Apple's $2 Billion UK Antitrust Appeal: Everything You Need to Know

Apple just made a bold move. The tech giant has filed an appeal with the UK's Court of Appeal to challenge a roughly $2 billion fine stemming from an antitrust lawsuit. This isn't some small legal skirmish. This is about the fundamental way Apple controls its App Store ecosystem, charges developers, and extracts fees from transactions happening on its platform.

Let me walk you through what happened, why it matters, and what comes next.

TL; DR

- The Fine: A UK court ordered Apple to pay approximately £1.5 billion ($2 billion USD) for abusing its dominant market position through App Store fees as reported by Engadget.

- The Ruling: The Competition Appeal Tribunal found Apple engaged in anticompetitive practices by forcing developers to use Apple's payment system at 30% commission rates according to The Guardian.

- The Appeal: Apple has now escalated the case to the UK's Court of Appeal, bypassing the Competition Appeal Tribunal's decision as noted by Apple Insider.

- The Stakes: A potential payout to UK App Store users who made purchases between 2015 and 2024, or a precedent-setting victory for Apple as discussed by WebProNews.

- The Timeline: Court of Appeal proceedings could take months or years to resolve according to Mayer Brown.

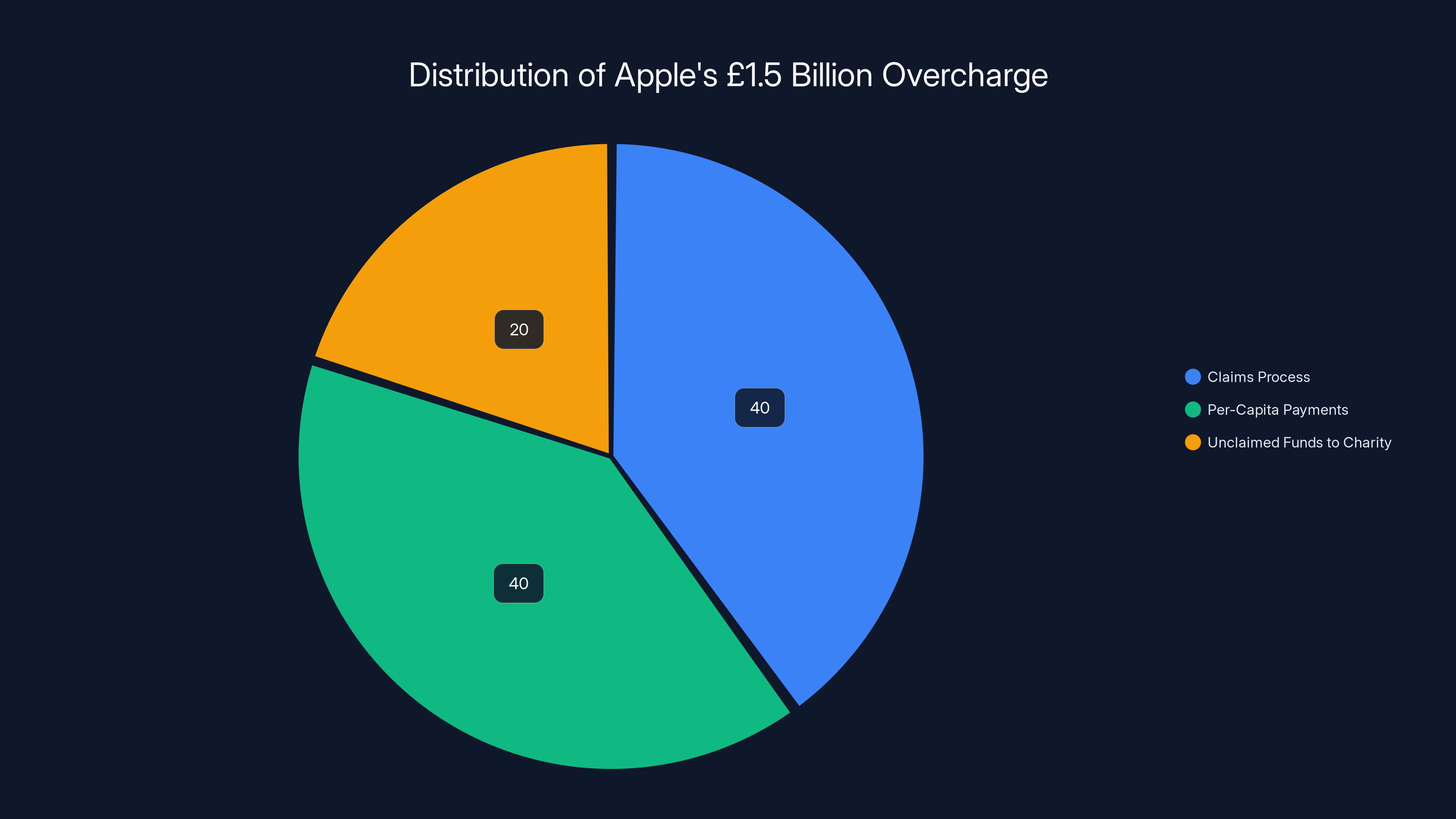

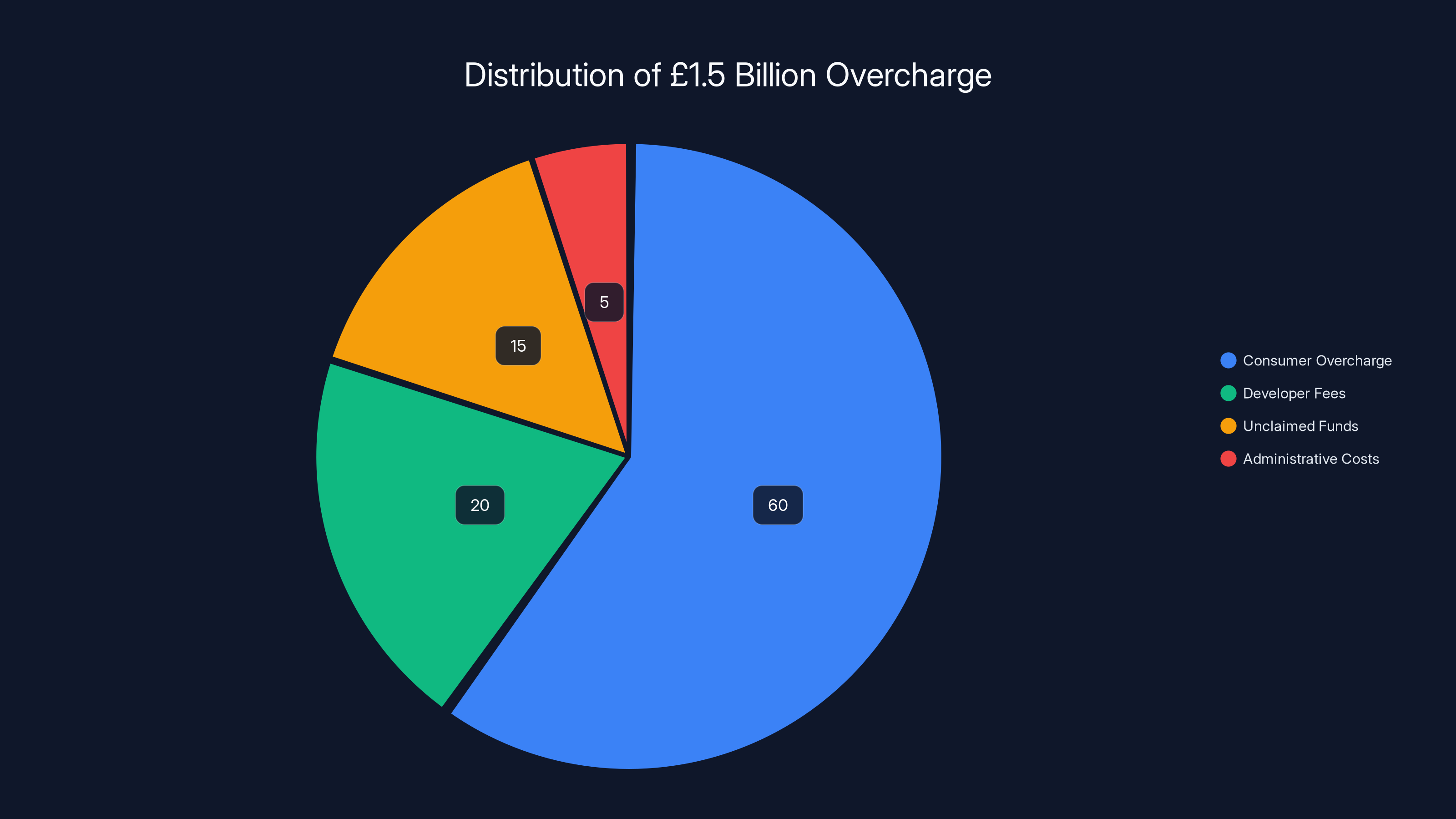

Estimated data showing potential distribution methods for Apple's £1.5 billion overcharge in the UK. Claims process and per-capita payments could each account for 40% of the total, with unclaimed funds potentially going to charity.

Understanding the Original Ruling and Why Apple Lost

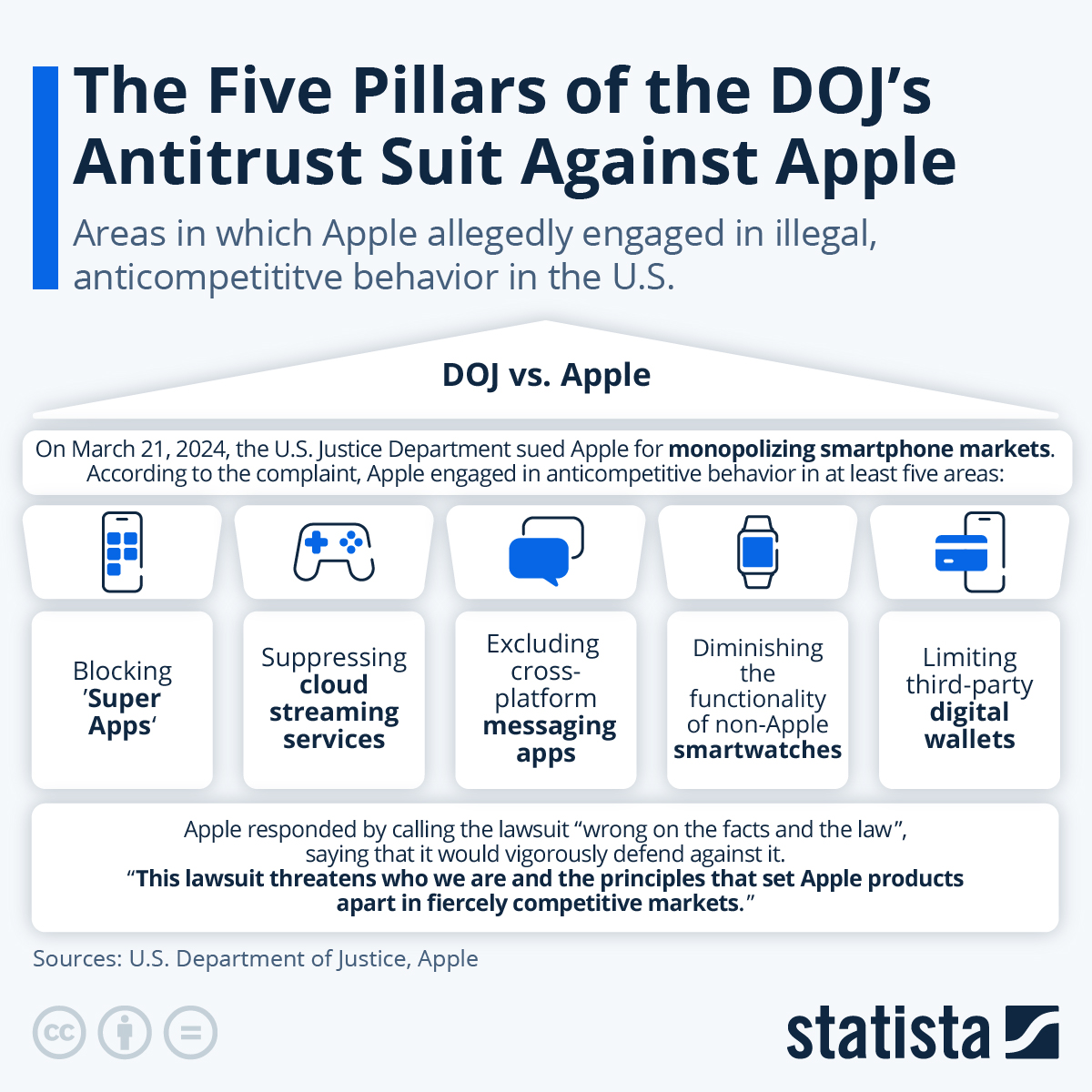

Let's start with what actually happened in October 2024. The UK's Competition Appeal Tribunal (CAT) handed down a decision that fundamentally challenged Apple's App Store business model. The court didn't just slap Apple with a fine and move on. It found that Apple had systematically exploited its dominant market position to extract unfair fees from developers and, ultimately, consumers as detailed by Engadget.

