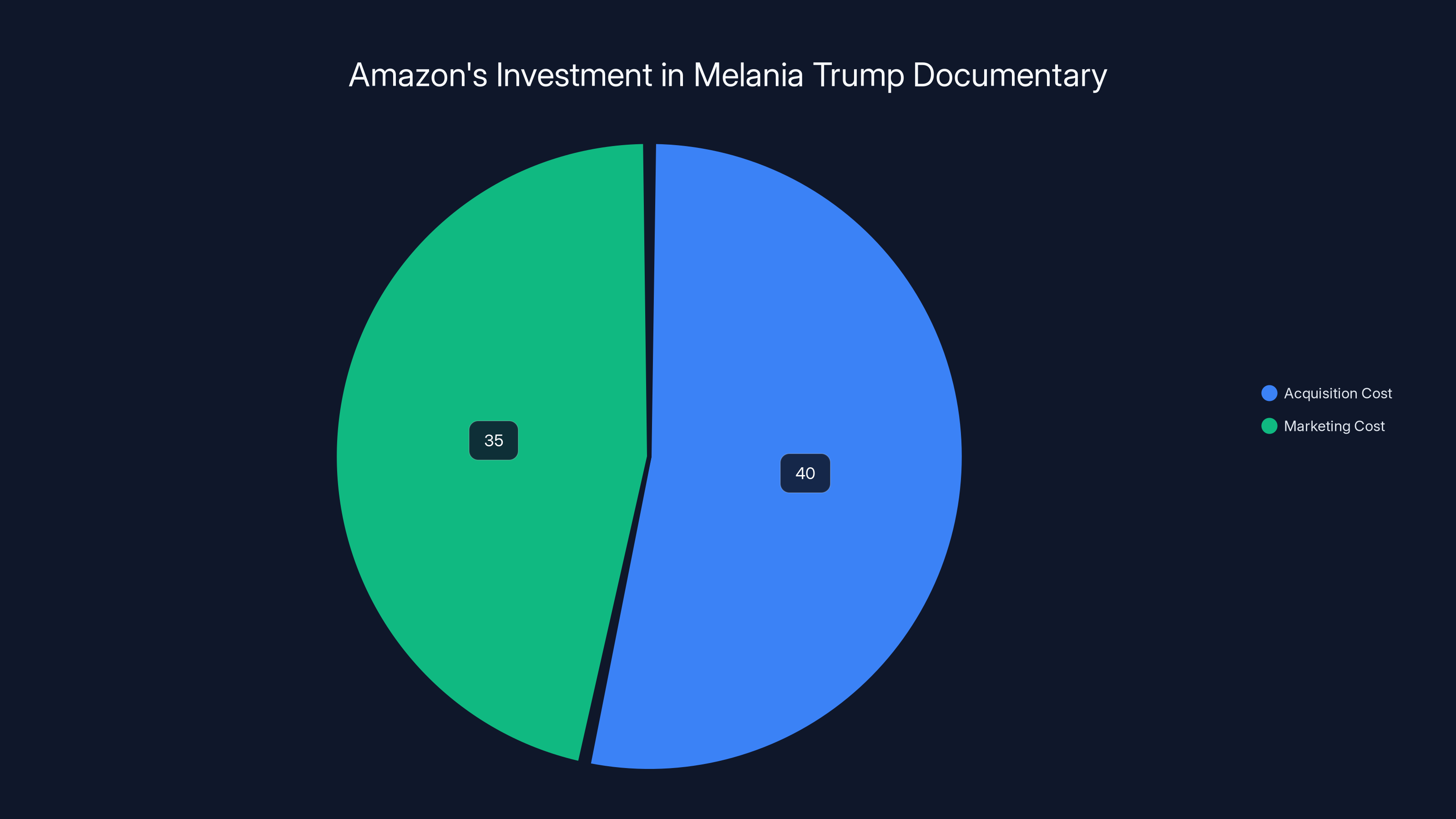

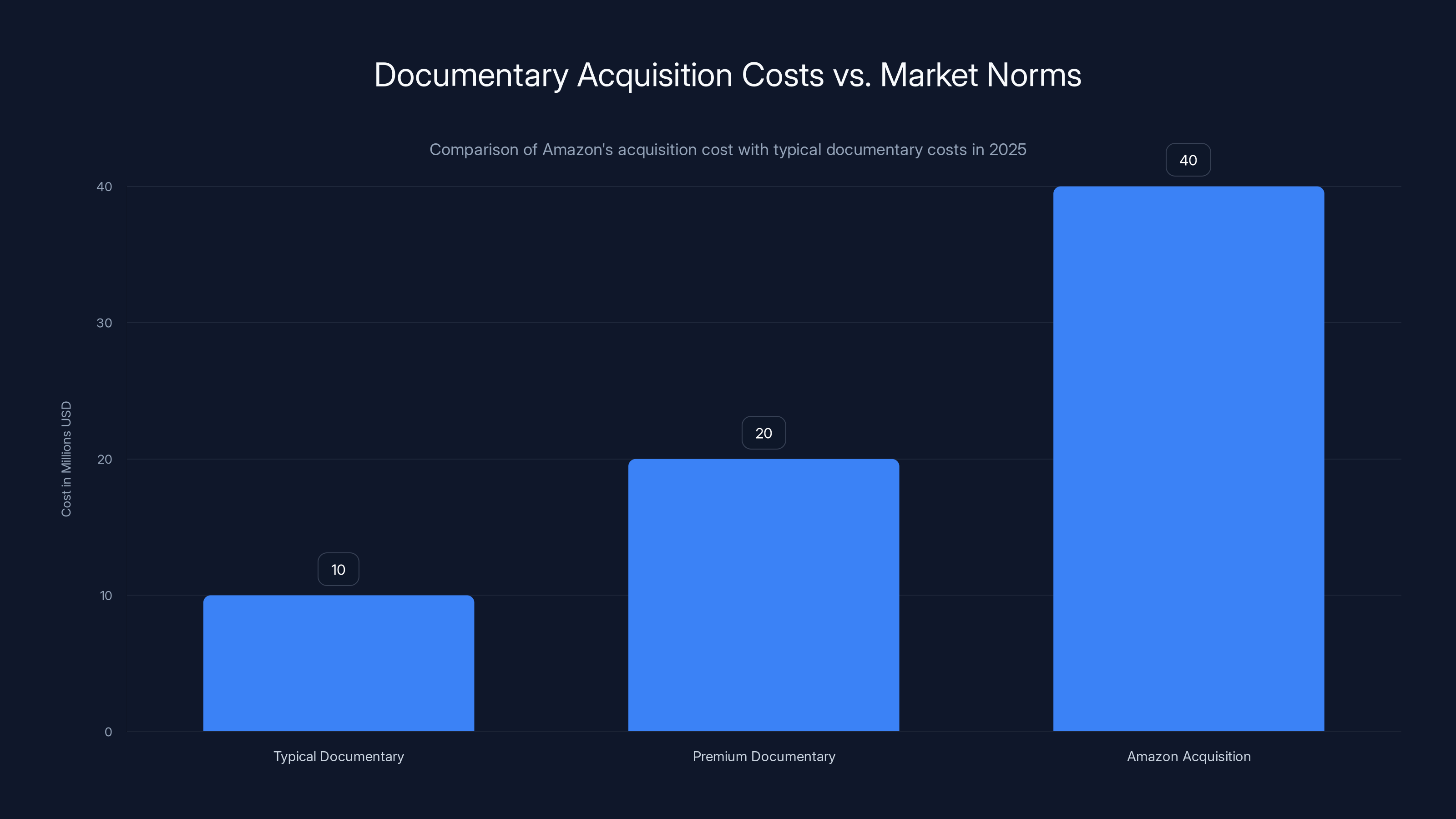

Why $40 Million Was Excessive for This Content

To understand how misaligned this decision was, consider the documentary market context in 2025. Most documentaries that achieve theatrical releases cost between

For a documentary. About Melania Trump.

The math only works if the film was a guaranteed blockbuster. But blockbuster documentaries are rare. Ken Burns' documentaries, David Attenborough's nature series, and a handful of critically acclaimed political documentaries have achieved significant box office numbers. Most haven't. The theatrical market for documentaries is inherently limited to perhaps 3,000 to 5,000 screens at peak interest, compared to 3,500 to 4,500 screens for wide releases of major films.

A former Amazon film executive reportedly asked the obvious question: how could this price be justified by anything other than "currying favor" with the Trump administration or representing "an outright bribe." That's harsh language, but it reflects the confusion industry insiders felt about the acquisition cost.

The Marketing Budget Trap

Then came the

Amazon's logic was likely this: the acquisition cost is sunk, so maximize marketing to drive theatrical attendance and subsequent streaming visibility. But this logic contained a fatal flaw. A $35 million marketing campaign for a niche documentary about a political figure doesn't necessarily convert to ticket purchases. Marketing can create awareness, but awareness without distribution or audience interest is just expensive noise.

