Flutterwave Acquires Mono: African Fintech's Biggest Exit [2025]

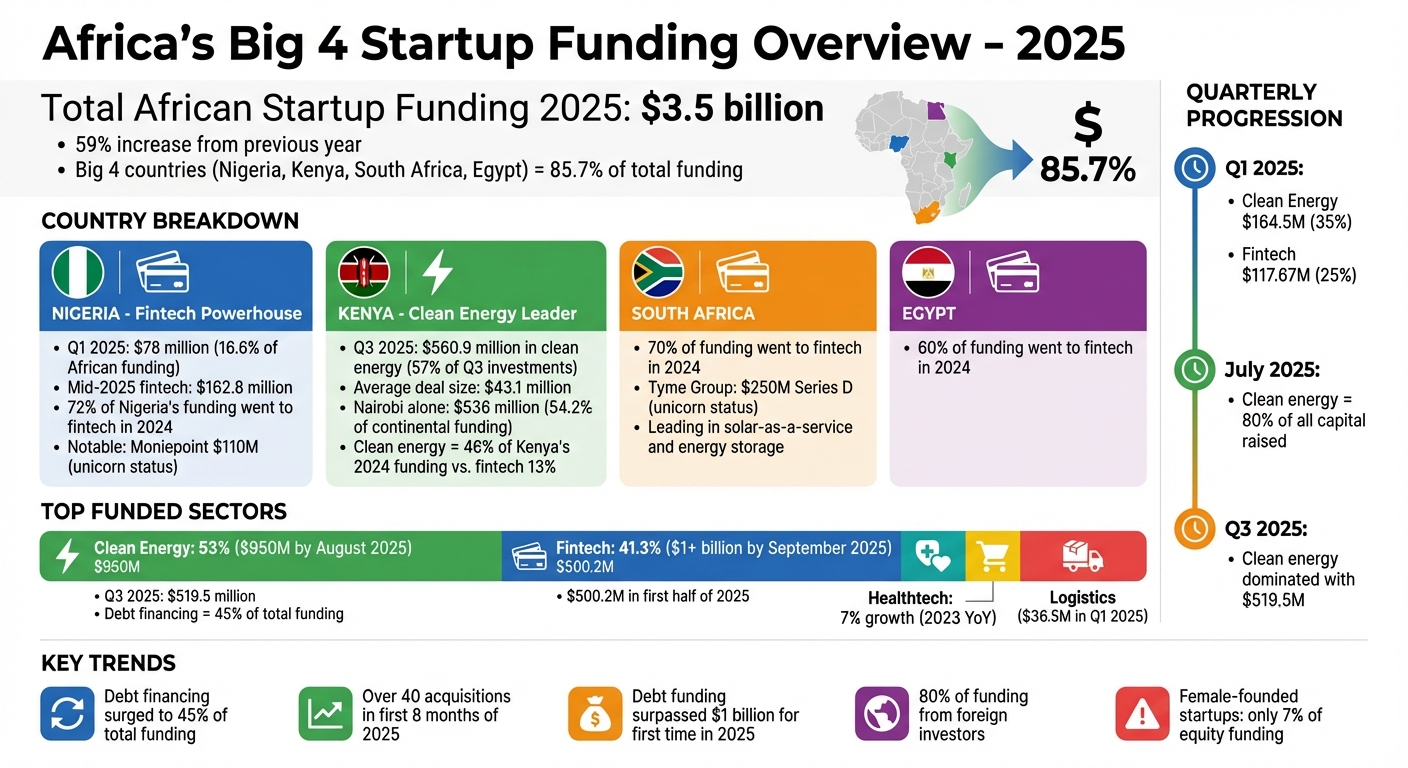

When Flutterwave announced it was buying Mono, the African fintech world paused. Not because the deal surprised people—it didn't. But because it represented something Africa's tech ecosystem had been waiting for: proof that homegrown fintech companies could consolidate and scale domestically without being forced to abandon ship to Silicon Valley. As reported by TechCrunch, the acquisition marks a significant milestone in African fintech.

