Introduction: Why 2025 is the Inflection Point for Global Trade

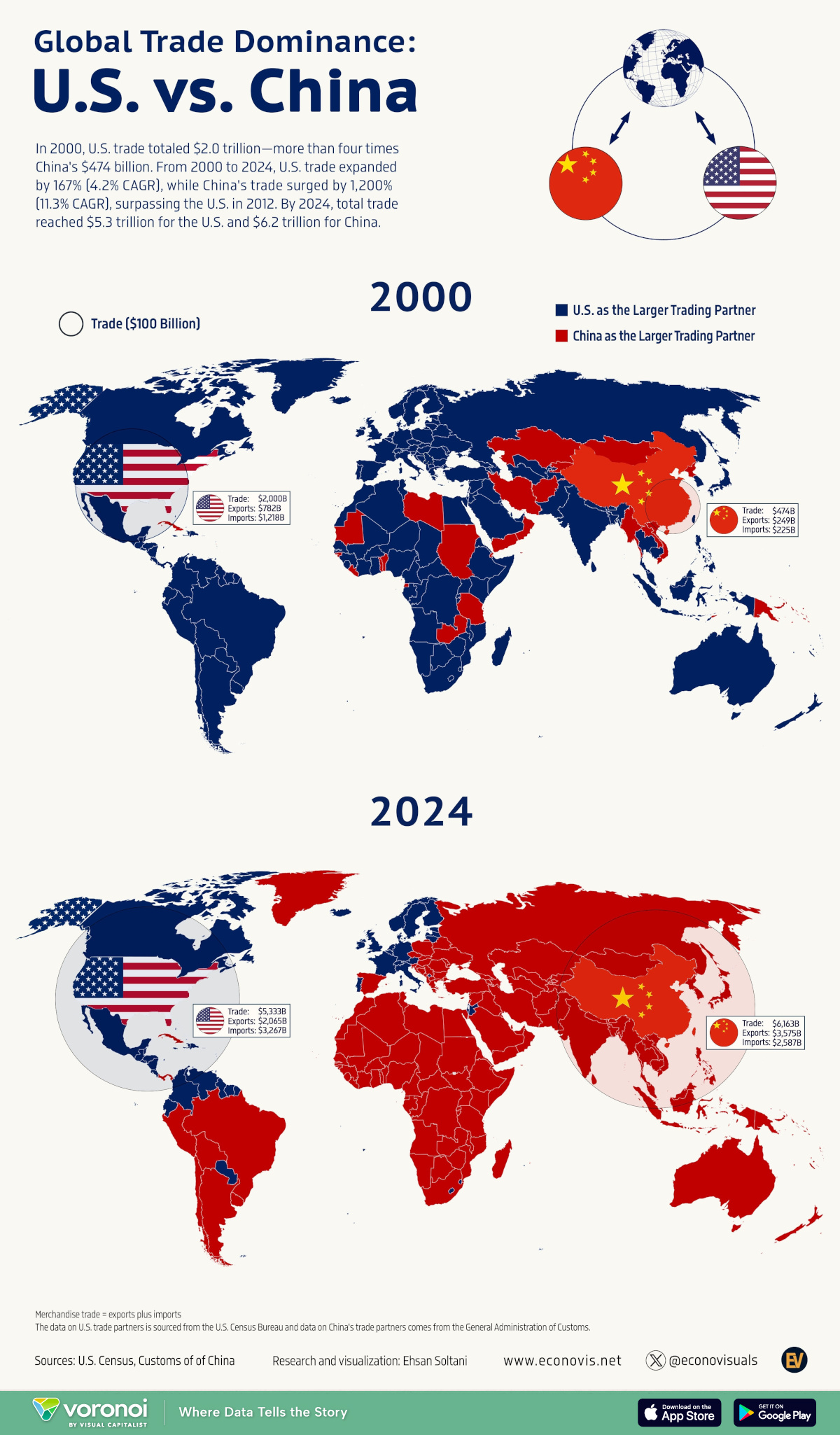

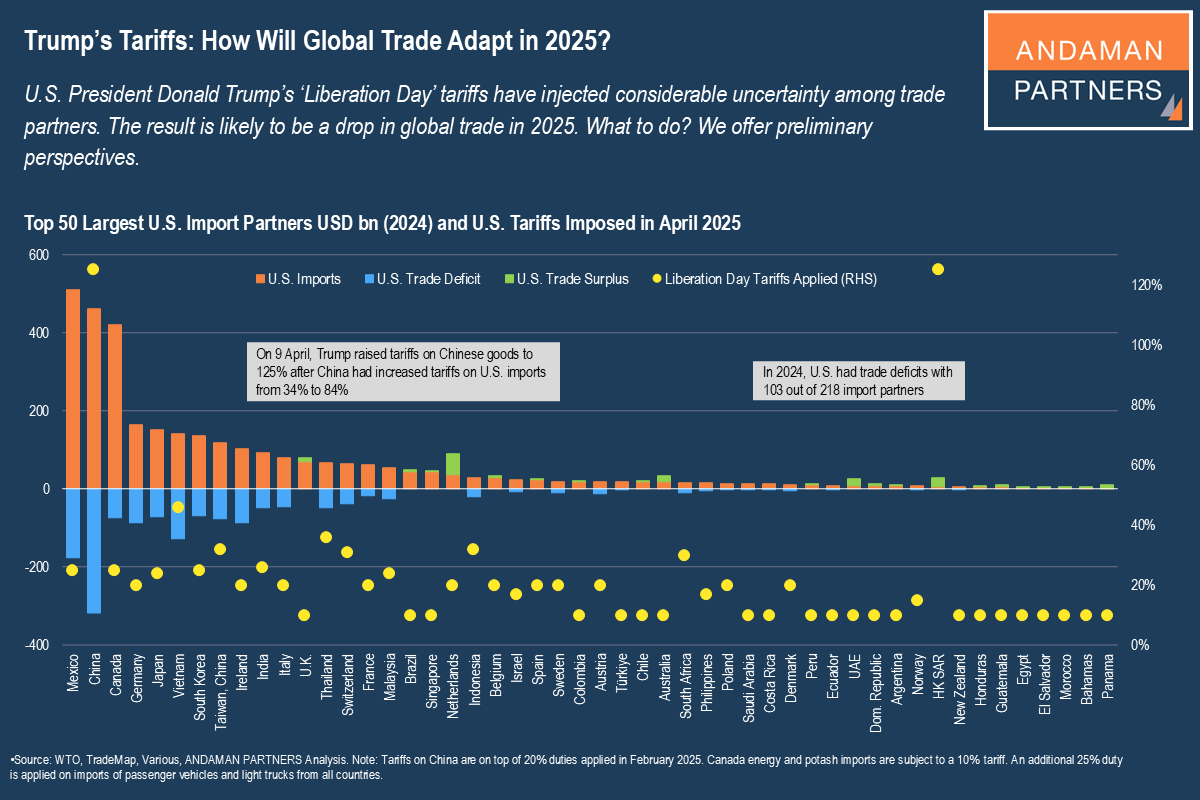

Tariffs are making headlines. Every news cycle brings fresh warnings about trade wars, retaliatory duties, and the economic damage spreading across continents. But here's the thing: most countries are still fighting like it's 1895, not 2025.

Right now, world leaders are debating tit-for-tat tariffs. You know the playbook. Country A imposes tariffs on Country B. Country B retaliates with tariffs on Country A. Both sides escalate. Consumers suffer. Politicians face public anger. Nothing really changes except the price tags.

But what if there's a smarter way?

The real story nobody's talking about involves something called anticircumvention laws. These are pieces of legislation that make it illegal—sometimes a felony—to modify devices and services without the manufacturer's permission. Think of them as digital locks. And for the past two decades, the US Trade Representative has been pressuring countries worldwide to adopt these laws, turning them into a prerequisite for accessing American markets.