The core argument was straightforward but damaging to Apple's case. By forcing all iOS developers to process payments through Apple's proprietary payment system, and by taking a 30% cut of every transaction, Apple created an anticompetitive environment. Developers couldn't offer their products through alternative payment processors. They couldn't negotiate fees. They couldn't direct users to cheaper alternatives. They had one choice: pay Apple 30% or don't distribute on iOS as reported by PPC Land.

What made this ruling particularly significant was the tribunal's reasoning. They didn't attack Apple for being successful or for having high fees in general. They attacked Apple for using its market dominance as a weapon. When you control the only way to reach 2 billion iPhone users globally, the tribunal argued, you can't simultaneously act as the referee and the player as noted by The Guardian.

The CAT estimated that between 2015 and 2024, Apple had collected fees that constituted an overcharge compared to what a competitive market would produce. That overcharge added up to roughly £1.5 billion. The court didn't order Apple to lower its fees going forward. Instead, it determined that users who were effectively overcharged deserved compensation as reported by Gam3s.gg.

Apple's initial response was telling. The company didn't accept the ruling. Instead, it called it a "flawed view of the thriving and competitive app economy." Notice the framing. Apple was saying the App Store is competitive. But the tribunal had just found it wasn't, based on Apple's own monopolistic control according to Engadget.

The Competition Appeal Tribunal Decision Explained

Before Apple's escalation, let's understand what the CAT actually decided. The tribunal didn't make this ruling on a whim. They examined evidence, heard arguments from both sides, and applied decades of UK and EU competition law as detailed by The Guardian.