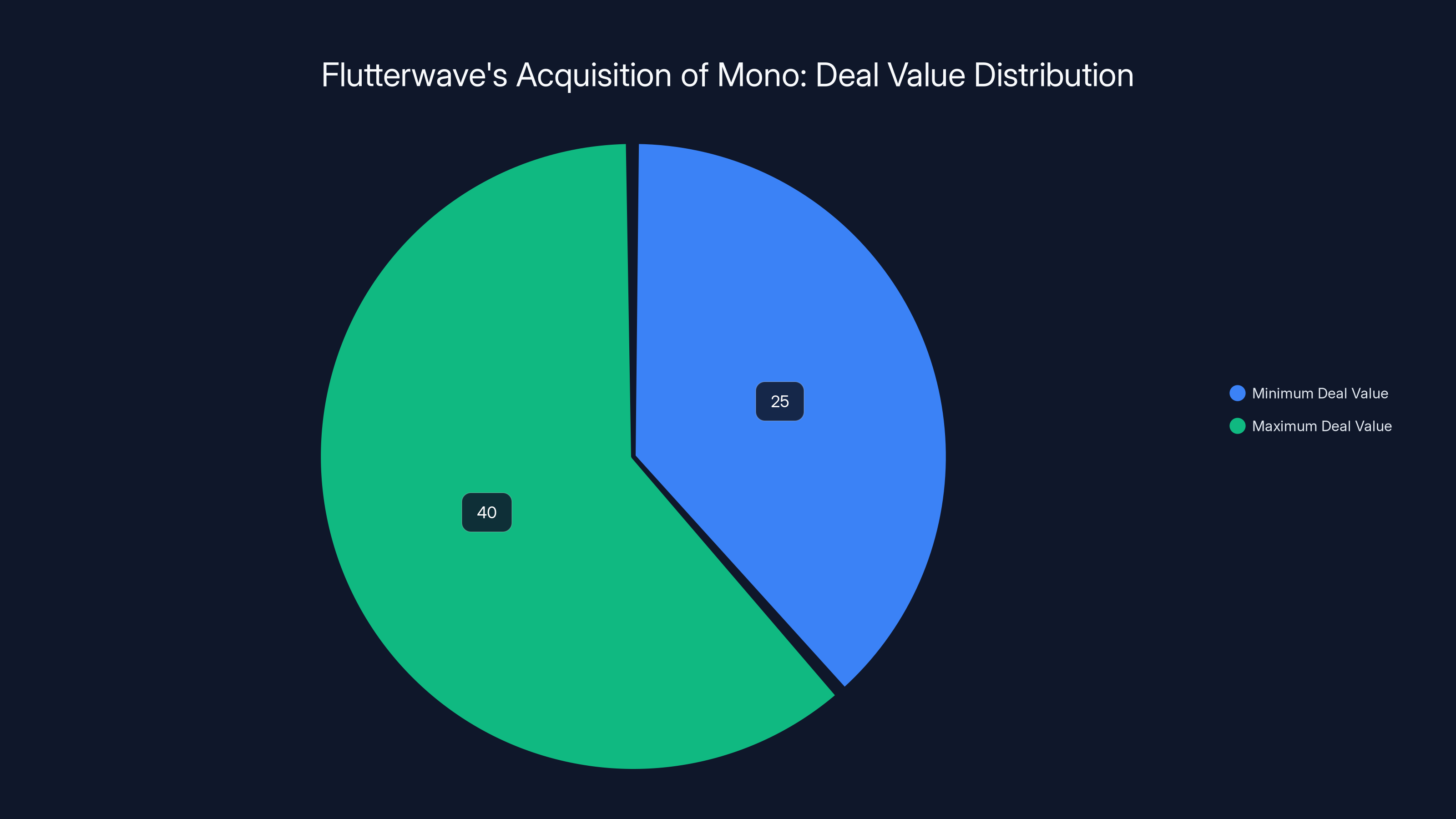

The all-stock deal valued Mono between

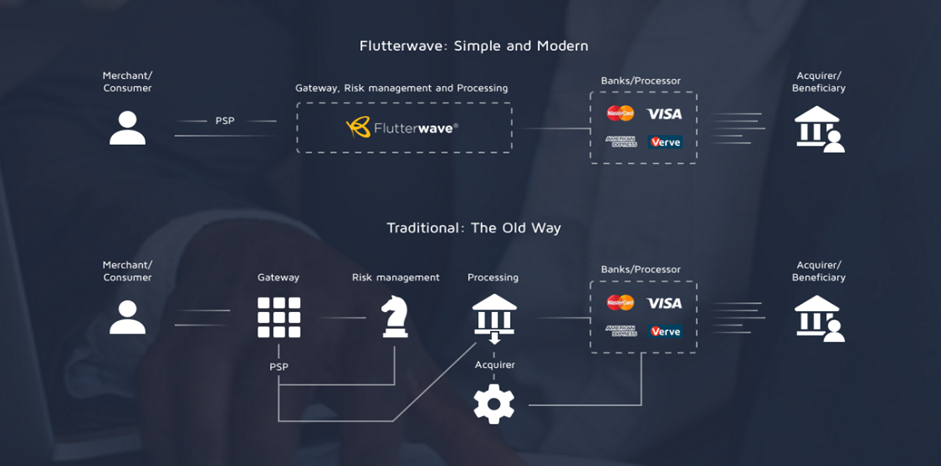

Flutterwave isn't some random acquirer either. It's Africa's largest fintech company. The company operates one of the continent's widest payments networks, touching more than 30 African countries. By bringing Mono into the fold, Flutterwave is doing something that failed spectacularly in the U.S. market: it's combining open banking infrastructure with payment rails into a single vertical stack. This strategic move is highlighted in TechCrunch's detailed analysis.

But here's what makes this deal fascinating. It's not just about Flutterwave getting bigger. It's about what happens when two of Africa's most important fintech infrastructure companies merge their capabilities. Mono built the data plumbing that African lenders rely on. Flutterwave built the payment pipes. Together, they're creating something neither could build alone: a complete financial infrastructure stack for Africa's emerging middle class.

Let me walk you through what actually matters about this acquisition—and why it signals a shift in how African fintech is evolving.

TL; DR

- Flutterwave acquired Mono for $25-40M, bringing together Africa's leading payments and open banking infrastructure companies

- Mono's investors returned capital plus 20x returns for early backers in a rare profitable African fintech exit

- The deal deepens vertical integration, allowing Flutterwave to offer identity checks, bank verification, data-driven lending, and payments in one stack

- Mono has powered 8 million+ bank linkages and serves nearly all Nigerian digital lenders, covering 12% of Nigeria's banked population

- This exit signals a shift toward domestic consolidation rather than forced sales or collapses, suggesting African fintech is maturing

The acquisition of Mono by Flutterwave was valued between

Why This Acquisition Actually Matters

On the surface, a $25-40 million acquisition might seem small. You'd be wrong. This deal is significant for reasons that go way beyond the check size.

First, let's talk about what Mono actually built. The company operates what people call "Plaid for Africa." That comparison matters. Plaid, the U.S. open banking platform, became so critical to fintech infrastructure that when Visa tried to acquire it for $5.3 billion in 2020, the U.S. Department of Justice blocked the deal. The concern? Combining data infrastructure with payment rails would be too powerful.

