Dell XPS Revival: Why the Rebranding Disaster Led to Redemption [2025]

Sometimes companies make decisions that seem smart on a Power Point slide but crash spectacularly in the real world. Dell did exactly that in 2024 when it decided to kill off the XPS brand.

For years, XPS was Dell's halo product. It was the laptop that made people pause and ask, "Wait, that's a Dell?" It stood for something: premium design, thoughtful engineering, and the kind of attention to detail that made professionals actually want to buy Dell instead of just settling for it.

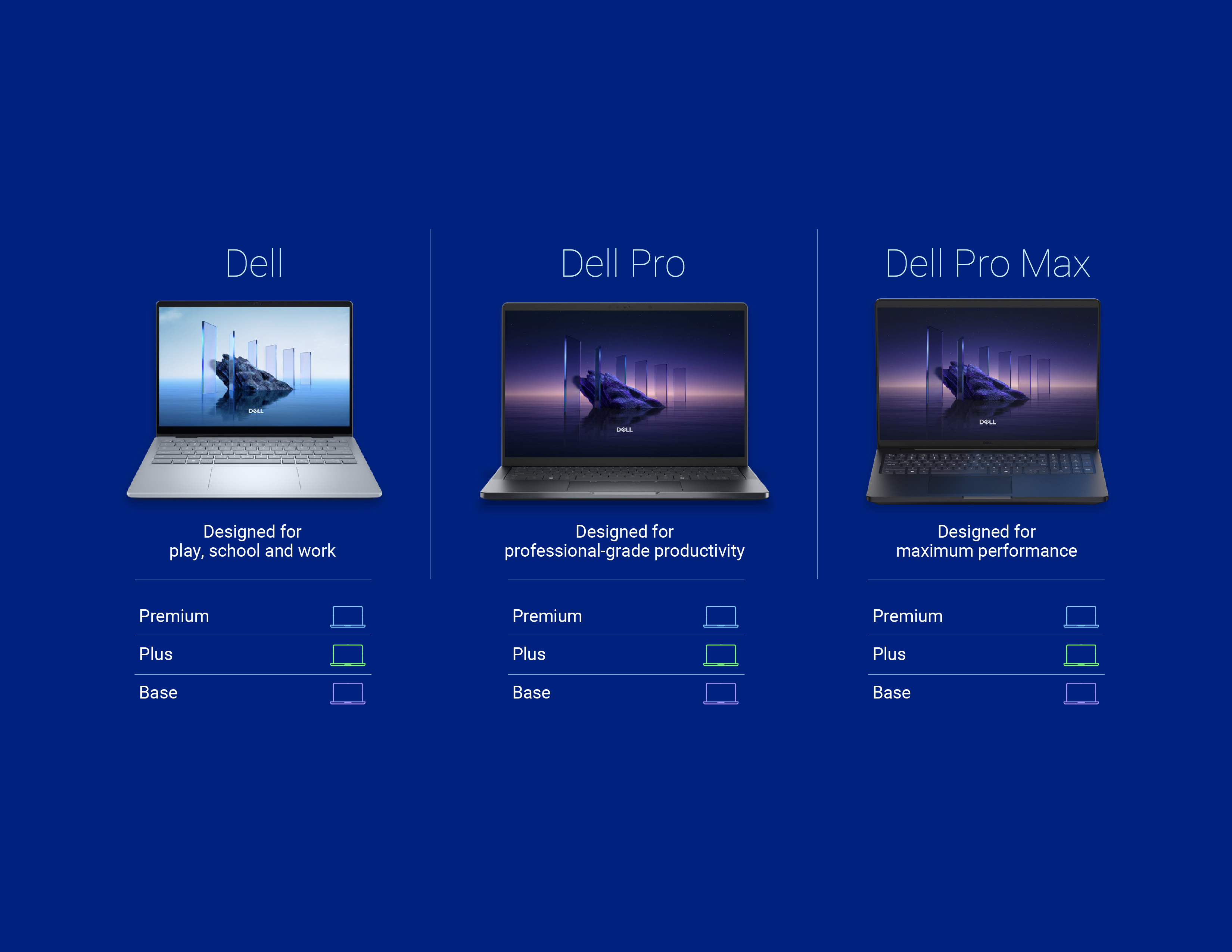

Then Dell decided to simplify. Gone were the individual brand names. Gone was XPS. Instead, everything became just "Dell," with a numbering system. It was supposed to make things clearer. Instead, it made the entire Dell lineup feel commoditized, interchangeable, and frankly, generic.

