Liverpool vs Newcastle: Your Complete Live Streaming Guide for the 2025-26 Premier League Season

The clash between Liverpool and Newcastle United represents one of English football's most compelling rivalries, and the 2025-26 season promises to deliver yet another chapter in their storied encounters. Whether you're a die-hard Reds supporter, a Magpies fan, or simply a neutral football enthusiast, accessing this fixture has never been more complex—or more rewarding. With broadcasting rights fragmented across multiple platforms, international borders creating variable access patterns, and the proliferation of legal streaming services, fans now face genuine decisions about how to experience the action in real-time.

This comprehensive guide navigates the intricate landscape of Liverpool versus Newcastle broadcasting options, providing you with verified, legitimate pathways to watch this Premier League encounter across virtually every major region globally. We've analyzed the streaming infrastructure, licensing agreements, and platform ecosystems that deliver these matches to millions of viewers annually, ensuring you have accurate, up-to-date information about subscription requirements, device compatibility, and picture quality expectations.

The streaming revolution has fundamentally transformed how football fans consume live matches. Where television broadcasters once held exclusive territories with geographic rights lasting years, today's digital ecosystem allows simultaneous coverage across continents, with variable pricing models and subscription tiers creating multiple entry points for viewers with different budgets and viewing preferences. Understanding these options empowers you to make informed decisions about your viewing investment while supporting legitimate broadcasters who compensate players, clubs, and content creators appropriately.

Beyond simply telling you where to watch, this guide explores the technological infrastructure behind live football streaming, the economics that determine which channels secure broadcast rights, and the evolving landscape of football media consumption that will define how supporters experience the sport through 2026 and beyond. We'll examine how time zones affect your viewing options, compare streaming quality across platforms, analyze the value propositions of various subscription services, and provide actionable recommendations tailored to your specific circumstances.

Understanding Premier League Broadcasting Rights and Distribution in 2025-26

How Broadcasting Rights Are Allocated and Licensed

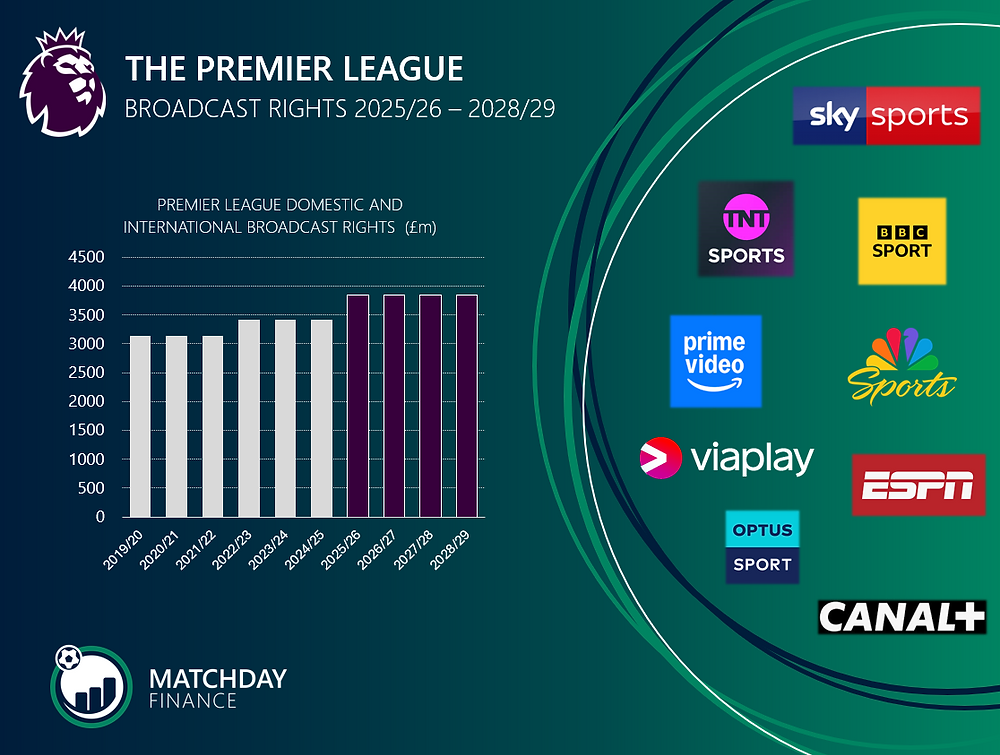

Premier League broadcasting rights represent some of the most valuable sports media assets globally, with the league generating approximately £3.1 billion annually from domestic and international broadcasting agreements. These rights are segmented into multiple categories: domestic (United Kingdom and Ireland), international regions, digital platforms, and increasingly, short-form content distributed through social media channels.

The allocation process follows a rigorous tender framework where the Premier League releases specific bundles of rights—typically organized by number of matches, time slots, and geographic regions—and allows broadcasters to bid competitively. This structure ensures maximum revenue while theoretically increasing choice for consumers across different price points and distribution platforms. The 2025-26 cycle introduced expanded international fragmentation, meaning a single Liverpool versus Newcastle match might be broadcast simultaneously across fifteen different platforms in different countries, each with distinct subscription models, advertising approaches, and technical specifications.

Broadcasters invest heavily in securing these rights because football content drives subscriber acquisition and retention at significantly higher rates than other programming. A marquee fixture like Liverpool versus Newcastle can drive thousands of new subscriptions in a single day, making these investment decisions critical to streaming platforms' long-term viability. This economic reality directly impacts your viewing options—platforms willing to pay premium prices for premium content necessarily pass some costs to consumers through subscription fees.

Regional Variation and Geographic Licensing

Geographic licensing creates the complexity that many international viewers encounter. A match simultaneously broadcast in the UK on Sky Sports might be shown on a completely different platform in Singapore, Australia, or Canada. These arrangements reflect historical distribution patterns, negotiated exclusivity windows, and regional licensing laws that prevent single global platforms from serving all markets identically.

Understanding your geographic location enables accurate identification of which services carry specific matches. Fans in the United States access Premier League matches through completely different channels than viewers in Scandinavia, despite the match being identical. This geographic segmentation also explains why virtual private networks (VPNs) exist—they allow access to content libraries in different regions, though this practice violates most streaming services' terms of service and raises ethical questions about supporting legitimate broadcasting arrangements.

