JPMorgan Chase Takes Over Apple Card: What Changes for Users [2025]

Apple announced it. The financial world collectively blinked. And then the real questions started.

After more than a year of behind-the-scenes negotiations, JPMorgan Chase officially sealed the deal to become the new issuer of the Apple Card, kicking Goldman Sachs to the curb after nearly six years of partnership. This isn't just a banking shuffle. It's a seismic shift in how premium fintech products get distributed, supported, and scaled in America.

For context: Apple Card launched in 2019 as a moonshot collaboration between Apple and Goldman Sachs. The vision was elegant. A credit card that lived entirely in your iPhone wallet, no plastic required, designed with the minimalism Apple invented. Real talk though? Goldman Sachs wanted out. The program quietly bled money, customer support became a nightmare, and the whole thing felt like a prestige project that lost its luster somewhere around 2021.

Now JPMorgan Chase, the largest bank in America with 67 million customers and a reputation for actually scaling fintech products, is taking over. The transition timeline? Two years. The price tag? Goldman Sachs is offloading roughly

This matters more than you think. Here's why, and what it means for your wallet.

Why Goldman Sachs Bailed Out

Let's start with the elephant in the room: Goldman Sachs never really wanted to be in the credit card business. It wanted to be associated with Apple. Those are two completely different things.

Goldman's traditional business is institutional finance: managing billions for wealthy clients, trading bonds and equities, advising Fortune 500 companies on mergers. The bank has genius-level traders but has always struggled with retail operations. They don't naturally understand consumer behavior. They don't ship customer service at scale. And honestly, they were horrified by the churn and complexity of managing millions of ordinary people's credit lines.

When the Apple Card partnership launched, Goldman saw an exclusive play: luxury, innovation, Apple ecosystem integration. What they got instead was operational chaos. Customer support tickets piled up. People got confused about how the card actually worked. Credit decisions felt opaque. Fraud protection lagged. The loss rates—percentage of customers who defaulted—climbed.

The Wall Street Journal reported that Goldman had been "looking for an out for years." By 2023 and 2024, internal conversations were happening. This isn't secret anymore. Financial analysts had been publicly questioning whether Goldman's Apple Card bet was worth the capital and attention.

Here's the math that probably scared them: Apple Card was chewing up regulatory resources, compliance resources, and customer service infrastructure. Each of these costs money. The program generated good press but not great margins. For a bank focused on profitability per dollar deployed, that's a losing trade.

Arguably, what finished Goldman's willingness to keep the program alive wasn't the operational burden. It was the regulatory pressure. Banks face strict capital requirements. Every dollar deployed to consumer credit is a dollar that needs backing. For a wholesale bank like Goldman, that's inefficient compared to their core business.

When JPMorgan came calling, Goldman probably felt relief more than resentment. Here was a bank that actually wanted the product, understood the customer base, and had the operational maturity to run it properly.

