India's App Downloads Surge to 25.5 Billion in 2025: The AI Assistant and Microdrama Revolution

India just pulled off something most markets can't: a dramatic rebound. After app downloads dipped to 24.6 billion in 2024, the country roared back with 25.5 billion downloads in 2025. That's not just a bounce-back. It's a complete reshaping of what Indians are downloading and why.

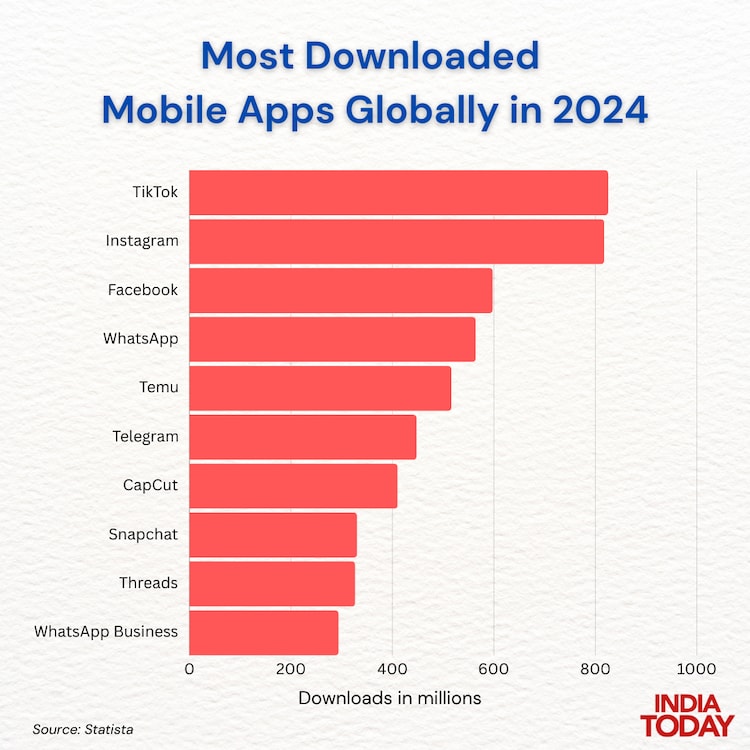

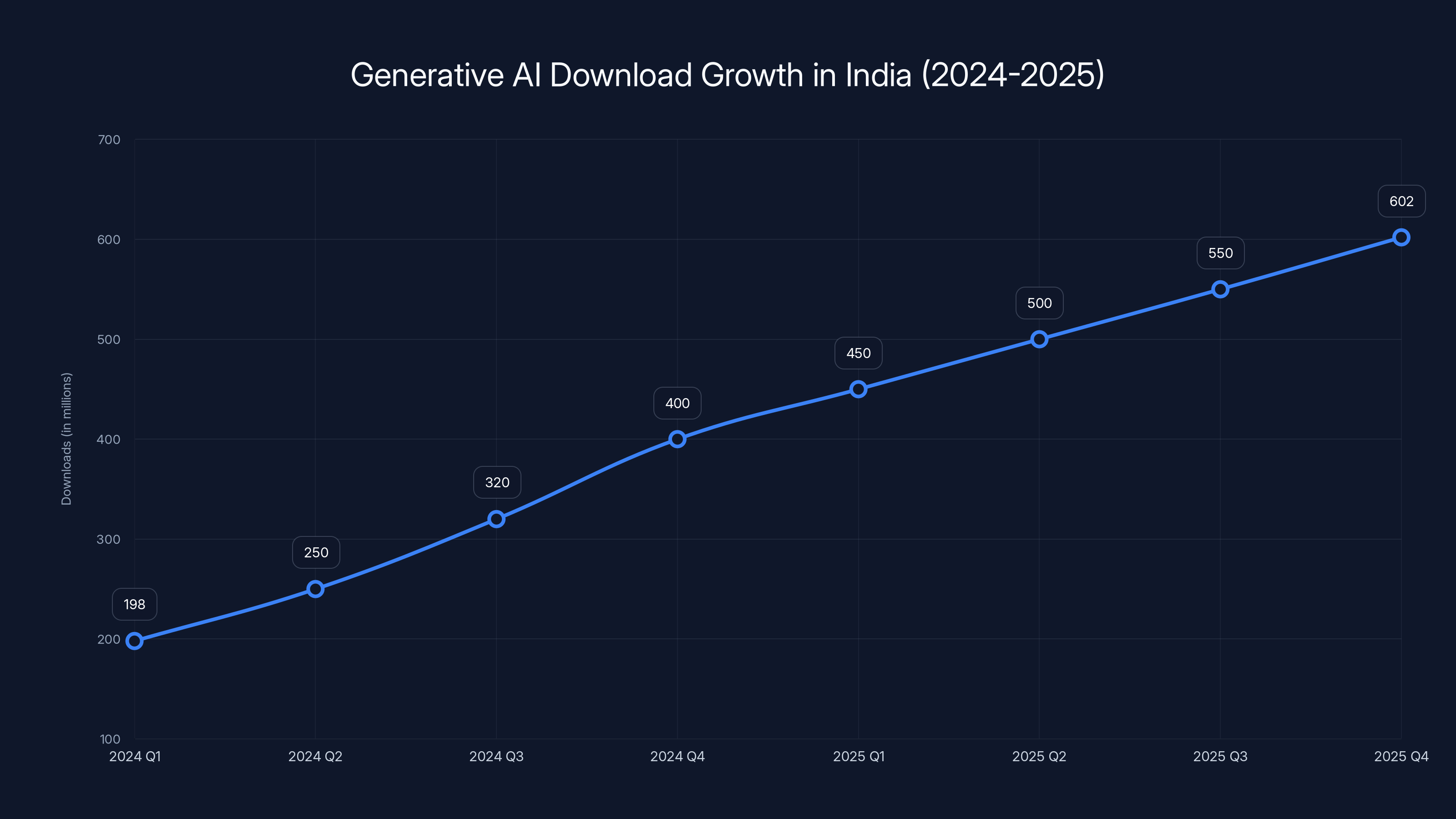

The numbers tell a fascinating story. This isn't about Instagram or WhatsApp dominating anymore. Chat GPT—an app most people thought was just a web interface—became the second most downloaded app in India after Instagram. AI assistants collectively exploded from 198 million downloads in 2024 to 602 million in 2025. That's a threefold jump in a single year.

Meanwhile, short-form drama apps gained over 350 million downloads, reshaping the entertainment category entirely. Users are spending more time in apps too: 1.23 trillion hours in 2025, up from 1.13 trillion in 2024. That's 88 billion more hours—just spent scrolling, watching, and interacting on phones.

What's driving this? The story goes deeper than "people like new things." Strategic business decisions, free premium tier rollouts, new AI capabilities, and ultra-fast commerce are all playing a role. India's domestic app makers are also gaining ground, with their share of downloads climbing from 33.91% to 36.52%.

This article breaks down exactly what happened in India's app ecosystem in 2025, why it matters for the global tech industry, and what trends are likely to shape 2026 and beyond.

