Game Stop Store Closures 2025: Inside the Retail Apocalypse

Game Stop just announced another wave of store closures, and honestly, it's hard not to feel something watching this unfold. The company that basically defined video game retail for two decades is dismantling itself piece by piece, store by store, location by location.

In January 2025 alone, at least 25 Game Stop locations across the US are shutting their doors. Ohio, Illinois, New York, Kansas, Kentucky, Connecticut, Minnesota, and several other states are losing their local gaming hubs. But here's the thing that really matters: this isn't a one-time bloodletting. This is part of a systematic demolition of Game Stop's physical footprint that's been accelerating for years.

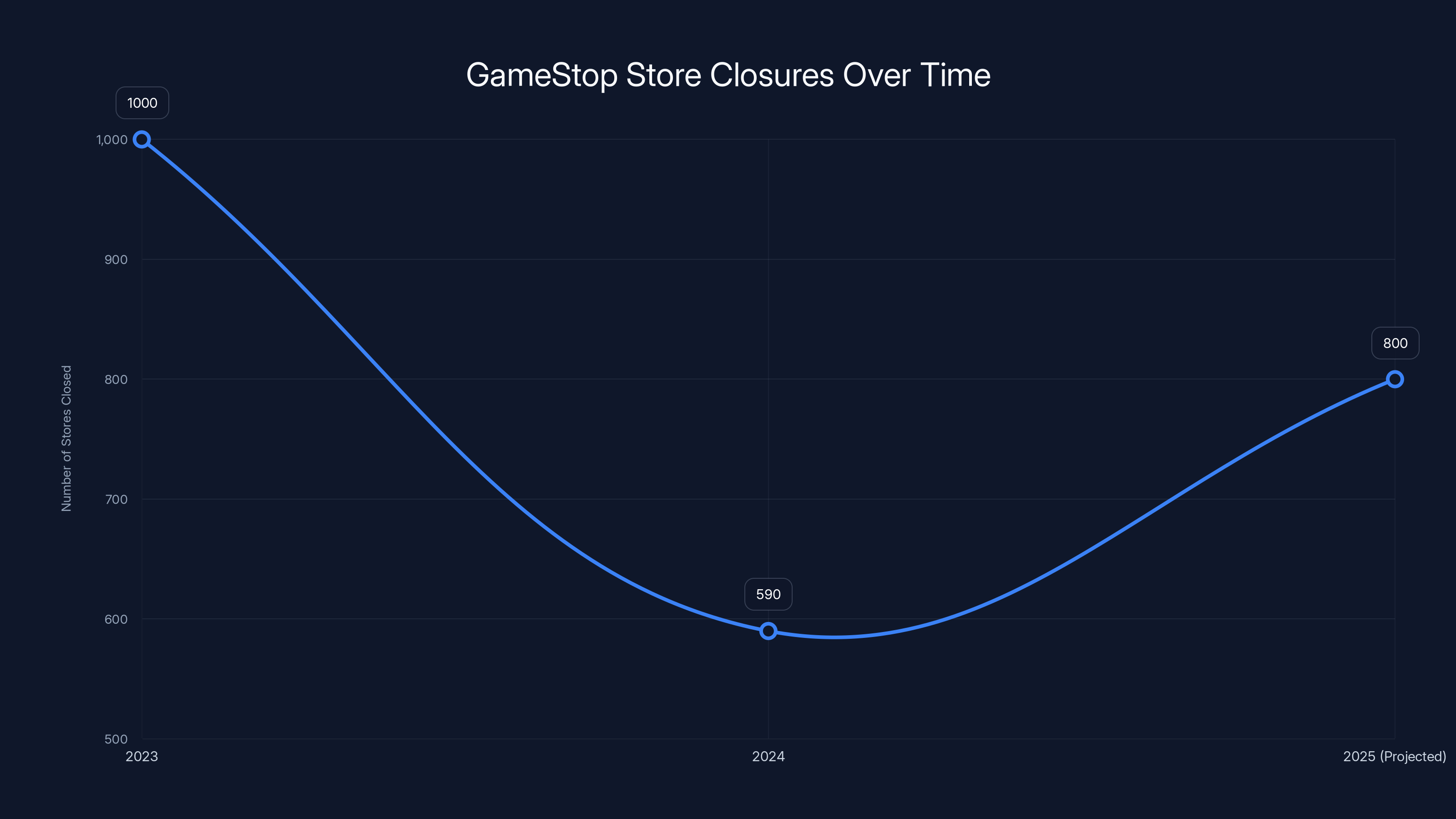

I know what you're thinking. Game Stop? Again? Yeah. The company closed 590 stores during its last fiscal year. Before that, 1,000 stores closed globally. The math gets ugly fast when you start adding it up. And the Securities and Exchange Commission filing from December made it crystal clear: Game Stop expects to close "a significant number of additional stores" during fiscal 2025.

So what's actually happening here? Why is this company imploding? And more importantly, what does this mean for you if you've got a Game Stop near you that you actually use?

Let's dig into this.

TL; DR

- Store Closure Scale: Game Stop is closing 25+ stores in January 2025 across multiple US states as part of ongoing cost-cutting

- Accelerating Closures: The company shut down 590 stores last fiscal year and 1,000 stores globally in the preceding year

- Official Acknowledgment: An SEC filing confirmed Game Stop will close "a significant number of additional stores" in fiscal 2025

- Current Store Count: Game Stop operates approximately 2,325 stores in the US and an estimated 3,200 stores globally

- Strategic Reason: Closures are driven by "store portfolio optimization review," market adaptation, and individual store performance evaluation

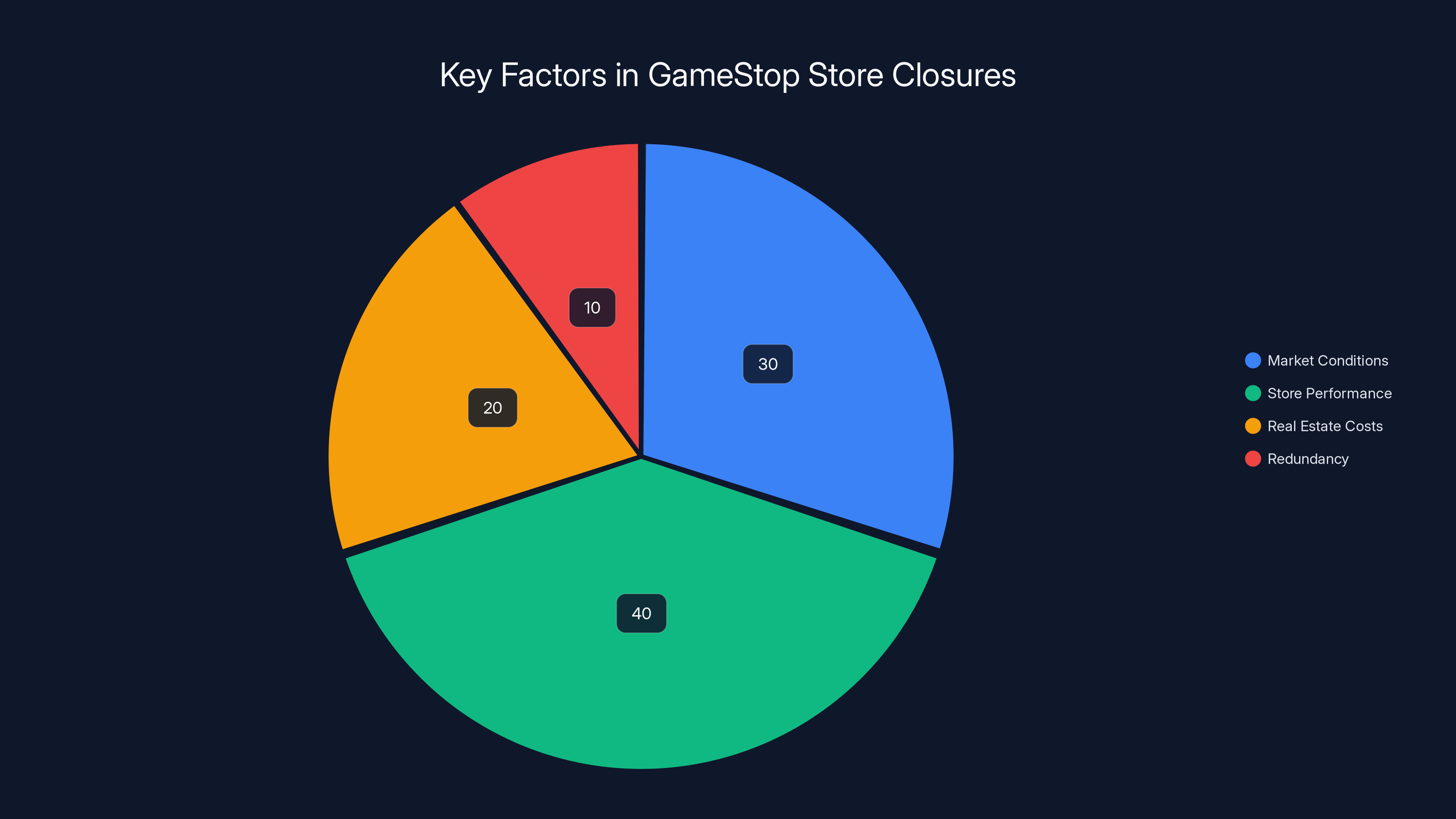

Store performance and market conditions are the primary factors in GameStop's store closure decisions, followed by real estate costs and redundancy. Estimated data.

