Eleven Labs $330M ARR: How AI Voice Disrupted SaaS Growth Curves

The Unprecedented Growth Phenomenon

In early 2026, Eleven Labs CEO Mati Staniszewski announced a milestone that shocked the SaaS community: the voice AI platform had reached $330 million in annual recurring revenue (ARR) in just 24 months from initial product-market fit. More strikingly, the growth wasn't linear—it was accelerating.

The numbers paint a picture of escape velocity:

For context, consider Twilio, the godfather of developer communications platforms. Founded in 2008 and credited with pioneering the entire category of developer-first communications APIs, Twilio required approximately 8 years to reach the same $330M ARR milestone. Twilio was itself considered one of the fastest-growing developer platforms of its era, yet it moved at roughly a third the speed of Eleven Labs.

This stark comparison has sparked intense discussions across the SaaS investment community: What changed? How is AI enabling companies to compress growth timelines that previously took decades? What does this mean for the next generation of enterprise software?

The answer lies at the intersection of three powerful forces: AI capability advancement, market readiness, and the fundamental nature of what voice AI can enable. Eleven Labs didn't just build a better Twilio—it fundamentally changed what customers could do with voice in their applications, creating entirely new use cases that didn't exist before.

The Market Conditions Were Different

When Twilio launched in 2008, cloud communications were nascent. Developers were still learning to think in APIs. The smartphone revolution was just beginning. SMS was the dominant communications channel. Building reliable, scalable voice infrastructure required massive capital expenditure and deep telecom expertise.

Eleven Labs arrived in a vastly different world. Cloud infrastructure was commoditized. Developers expected API-first solutions. Generative AI had captured the imagination of enterprises desperate to automate voice-based workflows. Most critically, Eleven Labs solved an immediate, burning problem: enterprises needed to deploy voice agents to handle customer service, sales calls, and internal workflows at scale, and they needed to do it now.

Where Twilio had to educate the market on why they should embed voice in applications, Eleven Labs inherited a world where the answer was already clear. They built the answer to a question the market was urgently asking.

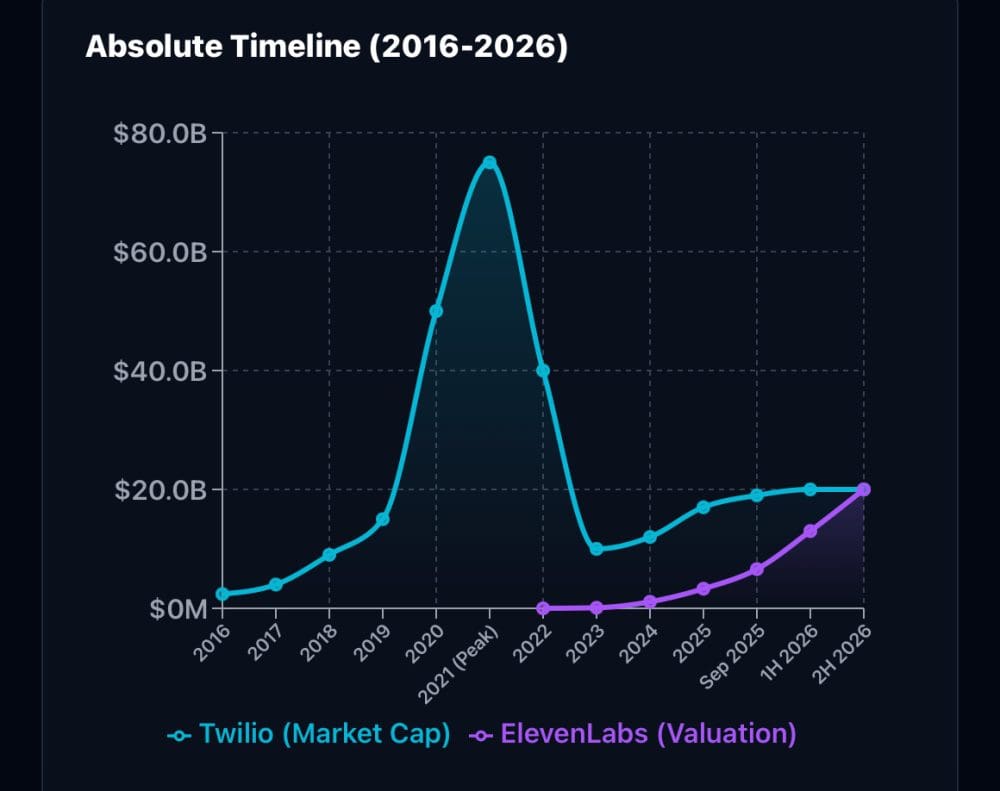

The Valuation Trajectory

The funding rounds tell their own story about market confidence:

- June 2023: Series A at $100M valuation (led by a 16z)

- January 2024: Series B at $1.1B valuation—achieving unicorn status in under 7 months

- January 2025: Series C at $3.3B valuation, co-led by a 16z and ICONIQ

- September 2025: Secondary round at $6.6B valuation

- 1H 2026: Projected $13B valuation (market whispers)

- 2H 2026: Projected $20B valuation

That's a 66x increase in company valuation in 2.5 years. More impressively, this wasn't pure speculation or hype-driven valuations. Each funding round came as the company demonstrated tangible revenue growth and enterprise customer traction.