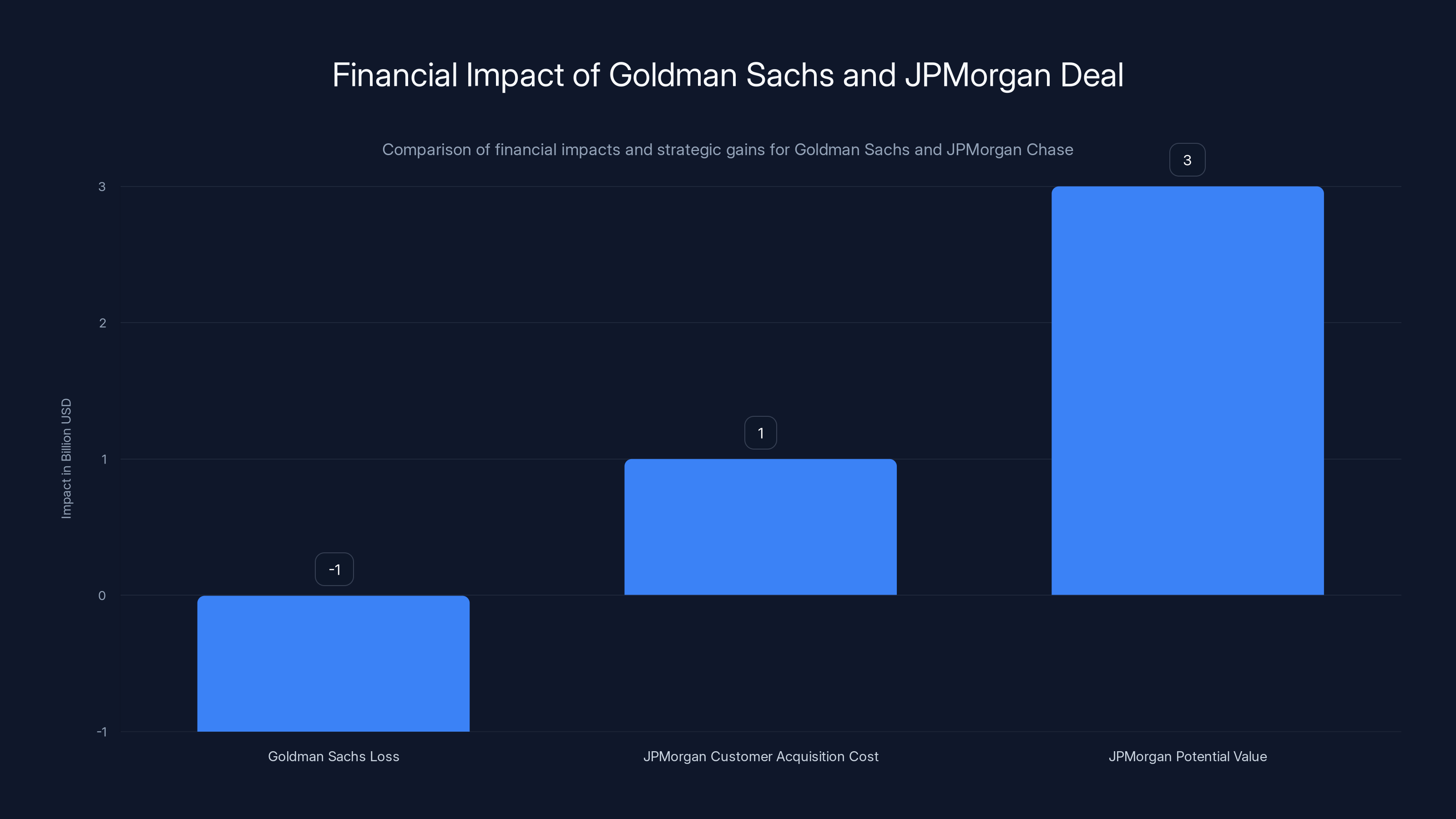

Goldman Sachs incurs a

JPMorgan Chase's Strategic Bet

JPMorgan Chase taking over the Apple Card isn't defensive or reactive. It's aggressive expansion into fintech infrastructure.

JPMorgan already operates Chase Bank, the second-largest retail bank in America with branches in most major cities. They manage Chase Credit, one of the most-used credit card networks in the world. They own Chase Sapphire, Chase Freedom, and premium cards that compete directly in the ultra-premium segment.

So why go after Apple Card?

Because the Apple ecosystem is worth billions in annual spend. When you're a cardholder in Apple's wallet, you're not just using a payment method. You're part of the Apple universe. You get notifications designed by Apple engineers. You see cash back visualized in Apple's UI. The entire experience is seamless.

JPMorgan understands this. They're not trying to replace the experience or rebrand it. The deal explicitly keeps Mastercard as the payment network. That's important because it signals continuity.

But here's what JPMorgan brings that Goldman couldn't: operational scale. JPMorgan has 4,800 branches, 16,000 ATMs, and a customer service operation that handles 50 million calls annually. They have fraud detection systems refined over decades. They have credit underwriting that moves at machine speed because they've optimized it a thousand times.

Goldman Sachs had to build all of this from scratch for Apple Card. JPMorgan can leverage existing infrastructure, which means faster onboarding, better fraud detection, and lower operational costs.

The second strategic angle: data. JPMorgan now owns the entire customer relationship for Apple Card holders. They see your spending patterns, your credit profile, your payment behavior. That's intelligence worth billions when you're building financial products.

