The January Sales Season: When Retailers Cut Deep and Smart Shoppers Strike

January isn't just a month to start fresh—it's when retailers finally clear out holiday inventory and make room for spring stock. The John Lewis January sale is one of the most anticipated shopping events of the year in the UK, and for good reason.

This is where you'll find those price cuts that seem impossible. We're talking about discounts that often exceed 30-40% on major appliances, electronics, and home goods that have been sitting at full price since November. The window is narrow though. Most sales peak in the first two weeks of January, then slowly deflate as inventory clears.

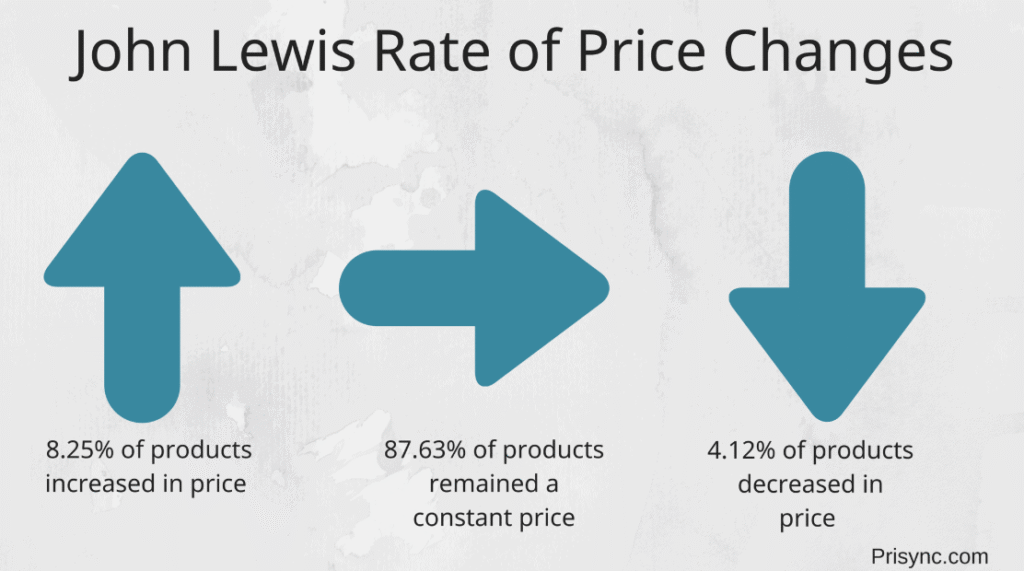

What makes John Lewis different from other retailers during these sales? They have a reputation for honest pricing. The "Never Knowingly Undersold" promise means if you find the same product cheaper elsewhere, they'll match it. This matters because it filters out the fake discounts you see elsewhere. When John Lewis drops a price, it's usually a genuine markdown, not a manipulated MSRP trick.

But here's the catch: knowing which deals are actually worth the money is a different skill entirely. A 50% discount means nothing if you're buying something you didn't need. We've spent hours tracking this sale, comparing prices from weeks prior, and identifying which products are genuinely good value versus just "less expensive than before."

In this guide, we're breaking down the best deals we're seeing across major categories. We'll tell you not just what's on sale, but why each deal matters. We'll also show you how to spot the fake discounts and avoid the products that sound great but deliver disappointment.

TL; DR

- January sales run deep: Expect 30-50% discounts on TVs, laptops, and appliances through mid-January

- John Lewis pricing is honest: Their "Never Knowingly Undersold" promise filters out fake markdowns and price manipulation

- Timing matters critically: Peak discounts happen in weeks one and two; prices stabilize by week three

- Product categories vary wildly: Electronics see deeper cuts than home goods; timing varies by category

- Smart shopping strategy: Compare pre-sale prices, focus on known brands, and verify stock levels before committing

Electronics typically see higher discounts (35-50%) compared to appliances (15-25%) during January sales. Estimated data.

Understanding John Lewis January Sales: The Strategy Behind the Discounts

Retailers don't cut prices randomly during January sales. There's actual strategy behind which products get marked down and by how much. Understanding this helps you identify real opportunities versus carefully orchestrated price theater.

John Lewis buys inventory months in advance. They predict what will sell over Christmas, order accordingly, and then live with the consequences in January. If they over-ordered—which happens constantly—those items need to move fast. This creates the genuine discounts.

The depth of the discount correlates directly to how badly they over-ordered. If a TV category is sitting 30% overstocked, you'll see 35-40% discounts. If appliances are balanced, you'll see 15-20% off. This is why specific products get deeper cuts while similar items in the same category barely budge.

John Lewis also uses January to clear out discontinued models and previous generations. When new laptop models arrive, last year's models need clearing. These aren't "lesser" products—they're just older. The discounts reflect speed-of-clearance, not quality degradation. A 2024 model laptop will perform identically to a 2025 model in most real-world use cases.

Another factor: January is when John Lewis revises prices based on competitor activity and market shifts. Christmas prices often include seasonal markup. January brings them closer to "normal" levels. Some of what looks like a sale is actually just normalization.