Twilio took over a decade post-IPO to reach a

Understanding Eleven Labs' Core Business Model

What Eleven Labs Actually Built

Eleven Labs isn't simply a voice generation API. The company built an intelligent voice agent platform that combines multiple capabilities: advanced text-to-speech synthesis, natural language understanding, real-time conversation management, and action execution. This is fundamentally different from legacy voice platforms that simply played back pre-recorded audio or synthesized speech in isolation.

Their flagship product allows enterprises to deploy autonomous voice agents that can:

- Answer customer calls and resolve issues without human intervention

- Conduct outbound campaigns at scale with natural, contextual conversations

- Integrate with business systems to look up information and take actions in real-time

- Handle complex, multi-turn conversations with appropriate emotional intelligence

- Adapt to customer responses and adjust conversation flow dynamically

The technology stack includes their proprietary voice generation engine, which produces remarkably natural-sounding speech across multiple languages. But the moat isn't just audio quality—it's the ability to handle real business conversations end-to-end.

The Customer Base Driving Growth

According to Bloomberg interviews, Eleven Labs' enterprise customers are handling over 50,000 calls per month on the platform. This isn't a trickle of experimental deployments—it's production-scale usage from Fortune 500 companies and ambitious startups alike.

The company serves multiple verticals: customer service centers (handling support calls), sales and revenue operations (conducting outbound calls for qualification and booking), healthcare providers (appointment reminders and follow-up), and financial services (transaction confirmations and account services).

Each segment represents a different value equation. For customer service, Eleven Labs competes against hiring costs, training, attrition, and scheduling complexity. A single competent customer service representative costs

For outbound calling, the math is similarly compelling. Sales teams spending thousands on dialers and training now deploy AI voice agents that qualify leads, book meetings, and handle objections at significantly lower cost and higher consistency.

The Geographic and Language Advantage

Eleven Labs' voice synthesis technology works across 30+ languages with near-native proficiency. This immediately opens markets that traditional voice platforms struggled with. A contact center in the Philippines can provide customer service in perfect English, Spanish, Mandarin, or Arabic. A sales team in India can call prospects in North America with voices that sound local.

This language flexibility became critical during their rapid expansion. Twilio had to build support for multiple languages over years. Eleven Labs had it from the beginning of their AI-native architecture.

The Comparison: Eleven Labs vs. Twilio

Financial Performance Side-by-Side

| Metric | Eleven Labs (2025) | Twilio (Q3 2025) |

|---|---|---|

| ARR | $330M | ~$5.2B (annual) |

| Years to $330M | 2 years | 8 years |

| Quarterly Revenue | ~$82.5M (estimated) | $1.3B |

| YoY Growth Rate | 100%+ | 15% |

| Operating Margin | Likely breakeven/slightly negative | 29% |

| Market Cap | ||

| FCF Generation | Early stage | $925M annually |

| Voice AI Growth | Primary focus | 60% YoY (small segment) |

The juxtaposition is striking. Eleven Labs is smaller by absolute revenue but growing at 6-7x the rate. Twilio generates more absolute profit but Eleven Labs is expanding faster. The market is essentially valuing a company 5 years into its journey that's growing at 100%+ annually roughly equivalent to a company 15+ years in with 15% growth.

Why Twilio Didn't Dominate AI Voice

This is perhaps the most intriguing question: How did Twilio, with $70B peak market cap, thousands of engineers, a decade head start, and deep customer relationships, miss the voice AI revolution?

The answer involves several compounding factors:

Legacy Infrastructure Constraints: Twilio built on top of telecom infrastructure they partially owned or deeply integrated with. Adding intelligent agents required rewiring core assumptions about how calls were routed, managed, and billed. Eleven Labs built AI-native from the start, with no legacy baggage.

Business Model Inertia: Twilio's economics revolved around minutes of use—charging per minute of API calls. Voice agents threatened to compress minutes of use dramatically (an AI agent might handle 10 calls in the time a human handles 3, but at lower per-minute cost). The financial incentives weren't aligned toward disrupting their own model.

Organizational Focus: Between 2015-2021, Twilio was busy digesting massive acquisitions (Segment for

Competitive Positioning: Twilio positioned itself as "the fabric of modern communications"—a platform for developers to build voice, messaging, and video applications. Moving into autonomous voice agents meant competing directly with customer service platforms and contact center software vendors. That required different sales motions, different messaging, and cannibalization risk.

When Twilio finally moved into voice AI (launching voice AI agents in 2024-2025), they were several years behind Eleven Labs, with a market already educated on what was possible by a competitor moving at escape velocity.

