January TV Sales 2025: Your Complete Guide to Premium Television Discounts

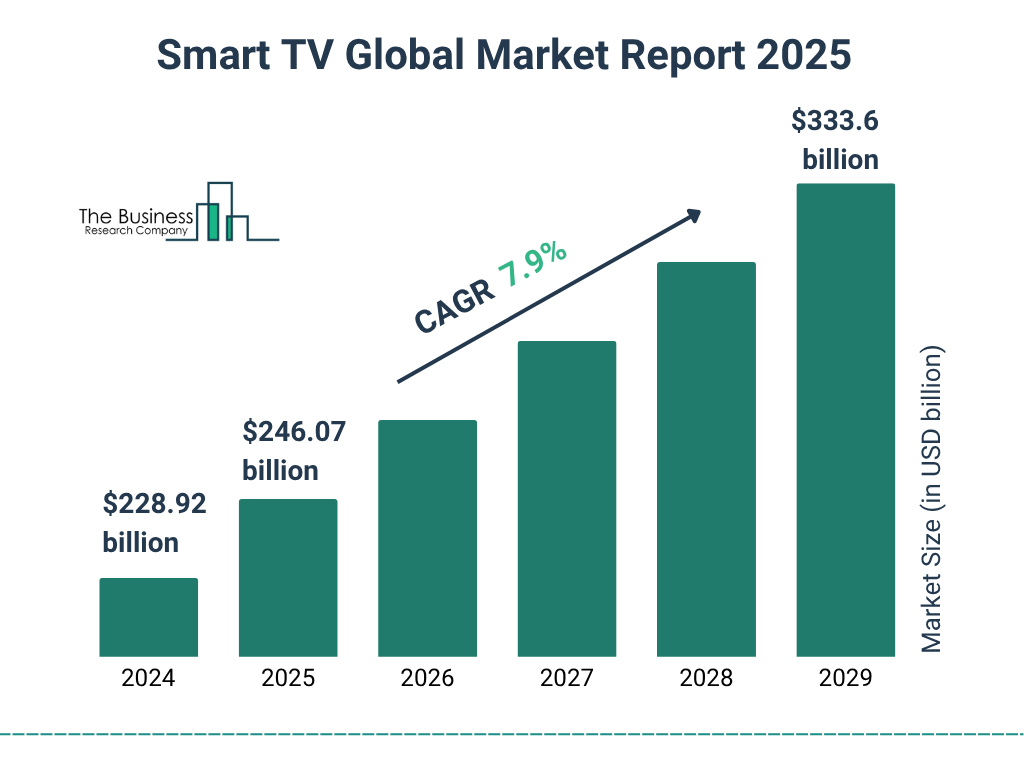

The January television sales season represents one of the most anticipated shopping periods for home entertainment enthusiasts and budget-conscious consumers alike. As retailers clear inventory following the holiday shopping surge and prepare for new model releases, they offer substantial discounts that can reduce premium television prices by hundreds of pounds. According to Altitudes Magazine, this comprehensive guide explores everything you need to know about January TV sales, including which models offer the best value, how to identify genuine savings, and strategic timing to maximize your investment.

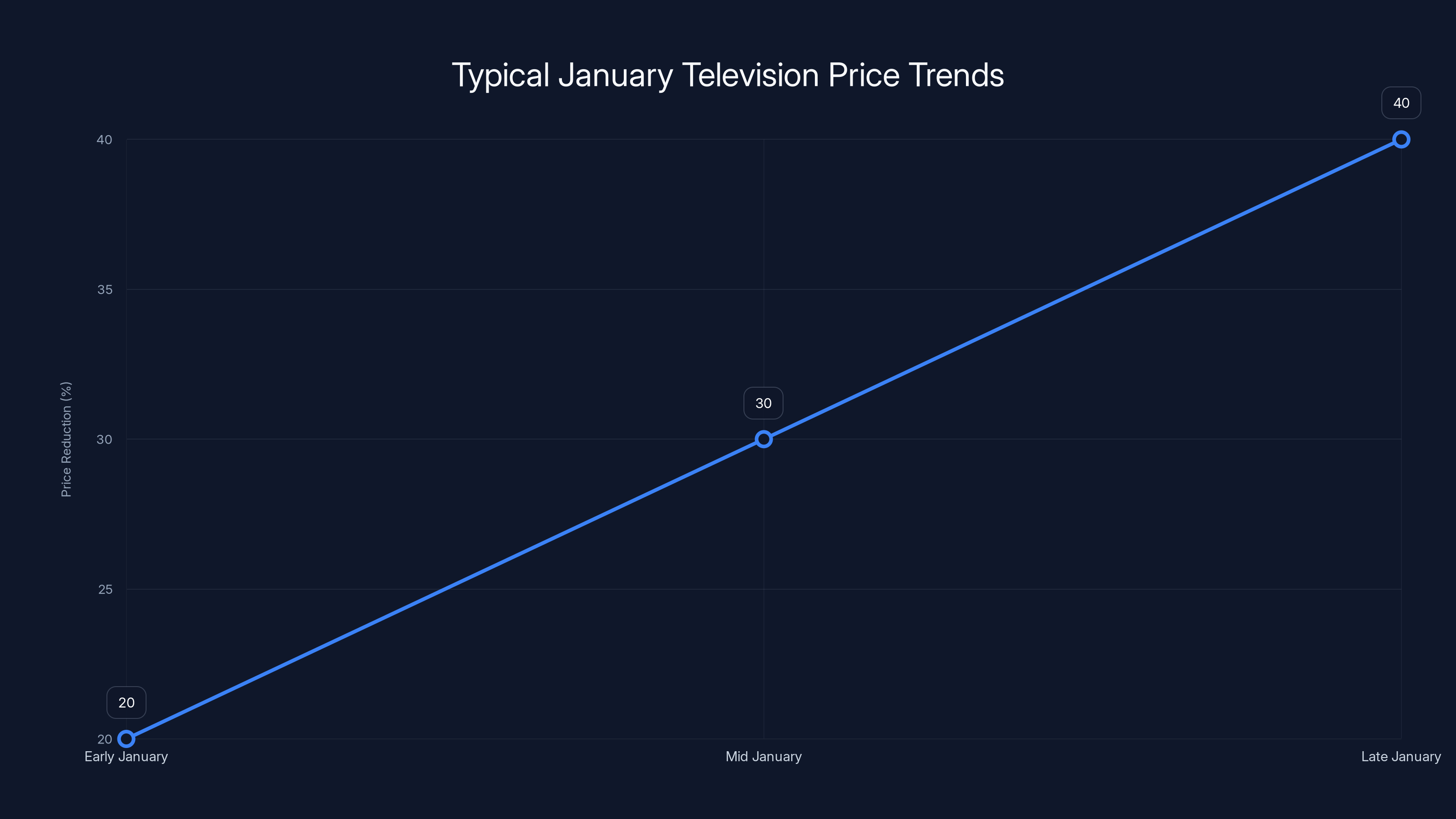

The January sales phenomenon didn't emerge by accident. Retailers operate on predictable cycles tied to manufacturing schedules, consumer behavior patterns, and fiscal calendars. During December and early January, television manufacturers and distributors need to shift inventory to make room for spring model releases. This creates a perfect storm of opportunity for consumers willing to understand the market dynamics. Television retailers face pressure to clear older stock before manufacturers announce next-generation models, often triggering price reductions of 20-40% on popular units, as noted by U.S. Census Bureau retail sales data.

Understanding the mechanics of January TV sales requires recognizing several interconnected factors. First, television manufacturing follows seasonal patterns, with major announcements typically occurring in January and February at trade shows. Second, consumer purchase patterns peak around Christmas, meaning retailers have significant excess inventory by early January. Third, many retailers use aggressive January promotions to drive foot traffic and create consumer loyalty for the remainder of the year. These factors combine to create an environment where finding exceptional deals becomes not just possible but likely.

The timing of January sales in 2025 presents particular opportunities. Unlike previous years when sales concentrated in the final week of January, 2025's retail landscape shows extended promotional periods beginning in early January and stretching through mid-month. This extended window accommodates both online and brick-and-mortar shoppers, accommodates supply chain variations, and aligns with January bonus spending patterns in the UK and Europe. Understanding these nuances helps consumers identify the optimal moment to purchase rather than assuming all January deals offer identical value.

Navigating January TV sales effectively requires more than simply comparing prices. Smart consumers understand the difference between genuine discounts and inflated recommended retail prices. They recognize that not all television models deserve equal consideration, and they understand how specifications translate to real-world viewing experiences. This guide provides the knowledge necessary to evaluate January TV sale offerings intelligently, comparing models across multiple criteria including display technology, refresh rates, smart TV functionality, and long-term reliability.