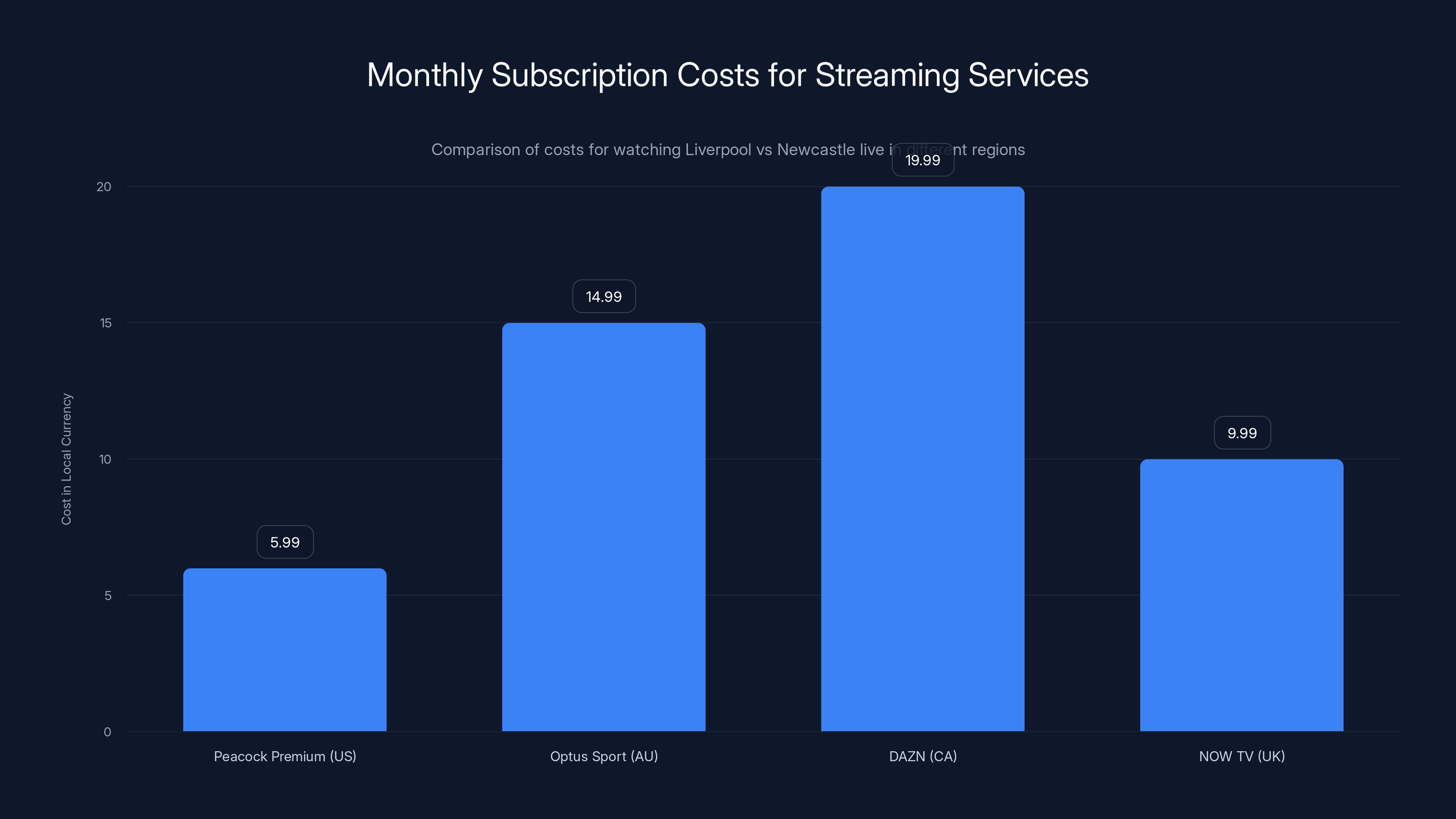

Subscription costs vary significantly by region, with the US offering the most affordable options due to competitive market dynamics. Estimated data based on currency conversion.

Official UK and Ireland Viewing Options

Sky Sports: The Dominant Broadcaster

Sky Sports remains the primary Premier League broadcaster across the United Kingdom and Ireland, holding exclusive rights to the majority of fixture rounds. For the 2025-26 season, Sky Sports secures approximately 128 matches from the 380-match calendar, providing the most consistent access to Liverpool versus Newcastle encounters whenever this fixture falls within their allocated time slots.

Sky Sports operates through multiple tiers: Sky Sports Premier League (the core football package), Sky Sports Main Event (premium fixtures), and Sky Sports Mix (selected secondary matches). Subscription costs for Sky Sports packages begin at approximately £25 monthly when bundled with broadband and television services, though standalone streaming access through NOW TV provides more flexible options for customers uninterested in traditional television contracts.

Picture quality on Sky Sports broadcasts reaches 4K resolution for select fixtures, with matches typically presented at 1080p resolution and 50 frames per second—exceeding standard broadcast specifications. Sky Sports invests substantially in production quality, on-field camera angles, and analytical commentary, justifying premium positioning within the UK broadcasting hierarchy. Multiple audio feeds, including standard commentary, alternative commentary, and in some instances club-specific feeds, provide viewer customization options unavailable through lower-cost platforms.

BT Sport: Secondary Coverage

BT Sport holds secondary rights to Premier League matches, broadcasting approximately 52 matches throughout the season. While BT Sport's fixture allocation generally privileges Manchester City, Chelsea, and other traditionally high-profile clubs, Liverpool versus Newcastle encounters occasionally fall within their programming slots, particularly when scheduling requires balanced distribution across broadcasters.

BT Sport subscription costs approximately £14.99 monthly for the BT Sport app standalone access, making it a budget-conscious alternative to Sky Sports while providing legitimate, official coverage. Quality standards match Sky Sports in most respects, with 1080p streaming and consistent framerates. Integration with BT's broadband and television services provides bundled discounts for existing customers, with some packages combining BT TV and BT Sport from £40 monthly.

BT Sport's interface emphasizes convenience for cord-cutting audiences, with comprehensive on-demand replay access, match highlights, and supplementary analysis available through their mobile and web applications. Their technical infrastructure generally performs reliably, though user reviews occasionally note interface navigation complexity compared to Sky Sports' more intuitive design.

NOW TV: Premium Flexibility

NOW TV represents Sky's streaming-focused offering, providing direct access to Sky Sports programming without requiring traditional television contracts. Pass pricing starts at £11.99 for a one-day pass (ideal for single fixture viewing), £25.99 for monthly packages, or £249 annually for committed fans seeking full-season access.

NOW TV's value proposition emphasizes flexibility—you're never locked into extended contracts and can pause subscriptions during summer months when fixture density decreases. The platform supports simultaneous streaming on multiple devices, though concurrent stream limits apply based on your subscription tier. Interface design prioritizes simplicity, with clear navigation to upcoming fixtures, live programming, and on-demand archives.

Device compatibility spans smart televisions (LG, Samsung, and others with integrated apps), streaming boxes (Apple TV, Amazon Fire TV, Roku), smartphones, tablets, and web browsers. Picture quality reaches 1080p with consistent 50fps delivery, though 4K streaming remains unavailable compared to satellite delivery's capabilities. Bandwidth requirements average 5-8 Mbps for consistent 1080p playback without buffering interruptions.

This chart compares the monthly subscription costs of different streaming services for watching Liverpool vs Newcastle live. Costs vary significantly by region, with DAZN in Canada being the most expensive at CAD $19.99.

United States Broadcasting and Streaming Landscape

NBC Sports and Peacock: Primary Coverage

The United States market operates under fundamentally different licensing agreements than the UK, with NBC Sports holding exclusive national broadcast rights to Premier League matches. This arrangement provides American audiences with 175 matches annually across NBC, CNBC, USA Network, and the Peacock streaming platform, ensuring comprehensive coverage of virtually all Liverpool versus Newcastle fixtures.

Peacock, NBCUniversal's streaming service, provides the most flexible American access. The platform offers tiered subscriptions: Peacock Free (limited Premier League coverage with advertisements), Peacock Premium (

NBC broadcasts marquee fixtures during prime-time or afternoon windows, leveraging traditional television audiences alongside Peacock streaming. Commentary quality emphasizes American broadcast standards, with personalities familiar to North American audiences providing analysis and match narration. Technical specifications match international broadcast standards, with 1080p resolution and consistent framerate delivery across both traditional and streaming distribution.

Cable and Traditional Television Access

Cable television subscribers can access NBC Sports programming through existing subscriptions, with no additional payment required beyond their cable package. This arrangement maintains relevance for households preferring traditional television delivery while eliminating streaming friction points like buffering or device compatibility concerns.

NBC's online platform allows cable subscribers to authenticate through their provider login, accessing full match streams through the NBC Sports website without requiring separate Peacock subscriptions. This "TV Everywhere" model leverages existing cable relationships to minimize subscriber attrition while supporting NBC's broadcast business model.

