The Scalper Problem That's Spiraling Out of Control

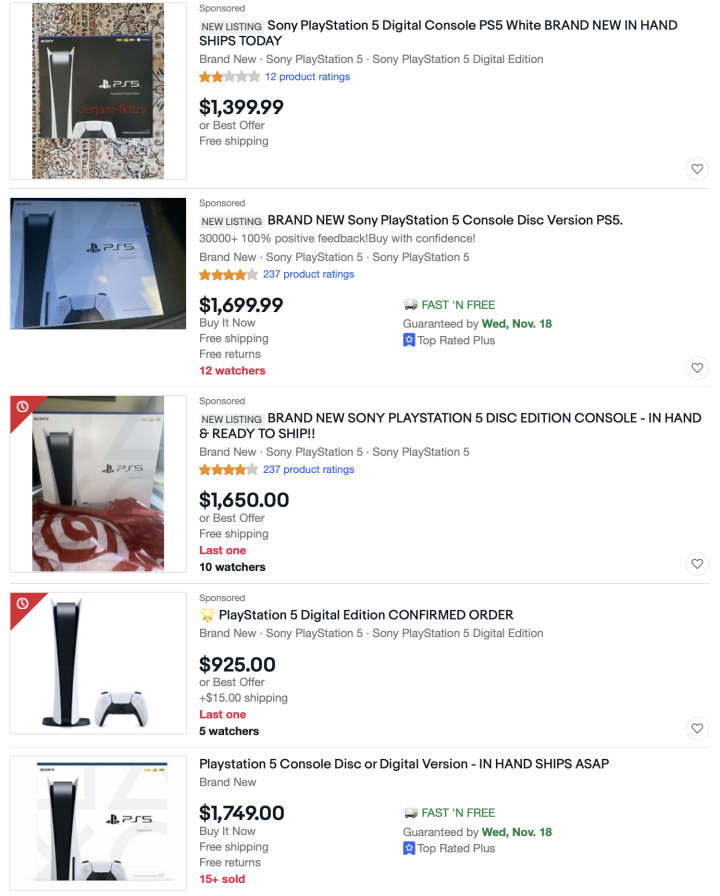

Scalping isn't just annoying anymore. It's become a full-blown internet epidemic that's fundamentally breaking how we buy things online. Last year, a PS5 that should've cost

This isn't just about missing out on stuff you want. Scalping is rotting the entire commerce ecosystem from the inside out. It's creating artificial scarcity, crushing consumer trust, and driving prices to absurd levels. And the worst part? The infrastructure that enables it keeps getting more sophisticated.

Here's what's happening: Scalpers use advanced bot networks, automated purchasing tools, and AI-powered strategies to beat legitimate buyers to limited inventory. They operate at industrial scale, sometimes running operations from overseas with minimal consequences. Retailers struggle to stop them. Law enforcement mostly ignores them. And consumers just keep getting frustrated.

But 2026 might be different. There's finally some momentum building around real solutions. New legislation is being proposed. Retailers are implementing smarter protections. Technology companies are developing detection systems that can actually work. It's not going to be a silver bullet, but there's real hope that we might finally turn this tide.

Why This Matters Right Now

Scalping affects way more than just gamers and sneakerheads. It's impacting everyday commerce. People can't get video game consoles for their kids at Christmas. Artists can't sell their own merchandise at their own shows because scalpers control the inventory. Vaccine appointments got scalped during the pandemic. The problem has metastasized.

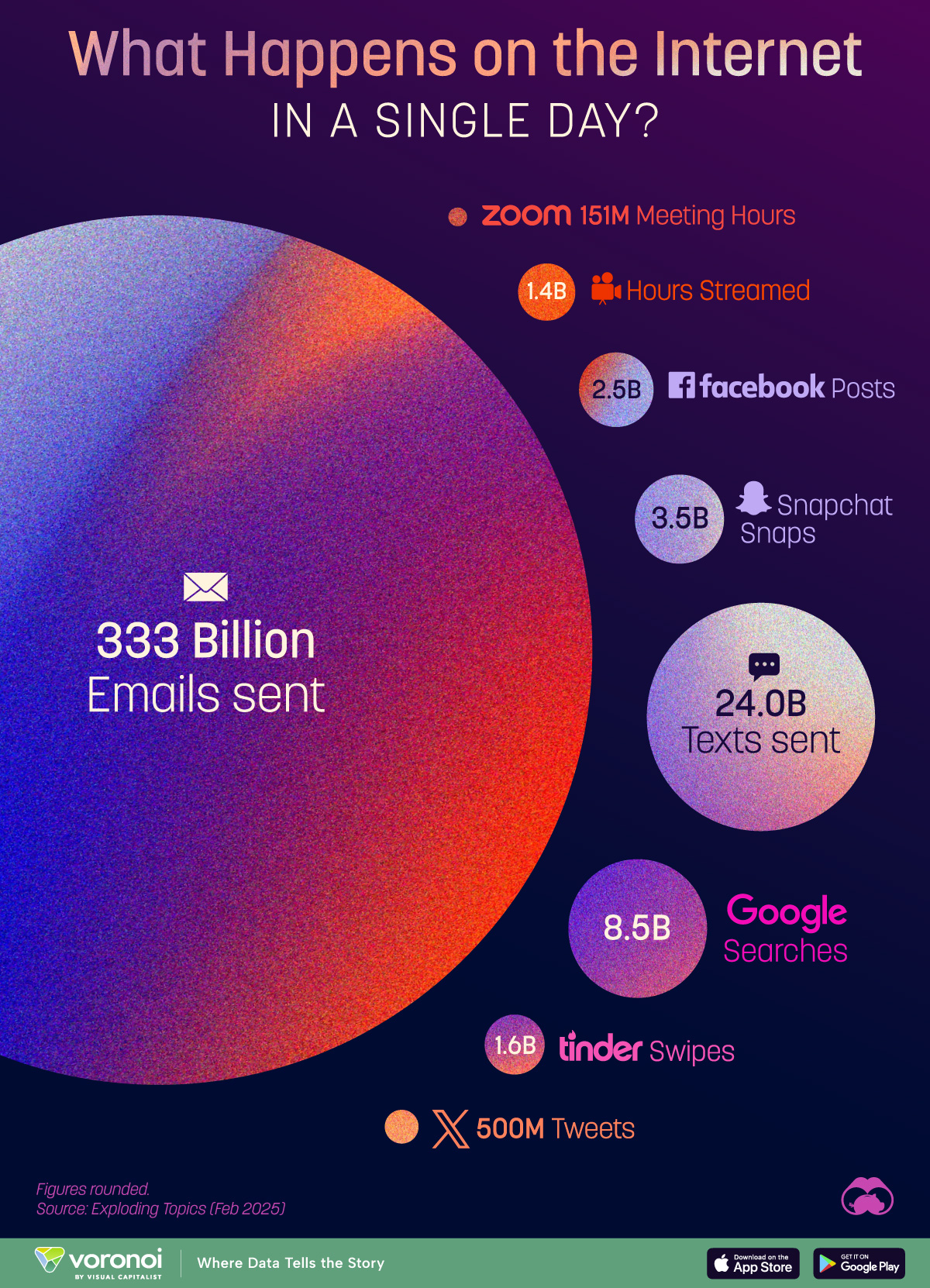

The economic impact is staggering. Estimates suggest the resale market for limited goods hit over $30 billion in 2024 alone. Most of that money is going directly to scalpers instead of staying in legitimate retail channels or flowing to original creators and artists. It's wealth extraction masquerading as commerce.

The Real Scale of the Problem

There's a reason people talk about scalpers like they're an existential threat. The numbers back it up. During major product launches, scalpers are now capturing anywhere from 30 to 80 percent of available inventory depending on the item and the retailer. That's not a niche problem. That's market manipulation.

Consumer frustration has reached critical levels. Surveys consistently show that over 75% of buyers have either been unable to purchase something they wanted due to scalpers or have paid significantly inflated prices because they felt they had no other option. People are giving up on trying to buy things legitimately.

How Scalpers Actually Work: The Technical Reality

If you think scalping is just people buying stuff and reselling it at a markup, you're vastly underestimating what you're up against. Modern scalping operations are sophisticated, coordinated, and increasingly powered by artificial intelligence.