The Numbers Behind Game Stop's Decline

Let's start with the brutal reality of the numbers. When you look at Game Stop's store count trajectory, it reads like a tragedy in spreadsheet form.

Back in early 2025, Game Stop reported operating 2,325 stores across the United States. That sounds like a lot until you realize where the company started. At its peak, Game Stop had thousands of locations. We're watching the slow-motion collapse of the biggest video game retailer in the country.

During fiscal 2024 alone, Game Stop closed 590 US stores. That's roughly 1.6 stores every single day for an entire year. Think about that for a second. Every morning, somewhere in America, another Game Stop location wasn't opening for business.

But the US closures are just part of the global story. In the year preceding March 2025, Game Stop shuttered 1,000 stores worldwide. That's nearly two stores closing every single day, globally, for 365 days straight.

So when the company's SEC filing states that it anticipates "closing a significant number of additional stores" in fiscal 2025, we're not talking about a modest adjustment. We're talking about the continuation of what might be the largest retail contraction in video game industry history.

The January 2025 closures, while significant, are really just the latest chapter. According to tracking from unofficial sources monitoring the closings, the list of confirmed January shutdowns includes locations with clear customer alerts, in-store signage, and direct notices from the company. Twenty-five confirmed locations might not sound like much compared to the 590 from last year, but remember: this is just one month.

Projecting that forward across a full year at current rates suggests Game Stop could close another 300 stores in fiscal 2025. That would bring the three-year closure total to approximately 2,000 locations. That's not a restructuring. That's a systematic dismantling.

What's particularly telling is the geographic spread. The January 2025 closures aren't concentrated in economically depressed areas. Ohio, Illinois, New York, Kansas, Kentucky, Connecticut, and Minnesota represent a mix of urban, suburban, and rural markets. This tells you something important: it's not just about location profitability anymore. It's about Game Stop fundamentally rethinking whether having physical stores makes sense at all.

The company's official reasoning, as stated in that SEC filing, points to a "comprehensive store portfolio optimization review." The language is corporate-speak for "we're closing underperforming locations," but what it really means is that Game Stop's executives have concluded that physical retail locations, as a whole, don't fit their future strategy.