Twilio's Current Positioning and Momentum

To be fair to Twilio, the company isn't standing still. The 2025 results showed meaningful improvements:

- 15% YoY revenue growth represented the best annual growth rate in years

- Operating margin reached 29%, demonstrating improved operational leverage

- **925M free cash flow expected for the full year

- Voice AI customer growth of 60% YoY, though still a small portion of overall revenue

- Back-to-back guidance raises throughout 2025 signaled real momentum

Twilio's strategy appears to be: own the developer communication platform layer, but also participate in the value capture of AI voice agents. They're betting they can win through developer mindshare (developers still thinking in Twilio APIs) and integration capabilities (making it easy to combine messaging, voice, video, and AI in a single application).

It's a reasonable strategy, but it's following rather than leading. In fast-moving markets, the follower rarely catches the leader.

The Macro Shift: What This Reveals About AI-Era SaaS

Compression of the Business Model Timeline

The Eleven Labs-vs-Twilio comparison reveals something fundamental about how AI is changing SaaS dynamics. Previous software revolutions followed predictable timelines:

- On-premise to cloud migration (1999-2015): Took 15+ years for the majority to adopt

- Mobile-first software (2007-2017): Required a decade for applications to rebuild for mobile

- API-first developer tools (2006-2020): Took Twilio 10+ years to become indispensable

With AI, the timeline is compressing dramatically:

- Generative AI adoption (2022-present): Major enterprise adoption in 18 months

- AI-native vertical tools (2023-present): Serious market presence in 12-24 months

- AI-first company building (2024-present): Enabling companies to launch and scale faster

Why? Because the underlying technology (large language models, voice synthesis, reasoning engines) is already built. Companies don't need to invent the AI—they need to apply it to specific problems better than competitors.

Eleven Labs didn't invent voice synthesis or natural language understanding. They applied it to a burning business problem (enterprise voice automation) with superior UX and customer success. They compressed years of development into months.

The Winner-Takes-Most Dynamics Accelerate

In faster-growing markets, the dynamics of winner-takes-most competition intensify. Eleven Labs' growth rate gives them several advantages:

Capital Leverage: Growing at 100%+ annually makes it easy to raise capital at favorable terms. This capital fuels faster hiring, better product development, and more aggressive go-to-market spending.

Talent Acquisition: Fast-growing companies attract top talent. The best engineers and salespeople want to work somewhere experiencing exponential growth where their stock grants are likely to be worth significant wealth.

Customer Momentum: Each new enterprise customer validates the solution for others. A Fortune 500 company running 50,000 calls monthly on Eleven Labs' platform is powerful social proof. Competitors need to explain why you should trust them instead—it's a harder sale.

Technology Moats: As more customers use Eleven Labs, the company gains more voice data to improve their models. They understand edge cases, accents, industry-specific language, and conversation patterns better than competitors.

Twilio's slower growth rate makes it harder to compete on these dimensions. They're profitable and generate serious cash, which provides staying power, but they're not winning the customer acquisition race.

The Network Effect Argument

Some argue that Twilio's 3 million developers and massive existing customer base provide a network effect that Eleven Labs can't overcome. In theory, developers prefer platforms where they can build multiple products (voice, messaging, video, authentication) from one vendor.

This argument has merit but has limits. Slack didn't beat email despite email's entrenchment. Stripe didn't win by being a better extension of existing payment processors—they won by being fundamentally better at a specific problem. Eleven Labs is pursuing a similar strategy: dominate voice agents first, become so valuable to customers that they can expand into related problems later.

Network effects are powerful, but only if the network is actually using the new capability. Twilio's millions of developers haven't primarily moved to voice AI—many are indifferent or still using legacy approaches. Eleven Labs has a smaller but far more engaged community of voice agent builders.

The Technology Advantage: Why AI Enables Faster Growth

The Shift from Infrastructure to Intelligence

Twilio's core insight was that communications infrastructure could be abstracted into an API. Developers no longer needed to understand telecom routing, carrier interconnection, or PSTN integration. They just called an API.

Eleven Labs' insight is that voice conversations themselves can be abstracted into an API. Developers no longer need to script call flows, train voice talent, or manage call quality. They define business logic, and the AI handles the conversation.

This represents a leap from solving "how do I transmit audio" to solving "how do I have intelligent conversations at scale."

The Data Advantage Loop

Each call on Eleven Labs' platform generates data: voice patterns, speech variations, cultural nuances, industry terminology, common objection handling approaches. This data trains better models.

Better models lead to better customer outcomes. Better outcomes drive more deployments. More deployments generate more data. This virtuous cycle accelerates the company's competitive advantage exponentially.

Twilio builds this advantage slowly through their voice AI customers. Eleven Labs builds it rapidly because voice agents are their primary focus.

Multi-Modal Intelligence

Eleven Labs' recent product evolution shows they're moving beyond voice. The platform increasingly integrates:

- Vision capabilities: Analyzing images shared during calls

- Reasoning engines: Complex decision-making in conversations

- Integration APIs: Connecting to business systems for real-time actions

- Workflow automation: Orchestrating multi-step processes triggered by conversations

This mirrors how Twilio evolved from voice-only to a communications platform. But Eleven Labs is doing it faster and more comprehensively because they're AI-native from inception.

Market Opportunity: How Big Is This Really?

