LTO Tape Storage: Why 40TB Cartridges Matter for Enterprise Data [2025]

Tape storage is dead. That's what everyone said ten years ago. Then cloud became expensive. Then ransomware became a real threat. Then machine learning workloads started generating petabytes of data nobody could afford to keep online. Now Fujifilm's launched a 40TB magnetic tape cartridge, and enterprises are paying attention—quietly, because admitting you still use tape feels a little old-school.

But here's the thing: tape never actually died. It just got less trendy.

While everyone was obsessing over SSDs and cloud storage, magnetic tape storage quietly kept grinding away in data centers worldwide, holding decades of archival data, regulatory compliance records, and disaster recovery backups. The economics never favored the romantic technology—they favored the practical one. And when your enterprise generates 100 petabytes of data annually and you need to keep it for seven years due to HIPAA requirements, tape costs pennies where cloud costs thousands.

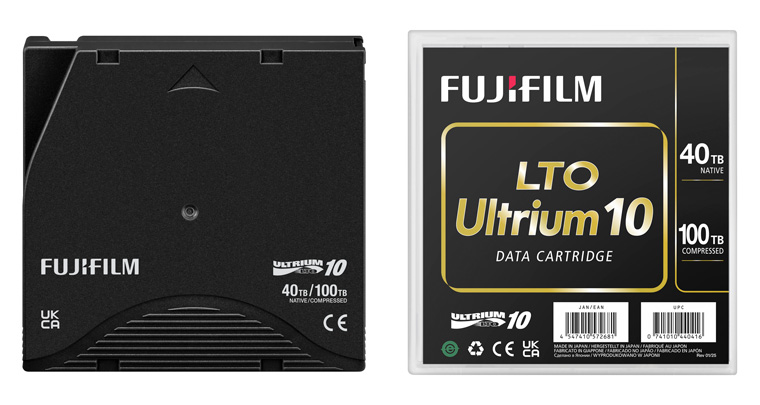

Fujifilm's new LTO Ultrium 10 cartridge with 40TB native capacity (100TB compressed) isn't revolutionary. It's the logical next step in a technology roadmap that's been running like clockwork since Linear Tape-Open was standardized in 1997. What's remarkable isn't the cartridge itself. It's what the cartridge represents: unmistakable proof that the enterprise world never abandoned tape, and that offline storage remains essential infrastructure in the ransomware era.

Let's break down why that matters, and why predictions of tape's death have been wildly exaggerated.

TL; DR

- Fujifilm's 40TB LTO-10 cartridge launches January 2026, storing 100TB with compression, directly addressing AI data retention needs

- Tape remains unmatched for offline archival, with costs as low as 0.10+

- Ransomware resilience drives enterprise tape adoption—physically removed cartridges can't be encrypted or accessed remotely

- LTO technology roadmap guarantees 65TB native capacity by 2030, with proven backward compatibility across drive generations

- Multi-tiered storage architecture pairs tape with SSD and cloud platforms, creating resilient, cost-effective data strategies

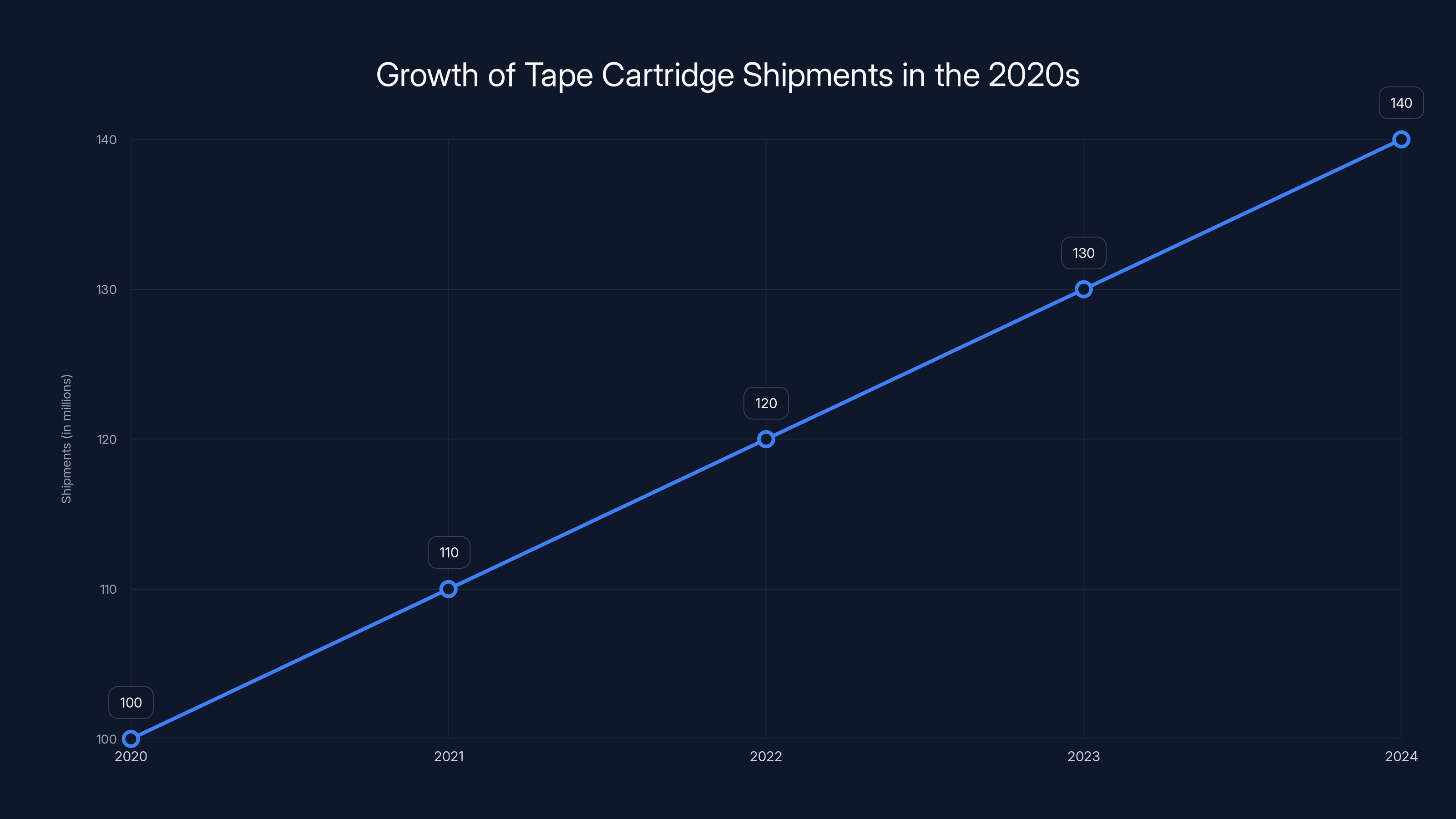

Estimated data shows consistent growth in tape cartridge shipments throughout the 2020s, highlighting the continued relevance of magnetic tape in enterprise storage.