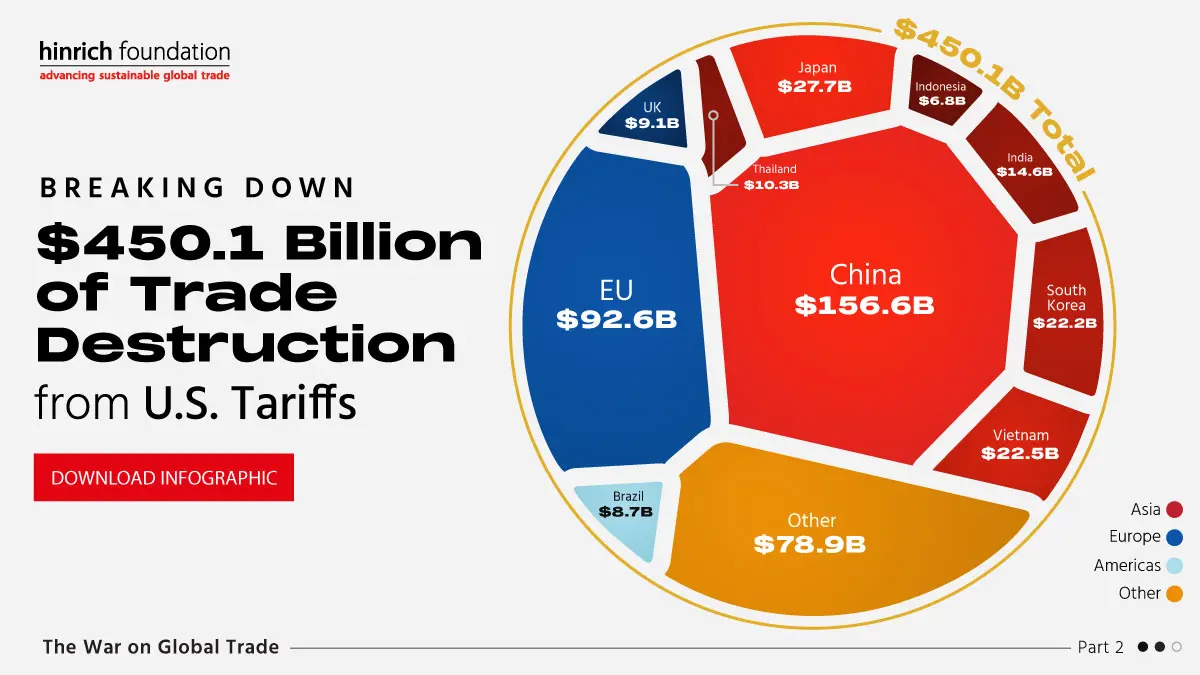

Here's where it gets interesting. These digital locks generate hundreds of billions of dollars in annual rent for US technology companies. Apple's walled ecosystem, Google's tracking systems, Amazon's proprietary file formats, Tesla's subscription services, and John Deere's repair monopolies all rely on anticircumvention laws protecting the digital walls.

In 2025 and beyond, countries facing American tariffs have discovered something radical: they could simply repeal these laws. Not through a violent revolution. Not through military action. Just by changing the rules for their own digital marketplaces. The result would be cheaper goods for billions of people, a collapsed revenue stream for some of America's most profitable companies, and a geopolitical power shift the world hasn't seen in decades.

This isn't theory. It's happening right now, in real time, as countries grapple with what happens next in a trade war where the US has already walked away from the bargains it made in exchange for these laws in the first place.

The implications are staggering. And in this article, we're going to explore exactly how this trade shift works, why it matters, and which countries are positioned to capitalize on what could be a fundamental reshaping of global tech dominance.

TL; DR

- Anticircumvention laws protect digital locks created by US companies, generating hundreds of billions in annual rent through restricted access

- Countries facing tariffs can repeal these laws to undercut US tech dominance without traditional retaliatory tariffs

- First-mover advantage gives countries that legalize jailbreaking and unlocking access to massive consumer surplus and startup opportunities

- Tesla, Apple, Google, and Amazon are most vulnerable because their business models depend on digital lock revenue

- The geopolitical shift could rival the mobile phone revolution, creating new tech powerhouses outside the traditional US-dominated ecosystem

Digital locks generate an estimated $300-500 billion annually, with smartphones, automobiles, and agriculture being the largest contributors. Estimated data.

The Anatomy of Digital Locks: How $300+ Billion in Annual Rent Was Built

Let's start with a concrete example, because understanding how digital locks actually work is essential to understanding why repealing them would shake the entire global economy.

You buy a Tesla. When something breaks—let's say your car's air suspension system—you take it to an independent mechanic instead of the Tesla service center. That mechanic needs to read the diagnostic codes. But Tesla has encrypted those error messages with digital locks. The mechanic can't legally access them without Tesla's permission. So you're forced to go to Tesla. You pay Tesla's prices. Tesla extracts rent.

This isn't accidental. It's by design.

The same pattern repeats across every major American tech company. You buy an iPhone. You want to install a third-party app store. Illegal without jailbreaking. You own a Kindle. You want to convert it to a format that works on other devices. Digital locks prevent it. You use an Android phone. You want to block Google's tracking. The encryption designed into the system makes it difficult without specialized tools.

These digital locks generate what economists call "rents"—money extracted not from providing additional value, but from controlling access. When you can't buy a competing product or service without permission, the company controlling the lock has monopoly power. It can charge what it wants.

According to industry analysis, US companies extract between

Here's how this became a global trade issue. Over the past two decades, the Office of the US Trade Representative began including anticircumvention provisions in trade agreements. The message was simple: if you want tariff-free access to American markets, you adopt these laws too. Most countries complied. The European Union adopted Article 6 of the Copyright Directive in 2001. Canada and Mexico had it built into NAFTA and later the USMCA. Dozens of other countries followed.

In exchange for adopting anticircumvention laws, countries got access to US markets and the promise of stable trading relationships. But that promise has been broken. The US has imposed tariffs on allies. Trade agreements have been renegotiated or abandoned entirely.

So the deal is dead. The countries that adopted these laws no longer have the bargaining chip they thought they had. And that's when the real revolution becomes possible.

Estimated data suggests that repealing anticircumvention laws could lead to significant consumer savings across various sectors, totaling over $62 billion annually.

Why Tariffs Are Yesterday's Weapon: The Case for 21st-Century Trade Strategy

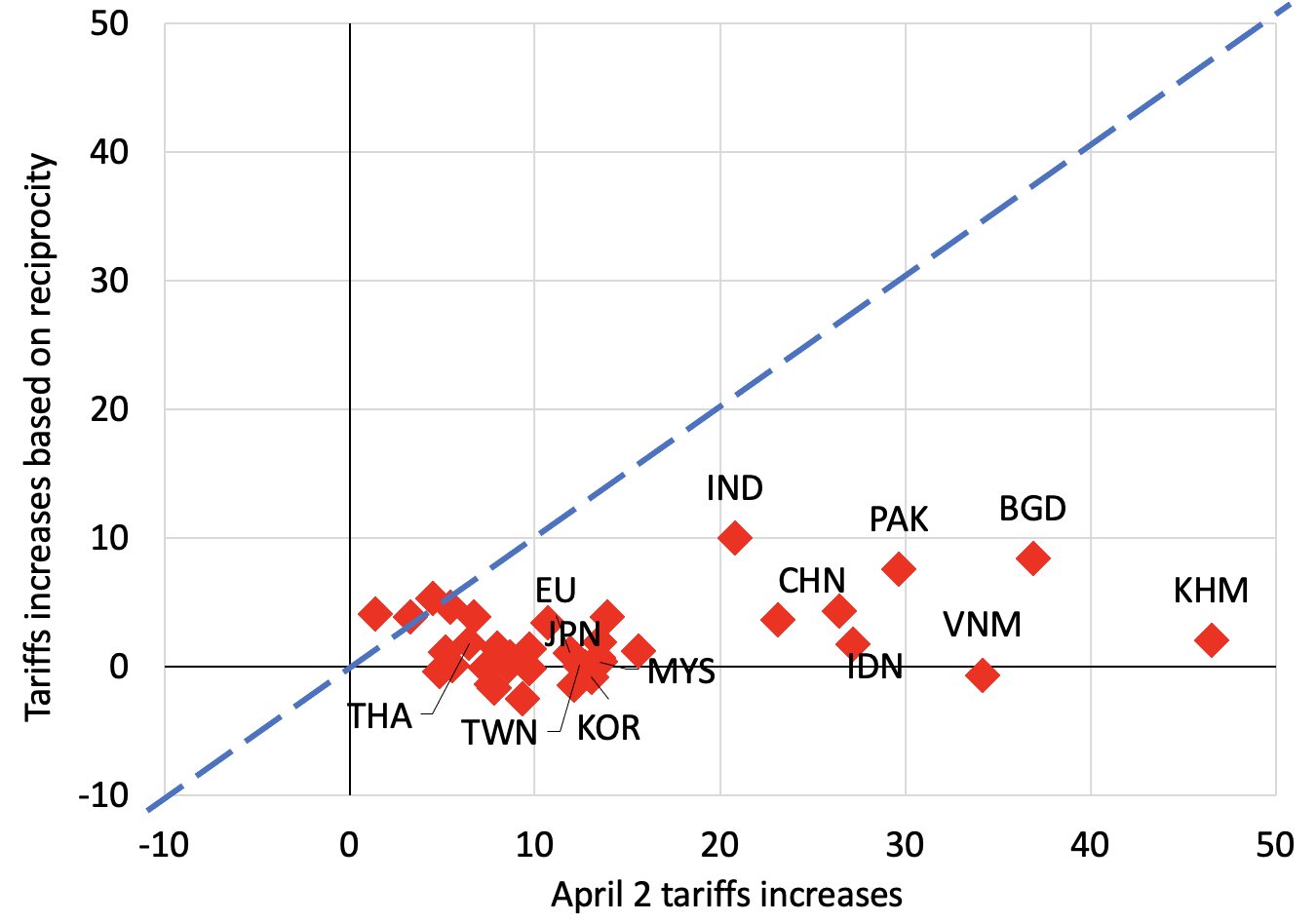

Retaliatory tariffs feel right. When someone punches you, you punch back. But economists have known for decades that tariffs are a terrible tool for actually winning trade wars. They hurt your own consumers more than they hurt your opponent's companies.