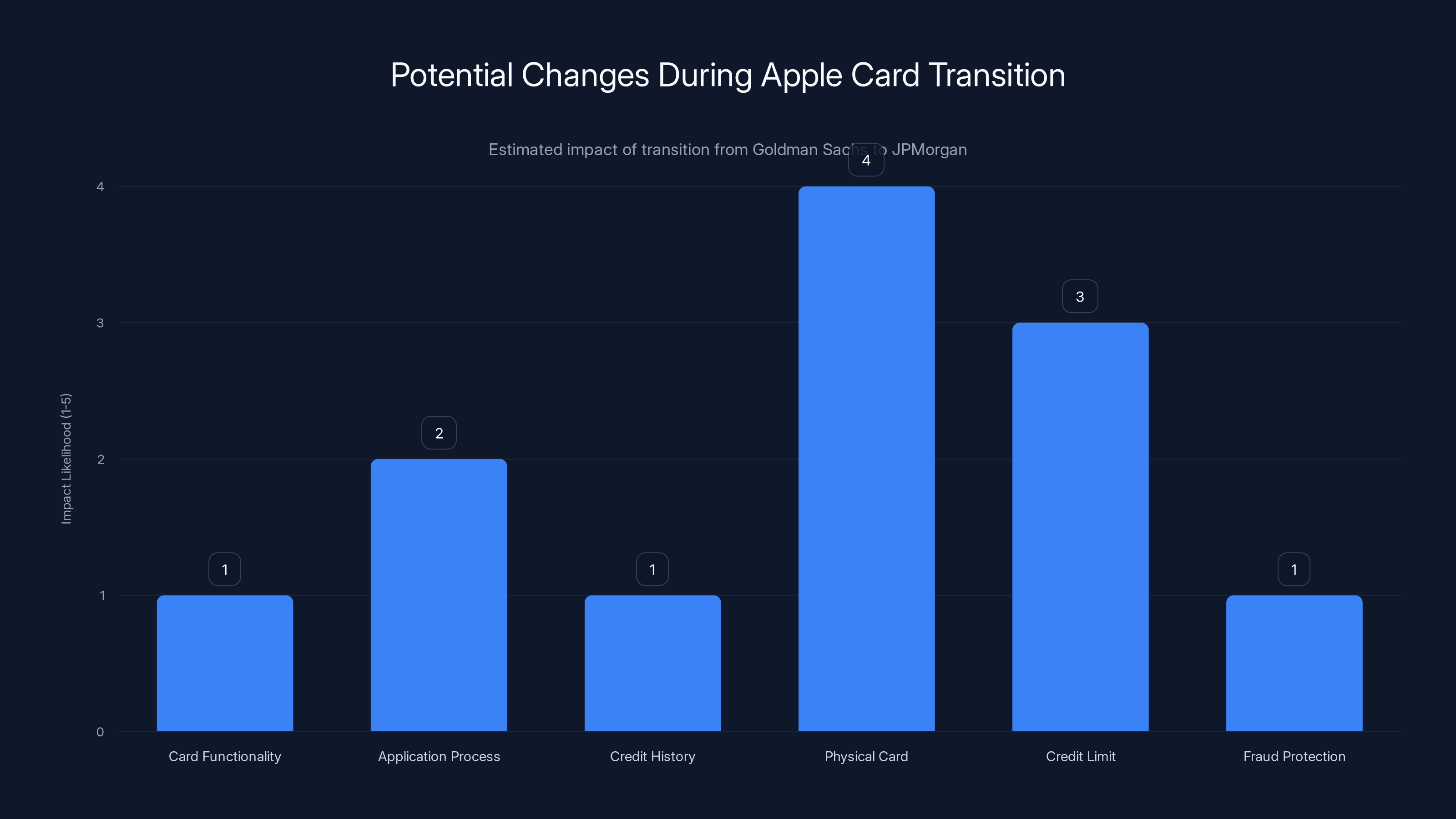

Estimated data suggests minimal impact on card functionality and fraud protection, while physical card issuance and credit limit adjustments are more likely during the transition.

The Transition Timeline and What Actually Happens

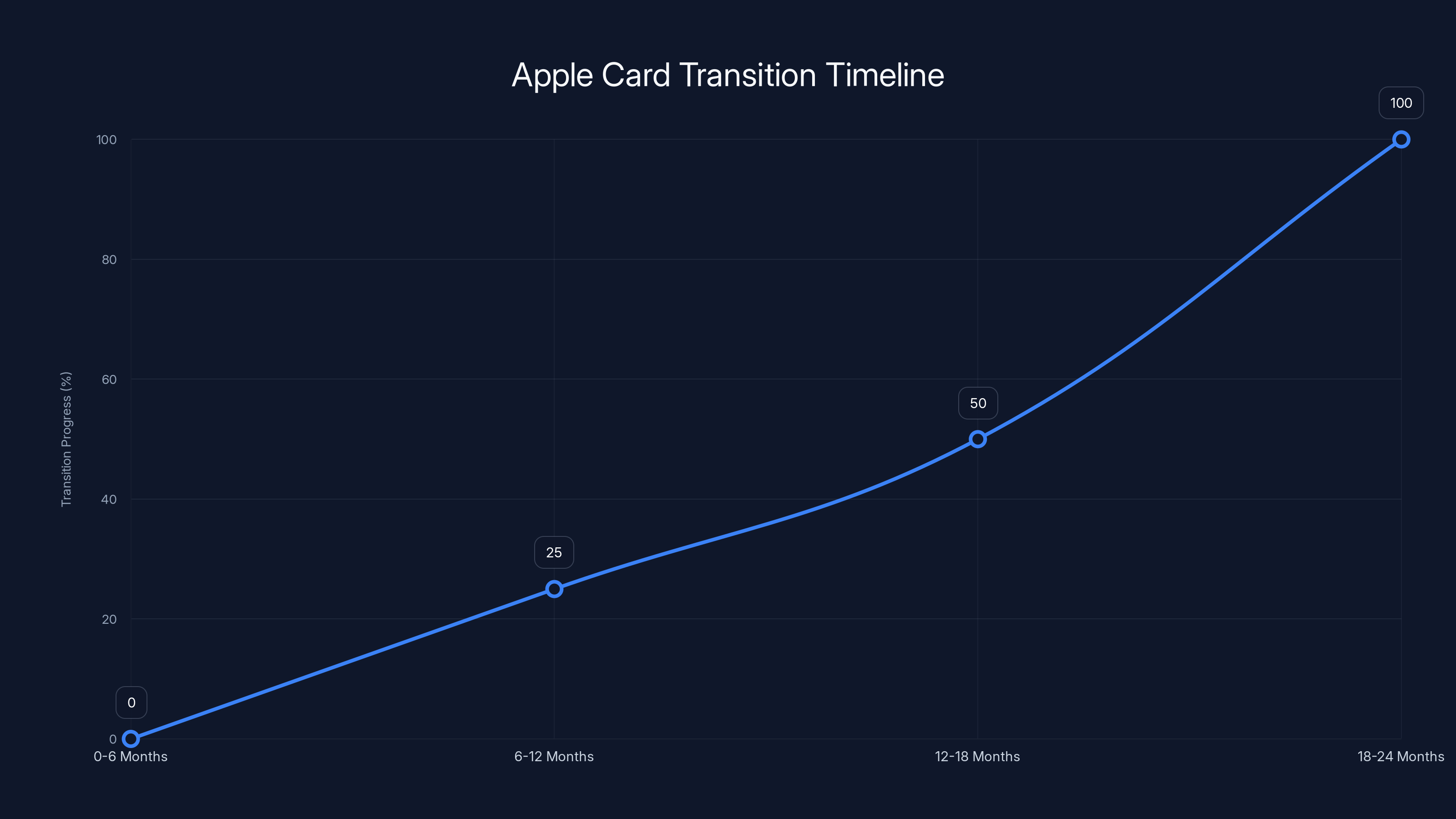

Apple's official statement said the transition would take "approximately 24 months." Let's unpack what that actually means because transition timelines are where fintech deals usually get messy.

Here's the practical reality: you won't notice anything for at least six months. Goldman Sachs remains your issuer. Your card number doesn't change. Your credit limit doesn't change. Mastercard continues processing transactions. From a customer perspective, the product experience should remain identical.

Behind the scenes, though? Chaos.

JPMorgan is building a complete infrastructure stack for Apple Card. This includes account migration systems (moving your data from Goldman's systems to theirs), fraud detection model retraining (your transaction patterns teach new models), credit limit recalculation (JPMorgan might score you differently than Goldman did), and customer communication infrastructure (they're building new notification systems).