Total Addressable Market Assessment

Estimating the TAM for enterprise voice automation requires breaking down several adjacent markets:

Customer Service & Contact Centers: The global customer service software market exceeded

Sales and Revenue Operations: B2B companies spend heavily on sales dialers, calling infrastructure, and staffing. The market for sales engagement tools alone exceeded $3 billion in 2025. Voice agents could address 30-40% of this market as quality improves.

Healthcare Communications: Appointment reminders, medication adherence, follow-up calls, and clinical consultations represent a multi-billion dollar opportunity. Voice AI is particularly valuable here because it can personalize at scale.

Financial Services: Banks and fintech companies manage millions of customer interactions annually. Automating verification, transaction confirmation, and dispute resolution with voice agents is exceptionally high ROI.

Enterprise Operations: Internal communications (IT helpdesk, HR inquiries, facilities requests) represent a significant opportunity as enterprises automate routine conversations.

Adding these segments conservatively: **

Geographic Expansion Opportunity

Eleven Labs has primarily grown in English-speaking markets (US, UK, Australia, Canada). But their multi-language capabilities create massive opportunities in:

- Europe: GDPR-compliant, privacy-conscious markets where European competitors are emerging

- Asia-Pacific: Countries with lower labor costs where outsourcing is common—now a juicy target for AI displacement

- Latin America: Spanish-speaking markets with large contact center operations

- Middle East & Africa: Underserved markets where modernization is happening rapidly

Expanding to these regions could easily 3x the addressable market size.

The Competitive Landscape: Who Else Is Building Voice AI?

Direct Competitors Emerging

The success of Eleven Labs has sparked competitive responses across multiple categories:

Specialized Voice Agent Platforms: Companies like Vapi, Retell AI, and others are building voice agent solutions specifically for customer service and sales. These are venture-backed companies moving fast but typically specialized in one use case.

Traditional Contact Center Software Companies: Genesys, NICE CXone, Five9, and others are integrating AI voice agents into their platforms. They have distribution advantage but face challenges upgrading legacy architectures.

Broader AI Platforms: Companies like OpenAI, Anthropic, and others are releasing capabilities (voice, reasoning, etc.) that startups can layer on. This democratizes the core technology but doesn't eliminate the need for specialized platforms.

Telecom Giants: AT&T, Vodafone, and others are exploring voice AI but face similar constraints as Twilio—legacy business models and infrastructure challenges.

None of these competitors have Eleven Labs' combination of: pure-play focus, venture-funded growth, strong voice quality, real enterprise traction, and rapid product velocity.

What Would It Take to Catch Eleven Labs?

A competitor would need to:

- Match voice quality: This is table stakes. The speech synthesis and conversation quality needs to be as natural or better

- Build enterprise features: Compliance, security, reliability requirements for Fortune 500 deployments

- Demonstrate customer success: Prove that customers save money, reduce costs, or increase revenue

- Execute sales motion: Get in front of large customers and win multi-million dollar deals

- Maintain product velocity: Keep ahead on features, capabilities, and intelligence

Eleven Labs has 18-24 months head start and is moving faster than anyone else. Competitors would need to outexecute them significantly to catch up.

Unit Economics: Why Growth Matters

The Math of Voice Agent Deployment

Let's model a typical enterprise voice agent deployment for a customer service center:

Traditional Human-Based Service Center:

- 50 customer service representatives

- Fully loaded cost: 1.75M annually

- Can handle ~100 calls daily, 250 working days = 1.25M calls annually

- Cost per call: ~$1.40

AI Voice Agent Replacement:

- Eleven Labs platform cost: ~100,000 annually (estimated for this volume)

- Can handle 1M+ calls annually with quality comparable to humans for routine issues

- Cost per call: ~0.10

- Gross margin for Eleven Labs: >80% (API cost is heavily infra, not labor)

Customer ROI: Replaces

This dynamic explains the viral adoption. The ROI is so compelling that enterprises feel compelled to deploy quickly.

How This Enables Hypergrowth Spending

With these unit economics, Eleven Labs can afford:

- Aggressive sales spending: Sales acquisition cost can be higher because customer lifetime value is enormous

- Customer success investment: Every enterprise customer they sign is worth 5M+ in 3-year value

- R&D spending: They can outspend competitors on product development while still improving margins

- Marketing and brand building: Building awareness and trust as the market leader

Twilio's lower growth rate limits how much they can invest in sales and marketing relative to revenue. This compounds the advantage for Eleven Labs.

Challenges and Risks Ahead

The Quality Tightrope

Eleven Labs' success depends on continuous improvement in voice quality and conversation naturalness. As customers deploy agents in higher-stakes situations (sales calls, healthcare interactions), the bar for voice quality rises.

If a voice agent sounds too robotic or makes mistakes in critical conversations, enterprises will lose confidence. Eleven Labs needs to maintain a 98%+ quality bar across all conversations to defend their position.

Competitors with improvements in any particular area (certain accents, specific industries, particular conversation types) could carve out niches.

Regulatory Risk

As voice agents become more prevalent, regulation is inevitable:

- Disclosure Requirements: Will regulators require that voice agents identify themselves? ("You are speaking to an AI")

- Consent Requirements: Can voice agents call consumers without explicit consent?