Understanding Television Technology in 2025

LCD vs QLED vs OLED Display Technologies

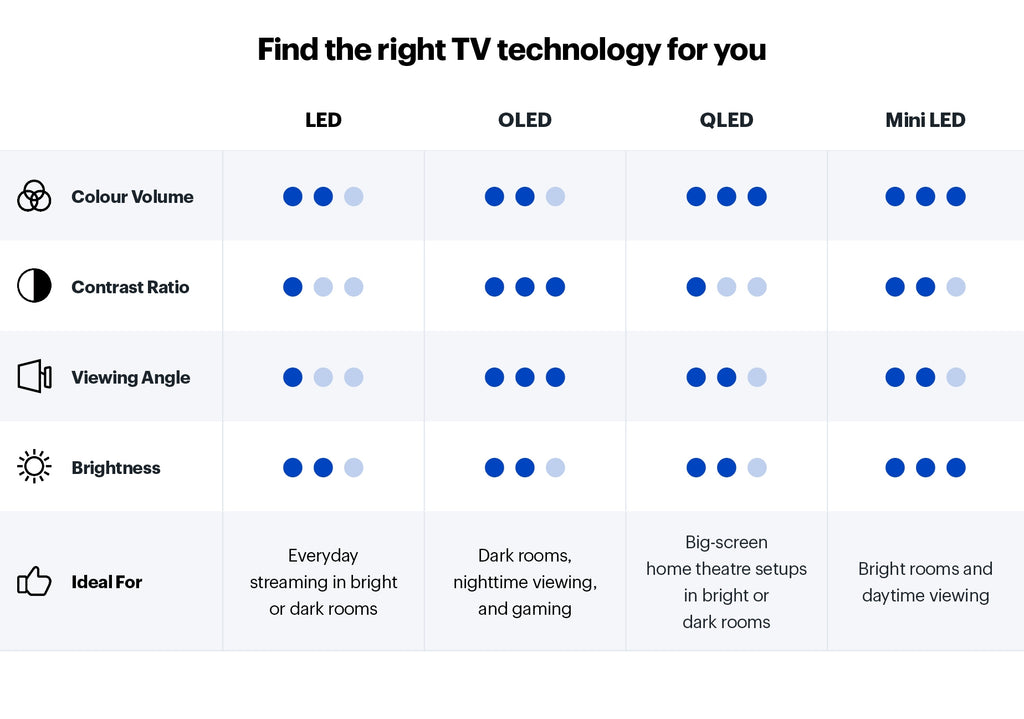

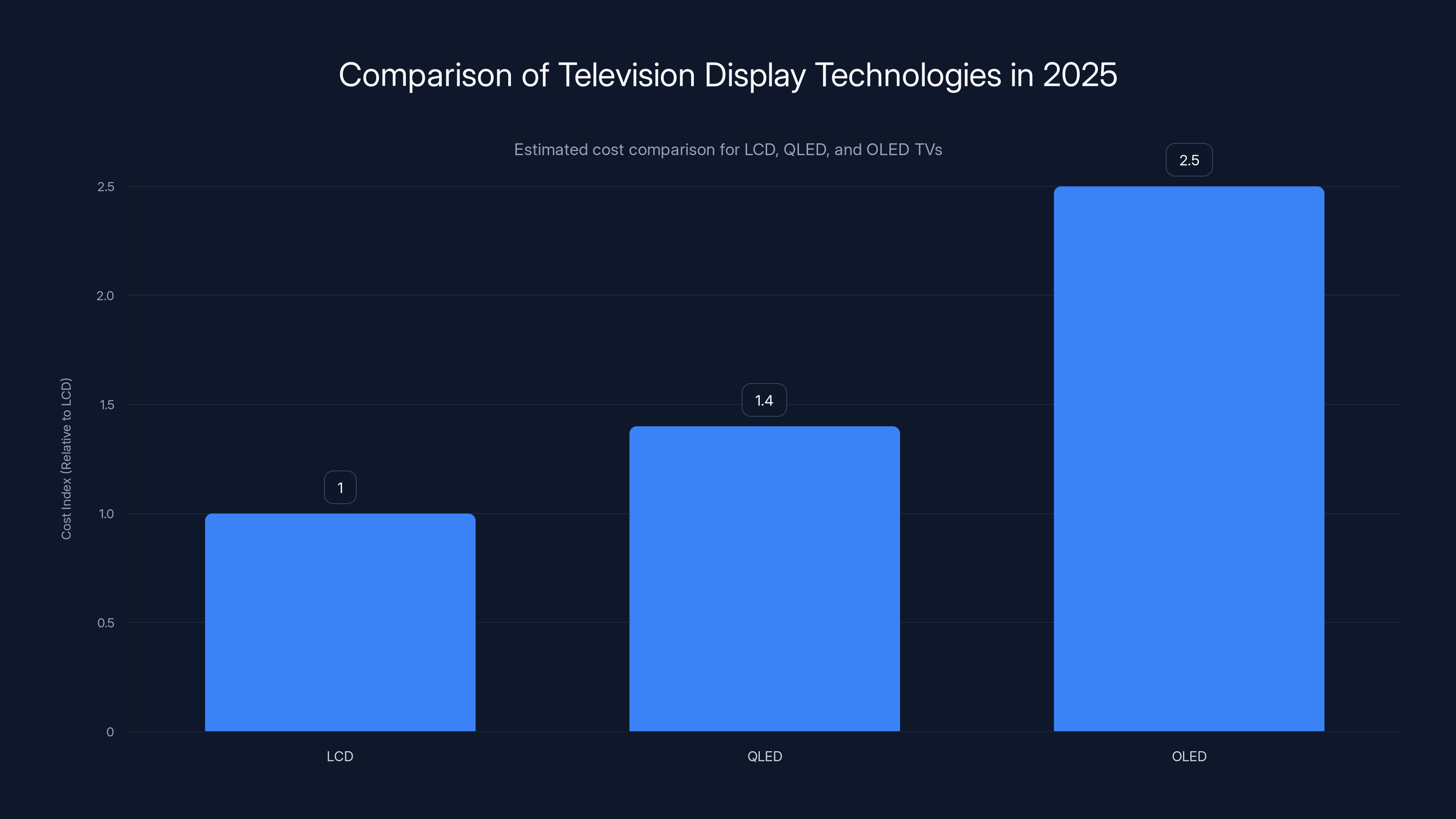

Modern television displays employ fundamentally different technologies, each with distinct advantages relevant to January purchasing decisions. LCD (Liquid Crystal Display) televisions remain the most affordable option, using backlighting systems to illuminate liquid crystal layers. This technology powers budget and mid-range televisions, offering decent picture quality at reasonable price points. During January sales, LCD models typically see the deepest discounts because retailers prioritize clearing this category to prepare for premium technology showcases, as highlighted by Tom's Guide.

QLED (Quantum Dot LED) technology represents Samsung's premium LED offering, incorporating quantum dots to improve color accuracy and brightness. These tiny semiconductor particles emit precise wavelengths when illuminated, delivering superior color volume compared to standard LED televisions. QLED models bridge the gap between budget LCD and ultra-premium OLED, typically costing 30-50% more than comparable LCD models but substantially less than OLED equivalents. January sales frequently feature significant QLED discounts because manufacturers introduce new QLED generations annually, making previous-year models excellent values, as noted by What Hi-Fi?.

OLED (Organic Light Emitting Diode) technology represents the current pinnacle of consumer television displays. Each pixel generates its own light independently, eliminating the need for backlighting systems entirely. This architecture delivers infinite contrast ratios, perfect blacks, and superior viewing angles compared to LCD and QLED technologies. OLED televisions cost two to three times more than equivalent LCD models, positioning them as luxury purchases. January sales occasionally feature OLED discounts, though these reductions typically apply to previous-generation models or smaller screen sizes rather than flagship units, as discussed by Business Insider.

Understanding these technologies informs intelligent purchasing decisions during January sales. Budget-conscious consumers with primary usage focused on casual viewing find excellent value in LCD models discounted 30-40% during January. Those seeking premium picture quality without OLED pricing discover QLED technology hits the sweet spot. Consumers with higher budgets and serious interest in picture quality should specifically monitor OLED discounts, as January offers some of the best OLED pricing throughout the year.

Resolution and Refresh Rate Considerations

4K resolution has become the standard for televisions larger than 50 inches, offering four times the pixel count of 1080p displays. This resolution translates to sharper images, particularly on larger screens where individual pixels become visible without 4K density. Nearly all televisions in January sales events offer 4K resolution, making this an expected baseline rather than a premium feature. The real distinction emerges between standard 4K models and those incorporating advanced processing and premium panels, as noted by RTINGS.

Refresh rates determine how smoothly motion appears on screen, measured in hertz (Hz). Standard refresh rates of 60 Hz suffice for most television viewing, including streaming services, broadcast television, and standard movies. However, 120 Hz refresh rates offer substantially smoother motion for gaming, sports, and action-heavy content. During January sales, consumers should examine refresh rates carefully, as some budget models default to 60 Hz while gaming-focused models emphasize 120 Hz capabilities. For general television consumption, the 60 Hz versus 120 Hz distinction matters less than for dedicated gaming or sports enthusiasts.

Variational refresh rate (VRR) technology synchronizes display refresh rates with content delivery, eliminating motion artifacts and tearing. This feature particularly benefits gamers using Play Station 5 or Xbox Series X consoles. January sales sometimes highlight VRR capability as a differentiator, though most modern televisions include this functionality. Understanding whether specific January deals include VRR helps buyers evaluate value, particularly for gaming-focused purchases. The distinction between basic VRR implementation and sophisticated frame rate conversion significantly impacts real-world gaming performance.