TL; DR

- India bounced back hard: App downloads climbed from 24.6B (2024) to 25.5B in 2025, defying global download trends

- Chat GPT became a mobile phenomenon: Reached #2 in overall downloads (behind Instagram), driven by AI image models and free premium tiers

- Microdrama apps exploded: Short-form drama category grew 350M+ downloads, with Kuku TV ranking #4 globally in video streaming

- AI assistants tripled: Downloads jumped from 198M (2024) to 602M (2025), outpacing all other categories

- Domestic apps are winning: Indian-made apps now represent 36.52% of downloads (up from 33.91%), capturing the quick commerce wave

- User engagement doubled: Time spent in apps rose 88 billion hours, from 1.13T to 1.23T hours year-over-year

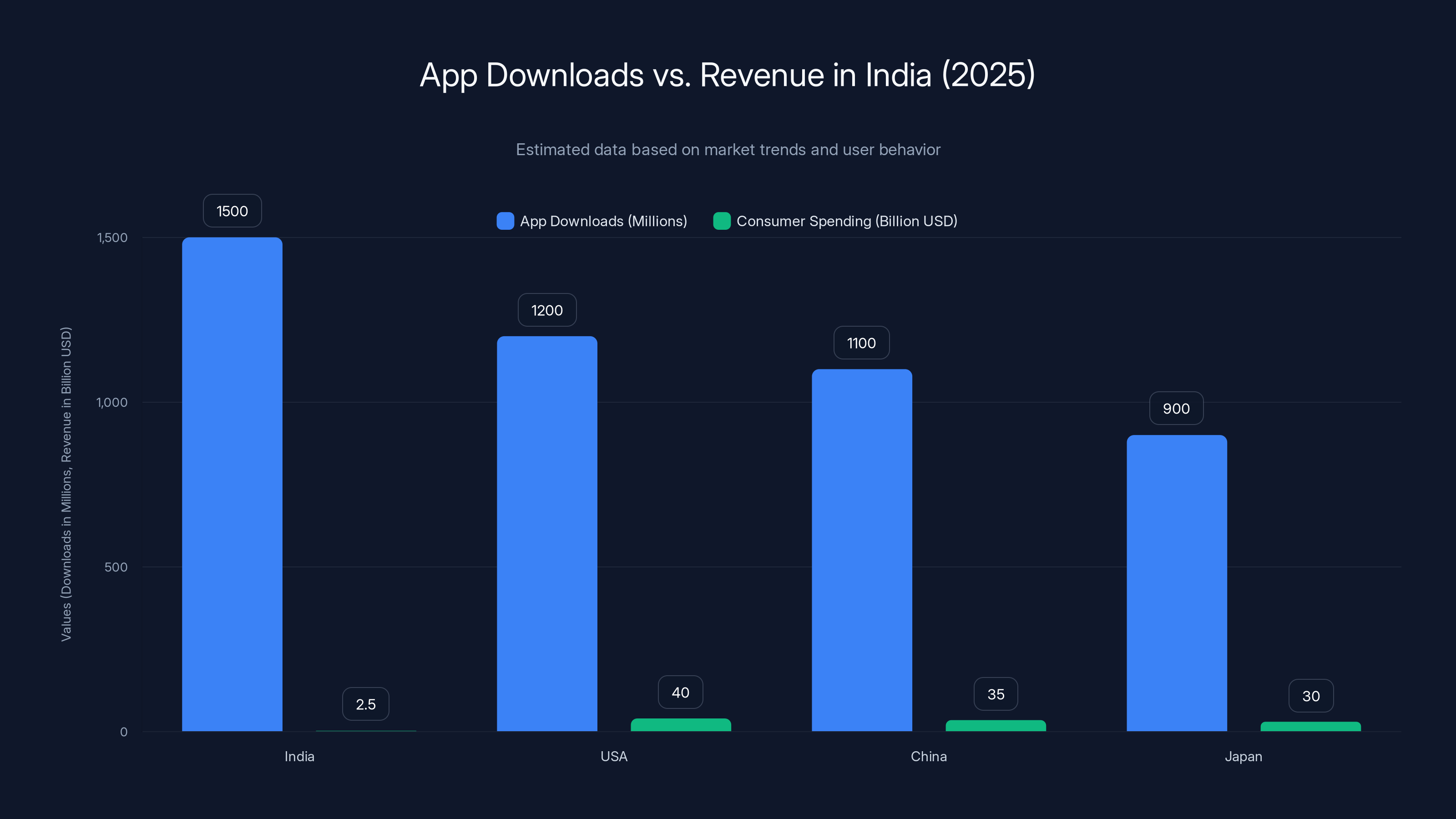

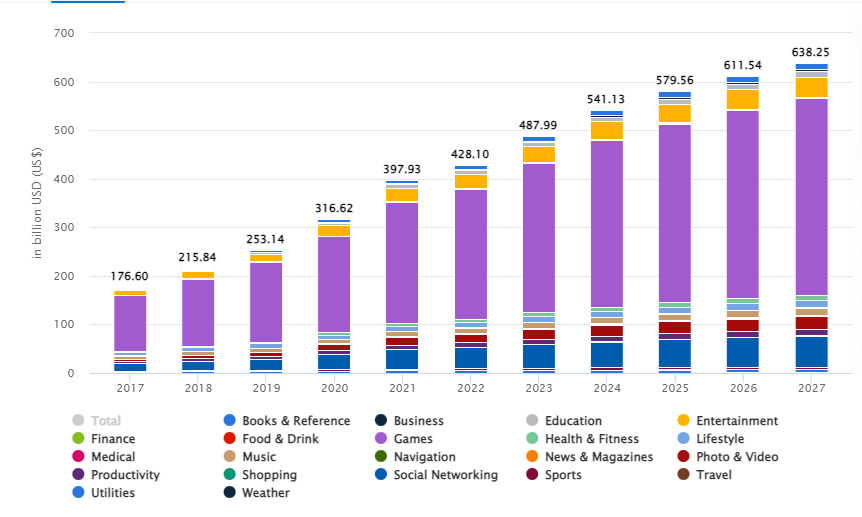

India leads in app downloads with 1500 million but lags in consumer spending at $2.5 billion, highlighting the revenue paradox. (Estimated data)

The India Paradox: Downloads Boom, Revenue Drought

Here's the thing that makes India's app market confusing to investors and analysts: the country leads the world in app downloads but barely cracks the top 20 in consumer spending. In 2025, India was one of only two countries in the top 10 to see year-on-year download growth (alongside Pakistan), while markets like the US, China, and Japan saw declining or flat numbers.

This creates a strange dynamic. India's 1.4 billion people are incredibly engaged with apps. They're downloading more, using them longer, and exploring new categories aggressively. But the average revenue per user remains stubbornly low compared to Western markets.

Why? First, the economic reality. India's median income is a fraction of developed markets. A $9.99 monthly subscription that seems reasonable to a Silicon Valley engineer is substantial for most Indian users. Second, free alternatives dominate. Between YouTube, WhatsApp, and now free AI tiers from every major company, users have learned to expect premium features without paying.

Third, monetization preferences differ dramatically. Indians prefer freemium models, in-app advertising, and ultra-affordable paid tiers over premium subscriptions. They'll sit through ads or pay a rupee or two rather than commit to a $10 monthly plan.

But here's where it gets interesting: companies are finally adapting. They're localizing pricing, offering free premium trials, and building ad-supported premium tiers specifically for the Indian market. Open AI, Google, Perplexity, and others realized that free access in India now means market dominance later when users graduate to paying tiers globally or when they increase their earning power.

The 2025 data shows this strategy working. Chat GPT's rise to #2 downloads wasn't accidental. It was the direct result of free access, aggressive promotion, and features tailored to Indian users (like support for Indian languages and local payment options).

