Why Fortnite's New Crossover Strategy Matters More Than You Think

Fortnite has always been the ultimate playground for pop culture collisions. One week you're fighting alongside characters from Marvel. The next, you're dancing in a suit from The Office. But here's what's actually changing: Epic Games just formalized how crossovers happen, and it's about to explode in scale.

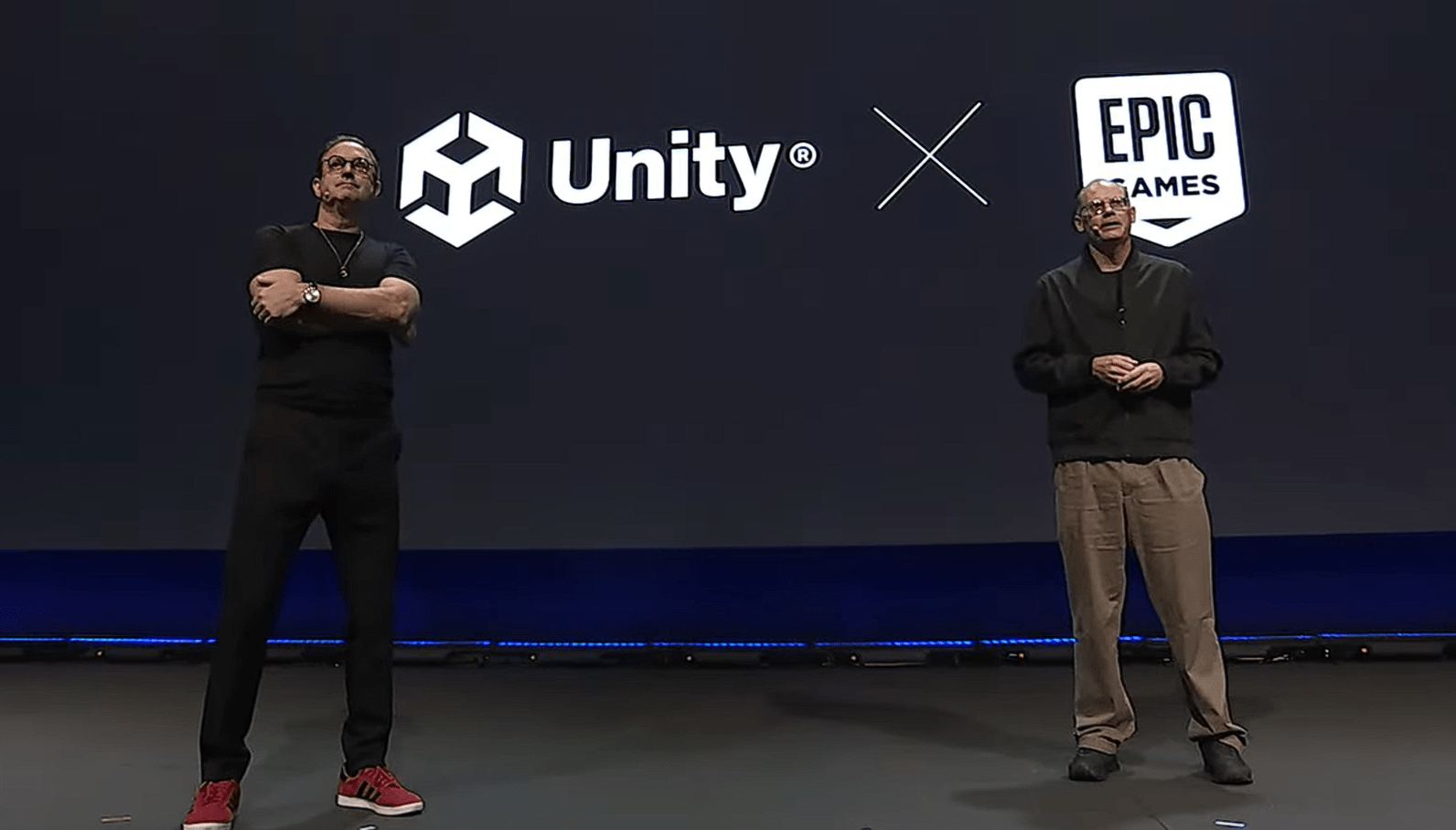

Last month, Epic Games Store General Manager Steve Allison announced something that seemed deceptively simple. The company is launching an official program that connects game developers with Fortnite cosmetics. Buy a game on the Epic Games Store, get an exclusive Fortnite skin. That's it. But the implications? They're massive.

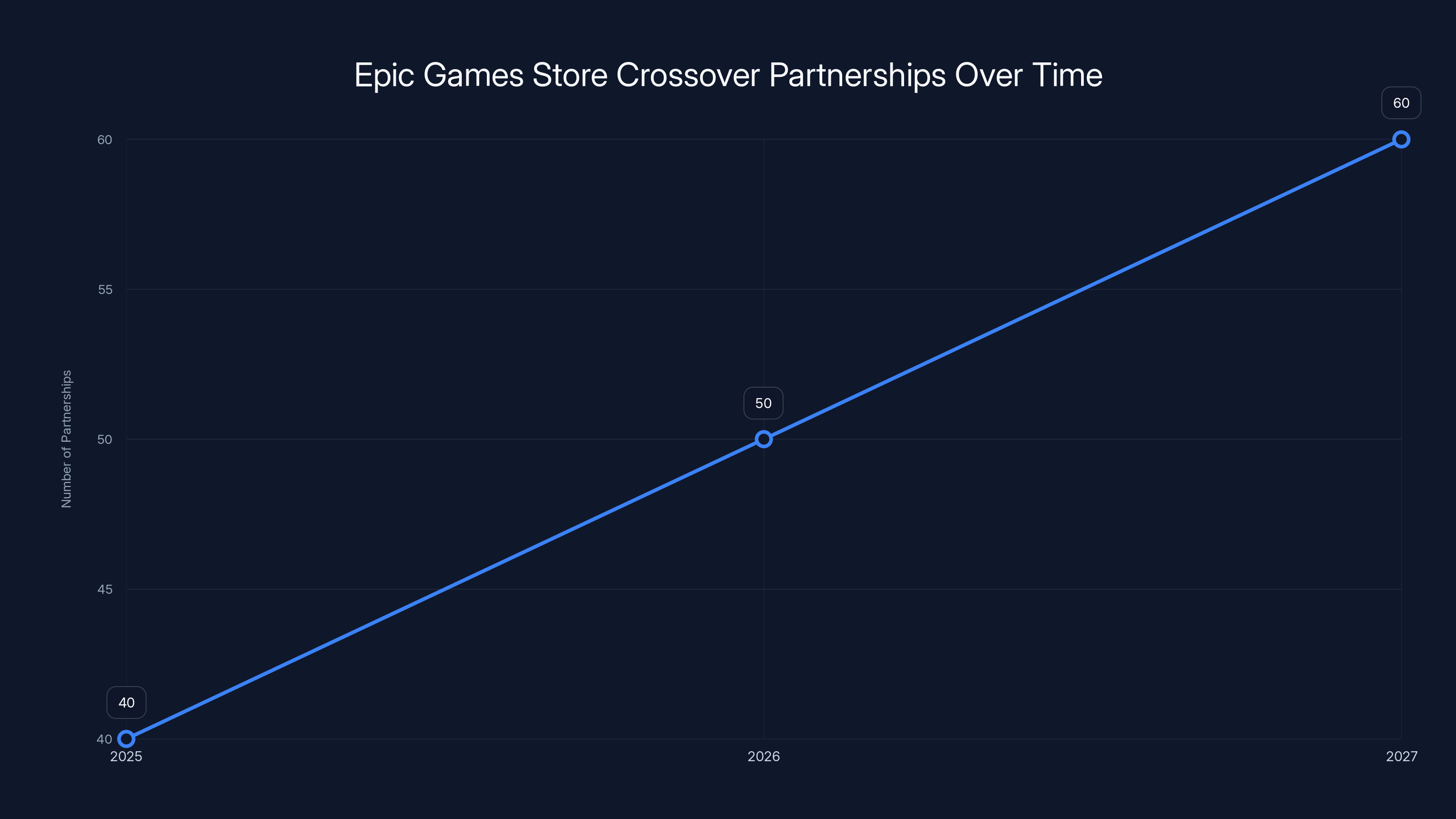

The numbers tell the story. Epic is aiming for "over 100 partnerships per year" eventually. This year, there will be approximately 40 crossovers. By 2027, they're projecting 60-plus partnerships. For context, that's roughly one major gaming crossover every week. Not special events. Not seasonal surprises. Just regular, expected cosmetics tied to actual game releases.