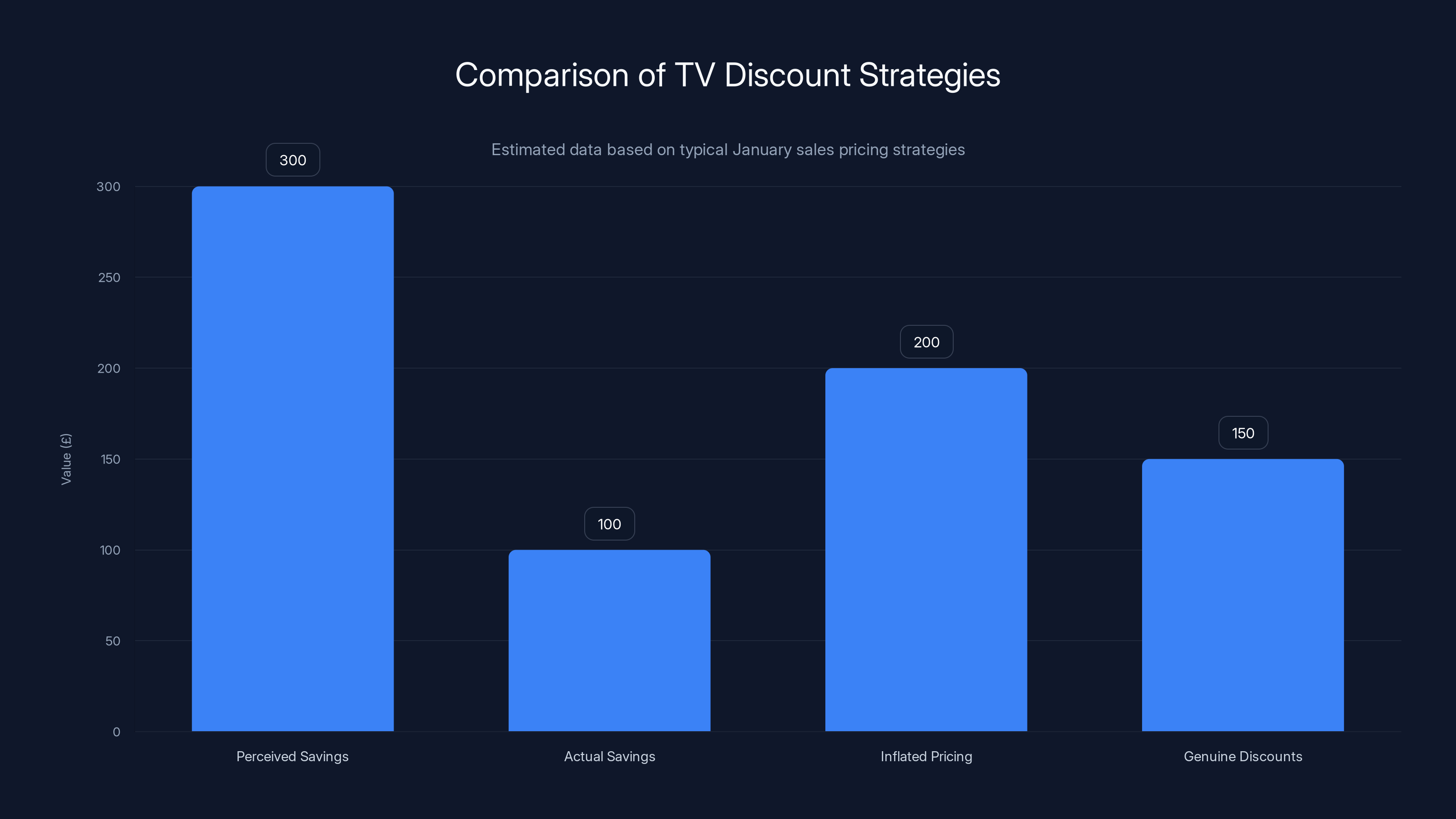

Estimated data shows that perceived savings often exceed actual savings due to inflated pricing strategies, highlighting the importance of verifying genuine discounts.

Major Television Brands and January Pricing Patterns

Samsung Television Strategy During January Sales

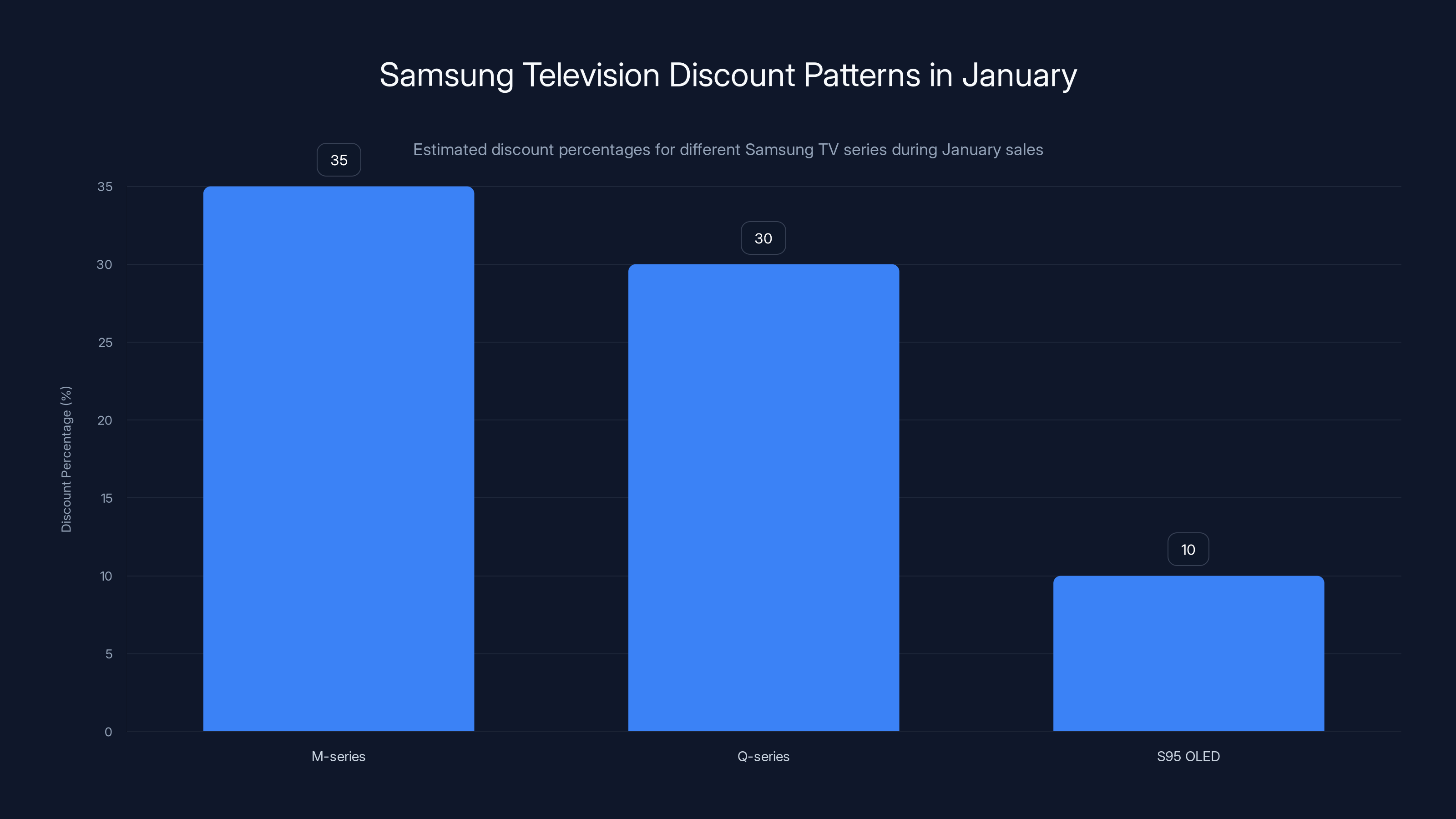

Samsung maintains the largest global television market share and therefore heavily features in January sales events. The company structures its offerings across multiple technology tiers: budget M-series models, mid-range Q-series QLED televisions, and premium S95 OLED units. During January sales, Samsung typically discounts M-series and Q-series models aggressively (25-40% reductions) while maintaining higher prices on latest OLED releases. This strategy clears space for new model introductions while protecting premium product margins, as reported by Samsung Newsroom.

Samsung's television sales approach emphasizes smart TV functionality, integrating their Tizen operating system across all models. The company's One Remote technology unifies control across multiple devices, appealing to consumers building smart home ecosystems. January sales frequently feature bundles combining televisions with Samsung soundbars, streaming devices, or wall-mounting services. These bundled deals often represent better overall value than individual product discounts, though astute consumers should verify whether bundle components interest them before accepting the combined price.

The company's gaming focus has intensified in recent years, with emphasis on 144 Hz refresh rate capability and AMD Free Sync Premium technology. Gaming-focused consumers examining January sales should specifically identify Samsung models featuring gaming-oriented specifications, as these command premium pricing despite potential January discounts. Understanding which Samsung models target casual viewers versus gaming enthusiasts helps buyers evaluate whether higher prices correlate with features they'll actually utilize.

LG Television Market Positioning

LG holds significant market share in premium television categories, particularly OLED technology where the company maintains substantial manufacturing capacity. LG's January sales strategy differs markedly from Samsung, focusing on selective OLED discounting rather than aggressive across-the-board reductions. The company structures offerings into B-series budget LCD models and C-series through G-series OLED tiers, with each tier addressing different consumer segments and price points.

LG's OLED lineup receives careful pricing attention during January sales because OLED production involves significant capital investment and manufacturing complexity. Unlike LCD production, which multiple manufacturers can execute reliably, OLED manufacturing requires sophisticated equipment and process controls. Consequently, LG protects OLED pricing more carefully during January sales, offering discounts selectively on previous-generation models while maintaining list prices on current-generation offerings. Consumers hunting OLED bargains should specifically seek 2024 model-year LG OLED televisions, which sometimes see 15-25% reductions as 2025 models emerge, as noted by Consumer Reports.

LG's Web OS smart TV platform competes directly with Samsung's Tizen, offering intuitive navigation and strong streaming application support. The company emphasizes picture processing quality, touting advanced motion handling and upscaling technology. January sales often highlight these processing advantages as differentiators from budget competitors. Consumers valuing elegant interface design and reliable software updates frequently find LG television value propositions compelling, particularly when January discounts apply.

Sony Television Premium Positioning

Sony maintains a niche position in global television markets, emphasizing picture quality and processing over aggressive market expansion. The company's January sales approach reflects this premium positioning, with selective discounting focused on moving previous-generation models while new releases maintain list pricing. Sony's television expertise traces to decades of professional display manufacturing, lending credibility to their consumer television offerings.