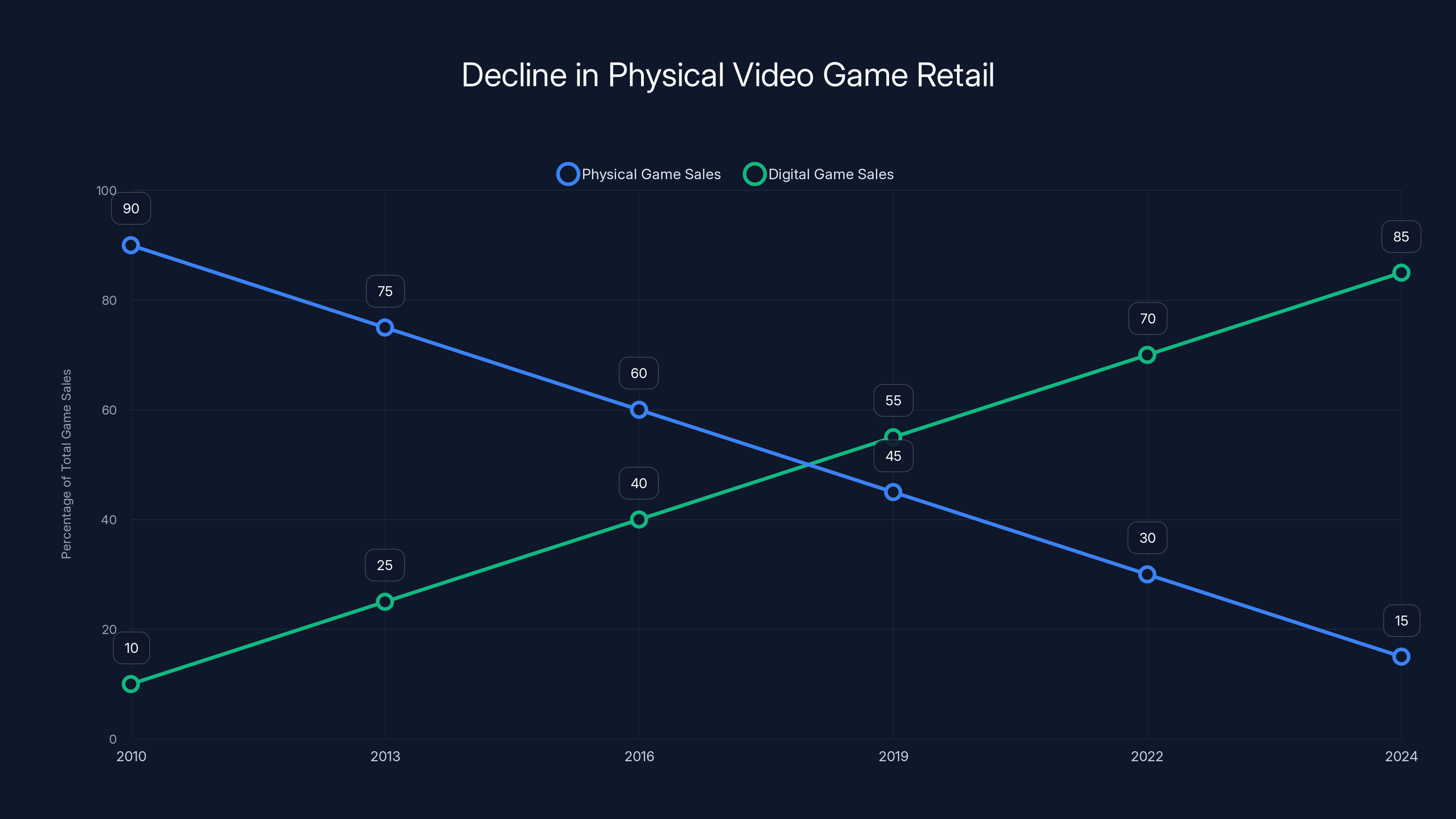

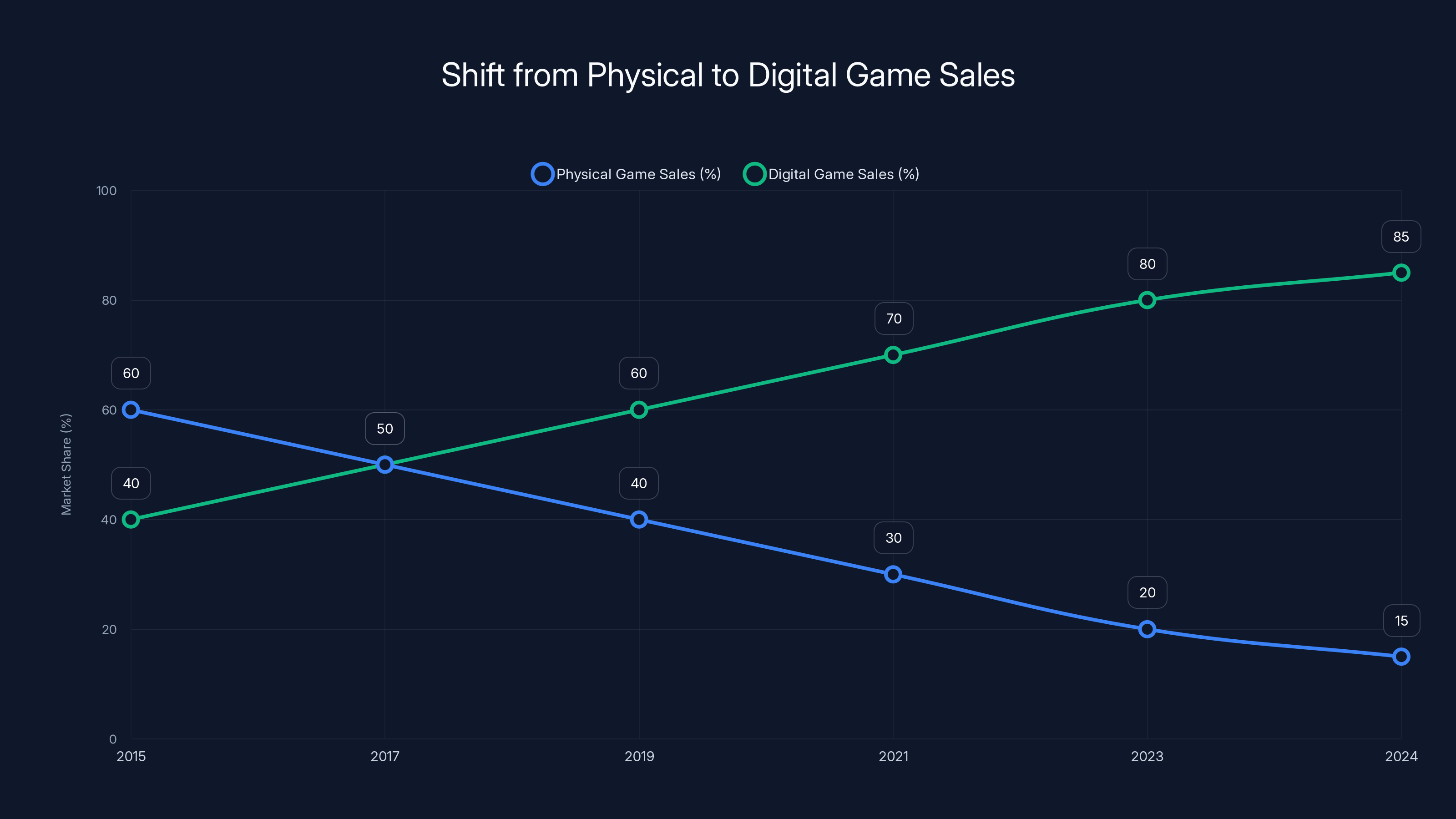

The shift from physical to digital game sales has accelerated since 2010, contributing to the decline of traditional video game retailers like GameStop. (Estimated data)

Why Is Game Stop Closing So Many Stores?

Here's where we need to be honest about what's actually driving this collapse. It's not one thing. It's a perfect storm of circumstances that have basically made traditional video game retail obsolete.

First, let's talk about the obvious: digital distribution. When you can download the latest game to your console at home, why drive to Game Stop? When Steam, Epic Games Store, Play Station Network, Xbox Game Pass, and Nintendo e Shop all offer instant access to thousands of games, the friction of going to a physical store becomes absurd.

Back in 2010, you needed to go to Game Stop if you wanted a new game. You had no choice. Now? Most serious gamers have already abandoned physical retail completely. They buy digital, they get day-one access, they don't deal with inventory issues, and they save the drive. For Game Stop, this fundamental shift in how games are distributed basically pulled the rug out from under their entire business model.

But there's more to it than just digital games replacing physical copies. Let's talk about the broader console market. New console cycles are getting longer. We're currently seven years into the Play Station 5 and Xbox Series X generation, and there's no indication of when the next generation arrives. Longer console cycles mean fewer new console sales. Fewer console sales means less reason for consumers to visit game retailers.

Add in the fact that console hardware increasingly requires online account setup and downloads anyway. You can't just buy a console, bring it home, and play. You need to update the OS, possibly download the actual game, set up your network connection. The unboxing experience that used to drive foot traffic has essentially disappeared.

Game Stop's secondary business, trading in used games, has also collapsed. When games are digital, you can't resell them. Digital ownership means you own a license, not a product. You can't trade in a license. You can't sell it secondhand. This eliminates the entire pre-owned game market that used to be incredibly profitable for Game Stop.

Then there's the merchandise problem. Game Stop sells more than just games now. They've tried to pivot to gaming merchandise, collectibles, controllers, headsets, and accessories. But here's the problem: Amazon can ship any of that stuff to your home faster and often cheaper. Why go to Game Stop?

The company also faces brutal competition from Best Buy, which carries gaming hardware and software in addition to general electronics. If you need a controller or a console, Best Buy has it, you can get it same-day, and the shopping experience is often better.

Beyond all that, there's the fundamental economics of retail itself. Store rent, employee salaries, utilities, inventory management, insurance, supply chain complexity. All of it costs money. And when comparable sales keep declining year over year, at some point you have to ask whether it makes sense to keep any physical locations open at all.

Game Stop's management has clearly decided that the math no longer works. Every store that remains open is essentially a legacy operation from a business model that's become obsolete. The company is accelerating the closure timeline because continuing to operate unprofitable stores just bleeds cash that could be preserved.

The Store Portfolio Optimization Strategy

Game Stop's official explanation for the closures comes wrapped in the phrase "store portfolio optimization review." Let's unpack what that actually means and what the company is really trying to do.

When a major retailer uses the word "optimization," they're usually talking about a data-driven process where they analyze each location and decide which ones generate enough profit to justify their operating costs. The analysis includes factors like foot traffic, average transaction value, local competition, rent costs, and expected future performance.

For Game Stop, this optimization process has been ongoing for years. The company started systematically closing stores back around 2019, when the first signs of the retail apocalypse began affecting not just game retailers but brick-and-mortar retailers across the board.

The criteria Game Stop states they use for closure decisions include several key factors. First is current market conditions. This is code for "where are people actually shopping online instead of in stores?" In many markets, especially suburban areas with nearby shopping malls that are also dying, Game Stop locations see minimal foot traffic.

Second is individual store performance. This is the data point: how much money does this specific location make? If a store's annual revenue doesn't cover its operating costs and the rent, it's a candidate for closure. Given declining industry trends, more and more stores fall below this threshold.

Third is real estate costs. Game Stop pays rent for locations, and that rent gets renegotiated periodically. Some stores are in expensive mall locations where the landlord wants higher rent. As revenue declines, the rent-to-revenue ratio becomes unsustainable. It makes sense to close these locations rather than pay escalating rent on a dying business.

The optimization strategy also considers redundancy. In urban areas where Game Stop once had multiple locations within a few miles, the company is consolidating. If one store can capture the business from two nearby locations, why keep both open?

What's interesting is that Game Stop's portfolio optimization isn't really about identifying a profitable "optimized" set of stores. It's more about controlled contraction. The company isn't trying to maintain a smaller number of highly profitable stores. It's trying to reduce total store count as aggressively as possible while maintaining some level of brand presence in key markets.

This makes sense when you consider Game Stop's stock price and investor expectations. Closing stores is a way to immediately reduce costs and improve reported profitability metrics, even if it doesn't actually improve the underlying business.

The SEC filing language is important here: "This review, among other things, resulted in the closure of 590 stores in the United States in fiscal 2024. We anticipate closing a significant number of additional stores in fiscal 2025." That "among other things" suggests they're also evaluating other strategic options, which might include further business model changes.

The portfolio optimization strategy essentially amounts to this: Game Stop is trying to figure out the minimum number of physical locations needed to maintain some retail presence while minimizing costs and losses. It's essentially the endgame for physical retail in the video game industry.