The documentary market doesn't respond to traditional blockbuster marketing. Television ads, billboards, and social media campaigns work better for films with broad appeal. Political documentaries attract specific audience segments who discover content through word-of-mouth, journalist coverage, and recommendation algorithms, not through paid advertising saturation.

Amazon's $40 million acquisition of the Melania Trump documentary significantly exceeded typical and premium documentary costs, highlighting a potential miscalculation in their strategy. Estimated data.

The Second-Weekend Collapse: What 67% Drop Actually Means

Parsing the Numbers

Opening weekend: approximately

Then the crash came.

A 67% second-weekend drop is catastrophic for any film, but especially for a documentary that should benefit from word-of-mouth and sustained interest. To understand the severity, consider that typical films see 50-60% drops in second weekends as audience interest naturally declines and new releases compete. A 67% drop indicates something worse than normal attrition. It suggests audiences who saw it opening weekend weren't recommending it to friends, critics weren't rallying support, and the film didn't expand its appeal beyond initial curiosity seekers.

Competitive Context: The Real Story

Amazon's own statement about the collapse attempted to downplay the numbers. Kevin Wilson, head of domestic theatrical distribution, said theatrical and streaming "represent two distinct value creating moments." Translation: the theatrical run was never expected to be profitable. That might be true, but it's a costly way to drive Prime Video subscribers if you're spending $75 million for the theatrical leg.

