Legal Zoom Discounts & Promo Codes: Complete LLC Formation Savings Guide [2025]

Starting a business shouldn't require a law degree or a second mortgage. Yet too many entrepreneurs overpay for basic legal services because they don't know where to find real savings. Online legal platforms have democratized access to incorporation documents, but pricing transparency? That's still a mess.

The truth is, most small business owners leave 15-40% on the table by not knowing about available discounts, seasonal promotions, and bundling strategies. You might spend

This guide breaks down exactly how to navigate pricing across the major online legal service platforms, stack multiple discount strategies, and know which services actually justify their cost. We've analyzed current promotion calendars, tested discount codes, and calculated real savings across different business formation types and state requirements.

Here's what you need to know: the baseline cost to file an LLC varies dramatically by state and service provider. But with strategic timing, the right promotional code, and bundling decisions, you can cut expenses significantly.

TL; DR

- LLC formation costs range 500 depending on your state, plus service fees that typically add299

- Seasonal promotions save 10-50%: Black Friday, New Year, and Q1 offer the deepest discounts

- Stack multiple savings: Combine promo codes (10% off), annual plans (20% savings), and installment financing

- Estate planning bundles save 25-35%: Premium trust packages often include both will and trust documents

- Don't overpay for add-ons: Many "packages" include services you don't need; buy strategically

- Timing matters most: Incorporating in January costs 30% less than March for the same service

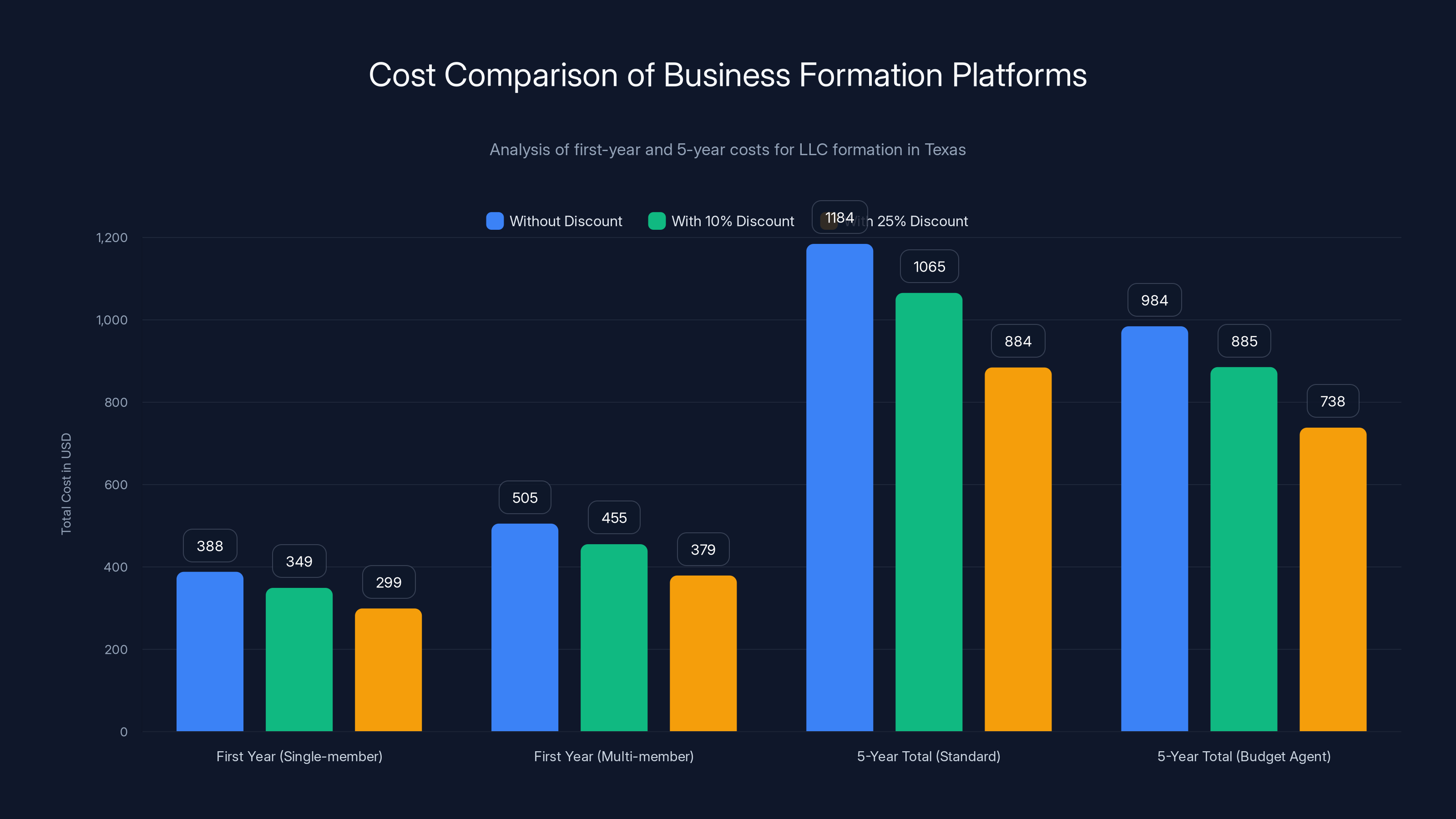

The chart illustrates the cost differences for forming a single-member and multi-member LLC in Texas, including potential savings with discounts. Over five years, choosing a budget registered agent can save up to $200.