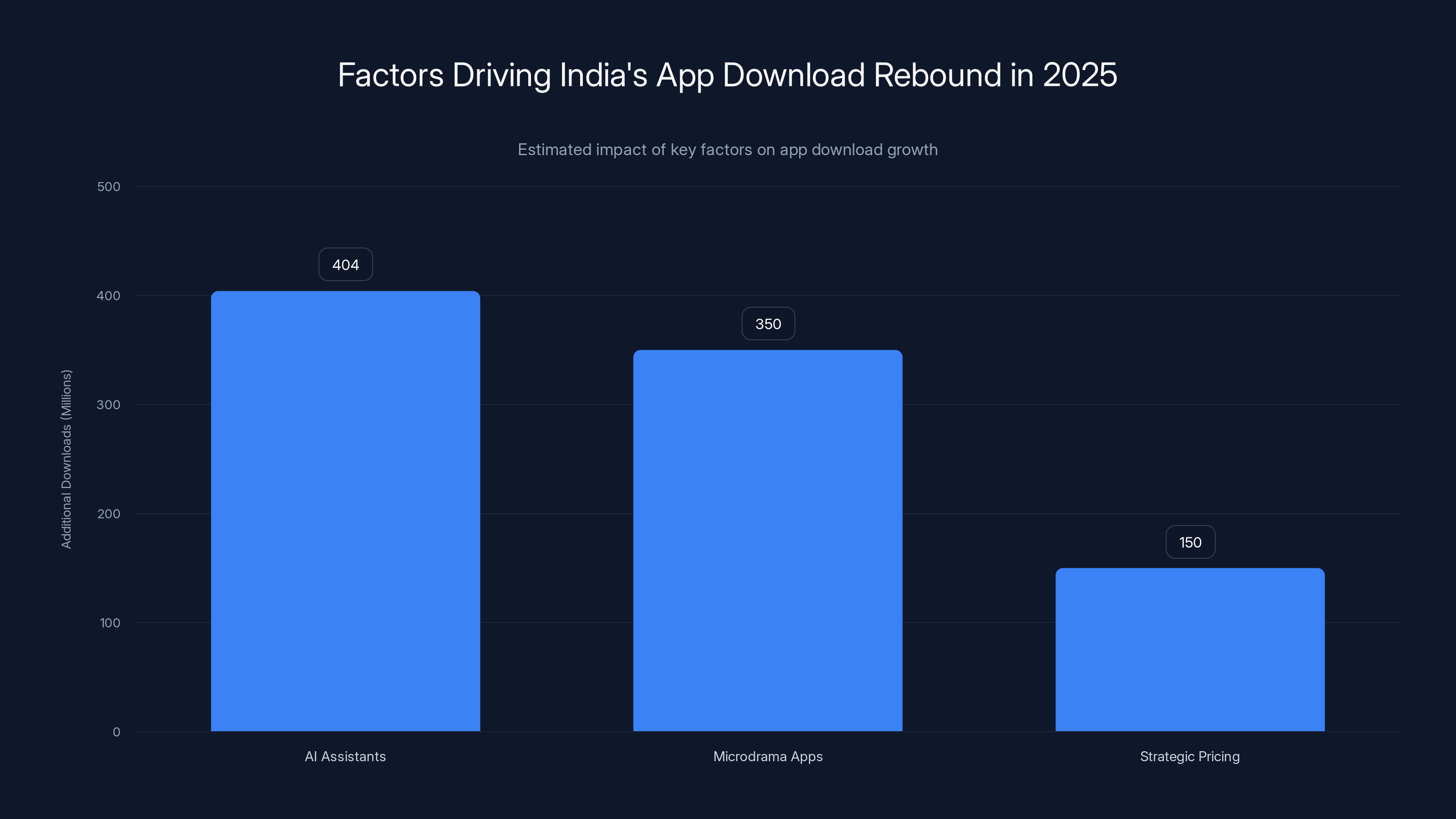

AI assistants and microdrama apps significantly contributed to India's app download rebound in 2025, with strategic pricing also playing a crucial role. Estimated data.

Chat GPT's Meteoric Rise: How AI Went Mainstream in India

Chat GPT hitting #2 in overall downloads—behind only Instagram—is a watershed moment. It signals that AI assistants are no longer niche tools for tech enthusiasts. They're mainstream consumer products. And India is leading the charge.

The timing matters. Open AI released GPT-4 with image capabilities in mid-2024. By late 2024 and into 2025, these image models became genuinely useful for tasks Indians actually perform: creating social media graphics, designing small business materials, generating product images for e-commerce listings, and creating thumbnails for YouTube videos.

Small business owners suddenly had access to tools that used to require hiring a designer. Freelancers could automate routine image generation. Students could create study materials faster. The use cases multiplied, and download numbers reflected that.

But the real catalyst was pricing strategy. Open AI, Google, and other AI companies started offering free or heavily discounted premium tiers specifically in India. Chat GPT Plus normally costs $20/month globally. In India, users could access most features for free or for a fraction of that price. This wasn't charity. It was market penetration disguised as generosity.

The math is simple: capture market share in the world's largest app market now, and monetize heavily once the market matures. India's AI assistant downloads growing from 198 million (2024) to 602 million (2025) proves the strategy works. That's 404 million new AI app downloads in a single year.