What makes this different from previous Fortnite collaborations isn't just scale. It's systematization. Fortnite's had crossovers for years, sure, but they've mostly been ad-hoc partnerships with entertainment properties—movies, TV shows, celebrities, music artists. Those still happen. But now, Epic has built infrastructure specifically designed to partner with game developers on the Epic Games Store. They've essentially created a new revenue stream and marketing channel that benefits everyone: Epic gets more store traffic, developers get exposure to millions of Fortnite players, and players get cosmetics tied to games they actually play.

The first game in this program? Capcom's Resident Evil Requiem, launching February 27th. The horror publisher is already known for Fortnite collaborations—those Resident Evil skins are popular. But this is the first official partnership under the new structured program.

Other publishers already signed up include mi Ho Yo (Honkai: Star Rail, Genshin Impact), Pearl Abyss (Black Desert), S-Game, Mint Rocket, and Kakao Games. If you know the gaming industry, you'll recognize these names immediately. These aren't small indie studios. These are major publishers with millions of players.

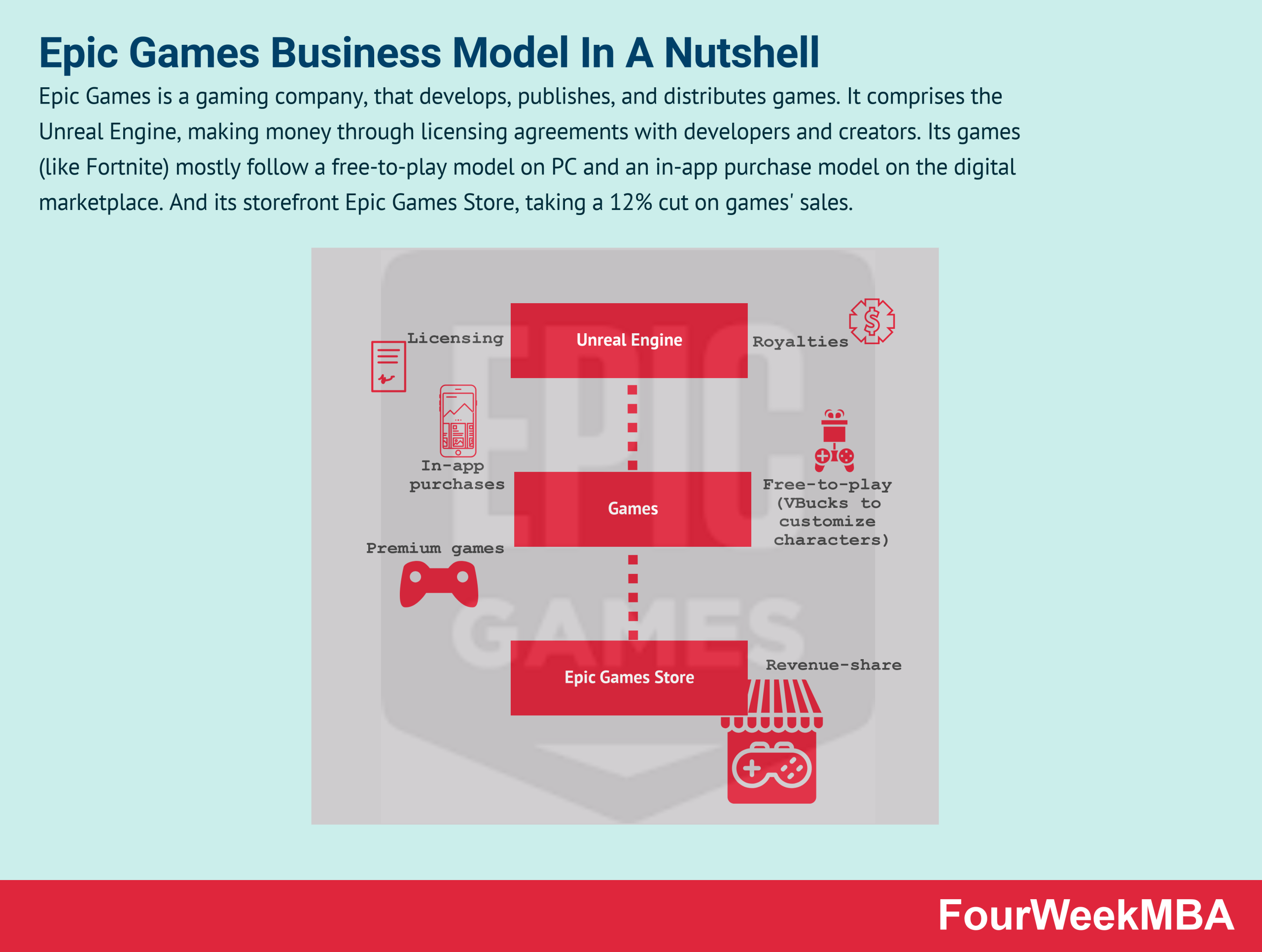

But here's the real story underneath: this program is Epic's answer to Steam's dominance. The Epic Games Store has spent years trying to compete with Valve's platform, offering free games weekly and exclusive releases. That strategy works—it drives downloads and engagement. But it doesn't fundamentally change why developers and players stick with Steam. Epic just found a new lever: use Fortnite's cultural relevance as the platform's competitive advantage.

Fortnite isn't just a game anymore. It's become a cultural hub. Players spend money on cosmetics not because they need them, but because they want to express themselves. A Resident Evil skin in Fortnite means something. It connects two gaming worlds. And if you're on Steam with the same game, you might start thinking: "I could be rocking this skin right now if I'd bought it on Epic."

That psychology is subtle, but it works. And it scales beautifully across hundreds of partnerships.