Understanding the True Cost of LLC Formation

When you're evaluating online legal services, pricing feels straightforward until you actually try to incorporate. A service advertises "LLC formation from

The real numbers depend on three things: state requirements, service tier selection, and ancillary add-ons.

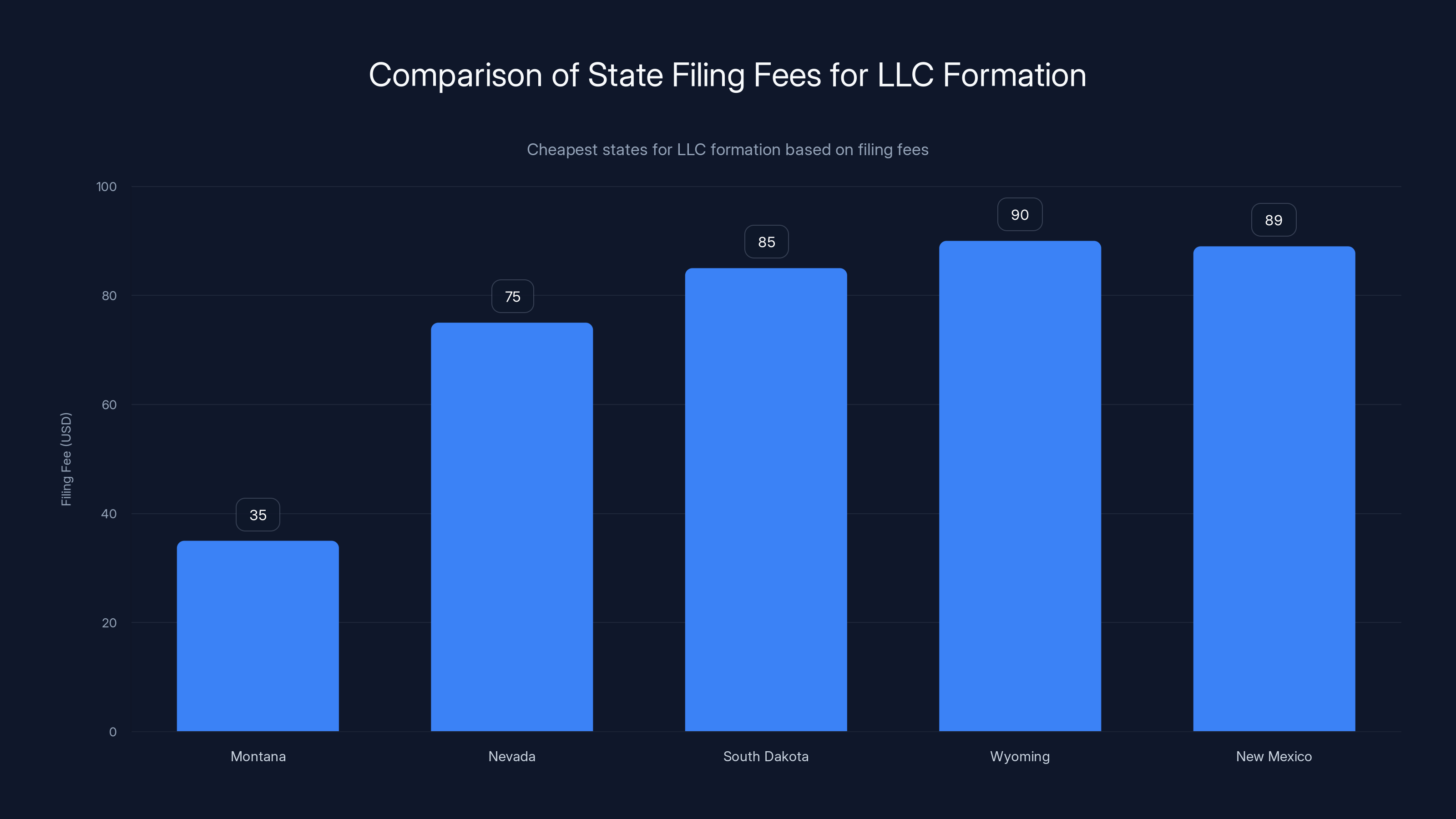

State filing fees are non-negotiable. Montana charges

Service provider fees vary wildly. The platform's cut for preparing documents, handling submissions, and managing your registered agent services typically ranges

Add-on costs multiply quickly. Operating agreements (

Let's calculate real examples. Say you're starting an e-commerce business in Texas. Texas filing fees:

Compare that to New York. Filing fees:

The variance isn't just between states. It's between what you actually need and what the platform's sales interface convinces you to buy. This is where real savings live.