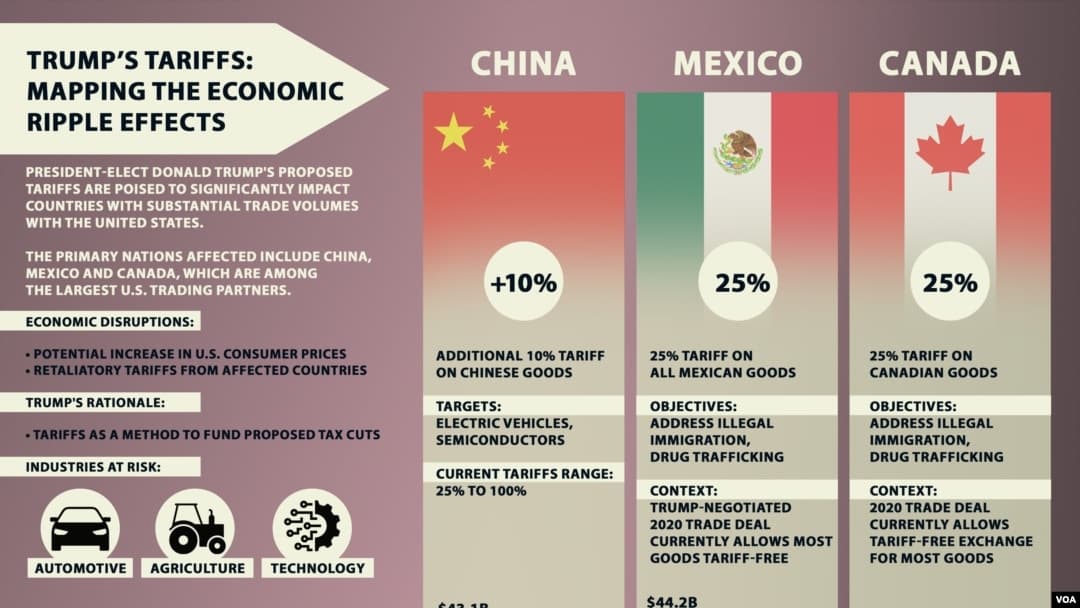

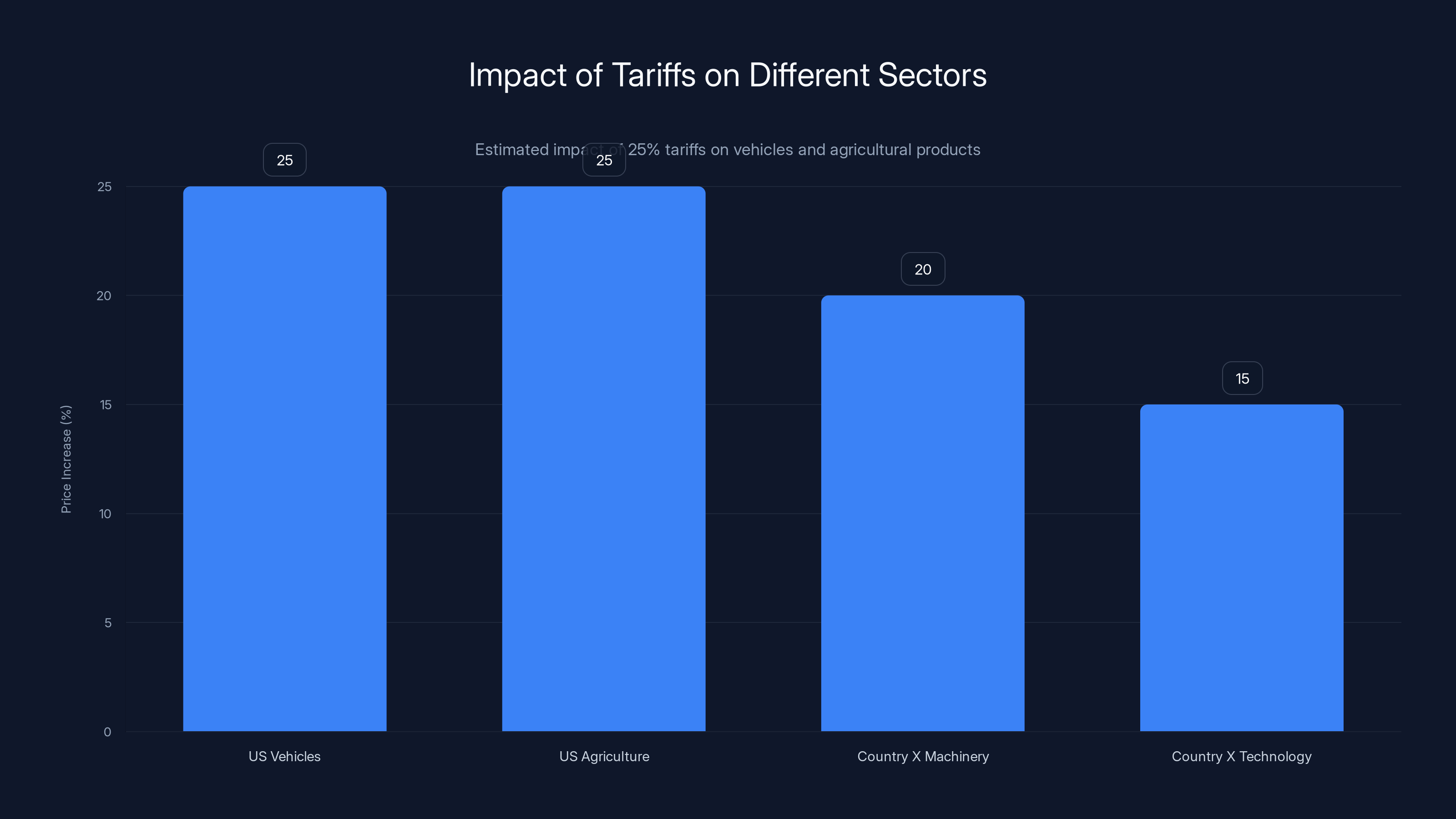

Let's do the math. The US imposes a 25% tariff on vehicles from Country X. Country X retaliates with a 25% tariff on agricultural products from the US. Both sides claim victory. But what actually happened?

American farmers watch their soybean exports collapse. Farmers lose income. Their rural communities lose economic activity. Meanwhile, American consumers buying cars pay 25% more. That's a direct tax on everyone. Over the past few years, Americans have experienced inflation in goods due to tariffs. Prices went up. Voters got angry. Politicians who presided over rising prices got voted out.

And this isn't speculation. This is empirical fact supported by decades of economic research. A tariff is a consumption tax. You're paying it every time you buy something.

Now look at what Country X's leaders face. They passed retaliatory tariffs to show strength. Their voters approved initially. But within months, the price of imported American goods—everything from machinery to technology to agricultural inputs—went up. Their own consumers suffered. Their own businesses struggled to compete internationally because their input costs rose. The political pressure builds. The government becomes unpopular.

Tit-for-tat tariff wars are essentially fights over who can inflict more economic pain on their own citizens. The country that can absorb higher consumer prices without facing political consequences wins. And that's usually the country with the largest internal market, which is usually the US.

But there's another way. And it doesn't involve tariffs at all.

Imagine instead that Country X simply repealed its anticircumvention law. Suddenly, it's legal for companies in Country X to manufacture jailbreaking tools. It's legal to unlock phones. It's legal to convert e-book formats. It's legal to disable telemetry on software. It's legal to repair electronics without manufacturer permission.

What happens next?

Small companies in Country X start offering services that Apple, Google, and Tesla can't legally offer in the US (or can only offer after years of legal battles). A startup develops a competing app store. Another develops a service that unlocks Kindle books to work on multiple devices. A third creates third-party Tesla diagnostic tools that mechanics can legally use.

These startups grow fast. They're solving problems that millions of people have. Because the digital locks are gone, they can do it freely. They hire more workers. They expand internationally. They become legitimate competitors to American tech giants.

Meanwhile, what's the impact on American companies? Tesla can't legally enforce its subscription model in Country X anymore. Apple's walled ecosystem becomes less profitable there. Google's tracking advantage disappears. John Deere can't prevent third-party repairs.

