Grubhub Acquires Claim: What This Restaurant Rewards Deal Means for Diners and Merchants

In early 2025, Grubhub's parent company Wonder announced it was acquiring Claim, a restaurant rewards startup founded in 2021. The deal marks a significant strategic shift in how food delivery platforms approach customer loyalty and merchant retention. But here's what really matters: this acquisition could fundamentally change how restaurants acquire and keep customers, and how millions of diners experience rewards when ordering food.

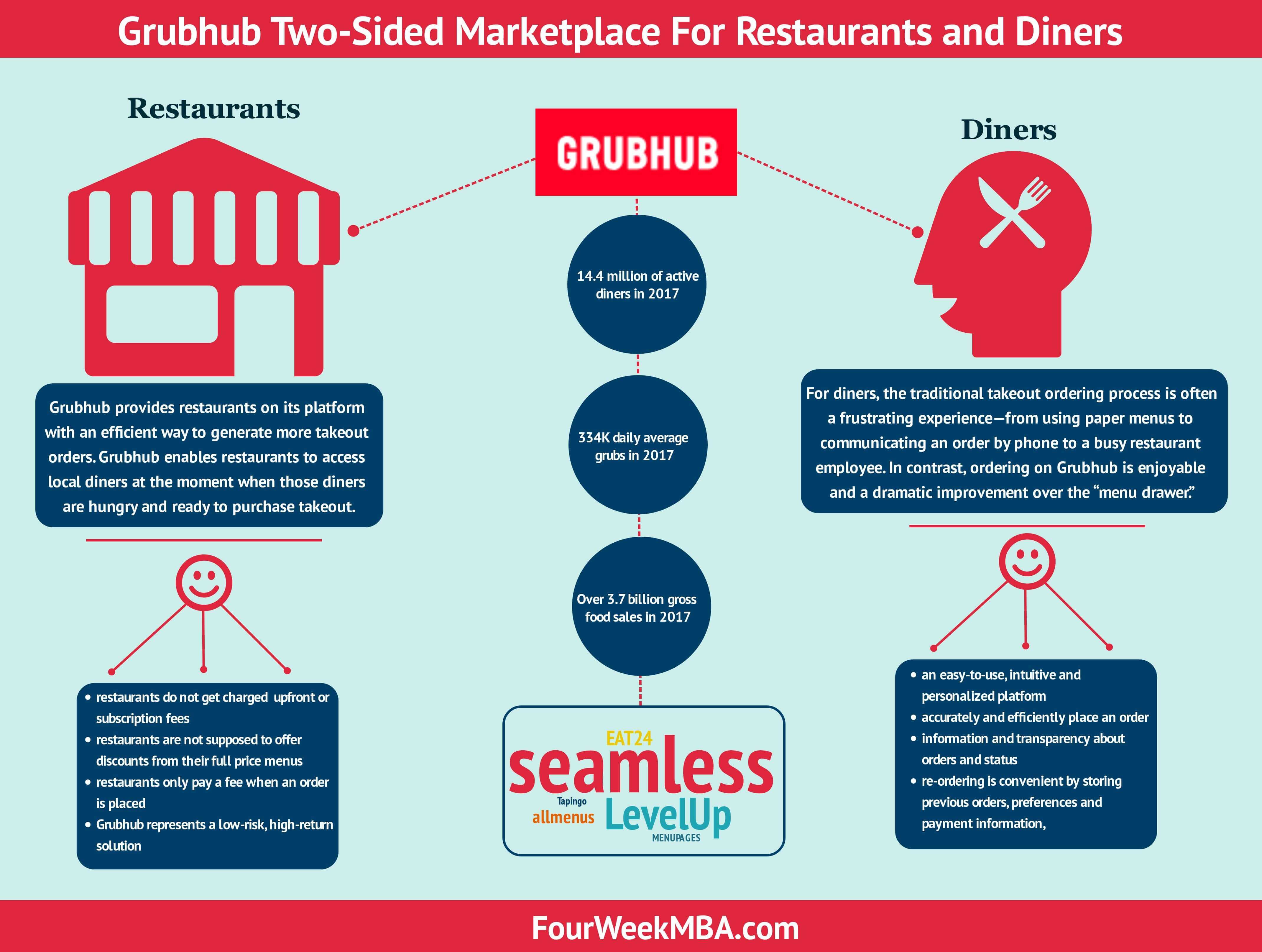

Let's be clear about what's happening here. Grubhub isn't just buying another app to add to its portfolio. The company is acquiring a sophisticated, data-driven customer acquisition and retention engine that restaurants desperately need. With over 415,000 merchants on Grubhub's platform and nearly 20 million diners, the scale potential is enormous. But before we get to the hype, let's break down what Claim actually does, why Grubhub wanted it, and what this means for your next takeout order.

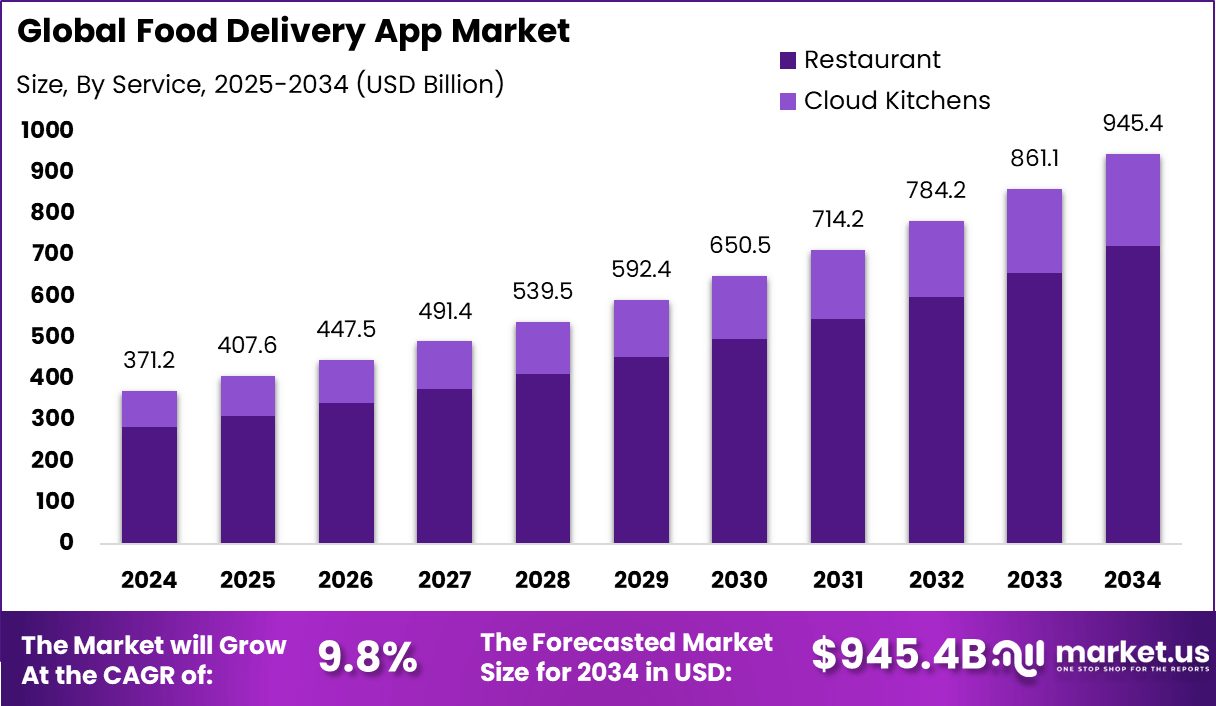

The restaurant delivery space has become increasingly competitive. Third-party delivery platforms like Door Dash and Uber Eats have dominated headlines and market share in recent years. Grubhub's move to acquire Claim represents a calculated response to this competition, focusing on what the company knows best: connecting restaurants with customers through innovative technology. The acquisition also reflects a broader industry trend of consolidation and vertical integration among food delivery platforms, as noted by ERP Today.

TL; DR

- Claim raised 62 million valuation before the Grubhub acquisition

- Claim's core function: Cash-back rewards for local restaurants, helping merchants reduce customer acquisition costs and boost repeat orders

- Grubhub's scale advantage: 415,000+ merchants and 20 million diners provide immediate scale for Claim's rewards technology

- Launch timeline: Claim available in New York City first, with nationwide rollout planned for later in 2025

- Bottom line: This acquisition gives Grubhub a powerful tool to compete with Door Dash's aggressive customer loyalty strategies while helping restaurants convert one-time diners into regulars

Loyalty programs like Claim can reduce repeat customer acquisition costs to nearly zero, compared to $15-25 through traditional marketing channels (Estimated data).

What Is Claim? Understanding the Rewards Platform

Claim isn't a household name like Grubhub or Door Dash, but it solves a very real problem for restaurants: how to get customers to come back. Founded in 2021, Claim operates as a customer rewards app specifically designed for local restaurants. Think of it as a loyalty program builder that doesn't require restaurants to manage their own complex infrastructure.