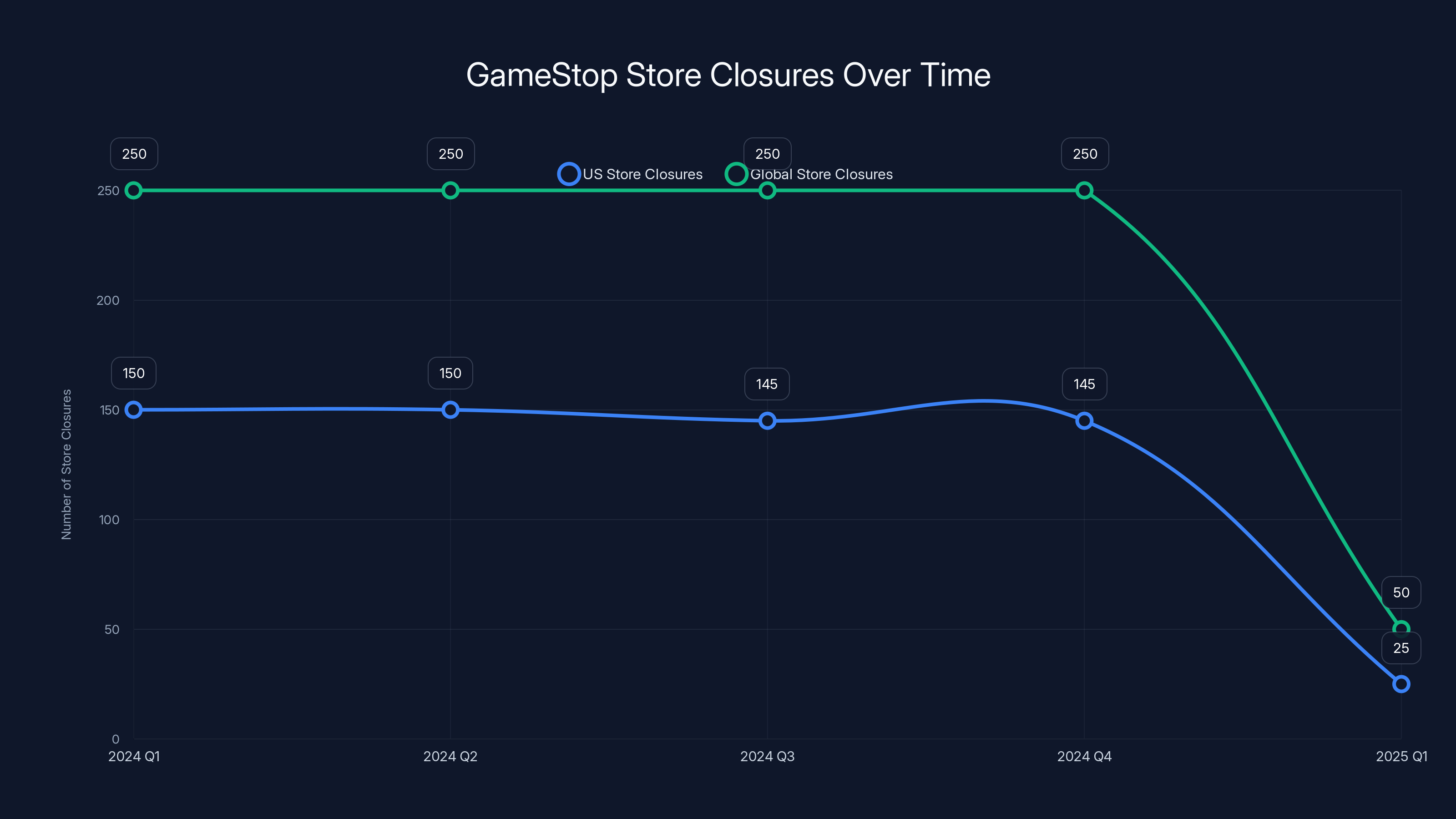

GameStop has closed a significant number of stores worldwide, with 1,000 closures in 2023 and 590 in 2024. Projections suggest continued closures in 2025, estimated at 800 stores.

Geographic Impact and Local Market Effects

The January 2025 closures hit a surprisingly diverse set of markets, which tells us something important about how Game Stop's decline is distributed across the country.

Looking at the states affected, Ohio is losing multiple locations. Ohio has both urban markets like Columbus and Cincinnati as well as smaller cities and suburbs. The closures there suggest that Game Stop's analysis concluded even relatively healthy mid-sized markets don't justify keeping stores open.

Illinois, which includes Chicago, is another major market losing locations. Chicago is one of the most expensive real estate markets in the country. Game Stop likely faced escalating rent costs that made continuing operations impossible. In a major city with robust online shopping infrastructure, a Game Stop store can't compete on convenience, selection, or price.

New York always seems to suffer disproportionately in retail collapses, and Game Stop is no exception. Multiple closures are hitting the state. This is significant because New York includes both the ultra-expensive New York City market and smaller upstate communities. The fact that both are represented in the closure list suggests the geographic diversity isn't about real estate costs alone.

Kansas, Kentucky, Connecticut, and Minnesota represent a mix of rural, suburban, and smaller urban markets. These closures suggest that even in areas with less competition and lower operating costs, Game Stop's foot traffic has declined so dramatically that stores can't justify their operations.

What we're seeing is a truly nationwide phenomenon. This isn't about one region being more digitally advanced than another. It's not about one area having better online shopping adoption. The closures are hitting everywhere because the fundamental problem is everywhere: video game retail as a business model is broken.

For local communities, losing a Game Stop has cascading effects. First, there's the immediate impact: local employees lose their jobs. Game Stop stores employ multiple people per location, so we're talking potentially hundreds of job losses across these January closures alone.

Second, there's the loss of a gathering place. Yes, Game Stop is a store, but for many gamers, especially younger ones without a huge disposable income, it's also been a place to browse, get recommendations, see new products, and interact with the gaming community. Other retailers might sell games, but they don't create that social space.

Third, there's the practical impact. For people without online payment methods, without reliable home internet, or simply preferring to shop in person, losing local retail access means loss of convenience. Some consumers will order online. Some will drive farther to the next Game Stop. Some will simply buy fewer games.

From Game Stop's perspective, these local impacts don't matter. The company's analysis is purely financial. If a store doesn't generate enough profit, it closes. The company isn't in the business of providing community gaming spaces. It's in the business of selling games at a profit. And that business has become very unprofitable.

The geographic distribution also suggests something about Game Stop's future strategy. The company isn't selectively preserving locations in high-revenue markets. They're closing stores in major cities and smaller markets alike. This suggests the company might be preparing for a future where it has minimal physical retail presence or possibly none at all.

The Broader Video Game Retail Crisis

Game Stop's collapse isn't happening in isolation. It's part of a much larger death of video game retail as a business category.

Let's zoom out and look at the video game industry itself. The industry has fundamentally transformed over the past decade. In 2015, physical game sales represented roughly 60% of the gaming market. By 2024, digital sales had grown so much that physical copies were a minority purchase. The trend line is clear, consistent, and shows no signs of reversing.

This shift started with mobile gaming, accelerated with digital storefronts on consoles, and reached critical mass when gaming subscriptions became mainstream. Services like Xbox Game Pass and Play Station Plus let players download hundreds of games instantly. Why buy a physical copy when you can access an entire library for fifteen bucks a month?

The metrics confirm what we intuitively know. Video game hardware sales in the United States hit levels not seen since 1995 during November 2024. That's not just a decline. That's a collapse back to the era of dial-up internet and cartridges.

Beyond just the sales volume, the nature of gaming hardware itself has changed. Modern consoles require internet connectivity. Most games require day-one patches and updates. You can't buy a game, take it home, and play it instantly anymore. The installation and update process might take hours. This structural change fundamentally undermined the value proposition of physical retail.

Other game retailers have faced similar pressures. Smaller independent game stores have mostly disappeared. Best Buy, the last major retailer carrying a decent selection of games, has reduced its gaming section dramatically. Target carries some games but doesn't prioritize them. Walmart stocks games but typically has minimal selection.

Game Stop was uniquely positioned because they were the specialist. They had the expertise, the inventory, the culture around gaming. But specialization stopped mattering when the entire category became obsolete.

The consolidation also reflects changes in how games are sold. Publishers increasingly push digital distribution directly to consumers. They don't need Game Stop. They don't need any retailer. They can sell straight through their own digital storefronts and distribution platforms.

Additionally, the economics of new game sales have shifted. When a new AAA game launches, it's available everywhere: Play Station Store, Xbox Store, Steam, Epic Games Store, Amazon, Best Buy, Target, Walmart. The game isn't scarce. Game Stop can't compete on availability, price, or convenience.