Months 6 through 18 will likely involve soft testing. Some customers might get migrated to JPMorgan systems first. Your card might experience momentary outages as systems sync. You might see changes to your cash back calculation (JPMorgan uses different partner data than Goldman).

Months 18 through 24 should be the main migration wave. This is when Apple starts sending official communications saying "your card is moving to JPMorgan, here's what to expect." Existing cardholders shouldn't need new cards, but JPMorgan will likely issue new physical Apple Cards (for those who have them) with updated security features.

The wildcard: credit limit changes. JPMorgan might reassess your creditworthiness. You could see your credit limit increase if JPMorgan's models like your profile, or potentially decrease if they're being more conservative. The bank hasn't publicly stated whether credit limits will change, which suggests they're still deciding.

One critical detail Apple emphasized: Mastercard remains the payment network. This matters because it means your card will continue working everywhere Mastercard is accepted globally. JPMorgan isn't changing the fundamental payment rails.

Financial Impact: Who Wins and Who Loses

Let's talk money because that's what actually drives these decisions.

Goldman Sachs is taking a **

Why would Goldman take that hit? Because the alternative is worse. Keep the program, keep bleeding money, keep deploying capital that could be earning returns elsewhere. The $1 billion one-time loss is an insurance policy on an even bigger future disaster.

For JPMorgan Chase, the calculus is different. They're acquiring a customer base of roughly 3 million Apple Card holders (estimated, Apple doesn't disclose exact numbers). These are premium customers. They're owners of iPhones. They skew younger, more tech-savvy, higher credit scores.

Here's what JPMorgan is really buying:

-

Customer acquisition: 3 million new customers at a cost of roughly

1 billion cost divided by 3 million). That's expensive for a bank but cheap for a premium fintech product. JPMorgan's average customer acquisition cost is probably 60-40% of that when they recruit from their own branches, but Apple Card customers are higher value. -

Deposit optionality: Apple Card holders might become JPMorgan checking account holders. They might open savings accounts. This is the real prize. A customer who trusts JPMorgan with their checking and credit together is worth 3-5x more long-term.

-

Data: Apple Card spending behavior teaches JPMorgan's algorithms. These machine learning models improve credit decisions, fraud detection, and product development.

For Apple customers, the economics are simple: your card works better. JPMorgan has better fraud detection, better customer service, and faster issue resolution. Those improvements should show up within 12 months of the transition.

For the broader fintech ecosystem, this sends a message: building premium financial products requires either owning distribution (Apple's model) or partnering with a bank that can scale (JPMorgan's model). Trying to build in-between doesn't work. Goldman Sachs learned this the hard way.