But here's the revealing comparison. The weekend's top film, "Send Help," declined just 47%. This represents a $10+ million difference in second-weekend performance between the two films in the same competitive environment. "Send Help" clearly had stronger word-of-mouth, more positive audience reception, and better staying power. The fact that Melania outperformed so badly in that specific context proves the problem was content-specific, not market-wide.

After opening at third place on the box office charts, Melania plummeted to ninth place by week two. It went from being a top-three cultural event to becoming an afterthought in just seven days. For a film banking on curiosity and controversy to drive attendance, this represents an epic failure in converting initial interest into sustainable audience loyalty.

Why Documentaries Crash Harder Than Narrative Films

Documentaries have different viewing dynamics than fictional films. When you see a documentary once, you've experienced the content. Rewatch value is limited unless the film offers new layers of analysis or emotional resonance that deepens on second viewing. Most documentaries don't meet that threshold.

Narrative films, by contrast, can be experienced differently on repeat viewings. Comedy gains from shared laughs with friends. Drama deepens with emotional investment. Action films offer spectacle that benefits from theatrical presentation. But documentaries? Once you know the story, the facts, and the narrative arc, theatrical presentation offers diminishing returns.

This is why streaming is the natural home for documentary content. People want to watch documentaries on their own time, pause to discuss points with whoever's in the room, and integrate viewing into their daily lives rather than scheduling a dedicated theater trip.

Amazon's decision to pursue theatrical as the primary release channel was fundamentally misaligned with how documentary audiences actually consume content.

The Critical vs. Audience Rating Paradox

When 99% Audience Approval Becomes Suspicious

Amazon's documentary received universally negative reviews from professional critics. Major publications criticized everything from editorial choices to factual accuracy to narrative structure. The critical consensus was clear: this was not a well-made documentary.

Yet the film achieved a 99% audience score on Rotten Tomatoes, the rating aggregation platform. This disparity was so unusual, so mathematically improbable, that Rotten Tomatoes felt compelled to issue a public statement explaining that the score was indeed real and not an error.

What happened here? Several possibilities:

First, the audience rating could reflect actual positive reception from people who paid to see the film in theaters. But this seems unlikely given the 67% second-weekend drop and poor word-of-mouth.

Second, the rating could reflect a deliberate campaign by supporters to artificially inflate the score by rating the film highly on the platform. Rotten Tomatoes has long struggled with review bombing on politically controversial films. The audience score has become less reliable as a metric precisely because it's vulnerable to organized rating campaigns from ideological groups.

Third, the disparity could reflect different audience segments. The people willing to pay $15-20 for a theatrical ticket to see a Melania Trump documentary might be a highly self-selected group of supporters, while the broader audience that might watch on streaming platforms includes more skeptics and critics.

The Credibility Cost

Rotten Tomatoes' decision to defend the 99% audience score as legitimate created a credibility problem. When the platform needs to issue official statements explaining why a rating isn't fake, it undermines trust in the entire scoring system. Audiences rely on ratings to make decisions. When those ratings appear manipulated, the platform's utility declines.

For Amazon, this created an awkward situation. The studio wanted to trumpet positive audience reception to offset critical panning. But a 99% score that required official platform defense wasn't the powerful marketing tool Amazon hoped for. Instead, it became evidence of how controversial and divisive the film was.

This reveals something important about political content in the streaming era. Documentaries about contentious figures generate passionate reactions, but not necessarily in ways that translate to sustainable audience engagement or word-of-mouth recommendations. You can have ardent supporters and ardent detractors, but the middle ground—the people who might casually watch and tell friends about it—remains empty.

Why Theatrical Was the Wrong Distribution Channel

The Documentary Audience Problem

People who watch documentaries in the streaming era have fundamentally different consumption patterns than theatrical audiences. Theatrical documentary viewers are a small, dedicated subset of the broader documentary audience. They're willing to plan ahead, travel to theaters, and pay premium prices. But they're also typically more critical, more sophisticated, and more likely to care about film quality, directorial vision, and artistic merit.

This creates a mismatch with a Melania Trump documentary. The film isn't trying to be a prestige project comparable to "Free Solo" or a Ken Burns retrospective. It's a topical, newsworthy documentary designed to capitalize on public curiosity about a political figure. This type of content appeals to a mass audience on streaming, but a narrow audience in theaters.

Theatrical audiences want event experiences, artistic significance, or spectacular visuals that justify the trip. A documentary about a political figure doesn't offer any of those things. It offers information that could be consumed more conveniently at home.

The Streaming Natural Advantage

Amazon Prime Video had every advantage to make this film successful, yet the company chose theatrical release. This decision reveals a fundamental misunderstanding of how streaming has changed audience behavior.

On Prime Video, the film would have been instantly accessible to 200+ million subscribers. No scheduling required. No travel necessary. People could watch at their own pace, share with friends, and discover through algorithmic recommendations. The platform's recommendation engine could target the likely audience segments—people interested in political content, biography, celebrity documentaries, and contemporary history.

The economics would have been completely different. Instead of spending $35 million on traditional marketing to drive theatrical attendance, Amazon could have spent a fraction of that on targeted streaming advertising, knowing that conversion rates would be exponentially higher when the content is immediately accessible.

A $75 million investment makes sense if you're driving hundreds of millions of streaming impressions and cultivating subscriber interest. It makes no sense if you're hoping to drive theatrical ticket sales for a documentary about a political figure.