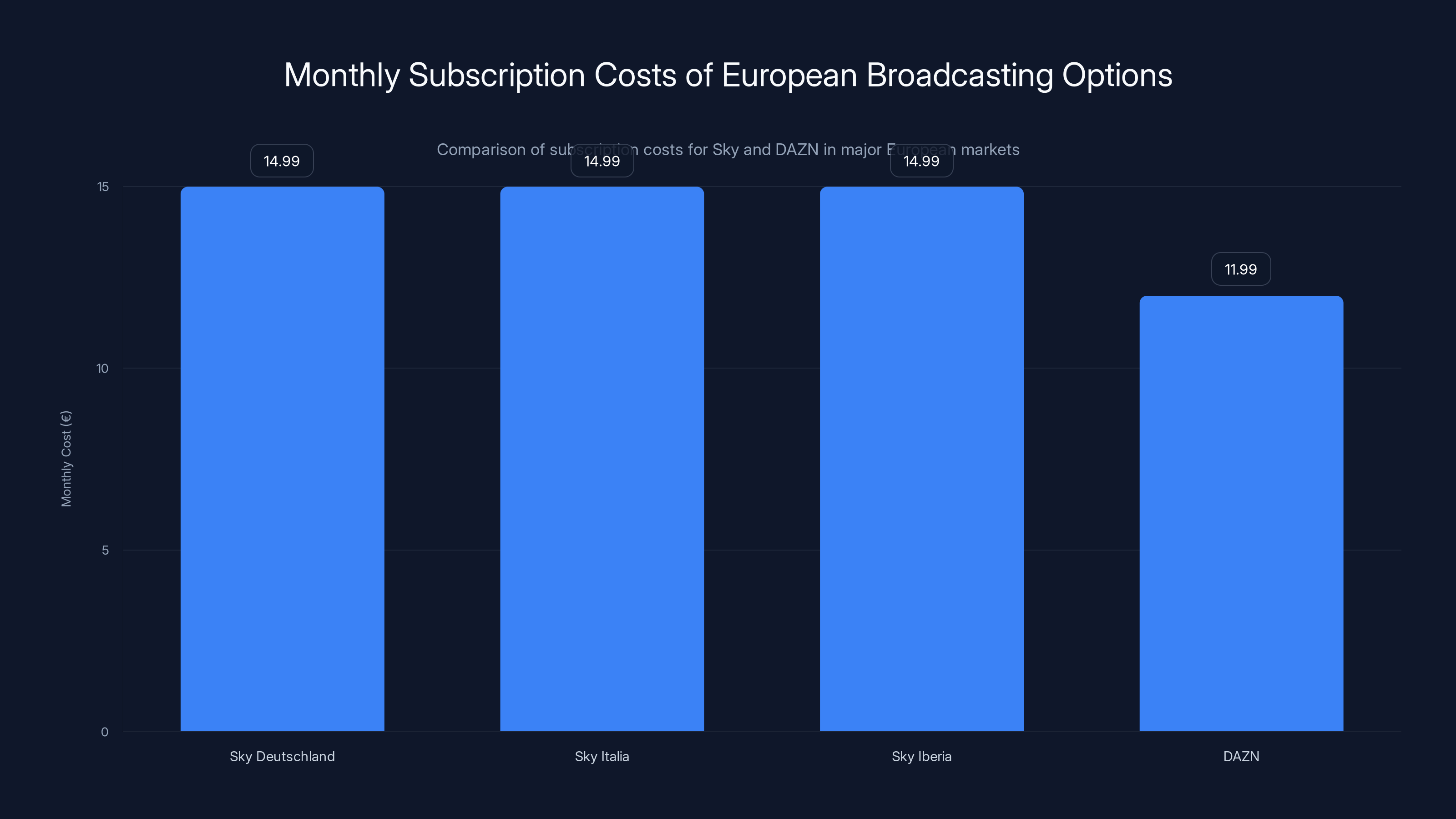

European Broadcasting Options Across Major Markets

Sky Deutschland, Sky Italia, and Sky Iberia

Sky's European presence extends beyond the UK, with German, Italian, and Spanish subsidiaries holding regional broadcasting rights. Sky Deutschland offers Premium League packages starting at approximately €14.99 monthly, with streaming access through the Sky Go application. Similar structures apply across Sky's European operations, creating consistent viewing experiences despite regional variations in matching specific fixtures to time slots and commentary languages.

Picture quality standards across Sky's European operations match UK specifications, with 1080p streaming and 50fps delivery. Multilingual commentary options respect regional preferences, with German, Italian, and Spanish language feeds available depending on viewer location and subscription tier.

DAZN: The Disruptive Streaming Giant

DAZN has fundamentally reshaped European football streaming through aggressive rights acquisition and subscription model innovation. Operating across Germany, Austria, Switzerland, and expanding to additional European markets, DAZN offers Premier League coverage at €11.99 monthly (with annual commitment discounts reducing effective cost to approximately €9.99 monthly). This aggressive pricing undercuts traditional broadcasters while providing comprehensive match coverage, particularly in regions where DAZN secured exclusive rights.

DAZN's technological infrastructure emphasizes multi-device accessibility, supporting smartphone, tablet, smart television, and streaming device viewing simultaneously. Picture quality reaches 4K resolution for select matches, exceeding traditional broadcast specifications. The platform's international expansion strategy positions DAZN as a major competitor to regional Sky operations, with ongoing rights acquisitions expanding their European footprint.

Telecom Italia and Regional Operators

Telecom Italia's Tim Vision service provides Italian viewers access to Premier League matches, leveraging existing broadband customer relationships. Subscription costs approximately €10 monthly for Premier League content when bundled with broadband services. While less feature-rich than Sky or DAZN platforms, Tim Vision provides legitimate official access to Liverpool versus Newcastle fixtures within Italy.

Various regional operators across Scandinavia, Poland, Netherlands, Belgium, and France hold specific broadcasting rights through licensing arrangements with the Premier League. These include TV2 (Scandinavia), Polsat (Poland), Ziggo Sport (Netherlands), Proximus (Belgium), and Canal+ (France). Identifying the correct platform for your specific European location requires verification through official Premier League channels or regional broadcaster websites.

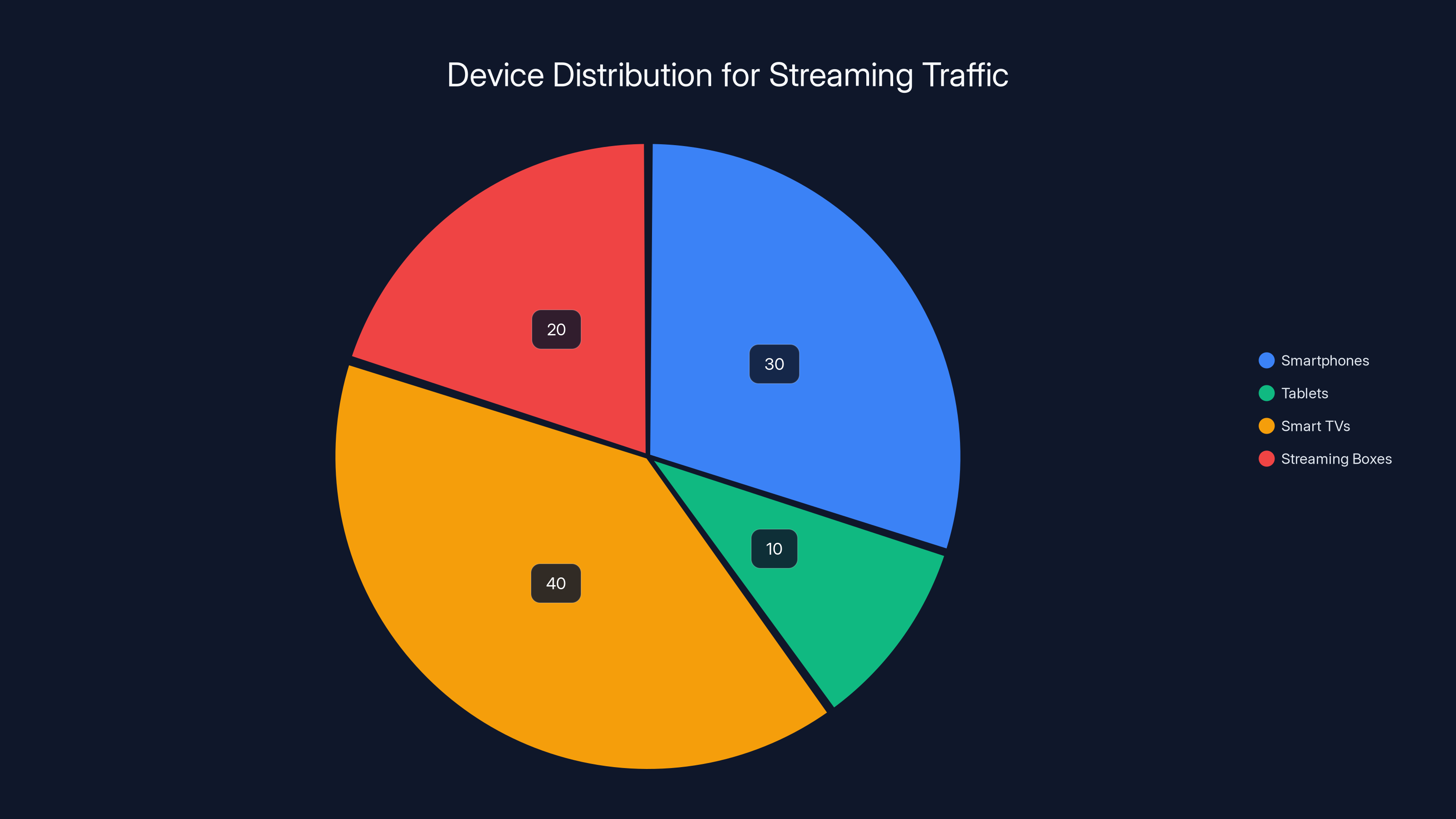

Smart TVs lead with 40% of streaming traffic, followed by smartphones at 30%. Tablets and streaming boxes account for 10% and 20% respectively. Estimated data.