Sony televisions typically command 10-15% price premiums over comparable specification Samsung or LG models, justified by superior picture processing and build quality. During January sales, this premium often narrows as Sony offers deeper discounts on certain models to maintain sales velocity. Consumers prioritizing picture quality should specifically examine Sony January offerings, as the convergence of Sony's inherent quality and January discounting can create exceptional value for picture-focused viewers. Sony's exclusive features like OLED evo technology (in premium models) and advanced motion handling justify premium positioning even during sales events, as discussed by Deadline.

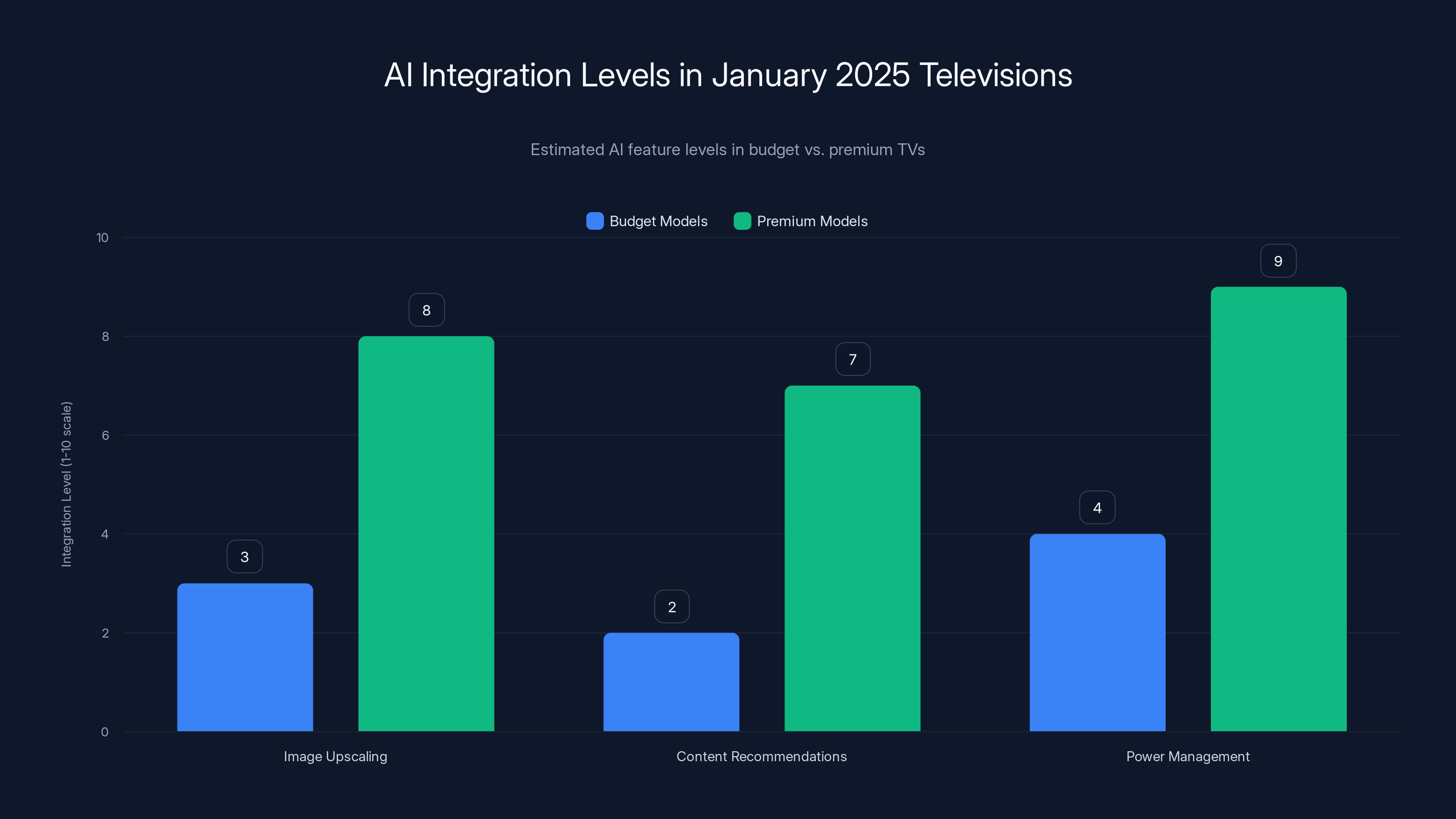

Premium televisions in January 2025 are expected to have significantly higher AI integration across features like image upscaling and power management compared to budget models. Estimated data.

Strategic Timing for January TV Purchases

Early January Opportunities and First-Wave Discounting

Early January (roughly January 1-10) represents the initial wave of television discounting, when retailers first activate promotional pricing in response to post-holiday inventory levels. During this period, deep discounts concentrate on slow-moving models from the previous fall's releases. Early January shopping favors consumers with flexible preferences willing to accept available inventory rather than holding out for specific models. Retailers stock ample inventory during this period because holiday shopping concluded only days earlier, meaning supply levels are at seasonal maximums.

Temperament and consumer psychology significantly influence early January pricing dynamics. Many shoppers experience New Year resolution enthusiasm for home improvements, driving retailers to emphasize encouraging early purchases through competitive opening offers. This creates an environment where first-week January deals genuinely represent some of the season's best pricing, contrary to conventional wisdom suggesting waiting for end-of-month deeper discounts. Consumers requiring televisions for specific purposes (home theater renovation, gaming setup completion) often discover optimal purchase windows during early January before attractive inventory sells through.

Early January's primary advantage involves selection maximization. Retailers maintain full inventory across all brands, sizes, and technologies at this point in the sales cycle. Consumers seeking specific models or particular sizes find availability maximized during early January, with later shopping periods potentially encountering limited selection as popular items sell out. This inventory breadth allows detailed comparison shopping and evaluation without concern that preferred models will disappear before purchase. For buyers uncertain between options, early January provides the leisure to evaluate multiple models side-by-side before committing.

Mid-January Strategic Considerations

Mid-January (January 11-20) represents a transition period where initial promotional enthusiasm moderates while retailers prepare for late-month clearance events. During this window, pricing remains competitive but less aggressive than early January, with focus shifting toward moving specific inventory segments rather than broad category discounting. Retail psychology at mid-January reflects stabilization after New Year rush, with consumer purchasing patterns normalizing toward regular seasonal baselines.

Mid-January pricing strategies vary significantly by retailer and product category. Some retailers maintain early-January pricing to sustain sales velocity, while others have begun reducing selections to clear shelf space. This variation creates opportunities for disciplined comparison shoppers willing to monitor multiple retailers. The mid-January period often features targeted promotions on specific brands or technologies, rather than across-the-board reductions. Retailers use mid-January to execute strategic inventory management, clearing slow movers while protecting margins on popular items.

Mid-January suits consumers with moderate flexibility on purchase timing. Rather than rushing into early-January purchases without adequate evaluation, mid-January shoppers benefit from early month experience data and customer feedback accumulating across their potential purchases. Consumers can observe which January deals generated purchasing enthusiasm versus which promotions moved slowly. This information helps identify whether specific bargains represent genuine value or merely discounted slow-moving stock no one else wanted.

Late-January Clearance Period Dynamics

Late January (January 21-31) historically featured the deepest discounts as retailers executed final clearance before February inventory replenishment. Modern retail dynamics have moderated this pattern somewhat, with retailers beginning clearance events earlier and extending promotions through early February. Nevertheless, late January typically offers exceptional pricing on models approaching model-year transitions and inventory approaching sell-through targets.

Late-January discounting reflects mathematical realities of retail inventory management. Retailers operate under specific financial targets requiring inventory conversion by month-end. Television stock remaining unsold by late January creates accounting complications and warehouse space constraints. These operational pressures translate to aggressive final-week promotions, occasionally featuring prices not seen during earlier January periods. Consumers with high price sensitivity and flexible model preferences often find late January most advantageous.

The tradeoff accompanying late-January shopping involves selection limitations. Popular models likely sold out during early and mid-January, leaving late-month shoppers choosing among remaining inventory. This inventory composition skews toward slow-moving models, unusual sizes, or specification combinations less popular among general consumers. Late-January buyers should approach with specific flexibility, accepting that premium model availability will be limited. However, those finding acceptable alternatives among available stock can capture exceptional pricing.

Maximizing January TV Sales Discounts Through Strategic Shopping

Identifying Genuine Value Versus Marketing Hype

Retailers employ sophisticated pricing psychology during January sales, creating perceptions of value that don't always reflect genuine savings. Understanding the distinction between legitimate discounts and marketing manipulation directly impacts purchasing outcomes. Retailers frequently employ artificial reference pricing, establishing exaggerated recommended retail prices and then discounting from these inflated baselines. A television with a £999 "recommended retail price" discounted to £699 creates perception of £300 savings, though the realistic market price may have been £599 throughout the year.

Identifying genuine value requires investigating reference pricing thoroughly. Smart shoppers check historical pricing across retailers over preceding months, establishing realistic price expectations. Online price tracking tools and retail history databases reveal whether current sales prices actually represent savings or merely standard pricing labeled as promotional. A television genuinely costing £800 throughout the year and discounted to £700 offers legitimate savings, while one with inflated £1,200 reference pricing discounted to £750 may represent worse value than non-sale pricing elsewhere.

Specification analysis reveals another dimension of value evaluation. A discounted television costing significantly less than competitors might feature inferior processing, older technology, or reduced smart TV functionality. January sales occasionally feature dramatic price reductions on models retailers urgently need to clear for other reasons—perhaps warranty issues, regional availability discontinuation, or preparation for model refreshes. Assessing value requires honest evaluation of why specific models receive deeper discounting than competitors. Understanding reasoning behind promotions helps buyers distinguish between strategic clearance creating genuine opportunity versus discounts indicating underlying problems.