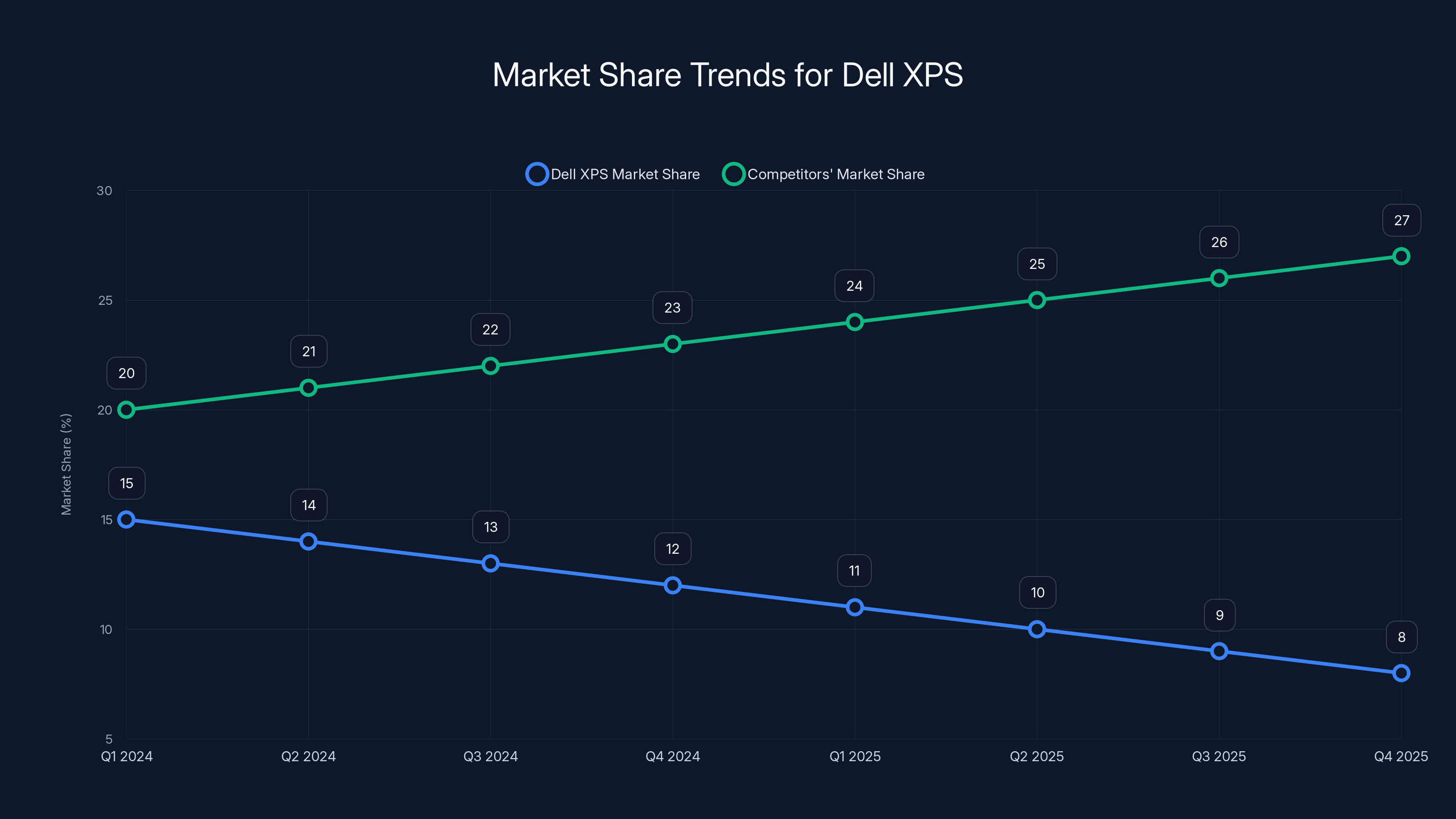

The results were immediate and brutal. Dell's PC market share dropped throughout 2025. Customers were confused. Retailers didn't know what to push. The brand that had been climbing stopped dead.

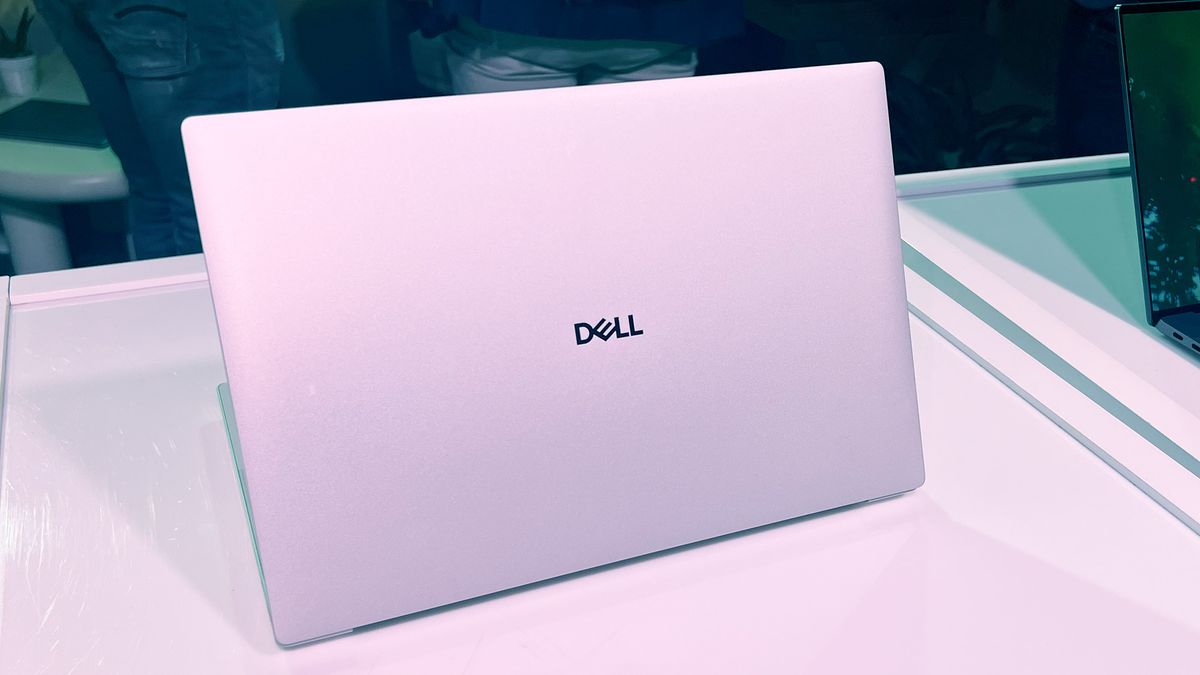

So at CES 2026, Dell did something you rarely see in corporate America: it admitted it was wrong. The company brought back XPS. Not just the name, but a renewed commitment to the line with the new XPS 14 and 16, featuring a complete design overhaul that addresses nearly every complaint people had about the previous generation. There's also a teased XPS 13 coming later that's supposed to be thinner and lighter than anything Dell has made before.

This is one of the most interesting case studies in recent tech history. It's about brand equity, marketing miscalculation, and what happens when a company mistakes simplification for strategic thinking.

Let's dig into what happened, why it mattered, and what the new XPS lineup actually means for Dell's future.

TL; DR

- The Rebranding Disaster: Dell killed the iconic XPS brand in 2024, replacing it with a simplified naming scheme that backfired spectacularly.

- Market Impact: The move correlated with measurable losses in PC market share throughout 2025, signaling customer confusion and brand damage.