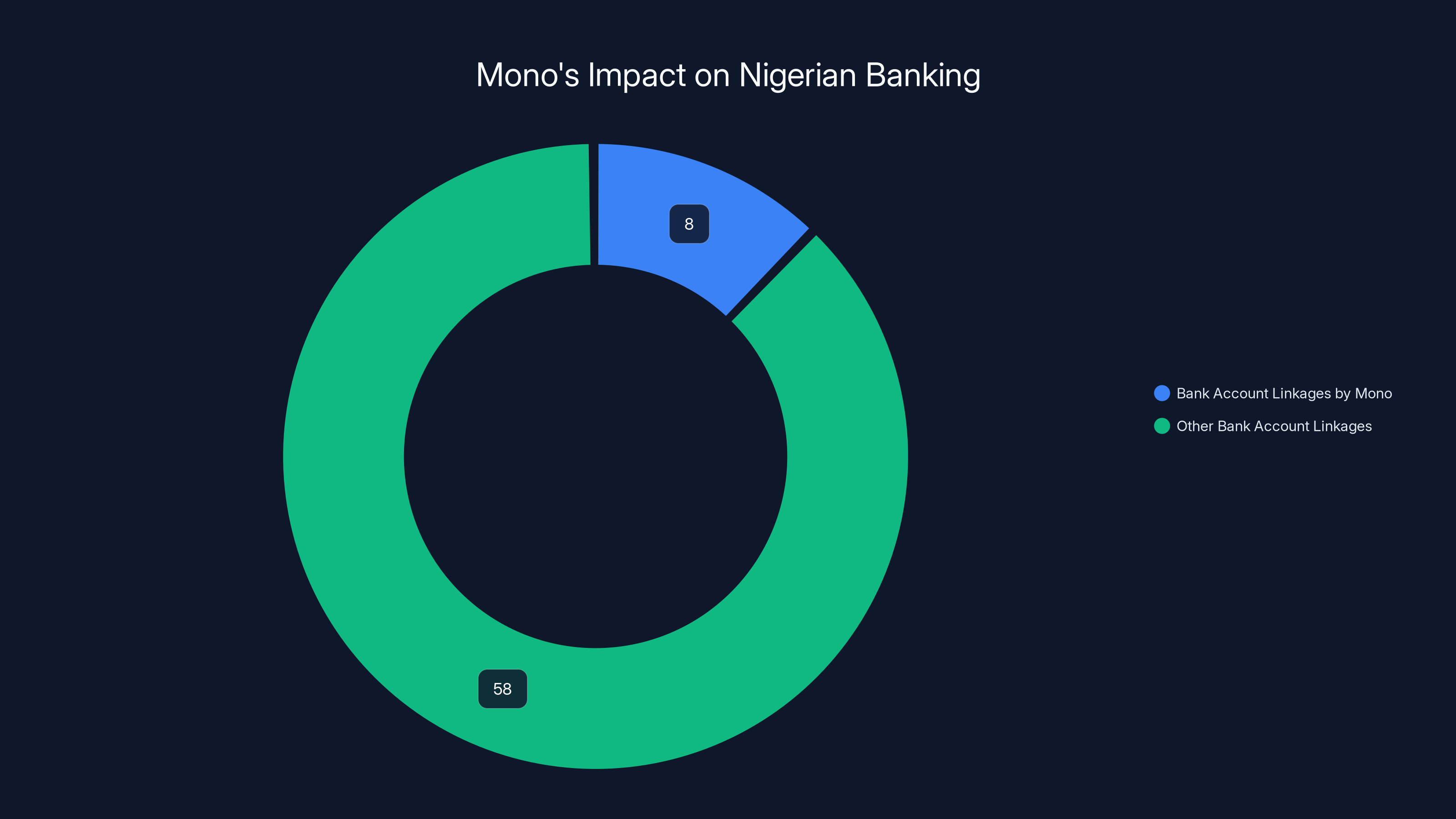

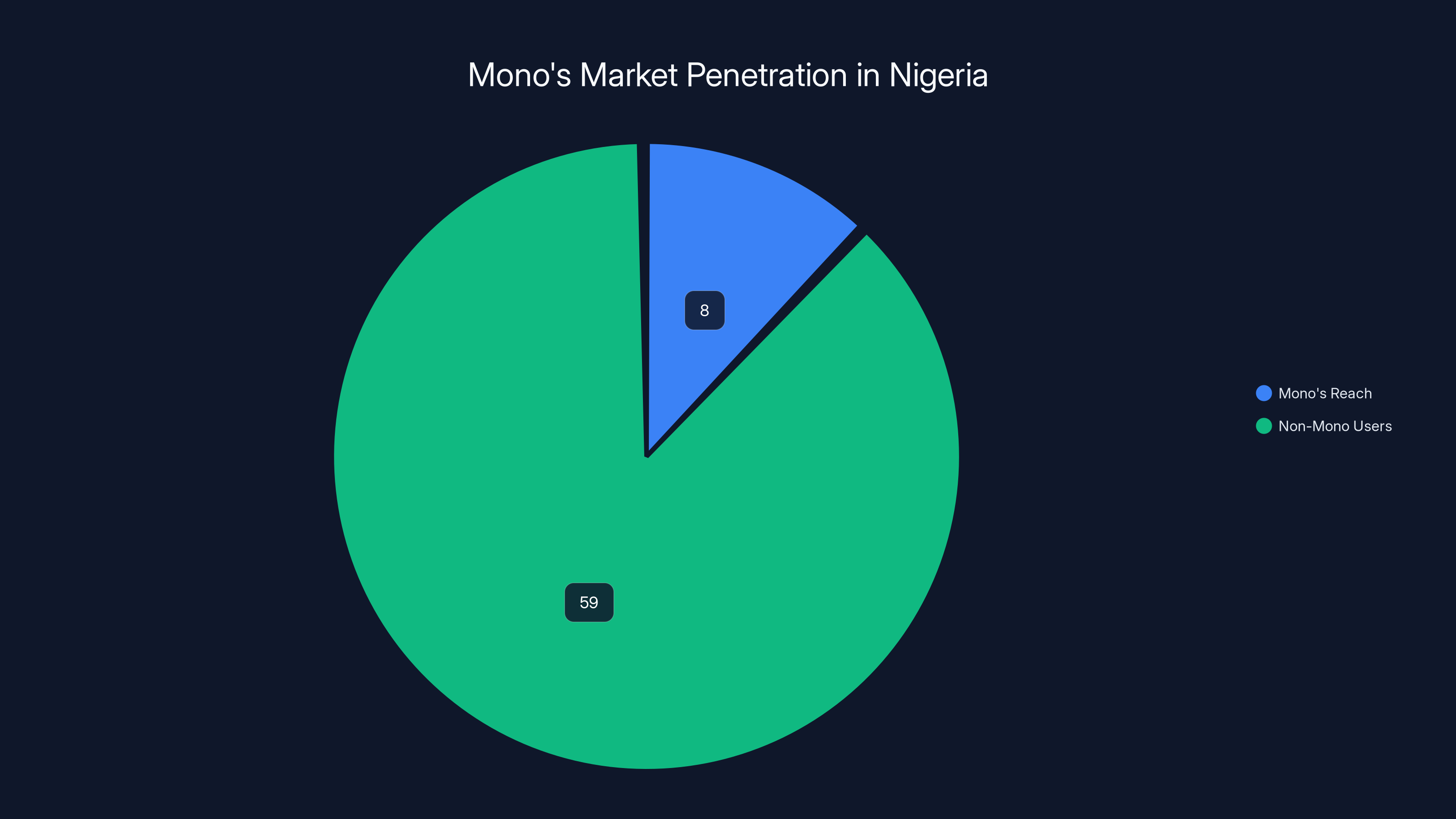

Mono did exactly what Plaid did in the U.S., but in Africa. The company built APIs that let businesses access bank data, initiate payments, and verify customers. In Nigeria, nearly every digital lender now relies on Mono's infrastructure. The company has powered more than 8 million bank account linkages—that's roughly 12% of Nigeria's entire banked population. This extensive reach is highlighted in LaunchBase Africa's report.

Think about what that means. Mono has become invisible infrastructure that doesn't work without it. Nigerian fintechs like Moniepoint (backed by Visa) and Palm Pay (backed by GIC) use Mono's APIs daily. They're processing millions in direct bank payments through Mono's network. The company claims to have delivered 100 billion financial data points to lending companies.

Now imagine combining that data infrastructure with Flutterwave's payments network. Suddenly, Flutterwave isn't just moving money. It's understanding where that money comes from, where it goes, and whether the person moving it can repay a loan. That's vertical integration done right.