Montana offers the lowest state filing fee for LLC formation at

How Promotional Codes Actually Work

Discount codes aren't magic. They're calculated percentage reductions applied to service fees, not state filing fees. Understanding this distinction saves you from disappointment at checkout.

When you see "10% off LLC Formation," that code reduces only the platform's service charge. The state filing fee, which comprises 25-60% of your total cost depending on your state, doesn't change. In low-fee states like Montana or Nevada, a 10% discount might cut

Promo codes typically fall into a few categories: permanent availability codes (usually 10% off, always accessible), seasonal promotions (25-50% off during Black Friday, New Year, January), time-limited flash sales (48-72 hour windows), and bundle codes (discounts on multiple service packages purchased together).

The most valuable promotions hit in January. Businesses are forming resolutions, filing taxes, and thinking about legal structure. January promotions often hit 25-40% off service fees. December and Black Friday usually see 15-30% off. March through September? Expect 5-15% discounts.

Stacking matters. You might apply a 10% permanent code, then use an annual plan discount (additional 15% off), then choose installment payments (which sometimes add a 5% fee, but not always). Your actual savings depend on exactly what you're purchasing.

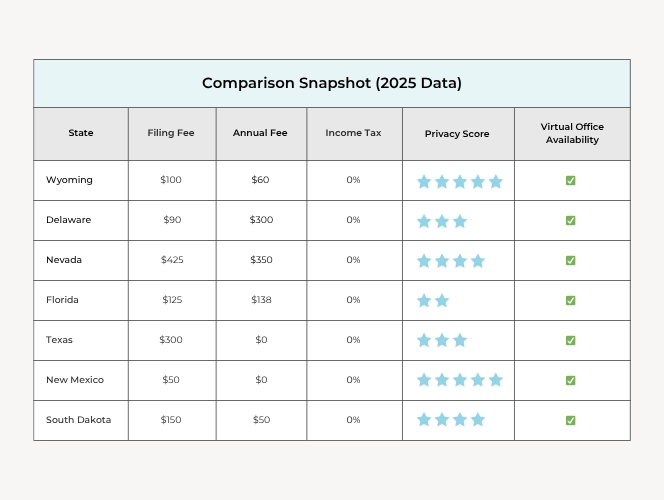

State-by-State Filing Fee Landscape

Your state makes a massive difference in your true all-in cost. This isn't something you can negotiate or discount away.

Low-fee states (under

Mid-range states (

High-fee states (

This is why some entrepreneurs incorporate in Delaware or Nevada despite operating in California or Massachusetts. The initial savings (often

One more critical detail: don't assume you can incorporate anywhere. Some states require that your registered agent or principal office be located within state. Others don't care where you physically are. Verify your state's requirements before choosing your incorporation location based purely on cost.