The Numbers Behind Epic's Gaming Store Growth

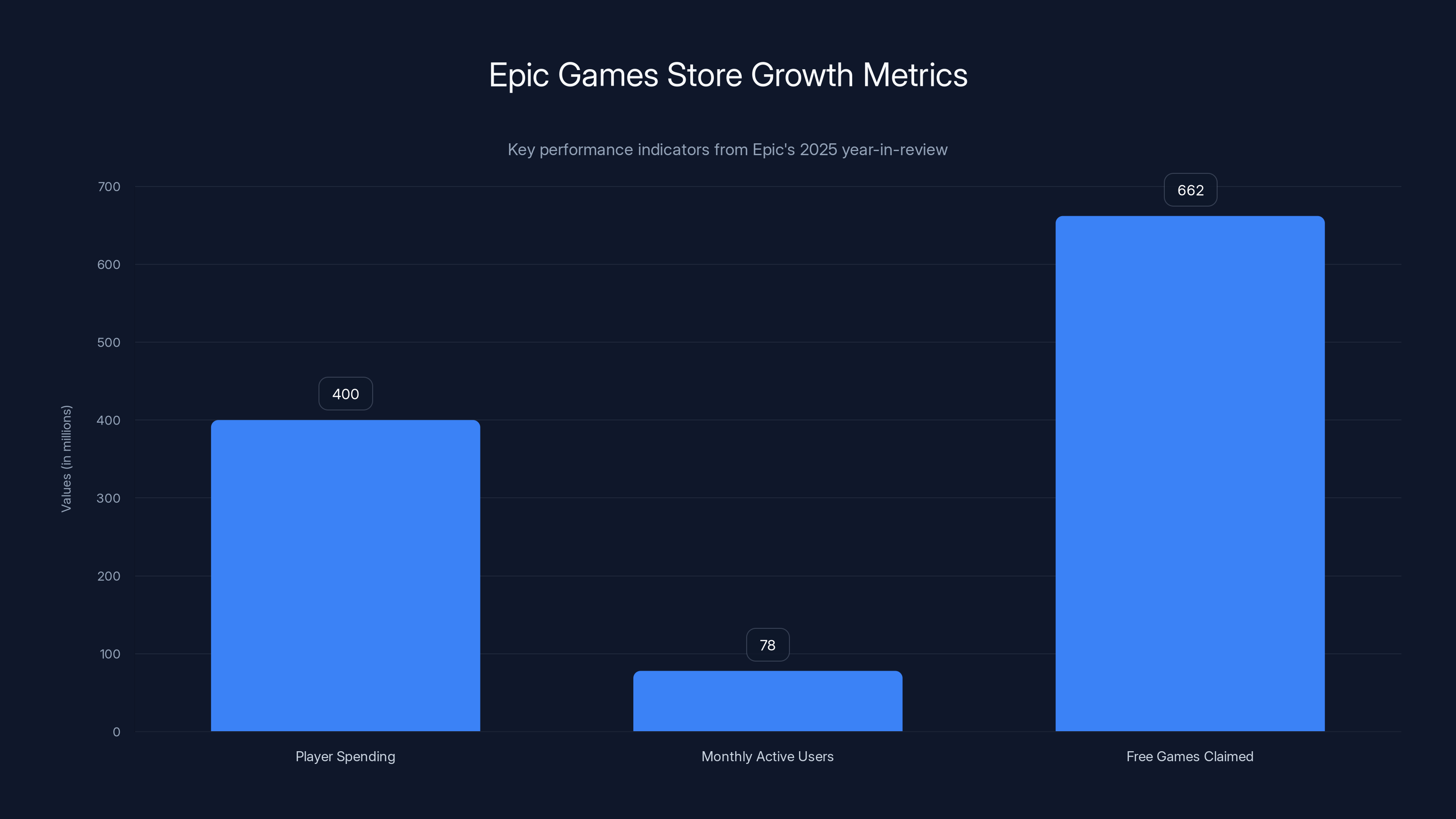

Before diving into what this means for the future, let's ground this in reality: Epic is making real money with the Games Store. The numbers they shared in their 2025 year-in-review validate that the platform isn't just a vanity project.

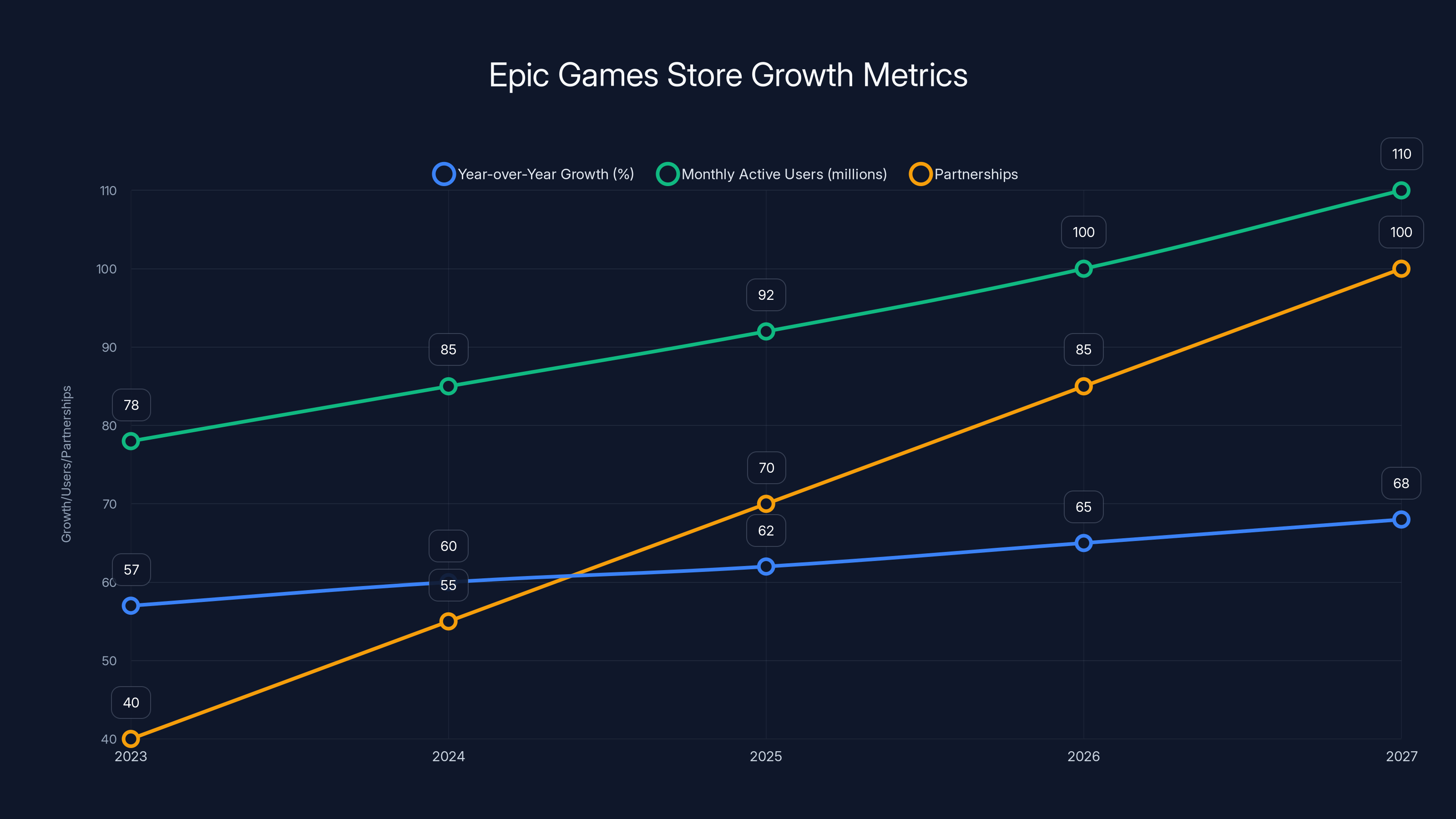

Player spending in third-party PC games grew 57% year over year, reaching an "all-time record" of $400 million. That's a substantial jump. For context, that kind of year-over-year growth suggests the platform is genuinely gaining market share and player confidence.

Monthly active users hit an all-time peak of 78 million on PC. That's not trivial. Steam's monthly active user count is higher (around 120 million), but Epic's is still a meaningful slice of the PC gaming market. And importantly, it's growing.

The free games program—where Epic gives away games for free every week—drove even more engagement. Players claimed 662 million titles through this program in 2024 alone. Steve Allison calls it "basically our marketing budget," and he's not wrong. That strategy costs Epic money, but it builds habits. People install the launcher to grab the free game, then they discover other things, and suddenly they're an active user.

But here's the issue: the free games model has ceiling limits. You can't scale customer acquisition on free stuff forever. You need an ecosystem that keeps people coming back, spending money, and telling others about it. That's where the crossover program comes in.

Epic Games Store saw significant growth in 2024 with $400 million in player spending, 78 million monthly active users, and 662 million free games claimed. Estimated data.

How the Developer Partnership Program Actually Works

Let's demystify how this program operates in practice. It's straightforward, and that's intentional.

A game developer publishes their title on the Epic Games Store. They don't need to do anything special—it's just a regular release. But if they want to participate in the crossover program, Epic creates a cosmetic inspired by that game. The cosmetic could be a skin, glider, pickaxe, emote, or any of Fortnite's cosmetic categories.

Here's the key: the cosmetic is exclusive to players who purchase the game on Epic's storefront. You can't buy it with V-Bucks. You can't earn it through Fortnite's battle pass. You get it by supporting the game on Epic's platform. That scarcity and exclusivity make it valuable.

The timeline works like this: Game launches on Epic Games Store. Within the launch window or shortly after, Fortnite players who buy the game receive the corresponding cosmetic, usually within a few days of purchase. The promotional period might last a few weeks to capture the launch momentum.

Epic benefits because:

- Store traffic increases around game launches

- New users install the launcher

- Existing players make purchases (and might explore other titles while they're there)

- The platform feels like a premium ecosystem where exclusives matter

Developers benefit because:

- Fortnite has over 500 million registered players

- Marketing to that audience is massive

- Cosmetic tie-ins create emotional connections between games

- They get free PR and visibility

Players benefit because:

- They get exclusive cosmetics tied to games they play

- Cosmetics are meaningful—they represent games you care about

- There's a collection element that encourages trying new titles

This is a textbook win-win-win scenario. Those are rare in business, which is why this program is significant.