Brand-new model year introductions complicate value assessment during January sales. Retailers introducing 2025 model-year televisions sometimes create artificial urgency around 2024 models through aggressive discounting. While 2024 models often offer superior value on a pure specification basis, 2025 models might feature subtle improvements in processing or longevity justifying slightly higher prices. January shoppers should research manufacturer announcements and technical comparisons between model years rather than assuming older equals better value. Occasionally, newest models available during January sales offer better long-term value despite higher prices, because extended warranty periods and software support favor newer models.

Leveraging Bundle Deals and Package Offerings

January television sales frequently feature bundled packages combining televisions with complementary products at promotional pricing. These bundles might include wall mounting services, extended warranty coverage, soundbar packages, or streaming device subscriptions. Sophisticated evaluation of bundle value requires honest assessment of whether included components align with actual needs and preferences.

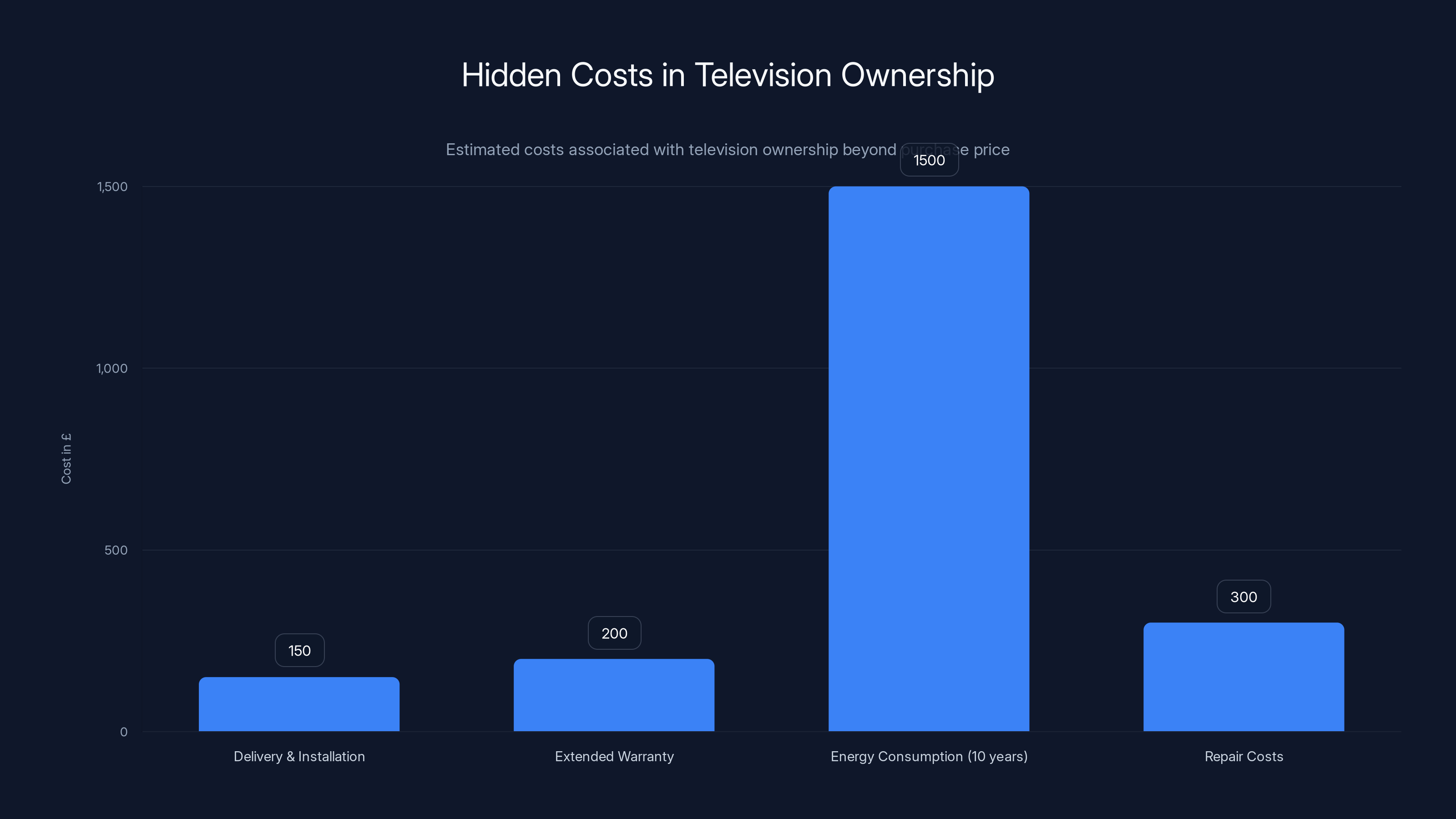

Wall mounting services offer particular value in bundles, as professional installation costs £150-300 when purchased separately. Bundled mounting often requires specific bracket types and installation appointments, potentially limiting customer flexibility. Consumers planning professional installation anyway should strongly weight bundled mounting service value when evaluating overall package pricing. Conversely, those preferring to arrange independent installation should carefully calculate whether bundle pricing advantage persists after removing unwanted mounting services.

Soundbar bundles deserve careful consideration because television audio quality matters substantially for daily viewing enjoyment. Television manufacturers sometimes bundle entry-level soundbars offering marginal audio improvement over built-in television speakers. Consumers should evaluate whether bundled soundbar specifications meet their audio expectations or whether they would upgrade to premium soundbars eventually anyway. A bundled budget soundbar might save £50-100 but represent poor value if the consumer would purchase a superior £300+ soundbar shortly after television purchase. Bundled soundbars make sense primarily for consumers accepting entry-level audio quality or those building complete home theater systems for the first time.

Extended warranty bundles require particularly careful analysis. January television sales frequently bundle extended warranty coverage, transforming a standard manufacturer warranty (typically 1-2 years) into extended protection (3-5 years). Warranty value depends significantly on television technology and consumer risk tolerance. OLED televisions with inherent technology risks might justify warranty extension, while budget LCD televisions involve minimal failure risk making warranty extensions less essential. Understanding specific warranty coverage—whether protection covers accidental damage, provides replacement units, or merely repair services—directly impacts real value of warranty bundles.

Utilizing Financing and Payment Options

Many retailers offer January promotional financing, providing zero-interest payment plans for 12-24 months on television purchases. These financing opportunities effectively reduce real costs when compared against immediate payment, particularly for expensive OLED purchases. A £2,000 OLED television financed over 24 months at zero interest costs substantially less than the same purchase with cash paid immediately, because money retained for 24 months maintains value or generates returns through other investments.

Financing decisions require honest assessment of personal financial discipline. Only consumers confident in maintaining monthly payments should utilize zero-interest financing, as missed payments typically trigger retroactive interest at considerable rates (often 18-29% annually). Financially disciplined consumers comfortable with monthly commitments benefit significantly from promotional financing, effectively accessing expensive premium televisions with genuine cost reduction. Those uncertain about maintaining consistent payments should prioritize lower television costs through simpler purchasing methods.

Cash-back and rewards programs represent underutilized optimization mechanisms during January sales. Consumers using retail-specific credit cards or rewards programs often earn 2-5% cash back on purchases, effectively reducing final cost beyond listed sale prices. January sales frequently increase rewards earning rates as retailers incentivize charging purchases. Optimized shopping involves calculating not just advertised sale prices but final costs after applying all available rewards and cash-back opportunities. A consumer earning 3% rewards on a £2,000 television purchase effectively reduces cost to £1,940 through rewards allocation, a benefit sometimes exceeding the advertised discount percentage.

Estimated data shows that energy consumption over 10 years can exceed initial purchase costs, highlighting the importance of considering total cost of ownership.

Screen Size Selection and Space Considerations

Determining Optimal Screen Sizes for Living Spaces

Television screen size dramatically impacts both visual experience and home environment integration. January sales feature extensive size ranges from 43 inches (appropriate for compact apartments and bedrooms) through 85 inches (suitable for large living rooms and home theater installations). Selecting appropriate size requires honestly assessing viewing distance, room layout, and content preferences rather than defaulting to "larger is better."

Optimal viewing distances generally follow the formula of 1.5 to 2.5 times the screen diagonal distance for comfortable 4K viewing. A 55-inch television optimally positions viewers 82-137 inches away (approximately 7-11 feet), matching typical living room distances. 65-inch televisions suit 10-16 foot viewing distances, while 75-inch models work well for 11-19 foot distances. This scientific approach prevents common mistakes of purchasing too-large televisions creating neck strain and eye discomfort during normal viewing. Conversely, undersized televisions fail to deliver immersive experiences despite advanced technology features.

Wall space and furniture arrangements impose practical constraints on screen size selection. An 85-inch television requires wall space measuring nearly 8 feet wide, limiting applications to homes with large dedicated wall surfaces. Furniture positioning relative to television location affects perceived size; a sofa positioned close to the television wall necessitates smaller screen sizes to maintain comfortable viewing angles. Room darkness also influences appropriate screen selection, as brighter rooms suit larger screens (which maintain brightness over viewing angles better) while darker home theater rooms accommodate smaller screen sizes.

Content consumption patterns inform size selections more than technical specifications. Consumers primarily watching streaming services with small text (news, social media content) might prefer slightly smaller screens with superior picture processing over maximum screen size. Those predominantly watching movies and sports benefit from larger screens delivering immersive experiences. January sales require matching screen size to actual viewing preferences rather than defaulting to popular intermediate sizes.