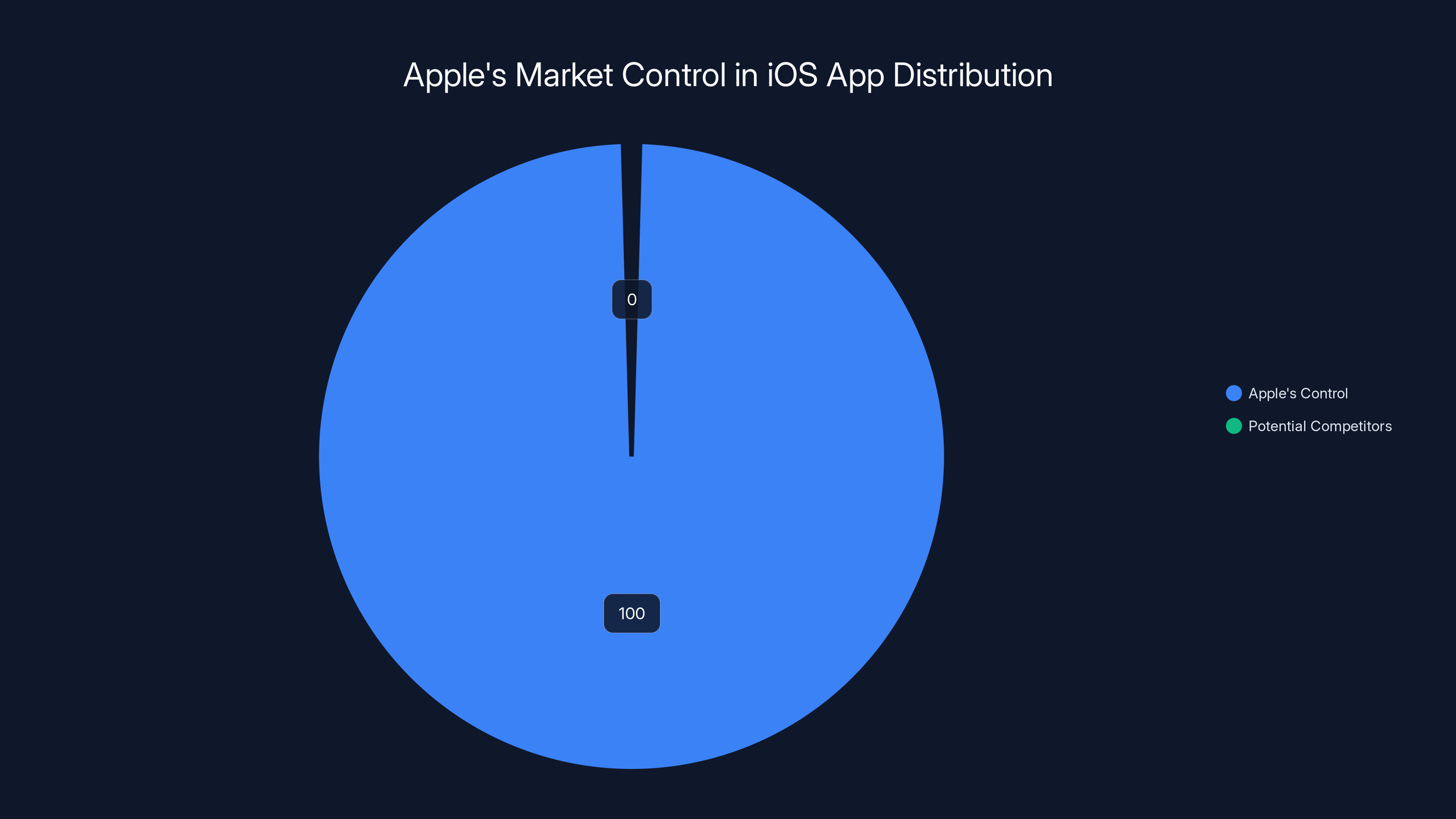

The CAT's analysis broke down into a few key components. First, they established that Apple held a dominant position in the market for app distribution on iOS devices. This wasn't controversial. Apple controls 100% of App Store access for iOS users. That's dominance, full stop according to Statista.

Second, they examined whether Apple abused that dominance. Here's where it got granular. The tribunal looked at Apple's behavior: the mandatory 30% fee, the prohibition on alternative payment methods, the opaque algorithm that determines app visibility, and the lack of any real negotiation mechanism for developers as reported by Engadget.

They found that these practices were anticompetitive because they prevented normal market forces from operating. In a truly competitive market, developers would switch to alternatives if fees got too high. They'd negotiate with multiple distributors. Prices would adjust based on supply and demand. But with Apple's walled garden, none of that happens as noted by WebProNews.

The tribunal also looked at whether these practices had an actual effect on competition. And here's where the economic analysis got interesting. They found that the 30% fee itself might be justifiable as a charge for services Apple provides. But the way Apple enforced it uniformly, with no flexibility and no alternatives, meant developers couldn't compete on payment terms. That artificial rigidity, they argued, was the abuse as detailed by Engadget.

Apple had an opportunity to argue that the 30% fee reflected genuine value provided by the App Store. The tribunal was open to that. But Apple's defense essentially came down to: "Developers are still making money, and the App Store is successful, so it's competitive." The tribunal found that unconvincing as reported by The Guardian.

The tribunal's proposed remedies were interesting too. They suggested that Apple could reduce its commission to somewhere between 15% and 20% per transaction, which is what competitors like Google typically charge. This wasn't arbitrary. The tribunal had examined competitor pricing and market studies to arrive at that range as noted by PPC Land.

Developers retain $150,000 more with a 15% fee compared to Apple's 30%, highlighting significant potential savings and increased capital for innovation and growth.

What the $2 Billion Fine Actually Covers

Now let's talk about the money. £1.5 billion is a significant number, but understanding what it actually represents is crucial.

The tribunal calculated that between 2015 and 2024, Apple had collected overcharges on in-app purchases and subscriptions sold through the App Store. These weren't purchases Apple made directly. They were transactions between developers and consumers. But because Apple controls the payment system and forces everyone through it at a 30% fee, the tribunal viewed consumers as effectively overpaying as reported by Engadget.

Think of it like this: Imagine a shopping mall that controls the only point-of-sale system. It charges every store 30% of every transaction, while other malls charge 15%. If you can't shop anywhere else because this mall has all the stores you want, you're effectively overpaying. The tribunal was saying consumers should get back the difference between what Apple charged and what a competitive market would charge as noted by The Guardian.

Apple's own numbers actually work against it here. The App Store processed hundreds of billions of dollars in transactions during that period. The tribunal estimated that an overcharge of roughly £1.5 billion accumulated from these transactions as detailed by Engadget.

Here's where it gets complicated though. How do you distribute £1.5 billion to millions of consumers across nearly a decade? The tribunal suggested that any payout would need to be distributed to everyone who made purchases in the UK App Store during that period. But calculating individual shares would be a nightmare. A consumer who spent

The tribunal didn't solve this distribution problem in their ruling. They just said the money had to go back to consumers somehow. It's likely that any distribution would involve registration systems, claims processes, or possibly donations to charity if unclaimed funds remained as noted by The Guardian.

Why Apple Is Fighting This and the Appeal Process

Apple isn't appealing because it thinks the tribunal made a minor procedural error. The company is appealing because it fundamentally disagrees with the ruling's entire premise. Apple believes it has the right to charge whatever it wants for the App Store because, well, it's Apple's App Store as reported by Engadget.

This is where legal philosophy meets business reality. Apple's position is essentially: "We built this. We maintain it. We provide security, curation, and a platform that developers couldn't access without us. We should get to decide how much that's worth" as noted by The Guardian.

The tribunal's position is: "Yes, you built it, but now that it's the only way to reach iOS users, it's not really just your private platform anymore. It's essential infrastructure. And when you have that kind of power, market rules apply" as detailed by Engadget.