But here's the crucial part: consumers win. The entire world wins. Someone in the US can buy gray-market jailbreaking tools from Country X's companies and use them legally in a gray area. The world gets cheaper technology. The world gets more competition. The world gets innovation that American gatekeepers had been suppressing.

And Country X's leaders can stand in front of voters and say: "Instead of a tariff war that hurts everyone, we changed the rules. Now our economy is growing. New tech companies are launching. Consumer prices are dropping. And we did it without a single trade war."

That's a political win. That's an economic win. That's actually solving the problem instead of punishing your own citizens.

The Countries Positioned to Make the First Move

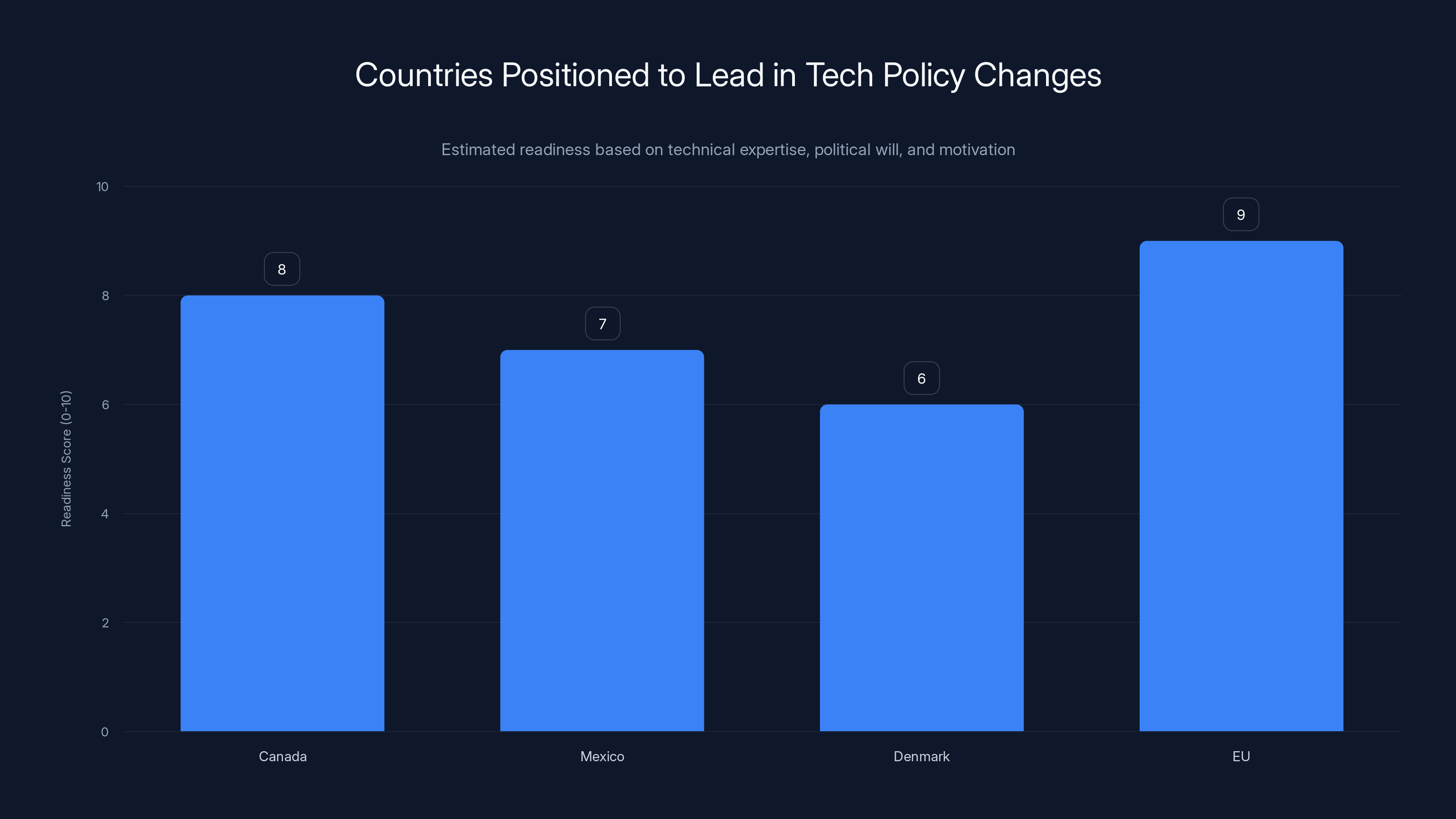

So which countries are actually positioned to do this? Which have the technical expertise, the political will, and the geopolitical motivation?