- Data Privacy: How is conversation data stored, processed, and protected?

- Bias and Discrimination: Are AI voice agents making decisions that discriminate against protected classes?

Each jurisdiction (US, EU, APAC) may have different requirements. Eleven Labs will need to navigate this complex landscape.

Customer Concentration Risk

If Eleven Labs' growth is concentrated in a small number of enterprise customers, losing one major customer could significantly impact growth. The "50,000+ calls per month" customers likely represent a meaningful percentage of revenue.

As with any fast-growing company selling to enterprise, customer concentration is a key metric to monitor.

Competition from AI Giants

OpenAI, Google, Meta, and other AI giants have the resources to build competitive voice agent capabilities. If they decide to prioritize this market, they could leverage:

- Distribution advantage: Existing relationships with enterprises

- Technology advantage: Best-in-class LLMs and voice models

- Capital advantage: Ability to acquire competitors or price aggressively

Eleven Labs' bet is that specialization and focus will beat generalist platforms. History suggests this is often true (Stripe beat PayPal in payments; Canva beat Adobe in design templates), but it's not guaranteed.

Adoption Ceiling and Utility

At some point, the market for voice automation reaches saturation. Not all business conversations need automation. Some require human touch. As enterprises deploy agents broadly, ROI per additional agent may decline.

Eleven Labs will need to expand use cases (beyond customer service into sales, operations, healthcare) to maintain growth once the primary market saturates.

Lessons for the Broader SaaS Industry

The AI Acceleration Thesis

Eleven Labs' trajectory demonstrates a critical thesis for AI-era businesses: AI doesn't just improve existing products—it can fundamentally change scaling dynamics.

When the underlying technology (LLMs, voice synthesis, reasoning) is democratized and commodified, the winners are companies that:

- Focus narrowly: Solve one problem exceptionally well

- Move fast: Execute quickly on product improvements

- Build moats: Create defensibility through customer success and data

- Expand deliberately: Add adjacent features once the core is dominant

This is different from cloud infrastructure winners (AWS, Azure), which won by being generalist platforms. It's different from developer tools winners (GitHub, which benefited from network effects). Voice AI winners win by being specifically and intensely focused on solving one problem better than anyone else.

The Incumbent Vulnerability

The Twilio story reveals a critical insight: market leaders in pre-AI eras are vulnerable to disruption in AI eras.

Why? Because their strengths become weaknesses:

- Installed base: A huge base of existing customers on older technology means cannibalizing becomes a concern

- Organizational complexity: Large teams with established processes move slower than focused startups

- Business model constraints: Pricing and revenue models optimized for old technology fit poorly with AI

- Organizational inertia: Success breeds confidence that might not be justified in rapidly changing markets

This suggests that companies currently dominant in their categories (Salesforce in CRM, ServiceNow in workflows, Workday in HR) should be concerned about AI-native competitors specializing in their niches.

The Investment Implications

For venture capitalists and founders, the Eleven Labs story has several implications:

First-mover advantage matters more than before: In fast-moving AI markets, the second-place competitor is not close behind—they're far behind.

Specialization beats generalization: The most successful AI companies are focused on solving specific problems, not building "AI for everything."

Growth capital is cheap when growth is fast: Eleven Labs can raise at rapid valuations because growth is self-evident and verifiable.

The timeline to "unicorn" has compressed: Companies that once took 5-7 years to reach $1B valuation are doing it in 12-18 months.

How Eleven Labs Could Stumble (and How They're Protecting Against It)

The Execution Risk

Rapid growth creates its own challenges:

- Hiring quality: Fast hiring at scale means culture and quality can suffer

- Customer success: Rapid customer onboarding at large enterprises is operationally complex

- Product quality: Rapid feature shipping can introduce bugs or quality issues

- Organizational structure: What works at 200M ARR

Eleven Labs appears to be protecting against this by:

- Maintaining founder focus: CEO Mati Staniszewski is deeply involved in product and strategy

- Selective hiring: Recent hiring announcements suggest quality over speed

- Customer-centric culture: Product decisions clearly driven by customer feedback

- Enterprise operational standards: Building SOC2, HIPAA, and compliance requirements that enterprise customers require

The Product Expansion Challenge

There's always a temptation for fast-growing companies to expand their product roadmap aggressively. Add more verticals, more features, more complexity.

Eleven Labs is resisting this by maintaining narrow focus:

- Voice agents are the core: Not expanding into text, video, or other modalities prematurely

- Specific use cases drive features: Building features that solve actual customer problems, not hypothetical ones

- API-first design: Allowing integrations rather than building everything in-house

The Talent Retention Challenge

Hypergrowth at a unicorn creates a problem: early employees who held options now have paper wealth but see their ownership diluted with each funding round. Late hires won't get the same wealth creation opportunity.

This drives attrition. Founders and early team members are often lured away to start new companies. Individual contributors become restless.

Eleven Labs will need to:

- Maintain compelling equity packages: Ensure late hires still have meaningful wealth creation opportunity

- Provide growth opportunities: Prevent ambitious people from feeling stuck

- Create distinct company culture: Build something worth staying for beyond stock appreciation

The Broader Market: What's Next for Voice AI?