The Quiet Persistence of Magnetic Tape in Enterprise Storage

Magnetic tape has been declared dead more times than any technology in computing history. Yet every single obituary has been premature.

In the 1980s, industry analysts confidently predicted tape would be replaced by optical media. Then SSDs would kill tape. Then cloud storage would eliminate tape entirely. None of it happened. Instead, tape adapted. It became faster, denser, and more reliable. It remained cheaper per gigabyte for long-term retention. And when enterprises realized their cloud bills were destroying quarterly budgets, they quietly dusted off their tape strategies.

The data supports this. The LTO Consortium, which oversees the Linear Tape-Open standard, reported consistent year-over-year growth in tape cartridge shipments throughout the 2020s. This isn't growth in a niche market for legacy systems. It's growth across new deployments, driven by organizations actively choosing tape over alternatives.

What changed wasn't technology capability. What changed was business reality. Cloud storage providers optimized pricing for active workloads where performance justifies cost. But enterprises don't pay premium prices for data they might never access again. A backup image of a database from 2018, preserved for legal compliance? That doesn't need SSD performance. It needs to exist, be verified, and remain inaccessible to ransomware.

Tape solves that problem better than anything else at scale.

The persistence of tape also reflects a deeper truth about enterprise IT: organizations don't adopt new technologies because they're theoretically better. They adopt them because they solve real problems at acceptable costs. Tape solves the offline archival problem. Cloud solved the anywhere-access problem. SSDs solved the high-performance problem. Each technology owns a niche where it wins on economics and capability combined.

Fujifilm, IBM, and Quantum—the three companies dominating the enterprise tape market—understand this perfectly. They're not trying to convince anyone tape is trendy. They're just iterating the standard, improving capacity and transfer rates, and watching enterprises queue up to buy. The fact that industry outsiders like Elon Musk dismiss tape as obsolete says nothing about actual enterprise purchasing decisions. It says everything about how invisible mature technologies become once they stop being newsworthy.