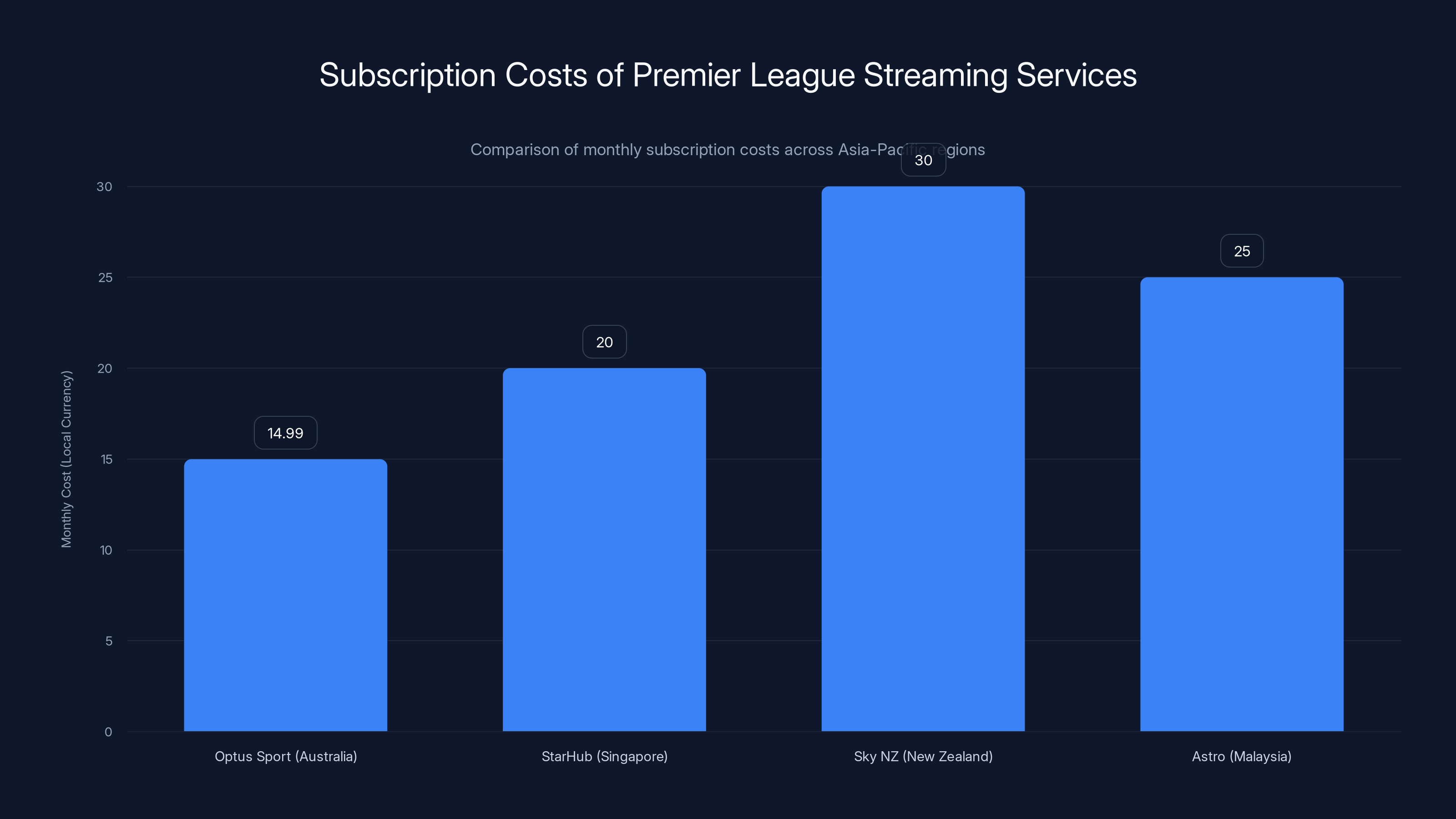

Asia-Pacific Broadcasting and Streaming Services

Australia: Optus Sport Dominance

Optus Sport holds exclusive Premier League rights across Australia, delivering comprehensive coverage through their dedicated streaming application and website. Subscription costs AUD

Fixtures typically broadcast in evening Australian Eastern Time, creating convenient viewing windows for most metropolitan audiences. Optus Sport integrates with Optus's broader telecommunications ecosystem, providing bundled pricing for existing mobile or broadband customers. The platform emphasizes local commentary and analysis, with Australian personalities providing match narration and post-match analysis tailored to domestic audiences.

Singapore and South East Asia: Star Hub and Official Streamers

Star Hub provides comprehensive Premier League coverage across Singapore through their sports packages, with streaming access available through the Star Hub Go application. Subscription tiers range from approximately SGD $15-25 monthly depending on broader sports content included. Picture quality specifications match regional standards, with 1080p streaming typically achieving consistent playback quality on devices with sufficient bandwidth.

Other Southeast Asian markets utilize regional broadcasters including true 4U (Thailand), Shahid (Middle East), and Astro (Malaysia). These platforms often incorporate Premier League rights alongside domestic football leagues and international sporting events, creating bundled offerings that reflect regional viewing preferences and competitive dynamics.

New Zealand: Sky NZ and Streaming

Sky New Zealand holds exclusive Premier League broadcast rights, offering comprehensive coverage through traditional television and streaming platforms. Sport Max packages including Premier League access cost approximately NZD $25 monthly, with annual commitment discounts available. Streaming access through Sky's mobile applications provides flexibility for viewers preferring cord-cutting approaches.

Japan and Asia-Pacific Expansion

DAZN Japan has aggressively expanded into Asia-Pacific markets, securing Premier League rights in Japan and expanding to additional Asian territories. Subscription costs approximately ¥3,000 monthly (approximately USD $20), providing comprehensive coverage to Japanese audiences. The platform's international expansion reflects growing recognition that Asian markets represent significant revenue opportunities for premium sports content.

China's restrictions on foreign sports broadcasting create unique challenges, with CCTV Sports providing occasional Premier League coverage alongside regional streaming services like i QIYI Sports offering selective match access. Regulatory restrictions and limited international licensing agreements create fragmented availability within China compared to other major markets.

Canadian Broadcasting: Streaming-First Approach

DAZN Canada: Market Leader

DAZN Canada holds exclusive Premier League rights across Canada, representing the streaming platform's most comprehensive North American presence. Subscription costs CAD

DAZN Canada's technology emphasizes multi-device support, with simultaneous streaming across smartphones, tablets, smart televisions, and web browsers available through premium tier subscriptions. Picture quality reaches 1080p with consistent performance across regions with adequate broadband capacity. The platform bundles Premier League content alongside other sporting properties including Champions League matches, Serie A coverage, and additional international football competitions.

Technical support and customer service emphasize Canadian-specific infrastructure, with servers distributed to minimize latency and buffering for viewers across Canada's geographically dispersed population. DAZN's investment in local commentary and analysis reflects recognition of Canada's substantial football audience, with dedicated Canadian broadcasting personalities providing match narration.

Optus Sport in Australia offers a competitive monthly rate at AUD

Mobile and Multi-Device Viewing Optimization

Smartphone and Tablet Streaming

Modern streaming platforms have optimized mobile viewing experiences, recognizing that approximately 40% of streaming traffic originates from smartphones and tablets in major markets. Official applications across Sky Sports, Peacock, DAZN, NOW TV, and regional broadcasters incorporate responsive design, adaptive bitrate streaming, and offline download capabilities in select cases.