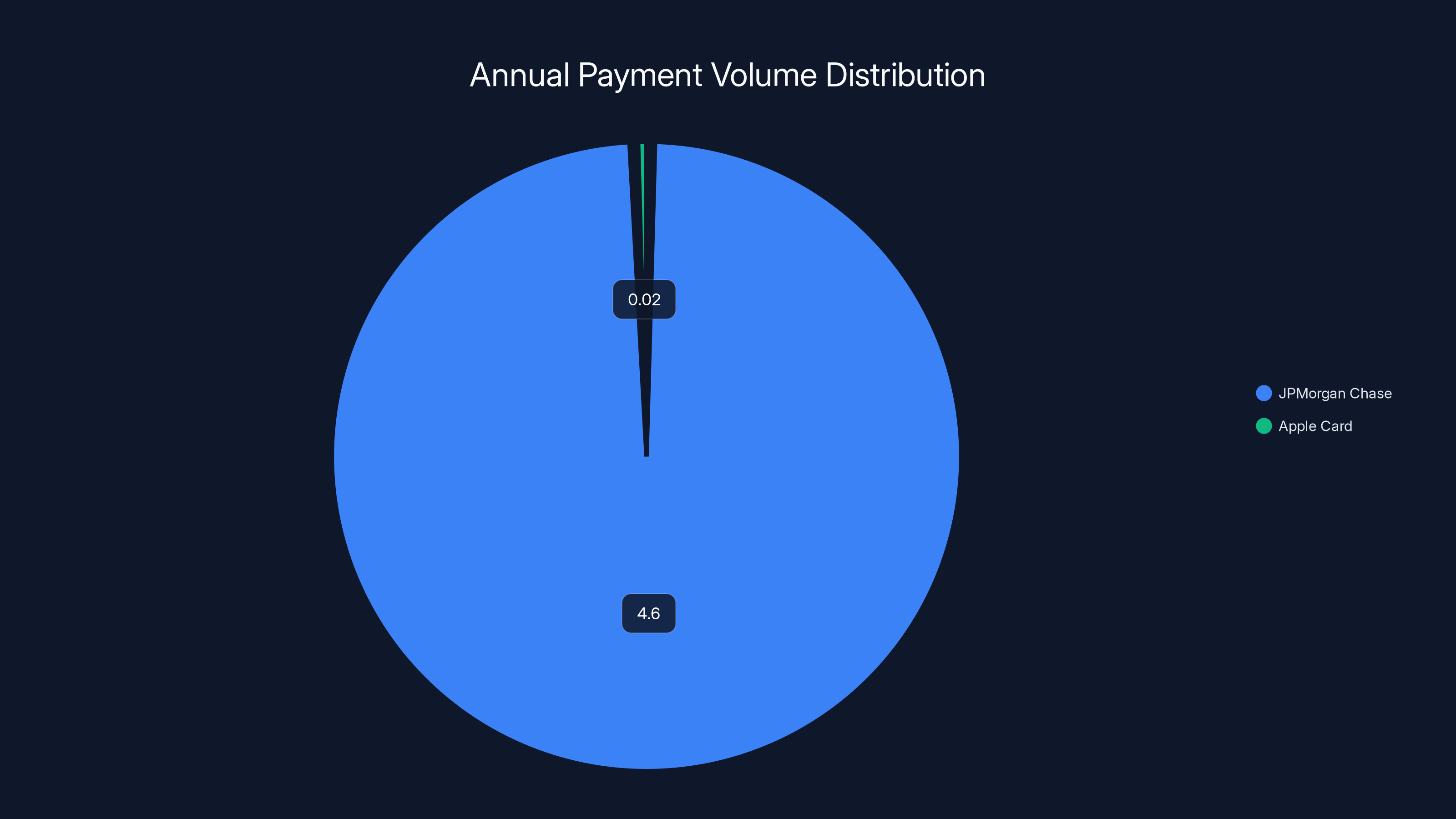

JPMorgan Chase processes

How This Reshapes the Credit Card Industry

The Apple Card transition isn't just a corporate reshuffle. It's evidence of a fundamental shift in how credit cards are distributed and designed in 2025.

For 30 years, the credit card industry was dominated by national banks: Chase, Bank of America, Citibank, American Express. They owned the customer relationship. They owned the brand. Consumers chose cards based on rewards programs, interest rates, and customer service.

Then fintech came along and said: what if the consumer relationship wasn't with the bank, but with the tech company? What if the tech company (Apple, Google, your payment app) provided the user experience, and a bank quietly handled the actual lending and compliance in the background?

Apple Card was the first serious attempt at this model. A credit card that felt like an Apple product, not a financial product. The experience was the card, not the bank.

Problem: execution at scale is hard. Goldman Sachs learned this. Customer support for fintech products is surprisingly complex because you're supporting both the technology layer (app integration, Wallet issues, iPhone-specific problems) and the finance layer (credit decisions, fraud, account management).

JPMorgan Chase's takeover signals that fintech credit products might eventually consolidate around two models:

Model 1: Full Ownership. JPMorgan, Bank of America, and other mega-banks build their own premium fintech cards and own the entire stack. They control the UI, the customer experience, the backend processing. The advantage: vertical integration. The disadvantage: they're not as good at consumer design as Apple.

Model 2: Strategic Partnership. A tech company (Apple, Google, Amazon) partners with a bank that can scale. The tech company owns the UI and customer experience. The bank owns the credit decisions and compliance. This is what Apple is moving toward with JPMorgan.

The Apple Card's success despite Goldman's operational struggles proves the model works. People want premium credit cards designed beautifully. They'll use them if the tech is invisible.

For competition, this is a wake-up call. Google Pay, which has been quietly building a financial services layer, is watching. Amazon, which has millions of Prime members, is watching. Even Samsung Pay is paying attention.

The lesson: you can't be a fintech product with a banking problem bolted on. You need a bank that actually wants to serve that customer base.

What Changes for Apple Card Users

Let's get specific about what you should actually care about if you own an Apple Card.

First: Your card keeps working. The physical and digital card numbers don't change. Your credit limit doesn't immediately change. Your current credit line, as extended by Goldman Sachs, transfers to JPMorgan as-is. From day one of the transition, the product should feel identical.

Second: Customer service should improve. JPMorgan runs one of the largest customer service operations in the world. Apple Card support, which was sometimes slower under Goldman Sachs, should get faster. Phone wait times should decrease. Chat responses should become more reliable. This typically takes 3-6 months post-integration to stabilize.

Third: Fraud detection gets better. JPMorgan's fraud teams are larger and more sophisticated than Goldman's. They have 24/7 monitoring. If someone tries to use your card fraudulently, JPMorgan's systems should catch it faster. The bank's zero-fraud-liability guarantee means you won't pay for unauthorized charges either way, but detection matters because it's less disruptive to your life.

Fourth: Potential credit limit changes. This is the one uncertainty. JPMorgan might recalibrate credit limits for existing cardholders. Given Apple Card's high approval rate (Goldman approved most applicants), JPMorgan might take a more conservative stance. On the flip side, they might approve higher limits for premium profiles. There's no way to predict this individually.

Fifth: Long-term product innovation. JPMorgan is much more likely to ship new features. They might add partnership rewards (JPMorgan has hundreds of business partners, compared to Goldman's handful). They might expand the card to Android and other ecosystems (JPMorgan isn't wedded to Apple like Goldman's original deal was). They might introduce new credit products built on the same infrastructure.

One more detail worth mentioning: Apple's FAQ confirmed that cardholder protections and fraud liability don't change. You're protected under federal law regardless of whether Goldman or JPMorgan is the issuer. That's comforting from a regulatory perspective.

The transition of Apple Card from Goldman Sachs to JPMorgan is expected to complete over 24 months, with major migration activities occurring in the last 6 months. Estimated data.

The Mastercard Angle: Why It Matters

One detail many articles skip over is the Mastercard decision. Apple Card runs on Mastercard's payment rails, not Visa. That was Goldman Sachs' choice originally.

JPMorgan has major relationships with both Visa and Mastercard. They issue Visa cards and Mastercard cards. For Apple Card to stay on Mastercard, JPMorgan either negotiated some special deal with Mastercard, or Apple specifically requested it.

My guess? Apple did. The experience consistency matters more than the payment network to Apple. Switching payment networks mid-transition would confuse users and complicate systems.

But here's what's interesting: JPMorgan could theoretically move Apple Card to Visa in the future. The transition gives them a window. They might use that window to negotiate better rates or clearer terms with Visa. Or they might keep Mastercard because it's working.