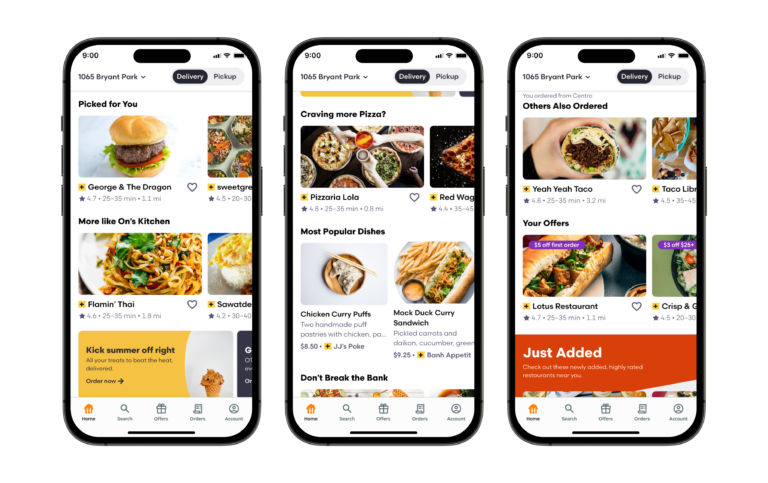

Here's how Claim actually works in practice. A restaurant partner creates a promotional offer through Claim's dashboard. When a customer uses Claim to place an order—either for dine-in or pickup—they receive cash-back rewards. Those rewards accumulate, and customers can use them for future dining purchases. The restaurant gets valuable data about which customers are returning and which promotions are driving repeat business. This is critical information for merchants trying to optimize their marketing spend.

The technology behind Claim leverages machine learning to match restaurants with potential regulars. Instead of blind marketing spend, restaurants get algorithmic insights about customer preferences and behavior. Sam Obletz, Claim's CEO and co-founder, described this approach in the acquisition announcement: combining "a delightful rewards experience and powerful machine learning models" to "match restaurants with their next regulars."

Claim's dashboard gives restaurants real-time visibility into performance metrics. Merchants can track which rewards are driving engagement, which customer segments are most valuable, and which menu items are most popular among returning customers. This transparency matters because most restaurant owners don't have the technical expertise to build or analyze customer retention systems themselves. Claim removes that friction.