Managing Space for Ultra-Large Televisions

Ultra-large televisions (75+ inches) create dramatic immersive experiences but introduce practical installation challenges. January sales frequently feature aggressive discounting on these premium sizes because customer demand proves more limited than for 55-65 inch sweet-spot models. Consumers considering ultra-large January purchases should account for installation logistics, including whether existing walls accommodate mounting and whether furniture arrangement permits comfortable viewing.

Wall mounting ultra-large televisions requires professional installation expertise. The weight of 75-inch televisions (often 40+ kilograms) exceeds typical user installation capacity, demanding professional equipment and wall anchoring verification. Installation costs range from £200-400, representing significant expenses beyond the television purchase. Some January bundles include installation, making bundled pricing analysis critical for ultra-large television purchases. Professional installation additionally certifies proper wall preparation, preventing catastrophic failures that could injure inhabitants or damage property.

Room-scale considerations become critical for ultra-large models. An 85-inch television occupies approximately 3,800 square inches of wall surface, fundamentally reshaping room aesthetics and furniture arrangement. Rooms with windows, doors, or architectural features consuming wall space might lack adequate unobstructed surface for ultra-large televisions. Some rooms benefit more from 65-75 inch models despite having space for larger options, because proportions and viewing angles work more effectively with slightly smaller sizes. Visiting showrooms displaying various sizes in similar room contexts helps visualize how specific models will appear in personal spaces.

Smart TV Features and Operating Systems in 2025

Streaming Integration and Content Access

Modern smart televisions serve as primary entertainment hubs, integrating streaming services, broadcast television, and gaming into unified platforms. Operating system quality significantly impacts daily user experience, often mattering more than raw display specifications for casual viewers. January sales feature televisions running different operating systems—Samsung Tizen, LG Web OS, Sony Google TV, and TCL Roku—each offering distinct advantages and limitations.

Tizen and Web OS maintain purpose-built designs optimized for television interfaces, providing responsive navigation and intelligent content discovery. These proprietary systems update frequently with feature improvements and performance optimizations. Google TV, running on Sony and other manufacturers' premium models, integrates Google services including You Tube, Google Play, and Google Assistant voice control. Roku, found on TCL and other budget brands, emphasizes simplicity and neutral streaming service placement, avoiding preferential algorithmic promotion toward specific services.

Streaming application availability has largely standardized across platforms, with Netflix, Prime Video, Disney+, and major services supporting all major operating systems. However, subtle differences in application quality persist; some platforms offer faster loading times, superior user interfaces, or more responsive streaming than others. Consumers should research application performance on specific platforms they use frequently, as day-to-day user experience depends more on these operational aspects than display specifications. January sales facilitate this research, as extended shopping windows allow time to visit showrooms and experience interfaces directly.

Voice control integration varies significantly across platforms. Google TV platforms provide robust Google Assistant integration for voice search, control, and smart home management. Samsung Tizen offers Alexa integration for Amazon ecosystem users. This compatibility divergence matters for consumers with existing smart home systems; purchasing a television compatible with existing voice infrastructure preserves unified control consistency. January sales enable verification of voice control compatibility before purchase, ensuring selected models integrate seamlessly with existing smart home environments.

Gaming Features and Console Compatibility

Gaming functionality has evolved dramatically as Play Station 5 and Xbox Series X consoles leverage television capabilities fundamentally. Modern televisions supporting 4K resolution at 120 Hz refresh rates, variable refresh rate technology (HDMI 2.1 support), and low-input-lag mode create gaming experiences substantially superior to non-gaming televisions. Serious gamers should specifically prioritize these specifications when evaluating January sales offerings.

HDMI 2.1 support represents the critical gaming specification, providing bandwidth necessary for 4K resolution at 120 Hz refresh rates. Televisions lacking HDMI 2.1 support cannot deliver console gaming at maximum capabilities, regardless of other features. January sales sometimes feature "gaming-focused" marketing on televisions without HDMI 2.1, representing misleading marketing exploiting consumer unfamiliarity. Verifying HDMI 2.1 presence through manufacturer specifications prevents this costly mistake. Only televisions explicitly listing HDMI 2.1 support deliver genuine next-generation console gaming capabilities.

Variable refresh rate (VRR) technology including AMD Free Sync and NVIDIA G-Sync eliminates motion artifacts when frame rates vary, essential for smooth console gaming experiences. Low-input-lag gaming modes reduce processing delays that would otherwise create controller-response latency. These gaming-specific features deserve emphasis during January shopping by consumers prioritizing gaming experiences. Conversely, casual viewers unconcerned with gaming should not prioritize gaming specifications, as they increase prices without benefit for non-gaming content.

Samsung and LG both emphasize gaming features in 2024-2025 television lineups, competing for gaming-focused consumers. January sales frequently highlight gaming functionality as differentiators between budget and gaming-focused models at similar price points. Consumers should carefully evaluate whether gaming capabilities justify price increases above base models or whether casual gaming utility makes lower-cost options more sensible. Testing games directly on potential television models through showroom demos provides valuable perspective on gaming experience quality.

Television prices typically drop from 20% in early January to 40% by late January as retailers clear inventory. Estimated data.

Technology Trends Influencing January 2025 Television Values

Artificial Intelligence Integration in Television Processing

Artificial intelligence increasingly influences television operation, from image upscaling to content recommendations to power management. January 2025 sales feature televisions with varying levels of AI integration, with premium models emphasizing sophisticated machine learning capabilities while budget models offer basic implementations. Understanding AI integration's actual impact on user experience prevents paying excessive premiums for marginal improvements.

Upscaling represents AI's most visible television application, where algorithms trained on massive image datasets enhance lower-resolution content to approximate higher resolution appearance. This processing proves particularly valuable for consumers watching standard-resolution broadcast television or older streaming content. Advanced AI upscaling can meaningfully improve viewing experience with older content sources. January sales should emphasize upscaling quality differences between models, as premium upscaling justifies modest price increases for consumers regularly viewing lower-resolution content.

Brand-specific AI processing differs significantly across manufacturers. Samsung's AI processing, LG's OLED processing, and Sony's processing each approach enhancement differently, reflecting different algorithmic priorities. Some emphasize noise reduction, others color accuracy, others motion smoothing. Evaluating whether specific AI processing aligns with viewing preferences matters more than raw processing power. Consumers watching primarily modern streaming content with strong native quality benefit less from advanced upscaling than those regularly viewing older content.

Power management represents an overlooked AI benefit where machine learning optimizes energy consumption based on viewing patterns. Televisions learning when viewing typically occurs and adjusting standby power consumption accordingly deliver cumulative savings. Over television lifespans spanning 7-10 years, optimized power management can reduce energy costs by several hundred pounds. January sales should include power consumption information allowing calculation of operational cost differences beyond purchase prices.

Sustainability and Environmental Considerations

Environmental consciousness increasingly influences consumer purchasing, with January sales featuring sustainable television options aligned with climate commitments. Manufacturers implementing recycled plastic content, reduced packaging materials, and energy-efficient designs market these attributes prominently during sales events. Consumers prioritizing environmental impact should specifically seek models emphasizing sustainability metrics beyond basic energy efficiency.

Energy efficiency ratings significantly impact operational costs. European Energy Label classifications (A through G) provide standardized efficiency comparison across models. A-rated televisions consume 20-40% less electricity than lower-rated equivalents, accumulating to thousands of pounds in reduced energy costs over television lifespans. January sales sometimes feature A-rated models at competitive prices with lower-efficiency alternatives, making sustainability-conscious purchasing financially advantageous beyond environmental benefits.

Manufacturer recycling programs add value for environmentally conscious consumers, though implementation varies considerably. Some manufacturers provide free pickup and recycling of old televisions upon purchasing replacements, eliminating disposal hassles. Others offer modest rebates for returning old electronics. Understanding recycling program details when evaluating January purchases helps identify real environmental advantages versus marketing rhetoric. Televisions with comprehensive manufacturer recycling support create true environmental lifecycle benefits beyond simple energy efficiency.

Common Mistakes to Avoid During January Television Sales

Overlooking Total Cost of Ownership

Purchase price represents only one component of total television ownership cost. Consumers comparing televisions based solely on sale prices frequently overlook delivery fees, installation charges, warranty costs, power consumption expenses, and potential repair outlays. Comprehensive cost analysis including these components reveals that seemingly cheapest options sometimes cost substantially more over ownership periods.

Delivery and installation costs vary dramatically between retailers and television sizes. Some retailers include free delivery and standard installation, while others charge £50-200 for these services. Ultra-large televisions particularly benefit from professional installation (£200-400 costs), making bundled installation significant financial components. Calculating true out-of-pocket cost requires adding all service fees to advertised sale prices, rather than assuming listed prices reflect final costs.

Warranty cost-benefit analysis matters more than casual consideration suggests. Standard manufacturer warranties covering 1-2 years provide minimal financial protection given television lifespans of 7-10 years. Extended warranties adding years of coverage cost £100-300 but provide meaningful risk mitigation for expensive OLED models. Budget LCD televisions, particularly when purchased for secondary rooms with lower viewing hours, less frequently justify warranty extension costs. January sales prominently advertise warranty options, requiring analytical evaluation rather than reflexive acceptance.

Energy consumption translates to surprising long-term costs. A television consuming 400 watts running 8 hours daily costs approximately £150 annually in electricity (at UK rates circa 24p per kilowatt-hour). Over 10-year ownership periods, energy costs accumulate to £1,500, exceeding the television purchase price on budget models. Selecting energy-efficient A-rated models over less-efficient equivalents recovering 20-30% consumption reductions saves £300-450 over ownership periods. January comparisons should factor these operational cost differences when evaluating apparently cheaper less-efficient models.