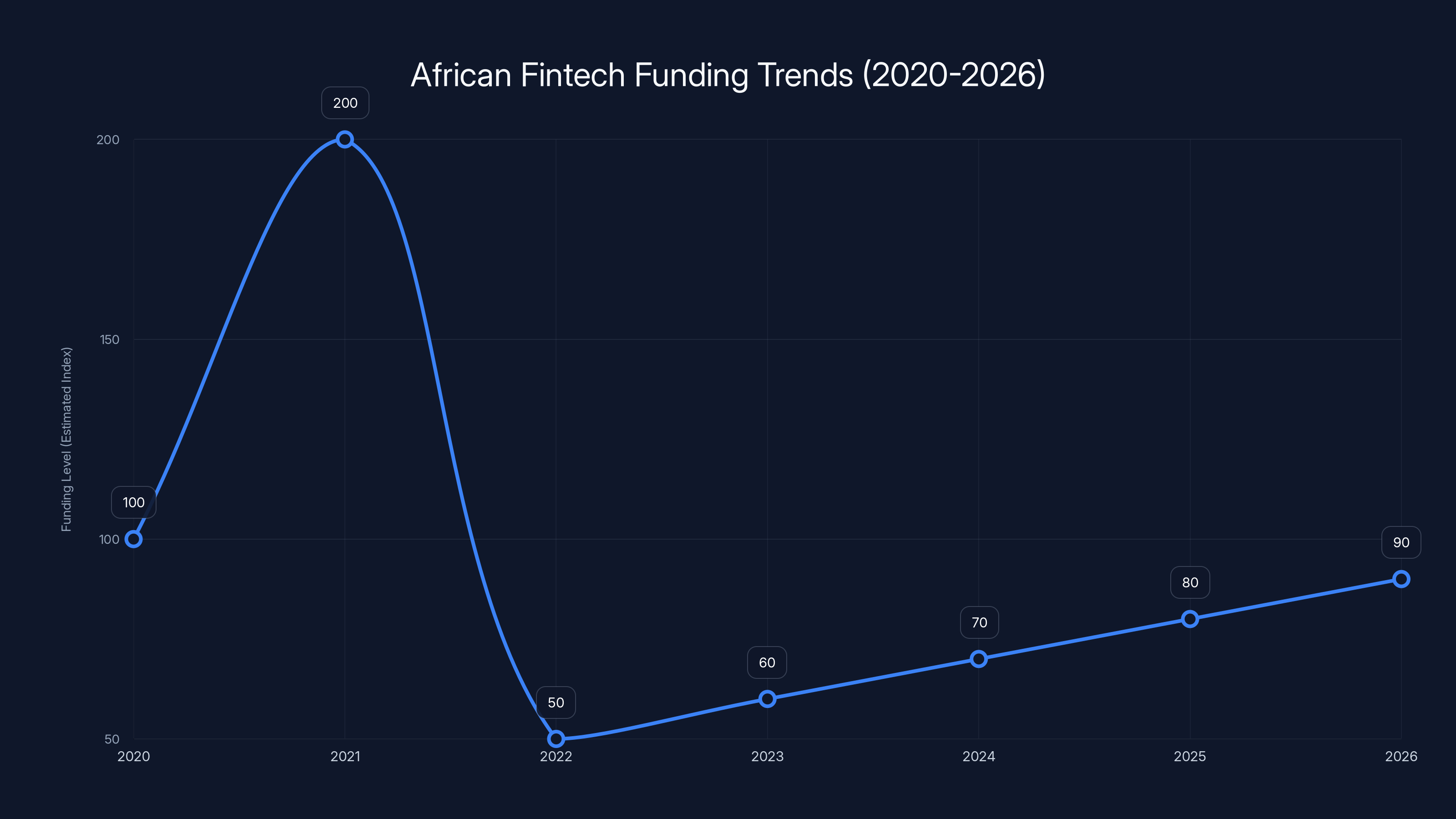

The chart illustrates the rise and fall of African fintech funding from 2020 to 2026, highlighting a peak in 2021 followed by a significant drop in 2022. Estimated data based on narrative.

The Context: African Fintech's Brutal Years

To understand why this deal matters, you need to understand what African fintech has been through.

From 2020 to 2021, African fintech was on fire. Startups were raising insane amounts of money. Stripe went all-in on the continent. Tiger Global was throwing capital at everything with a .ng domain. The narrative was simple: Africa would leapfrog traditional banking, mobile-first fintech would dominate, and this would be the next great tech frontier.

Then 2022 happened. Funding collapsed. Rising interest rates tanked valuations. Suddenly, African startups that had raised at $1 billion valuations were running out of runway. Companies pivoted. Companies died. Some founders, exhausted from the grind, just walked away.

We're not talking about small losses either. The funding crunch was real. African startups that had raised at peak valuations in 2021 were facing down rounds where investors cut valuations by 60%, 70%, sometimes more. Raising another round meant accepting massive dilution or watching your company slowly die.

For Mono specifically, the calculus was different. According to LaunchBase Africa, Mono raised a

But in the funding environment of 2025, raising another round meant accepting that the next investor would dictate new terms, new valuations, new growth expectations. As Mono's CEO put it, "In a tough funding environment, raising another round would have introduced new valuation and growth expectations."

Instead, Mono made a strategic choice. Rather than fight for capital in a brutal market, they joined forces with the African company best positioned to help them scale. That's not desperation. That's strategy.