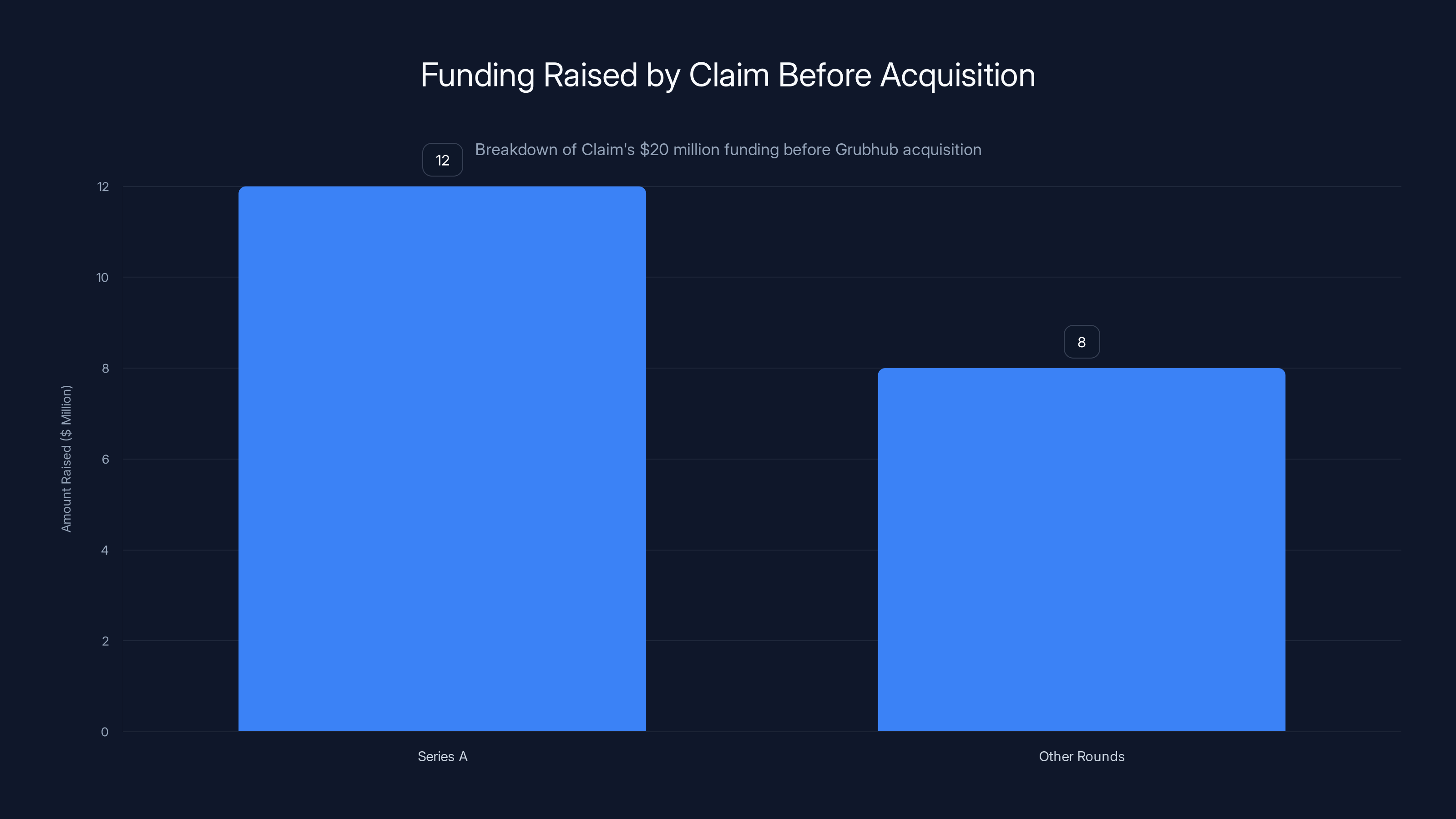

Before the Grubhub acquisition, Claim had raised

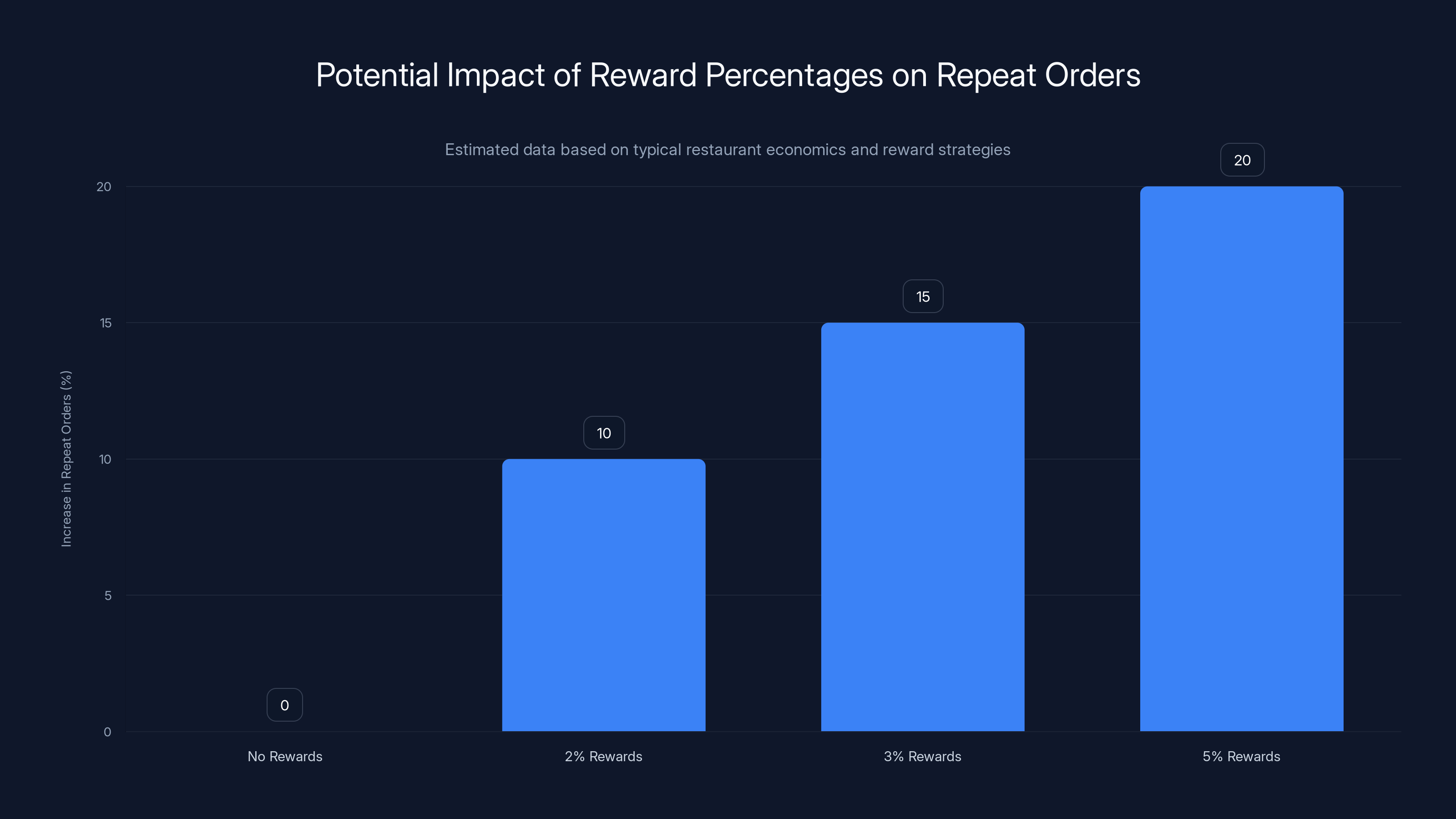

Estimated data suggests that offering 2-5% rewards could increase repeat orders by 10-20%. Testing is crucial to find the optimal reward level.

Why Grubhub Needed Claim: The Competitive Pressure

Great acquisitions rarely happen in a vacuum. They're usually responses to competitive threats or strategic gaps. In Grubhub's case, both factors apply.

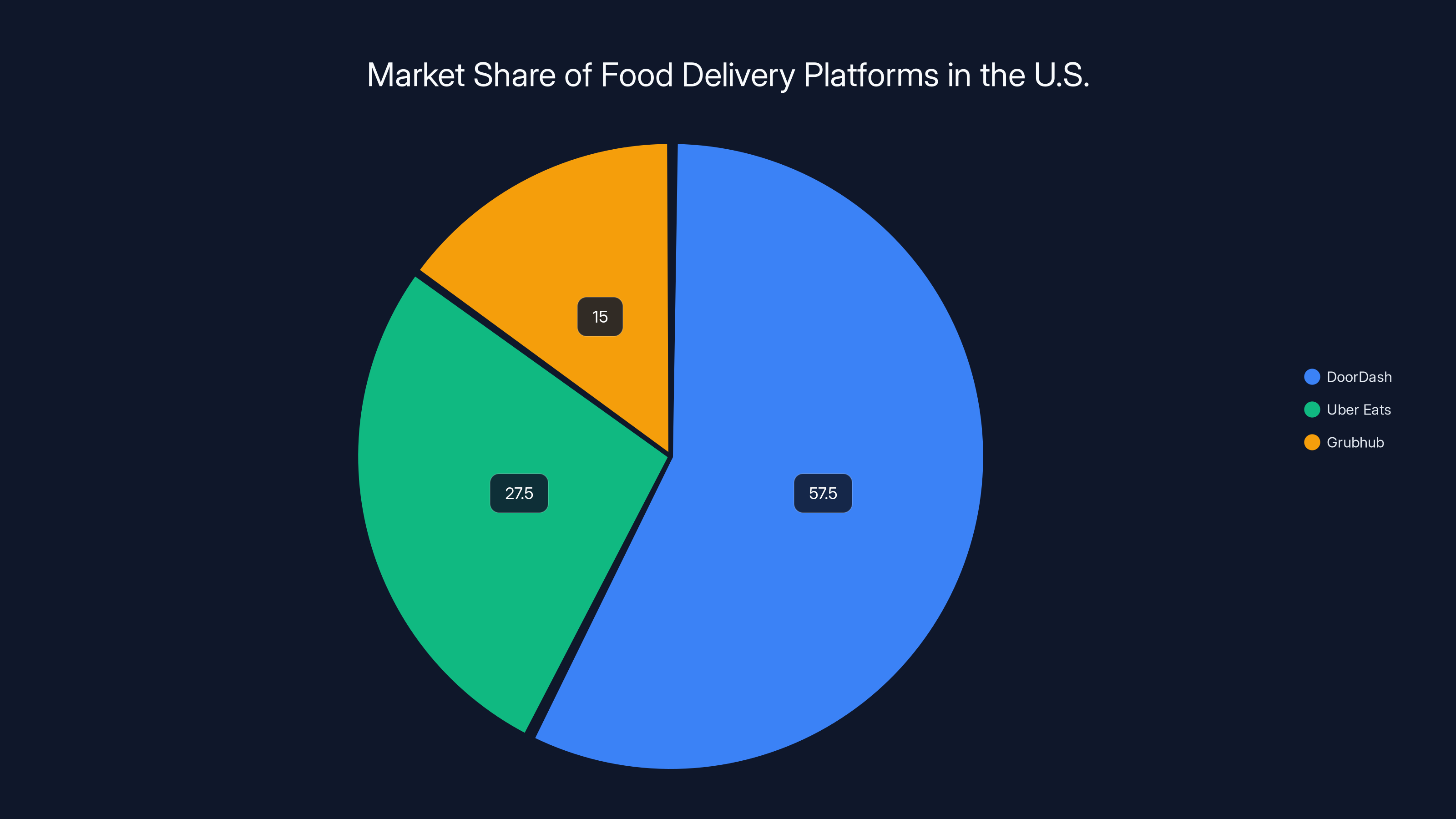

The food delivery market has become a three-horse race dominated by Door Dash, Uber Eats, and Grubhub. Door Dash holds roughly 55-60% market share in the United States, while Uber Eats controls about 25-30%. Grubhub, despite being the oldest of the three platforms, has dropped to roughly 15-20% market share. That gap is enormous, as highlighted by Food & Wine.

Door Dash has built its market dominance partly through aggressive customer acquisition spending and loyalty features. The company's subscription service, Dash Pass, offers free delivery and reduced fees for a monthly subscription. Uber Eats has similar strategies with Uber Eats Pass. These programs work because they create habit formation—customers who subscribe tend to order more frequently because the marginal cost of each order feels lower.

Grubhub's challenge is that the company has historically focused on both diners and merchants, trying to balance the needs of both sides. This dual focus, while sensible strategically, meant the company lacked sophisticated tools for driving repeat customer behavior. Grubhub CEO Howard Migdal stated the strategic rationale clearly: "With Grubhub and Claim together under one roof, we can scale Claim's data-driven tools to our more than 415,000 merchants and help our nearly 20 million diners save more money at the restaurants they love."

That language reveals the acquisition's true purpose. Grubhub isn't primarily trying to compete with Door Dash's consumer loyalty features. Instead, Grubhub is attacking the problem from the merchant side. By giving restaurants powerful customer retention tools, Grubhub makes the platform more valuable for merchants. Merchants who see real revenue growth from Grubhub orders are more likely to continue using the platform and less likely to switch to competitors.

This is a clever play. Instead of engaging in a price war with Door Dash over customer subsidies, Grubhub is offering restaurants the ability to build more profitable customer relationships. For restaurants operating on thin margins, this proposition is often more compelling than just discounts.

The Financial Story: What Claim Was Worth

Understanding the financial context of this deal requires looking at Claim's funding history and what those numbers reveal about the startup's trajectory and valuation.

Claim raised its seed round of funding in 2021, the year it was founded. The exact size of that round wasn't disclosed publicly, but seed rounds for B2B SaaS startups typically range from

The Series A round in October 2024 brought in $12 million from institutional investors. This is a meaningful amount—not enormous by Silicon Valley standards, but substantial enough to indicate serious investor conviction. The investors list reads like a who's who of foodtech and commerce investing. Sequoia Capital, one of the world's most prestigious venture firms, typically invests in startups they believe will become category leaders. The presence of Sequoia on the cap table signaled that Claim had achieved something noteworthy: proof of product-market fit in a category (restaurant loyalty) that had historically been difficult to penetrate.

Claim's total funding of $20 million before the Grubhub acquisition meant the startup had raised enough to hire a solid team, scale operations into new cities, and refine its product. The company had expanded beyond its initial launch city (the sources don't specify which city, but it was likely a major metropolitan area) and was seeing sufficient adoption to justify a Series A from top-tier investors.

PitchBook, an authoritative database of private company valuations, estimated Claim's pre-acquisition valuation at approximately $62 million. This valuation tells us something important: despite having only been founded in 2021, Claim had achieved a 3.1x valuation multiple on its total funding. For context, many Series A startups are valued at 4-6x their funding raised. Claim's 3.1x multiple suggests the startup was valued conservatively, likely because restaurant loyalty is a capital-intensive business with high customer acquisition costs.