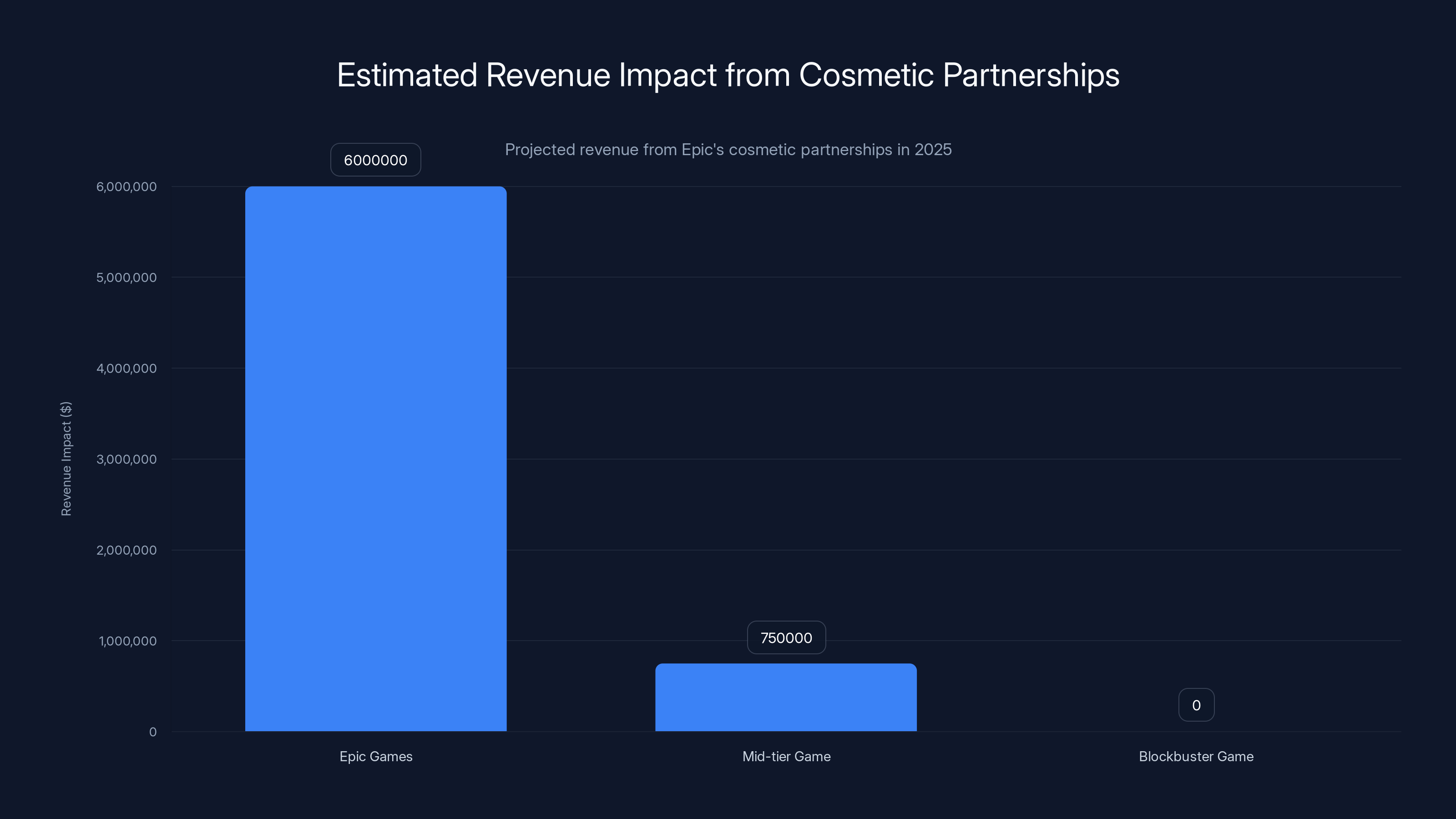

Estimated data shows Epic Games could generate

The Strategic Competition: Why Epic Needs This (And Why Steam Doesn't)

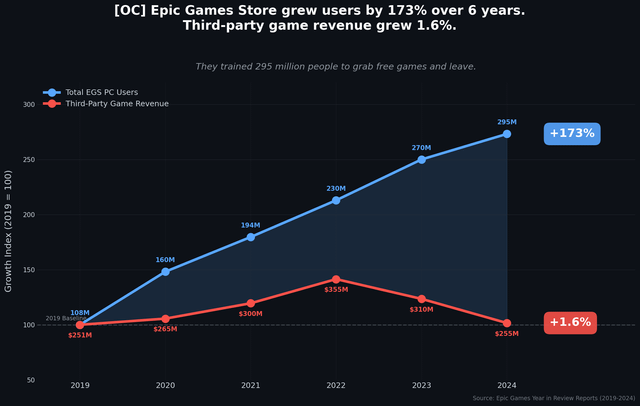

Let's be real: Steam's grip on PC gaming is still dominant. Valve's platform has network effects so strong that most players just default to it. You have your library there. Your friends are there. The forums, workshop, and community features are robust. Moving is friction.

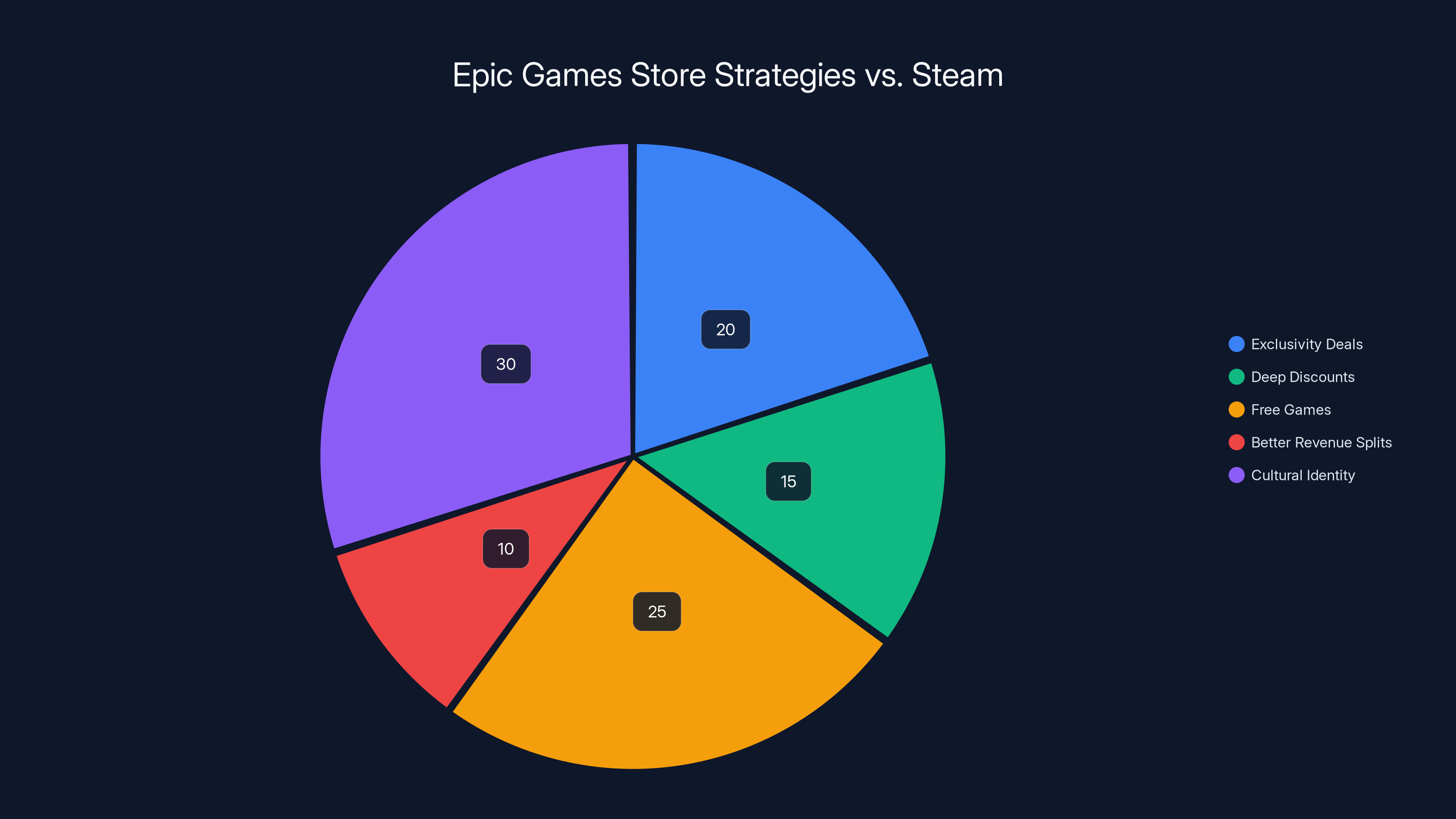

Epic's been trying to chip away at this for years. They've tried:

- Exclusivity deals (paying publishers millions to release only on Epic)

- Deep discounts (funding developers to offer lower prices)

- Free games (662 million claimed titles in 2024)

- Better revenue splits (giving developers 88% instead of Steam's 70%)

None of this has fundamentally shifted the market. Steam still dominates. Why? Because Steam's moat isn't pricing or features. It's inertia and network effects. Everyone's already there.