Emerging Use Cases Beyond Customer Service

While customer service and outbound sales dominate initial deployments, voice AI is expanding into:

Healthcare: Providers are deploying voice agents for appointment scheduling, medication reminders, post-operative follow-up, and clinical documentation. The high cost of healthcare labor makes automation particularly valuable.

Insurance: Claims assessment, customer support, and fraud detection are moving to voice agents. Insurance companies are early adopters because of high volume and cost-sensitive operations.

Education: Universities are testing voice agents for student support, enrollment inquiries, and admissions processes. This is an emerging but growing category.

Banking and Financial Services: Account verification, fraud detection, transaction confirmation, and customer inquiries are increasingly handled by voice agents. Regulatory compliance is high but so is ROI.

Real Estate and Hospitality: Property inquiries, booking confirmations, and guest services are increasingly voice AI-powered. The ability to handle complex questions about features and availability is improving.

Each vertical will develop its own specialized requirements and best practices. Platforms like Eleven Labs that can support multiple verticals have inherent advantages over single-vertical specialists.

The Shift Toward Proactive Agents

Initial voice agent deployments are reactive: the customer calls, an agent answers. The evolution will be toward proactive agents that:

- Initiate outbound conversations: Reaching out to customers with relevant information or offers

- Anticipate needs: Based on past interactions, calling to proactively address issues

- Orchestrate workflows: Coordinating across multiple departments or systems

- Negotiate and close: Handling complex sales conversations with objection handling and value articulation

These represent more complex AI challenges and higher-value use cases. Companies succeeding here will generate significantly higher revenue per customer.

The Price Compression Reality

As competition increases and commoditization happens, pricing will eventually compress. What costs

This is normal in SaaS markets. The question is whether Eleven Labs can maintain market leadership as pricing declines. Companies that:

- Maintain superior quality: Can command premium pricing longer

- Build strong customer relationships: Benefit from switching costs and expansion revenue

- Expand into adjacent markets: Can maintain growth even as core pricing declines

- Improve efficiency: Improving their own margins as pricing falls

Should be positioned well. Eleven Labs is building all of these capabilities.

Strategic Insights for Builders and Investors

Why Speed Now Matters More Than Ever

The Eleven Labs story makes one thing clear: in AI-powered markets, first-mover advantage and execution speed are more valuable than in previous eras.

Why?

-

Technology commoditizes faster: AI models improve monthly. Any competitive advantages based on core technology (speech synthesis, language models) erode quickly as everyone accesses the same underlying models.

-

Customer mind share becomes the moat: If you're the first company customers learn about, you shape how they think about the category. Being first into enterprise accounts matters.

-

Data advantage accelerates: More customers mean more usage data, which trains better models. This compounds over time.

-

Market timing is critical: Voice AI reached a critical inflection point in 2023-2024. Being there first and having customer traction first meant raising capital at better terms.

For founders and investors, this means: identify the inflection point, move fast, and get customer traction before competitors recognize the opportunity.

The Infrastructure Paradox

There's an interesting inversion happening: previous SaaS winners (like Twilio) succeeded by building and owning infrastructure. Eleven Labs is succeeding by NOT building infrastructure—they use cloud APIs for compute, telecom infrastructure from existing providers, and language models from vendors.

This suggests that in AI eras, specialization and focus beat infrastructure ownership. Build the intelligence layer, not the infrastructure layer. Let others handle the commodity pieces.

This has profound implications: it means more companies can succeed without massive capital. You don't need to build data centers, negotiate carrier relationships, or own infrastructure. You need to build smart software on top of commodity infrastructure.

What This Means for Alternatives and Related Solutions

For Teams Evaluating Voice Automation Solutions

The choice between Eleven Labs and Twilio (or other competitors) involves tradeoffs:

Choose Eleven Labs if:

- Your primary need is voice agent automation

- You want latest AI capabilities

- You prioritize customer support and product velocity

- You're building new, AI-first workflows

- You need multi-language support

Choose Twilio if:

- You're already using Twilio for other communications

- You need a broad platform supporting voice, messaging, video, and authentication

- You value stability and existing integrations

- You're building communications infrastructure

- You prioritize proven, mature product

Consider alternative platforms if:

- Your use case is specialized (specific industry, specific geography)

- You need extreme cost optimization

- You're evaluating multiple vendors (healthy practice)

- You have unique compliance or security requirements

For teams building automation and productivity tools that need workflow orchestration alongside voice capabilities, platforms like Runable offer AI-powered workflow automation with document generation, content creation, and automation features at $9/month, providing a different approach to building intelligent automation across your organization. While Runable focuses on general automation and content generation rather than voice specifically, it can complement voice solutions for teams needing broader automation.