Used game sales, which used to be hugely profitable for Game Stop, have also effectively disappeared. Digital games can't be resold. Even some physical releases now come with digital codes that prevent resale. Publishers actively fought against used game markets because they wanted to eliminate Game Stop's second-hand business.

The bigger picture is this: Game Stop is dying because the entire retail channel they depend on has become irrelevant. No amount of store optimization, no pivot to merchandise, no new strategy can change the fundamental reality that people don't need to visit a physical store to buy games anymore.

GameStop's store closures show a significant decline, with 590 US closures in 2024 and continued closures into 2025. Estimated data reflects a consistent pattern of decline.

How Game Stop Got Here: A Decade-Long Decline

Understanding Game Stop's current crisis requires looking at how the company got here. This didn't happen overnight. It's been a slow-motion collapse across roughly ten years.

Game Stop's peak was around 2008-2010. The company had thousands of stores, a near-monopoly on game retail in the United States, and strong revenue. At that time, the only way to get a new game was to go to Game Stop (or Best Buy, but Game Stop dominated). The business model was incredibly profitable.

The first major shift came with digital distribution on consoles. When the Xbox 360 got Games on Demand and the Play Station 3 got the Play Station Store, it didn't immediately destroy Game Stop. But it planted the seed. Gradually, more players started buying games digitally instead of physically.

Game Stop initially didn't take this threat seriously. The company continued opening stores and expanding inventory of physical games even as the trend toward digital became obvious to industry analysts.

Then came the next major shock: mobile gaming exploded. Angry Birds, Candy Crush, and millions of other mobile games meant that a massive portion of the gaming audience wasn't buying traditional console games at all. These weren't Game Stop customers.

Following that, subscription services emerged. First Xbox Game Pass Beta in 2017, then the full rollout. Play Station introduced Play Station Plus Extra and Premium tiers with game libraries. Nintendo launched Switch Online with a growing game library. Suddenly, consumers could access hundreds or thousands of games for a subscription fee.

Each of these shifts were strategic mistakes that Game Stop failed to capitalize on. The company could have pivoted to digital distribution. It could have become a gaming platform curator. It could have focused on community and events. Instead, it doubled down on physical game sales, which became increasingly irrelevant.

By 2019-2020, the deterioration became undeniable. Game Stop reported declining same-store sales year after year. Foot traffic dropped. Transaction values decreased. The company's stock price reflected the reality that the business model was broken.

Then came the pandemic, which actually accelerated some trends that were already happening. Lockdowns forced people to shop online, which they increasingly did even after lockdowns ended. Supply chain chaos made console availability inconsistent. The situation deteriorated further.

The period from 2020 to 2024 has been marked by attempted pivots and restructuring. New management came in with plans to refocus on the core business, develop an online presence, pivot to merchandise and collectibles. None of it significantly changed the trajectory.

By 2024, the conclusion was unavoidable: Game Stop needed to dramatically reduce its physical footprint or face eventual complete failure. The store closures we're seeing now are the inevitable result of that realization.

Employment and Community Effects

When we talk about Game Stop closing stores, we're not just discussing retail metrics. We're talking about real people losing their jobs.

Each Game Stop store typically employs between 4 and 10 people, depending on location and store size. A 25-store closure represents somewhere between 100 and 250 jobs lost immediately. Scale that up across the 590 closures from last fiscal year, and we're talking about between 2,360 and 5,900 jobs eliminated in a single year.

For these employees, Game Stop typically isn't paying Fortune 500 salaries. These are retail positions, often entry-level or mid-level roles. The people working there might be students trying to earn money, people transitioning between careers, or longtime retail veterans.

Game Stop does offer severance for store closures, and employees typically have some time to find other work as the company announces closures in advance. But that doesn't eliminate the hardship. Job searching, transitions to new employers, potentially lower wages at replacement jobs, all of this creates real impact on real people.

For many communities, Game Stop employees have deep roots. They're people who have built careers in gaming retail, who know the community, who've helped countless customers find the games and hardware they wanted. Losing those jobs means losing that expertise and community connection.

There's also a ripple effect through local economies. Game Stop stores generate foot traffic that benefits neighboring businesses. The coffee shop nearby, the food retailers in the mall, the other stores in the shopping center. When Game Stop closes, that foot traffic disappears. Some neighboring businesses may suffer.

For landlords, Game Stop closures mean lost tenants. In many cases, landlords can't immediately replace a departed retailer with another tenant. Empty storefronts represent lost rent revenue and potentially decreased property values.

The community effects are also cultural. Game Stop stores serve as gathering places for gamers. They're places where people can get recommendations, discuss games, pre-order titles, and connect with other gamers. This social function is hard to quantify but very real. Losing these spaces eliminates a community anchor, especially for younger gamers.

From Game Stop's perspective, these are necessary costs of restructuring a failing business. From the perspective of employees and communities, these are losses that will take time to recover from.

The video game industry has seen a dramatic shift from physical to digital sales over the past decade, with digital sales projected to dominate by 2024. (Estimated data)

What This Means for Gamers

If you're a gamer, Game Stop's collapse likely affects you in some way, whether you use the store or not.

First, the obvious effect: if you have a Game Stop near you, it might close. When that happens, your options for buying physical games change. You need to drive farther or order online. For people who prefer to own physical copies, this is increasingly inconvenient.

Second, the loss of specialized retail expertise. Game Stop staff, at their best, are knowledgeable about games. They can make recommendations, discuss technical requirements, explain features. When Game Stop disappears, where do you get that expertise? Best Buy employees generally know about computers and electronics but not specifically about gaming. Online reviews help but can't replace talking to an expert in person.

Third, the reduced accessibility for people who prefer in-person shopping. Not everyone uses online shopping. Some people don't trust shipping their games. Some don't have reliable payment methods for online purchases. Some simply prefer to see products in person before buying. Game Stop's decline means fewer in-person options.

Fourth, the impact on pre-orders and launch day purchases. Game Stop used to be the place where you could pre-order games and pick them up on launch day. That experience is declining as stores close. More people are forced to order online and wait for shipping or deal with digital downloads that they can't hold in their hands.

Fifth, there's the merchandise and collectibles aspect. Game Stop expanded into figures, artwork, apparel, and other gaming-related merchandise. As physical stores close, this merchandise becomes harder to find locally. Some consumers who prefer in-person shopping for collectibles will have fewer options.

For collectors of retro games and vintage gaming hardware, Game Stop's decline might actually be slightly positive. As the company exits the market, it's selling off inventory and possibly vintage stock. But this is a minor silver lining to a much darker cloud.

For the broader gaming industry, Game Stop's decline signals something important: physical retail is no longer a significant distribution channel. This means publishers can depend almost entirely on digital distribution. It also means the gaming industry has successfully eliminated an intermediary, potentially allowing publishers to capture more profit directly.

Future Scenarios: Where Does Game Stop Go From Here?

So what's actually going to happen to Game Stop over the next few years? The company isn't going to completely disappear overnight, but the trajectory is clear.

