The Ultimate Guide to the Best Mint Alternatives in 2025: Find Your Perfect Budgeting App

Introduction: Why Mint Users Need a New Solution

When Intuit announced the shutdown of Mint in December 2023, millions of users faced an unexpected loss of their trusted financial companion. For nearly two decades, Mint had served as the go-to budgeting application for people seeking a straightforward, free way to manage their finances, track spending, and monitor their credit scores from a single dashboard. The app's simplicity was its greatest strength—users could link their bank accounts, watch transactions auto-categorize, and gain comprehensive insight into their financial picture without navigating a complex interface or paying monthly subscription fees.

The departure of Mint left a significant void in the personal finance technology landscape. This wasn't merely the loss of a functional tool; it represented the discontinuation of a platform that had become integral to how millions of people understood their money. Users had grown accustomed to Mint's particular approach to budgeting: its straightforward visualization of spending patterns, its ability to suggest budget limits based on historical data, and its frictionless connection to most major financial institutions through Plaid integration.

Today's budgeting app market has evolved considerably since Mint's heyday. The successor applications incorporate lessons learned from Mint's limitations while introducing sophisticated features that weren't feasible a decade ago. Modern alternatives leverage artificial intelligence to detect recurring transactions, offer cryptocurrency and investment tracking, provide collaborative budgeting for couples, and integrate with a broader ecosystem of financial tools. However, this evolution means the landscape has become more fragmented and specialized—there's no longer a single universal choice.

The critical challenge for former Mint users involves identifying which alternative aligns with their specific financial situation and priorities. Someone focused purely on spending categorization and budget setting has different needs than an investor tracking a diverse portfolio, which differs again from a couple managing joint finances. The five-to-ten top contenders each excel in different areas while introducing tradeoffs in pricing, complexity, or feature breadth.

This comprehensive guide examines the landscape of 2025 budgeting applications through the lens of someone transitioning from Mint. Rather than offering a simplistic top-five list, we'll dissect what makes each platform distinctive, where they outperform or underperform relative to Mint's original strengths, and most importantly, how to match your financial management style with the right tool. Whether you prioritize affordability, investment tracking, collaborative features, or maximum customization, you'll find detailed analysis of viable options that can genuinely replace Mint in your financial workflow.

What Made Mint Special: Understanding the Baseline

The Mint Legacy and Its Defining Features

To properly evaluate Mint's successors, we must first understand what made the original application distinctive. Mint's fundamental appeal rested on three pillars: zero cost, frictionless setup, and intelligent transaction categorization. When Mint launched in 2006, it introduced a revolutionary concept to personal finance—a completely free budgeting tool that could aggregate information across multiple banks and present a unified view of your financial life.

The free-forever model was transformative. While financial institutions had desktop applications like Quicken (which required significant upfront investment), Mint democratized personal finance tracking. This accessibility resonated with millions of people who might otherwise have never systematically tracked their spending or created formal budgets.

Mint's technical infrastructure relied on Plaid, a financial data aggregation service that securely connected to thousands of institutions. This integration meant setting up Mint required minimal friction—provide your banking credentials once, and the app would display all connected accounts with near-real-time transaction visibility. The automatic transaction categorization, powered by machine learning algorithms, saved users from manually tagging hundreds of transactions each month.

The application's interface philosophy emphasized simplicity. Mint's dashboard presented complex financial data in a digestible format: your net worth at a glance, spending broken down by category, upcoming bills, and savings goals. The visual hierarchy was intuitive, and the app didn't overwhelm users with options or require extensive configuration before delivering value.

Mint also pioneered the idea of "set and forget" budgeting. Users could input their desired spending limits by category, and Mint would track progress throughout the month, alerting them when approaching or exceeding limits. This passive monitoring approach suited people who wanted budget oversight without constant manual engagement.

The Gaps Mint Couldn't Address

While Mint was exceptional at foundational budgeting, it had acknowledged limitations that successors have now addressed. Investment tracking remained rudimentary—Mint could display investment account balances but offered minimal analysis of portfolio composition, asset allocation, or investment performance. Users serious about investment tracking needed separate tools.

Mint's free model, while appealing to consumers, created constraints on feature development and customer support. The company couldn't justify intensive customer service for a zero-revenue product. Advanced features like multi-user access, customization options, and premium analytics remained limited.

The original Mint also struggled with accuracy in subscription detection and recurring transaction identification. Users frequently found themselves manually correcting miscategorizations or adding subscriptions that Mint's algorithms failed to recognize. For power users seeking granular control over categorization rules, Mint offered limited customization.

Quicken Simplifi: The Most Mint-Like Successor

Why Simplifi Emerges as the Top Alternative

Quicken Simplifi has established itself as the closest spiritual successor to Mint, and the data supports this positioning. At **

Simplifi's core philosophy mirrors Mint's approach: present a unified dashboard aggregating all financial accounts with minimal setup friction. The application connects to over 14,000 financial institutions through Plaid, providing the same frictionless authentication experience Mint users experienced. Once connected, account information updates within minutes, and transaction categorization happens automatically.

The user interface maintains Simplifi's commitment to simplicity without sacrificing comprehensiveness. The dashboard displays your current net worth prominently, followed by a scrollable overview of all connected accounts, recent transactions, upcoming bills, and spending by category. Unlike some competing platforms that emphasize customization and visual variety, Simplifi's design stays clean and focused—information density remains high without becoming overwhelming.

One particularly valuable feature for married users or those managing finances with partners: Simplifi offers guest access that allows you to share read-only views or grant co-management privileges to a spouse or financial advisor. This collaborative capability represents a significant advantage over Mint's purely individual-focused design. For couples who consolidated finances or want to maintain transparency, Simplifi provides legitimate collaborative tools without requiring both partners to maintain separate premium accounts.

Core Functionality and Feature Set

Simplifi's spending plan feature transforms the traditional budget into something more flexible and realistic. Rather than rigid monthly category limits, you set spending targets, and the application suggests appropriate limits based on your historical spending patterns from the past six months. This data-driven approach prevents the common budgeting frustration of setting unrealistic targets that immediately fail.

The application handles both recurring expenses and one-time costs within the same budgeting framework. You might allocate $500 to "dining" for the month, with some of that amount reserved for known recurring subscriptions (Netflix, Spotify) and the remainder available for discretionary restaurant visits. Simplifi visualizes this allocation clearly, showing which portions of your budget are committed to recurring bills versus available for discretionary spending.

Transaction categorization deserves specific examination because it represents where Simplifi significantly exceeds Mint's capabilities. The algorithm learns from your patterns and adapts categorization over time. More importantly, Simplifi permits nuanced rules—you can designate certain vendors as recurring even if you visit them irregularly. For example, you might mark two specific Amazon purchases as recurring subscriptions while leaving other Amazon transactions for standard categorization. This granularity acknowledges real-world complexity that Mint often missed.