Adaptive bitrate technology automatically adjusts video quality based on available bandwidth, preventing frustrating buffering interruptions while maximizing picture quality within your connection's constraints. Streaming quality typically ranges from 360p on weak mobile networks to 1080p on strong 5G or Wi Fi connections, with the application's algorithm selecting optimal bitrates without manual intervention. This automated approach eliminates technical friction for non-technical viewers while providing sufficient quality for small-screen viewing.

Smart Television Integration and Casting

Most official streaming platforms offer native applications for major smart television brands (LG, Samsung, Sony, etc.), enabling direct installation and seamless viewing without requiring external devices. These native applications typically provide superior performance compared to casting protocols (like Chromecast or Air Play), with direct television-to-internet connections eliminating intermediate processing overhead.

Streaming boxes including Apple TV, Amazon Fire TV, and Roku provide alternative paths for viewers with older televisions lacking built-in streaming capabilities. These devices maintain current application versions, often receiving updates more promptly than some television manufacturers' built-in software. Bandwidth requirements remain consistent (5-8 Mbps for 1080p), though high-end devices sometimes provide 4K streaming capabilities where available through the platform.

Desktop and Laptop Web Streaming

Web browser streaming through official broadcaster websites provides maximum flexibility, accessible from any device with internet connectivity and a modern browser (Chrome, Firefox, Safari, Edge). Picture quality specifications match application-based delivery, with 1080p resolution and consistent framerates. Browser-based streaming occasionally includes additional features like detailed match statistics, alternate camera angles, or supplementary analysis feeds unavailable through television broadcasts.

Browser-based streaming typically provides superior codec support compared to mobile applications, with some platforms delivering AV1 or VP9 codec streams reducing bandwidth requirements while maintaining visual quality. For viewers with limited bandwidth, browser-based options sometimes offer explicit quality selection, allowing manual downscaling below automatic bitrate selection thresholds.

Comparative Streaming Quality and Technical Specifications

Video Resolution and Framerates

Most official Premier League broadcasts deliver 1080p resolution at 50 frames per second, meeting international broadcast standards established decades before streaming technology emerged. This specification reflects football's fast motion and tactical complexity, with higher framerates enabling viewers to perceive rapid ball movement without motion blur degrading situational awareness.

Premium platforms increasingly offer 4K resolution streaming (3840x 2160) for selected marquee fixtures, with Sky Sports, DAZN, and some NBC Sports broadcasts occasionally providing Ultra HD content. 4K broadcasting requires approximately 2.5x the bandwidth of 1080p streaming (15-20 Mbps versus 5-8 Mbps), creating accessibility challenges for viewers with limited internet capacity. However, 4K viewing on smaller screens (phones, tablets) provides minimal perceptual improvement compared to 1080p, with benefits primarily evident on large televisions (55+ inches).

Framerate consistency matters substantially for live sports viewing. 120fps (high frame rate) streaming remains largely unavailable through consumer platforms, though select broadcasters experiment with this technology for enhanced motion rendering. Current 50fps delivery provides sufficient temporal resolution for football viewing, with superior quality at higher framerates primarily benefiting slower-motion replay sequences.

Audio Specifications and Commentary Options

Most broadcasts provide 2.0 stereo or 5.1 surround sound audio, with premium services occasionally offering Dolby Atmos spatial audio for enhanced immersion. Stereo delivery remains industry standard, with surround sound providing audience ambiance, crowd noise directional information, and enhanced commentary immersion through separated audio channels.

Multiple commentary options increasingly differentiate premium platforms, with viewers selecting between standard stadium commentary, alternative commentary emphasizing different analytical perspectives, or club-specific feeds prioritizing information relevant to particular team supporters. This customization represents genuine value differentiation compared to traditional broadcasting's single commentary approach.

Latency and Streaming Delays

Cloud-based streaming introduces inherent latency compared to traditional broadcast delivery, with 15-45 second delays typical for live streaming. This delay reflects encoding, transmission, buffering, and decoding processes necessary to deliver streams reliably across variable internet conditions. Viewers watching broadcasts simultaneously through television and streaming platforms will notice streaming versions lagging behind television broadcasts by several seconds—a practical consideration during matches where live score discussions occur simultaneously across multiple media.

Streaming protocols continue optimizing latency through technological improvements. Low-latency streaming protocols reduce delays to 5-10 seconds for viewers with optimal network conditions, though mainstream implementations haven't achieved parity with television's direct broadcast capabilities. This technical limitation remains largely unavoidable without substantial infrastructure investment from streaming platforms.

DAZN offers a more competitive monthly subscription rate (€11.99) compared to Sky's consistent pricing across its European subsidiaries (€14.99). Estimated data.

Subscription Pricing Models and Value Comparison

Monthly Subscription Costs Across Regions

Subscription pricing varies dramatically by region and platform, reflecting different competitive landscapes, rights costs, and service positioning:

| Region | Primary Platform | Monthly Cost | Annual Cost | Value Proposition |

|---|---|---|---|---|

| UK/Ireland | Sky Sports | £25.00 | £300.00 | Comprehensive coverage, 4K availability |

| UK/Ireland | BT Sport | £14.99 | £179.88 | Budget alternative, 1080p quality |

| UK/Ireland | NOW TV | £25.99 | £311.88 | Month-to-month flexibility, no contracts |

| United States | Peacock Premium | $5.99 | $71.88 | Comprehensive NBC coverage, affordable |

| Australia | Optus Sport | AUD $14.99 | AUD $149.00 | Exclusive coverage, Australian timing |

| Canada | DAZN | CAD $19.99 | CAD $169.99 | Exclusive coverage, multiple sports |

| Germany | Sky Deutschland | €14.99 | €179.88 | Regional coverage, German commentary |

| Germany | DAZN | €11.99 | €119.90 | Competitive pricing, 4K options |

| Italy | Tim Vision | €10.00 | €120.00 | Bundled broadband deals available |

| Singapore | Star Hub | SGD $15-25 | SGD $180-300 | Regional competitive coverage |

Annual subscription calculations reveal significant savings through commitment: UK annual Sky Sports (

Free Trial Periods and Promotional Access

Most premium streaming platforms offer 14-30 day free trial periods for new subscribers, enabling trial viewing before financial commitment. These trials provide genuine value for viewers seeking to evaluate service quality, interface usability, and device compatibility without risk. However, promotional periods require active management to prevent unwanted subscription charges—setting calendar reminders to cancel before trial expiration prevents accidental billing.

Occasional promotional campaigns offer discounted annual subscriptions or extended trial periods during off-season periods (June-August in northern hemisphere), incentivizing new subscriber acquisition when fixture volume decreases. Strategic timing of subscription activation can maximize value through purchasing annual access during promotional windows offering 20-30% price reductions.

Bundle Discounts and Multi-Service Packages

Telecommunications companies increasingly bundle streaming sports access with broadband or mobile services, creating $10-20 monthly savings for customers consolidating providers. Sky Sports' integration with Sky Broadband, for instance, reduces combined costs substantially compared to separate subscriptions. These bundled arrangements create switching costs favoring incumbent providers while legitimately reducing customer expenses.

Legal Considerations and Account Security

Terms of Service Implications

All legitimate streaming platforms include geographic restrictions limiting account usage to licensed territories. Using Virtual Private Networks (VPNs) to access content outside your licensed region violates these terms of service, potentially resulting in account suspension or permanent termination. While VPN usage remains technically undetected in many cases, the practice contradicts content licensing agreements designed to compensate creators and rights holders appropriately.

From an ethical perspective, accessing geographically restricted content without payment through VPN circumvention essentially constitutes theft of services. The complexities surrounding global licensing, while frustrating for consumers, reflect legal frameworks designed to manage international copyright and broadcasting rights. Supporting legitimate platforms through appropriate subscription and geographic compliance ensures continued investment in production quality and content creation.

Account Sharing Restrictions

Most streaming platforms explicitly restrict account sharing beyond immediate household members, with ongoing crackdowns on shared password access particularly prevalent since 2023. Password sharing violations may result in account suspension, forced password changes, or subscription termination. Platforms increasingly implement geographic IP verification and concurrent stream monitoring to detect unauthorized sharing patterns.

These restrictions reflect evolving business models emphasizing per-subscriber revenue recognition rather than household-level access. While frustrating for families with members in different residences, these policies follow revenue models supporting platform investment in content acquisition and production quality.