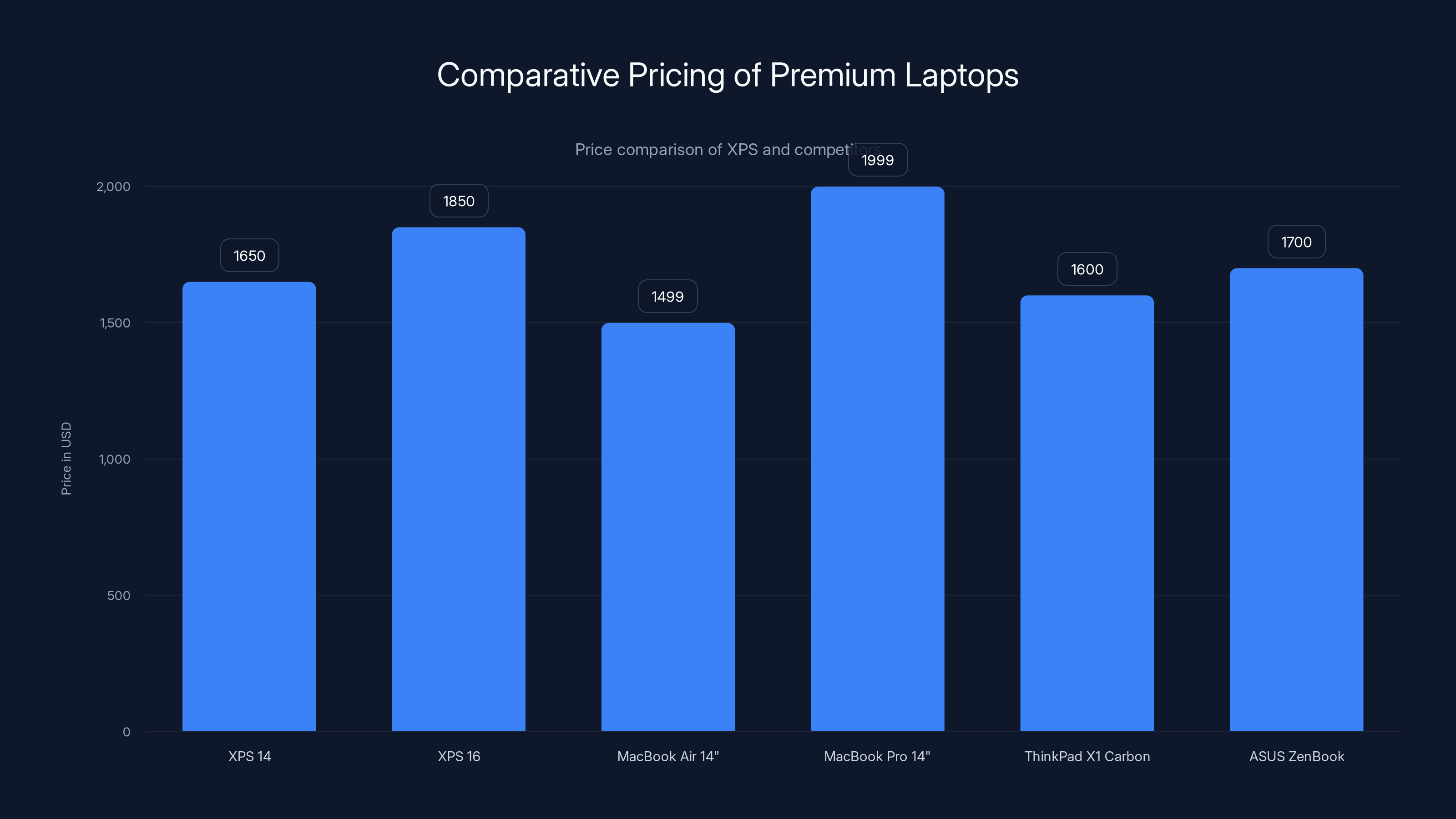

- The Revival: New XPS 14 and 16 models launch January 6 at 1,850, featuring refined designs that directly address previous criticisms.

- Key Improvements: Function key row (replacing capacitive buttons), visible trackpad borders, reduced weight (0.5-1 pound lighter), and tandem OLED options.

- Future Plans: Dell teased an ultra-thin XPS 13 coming later in 2026, positioning XPS as a premium tier with dedicated branding and investment.

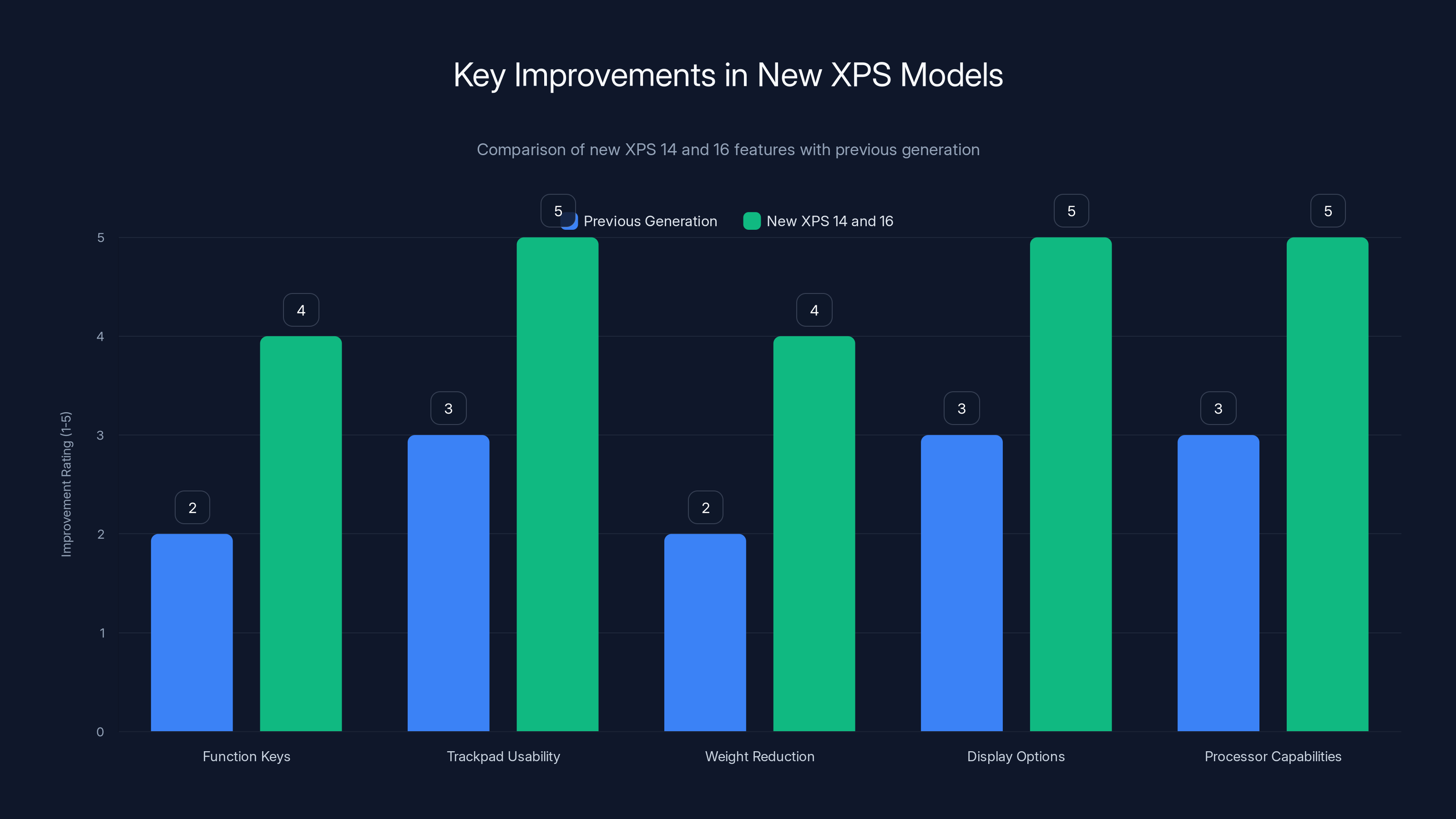

The new XPS 14 and 16 models show significant improvements in usability, weight, display, and processing power compared to the previous generation. Estimated data.

The XPS Brand: What It Meant and Why It Mattered

The XPS lineup wasn't just a product category for Dell. It was a statement of intent.

When Dell launched the first XPS laptop in the early 2000s, the company was already enormous. It was making millions of commodity business laptops, competing on price and reliability. The XPS line said something different: "We can make something beautiful too."

Over the years, XPS became shorthand for Dell's most thoughtfully designed, most premium offerings. It wasn't the most powerful. It wasn't always the cheapest. But it was the line that people pointed to when they wanted to show that Dell could compete with Apple's design philosophy.

The XPS 13 became iconic. Launched in 2012 with minimal bezels (years before that became standard), it showed that a premium Windows laptop could exist without apologizing for its existence. Professionals used it. Design-focused people used it. People who actually cared about what their laptop looked like chose XPS.