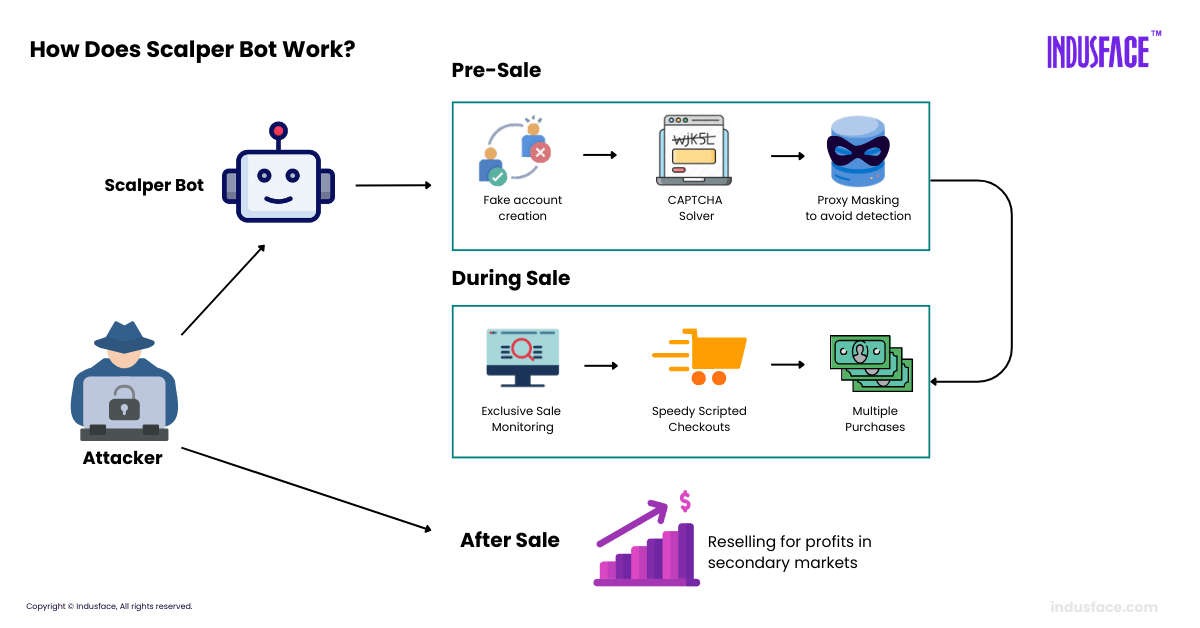

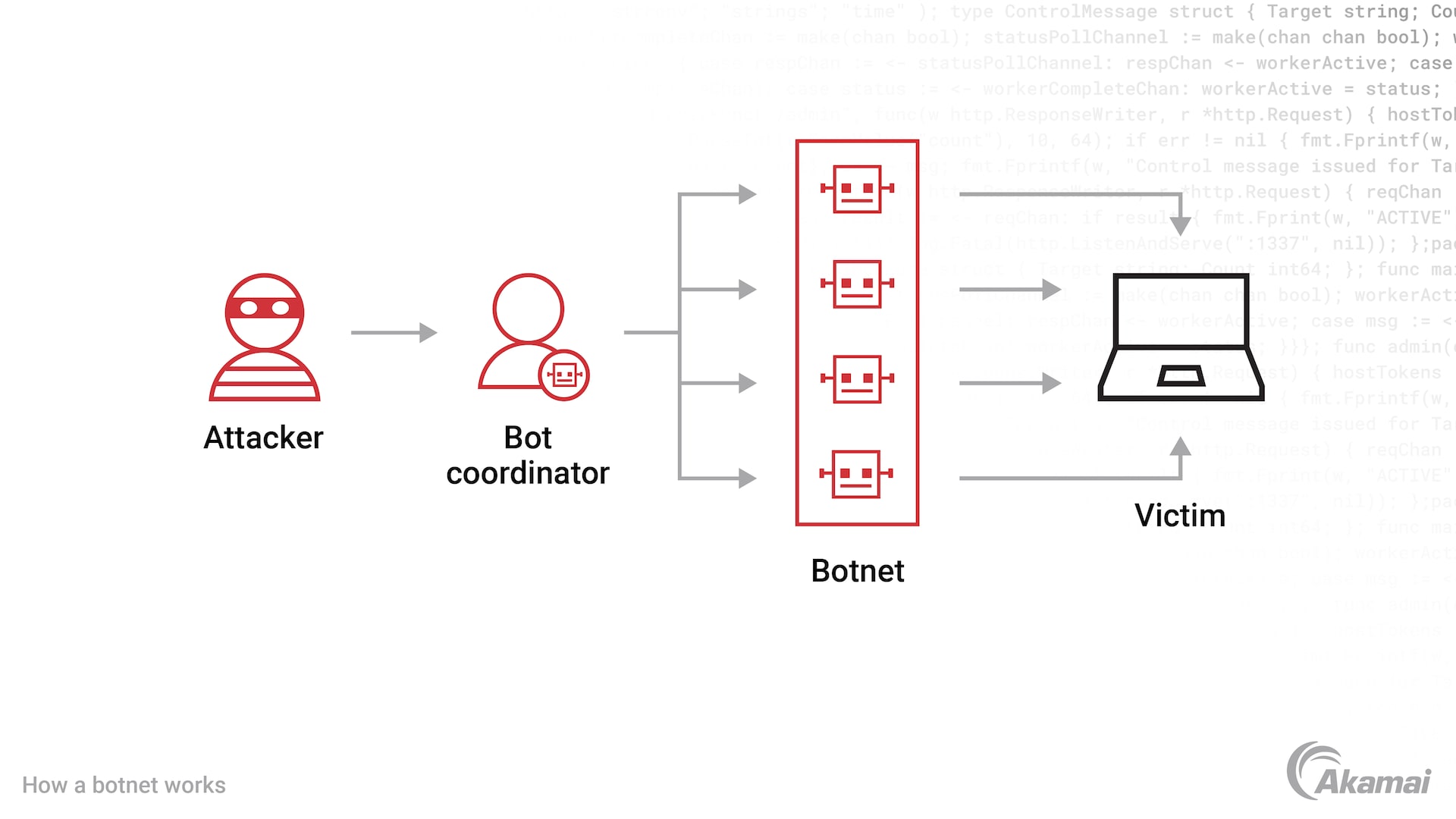

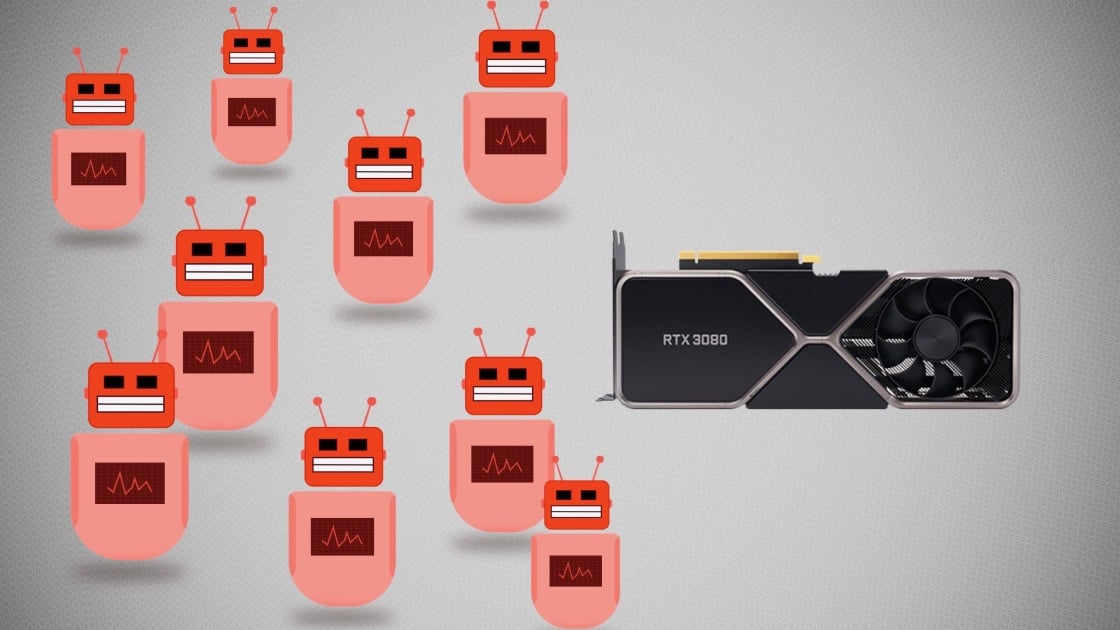

The Bot Infrastructure

At the core of industrial-scale scalping is bot technology. These aren't simple scripts. Modern scalping bots are complex applications that automate every step of the purchase process at speeds humans can't match. A sophisticated scalping bot performs multiple functions simultaneously. It monitors retailer websites for inventory drops. It uses multiple IP addresses and device fingerprints to appear as different users. It fills shopping carts in parallel across dozens of sessions. It checks out with stolen or spoofed payment methods or legitimate ones paid for by money mules. It coordinates with other bots to distribute purchases across different accounts and shipping addresses.