Fundamentally, it doesn't matter much to Apple Card users. Mastercard and Visa are both universally accepted. Neither is better for daily spending. The difference is backend economics and card network rewards (which JPMorgan negotiates).

What matters more is that JPMorgan explicitly chose to maintain continuity here. They're saying: we're not coming in to upend the Apple Card. We're coming in to make it work better at scale.

Goldman Sachs' Fintech Reckoning

Goldman Sachs bailing on Apple Card says something bigger about how traditional banks approach fintech.

For most of the 2010s, every major bank claimed to be "becoming fintech." They meant it literally: they were going to hire engineers, build apps, launch digital-first products. Goldman was part of that wave.

What they learned: being fintech requires different DNA. It's not just technology. It's product philosophy (everything should be fast, beautiful, and simple). It's operational philosophy (fail fast, iterate constantly, embrace chaos). It's customer philosophy (you're not a customer to serve, you're a user to delight).

Traditional banks are good at compliance, security, and profitability. Those are table stakes in finance. But they're not naturally good at surprise and delight. They're not good at shipping intuitive UX. They're not good at moving fast.

Goldman Sachs' departure from Apple Card is them admitting: we can partner on prestige, but we can't build fintech products. JPMorgan's arrival is them saying: we can, and we've proven it (Chase has a solid mobile app and digital offerings).

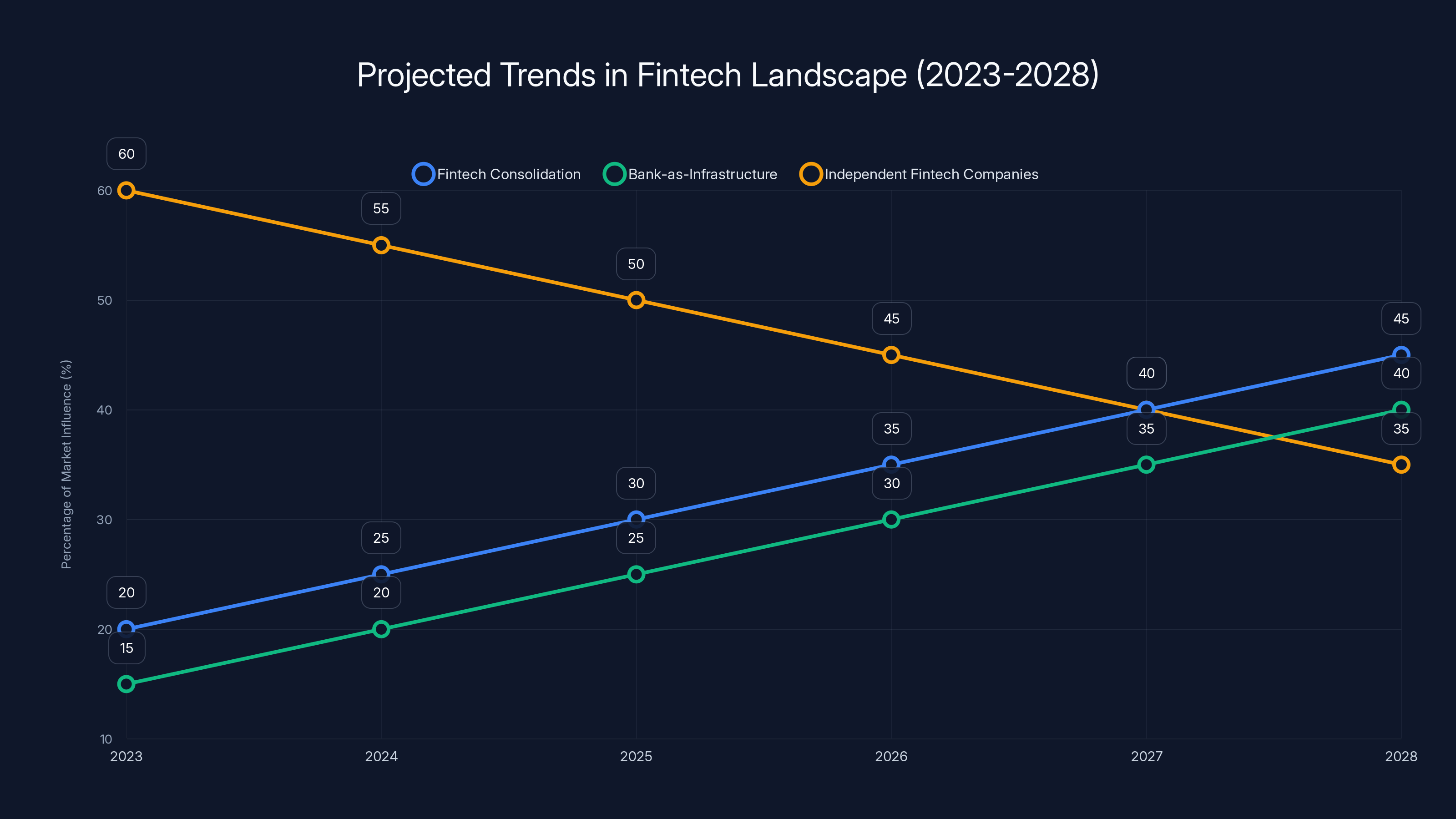

This creates an interesting future landscape. Over the next 5 years, we'll likely see:

-

Fintech consolidation. Startups that can't reach profitability get acquired by banks that can scale them. We saw this with Square and Cash App (bought by Block), Blend (fintech lending platform), and dozens of smaller plays.

-

Bank-as-infrastructure. Banks increasingly become invisible backend providers. Tech companies provide the customer experience. Banks provide the license and compliance.