By 2024, XPS had been refined through generations of iteration. Yes, there were missteps. The previous generation's capacitive function keys were controversial. The invisible trackpad was confusing to some. But the brand itself was strong. People knew what they were getting.

That brand equity is worth billions of dollars. A name that instantly signals quality, taste, and attention to detail. That's not something you build in a year. It takes a decade of consistent execution and positive word-of-mouth.

Dell had built something valuable with XPS. So why did they throw it away?

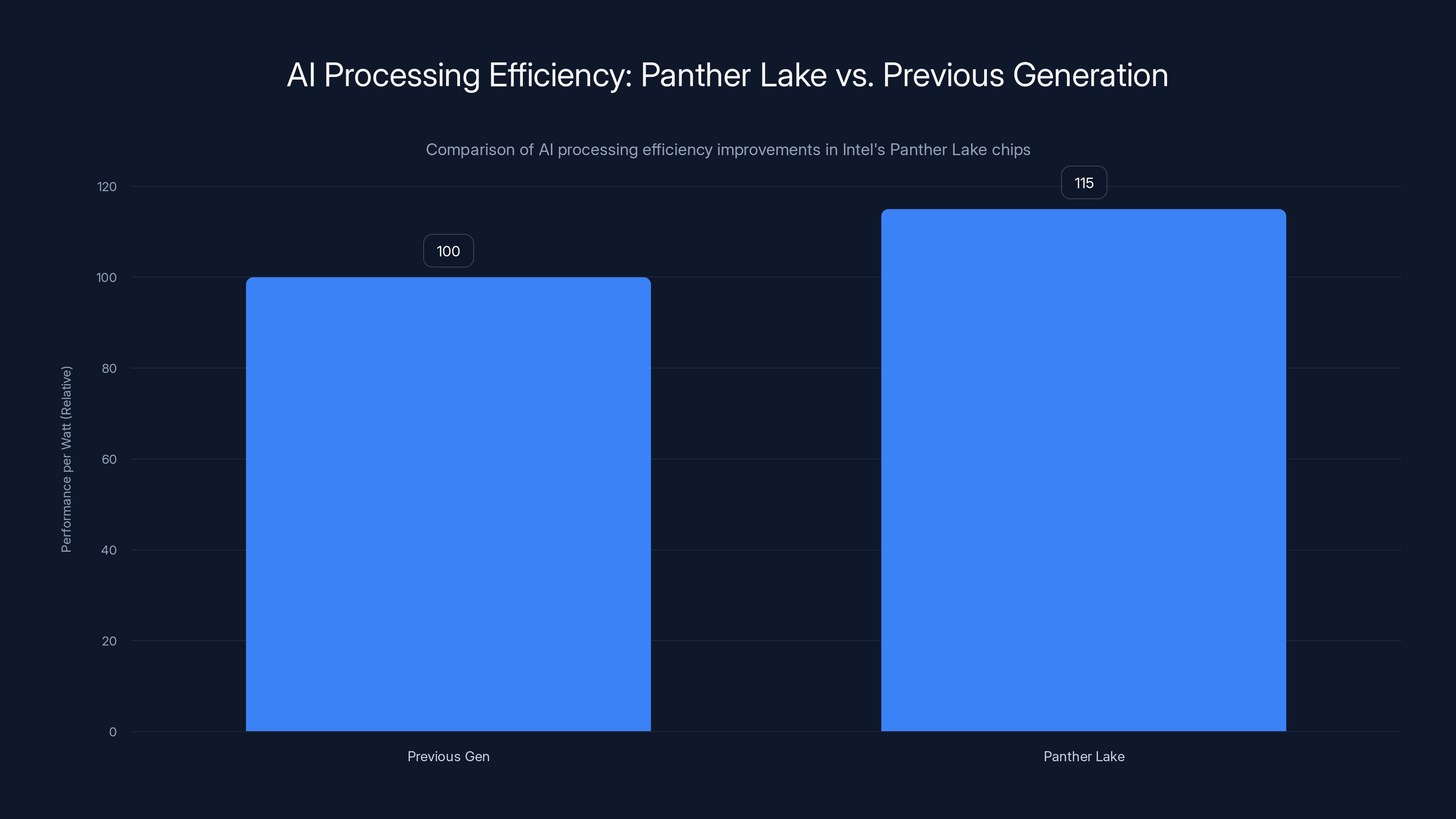

Panther Lake offers a 15% improvement in performance per watt over the previous generation, enhancing battery life and local AI processing capabilities.

The "Simplification" Strategy: Where It All Went Wrong

In early 2024, Dell announced it was consolidating its PC brand portfolio. The Inspiron brand? Merged into the new naming scheme. Vostro? Same treatment. XPS? You guessed it.

The logic made a kind of sense, at least in theory. Dell had created too many sub-brands. Marketing was spread thin. Retailers were confused about which brand to push. The company produced spreadsheets showing that a simpler, unified naming system would make everything clearer for customers.

What they didn't account for was this: simplification for operational efficiency isn't the same as simplification for customer understanding.

What Dell actually did was remove the signal that helped customers navigate the lineup. The XPS brand said "This is premium." The Inspiron brand said "This is consumer-friendly." Vostro said "This is business-focused." These distinctions matter to people making purchase decisions.

Instead, customers got a numbering system. Higher numbers meant better specs, supposedly. But without the brand signaling, everything felt interchangeable. If the 15 and the 16 and the 17 are all just "Dell," why wouldn't you just pick the cheapest one?

From a market psychology perspective, this was a catastrophic error. Brand equity isn't a feature. It's not a spec sheet item. It's the accumulated goodwill and trust that people have developed over years of positive experiences. When you throw that away, you're burning years of marketing investment in a single decision.

The consequences became visible in market share data. Throughout 2025, Dell's PC market share contracted. This wasn't because the hardware got worse. It was because the brand messaging got confused. When retailers and customers couldn't identify what made a Dell laptop special, they started looking at alternatives. Lenovo. HP. ASUS. Brands that maintained clear positioning.

It's a textbook case of mistaking internal operational convenience for customer communication. The spreadsheets said consolidation was efficient. The market said it was a disaster.

Why 2025 Was So Brutal for Dell's PC Business

The rebranding didn't happen in a vacuum. It coincided with the AI PC boom, which should have been a massive opportunity for Dell.

Throughout 2024 and 2025, the entire PC industry was pivoting to "AI PCs." These were laptops with dedicated AI processors, like Qualcomm's Snapdragon X chips or later Intel's Panther Lake Core Ultra Series 3. The marketing message was clear: "Your next PC will have AI built in."

But this was also when customers were confused about what "AI PC" even meant. Copilot integration? Local LLM processing? Cloud-based AI features? The terminology was murky, and the customer value proposition was unclear.

Normally, strong branding helps cut through confusion. If you know and trust a brand, you're more likely to adopt its products even when the category itself is nebulous. But Dell had just eliminated the branding that made it trustworthy and aspirational.