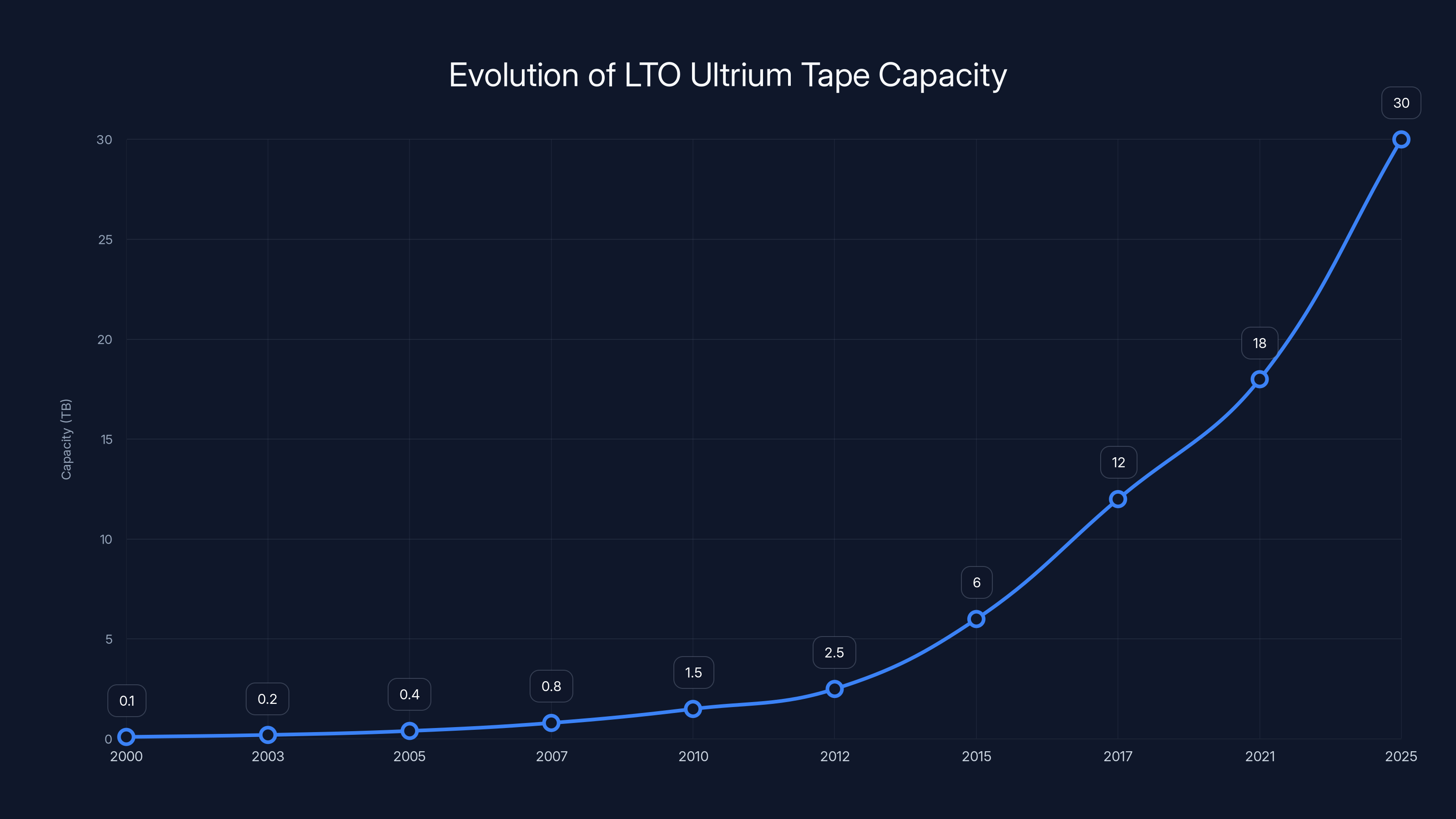

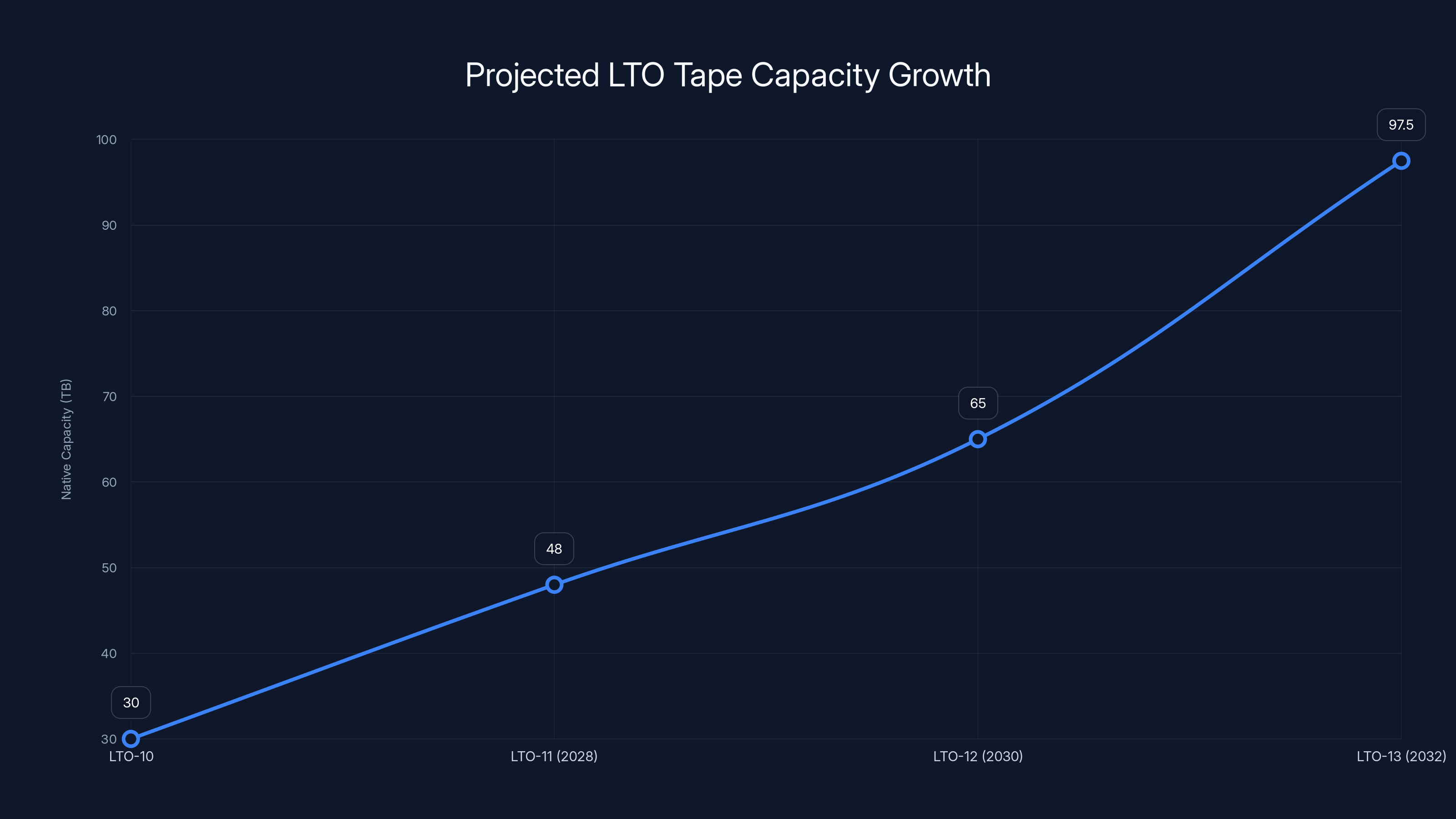

The LTO Ultrium series has shown exponential growth in native capacity, reaching 30TB in 2025, with Fujifilm's variant pushing it to 40TB. Estimated data for future projections.

Fujifilm's 40TB LTO Ultrium 10: Technical Specifications and Capacity Evolution

Let's talk specifics, because the engineering behind this cartridge is worth understanding.

Fujifilm's LTO Ultrium 10 40TB cartridge represents the eighth generation of capacity increases in the LTO standard. Here's the timeline showing exponential growth:

- LTO-1 (2000): 100GB native

- LTO-2 (2003): 200GB native

- LTO-3 (2005): 400GB native

- LTO-4 (2007): 800GB native

- LTO-5 (2010): 1.5TB native

- LTO-6 (2012): 2.5TB native

- LTO-7 (2015): 6TB native

- LTO-8 (2017): 12TB native

- LTO-9 (2021): 18TB native

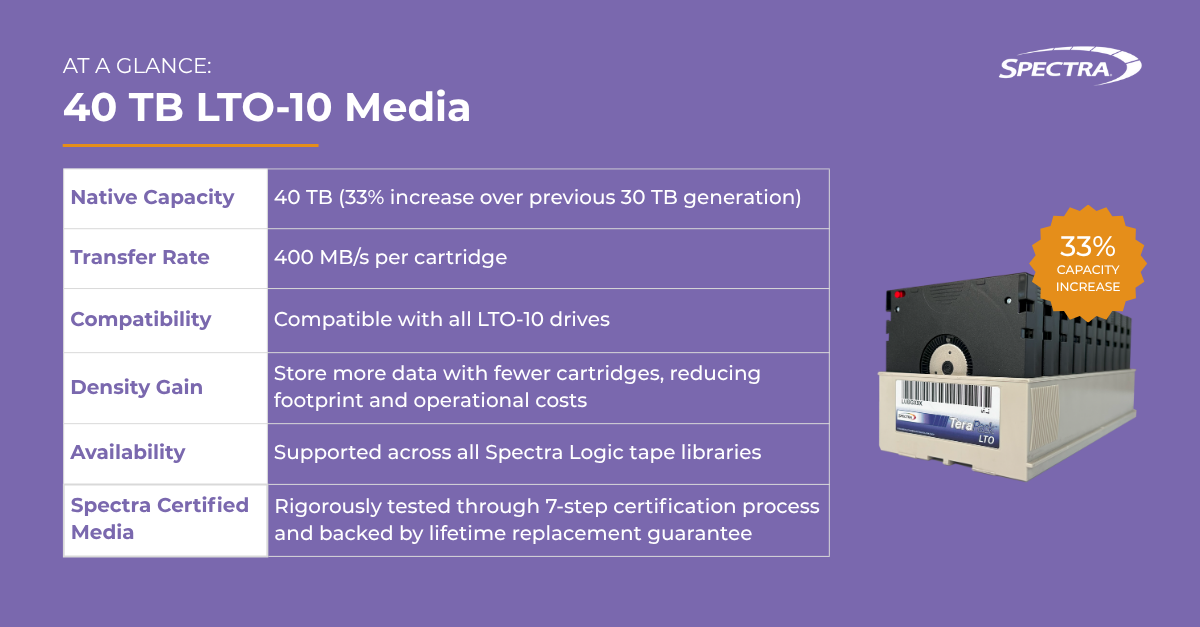

- LTO-10 (2025): 30TB native, with Fujifilm's new 40TB variant

This isn't random iteration. The LTO Consortium publishes its roadmap publicly, extending decades forward. Industry members commit to meeting capacity targets years in advance. It's engineering discipline, not marketing hype.

The 40TB cartridge achieves increased capacity through several refinements:

Magnetic Particle Engineering: Fujifilm refined the barium ferrite particles coating the tape surface. Smaller, more uniform particles allow tighter magnetic recording without sacrificing signal integrity. This is fundamental materials science—no shortcuts, just steady improvement.