The appeal process in the UK is important to understand. When Apple appeals to the Court of Appeal, it's not asking for a fresh trial with new evidence. Instead, it's asking a higher court to review whether the lower court made legal errors in its reasoning. Did the CAT misapply competition law? Did they misinterpret precedent? Did they ignore relevant facts? as explained by Mayer Brown.

Apple likely has several angles of attack. First, it might argue that the tribunal misdefined the relevant market. Maybe the correct market to analyze is "digital payments" broadly, not "iOS app distribution" specifically. In a broader market, Apple would have less dominance as noted by The Guardian.

Second, Apple could argue that the tribunal overestimated the overcharge amount. The tribunal itself admitted they used "informed guesswork" to calculate the £1.5 billion figure. Apple will probably argue the tribunal should have used different methodology or different comparators as reported by Engadget.

Third, Apple might claim that even if it does hold a dominant position, its behavior isn't abusive because it provides genuine value and because developers aren't actually harmed (they're still profitable) as detailed by The Guardian.

These arguments will now go to the Court of Appeal, which has broader jurisdiction than the CAT and can reconsider the legal framework entirely as explained by Mayer Brown.

The Broader Context: Global Antitrust Pressure on Apple

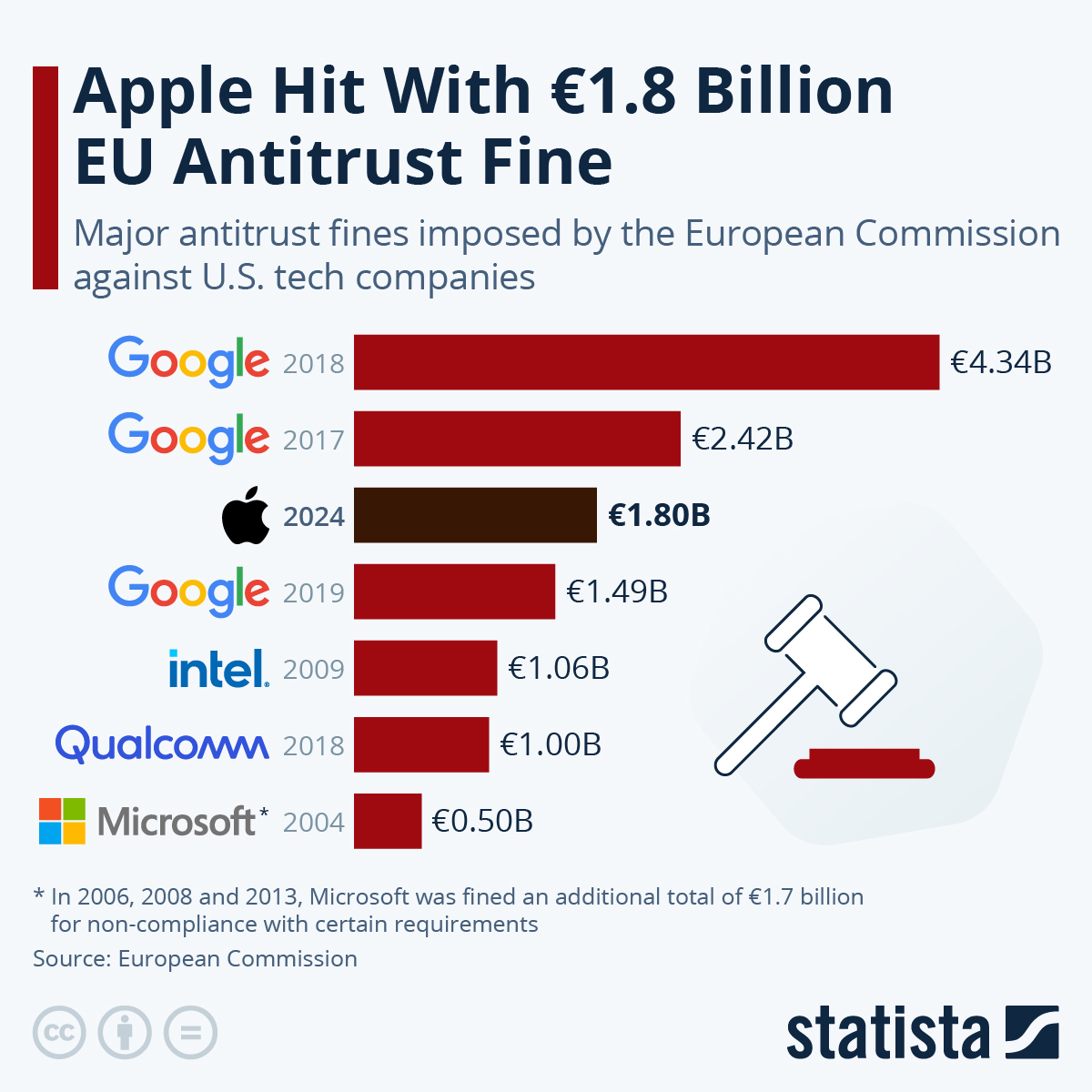

This UK case doesn't exist in a vacuum. Apple is facing antitrust scrutiny across the entire world. Understanding the broader context makes Apple's decision to appeal even more significant as reported by Engadget.

In the European Union, regulators have been extremely aggressive. The EU's Digital Markets Act essentially forced Apple to open up the App Store to third-party app stores and alternative payment systems. Apple fought this hard, dragging its feet on implementation, but ultimately had to comply. If the EU fines Apple for App Store monopoly abuse, those fines could dwarf the UK's £1.5 billion as noted by PPC Land.

In the United States, the situation is more complex. The Epic Games case against Apple went to trial, and while Epic won a significant victory (forcing Apple to allow link-outs to external payment), Apple successfully defended most of its practices. But regulators, including state attorneys general, continue investigating as reported by WebProNews.

South Korea banned Apple from forcing developers to use its payment system. Japan is investigating. The global trend is unmistakably toward opening up Apple's ecosystem as noted by Appleosophy.

So why does the UK case matter in this context? Because it establishes a precedent that developed-economy courts will find Apple's App Store practices anticompetitive if Apple can't prove genuine competitive benefits. A defeat in the UK Court of Appeal would signal to every other regulator that this is a winnable argument as detailed by Engadget.

Conversely, if Apple wins in the UK Court of Appeal, the company gains momentum. It can point to the precedent in defending against cases elsewhere. It also buys time. Each appeal takes years. Apple can keep the fine in legal limbo as noted by The Guardian.