Meanwhile, competitors were doubling down on brand positioning. Apple marketed its MacBooks as the premium choice with seamless AI integration. Lenovo repositioned itself as the premium business alternative. ASUS and MSI focused on the gaming and creator segments. Everyone had a story.

Dell was just... Dell. A number. A spec sheet. No story.

Market share erosion during this period wasn't inevitable. It was a direct consequence of poor branding strategy during an uncertain market transition. Customers needed reasons to trust a new technology category. Dell removed the one consistent signal it had built over two decades.

The XPS 14 is competitively priced between the MacBook Air and MacBook Pro, positioning itself as a premium option among Windows laptops.

The New XPS 14 and 16: Engineering Redemption

When Dell announced the new XPS 14 and 16 at CES 2026, it wasn't just bringing back a brand name. It was introducing a fundamentally redesigned product line that addressed nearly every criticism leveled at the previous generation.

Let's talk about the specific improvements, because they matter.

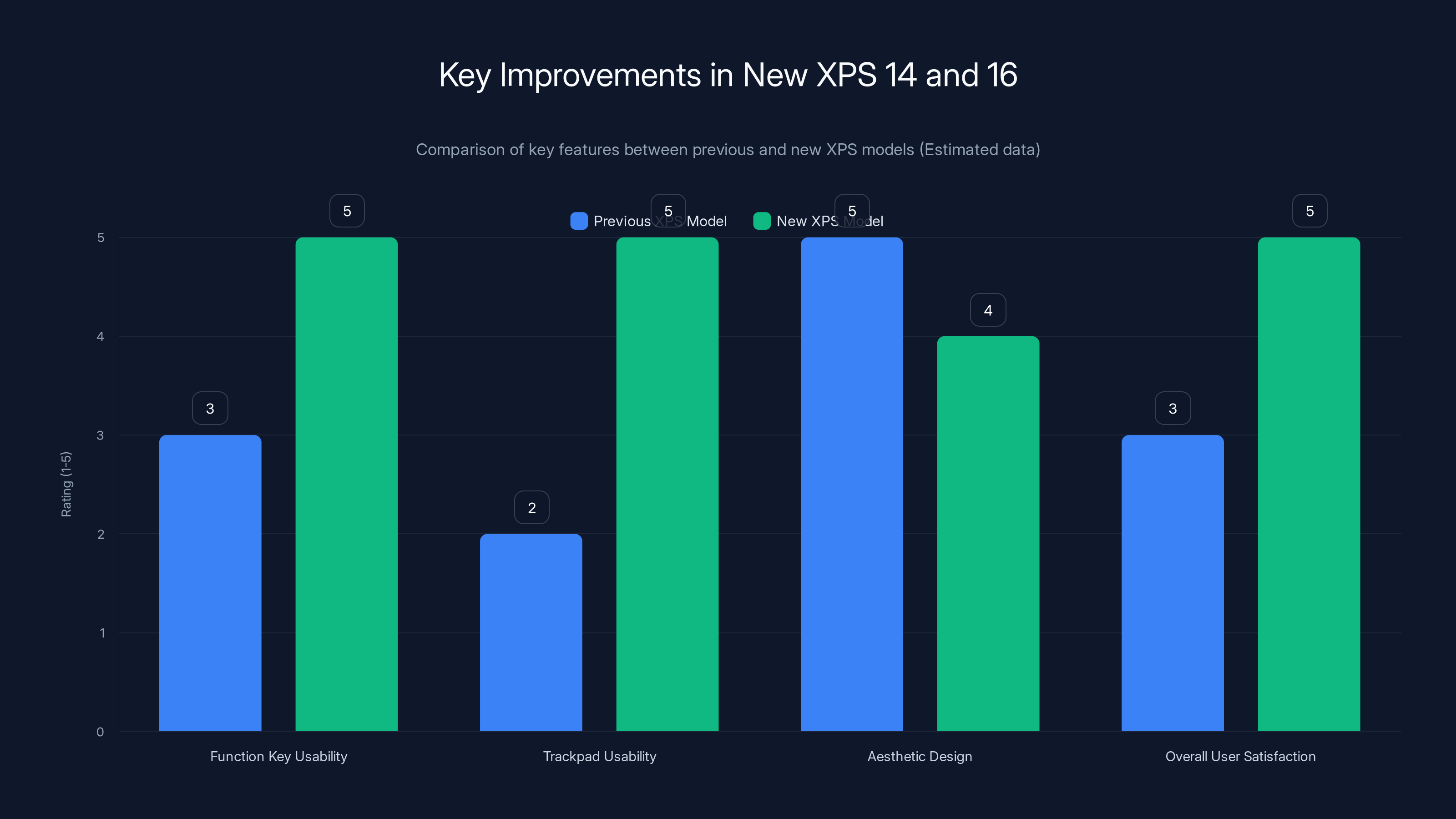

The Function Key Row: A Return to Normalcy

The previous generation XPS used capacitive function keys. You know, those touch-sensitive buttons that work sometimes and are invisible in sunlight. They were controversial from day one.

The philosophy behind them was understandable: Dell was trying to maximize screen real estate by minimizing the physical space occupied by the function row. Clean lines, minimal bezels, premium aesthetic.

But function keys are something you use without looking. You develop muscle memory. With capacitive buttons, you had to look down, touch the right area, and hope the sensor registered. Sometimes they didn't. Sometimes they registered when you didn't intend them to. In sunlight, they were basically unusable.

The new XPS returns to a traditional function key row with actual physical keys. This is a win for usability, even if it's a tiny retreat from the previous aesthetic minimalism. It's the right trade-off.

The Trackpad Border: Solving an Invisible Problem

Dell's invisible trackpad was another controversial feature. The trackpad sat completely flush with the wrist rest, with no visible delineation. This maximized visual sleekness but created a real usability problem: you didn't know exactly where the trackpad ended and the palm area began.

Users reported accidentally triggering the trackpad while typing, or moving their hands awkwardly because they weren't sure where to safely rest their palm.

The new XPS adds a subtle light border around the trackpad edges. This solves the problem without sacrificing the overall aesthetic. You can see where the trackpad is, but the design remains clean and modern. It's the kind of refinement that shows actual user testing and feedback incorporation.

Weight Reduction: Meaningful Portability Gains

The XPS 14 weighs approximately 3 pounds in the new design, down from 3.5 pounds. The XPS 16 weighs 3.6 pounds, down from 4.6 pounds.

These numbers might look small on paper, but for all-day portable laptops, they matter significantly.

For the XPS 14, a half-pound reduction is about 8% lighter. That's roughly equivalent to removing two smartphones from your bag. If you're carrying this laptop every day, that compounds over months. Your shoulder, your back, your wrist all feel the difference.

For the XPS 16, a full pound reduction is enormous. That's a 22% weight reduction on a 15-inch class machine. That takes it from "portable but noticeable" to genuinely portable. The XPS 16 becomes viable for frequent travelers in a way the previous generation wasn't.