Understanding Mono's Technology and Market Position

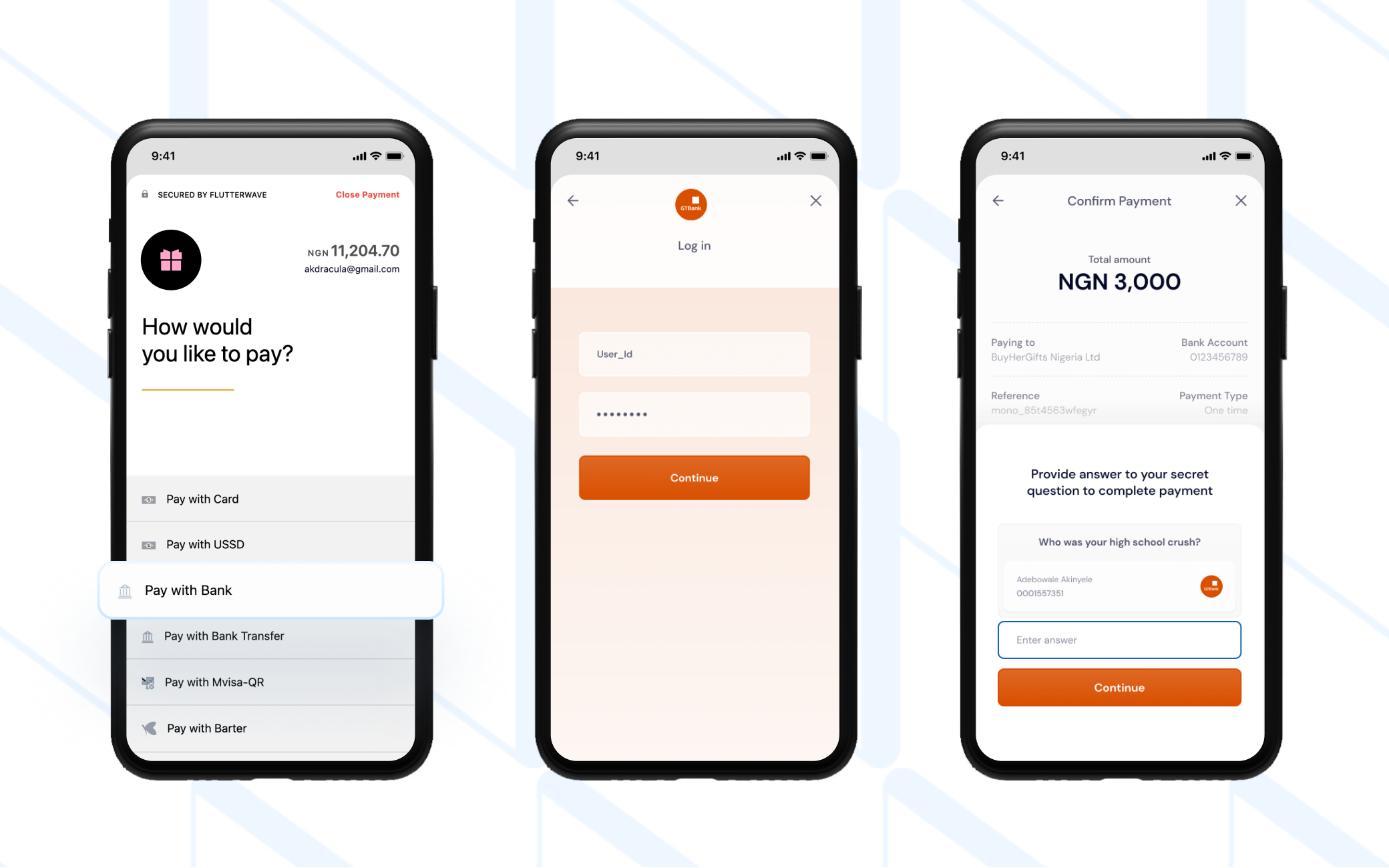

Let's dig into what Mono actually does, because the technical foundation is what makes this acquisition valuable.

Mono's core product is consent-based bank data access. Here's how it works in practice: A customer wants a loan from an online lender. Instead of asking for bank statements (which are easy to fake), the lender asks permission to access the customer's actual bank data through Mono's API. The customer opens their banking app, signs in, and consents to share three months of transaction history. Mono's API pulls that data and securely sends it to the lender.

The lender can now see everything: income patterns, spending habits, existing debt obligations, bill payments, even payday loans. Within minutes, an algorithm assesses creditworthiness based on real financial behavior instead of a credit score (which doesn't exist in many African markets or is incomplete).

This solves a massive problem in African lending. Traditional credit bureaus are limited or nonexistent across most African countries. Banks have their own data, but they don't share it with fintech lenders. So how do online lenders assess risk? They used to rely on phone-based credit assessments, which are crude at best and discriminatory at worst.

Mono's technology changed that equation. By providing standardized API access to bank data, Mono made it possible for lenders to make data-driven decisions at scale. And because the consent is digital and traceable, regulators feel comfortable with it. It's not scraped data or hacked credentials. It's legitimate, consented bank information.

The scale here is worth emphasizing. Mono has processed 100 billion financial data points. That's not metaphorical—it's billions of individual data points across millions of transactions. The company has enabled 8 million bank account linkages. To put that in perspective, Nigeria's banked population is roughly 67 million people. Mono has direct data access to 12% of that population. That's not a startup. That's critical infrastructure.

Investors in Mono see varied returns: 1.43x in a conservative scenario, 2.29x optimistically, and 13-20x for early investors. Estimated data for early investors.

Flutterwave's Vertical Integration Play

Now let's talk about what Flutterwave gets from this acquisition. It's not just buying a company. It's building a moat.

Flutterwave powers payments across more than 30 African countries. The company processes payments for merchants, cross-border transfers, bill payments, and merchant disbursements. They've built the pipes that move money. But up until now, they haven't owned the data pipes.

With Mono, that changes. Flutterwave now owns:

Identity and KYC verification - Mono's data infrastructure can verify who someone is based on their financial identity, not just government ID

Bank account verification - Know whether a bank account is real, active, and in good standing before initiating payments

Data-driven risk assessment - Understand customer creditworthiness through actual financial behavior

Direct bank payments - Process both one-time and recurring payments directly from bank accounts

All of this operates within a single product stack. Imagine a merchant using Flutterwave: they can verify a customer's identity, check their creditworthiness, and process a payment—all without leaving the Flutterwave dashboard. That's the vertical integration play.

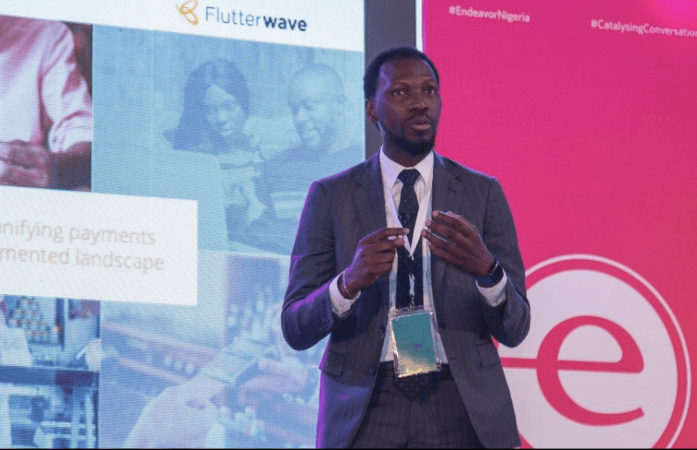

Flutterwave's CEO Olugbenga "GB" Agboola framed it this way: "Payments, data, and trust cannot exist in silos. Open banking provides the connective tissue, and Mono has built critical infrastructure in this space."

That's corporate speak for "we just bought the thing that makes us dramatically harder to compete against."

The Regulatory Tailwind

There's a regulatory angle here that's often overlooked, but it's crucial.

Nigeria is moving toward formal open banking regulation. The central bank and financial regulators are discussing frameworks for how open banking should work, what data can be shared, and how to protect customer funds. This is still evolving—there's no final regulatory framework yet. But it's coming.

Mono has been working with regulators on this evolution. The company has actual relationships with the Central Bank of Nigeria and other financial authorities. They understand what regulators care about (customer data protection, fraud prevention, transparency) and have built systems that address those concerns.

Flutterwave acquiring Mono means Flutterwave now owns those regulatory relationships and that regulatory expertise. As Nigeria's open banking framework becomes law, Flutterwave is positioned to shape how it gets implemented. That's regulatory moat-building.

Mono's CEO emphasized this point: "For open banking to really work, regulators need to be confident that customer funds are safe. If the economy is going to be credit-driven, you need deep data intelligence to know how people earn and spend. But at the same time, regulators need confidence."

Mono has built that confidence. Flutterwave just acquired it.

Mono has facilitated 8 million bank account linkages, representing approximately 12% of Nigeria's banked population. Estimated data.

Why This Mirrors (and Differs From) the Plaid-Visa Deal

The deal structure here is eerily similar to what Visa tried to do with Plaid in 2020. Let's compare them.