We don't know the exact price Grubhub paid for Claim because the acquisition agreement was not publicly disclosed. However, based on typical acquisition multiples in the food tech and SaaS sectors, Grubhub likely paid somewhere in the $80-150 million range. This represents a premium to Claim's pre-Series A valuation, but not an outrageous one. The premium likely reflects the strategic value of Claim's team, technology, and existing merchant relationships to a large platform like Grubhub.

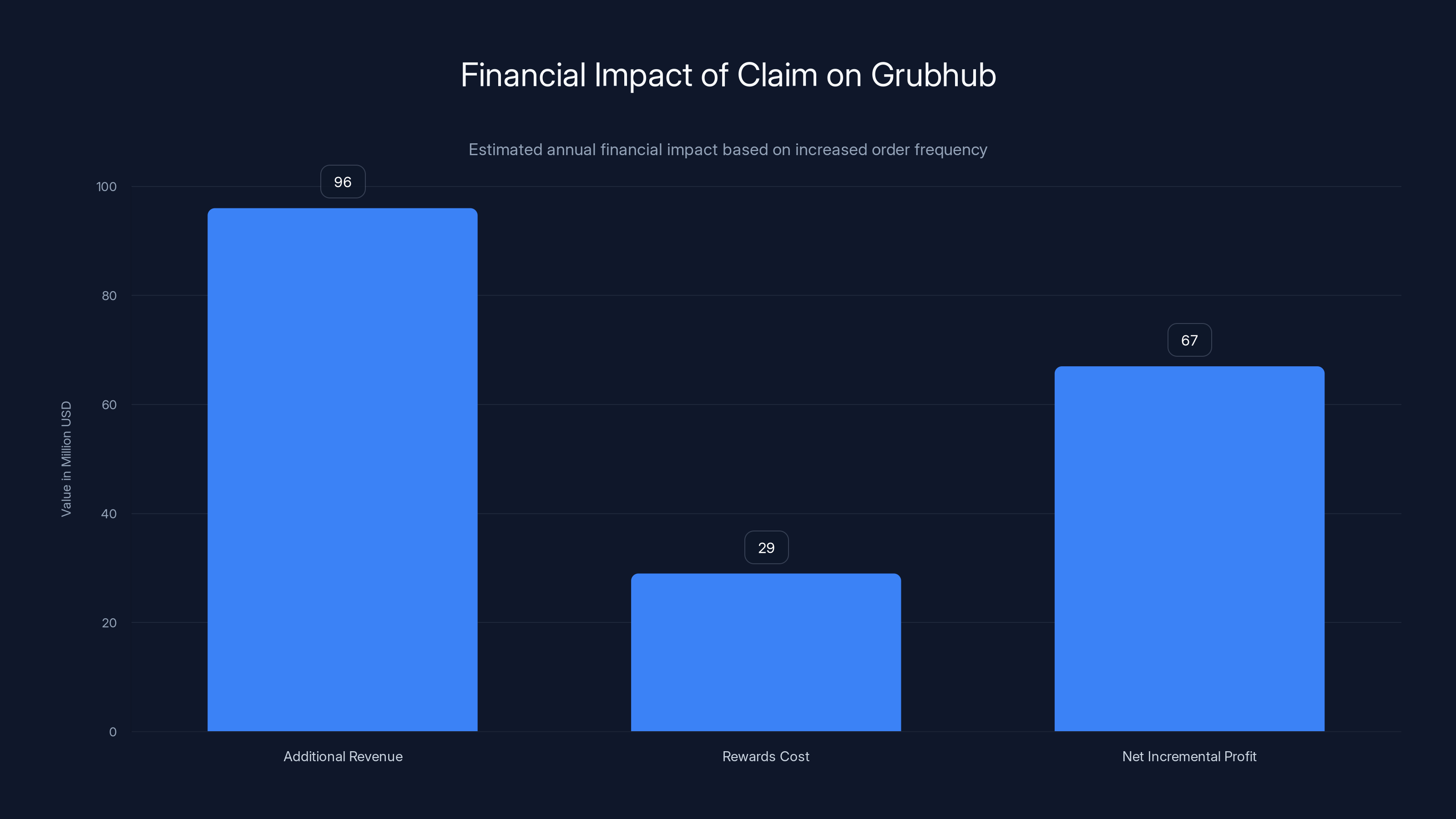

Claim's integration could generate $67 million in net incremental profit annually for Grubhub, with a payback period of less than two years. Estimated data based on projected order increases.

How the Integration Works: Technology and Operations

One of the most critical questions around any acquisition is how the technologies and operations will actually integrate. In Grubhub's acquisition of Claim, this process is more complex than it might initially appear.

Grubhub has committed to keeping Claim operational as a standalone app and website for existing users "for the time being," according to the company's official statement. This is a common approach in acquisitions where the acquirer wants to preserve the existing customer base and brand equity while working on longer-term integration plans. Claim users who prefer the standalone app will continue to have that option, at least in the near term.

However, Grubhub's real integration strategy involves creating what the company calls a "streamlined experience" across both the Grubhub and Claim apps. What does this actually mean? Here's the most likely scenario based on how similar acquisitions have played out.

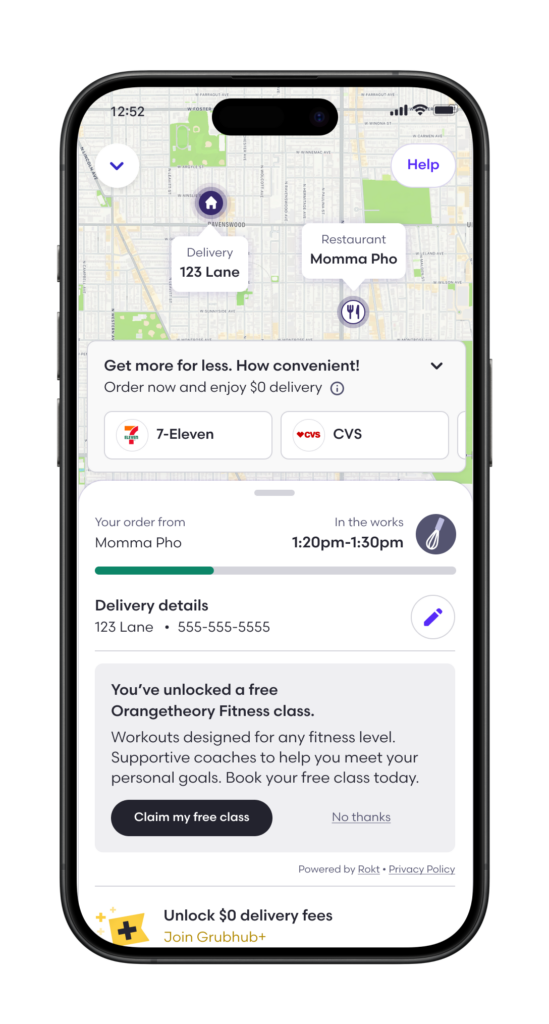

First, Grubhub will build APIs to connect the Claim rewards system with the Grubhub platform. When a diner uses Grubhub to order from a restaurant that has Claim rewards enabled, the diner will automatically accumulate and can redeem Claim rewards. This creates a seamless experience without forcing users to switch apps.

Second, Grubhub will integrate Claim's merchant dashboard into Grubhub for Business, the platform's tool suite for restaurant partners. Instead of logging into separate systems to manage Claim rewards and Grubhub orders, merchants will see everything in one place. This reduces friction and increases the likelihood that restaurant partners will actually use the rewards tools.

Third, Grubhub will use Claim's machine learning models to power recommendation algorithms across its own platform. Claim's technology for "matching restaurants with their next regulars" can be applied to Grubhub's user base. When Grubhub knows which restaurants are likely to convert a one-time customer into a regular, the platform can show those restaurants more prominently in search results or recommendations.

Grubhub was transparent about one important caveat: "For current Claim users, Grubhub says there may be some changes to the product and how rewards are paid out, but that users can continue to expect personalized promotions and rewards for going to local restaurants." This language suggests that the rewards structure might change as Grubhub optimizes for its own economics, but the core promise of rewards remains.

Rollout Timeline and Geographic Strategy

Grubhub has taken a measured approach to rolling out Claim to its user base. This isn't a "flip the switch" acquisition. Instead, the company is being deliberate about where and how the rewards feature launches.

As of the acquisition announcement in January 2025, Claim is available exclusively to Grubhub merchants and diners in New York City. This is a significant choice. New York City is the largest food delivery market in the United States and home to tens of thousands of restaurants. It's also a market where restaurant operators are typically more sophisticated and more willing to experiment with new technology tools. NYC is the obvious testing ground for a restaurant-focused feature like Claim.