Dell achieved this through material science and design refinement. They haven't disclosed all the specifics, but using aerospace-grade aluminum and optimizing internal component placement both help.

Design Lineage: Borrowing from Surface

Anyone looking at the new XPS immediately notices the design language has shifted. It looks cleaner, more subtle, with less aggressive industrial design. The comparison to Microsoft's Surface Laptop is unavoidable, and it's fair.

Dell is essentially saying: "We like what Microsoft did with design restraint. That's the direction we're going."

This is interesting because it signals a shift in Dell's design philosophy. The previous XPS was design-forward, almost aggressive in its aesthetic choices. The new XPS is design-aware but understated. It's a more mature approach, and it's also more versatile. This design language works in a creative's loft and in a corporate conference room.

The Processor Inside: Panther Lake and AI Capability

The new XPS 14 and 16 are powered by Intel's Panther Lake Core Ultra Series 3 chips. This is Intel's latest and most capable generation for consumer and prosumer laptops.

Panther Lake represents Intel's most serious attempt yet at competing with Apple's neural engines and ARM-based AI acceleration. The chips include dedicated NPU (neural processing unit) capacity, as well as beefier GPU cores than previous generations.

In practical terms, this means:

Local AI processing becomes viable. Instead of sending every AI request to the cloud, the laptop can handle many tasks locally. This is faster, more private, and doesn't require an internet connection. For professionals working with sensitive data, this is significant.

Better battery life with AI features. Cloud-connected AI is power-hungry. Local processing is more efficient. Dell is targeting better battery life on these machines, which Panther Lake enables through its efficiency improvements.

Compatibility with emerging AI tools. More and more applications are adopting on-device AI capabilities. Having a powerful NPU means the XPS can take full advantage of these features as they mature throughout 2026 and beyond.

Intel's performance claims for Panther Lake suggest roughly 15% better performance per watt compared to the previous generation, which translates to meaningful battery life improvements.

The new XPS models significantly improve usability with physical function keys and a bordered trackpad, enhancing user satisfaction despite a slight compromise in aesthetic design. Estimated data.

Tandem OLED: Display Technology That Matters

Dell is offering tandem OLED display options on both the new XPS 14 and 16. This is a big deal, and it's worth understanding why.

Tandem OLED is a display architecture where two OLED layers are stacked together. This allows for higher brightness levels without the lifespan concerns that plagued earlier OLED displays. You get the deep blacks and perfect color accuracy of OLED, but with brightness levels that compete with traditional LCD displays.

For a premium laptop, this is a significant feature. The XPS line has always been about professionals who care about color accuracy: photographers, designers, video editors. OLED natively delivers better color reproduction than LCD. Adding tandem OLED means they get OLED's color benefits without sacrificing brightness for outdoor use or presentation scenarios.

Is it expensive? Yes. But for the target audience, it's worth it. A photographer or designer using the XPS 14 or 16 isn't choosing based on price. They're choosing based on color accuracy and workflow efficiency.

Pricing: Where the XPS Lands

The new XPS 14 starts at

This positioning is interesting. These are premium prices, but not absurd. For comparison, a MacBook Air 14-inch starts at

The key question: is the new XPS compelling enough to justify the price versus alternatives?

Against MacBook Air: The XPS 14 offers comparable design, better display options (OLED vs Apple's standard Retina), and Windows flexibility. Some will prefer macOS. Some will prefer the open ecosystem. Price is comparable.

Against other Windows premium laptops: The XPS 14 is competitively priced. A ThinkPad X1 Carbon (Lenovo's premium business laptop) is similarly priced. A premium ASUS ProArt or ZenBook is in the same ballpark.

The pricing strategy signals that Dell is returning to premium positioning for XPS. It's not a budget play. It's saying: "This is the laptop for people who care about design, performance, and display quality."

With the brand reestablishment and the design refinements, the price is justified. You're paying for brand recognition, engineering thoughtfulness, and proven track record. These are real things that matter for a laptop you'll use for four or five years.

The chart illustrates the estimated decline in Dell XPS market share from Q1 2024 to Q4 2025, highlighting the impact of brand confusion and competitive pressure. Estimated data.

The Teased XPS 13: Ultra-Thin Future

Dell briefly teased that an updated XPS 13 is coming later in 2026. This is significant for a couple of reasons.

First, the 13-inch form factor has become the design proving ground for premium laptop makers. Apple's MacBook Air 13 is the category standard. It's the machine that inspired countless discussions about bezels, thinness, and light weight.

Dell's next XPS 13 is supposed to be "the company's thinnest and lightest notebook ever." That's a big claim. If Dell pulls it off, it becomes a competitive alternative to the MacBook Air for people who prefer Windows.

Second, the promise that it will be "cheaper than XPS has been in the past" suggests Dell is thinking about volume and market share recovery. The new XPS 14 and 16 are premium-tier products. The new XPS 13 is presumably positioned to capture the broader premium market at a more accessible price point.

This is smart portfolio thinking. Premium customers get the 14 and 16 with high-end displays and performance. Good-enough customers get the 13 as an affordable entry to the XPS brand.

What Brought XPS Back: Corporate Humility in Action

Let's be honest: companies don't usually admit they made a mistake and reverse course. Doing so requires accepting that the rebranding strategy was wrong, that the market response was negative, and that the executives who championed the consolidation made a costly error.

That's a difficult thing to do publicly. It requires genuine humility and customer-focused thinking.

What likely happened:

Sales data became undeniable. By Q3 and Q4 2025, market share losses were measurable and attributable to brand confusion. Retailers reported that customers didn't know what to buy. Investors were asking questions. The numbers forced a reckoning.

Competitive pressure from other brands. When Lenovo, HP, and ASUS maintained clear brand positioning and grabbed market share, it became clear that the simplification strategy had failed. Competitors were eating Dell's lunch.

Customer feedback was vocal. Enthusiasts, professionals, and even casual users pointed out that the rebranding was confusing. Tech reviewers called it a misstep. This feedback matters, especially in the premium market where opinions drive purchases.

New leadership or decision-making power. Sometimes a change in strategy requires a change in the people making decisions. Dell may have rotated executives or given more power to voices arguing for brand restoration.

Whatever the internal dynamics, the decision to restore XPS was a good one. It shows that Dell is willing to listen to market feedback and make difficult corrections.