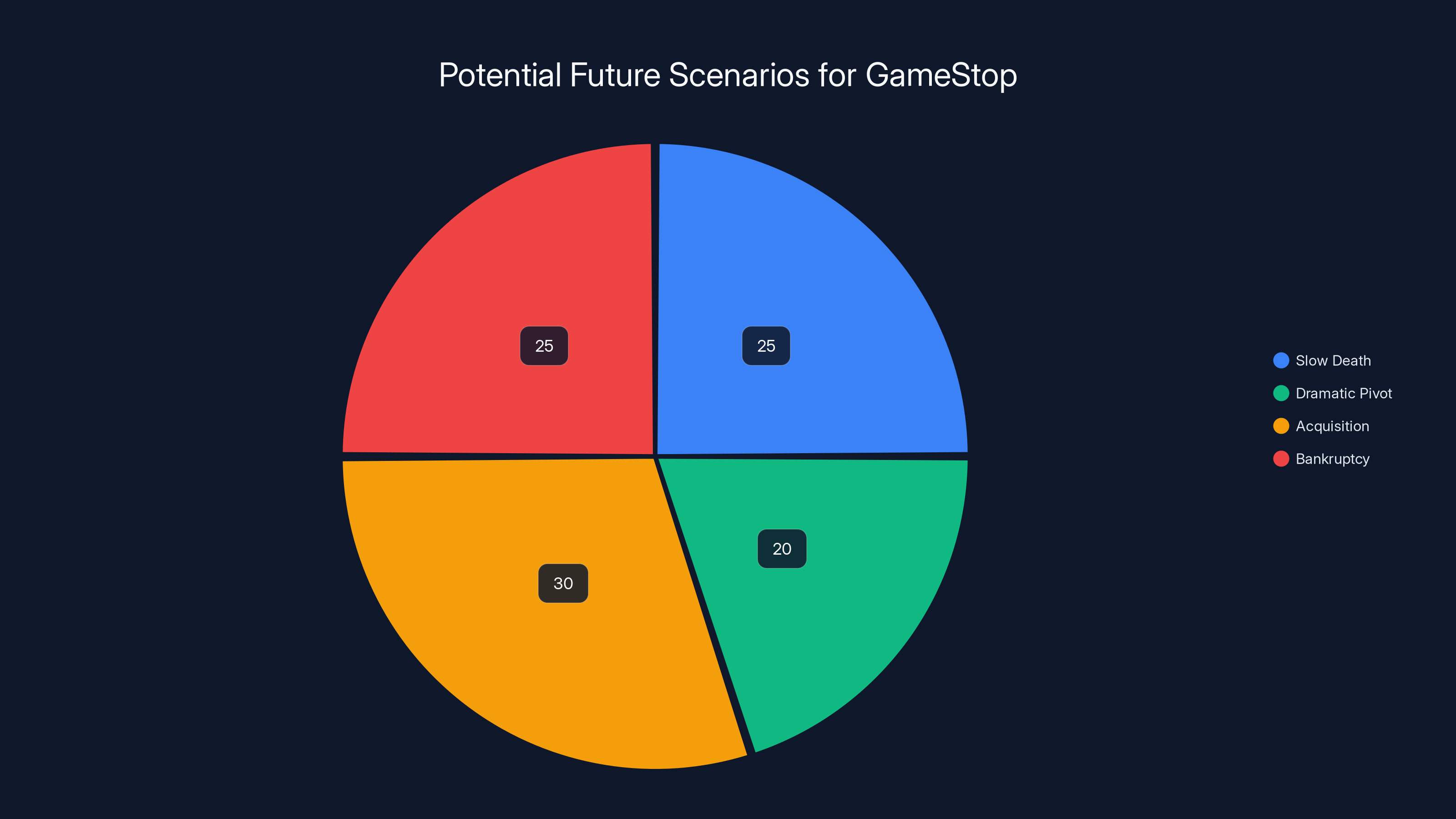

Scenario One is the "slow death" trajectory. Game Stop continues closing stores gradually, reducing headcount, cutting costs, and shrinking into a smaller and smaller company. Eventually, the company might stabilize with a handful of flagship locations in major cities, maintained primarily for brand presence rather than profit. The company might exist as a zombie company for years, limping along with minimal revenue.

Scenario Two involves a dramatic pivot. The company could attempt to transform itself into something entirely different. This might mean focusing exclusively on merchandise and collectibles, abandoning games entirely. It might mean becoming an online-only company and closing all physical stores. It might mean pivoting to gaming cafes or esports venues. These pivots seem unlikely given the company's history of failed attempts, but they're possible.

Scenario Three is acquisition. Game Stop could be acquired by a larger company. Who might buy a failing video game retailer? Possibly a company like Best Buy, trying to consolidate retail gaming expertise. Possibly an investor betting that the company is oversold. Possibly a private equity firm trying to strip assets and restructure. This is probably more likely than the company finding success independently.

Scenario Four is complete bankruptcy and liquidation. The company simply runs out of cash, files for bankruptcy, and shuts down completely. All remaining stores close. The company disappears. Given the continued store closures and limited new revenue sources, this is increasingly likely.

What's interesting is that none of these scenarios involve Game Stop returning to profitability in its traditional form. The fundamental business model of video game retail is broken. You can't fix it by closing stores. You can't fix it by pivoting to merchandise. You can't fix it because the underlying problem isn't operational. The problem is that people don't need physical game retailers anymore.

The most likely scenario is a combination: continued store closures, an attempted pivot toward collectibles and online sales, and eventual acquisition or bankruptcy within the next three to five years. The company might exist as a brand, but it probably won't exist as a meaningful retailer.

For gamers, the practical implication is this: don't rely on Game Stop for anything. If you want games, buy them digitally or from other retailers. If you want collectibles, check multiple sources. The company can't be counted on to remain available or to stock what you need.

Estimated data suggests that acquisition and bankruptcy are the most likely scenarios for GameStop's future, each with a 25-30% chance. Estimated data.

The Bigger Retail Picture: Industry-Wide Implications

Game Stop's crisis isn't isolated to gaming. It's part of a much larger transformation in retail that's reshaping the entire industry.

Over the past decade, we've seen the decline or collapse of numerous specialty retailers. Best Buy, once the dominant electronics retailer, has dramatically shrunk its footprint and shifted toward online sales. Blockbuster Video, the video rental giant, is completely gone. Barnes and Noble, the bookstore chain, has contracted significantly. Toys R Us went bankrupt and disappeared.

The pattern is consistent: specialty retailers that depend on physical location and inventory struggled when e-commerce became viable. Consumers could find better selection online, often at better prices, with home delivery. The convenience of e-commerce outweighed the convenience of a nearby physical store.

Game Stop is following the exact same trajectory as these other retailers. The company's business model was viable when digital distribution didn't exist. It became less viable as digital emerged. And it became essentially unviable once subscriptions and services like Game Pass made individual game purchases obsolete for many consumers.

What's instructive about Game Stop's case is that the company had advance warning. The decline wasn't sudden. It was predictable. And yet the company failed to adapt. This is a lesson that plays out repeatedly in retail: incumbents often can't successfully pivot away from their core business model, even when that model becomes clearly broken.

The implications for the retail industry broadly are significant. Physical retail isn't disappearing entirely, but it's being drastically reduced. Most categories that can be shipped digitally or delivered to your home are moving in that direction. That leaves physical retail primarily with categories like groceries, restaurants, and luxury goods where the in-person experience adds genuine value.

For employees and communities affected by retail decline, the challenge is real. Retail has historically been a major source of employment, especially for people without specialized education or credentials. As retail shrinks, these job opportunities disappear, and workers must transition to other sectors that may not offer the same stability or community presence.

Adaptation Strategies for Gamers and Communities

Given that Game Stop is unlikely to recover and more closures are coming, what can gamers and communities do to adapt?

For individual gamers, the adaptation is relatively straightforward. First, diversify your purchasing channels. Don't rely on Game Stop. Know where you can buy games online. Understand your options with different retailers and platforms. Build a comfortable relationship with digital storefronts.

Second, embrace digital distribution. If you're still buying physical games exclusively, understand that the era of physical games is ending. Digital games are convenient, often discounted, and immediately accessible. Learning to prefer digital distribution is part of adapting to modern gaming.

Third, if you want physical copies, explore alternatives. Used game markets on Facebook, Reddit, and e Bay can help you buy and sell physical games. Other retailers like Best Buy and Target still carry some games. Amazon has extensive selections. Options exist beyond Game Stop.

Fourth, consider subscription services. Game Pass, Play Station Plus, and Nintendo Switch Online represent the future of gaming access. Rather than buying individual games, subscriptions provide access to libraries of content. The value proposition is compelling for most gamers.

For communities and local businesses affected by Game Stop closures, the challenge is greater. Some communities can fill the gap. Best Buy locations might expand their gaming sections slightly. Some independent retailers might attempt to fill the void with retro gaming or collectibles. Online communities increasingly serve the social function that physical stores once provided.

For communities that lose economic activity when Game Stop closes, the adaptation involves economic diversification. Retail landlords need to find new tenants. Local businesses need to find ways to replace lost foot traffic. This is part of the larger transition away from shopping centers and toward online commerce.

The uncomfortable truth is that there's no perfect adaptation strategy. Game Stop provided jobs, gathered gamers, and served a function. As that function becomes obsolete, communities must simply adjust. Some communities will adjust better than others. Some workers will find equivalent jobs quickly. Some will face longer transitions. The disruption is real and unavoidable.

Lessons for Other Retailers and Industries

Game Stop's collapse offers important lessons for other retailers facing similar pressures.

First lesson: adapt early. If you see disruption coming, start adapting immediately. Don't wait until the business model is clearly broken. Game Stop had years of warning that digital distribution was growing. Earlier investment in digital channels, online sales, or different business models might have produced different outcomes.