-

Fewer independent fintech companies. The era of fintech startups getting $500 million in funding and staying independent is ending. The capital markets dried up. The regulations got stricter. The only path to scale is partnership or acquisition.

Goldman Sachs can return to what it does best: institutional finance. They're already quietly expanding their asset management business. They're competing for institutional clients. That's where their DNA actually lives.

Estimated data suggests that fintech consolidation and bank-as-infrastructure roles will increase, while the number of independent fintech companies will decline over the next five years.

Why This Matters More Than You Think

On the surface, this is a story about one premium credit card changing hands. Underneath, it's three stories stacked together.

Story 1: Fintech reached maturity. The age of pure fintech domination is over. What remains is fintech partnered with banks. This is actually healthy for consumers because it means you get innovation with stability.

Story 2: Apple's strategy is clear. Apple doesn't want to own the financial infrastructure. They want to own the user experience. JPMorgan owning Apple Card means Apple can focus on design. That's their real competitive advantage.

Story 3: The credit card industry is consolidating. In 2015, you could launch a new credit card as a startup and compete with Chase. In 2025, you need a bank partner immediately. The era of pure fintech credit products is ending. The era of bank-partnered premium fintech products is beginning.

For users, the JPMorgan transition should feel like an upgrade. Better support. Better technology. Better innovation. For the industry, it's a signal about how financial products get built in the future.

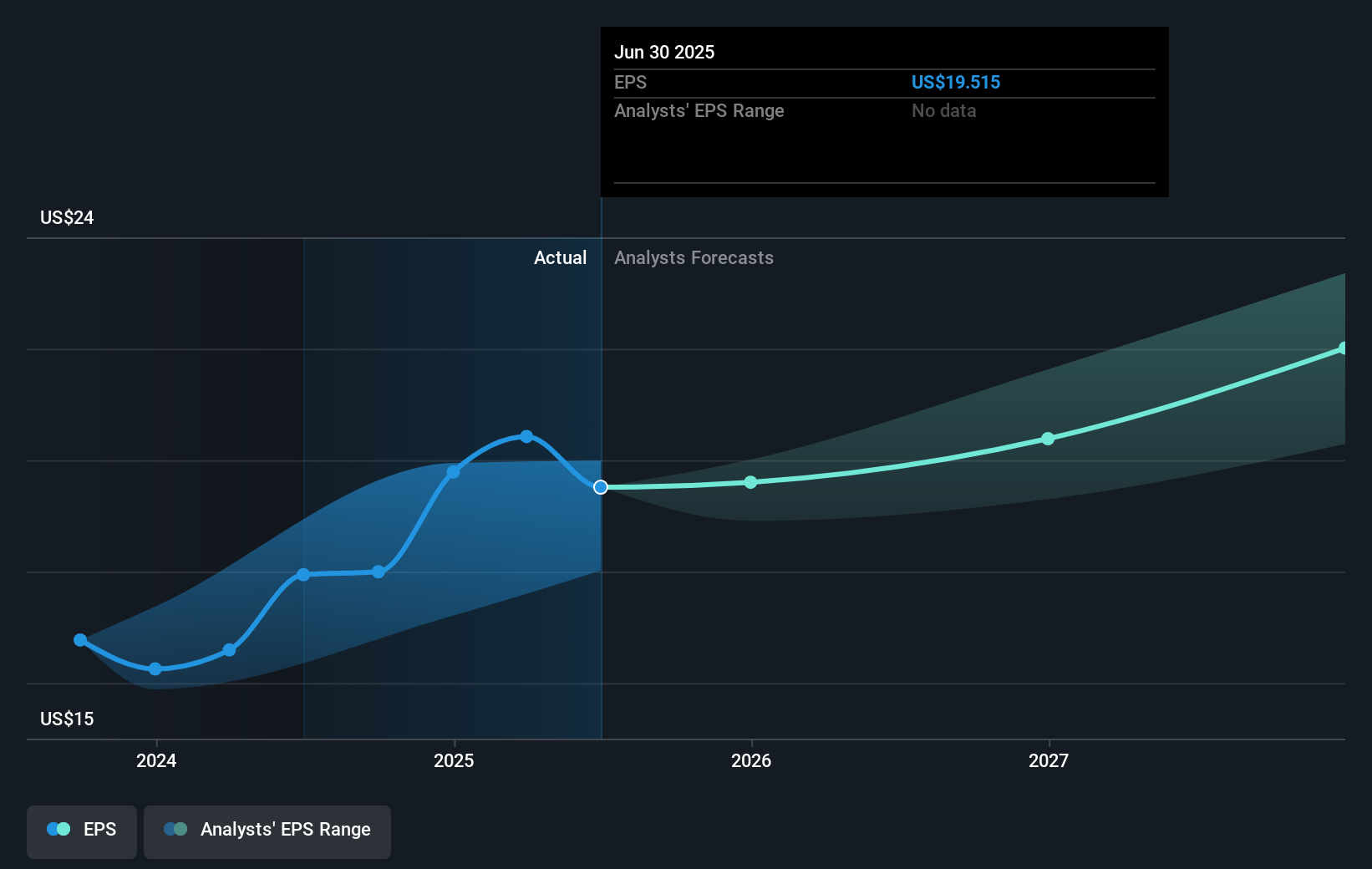

What Happens Next: 2025-2027 Predictions

If JPMorgan executes well (and they usually do), here's what we should expect:

2025 (Year 1 of transition): Quiet behind-the-scenes work. Customer notices nothing. JPMorgan builds infrastructure, tests systems, trains support staff. Apple prepares user communications. Mastercard ensures payment processing stability.