Grubhub has announced that a "nationwide rollout" is planned for later in 2025, but hasn't specified a timeline. Based on typical SaaS rollout patterns, this likely means: Q2 2025 expansion to major metropolitan areas (Los Angeles, Chicago, San Francisco), Q3 2025 expansion to secondary markets, and Q4 2025 broader availability. This phased approach serves several purposes.

First, it allows Grubhub to identify and fix integration issues before they affect millions of users. There's always friction when integrating two different technology systems. By starting in NYC, Grubhub can work out bugs and optimize the experience in a manageable geography.

Second, a phased rollout gives restaurants time to onboard and learn how to use the new tools. If Grubhub suddenly enabled Claim for hundreds of thousands of restaurants, many would be confused about how to access and use it. Merchant education is critical for driving adoption.

Third, the staggered rollout creates marketing opportunities. Each new city announcement becomes a PR moment. Grubhub can generate earned media coverage in each market, positioning Claim as an exciting new feature that helps local restaurants.

The NYC-first strategy also makes economic sense. New York City has a disproportionate number of food delivery transactions. If Claim drives a 5-10% increase in repeat orders (a conservative estimate), that impact in NYC alone could generate significant incremental value for Grubhub, as reported by New York Comptroller's Office.

DoorDash leads the U.S. food delivery market with an estimated 57.5% share, followed by Uber Eats at 27.5% and Grubhub at 15%. Estimated data.

Impact on Restaurant Merchants: Customer Acquisition and Retention

For restaurant operators, this acquisition represents both an opportunity and an operational change they'll need to manage.

Let's start with the opportunity. Customer acquisition is one of the largest expenses for restaurants using delivery platforms. A typical restaurant might spend 15-25% of its delivery order revenue just on platform commissions. On top of that, many restaurants invest in additional marketing to drive orders. The math gets brutal quickly. If a restaurant averages

Claim's rewards system attacks this problem differently. Instead of paying for acquisition, restaurants pay for retention. The economics are much more favorable. A customer who places their second order from a restaurant has a dramatically higher lifetime value than a first-time customer. Getting that second order is where Claim creates value.

Consider a concrete example. Restaurant A uses Grubhub without Claim. A customer places a first order, the restaurant pays 20% commission to Grubhub. The restaurant makes a

Now imagine the same scenario with Claim. The customer places a first order. Grubhub credits them with $2-3 in Claim cash-back. The customer is delighted by the rewards. They place a second order two weeks later, using their Claim cash-back. The restaurant again pays commission to Grubhub, but now the customer has placed two orders instead of one. The lifetime value of that customer has doubled. More importantly, the second order often leads to third, fourth, and fifth orders as the customer develops a habit.

This is network economics at work. Claim makes the Grubhub platform more valuable for restaurants because it helps them acquire and retain customers more efficiently.

However, restaurants will need to understand how to use Claim effectively. The best reward structure isn't always obvious. Too generous a reward and a restaurant's margins get squeezed. Too stingy and customers don't feel the incentive. Grubhub's challenge will be helping merchants figure out the optimal reward level for their business.

Grubhub will also need to manage the rollout from an operational perspective. Merchants will need training. Some restaurants will need help understanding how to structure their rewards. Support teams will need to be prepared for questions. All of this requires execution, and execution is where many tech acquisitions stumble.

Impact on Diners: Rewards and Incentives

From a consumer perspective, the Claim acquisition means more money in diners' pockets when they order through Grubhub. But the actual experience depends on how Grubhub and Claim design the integration.

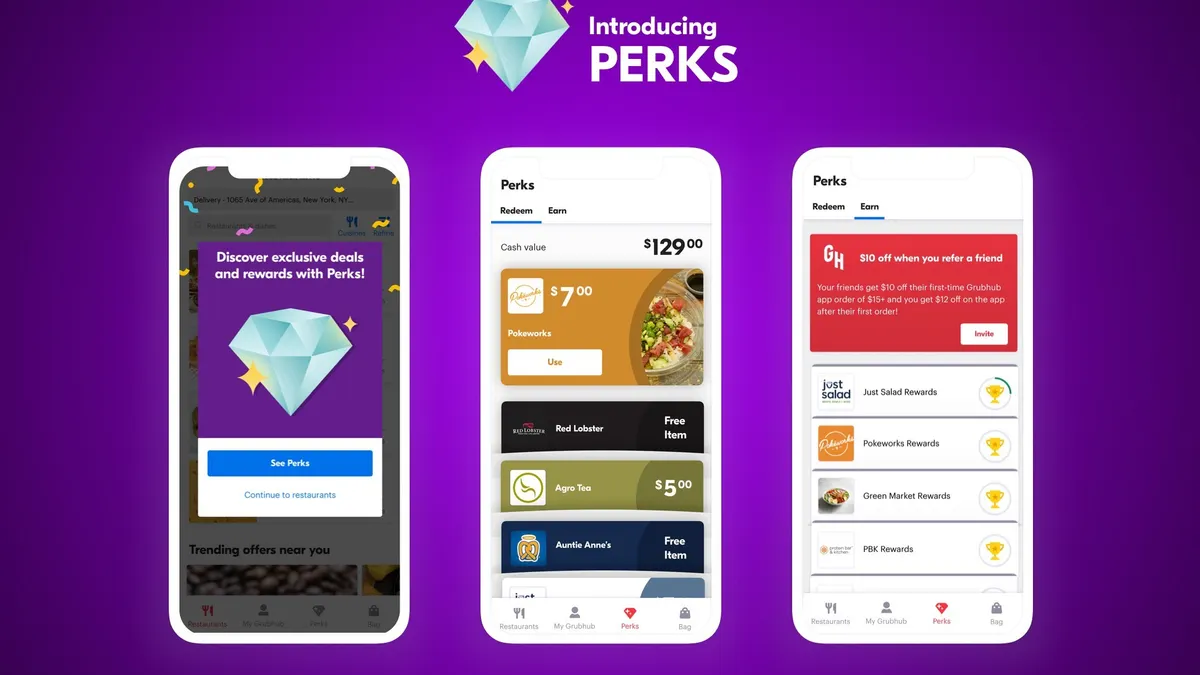

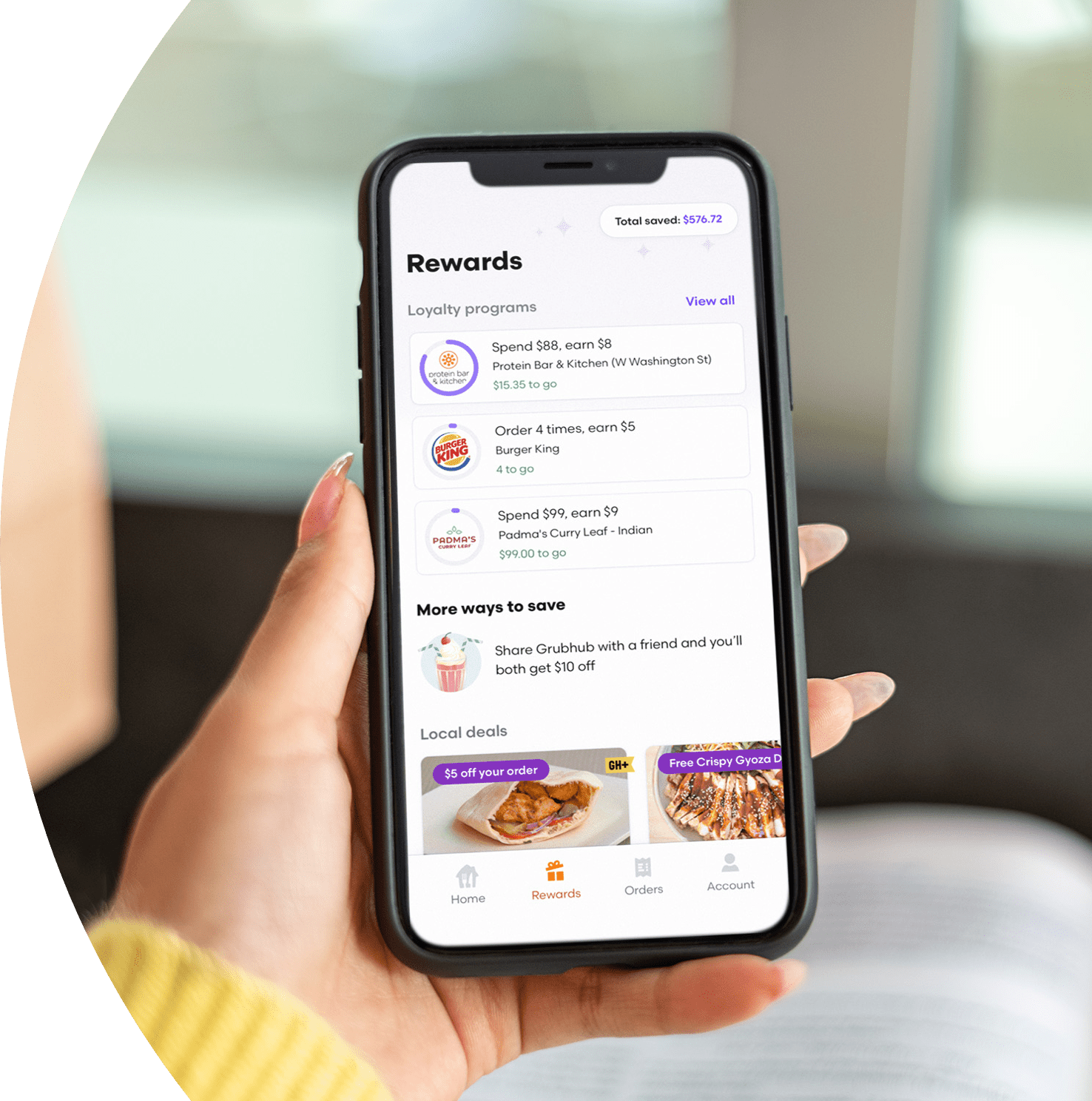

In the simplest scenario, every Grubhub order at a Claim-enabled restaurant automatically earns rewards. Diners see a cash-back percentage displayed on the restaurant listing ("Get 5% cash-back at this restaurant"). After the order, the cash-back appears in their Claim account or wallet. They can use that cash-back on future orders.