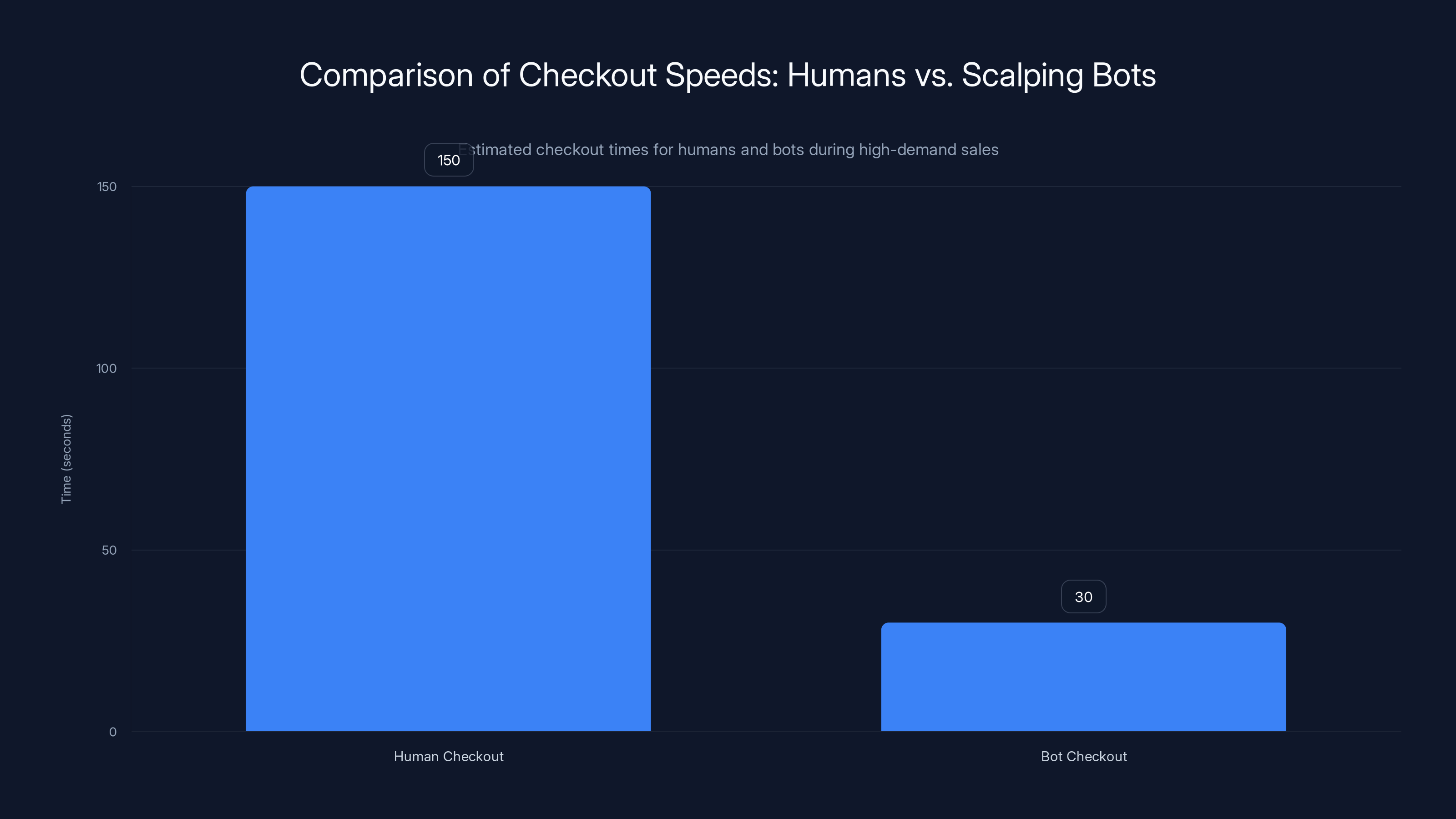

The speed advantage is enormous. A human checking out takes 2 to 3 minutes minimum. A bot completes a checkout in under 30 seconds. When a store releases 5,000 items and receives 100,000 purchase attempts in the first minute, you can do the math. Humans never stood a chance.

Retailers have implemented CAPTCHA verification to slow bots down, but that's become a game of cat and mouse. Modern bot networks use CAPTCHA-solving services that employ human workers in low-wage countries to solve them at scale. You defeat one bot protection and five more emerge using a different approach.

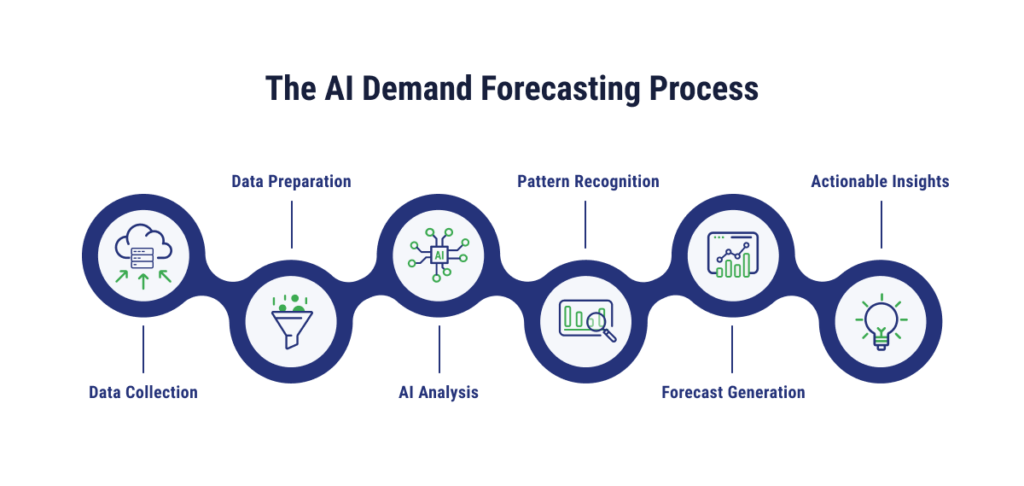

AI-Powered Demand Prediction

The latest evolution in scalping is AI-driven market analysis. Scalpers are now using machine learning to predict which products will be most valuable on the resale market before they even drop. They analyze historical resale data, social media sentiment, production numbers, and collector demand patterns. Sophisticated algorithms predict which limited editions will see 200% markup versus which ones will struggle to resell at face value. This lets scalpers target their bot operations precisely at items with the highest profit potential.

This takes the guesswork out of scalping. You're not randomly buying stuff hoping it resells well. You're using AI to guarantee you're buying products with guaranteed demand and proven resale value. The economics become almost risk-free.

Distributed Networks and Infrastructure

Professional scalping operations look less like one person with a laptop and more like organized retail operations. They maintain infrastructure including proxy networks to hide their identity, payment processing accounts across multiple services, shipping address networks across different regions, and coordination systems to manage thousands of simultaneous transactions.

Many high-level scalpers operate from Eastern Europe, Southeast Asia, or China, where enforcement is minimal and operating costs are low. They hire local teams to manage logistics, convert digital purchases into physical shipments, and handle payment processing. They've essentially built supply chain infrastructure optimized for resale velocity.

Some operations use drop-shipping services to avoid holding inventory themselves. Others coordinate directly with payment processors and shipping carriers. The most sophisticated operations have negotiated relationships with logistics companies that give them preferential treatment on shipping costs and speed.