The crossover program is different. It doesn't compete on features or price. It competes on culture and identity. It says: "Buy on Epic and get something you literally cannot get anywhere else." That's powerful because it's not a functional advantage—it's emotional.

Fortnite players care deeply about cosmetics. The global cosmetics market in gaming is estimated in the tens of billions of dollars annually. Players spend money on skins because they represent self-expression. An exclusive cosmetic tied to a game you love? That resonates.

Steam couldn't replicate this if it tried. Valve doesn't own a massively popular free-to-play game with cultural dominance. Epic does. That's the asymmetry.

For Steam, cosmetic exclusivity doesn't work because people aren't installing Steam to play cosmetics. They install it to access their library and play games. For Epic, it's different—Fortnite is the cultural property that makes the Games Store interesting.

Resident Evil Requiem: The Program's Flagship Launch

Capcom's Resident Evil Requiem is launching on February 27th, 2025, and it's the flagship partnership for this new program. This is intentional positioning.

Why Resident Evil? The franchise has massive cultural relevance beyond gaming. It's been in movies, TV shows, merchandise. Capcom has already collaborated with Fortnite on cosmetics before, so the audience overlap exists. Players know what Resident Evil is.

But more importantly, Resident Evil is a premium, AAA title with a $70 price tag. This is significant. Earlier Fortnite crossovers often tied to free-to-play games or lower-price-point titles. Resident Evil Requiem signals that Epic's crossover program isn't just for indie developers fighting for visibility—it includes major publishers with major releases.

For Capcom, the deal works like this: Resident Evil Requiem players on Epic get exclusive cosmetics. Not just skins—probably the full package. Character skins (Jill, Chris, maybe a Tyrant), gliders (maybe a helicopter or vehicle), pickaxes (weapons), back bling (equipment), emotes (gestures or animations).

Capcom knows that a significant portion of players might buy the game on Epic specifically because of Fortnite cosmetics. It's not the primary reason—the game itself is the main attraction. But it's a tiebreaker. It's the reason someone chooses Epic over Steam when the release is simultaneous on both platforms.

For Epic, Resident Evil Requiem is the proof of concept. If this partnership drives measurable sales lift on the Games Store, it validates the entire program. That success justifies the infrastructure investment and convinces other publishers to participate.

Fortnite players get Resident Evil cosmetics that are actually relevant because Resident Evil Requiem is a new, interesting game launching right now. Not a random celebrity collab or a 10-year-old IP revival. Current, relevant content.

Epic's strategy of leveraging cultural identity through exclusive cosmetics is estimated to have the highest potential impact on market share, surpassing traditional tactics like discounts and exclusivity deals. Estimated data.

The Publishers Already on Board: A Who's Who of Gaming

Epic didn't announce the crossover program with zero takers. Multiple publishers are already committed to multiple cosmetics across 2025 and 2027. Let's break down who they are and what it means.

mi Ho Yo is a major Chinese gaming company behind Genshin Impact and Honkai: Star Rail. Genshin Impact alone has over 60 million monthly active users. That's a massive audience. A Genshin Impact cosmetic in Fortnite could be huge—the two games have overlapping audiences (action RPG enthusiasts, anime aesthetics). If Epic does this right, Genshin Impact players will see a cosmetic in Fortnite that speaks to them, which drives Game Store traffic.

Pearl Abyss makes Black Desert Online, one of the most successful MMORPGs of the last decade. Black Desert has a specific aesthetic—dark fantasy, beautiful character design, intense combat. That translates well to cosmetics. Players who've invested hundreds of hours in Black Desert would absolutely want that skin in Fortnite.

S-Game, Mint Rocket, and Kakao Games are less familiar to Western players, but they're significant in their respective regions and genres. This suggests Epic's strategy isn't just about Western AAA publishers—it's about scaling globally. Korean games, Chinese games, indie publishers from emerging markets. All welcome.

The sheer diversity of publishers signals that Epic's not cherry-picking one-off partnerships. It's systematizing crossovers as a standard part of the Games Store's value proposition.

What does this mean for the industry long-term? It creates a new marketing channel that didn't exist before. For mid-tier games struggling to get visibility in a saturated market, a Fortnite cosmetic could be disproportionately valuable. For AAA games, it's an optional marketing boost on top of existing marketing. For publishers, it's a negotiation point with Epic: "What marketing support do we get? What cosmetic will represent our game?"

The Mobile Games Store: Epic's Tougher Battle

While the crossover program is growing on PC, Epic's mobile effort is struggling. This is important context.

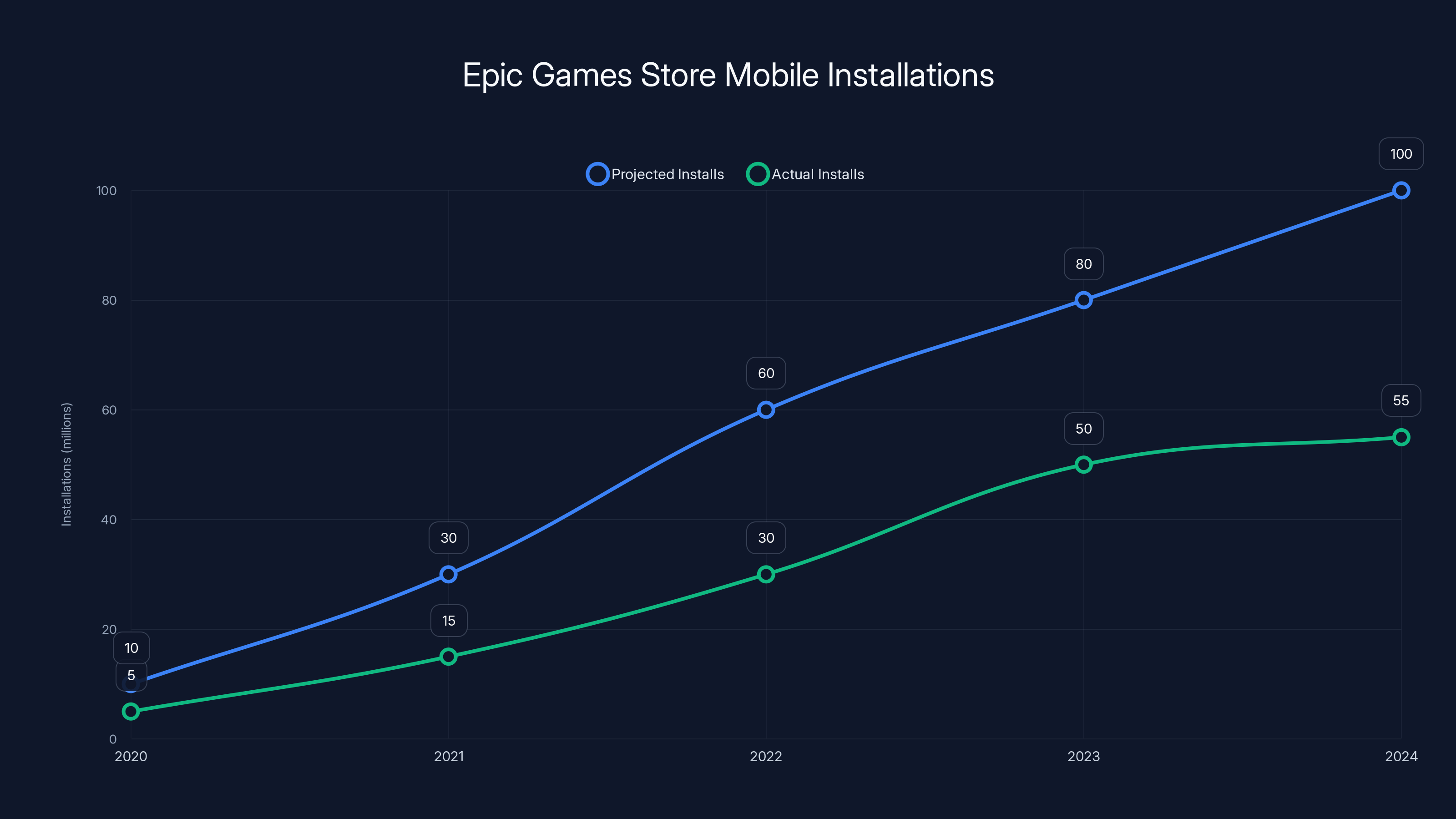

Epic launched the mobile Epic Games Store to compete with the Apple App Store and Google Play Store. The goal was ambitious: 100 million installs by the end of 2024. They didn't hit it. Current installs are over 50 million—respectable, but significantly short of the target.