Impulse Purchasing Without Adequate Research

January sales' promotional intensity creates psychological pressure for rapid decision-making, frequently leading consumers to purchase without adequate evaluation. This impulse buying results in mismatched purchases, buyers remorse, and suboptimal value capture. Successful January shopping requires disciplined research preceding any commitments, resisting sales pressure despite promotional urgency claims.

Retailers deliberately create false scarcity through limited-quantity promotions and time-limited offers, claiming availability will end soon if purchases don't occur immediately. While some inventory limitations prove genuine, many promotions extend far longer than initial messaging suggests. Consumers should verify actual scarcity by examining competitor offerings and monitoring promotional duration across multiple retailers. Genuine scarcity requiring immediate decisions proves relatively uncommon compared to marketing claims suggesting urgency.

Detailed specification comparison before shopping prevents costly mistakes. Creating comparison spreadsheets identifying critical features (display technology, refresh rate, HDMI 2.1 support, smart TV platform, dimensions) ensures evaluation includes all relevant criteria rather than focusing narrowly on price. This preparation enables rapid confident decisions when examining actual products, avoiding regrettable impulse choices made without adequate comparative context. January sales reward prepared shoppers with optimal decisions while penalizing those making uninformed snap judgments.

Choosing Features Over Durability and Support

Consumers frequently prioritize impressive specifications and features while overlooking reliability, longevity, and manufacturer support quality. A television with exceptional processing but questionable build quality creates lasting frustration. January sales emphasize feature lists while manufacturers minimize discussing durability, warranty support, or software update policies determining long-term ownership experiences.

Brand reputation and customer service quality matter substantially for television satisfaction. Manufacturers offering responsive customer support, readily available replacement parts, and consistent software updates deliver better long-term experiences than feature-rich brands with poor support infrastructure. Reviews emphasizing reliability and support quality should influence purchasing decisions as heavily as specification sheets. January sales represent opportunities to purchase from brands with proven support track records rather than experimental purchases from unknown manufacturers offering low prices.

Software update policies directly impact television functionality over 7-10 year ownership periods. Manufacturers committing to multi-year security and feature updates maintain television relevance as smart TV ecosystems evolve. Brands abandoning older television support as new models release create frustrating situations where televisions gradually lose functionality. Understanding manufacturer update policies before purchase prevents discovering mid-ownership that software support has terminated, leaving televisions vulnerable to security threats or incompatible with updated applications.

Samsung offers significant discounts on M-series and Q-series TVs (25-40%) during January sales, while maintaining higher prices on premium S95 OLED models. Estimated data.

Comparing January TV Sales Across Retailers

Major Retailer Promotional Strategies

Primary UK retailers including Currys, John Lewis, Argos, AO.com, and specialist electronics retailers execute distinct January promotional strategies reflecting different brand positioning and customer demographics. Understanding retailer-specific approaches helps identify which venues offer best deals on specific product categories.

Currys typically emphasizes price competitiveness and largest available selection, featuring extensive January discounts across all brands and price ranges. The retailer's loyalty program provides additional savings for members, effectively extending discounts beyond advertised prices. Currys' January strategy focuses on volume, moving substantial inventory through aggressive pricing and frequent sales updates. Consumers seeking broadest selection and deepest discounts frequently find Currys optimal, though service quality varies by location.

John Lewis positions on customer service and brand prestige, accepting lower volume for higher-margin sales. January promotions on John Lewis typically involve moderate discounting with emphasis on service guarantees, generous returns policies, and installation coordination. The retailer's customer service focus benefits consumers valuing support quality over maximum discounts. John Lewis January sales attract customers willing to pay modestly more for superior service infrastructure and reliability.

AO.com's online-first approach emphasizes convenience and fast delivery, featuring competitive January pricing with expedited next-day delivery options. The retailer's online platform enables real-time price comparisons and customer reviews, supporting informed purchasing. AO.com's January strategy emphasizes delivery speed and online service, appealing to consumers preferring minimal retail interaction.

Leveraging Price Matching Guarantees

Most major retailers offer price matching guarantees committing to matching competitor pricing, effectively eliminating retailer selection based purely on price. Successful price matching requires identifying lower prices at competitor venues and requesting matching, often completed within minutes at point of purchase. This mechanism enables purchasing from preferred retailers while capturing best available pricing.

Price matching policies include important limitations and exclusions. Some retailers decline matching special clearance items or previous-generation models. Others require matching only from local competitors, excluding online-only retailers. Understanding specific price matching policies before shopping prevents discovering ineligible deals after completing research. Successful January shopping frequently involves identifying best pricing across multiple retailers, then purchasing from preferred vendor leveraging price matching guarantees.

Online and in-store price differences create additional complications, as some retailers maintain separate online and physical store pricing. Consumers should clarify whether price matching applies across channels before assuming all pricing aligns. Large purchases justify this extra verification, as small pricing differences accumulate to meaningful amounts on expensive televisions.

Future-Proofing Television Purchases Through January Sales

Assessing Longevity and Upgrade Paths

Television technology evolution proceeds steadily, with incremental improvements rather than revolutionary changes characterizing annual generations. Selecting models with strong foundational specifications ensures remaining relevant despite advancing technology, preventing premature obsolescence. January sales provide opportunities to purchase resilient televisions likely to satisfy requirements throughout extended ownership periods.

HDMI 2.1 support represents critical future-proofing specification, accommodating next-generation gaming consoles and emerging high-bandwidth content delivery. Televisions lacking HDMI 2.1 will gradually become incompatible with advancing content ecosystem. Selecting models with full HDMI 2.1 support ensures compatibility with foreseeable developments over 7-10 year periods. January sales should prioritize models with comprehensive HDMI 2.1 implementation across all ports rather than limited single-port support.

Refresh rate capacity similarly influences longevity, with 120 Hz refresh rates supporting advanced gaming and sports content beyond current standard refresh rate capabilities. While 120 Hz content remains relatively uncommon currently, adoption likely continues over television ownership periods. Selecting 120 Hz-capable models future-proofs against content ecosystem evolution, ensuring compatibility when 120 Hz content becomes standard.

Manufacturer software update commitments directly impact long-term functionality. Brands committing publicly to multi-year security and feature updates provide better long-term value than those remaining noncommittal. Verifying manufacturer statements regarding update duration and scope before purchase prevents discovering support termination years into ownership. January sales research should include documentation of manufacturer update policies.

Considering Secondary Use Cases and Longevity Planning

Most television purchases serve primary entertainment purposes but frequently transition to secondary roles (bedroom televisions, office displays, streaming devices) as consumer circumstances change. Selecting versatile models serving multiple purposes increases total value extracted from television investment. January sales enable purchasing higher-quality models for secondary purposes rather than defaulting to budget options.

Bedroom televisions benefit from smaller sizes (43-55 inches) with excellent motion handling and color accuracy enabling film viewing without excessive eye strain from close distances. Gaming-focused purchases merit emphasis on HDMI 2.1 support and low-input-lag modes ensuring capability optimization throughout ownership periods. Work-from-home offices increasingly utilize television displays for productivity, requiring excellent clarity and low blue-light characteristics minimizing eye fatigue. January sales provide opportunities to invest in quality models serving multiple purposes rather than accepting budget compromises.

Evaluation of potential secondary purposes during initial purchasing ensures selecting televisions maintaining value across various usage scenarios. A television with exceptional film processing capabilities might also serve home office purposes admirably, whereas specialized gaming models might poorly serve film-watching purposes. Versatile televisions balancing strengths across applications provide superior long-term value despite potentially higher initial prices.

OLED TVs are estimated to cost 2.5 times more than LCDs, with QLEDs priced in between. Estimated data based on typical market trends.

Understanding Price Fluctuations and Market Dynamics

Manufacturing Cycles and Inventory Management

Television manufacturers introduce new model lineups annually, typically during January-February periods. These introduction cycles create inventory management pressures requiring substantial clearing of previous-year stock. Understanding manufacturing cycles enables predicting which products will receive deeper January discounting, informing purchase timing and model selection.

Manufacturers produce television models in specific quantities aligned with sales forecasts. Miscalculations result in excessive inventory requiring aggressive clearance or insufficient inventory creating shortages. January sales represent opportunities for consumers when forecasts exceeded actual demand, forcing retailer markdowns. Conversely, unexpected demand surges limit January discounting because inventory constraints prevent aggressive promotions. Market observers monitoring pre-January sales data can predict which manufacturers face inventory overages likely to trigger deeper discounting.

Model transitions significantly influence January pricing. Manufacturers preparing to discontinue particular models aggressively discount inventory, creating exceptional deals on products about to exit production. Consumers should monitor manufacturer announcements identifying discontinuations, as these represent optimal purchasing windows. Conversely, newly introduced models typically maintain list pricing during January despite availability, as manufacturers protect margins on current releases.

Supply Chain and Currency Fluctuation Effects

Global television manufacturing and supply chain dynamics influence pricing through currency fluctuations and logistics costs. Pound weakness relative to manufacturing currencies (particularly Korean won and Chinese yuan) increases imported television costs, potentially limiting January discount depths. Conversely, pound strength reduces import costs, enabling more aggressive discounting. Monitor currency trends preceding January sales to anticipate pricing environment.

Shipping costs and logistics influence wholesale pricing manufacturers quote retailers, indirectly impacting retail promotions. Elevated international shipping costs reduce retailer margins, occasionally limiting aggressive discounting. Lower logistics costs expand margin capacity enabling deeper promotions. These macro factors remain beyond consumer control but understanding their influence helps explain why some January sales prove deeper than others despite similar retailer competitiveness.

Seasonal supply chain pressures compound mid-January, as transportation constraints and manufacturing capacity limitations peak. Later January purchasing sometimes encounters reduced inventory and less aggressive discounting due to supply chain constraints. Early January shopping captures benefits of maximum inventory availability before seasonal logistics pressures develop.