2026 (Year 2 of transition): Visible migration begins. Customers start seeing official communications. Some might see minor account adjustments. Credit limit recalculations happen. New cards issued. A few inevitable glitches that get fixed quickly. By mid-2026, most Apple Card holders should be on JPMorgan systems.

2027 and beyond: JPMorgan begins shipping new features. Expanded partnership rewards (maybe earn points with JPMorgan business partners). International benefits (JPMorgan has global reach Goldman didn't). Integration with JPMorgan's other products (checking accounts, investment services). Possible expansion to non-iPhone platforms.

The risk: JPMorgan screws it up. They accidentally merge Apple Card into their existing rewards program or branded credit card. They change the card's aesthetic. They prioritize profitability over user experience. This seems unlikely given their track record, but it's the scenario Apple Card users should hedge against.

The opportunity: Apple Card becomes the gateway product to JPMorgan's financial ecosystem. You get a beautiful credit card, then realize JPMorgan's checking account is good, then suddenly you're fully in the JPMorgan ecosystem. That's worth billions in lifetime customer value.

FAQ

Will my Apple Card stop working during the transition?

No. Your card will continue to work without interruption. Goldman Sachs remains your issuer throughout the approximately 24-month transition period. You can use your card exactly as before. JPMorgan is building infrastructure behind the scenes, but your existing card number, credit limit, and account remain active.

Can I apply for an Apple Card right now?

Yes, you can still apply. Goldman Sachs will continue approving new applicants during the transition. However, it's worth noting that terms and eligibility criteria may change once JPMorgan takes over, so if you've been considering applying, sooner might be better than later to lock in current terms and approval criteria.

What happens to my credit history and payment record?

Your credit history transfers completely to JPMorgan as part of the account migration. All your payment history with Goldman Sachs, your current credit limit, and your account standing are preserved. Your credit report shouldn't be affected because there's no delinquency or account closure involved.

Will I need a new physical Apple Card after the transition?

This hasn't been officially confirmed, but historically, when credit cards change issuers, new cards are issued. JPMorgan will likely send you a new physical card during the transition, but you'll be notified well in advance. Your digital card in Apple Wallet should work immediately without reissuance.

Could my credit limit change during the transition?

Potentially, yes. JPMorgan will likely reassess creditworthiness using their own underwriting models and scoring criteria. Existing cardholders could see credit limits increase or decrease depending on JPMorgan's assessment. However, the company hasn't publicly committed to specific policies about limit changes.

What about fraud protection and cardholder liability?

Fraud protection remains unchanged. Both Goldman Sachs and JPMorgan offer zero-fraud liability, which is required by federal law. Your protection against unauthorized charges and fraudulent activity doesn't change with the issuer transition. JPMorgan's fraud detection systems are actually more sophisticated, so you might experience better protection in practice.

Does Mastercard staying involved mean anything changes for how I use the card?

No. Mastercard remaining as the payment network means nothing visible changes for you as a customer. Your card will continue working at all Mastercard-accepting merchants worldwide. The network partnership is a backend detail that doesn't affect usability or acceptance.

What if I'm unhappy with JPMorgan once they take over?

You can close your Apple Card account, though you should understand that paying off a closed account doesn't hurt your credit score (paying as agreed until closure is actually good). You could also open a different premium credit card. However, Apple has chosen JPMorgan as their long-term partner, so the product isn't going anywhere or changing to a different issuer again soon.

Will Apple Card get new features once JPMorgan takes over?

Very likely. JPMorgan has more resources, partnerships, and infrastructure than Goldman Sachs. New features could include expanded rewards, partnership benefits, possible expansion to Android, integration with JPMorgan's other financial products, and enhanced travel or business benefits. JPMorgan will want to innovate to justify the $1 billion transition investment.

How does this transition compare to other credit card issuer changes?

Most credit card issuer changes happen due to bank mergers or portfolio sales. This is less common in the premium fintech space. Recent comparable transitions include Costco moving their credit card from American Express to Visa (2015), which saw some customer disruption but ultimately smooth migration. The Apple Card transition should be smoother because both Goldman and JPMorgan are highly operational, motivated banks with strong reputations.

The Bigger Picture

The Apple Card's move from Goldman Sachs to JPMorgan Chase marks a turning point in how premium financial products get built and scaled. It proves that fintech companies need banking partners with real operational chops, that beautiful design matters in finance, and that the future belongs to companies that understand both consumer technology and financial complexity.

For Apple Card holders, this should be optimistic news. JPMorgan is bigger, smarter at operations, and genuinely excited about the product. The next two years might feel uncertain, but the end state should be a better product.

For the industry, it's a bookend on an era. The era of fintech startups building independent financial products is ending. The era of fintech-as-partnership, where tech companies and banks collaborate on infrastructure, is beginning. That's not a story about failure. It's a story about maturation.

Key Takeaways

- JPMorgan Chase officially became the new issuer of Apple Card after Goldman Sachs exited, offloading 1+ billion discount

- The 24-month transition maintains continuity for existing cardholders—your card works unchanged throughout, with Goldman Sachs remaining issuer initially

- Goldman Sachs struggled with operational execution and consumer service complexity; JPMorgan brings proven fintech scaling expertise and infrastructure at magnitude

- This transition reflects fintech's maturation: pure fintech startups are being replaced by tech-bank partnerships where firms own what they do best

- Apple Card users should expect improved customer service, better fraud detection, and new features post-transition, positioning the card for long-term growth

![JPMorgan Chase Takes Over Apple Card: What Changes for Users [2025]](https://tryrunable.com/blog/jpmorgan-chase-takes-over-apple-card-what-changes-for-users-/image-1-1767830897935.jpg)