Why the shortfall? Partly it's that mobile gaming is heavily entrenched on the App Store and Play Store. Network effects are real. But Steve Allison acknowledges the real issue: scare screens.

Scare screens are the warnings that appear when you download an app from outside the official app store. Apple and Google have made the process intentionally friction-heavy to discourage sideloading. When users see "This app is not from the App Store" or "This app may be unsafe," many abandon the download. That friction is killing Epic's mobile expansion.

But here's the thing: regulatory changes are creating opportunities. The EU, US, and other regions are pressuring Apple and Google to reduce restrictions on sideloading and third-party app stores. As regulations shift, the friction decreases. That's why Epic is planning to expand the mobile store to Japan in March and Brazil in June—regulatory environments in those countries are more favorable.

This is Epic's long-term bet: regulations change, sideloading becomes less scary, and the mobile Games Store can actually scale. Once that happens, the crossover program could expand to mobile games too. Imagine buying a game on the Epic mobile store and getting a Fortnite cosmetic. Same model, but on phones.

For now, mobile is a work in progress. But it's important because the PC store success gives Epic leverage to keep investing in mobile. Revenue growth of 57% year-over-year suggests the Games Store is becoming sustainable, not just an expensive Hail Mary.

Epic Games Store plans to increase its crossover partnerships from 40 in 2025 to over 60 by 2027, indicating a strategic growth in collaborations with game developers.

The Fortnite Cosmetics Economy: Why This Matters

To understand why the crossover program is significant, you need to understand Fortnite's cosmetics economy. It's a multi-billion-dollar business.

Fortnite cosmetics fall into several categories:

- Skins (character outfits)

- Gliders (deployment visuals)

- Pickaxes (harvesting tool skins)

- Backblings (back accessories)

- Emotes (dances and animations)

- Wraps (vehicle skins)

Players buy these with V-Bucks, Fortnite's premium currency. A single skin typically costs 1,200-2,000 V-Bucks (

The cosmetics that succeed are the ones that create emotional connection. That's why Fortnite collaborates with pop culture properties. A DC skin appeals to superhero fans. A Star Wars skin appeals to sci-fi enthusiasts. A music artist collab appeals to music fans.

The developer crossover program systematizes this at scale. Instead of occasional special event cosmetics, there's a steady stream of game-themed skins. A player might see:

- Resident Evil cosmetics this month

- Genshin Impact cosmetics next month

- Black Desert cosmetics three months later

That cadence creates collection motivation. It keeps cosmetics feeling fresh and relevant. And importantly, it ties cosmetics directly to games players should be playing.

From a monetization perspective, this is brilliant. Game developers spend massive budgets on marketing. Epic's giving them a new marketing channel—one that reaches Fortnite's 500+ million players—in exchange for Epic driving traffic to the Games Store. It's leveraging existing audiences.

The cosmetics themselves are also valuable IP. A well-designed Resident Evil skin becomes an asset that Capcom might promote in their own marketing. They'll put it on trailers, social media, press materials. Free marketing for Epic.

Platform Architecture Updates: Making the Epic Games Store Not Suck

Epic's strategy isn't just about cosmetics and partnerships. It's also about fixing the platform itself. The Games Store has had a reputation problem: it's slow.

Steve Allison doesn't shy away from acknowledging this: "We know the criticism. We don't disagree with it." That's refreshingly honest. The launcher has been laggy, features have been slow to load, and the overall experience feels clunky compared to Steam's polish.

This year, Epic is shipping significant infrastructure upgrades. They're "rebuilding the underlying architecture" with updates coming this summer. The goal is to make the app feel "instant" and "snappy"—Allison's words.

What does this actually mean? Likely optimizations like:

- Faster load times for the store homepage and game pages

- Better search performance (searching the library should be instant, not laggy)

- Improved stability (fewer crashes, better memory management)

- Faster downloads and install processes

- Streamlined navigation (less clicking to get where you want)

These aren't flashy features. They don't make headlines. But they matter more than any cosmetic crossover. A launcher that's slow to use is a launcher people abandon. If Epic can fix that, it removes one major pain point preventing people from using the Games Store.

The timing is strategic. As the crossover program launches and drives new users to the store, the improvements ensure those users have a good experience. New players trying the launcher for the first time won't think "wow, this is slow." They'll think "okay, this works fine."

This is also why the free games program continues through 2026. Free games drive downloads. Infrastructure improvements keep people engaged. Cosmetic crossovers give people reasons to spend money. It's a coherent ecosystem strategy.

Epic Games Store is projected to see significant growth in user base and partnerships, driven by its cultural dominance strategy. Estimated data shows increasing trends in growth, user engagement, and partnerships.

How This Changes Developer Strategy: The Ripple Effects

If you're a game developer or publisher, the crossover program creates new decision trees.

When launching a game simultaneously on multiple storefronts (Steam, Epic, GOG, console platforms), you now have to ask: "Do we partner with Epic's cosmetic program?" The calculus looks like this:

Pros of participating:

- Extra marketing reach (100 million monthly active users)

- Brand awareness among Fortnite's audience

- Exclusivity creates urgency (some players might buy on Epic instead of Steam)

- Additional monetization potential (cosmetics can drive interest)

- Relatively low effort (Epic handles cosmetic design and implementation)

Cons:

- Revenue share negotiations (Epic might request favorable terms in exchange)

- Potential cannibalization (players who would've bought on Steam buy on Epic instead)

- IP control (letting Epic create cosmetics means less control over how your brand is represented)

- Relationship with Steam (though Valve hasn't been retaliatory, there's potential friction)

For most publishers, the math favors participation. The reach is too big to ignore. But it creates interesting dynamics.

Consider indie developers without massive marketing budgets. A cosmetic in Fortnite could be genuinely transformative. It's free marketing to an audience that's literally hundreds of millions large. That's worth the participation in most cases.

For AAA publishers, it's more of a "nice to have" unless there's a specific audience overlap. A Call of Duty cosmetic in Fortnite might not move the needle much because the audiences don't overlap as much. But a game like Honkai: Star Rail (mi Ho Yo's title)? Perfect fit. Genshin Impact fans would absolutely buy cosmetics representing that world.

This is also going to create secondary effects in esports and streaming. If a major esports cosmetic or tournament skin becomes available through a game crossover, pros and streamers will want it. That drives more traffic to the Games Store.

The Competitive Landscape: Could Steam or Others Copy This?

Steam has a huge advantage: 400+ million registered players, 120+ million monthly active. Could Valve just copy Epic's crossover strategy and crush them?

Technically, yes. Steam could create a program where games include cosmetics from... something. But here's the problem: Steam doesn't own a cosmetics platform. Half-Life 2 was 20 years ago. Team Fortress 2 exists but it's aging. Dota 2 has cosmetics, but it's not the cultural juggernaut Fortnite is.

Steam's strength is being the neutral platform where every publisher publishes. Valve doesn't create competitive pressure the way Epic does. If Steam started pushing harder into cosmetics or exclusive content, it might break that perception of neutrality.

Epic, meanwhile, has the unique advantage of owning Fortnite while also operating the Games Store. This vertical integration is exactly the kind of moat that's hard to replicate. You'd need to own a massively popular F2P game AND operate a storefront. That's rare.

Could GOG (CD Projekt Red's storefront) copy this? Technically, but they lack both the cosmetics platform and the scale. Xbox Game Pass could theoretically do this if they partnered with a massively popular game, but that's not their current strategy.

The reality is: Epic's strategy is defensible specifically because of Fortnite. Without owning Fortnite, you can't execute this playbook. That's why it's such a clever move.

Epic Games Store aimed for 100 million mobile installs by 2024 but is currently at 50 million, highlighting a significant shortfall due to sideloading challenges. Estimated data.

The Next 100 Partnerships: What Games We'll Probably See

Epic's targeting 40 partnerships in 2025 and 60+ in 2027. That's roughly one partnership every week at scale. What types of games will participate?