Canada and Mexico: The Obvious Targets

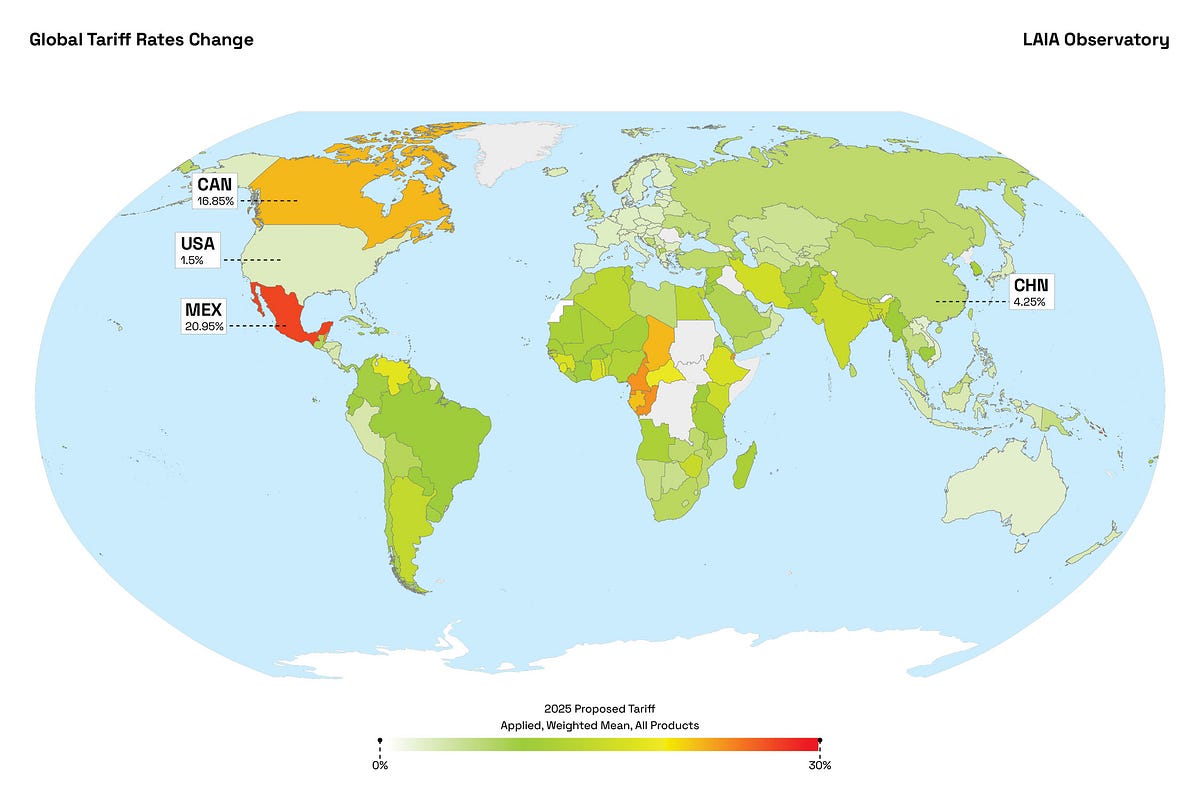

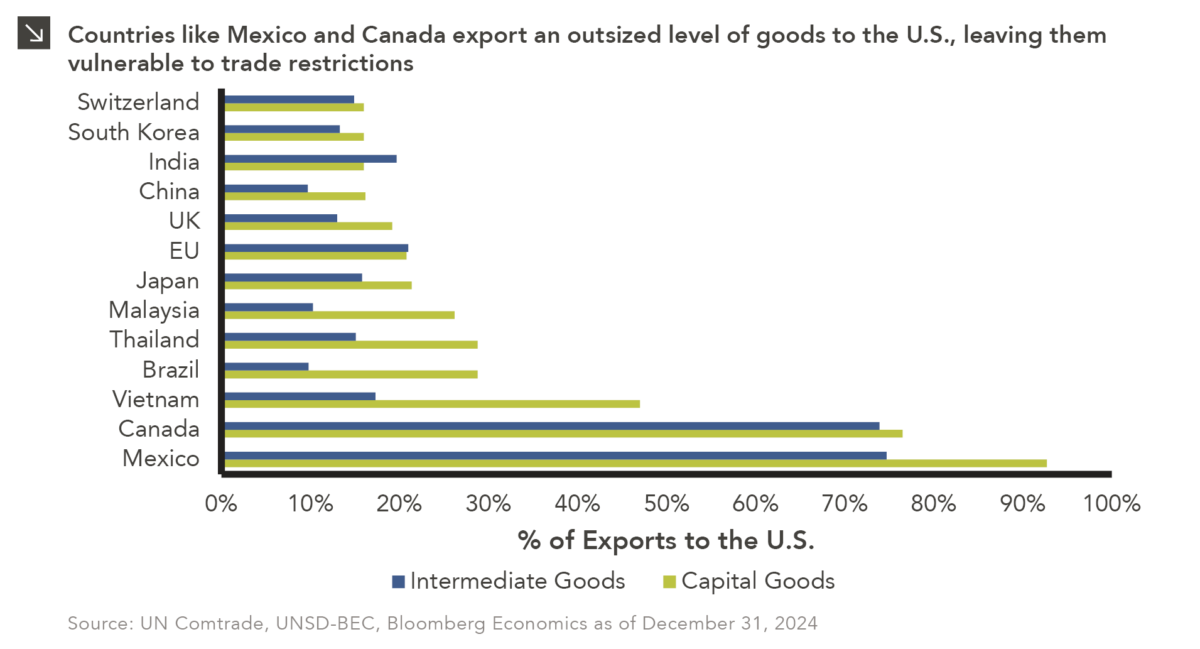

Canada and Mexico have gotten the rawest deal. They were pressured into the USMCA in 2020. The Trump administration extracted promises, tariff reductions, and labor provisions. In exchange, they got tariff-free access to American markets.

Then Trump reneged on the entire agreement. He's threatened tariffs on Canada and Mexico repeatedly. The political rhetoric has been hostile. Mexico especially has faced racist language and even annexation rhetoric.

These countries have legitimate grievances. And they have the technical capacity to pull off a repeal of anticircumvention laws. Canada's tech sector is sophisticated. Mexico's manufacturing base is world-class. Both countries have the engineering talent to build jailbreaking tools, third-party services, and competitive technology solutions.

Canada's already shown willingness to be bold on tech policy. It's been more aggressive with data privacy regulation than the US. A repeal of anticircumvention laws would be a natural extension of that approach.

For Mexico, the stakes are even higher. A technological breakthrough could transform the country's economy. Right now, Mexico's known for manufacturing and agriculture. But tech entrepreneurship is rising. A legal environment that permits circumventing digital locks could attract startups, venture capital, and talent from across Latin America and beyond.

The Nordic Route: Denmark and the EU

Denmark and other Nordic countries are in a unique position. They're wealthy. They have high technical expertise. They have strong rule-of-law traditions that make them trustworthy to consumers and businesses. And they've already shown skepticism toward some American tech dominance.

But more importantly, the EU as a whole is frustrated. The bloc agreed to Article 6 of the Copyright Directive in 2001, primarily under pressure from the US Trade Representative. The provision made it illegal to circumvent copy protection across Europe. In exchange, Europe got access to American markets and the promise of fair treatment.

That promise has been broken repeatedly. Tariffs have been imposed. American companies have been given special treatment. And Europe has watched its own tech sector lag while Silicon Valley companies extracted rents from European consumers.

A single European country—Denmark could lead the charge—could repeal anticircumvention laws and face no legal consequences under EU law (the directive doesn't require enforcement, just adoption in principle). This would create a safe harbor for jailbreaking, circumvention tools, and competitive services. Startups across Europe could base operations there. The entire EU would benefit from cheaper technology and new competitors to American tech giants.

Denmark's already got the credibility and the tech sector to make it work.

The Global South: Brazil, Nigeria, Costa Rica, and the Rest

Here's where it gets really interesting. The global south has been getting hammered by trade policies that favor wealthy countries. Countries like Brazil, Nigeria, India, and Costa Rica have large, young populations. They have growing tech sectors. They have legitimate grievances about trade deals that benefit the US and Europe.

Costa Rica especially has leverage. It's a small country that punches above its weight on technology. It's got a thriving startup ecosystem. It was a beneficiary of CAFTA (the Central American Free Trade Agreement), which it now sees as exploitative. Repealing anticircumvention laws would be a natural response.

Brazil is even more intriguing. It's a continental-scale economy with massive consumer demand. Repealing anticircumvention laws could transform Brazil into the center of tech innovation for the entire Latin American region. Instead of Brazilian companies building services for Brazil, they could build for 500 million+ people across South America.

Nigeria and other African tech hubs have even more upside. Africa's got the youngest population on Earth. Mobile phones are the primary computing device. Removing digital lock restrictions could unleash innovation in fintech, agricultural technology, and consumer services designed specifically for African needs—not designed in California and imposed on Africa.

Estimated data shows that tariffs lead to significant price increases across sectors, affecting both consumers and producers negatively.

Which American Companies Are Most Vulnerable?

Not all American companies are equally vulnerable to a repeal of anticircumvention laws. Some have built sustainable advantages that don't depend on digital locks. Others have built entire business models on lock-based rent extraction.

Tesla: The Most Vulnerable

Tesla might be the most vulnerable American company on the planet. And that's not hyperbole.

Tesla's business model is built on recurring revenue from software subscriptions and over-the-air updates. Want to unlock your car's full performance? Pay Tesla monthly. Want certain features? Pay Tesla. Want to keep features when you sell the car? Tough luck. They're locked to the owner.

This subscription model works because digital locks make it impossible for third parties to unlock features or create alternatives. Tesla mechanics can't legally disable Tesla's telemetry systems. Car buyers can't legally transfer features across ownership transfers.

If a country legalizes jailbreaking, that entire business model collapses overnight. Suddenly, a mechanic in Brazil can unlock every Tesla feature for one-time fee. Car buyers can modify their own vehicles. Competition emerges. Tesla's pricing power evaporates.

And here's the kicker: Elon Musk used Tesla's overvalued stock as collateral for loans to buy Twitter and fund his political ambitions. If Tesla's valuation collapses because its subscription revenue model gets undermined, those loans could be called in. The collateral wouldn't be worth what Musk thought it was.

That's why Musk's been so aggressive in politics. He's protecting the digital lock infrastructure that keeps Tesla's business model intact.

Apple: Vulnerable but Defensible

Apple's ecosystem is incredibly profitable because of digital locks. The App Store generates tens of billions in annual revenue. The walled garden around iOS keeps competitors out. The inability to sideload apps means Apple controls everything that happens on the device.

But Apple has something Tesla doesn't: a brand so strong that many customers actually prefer the walled garden. They like that Apple controls quality. They like the integration. They like knowing that apps have been vetted.

Still, repealing anticircumvention laws in major markets would create significant pressure. Users could install competing app stores. Apple's pricing power would decline. The company's margins might compress.

Apple's probably got 3-5 years before this becomes critical. Because once jailbreaking tools are legally available and easy to use, they'll spread. Network effects kick in. Suddenly, having an alternative app store isn't weird—it's normal.

Google: Tracking and Advertising at Risk

Google's entire business model depends on tracking users across the web and devices. Digital locks that encrypt this tracking and make it difficult to block are essential. If users can legally install ad blockers and tracking blockers that Google can't prevent, Google's advertising model becomes much less valuable.

But Google's also more diversified than Tesla. It's got YouTube, cloud services, enterprise software. The company could survive and thrive even if its core advertising model got disrupted.

The real vulnerability is timing. If a major market repeals anticircumvention laws and tracking blockers become mainstream, Google's incentives to develop privacy-friendly alternatives increase dramatically. That's good for users but bad for Google's margins.

Amazon: E-Books and Ecosystem Risks

Amazon's Kindle business depends on keeping e-books locked to the Kindle ecosystem. Want to read your Kindle book on another device? Tough luck. That lock gives Amazon pricing power and customer lock-in.

But the Kindle market is already declining as reading shifts to apps and tablets. Repealing anticircumvention laws probably wouldn't hurt Amazon as much as it would hurt the other tech giants. Amazon's already diversified into cloud, advertising, and retail.

The real risk for Amazon is ecosystem creep. If anticircumvention laws disappear in major markets, customers could move their e-book libraries to competing platforms. That's one less reason to use Amazon's ecosystem.

John Deere and Automotive Repair Monopolies

John Deere has famously fought right-to-repair activists who want to fix their own tractors. The company encrypts error messages and uses digital locks to prevent aftermarket repairs.

This has created massive resentment in farming communities. Farmers have hacked their own equipment. They've bought used parts from competitors and swapped firmware. They've hired independent mechanics to work around John Deere's locks.

If a country repeals anticircumvention laws, John Deere loses all its legal leverage. Independent mechanics can operate freely. Farmers can fix their own equipment. The entire business model of charging premium prices for repairs collapses.

The same applies to other automotive manufacturers who use digital locks to prevent third-party diagnostics and repairs.