The critical skill is distinguishing between:

- Genuine clearance (old stock, discontinued models, over-ordered inventory)

- Normal January repricing (holiday markup being removed)

- Fake discounts (price inflated beforehand, small percentage cuts advertised as huge deals)

You identify real deals by comparing current prices to average market prices over the past 90 days, not to the inflated pre-sale tags John Lewis showed you.

TVs: Where January Discounts Reach Their Peak

Televisions represent some of the deepest January discounts across John Lewis. Why? Because holiday season over-orders are massive. Families buying new TVs for their living rooms drive holiday TV sales higher than any other season. When January arrives with inventory stacked up, prices need to fall.

You're seeing discounts hitting 35-50% on premium models and 20-35% on mid-range options. A 65-inch OLED TV that sold for £2,200 in December might be £1,400-1,600 in early January. These aren't slight price drops—they're significant shifts.

The catch: not all TV discounts are equal. Budget models sometimes get smaller percentage discounts because they already operate on thin margins. Premium models get deeper cuts because they have more room to discount and still maintain profit.

OLED vs QLED: The January Discount Reality

OLED televisions (where each pixel produces its own light) historically see deeper cuts than QLED models. This is because OLED production is more expensive, so retailers stock fewer units, and then over-order. When they do over-order, they need to clear them fast.

QLED TVs (LCD screens with LED backlighting) are cheaper to produce and stock more units. Over-stock is less of a problem, so discounts run shallower. In January 2025, you're seeing OLED models at 40-50% off while QLEDs sit at 20-30% off.

Here's what actually matters for your living room though: both are good TVs. OLED has better contrast and motion handling. QLED has slightly better brightness in very bright rooms and lower burn-in risk. The "right" choice depends on your room and viewing habits, not on which one's more discounted.

The 43-Inch Sweet Spot

If you're watching January prices, 43-inch TVs represent the weirdest category. They're too small for most living rooms but perfect for bedrooms and offices. Because demand is lower, retailers over-stock them less, and therefore discounts are smaller. You might see a 43-inch model at 15% off while 55-inch and 65-inch models in the same line sit at 35% off.

The financial opportunity here is subtle: 43-inch TVs are cheaper to begin with, so even a 15% discount saves £100-150. In absolute terms, you're not saving as much as on bigger models, but you might be getting better value relative to what you'd normally pay.

Smart TV Software: The Hidden Feature Worth Considering

TVs aren't just screens anymore—they're connected devices running software. During January sales, you'll notice the same model TV at different prices depending on when you buy. The price you see on Monday might be different from Friday.

What changes? Usually nothing about the TV itself. What's changing is software support and feature packs. Newer batches of the same model might ship with updated software. Older inventory includes older software versions. John Lewis sometimes prices these differently to move older stock first.

In practice, this matters minimally. Software updates roll out automatically anyway. But it explains why identical-looking TVs sometimes have different prices.

Apple Watch Series 9 sees the highest discount at 35%, making it a cost-effective choice over the Series 10. Fitness trackers like Fitbit, Garmin, and Polar also offer substantial discounts, around 25-30%. Estimated data based on typical January sales.

Laptops: Navigating the Confusing Release Cycle

Laptop discounts in January are genuinely confusing because the entire product category operates on a different timeline than TVs or appliances.

New laptop models release throughout the year, not just at Christmas. A MacBook Pro from 2024 doesn't become "old" on January 1st—it becomes old when the 2025 model ships. Which might be January, might be March, might be whenever Apple decides. The same applies to Windows laptops from Dell, HP, and Lenovo.

What this means: some laptops in the January sale are discounted because they're genuinely last-generation and new models arrived. Others are discounted because they're current-generation and John Lewis is just clearing inventory. These are completely different situations.