The Prestige Argument vs. Reality

Some industry analysts suggested Amazon pursued theatrical to lend prestige and legitimacy to the documentary. Theatrical release implies artistic significance and quality in ways streaming releases don't. But this argument fails on execution. Prestige documentaries that justify theatrical release feature celebrated directors, significant artistic achievement, or spectacular cinematography that benefits from theater screens.

The Melania documentary met none of these criteria. It wasn't directed by an Oscar-winning filmmaker. It didn't feature innovative filmmaking techniques or visual spectacle. It was straightforward biography that happened to be about a controversial figure. That's not prestige content, no matter where you release it.

Prestige comes from critical reception and audience regard, not from theatrical release. This documentary received critical panning and audience suspicion. No distribution channel was going to change those fundamental problems.

Melania experienced a 67% drop in its second weekend, significantly higher than the typical 50-60% drop and the 47% drop of 'Send Help'. This suggests poor audience retention and word-of-mouth. Estimated data for typical films and Super Bowl effect.

The Super Bowl Weekend Factor: Not Actually the Problem

What Super Bowl Does to Box Office

Super Bowl weekend consistently depresses box office numbers. Sports fans prioritize the game over movies. Families gather around televisions. The cultural event dominates leisure time. Most years, box office drops 10-20% during Super Bowl weekend compared to normal weekends because of reduced theater attendance.

Amazon and industry observers pointed to Super Bowl weekend as context for Melania's collapse. This was an implicit excuse: the broader market was down, so the film's performance should be understood in that light. This argument would have merit if all films suffered equally. They didn't.

"Send Help," the weekend's number-one film, declined only 47%. That's significantly better than Melania's 67% drop. Both films faced the same Super Bowl headwind. Both competed for the same audience's leisure time. Yet one held its audience substantially better than the other. The difference wasn't external market factors—it was the films themselves.

Why Super Bowl Affected Melania More

The Melania documentary likely attracted a specific demographic: older viewers, political enthusiasts, and people with strong opinions about Melania Trump herself. These viewers already have entertainment options. Super Bowl weekend didn't create the collapse—it provided an excuse for viewers who were already losing interest.

"Send Help," being a broader comedy with wider appeal, maintained its audience better because different audience segments have less competing attractions. Younger viewers weren't as interested in Super Bowl parties. Comedy fans who saw it opening weekend had stronger reasons to tell friends and family. The film's natural appeal transcended the Super Bowl factor.

The Super Bowl weekend context obscured the real issue: the documentary was losing audience interest due to fundamentals—critical reception, limited word-of-mouth appeal, and niche audience segments. The weekend timing was a convenient explanation, but not the root cause.

Breaking Even: The Math Behind the Disaster

Total Acquisition and Marketing Cost: $75 Million

- Film acquisition: $40 million

- Marketing and promotion: $35 million

- Total sunk cost: $75 million

Current Revenue: $13.5 Million

Gross box office domestic:

The Break-Even Threshold

Using the Rentrak formula for total revenue needed:

With a $75 million total cost and a 50% exhibitor share:

The film needs to reach

International and Ancillary Revenue

The

Even accounting for ancillary revenue, the film is looking at total revenue in the

What This Means for Studio Decision-Making

For a media company like Amazon with annual entertainment budgets in the billions, a

This loss also impacts future greenlight decisions. Studios become more cautious after spectacular failures. Amazon may be more skeptical about documentary acquisitions generally, or about theatrical releases for non-prestige documentaries specifically. The downstream effects of this decision will ripple through the industry.

The Streaming Strategy Mismatch

Why Amazon Actually Owns Documentary Distribution

Amazon Prime Video has become the dominant documentary distribution platform. The service has excellent documentary discovery algorithms, a massive subscriber base actively consuming documentary content, and sophisticated recommendation systems that can surface niche documentaries to interested audiences. The platform's documentary success rate is dramatically higher than theatrical distribution for this content category.

Conversely, theatrical documentary releases have declined steadily. Five years ago, 50+ documentaries received wide theatrical releases annually. Today, fewer than 30 receive meaningful theatrical distribution. Audiences have shifted. Consumption patterns have changed. Documentary filmmakers should be distributing on streaming platforms, not forcing films into theatrical molds they don't fit.

Amazon's decision to pursue theatrical release for the Melania documentary contradicted everything the company knows about documentary audiences and distribution strategy.

The Subscriber Acquisition Cost Problem

Streaming platforms measure success not just in direct revenue but in subscriber acquisition and retention. A controversial documentary like this could have driven significant Prime Video trial sign-ups. People curious about Melania Trump might have signed up for a free trial specifically to watch the film, then remained as paying subscribers.

Amazon rarely discloses how much individual pieces of content contribute to subscriber growth, but documentary releases are known to be efficient subscriber drivers. Making the film immediately available on Prime Video would have been far more valuable to Amazon's core streaming business than theatrical exhibition.

Instead, Amazon spent $75 million to chase theatrical revenue that was never going to materialize at necessary scale. This represents a fundamental misalignment between company strategy and content distribution decision-making.

The Amazon documentary received a 20% critical rating versus a 99% audience score, highlighting a significant disparity likely influenced by review bombing. Estimated data.