Regional Variations in January Television Sales

UK and European Market Differences

January sales timing and promotional intensity vary notably across regions, reflecting different consumer behaviors, retail structures, and fiscal calendar alignments. UK January sales broadly align with other Northern European markets (Germany, France, Netherlands), featuring aggressive discounting across similar timeframes. However, promotional emphasis differs by region based on consumer preferences and retail concentration patterns.

UK retailers emphasize price competitiveness and promotional urgency more than Continental European counterparts, reflecting intense competition among major chains. German retailers, conversely, emphasize quality and service, with January discounting less aggressive but accompanied by stronger guarantees and support. French consumers exhibit greater preference for brand reputation, reducing effectiveness of deep discounting compared to UK markets. Understanding these regional psychological differences explains promotional variance between countries.

VAT and tax treatment varies across regions, influencing true purchase costs. UK VAT at 20% applies to televisions, while some EU markets maintain different rates. Cross-border purchasing occasionally provides savings, though logistics and warranty complications often negate pricing advantages. Most consumers optimize within their regional markets rather than pursuing complex cross-border transactions.

Timing Considerations Across Time Zones

Online January sales introduce timing complexities, with US and Asian retailers often initiating sales days before UK retailers. Consumers with access to international retailers gain potential advantage through earlier shopping windows. However, shipping costs and customs complications typically outweigh pricing advantages unless engaging through international retailers with established UK warehousing.

Making Final Purchase Decisions

Creating Evaluation Frameworks

Successful television purchases result from systematic evaluation comparing multiple candidates across comprehensive criteria. Creating decision frameworks preventing overlooked factors ensures optimal selections. Framework components should include display technology assessment, size/fit evaluation, feature evaluation, value comparison, and brand reputation verification.

Weighting different criteria according to personal priorities prevents analysis paralysis while ensuring comprehensive evaluation. Consumers prioritizing picture quality should weight display specifications heavily, while gaming-focused buyers should emphasize HDMI 2.1 and refresh rate specifications. Families with varied preferences should identify compromise positions satisfying multiple user needs rather than optimizing for single-use cases.

Post-Purchase Verification and Return Protocols

January sales require understanding return policies and verification procedures before committing to purchases. Most UK retailers allow 14-30 day returns, sufficient for comprehensive testing of television functionality. Verify specific return window and potential restocking fees, as some retailers apply charges for returning discounted merchandise. Confirming return policies before purchase prevents discovering inadequate windows for proper evaluation after money commitment.

Post-purchase verification should include careful inspection of physical condition, verification of all components (remotes, cables, documentation), and testing of core functionality. Gaming-focused buyers should verify HDMI 2.1 functionality through actual console testing rather than accepting retailer assurances. Smart TV users should verify streaming applications function correctly and software updates complete successfully. These verification steps require time, emphasizing importance of adequate return windows during January purchasing.

FAQ

What determines the best January television deals?

Optimal January deals combine legitimate discounts (25-40% below realistic market prices) on models featuring specifications matching personal requirements. Best deals require balancing desired specifications against price, selecting models offering premium capabilities without unnecessary features inflating costs. Success requires researching realistic pricing throughout preceding months, identifying deep discounts reflecting genuine savings versus inflated reference pricing typical of sales marketing.

Why are January television prices lower than other seasons?

Retailers clear inventory after December holiday surge and prepare for spring model releases, creating inventory overages requiring aggressive discounting. Manufacturers introduce next-generation models in January-February, reducing demand for previous-year stock. These supply and demand misalignments force retailers to reduce prices substantially to move inventory before accounting period transitions and model releases occur.

Should I purchase televisions early January or late January?

Early January offers maximum selection and full inventory availability, suiting consumers uncertain between options or seeking specific models. Mid to late January provides deeper discounting as retailers execute final clearance, benefiting price-sensitive consumers with flexible preferences. Purchase timing depends on individual priorities; price-focused consumers should wait while those valuing selection should shop early.

How do I verify if January sales represent genuine value?

Compare current prices against historical pricing from preceding months using price tracking tools and retailer archives. Calculate total ownership costs including delivery, installation, warranty, and energy consumption rather than comparing purchase prices alone. Research whether reference prices represent realistic non-sale pricing or inflated baselines. Evaluate specifications against personal requirements rather than assuming lowest prices offer best value.

What television specifications matter most for January purchasing?

Display technology (LCD, QLED, OLED) determines picture quality and price, with LCD budget-friendly, QLED mid-premium, and OLED ultra-premium. 4K resolution is standard while 60 Hz refresh rates suffice for general viewing and 120 Hz benefits gaming/sports enthusiasts. Smart TV platform and streaming application support affect daily user experience significantly. HDMI 2.1 support matters for gaming console compatibility. Energy efficiency impacts long-term operating costs substantially.

Are bundle deals worthwhile during January sales?

Bundle value depends on whether included components align with actual needs. Wall mounting services offer genuine value (£150-300 costs) for installations planned anyway. Soundbar bundles make sense for consumers accepting entry-level audio; those requiring premium audio should purchase higher-quality soundbars separately. Extended warranty bundles require careful evaluation based on technology type and personal risk tolerance. Calculate whether bundled items would be purchased separately before accepting bundles as value.

How important is brand reputation compared to specifications during January sales?

Brand reputation significantly influences long-term satisfaction through software update frequency, customer service quality, and reliability. Exceptional specifications mean little if manufacturers provide poor support or televisions fail prematurely. January sales should balance specifications against brand track records, avoiding unknown brands offering suspiciously low prices. Established brands' January discounting provides confidence in both current products and ongoing support throughout ownership periods.

What warranties matter for January television purchases?

Standard manufacturer warranties (1-2 years) cover manufacturing defects but exclude wear and accidental damage. Extended warranties add years of coverage (typically 3-5 years), protecting against potential failures mid-ownership. OLED televisions benefit more from extended warranty protection due to technology-specific failure risks. Budget LCD televisions rarely justify warranty extension given low failure rates. Evaluate specific warranty coverage (repair vs. replacement, accidental damage inclusion) rather than accepting standard extensions reflexively.

Conclusion

January television sales represent significant opportunities for informed consumers willing to undertake systematic research and evaluation. Understanding technology fundamentals, recognizing genuine value versus marketing manipulation, and applying disciplined purchasing frameworks enables identifying exceptional bargains that provide satisfaction throughout extended ownership periods. Success requires acknowledging that cheapest prices don't automatically indicate best value; genuine optimization balances price against total cost of ownership, specification alignment with requirements, and brand reliability.

The January sales environment of 2025 extends across the full month rather than concentrating in final days, creating flexibility for consumer shopping timelines. Early-month shoppers benefit from maximum selection and full inventory availability, ideal for those evaluating multiple options. Late-month shoppers access deeper discounting from clearance pressures, advantageous for price-sensitive buyers with flexible preferences. Between these bookends, mid-January offers moderate discounting with still-substantial inventory selection, potentially representing optimal timing for many consumers.

Retailers strategically orchestrate January promotions to balance inventory clearing with margin protection, meaning price depth varies significantly by brand, technology, and size category. Navigating this complexity successfully requires avoiding impulse decisions, verifying reference pricing authenticity, and evaluating total ownership costs rather than focusing narrowly on purchase prices. Bundled offerings deserve careful analysis rather than reflexive acceptance; bundle value depends on whether included components align with actual preferences and planned expenditures.

Building sustainable television satisfaction requires prioritizing longevity and future-proofing alongside immediate specification matching. Selecting models with comprehensive HDMI 2.1 support, adequate refresh rates, and strong manufacturer update track records ensures relevance throughout 7-10 year ownership periods. These future-focused considerations occasionally justify modest price increases above absolute cheapest options, delivering superior long-term value despite higher initial outlays.

The distinction between genuine January opportunities and marketing-driven impulse purchases hinges on disciplined analysis preceding any commitments. Consumers establishing clear requirements, researching realistic pricing, evaluating multiple retailers, and understanding competing technologies make optimal decisions despite promotional pressure and artificial urgency. Those prioritizing price-hunting over values-based decision-making frequently experience buyer's remorse discovering their selections failed to satisfy requirements or broke sooner than anticipated.

Final purchases represent commitments affecting daily entertainment and work experiences throughout years, justifying the analytical effort January shopping demands. Taking advantage of seasonal pricing leverage while maintaining rigorous evaluation standards enables securing genuinely premium televisions at exceptional values. January represents the optimal purchasing window for most consumers, but only those approaching selection methodically realize full benefits of seasonal discounting. Implement the frameworks, criteria, and analytical approaches outlined throughout this guide to transform January shopping from overwhelming marketplace navigation into confident, satisfying decision-making supporting years of entertainment enjoyment.

Key Takeaways

- January television sales create seasonal opportunities with discounts 25-40% below regular pricing through manufacturer clearance and inventory pressures

- Display technology selection (LCD, QLED, OLED) fundamentally impacts picture quality and pricing, requiring alignment with budget and viewing preferences

- Optimal purchase timing varies: early January offers maximum selection while late January features deeper discounting for price-sensitive buyers

- Genuine value requires evaluating total ownership costs including delivery, installation, warranties, and energy consumption rather than purchase price alone

- Smart feature evaluation prevents paying premiums for functionality not aligned with actual viewing habits and content consumption patterns

- Brand reliability and manufacturer support quality significantly influence long-term satisfaction despite potentially lower prices from lesser-known alternatives

- Future-proofing through HDMI 2.1 support and extended refresh rate capability ensures television relevance throughout 7-10 year ownership periods

- Avoiding common mistakes including impulse purchasing without research, overlooking total costs, and prioritizing features over durability maximizes January sales benefits

- Screen size optimization based on viewing distance and room dimensions prevents discomfort and maximizes picture quality benefits from premium technology