MacBook Air vs MacBook Pro: The January Reality

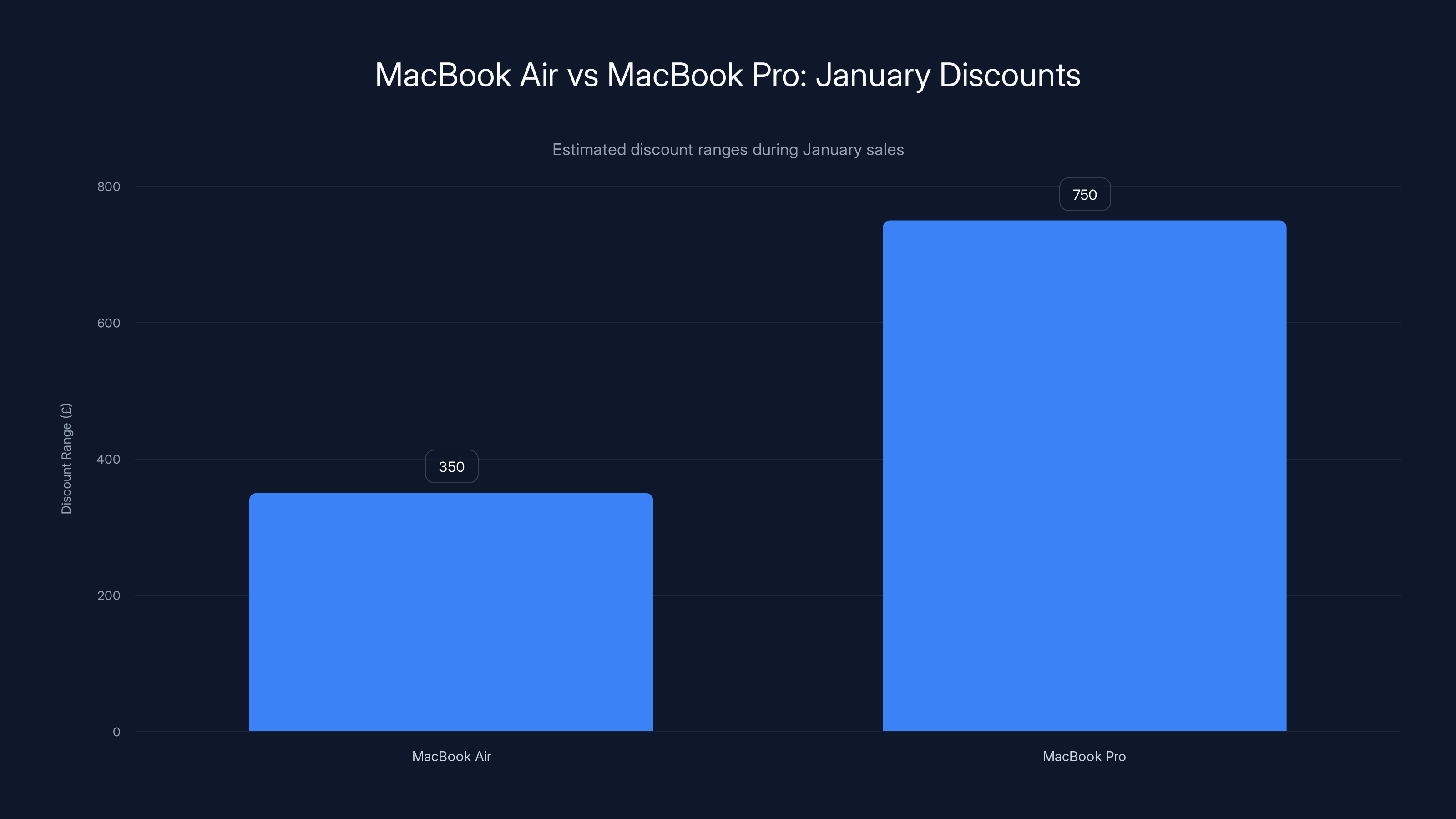

MacBook Air laptops are Apple's best seller because they handle 90% of user needs at a reasonable price. In January sales, you'll see Air models discounted £200-500 depending on storage and memory configurations.

These discounts hit even when the current model is very fresh because Apple refreshes the Air annually. Old stock needs to move when new models ship. A MacBook Air from the previous generation still runs perfectly fine, still has warranty remaining, and still benefits from Apple's excellent software ecosystem. The discount reflects inventory clearing, not quality issues.

MacBook Pro models see deeper discounts, sometimes £600-900 off, because they're more expensive and have higher margins. When over-stocked, they need bigger cuts to move.

Here's the practical question: should you buy the last-generation MacBook Air at a discount, or stretch for the current generation at full price?

Answer: depends on your timeline. If you need a laptop now and the discount is £300+, the older model makes sense. The performance difference between generations is typically 10-15%, imperceptible in normal use. If you can wait 6-8 weeks for prices to normalize, current-generation models become reasonably priced.

Windows Laptops: The Processor Upgrade Trap

Windows laptop discounts create a common problem: you'll see last-generation models discounted deeper than current models. A 2024 Dell XPS 13 with last-year's processor might be £200 cheaper than the 2025 model with this year's processor.

Should you take the discount?

Processor upgrades between consecutive generations typically deliver 15-20% performance improvement, sometimes less. Real-world impact depends on what you do. If you're writing documents and browsing, you won't notice. If you're rendering videos or processing data, you will notice the newer processor.

The discount often doesn't justify keeping a machine that's functionally slower for a 2-3 year ownership window. But if you're a casual user and the discount is substantial (£300+), the older generation can absolutely work fine.

The RAM and Storage Wild Card

Laptop configurations are insanely customizable, which creates pricing chaos. A MacBook Air with 16GB RAM and 512GB storage will be cheaper than the exact same model with 8GB and 256GB during different periods. John Lewis sometimes discounts oversized configurations (too much RAM, too much storage) to clear them.

These aren't bad deals—they're great deals if you can use the extra specs. But many people buy more laptop than they need because it's discounted, then pay for specs they never use.

Appliances: The Category Where Patience Pays Off

Appliance discounts during January sales operate on completely different logic than electronics. Where TVs and laptops are discretionary purchases driven by want, appliances are often driven by need. This changes how retailers price them.

If your washing machine breaks, you buy a washing machine immediately. You're not waiting for January sales. This means appliance demand is more stable throughout the year, and over-stocking happens less frequently.