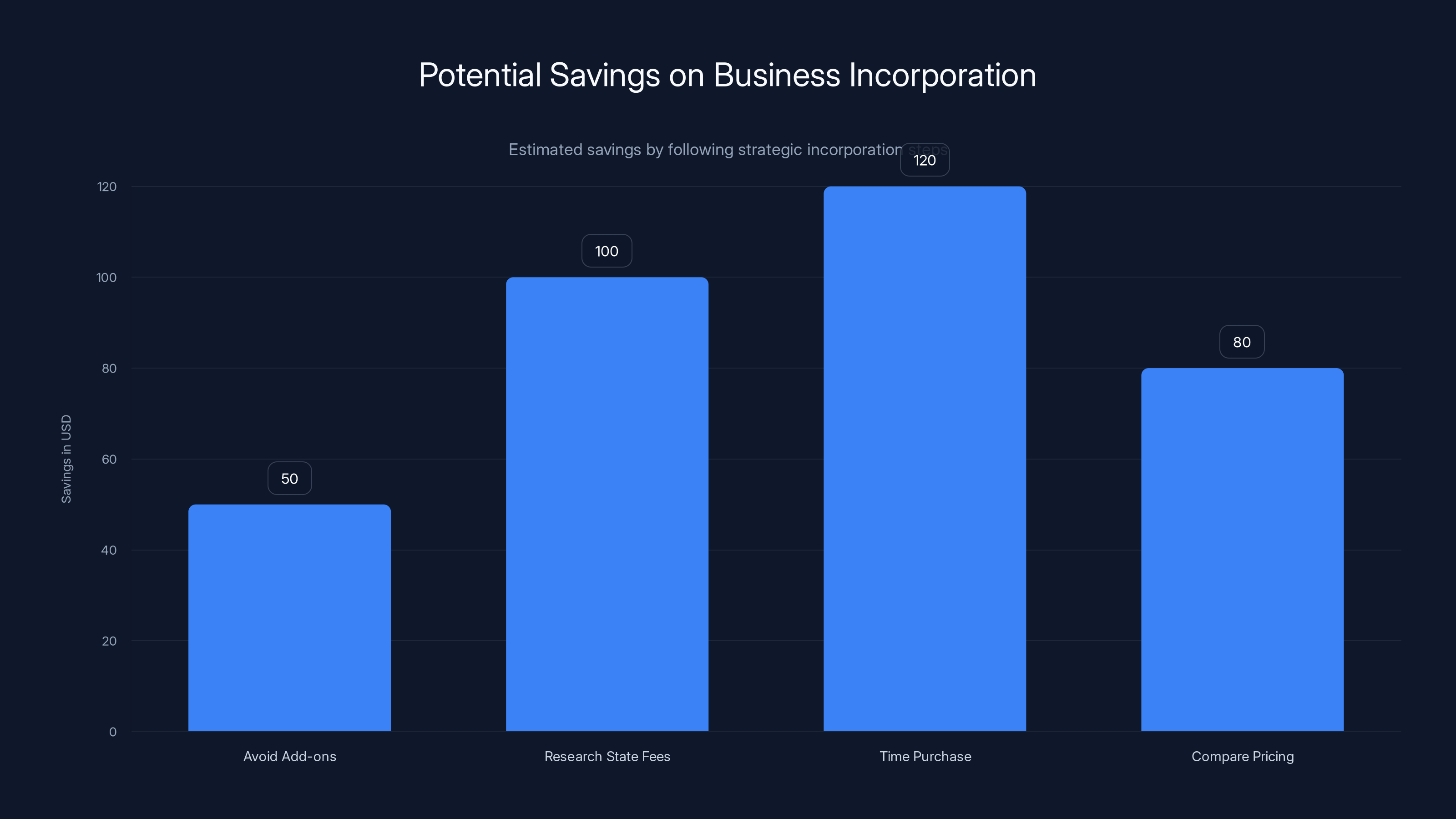

By avoiding unnecessary add-ons, researching state fees, timing purchases, and comparing pricing, entrepreneurs can save

LLC vs. Corporation vs. DBA: Which Costs What

Not all business structures cost the same. Your choice isn't just about legal protection—it directly impacts your filing costs and ongoing service requirements.

Limited Liability Company (LLC) is the most popular structure for small businesses. It costs least upfront because it requires minimal documentation. Expect platform service fees from

LLCs protect your personal assets from business liability. A lawsuit against your business doesn't necessarily reach your personal savings and home. This protection is genuinely valuable but comes at minimal cost.

Corporations (C Corp or S Corp) are more complex but useful for specific situations. A C Corporation allows multiple shareholders, can retain earnings, and provides stronger liability protection. Platform fees jump to

S Corporations offer tax advantages if you're earning substantial income, but they require separate tax filings (

Nonprofit Corporations (501c 3) serve organizations pursuing charitable, religious, or educational purposes. Platform fees range from

Doing Business As (DBA) is the budget option at

The cost-benefit analysis isn't complex: For real businesses with ongoing operations, an LLC costs maybe $100 more than a DBA but provides asset protection worth thousands. The upgrade is almost always worth it.

Estate Planning Discounts and Bundle Strategies

Estate planning feels morbid, which is probably why most people avoid it. But the financial impact of not planning is genuinely severe. You might not care what happens to your money after you're gone, but your family will.

Basic online estate planning costs

Here's where platforms add value: they bundle documents at discounts. Buy a will and living trust together, and you might save 20% compared to purchasing separately. Buy a comprehensive estate plan including healthcare power of attorney and you'll save 25-35% versus individual document pricing.

The real savings come from recognizing what you actually need. Many people buy comprehensive plans with 15 documents when they need 3-4. A 25-year-old with no kids probably needs a basic will and healthcare directive. That's

Promotional timing matters more for estate planning than LLC formation. Platforms run aggressive estate planning promotions in November (estate planning awareness month), January (New Year resolutions), and around major news events (a celebrity death case hits the news, suddenly people want wills). Discounts during these periods hit 30-50% off. Outside these windows? Expect 10-20% off.

Bundle offers multiply your savings. A couple each buying a separate will and designating the other as executor might spend

Comparing registered agent service costs shows self-designation is free but requires availability. Platform services are convenient but can be more expensive than hiring a separate company. Estimated data based on typical costs.

Business License and Registration Assistance Services

Most online legal platforms upsell business license research and registration services. These run

What they do: They research your state and local requirements, identify which specific licenses or permits your business type needs, and sometimes submit applications on your behalf. They handle the bureaucratic research you might otherwise do yourself by calling your county clerk, city hall, and state department.