Thinner Base Film: The polyester substrate supporting the magnetic coating is now thinner (4.0 micrometers) without mechanical degradation. This counterintuitively improves reliability because the thinner substrate allows more tape length per cartridge spool. A 1,337-meter tape with tighter packing stores more data in the same physical cartridge.

Transfer Rate Performance: The native transfer rate climbs to 400MB/sec, with 1000MB/sec under compression. This addresses a historical tape complaint: slow recovery times for large datasets. Modern implementations can now retrieve hundreds of gigabytes per hour, making tape viable for disaster recovery scenarios where you need speed, not just cost-efficiency.

Temperature and Humidity Flexibility: The expanded operating range now supports 15-35°C operating temperature and up to 80% humidity (within 15-25°C), compared to earlier 16-35°C and more restrictive humidity specs. This seemingly minor change is huge: it means tape deployments don't need pristine air-conditioned data centers. Regional archives, secondary facilities, even locations with inconsistent climate control become viable tape storage sites.

EEPROM Cartridge Memory: The cartridge carries 32k B of embedded memory with electromagnetic induction antenna. This stores metadata, error logs, and drive history without requiring external systems. During tape loading, the drive reads this memory instantly, understanding the cartridge's history and current state. It's a small thing that makes operations faster and more reliable.

Fujifilm emphasizes backward compatibility—the 40TB cartridges work with existing LTO-10 drives without firmware updates. That compatibility promise is crucial for enterprise deployments where replacing drive hardware takes months and enormous capital expense.

Why Ransomware Turned Enterprises Back to Tape

Ransomware changed the calculus for offline storage.

For decades, offline tape was a compliance requirement—you needed it for regulatory mandates, disaster recovery, and legal holds. It wasn't strategic. It was an insurance policy that enterprises reluctantly maintained because lawyers and auditors insisted.

Then ransomware became sophisticated enough to target backup systems themselves.

By the early 2020s, gangs like Conti, REvil, and Lock Bit didn't just encrypt production systems. They systematically sought out and encrypted backup repositories. They looked for cloud backups, attacked backup software, even surveilled for months to understand how organizations tested disaster recovery. The assumption that "we have backups so we're safe" evaporated.

Enterprise security teams realized something uncomfortable: if every backup is connected to the network, attackers with sufficient dwell time will find it, encrypt it, and make recovery impossible. Your beautiful automated backup system becomes a single point of failure.

This is where offline tape becomes strategically important rather than just operationally necessary.

A tape cartridge sitting in a locked cabinet in a locked facility isn't vulnerable to ransomware. It can't be encrypted remotely. It can't be accessed by attackers who compromise your network. It's not protected by software, firewalls, or authentication systems that can be bypassed. It's protected by physics: attackers need physical access to the room where it's stored.

This created what security experts call "air-gapped backup"—backups maintained on media that's physically disconnected from the network. Tape became the standard implementation because:

- Cost-effective scale: You can maintain enormous backup sets for reasonable cost

- Proven longevity: Tape lasts decades without degradation, unlike SSD longevity questions

- Established procedures: Organizations know how to manage, verify, and recover from tape

- Vendor diversity: Multiple manufacturers prevent vendor lock-in on critical infrastructure

- Regulatory trust: Auditors and compliance frameworks explicitly recognize tape as acceptable for archival

Ransomware didn't make tape the only solution—cloud providers added air-gapped backup tiers, immutable object locks, and versioning systems. But ransomware made tape relevant again for organizations that previously saw tape as legacy infrastructure.

The statistics reflect this shift. A 2023 survey by the Information Leakage and Recovery Organization found that 78% of enterprises with significant data volumes now maintain air-gapped backups, and magnetic tape represents the largest percentage of those implementations. It's not because tape is trendy. It's because tape works, costs less than alternatives, and survives ransomware attacks.

Projected data shows a consistent increase in native capacity for LTO tapes, with LTO-13 expected to reach 97.5TB. Estimated data based on industry trends.

The Economics: Why Tape Wins on Cost Per Gigabyte for Long-Term Retention

Let's do some math.