Simplifi detects recurring income sources with surprising accuracy. Rather than requiring manual entry of your salary or freelance income, the application identifies patterns and suggests recurring income, which you can confirm or adjust. This feature significantly streamlines initial setup and helps the application calculate your true discretionary spending more accurately.

Strengths and Practical Advantages

Simplifi's strongest advantage is its learning curve—most users become functionally proficient within a single session, and complete comfort arrives within a few days. There's minimal frustration involved in understanding core features. The mobile app (iOS and Android) provides genuine feature parity with the web version, allowing you to check spending, categorize transactions, and adjust budgets from your phone with the same ease as desktop users.

The refund tracker represents a thoughtful feature absent from most competing platforms. If you process a return, you can mark it as a refund, and Simplifi will deduct the amount from your spending metrics rather than creating a false positive for overspending. This practical attention to how people actually conduct financial transactions makes a difference in real-world usage.

Simplifi also incorporates credit score monitoring, pulling your score from one of the major bureaus. While not as comprehensive as dedicated credit monitoring tools, this integration means you can view your credit score alongside your spending patterns and net worth—all indicators of your overall financial health consolidated in one place.

Notable Limitations

While Simplifi excels at general-purpose budgeting, it doesn't provide sophisticated investment analysis. If you hold individual stocks, ETFs, or have diversified brokerage accounts, Simplifi can display their balances but offers minimal insight into asset allocation, performance analysis, or investment-specific planning. Investors need supplementary tools for those functions.

Zillow integration—popular among homeowners seeking to track home equity as part of their net worth—remains absent from Simplifi. Competitors like Monarch Money and Copilot Money have incorporated Zillow APIs, but Simplifi users must manually input estimated home values or leave real estate out of their net worth calculations. For some users, this represents a meaningful gap.

Simplifi also lacks certain customization options that power users of YNAB or Monarch Money appreciate. You cannot create custom categories beyond the predefined list, adjust the chart visualizations extensively, or export data in specialized formats. The simplicity that makes Simplifi attractive to general users limits its appeal to those seeking maximum control.

Another constraint: you cannot create accounts using Apple ID or Google ID single sign-on. You must create a traditional username and password, which adds a minor friction point compared to competitors offering streamlined authentication.

YNAB (You Need A Budget): The Philosophy-First Approach

Understanding YNAB's Revolutionary Budgeting Methodology

YNAB (You Need A Budget) occupies a distinctly different position in the budgeting landscape than Simplifi. While Simplifi seeks to replicate Mint's straightforward tracking approach, YNAB represents an intentional philosophical shift in how people should relate to budgeting itself. YNAB is built upon the "envelope budgeting" methodology, also called the "zero-based budgeting" approach.

The core principle: every dollar you earn should be assigned a specific purpose before you spend it. Rather than tracking spending against historical averages (Simplifi's data-driven approach), YNAB requires active intention-setting. You allocate funds to categories before the month begins, and that allocation process forces you to confront your financial priorities and make deliberate choices about money allocation.

This methodology produces measurable behavioral change for practitioners. Users report that YNAB's structured approach creates awareness that prevents impulse spending and encourages savings. The discipline required to allocate every dollar upfront creates accountability—you're not reactively reviewing overspending at month's end; you're actively preventing it through intentional allocation.

YNAB's pricing starts at **

The Four Rules and YNAB's Framework

YNAB's methodology rests on four core principles, often summarized as "The Four Rules."

Rule One: Give Every Dollar a Job. Before spending any money, you explicitly allocate it to categories (mortgage, groceries, entertainment, savings). This upfront assignment transforms budgeting from a tracking exercise into a planning discipline. You must decide consciously how to allocate every dollar rather than discovering at month's end that you overspent.

Rule Two: Embrace Your True Expenses. Some expenses don't occur monthly—insurance premiums, vehicle registration, annual subscriptions, or holiday gifts come irregularly. YNAB suggests identifying these true expenses and allocating money monthly toward them, so when the bill arrives, funds already exist. This prevents the shock of large irregular expenses and eliminates the excuse that "I forgot about that expense."

Rule Three: Roll With the Punches. Budgets never survive first contact with reality—unexpected expenses emerge, income fluctuates, priorities shift. Rather than abandoning the budget, YNAB teaches users to adjust allocations dynamically. If your car requires unexpected repair, you reassign funds from discretionary categories to cover it. This flexibility prevents the all-or-nothing thinking that causes many budgets to fail.

Rule Four: Age Your Money. This represents YNAB's unique financial liberation principle. By breaking the paycheck-to-paycheck cycle, you fund your current month's expenses from last month's income. This separation decouples financial stress from income timing and provides psychological breathing room. Instead of living on the edge, you operate with a one-month buffer.

YNAB's Technical Implementation and User Experience

YNAB's interface differs substantially from Simplifi's simplicity. The primary screen displays a detailed table where each row represents a budget category, and columns show your budget allocation, spending to date, available funds, and age of money. This visual format delivers comprehensive information density but requires some interpretation skill.

For users transitioning from Mint's visual dashboard to YNAB's tabular format, the shift involves a meaningful learning curve. YNAB's community acknowledges this—the 34-day free trial essentially functions as an extended onboarding period where users can decide if the methodology resonates before committing financially.

YNAB connects to financial institutions through Plaid, similar to Simplifi, and automatically imports transactions. However, the application's philosophy treats automatic importing as a convenience, not a primary budget-setting mechanism. You've already allocated money by category; the imported transactions simply update your spending against those allocations.

The application's mobile apps (iOS and Android) function as companions to the primary budgeting interface rather than standalone tools. You can check your available balance by category and categorize transactions from your phone, but comprehensive budget adjustments typically happen on the web version. This design choice reflects YNAB's emphasis on deliberate budget planning rather than ad-hoc management.

YNAB's Competitive Advantages

YNAB's strongest advantage is its behavioral impact. Users who genuinely commit to the four rules and implement zero-based budgeting report transformative changes in financial behavior. Spending typically decreases, savings increase, and the sense of financial control improves measurably. This isn't merely a feature advantage—it's a philosophical framework that works for many people.

The community support represents another meaningful advantage. YNAB maintains active forums, publishes educational content about the budgeting methodology, and has cultivated a community where experienced users help newcomers. This social dimension transforms YNAB from a software tool into something approaching a financial coaching service.

YNAB also offers investment tracking through partner integrations and handles cryptocurrency explicitly (a feature many traditional budgeting tools ignore). While not as comprehensive as dedicated investment platforms, this flexibility suits users whose financial lives include digital assets.

Reports and analytics in YNAB provide deep insights into spending patterns. You can view spending trends over months or years, identify categories where you consistently overspend, and understand where your money actually goes. These analytics support behavioral change by making patterns visible.

YNAB's Limitations and Suitability Questions

YNAB's significant limitation is its learning curve and the sustained behavioral effort required. Unlike Simplifi, which users can operate productively within hours, YNAB requires understanding the four rules, embracing the zero-based budgeting philosophy, and committing to the monthly allocation discipline. Users who resist this structure or prefer passive tracking will find YNAB frustrating rather than liberating.