What you actually need: This depends on your business type and location. A freelance web design business operating from home? You might need nothing beyond the LLC. A food business? You'll need health permits, food service licenses, and possibly other certifications. A contracting business? State contracting licenses, construction permits, bonding.

The question is whether the platform's

Here's the honest truth: for 80% of service businesses and online businesses, basic business licenses aren't required. For 15%, you need basic local registration (

Most platforms charge too much for this service. If you opt for it, negotiate it into bundle discounts. And definitely ask: what exactly are you paying for? Some platforms research and present findings; you submit applications. Others handle full submission. These aren't the same value.

Seasonal Promotion Calendar and Timing Strategy

Discount timing is the single biggest leverage point for savings. Platforms follow predictable promotion calendars based on consumer behavior and tax cycle patterns.

January (the golden month): Businesses are forming New Year resolutions, people are thinking about tax implications, and entrepreneurs are motivated. Expect 25-40% off service fees. This is the absolute best time to incorporate if you have flexibility. The difference between incorporating January 15 (25% off) versus March 15 (10% off) saves you

Black Friday and Cyber Monday (November): Despite the name, these promotions run from early November through the following Tuesday. Expect 20-35% off service fees. Gift-giving season means people buy services for others (incorporating a friend's business idea, helping a parent with estate planning). Platforms capitalize on this with aggressive discounting.

New Year and early January: Similar timing to Black Friday but slightly deeper discounts as platforms want to capture business formation demand. Promotions usually run through January 31.

Tax season (March-April): As tax deadline approaches, some platforms run 10-20% promotions on business formation and bookkeeping services. The discount is shallower because demand is driven by deadline panic rather than forward planning.

Summer (June-August): Promotion activity drops significantly. Expect 5-10% off standard codes, little else. If you can avoid incorporating in summer, do so.

Back to school (August-September): Some platforms tie promotions to small business formation (because some small businesses are student-founded). Expect 10-15% off. This is moderate timing.

Holiday season (November-December): Starting in November, promotions ramp up as mentioned above. They typically expire December 31 or early January.

The math is straightforward: a

Better bundling strategies can lead to significant savings, with the 'Better Bundling' approach saving $112 compared to the base cost. Estimated data.

Annual Plans and Monthly Billing Comparison

Many platforms offer annual subscription plans if you expect to need multiple filings, amendments, or ongoing services. Understanding when these make sense requires honest forecasting.

Annual plans typically cost 15-25% less per month than month-to-month billing. If you're purchasing a

But this only makes sense if you'll actually use the services. The most common annual plans include registered agent services, annual report filing, business license renewal monitoring, and tax deadline reminders. If you're using registered agent services (

Here's where people lose money: they buy annual plans for services they don't need. A business that won't need registered agent services until year two shouldn't pay 12 months upfront. A business that doesn't plan to hire employees shouldn't pay for payroll integration.

Calculate the ROI. If you need registered agent services (most LLCs do) and you'll need business license compliance monitoring (most states require annual filing), annual plans save money. If you're uncertain, start monthly and upgrade after three months when you understand your actual needs.

Registered Agent Services: Build-in vs. Outsource

Every business structure requires a registered agent—a person or company authorized to accept legal documents. This costs

You have three options: use the platform's registered agent service (included or

The math is simple. If the platform charges

This is where bundling becomes critical. If you buy the platform's LLC formation (

But if you buy only LLC formation and the platform charges

The key insight: registered agent services are fungible. They're mostly the same across providers. Compare pricing explicitly and buy from the cheapest option, even if it's not your primary platform.