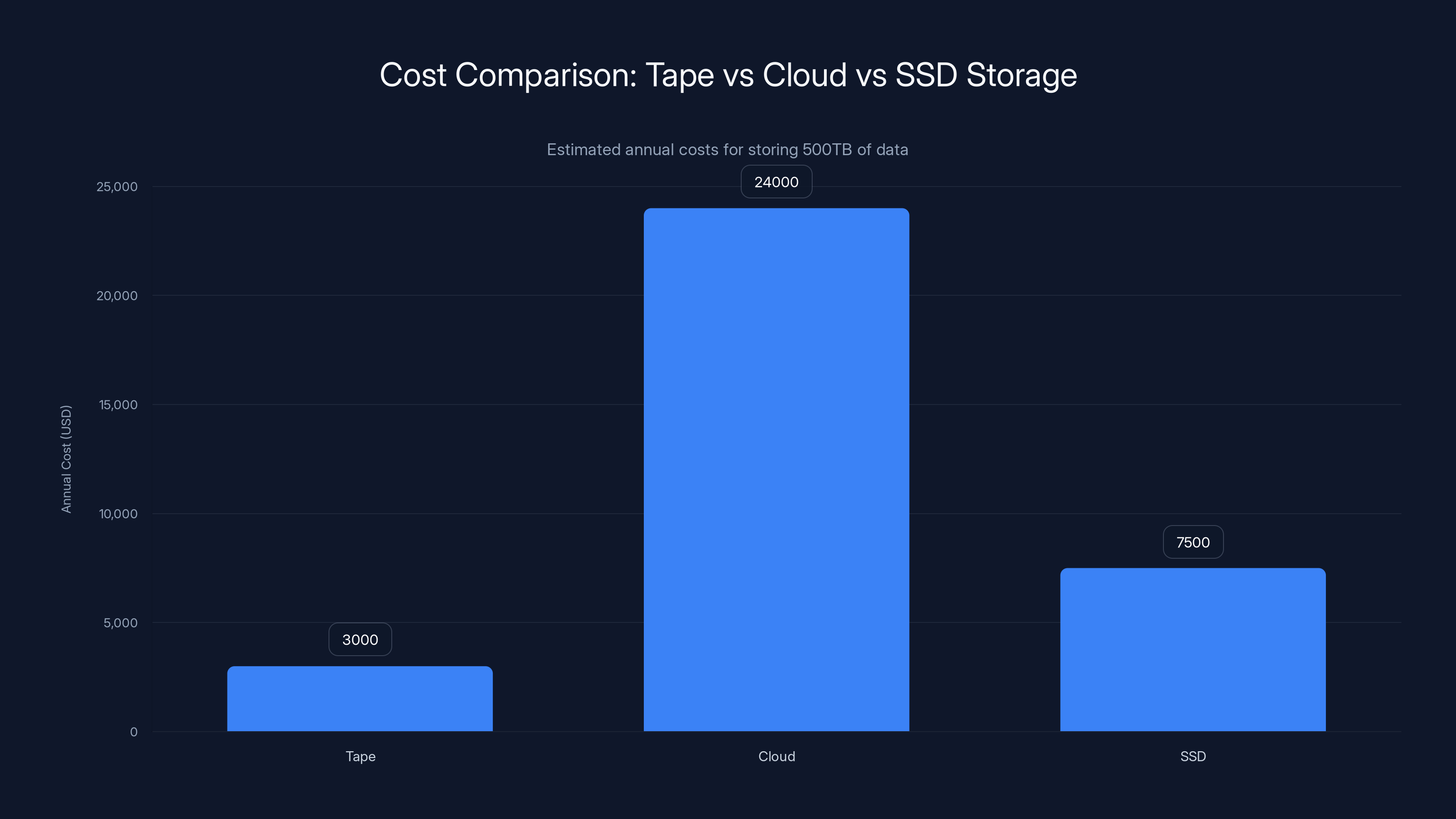

Assume an enterprise needs to retain 500TB of archival data—old databases, email archives, compliance records, medical imaging—for seven years.

Option 1: SSD Storage

- Hardware cost: ~7,500 for 500TB)

- Infrastructure (racks, cooling, power): ~$3,000 annually

- Replacement cycle (5 years): ~$7,500 halfway through the cycle

- Electricity: ~2,000W continuous, 21,000 over 7 years

- Management/monitoring: ~$5,000 annually

Total 7-year cost: ~

Option 2: Cloud Storage (AWS Glacier)

- Storage: 2,000/month or $168,000 per year

- Retrieval: assume 2 recoveries annually, ~$5,000 per recovery

- Management/integration: ~$10,000 annually

Total 7-year cost: ~

Option 3: Magnetic Tape

- Cartridges: ~15,000 for 500TB capacity)

- Drive hardware: $30,000 for enterprise drives

- Maintenance: ~$2,000 annually

- Facility (climate-controlled cabinet): ~$200 annually

Total 7-year cost: ~

This is why tape wins. At seven-year retention windows, tape costs less than SSDs and costs 20x less than cloud. Scale this to petabyte-level datasets, and the gap becomes absurd. A petabyte of data costs

Tape's economics only improve when you add complexity:

- Redundancy: Enterprises maintain 2-3 copies of critical backups. Tape makes this affordable. Cloud makes it budget-destroying.

- Longer retention: Legal holds sometimes require 10-20 year retention. Every additional year strengthens tape's advantage.

- Tiered architecture: Combining tape with cloud creates economic optimization—hot data on cloud, cold data on tape, archival on tape cartridges in vaults.

Fujifilm's 40TB cartridge amplifies this advantage. More capacity per cartridge means fewer cartridges, fewer drives, less infrastructure. A customer who previously needed 25 30TB cartridges (750TB total) now buys 19 40TB cartridges for the same capacity.

For organizations with hundreds of tape cartridges, this translates to real money saved on infrastructure, climate control, and management overhead.

Regulatory Compliance and the Tape Requirement

Compliance frameworks don't care about your technology preferences. They care about demonstrating controls.

Magnetic tape appears explicitly in dozens of regulatory standards because it was proven reliable for archival before digital became universal. Now, that history works in tape's favor.

HIPAA (Health Insurance Portability and Accountability Act) requires covered entities to maintain medical records with integrity and confidentiality protections. The regulation doesn't mandate tape, but it requires data retention periods (typically 6-10 years) and specifically mentions physical safeguards for backup media. Tape's physical isolation (air-gapped, removable, stored offline) directly satisfies those requirements.

FINRA (Financial Industry Regulatory Authority) mandates that securities firms retain communications and trading records for minimum 6 years. The regulation mentions "original media" in several contexts, which has historically meant tape cartridges. Cloud storage satisfies this for some firms, but many still deploy tape because auditors are comfortable with it and the regulation's language predates cloud.

GDPR (General Data Protection Regulation) requires European organizations to demonstrate data minimization and appropriate safeguards. Tape provides clear audit trails: cartridges are labeled, tracked, and physically managed. Cloud storage provides audit logs, but those logs are digital and potentially subject to compromise if the cloud infrastructure is breached.

SOX (Sarbanes-Oxley) and SEC regulations for financial record retention explicitly reference backup and recovery procedures. Tape forces organizations to document procedures—how cartridges are backed up, stored, rotated, tested—in ways that cloud sometimes encourages to remain opaque.

The irony is that tape appears in these regulations partly because it was the only technology available when the regulations were written. But tape's characteristics—offline storage, physical media, clear chain of custody, proven durability—still satisfy modern compliance requirements in ways that newer technologies sometimes struggle to demonstrate.

A 2024 audit of enterprise compliance practices found that 62% of enterprises maintaining tape archives cited regulatory compliance as the primary driver of tape retention (not cost, not performance, but regulatory mandate). Organizations could use alternatives, but tape is the path of least resistance with auditors and regulators.