Based on the initial wave (Resident Evil, mi Ho Yo, Pearl Abyss), we can predict:

Action RPGs will be heavily represented. Games with strong visual aesthetics and passionate fanbases translate well to cosmetics. Think Dragon's Dogma 2, Dragon Age: The Veilguard, Monster Hunter, FFXVI (when it comes to PC).

Battle royales might seem like natural fits, but there could be conflicts. Are they going to have Call of Duty cosmetics? Apex Legends? Probably not if those games see Epic as competitors. But Free-to-play titles without battle royale elements are open season.

Chinese and Asian games will be prominent. mi Ho Yo, Nexon, Net Ease—these publishers have massive player bases and aren't as entrenched in Steam exclusivity. The crossover program is a way for Epic to gain credibility in Asian markets.

Indie games with strong aesthetics will get opportunities. An indie game with a $20 price point might not get much marketing budget, but a Fortnite cosmetic? That's transformative. Look for horror games, roguelikes, and stylish action games.

Remasters and re-releases of classic franchises are likely. A Resident Evil cosmetic opens the door to remasters of other classic franchises. Expect cosmetics tied to re-released Capcom games, Konami games, etc.

Premium titles might be hesitant initially, but as more AAA games participate, it becomes the norm. Eventually, expecting a Games Store cosmetic at launch could become standard like having a day-one patch.

What probably won't get cosmetics: Games already on Steam with no intention to publish on Epic Games Store. The incentive only exists if the game's on Epic's platform.

The Economics: Who Makes Money and How Much

Let's break down the financial incentives. Who profits from this program and by how much?

For Epic:

- Increased store traffic and installations

- Higher conversion rates (players might buy something while browsing for cosmetics)

- Higher player lifetime value (players who try new games stick around longer)

- Reduced customer acquisition cost (free games brought them in, cosmetics keep them engaged)

- The cosmetics themselves might have a revenue split where Epic takes a cut

For Developers:

- Increased visibility (direct access to Fortnite's audience)

- Marginal sales uplift (some % of players buy specifically because of the cosmetic)

- Brand awareness (cosmetics serve as advertising)

- Possibility of cosmetics sales (if cosmetics are resold or appear in cosmetics bundles)

For Fortnite Players:

- Exclusive cosmetics (items they can't get anywhere else)

- Connection between games they love and their favorite cosmetics

- Incentive to try new games (some players will buy a game for the cosmetic)

Quantifying this is hard without insider data, but we can make educated guesses.

Assuming Epic attracts 100,000 additional Game Store installs per cosmetic partnership, and 10% of those players make a purchase averaging $15, that's:

Across 40 partnerships in 2025: $6 million in incremental revenue.

That's a guess, but it shows the scale. Even conservative estimates show meaningful impact. And as the program scales to 100+ partnerships, the effect compounds.

For individual games, the impact varies widely. A mid-tier game might see 5-10% sales uplift from a Fortnite cosmetic. A blockbuster game sees negligible uplift. But 5-10% on a million-unit game is significant.

The Cultural Significance: Cosmetics as Meta-Commentary

Here's something that doesn't get discussed enough: cosmetics are becoming a form of meta-commentary about gaming culture.

When you wear a Resident Evil skin in Fortnite, you're saying something. You're announcing: "I care about horror games. I'm hip to Capcom's legacy franchises. I appreciate crossover culture." It's a signal.

Fortnite understood this early. The game became a cultural phenomenon not just because it's good gameplay, but because cosmetics became self-expression. The fashion show in Fortnite lobbies is real.

The developer crossover program amplifies this. It creates a hierarchy of cosmetics. Some cosmetics are:

- Limited-time event cosmetics (available during seasonal events)

- Seasonal battle pass cosmetics (tied to seasonal progression)

- Store cosmetics (purchasable with V-Bucks, available for months)

- Exclusive partnership cosmetics (tied to specific games, available only to buyers of those games)

That last category creates scarcity and perceived value. A player wearing a Black Desert cosmetic in Fortnite is announcing "I own this game and I cared enough to buy it on Epic specifically to get this skin."

This is subtle psychological design, but it's powerful. It creates in-game status distinctions based on purchasing behavior. And importantly, it incentivizes purchasing on Epic Games Store because you get something unique that players on Steam can't get (if they buy there instead).

This is also why the crossover program is defensible from a community perspective. It's not pay-to-win cosmetics (Fortnite's cosmetics don't confer gameplay advantages). It's cosmetics with meaning and scarcity. Players generally view these as valuable.

The Mac and Linux Angle: PC Expansion Beyond Windows

One thing often overlooked: Epic Games Store supports macOS and Linux, not just Windows.

This matters because it opens partnerships to Mac and Linux gaming communities, which are historically underserved. A game launching with Linux support is relatively rare. When it happens, it's notable. If that game comes to Epic Games Store with a Fortnite cosmetic tie-in, it could drive material adoption.

Fortnite itself runs on Mac (via cloud, after Apple removed it from the App Store). So cosmetics are accessible to Mac players. Linux Fortnite support is less certain, but the Games Store's Linux compatibility is real.

This is a subtle advantage of Epic's approach versus Steam's. While Steam dominates gaming overall, Epic's vertical integration means it can support platforms that might otherwise be left out.

For a developer targeting Mac players specifically, an Epic Games Store partnership with cosmetics could be the marketing push that drives adoption. It's a small niche, but a niche Epic is explicitly serving.

Future Predictions: What Comes Next

Based on current trajectory, here's what's likely to happen:

Year 1 (2025): The program launches with ~40 partnerships. Early success with Resident Evil Requiem proves the concept. More publishers get comfortable with the idea. By year-end, Epic is publicly celebrating cosmetic partnership success and announcing expanded plans.

Year 2 (2026): The program scales to 60+ partnerships. Fortnite cosmetics become expected at game launches on Epic. Developers start requesting cosmetic tie-ins as a negotiation point when approaching Epic. The free games program continues, creating a habit-building ecosystem.

Year 3 (2027): 100+ partnerships is realistic. That's roughly two per week. Cosmetics become so commonplace that a game without a cosmetic tie-in seems like it lacked effort. Epic has fundamentally changed how game marketing works on PC.

Long-term: The model expands to mobile (once regulatory friction decreases) and potentially console (though that's more complicated with platform exclusivity rules). The crossover program becomes the default way major games get marketed on Epic.

The wild card is regulation. If antitrust actions against Epic succeed, it could change the company's strategy. If antitrust actions against Valve succeed, it could change Steam's strategy. But based on current trajectory, the cosmetic crossover program is a defensible, sustainable competitive advantage.

The Storytelling Angle: Why Cosmetics Matter

There's a narrative element to cosmetics that's worth exploring. A Resident Evil skin in Fortnite isn't just a visual novelty. It's a story beat.

When you equip that skin, you're stepping into Jill Valentine's (or Chris Redfield's) story. For a moment, you're connecting two gaming universes. The story of Resident Evil—survival horror, zombie apocalypses, corporate conspiracies—contrasts beautifully with Fortnite's absurdist battle royale setting. That contrast is the appeal.

Fortnite's cosmetics have always worked this way. Master Chief in Fortnite isn't just a skin. It's a narrative statement: sci-fi meets cartoonish multiplayer. DC heroes in Fortnite is a statement: superheroes in a colorful world. Music artist cosmetics are statements: pop culture in gaming.

The developer crossover program systematizes this storytelling. It says to developers: "Your game's story, characters, and aesthetic matter to us. They matter enough to bring into Fortnite's world."

For developers, this is affirming. It validates that their IP is culturally significant enough to appear in the world's most culturally dominant game. That's marketing value that's hard to quantify but real.

For players, it's an expansion of gaming culture itself. Cosmetics become a form of gaming literacy. "You have a Genshin Impact skin? Then you know about action RPGs and anime aesthetics." Cosmetics become a shorthand for shared cultural references.

The Risks: What Could Go Wrong

For all the promise, there are risks worth considering.

Cosmetic Fatigue: If cosmetics drop every week, they might lose value. Scarcity is part of the appeal. If every partner game gets a cosmetic, cosmetics become generic. Epic will need to carefully curate partnerships to maintain perceived value.

Quality Control: Not every game deserves a cosmetic. If Epic partners with low-quality games, it reflects badly on the program. Curating quality partnerships is essential but harder at scale.

Cannibalization: If the program primarily shifts sales from Steam to Epic (rather than growing total market share), publishers might resent feeling forced to participate. Epic will need to demonstrate that cosmetics genuinely drive incremental sales, not just channel-shift.