The Plaid-Visa Deal (2020):

- Visa tried to acquire Plaid for $5.3 billion

- Plaid was a payments-agnostic data infrastructure company

- Visa is a payments network operator

- Combining them would give Visa the ability to see all financial transactions AND move money

- The U.S. Department of Justice blocked the deal on competition grounds

- Key concern: combining data infrastructure with payments rails was too powerful and would stifle competition

The Flutterwave-Mono Deal (2026):

- Flutterwave is acquiring Mono for $25-40 million

- Mono is an open banking data infrastructure company

- Flutterwave is a payments network operator

- Combining them gives Flutterwave the ability to see financial data AND move money

- African regulators haven't blocked it (and seem unlikely to)

- Key difference: African markets are less mature, regulators are building frameworks, and there's less established competition

Mono's CEO actually cited the Plaid-Visa deal as evidence that the strategy works: "That deal was evidence that combining data infrastructure with payment rails can unlock scale."

The question is whether African regulators will eventually look at this deal and think "wait, should we have blocked this?" We don't know yet. But the regulatory framework in Africa is less mature than the U.S., and there's less established competition to protect. Unlike the U.S., where blocking Plaid-Visa was about protecting Mastercard and other payment networks, Africa doesn't have that incumbent competition dynamic.

This could change over time as African fintech matures. But right now, this deal seems likely to be approved and move forward.

The Broader Context: African Fintech's Evolution

This deal doesn't happen in isolation. It's part of a larger story about how African fintech is evolving.

For years, the narrative was "African startups will eventually be acquired by larger tech companies." Facebook buys African startups. Google buys African startups. Microsoft buys African startups. The assumption was that African entrepreneurs would build interesting technology, but exit would always be to a Silicon Valley buyer.

That narrative is changing. Flutterwave acquiring Mono shows that African companies can consolidate regionally. You don't have to sell to the U.S. The best buyer for a Nigerian open banking company might be Africa's largest payments platform, not some U.S. tech giant.

There's a practical reason for this shift. African financial infrastructure is unique. Regulatory requirements differ by country. Payment rails differ. Bank APIs are incompatible across markets. A U.S. company trying to integrate Mono would struggle because they don't understand the local regulatory context. But Flutterwave does. They operate across 30+ African countries. They have local licenses. They have compliance teams on the ground. They speak the language—literally and figuratively.

So the best buyer for Mono is the company that can most effectively deploy Mono's technology across Africa. That's Flutterwave.

This shift matters for African founders because it opens up a new exit path. You don't have to be a unicorn to get acquired. You don't have to have some crazy viral consumer app. If you build critical infrastructure that a larger regional company can leverage, you can create an exit. Mono did exactly that.

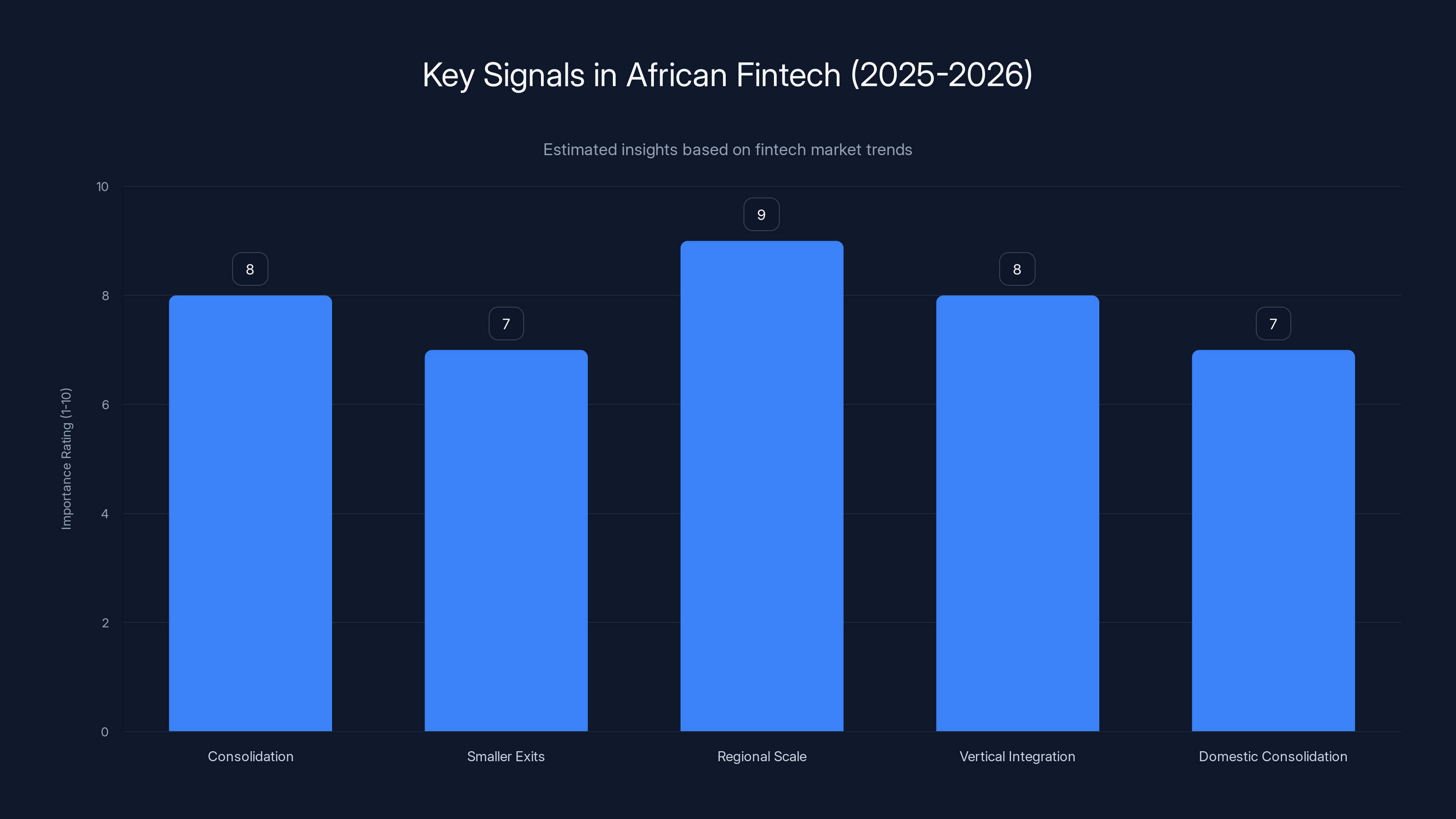

Estimated data suggests that regional scale and vertical integration are the most critical signals for the future of African fintech, highlighting the importance of local expertise and infrastructure development.

What This Means for Nigerian Digital Lenders

Let's think about what this means practically for the customers actually using Mono's technology—the digital lenders.

Mono powers credit decisions for companies like Branch, Carbon, Migo, and dozens of others. These are companies that lend to Nigeria's underbanked population. When someone on the other side of a phone screen wants a ₦50,000 loan, these companies use Mono's APIs to make the decision in minutes instead of hours.

When Flutterwave integrates Mono, several things could happen:

Deeper risk modeling - Lenders can now combine transaction data from Mono with payment data from Flutterwave to build more sophisticated risk models. They can see not just "how does this person spend money" but "can they make recurring payments."