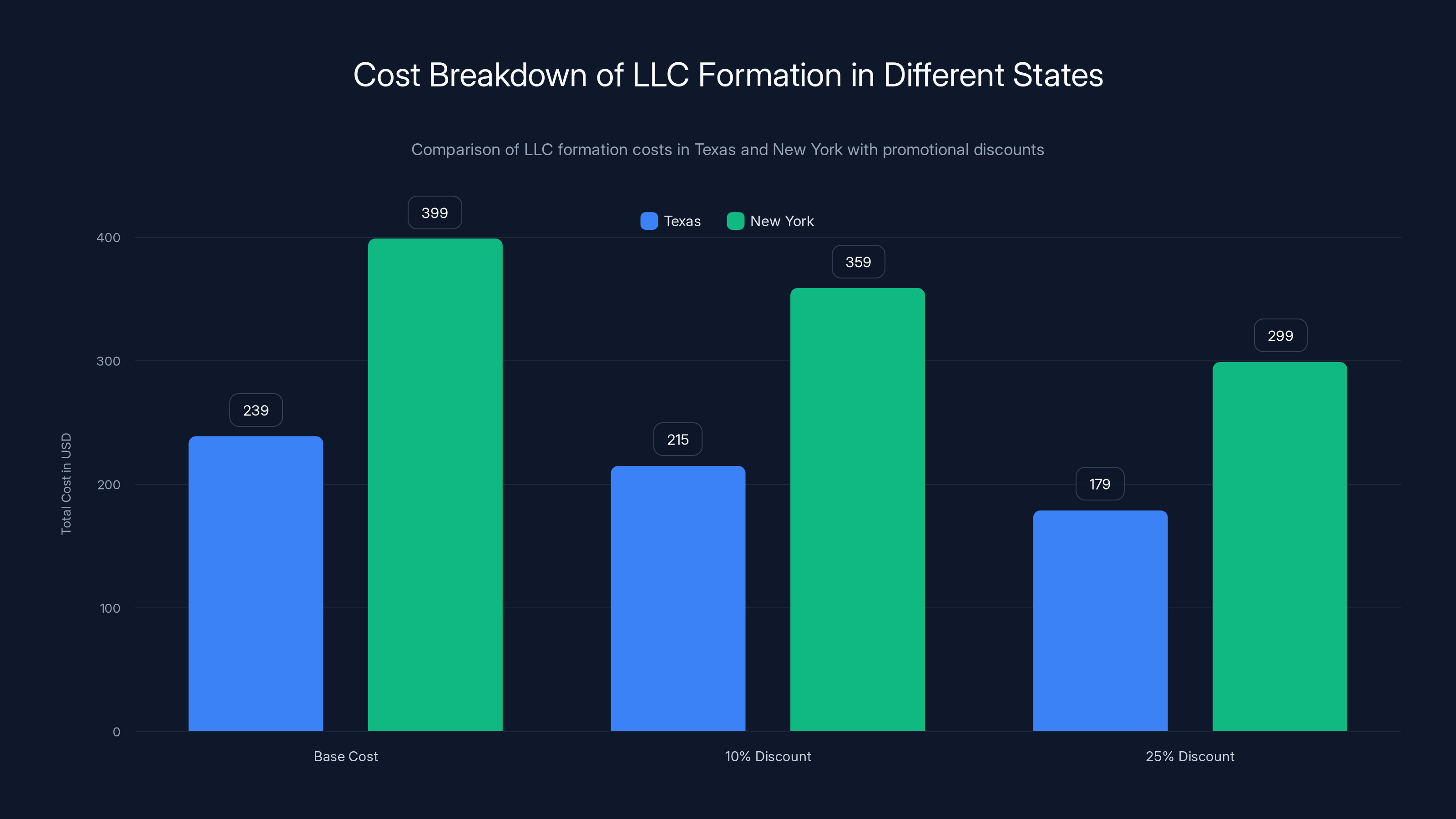

The cost of forming an LLC varies significantly between states and can be reduced with promotional discounts. Texas is generally cheaper than New York, especially with discounts.

Document Packages and Unnecessary Add-ons

Platforms make money by bundling services. Some bundles are legitimately valuable. Others are expensive padding.

Operating agreements are often presented as essential (they cost

Bylaws for corporations are necessary and run

Articles of amendment are used when you change your business structure (converting LLC to C Corp) or modify your registered agent. Platforms charge

EIN assistance costs

Business card printing and website services are sometimes bundled into packages. These are convenient but not legal services. You can get 500 business cards for

The pattern is clear: platforms make the biggest margins on add-ons that provide convenience rather than legal protection. Evaluate each add-on with a simple question: "Am I paying for something I couldn't easily do myself?" If the answer is yes, it might be worth it. If you're paying for convenience on a free or cheap government process, skip it.

Comparing Platforms: Real Cost Analysis

Multiple platforms serve the business formation market. Each has different pricing, promotional strategies, and included services. Comparing them requires standardized calculations.

Standard comparison: Single-member LLC in Texas Texas state filing fee:

Apply a 10% promotional code:

The pricing range across platforms for the identical service is 25-35%. This gap is worth shopping around.

Standard comparison: Multi-member LLC with operating agreement Texas filing fee:

With 10% off:

Notice operating agreements reduce platform differentiation. If one platform includes it free and another charges $99, that's a massive difference. Always compare all-inclusive costs.

Multi-year total cost analysis Year 1 investment:

Alternate path: form with one platform (

The 5-year difference is $200. It's not massive but illustrates that ongoing cost matters as much as formation cost.

Hidden Costs and Gotchas You're Missing

Platforms aren't intentionally deceptive, but their pricing models hide costs effectively. Watch for these.

State-specific unexpected fees come from particular states with unusual requirements. If you're incorporating in New York, you might think you're only paying

Annual report filing fees exist in most states but aren't always clearly disclosed. Some charge

Service fees that increase after year one happen more often than you'd think. Promotional pricing might make year one affordable, but year two returns to normal pricing. If you're budgeting multi-year costs, assume no discounts persist.

Forced bundling occurs when platforms won't let you skip certain services. You want LLC formation only, but the "cheapest plan" includes registered agent services. You're forced to overpay for bundled services you didn't want. Always check if individual service purchase is available.