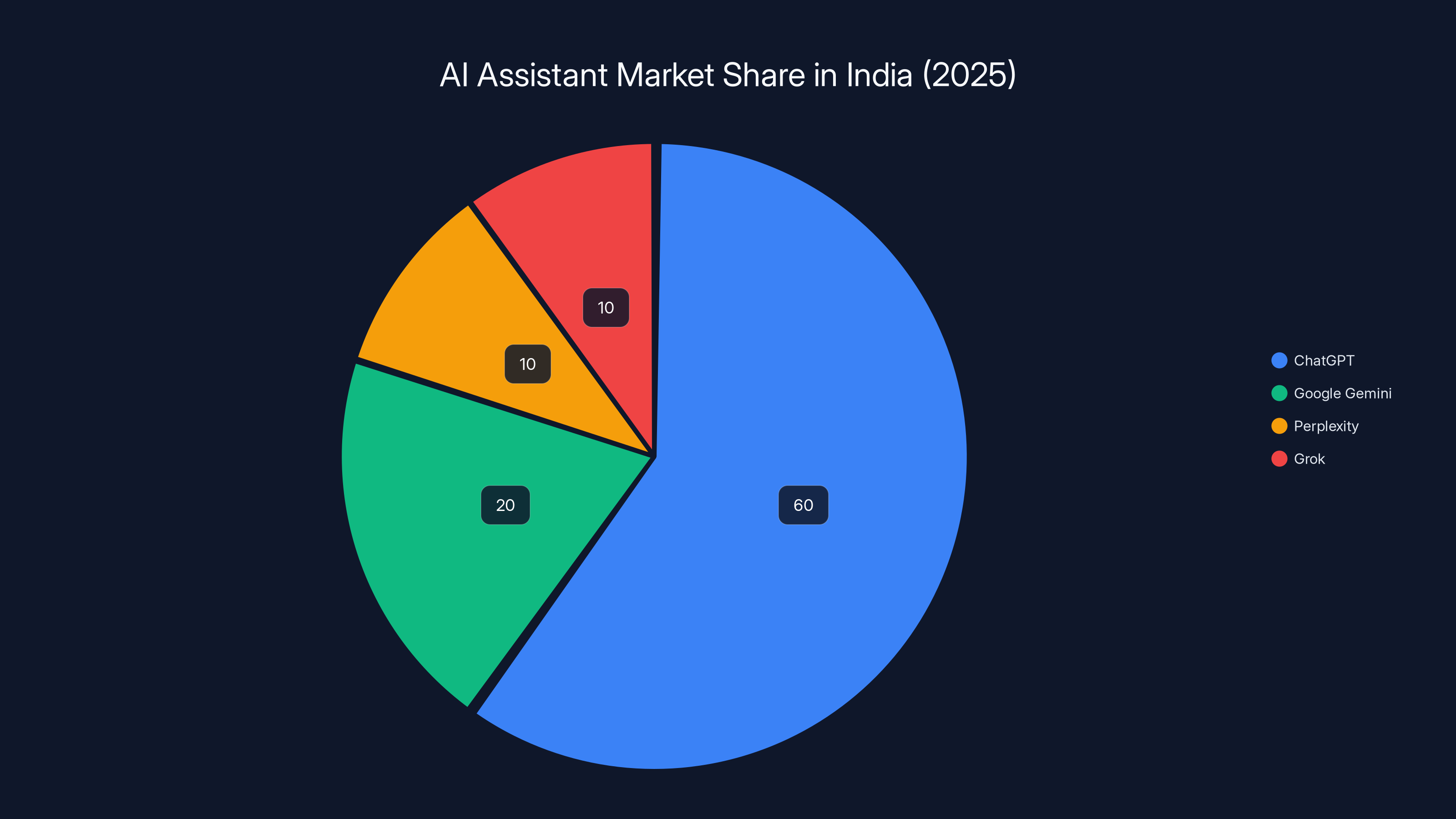

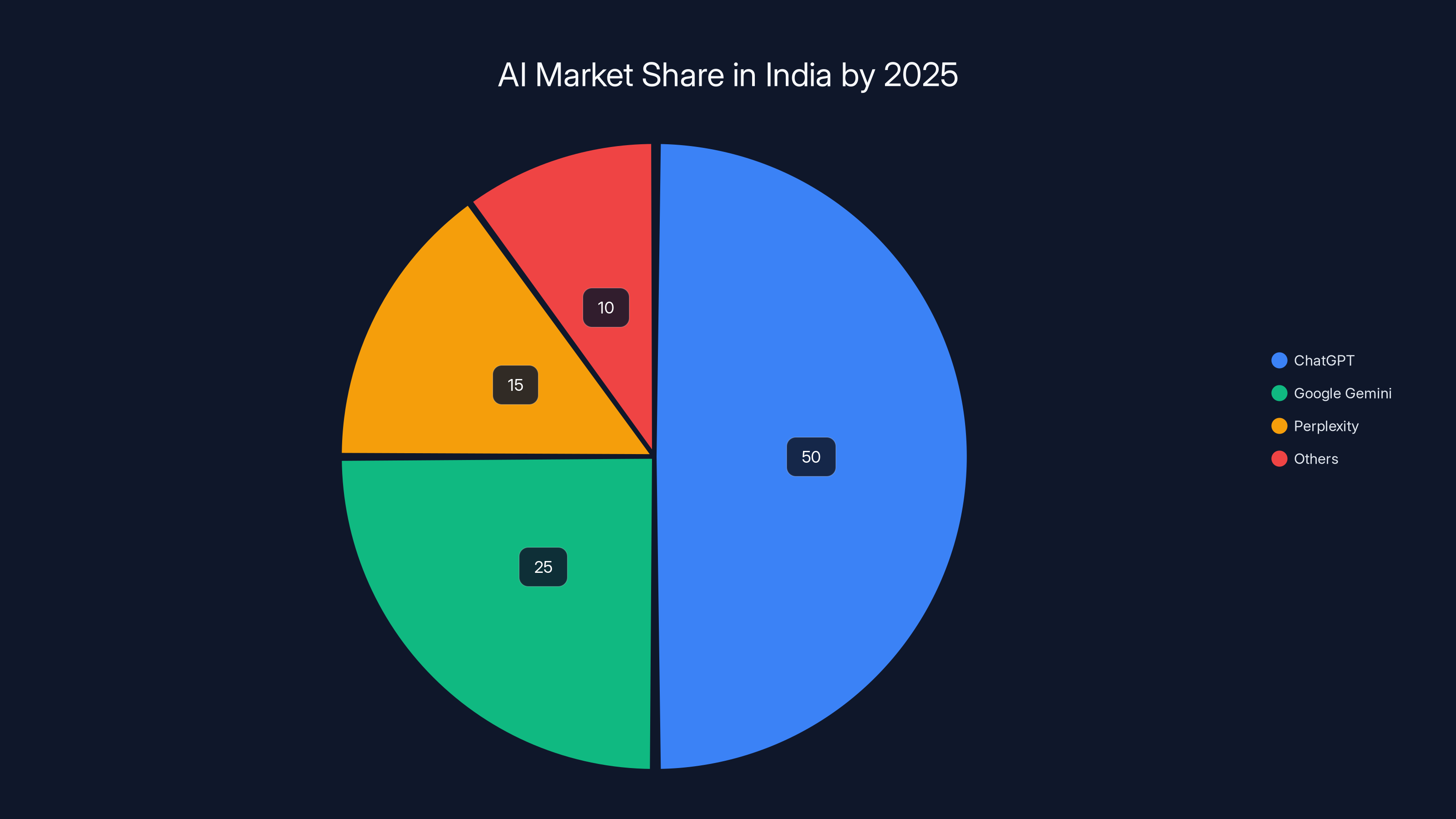

Google Gemini came in second among generative AI apps, followed by Perplexity and Grok. But Chat GPT's lead was dominant. Open AI's combination of consistent product improvements, aggressive Indian market focus, and institutional trust (developed through years of Chat GPT's global dominance) made it the clear winner.

What's especially interesting is that Chat GPT's success in India validates a broader trend: Indians adopt technology quickly when it delivers clear value. They're not loyal to brands—they're loyal to results. This makes them ideal early adopters for new categories and perfect customers for companies willing to adapt.

The Generative AI Explosion: From 198M to 602M Downloads

The numbers here deserve their own section because they're staggering. AI assistant downloads tripled in a single year. Let's break down what that means.

In 2024, generative AI was still somewhat novel in India. Yes, Chat GPT had millions of users, but most were either tech workers or people tinkering with the web interface on desktop. Mobile adoption was limited. The category felt experimental.

By 2025, AI assistants became utilities. Not everyone uses them daily, but if you're doing anything creative, technical, or knowledge-based, you've probably downloaded at least one. The category went from 198 million downloads to 602 million. That's a 204% increase.

What changed? Several things happened simultaneously:

New capabilities arrived: Image generation, voice features, and improved reasoning in large language models made AI assistants genuinely useful for tasks beyond chatting. Indians could use them for everything from creating product listings to generating business proposals to debugging code.

Distribution improved: Integration with existing ecosystems helped. Chat GPT became available through Instagram's search, search integrations appeared everywhere, and AI features started appearing in productivity apps that already had millions of Indian users.

Free access became standard: Companies learned that free access in India was the growth lever. Chat GPT's free tier, Gemini's free tier, and later Perplexity's free tier all removed barriers to entry.

Use cases became clearer: As awareness spread, Indians discovered practical applications. A small business owner could create product images. A student could get homework help. A freelancer could automate repetitive writing tasks.

The category also benefited from global AI infrastructure improvements. By 2025, latency had improved, languages were better supported, and reliability increased. An AI assistant that took 30 seconds to respond and made terrible mistakes in 2023 now responds in 2-3 seconds and produces genuinely useful output. That dramatic improvement drives adoption.

Looking at which AI apps dominated, the ranking tells you about market dynamics: Chat GPT first (brand trust, feature completeness), Google Gemini second (distribution through Android devices, integration with Google services), Perplexity third (superior search capabilities), and Grok fourth (novelty factor, integration with X).

The fragmentation is interesting. Unlike social media, where one or two apps dominate, AI assistants are experiencing healthy competition. Users download multiple AI apps because they serve different needs. Chat GPT for general queries, Perplexity for research, etc. This suggests the market hasn't consolidated yet and probably won't for several more years.