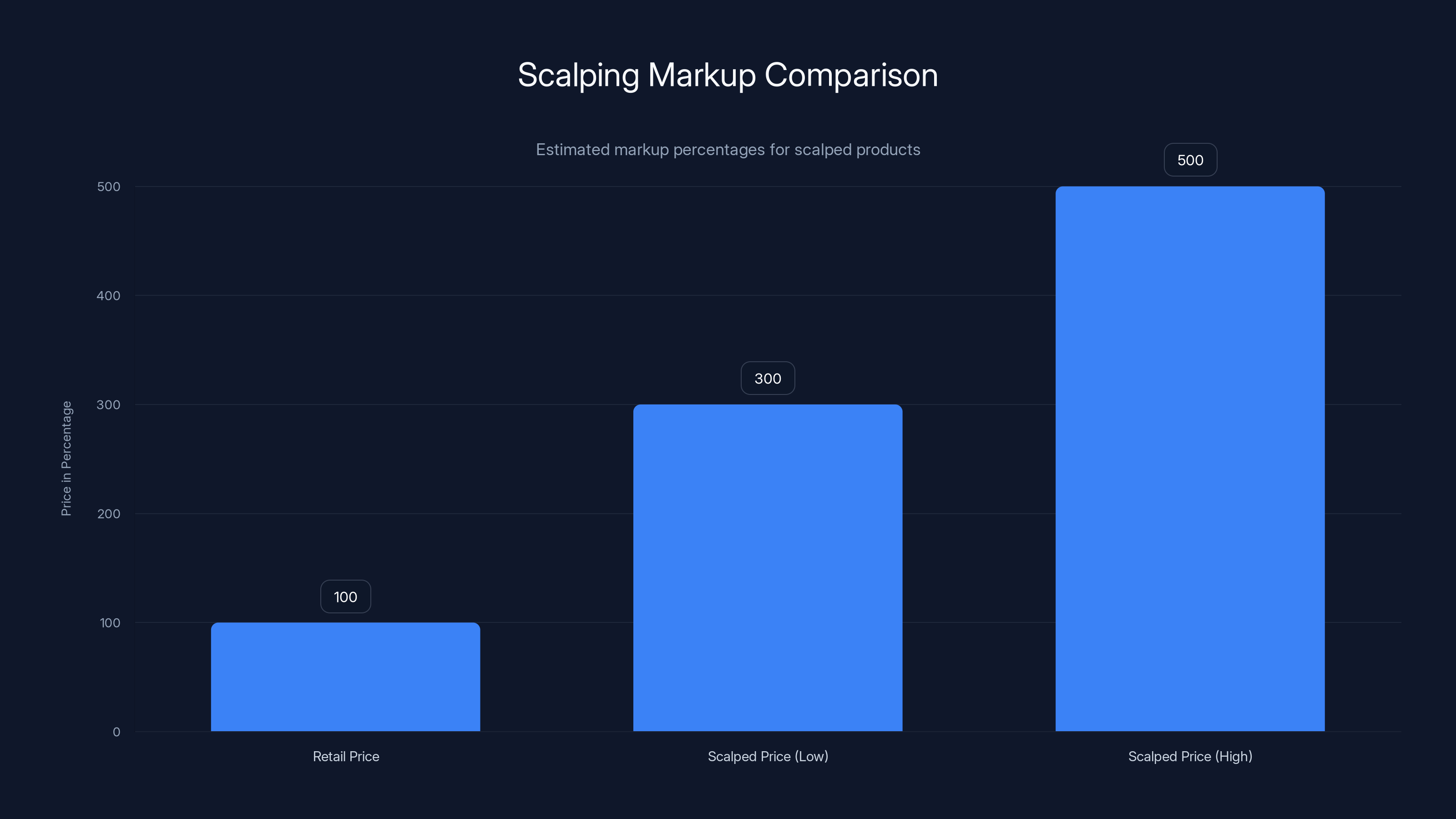

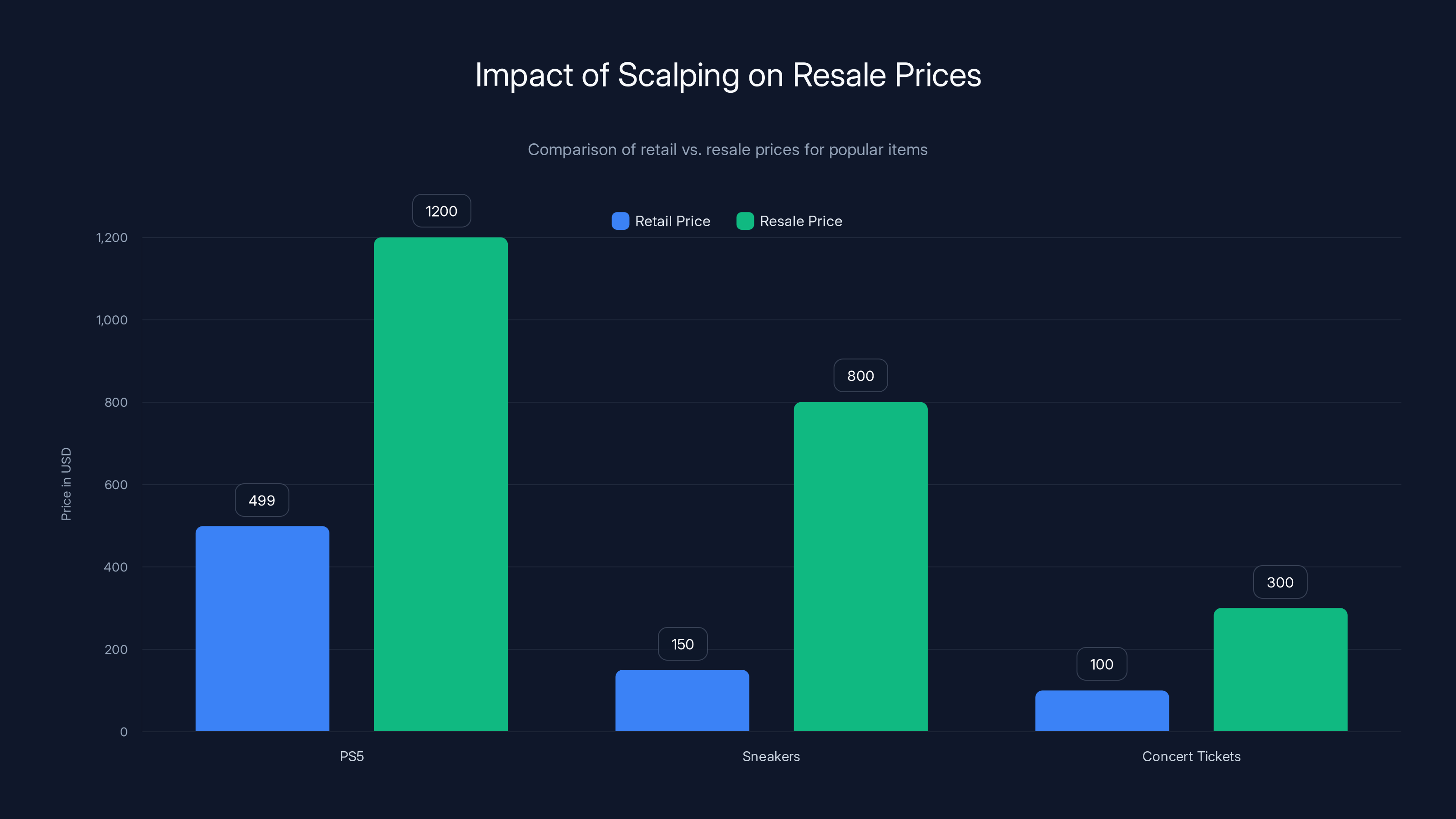

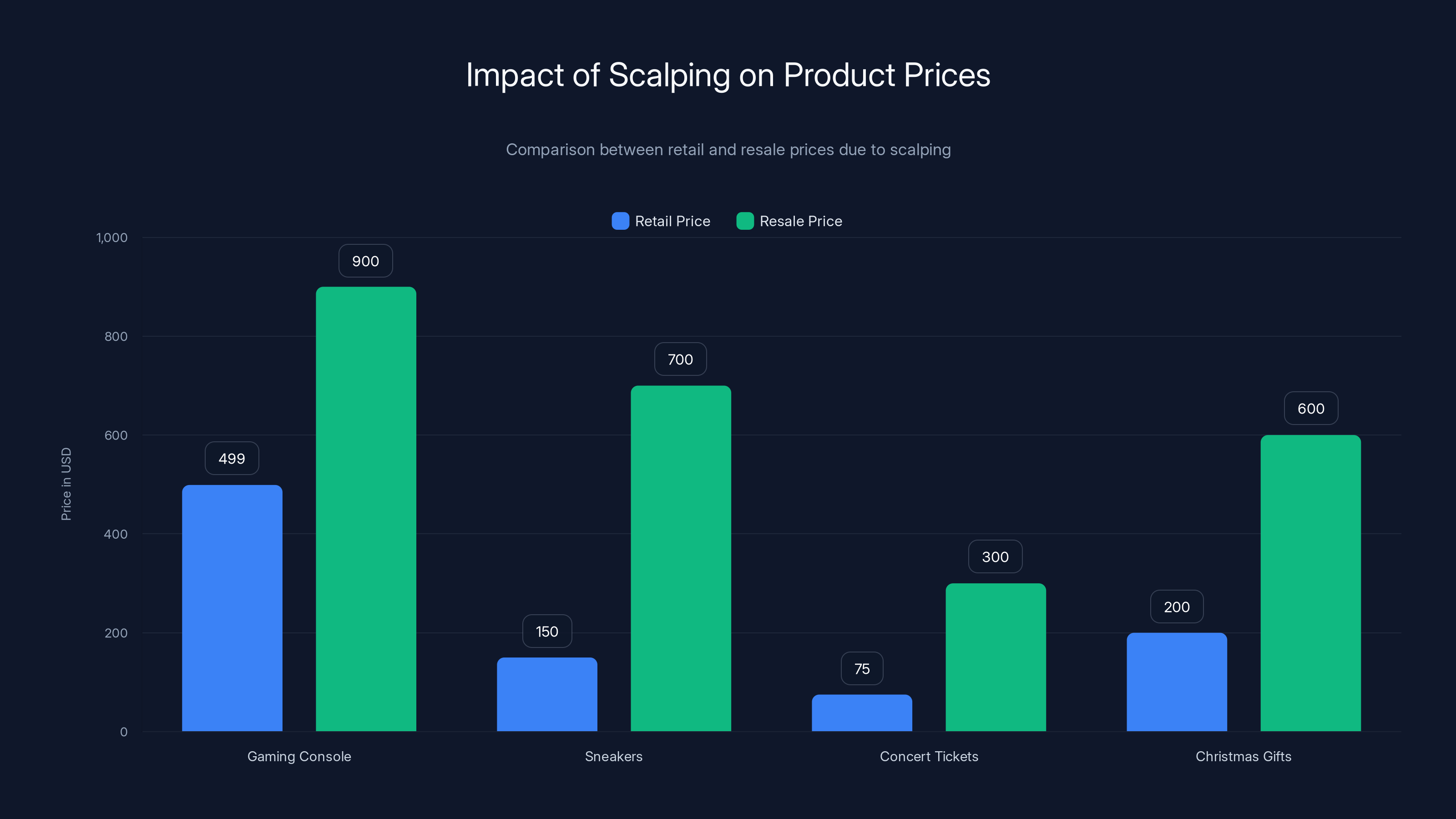

Scalped products are typically resold at 200-400% above retail price, significantly inflating costs for consumers. Estimated data.