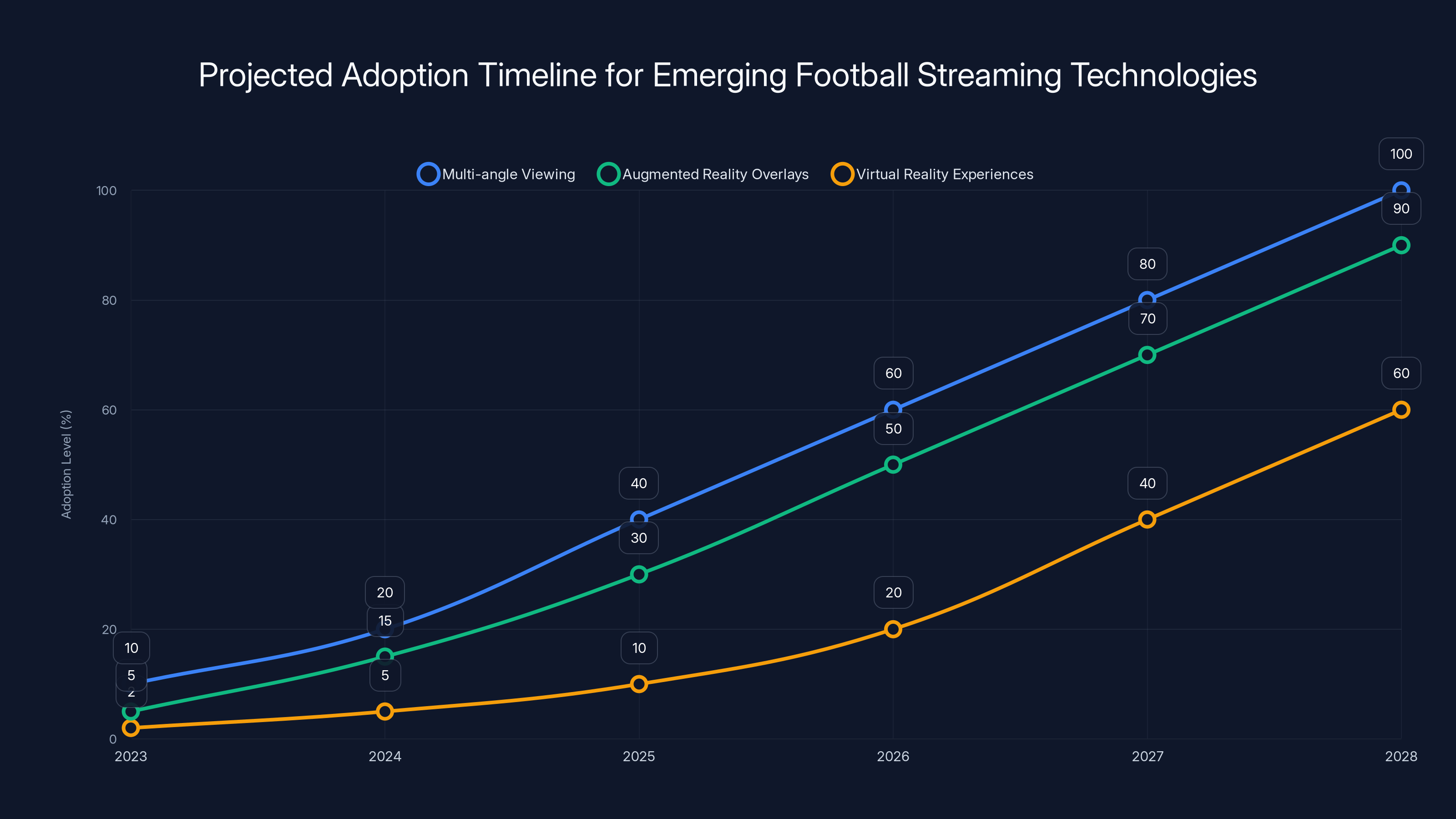

This chart estimates the adoption timeline for key football streaming technologies. Multi-angle viewing is expected to reach mainstream adoption by 2028, while AR overlays and VR experiences will follow closely. Estimated data.

Navigating Technical Challenges and Troubleshooting

Buffering and Streaming Quality Issues

Buffering—the interruption and reconstitution of streaming video—represents the most common streaming frustration. Root causes typically involve insufficient bandwidth, network congestion, or application-level performance issues. Diagnostic approaches include:

- Bandwidth verification through independent speed testing services (speedtest.net, fast.com) confirming adequate capacity (minimum 5 Mbps for 1080p, 15+ Mbps for 4K)

- Network optimization including Wi Fi signal strength improvement (proximity to router, interference minimization) or wired ethernet connection trials

- Device restart cycles clearing application caches and re-establishing network connections

- Application reinstallation addressing potential software corruption or outdated code

- Adaptive bitrate reduction manually selecting lower resolution options if available within the platform interface

Streaming service outages or infrastructure issues occasionally cause widespread buffering affecting all subscribers simultaneously. Checking official social media channels and status pages confirms whether individual technical issues or platform-wide problems cause the interruption.

Device Compatibility Problems

Older devices sometimes lack codec support or have insufficient processing power for streaming video decoding, particularly for 4K content or high frame rate delivery. Verification of device compatibility through official broadcaster platforms prevents purchasing subscriptions for unsupported devices.

Application updates frequently address compatibility issues and performance optimization. Enabling automatic app updates and regularly manually checking for updates ensures optimal performance on compatible devices. Some platforms gradually discontinue support for older device models, necessitating equipment upgrades for continued access.

Account Access and Authentication Issues

Password reset functionality, two-factor authentication requirements, and account lockout mechanisms occasionally prevent immediate access to subscriptions despite valid payment. Contacting platform customer support through documented channels (email, phone, chat) resolves most authentication issues within several hours. Providing detailed device information and account history expedites resolution.

Cord-Cutting Strategies and Multi-Platform Approaches

Building Your Football Streaming Stack

Football enthusiasts interested in comprehensive coverage beyond Liverpool versus Newcastle may benefit from strategic multi-platform subscriptions. Calculating total annual costs for different regional combinations enables informed decisions about worthwhile investment breadth.

A comprehensive North American approach combining Peacock Premium (

Timing Subscription Activation

Optimal subscription timing depends on your primary viewing interests. Premier League-focused viewers benefit from mid-August activation (season start), while late-season fixtures or playoff competitions may warrant strategic mid-season activation. Monthly subscriptions provide flexibility for trial approaches before annual commitment.

Off-season viewing (May-August) lacks Premier League fixtures but may include Champions League finals, Copa America, Euros, or other international competitions. Strategic subscription pause during fixture-free months and reactivation before season resumption minimizes annual costs while maintaining access continuity.