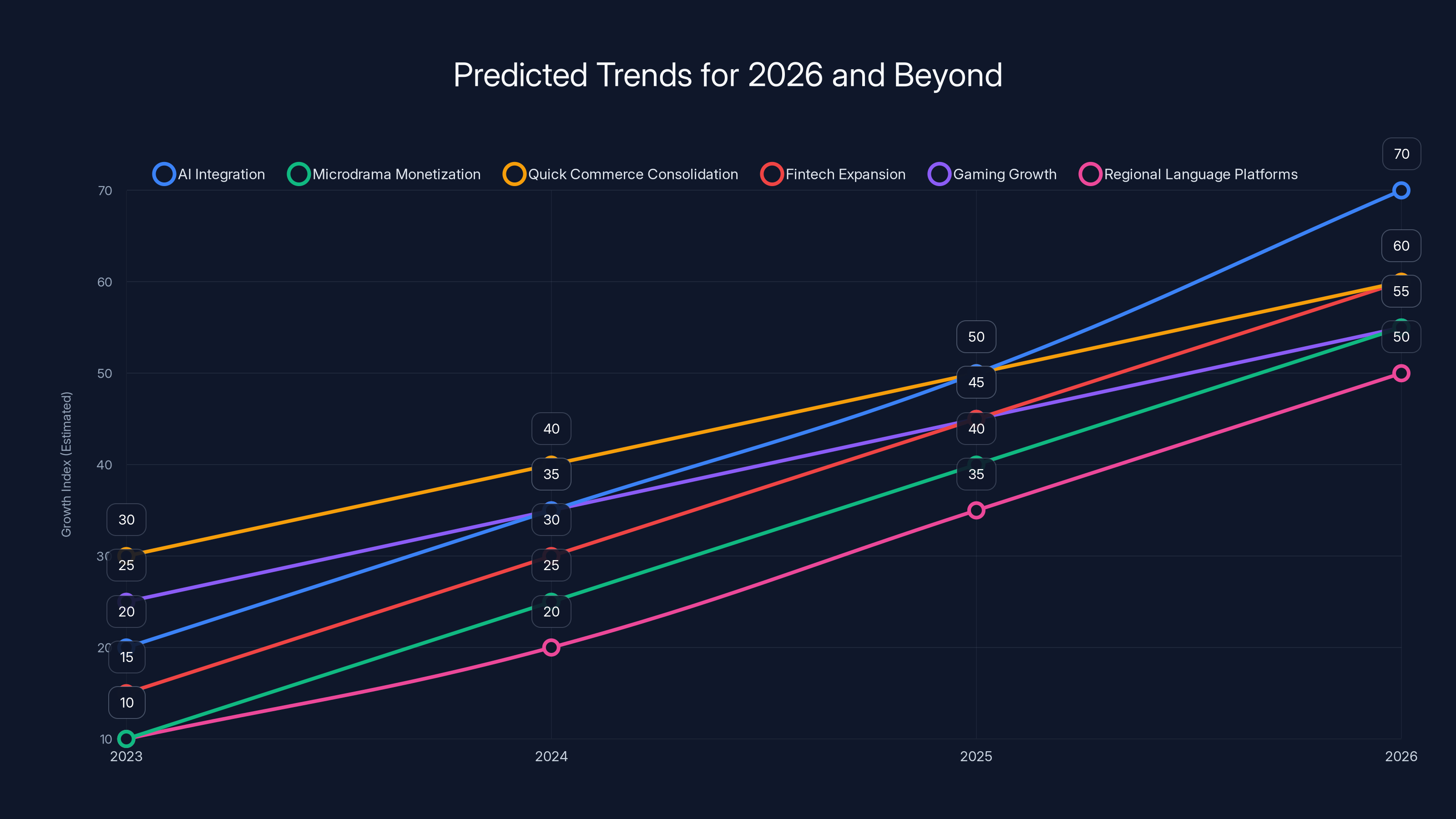

Estimated data suggests significant growth in AI integration and fintech expansion by 2026, with privacy-focused apps gaining traction due to regulatory pressures.

The Microdrama Phenomenon: Short-Form Entertainment Reshapes India's App Ecosystem

If AI was the story of the first half of 2025, microdrama was the surprise hit of the year. Short-form drama apps—also called ultra-short drama or quick drama apps—grew by over 350 million downloads. For context, that's approaching the size of entire categories in other markets.

Microdrama apps are simple: 2-5 minute episodes of serialized drama, cliffhanger storytelling, and addictive narratives. Think of them as the intersection of soap operas (emotional, serialized storytelling) and TikTok (short, mobile-first format). They're optimized to be watched during commutes, lunch breaks, or while doing other things.

Three apps dominated: Kuku TV, Quick TV (owned by ShareChat), and Dash Reels. Kuku TV ranked especially high globally, hitting #4 in the video streaming category worldwide. That's remarkable for a category that barely existed two years ago in most of the world.

Kuku TV's parent company raised $85 million in Series C funding in late 2024, led by Granite Asia. That capital injection accelerated their content production and marketing, which clearly paid off with massive download numbers in 2025.

Quick TV, owned by ShareChat (a successful short-video platform), leveraged its existing user base and distribution network to drive adoption. By November 2025, Quick TV reportedly had over 40 million users watching microdrama content on its platform. That's scaling at a pace that would make most startups envious.

Why did this category explode in India specifically? Several factors converge:

Cultural alignment: Indians love serialized storytelling. Television drama has been massive for decades. Microdrama is that format optimized for mobile screens and modern attention spans.

Production cost efficiency: Creating five 2-minute episodes is much cheaper than producing a 45-minute traditional TV show. Content creators in India are incredibly prolific, and the low production cost means more content gets made and tested.

Addiction mechanics work: The cliffhanger format is psychologically designed to make you watch the next episode. And because each episode is so short, you do. "Just one more episode" before bed turns into eight episodes consumed in an hour.

Mobile-first monetization: These apps are advertising-supported primarily. No expensive licensing deals required. Pure mobile ad inventory monetized in real-time.

Globalization of Indian stories: Indians weren't just consuming microdrama content; creators were producing it at scale. The category became a massive employment generator for screenwriters, directors, and production crews in India.

What really shocked traditional media and OTT platforms: after Q3 2025, Indians downloaded more short-drama apps than OTT streaming apps like Netflix and Jio Hotstar. That's a fundamental shift. People were choosing 2-minute episodes over 45-minute serialized shows.

The industry consensus is that India's microdrama market could reach tens of billions of dollars by 2030. Some analysts predict it could exceed YouTube's advertising revenue in India if the trend continues. That's not hyperbole when you look at user engagement metrics.

App Category Winners and Losers in 2025

Not all categories grew equally. In fact, 2025 revealed some clear winners and losers in India's app ecosystem. Understanding which categories declined gives insight into shifting user behaviors and market maturation.

The Winners:

AI assistants, microdrama, video editing, and social discovery all grew significantly. Quick commerce and food delivery also benefited from India's ongoing ultra-fast delivery boom. Every major city in India now has multiple apps competing to deliver groceries in 10-15 minutes. Downloads for these apps surged as competition intensified and advertising budgets exploded.

Video editing apps grew too, likely driven by content creator expansion. More Indians are creating content for YouTube, Instagram, and TikTok, which requires editing. Mobile editing apps became essential tools rather than novelties.

Social discovery apps—platforms helping users find new content, creators, or communities—also benefited from increased engagement and creator economy growth.

The Losers:

Social media apps actually declined. Instagram, Facebook, and related apps saw fewer downloads in 2025 than 2024. This wasn't user abandonment; these apps are already near-ubiquitous. It's market saturation. If 95% of smartphone users already have Instagram, you can't grow downloads significantly. The category is mature.

Messenger apps similarly declined. WhatsApp and Telegram aren't going anywhere—Indians rely on them for communication. But new user adoption has slowed. The category reached saturation years ago.

Security apps also declined. This might seem counterintuitive, but it reflects consolidation and built-in improvements. Android's built-in security has improved, phones ship with antivirus pre-installed, and dedicated security apps have become less necessary. The category matured and contracted.