Faster disbursement - Instead of coordinating between multiple vendors, lenders can verify identity, assess risk, and disburse funds through a single platform. That could cut the time to loan disbursal from hours to minutes.

Lower fees - Lenders currently pay Mono for API access and Flutterwave for payments. When those services consolidate, costs could drop. That could mean cheaper loans for borrowers.

Better transparency - A single company managing both data and payments means clearer audit trails and fewer coordination problems. That's better for compliance and regulatory oversight.

For borrowers, this should mean faster, cheaper access to credit. That's the promise of the deal.

But there's also risk. When you consolidate a critical piece of infrastructure into a single vendor, you increase single points of failure. If Flutterwave-Mono goes down, lenders across Africa lose access to both data and payment processing. That concentration risk is real.

The Investor Returns Story

Let's talk about the financial returns, because this is what makes the deal meaningful for the startup ecosystem.

Mono raised about

Now, with the acquisition valued at $25-40 million, let's think about the returns:

Conservative scenario ($25M valuation):

- Investors put in $17.5M

- They're exiting at $25M

- That's 1.43x their invested capital

- Not great

Optimistic scenario ($40M valuation):

- Investors put in $17.5M

- They're exiting at $40M

- That's 2.29x their invested capital

- Decent, but not amazing

Early investor scenario ($40M valuation, Series Seed participation):

- Early investors put in $2-3M at low valuations

- They're exiting at $40M

- That's 13-20x their invested capital

- That's real money

For Tiger Global, which led the Series C for Flutterwave and the Series A for Mono, this deal is interesting. Sources said Tiger didn't facilitate the transaction, but they have a seat at both tables. For a firm that's been criticized for overleveraging on the African tech boom, this deal shows some portfolio companies are generating returns.

Here's the key point: in a market where most African startups are either dying or raising at massive down rounds, Mono's investors are actually making money. That's rare. That matters.

Mono has achieved direct data access to 12% of Nigeria's banked population, highlighting its significant market penetration. Estimated data based on Nigeria's banked population.

The Competitive Landscape Shift

Who else was in the open banking space in Africa? And what happened to them?

Mono faced competition from Okra and Stitch, both well-funded open banking companies. Okra was backed by Base 10 Partners. Stitch was backed by Ribbit Capital. Both seemed like serious contenders.

Okra shut down. The company tried to pivot but eventually ran out of runway. Stitch is still around, but they moved away from pure open banking. They pivoted toward being a deeper payments ecosystem play, which allowed them to raise significantly more capital (Stitch has raised over $100 million).

Mono, meanwhile, became the dominant player in African open banking. Why? Because they focused. They didn't try to be a payments company (that's Flutterwave's job). They didn't try to be a lending company. They just built really good open banking infrastructure. And they built it in the market that mattered most: Nigeria.

By dominating Nigeria, Mono became too important to ignore. Nearly every Nigerian digital lender relies on them. That dominance is what made them valuable to Flutterwave.

The lesson here is that in fragmented African markets, you can dominate by being really good at one thing in one country. Mono didn't need to be in 54 African countries. They just needed to be the obvious choice in Nigeria. That's enough.

What's Next: Product Integration Questions

Mono will continue to operate as an independent product, the companies said. That's important to emphasize. This isn't a shut-down acquisition. It's a strategic integration.

But there are obvious questions about how the integration will actually work:

Will Mono's API get integrated into Flutterwave's dashboard? Probably, eventually. Lenders won't want to manage two separate integrations.

Will non-Flutterwave customers still be able to use Mono? That's unclear. Flutterwave could keep it open, or they could make it exclusive to their payments platform.

How will pricing change? Will lenders get discounts if they use both Mono and Flutterwave? Will Mono raise prices now that it's part of a larger company?

Will Mono expand beyond Nigeria? Flutterwave operates in 30+ countries. Will they roll out Mono-like services to other markets?

These are operational details that will take months or years to sort out. But they're important for the broader ecosystem.

If Flutterwave keeps Mono open and available to all lenders, this is a win for competition. If they shut it down or make it exclusive, it's a loss. We don't know yet which direction they'll go.

The Broader Economic Context: Credit-Driven Inclusion

Mono's CEO made an interesting point about why this acquisition matters now, not five years ago.

He said Africa is entering a "credit-driven phase" as governments push lending-led financial inclusion. That's actually true. The Central Bank of Nigeria has explicit mandates to expand credit access to underserved populations. West African governments are pushing financial inclusion as a development priority. This isn't just startups chasing a trend—it's government policy.

In that context, open banking infrastructure becomes essential. If you're going to lend to millions of people, you need to know they can repay. That requires understanding their income, spending, and financial behavior. Mono's infrastructure makes that possible at scale.

So the timing of this acquisition isn't random. Flutterwave is positioning itself to be the infrastructure provider for a government-led credit expansion wave. That's strategically sound.

It also explains why the valuation might seem low. The market for open banking infrastructure isn't huge yet. But as credit-driven inclusion accelerates, it will be.

Looking Forward: What This Exit Signals About African Fintech

Let's step back and think about what this deal signals about the state of African fintech in 2025-2026.

Signal 1: Consolidation is real. African fintech is consolidating around infrastructure plays. Mono isn't a consumer-facing app. It's infrastructure. The future winners in African fintech will own pieces of the stack.

Signal 2: Exits can happen at "smaller" valuations. You don't need a $100M exit to call something successful. Mono created genuine value and returned money to investors. In today's market, that's a win.

Signal 3: Regional scale matters more than geographic diversity. Flutterwave dominates 30+ countries. But their competitive advantage comes from operating in each of those countries really well locally. You don't win in Africa by building something that works everywhere. You win by building something that works in Nigeria, then Ghana, then Kenya.

Signal 4: Vertical integration works in fragmented markets. Because African payment infrastructure is fragmented by country, vertically integrated companies (payment rails + data infrastructure) have huge competitive advantages. Flutterwave just bought a way to lock customers in.

Signal 5: Domestic consolidation is becoming real. For years, every African startup exit went to a U.S. buyer. Now they can get acquired by another African company and still create value. That changes the dynamic.

For founders, this should be encouraging. You can build real infrastructure in Africa. You can create real value. And you can exit to companies that understand your market better than anyone else.

For investors, this should be a check on expectations. Not every fintech startup will become a decacorn. But infrastructure plays that solve real problems can generate solid returns. That's worth pursuing.

The Remaining Questions

There's still a lot we don't know about this deal:

What about other open banking companies? Are they also in acquisition conversations? Is this the start of a wave of consolidation?

How will Flutterwave deploy Mono beyond Nigeria? Do they try Mono in Ghana next? Or do they stay focused on payments?

Will regulators care about this consolidation? As African open banking regulation matures, will governments look back at this deal and think "we should have prevented this?"

What about the people? Will Mono's team stay? Will they have autonomy? These details matter for whether the integration actually works.

Will this inspire similar deals? If founders see Mono exiting successfully to a regional acquirer, does that change how they think about building companies?

These questions will play out over the next 12-24 months. But they're worth watching.