The Economic Cascade: What Happens When Digital Locks Disappear

Let's think through the actual economic cascade that would happen if a major country repealed anticircumvention laws.

Month 1-3: Legal and Technical Foundation

The country passes legislation repealing anticircumvention laws. Tech entrepreneurs immediately start building tools. Jailbreaking services launch. App store alternatives are developed. Repair tools for locked devices become legal.

Initially, adoption is slow. People don't know these tools exist. The legal status is still uncertain in other countries. But the foundation is laid.

Month 4-8: First Wave of Startups

Venture capital from around the world floods in. Founders realize they can build competitive services that were previously illegal. A company develops an unlocked operating system for phones. Another builds a competing app store. A third creates a subscription service that unlocks Tesla features.

These startups are scrappy. They're learning. They're hiring talented engineers who see an opportunity to compete with giants.

Meanwhile, American companies realize the threat is real. They consider leaving the market or dramatically dropping prices. Some choose to leave. Others stay and compete, which means lower prices for consumers.

Month 8-18: Regional Expansion

The successful startups begin expanding to neighboring countries and regions. Other governments, watching the success, consider following suit. Why not? If neighboring countries are getting the economic benefits and the lower consumer prices, why shouldn't we?

Network effects kick in. An app that works in one country where jailbreaking is legal now has users in five countries. A repair tool developed for one market now serves dozens.

International companies that had settled for serving markets with digital lock restrictions now have access to countries where they can operate freely. Some of these companies will be American competitors—but they'll also be Indian, Chinese, European, and Brazilian companies that can now compete globally.

Year 2+: Structural Shift

By year two, the market structure has shifted. New tech companies have achieved meaningful scale. They're hiring thousands of people. They're attracting venture capital that would have gone to Silicon Valley. They're being acquired by larger tech companies or going public.

Meanwhile, American companies have adapted. Some have dropped prices dramatically to compete. Others have repositioned around different value propositions. Tesla can't rely on subscription revenue anymore, so it focuses on manufacturing excellence and vehicle quality.

Consumers everywhere—including in the US through gray market channels—benefit from cheaper technology and more choice.

And here's the crucial part: the country that went first has a generational advantage. It's the hub for the new ecosystem. Talent migrates there. Capital locates there. The ecosystem attracts additional companies and entrepreneurs from around the world.

This is basically what happened with Nokia and Finland in the mobile phone industry. For a decade, Finland was the center of the mobile phone universe. Companies located there. Talent concentrated there. Capital flowed there. Then the ecosystem shifted, and other countries took leadership. But for a crucial moment, first-mover advantage created outsized benefits.

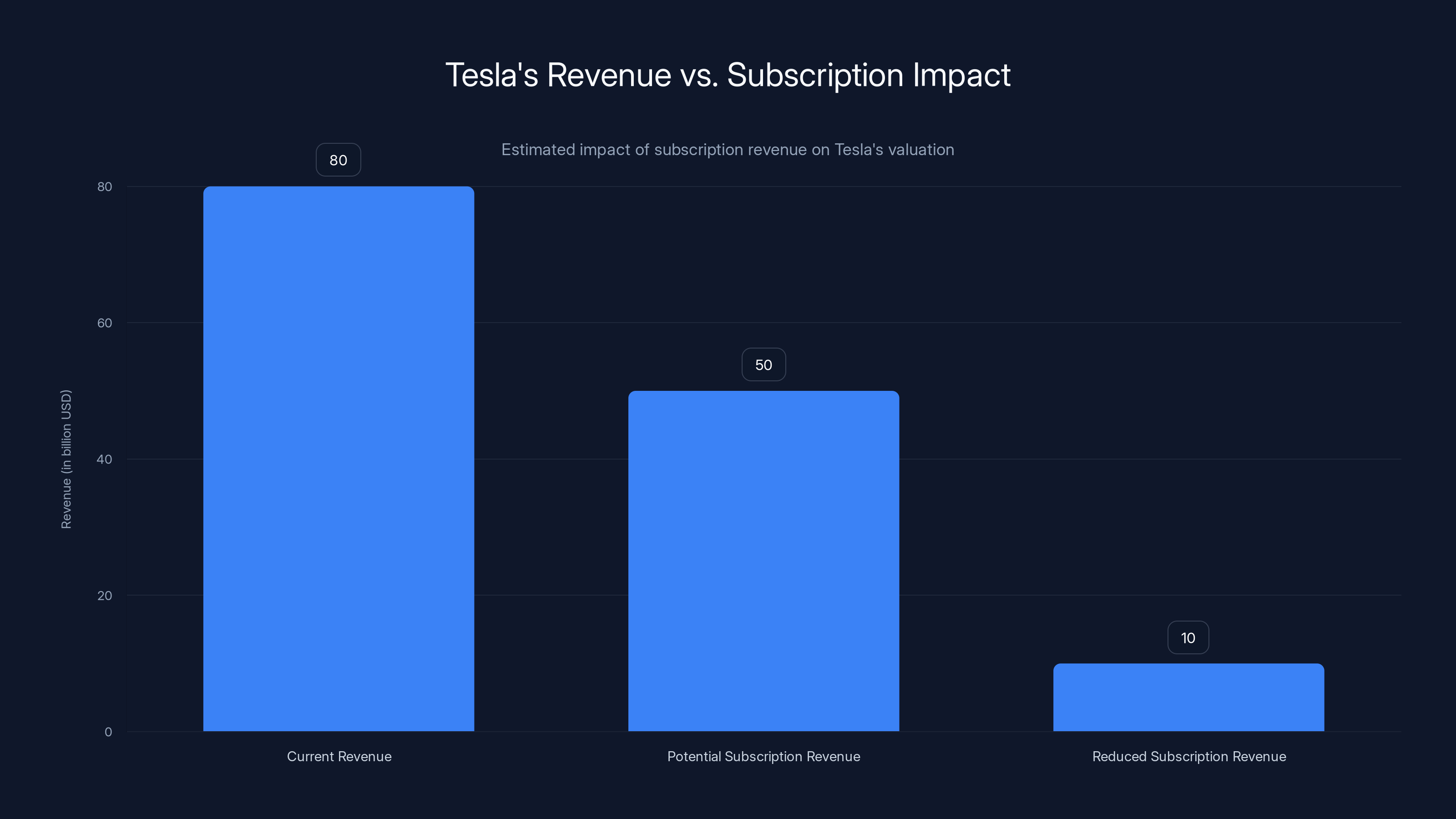

Tesla's valuation is heavily reliant on potential subscription revenue, estimated at

The Consumer Surplus: Making Technology Cheaper for Billions of People

Let's actually quantify what this means for consumers.

Right now, Apple charges $999 for an iPhone 16 Pro. Part of that price is justified—excellent engineering, quality materials, great software. But another part is pure digital lock rent. Apple can charge premium prices because it controls the entire ecosystem.

In a world where anticircumvention laws are repealed, what happens?

Competitors emerge offering unlocked phones with open app stores. They undercut Apple on price. Not because they have better technology, but because they don't need to extract as much rent. Apple's forced to respond by dropping prices or offering more value.

Let's say Apple's price drops from

Now multiply that across Tesla (subscription features worth maybe

The total consumer surplus is genuinely hundreds of billions of dollars globally.

That money doesn't disappear. It gets spent elsewhere. Economic activity increases. Consumers have more disposable income. Innovation accelerates.

For developing countries, this is especially significant. A Brazilian farmer buying a John Deere tractor might currently spend

Over the lifetime of the tractor (10-15 years), that farmer saves $30,000-60,000. That money can be reinvested into the farm. The farmer becomes more competitive. Agricultural productivity increases.

Multiply that across millions of farmers, and you're talking about transformative economic impact.

Geopolitical Implications: Who Wins, Who Loses, and Why It Matters

Here's where the geopolitical dimension comes in. Repealing anticircumvention laws isn't just an economic move—it's a fundamental power play.

For 25 years, the US Trade Representative has used anticircumvention provisions as leverage. Countries that wanted access to US markets had to adopt these laws. It was a requirement in trade agreements. It was the price of admission to the global economy.

But that leverage only works if the US actually delivers on its promises. If the US imposes tariffs anyway, if it reneges on trade agreements, if it threatens allies with annex rhetoric, then the bargain is broken. Countries are no longer obligated to honor agreements that weren't honored.

That's the geopolitical moment we're in. And it's revolutionary.

Countries that used to accept American tech dominance as the price of trade access are now realizing they can reject that price. They can change their own rules. And they can do it without military conflict, without UN votes, without any of the traditional levers of geopolitical power.

It's a quiet revolution. It doesn't involve tanks or missiles. It involves legislation. It involves tech startups. It involves the recognition that the deal was never as durable as it seemed.

The countries that move first get the most advantage. But the real winner is the global economy. The real winner is the billions of people who get cheaper technology, more choice, and more competition.