The Devastating Impact on Consumers

The human cost of scalping is real and it's intensifying. This isn't just about missing out on entertainment. It's affecting people's ability to access products they actually need.

Price Inflation and Accessibility

The most obvious impact is price. When scalpers control most inventory, legitimate market prices skyrocket. A gaming console that launches at

This pricing creates a two-tier market. Wealthy buyers can still access products at inflated prices. Everyone else either waits months for stock to normalize or gives up entirely. The economic inequality embedded in scalping is brutal.

For families trying to buy Christmas gifts, scalping turns a

Eroded Trust in Retail

Scalping is destroying consumer confidence in retailers. When people experience the frustration of being unable to buy something despite having money and being ready to purchase immediately, they blame the retailer. The fact that bots are the real culprit doesn't matter—the retailer is who failed to deliver.

This creates brand damage that's hard to quantify but very real. Consumers don't feel excited about product launches anymore. They feel dread. They know the experience will likely be frustrating, and they know they probably won't actually be able to buy the thing they want.

Over time, this erodes the entire foundation of retail excitement. A new console launch should be an event that creates hype. Instead, it creates anxiety. The emotional connection between brands and consumers deteriorates.

Secondary Market Corruption

Scalping has completely corrupted secondary markets like eBay, Grailed, and StockX. These platforms were originally designed to allow collectors to trade items with each other. Instead, they've become scalper distribution networks.

The economics are completely broken. On StockX, you can't find authentic products at reasonable prices anymore because scalpers are actively buying and selling on the platform as a business operation, not a hobby. The original purpose of these platforms, enabling peer-to-peer exchange, has been replaced by commercial resale operations.

Authenticity has also become a nightmare. With so many items passing through scalper hands, counterfeit products have flooded secondary markets. Buyers can't trust that something is real anymore. Some platforms are implementing verification systems, but they're always behind the curve of counterfeit sophistication.

Scalping significantly inflates resale prices, with PS5s reselling at over twice their retail price. Estimated data.

How Retailers Have Failed to Stop This

Retailers aren't innocent bystanders in this. Some have implemented protections, but many have done almost nothing to prevent scalping, and a few have actually benefited from it.

The Half-Hearted Defenses

Most retailers have implemented basic protections that are largely ineffective. Purchase limits (one per customer) don't work when scalpers use hundreds of accounts. CAPTCHAs get solved by automated services. IP-based restrictions get bypassed with proxy networks. Queue systems get beaten by coordinated bot operations using different IP addresses and device IDs.

The problem is that these defenses were designed to stop simple bots from five years ago. They're useless against modern bot networks that maintain thousands of concurrent connections using different device fingerprints, browser profiles, and network routing.

Some retailers have implemented waitlist systems or manual review processes, but these slow down the purchase experience for legitimate buyers while barely slowing down determined scalpers. The tradeoff doesn't work.

The Lack of Real Innovation

Few retailers have actually invested in sophisticated bot detection systems. Machine learning models that can identify bot traffic patterns, behavioral analysis that flags inhuman clicking patterns, and real-time inventory monitoring could catch most scalping operations. But these systems are expensive to implement and maintain.

The financial incentive structure is perverse. If a retailer is selling out either way (legitimate buyers or scalpers), and restocking quickly enough to maintain shelf availability, there's limited financial incentive to spend aggressively on bot prevention. The cost of the bot detection system has to be justified against a benefit that might just be "less frustrated customers," which is hard to quantify in financial terms.

When Retailers Benefit

Here's the uncomfortable truth: some retailers don't actually want to stop scalping. When a product is scalped, it means it was massively in demand. That demand signal is valuable. It tells retailers that they could charge more, produce more, or extend the product line.

Some retailers have even been accused of intentionally underproducing items to create artificial scarcity that drives up resale value and media coverage. While this is usually denied publicly, the incentives definitely exist. Scarcity creates buzz. Buzz drives future sales. Scalpers amplify that buzz by making products seem impossibly hard to get.

In some cases, particularly with sneaker manufacturers, there's been speculation that they tolerate or even encourage scalping because it creates lifestyle credibility. Limited availability makes products more desirable in collector communities. The resale market is essentially free marketing.

Why Law Enforcement Has Largely Ignored Scalping

You might think scalping would be illegal. It's not, and law enforcement has shown almost no interest in prioritizing it.

The Legal Gray Area

In most jurisdictions, scalping isn't actually illegal. Ticket scalping is illegal in some places, but product scalping exists in a legal gray area. You're allowed to buy things and resell them at whatever price you want. That's called capitalism.

The challenge is that most scalping laws, where they exist, were written for ticket scalping specifically. They often require physical presence, involve monetary transaction thresholds, or apply only to specific venues. They don't translate to online commerce or general merchandise.

Some jurisdictions have considered or proposed anti-bot legislation, but it's slow and complicated. How do you legally define a bot? What constitutes unauthorized automation? The First Sale Doctrine in the US and equivalent protections elsewhere basically allow you to buy things and resell them. Restricting that through legislation is constitutionally complex.

Resource Constraints

Police and prosecutors have finite resources. Scalping isn't violent crime. It doesn't involve direct harm to individual victims. From a law enforcement perspective, it's a commerce problem, which is typically handled by regulatory agencies or civil litigation, not criminal prosecution.

The FTC in the US has shown some interest, particularly around ticketing scalping and bot usage. But their resources are also limited, and pursuing scalping operations requires coordination across jurisdictions and potentially international law enforcement, which is slow and expensive.

The Victims Are Too Diffuse

Law enforcement prioritizes based on victim impact. With scalping, there isn't one person who's been directly harmed by $1,000. There's a diffuse group of consumers who each missed out on one purchase or paid more than they should've. It's hard to mobilize law enforcement around that kind of distributed harm.

Contrast this to organized retail crime, where you have a retailer suffering concrete inventory loss. Or ticket scalping at concerts, where there's a specific venue and artist affected. Those have clear victims and clearly quantifiable damage. Scalping of general merchandise doesn't fit that pattern.

Scalping significantly inflates product prices, creating a two-tier market where only wealthier consumers can afford immediate purchases. Estimated data.

Current Attempts to Combat Scalping (And Why They're Not Working Yet)

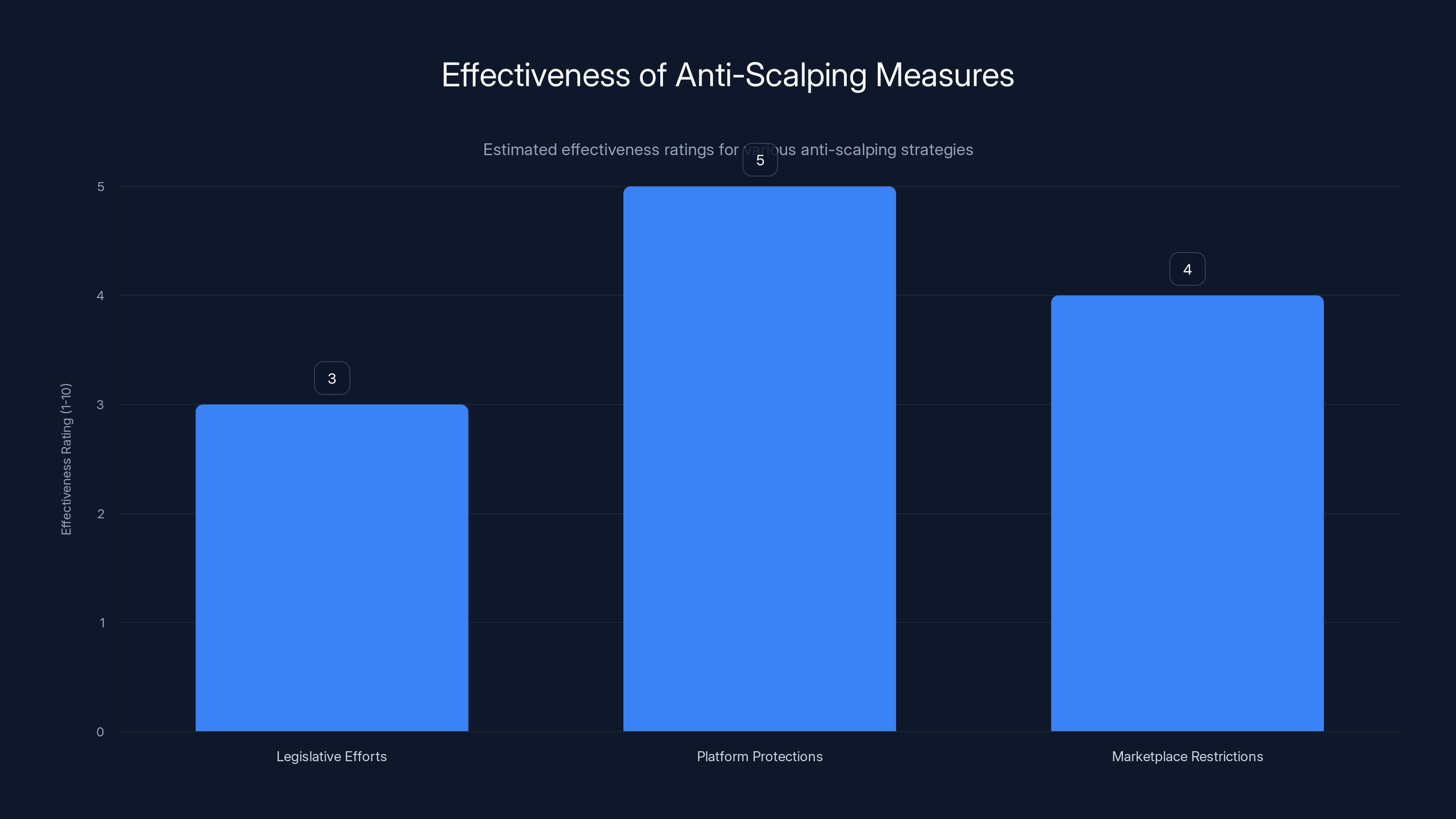

There are various initiatives trying to address scalping. They're well-intentioned, but mostly ineffective so far.