This frictionless design is what Grubhub should aim for because it mirrors the experience customers have with credit card cash-back. But there's a catch. Claim currently operates as a separate app and rewards system. Grubhub will need to integrate it deeply into the main Grubhub app to make it truly frictionless. Otherwise, users have to jump between apps to track and redeem rewards, which kills adoption.

The integration question matters a lot because there's a huge difference between "you can get cash-back if you download another app and go through multiple steps" and "you automatically get cash-back when you order through Grubhub." The first approach drives minimal adoption. The second drives viral adoption.

Grubhub has committed to building a "streamlined experience" across apps, which suggests they're thinking about this integration. But the devil is in the details. If the integration is truly seamless, this could be a significant competitive advantage versus Door Dash and Uber Eats.

Another important consideration is the rewards sustainability. Claim has to fund these rewards somehow. The money comes from one of three sources: restaurants paying for rewards as a marketing expense, the platform taking a cut of the transaction and using some of that to fund rewards, or venture capital funding the rewards until the company achieves scale. Grubhub, being a public company, can't rely on VC funding. So the rewards have to come from restaurants or Grubhub's transaction margins. Either way, it's sustainable long-term only if rewards drive enough incremental order volume to justify the cost.

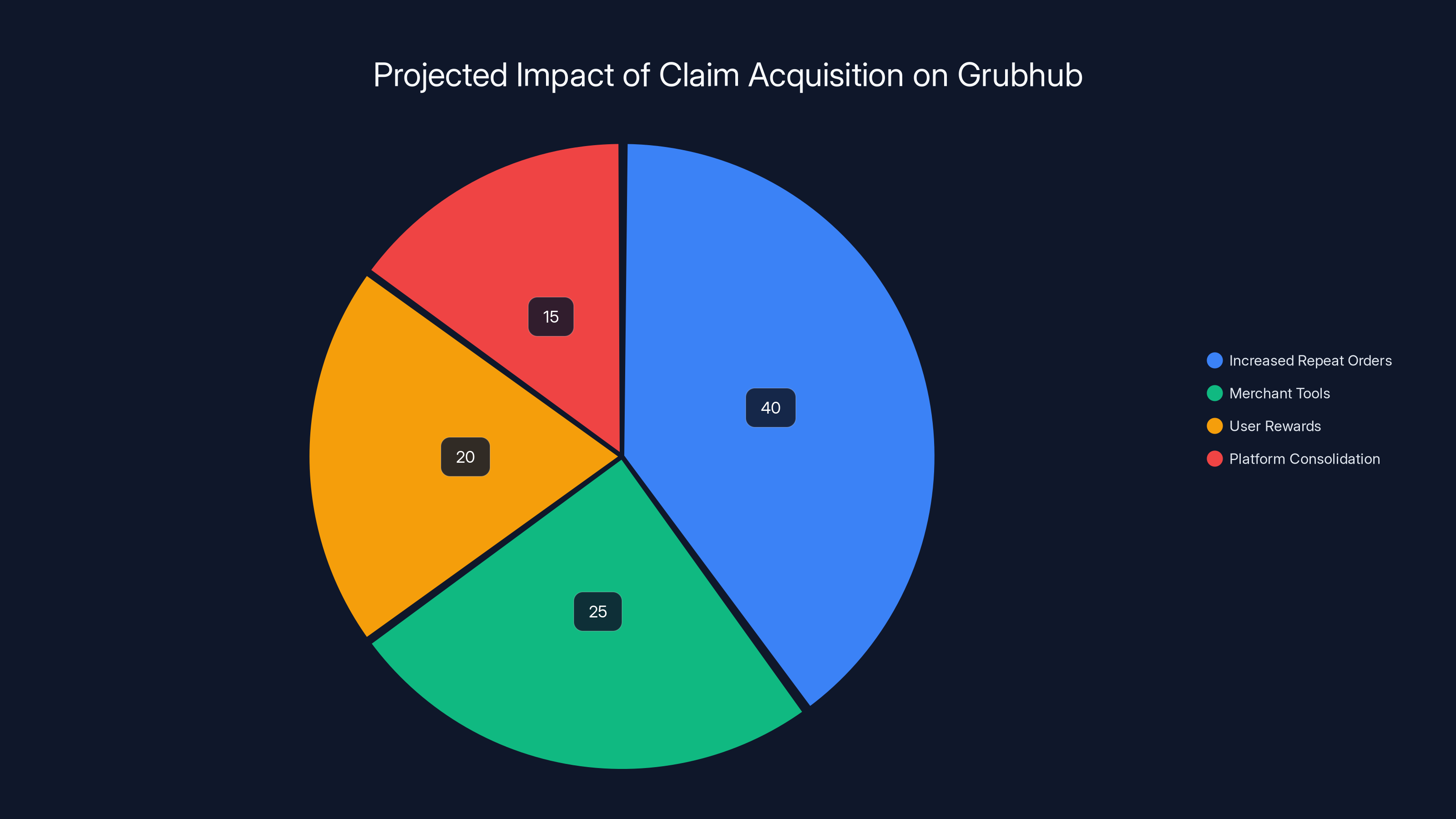

Grubhub's acquisition of Claim is expected to primarily increase repeat orders (40%) and enhance merchant tools (25%), with additional benefits in user rewards and platform consolidation. Estimated data.

Competitive Implications and Industry Response

Claim's acquisition by Grubhub sends a signal to the entire food delivery and restaurant technology market. Rewards and loyalty are becoming core competitive differentiators, not nice-to-haves.

Door Dash's response is likely to be measured. The company already has sophisticated customer loyalty features through Dash Pass and its own rewards programs. Door Dash's challenge is that it dominates on the consumer side but has been less aggressive on the merchant side. Door Dash's suite of restaurant tools has historically been simpler than Grubhub's. So while Door Dash might not feel threatened by Claim specifically, they may feel pressure to improve their merchant tooling overall.

Uber Eats faces a similar situation. Uber's platform sprawl (connecting Uber rides, Uber Eats delivery, Uber Cash payment, and now AI features) means the company has multiple levers to pull. But Uber's merchant tools are also a relative weakness compared to Grubhub. Expect Uber to either build or acquire restaurant loyalty and retention tools in the next 2-3 years.

Smaller players in the food delivery space like Wonder's other brands and regional players will watch Grubhub's execution closely. If Claim works and drives meaningful merchant retention, it validates the strategy of investing in restaurant tools rather than just consumer acquisition.

From a startup perspective, this acquisition raises interesting questions. Other restaurant technology startups focused on loyalty, marketing, or customer acquisition will see heightened acquisition interest from large platforms. Grubhub's move demonstrates that these problems are worth solving and that platforms are willing to pay to solve them.

One interesting angle: Grubhub's acquisition suggests that the company believes it can't build loyalty infrastructure as quickly as it can acquire it. This is actually a sensible approach. Claim had already spent three years refining its product and customer relationships. Grubhub could have spent three years building a competing product, but by that time Door Dash might have further extended its market lead. Acquisitions are often about buying time and capability.

Technical Architecture: How Claim's Machine Learning Actually Works

Claim's core competitive advantage isn't just the rewards mechanism—it's the machine learning that powers customer matching. Understanding this technology helps explain why Grubhub wanted the company badly enough to acquire it.

At its core, Claim's machine learning system works like a sophisticated recommendation engine, but in reverse. Instead of recommending restaurants to customers, it recommends customers to restaurants. The system ingests data about restaurant characteristics (cuisine type, price point, location, menu items, customer reviews) and customer behavior (order history, cuisine preferences, price sensitivity, location preferences) and identifies matches.