International/foreign LLC filings cost significantly more if you incorporate in one state but operate in another. This isn't the platform's fault—states charge for the privilege—but it's a cost people often underestimate. A business in California incorporating in Nevada might pay

Failure to disclose upfront. Some platforms quote a price, then reveal additional mandatory costs at checkout. If you've already committed time and mental energy, you'll often accept the higher price. Get complete pricing before you start.

Maximizing Discounts Through Strategic Bundling

You don't have to choose between discounts. Strategic bundling multiplies savings.

The math of layered discounts: Base service cost:

Wait, that got worse. Installment fees sometimes negate other savings. Here's a better approach.

Better bundling strategy: Base service cost:

Now you've achieved real savings by bundling related services and applying promotion codes.

Annual plan bundling: If you need registered agent services for 5 years, paying upfront in an annual plan saves the most. Compare:

- Year-by-year: 745

- Annual plan: 960

Actually, that example makes annual plans look worse. The real win comes when you need multiple services together:

- LLC formation + registered agent + annual reporting: 129 +328

- Same bundle offered at 25% discount: $246

- Saving: $82 on year one

The key is identifying what you actually need, then buying it all at once during promotional periods. Piecemeal purchases rarely offer the best pricing.

Refinancing and Amendment Strategies for Existing Businesses

If you've already incorporated, you're not stuck paying full price for updates. Amendments and refinancing have their own discount strategies.

Changing your registered agent costs

Amending your operating agreement or articles of incorporation triggers new filings. Some platforms waive or discount amendment fees for existing customers. If you need to modify something (adding a partner, changing business purpose, updating address), see if your current platform offers loyalty pricing before switching.

Converting business structures is common as businesses grow. Converting from LLC to S Corporation (for tax purposes) or from sole proprietorship to LLC costs platform fees (

Adding a business address or registered agent location shouldn't cost extra if you're already using the platform's registered agent service. But some platforms charge location-based fees. Clarify this before incorporating with a multi-location business in mind.

Dissolution services are needed if you're closing your business. These typically cost

Tax Implications and Deductibility

Legal service fees are business expenses, meaning they're often tax-deductible. This reduces your true out-of-pocket cost.

If you're paying

This applies to all legal services: formation, registered agent services, annual filing, amendments, even consultations. Document them as business expenses.

One caveat: if you're incorporating to test a business idea and haven't yet earned revenue, you can't deduct the expenses immediately. They become business start-up costs, which you either capitalize or deduct $5,000 in the first year and amortize the rest over 15 years. For most small business owners, this distinction doesn't matter because you'll start earning revenue immediately. But it's worth understanding.

Final Optimization: Your Personal Savings Checklist

Before you pay for legal services, use this checklist to ensure you're getting the best price:

-

Identify your actual needs. LLC only? Or LLC + registered agent + estate planning? Don't overbuy.

-

Research your state's costs. Don't estimate what your state charges. Look it up. Your Secretary of State's website has exact filing fees.

-

Calculate the state filing fee plus platform fee. This is your true base cost. Everything else is marketing.

-

Check the current promotion calendar. Is Black Friday coming? New Year? January? Time your purchase for peak discount periods.

-

Build your ideal package (formation + registered agent + X) and compare three platforms' all-in pricing.

-

Ask about promotional codes. Most platforms have codes beyond what's advertised online. Email their sales team and ask what codes are currently active.

-

Consider annual plans if you'll need recurring services (registered agent, annual reporting) for 3+ years.

-

Document for taxes. Save receipts. These are business deductions.

-

Avoid add-ons you can do yourself. EIN? Free from the IRS. Business cards? $10 online. These platform add-ons are expensive convenience.

-

Review the fine print. Some platforms auto-renew services you didn't intend to keep paying for. Understand cancellation policies before purchasing.

Following this process typically saves

FAQ

What is the average cost to form an LLC with an online platform?

The average cost ranges from

How do promotional codes and discounts stack with annual plans?

Promo codes (typically 10% off) and annual plan discounts (typically 15-25% off) can sometimes be combined, but not always. The most effective approach is identifying your full service needs, then comparing three platforms' all-in annual pricing with available promotional discounts already applied. Contact sales teams directly—they'll often quote better pricing than published discounts.

Which states have the cheapest LLC formation costs?

Montana (

Should I form my LLC in a cheap state or my operating state?

If you operate primarily in your home state, incorporating there is simplest. You'll pay the state's filing fee plus platform fees. If you want to incorporate in a cheaper state (like Nevada), you'll pay both Nevada filing fees (

What are the most important add-on services versus unnecessary ones?