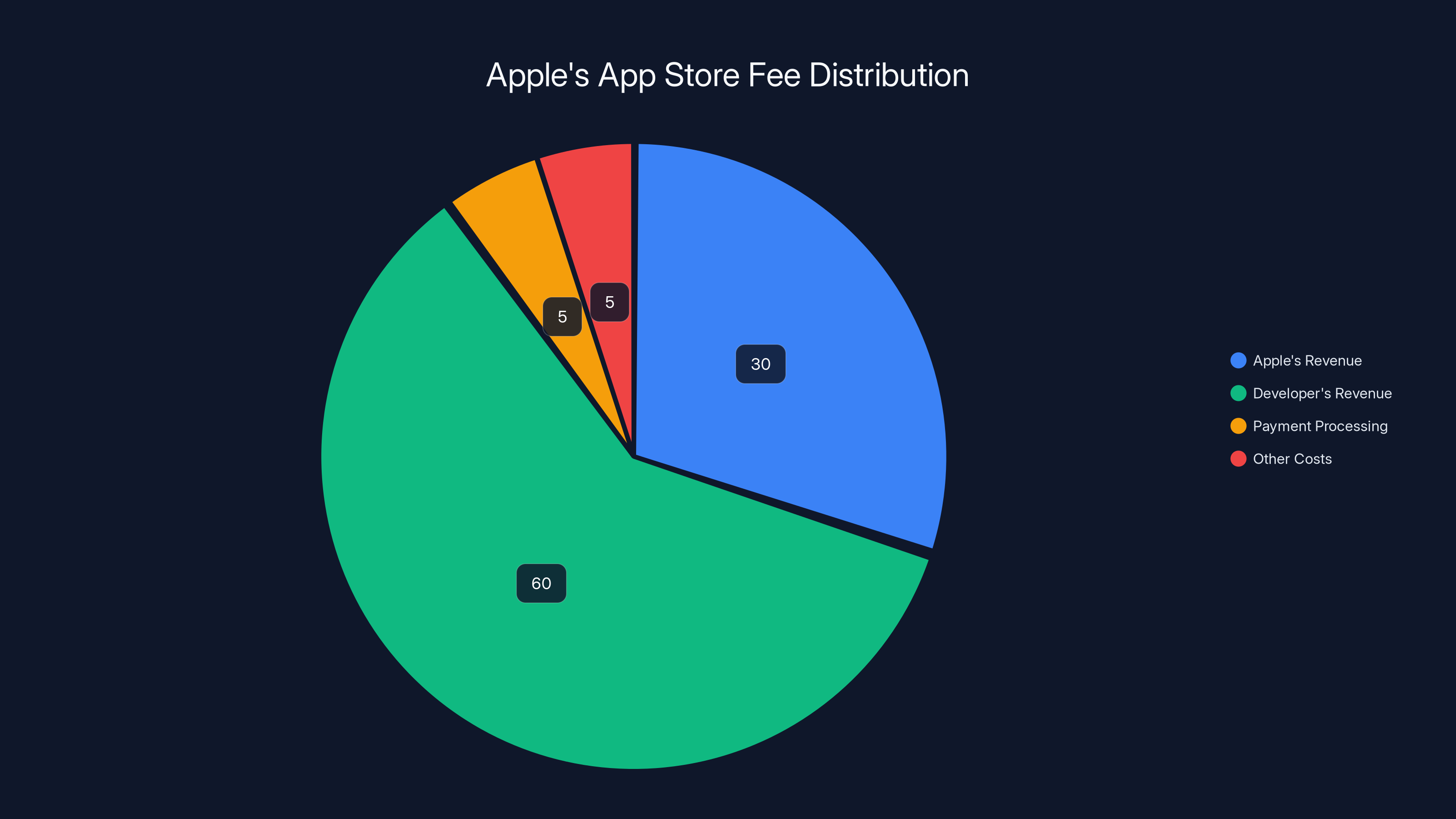

Estimated data shows Apple's 30% commission from App Store fees, with the majority going to developers. Estimated data.

The Economics of 30% vs. 15-20%: Why This Matters

Let's dig into the actual economics of the fee structure. Apple takes 30%. The tribunal says 15-20% would be competitive. What does that difference mean in real money?

Consider a developer earning

Now scale that across millions of apps and billions in annual App Store revenue. According to Statista, the App Store generated roughly

That's not theoretical money. It's real capital that could flow to innovation, job creation, and consumer benefits through lower prices. This is the economic argument behind the tribunal's finding of abuse. The tribunal essentially said: "By maintaining 30% when 15-20% would be competitive, Apple is extracting excess economic rent from the market" as detailed by Engadget.

Apple's defense on this front is weak. The company claims that 30% is necessary to maintain the App Store's quality, security, and discoverability. But competitors charge less and maintain similar quality. Google Play charges 15-30% depending on payment processor, but allows developers to use their own payment systems. The Epic Games Store charges significantly less. This undermines Apple's argument that 30% is a necessary cost recovery fee as reported by Engadget.

However, there's a complicating factor. Apple does provide genuine services. It maintains servers, processes payments, provides fraud detection, handles disputes, curates apps, and creates the discovery ecosystem that makes any app valuable in the first place. A developer can't just list an app and succeed. They need visibility, which Apple's algorithm provides as noted by The Guardian.

The question the tribunal had to answer was: Do those services justify 30% instead of 15-20%? The tribunal said no. Apple will argue yes. That's the crux of the appeal as detailed by Engadget.

How the UK Court of Appeal Process Works

Understanding the procedural path ahead is important because appeals can take years, and the process itself can shift the momentum.

When Apple filed its appeal application, it didn't automatically get to the Court of Appeal. First, it had to get permission to appeal. The Court of Appeal reviews the appeal application and decides whether there are potentially arguable legal grounds to reconsider the CAT's decision as explained by Mayer Brown.

Assuming Apple gets permission (which it almost certainly will, given the stakes and complexity), the case moves to full appellate briefing. Both Apple and the relevant parties will submit written briefs explaining their positions. Apple will argue why the CAT was wrong. The opposing parties will argue why the CAT was right as reported by Engadget.

After briefs, there will likely be oral arguments before a panel of appellate judges. These judges didn't hear the original evidence or see the witnesses. They're reading transcripts and documents. They're evaluating legal reasoning, not reconstructing facts as noted by The Guardian.

The whole process typically takes 12 to 24 months, though complex cases can take longer. During this time, the fine is typically held in abeyance. Apple doesn't pay until the appeal is resolved as explained by Mayer Brown.

The Court of Appeal's options are limited. It can affirm the CAT's decision (Apple loses), reverse it entirely (Apple wins), or reverse and remand for reconsideration (Apple wins procedurally but has to address something on remand). A partial reversal is also possible, where the Court agrees with some of the CAT's findings but not others as detailed by Engadget.

One scenario particularly favors Apple: the Court could agree that Apple engaged in anticompetitive practices but overturn the £1.5 billion fine calculation as too speculative. This would be a pyrrhic victory for Apple (the legal principle stands) but a financial win as noted by The Guardian.

The Implications for Developers and the App Ecosystem

Here's what often gets overlooked: how does this fight affect the millions of developers who actually build and sell apps through the App Store?

For small developers, Apple's 30% fee is often the single largest business expense. A developer making

If the Court of Appeal orders Apple to reduce its fee to 15-20%, it's a game-changer for the entire ecosystem. Small developers become more viable. More people can afford to quit their day jobs and build full-time. More apps reach profitability as reported by Engadget.

Conversely, if Apple wins the appeal, the 30% fee persists indefinitely. Apple signals to regulators that it can successfully defend aggressive fee structures in court. This has ripple effects. If Apple can charge 30%, why not 35%? Why not 40%? as noted by The Guardian.

There's also the question of precedent for other digital platforms. PlayStation, Nintendo, and Microsoft all take cuts for digital content. If Apple successfully defends 30%, it strengthens their positions too. If Apple loses, it suggests that all walled-garden digital platforms face antitrust risk as reported by WebProNews.

The Developer Program might also change. Currently, Apple offers some fee reductions for specific categories (games, media subscriptions). But the base 30% applies to most in-app purchases. The tribunal suggested a more flexible, competitive approach where fees reflect actual competition rather than Apple's decree as detailed by Engadget.

The Competition Appeal Tribunal found that Apple holds 100% control over app distribution on iOS devices, highlighting its dominant market position.

What If Apple Loses the Appeal?

Let's scenario-plan. Suppose the Court of Appeal affirms the CAT's decision. Apple loses the appeal. What happens?