Looking Forward: Evolution of Football Streaming Technology

Emerging Technologies in Sports Broadcasting

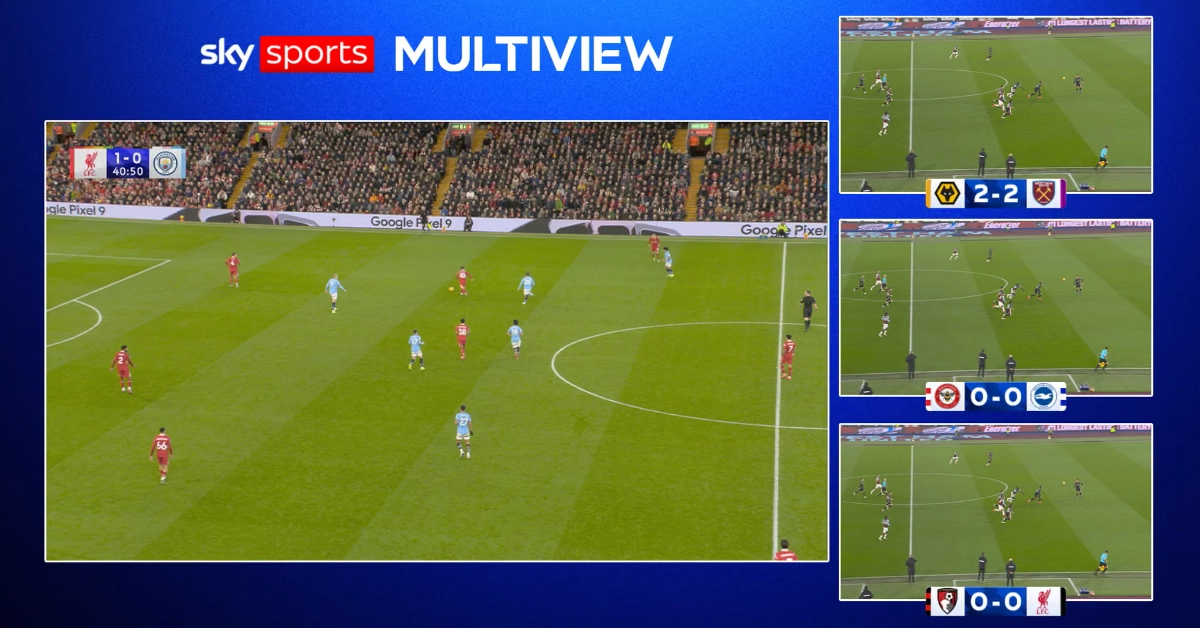

Multi-angle viewing represents the next evolution in broadcast technology, enabling viewers to select between multiple stadium camera angles during live matches. Several platforms experiment with this capability during supplementary fixtures, though mainstream implementation remains limited. Future developments likely include customizable camera angle selections, player-tracked automatic focusing, and AI-powered highlight generation during ongoing matches.

Augmented reality (AR) overlay systems promise interactive visualization of tactical information, player positioning, and statistical context during live viewing. Early implementations appear in supplement analysis packages, with full real-time overlay integration likely emerging within 3-5 years as infrastructure develops. These technologies could fundamentally enhance tactical understanding and engagement for serious football analysts.

Virtual reality (VR) stadium experiences represent longer-term potential, though technical barriers around latency, device ubiquity, and content production complexity suggest mainstream adoption remains 5+ years away. Early VR football broadcasts demonstrate technical feasibility, though expensive headset requirements and limited content library development prevent substantial adoption.

Continued Consolidation and Market Competition

Streaming market consolidation likely continues through 2026, with weaker platforms acquiring or merging while dominant services expand internationally. DAZN's acquisition strategy suggests continued European expansion, while traditional broadcasters like Sky and BT increasingly emphasize streaming-first delivery to younger audiences preferring cord-cutting approaches.

Pricing pressure should gradually benefit consumers as competition intensifies and churn reduction requires competitive positioning. However, increased rights costs as football properties recognize digital value potential may offset consumer savings. The equilibrium between rising content costs and competitive pricing pressures will largely determine whether streaming becomes more or less affordable than traditional television viewing.

Regulatory Considerations and Future Policy

Regulatory scrutiny on sports broadcasting increasingly focuses on competition and fair access, particularly around geographic exclusivity and bundling practices. European regulators examine whether streaming market concentration contradicts consumer interests, while American regulators monitor broadcaster consolidation implications. Future policy changes could mandate broader simultaneous access or restrict certain geographic exclusivity practices, fundamentally reshaping current licensing arrangements.

Premium Features and Enhanced Viewing Experiences

Multi-View and Alternate Angle Options

Select premium packages increasingly offer simultaneous multi-match viewing, enabling supporters of two different teams to follow fixtures in separate screen panels. This feature particularly appeals to supporters of multiple clubs or professional bettors monitoring multiple matches simultaneously. Implementation requires sufficient bandwidth and multi-stream subscription tiers.

Alternate angle packages providing tactical overhead perspectives, behind-goal views, or player-specific tracking elevate viewing experiences beyond traditional broadcast presentation. These supplementary angles support tactical analysis, particularly valuable for coaches, analysts, and dedicated supporters studying opposing team strategies.

Statistical Integration and Real-Time Analysis

Many platforms integrate live statistical feeds including possession percentage, pass completion rates, expected goals (x G), and player-specific performance metrics alongside broadcast video. These overlays enhance understanding of match tactical dynamics while appealing to data-driven supporters seeking quantitative context beyond visual observation.

Artificial intelligence applications increasingly generate automatic highlight packages during ongoing matches, identifying key moments and rapid-access replay sequences. Future implementations may enable user-customized highlights emphasizing specific players, tactical phases, or match segments according to individual preference.

Interactive Betting and Engagement Features

Some platforms integrate live betting interfaces alongside match streaming, enabling real-time wagering without alternative website navigation. These integrated approaches streamline user experience while creating potential gambling disorder concerns through accessibility and impulse behavior facilitation. Regulatory restrictions increasingly limit these integrations in jurisdictions prioritizing consumer protection.

Creating Your Viewing Plan: Practical Decision Framework

Assessing Your Viewing Priorities

Begin evaluating streaming options by clarifying your core viewing objectives. Are you Liverpool-focused, seeking to watch every Reds fixture regardless of opponent? Are you Newcastle-committed, prioritizing Magpies access? Or are you a general football enthusiast valuing comprehensive Premier League coverage beyond these two clubs?

Your geographic location determines available platform options—this represents the fundamental constraint within which all other decisions operate. Non-negotiable platform availability eliminates theoretically optimal but inaccessible services, narrowing your realistic options significantly.

Calculating Total Annual Investment

Summarize annual costs for each viable platform combination in your region, accounting for subscription frequency preferences (monthly versus annual), trial periods potentially reducing initial-year costs, and bundle discounts if switching telecommunications providers. This financial clarity prevents subscription creep where multiple small monthly commitments accumulate into substantial unexpected annual expenses.

Consider opportunity costs: does the viewing experience justify costs relative to alternative entertainment investments? A £300 annual Sky Sports subscription represents a genuine financial commitment warranting confidence in value delivery.

Device Compatibility Verification

Confirm that your preferred platforms support devices already owned or available for purchase. Forced equipment upgrades to support streaming services may substantially increase true subscription costs. Testing trial subscriptions on your actual devices before financial commitment prevents disappointment with incompatibility issues discovered after purchase.

Implementation and Ongoing Optimization

Activate subscriptions strategically around your viewing calendar, adjust network configuration to optimize streaming quality, and periodically reassess whether your chosen platforms continue meeting your viewing needs as offerings evolve and personal preferences shift.

FAQ

What are the best official ways to watch Liverpool vs Newcastle live?

Official viewing options vary by geographic location. In the UK and Ireland, Sky Sports and BT Sport hold the primary broadcasting rights, with NOW TV offering flexible streaming access without long-term contracts. United States viewers access the match through Peacock Premium (NBC Sports' streaming service), which costs

How can I improve my streaming quality if I'm experiencing buffering?

Buffering typically results from insufficient bandwidth, network congestion, or application-level issues. Start by confirming adequate internet speed (minimum 5 Mbps for 1080p resolution) through speed testing services like speedtest.net. Move closer to your Wi Fi router, minimize interference from other devices, or switch to wired ethernet connection for improved reliability. Restart your streaming application and device to clear caches. If issues persist, manually reduce video quality settings within your platform's preferences if available. Consider upgrading internet service if your provider's speed consistently falls below streaming requirements. Contact your streaming platform's technical support if these troubleshooting steps don't resolve issues.

Are there significant quality differences between official streaming platforms and traditional television broadcasts?

Modern streaming platforms deliver picture quality matching or occasionally exceeding traditional television broadcasts. Most official services provide 1080p resolution at 50 frames per second—international broadcast standards—with premium options offering 4K resolution for select fixtures. Latency differences (15-45 second delays in streaming versus live television) represent the primary technical distinction, which generally becomes apparent only when comparing scores with real-time discussions across multiple simultaneous media. Audio quality in stereo (2.0) or surround sound (5.1) formats matches broadcast standards. Professional streaming platforms invest substantially in production quality, including multiple camera angles, analytical overlays, and supplementary statistical information matching or exceeding traditional broadcast presentation. Streaming provides superior flexibility through customizable commentary options and on-demand replay access unavailable through linear television.

Can I legally use VPNs to access Premier League matches from different regions?