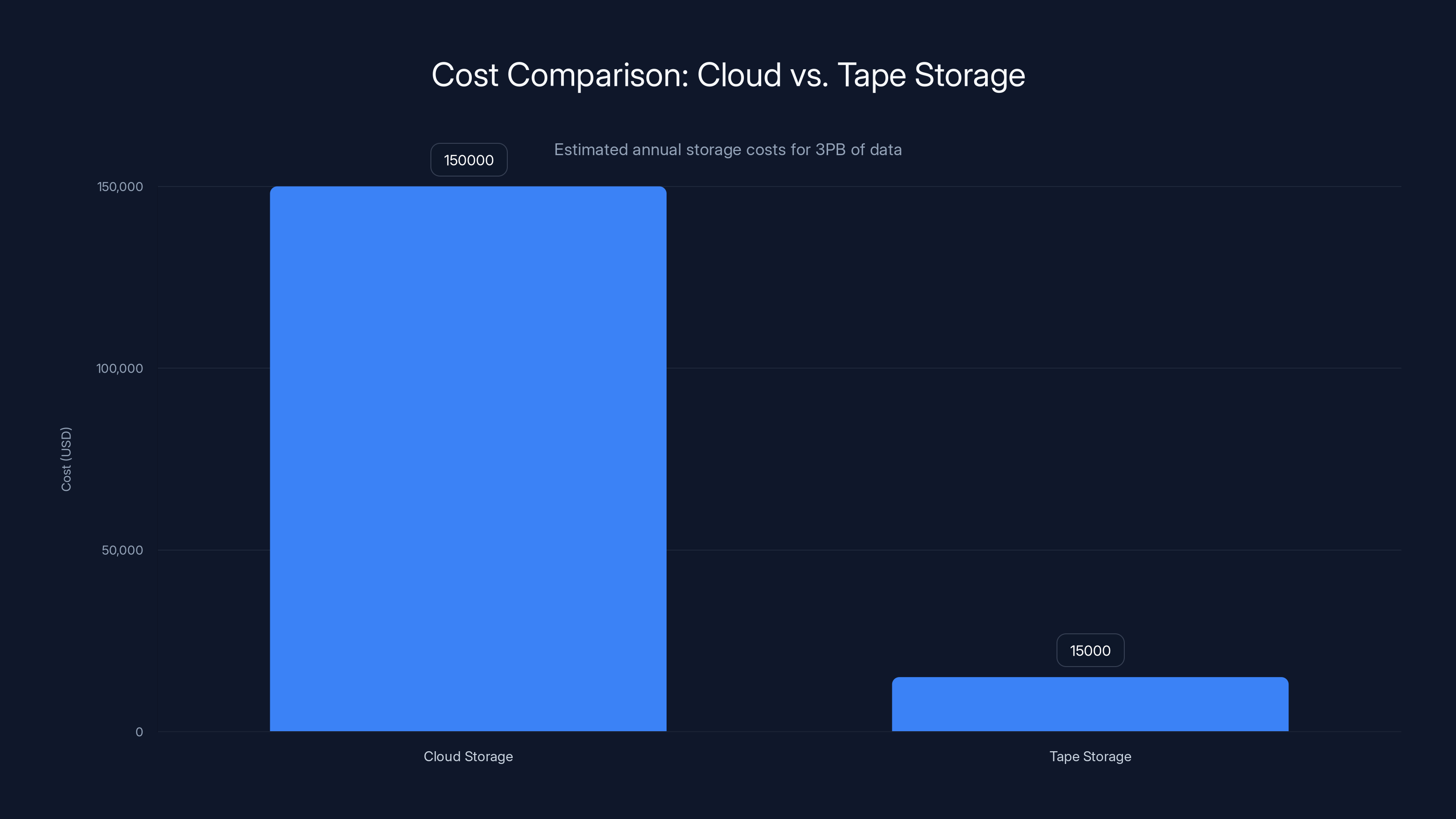

Storing 3PB of data on tape costs significantly less than cloud storage, highlighting tape's cost-effectiveness for large-scale, long-term data retention.

LTO Roadmap: Capacity Projections Through 2030

The LTO Consortium publishes its capacity roadmap publicly. This matters because it means organizations can plan infrastructure investments years in advance, knowing what's coming.

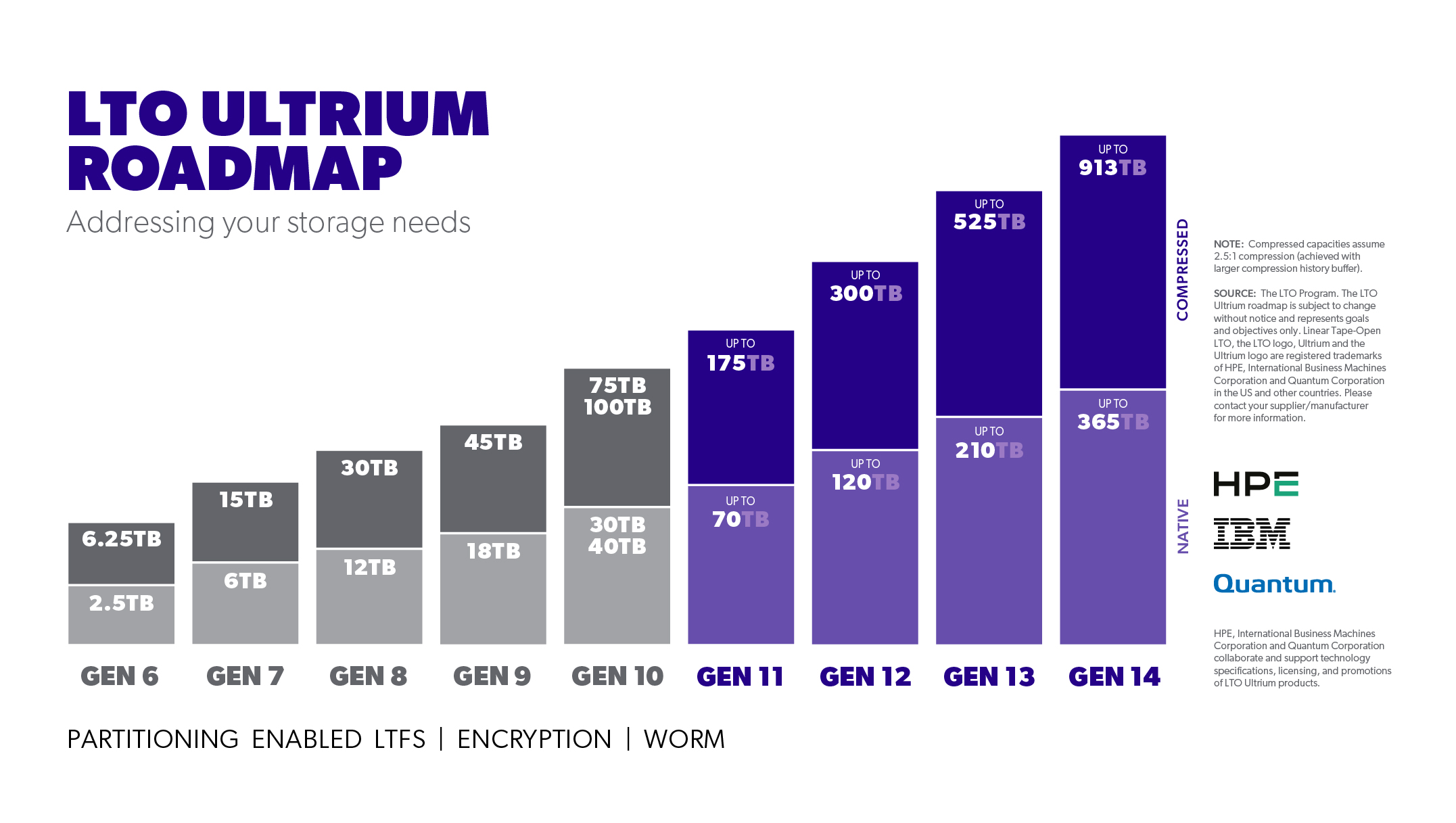

The announced roadmap extends to at least 2030:

- LTO-10 (2025): 30TB native, 75TB compressed (Fujifilm's 40TB variant exceeds baseline)

- LTO-11 (2028): 48TB native, 120TB compressed (estimated)

- LTO-12 (2030): 65TB native, 160TB compressed (estimated)

This trajectory matters because:

1. Backward Compatibility: Every LTO-11 drive will read LTO-10 cartridges. Every LTO-12 drive will read LTO-11 and LTO-10 cartridges. This means data stored today remains accessible for decades without format migration.