Legislative Efforts

Several jurisdictions have proposed or passed anti-scalping legislation. The US BOTS Act (Better Online Ticket Sales Act) passed in 2016 and specifically targets ticket scalping using bots. Some states have proposed similar legislation for other products. The UK has explored legislation. So has Australia.

The problem is that legislation is slow, reactive, and generally applicable only in the jurisdiction where it's written. A scalper operating from overseas isn't particularly affected by UK law. Enforcement requires international cooperation and extradition, which barely happens.

Where legislation does exist, it's often toothless. Penalties are usually small fines, not criminal charges. For a scalper running a profitable operation generating

Platform-Level Protections

Some major retailers have implemented more sophisticated systems. Sneaker retailers like Nike and Adidas use SNKRS apps with account verification and purchase history analysis. Gaming retailers use account age and purchase history to identify suspicious buyers. Some use machine learning models trained to identify bot traffic patterns.

These work, but they're expensive to maintain and they create friction for legitimate customers. A system that's too aggressive locks out real people. A system that's too lenient lets scalpers through. The balance is hard to strike.

Payment processors and shipping companies have also started flagging suspicious activity. When someone's making 100 purchases per day shipping to different addresses, that gets flagged. But by that point, hundreds of items have already been purchased and resold.

Marketplace Restrictions

Some secondary marketplaces like StockX and Goat have implemented seller verification and authentication requirements that make it harder for scalpers to operate. These systems actually work reasonably well, but they only affect secondary sales, not the primary problem of bots getting items in the first place.

These platforms also charge significant fees (typically 8-12%), which reduces scalper profit margins but doesn't eliminate them. For high-value items, margins are still substantial even after fees.

The Technology That Could Actually Stop Scalping (In 2026)

There are technological approaches that could genuinely address scalping. None of them are perfect, but implemented together, they could make scalping dramatically less profitable.

Advanced Bot Detection

Modern machine learning can identify bot traffic with remarkable accuracy. By analyzing thousands of parameters—mouse movement patterns, clicking behavior, device fingerprinting, IP reputation, temporal patterns, purchase history—you can identify bots with 95%+ accuracy.

The challenge is implementing this at scale without false positives that hurt legitimate customers. A legitimate buyer who uses a VPN gets flagged as suspicious. Someone buying from the same location as lots of other people might get flagged. An older person unfamiliar with the website might interact in patterns that look bot-like.

But companies like Cloudflare and specialized fraud prevention firms have proven these systems work. When properly tuned, they can eliminate 90%+ of bot traffic while maintaining a 99%+ legitimate user experience. The investment required is significant, but for major retailers with millions of daily visitors, it's economically justified.

Biometric Verification

Facial recognition and biometric authentication could make it much harder for scalpers to use fake accounts. If every purchase requires facial biometric verification, suddenly you can't buy 100 items using 100 different accounts. You can only buy items your face is authorized to buy.

This creates privacy concerns and isn't practical for all contexts, but for limited product releases, it would be devastatingly effective against scalping. A store could have policies like "one item per verified face." Scalpers couldn't operate at scale anymore.

Pipeline and supply chain companies are already exploring this. Some luxury goods retailers have experimented with it. The technology works. The only barriers are implementation costs and customer adoption. Most people find the concept acceptable if it means they can actually buy what they want.

Distributed Ledger and NFT-Based Authenticity

Blockchain and NFT technology get mocked (rightly, in many contexts), but there's a legitimate use case here. Connecting physical products to NFT verification creates an immutable record of authenticity and ownership.

When scalpers are forced to interact with a system where every resale is transparently recorded, where the original retailer can see every subsequent transaction, and where counterfeit items can be instantly identified, the economics of scalping change dramatically. There's an audit trail. Fraud becomes harder. The resale market becomes less opaque.

Some companies are experimenting with this. Luxury goods manufacturers like Gucci and Louis Vuitton have explored NFT-based authenticity verification. As the technology becomes cheaper and more ubiquitous, expect more adoption, particularly for limited products.

AI-Powered Resale Licensing

Here's a more radical idea: what if retailers could embed licensing terms directly into digital products that restrict how and when items can be resold? If a limited sneaker could only be resold at a maximum markup of 10%, scalping becomes unprofitable.

This requires integration with payment processors, resale platforms, and potentially legal enforcement, but it's technically feasible. When you sell an item, you sell it along with a smart contract that specifies terms for resale. The payment processor enforces those terms automatically.

Apple has experimented with similar concepts around digital goods. As commerce becomes increasingly digital and integrated with financial systems, this kind of license-based restriction becomes more practical.

Real-Time Inventory Intelligence

If retailers had perfect real-time information about inventory levels, resale prices, and demand patterns, they could react immediately to scalping. If they see a product that retailed for

This requires better integration between retailers, resale platforms, and inventory management systems. It's not a scalping prevention system per se, but it's a system that could make scalping less profitable by eliminating the scarcity that creates resale value.

Inventory intelligence systems are becoming standard in retail analytics. Retailers increasingly have the capability to implement this. They just need the organizational will to prioritize fighting scalping over maintaining artificial scarcity.

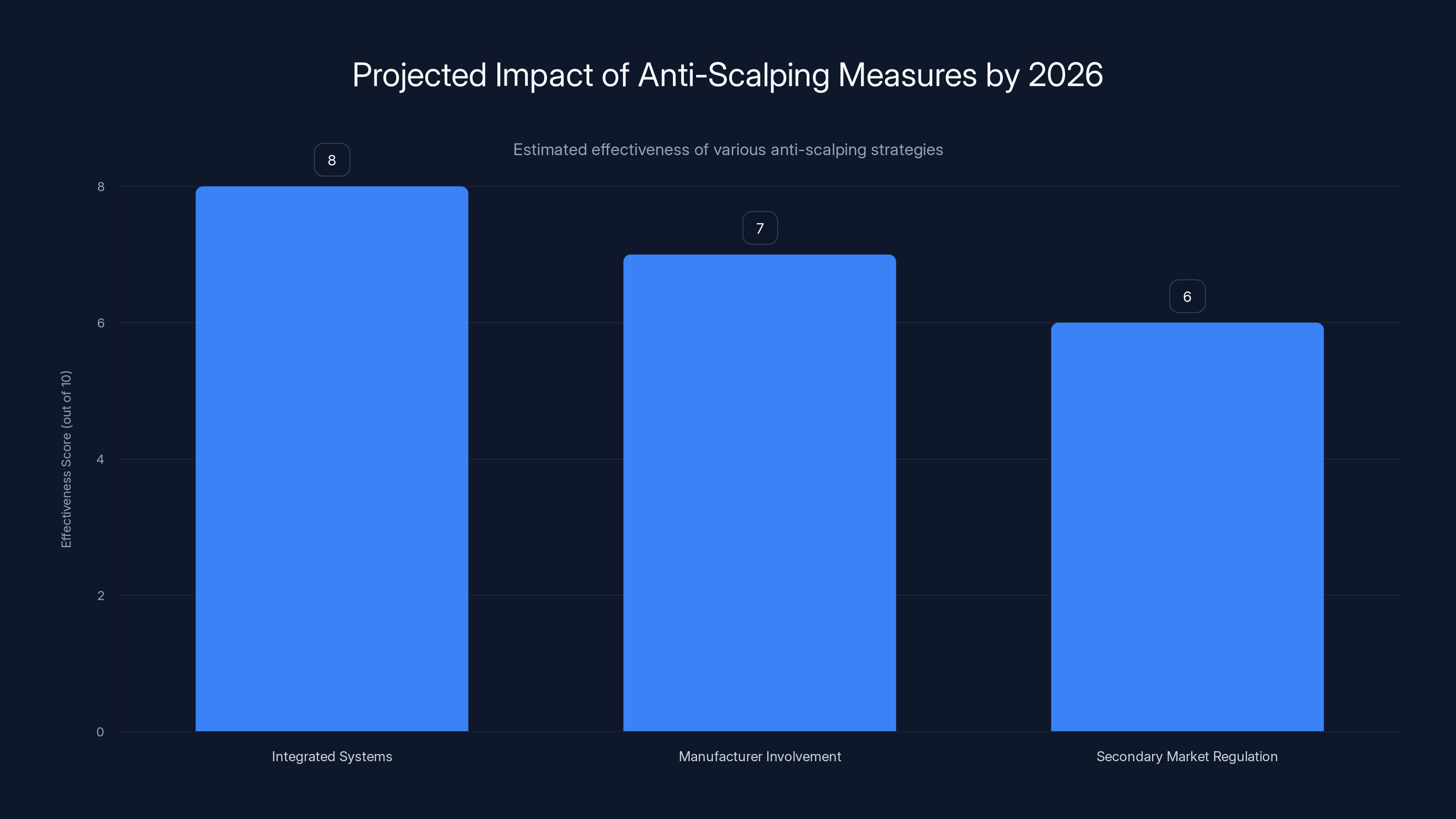

Integrated systems are projected to be the most effective anti-scalping measure by 2026, followed by manufacturer involvement and secondary market regulation. Estimated data.