The system probably operates something like this: a restaurant serves Thai food, has prices in the

Claim then uses this matching to serve targeted rewards. Instead of offering the same 5% cash-back to everyone, Claim might offer 10% cash-back to the customers most likely to convert to regulars. This sounds like it would cost the restaurant more, but actually it costs less because the restaurant is directing incentives at high-conversion-probability customers rather than wasting incentives on people unlikely to order again anyway.

The machine learning component learns and improves over time. As more data accumulates about which rewards drive repeat orders, the model gets smarter about predicting which customers will respond to offers and which won't. After several months of operation, Claim's recommendations become significantly more accurate than they were in month one.

This is why Sam Obletz's quote about "matching restaurants with their next regulars" matters. It's describing a real technical capability, not marketing fluff. Restaurants that use Claim are getting algorithmic targeting of their marketing spend.

Grubhub's acquisition of this technology gives the company access to this machine learning expertise and the trained models. Over time, Grubhub can apply these same techniques to its own recommendation systems, improving the entire platform's ability to match diners with restaurants they'll love.

Claim raised a total of

Challenges and Risks in the Integration

No acquisition is risk-free, and Grubhub faces several challenges in making this integration successful.

First, there's the classic integration risk. Grubhub and Claim have different technology stacks, different organizational cultures, and different ways of approaching problems. Claim was a startup with a small, nimble team. Grubhub is a large public company with more bureaucratic processes. Getting these two organizations to work together seamlessly is always harder than it sounds. History is full of acquisitions that looked great on paper but where integration friction dragged on for years.

Second, there's the merchant adoption risk. Claim's value proposition is compelling on paper, but actual restaurant owners need to understand it, set it up correctly, and use it consistently. If Grubhub's execution here is sloppy—if the integration is confusing, if restaurants don't understand how to use it, if the results aren't clearly communicated—adoption could be disappointing.

Third, there's the competitive risk. Door Dash and Uber Eats won't sit still. They'll likely accelerate their own merchant tool development and potentially build or acquire competing loyalty solutions. Grubhub needs to capture the first-mover advantage before competitors catch up.

Fourth, there's the consumer experience risk. If Grubhub's integration of Claim rewards into the main app is clunky, users might ignore it entirely. Consumer habits are powerful—if ordering through Grubhub still feels like the same experience as before, diners won't feel like they're getting a benefit and won't change their behavior.

Fifth, there's the unit economics risk. Claim's rewards have to be funded by something—either restaurants, Grubhub's margins, or some combination. If the rewards are too generous, they crush profitability. If they're too stingy, they don't drive behavior change. Finding the sweet spot requires careful optimization.

What This Means for the Broader Restaurant Technology Ecosystem

This acquisition is a signal about broader trends in restaurant technology. The industry is consolidating around platforms that can offer integrated solutions—not just delivery, but also marketing, payments, loyalty, and operations management.

Restaurant owners used to manage multiple systems: a POS system from Square or Toast, a delivery app like Grubhub, a loyalty program like Toast built-in rewards or a third-party service, a payment processor, etc. This fragmentation was annoying and inefficient. Modern platforms are integrating these functions.

Grubhub's acquisition of Claim is part of this broader consolidation. By owning the loyalty layer, Grubhub becomes a more comprehensive business solution for restaurants. A restaurant owner could theoretically run their entire delivery business through Grubhub with integrated loyalty rewards, without needing a separate Claim subscription or separate loyalty system.

This consolidation trend benefits large platforms and potentially hurts standalone point solutions. If you're a restaurant owner, managing one integrated platform is better than managing five separate ones. If you're a venture capital investor, you know that standalone tools face an existential threat from integrated platforms. That's why you see fewer venture-backed standalone restaurant tools getting funded and more platforms acquiring point solutions.

The trend also suggests that the era of "build, acquire, or die" is accelerating in restaurant tech. Smaller startups without a clear path to profitability or scale need to have an acquisition exit planned. The companies that thrive long-term will be either massive platforms that achieve global scale, or very specialized tools that solve such specific problems that they can't easily be acquired and integrated.

Financial Model: How Claim Creates Value for Grubhub

Ultimately, acquisitions are justified by financial models. Understanding how Grubhub believes Claim will create shareholder value is essential.

Let's walk through a simplified model. Assume Grubhub has 415,000 merchants. Currently, some percentage of those merchants are on the platform actively generating orders. Claim's goal is to increase repeat order frequency among Grubhub's 20 million diners.

Assume the average diner places 2 orders per month on Grubhub. That's 40 million orders monthly across the entire platform. Now assume Claim increases repeat order frequency by 10% for restaurants that use Claim rewards effectively. That's an additional 4 million orders per month.

Grubhub makes money through a combination of commission on restaurant orders (typically 15-30%) and delivery fees on consumer orders. Let's say the average commission and delivery fees total

Now subtract the cost of Claim rewards. Assume restaurants and Grubhub together spend an average of 3% of order value on rewards. The average order is

Net impact:

This is a very simplified model, and actual results could be better or worse. But it illustrates why the acquisition makes financial sense. Even a modest improvement in repeat order frequency across a huge user base creates billions of dollars in long-term value.

The real value isn't just the immediate incremental orders. It's the stickiness. A customer who orders five times per month instead of two times per month is more likely to remain a Grubhub user long-term. A restaurant seeing real revenue growth from Grubhub rewards is less likely to reduce its reliance on the platform. These retention benefits compound over years.

Future Evolution: What Comes Next

If Claim's integration is successful, we should expect Grubhub to extend the technology in interesting directions.

First, look for Claim technology to power more sophisticated restaurant marketing features. Once Grubhub knows which customers are likely to become regulars at specific restaurants, the company can serve targeted promotions not just to those customers, but to restaurants about those customers. "Here are 500 customers likely to order pad thai again. We can reach them for $X."

Second, expect Claim technology to be used for restaurant recommendation optimization. Grubhub's search and recommendations are important ranking real estate. Restaurants pay attention to which ones show up first. Claim's matching technology could be used to optimize recommendations not just for what Grubhub thinks users want, but for what will drive repeat order frequency. This could become a premium feature Grubhub charges for.

Third, look for Grubhub to apply Claim's machine learning to its own restaurant discovery features. Instead of just recommending restaurants based on cuisine type and ratings, Grubhub could recommend restaurants based on likelihood of becoming regulars.

Fourth, watch for Grubhub to extend rewards and loyalty beyond restaurants. The same customer matching and retention algorithms could work for Grubhub's other services. Wonder owns multiple delivery brands, and these brands could share loyalty benefits and customer matching intelligence.

Fifth, there's potential to extend Claim into new product categories. The same loyalty and customer matching technology that works for restaurants could theoretically work for grocery delivery, convenience store delivery, or other verticals where repeat customer behavior matters.

The long-term opportunity is that Grubhub owns a data-driven customer acquisition and retention platform that can be extended across multiple services and product categories.

Why This Matters: The Bigger Picture

At a zoomed-out level, Grubhub's acquisition of Claim reveals important truths about the current state of the food delivery industry and technology business in general.

First, the age of growth-at-all-costs is over. For years, food delivery platforms competed primarily on customer acquisition—who could spend the most on discounts and advertising to get users ordering on their platform. Door Dash won that game, and their market dominance shows it. But now that the market has matured and customer acquisition costs are high, platforms are shifting toward retention. Grubhub is essentially saying: "We can't out-spend Door Dash on acquisition, so we'll out-retain them." This is a strategic shift, not a tactical response.

Second, the value of data and network effects is increasingly recognized. Grubhub's value doesn't come from being the fastest delivery company or having the most restaurants. It comes from having massive networks of restaurants and diners, and the ability to match them efficiently. Claim's machine learning technology enhances that capability.

Third, vertical integration and consolidation are accelerating in software. Grubhub used to rely on third-party loyalty platforms like Xano or other restaurant tools. But as the importance of these tools becomes clear, large platforms want to own them. This is true across software: payment processors own e-commerce tools, CRM companies own marketing automation, office suite companies own collaboration tools. Every platform wants to be vertically integrated.

Fourth, this acquisition validates that the restaurant industry, despite being large and fragmented, is a worthy target for venture capital and strategic investment. There's real money to be made by solving restaurant problems, and Grubhub is willing to invest to defend and extend its position.

For Restaurant Owners: Preparing for Claim

If you run a restaurant and have Grubhub as a delivery partner, Claim's integration is coming to your market eventually. Here's what you should be thinking about now.

First, understand your current customer economics. What percentage of your customers order once and never return? What percentage become regulars? Understanding this baseline will help you evaluate whether Claim rewards are actually moving the needle. Many restaurant owners guess at these metrics but should measure them precisely.