This pattern is typical of app markets: explosive growth in new categories, market saturation in mature ones. India's 2025 data shows a market shifting from social communication to productivity, entertainment, and AI-powered tools.

ChatGPT holds a dominant 60% market share in India's AI assistant market in 2025, driven by strategic pricing and product improvements. Estimated data.

Engagement Metrics: 88 Billion More Hours Spent in Apps

Download numbers tell part of the story. Engagement tells the rest. Indians spent 1.23 trillion hours in apps in 2025, up from 1.13 trillion in 2024. That's an increase of 88 billion hours in a single year.

To put that in perspective: if one person worked full-time (2,000 hours/year), it would take 44 million people working every single day for an entire year to equal 88 billion hours. That's the scale of engagement increase in one country over 12 months.

Where did those hours go? Primarily to entertainment (microdrama, video streaming, social media), productivity (AI assistants, note-taking, office apps), and commerce (quick delivery, shopping). The engagement bump reflects the category shifts we discussed.

Microdrama apps specifically are likely responsible for a significant portion. These apps are designed to maximize time spent. Each episode ends with a cliffhanger. The next episode starts immediately. The reward loop is optimized for engagement. Users spend 30 minutes intending to watch one episode and suddenly three hours have passed.

AI assistants also contributed to the engagement increase, though differently. Rather than passive consumption, AI tools drive active engagement. Users actively prompt, edit, and iterate. They spend time crafting questions and reviewing outputs. It's engagement through participation rather than passive consumption.

The increase suggests that not only are more Indians downloading apps, but existing users are engaging more deeply. That's important for app monetization. Higher engagement enables better targeting, more ad inventory, and stronger conversion rates for in-app purchases and subscriptions.

The Domestic App Renaissance: How Indian Builders Are Winning

One of the most overlooked trends in 2025's data: Indian-made apps are gaining ground. Their share of downloads climbed from 33.91% to 36.52%. That's a 2.6 percentage point increase, which might sound small until you do the math.

In absolute terms, that shift represents hundreds of millions of additional downloads going to domestic apps. Every point of market share in India's app ecosystem is worth hundreds of millions of dollars in potential revenue.

Why are domestic apps gaining share? The reason matters because it shapes the competitive landscape going forward. First, regulatory tailwinds helped. The Indian government's "Atmanirbhar Bharat" (self-reliant India) initiative encouraged homegrown app development and created preference for domestic platforms. Some government services moved to Indian-built platforms.

Second, quick commerce and food delivery drove massive domestic app adoption. Apps like Blinkit, Zepto, and others—all Indian companies—exploded in usage as ultra-fast delivery became the norm. Millions of new app downloads went to these companies.

Third, fintech and payments apps saw huge growth, and several Indian companies dominate this space. Phonepe, Google Pay (localized for India), and other payment apps benefited from increased digital commerce.

But here's the important caveat: the revenue story is different. While domestic apps gained 2.6 percentage points in downloads, their share of in-app purchase revenue remained flat. That means Indians are downloading more apps from domestic makers, but not necessarily spending more money in them.

This reflects the business model differences. Indian apps have historically relied more on advertising than subscriptions. American and global apps have pushed paid tiers and in-app purchases more aggressively. So while Indians are engaging more with domestic apps, they're still spending more money in global apps.

Still, the download trend is significant. Market share is a leading indicator. Downloads today become revenue tomorrow as these markets mature. Indian app developers who built massive user bases in 2025 will have far more monetization options in 2026 and beyond.

Companies like ShareChat, Moj, Kuku TV, and smaller fintech players are proving that Indians can build world-class apps. They're competing globally, not just domestically. Kuku TV's #4 ranking in video streaming globally is proof that Indian builders can create products that appeal to everyone, not just their home market.

AI assistant downloads in India surged from 198M to 602M between 2024 and 2025, marking a 204% increase. Estimated data shows a consistent growth each quarter.

The Strategic AI Play: Why Companies Gave Away Premium Features for Free

If Chat GPT's rise to #2 downloads seems unexpected, understanding the business strategy behind it makes perfect sense. Open AI, Google, and other AI companies didn't accidentally dominate Indian downloads. They made a deliberate choice to give away premium features for free.

From a Western perspective, this seems like leaving money on the table. Why give away $20/month of features for free? But the answer is strategic market penetration. India has 1.4 billion people. If AI becomes the foundational computing interface (which many believe it will), then controlling India's AI adoption is controlling the future.

Here's the logic: whoever owns the India market in AI owns one of the world's largest software markets. That means integrations, partnerships, and ecosystem dominance. An AI company that controls 100 million Indian users can negotiate API deals with every Indian platform, from Reliance Jio to Amazon India to banks and fintech companies.

Moreover, free access today trains users on a specific AI platform's interface and capabilities. A teenager in Mumbai using Chat GPT daily is likely to keep using it throughout her career. She'll recommend it to friends, use it at work, and choose it when she has money to spend. Network effects matter enormously.

The short-term revenue loss is a deliberate investment in long-term dominance. Open AI probably spent tens of millions providing free access and servers in 2025 to capture market share. But the expected lifetime value of 100 million Indian users far exceeds that cost.

This strategy also had a defensive component. If Chat GPT didn't move aggressively into India, competitors might have. Google Gemini was already making moves. Perplexity was gaining share. Free access became the weapon to ensure Chat GPT stayed dominant.

The strategy worked spectacularly. By year-end 2025, Chat GPT had penetrated deep into Indian consciousness. News articles about Chat GPT spiked. Parents asked teachers about it. Small business owners integrated it into their workflows. The network effects kicked in exactly as planned.

Going forward, we'll likely see continued aggressive spending in India by AI companies. But the free tiers will gradually shift to freemium models where advanced features require payment. Users who became accustomed to free access might resist, but the path to monetization is clear.

Regional Variations: How India's App Market Differs by Geography

India's app ecosystem isn't monolithic. Regional variations matter enormously, though the 2025 data rolled up nationally doesn't capture these nuances. Understanding these variations is crucial for anyone building products for India.

Metropolitan markets (Delhi, Mumbai, Bangalore, Hyderabad) see adoption of cutting-edge apps first. AI assistants, microdrama apps, and premium subscriptions penetrate these cities first. Users here have higher incomes, better English proficiency, and faster internet.

Tier-2 and Tier-3 cities follow a different pattern. They adopt proven apps later but often in massive numbers. When an app reaches critical mass in metro markets, word-of-mouth and advertising drive adoption in smaller cities. Growth is explosive once it starts.

Language plays a huge role too. While English-language apps dominate in metros, regional language apps gain massive adoption in secondary cities. Hindi, Tamil, Telugu, Marathi, and other language-specific apps see strong download numbers in their regions. This fragmentation creates opportunities for local builders but challenges for global companies.

Internet quality varies significantly. Metros have 4G or 5G coverage almost everywhere. Rural areas still rely on 3G or 2G. This affects which apps gain traction. Heavy apps with poor connection handling see lower adoption in rural areas. Lightweight apps and those optimized for poor connectivity do better.

Payment methods also vary. In metros, credit cards and online payments are standard. In secondary cities, cash-on-delivery, UPI, and prepaid models dominate. Apps that support diverse payment methods outperform those that don't.

Microdrama apps illustrate this well. They have massive adoption in smaller cities where entertainment options are limited. A 2-minute drama episode is far more accessible than Netflix (requires credit card, English content). Traditional OTT platforms assume broadband and Western entertainment preferences. Microdrama apps assume limited bandwidth and preference for Indian narratives.

Understanding regional variation is critical for building successful apps. One-size-fits-all approaches fail. Successful builders localize extensively: language, payment methods, content, and feature prioritization all change by region.