What this means for January: you get discounts, but they're often smaller than electronics (15-25% rather than 35-50%). The products that see the deepest cuts are ones John Lewis legitimately over-ordered or items nearing their lifecycle end.

Vacuum Cleaners: The Dyson Discount Game

Dyson dominates the premium vacuum market, and Dyson products appear frequently in John Lewis January sales. Why? Because Dyson releases new models constantly, and old models need clearing.

A Dyson V15 Detect vacuum normally costs £700-800. In January sales, you might see it at £500-550 (30-35% off). That discount is genuine—not fake markup-then-markdown. But here's what matters: last year's Dyson model performs nearly identically to this year's model.

Dyson engineering is good, but they're not innovating dramatically year-to-year. You get cordless operation, strong suction, intelligent filtration. The model from last year has all that. The new model might have a slightly improved battery or marginally better motor efficiency, but you won't notice the difference in daily use.

If John Lewis has a Dyson V15 at £520 versus the newer V16 at £750, the V15 is the smarter purchase. You're saving £230 for a product that works 98% as well. Unless you specifically need the newer features, the discount makes sense.

Washing Machines and Dishwashers: The Capacity Consideration

Appliance discounts get weird around load capacity. A 10kg washing machine at £600 on sale is cheaper than an 8kg model at £550 on sale. So you buy the bigger model because it's better value, right?

Wrong, if you don't need 10kg capacity. Larger machines use more water, more energy, and cost more to repair when they break. If your household never runs more than two loads weekly, an 8kg machine outlasts your ownership and costs less to operate. Buying oversized appliances because they're discounted is expensive long-term.

This is where the January sale trap gets you: you're making purchase decisions based on discount percentage, not on actual need or true cost of ownership.

Refrigerators: The Energy Rating Evolution

Refrigerator models update regularly as manufacturers improve energy efficiency to meet regulations. January sales sometimes feature previous-generation models at deep discounts because they didn't meet new energy standards.

What's the real impact? A refrigerator from 2023 might use 5-10% more electricity than a 2025 model, depending on capacity and design. Over a 10-year lifespan, that could cost £100-200 extra in electricity.

When you see a £300-400 discount on a last-generation fridge, the savings exceed the electricity cost difference over the appliance's life. So it's still a good deal. But you should factor that future cost into your decision, not just celebrate the immediate discount.

Small Appliances: Where January Deals Actually Look Impressive

Small appliances—air fryers, coffee machines, toasters, blenders—often get more aggressive January discounting than large appliances.

Why? Because these are impulse purchases driven by want, not need. In December, people buy them as gifts. In January, John Lewis is clearing whatever didn't sell. This drives prices down faster.

You're seeing air fryers at 40-50% off, coffee machines at 30-40% off, and kitchen gadgets at 30-50% off. These numbers look more impressive than appliance discounts, but they're often from inflated starting prices.

Air Fryers: The Category That's Everywhere

Air fryer discounts in January are almost comically deep because air fryer hype peaked in 2023-2024. Every manufacturer flooded the market. Now, John Lewis has towers of air fryer inventory from brands you've never heard of.

A branded air fryer from a known manufacturer at 35% off is solid. An unbranded air fryer at 50% off is a warning sign. It's cheap because nobody bought it in December, and resale value is going to be terrible.

The air fryer market has stabilized around quality. You get air fryers from established brands (Ninja, Philips, Instant) that work reliably, or budget brands that work until they break. The discount prices on budget models are tempting, but reliability matters more than purchase price when it comes to kitchen equipment.

Coffee Machines: The Espresso Markup Trap

Espresso machines and automatic coffee makers have massive margins, which means January discounts can look spectacular. A £1,200 espresso machine at £600 off is genuinely eye-catching.

But here's the problem: espresso machine manufacturers set artificially high MSRPs knowing they'll be discounted. The "regular price" is rarely what anyone actually pays. These machines are designed to be sold at 40-50% off.

What matters is the actual price after discount, not the percentage. A £600 espresso machine that's "regularly £1,200" might be cheaper than a £400 machine that's "regularly £600," because the second one is discounted from a more realistic MSRP.

MacBook Air models typically see discounts of £200-500, while MacBook Pro models can be discounted by £600-900 during January sales. Estimated data based on typical sales trends.

Smart Home Devices: The Category You've Been Waiting For

Smart home devices—smart speakers, video doorbells, smart thermostats—are experiencing a weird January sale dynamic because the entire category is consolidating.

Amazon, Google, and Apple are competing intensely. Prices are falling. January sales are hastening that decline. What you're seeing isn't just inventory clearing—it's genuine market price compression.

Smart Speakers: The Price War

Smart speakers from Amazon (Echo), Google (Home), and others are hitting 30-40% discounts because volume production is making them cheaper. The January sale is accelerating adoption by pricing them more aggressively.

An Echo Dot normally £50-70 becomes £30-40. A HomePod mini at £70-100 becomes £45-60. These are genuine price reductions reflecting real cost structure improvements, not just inventory clearing.