For Enterprises Deploying Voice Agents

Deployment considerations:

- Pilot rigorously: Start with a small, controlled deployment before rolling out broadly

- Define success metrics: Cost savings, customer satisfaction, resolution rate—pick what matters to you

- Invest in integration: Voice agents need to integrate with existing business systems to be effective

- Plan for handoffs: Define when and how voice agents hand off to humans

- Build feedback loops: Continuously improve agents based on actual performance

- Ensure compliance: Verify the solution meets your regulatory requirements

Eleven Labs is well-positioned for enterprise deployments, but success depends on your ability to execute the integration and change management piece.

Financial Projections and Market Timeline

Potential Valuation Paths for Eleven Labs

If Eleven Labs maintains:

- 100% YoY growth through 2026: Reaches $660M ARR by end of 2026

- 75% YoY growth through 2027: Reaches $1.155B ARR by end of 2027

- 60% YoY growth through 2028: Reaches $1.848B ARR by end of 2028

At typical SaaS multiples (6-10x ARR for high-growth companies), this would imply:

- End of 2026: 6.6B valuation (market is already pricing in $13B+)

- End of 2027: 11.5B valuation

- End of 2028: 18.5B valuation

Critical caveat: these projections assume hypergrowth continues. In reality, growth will eventually moderate as the market matures and competition increases.

Realistic Market Outcomes

Bull case: Eleven Labs maintains >50% growth through 2028, reaches

Base case: Eleven Labs slows to 30-40% growth by 2027 as market matures, reaches

Bear case: Competition intensifies, quality parity emerges, growth slows to 20% or below by 2027, reaches

The bull case has significant probability because the market opportunity is genuinely large and Eleven Labs has real advantages. The bear case is possible if competitors move faster or market adoption slows.

Expert Perspective on Future Industry Dynamics

What Experts Are Saying

The venture and SaaS communities are largely bullish on voice AI but cautious about long-term valuations:

Positive signals:

- Enterprise demand for voice automation is real and growing

- Unit economics are compelling

- Technical capabilities are improving monthly

- Multiple large customers are in production deployment

Concerns:

- Valuation multiples might be stretched (is 330M ARR?)

- Competition will intensify as market validates

- Regulatory uncertainty could slow adoption

- Quality issues could undermine customer confidence

Consensus view: Eleven Labs is building an important company in a large market. They're executing well and deserve to be the category leader. But current valuations may be pricing in perfection.

The Broader AI SaaS Trend

Eleven Labs is emblematic of a broader trend: AI-first vertical SaaS companies growing faster than previous generation companies.

Other examples:

- Anthropic's Claude: Challenging OpenAI

- Jasper: AI content generation

- Synthesis: AI learning

- Harvey: AI for legal

Each is following the Eleven Labs playbook: focus narrowly, build best-in-class AI product, grow fast with enterprise customers, raise at increasingly high valuations.

The question is whether this pattern continues or whether we're in a bubble. Most experts believe both: real businesses are being built AND valuations are stretched. Correction will come through growth disappointing or multiples compressing, not through business failing.

FAQ

What is Eleven Labs and what does their product do?

Eleven Labs is an AI voice automation platform that enables enterprises to deploy autonomous voice agents for customer service, sales, and business operations. Their flagship product combines advanced text-to-speech synthesis, natural language understanding, and real-time conversation management to handle voice calls end-to-end without human intervention. The platform integrates with business systems to enable agents to lookup information, execute actions, and handle complex multi-turn conversations with natural speech quality.

How did Eleven Labs achieve $330M ARR in just 24 months?

Eleven Labs achieved hypergrowth through several factors: launching at the precise moment enterprises were desperate for voice AI solutions, building on commoditized AI infrastructure (large language models) rather than building infrastructure from scratch, focusing narrowly on voice agents rather than trying to be a general platform, providing exceptional unit economics that made enterprises eager to adopt (replacing

How does Eleven Labs compare to Twilio in terms of growth and market position?

Eleven Labs is growing 6-7x faster than Twilio (100%+ YoY vs. 15% YoY growth), reaching

What are the main use cases for Eleven Labs' voice agent platform?

The primary use cases include customer service and support (handling inbound calls at scale), outbound sales calling (lead qualification, appointment booking, objection handling), healthcare (appointment reminders, medication adherence, follow-up calls), financial services (transaction confirmations, fraud detection, account support), and internal enterprise operations (IT helpdesk, HR inquiries, facilities requests). Each vertical has different quality requirements and ROI calculations, but all benefit from the same core capability: replacing human labor with AI agents capable of natural, contextual conversation.

What is the total addressable market (TAM) for voice AI automation?

Conservative estimates place the TAM for enterprise voice automation at

Why didn't Twilio dominate the voice AI market given their head start?

Twilio missed the voice AI revolution due to several compounding factors: their legacy infrastructure was optimized for telecom integration and required significant rewiring to add AI capabilities, their business model economics (charging per minute) created incentives against voice agent adoption that would compress call volumes, the company was distracted by major acquisitions (Segment for

What are the main risks and challenges Eleven Labs faces going forward?

Key risks include maintaining voice quality as deployments scale (any degradation in naturalness could undermine customer confidence), navigating emerging regulatory requirements around voice agent disclosure and consent, managing customer concentration if revenue is dependent on a few large enterprise customers, facing competition from well-resourced AI giants who could enter the market with substantial capital, and eventually hitting growth ceilings as the addressable market saturates. Eleven Labs must successfully expand into adjacent use cases and geographies to maintain growth acceleration once the primary market matures.