By 2025, ChatGPT is estimated to hold a dominant 50% share of the AI market in India, thanks to strategic free feature offerings. Estimated data.

The YouTube Shorts and TikTok Alternative Landscape

A crucial context for 2025's app trends: YouTube Shorts and TikTok's uncertain future in India dramatically shifted the landscape. In 2020, India banned TikTok, and millions of creators and users migrated to alternatives. By 2025, that migration had matured into a full ecosystem.

Short-video apps like Moj (owned by ShareChat), Josh, and others captured massive portions of the video-creator market. These apps became the primary platforms for short-form content in India. They have different economics, different creator cultures, and different monetization models than TikTok.

YouTube Shorts emerged as another major player, leveraging YouTube's existing infrastructure and creator relationships. But YouTube Shorts' algorithm and monetization are different from YouTube's main platform. Creators often produce Shorts content specifically, with different storytelling and pacing.

This fragmentation of short-video platforms matters because it affects downstream categories. Video editing apps grow because creators need tools. Microdrama apps thrive because the short-video culture normalized 2-minute content. Trends born in short-video platforms (dances, challenges, narratives) spread to other app categories.

The absence of TikTok is also notable from a category perspective. TikTok's algorithmic recommendations drove exploration. Without it, users have less exposure to new trends and creators. This actually benefited established apps more than nascent ones. Instagram, YouTube, and other platforms with large user bases consolidated power because users already knew where to go.

But it also created opportunities for new platforms to capture niches. Microdrama, AI assistants, and specialized short-video apps all benefited from the fragmentation. If TikTok had existed, it might have absorbed much of the attention these apps captured.

Looking forward into 2026, any policy changes regarding TikTok or short-video regulation will significantly impact app download patterns. These categories are sensitive to regulatory shifts.

E-commerce and Quick Commerce's Acceleration

The food delivery and quick commerce booms were major drivers of app downloads in 2025. Every major Indian city saw intensified competition among quick-commerce apps. Companies like Blinkit, Zepto, Swiggy Instamart, and others all invested heavily in marketing and coverage expansion.

Quick commerce's appeal is straightforward: grocery delivery in 10 minutes rather than 30. It transforms shopping behavior. Instead of visiting a store weekly, users order small quantities daily through apps. That's a fundamental shift in purchase frequency and shopping patterns.

From an app download perspective, the competition was fierce. Each company spent millions on ads, discounts, and referral programs to acquire users. Every rupee spent on customer acquisition drove incremental app downloads and user retention efforts.

Food delivery also benefited from the broader delivery infrastructure boom. Swiggy, Zomato, and newer entrants all saw strong growth. The delivery worker network became dense and reliable, enabling faster delivery and better user experience.

These categories also drove significant employment growth. Thousands of delivery workers, warehouse staff, and operations people were hired to support the app-based commerce boom. This created economic activity and spending that fed back into the app ecosystem.

From a data perspective, e-commerce and delivery apps generated massive engagement metrics. Users shop frequently, check apps multiple times per day, and spend money. These categories drive significant monetization despite having lower headline user numbers than social media or entertainment.

Looking at 2026, we'll likely see consolidation in quick commerce as the category matures. But for now, competition is driving innovation and user acquisition, which benefits app download statistics.

The Creator Economy Explosion and Its App Ecosystem

India's creator economy exploded in 2025, and the app ecosystem reflects this. Video editing apps, stream-setup software, lighting apps, and creator-focused tools all saw significant growth. Why? Because millions of Indians decided to create content professionally or semi-professionally.

YouTube, Instagram, and other platforms provided the revenue mechanisms. Creators could earn money through ads, sponsorships, and fan funding. Apps like UPI-based payment tools, creator analytics dashboards, and content calendars became essential infrastructure.

CapCut, a video editing app owned by TikTok's parent company ByteDance, became ubiquitous. Millions of Indian creators used it to edit YouTube videos, Instagram Reels, and short-drama content. Its download numbers reflected this adoption.

The creator economy isn't just about individual creators. It's an ecosystem: tools for creation, platforms for distribution, payments infrastructure, and audiences for consumption. All layers grew in 2025.

What's interesting from a category perspective: creator tools showed remarkably strong growth despite being vertical-specific. Rather than generic app categories, specialized tools for creators thrived. This suggests that functional specialization beats generalization in India's app market.

Companies building creator tools had significant tailwinds. Each creator is a highly engaged user willing to pay for tools that increase productivity or improve output quality. Conversion rates from free to paid are higher in creator tools than most categories.

Going into 2026, expect more investment in creator economy apps. Every platform will build out creator monetization and retention tools. The ecosystem will deepen, and engagement will increase.

Challenges and Friction Points in India's App Market

Despite the growth, India's app market faces significant friction points that constrain further expansion. Understanding these challenges is crucial for product builders and investors.

Data costs: While 4G coverage is ubiquitous in metros, data plans remain expensive for many users. An unlimited monthly 4G plan still costs $5-10 in secondary cities and rural areas. This limits how much users engage with data-heavy apps.

Device limitations: While smartphone ownership is high, many users have low-end devices with limited storage and RAM. Apps must optimize ruthlessly for performance. Bloated, slow apps don't succeed in India.

Payment friction: Despite improvements in payment infrastructure, converting free users to paying users remains challenging. Credit card penetration is low. Cash payments and UPI work well, but each payment method has different conversion rates.

Content authenticity: Misinformation and fake content spread rapidly in India's apps. Platforms struggle with content moderation at scale. Trust in apps fluctuates based on content quality.

Literacy variations: Digital literacy varies dramatically. Many users struggle with complex app interfaces. Successful apps for mass markets need extremely simple UX.

Language support: While English-language apps dominate headlines, successful mass-market apps support regional languages. Building multi-language support is expensive and complex.

Regulatory uncertainty: App regulation in India remains unpredictable. Data localization requirements, content censorship, and emerging regulations create uncertainty for builders and investors.

Support infrastructure: While India has strong engineering talent, customer support remains a challenge. Most users expect responsive support, but providing 24/7 support in multiple languages at scale is expensive.

Successful app companies solve multiple friction points simultaneously. They build low-bandwidth-friendly apps (solving data costs), optimize for low-end devices (solving device limitations), support multiple payment methods (solving payment friction), and provide robust content moderation (solving authenticity).

Looking Ahead: 2026 and Beyond Predictions

If 2025 established AI assistants and microdrama as dominant categories, 2026 will likely see consolidation and expansion into adjacent categories. Here's what we expect:

AI Integration Deepens: Rather than standalone AI apps, we'll see AI features integrated into existing platforms. WhatsApp will have AI assistants. Email apps will have writing assistants. Video editors will have AI-powered effects. The app download impact will be less about new AI apps and more about enabling AI across the ecosystem.

Microdrama Monetization Attempts: As the category matures, monetization pressure will increase. We'll see experiments with premium tiers, paid episodes, and direct creator support. Some experiments will succeed; others will fail. The category won't grow at 350M+ downloads annually, but it will be profitable.

Consolidation in Quick Commerce: After years of competition and explosive growth, we'll likely see consolidation among quick-commerce players. Downloads will plateau, but engagement and revenue per user will increase as the market matures.

Fintech Expansion: India's fintech ecosystem remains underpenetrated. We'll see more niche apps: lending apps, investment apps, insurance apps. Each addressing specific financial needs rather than general finance.

Gaming's Quiet Growth: Mobile gaming in India is massive but underreported in headline statistics. Casual games, MOBA games, and esports apps will continue growing. International publishers will increasingly localize for India.

Regional Language Platforms Rise: As metros saturate, growth in secondary cities becomes the lever. Apps with strong regional language support and local content will dominate regional markets.