Industry Implications: The Death of Theatrical Ambitions for Niche Content

What This Teaches Streaming Studios

The Melania documentary collapse will likely accelerate a trend already underway: streaming platforms will reduce theatrical release experiments for niche, non-prestige documentaries and limited-appeal content. The financial case for theatrical distribution is increasingly weak unless content has true blockbuster potential or significant awards-season viability.

For documentaries about political figures, cultural personalities, or current-events topics, the financial logic points decisively toward streaming. Production companies and platforms should internalize this lesson: niche documentaries belong on streaming platforms, not in theatrical distribution.

This doesn't mean the end of theatrical documentaries. Prestige projects, visually spectacular films, and true cinematic experiences will continue theatrical releases. But the long tail of documentaries—the ones covering interesting but not blockbuster topics—will increasingly skip theatrical entirely and go directly to streaming.

Amazon's expensive failure accelerates this inevitable transition.

Competitive Intelligence for Other Studios

Other streaming platforms watching this collapse learned valuable lessons. Netflix, Apple TV+, Disney+, and HBO Max all noticed that Amazon spent $75 million on a theatrical experiment that failed spectacularly. None of these competitors are likely to replicate Amazon's approach for similar content.

Instead, expect to see more direct-to-streaming releases for documentary and limited-appeal content. Budget allocations will shift away from theatrical marketing and toward targeted streaming promotion. The documentary acquisition market will cool, as studios become more conservative about spending premium prices on unproven properties.

For filmmakers, this is actually unfortunate. The theatrical experiment's failure might reduce acquisition budgets for documentary content generally, making it harder to fund ambitious documentary projects. The creative industry may end up worse off because Amazon made such a poor strategic decision.

Amazon's Response and Spin Control

The Kevin Wilson Statement and Strategic Reframing

Amazon's head of domestic theatrical distribution, Kevin Wilson, released a carefully worded statement attempting to reframe the collapse: "Together, theatrical and streaming represent two distinct value creating moments that amplify the film's overall impact."

This is corporate-speak for: "We're losing money on theatrical, but that's fine because we're planning to make money elsewhere." Translation: the theatrical release was never expected to be profitable; it was always a stepping stone to a streaming release that would supposedly drive greater value.

But this explanation creates a logical problem. If theatrical was always intended as a loss-leader for streaming, why spend

Amazon's reframing suggests the company is backpedaling from an expensive strategic mistake. They're attempting to create a narrative where theatrical failure doesn't matter because the real strategy was always to eventually release on streaming. But that narrative doesn't hold up to scrutiny. If that was the real strategy, theatrical was unnecessary and wasteful.

The Timing of the Pivot

Watch for Prime Video to release the documentary on the platform shortly. Amazon will likely announce the streaming release as a "triumph," claiming that reaching hundreds of millions of subscribers represents success regardless of theatrical performance. The company will publish impressive streaming viewership numbers (without providing context for what "impressive" means for documentaries) and claim vindication for the overall strategy.

But this pivot won't change the underlying financial reality. The company lost approximately $50 million on a bad decision. Reframing that loss as part of a larger strategy doesn't make it less expensive or less damaging.

The Role of Political Content in Modern Media

Why Political Documentaries Are Risky

Political content has become increasingly polarizing. Audiences don't watch political documentaries neutrally; they watch with preexisting opinions about the subject matter. This creates extreme rating patterns—people who are sympathetic give high ratings regardless of quality, while detractors give low ratings regardless of execution.

For the Melania Trump documentary, this dynamic produced the 99% audience rating paradox. Supporters rated it highly as a cultural artifact, regardless of film quality. Critics either avoided it entirely or rated it critically. The middle ground—people who might watch out of curiosity and recommend to friends—barely exists for political content.

This is fundamentally different from other documentary subjects. A nature documentary, a true-crime story, or a biographical film about an apolitical figure can appeal to broader audiences with diverse political views. Political content inherently appeals to narrower, more ideologically aligned audiences.

Streaming platforms understand this. They recognize that political documentaries have limited appeal in theatrical distribution but potentially valuable appeal to ideologically motivated streaming subscribers. The economics work better on streaming for this specific content category.

The Trump Factor

Any documentary about Donald Trump, Melania Trump, or anyone closely associated with Trump enters an extremely polarized media environment. Supporters will view it through a favorable lens. Critics will scrutinize it skeptically. Mainstream audiences will largely avoid it due to the political baggage.

Amazon executives presumably calculated that the Trump name alone would drive curiosity and ticket sales. They miscalculated how that curiosity translates to actual theater attendance in a polarized environment. Theater-going requires commitment—you have to plan, travel, pay money. For controversial political content, that commitment barrier is higher. Streaming lowers that barrier dramatically.

Future documentaries about controversial political figures should probably skip theatrical entirely. Streaming is the natural channel for content that attracts ideologically motivated audiences.

The Melania Trump documentary experienced a significant 67% revenue drop from its first to second weekend, highlighting the strategic misalignment of its theatrical release. Estimated data.

Lessons in Budget Discipline and Strategic Alignment

The $40 Million Acquisition Question

The most glaring mistake wasn't the marketing spend or the theatrical release decision—it was the initial $40 million acquisition price. That number set off alarm bells for industry observers because it lacked justification.