Second lesson: don't assume specialization is protection. Game Stop thought that being the specialist in games gave them an advantage. It didn't. When the core product category became commoditized and digital, specialization actually became a liability. A diversified retailer like Walmart could easily carry games alongside other products.

Third lesson: don't underestimate technological disruption. Management often believes that their business model is somehow protected from disruption. They're wrong more often than they're right. Digital distribution was always going to reduce demand for physical retail. Pretending it wouldn't happen doesn't change anything.

Fourth lesson: transformation is hard. Even when companies recognize disruption, successfully transforming is incredibly difficult. Game Stop attempted pivots into collectibles, merchandise, online sales, and other areas. None of them were successful because they were attempts to fix a broken core business rather than genuine transformations.

Fifth lesson: cost-cutting can't save a broken business model. Game Stop has been cutting costs aggressively: closing stores, reducing staff, streamlining operations. But you can't cut your way to profitability when the fundamental business doesn't work. Cost-cutting just prolongs the inevitable decline.

These lessons apply across retail and beyond. Companies in vulnerable categories, from bookstores to video rental services to travel agents, have faced similar pressures. The ones that survive are the ones that adapt early, diversify, and embrace rather than resist technological change.

The Environmental and Waste Implications

One aspect of Game Stop's decline that doesn't get much attention is the environmental impact. Physical retail has significant environmental costs, and the decline of retail actually provides some environmental benefits.

Game Stop stores, like all retail locations, consume electricity for heating, cooling, lighting, and operations. They generate waste. They require supply chains to stock inventory. Closing these stores reduces environmental impact in those specific ways.

However, the shift to digital distribution creates different environmental costs. Data centers that power digital storefronts consume enormous amounts of electricity. Shipping games and products to individual homes uses more fuel than having customers visit centralized retail locations.

The net environmental impact is complex and somewhat unclear. Physical retail is inefficient in some ways, digital distribution in others. The shift from physical to digital doesn't clearly reduce overall environmental impact. It mostly changes where the impact occurs.

What's interesting is that neither Game Stop nor the gaming industry more broadly has emphasized environmental considerations in the shift toward digital. The transition is driven purely by economics and convenience. Whether it's better or worse for the environment is secondary to whether it's more profitable.

This is a reminder that retail disruption is about much more than just economics. It affects employment, community, culture, and environment. The focus on economic impacts often overshadows these other considerations.

Investment and Financial Perspectives

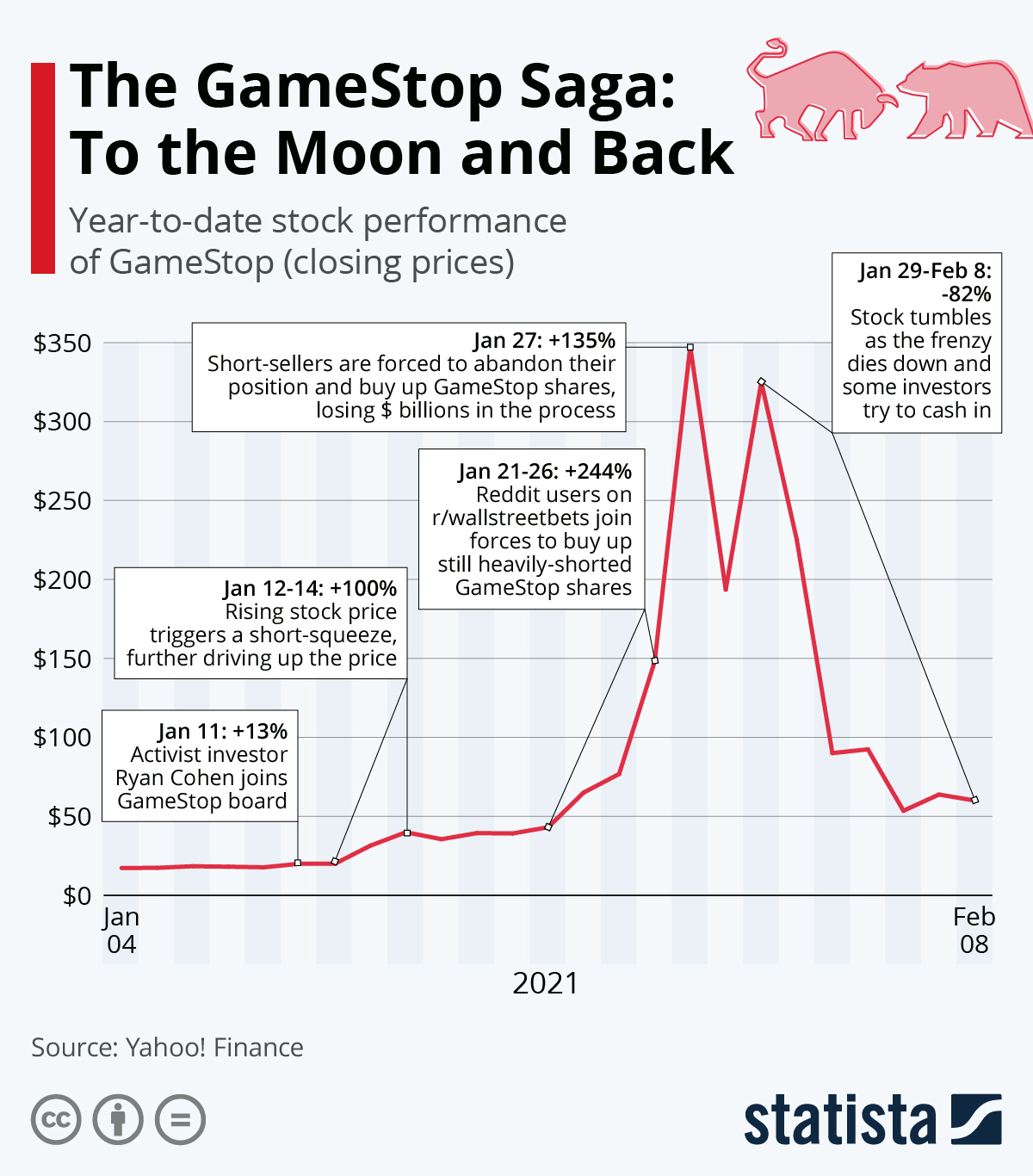

From an investment standpoint, Game Stop is a fascinating case study in a failing business. The company's stock has been volatile, with periods of hype followed by crashes as reality sets in.

The meme stock phenomenon of 2021, when Game Stop stock soared as retail investors attempted to short-squeeze institutional investors, was interesting but ultimately irrelevant to the company's fundamental business. Stock price surges don't change the fact that physical game retail is dying.

Investors in Game Stop face a choice: bet that the company can somehow transform itself into something viable, or accept that the company is in decline and might eventually go to zero. Most rational investment analysis suggests the latter is more likely.

The company does have some assets that might have value. Its brand is still recognized. It has customer data and relationships. It has real estate leases, some of which might be valuable. In a bankruptcy scenario, these assets might be worth something to acquirers.

But as a going concern, Game Stop is increasingly questionable. The company burns cash through operations, accelerating store closures doesn't immediately return to profitability, and new revenue sources aren't materializing.

For shareholders, the reality is harsh. If you own Game Stop stock, you're betting against the consensus view that the business is finished. That's a risky bet. Some contrarian investors believe the company is a turnaround opportunity. Most professional investors see it as a value trap: it looks cheap but gets cheaper as the business continues to deteriorate.

The lesson for investors is important: don't confuse cheap stock price with investment value. A company can be cheap because it's undervalued, or it can be cheap because it's worthless. Game Stop is increasingly in the latter category.

The Role of Digital Distribution and Subscription Services

To fully understand Game Stop's collapse, we need to understand the forces replacing it: digital distribution and subscription services.

Digital distribution on consoles started in the mid-2000s but has completely dominated by the 2020s. Every major platform now offers digital purchasing. Most games are available digitally. Many games are digital-exclusive.

The advantages of digital for consumers are clear: instant access, no physical storage required, no shipping delays, no inventory issues. The advantages for publishers are even clearer: no physical manufacturing costs, no retailer markups, no used game competition, higher profit margins.

Subscription services like Xbox Game Pass have accelerated this shift. Game Pass offers access to hundreds or thousands of games for $17 per month. For most casual gamers, this is far cheaper and more convenient than buying individual games. The service has grown dramatically, and it directly competes with and replaces game purchases.