The pricing—

YNAB also doesn't provide the simplicity that attracted many Mint users initially. Mint's appeal rested partly on its passivity—set up accounts, watch transactions categorize, glance at the dashboard occasionally. YNAB demands active engagement. You must allocate funds monthly, monitor your available balance by category, and adjust when reality diverges from plans. This isn't a flaw—it's intentional design—but it's a fundamental mismatch for users seeking passive tracking.

The interface, while powerful, doesn't match Simplifi's intuitive appeal. The grid-based budget display communicates information efficiently but lacks visual sophistication. Users prioritizing attractive design or mobile-first interaction might find YNAB utilitarian.

Monarch Money: The Comprehensive All-in-One Platform

Monarch's Positioning and Core Philosophy

Monarch Money represents a different archetype of Mint alternative—it positions itself as a comprehensive wealth management platform rather than a budgeting-focused tool. Monarch combines budgeting, investment tracking, financial planning, and credit monitoring into an integrated ecosystem designed for users who want a single dashboard for their complete financial life.

Monarch's pricing model offers multiple tiers. The free version provides basic budgeting and account aggregation, functioning somewhat similarly to Simplifi's basic approach. Paid tiers begin at **

Monarch differentiates itself through several technical and feature advantages. The platform integrates with institutional investment accounts more comprehensively than competitors. Where Simplifi displays investment balances and YNAB requires workarounds, Monarch provides detailed portfolio analysis, asset allocation visualization, and performance tracking alongside budgeting functionality.

The application also incorporates Zillow integration for home valuation, addressing a gap where Simplifi falls short. Homeowners can track their home's estimated value as part of net worth calculations automatically. This integration appeals to users for whom home equity represents a significant component of overall wealth.

User Experience and Interface Design

Monarch's interface reflects its comprehensive positioning. The dashboard displays more information simultaneously than Simplifi—your net worth, account balances, investment portfolio composition, monthly spending overview, and upcoming bills coexist on a single screen. This density serves users seeking comprehensive visibility but might overwhelm those preferring simplicity.

The design aesthetic is modern and visually appealing compared to Simplifi's utilitarian approach. Charts display information in visually engaging formats, category breakdowns use color-coded pie charts, and spending trends appear as interactive line graphs. For users who were frustrated by Mint's aging interface before shutdown, Monarch's contemporary design represents a substantial upgrade.

Monarch's budgeting system borrows elements from both Simplifi and YNAB but commits fully to neither. Like Simplifi, it suggests budget limits based on historical spending. Like YNAB, it emphasizes intentional allocation, though without the philosophical rigor. The result is a middle-ground approach—flexible budgeting that provides structure without requiring the discipline YNAB demands.

The mobile applications (iOS and Android) represent substantial feature parity with the web platform. Unlike YNAB's mobile-as-companion approach, Monarch's mobile apps function nearly identically to desktop versions. Users can manage their complete financial picture from their phones, making the platform genuinely device-agnostic.

Monarch's Investment Tracking Capabilities

Monarch's most significant competitive advantage relative to Simplifi and YNAB is its investment tracking sophistication. The platform displays your complete portfolio with asset allocation visualization showing what percentage you hold in stocks, bonds, cash, cryptocurrencies, and alternative investments.

The application calculates portfolio performance, showing you your gain or loss in dollars and percentages. It displays your asset allocation relative to recommended allocations based on your age and risk profile, helping you identify whether your portfolio matches your stated goals. These analytics would typically require separate tools like Personal Capital or Morningstar; Monarch integrates them natively.

Monarch also tracks investment accounts across multiple institutions. If you hold brokerage accounts at Fidelity, Vanguard, and Robinhood, plus a 401(k) with your employer and an IRA elsewhere, Monarch consolidates all holdings into a single portfolio view. This comprehensiveness appeals to investors who maintain accounts across multiple platforms and previously needed multiple tools to track everything.

The platform's ability to model alternative investments and track real estate holdings (beyond home equity through Zillow integration) extends its reach beyond traditional investment tools. Users with more complex financial lives find Monarch's scope genuinely valuable.

Financial Planning and Goal-Setting Tools

Monarch incorporates financial planning tools that exceed what Mint offered and approach capabilities of dedicated financial planning software. You can define financial goals (retire at 60, save $500,000 for a house, pay off student loans) and Monarch models whether your current savings rate and investment returns will achieve those goals.

These projections use Monte Carlo analysis, which tests your plan against thousands of simulated market scenarios rather than assuming linear returns. This statistical approach provides more realistic goal achievement probabilities than simple mathematical projections.

The application also includes retirement planning features—it calculates your net worth trajectory, estimates retirement readiness, and suggests savings adjustments if projections show shortfalls. For users approaching retirement or making major financial decisions, these planning tools provide genuine decision-support value beyond what budgeting tools offer.

Monarch's premium tiers include access to financial advisors who can review your financial plan and offer personalized recommendations. This human advisory layer addresses a gap many automated platforms have—sometimes financial questions require human expertise beyond what algorithms can provide.

Monarch's Limitations and Consideration Factors

Monarch's comprehensiveness creates a usability tradeoff. The platform demands more engagement than Simplifi and maintains steeper complexity than basic budgeting apps. Users seeking the simplicity that initially attracted them to Mint may find Monarch overwhelming.

The pricing, while moderate, introduces ongoing cost. For users specifically seeking a free or nearly-free Mint replacement, Monarch's

Monarch's core strength—comprehensive investment tracking and portfolio analysis—provides less value for users with straightforward financial situations (single bank account, modest 401(k), minimal trading activity). For such users, Simplifi's simplicity and lower cost might prove more appropriate than Monarch's comprehensive but complex approach.

The platform also relies on Plaid for investment account connections, which means certain investment institutions or alternative brokers that Plaid doesn't support remain disconnected. While Plaid's coverage is extensive, users with accounts at newer fintech platforms might encounter integration gaps.