The Role of Artificial Intelligence in the Future of Scalping

As AI becomes more sophisticated, both the scalping operations and the detection systems will evolve. The question is which side will innovate faster.

Generative AI for Automated Scaling

Generative AI can create synthetic user profiles, automate account creation across platforms, generate convincing human-like interaction patterns, and coordinate complex purchasing sequences across hundreds of accounts simultaneously. This makes scaling scalping operations dramatically easier.

A scalper using AI can operate 1,000 automated purchase attempts where a human scalper managed 10. The labor barrier disappears. The operation becomes almost entirely automated.

This is a major risk. As AI capabilities expand, scalping could become an increasingly automated, low-oversight operation that's profitable at massive scale with minimal human intervention.

AI-Powered Detection Systems

On the flip side, AI can also detect scalping with unprecedented accuracy. By analyzing behavioral patterns, purchase sequences, payment processor activity, and shipping address networks, machine learning models can identify scalping operations with 95%+ accuracy.

These detection systems can adapt in real-time to new scalping techniques. As scalpers develop new bot techniques, detection systems can automatically learn to identify them based on their behavioral fingerprints.

The arms race will intensify. Scalpers will use generative AI to evade detection. Retailers will use AI to detect evasion. Eventually, the most sophisticated side wins. The question is whether retailers will invest as aggressively as scalpers.

What 2026 Solutions Might Actually Look Like

If we're realistic about what's possible, 2026 is probably not when scalping gets eliminated. But it could be when it gets meaningfully reduced through a combination of approaches.

Integrated Multi-Layer Systems

The most effective approach will combine several technologies. Bot detection flags suspicious activity. Behavioral analysis identifies inhuman patterns. IP reputation systems flag proxy network traffic. Payment processor analysis flags suspicious financial activity. Shipping address analysis identifies distribution networks.

No single system is bulletproof, but combining all of them makes scalping operations much harder and more expensive. A scalper has to defeat multiple systems simultaneously, which increases the sophistication and cost of the operation.

We'll likely see major retailers implementing these integrated systems by 2026. The cost will be substantial, but the benefit (actually having products available for legitimate customers) will justify it.

Manufacturer Involvement

Brand manufacturers will take more direct control of limited releases rather than relying on retailers. They'll use official apps for distribution, implement their own bot detection and account verification, and maintain direct relationships with consumers.

Nike, for example, has already moved heavily to this model with the SNKRS app. They control the entire experience, so they can implement sophisticated anti-scalping measures without coordination with retail partners. Expect more brands to follow this pattern.

Secondary Market Regulation

Resale platforms like StockX, Grailed, and eBay will face increasing regulatory pressure to implement stricter seller verification, pricing limits, and authenticity requirements. Some platforms might voluntarily implement price-cap systems where resale markups are capped at 15-20% and the additional revenue goes to the original manufacturer or charity.

This won't eliminate scalping, but it will reduce profitability significantly. If a scalper can only make a 10% profit after fees and taxes, the economics become much less attractive.

Legal Enforcement

International law enforcement cooperation will improve, particularly around organized scalping operations that are run at commercial scale. The FTC will develop more specific anti-bot legislation and enforcement priorities. Some jurisdictions will criminalize scalping of specific product categories.

This won't eliminate individual scalpers, but it will make large-scale, professional scalping operations riskier and more expensive.

Consumer Education

Consumers will become more aware of the scalping problem and more willing to avoid scalped goods. Tracking the provenance of products through blockchain or serial number verification will make it easier to identify which items are retail and which are scalped.

Over time, some consumer segments might develop stigma around buying scalped products. "Ethical consumption" becomes a brand advantage for items that are verified retail.

Scalping bots can complete a checkout process in under 30 seconds, significantly faster than the 2-3 minutes it takes humans, giving them a substantial advantage during high-demand sales. Estimated data.

Case Study: How Limited Drops Actually Work Now

Let's look at a specific example to understand the current reality.

When a major sneaker brand releases a limited edition shoe, here's what actually happens:

T-Minus 24 Hours: Sneaker bot providers announce the upcoming drop and recommend optimal bot configurations. Resale price prediction algorithms analyze historical data and estimate the shoe will resell for

T-Minus 1 Hour: The brand posts the release details. Scalpers are already queued in their bot networks. Legitimate customers start setting alarms to remember to try to buy at the exact release time.

T-0 (Release Time): The site goes live. Within 3 seconds, bot networks have captured 70% of available inventory. The first scalpers are already checking out. Within 30 seconds, the site crashes from traffic. Within 2 minutes, the site comes back and the remaining 30% of inventory is gone, split between bots and lucky human buyers. Legitimate customers are still on the loading page.

T+5 Minutes: The product is marked as sold out on the official site. The same product is already appearing on secondary resale platforms at

T+1 Hour: Resale platforms show 500+ listings at increasingly inflated prices as the cheapest options sell out and price floors rise. Legitimate buyers who missed out are now paying

T+24 Hours: The product has been resold 50+ times on secondary markets. The original shoe is now a commodity being traded like a financial asset. Five different scalpers have taken profit margins. Multiple counterfeit versions have appeared on Wish and AliExpress. The secondary market is thoroughly corrupted.

This process repeats hundreds of times daily across different product categories.

The International Dimension: Where Most Scalping Operations Are Based

Understanding where scalpers operate helps explain why they're hard to stop.

Eastern European Operations

A significant portion of professional scalping infrastructure is based in Eastern Europe, particularly Ukraine, Romania, and Bulgaria. These regions have highly skilled software developers, low operating costs, favorable tax treatment, and minimal enforcement action against e-commerce fraud.

A scalping operation running from Bucharest can access global inventory, operate with minimal oversight, and maintain anonymity through numerous layers of proxies and payment obfuscation. Local law enforcement has neither the resources nor the motivation to investigate what they see as a foreign commerce problem.

Southeast Asian Logistics Hubs

Many scalping operations use Southeast Asia (particularly Vietnam and Thailand) as logistics hubs. Products purchased globally are shipped there, consolidated, and redistributed. Counterfeit goods are often manufactured in the same regions. This creates a natural ecosystem for scalping operations.

The cost of shipping consolidation, payment processing, and local logistics is dramatically cheaper than operating from North America or Europe. A scalper can maintain a profitable operation with much lower margins.

Chinese Wholesale Integration

Some of the most sophisticated scalping operations are integrated with Chinese wholesale suppliers. Counterfeit products are manufactured concurrently with legitimate releases, and both are sold through the same resale networks. The scalping operation subsidizes production of counterfeits, making both more profitable.

This creates a market where legitimate products and counterfeits are intermingled on resale platforms, making it nearly impossible for consumers to know what they're buying.

Legislative efforts are rated lowest due to limited jurisdiction and enforcement challenges. Platform protections are more effective but costly, while marketplace restrictions show moderate success. (Estimated data)

What Consumers Can Actually Do Right Now

While waiting for systemic solutions, what can individual consumers do?

Verify Product Authenticity

When buying from secondary markets, use authentication services. StockX and Goat provide authentication. For sneakers, specific apps and websites can verify legitimacy. For gaming gear, check serial numbers with manufacturers.

Paying a small authentication fee beats getting scammed. It's now a standard cost of buying from secondary markets.

Use Brand-Controlled Channels

Whenever possible, buy directly from manufacturer sites or official brand apps. These have the strongest anti-scalping protections because the brand has direct control and financial incentive.

Brand apps like Nike SNKRS, Adidas CONFIRMED, and Yeezy Supply have dramatically better chances of getting items if you're a legitimate buyer.

Set Alerts for Price Drops

Products that are heavily scalped initially often drop significantly in price within 3-6 months as the secondary market stabilizes. If you can wait, wait. A product that's

Use price tracking tools to get alerts when resale prices drop below thresholds you've set.

Report Counterfeits

When you encounter obvious counterfeits on resale platforms, report them. Platforms are required by law to remove counterfeit listings, and they take intellectual property violations seriously because they create legal liability.

Reporting helps clean up the market for everyone and can get your account flagged as trustworthy when you flag problems.

The Psychology of Why People Become Scalpers

Understanding scalper motivation helps predict what will actually deter them.

Economic Desperation

Some scalpers are individuals in economically difficult situations looking for a side income. For someone in a developing country or economically depressed region, a part-time scalping operation can generate meaningful income relative to local wage levels.