Play Station Plus has responded with its own tiers offering game libraries. Nintendo Switch Online provides access to classic games and newer titles. These services are reshaping how consumers think about game access.

The impact on Game Stop is direct: if players are buying through Game Pass instead of buying individual games, Game Stop's core business disappears. The company can't compete with subscription services because it can't offer what they offer.

The irony is that Game Stop could theoretically compete in the subscription space. The company could have developed a game subscription service. It could have become an intermediary or partner in the digital ecosystem. Instead, the company clung to its core business of selling physical copies, which became increasingly irrelevant.

What's Next for Gaming Retail

If Game Stop is disappearing, what replaces it? What does gaming retail look like in the future?

First, gaming retail becomes much smaller. Fewer stores, less selection, less importance overall. The specialized gaming retail experience becomes a niche offering rather than a mainstream distribution channel.

Second, remaining retail gaming probably consolidates with other retailers. Best Buy carries some games. Target carries some games. Walmart carries some games. These general retailers might increase their gaming selection slightly to pick up the slack from Game Stop closures, but they won't match Game Stop's historical breadth.

Third, specialty becomes community and experience. Some independent retailers might thrive by offering gaming cafes, tournaments, events, and community gathering spaces. The focus shifts from selling products to creating experiences.

Fourth, collectibles and merchandise likely become more important. As games themselves move to digital distribution, the physical products that remain are collectible figures, artwork, apparel, and gaming hardware. Retailers that can focus on these items might find a market.

Fifth, online retailers dominate. Amazon, specialty online retailers, and direct-to-consumer channels become the primary way people buy gaming products. The efficiency of online distribution is simply superior to physical retail.

The consolidation of gaming retail into online channels is essentially complete. The remaining question is just how fast the last remnants of physical gaming retail disappear.

FAQ

Why is Game Stop closing so many stores?

Game Stop is closing stores because the business model of physical video game retail has become obsolete. Digital distribution, subscription services like Game Pass, and changing consumer preferences have made physical stores increasingly unprofitable. The company is conducting a "store portfolio optimization review" that involves evaluating each location's profitability and closing underperforming locations. Additionally, rent costs, declining foot traffic, and the rise of online shopping have made operating physical locations economically unsustainable for the company.

How many stores has Game Stop closed recently?

Game Stop closed 590 stores in the United States during its last fiscal year and 1,000 stores worldwide in the preceding year. In January 2025 alone, at least 25 locations across multiple US states are closing. The company's SEC filing indicates it expects to close "a significant number of additional stores" during fiscal 2025, suggesting the closure rate will continue.

Will Game Stop go completely out of business?

It's increasingly likely that Game Stop will eventually cease operations entirely or shrink to a minimal presence. The company's business model is fundamentally broken due to digital distribution making physical retail obsolete. While the company might survive for several more years through cost-cutting and asset sales, a complete bankruptcy and liquidation seems like a probable outcome within the next few years unless a dramatic business transformation occurs.

What are the alternatives to buying games from Game Stop?

Alternatives include purchasing digital games directly from platform storefronts like Play Station Store, Xbox Store, Steam, and Nintendo e Shop; using subscription services like Xbox Game Pass, Play Station Plus, or Nintendo Switch Online; buying from other retailers like Best Buy, Target, Walmart, and Amazon; and purchasing used games through online marketplaces like Facebook Marketplace, e Bay, and Reddit communities. Many of these alternatives offer better pricing, convenience, and selection than Game Stop historically did.

How does digital distribution affect Game Stop's business?

Digital distribution is the primary force killing Game Stop's business. When games can be downloaded instantly to consoles and computers, there's no need to visit a physical store. Publishers also prefer digital distribution because it eliminates retailer markups and second-hand markets, allowing them to capture more profit directly. Digital games can't be resold, eliminating Game Stop's profitable used game business. The shift to digital makes physical retailers like Game Stop economically inviable.

What impact do Game Stop closures have on local communities?

Game Stop closures result in job losses for store employees, reduced foot traffic for neighboring businesses, and loss of a community gathering place for gamers. For some consumers, especially those preferring in-person shopping or without reliable online payment methods, closures mean reduced convenience. However, the closures also reflect broader economic trends as consumers increasingly prefer online shopping, so communities must adapt by finding new businesses and gathering places for residents.

Is it worth buying a Game Stop franchise or opening a gaming retail store?

Opening a traditional gaming retail store is generally not a sound investment in 2025. The structural forces destroying Game Stop, especially digital distribution and subscription services, affect the entire category. Instead, consider alternative approaches like gaming cafes, esports venues, collectible and merchandise focus, online retail, or community events. The retail model itself is the problem, not just Game Stop's execution.

What happened to Game Stop's market dominance?

Game Stop had near-monopoly dominance in video game retail at its peak because physical games were the only way to access new releases, and Game Stop had the most extensive selection. This dominance couldn't survive digital distribution. When consumers could download games instantly without visiting a store, Game Stop's value proposition evaporated. The company failed to adapt early enough to this disruption, and by the time it recognized the threat, the shift was already inevitable and unstoppable.

Conclusion: The End of an Era

Watching Game Stop collapse in real time is strange. This is a company that was genuinely important to gaming culture. For two decades, Game Stop wasn't just a retailer. It was the retailer. It was where gamers gathered, where they talked about new releases, where they traded games, where they felt part of a community.

But business models don't survive on nostalgia. They survive on relevance. And Game Stop's model stopped being relevant the moment digital distribution made physical stores optional.

The January 2025 closures are just the latest chapter in a story that's been unfolding for years. The company closed 590 stores last fiscal year. It's closing dozens more in January 2025. The trajectory points toward the eventual disappearance of Game Stop as a meaningful retailer.

This matters beyond just Game Stop. It's a symbol of how quickly technology can make entire business models obsolete. It's a reminder that even dominant companies can't guarantee their own survival. It's a cautionary tale for any business dependent on physical distribution.

For gamers, the practical impact is manageable. You can buy games through other channels. Digital distribution works fine. Subscription services like Game Pass offer incredible value. The loss of Game Stop is inconvenient but not catastrophic.

For Game Stop employees and the communities that depend on those jobs, the impact is much more significant. Job losses, economic disruption, and loss of community gathering spaces are real. The transition away from physical retail creates challenges that take time to overcome.

But the fundamental reality is undeniable: physical video game retail as a significant business category is ending. Game Stop's closures are the visible manifestation of that structural change. No amount of store optimization, no pivot to merchandise, no new strategy changes this reality.

The company that once dominated gaming retail is being dismantled store by store, location by location. What comes next remains to be seen, but one thing is certain: it won't look anything like the Game Stop of the past.

For those who remember visiting Game Stop on release day, trading in games, and feeling part of a gaming community, the closures mark the end of an era. Digital distribution and online shopping are more efficient and more convenient. But something intangible is being lost in that transition. The gathering place, the expertise, the social experience, the sense of a gaming culture centered in a physical location.

Game Stop's fall is the story of retail in the 21st century: disrupted, accelerated, and ultimately overwhelmed by forces it couldn't control and largely failed to anticipate.

Key Takeaways

- GameStop is closing 25+ stores in January 2025 as part of systemic cost-cutting driven by obsolete retail business model

- The company closed 590 US stores in fiscal 2024 and 1,000 globally, with more closures expected throughout 2025

- Digital distribution, subscription services, and changing consumer preferences have made physical game retail fundamentally unprofitable

- Video game hardware sales reached 30-year lows in late 2024, reflecting the broader market contraction

- Future of gaming retail likely involves minimal physical presence, consolidation into general retailers, and focus on online and subscription channels

Related Articles

- His & Hers Netflix Ending Explained: Why Critics Are Divided [2025]

- 13 Trending TikTok Songs in January 2026 [2026]

- Best Kindle E-Readers and Digital Reading Devices [2025]

- Smart Chargers With Built-In Screens: The Anker Innovation [2025]

- 2025 Social Media Predictions Reviewed: What Actually Happened [2026]

- America's Energy Imperialism Era: Control, Resources, and Global Power [2025]

![GameStop Store Closures 2025: Inside the Retail Apocalypse [2025]](https://tryrunable.com/blog/gamestop-store-closures-2025-inside-the-retail-apocalypse-20/image-1-1767879498278.jpg)