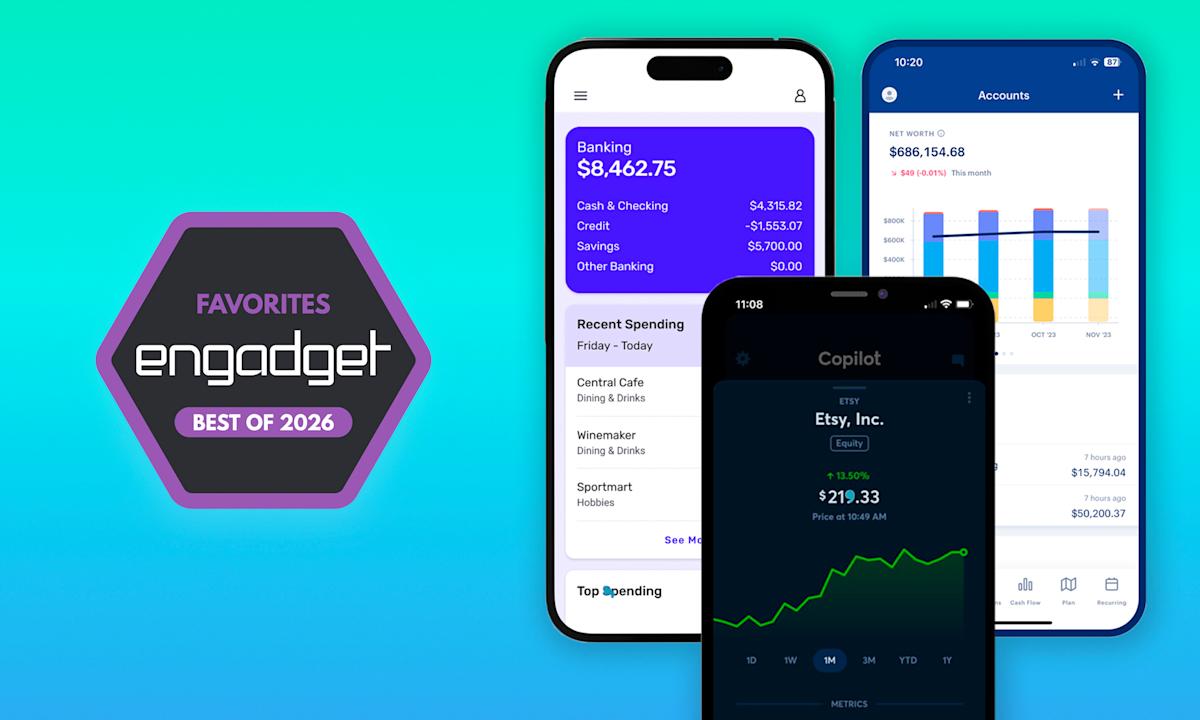

Copilot Money: The Rising Alternative for Collaborative Finance

Market Positioning and Growth Trajectory

Copilot Money has emerged as a significant recent entrant in the budgeting applications space, gaining traction particularly among younger users and couples seeking collaborative financial management. The platform launched in the post-Mint era, specifically designed to capture users searching for alternatives and learning from what those users valued in Mint while iterating on its limitations.

Copilot's pricing is aggressive: **

The application's interface design represents perhaps the most modern aesthetic among Mint alternatives. Copilot embraces contemporary design patterns—customizable themes, dark mode by default, emoji-enhanced category labeling, and smooth animations. For users who appreciated Mint's clean design but found it dated by 2023, Copilot's contemporary interface provides an emotional appeal.

Copilot distinguishes itself through emphasis on multi-user collaborative budgeting. While Simplifi offers guest access, Copilot treats couples and co-managers as first-class citizens. Both parties maintain full accounts with complete access, and the application emphasizes transparency and communication around finances. For couples managing joint finances, Copilot's design assumes collaboration throughout.

Core Features and Competitive Positioning

Copilot's feature set covers the essential budgeting functions: account aggregation through Plaid, automatic transaction categorization, spending visualization, budget setting and monitoring, and savings goal tracking. In terms of raw functionality, Copilot and Simplifi offer largely equivalent coverage—both deliver what Mint users expect.

The differentiation emerges in specific features and experience design. Copilot's transaction categorization leverages machine learning similarly to competitors but includes a novel element: multi-categorization of single transactions. If you purchase groceries and also grab gas at a Sam's Club, you can split the transaction and categorize portions separately without manual data entry. This practical feature acknowledges real-world shopping patterns that traditional apps struggle with.

Copilot also incorporates AI-powered spending insights, using natural language generation to explain your spending patterns. Rather than presenting raw data, the application generates human-readable summaries: "Your spending in dining increased 23% compared to last month, primarily driven by increased restaurant visits rather than takeout orders." These narrative insights help users understand not just what they spent, but why and how it changed.

The application provides Zillow integration for home valuation (matching Monarch's capability and exceeding Simplifi) and cryptocurrency support. Users holding Bitcoin, Ethereum, or other digital assets can track their crypto holdings as part of their net worth, addressing another gap many budgeting tools historically ignored.

Mobile-First Design and Experience

Copilot prioritizes mobile experience over web platform. While the application offers a web interface, the iOS and Android apps represent the primary platform. This mobile-first philosophy resonates with younger users who might check financial status while on the go and don't necessarily access desktop applications frequently.

The mobile interface presents information clearly with large, tappable surfaces and intuitive gestures. Adding transactions, adjusting budgets, and viewing reports requires minimal interaction design cognition—actions map intuitively to user intent.

Copilot also implements push notifications thoughtfully. Rather than overwhelming users with alerts, the application can notify you when approaching category spending limits, remind you of upcoming bills, or highlight unusual spending patterns. These notifications serve informational purposes without becoming intrusive.

Strengths Relative to Alternative Solutions

Copilot's contemporary design and user experience arguably surpass all competing options for general users prioritizing aesthetic appeal and intuitive interaction. For users who were disappointed by Mint's interface decay and unimpressed by Simplifi's utilitarian approach, Copilot delivers the emotional satisfaction of using a modern, well-designed application.

The focus on collaborative finance creates genuine value for couples. Both parties can see shared budgets, track joint spending, and coordinate financial decisions. The transparency that underlying design assumes can either strengthen couples' financial communication or illuminate existing tensions—but either way, Copilot supports the visibility couples increasingly value.

Copilot's practical features—split transaction categorization, AI-powered insights, and support for digital assets—address real-world complexity that earlier-generation tools oversimplified. The development team clearly studied how people actually manage finances and designed features around those patterns.

The aggressive pricing matches Simplifi's tier while offering a slightly broader feature set and more modern interface, creating strong value proposition for price-conscious users.

Potential Limitations and Considerations

Copilot's biggest risk is survivability. As a newer entrant competing against established players backed by larger organizations (Quicken owns Simplifi; Intuit owns Credit Karma but redirects users away; YNAB maintains strong community loyalty), Copilot must sustain user growth and profitability. While the company has received venture capital funding, the fate of well-designed startup financial applications remains uncertain in a consolidating market.

The investment tracking capabilities remain basic compared to Monarch Money. Copilot displays investment balances and overall portfolio value but lacks detailed asset allocation visualization or performance analytics. Investors requiring sophisticated portfolio analysis need supplementary tools.

Copilot's financial planning features remain rudimentary. The application doesn't model retirement readiness or project financial futures like Monarch Money does. For users seeking planning tools beyond basic budgeting, Copilot falls short.

The platform's nascence means ongoing refinement and potential feature changes. Early adopters might find that planned features remain in beta or that development priorities shift. Users preferring stable, mature platforms might prefer established alternatives despite Copilot's current appeal.

Rocket Money (Formerly Truebill): The Smart Assistant Approach

Understanding Rocket Money's Market Position

Rocket Money (previously known as Truebill, rebranded in 2022) represents another distinct approach to budgeting and financial management. Rather than positioning itself as a direct Mint replacement, Rocket Money frames itself as a personal financial assistant—a tool that automates money management tasks and provides actionable insights rather than merely tracking spending.