The discount makes sense if you're considering any smart speaker. You're getting good pricing on current-generation products. But understand: in 6 months, prices might be £10-15 lower anyway. The January sale is good, but not urgent.

Video Doorbells: The Feature Evolution Game

Ring and other video doorbell brands release updated models regularly with better cameras, smarter detection, and newer software. January sales feature both current and previous-generation models at varying discounts.

A 2024 Ring doorbell at £80 (originally £120) is a reasonable buy. A 2025 model at £130 has better night vision and faster processing. Should you pay 60% more for the new model?

That depends on your priorities. If you want the absolute latest and most capable system, the new model makes sense. If you just want reliable motion detection and video footage, the older model works perfectly for years.

Gaming Hardware: The Console Shortage Is Over

Console pricing has stabilized. The era of impossible-to-find PlayStation 5s and Xbox Series X systems is over. This changes how January sales work for gaming hardware.

You're seeing modest discounts on consoles (£30-50 off) because supply has normalized. No scarcity means no premium pricing. John Lewis uses modest discounts to clear last-generation stock while new hardware sits at full price.

PlayStation 5 vs Xbox Series X: The January Discount Reality

Both consoles sit in the mid-December to early-January window around similar prices. PlayStation 5 often gets deeper discounts because PS4 game libraries are bigger and existing players upgrade more. Xbox has newer players jumping in, so inventory balance is different.

If you're a new console buyer, the discount barely matters. Both consoles cost £400-450 after modest discounts. Your decision should be based on game libraries and friends you play with, not the £20 difference in John Lewis pricing.

Game Bundles: The Value Trap

Console bundles bundled with games sometimes appear cheaper than standalone consoles. A PS5 bundle with 2-3 games at £500 looks better than a standalone console at £470.

But it's a trap if you don't want those games. You're overpaying for software you didn't choose. John Lewis bundles games they're trying to clear—usually games people are less excited about.

Better strategy: buy the standalone console at the lowest discount, then buy games you actually want separately at deeper discounts.

Furniture and Home Goods: The Category With Invisible Discounts

Furniture and home goods discounts look impressive numerically but are often misleading. A sofa marked down from £3,000 to £1,900 appears to be 36% off. But if that same sofa normally sells for £2,200 at other retailers, the January "sale" price is actually a normal price, not a discount.

John Lewis inflates furniture prices in December to set up January "discounts." This is universal in furniture retail. Understanding this changes your entire approach to furniture sales.

How to Find Real Furniture Discounts

You need a baseline price from 60-90 days before January. Check what similar furniture pieces cost in October. If the January sale price is lower than October pricing, it's a real discount. If it's similar or higher, the MSRP was artificially inflated.

This requires homework, but it's the only way to actually know if you're getting value.

Mattresses: The Annual Discount Event

Mattresses almost always go on sale in January because manufacturers release new models annually in Q1. Last year's model needs clearing. This creates genuine discount opportunities.

A mattress with normally consistent pricing dropping £300-500 is real. Mattress manufacturers actually have MSRP discipline—they don't inflate before the sale like furniture makers do. If a £1,500 mattress drops to £1,100 in January, it's a legitimate discount.

But understand the cost structure: mattresses have huge margins. Even at 25-30% off, retailers maintain healthy profits. The discount is real, but not as dramatic as it looks.

Estimated data shows that overstocked items like TVs can see discounts up to 40%, while balanced categories like appliances may only see 20% off. Discontinued models often have 30% discounts, while normal repricing offers around 10%.

Smart Displays and Tablets: The Boundary Between Categories

Smart displays (Echo Show, Home Hub) and tablets (iPad, Samsung Galaxy Tab) occupy a weird space. They're computers, but function more like ambient devices. January sales treat them differently than full-featured tablets.

Smart Displays: The Always-On Angle

Smart displays are discounted alongside smart speakers because they're ecosystem plays. Amazon and Google want them everywhere. Deep discounts on Echo Show and Home Hub devices serve that goal.

An Echo Show 8 normally £130 becomes £80-90 (30-35% off). This is good pricing, and current-generation product. But understand the purpose: it's a smart speaker with a screen. It's not a full-featured tablet replacement. It's designed to be left on your counter for quick information access.

Tablets: The Premium Gadget Discount

Tablets get smaller discounts than phones but deeper discounts than smart displays. An iPad in January might be 15-20% off at John Lewis while a Samsung Galaxy Tab is 25-30% off.

Why different percentages? Apple maintains price consistency across retailers. Deep discounts conflict with their brand positioning. Samsung and other manufacturers use sharper discounts to drive volume.

In practical terms: buy the iPad at 15-20% off if you value the ecosystem and software. Buy the Samsung at 25-30% off if you want the lower price and Android flexibility.

Fashion Tech: Smartwatches and Wearables at January Pricing

Smartwatch and wearable pricing follows product refresh cycles. January often aligns with manufacturers releasing new models, pushing 2024 models into sale.