Production companies typically acquire film rights based on:

- Expected box office revenue potential

- Awards-season viability

- Streaming subscriber acquisition value

- Brand partnership value

- Strategic or political motivations

For this documentary, the first four factors didn't justify a

This is where strategic discipline breaks down. Studios should have policies limiting acquisition prices relative to realistic revenue projections. A

Budget Variance Analysis

Once the

A better approach: if the

This is a difficult lesson for large corporations. Nobody wants to admit a

The Future of Documentary Distribution

Streaming-First Strategy

The Melania documentary collapse will accelerate adoption of streaming-first strategy for documentaries across the industry. Production companies, platforms, and filmmakers will increasingly recognize that theatrical distribution adds cost and complexity without corresponding revenue for niche documentary content.

Expect to see:

- Acquisition prices decline for documentary content as studios become more conservative

- Theatrical exclusivity periods shrink from 45-60 days to 7-14 days for limited releases

- Direct-to-streaming launches increase for documentary content that's not designed for theatrical prestige

- Festival-to-streaming pipelines accelerate as Sundance, SXSW, and other festival premieres lead directly to streaming platforms

- Marketing budgets rebalance away from theatrical promotion toward targeted streaming advertising

This shift isn't necessarily bad for the industry. It aligns distribution with audience behavior and reduces wasted spending. Documentaries will reach larger audiences on streaming platforms than they would in limited theatrical releases. The ecosystem becomes more efficient.

Quality Implications

One concern: will higher quality and prestige documentaries suffer if theatrical releases become less common? Will filmmakers lose the financial incentive to pursue ambitious, expensive documentary projects if theatrical distribution is removed from the financial model?

Probably not. Prestige documentaries will continue theatrical releases because they offer something theatrical audiences value: artistic vision, visual spectacle, or cinematic experience. True prestige projects like nature documentaries, visual essays, and films intended for festival circuits will continue pursuing theatrical. The content that loses theatrical access will be niche documentaries about topical subjects—exactly the category that doesn't benefit from theatrical presentation anyway.

Over time, this should improve both theatrical and streaming. Theatrical gets fewer, higher-quality documentaries. Streaming gets more diverse documentary content optimized for its platform. Both audiences benefit.

How Streaming Platforms Should Evaluate Acquisitions

The Acquisition Framework

Streamers should establish clear frameworks for acquisition decisions:

Market analysis: What's the addressable audience? How does the target audience consume similar content? What's the competitive landscape?

Subscriber acquisition value: Will this content drive new subscriber sign-ups? Will it improve retention? What's the estimated lifetime value of acquired subscribers?

Library building: Does this content fill gaps in the library? Does it align with existing content strengths? How does it position the platform competitively?

Financial return: What are realistic revenue projections from all channels? What's the payback period? What's the acceptable loss threshold?

Strategic fit: Does this align with the platform's overall brand and positioning? Does it serve existing subscribers? Does it extend reach to new audiences?

The Melania documentary likely failed on most of these criteria. The subscriber acquisition value was uncertain for polarizing political content. The library-building value was limited—documentaries about contemporary political figures rarely achieve long-term value. The financial return projections should have been obviously negative.

Setting Price Discipline

Platforms should implement price discipline:

- Documentary acquisitions should rarely exceed 30-40% of projected total revenue

- Niche documentaries should have hard price ceilings ($5-15 million)

- Political documentaries require premium content to justify premium prices

- Novelty or topical value shouldn't drive acquisition prices above fundamentals

Amazon violated multiple discipline rules with the Melania acquisition. The $40 million price represented approximately 60% of even optimistic revenue projections. That's unsustainable math.

Amazon's documentary experienced a severe 67% drop in its second weekend box office, significantly higher than its competitor's 47% drop. Despite this, it achieved an unusually high 99% audience score on Rotten Tomatoes.

Competitive Takeaways for Streaming Platforms

Netflix's Advantage

Netflix has historically been more disciplined about documentary spending. The platform invests in original documentary production rather than acquiring finished films. This gives Netflix better margins, more creative control, and content better optimized for streaming audiences.

Netflix also benefited from studying theatrical experiments by competitors. Watching Amazon, Disney+, and others learn expensive lessons about theatrical distribution, Netflix refined its strategy toward pure-play streaming content with minimal theatrical ambitions.

Apple TV+ Strategy

Apple TV+ has taken a different approach: acquire prestige documentaries and films that justify theatrical releases due to artistic merit or awards-season viability. The platform releases select titles theatrically for prestige positioning, then transitions to streaming after appropriate windows.

This is fundamentally different from the Melania approach. Apple acquires prestige content that benefits from theatrical recognition. Amazon tried to create prestige through theatrical release, a backward strategy that failed.

Disney+ and HBO Max

Both platforms primarily release documentaries directly to streaming, occasionally making exceptions for prestige documentary features that justify theatrical runs. They maintain discipline about acquisition prices and focus on maximizing subscriber value rather than theatrical returns.

Both platforms learned from competitors' mistakes and implemented conservative acquisition strategies accordingly.

The Content Acquisition Market Impact

Cooling Documentary Budgets

The Melania documentary's collapse will chill documentary acquisition and production budgets across the industry. Studios will become more conservative about bidding wars for documentary content. Prices will decline. Acquisition budgets will shrink.