Rocket Money's pricing structure differs notably from competitors. The application offers a free tier with core budgeting and account aggregation features, positioning it alongside Mint's zero-cost model. Paid tiers begin at

Rocket Money's signature feature differentiates it meaningfully from traditional budgeting tools: subscription management and cancellation. The application identifies recurring subscriptions across your connected accounts, categorizes them, and allows one-click cancellation. Many users accumulate unwanted subscriptions (free trial periods that convert to paid, services used once and forgotten about), and Rocket Money makes identifying and eliminating them trivial.

The financial impact of subscription management can be substantial. Typical users discover $100-200 monthly in forgotten subscriptions. For someone using Rocket Money's free tier purely for subscription cleanup, the value proposition is straightforward and immediately quantifiable.

Core Features and Functional Breadth

Rocket Money's foundational budgeting features match competitors' offerings: account aggregation, transaction categorization, spending visualization, and budget monitoring. In terms of baseline functionality, Rocket Money is equivalent to Simplifi and Copilot Money.

The application's strength emerges in financial task automation. Beyond subscription management, Rocket Money negotiates lower bills on your behalf. The application identifies opportunities to reduce your insurance, phone, or internet bills and can contact providers to negotiate lower rates. For users with no inclination to call insurance companies, this automated negotiation service provides genuine value—and it's included in the highest tier at $9.99 monthly.

Rocket Money also incorporates credit score monitoring (pulling from one of three major bureaus), though less comprehensively than dedicated credit services. The integration provides visibility into how your financial behavior impacts creditworthiness without requiring additional signups.

The application's reporting and insights functionality generates spending analysis and financial recommendations. Similar to Copilot's AI-powered insights, Rocket Money identifies spending patterns and opportunities for optimization. However, Rocket Money frames these insights around specific actions you can take—if the algorithm detects high discretionary spending, it suggests specific categories to target, or it might recommend increasing emergency savings.

Strengths of the Rocket Money Approach

Rocket Money's most compelling advantage is the combination of free tier plus optional paid services. Many users will get substantial value from the free budgeting and account aggregation without paying. This aligns with Mint's free-to-user philosophy, making Rocket Money genuinely accessible to price-conscious users.

The subscription management focus addresses a real problem that most budgeting tools ignore. While competitors track subscriptions as recurring expenses, only Rocket Money makes cancellation frictionless. For many users, this single feature justifies the free tier adoption, and discovering $100+ monthly in savings creates psychological momentum to explore other features.

The bill negotiation service, while requiring the paid tier, represents genuine automation of a task most people procrastinate on indefinitely. Outsourcing negotiation calls to an AI system removes friction from a task people generally find annoying—and the fee ($9.99 monthly) is often less than the savings generated.

Rocket Money's mobile apps are thoughtfully designed with similar user experience priorities to Copilot Money. The interface feels contemporary, interactions are intuitive, and push notifications alert you to meaningful changes without becoming intrusive.

Limitations and Appropriate Use Cases

Rocket Money's main limitation is its lack of comprehensive wealth management features. The application doesn't provide investment portfolio tracking (beyond account balance aggregation), retirement planning, or financial planning tools. Users with significant investment holdings or complex financial situations requiring analysis need supplementary tools.

The bill negotiation service, while innovative, isn't guaranteed to produce savings. The feature works best if your current provider hasn't already optimized your rate recently. Existing customers getting excellent rates might see minimal benefit from this capability.

Rocket Money's paid tiers remain optional for core functionality—the

For non-technical users who find the subscription tracking and bill negotiation features confusing or intimidating, Rocket Money's focus on automation might create more confusion than value. Simplifi's straightforward approach might suit such users better.

Credit Karma: Why It Fell Short as a Mint Replacement

Understanding Credit Karma's Positioning

Intuit's first attempt to redirect Mint users involved Credit Karma, its free credit monitoring platform. The logic seemed sound: Credit Karma already aggregated financial accounts (linking to checking and credit card accounts to analyze credit utilization and payment history), offered credit score monitoring, and provided debt payoff optimization tools. Intuit positioned Credit Karma as Mint's logical successor, encouraging Mint users to migrate their account information.

However, Credit Karma's core purpose as a credit monitoring and optimization tool didn't align well with Mint users' primary need: budgeting and spending tracking. While Credit Karma could display account balances and track how payments affected credit scores, it didn't provide the spending categorization, budget setting, or expense visualization that defined Mint's value.

Credit Karma offered free service through the money.com affiliate commission model—when you applied for new credit products (credit cards, loans, mortgages), Credit Karma earned referral fees. This business model left Credit Karma's budgeting features underdeveloped compared to dedicated tools. The company prioritized credit optimization and product recommendations because those activities directly generated revenue.

Why the Migration Failed

Many Mint users attempted the Credit Karma transition based on Intuit's recommendation, only to discover that Credit Karma didn't replicate Mint's core functionality. The application's interface prioritized credit monitoring and debt management over spending visualization and budget tracking. Users were left with a tool that addressed different needs than they had when using Mint.

Credit Karma's strength—detailed credit analysis and recommendations for credit improvement—provided insufficient value for Mint users seeking a budgeting replacement. Someone trying to create a detailed budget and track daily spending found Credit Karma incapable of serving that purpose. The tools addressed different problems.

This mismatch became so apparent that Intuit eventually discontinued the budgeting features Credit Karma had offered, conceding that attempting to repurpose a credit monitoring tool as a budgeting solution had failed. Many Mint users who tried Credit Karma later migrated to actual budgeting applications like Simplifi or YNAB.

Credit Karma remains valuable for users specifically seeking credit monitoring, credit score optimization, and product recommendations. But as a Mint replacement for general budgeting, it failed to deliver what users needed.

Essential Considerations for Choosing Your Mint Alternative

Assessment Framework: Matching Your Needs to Platform Capabilities

Selecting a Mint alternative requires honest self-assessment about your actual financial management needs. What aspects of Mint did you use most? What features did you rarely or never access? What frustrated you about Mint's limitations?

If your Mint usage centered on spending tracking and budget setting—checking the dashboard occasionally and monitoring whether you stayed within monthly category limits—you're seeking a simplified budgeting tool. Simplifi aligns exceptionally well with this need, offering the same frictionless tracking with modest improvements over Mint.

If you want to fundamentally change your financial behavior through disciplined budgeting and embrace a methodology that emphasizes intentional allocation, YNAB's philosophical approach and active engagement model creates genuine behavioral transformation. This requires commitment to the methodology and sustained engagement, but the results justify the investment for users willing to participate.

If your financial life involves significant investment holdings, rental properties, or complex income sources (freelancing, business ownership), you need comprehensive wealth management beyond basic budgeting. Monarch Money's investment tracking, financial planning, and goal modeling provide decision-support that simpler platforms lack.