And the real loser is the old order. American tech giants have enjoyed decades of protected rents. That's ending. It might not happen overnight, but it's ending.

Estimated data: The EU shows the highest readiness for tech policy changes, followed by Canada, Mexico, and Denmark. This reflects their technical expertise, political will, and geopolitical motivation.

Historical Precedent: The Nokia Era and What It Teaches Us

We've been here before. Not exactly, but close enough to learn from it.

In the early 2000s, Nokia dominated mobile phones. The company had 40% of the global market. It was Finnish. It was the undisputed leader. Samsung and Motorola were competitors, but they were trailing.

Then something shifted. The iPhone arrived. Touchscreen technology became standard. The ecosystem shifted from hardware-dominated to software-dominated. Android emerged as an open alternative to the closed iPhone ecosystem.

Within five years, Nokia's market share had collapsed. By 2013, Microsoft bought the Nokia mobile division and ultimately wrote it down to essentially zero value.

The lesson? Market leadership can evaporate with shocking speed when the underlying technology paradigm shifts.

What we're potentially seeing with anticircumvention law repeal is a similar paradigm shift. For 25 years, American tech companies have dominated because they controlled the locks. That was the competitive advantage.

But if countries repeal anticircumvention laws, the lock advantage disappears. Suddenly, any company in any country can compete on merit. The best product wins, not the one with the strongest locks.

That's terrifying for companies like Tesla and Apple. And it's exciting for startups and countries that see an opportunity.

The difference from Nokia is that this shift is driven by policy, not technology. Which means it's actually more controllable. American companies could try to lobby governments to keep anticircumvention laws. They probably will. But they're fighting against economic incentives, consumer preferences, and geopolitical reality. The lobbying might slow the change, but probably not stop it.

The Tesla Case Study: Why Digital Locks Are Existential

Let's focus on Tesla as a case study because it's the clearest example of a company whose entire existence depends on digital locks.

Tesla's revenue is somewhere around

Investors are betting on future profitability. But Tesla's not actually that profitable right now. The real bet is on the subscription revenue model. Investors believe that as Tesla's car fleet grows, recurring subscription revenue will eventually be massive—maybe $50 billion+ annually.

That bet only makes sense if Tesla can lock customers into its ecosystem. If a customer has to pay Tesla every month to unlock premium features, Tesla extracts that rent. The business model is fundamentally based on lock-in.

Now imagine a country repeals anticircumvention laws. Suddenly, a startup develops a tool that permanently unlocks all Tesla features for

Tesla's subscription revenue evaporates. Instead of

Tesla's valuation rests on this subscription revenue assumption. If it evaporates, the valuation drops. And Elon Musk—who owns about 13% of Tesla stock and has used that stock as collateral for various loans and purchases—suddenly faces margin calls.

This is probably why Musk has been so politically aggressive. Protecting digital lock laws isn't a side project. It's existential to his wealth and power.

For countries considering repeal, that's actually good news. It means the economic disruption to a major American company is significant—which means the benefit to consumers and alternative companies is also significant.

Tesla is highly vulnerable to anticircumvention law repeal due to its reliance on digital locks for recurring revenue. Apple is also vulnerable but has a more defensible position. (Estimated data)

Canada's Position: The Obvious First Move

Of all the countries we've discussed, Canada might be the most likely to move first. And it might be the most consequential.

Canada shares a border with the US. It's fully integrated into North American supply chains. It's got sophisticated technology companies and a highly educated workforce. It's recently been treated poorly by the Trump administration on trade.

Canada also has precedent for being bold on technology policy. It's adopted strong data privacy laws. It's been willing to regulate tech companies. It's got a strong rule-of-law framework that would make any change credible.

If Canada repealed anticircumvention laws tomorrow, what would happen?

Immediately, tech entrepreneurs from around the world would relocate to Canada. Venture capital would follow. Companies building competing services to Apple, Google, and Tesla would base themselves there. They'd have access to the entire North American market for their services (and beyond, for gray market sales).

Canadian consumers would benefit from cheaper technology almost immediately. Tech startups would create hundreds of thousands of jobs. The Canadian tech sector would experience a growth spurt.

America would respond with diplomatic pressure. Maybe threats. Maybe actual tariffs (which would further justify Canada's decision). But the economic logic would be hard to reverse. Once the ecosystem started forming, inertia would keep it growing.

Within 5-10 years, Canada could become the center of alternative tech innovation in the Western hemisphere. That's a generational economic opportunity.

So watch Canada. And watch whether Canada's political leadership is bold enough to grab this opportunity.

The EU's Complexity: Coordination and Fragmentation

The European Union is more complex because it's a bloc with 27 countries. Any one country could repeal anticircumvention laws unilaterally. But the EU also has a digital rights framework that complicates things.

The Copyright Directive's Article 6 doesn't technically require enforcement—it just requires member states to adopt legislation protecting technological measures. But there's certainly legal and political friction around circumventing it.

Still, a single country like Denmark or Poland could repeal its anticircumvention law. There's no mechanism to stop them. And once one country does it, pressure builds on others.

The EU could actually benefit from this more than any other bloc because it's diverse. If one country creates the jailbreaking ecosystem, others can build services on top of it. Talent flows across EU borders more freely than across US borders. Capital finds the best opportunities.

Within 10 years, a decentralized European tech ecosystem could actually rival Silicon Valley—not because Europe has better technology, but because the constraints are different. The digital locks are gone. The competition is real. Innovation accelerates.

India's Hidden Advantage: The Mobile-First Economy

India hasn't been discussed much in this context, but it's got hidden advantages most people don't consider.

India has 1.4 billion people. It has a massive mobile-first economy where smartphones are the primary computing device. It has significant tech talent and a growing startup ecosystem. And it's been frustrated by American tech dominance and digital lock constraints.

If India repealed anticircumvention laws—or perhaps more specifically, passed legislation allowing software circumvention for innovation purposes—it could unleash a wave of entrepreneurship.

Startups building services specifically for Indian consumers, without artificial lock constraints, could achieve scale at a speed impossible in the current environment. A competitor to Google's mobile services built specifically for Indian users might capture massive market share from Google in India specifically, then expand globally.

India's advantage is its market size and its pool of talented engineers who understand both the global market and local needs. A repeal could transform India into a serious competitor to Silicon Valley.

Probable Timeline: When This Actually Happens

Let's be realistic about timing. Governments move slowly. There's lobbying. There's legal complexity. There's uncertainty about consequences.

But we're probably looking at this happening in waves:

2025-2026: First moves by smaller countries (Costa Rica, possibly Uruguay) or bold leaders (possibly Denmark or a Latin American country). These are signal moves—countries showing they're willing to take the risk.

2027-2029: Second wave. If the first moves work out economically, other countries follow. Canada or a major EU country might move in this window. Brazil might consider it seriously.

2030-2035: By this point, it's probably irreversible. Multiple major economies have repealed anticircumvention laws. The ecosystem is self-reinforcing. American companies have adapted or been disrupted.

2035+: Digital locks become a relic of the early 21st century. The whole system that took 25 years to build is dismantled in 10 years.

This timeline isn't inevitable. American companies will lobby hard. The US government might threaten retaliation. Some countries might not have the political will to move.

But the economic logic is strong. The geopolitical logic is strong. And there's a clear first-mover advantage. That combination usually produces change, even when change is resisted.

Why This Matters Beyond Economics

We've focused on the economic and tech dimensions. But there's a deeper significance.

For 25 years, the US has used trade policy to protect American tech companies. It's been remarkably effective. American companies have extracted hundreds of billions in rents from the rest of the world. American investors have gotten rich. American talent has concentrated in Silicon Valley.

This has been justified as promoting innovation. But much of the innovation incentive would exist without digital lock rents. The lock rents are mostly about extraction, not innovation.

If countries repeal anticircumvention laws, they're rejecting the idea that protecting American company monopolies is worth the cost. They're saying: we'd rather have competition and lower prices. We'd rather build our own tech sectors.

That's not just a trade policy change. It's a philosophical rejection of American exceptionalism in technology. It's a statement that other countries' innovations matter. That their startups can compete. That their consumers deserve cheaper products.

That's actually pretty radical. And it's probably why American companies and the US government will fight so hard against it.

But here's the thing: the fight is already over. The US has already broken the social contract by imposing tariffs and reneging on trade agreements. Countries are already done waiting for fair treatment.

The only question is who moves first. And when they do, everything changes.

FAQ

What exactly are anticircumvention laws and why were they created?

Anticircumvention laws make it illegal to bypass technological protection measures, even for purposes that would otherwise be legal—like repairing devices you own or converting file formats. They were created in the late 1990s (primarily through the Digital Millennium Copyright Act) to protect copyrighted content and intellectual property in the digital age. The US then pressured countries worldwide to adopt similar laws as part of trade agreements, making them a key requirement for accessing American markets.