This creates downstream effects:

- Documentary filmmakers will have harder time securing financing

- Production companies will be more cautious about ambitious documentaries

- Independent filmmakers may shift toward television or podcast production

- Documentary festival prestige will become more important for financing

For content creators, Amazon's expensive lesson translates to reduced opportunity in the market.

The Prestige Documentary Advantage

Documentaries with strong awards-season viability or critical prestige will continue commanding premium prices and acquisition interest. The market will bifurcate between:

- Prestige documentaries: Premium pricing, theatrical releases, awards campaigns, potential for significant subscriber acquisition

- Niche documentaries: Conservative pricing, streaming-first releases, targeted subscriber appeals, faster payback horizons

Filmmakers targeting prestige status (festivals, critical acclaim, director reputation) will find reasonable acquisition markets. Filmmakers creating topical or celebrity content will find a much tougher environment.

What Amazon Should Do Next

The Inevitable Streaming Release

Amazon will release the Melania documentary on Prime Video, probably within 90 days of the theatrical run. The company will announce impressive streaming numbers without providing comparative context. Headlines will tout "millions of viewers" without clarifying whether that represents success or modest performance.

This is corporate spin control: converting a theatrical failure into a streaming story by moving goalposts. It's not dishonest per se, but it's definitely misdirection.

Accountability Measures

Internally, Amazon should implement accountability for the executives responsible for this acquisition decision. The $75 million loss is recoverable for a company of Amazon's scale, but the decision-making process that led to such poor judgment requires correction.

This might mean:

- Reassignment of executives responsible for acquisition approvals

- Revised acquisition frameworks with stricter price discipline

- Increased scrutiny of theatrical release decisions for niche content

- Post-mortems on the decision-making process that led to the inflated acquisition price

Without accountability, the decision-making patterns that produced this failure will persist.

Strategic Learnings

The most important learning: distribution strategy should drive acquisition decisions, not the reverse. Amazon should have determined the optimal distribution channel for a Melania Trump documentary (clearly streaming) and then negotiated acquisition prices based on streaming value, not on abstract prestige or theatrical aspirations.

Future acquisitions should follow this logic:

- Identify target audience and optimal distribution channels

- Model revenue potential based on realistic audience capture

- Price acquisitions accordingly

- Execute distribution strategy aligned with that pricing discipline

The Melania documentary reversed this logic. Amazon paid premium theatrical prices for content optimized for streaming. That fundamental misalignment doomed the project.

Broader Media Industry Trends

The Theatrical vs. Streaming Divide

The film industry is experiencing a permanent shift in which content belongs in theaters and which belongs on streaming. Theatrical is increasingly reserved for:

- Blockbuster franchises and sequels

- Big-budget action and spectacle films

- Prestige awards contenders

- Event films designed for theatrical presentation

Streaming dominates:

- Documentaries and limited-appeal content

- Niche documentaries and specialty content

- Television-adjacent content

- Direct-to-consumer distribution

The Melania documentary collapse accelerates this bifurcation. Content that doesn't fit theatrical economics clearly belongs on streaming.

The Future of Documentary

Documentary filmmaking will evolve in response to these changing distribution realities. Producers will optimize for streaming presentation rather than theatrical presentation. Camera techniques, editing patterns, and narrative structures will shift to accommodate smaller screens and home viewing.

This isn't inherently negative. Documentaries optimized for streaming can be brilliant. The shift simply reflects changed audience behavior and distribution economics.

Filmmakers should embrace streaming as the primary distribution channel for documentary content. Fighting that reality, as Amazon did with the Melania project, produces expensive failures.

FAQ

Why did Amazon spend $75 million on this documentary?

Amazon spent

What does a 67% second-weekend drop mean for films?

A 67% second-weekend drop is catastrophic and indicates severe audience dissatisfaction or lack of word-of-mouth promotion. Typical films see 50-60% second-weekend declines as audiences naturally thin and new releases compete. This film's steeper decline suggests audiences weren't recommending it to friends and the film failed to expand its appeal beyond initial curiosity-driven opening-weekend viewers who saw it because of the controversy.

Why was theatrical the wrong distribution strategy for this documentary?

Documentary audiences in 2025 prefer streaming over theatrical viewing because documentaries require commitment to watch, don't benefit from theatrical presentation, and are more convenient to consume on-demand at home. A political documentary about Melania Trump had even narrower theatrical appeal than typical documentaries because the audience is highly polarized and ideologically motivated, making them less likely to commit to theater trips but more likely to watch on familiar streaming platforms.

How much money did Amazon actually lose on this project?

Based on current box office performance of

What is the Rotten Tomatoes 99% audience score and why is it suspicious?

The 99% audience score on Rotten Tomatoes represents ratings from viewers who purchased tickets to see the film in theaters. This score is unusually high compared to critical reviews and second-weekend box office performance, which is why Rotten Tomatoes issued a statement confirming the score was legitimate. The disparity likely reflects review bombing by ideologically motivated supporters who rated the film highly regardless of artistic quality, combined with the self-selected nature of paying viewers who attended theaters.

Will other streaming platforms make similar theatrical experiments?

No. The Melania documentary's failure will likely discourage theatrical release experiments for niche documentaries and limited-appeal content across the industry. Netflix, Apple TV+, Disney+, and HBO Max will become more conservative about theatrical distribution for non-prestige content, shifting toward streaming-first strategies that provide better financial returns and audience reach for niche documentaries.