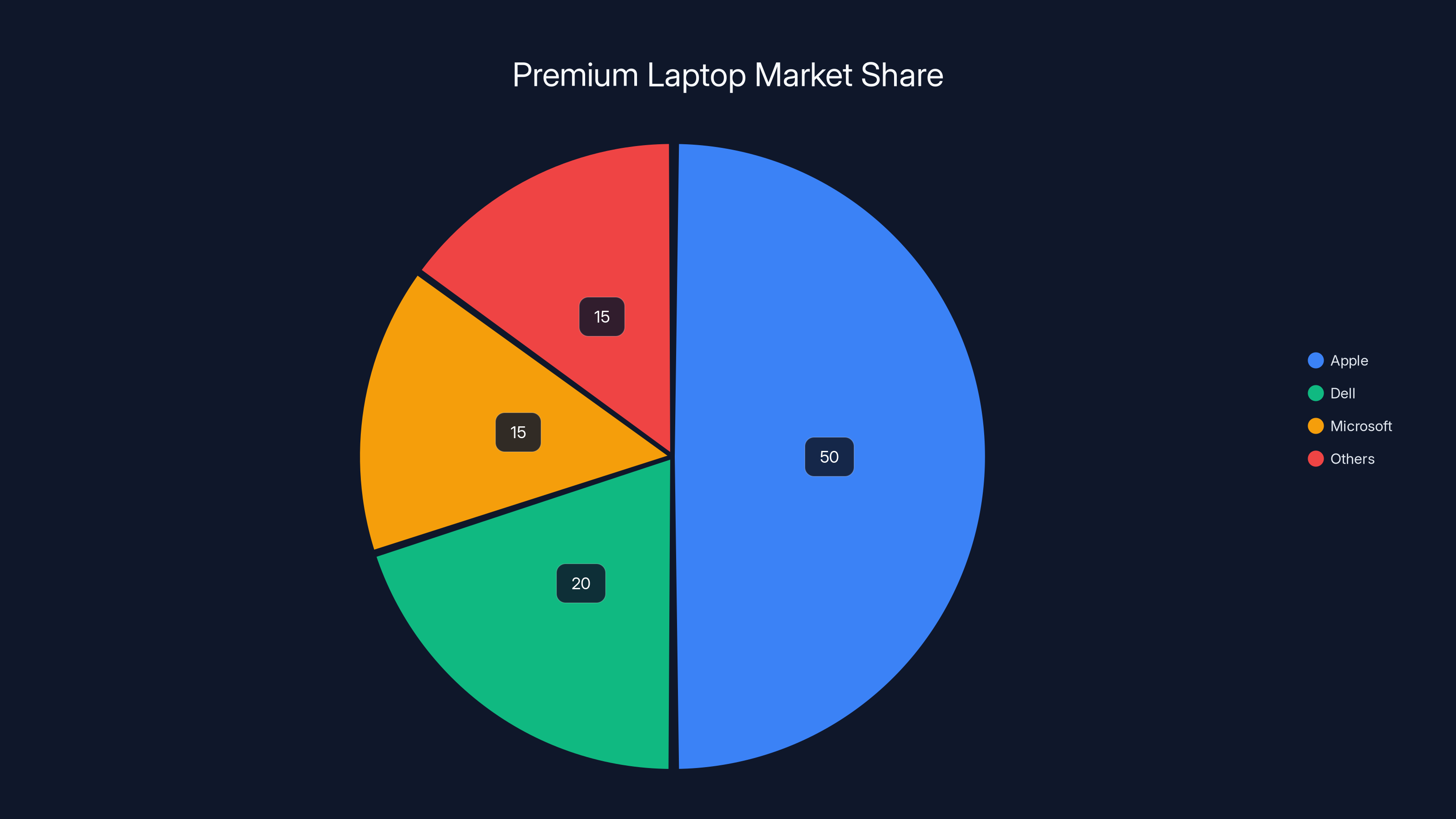

Estimated data shows Apple's dominance in the premium laptop market with a 50% share, while Dell's renewed focus on XPS aims to increase its current 20% share.

The Broader Lesson: Why Brands Matter More Than You Think

The XPS rebranding story teaches a fundamental lesson about business strategy that's often overlooked in discussions about technology: brand architecture matters more than operational efficiency.

On an organizational chart, consolidating brands makes sense. One marketing team instead of three. One PR operation instead of multiple. Centralized decision-making. Lower overhead.

But from a customer perspective, brand architecture is the signaling system that helps people navigate choices.

When you have dozens of products in a category, brand names are the shorthand that says: "Here's what to expect." XPS meant "premium, thoughtfully designed, for people who care." Inspiron meant "good value, suitable for everyday use." Vostro meant "business-focused, reliability-oriented."

Remove those signals, and customers are left with spec sheets and prices. They make decisions on the lowest common denominator. Everyone competes on price. Margins compress. The category becomes commoditized.

This is why Apple maintains separate brands for different market segments. The MacBook Air is one brand experience. The MacBook Pro is another. Even though they use similar components, the branding creates different positioning and justifies different prices.

Dell learned this the hard way in 2025. The costs of the rebranding were real: lost market share, customer confusion, brand dilution, and billions in equity destroyed.

The lesson: Operational efficiency should never trump customer communication. A simple org chart is worthless if it leaves customers confused about what they're buying.

What This Means for the Premium Laptop Market

The XPS revival signals that Dell is recommitting to the premium segment. This matters for the entire premium laptop market, which has been increasingly dominated by Apple.

For years, the premium laptop category has been Apple-centric. Everyone else competed for second place. The XPS used to be the "best Windows alternative to a MacBook," but without clear branding and positioning, it lost even that positioning.

By restoring XPS, Dell is explicitly saying: "We want to compete head-to-head in premium." This likely means:

Continued investment in design and materials. The new XPS 14 and 16 show thoughtful engineering. Expect this to continue with future generations.

Premium pricing power. Dell is pricing the new XPS at premium levels (

Distinct market positioning. XPS will be the premium brand. It will get first access to new processors, displays, and materials. It will be the design flagship.

For consumers, this is good. It means Dell is committing resources to a segment where it can actually differentiate from commodity competition. It means more options in the premium laptop market beyond just Apple and Microsoft.

For the industry, it means renewed competition in a market segment that often feels Apple-dominated. When any competitor signals commitment to premium, it tends to raise the overall bar for design and engineering quality.

The Road Ahead: 2026 and Beyond for XPS

If the new XPS 14 and 16 succeed in the market, we should expect to see continued investment in the brand.

Likely scenarios:

Annual or bi-annual refresh cycles. Just like MacBooks and premium Windows competitors, XPS will probably follow a regular update cadence. This keeps the brand feeling fresh and gives customers a reason to pay attention regularly.

Expansion of the line. The teased XPS 13 is just the beginning. Expect potential XPS Tablet offerings or other form factors. Dell likely wants XPS to encompass all premium mobile computing, not just laptops.

Deeper integration with software and services. Apple's success in premium comes partly from ecosystem integration. Dell might invest in software experiences that are exclusive to XPS or leverage its corporate relationships for enterprise-focused tools.

International market focus. The rebranding likely hurt Dell's premium positioning globally. Restoring XPS is a global effort, not just North America.

Competitive response to AI. As AI capabilities become more central to laptop marketing, expect XPS to be positioned as the premium choice for AI. The Panther Lake processors and NPU capabilities will be central to this narrative.

If Dell executes well, XPS could reclaim some of the ground it lost during the rebranding period. It won't catch Apple in absolute market share, but it could become the clear second choice for professionals and enthusiasts who prefer Windows.

Lessons for Other Tech Companies

The XPS story has implications beyond just Dell and beyond just laptops.

It's a case study in what happens when strategic thinking becomes disconnected from customer perception. It shows the hidden costs of administrative efficiency. It demonstrates that brand equity, built over years, can evaporate quickly if you're not careful.