First, the £1.5 billion fine becomes executable. Apple will pay it, though the logistics of distribution remain unsolved. The court will likely order Apple and the parties to work out a claims process. Some money will go to individual consumers who submit claims with proof of purchases. Some might be distributed per-capita to all UK App Store users during the period. Some might go unclaimed and be diverted to charity as reported by Engadget.

Second, Apple faces immediate regulatory pressure everywhere else. The EU, US states, and other countries will cite the decision as precedent. "The UK court found this anticompetitive. Here's why we agree." The legal landscape becomes much harder as noted by The Guardian.

Third, Apple might be forced to lower App Store fees not by court order, but by business pressure. If the UK enforces fee reductions, the EU likely will too. Apple might decide it's better to proactively reduce fees globally than fight every regulator on the planet as reported by PPC Land.

Fourth, developers and consumers gain leverage. If Apple's absolute control is established as legally problematic, alternative distribution channels become more attractive. More developers might accept the pain of alternative app stores as noted by Appleosophy.

Fifth, Apple's Services revenue comes under pressure. The App Store is a cash cow. Lower fees mean lower revenue. Apple might report that to investors in the next earnings call, which could affect stock price as detailed by Engadget.

None of these scenarios is catastrophic for Apple. The company has enormous resources and can adapt. But losing this appeal would be a significant strategic defeat as noted by The Guardian.

What If Apple Wins the Appeal?

Now flip the scenario. Apple wins. The Court of Appeal reverses the CAT's decision, either in whole or in substantial part.

First, Apple avoids the £1.5 billion fine entirely or pays significantly less. This is a direct financial win as reported by Engadget.

Second, Apple gets a legal precedent. The company can cite the decision in defending against other cases. "A UK appellate court found Apple's practices were not anticompetitive." This is powerful in jurisdictions that respect UK legal reasoning as noted by The Guardian.

Third, Apple buys time. Even if this case is resolved, other cases continue. But each legal victory delays the moment when Apple has to fundamentally change its business model. Years of appeals can stretch into decades of status quo as explained by Mayer Brown.

Fourth, Apple's confidence increases. The company can tell regulators: "We've successfully defended this in court. The App Store fees are justified." This makes negotiated settlements less likely as detailed by Engadget.

Fifth, developers get no relief. The 30% fee stays. The ecosystem continues unchanged. Other platforms might be emboldened to increase their own fees as reported by WebProNews.

The real wildcard is what happens if Apple wins but the UK or EU regulators decide to change the law anyway. Even if Apple legally wins this case, legislatures and regulators can change the rules going forward. A court victory doesn't protect Apple from the Digital Markets Act or future legislation as noted by PPC Land.

The Timeline: How Long Will This Take?

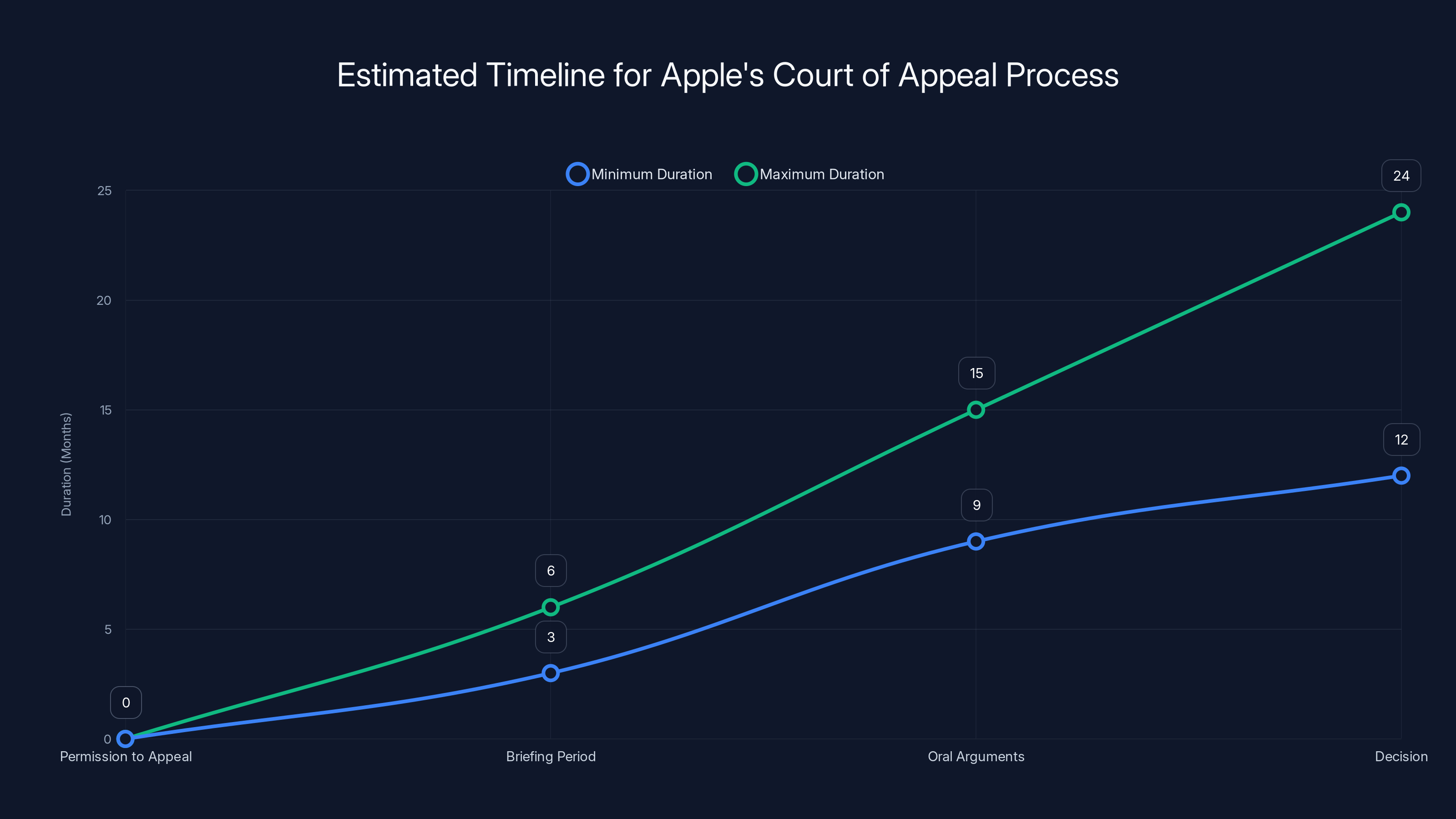

Apple has now escalated to the Court of Appeal. Based on UK legal timelines, here's what to expect.

Permission to appeal: Already granted or will be granted within weeks. Apple's arguments have merit, so permission is essentially guaranteed as explained by Mayer Brown.

Briefing period: 3 to 6 months. Both sides submit detailed written arguments as reported by Engadget.

Oral arguments: 6 to 9 months from initial appeal filing. The court schedules a hearing as noted by The Guardian.

Reservation of judgment: The judges will typically "reserve judgment" after oral arguments, meaning they take time to deliberate as detailed by Engadget.

Decision: 3 to 6 months after oral arguments. The court publishes its decision as explained by Mayer Brown.

Total timeline: 12 to 24 months is realistic, possibly longer if the case is particularly complex as noted by The Guardian.

This means we're probably looking at a decision sometime in 2026 or 2027. That's years of regulatory uncertainty as reported by Engadget.

During all this time, the App Store operating model doesn't change. Apple keeps the 30% fee. Developers keep paying. The competitive distortion persists as noted by WebProNews.