What should filmmakers learn from this failure?

Filmmakers should prioritize audience behavior and distribution economics when evaluating theatrical versus streaming release. For documentaries about contemporary figures, topical content, or niche subjects, streaming is the superior distribution channel that reaches larger audiences, reduces distribution friction, and provides better returns. Theatrical should be reserved for prestige documentaries with artistic merit or visual spectacle that justifies theatrical presentation.

How does this impact documentary financing?

Amazon's expensive failure will likely reduce documentary acquisition budgets and make financing more difficult for ambitious independent documentary projects. Production companies will become more conservative about bidding on documentary rights. Prestige documentaries with strong festival prospects will command premium interest, while topical documentaries about contemporary figures will face a much tougher financing environment.

Why didn't the Super Bowl effect explain the full collapse?

While Super Bowl weekend depresses box office generally, the Melania documentary's 67% decline was significantly worse than competitors like "Send Help," which only declined 47%. Both films faced identical Super Bowl competition, proving the problem wasn't the external environment but the film itself. The documentary's poor word-of-mouth, critical reception, and limited audience appeal produced the collapse regardless of the weekend context.

What does Amazon's response to the failure reveal?

Amazon's statement about theatrical and streaming as "distinct value creating moments" represented corporate spin control attempting to reframe the theatrical failure as part of a larger strategy. This framing suggests the company is rationalizing an expensive mistake rather than acknowledging the fundamental strategic misalignment between content type and distribution channel. The statement's vagueness and lack of specific metrics indicate Amazon is not claiming victory on any front.

Conclusion: Strategic Misalignment and $75 Million Lessons

The Melania Trump documentary represents one of the most striking examples of a media company misaligning content, distribution strategy, and audience expectations. Amazon had every advantage: a massive streaming subscriber base, sophisticated recommendation algorithms, proven expertise in documentary distribution on Prime Video, and substantial resources to market the film.

Instead, the company pursued theatrical release for a niche political documentary about a controversial figure. The decision contradicted everything we know about documentary audience behavior, streaming advantage, and the economics of theatrical distribution in 2025.

The second-weekend collapse—from

Amazon will likely recover the $75 million loss eventually through a combination of Prime Video streaming, international licensing, and secondary markets. For a company with billions in annual entertainment budgets, this isn't a catastrophic hit. But it should be a strategic inflection point.

The real cost isn't just the money. It's the lesson: streaming-first thinking should dominate acquisition decisions. Distribution strategy should drive content acquisition, not the reverse. Price discipline and financial fundamentals should constrain acquisition enthusiasm. Theatrical prestige shouldn't drive decisions about topical, niche documentary content.

Every streaming platform that watched Amazon's expensive failure learned something valuable. Future documentaries will be better distributed. Acquisition prices will be more disciplined. Theatrical experiments will be reserved for content that actually benefits from theatrical presentation.

The Melania documentary's box office collapse wasn't just a failure—it was a necessary correction in how the media industry thinks about documentary distribution and streaming strategy. Sometimes the most valuable lessons come from expensive mistakes. This one cost $75 million, but it will prevent similar mistakes across the industry for years to come.

For Amazon, the path forward is clear: pivot to Prime Video release, claim success based on streaming metrics, and learn from the strategic misalignment that produced this loss. For the industry, the path is equally clear: theatrical documentaries are increasingly obsolete for niche content. Streaming is the natural home for documentary films.

The question now is whether Amazon and other studios will internalize these lessons or repeat similar mistakes with different projects. Based on historical patterns, expect some studios to learn, others to repeat similar errors. But the Melania documentary collapse made the case clearly enough: niche documentaries belong on streaming, and theatrical experiments on such content are expensive mistakes waiting to happen.

The $75 million price tag for that lesson is steep, but in the long run, it might prevent billions in wasted spending across the industry.

Key Takeaways

- Amazon's 40M acquisition +13.5M box office revenue, representing a $50M+ loss on the Melania documentary

- The film's 67% second-weekend drop from 2.37M was significantly steeper than competitor films, proving the problem was content-specific, not market conditions

- Theatrical distribution was fundamentally misaligned with documentary audience behavior, which strongly prefers streaming over theater attendance for topical content

- The 99% Rotten Tomatoes audience score combined with universal critical panning revealed the polarized political nature of the content and review platform vulnerabilities

- Documentary acquisition prices and theatrical release strategies will become more disciplined across the industry following this expensive failure as a cautionary lesson

Related Articles

- Spotify's Song Stories Feature vs YouTube Music's Free Tier Changes [2025]

- The 24 Best Movies on Amazon Prime Video [2025]

- Prime Video's Steal: A Thrilling Heist That Delivers [2025]

- Best Amazon Prime Shows to Watch Right Now [2025]

- Celebrity Traitors UK Season 2: Seven Dials Cast Want In [2025]

- Best Streaming Shows & Movies This Weekend [January 2025]

![Amazon's Melania Documentary Box Office Collapse: Why Theatrical Release Failed [2025]](https://tryrunable.com/blog/amazon-s-melania-documentary-box-office-collapse-why-theatri/image-1-1770592002630.jpg)