Every company faces pressure to simplify, streamline, and consolidate. These pressures are real. But the XPS case study shows that some complexity exists for good reasons.

A brand architecture that might seem redundant from an org chart perspective might be essential for customer understanding. A product lineup that looks inefficient might actually be navigable for customers. Operational simplicity isn't always aligned with customer perception.

The smartest companies find the balance. They simplify internally (org structure, decision-making) while maintaining clarity externally (brand positioning, customer messaging).

Dell forgot this balance in 2024. It's correcting course in 2026. The question now is whether that correction is fast enough to rebuild the brand equity that was lost.

FAQ

Why did Dell kill the XPS brand in the first place?

Dell attempted to simplify its PC brand portfolio by consolidating Inspiron, Vostro, XPS, and other brands into a unified naming scheme. The goal was to reduce marketing complexity and make it easier for customers to understand the lineup. In practice, removing distinct brand signals eliminated the way customers differentiated between premium (XPS), consumer (Inspiron), and business (Vostro) products, leading to market confusion and brand dilution.

What makes the new XPS 14 and 16 different from the previous generation?

The new models feature a return to physical function keys (replacing capacitive buttons), visible trackpad borders for better usability, significantly reduced weight (0.5 to 1 pound lighter), tandem OLED display options for superior color accuracy and brightness, and Intel's Panther Lake Core Ultra Series 3 processors with improved AI capabilities. These changes directly address customer complaints about the previous design approach.

Is the new XPS worth 1,850?

For professionals who care about design, display quality, and build materials, yes. The XPS 14 competes directly with MacBook Air and is priced comparably. The XPS 16 is positioned against 16-inch MacBook Pro and premium Windows alternatives. You're paying for brand reputation, engineering thoughtfulness, proven reliability, and access to cutting-edge displays. Whether that's worth it depends on your specific needs and budget.

When will the new XPS 13 be available?

Dell announced the new XPS 13 is coming later in 2026, with no specific launch date disclosed. The company promised it will be thinner and lighter than any previous XPS and cheaper than the XPS has historically been priced. This suggests a mid-to-late 2026 launch window, though Dell could accelerate or delay depending on component availability and manufacturing readiness.

How much better is Panther Lake than Intel's previous generation?

Intel claims approximately 15% better performance per watt with Panther Lake, which translates to meaningful battery life improvements in real-world use. The chips also include more capable NPUs for AI processing, better GPU cores for creative work, and improved efficiency for everyday tasks. For laptop use, these improvements should be noticeable but not revolutionary.

What's tandem OLED and why does it matter for a laptop?

Tandem OLED uses two stacked OLED layers to achieve high brightness (1000+ nits) while maintaining OLED's superior color accuracy and deep blacks. This solves the main limitation of earlier OLED laptops, which were too dim for outdoor use. For professionals like photographers and video editors, tandem OLED enables accurate color work in any lighting condition without switching to a different display.

Why did Dell's market share drop in 2025?

Market share erosion was primarily driven by customer confusion during the rebranding period. Without clear brand positioning, customers couldn't easily identify which Dell laptop was right for them. Competitors maintained clearer brand architecture (Apple's MacBooks, Lenovo's ThinkPad and Yoga lines, ASUS's premium tiers), making it easier for customers to choose alternatives. The timing coincided with the AI PC transition, when customers needed clear positioning more than ever.

How does the new XPS compare to Apple's MacBook Air?

Both are premium thin-and-light laptops priced around $1,500. The MacBook Air offers superior battery life and ecosystem integration with iPhones and iPads. The new XPS 14 offers better display options (tandem OLED vs Apple's standard Retina), Windows flexibility, and more ports. The choice depends on whether you prefer macOS or Windows and whether you're invested in Apple's ecosystem.

Will this brand restoration actually stick, or could Dell rebrand again?

Unless Dell's leadership changes dramatically, another major rebranding is unlikely in the near term. The 2024-2025 rebranding cost Dell measurable market share and brand equity. That lesson is expensive enough that executives will be cautious about major brand changes for years. However, Dell might evolve XPS positioning or create new sub-brands for emerging categories (like AI-focused lines or gaming variants).

What does this mean for Dell's overall laptop strategy?

Dell is signaling a return to segment-based positioning: XPS for premium, Inspiron for consumer, Vostro for business. This is a reversal of the 2024 consolidation strategy. It suggests Dell believes that clear market positioning matters more than administrative efficiency. Expect Dell to invest more in XPS design, marketing, and innovation, treat it as a flagship brand, and use it to compete directly against MacBook Premium and high-end alternatives from other manufacturers.

Key Takeaways for Tech Enthusiasts and Professionals

The XPS revival is about more than just new laptop hardware. It's a statement about the importance of branding, customer communication, and listening to market feedback.

For consumers evaluating a new laptop, the return of XPS offers a clear signal: Dell is committed to the premium segment and willing to invest in thoughtful design. The new XPS 14 and 16 deserve serious consideration if you're in the market for a Windows-based premium laptop.

For tech industry observers, the XPS story is a masterclass in what happens when operational thinking overrides customer psychology. It's a reminder that simplification is valuable only when it actually simplifies things from the customer's perspective.

For business leaders considering brand consolidation, the XPS case offers a cautionary tale. Sometimes the brand complexity you're trying to eliminate exists because customers actually need it to make decisions. Before consolidating, ask whether your organizational convenience is worth losing your customer's ability to understand the difference between your products.

Dell made a mistake in 2024. By bringing XPS back in 2026 with genuinely improved products, it's showing that even large corporations can course-correct when they listen to the market. That's not a common thing to see, and it's worth acknowledging.

The real test comes over the next two years. If the new XPS 14 and 16 resonate with customers, if they recapture market share from competitors, if they establish XPS as the clear alternative to premium MacBooks for Windows users, then the rebranding disaster becomes a footnote to a comeback story.

If they don't gain traction, if customers remain confused, if Dell's market share continues sliding, then the company will face deeper questions about whether brand restoration alone is enough to fix what went wrong.

Based on the design thoughtfulness evident in the new models and Dell's commitment to bringing back the XPS brand, there's reason to be optimistic. But optimism isn't certainty. Execution matters. Product quality matters. Marketing and positioning matter.

Dell has the opportunity to prove that it learned its lesson. Let's see if it takes it.

Related Articles

- Dell XPS Comeback 2026: How Bold Admission Led to Redemption [2026]

- Dell XPS 14 & XPS 16 2026: Complete Review & Specs [2025]

- Dell XPS Makes Epic Comeback at CES 2026 [2025]

- Dell XPS Laptops Return: Why This Matters for Premium Notebooks [2025]

- How to Watch Intel's CES 2026 Launch Event: Panther Lake [2025]

![Dell XPS Revival: Why the Rebranding Disaster Led to Redemption [2025]](https://tryrunable.com/blog/dell-xps-revival-why-the-rebranding-disaster-led-to-redempti/image-1-1767659777718.jpg)