2. Infrastructure Planning: If you buy drives today, you know what's coming in 3-5 years. You can plan capacity expansion, retirement, and refresh cycles with confidence. Cloud services can't offer this visibility—pricing and capabilities change rapidly.

3. Competitive Moat: The standardization and roadmap transparency actually protect enterprises because no single vendor can obsolete the technology. Cloud providers can change terms, features, or pricing. LTO can't—the consortium enforces compatibility.

The trajectory also suggests that LTO technology isn't approaching physical limits yet. Magnetic tape can theoretically store more than 1,000TB per cartridge with future engineering advances. We're nowhere near tape's practical density ceiling.

Quan, Fujifilm, and IBM don't discuss this publicly, but there are research papers exploring tape densities that would dwarf current cartridges. The 40TB cartridge isn't a sign that tape is maxing out. It's evidence that the technology still has room to grow for decades.

Multi-Tier Storage Architecture: How Tape Fits Into Modern Data Strategy

Modern enterprises don't use a single storage tier anymore. They use multiple tiers, optimized for different use cases.

The typical architecture looks like this:

Tier 1: SSD/NVMe (Hot Storage)

- Data accessed daily or weekly

- High performance (sub-millisecond latency)

- Expensive per gigabyte

- Used for: production databases, active analytics, working datasets

- Retention: 7-30 days

- Cost: $0.10-0.30 per GB annually

Tier 2: HDD (Warm Storage)

- Data accessed occasionally (monthly or quarterly)

- Medium performance (10-100ms latency)

- Moderate cost per gigabyte

- Used for: backup repositories, archive staging, historical analytics

- Retention: 30 days to 1 year

- Cost: $0.02-0.05 per GB annually

Tier 3: Cloud Storage (Cool)

- Data accessed rarely (annually or less)

- Slow retrieval (hours to days)

- Low cost per gigabyte, but retrieval expensive

- Used for: cloud backups, disaster recovery, compliance archives

- Retention: 1-7 years

- Cost: $0.004/month storage + retrieval fees

Tier 4: Magnetic Tape (Cold/Archive)

- Data accessed very rarely or never

- Very slow retrieval (days)

- Lowest cost per gigabyte

- Used for: long-term retention, compliance holds, disaster recovery backups

- Retention: 7-30+ years

- Cost: $0.003-0.005 per GB annually

This is the reality of enterprise storage in the 2020s. Tape isn't replacing other tiers—it's complementing them. The economics work because each tier solves different problems.

An example: a healthcare organization with 2 petabytes of medical imaging data:

- Active imaging (1 week old, in use): 50TB on SSD ($50,000 annually)

- Recent imaging (1 month to 2 years, accessed occasionally): 500TB on HDD ($15,000 annually)

- Historical imaging (2-7 years, rarely accessed): 750TB on cloud cold storage ($60,000 annually)

- Archive (7-20 years, compliance hold): 700TB on tape ($12,000 annually)

Total cost:

Fujifilm's 40TB cartridge improves this by making Tier 4 more efficient. Fewer cartridges means less infrastructure, less climate control, less management overhead.

Tape storage consistently offers the lowest total cost across all scenarios, with its cost advantage growing significantly as data volume and retention periods increase.

AI Data Retention: Why Machine Learning Workloads Drive Tape Adoption

Machine learning is generating more data than enterprises know how to handle.

A single large language model training run on modern hardware generates terabytes of log data, intermediate results, and model checkpoints. Image generation services produce millions of images daily. Recommendation systems log billions of user interactions. The volume is staggering.

Most of this data can be discarded after training completes. But some organizations are keeping it—either because regulatory requirements demand it, because they might retrain models later, or because they're uncertain whether they'll need it.

This creates a retention problem: you have petabytes of data that might be valuable, probably won't be accessed again, and must be kept for years.

Tape was designed for exactly this problem.

Fujifilm explicitly marketed the 40TB LTO-10 cartridge as suitable for "analytics and machine learning workloads." This isn't accidental marketing language. It reflects actual customer demand.

Consider a mid-size financial services firm training fraud detection models:

- They process 100TB of transaction logs monthly

- They keep 24 months of logs for regulatory retention (2.4PB total)

- They train models weekly, each run generating 50TB of intermediate data

- They keep model checkpoints and logs for retraining (500TB annually)

- Total retention requirement: 3PB

Storing 3PB on cloud would cost roughly

The interesting part is that most of this data is never accessed once stored. It sits in the archive as insurance—if they need to retrain a model, if they're audited, if legal discovery requires proving what data they used, the cartridges are available. But in most cases, it's write-once, never-read-again data.

Tape is perfect for write-once, never-read-again data.

AI adoption is accelerating this trend. As enterprises deploy more ML models, they generate more data, and tape becomes more attractive. The LTO Consortium's public statements acknowledge this directly—their growth projections through 2030 explicitly factor in AI workload growth.

The Criticism of Tape: Valid Points and How They're Addressed

Critics of tape bring real concerns. Let's address them honestly.

1. Slow Recovery Times: Retrieving data from tape means physically locating the cartridge, loading it into a drive, and reading sequentially. This takes hours or days, not seconds. For disaster recovery where you need instant data access, tape isn't ideal.

Counter: Modern implementations maintain hot and warm backup tiers for active recovery scenarios. Tape is the tier for long-term retention where recovery takes days. If you need instant recovery, don't use tape.

2. Handling and Degradation: Tape degrades if exposed to extreme temperature, humidity, dust, or physical damage. Organizations need proper environmental controls and handling procedures.

Counter: So do SSDs. Proper data center climate control protects both. The difference is that tape can survive 30+ years without power consumption, while SSDs in cold storage risk data loss. And Fujifilm's expanded temperature/humidity range makes tape more forgiving.

3. Skill Depletion: As tape became "obsolete," fewer technicians learned tape operations. Organizations sometimes struggle to find people who can manage tape deployments and troubleshoot failures.

Counter: This is real, but it's correcting itself. As enterprises embrace tape again for cyber resilience, training and expertise are returning. Cloud engineers who learned tape years ago are becoming valuable again.

4. Vendor Dependency: Customers worry about vendor lock-in if a tape manufacturer fails or discontinues support.

Counter: The LTO Consortium ensures this won't happen. Multiple manufacturers (Fujifilm, IBM, Quantum) produce compatible cartridges and drives. If one company exits the market, the others continue. This is exactly why the LTO standard exists.

5. Compression Unreliability: Compression ratios vary wildly depending on data type. You can't always rely on 100TB capacity if your data doesn't compress.

Counter: Fair point. Enterprises should plan using native capacity (40TB) unless they've tested their specific data. Marketing is often misleading on compression, but users shouldn't be deceived by it.

The valid criticism is that tape requires more operational discipline than cloud storage. You can't just throw it at a problem and walk away. You need proper procedures, environmental controls, handling discipline, and testing.

But that's not a weakness of tape—it's a cost of offline storage. Organizations that choose tape want that discipline because the discipline is part of why tape survives ransomware.