If you value contemporary interface design, collaborative finance management with a partner, and want a modern alternative to Mint's aging interface, Copilot Money delivers an excellent experience at reasonable cost.

If you're primarily motivated by automating financial tasks—particularly discovering and canceling unwanted subscriptions and negotiating bill reductions—Rocket Money's automation focus provides tangible value that budgeting-focused tools can't match.

Cost-Benefit Analysis and Price Sensitivity

Former Mint users often prioritize pricing because Mint's free-forever model set expectations. Evaluate total cost of ownership when comparing alternatives. Simplifi's **

Cost-benefit analysis reveals different conclusions for different users. Someone implementing YNAB's methodology who reduces discretionary spending by

Copilot Money at

Feature Prioritization Matrix

Create a personal feature importance ranking to systematically evaluate options:

- Essential features (non-negotiable): Account aggregation, automatic categorization, spending visualization, basic budgeting

- Very important features (strongly preferred): Investment tracking, goal setting, multi-user access, mobile apps with feature parity

- Nice-to-have features (would enhance experience): Zillow integration, cryptocurrency tracking, AI insights, bill negotiation

- Unnecessary features (not relevant to your situation): Advanced portfolio analysis, retirement planning, financial advisory access

Score each platform against your prioritized feature list. This structured approach prevents either dismissing platforms without evaluating them fully or becoming seduced by impressive features you'll never use.

Technical Considerations: Data Security, Integration, and Infrastructure

Understanding Plaid and Financial Data Aggregation

Virtually every Mint alternative relies on Plaid for financial institution connectivity. Plaid operates as a secure intermediary between budgeting applications and financial institutions, obtaining account information without requiring users to share banking credentials directly with third-party applications.

Plaid's architecture uses read-only API connections where available or secure OAuth authentication. You authenticate with your financial institution directly (via your bank's login interface), and Plaid receives only the financial data, never your banking credentials. This fundamental difference from Mint's older credential storage represents a security improvement.

Plaid supports connections to over 14,000 institutions across US, Canada, and Europe, covering nearly all major financial institutions and most regional banks. If your primary financial accounts are at major banks (Bank of America, Wells Fargo, Chase, Citibank) or large online lenders (Charles Schwab, Fidelity), Plaid integration is reliable.

However, certain institutions or account types might not integrate fully. Newer fintech platforms, credit unions, or certain investment accounts might lack Plaid support, requiring manual transaction entry or account balance updates. Before committing to a platform, verify your specific financial institutions support Plaid integration.

Data Privacy and Encryption Standards

Evaluate each platform's privacy policies and security certifications. Reputable budgeting applications should meet these standards:

- Encryption in transit: All connections use TLS/SSL protocols (https:// in URLs)

- Encryption at rest: Stored financial data is encrypted and decryption keys are protected

- SOC 2 Type II compliance: Third-party audits verify security controls and data handling practices

- Two-factor authentication: Available for additional account security

- Limited data retention: Financial institutions cannot access application data; applications don't store banking credentials

Monarch Money, YNAB, Simplifi, and Rocket Money all meet these standards. Smaller or newer platforms might lack formal certifications—if security is paramount, prioritize established providers with documented certifications.

Integration Ecosystem and API Access

Consider how each platform integrates with complementary services. YNAB offers integrations with mortgage tracking, utility monitoring, and expense receipt capture through partner services. Monarch Money's Zillow integration and investment account support extend functionality beyond core budgeting.

Some platforms support API access for power users who want to build custom integrations or export data in specialized formats. YNAB, for instance, offers developer APIs that enable building custom tools leveraging YNAB data. If you're technically inclined and want to extend platform functionality, API availability matters.

Data Migration: Importing Your Mint History and Getting Started

Exporting Data from Mint Before Shutdown

Unfortunately, Mint's shutdown happened with limited notice, and many users didn't export their historical data before the app ceased functioning. However, if you saved backups or have access to your Mint data, importing it into a successor platform can provide continuity.

Most Mint alternatives accept CSV (comma-separated value) imports, allowing you to reconstruct transaction history. You can export Mint data in several formats—transaction lists, category summaries, budget configurations—and import that structure into new platforms.

The import process typically follows these steps:

- Export Mint data: If you have access to Mint before shutdown (unlikely for most users) or previously exported data, download transactions in CSV format

- Verify data format: Ensure the CSV includes transaction date, amount, category, merchant, and account information

- Transform if necessary: Some platforms require specific column formatting; you might need to restructure data using spreadsheet tools

- Connect bank accounts: Connect your current financial institutions to the new platform through Plaid integration

- Import historical transactions: Upload your exported CSV data, allowing the platform to merge it with new automatically-imported transactions

- Verify categorization: Review imported transactions for accuracy, noting any miscategorizations that need correction

Getting Maximum Value from Initial Platform Setup

When transitioning to a new budgeting platform, several setup steps dramatically improve initial experience:

Connect all financial accounts: Link every bank account, credit card, investment account, and loan that you maintain. Completeness of account aggregation is fundamental to platform value—partial connectivity creates incomplete net worth calculations and missing transaction visibility.

Ensure accurate income entry: Verify that recurring income is correctly identified (salary, freelance income, rental income). Budget planning relies on accurate income understanding, and misconfigured income produces invalid budgets.

Categorize test transactions: After the first week of transactions, review categorization accuracy. If the algorithm consistently miscategorizes certain merchants, create specific rules or note patterns for manual correction.

Configure accounts for collaborative access (if relevant): If using the platform with a partner, set up shared access carefully, determining whether each person sees all data or maintains separate visibility.

Set initial budget targets: Create conservative budget allocations based on historical spending patterns. The platform typically suggests targets based on previous months; use these suggestions as starting points.

Advanced Features and Power User Considerations

Investment Portfolio Tracking and Integration

For users with significant investment holdings, investment portfolio integration separates adequate platforms from comprehensive solutions. Here's what to evaluate:

Basic investment tracking (offered by most platforms): Account balance aggregation showing total investment value by institution. This level of integration answers "How much do I have?" but not "Is my portfolio well-constructed?"

Portfolio analysis (offered by Monarch Money): Asset allocation visualization showing stock/bond/cash percentages, performance tracking showing gains and losses, and comparison to recommended allocations based on your age and risk profile. This level addresses "How is my portfolio performing and is it aligned with my goals?"

Advanced investment analytics (dedicated investment platforms): Expense ratio analysis, tax-loss harvesting identification, international diversification assessment, and environmental/social governance metrics. This level addresses sophisticated investing questions.

Most budgeting platforms provide basic-to-intermediate investment integration. Users with $500,000+ in investments or seeking sophisticated analysis typically need dedicated investment platforms supplementing budgeting tools.

Multi-user Collaboration and Family Finance Management

For couples and families managing finances collectively, collaboration features vary meaningfully:

Simplifi: Guest access allows sharing read-only views or providing co-management privileges. One partner maintains the primary account; the other accesses it through invitation.