Meanwhile, regulatory developments elsewhere might outpace this case. The EU is already implementing its Digital Markets Act. If Apple modifies fees for EU users before the UK Court of Appeal decides, the Company could argue the competitive landscape has changed as reported by PPC Land.

Estimated data: The £1.5 billion overcharge is primarily attributed to consumer overpayments, with smaller portions going to developer fees and administrative costs. Unclaimed funds may also play a role.

Comparison to Other Major Tech Antitrust Cases

To understand what might happen next, it helps to look at how similar cases have resolved.

The Microsoft antitrust case from the 1990s-2000s is instructive. Microsoft faced findings of abuse for its dominance in operating systems and browser bundling. The case dragged through courts and settlements for years. Ultimately, Microsoft was forced to change some practices, but the company's market position remained intact. Microsoft is now more valuable than ever as reported by Engadget.

The Google search antitrust cases are still ongoing. Despite multiple findings of anticompetitive behavior, Google keeps most of its practices. The case has moved slowly through courts and regulators as noted by The Guardian.

The recent Epic vs. Apple case in the US resulted in a mixed outcome. Epic won on the issue of linking out to external payment systems, but Apple successfully defended most of its App Store practices as reported by WebProNews.

The pattern: Tech companies have enormous resources to litigate. Cases take years. Even when companies lose, the practical business changes are often smaller than the legal principles suggest. But the trajectory is clear. Regulators are becoming more aggressive, courts are finding abuse more readily, and the era of unchecked platform power is ending as noted by PPC Land.

Apple's appeal will likely follow a similar pattern. The company might lose the specific case but delay meaningful change for years as detailed by Engadget.

The Role of Regulators Beyond Courts

Here's an important wrinkle: courts aren't the only power here. Regulators can act independently of litigation.

The UK's Competition and Markets Authority has its own enforcement powers separate from this case. The EU's Digital Markets Act is regulatory law, not court-imposed. US state attorneys general can bring separate cases as reported by Engadget.

This creates a dynamic where even if Apple wins in court, it faces pressure from multiple regulators simultaneously. It's like playing chess on three different boards at once as noted by The Guardian.

The EU is probably the most aggressive. The Digital Markets Act already forces Apple to support third-party app stores and alternative payment systems. This is happening through regulation, not court orders. Apple has to comply regardless of what any court decides as noted by PPC Land.

The FTC in the US is investigating multiple aspects of Apple's practices. These investigations can lead to enforcement actions, fines, or consent decrees without any court involvement as reported by WebProNews.

The UK's CMA could pursue its own investigation parallel to this litigation. They might find that even if this specific case rules in Apple's favor, broader App Store practices warrant enforcement action as detailed by Engadget.

So Apple's strategy isn't just about winning this case. It's about managing multiple regulatory fronts while trying to preserve its business model as noted by The Guardian.

What Apple's Defense Strategy Likely Looks Like

Apple hasn't published its full legal brief yet, but we can infer what arguments the company will make based on its public statements and past positions.

First, Apple will argue that the relevant market isn't "iOS app distribution" but rather "digital app distribution broadly." If you include Android, web apps, console games, and other distribution channels, Apple's market share is far smaller. In a broader market, Apple can't be dominant as reported by Engadget.

Second, Apple will argue that even if it is dominant, its behavior isn't anticompetitive because there's legitimate justification. Apple will present data on how much it invests in security, fraud prevention, curation, and infrastructure. The company will argue the 30% fee is proportionate to these costs and benefits as noted by The Guardian.

Third, Apple will argue that developers aren't actually harmed. They'll point to billions in payouts to developers, millions of profitable apps, and the fact that developers voluntarily choose to be in the App Store despite the 30% fee. If it were truly anticompetitive, developers wouldn't participate, Apple will argue as detailed by Engadget.

Fourth, Apple will challenge the tribunal's £1.5 billion damage calculation as speculative and unsupported. The tribunal admitted using "informed guesswork" to reach this number. Apple will argue there's no scientific basis for the figure as noted by The Guardian.

Fifth, Apple will argue that the tribunal misapplied UK and EU competition law precedent. The company will distinguish this case from prior abuse-of-dominance findings based on legal technicalities as reported by Engadget.

Apple's strongest argument is probably the first one: market definition. If the appellate judges agree that the relevant market is broader than just iOS, the entire case might collapse. It's a technical legal argument, not a business argument, which makes it potentially persuasive to appellate judges as noted by The Guardian.

The estimated timeline for Apple's appeal process ranges from 12 to 24 months, highlighting the prolonged period of regulatory uncertainty. Estimated data.

The Opposing Arguments and Why the Tribunal Sided Against Apple

The parties opposing Apple (likely including the CMA and consumer representatives) will argue the opposite on every count.

They'll argue that market definition matters for this case. While Android and web apps exist, they're not perfect substitutes for iOS apps. iOS users are a specific market. If you want to reach them, the App Store is mandatory. In that specific market, Apple has 100% dominance as reported by Engadget.

They'll argue that even significant benefits don't justify abuse. Yes, Apple provides valuable services. But competitors provide similar services at lower cost. That proves 30% is excessive, not proportionate as noted by The Guardian.

They'll argue that developer participation doesn't prove there's no abuse. Developers participate because they have no choice, not because the terms are fair. Abuse can exist while victims continue participating if they have no alternatives as detailed by Engadget.

They'll defend the £1.5 billion calculation by pointing to economic methodology and comparable cases. They'll argue the tribunal appropriately estimated damages given imperfect information as noted by The Guardian.

They'll argue that UK and EU competition law clearly cover this situation. Dominant firms can't use control over essential infrastructure to extract excessive fees as reported by PPC Land.

The opposing side's strongest argument is market power. Apple demonstrably controls iOS app distribution. That power was exercised through uniform, non-negotiable fees. This is the textbook definition of abuse in competition law. Apple's burden is to show why this shouldn't apply, and its arguments haven't been particularly convincing as detailed by Engadget.

What This Means for the Future of App Stores

Whatever the Court of Appeal decides, it will influence the future structure of app stores globally.

If Apple loses, expect regulatory pressure to push all major platforms toward lower, more flexible fees. Google, Microsoft, Sony, and Nintendo might all face similar cases. The 30% fee could become as outdated as the 2.5% credit card processing fee from decades ago as reported by Engadget.

If Apple wins, the 30% fee becomes defensible for the foreseeable future. But regulatory pressure will still mount through legislative action rather than litigation as noted by The Guardian.

Either way, the era of unchallenged digital gatekeeping is ending. The only question is whether courts or regulators move faster as noted by PPC Land.

For consumers, lower app store fees could eventually translate to lower app prices, though Apple might capture most of the benefit as increased profit. For developers, especially small ones, the impact could be substantial as reported by WebProNews.

For Apple, the company's business model is entering a transitional phase. The financial impact of lower fees might be manageable, but the reputational and regulatory costs of fighting developers are significant as detailed by Engadget.

The Wider Implications for Tech Regulation

This case matters beyond Apple and App Store fees. It signals something broader about how democracies are regulating digital platforms.

For years, tech companies argued that their platforms were private property and shouldn't be regulated like utilities. That argument is now officially dead in UK courts. The CAT established that once a platform becomes essential infrastructure—the only way to reach a market—it becomes subject to competition law constraints as reported by Engadget.

This principle will reshape how digital platforms operate globally. Cloud infrastructure, operating systems, payment networks, and social media platforms might all face similar scrutiny if they achieve dominance and restrict competition as noted by The Guardian.

Governments are also learning that courts move too slowly. The UK's Digital Markets Act and EU's Digital Markets Act are regulatory interventions that don't wait for litigation to conclude. We're seeing a shift from litigation-based enforcement to proactive regulation based on market structure as noted by PPC Land.