Second, think about your margins and what level of rewards you can afford. If your average order is

Third, plan to test Claim in your actual operation. Don't just accept default settings. If Claim allows you to customize rewards by menu item or customer segment, experiment with different structures and measure results. Some restaurants will find that modest rewards (2%) drive significant repeat business. Others might find that rewards don't move the needle. You won't know until you test.

Fourth, integrate Claim data into your broader restaurant strategy. Information about which customers are becoming regulars and which rewards resonate should inform your menu, pricing, and promotional decisions. If Claim shows that customers who order pasta are becoming regulars but customers who order salads never return, that's important strategic information.

For Grubhub Users: What to Expect

If you're a regular Grubhub user, expect the Claim integration to start rolling out over the next 6-12 months. Here's what you should anticipate.

First, look for cash-back percentages to start appearing on restaurant listings. You'll see something like "5% cash-back" or "$2 cash-back on this order" displayed prominently. These will likely appear first on restaurants in New York City (where Claim is launching first), then gradually on restaurants nationwide.

Second, expect a cash-back or rewards wallet to appear somewhere in your Grubhub account. This is where your accumulated cash-back from Claim rewards will be stored. Grubhub will need to make this easy to find and use, otherwise adoption will suffer.

Third, watch for push notifications encouraging you to order from restaurants where you've been rewarded before. Grubhub will use Claim data and machine learning to identify restaurants where you're likely to become a regular, then promote those restaurants more prominently to you.

Fourth, look for Claim rewards to become better integrated into Grubhub's general rewards and loyalty ecosystem. Initially, Claim might feel like a separate thing. Over time, it will likely become seamlessly integrated into how Grubhub handles all rewards and loyalty.

The bottom line for users: this should mean better deals and more cash-back when ordering through Grubhub, especially at restaurants you already like. That's good news for your wallet.

FAQ

What is Claim and why did Grubhub acquire it?

Claim is a restaurant rewards startup founded in 2021 that helps restaurants acquire and retain customers through personalized cash-back rewards and machine learning-powered customer matching. Grubhub's parent company Wonder acquired Claim to give its 415,000+ restaurant partners powerful customer retention tools and to help its 20 million diners earn rewards. The acquisition allows Grubhub to compete more effectively with Door Dash's market dominance by shifting focus from customer acquisition to retention.

How much did Claim raise before the Grubhub acquisition?

Claim raised a total of

How does Claim's machine learning technology work?

Claim's machine learning system analyzes restaurant characteristics (cuisine type, price point, location, reviews) and customer behavior (order history, cuisine preferences, spending patterns) to identify which customers are most likely to become regulars at specific restaurants. Instead of offering the same rewards to everyone, Claim targets higher-value incentives to high-probability customers, making restaurant marketing spend more efficient. The system learns and improves over time as more data accumulates, becoming increasingly accurate at predicting which customers will respond to rewards and become repeat customers.

When will Claim rewards be available in my city?

Claim is currently available in New York City for Grubhub merchants and diners, with a nationwide rollout planned for later in 2025. Based on typical product rollout patterns, expect expansion to major metropolitan areas like Los Angeles, Chicago, and San Francisco in Q2-Q3 2025, followed by secondary markets and broader availability through the rest of 2025. Grubhub is taking a phased approach to allow for integration refinements and merchant onboarding in each geography.

What does Claim mean for restaurant owners?

For restaurant owners, Claim offers a way to reduce customer acquisition costs by focusing on retention instead. Rather than paying for additional marketing, restaurants can use Claim rewards to encourage first-time customers to become regulars. The platform provides data about which rewards are driving repeat business, helping restaurants optimize their marketing spend. Restaurants pay for rewards through a combination of direct rewards funding and platform commissions, so the economics need to be evaluated based on each restaurant's margins and target repeat order rates.

How does this acquisition affect Grubhub's competition with Door Dash and Uber Eats?

Grubhub's acquisition of Claim represents a strategic shift from competing on customer acquisition discounts to competing on retention and merchant value. While Door Dash dominates in market share and consumer loyalty through Dash Pass, Grubhub is attacking from the merchant side with better tools for driving repeat orders. This could help Grubhub improve merchant retention and increase order frequency, indirectly boosting its competitive position. Expect Uber Eats and Door Dash to accelerate their own merchant tool development in response.

Will I have to use a separate app to access Claim rewards?

Initially, Claim will continue to operate as a standalone app and website for existing users "for the time being." However, Grubhub has committed to building a "streamlined experience" across both the Grubhub and Claim apps. This means over time, you should be able to earn and redeem Claim rewards directly through the Grubhub app without needing separate logins or switching between apps. The exact timeline and final design haven't been specified, but deep integration is the likely end state.

What does Grubhub CEO Howard Migdal mean by "scaling Claim's data-driven tools"?

Grubhub has 415,000+ merchant partners and nearly 20 million diners on its platform. Claim, before the acquisition, had a much smaller footprint. By integrating Claim's technology and applying it across Grubhub's entire network, the company can expose Claim's rewards and customer matching capabilities to far more restaurants and diners than Claim could reach independently. This scaling allows Grubhub to generate significant incremental value from its large existing user base and network effects.

Are Claim rewards guaranteed to make my restaurant more profitable?

Claim rewards work best when they drive genuine repeat customer behavior, but there's no guarantee they'll work for every restaurant. Success depends on multiple factors: reward levels appropriate to your margins, effective marketing of the rewards to customers, quality of your food and service, and restaurant type. Claim's machine learning helps by targeting rewards to high-probability customers, but restaurants still need to deliver good experiences and measure results. Early adopters should test and measure the impact before assuming rewards will directly improve profitability.

What happens to Claim's existing non-Grubhub restaurant partners?

Grubhub has stated that Claim will "continue to be available to its current merchants and consumers through the Claim app and website 'for the time being.'" This suggests that restaurants using Claim independently of Grubhub will retain access to the platform. However, over the long term, as Grubhub integrates Claim more deeply and focuses resources on the Grubhub integration, Claim may eventually phase out standalone operations or focus primarily on Grubhub merchants. Current Claim users should plan for potential changes to the product and how rewards are managed.

Conclusion: A Strategic Move That Could Reshape Food Delivery

Grubhub's acquisition of Claim in early 2025 represents far more than a typical tech deal. It's a strategic declaration that the future of food delivery competition lies in retention and merchant value, not customer acquisition discounts.

For nearly a decade, the food delivery space was defined by cash burn and customer acquisition wars. Door Dash spent its way to dominance. Uber Eats leveraged its Uber user base. Grubhub, older and less flush with venture capital, got left behind.

But markets mature. Customer acquisition costs rise. Investors demand profitability. When the rules change, strategy has to change too. Grubhub's Claim acquisition is this strategic evolution in action.

The math is compelling. If Claim can drive even a modest 10% increase in repeat order frequency across Grubhub's massive user base, the financial impact is staggering—potentially $100+ million annually in incremental gross profit. The long-term impact on customer lifetime value and merchant stickiness compounds that advantage.

For restaurant owners, this acquisition means help is coming in the form of sophisticated customer retention tools. But it also means they need to be ready to evaluate and optimize reward structures when Claim lands in their market.

For Grubhub users, the near-term benefit is straightforward: more cash-back and rewards when you order through Grubhub. The long-term benefit is a more intelligent platform that better matches you with restaurants you'll love.

For the broader food delivery and restaurant tech industry, Claim's acquisition validates an important trend: platform consolidation and vertical integration are accelerating. Standalone point solutions face existential threats from large platforms acquiring and integrating competing capabilities. The future belongs to integrated platforms that solve multiple problems at once.

Execution matters enormously. Many acquisitions look brilliant on a whiteboard but stumble in reality. Grubhub's challenge is to integrate Claim smoothly, get merchants excited about the tools, and ensure that rewards actually drive behavior change. If they succeed, Claim could become one of the critical pieces of Grubhub's competitive comeback. If they stumble, it's an expensive lesson in technology integration.

The rollout starts in New York City and expands nationwide through 2025. By year-end, millions of restaurant orders will flow through Claim's intelligence. And then we'll know whether Grubhub's strategic shift from acquisition dominance to retention excellence was genius or just expensive.

Key Takeaways

- Grubhub's acquisition of Claim represents a strategic pivot from customer acquisition discounts to retention-focused competition

- Claim raised 62 million valuation before acquisition, with backing from Sequoia Capital and tier-1 VCs

- The deal gives Grubhub's 415,000 merchants and 20 million diners access to machine learning-powered customer matching and loyalty tools

- Claim rewards launch in NYC first with nationwide rollout planned through 2025, with early phased approach managing integration risk

- For restaurants, Claim reduces customer acquisition costs by focusing on retention; for diners, it means more cash-back rewards

![Grubhub Acquires Claim: Restaurant Rewards Strategy Explained [2025]](https://tryrunable.com/blog/grubhub-acquires-claim-restaurant-rewards-strategy-explained/image-1-1768927057220.jpg)