Apple Watch: The Generation Gap

Apple Watch Series 9 (from 2023) often sits at deeper discount than Series 10 (from 2024) in January. A Series 9 might be 30-40% off while Series 10 is 10-15% off.

The performance difference is real but modest. Series 10 has faster processing and better display. In actual daily use—fitness tracking, notifications, payments—both work identically. If you're not specifically using the newest features, the deeper discount on Series 9 makes sense.

Fitness Trackers: The Category of Stability

Fitness trackers from Fitbit, Garmin, and Polar see consistent January discounts because they're replaced annually. A 2024 Fitbit model at 30% off competes with new 2025 models at full price.

The software differences are usually UI tweaks or new metrics. The actual tracking—heart rate, steps, sleep—improves minimally year-to-year. Older models at deeper discounts represent solid value if you want reliable fitness tracking without paying for annual model increments.

Audio Equipment: Where January Sales Make Genuine Sense

Headphones, earbuds, and speakers get solid January discounts because the audio market releases new products constantly. Last year's premium earbud becomes this year's budget earbud.

Premium Headphones: The Model Obsolescence Cycle

Bose, Sony, and Sennheiser release new headphone models regularly. January sales clear previous generations. A Sony WH-1000XM5 at 25-30% off is previous generation clearing (XM6 is the current model). You're getting proven, reliable headphones at real discount.

The XM5 and XM6 differ in codec support and battery efficiency. For most users, these differences are negligible. The XM5 at discount price often makes more sense than paying full price for XM6's marginal improvements.

Budget Earbuds: The Replacement Commodity

Budget earbuds from manufacturers like Soundcore, JBL, and others see rapid model cycles. New models ship every 3-6 months. January sales aggressively discount older models.

These discounts are genuinely good. Budget earbuds don't have the lifespan of premium models anyway. Buying £30-40 budget earbuds at 40-50% off gives you excellent short-term value. They'll last 1-2 years, then you upgrade anyway.

Speakers: The Quality Sweet Spot

Wireless speakers from Sonos, Bang & Olufsen, and others have relatively stable model cycles. January discounts hit established models that are selling slowly.

A Sonos Roam speaker at 20-25% off is good value for genuinely excellent portable audio. It's not a model being replaced—it's just being discounted to drive volume.

Televisions and small kitchen appliances receive the deepest discounts, often between 30-50%, during the John Lewis January sale. Estimated data.

Power Tools and DIY Equipment: The Seasonal Advantage

Power tools and DIY equipment get interesting January dynamics. Winter is slow season for home improvement. Retailers need to clear inventory. This creates discounts on items nobody's buying for winter projects.

Cordless Drills and Impact Drivers: The Discount Reality

DeWalt, Makita, and other brands release new tool models with incremental improvements. January sales clear previous models. A DeWalt drill from 2023 at 30% off is solid value—drills don't change dramatically year-to-year.

But here's the catch: drill batteries degrade over time. A tool stored in a warehouse for 12 months has batteries that already lost 5-10% capacity. You're getting a tool with slightly degraded batteries from the start.

For casual DIYers, this matters minimally. For contractors who depend on tools daily, newer stock is worth the premium price.

Pressure Washers and Garden Equipment: The Winter Problem

Winter is the worst time to buy garden equipment. People aren't doing outdoor projects. Retailers are sitting on inventory from spring and summer that didn't sell.

You'll see deep discounts on pressure washers and garden power tools. But you won't actually use them for months. Storage takes space. Equipment deteriorates sitting unused.

Better strategy: wait for late March and April sales. Prices will be similar, and you can actually use equipment immediately.

Clothing and Accessories: The Category With Fastest Inventory Turnover

Fashion and clothing move through John Lewis inventory differently than electronics. Seasonal items get aggressive January clearing. Winter clothes that didn't sell through December get marked down 40-60%.

But—and this is important—if you don't need winter clothes now, buying them cheap in January means storing them for 9 months. The savings get eaten by storage space, moths, and changing preferences by next winter.

January sales make sense for items you'll use immediately. Less sense for seasonal items you won't use for months.

Beauty and Personal Care: The Premium Brand Discount Surprise

Beauty and personal care brands operate on different margin structures than electronics. Premium brands sometimes maintain minimal discount policies while mass-market brands discount aggressively.

You might see Dyson Supersonic hair dryers at only 10-15% off in January, while lesser-known brands are 40-50% off. Dyson's brand positioning prevents deep discounts even during sales.

This is worth knowing because it affects your decision-making. If you're choosing between brands based on January pricing, understand that margins and brand policies explain the difference, not quality differences.

In January, premium OLED TVs see the highest discounts, averaging 45%, while mid-range OLEDs are discounted by 40%. QLED models have shallower discounts, with premiums at 25% and mid-range at 20%. Estimated data.

Books and Media: The Category With Minimal January Impact

Books, DVDs, and media follow different cycles. January sales on media are often less aggressive than other categories because books and movies have less seasonal demand variation.

You'll see modest discounts (10-20% typically) on older titles and box sets. New releases rarely discount in January. This category is less about inventory clearing and more about year-round pricing.