How do digital locks generate hundreds of billions in revenue for US companies?

Digital locks create monopolistic control over repair, modification, and ecosystem access. When Apple locks an iPhone, it prevents third-party app stores, forcing users to buy apps through Apple's store where Apple takes 30% commission. When Tesla locks cars, it requires factory repairs and monthly subscriptions that competitors can't undercut. When John Deere locks tractors, it forces farmers to use expensive John Deere repairs instead of affordable independent mechanics. These locks aren't about security—they're about forcing consumers to pay premium prices. The collective rent extracted this way totals $300-500 billion annually across all American tech and industrial companies combined.

Why would repealing anticircumvention laws help countries win trade wars without tariffs?

Tariffs are consumption taxes that hurt your own consumers and create retaliatory cycles where everyone loses. Repealing anticircumvention laws is targeted and constructive—it opens your market to competition, which makes goods cheaper for consumers and creates opportunities for domestic startups to compete with American giants. Countries that do this become hubs for innovation because entrepreneurs can now legally build competing services. Consumers win through cheaper products and more choice. Startups win through new opportunities. And the country gains economic growth and tech sector development—all without tariffs that hurt ordinary people. As an added benefit, American consumers can purchase these cheaper services through gray markets, making the change beneficial globally.

Which countries are most likely to repeal anticircumvention laws first?

Canada and Mexico have the strongest motivation—they've been treated poorly by the Trump administration despite USMCA. They have sophisticated tech sectors and political precedent for bold tech policy. Denmark or another Nordic country could lead the EU because they have credibility and technical capacity. Brazil and Costa Rica have leverage as CAFTA beneficiaries whose agreement was broken. Nigeria and other African tech hubs could move because they have limited legacy digital lock dependence and young, tech-savvy populations. Most likely, a smaller country moves first as a signal (Costa Rica or Uruguay), creating political cover for larger countries to follow.

How vulnerable is Tesla to anticircumvention law repeal?

Tesla is possibly the most vulnerable American company to anticircumvention law repeal because its entire business model depends on digital locks. Tesla's valuation rests on projections that recurring subscription revenue (for software upgrades, premium features, and monthly services) will eventually be massive. If countries legalize jailbreaking, startups can offer permanent unlocks of all features for one-time fees, making Tesla's subscription model uncompetitive. Tesla's share price could collapse, which would trigger margin calls on CEO Elon Musk's collateralized loans. This is likely why Musk has become so politically aggressive—protecting digital lock infrastructure is existential to his wealth and power.

What would the consumer savings be if anticircumvention laws were repealed globally?

Consumer savings would be substantial. A

How would repealing anticircumvention laws actually help a country build a competitive tech sector?

Once anticircumvention laws are repealed in a country, that country becomes a legal safe harbor for jailbreaking tools, competing services, and open-source alternatives. Entrepreneurs immediately start building services that were previously illegal—competing app stores, repair tools, format conversion services, tracking blockers, and feature unlockers. Venture capital from around the world flows in because the opportunity is clear and the legal risk is gone. Startups scale rapidly because they're solving real problems that millions of people have. This attracts top talent, creates high-wage jobs, and builds network effects. Within 5-10 years, you could have a self-reinforcing tech ecosystem rivaling Silicon Valley, not because the technology is better but because the competitive constraints are different and innovation is real rather than lock-protected.

What would happen to Apple, Google, and other tech giants if anticircumvention laws were repealed in major markets?

These companies would face genuine competition for the first time in decades. Apple would see the iPhone's price pressure as alternatives emerge with competing app stores and open ecosystems. Google would lose tracking advantages as users can legally install ad blockers that Google can't prevent. Amazon's Kindle ecosystem would face competition from format-neutral e-reading alternatives. None of these companies would collapse, but their margins would compress and their market dominance would decline. Interestingly, they might become more profitable by competing on actual value rather than lock-in rents. Companies like Apple might discover that building excellent hardware and software actually generates more sustainable revenue than extracting lock-based rents. But their stock prices, which are currently inflated by lock-based rent assumptions, would decline substantially.

Has anything like this happened before in tech history?

Yes—the Nokia era provides a parallel. Nokia dominated mobile phones (40% global market share) through superior hardware and a proprietary ecosystem. When the paradigm shifted to software-driven phones and open ecosystems (iPhone, Android), Nokia's competitive advantage evaporated despite being the market leader. Nokia lost its position within five years. The difference is that current digital lock repeal is driven by policy change rather than technology change, which means it's more predictable and controllable. Countries are essentially choosing to shift the competitive paradigm to enable local competitors and reduce American tech dominance. The lesson from Nokia: market leadership built on lock-in is fragile and can evaporate with shocking speed.

Why would repealing anticircumvention laws make technology cheaper for Americans too?

Americans would benefit through gray market channels. If a company in Brazil develops a jailbreaking tool or competing service that's legal in Brazil, Americans could purchase it from Brazilian companies. While American companies might try to block these purchases, they can't prevent imports of information and software. Americans could also move to other countries temporarily to unlock their own devices. More importantly, the competition created by repeal in other markets would force American companies to drop prices to compete globally. If an alternative app store for iPhones is available globally, Apple has pressure to lower App Store fees even in the US. And if Tesla's subscription model is undercut in every other market, Tesla has pressure to adjust pricing everywhere. The competitive pressure spreads globally even if the legal repeal only happens in specific countries.

Conclusion: The Choice Between Yesterday's Weapons and Tomorrow's Opportunities

World leaders in 2025 and 2026 face a choice. They can respond to American tariffs with tariffs of their own. It's the traditional move. It feels powerful. It looks tough in front of voters.

Or they can be bold. They can recognize that the deal is dead, that the US has already broken its promises, and that fighting with 19th-century weapons in a 21st-century world is a losing strategy.

Repeal anticircumvention laws. Make jailbreaking legal. Let startups compete. Let consumers save money. Let your own tech sector grow.

It's not just economically rational. It's elegant. Instead of hurting your own consumers with tariffs, you're benefiting them with cheaper products and more choice. Instead of punishing American farmers with retaliatory tariffs, you're punishing American tech companies that actually deserve it because they've been extracting rents from the global economy.

The first country to move will look like a strategic genius in 10 years. The tech companies that locate there will become global leaders. The startups that launch there will rival Silicon Valley. The consumers that benefit will have cheaper, better technology.

And the American companies that built entire business models on digital lock rents? They'll finally face real competition. Their stock prices will decline. Their executives will be shocked. And most of them will actually become better companies because they'll have to innovate on merit rather than just protecting their locks.

This is coming. The geopolitical logic is irresistible. The economic logic is undeniable. The consumer benefit is obvious.

The only question is which country will be bold enough to move first. Watch that country. Because it's about to change the world.

That's not hyperbole. Repealing anticircumvention laws in major markets would be the most significant trade policy shift in 25 years. It would reshape global tech dominance. It would create hundreds of billions in consumer surplus. It would shift economic power away from the US and toward countries willing to break from American-imposed constraints.

When it happens—and it will happen—we'll look back at this moment as the inflection point. The moment when countries realized they had a better weapon than tariffs. The moment when the era of American tech dominance through legal lock-in came to an end.

Make no mistake: American tech giants will fight this with everything they have. Lobbying. Political pressure. Threats. Lawsuits. They'll argue it'll destroy innovation and IP protection. They'll argue about chaos and piracy and security.

But the arguments are weak because the economic reality is strong. Digital locks aren't necessary for innovation—they're just profitable for monopolies. And consumers deserve better than paying monopoly rents forever.

The countdown to the first repeal has probably already started. Some country's government is probably having these conversations right now. Some entrepreneur is probably laying the groundwork. Some venture capitalist is probably betting on the opportunity.

When the first domino falls, the others will follow quickly. And the world will never be the same.

Key Takeaways

- Anticircumvention laws generate $300-500 billion in annual rent for US tech companies by preventing circumvention of digital locks that enforce monopolistic pricing

- Countries facing tariffs have a better strategy than retaliatory tariffs: simply repeal anticircumvention laws to compete freely with American tech giants

- First-mover countries (Canada, Denmark, Brazil, Costa Rica) will become hubs for alternative tech ecosystems within 5-10 years, rivaling Silicon Valley

- Tesla is most vulnerable because its entire business model depends on digital lock subscription revenue; Apple, Google face margin compression but remain competitive

- Consumers would save $200-600 billion annually globally if anticircumvention laws were repealed, with developing nations seeing 30-50% reductions in locked equipment costs

- The shift from tariff wars to regulatory repositioning represents a 21st-century trade strategy that rewards countries with bold policy changes rather than punishing their own consumers

![How Global Trade Power Is Shifting: The Tariff War's Hidden Weapon [2025]](https://tryrunable.com/blog/how-global-trade-power-is-shifting-the-tariff-war-s-hidden-w/image-1-1766750898240.jpg)