Community Backlash: Fortnite's community is vocal. If cosmetics are perceived as pay-to-win adjacent or if cosmetics feel "forced," players might backlash. Epic has to maintain cosmetics as purely cosmetic.

Regulatory Risk: If antitrust regulators view this as anticompetitive (leveraging Fortnite's dominance to force platform adoption), it could face legal challenges. This is unlikely but not zero risk.

The Bigger Picture: Gaming as Platform

Zoom out for a moment. What's really happening here isn't just about cosmetics or the Games Store. It's about redefining games as platforms.

Fortnite is no longer just a battle royale. It's a cultural platform. A place where brands, IP, and other games come to exist. The cosmetic crossover program formalizes this. It says: "Fortnite is the place where games converge."

This is similar to how YouTube became a platform for content, not just a video player. Or how TikTok became a platform for creators, not just a social network. Or how Discord became a platform for communities, not just a voice chat tool.

Epic is making a sophisticated strategic bet: Fortnite is the platform. Everything else is content for that platform.

The Games Store is just one application. The cosmetics program is another. Fortnite Creative mode (where players build) is another. Fortnite Festival (the rhythm game mode) is another. These aren't disconnected products. They're all pieces of Fortnite as a cultural ecosystem.

If Epic executes this well, it becomes a defensible moat. You're not competing against Epic Games Store as a storefront. You're competing against Fortnite as a cultural phenomenon. That's much harder.

Conclusion: The Long Game

Fortnite getting more gaming crossovers isn't just a cosmetics story. It's about how gaming platforms will compete in the next decade.

Epic Games understood something others didn't: cultural dominance beats feature parity. Steam has more features, more games, more stability. But Fortnite has cultural relevance. That's worth more.

The developer crossover program is the formalization of this insight. It's a systematic way to convert Fortnite's cultural dominance into Games Store adoption. It's a growth engine that scales across hundreds of partnerships.

For game developers, it's an opportunity. A Fortnite cosmetic isn't a novelty anymore. It's a marketing channel. For indie games without massive budgets, it could be transformative. For AAA games, it's expected.

For players, it's the continuation of a trend: gaming is becoming more crossover-heavy. Boundaries between games are collapsing. You can be in Fortnite, see a cosmetic from a game you've never played, try that game because the cosmetic appealed to you, and discover a new favorite. That's a feature, not a bug.

The numbers suggest this works. 57% year-over-year growth for Games Store spending. 78 million monthly active users. 40 partnerships in 2025 alone. These aren't theoretical improvements. They're real business results.

What's happening now is just the beginning. When the program scales to 100+ partnerships per year, when it expands to mobile, when it becomes expected that games have Fortnite cosmetics, we'll look back and recognize this moment as significant.

Epic took a long shot by trying to compete with Steam. But they found their angle: leverage cultural dominance to drive platform adoption. It's working. And it's going to reshape how games are marketed and discovered for years to come.

The crossover program isn't about cosmetics. It's about power. And Epic just proved they have it.

FAQ

What is the Epic Games Store crossover program?

The Epic Games Store crossover program is an official initiative that gives Fortnite players exclusive cosmetics when they purchase games on the Epic Games Store. When you buy a game like Resident Evil Requiem on Epic, you receive a related cosmetic (skin, glider, pickaxe, etc.) that you can use in Fortnite. Epic is targeting over 100 partnerships per year at scale, with approximately 40 in 2025 and 60+ planned for 2027.

How does the cosmetic crossover program work for developers?

Developers publish their game on the Epic Games Store as normal. Epic then creates cosmetics inspired by that game and makes them exclusive to players who purchase the game on Epic's platform. The cosmetics can only be obtained through game purchase, not with V-Bucks or through other means, creating scarcity and value. This drives store traffic during game launches while providing developers with free marketing access to Fortnite's 500+ million registered players.

What are the benefits of participating in the crossover program?

For developers, benefits include massive marketing reach to Fortnite's audience, brand awareness among hundreds of millions of players, potential sales uplift from players choosing Epic over competing storefronts, and minimal implementation effort since Epic handles cosmetic design. For players, the benefits are exclusive cosmetics that represent games they care about, creating identity and status signals in the Fortnite community. For Epic, it drives Games Store traffic, increases user retention, and creates a competitive advantage against Steam's dominance.

Which publishers have already signed up for the program?

Epic has confirmed partnerships with Capcom (Resident Evil Requiem), mi Ho Yo (Genshin Impact, Honkai: Star Rail), Pearl Abyss (Black Desert), S-Game, Mint Rocket, and Kakao Games. These represent major publishers from North America, Europe, China, and Korea, indicating Epic's strategy to scale globally rather than focus exclusively on Western AAA publishers.

Can players get cosmetics without buying the game on Epic Games Store?

No, the cosmetics are exclusive to players who purchase the game on the Epic Games Store. You cannot buy them with V-Bucks, earn them through the battle pass, or obtain them through other means. This exclusivity is intentional—it creates scarcity and incentivizes purchasing games on Epic's platform rather than competing storefronts like Steam.

How does this compare to Fortnite's previous crossovers?

Previous Fortnite crossovers were largely ad-hoc partnerships with entertainment properties (movies, TV shows, celebrities, music artists). While those still happen, the new developer crossover program systematizes gaming partnerships specifically. It creates infrastructure for partnerships to scale to 100+ per year with formal agreements, making gaming cosmetics a standard part of the Games Store value proposition rather than occasional special events.

Will the crossover program expand to mobile platforms?

Epic has indicated plans to expand the mobile Epic Games Store to Japan (March 2025) and Brazil (June 2025) based on regulatory changes. Once scare screen friction decreases and regulatory environments become more favorable globally, the cosmetic crossover program could expand to mobile gaming, applying the same model to mobile game purchases and mobile Fortnite players.

Why did Resident Evil Requiem launch first in this program?

Resident Evil Requiem was chosen as the flagship partnership because it represents a AAA premium title ($70 price point) with massive cultural relevance beyond gaming, including movie and TV adaptations. Capcom has previously collaborated with Fortnite, proving audience overlap exists. It signals that the program isn't just for indie developers—major publishers with major releases are participating, which validates the program's value proposition to other publishers.

What types of games will likely get cosmetics in the future?

Based on initial partnerships, cosmetics will likely expand across action RPGs (strong visuals and passionate fanbases), Chinese and Asian games (massive player bases less entrenched on Steam), indie games with distinctive aesthetics (who lack marketing budgets but have niche appeal), remasters and re-releases of classic franchises, and eventually premium AAA titles as participation becomes normalized. Games already exclusive to Steam without plans for Epic publication are unlikely to participate.

How does this affect competition with Steam?

The crossover program is Epic's direct response to Steam's market dominance. While Steam has superior features and network effects, the program leverages Fortnite's cultural dominance as a competitive advantage. Steam can't replicate this without owning a massively popular cosmetics platform, creating a defensible moat. The program doesn't compete on features or price—it competes on cultural identity and exclusivity, which is harder for competitors to counter.

This article explores how Epic Games' new developer partnership program is reshaping game marketing and platform competition. As the gaming industry evolves, the intersection of cosmetics, marketing, and platform strategy will continue to define how games reach audiences.

Key Takeaways

- Epic is launching a formal developer partnership program targeting 100+ cosmetic crossovers annually, with 40 launching in 2025 and 60+ planned for 2027

- The strategy leverages Fortnite's 500+ million players to drive Epic Games Store adoption, achieving 57% year-over-year spending growth and 78 million monthly active users

- Major publishers including Capcom, miHoYo, Pearl Abyss, and others are already committed to cosmetic partnerships, validating the program's value

- Cosmetics remain exclusive to Epic Games Store purchases, creating competitive pressure against Steam through cultural relevance rather than technical features

- The program systematizes marketing for indie developers and creates new revenue opportunities while strengthening Epic's vertical integration strategy

Related Articles

- Best New Indie Games Worth Playing in 2025

- UpScrolled Surges as TikTok Alternative After US Takeover [2025]

- Resident Evil Requiem: Dual Protagonists & Combat Innovation [2025]

- X's New Starterpacks Feature: How Social Discovery is Evolving [2025]

- NYT Games' Crossplay: The Ad-Free Word Game Disrupting Mobile Gaming [2025]

- The Office Fortnite Crossover: Everything We Know [2025]

![Fortnite Gaming Crossovers: Epic's New Developer Partnership Program [2025]](https://tryrunable.com/blog/fortnite-gaming-crossovers-epic-s-new-developer-partnership-/image-1-1770127635451.jpg)