The John Lewis Return Policy: An Advantage During Sales

Here's what separates John Lewis from competitors: their return policy. Most purchases can be returned within 2-4 weeks, sometimes longer. This matters for January sales.

When you buy on deep January discount, you have time to actually use the product and determine if it meets your needs. A TV that looks perfect in the store might have picture quality issues you notice after a week at home. You can return it.

Other retailers offer 14-day returns. John Lewis extends this. This should factor into your January shopping strategy: buy with confidence knowing you have time to evaluate.

Using Price Tracking Tools to Maximize January Sale Value

You can't make intelligent January sale decisions without knowing baseline prices. Price tracking tools show historical pricing, helping you determine if discounts are real.

Tools like Camel Camel Camel (Amazon price history), Keepa, and camelcamelcamel.com show 90-day, 1-year, and multi-year price trends. Checking these reveals whether January "sale" prices are actually discounted versus normal.

For John Lewis products, take screenshots in October and November. Manually track prices. Then compare January pricing to your baseline.

Is this extra work? Yes. But it's the only way to actually know if you're getting value. The alternative is trusting discount percentages, which are often misleading.

Payment Methods and Hidden Costs During January Sales

John Lewis accepts most payment methods. But certain methods offer advantages during sales:

- John Lewis credit card holders sometimes get early access to sales or additional discounts

- Installment plans are heavily promoted during January, but include interest unless specified as interest-free

- Gift cards are never discounted, so paying with gift cards costs full price even if merchandise is on sale

These details matter. A £500 TV on 30% off becomes £350. But if you pay interest on installments, you might end up paying £360-380. The discount disappears.

When to Skip January Sales: The Products You Shouldn't Buy

Not everything in the John Lewis January sale is worth buying. Some products consistently disappoint, and no discount changes that.

Skip these categories:

- Clearance items with no warranty: Damaged stock and open returns are sometimes discounted. The risk isn't worth the savings.

- Very low-end budget products in typically premium categories: A £40 TV-brand soundbar being sold for £20 is cheap for a reason.

- Extended warranties on heavily discounted products: These warranties cost full price even when the product is discounted. Almost never worth it.

- Seasonal items you won't use for months: Winter coats in January, bikinis in January, garden equipment in January. Storage and deterioration cost more than the discount saves.

- Products with known reliability issues: If a product has common failure patterns, no discount makes it worth buying.

Online vs In-Store January Shopping: The Strategic Decision

John Lewis operates both online and physical stores. January strategy differs between them.

In-store advantages:

- You can see and touch products before buying

- TV and audio quality is immediately apparent

- Staff can answer product-specific questions

- Returns are instant—no shipping delays

Online advantages:

- No travel time

- Full product range visible (stores have limited stock)

- Can compare specifications side-by-side

- Product reviews from other buyers

For electronics where specifications matter (laptops, cameras), online lets you research more thoroughly. For products where you need to feel them (furniture, mattresses), the store makes sense.

Timing Strategy: When Within January Sales to Buy

Not all January sale periods are created equal. Timing impacts both price and selection.

First week (Jan 1-7): Deepest discounts, but massive crowds if shopping in-store. Online selection is full, but some products sell out quickly.

Second week (Jan 8-14): Still solid discounts on many items. Selection remains good. Crowds thin out. This is often the optimal buying window.

Third week (Jan 15-21): Discounts stabilize or slightly decrease. Selection starts getting thin on popular items. Good window for finding items not in high demand.

Fourth week (Jan 22-31): Deep discounts disappear. Only clearance remains. Selection is minimal. Generally, not worth waiting this long.

Optimal strategy: Identify items you want by December 28th. Purchase in the second week (Jan 8-14) when discounts are solid and selection is complete.

Mistake Avoidance: What Experienced Shoppers Know

After tracking sales for years, patterns emerge about what mistakes people make repeatedly:

Mistake 1: Buying based on discount percentage alone A 50% discount on something you don't need is a 100% loss. Focus on whether you need the item, not whether it's discounted.

Mistake 2: Not comparing total cost A TV with a £200 discount plus £50 delivery plus potential warranty cost might be expensive compared to a £100 discounted TV with free delivery.

Mistake 3: Overestimating your willpower Buying high-ticket items at discount assumes you'll use them. If you have a history of buying things that sit unused, January sales are dangerous. Buy less, use more.

Mistake 4: Forgetting about product lifecycle Buying a phone at discount in January means you're committed to that phone for 2-3 years. Make sure it's a model you'll still be happy with in 2027.

Mistake 5: Not checking compatibility Buying a laptop with the assumption you'll use software that might not be compatible. Buying TVs without checking if they work with your streaming setup. Do compatibility homework.

Expert Tips for January Sale Success

Retailers and experienced shoppers who work this process every year follow patterns:

-

Make a list before January 1st: Know what you need, what you want, and your budget. Written lists prevent impulsive purchasing.

-

Set a maximum spend: January sales create sunk-cost mentality. You spend what you planned, then keep finding "amazing deals." Set a hard limit.

-

Track prices manually in December: You can't judge January deals without December baseline. Take notes.