For these individuals, increasing the difficulty or reducing profit margins might be enough to make the activity not worthwhile. But for professional operations, it's not about desperation—it's about profit.

Sophisticated Financial Operations

Many modern scalping operations are run as actual businesses with accountants, legal structures, and operational infrastructure. These are people who've decided that scalping is their business.

For these operations, small friction increases don't matter. They'll invest in more sophisticated technology and operational complexity. They only care about whether the operation is profitable, not whether it's easy.

The Thrill Factor

Some scalpers are attracted to the competitive nature of beating bots and other scalpers to inventory. It's a game with economic stakes. The profit is almost secondary to the satisfaction of winning the game.

This population is almost impossible to deter with friction or regulations. They enjoy the challenge.

Looking at Ticket Scalping as a Model

The BOTS Act was passed in 2016 to address ticket scalping. It's worth examining how effective it's been and what lessons apply to product scalping.

The BOTS Act made it illegal to use bots to purchase tickets and to resell tickets in violation of venue policies. It's had measurable impact, particularly on major events where enforcement is coordinated.

But it hasn't eliminated ticket scalping. It's just made it more expensive and complex. Scalpers have adapted by using stolen credentials, working with insiders at ticketing companies, and purchasing through different channels.

The lesson: legislation and enforcement are necessary but insufficient. They increase the operational complexity and cost for scalpers, but don't eliminate them. Combined with other measures (bot detection, account verification, price limits), they create meaningful friction.

Applying this to product scalping suggests that a combination of legislation, bot detection, account verification, and resale market regulation could reduce scalping significantly without eliminating it entirely.

Predictions for 2026 and Beyond

If momentum continues building on anti-scalping initiatives, here's what's plausible:

What's Likely

Widespread bot detection adoption: By 2026, most major retailers will have implemented sophisticated bot detection systems. This becomes an industry standard like SSL certificates or payment processing security.

Resale platform restrictions: StockX, Grailed, and similar platforms will implement price-cap systems limiting markups to 15-20%. New platforms might emerge specifically designed to fight scalping, offering better authenticity verification and lower fees for retail products.

Brand-controlled releases: More brands will move away from retail distribution for limited items and instead sell directly through official channels with built-in anti-scalping measures.

Consumer awareness: A significant portion of consumers will check product provenance before buying secondhand items and will prefer retail-verified products. Resale platforms might label items as "verified retail" versus "secondary market."

International enforcement: The FTC will coordinate with enforcement agencies in major countries to prosecute large-scale scalping operations. This won't eliminate individual scalpers but will disrupt professional organizations.

What's Unlikely

Complete elimination of scalping: There's always going to be scarcity-driven resale markets. Complete elimination would require abolishing the free market, which isn't happening. Scalping will reduce but not disappear.

Unified global legislation: No single law will solve this. Different countries will approach it differently. This fragmentation creates loopholes.

Biometric requirements everywhere: While some luxury goods might require biometric verification, mass market products won't. The friction is too high and privacy concerns too significant.

Dramatic technology breakthroughs: The technologies to fight scalping exist now. It's not a technology problem anymore—it's an implementation and willpower problem.

FAQ

What exactly is product scalping?

Product scalping is the practice of using bots or coordinated purchasing strategies to quickly buy limited-availability products at retail price and immediately resell them at inflated prices on secondary markets. Scalpers profit from the markup, typically 200-400% above retail price, while reducing product availability for legitimate customers.

How do scalpers use bots to buy products faster than humans?

Scalping bots automate every step of online purchasing at machine speed, completing checkouts in under 30 seconds compared to the 2-3 minutes required by human buyers. These bots use multiple IP addresses and device fingerprints to appear as different users, coordinate parallel purchase attempts, and integrate with CAPTCHA-solving services to bypass security measures that would slow human buyers.

Why haven't retailers completely stopped bot scalping?

Retailers face a tension between preventing bots and maintaining a smooth experience for legitimate customers. Effective bot detection sometimes creates false positives that lock out real people. Additionally, some retailers benefit from artificial scarcity that creates buzz and brand prestige, reducing their motivation to aggressively fight scalping. Most anti-scalping measures are also expensive to implement and maintain.

Is product scalping illegal?

Product scalping exists in a legal gray area. While ticket scalping is illegal in some jurisdictions, general product scalping is usually legal because the First Sale Doctrine in US law and equivalent principles elsewhere allow you to purchase items and resell them at whatever price you choose. Some jurisdictions are proposing legislation to address bot-based scalping, but comprehensive legal prohibition is unlikely.

What technologies could actually stop scalping in 2026?

Effective solutions likely involve combining multiple technologies: advanced machine learning for bot detection, behavioral analysis to identify inhuman purchasing patterns, biometric verification for high-value items, blockchain-based authentication to verify product provenance, and AI-powered analysis to predict scalping targets before they're created. No single technology is sufficient, but implemented together they can make scalping dramatically more difficult and expensive.

What can I do to avoid buying scalped products?

Buy directly from brand official channels and apps (Nike SNKRS, Adidas CONFIRMED) rather than general retailers. Use product authentication services when buying secondhand. Check for "verified retail" badges on resale platforms. Set price alerts and wait 3-6 months for resale prices to normalize rather than buying immediately after release. Report counterfeit listings on secondary platforms to keep the market clean.

Are scalpers operating from specific countries?

Yes. Major scalping operations are based in Eastern Europe (particularly Ukraine, Romania, Bulgaria), Southeast Asia (Vietnam, Thailand), and China. These regions have skilled technical talent, low operating costs, minimal enforcement action against e-commerce fraud, and established logistics infrastructure. This geographic distribution makes international law enforcement coordination difficult and necessary.

How has the BOTS Act performed at stopping ticket scalping?

The BOTS Act, passed in 2016, has reduced ticket scalping significantly for major events by making it illegal to use bots and to violate venue resale policies. However, it hasn't eliminated scalping entirely. Scalpers have adapted by using stolen credentials, working with insiders, and finding alternative distribution channels. The lesson for product scalping is that legislation is necessary but insufficient without complementary technical and enforcement measures.

What's the economic impact of product scalping?

The secondary resale market for scalped products exceeded $30 billion in 2024. During major product launches, scalpers capture 30-80% of available inventory depending on the product. This represents wealth transfer from consumers and brands to scalpers, along with economic losses from counterfeit infiltration, consumer frustration reducing future purchases, and brands losing direct customer relationships through their own channels.

Will scalping get better or worse in 2026?

Scalping will likely decrease but not disappear. Improved bot detection, resale platform restrictions, stronger authentication systems, and modest legal enforcement will make scalping more difficult and less profitable. However, scalpers using AI-powered systems will become increasingly sophisticated, and completely eliminating scalping would require restricting free markets in ways that are politically and economically unlikely. The most probable scenario is scalping becoming less dominant but remaining a persistent problem.

Conclusion: A 2026 We Actually Want

Scalping isn't going to vanish overnight. The economic incentives are too strong and the technical barriers are too low. But 2026 could be the year when scalping stops being the default outcome and becomes the exception.

That requires a genuine commitment from multiple stakeholders simultaneously. Retailers need to invest in bot detection and account verification. Brands need to control their own limited releases. Payment processors and shipping companies need to flag suspicious activity. Resale platforms need to implement pricing limits and authentication. Law enforcement needs to prioritize large-scale operations. Consumers need to demand accountability and choose verified retail when possible.

None of this is inevitable. It requires sustained effort and the willingness to accept some friction in the purchasing experience to create fairness. But the alternative is continuing to watch legitimate consumers get priced out of limited products while scalpers profit from artificial scarcity they've created.

The infrastructure to fight scalping exists now. What's needed is implementation. If 2026 is the year that commitment arrives, maybe we can actually buy the things we want at the prices they're supposed to cost. That's not too much to hope for.

Key Takeaways

- Industrial-scale scalping operations capture 70-80% of limited inventory within seconds using sophisticated bot networks and AI-powered demand prediction, making manual competition impossible.

- Scalpers operate from Eastern Europe, Southeast Asia, and China where development talent is abundant, operating costs are low, and enforcement action is minimal.

- Current anti-scalping measures are largely ineffective because they were designed for simple bots from five years ago, not modern networks using proxy services, CAPTCHA solvers, and distributed accounts.

- Effective 2026 solutions will likely combine multiple technologies: bot detection, behavioral analysis, biometric verification, blockchain authentication, and resale market price limits—no single approach is sufficient.

- Most product scalping remains legal in most jurisdictions, law enforcement has minimal resources for commerce fraud, and some retailers benefit from artificial scarcity, all reducing pressure to solve the problem.

Related Articles

- Master Windows 11 Keyboard Shortcuts: The Complete Productivity Guide [2025]

- Bill & Ted's Bogus Journey: Prime Video's Best Holiday Comedy [2025]

- How AI Critiques Photography: What ChatGPT Taught Me [2025]

- Dyson's Flagship Vacuum Innovations Explained [2025]

- Walmart Promo Codes & Coupons: Save Up to 65% [2025]

- LG xBoom Speakers 2026: AI EQ, Smart Lighting, and Design Innovation [CES]