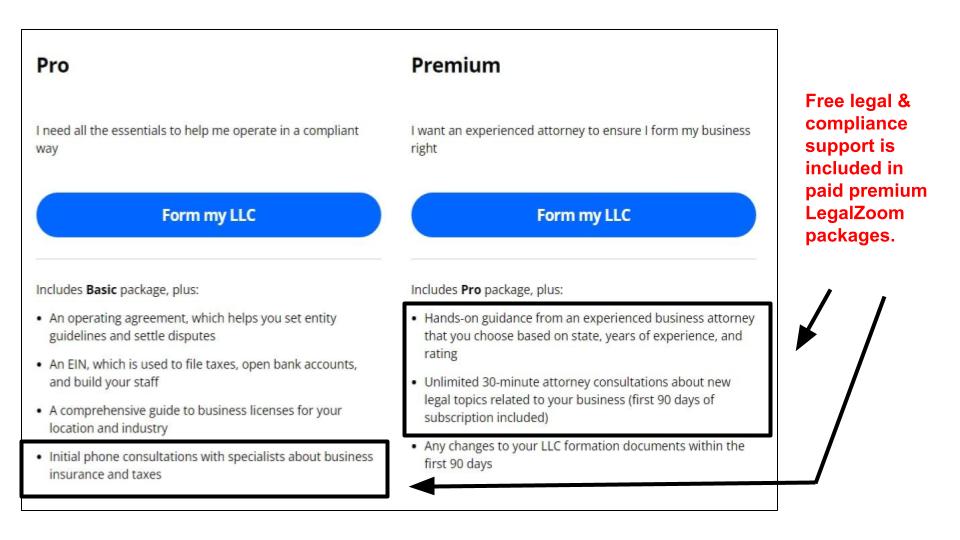

Essential add-ons include operating agreements for multi-member LLCs and bylaws for corporations. Consider registered agent services (required by all states, costs

How much does registered agent service actually cost if purchased separately?

Standalone registered agent services cost

Can I form an LLC, then switch platforms later for ongoing services?

Yes. You can form your LLC with Platform A, then purchase registered agent services from Platform B, and file your annual report with Platform C if their pricing is better. There's no penalty for splitting services across providers. The only inefficiency is missing bundle discounts that come from purchasing everything with one provider.

What hidden costs appear at checkout that aren't advertised upfront?

Common surprises include state publication fees (required in New York, Illinois, and a few others), rush processing fees if you didn't select standard processing, state-specific annual fees, and pre-checked optional services that bundle into the final cost. Always read checkout carefully. Some platforms have a disclosure phase right before payment where all fees appear together. That's when you catch surprises.

How do I know if annual plans save money versus month-to-month billing?

Calculate your annual commitment: if you need registered agent service (

Are legal service fees tax-deductible?

Yes, as business expenses if your business is already operating and earning revenue. If you're forming a new business that hasn't earned revenue yet, formation costs are "start-up costs"—you can deduct up to $5,000 in the first year and amortize the rest over 15 years. Once you're operating and profitable, legal service fees become standard business deductions. Keep receipts and categorize them as legal/professional services on your tax return.

What timing strategy saves the most money on legal services?

January offers the deepest discounts (25-40% off) because platforms promote business formation for New Year resolutions. Black Friday and Cyber Monday offer secondary discounts (20-35% off). Incorporating in January versus June saves

Conclusion: Your Path to Affordable Incorporation

Incorporating your business doesn't have to be expensive. The difference between an informed purchaser and an impulsive one is often

The key insights are simple: understand your actual legal needs (don't overbuy add-ons), research your state's specific requirements (filing fees vary wildly), time your purchase for promotional periods (January beats June by 30-40%), and compare complete all-in pricing across providers (don't compare partial pricing).

Most entrepreneurs leave 20-40% savings on the table by not following these steps. You're starting a business—conserving capital matters. Every dollar saved on legal services is a dollar you can invest in marketing, inventory, or hiring.

Your formation cost doesn't define your business's success. Your execution does. But there's no reason to overpay for something as straightforward as incorporating your LLC. With the strategies outlined here, you'll find legitimate discounts, avoid unnecessary add-ons, and complete the entire process for

The formation is just the beginning. Your business's real journey starts after incorporation. Make sure you've preserved resources for what actually matters.

Key Takeaways

- LLC formation costs 35-500) being fixed and platform fees ($99-299) being where discounts apply

- Promotional timing is the single biggest leverage point: January offers 25-40% discounts vs summer's 5-10%, potentially saving $100-200 on identical services

- Avoid expensive add-ons like EIN assistance (free from IRS) and business card printing (cheaper elsewhere), focusing instead on essential services like operating agreements for multi-member LLCs

- Registered agent services are fungible commodities—compare pricing across platforms and hire from the cheapest provider even if it's not your formation platform

- Strategic bundling multiplies savings: combining LLC formation with estate planning and purchasing during promotional periods can reduce total first-year costs by 25-35%

![LegalZoom Discounts & Promo Codes: Complete LLC Formation Savings Guide [2025]](https://tryrunable.com/blog/legalzoom-discounts-promo-codes-complete-llc-formation-savin/image-1-1767336090027.png)