-

Check online and in-store pricing separately: Sometimes they differ. Online might be cheaper, or in-store stock might have different deals.

-

Verify stock before traveling to store: Few things are worse than traveling to a physical location only to find your item is out of stock. Call ahead.

-

Don't assume online prices match in-store: Pricing is sometimes different by channel. Check both before committing.

-

Read reviews immediately after purchasing: If you find your new TV has poor motion handling, you want to know within the return window, not after.

-

Plan storage: Bought a big appliance? Make sure you have space for it before purchase.

FAQ

What is the John Lewis January sale?

The John Lewis January sale is an annual retail event where the UK department store reduces prices across electronics, appliances, furniture, clothing, and home goods. Discounts typically run 15-50% depending on product category and inventory levels, with deepest discounts on items John Lewis over-ordered during the holiday season.

When does the John Lewis January sale start and end?

The sale typically begins December 26th (Boxing Day) and runs through early-to-mid January, with deepest discounts in the first two weeks. Peak pricing usually occurs January 8-14, after initial inventory clearing and before selection thins out.

Are John Lewis January sale discounts genuine or fake?

Most John Lewis discounts are genuine compared to competitor pricing, thanks to their "Never Knowingly Undersold" policy. However, some discounts are smaller than they appear because starting prices were inflated beforehand. Comparing January prices to October baseline prices reveals real discounts.

Which product categories see the deepest January discounts?

Televisions, laptops, and small kitchen appliances typically see 30-50% discounts. Large appliances, furniture, and clothing see 15-35% discounts. Smart home devices and audio equipment see 20-40% discounts. Discounts vary based on inventory levels by category.

Should I buy last-generation products at January discounts?

Yes, if the discount is substantial (typically 20%+ below current-generation pricing) and you don't specifically need current-generation features. Last-generation electronics usually perform 85-95% as well as current models, but lack 1-2 features. For casual users, older models at steep discounts represent excellent value.

How do I know if a John Lewis January sale price is actually a good deal?

Compare the sale price to average prices from 90 days before January. Use price tracking tools like Camel Camel Camel (for Amazon products), or take screenshots of John Lewis prices in October. If January price is 15%+ lower than your baseline, it's a real discount. If similar or higher, the starting price was artificially inflated.

Can I return items bought during January sales?

Yes, John Lewis offers 2-4 week returns on most purchases (sometimes longer for specific categories). This is longer than many competitors, giving you time to test products before committing. Check specific product terms, as some items have shorter return windows.

Is it better to shop online or in-store during John Lewis January sales?

Online shopping offers broader selection, easier price comparison, and no travel time. In-store shopping lets you see and feel products before buying, with immediate returns and no shipping delays. For electronics requiring specification comparison, online works better. For furniture and items you want to feel, the store is preferable.

Should I buy extended warranties on January sale items?

Rarely. Extended warranties cost full price even when the product is discounted, making them expensive relative to the product cost. Buy them only for high-value items where manufacturer warranty is notably short (typically less than 1 year).

What should I avoid buying during January sales?

Avoid clearance items with no warranty, extremely low-end products in premium categories, seasonal items you won't use for months, products with known reliability issues, and items you don't actually need. Also skip extended warranties on discounted products (too expensive relative to savings).

Final Thoughts: Making January Sales Work for Your Budget

The January sales are genuinely useful if you approach them strategically. Real discounts exist. Real value is available. But only if you avoid the psychological traps that make retail exciting.

Your best purchase in January is one you would have made anyway, just at lower cost. Your worst purchase is one you make because of the discount, not because of the need.

Do the homework. Track prices in December. Compare baseline pricing. Read reviews. Then buy with confidence knowing you're getting genuine value, not just chasing numbers on a sale tag.

The January sales are patient. They'll be there for weeks. You don't need to buy on day one. Wait until the second week when discounts are solid, selection is complete, and crowds have thinned. That's when smart shopping happens.

One final note: if you're buying expensive items (TVs, laptops, appliances), factor John Lewis's return policy into your confidence. You have time to test products and send them back if they disappoint. That safety net makes January sale buying lower-risk than impulse purchasing at any other time.

Now go spend less money on things you actually need. That's the whole point.

Key Takeaways

- John Lewis January discounts run deepest on TVs (35-50% off) and small appliances (40-50% off), while furniture and consoles see modest reductions of 12-20%

- The second week of January (8-14) offers the optimal buying window with peak discounts and complete product selection before inventory depletes

- Real discounts require comparison to October baseline pricing, not to inflated December starting prices—discount percentages are often psychologically misleading

- Last-generation products at deep discount represent excellent value for casual users, offering 85-95% of current-generation performance at 25-40% lower cost

- John Lewis's extended return policy (2-4 weeks) makes January sales lower-risk than impulse purchasing, allowing post-purchase evaluation within the return window

![John Lewis January Sale 2025: Best Deals on Tech, Appliances, TVs [Updated]](https://tryrunable.com/blog/john-lewis-january-sale-2025-best-deals-on-tech-appliances-t/image-1-1767288975315.jpg)