Copilot Money: Both parties maintain independent accounts with shared access to budgets and spending. The design assumes equals collaborating rather than a primary account with guest access.

Monarch Money: Premium tiers include features for couples, though the collaboration is less extensive than Copilot's design.

YNAB: Multi-user access is available but requires additional licenses; it's not seamlessly integrated for couples like Simplifi or Copilot.

For couples wanting transparent finances without hierarchy, Copilot Money's bilateral design excels. For partnerships where one person manages finances and the other wants visibility, Simplifi's guest access model works well.

Customization Depth and Flexibility

Some users want to customize every aspect of their budgeting experience—custom category names, categorization rules, visualizations, reports. Others want simplicity and defaults.

YNAB and Monarch Money offer significant customization: custom categories, detailed transaction rule creation, report customization, and data export. Power users appreciate this control.

Simplifi and Copilot Money offer moderate customization within predefined frameworks. You can set spending targets and adjust allocations but not reshape the fundamental structure.

If you're technically inclined or have unusual financial structures requiring custom categorization, prioritize platforms offering customization depth.

Troubleshooting Common Transition Challenges

Account Connectivity and Plaid Integration Issues

Occasionally, financial institutions fail to connect properly through Plaid. Common causes and solutions:

Problem: "Connection failed" error for specific accounts

Solution: Verify your banking credentials are current. If you've recently changed your password, the old credentials in Plaid fail. Re-authenticate through the app's settings, re-entering your current banking password.

Problem: Transactions aren't updating automatically

Solution: Financial institutions sometimes require re-authentication when security protocols change. Check your bank's app for alerts requiring password update. Re-link the account in your budgeting app.

Problem: Account types missing (mortgages, investment accounts, credit lines)

Solution: Not all account types integrate through Plaid. Mortgages specifically often require manual setup. Check your platform's documentation for supported account types; you might need to manually track certain accounts.

Categorization Accuracy and Overcorrection

When switching platforms, the new application's categorization algorithm will differ from Mint's, creating apparent miscategorizations. Understanding what's happening prevents frustration:

Initial miscategorization phase: For the first month, expect higher miscategorization rates as the algorithm learns your patterns. After 30-60 days, accuracy typically improves to 85-95% for standard merchants.

Merchant ambiguity: Certain merchants legitimately create categorization challenges. Gas stations sell snacks (grocery miscategorization), pharmacy chains sell personal care items and medications (category ambiguity), and wholesale clubs like Costco sell everything. Rather than expecting perfect categorization, create specific rules for merchants you visit regularly.

Reclassification strategy: Don't attempt to recategorize your entire transaction history immediately. Focus on correcting recent transactions (current month and last month). Once patterns stabilize, selective recategorization of older transactions provides sufficient accuracy.

Budget Anxiety and Overspending Detection

Transitioning to active budgeting creates psychological challenges some users don't anticipate:

Anxiety from budget visibility: Seeing exactly how much you spend on categories you previously tracked unconsciously can create negative feelings. Rather than abandoning budgeting, reframe: accurate awareness is the foundation for behavior change.

Frequent overspending in early months: If you're used to passive tracking, initial budgets might be unrealistic. Adjust downward expectations gradually over 2-3 months as you establish real spending patterns.

Decision paralysis when approaching limits: Some users experience stress when approaching category limits, uncertain whether to reduce spending or adjust the budget. Remember: budgets are tools for understanding your spending patterns, not rigid restrictions. Adjust when patterns change.

Looking Forward: The Evolution of Personal Finance Technology

Emerging Trends in Budgeting and Financial Management

The personal finance technology landscape continues evolving. Observing emerging trends helps predict which platforms will thrive and which might decline:

AI-driven personalization: Modern budgeting platforms increasingly use machine learning to understand your unique financial patterns and provide personalized recommendations. Rather than generic budgeting templates, sophisticated algorithms analyze your spending and suggest category limits specifically tailored to you.

Behavioral economics integration: Newer platforms leverage behavioral finance principles—understanding that people are irrational about money and designing experiences accommodating that irrationality. Gamification elements (achievement badges, streak tracking), loss aversion framing (visualizing what spending prevents you from achieving), and social comparison (seeing how your spending compares to similar users) motivate behavior change more effectively than traditional approaches.

Embedded financial services: The line between budgeting tools and financial services continues blurring. Platforms increasingly offer integrated bill negotiation (Rocket Money), savings optimization, debt payoff planning, and investment management rather than functioning as pure tracking tools.

Privacy-first design: Users increasingly demand control over their financial data. Platforms emphasizing privacy—local data processing, minimal data sharing with third parties, transparent data policies—will attract privacy-conscious users.

Mobile-primary experiences: While web platforms remain important, mobile-first design is becoming table stakes. Users expect smartphone access with feature parity, not limited mobile versions.

The Role of AI Agents in Future Budgeting

Emerging AI capabilities create intriguing possibilities for future budgeting platforms. Conversational AI interfaces (similar to Chat GPT) could allow natural language budget queries: "How much have I spent on groceries this month?" or "What categories am I overspending in?" Rather than navigating complex interfaces, you converse with a financial assistant that understands context and provides thoughtful responses.

AI agents could also handle routine financial tasks autonomously within appropriate boundaries. An AI might automatically execute small transfers to savings accounts when it detects temporary spending dips, negotiate on your behalf with merchants when overspending patterns trigger opportunities for bill reduction, or rebalance investment portfolios according to your preferences.

These capabilities remain nascent but emerging rapidly. Platforms investing in AI integration early might achieve significant advantages as these technologies mature.

Comparative Feature Matrix: Quick Reference Guide

| Feature | Simplifi | YNAB | Monarch Money | Copilot | Rocket Money |

|---|---|---|---|---|---|

| Price (Monthly) | $4 | $15 | $12 | $4.99 | Free-$9.99 |

| Free Tier | No | 34-day trial | Limited | No | Yes |

| Spending Tracking | Excellent | Excellent | Excellent | Excellent | Excellent |

| Budget Flexibility | Suggested limits | Rigid allocation | Flexible | Flexible | Flexible |

| Investment Tracking | Basic | Basic | Comprehensive | Basic | Basic |

| Zillow Integration | No | No | Yes | Yes | No |

| Crypto Support | No | Limited | Yes | Yes | Limited |

| Multi-user Access | Guest access | Limited | Limited | Full collaboration | No |

| Mobile Experience | Strong | Companion | Excellent | Excellent | Excellent |

| Learning Curve | Minimal | Steep | Moderate | Minimal | Minimal |

| Best For | Simplicity seekers | Behavior change | Investors | Couples/Design | Task automation |

Final Recommendations: Choosing Your Mint Successor

Decision Framework Summary

Your ideal Mint alternative depends on your specific financial management style, needs, and preferences:

Choose Simplifi if: You want minimal setup, straightforward spending tracking, and affordability. Simplifi is the closest spiritual successor to Mint, offering similar functionality with modest improvements and exceptional ease of use. The $4 monthly price is genuinely minimal, and the learning curve is negligible.