Using VPNs to access geographically restricted content technically violates most streaming platforms' terms of service, despite technical feasibility. Legitimate licensing agreements establish geographic restrictions ensuring appropriate compensation to content creators, broadcasters, and rights holders across different regions. Circumventing these restrictions through VPN usage, while often undetected, contradicts the legal and ethical frameworks underlying intellectual property protection. Additionally, streaming services actively detect and terminate accounts engaging in VPN-based access circumvention. From both ethical and practical perspectives, accessing content through your licensed regional platform represents the appropriate approach. If your region lacks convenient access to desired matches, alternatives like delayed broadcast viewing, official highlights packages, or legitimate streaming services in accessible regions provide legal compliance.

What's the difference between Sky Sports, BT Sport, and NOW TV for UK viewers?

Sky Sports and BT Sport both hold official Premier League broadcast rights, with Sky securing approximately 128 matches (34% of fixtures) and BT Sport securing approximately 52 matches (14%) throughout the season. Sky Sports carries premium positioning with top-tier presentation quality, 4K availability for select fixtures, and comprehensive commentary options, justifying higher subscription costs (£25 monthly). BT Sport provides legitimate secondary coverage at more affordable pricing (£14.99 monthly), with quality specifications matching Sky Sports in most respects. NOW TV represents Sky Sports' streaming-focused offering providing identical content to traditional Sky Sports packages without requiring long-term television contracts—offering month-to-month flexibility at comparable premium pricing. Choosing between them depends on whether specific fixtures you prioritize appear within each platform's allocated schedule, making verification of upcoming Liverpool versus Newcastle fixture assignments before subscription commitment essential.

How far in advance should I activate my streaming subscription to watch Liverpool vs Newcastle?

Optimal subscription activation timing depends on specific match scheduling, which the Premier League announces approximately 2 weeks before fixture weeks. Once fixture scheduling becomes public, identify which platform carries the specific Liverpool versus Newcastle match through official broadcaster websites or Premier League channels. For streaming services offering free trial periods, activate trials approximately 2-3 days before your target fixture, ensuring trial duration extends through match completion. For services without trial periods or for viewers uninterested in trial approaches, subscribe immediately after confirming platform assignment to avoid late activation preventing match access. Services occasionally require 24-48 hours for account activation and payment processing completion, making advance timing prudent. For recurring fixtures throughout seasons, annual subscription activation at season start (mid-August) proves most economical compared to fixture-by-fixture monthly subscriptions.

What are the most cost-effective ways to watch Premier League football without paying for every platform?

Identifying the single most cost-effective platform for your region provides the primary savings approach. Peacock Premium ($5.99 monthly in the United States) represents exceptional value compared to UK platforms requiring £15-25 monthly investment. Outside high-value outlier regions, calculating annual costs for each viable platform and selecting the single best option typically yields better value than partial subscriptions to multiple services. Consider your specific viewing focus: Liverpool-centric supporters benefit from comprehensive annual subscriptions ensuring fixture access, while casual viewers may optimize through monthly subscriptions activated only during fixture weeks you prioritize. Bundled pricing through telecommunications providers sometimes offers substantial savings compared to standalone streaming subscriptions. For comprehensive football consumption beyond Liverpool versus Newcastle, strategic multi-platform approaches (Peacock + one additional service) sometimes cost less than single premium platforms while providing broader coverage. Avoid impulse subscriptions to "free trials" that automatically convert to paid subscriptions—setting calendar reminders before trial expiration prevents unexpected charges.

Can I watch Liverpool vs Newcastle through free streaming options or is legitimate free access impossible?

Most jurisdictions lack legitimate free Premier League streaming options due to expensive broadcasting rights requiring subscription-based business models for profitability. Exceptions include occasional free matches through specific platforms' promotional offerings or public broadcast corporations in some countries providing limited free coverage. Channels claiming to provide free streams outside these official exceptions typically distribute unauthorized content violating intellectual property rights. These unauthorized services carry substantial risks including malware exposure, account compromise through credential theft, and legal consequences in jurisdictions aggressively prosecuting copyright infringement. From both security and ethical perspectives, legitimate paid platforms represent the appropriate approach. Most regions offer at least one reasonably priced option—Peacock Premium's $5.99 monthly cost represents particularly accessible legitimate access compared to alternatives. Supporting paid legitimate access ensures continued investment in production quality and talent compensation supporting the sport's long-term sustainability.

Conclusion: Making Your Liverpool vs Newcastle Viewing Decision

Navigating the complex landscape of football streaming requires balancing convenience, cost, technical quality, and ethical considerations in ways that previous television broadcasting eras never demanded. The fragmentation of Premier League broadcasting rights across dozens of platforms globally creates genuine friction for fans seeking straightforward access, yet simultaneously offers unprecedented flexibility and viewing customization compared to traditional linear television broadcasting's limitations.

Your optimal viewing choice ultimately depends on several interconnected factors: your geographic location (the fundamental constraint determining available platforms), your viewing priorities (Liverpool-focused, Newcastle-committed, or general Premier League interest), your technical infrastructure (internet speed, device compatibility), and your budget parameters. Understanding these requirements empowers informed decision-making rather than passive acceptance of whatever platforms your location offers.

The legitimate streaming platforms detailed throughout this guide represent genuine investments in content production quality, talent development, and technological infrastructure supporting the sport's growth and sustainability. While subscription costs may seem excessive compared to unlimited video content available elsewhere online, Premier League broadcasting rights costs justify premium positioning—Sky, BT Sport, DAZN, Peacock, and regional broadcasters pay hundreds of millions annually for content that fuels club operations, player salaries, and facility development.

As streaming technology continues evolving and competitive dynamics reshape the broadcasting landscape through 2026 and beyond, viewer expectations for quality, accessibility, and pricing will challenge platforms to innovate continuously. Multi-angle viewing, artificial intelligence-powered highlights, augmented reality overlays, and enhanced statistical integration promise to elevate viewing experiences beyond current capabilities. The platforms that successfully balance content investment, competitive pricing, technical reliability, and user experience innovation will capture subscriber loyalty in an increasingly crowded marketplace.

Moving forward, approach your streaming subscription decisions with the same analytical rigor you'd apply to other significant consumer investments. Verify platform availability in your region, confirm device compatibility with equipment you already own, calculate true annual costs accounting for promotional opportunities, and periodically reassess whether your chosen services continue delivering adequate value. Subscribe through official channels directly from broadcasters rather than third-party resellers, enabling direct customer support relationships and ensuring payment security.

Ultimately, watching Liverpool versus Newcastle unfold through legitimate streaming services connects you to millions of supporters globally experiencing the same match simultaneously—a shared cultural moment enabled by the technological infrastructure and content licensing agreements described throughout this guide. That collective experience, supported by legitimate subscription contributions sustaining the sport's ecosystem, represents genuine value beyond the match itself. Embrace your chosen official platform with confidence, knowing your investment supports the beautiful game's continued excellence and accessibility for future generations of supporters.

Key Takeaways

- Geographic location fundamentally determines available official viewing platforms—verify your region's primary broadcaster before subscription commitment

- UK viewers access matches through Sky Sports (premium, comprehensive), BT Sport (budget alternative), or NOW TV (flexible, contract-free)

- United States audiences benefit from exceptional value through Peacock Premium ($5.99 monthly) providing comprehensive NBC Sports coverage

- International markets including Australia, Canada, and Europe offer region-specific platforms like Optus Sport, DAZN, and Sky's regional operations

- Modern streaming delivers quality matching or exceeding traditional television (1080p resolution, 50fps, with 4K available for premium fixtures)

- Annual subscriptions typically offer 15-30% savings compared to month-to-month commitment—strategic timing maximizes value

- Legitimate streaming platforms support content creators, broadcasters, and players through subscription revenue—VPN circumvention violates terms and undermines ecosystem

- Multi-platform subscription strategies can cost less than single premium services while providing broader football coverage beyond Liverpool vs Newcastle

Related Articles

- How to Watch Bournemouth vs Liverpool: Premier League 2025-26 Streaming Guide

- Arsenal vs Aston Villa Premier League 2025-26: Complete Live Streaming Guide

- Macclesfield vs Crystal Palace FA Cup 2025: Complete Streaming Guide

- Burnley vs Man Utd Live Stream 2025-26: Watch Free Guide

- How to Watch Sunderland vs Man City Live Stream 2025-26 | Guide & Alternatives

- Leeds vs Arsenal Live Stream 2025-26: Complete Guide to Watching