Privacy and Security Become Features: Regulatory pressure on data privacy will increase. Apps that emphasize privacy and security will gain competitive advantages. This will accelerate the decline of generic social media apps.

AR/VR Experimentation: Limited by device capabilities currently, but as 5G expands and device costs decline, we'll see more AR/VR experiments. Early adopters will test immersive social, shopping, and entertainment experiences.

The overarching trend: India's app market will continue maturing. Explosive growth in specific categories will moderate, but overall engagement will deepen. The era of fast growth is transitioning to the era of profitability and monetization.

What This Means for Global Tech Companies

India's 2025 app trends have significant implications for global tech companies. First, India is no longer optional. With 25.5 billion downloads and 1.23 trillion hours of engagement, ignoring India means ignoring one-fifth of global app engagement.

Second, the competitive dynamics are different. Domestic companies are winning in specific categories (quick commerce, payments, microdrama). Global companies that succeed do so through localization and adaptation, not just exporting Western product strategies.

Third, pricing and monetization must adapt to local economics. The $9.99/month subscription model that works in the US doesn't work in India. Companies need freemium models, advertising-supported tiers, and ultra-cheap paid options.

Fourth, product quality matters intensely. With millions of app choices, even small quality issues or design oversights lead to uninstalls. Optimization for low-bandwidth, low-storage, and low-compute-power devices is mandatory.

Fifth, regulatory relationships matter. Understanding and complying with Indian government policies, data localization requirements, and content guidelines is essential.

Global companies that treat India as a serious market (not an afterthought for emerging market strategies) are winning. Those shipping generic global products without adaptation are losing to domestic competitors.

The Bottom Line: India's App Market is Redefining Global Tech

India's 2025 app ecosystem rebound isn't just a statistics story. It's a proof point about how technology adoption works in the world's most populous democracy. When AI became genuinely useful, people downloaded it by the hundreds of millions. When a new entertainment format (microdrama) emerged, adoption exploded.

The app market in India is efficient at discovering and amplifying what works. Categories that solve real problems scale rapidly. Categories that don't fade. Unlike more mature markets where incumbents resist disruption, India's app market rewards innovation and punishes complacency.

What's happening in India in 2025 and 2026 will foreshadow what happens globally in 2027 and 2028. AI assistants will become essential utilities. Short-form entertainment will fragment into specialized formats. Localization will become as important as product quality.

For entrepreneurs, investors, and product builders, India's 2025 trends provide a roadmap: build for mobile-first, optimize ruthlessly for performance and cost, localize extensively, and focus on solving real problems rather than chasing trends.

The 25.5 billion app downloads in 2025 aren't just numbers. They represent 1.4 billion people accessing the world's information, entertainment, and services through apps. Each download is a decision to try something new. Each hour spent in an app is time invested in a digital tool. The cumulative effect is reshaping how humanity uses technology.

India showed the world what's next. The question now is whether the rest of the tech industry will adapt quickly enough.

Key Takeaways

- India's app downloads rebounded from 24.6B to 25.5B in 2025, defying global download decline trends

- ChatGPT became the #2 most downloaded app in India by offering free premium access and new image capabilities

- Generative AI app downloads exploded 204% year-over-year, from 198M to 602M downloads

- Microdrama apps grew 350M+ downloads, with Kuku TV reaching #4 globally in video streaming—a new category dominance

- User engagement hours increased 88 billion year-over-year, showing deeper app ecosystem involvement beyond downloads

- Domestic Indian apps increased market share to 36.52% through quick commerce and fintech dominance

- Free premium tier strategies by AI companies proved highly effective for market penetration in emerging economies

- India's app market trends typically foreshadow global trends by 18-24 months, making it a leading indicator ecosystem

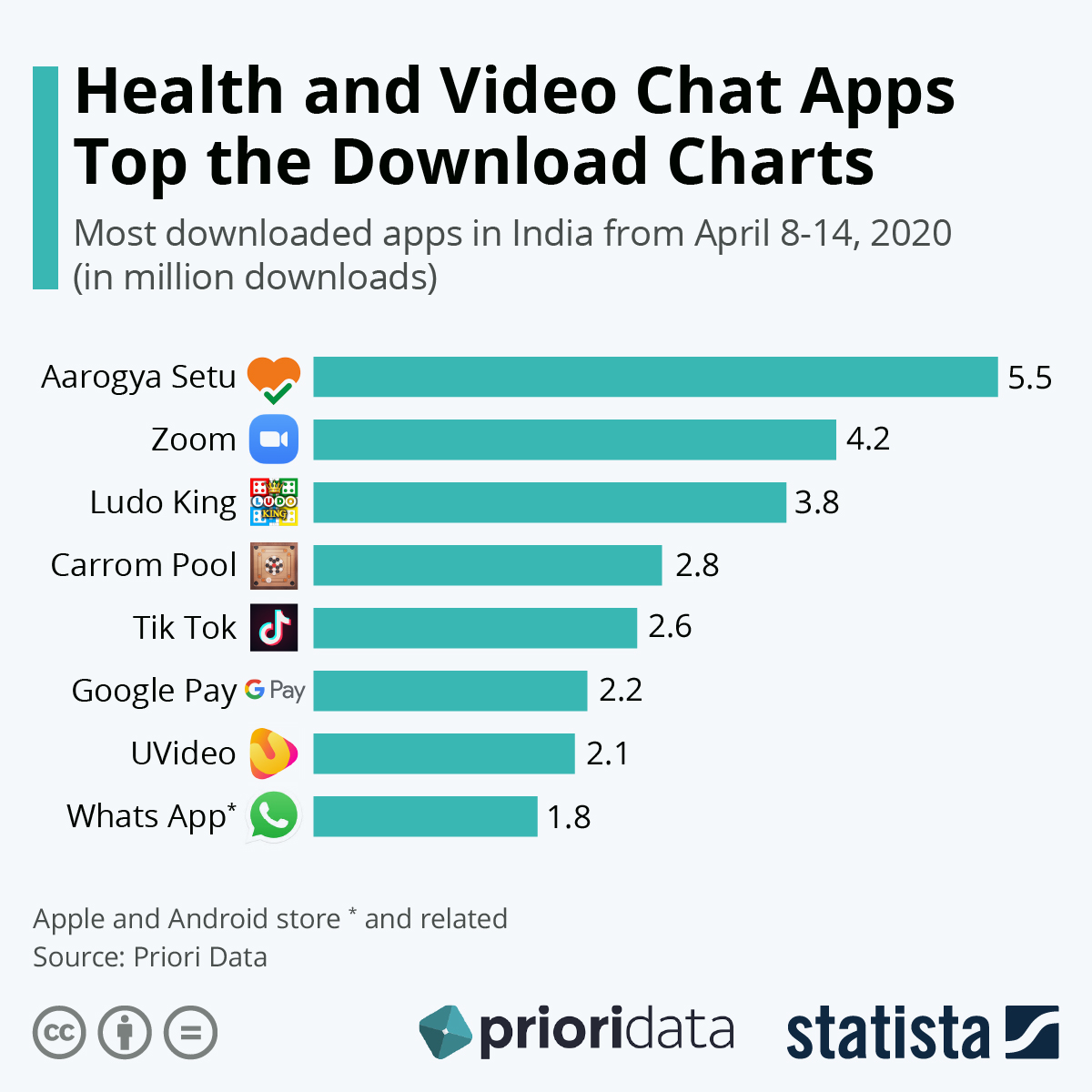

![India's App Downloads Hit 25.5B in 2025: AI & Microdrama Boom [2026]](https://tryrunable.com/blog/india-s-app-downloads-hit-25-5b-in-2025-ai-microdrama-boom-2/image-1-1768995401827.jpg)