Choose YNAB if: You want to transform your financial behavior through disciplined budgeting, and you're willing to invest effort in understanding and implementing zero-based budgeting principles. The $15 monthly cost represents genuine value for users who embrace the methodology and achieve measurable spending reduction.

Choose Monarch Money if: Your financial life involves significant investments, real estate, or complex holdings requiring comprehensive analysis. The $12 monthly investment tracking and financial planning tools provide decision-support that simpler platforms can't offer.

Choose Copilot Money if: You value contemporary interface design, want to manage finances collaboratively with a partner, or prefer modern technology approach to budgeting. The $4.99 monthly cost is competitive, and the experience quality is genuinely excellent.

Choose Rocket Money if: Your primary motivation is automating financial tasks, particularly discovering and eliminating unwanted subscriptions. The free tier provides real value, and optional paid tiers (

FAQ

What are the key differences between budgeting apps and banking apps?

Budgeting apps aggregate accounts from multiple institutions, analyze spending patterns, set budgets, and track financial goals. Banking apps typically connect to a single bank and offer basic account management. Budgeting apps provide holistic financial visibility across all your accounts, while banking apps focus on transaction management within that single institution. For comprehensive financial management, budgeting apps are essential.

How secure are budgeting apps with my financial data?

Reputable budgeting apps like Simplifi, YNAB, and Monarch Money employ bank-level security: encryption in transit (TLS/SSL), encryption at rest, SOC 2 Type II compliance, two-factor authentication, and secure Plaid integration. Crucially, these apps never store your banking credentials—they use Plaid as a secure intermediary. Your data receives stronger protection than if you maintained accounts across separate banking portals.

Can I use multiple budgeting apps simultaneously?

Yes, you can use multiple apps simultaneously, though it creates complexity. Some users maintain a budgeting app (Simplifi) for spending tracking and a second app (Monarch Money) for investment portfolio analysis. However, multiple simultaneous apps means duplicate account connections, duplicated notification alerts, and synchronization challenges. Most users find choosing one primary platform more practical than juggling multiple tools.

What's the difference between recommended and actual spending categories?

Recommended spending categories are suggested limits based on your historical spending patterns. Actual spending is what you genuinely spent. Comparing these helps identify categories where you consistently overspend (suggesting unrealistic recommendations) or underspend (suggesting opportunities to redirect funds to other goals). Over time, recommended limits become more accurate as algorithms learn your true patterns.

How quickly can I switch from Mint to a new platform?

Basic setup—connecting accounts and spending 30 minutes exploring the interface—typically takes one session. However, achieving accuracy and customization takes 2-4 weeks. During the first month, categorization accuracy improves as the algorithm learns your patterns. Most users feel fully comfortable with a new platform within 30-45 days. Patience during the initial transition period produces better long-term outcomes than rushing setup.

Should I wait for new budgeting apps or switch to an established platform?

Established platforms (Simplifi, YNAB, Monarch Money) have proven track records, active development, and sustainable business models. Newer apps (Copilot Money) offer contemporary design and fresh perspectives but carry more risk of feature changes or potential discontinuation. Unless you have specific reasons preferring newer platforms, established options provide more security. However, Copilot Money's quality and funding appear solid, making it reasonable for users valuing design above all else.

How do I export data from my new budgeting app if I want to switch later?

Most reputable budgeting apps allow CSV export of transactions, budgets, and categories. This data portability means you're not permanently locked into any single platform—if a superior alternative emerges, you can export your history and import it elsewhere. Verify export capabilities before committing to any platform long-term.

What's the difference between tracking spending and budgeting?

Spending tracking is recording where money goes after the fact—reviewing past transactions and categorizing them. Budgeting is allocating money proactively to categories before spending. Tracking is reactive ("Where did I spend money?"), while budgeting is proactive ("Where should I spend money?"). Most apps combine both: you set budgets, then track spending against those budgets to monitor variance.

Can budgeting apps help me save more money?

Budgeting apps don't inherently make you save more—they make spending visible. Visibility creates awareness, and awareness enables behavior change. Platforms like YNAB that emphasize intentional allocation and goal setting are more likely to drive behavior change than passive tracking apps. However, the tool's effectiveness depends entirely on your willingness to use insights and modify behavior. Disciplined users achieve significant savings; passive users might gain awareness without achieving behavior change.

What should I do if my bank doesn't support Plaid integration?

If your financial institution doesn't connect through Plaid, most budgeting apps allow manual account setup where you provide account numbers and routing numbers. You'll need to enter transactions manually or through bank statement imports rather than real-time automatic synchronization. Smaller credit unions and some regional banks sometimes lack Plaid support, but this affects minority of users. Verify Plaid support for your specific institutions before selecting a platform.

Conclusion: Making Your Final Decision

Mint's discontinuation forced millions of users to reevaluate their budgeting platforms, and while the transition proved frustrating initially, the alternative solutions available in 2025 offer meaningful improvements over Mint's original capabilities. The market has matured significantly—rather than a single dominant platform, you now have several excellent options optimized for different financial management approaches and user preferences.

The path forward isn't finding a single "best" alternative but identifying which platform aligns with your specific financial situation, management style, and priorities. Someone seeking minimal complexity and maximum simplicity finds excellence in Simplifi's $4/month offering. Someone committed to behavior change discovers transformation through YNAB's structured methodology. Someone managing complex investments gains decision-support through Monarch Money's portfolio analysis. Someone valuing collaborative finance with a partner finds joy in Copilot Money's modern design. Someone focused on automating financial tasks discovers genuine value in Rocket Money's subscription and bill management features.

The transition process itself represents an opportunity. Rather than passively importing settings, actively consider whether your previous budgeting approach served you well. Did you check Mint weekly, find the budget useful, and make spending decisions based on the information? Or did you accumulate thousands in unexpected expenses because budgeting was abstract until you faced consequences? The answers determine whether you need a simple tracking tool or a more structured methodology.

Give yourself 4-6 weeks with your selected platform before deciding whether it truly fits. The initial learning curve—understanding the interface, letting algorithms learn your patterns, establishing categorization accuracy—creates a transition period where new platforms feel unfamiliar relative to long-familiarity with Mint. By week 4-6, you'll have sufficient experience to evaluate whether the platform genuinely matches your needs.

One final thought: whichever platform you choose, the most important outcome isn't which specific app you use—it's that you maintain engaged oversight of your finances. Users who actively monitor spending, set intentions around money allocation, and periodically review whether their behavior aligns with their goals achieve financial wellbeing regardless of which specific platform enables that awareness. Mint, Simplifi, YNAB, Monarch Money, and the other alternatives are all tools serving that fundamental purpose. Your commitment to using them effectively matters more than which specific tool you select.

The shutdown of Mint, while disappointing, created an opportunity for better alternatives to emerge. Take advantage of that opportunity by selecting a platform matching your needs, giving yourself time to adapt, and then building sustainable financial habits that genuinely improve your economic wellbeing.