How does Eleven Labs' business model differ from Twilio's?

Eleven Labs operates as a pure-play AI voice agent platform charging customers based on usage and deployment scale (estimated

What does the Eleven Labs example teach us about AI-era SaaS companies?

The Eleven Labs story reveals that AI-native companies can compress traditional SaaS growth timelines dramatically—reaching in 2 years what took previous generation companies 8+ years—by building on commoditized AI infrastructure, focusing narrowly on specific problems, executing quickly on product improvements, and building strong data moats through customer usage. This suggests that market leaders in pre-AI categories are vulnerable to disruption from AI-native specialists who lack legacy business model constraints and organizational inertia. For founders and investors, the implication is clear: identify AI inflection points early, move fast, and achieve customer traction before competitors recognize the opportunity.

How can enterprises evaluate whether to adopt Eleven Labs versus competitors?

Enterprises should evaluate voice automation solutions across several dimensions: voice quality and naturalness in your specific use case, quality and speed of customer success teams, regulatory compliance capabilities (HIPAA, GDPR, etc.), integration capabilities with existing business systems, pricing transparency and predictability, and vendor stability/track record. For Eleven Labs specifically, advantages include cutting-edge AI capabilities, rapid product velocity, and strong enterprise customer traction. Trade-offs include relative newness as a company versus Twilio's maturity, and integration requirements that depend on your existing infrastructure. A robust evaluation should include pilots with top contenders before making a final decision.

What's the realistic timeline for voice agents to become mainstream in enterprises?

Based on current adoption trajectory, voice agents are likely mainstream in customer service and outbound sales by 2027-2028, with broader enterprise adoption (healthcare, financial services, operations) by 2028-2030. This timeline assumes continued AI capability improvements, regulatory frameworks that clarify agent disclosure requirements, and competitors reaching feature parity with Eleven Labs. The factors most likely to accelerate this timeline are regulatory clarity (enterprise caution will decrease) and cost compression (as more vendors compete, pricing falls). Factors that could slow adoption include regulatory restrictions on voice agent usage or high-profile failures that undermine customer confidence.

Conclusion: What This Means for SaaS and AI-Era Business

Eleven Labs' journey from founding to $330M ARR in 24 months isn't just impressive on its surface—it's a revealing window into how artificial intelligence is fundamentally changing how SaaS companies scale, compete, and create value.

When Jason Lemkin observed that Eleven Labs would likely exceed Twilio's market cap by mid-2026, he was capturing something profound: the old rules of SaaS are breaking down. Twilio spent eight years building developer relationships, proving cloud communications could work at scale, and establishing themselves as an essential platform. That was legitimate dominance in its era.

Eleven Labs compressed that entire journey into two years because the foundational questions were already answered. Developers understood APIs. Enterprises understood cloud computing. Language models were proven. What remained was focusing intensely on solving a specific problem—autonomous voice agents—exceptionally well. That focus, combined with operating as an AI-native company without legacy constraints, enabled unprecedented growth.

For the SaaS industry broadly, the implications are striking. Companies that built dominant positions in pre-AI eras face new vulnerabilities. Twilio's scale and customer base provide defensive strength, but they don't guarantee dominance in an AI world. Salesforce, ServiceNow, Workday, and other incumbents face similar dynamics: they can defend their bases, but specialized competitors focused on AI-native solutions might outgrow them.

For founders and investors, the lesson is equally clear: identify the inflection point, focus intensely on one problem, move fast, and achieve market leadership before the obvious competitors show up. By the time Twilio recognized voice AI as critical, Eleven Labs had already established customer traction and market mindshare that's proving difficult to overcome.

Will Eleven Labs succeed long-term? That depends on execution: maintaining product quality as they scale, navigating regulatory evolution, resisting the temptation to broaden their product too quickly, building defensible advantages through data and relationships, and executing excellence in customer success. These are difficult, but their trajectory suggests they're well-positioned to execute.

Will they maintain $100%+ growth for the next 5 years? Probably not. Growth will moderate—that's normal as markets mature. But even if Eleven Labs slows to 50% growth within 18 months and 25% growth by 2028, they'll still be one of the fastest-growing major SaaS companies. That's a position of strength.

The broader trend—AI-native vertical specialists outgrowing generalist platforms—is likely just beginning. Over the next 3-5 years, we'll see Eleven Labs-like stories in healthcare, financial services, legal, design, sales, marketing, and dozens of other categories. Some will be founded by first-time entrepreneurs. Some will come from unexpected places. What they'll have in common is focus, speed, and excellence in solving one problem better than the generalists.

Twilio's story isn't over—they're a multi-billion dollar company with real staying power. But their dominance in communications is being challenged by specialists who've seized on AI as an opportunity to reset the competitive game. That's the real lesson of the Eleven Labs story: in AI eras, the old advantages matter less, and execution speed and focus matter more. The next decade of SaaS will be shaped by companies that understand and act on that principle.