Apple's appeal will matter less as precedent and more as a test of how hard tech companies can push back against this regulatory tide as detailed by Engadget.

Likely Outcomes and Probability Estimates

Let me offer some educated speculation about what might happen, with caveats that courts are unpredictable.

Outcome 1: Apple loses on appeal (probability 40%) The Court of Appeal affirms the CAT and either upholds or increases the fine. Apple faces the £1.5 billion payout. The precedent strengthens regulators globally as reported by Engadget.

Outcome 2: Apple wins on appeal (probability 25%) The Court fully reverses the CAT's decision. Apple avoids the fine. The company gains breathing room, though regulatory pressure persists as noted by The Guardian.

Outcome 3: Partial reversal (probability 35%) The Court agrees with the legal finding of abuse but overturn the damages calculation. Apple loses the principle but wins financially. This is probably the most likely scenario given how appellate courts typically handle economically complex cases as explained by Mayer Brown.

These estimates reflect the inherent uncertainty of litigation plus the technical complexity of the case. Appeal courts are more likely to reverse on specific legal points than to uphold everything or reverse everything as detailed by Engadget.

FAQ

What exactly did Apple do that was found anticompetitive?

The UK's Competition Appeal Tribunal found that Apple abused its dominant market position by forcing all iOS developers to use Apple's proprietary payment system and charge Apple a 30% commission with no flexibility or alternatives. The tribunal determined that by controlling the only way to distribute apps to iOS users and simultaneously controlling the payment mechanism, Apple created an anticompetitive environment where developers couldn't negotiate fees, couldn't use alternative payment processors, and couldn't offer users cheaper ways to purchase. This combination of dominance and control over payments was the abuse as reported by Engadget.

How much money are we actually talking about here?

The original fine is approximately £1.5 billion, which converts to roughly $2 billion USD at current exchange rates. However, this is the amount the tribunal calculated as overcharges accumulated between 2015 and 2024, not a penalty. If Apple ultimately pays, the money would theoretically be distributed to UK App Store users who made purchases during that period. The actual distribution method hasn't been fully determined, but it could involve claims processes, per-capita payments, or unclaimed funds going to charity as noted by The Guardian.

Could Apple actually have to pay this money if it loses the appeal?

Yes, Apple would almost certainly have to pay if the Court of Appeal upholds the CAT's decision. UK courts have enforcement mechanisms to ensure compliance with financial judgments. However, the distribution of funds to consumers would likely require a separate mechanism. Apple and the parties would need to work with the court to establish how billions of pounds get distributed fairly to millions of individual consumers. This could take additional years to implement even after a final judgment as reported by Engadget.

How does this case compare to the Epic Games vs. Apple lawsuit?

The Epic case, which occurred in the United States, focused on whether Apple could require developers to use its payment system and take a cut. Epic won the right for developers to direct users to external payment options, a meaningful victory. However, the judge largely upheld Apple's right to take a 30% cut for using its payment processor specifically. The UK case goes further by arguing that even the fee itself is anticompetitive because Apple's dominance over iOS distribution gives it unfair leverage. The UK approach is more aggressive toward Apple's business model than the US approach as noted by WebProNews.

What would Apple have to change if it loses?

If Apple loses and the ruling is upheld, the company would likely face pressure to reduce App Store commission rates, though the court hasn't mandated specific changes. The tribunal's suggestion of 15-20% rates hints at where Apple might need to go. Additionally, Apple might face requirements to allow alternative payment methods, make the commission structure more transparent, or create negotiation mechanisms for larger developers. In the EU, regulatory law is already forcing some of these changes regardless of court outcomes as reported by PPC Land.

How long will this appeal process take?

Based on typical UK Court of Appeal timelines, the process could take 12 to 24 months from appeal filing to decision. This includes permission to appeal (a few weeks), briefing periods (3-6 months), oral arguments (6-9 months from filing), deliberation, and judgment (3-6 months after oral arguments). Complex cases sometimes take longer. During this entire period, the original fine typically remains in legal limbo, though Apple isn't required to pay until a final decision is reached as explained by Mayer Brown.

Why is Apple fighting this so hard instead of just accepting the fine?

Apple is fighting because the stakes extend far beyond this single £1.5 billion. A loss establishes legal precedent that could accelerate enforcement actions by regulators worldwide. Additionally, if Apple's 30% fee is ruled anticompetitive in the UK, it strengthens similar arguments in the EU, the US, and other jurisdictions. The company is essentially fighting to preserve its ability to maintain uniform 30% App Store fees globally. Economically, the £1.5 billion payout might be manageable, but the precedent and potential for future fee reductions is what concerns Apple most as reported by Engadget.

Could this affect iPhone prices or Apple's profits significantly?

If Apple is forced to reduce App Store fees, it would reduce Apple's Services revenue, which is currently one of the company's highest-margin business segments. However, Apple's total profit impact might be smaller than the headline fee reduction suggests. If developers keep more revenue due to lower fees, they might develop better apps, generate higher sales, pay Apple lower commissions on higher volumes, and create a healthier ecosystem. Additionally, Apple could partially offset fee reductions through other monetization strategies. For consumers, lower fees might eventually lead to lower app prices, though Apple's pricing power means developers might capture most of the benefit as noted by The Guardian.

What happens to developers during all these appeals?

Developers continue operating under the current 30% fee structure while appeals proceed. There's no automatic fee reduction when Apple appeals. However, developers in EU markets are already starting to see changes due to the Digital Markets Act. For UK developers specifically, there's regulatory uncertainty. Some large developers might take a "wait and see" approach before major investments, though most continue building because they need the iOS market regardless. Small developers are the most vulnerable during prolonged uncertainty because they can't easily access capital for growth investments as reported by PPC Land.

What would a victory for Apple mean for other platforms?

If Apple successfully defends its business model in court, it strengthens the position of every other digital platform that takes a similar cut. Microsoft's Xbox Store, PlayStation Store, Nintendo eShop, and Google Play might all feel emboldened to maintain or increase their fees, citing Apple's legal victory as precedent that such fees are defensible. Conversely, if Apple loses, every platform faces increased regulatory pressure and legal risk, which could accelerate a global shift toward lower, more competitive fee structures. The court decision will essentially set a precedent that applies across the entire digital ecosystem as detailed by Engadget.

Final Thoughts: The Bigger Picture

Apple's appeal of the £1.5 billion fine represents far more than a single legal dispute. It's a conflict between traditional property rights concepts and modern regulatory frameworks designed to govern essential digital infrastructure as reported by Engadget.

Apple built the App Store. Apple maintains it. Apple provides genuine value through curation, security, and discoverability. These facts are not in dispute. The real question is whether ownership of a platform that becomes essential infrastructure creates unlimited rights to extract economic value from users of that platform as noted by The Guardian.

The tribunal said no. Apple says the tribunal misunderstood both the law and the economics. The Court of Appeal will have to decide as explained by Mayer Brown.

What's certain is that digital platforms can't operate in legal and regulatory limbo forever. Either courts will constrain them through litigation, legislatures will constrain them through regulation, or both. The only variable is which happens first and how aggressive the constraints will be as noted by PPC Land.

For Apple, the stakes could hardly be higher. A loss signals that the era of platform independence is over. For developers, a win means continued pressure from Apple's 30% fee,

![Apple's $2 Billion UK Antitrust Appeal: What's at Stake [2025]](https://tryrunable.com/blog/apple-s-2-billion-uk-antitrust-appeal-what-s-at-stake-2025/image-1-1766954187191.jpg)