Why This Matters Beyond the Deal

If you're not running a fintech company in Africa, you might think this deal is irrelevant to you. You'd be wrong.

This acquisition signals how infrastructure gets built in emerging markets. It shows how consolidation works when regulatory frameworks are still developing. It demonstrates that companies can create real value even when external funding is scarce. And it proves that African companies can acquire other African companies and create value, rather than waiting for a Silicon Valley acquirer.

Those lessons apply everywhere. In Latin America, Southeast Asia, India, and other emerging markets, this is how infrastructure gets built. Companies solve local problems, become critical, and get acquired by larger regional players. That's not a failure. That's how markets mature.

For the African tech ecosystem specifically, this deal is a turning point. It's the beginning of regional consolidation rather than international acquisition. And that's healthy.

FAQ

What did Flutterwave acquire?

Flutterwave acquired Mono, a Nigerian open banking infrastructure company that provides APIs allowing businesses to access customer bank data, initiate payments, and verify customers. Mono had become the dominant open banking provider in Africa, powering nearly all Nigerian digital lenders and serving roughly 12% of Nigeria's banked population.

Why did Flutterwave buy Mono?

Flutterwave acquired Mono to vertically integrate its payments network with data infrastructure and lending verification services. This combination allows Flutterwave to offer identity verification, bank account validation, credit risk assessment, and payments through a single platform, creating a more powerful and sticky product for customers and making it harder for competitors to replicate.

How much was the deal worth?

The acquisition was valued between

Is this a good deal for Mono's investors?

Yes and no. While the headline returns seem modest (1.5-2.3x on invested capital), this is actually solid performance in today's African fintech market where most companies are struggling or raising at down rounds. Early investors who got in at seed rounds saw significant returns (up to 20x). More importantly, for an infrastructure company that wasn't forced into a sale, exiting with positive returns and strategic integration is a win.

What happens to Mono after the acquisition?

Mono will continue operating as an independent product within Flutterwave, according to official statements from both companies. However, the long-term integration path isn't entirely clear. Flutterwave will likely integrate Mono's APIs into their platform and potentially expand Mono's services to other African markets where Flutterwave operates.

What does this deal mean for Nigerian digital lenders?

Nigerian digital lenders that rely on Mono's infrastructure will likely see faster, cheaper loan disbursement as Flutterwave integrates identity verification, risk assessment, and payments into a single platform. However, the consolidation also creates concentration risk—if Flutterwave's system goes down, lenders lose access to both payment processing and data infrastructure simultaneously.

Is this deal similar to Visa's failed acquisition of Plaid?

Yes and no. The strategic logic is identical: both deals combine payment rails with data infrastructure to create vertical integration. However, the Visa-Plaid deal was blocked by U.S. regulators on competition grounds, while the Flutterwave-Mono deal occurred in Africa where regulatory frameworks are less mature and there's less established competition to protect. African regulators seem unlikely to block the deal, though this could change as markets mature.

Why did Mono not just raise another funding round?

Mono's CEO stated the company had sufficient cash reserves and was on track to profitability. Raising another round in the tough 2025 funding environment would have meant accepting new investor terms, lower valuations, and new growth expectations. Instead, joining Flutterwave gave Mono access to capital, scale, and distribution without the complications of a traditional fundraise.

What happened to other African open banking companies?

Mono's competition has consolidated or shifted strategy. Okra, backed by Base 10 Partners, shut down after struggling to raise follow-on funding. Stitch, backed by Ribbit Capital, pivoted away from pure open banking toward broader payments ecosystem plays, which allowed them to raise over $100 million. Mono's focus on Nigeria and refusal to expand too broadly made them the clear winner in the space.

What's the broader significance of this deal for African fintech?

This acquisition signals a major shift in how African fintech is evolving. Rather than all exits going to Silicon Valley acquirers, we're now seeing African companies consolidate regionally. It shows that infrastructure plays can generate returns without reaching unicorn status. It demonstrates that domestic consolidation is becoming viable. And it proves that the African fintech ecosystem is maturing from a venture-capital dependent model to one where companies can create real value and generate legitimate exits.

Conclusion: The Maturation of African Fintech Infrastructure

When Flutterwave announced the acquisition of Mono, it might have seemed like just another startup deal. Another acquihire. Another pivot. But it's actually something more important: evidence that African fintech is maturing.

For years, the narrative around African startups was that they'd build interesting things, then get acquired by Silicon Valley companies at some point. That was the natural endpoint. But this deal shows that African companies can now be the acquirer. And they can make smart, strategic acquisitions that create real value.

Mono wasn't a company that was struggling and needed rescuing. It was a company that had built something genuinely important (critical infrastructure that nearly every Nigerian digital lender relies on) and chose to scale that impact by joining a larger regional player. That's a mature decision.

For Flutterwave, this acquisition makes them dramatically harder to compete against. They now own the payments rails, the data infrastructure, the identity verification, and the lending assessment tools. That's a comprehensive stack. Competitors will struggle to replicate it.

For investors, this deal signals that African fintech still creates returns, even if those returns come at $25-40 million valuations rather than multi-billion dollar exits. In a market where most African startups are facing down rounds, Mono's positive exit is noteworthy.

For founders building in Africa, this deal sends a clear message: you don't need to be a decacorn. You don't need to raise $500 million. You can build critical infrastructure, become indispensable, and create an exit that makes sense for your investors and your team.

The Flutterwave-Mono acquisition is important not because it's a particularly large deal or a dramatic exit story. It's important because it represents business maturity. And that's the beginning of something bigger—a sustainable, profitable African fintech ecosystem that doesn't need Silicon Valley's blessing to succeed.

That's the real story here. And it's a story that's just getting started.

Key Takeaways

- Flutterwave acquired Mono for $25-40M in rare African fintech exit that returned capital to all investors

- Mono has become critical infrastructure for African lending, powering nearly all Nigerian digital lenders with 8M+ bank linkages

- The deal creates vertical integration combining open banking data infrastructure with payment processing, similar to failed Visa-Plaid acquisition

- African fintech is shifting from external exits to regional consolidation, signaling ecosystem maturation beyond venture capital dependency

- Mono's investors realized positive returns (up to 20x for early backers) despite lower headline valuation, proving infrastructure plays generate value

Related Articles

- L'Oréal's Flexible LED Face Mask: The Future of Beauty Tech [2026]

- Samsung's 130-Inch Micro RGB TV: The Future of Home Displays [2026]

- Samsung Freestyle+ Projector Review: The Portable Game-Changer [2026]

- Samsung HW-QS90H Soundbar Review: Quad Bass Without a Sub [2025]

- Birdbuddy 2 & Mini Smart Bird Feeders: Complete Guide [2025]

- Samsung's New Flagship OLED TV: The Upgrade That's Also a Downgrade [2025]

![Flutterwave Acquires Mono: African Fintech's Biggest Exit [2025]](https://tryrunable.com/blog/flutterwave-acquires-mono-african-fintech-s-biggest-exit-202/image-1-1767603952578.jpg)