For storing 500TB of data annually, tape storage is significantly cheaper than both cloud and SSD storage, with tape costing approximately

Competitive Landscape: Quantum, IBM, and Emerging Alternatives

Three companies dominate enterprise tape: Fujifilm, IBM, and Quantum.

Fujifilm manufactures cartridges and, through partnerships, co-manufactures drives. They're pushing the capacity envelope aggressively, with the 40TB cartridge first to market and plans for even higher capacity variants.

IBM manufactures cartridges and drives, selling primarily through enterprise channels. IBM's tape division is profitable and growing, despite being a tiny part of IBM's overall business.

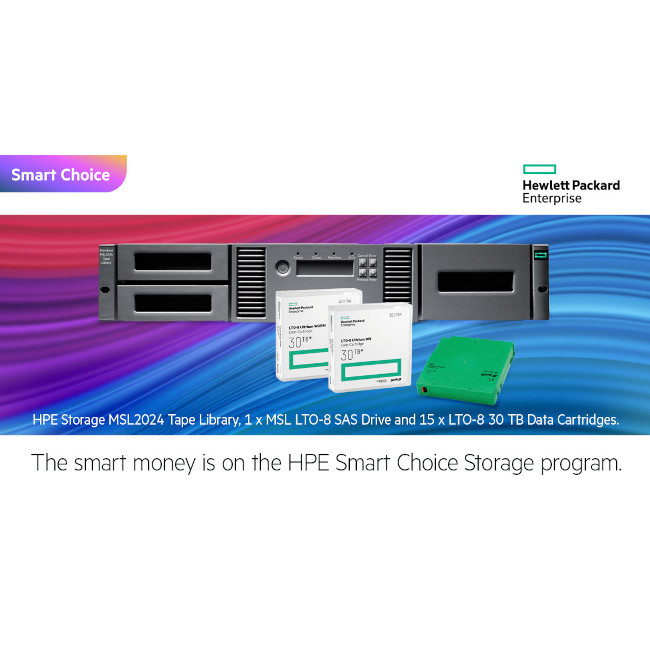

Quantum (formerly Overland Storage) manufactures drives and sells complete tape automation systems—robotic libraries that store thousands of cartridges and automatically load them. Quantum dominates the large-scale enterprise automation market.

These three have collectively maintained steady profitability in tape for 20+ years. None of them have abandoned tape or signaled plans to discontinue support. This contrasts with startups and smaller players who've exited the market, reducing vendor diversity.

Why haven't new competitors entered? Because:

- Capital intensity: Building tape drive manufacturing requires enormous investment in precision engineering

- Standards compliance: Any new entrant must support the LTO specification perfectly or risk incompatibility

- Network effects: Enterprises stick with vendors they know, and switching costs are high

- Low volume/high margin: Tape is profitable, but volumes are small compared to cloud or SSD markets

This means the tape market is consolidating around the three dominant players, but that consolidation is stable—none of the three are threatening to exit.

New alternatives to tape do exist:

Object Storage (S3-compatible) with immutable object locks provides some of tape's offline protection through software controls. But it requires continuous power and network connectivity, making it expensive for long-term archival.

Optical Media (M-DISC) promises 1000-year archival life, but capacities remain low (~40GB per disc) and random access isn't practical for large datasets.

DNA Storage remains experimental. Theoretically capable of 215 petabytes per gram, but costs, speed, and reliability make it impractical for current enterprise deployments.

None of these truly compete with tape for the offline archival use case. They solve different problems or have limitations that make tape more practical for now.

Implementation Best Practices: Building Reliable Tape Strategies

If you're considering tape (or expanding existing tape infrastructure), several practices improve reliability and operational efficiency.

1. Automate Tape Lifecycle Management

Use dedicated software (like Symantec Net Backup with tape modules, or Quantum's Stor Next) to automate tape staging, rotation, and archival. Manual tape management is error-prone and expensive at scale.

Automation should handle:

- Automatic staging of data from hot to warm to cold storage

- Cartridge lifecycle tracking (when cartridges are full, when they should be retired)

- Mandatory verification (reading back data to ensure integrity)

- Offsite transport and rotation

2. Implement Verification and Testing

Verify every cartridge after writing. Don't assume the data is good. Modern tape drives include LTFS (Linear Tape File System) which allows random file access and automatic verification.

Quarterly, restore a sample of cartridges to confirm:

- The drive can load and read the cartridge

- The data is recoverable without errors

- Your restoration procedures actually work

Many organizations skip this and discover during actual recovery that their tapes are unreadable.

3. Geographic Redundancy

Maintain cartridge copies in multiple geographic locations. If your primary data center suffers catastrophic failure, secondary cartridges in a different location ensure recovery.

This typically means:

- Primary production tapes on-site

- Backup tapes in an off-site facility

- Annual test recover from backup tapes

4. Climate Control

Optimal storage is 18-25°C and 40-60% relative humidity. Fujifilm's expanded range (15-35°C, up to 80% humidity) helps, but it's a limit, not a target.

If you can't maintain proper climate control, plan for shorter cartridge life and more frequent replacement. Degradation accelerates in poor conditions.

5. Drive and Cartridge Compatibility

Know which drives can read which cartridges. A newer LTO-10 drive can read LTO-9, LTO-8, and earlier cartridges, but an older LTO-8 drive cannot read LTO-9 cartridges.

Maintain a compatibility matrix and plan drive refresh cycles accordingly.

6. Documentation and Training

Document:

- Where cartridges are stored

- What data is on which cartridges

- How to load cartridges and test recovery

- Who is authorized to access cartridge storage

- How often cartridges are verified

Train operators. Tape isn't intuitive to people who've only worked with cloud storage.

Cost Comparison: Tape vs. Cloud vs. SSD for Various Retention Scenarios

Let's run several realistic scenarios comparing the three storage types across different data volumes and retention periods.

Scenario 1: Small Organization, 100TB, 5-Year Retention

| Storage Type | Hardware | Annual Facility | Retrieval | Total 5-Year Cost | Annual Cost |

|---|---|---|---|---|---|

| Tape | $8,000 | $1,000 | $500 | $13,500 | $2,700 |

| Cloud (Glacier) | $0 | $0 | $5,000 | $245,000 | $49,000 |

| SSD | $15,000 | $3,000 | $0 | $32,000 | $6,400 |

Winner: Tape by 5.5x vs. Cloud, 2.4x vs. SSD

Scenario 2: Mid-Market Organization, 1PB, 7-Year Retention

| Storage Type | Hardware | Annual Facility | Retrieval | Total 7-Year Cost | Annual Cost |

|---|---|---|---|---|---|

| Tape | $120,000 | $10,000 | $5,000 | $175,000 | $25,000 |

| Cloud (Glacier) | $0 | $0 | $50,000 | $2,450,000 | $350,000 |

| SSD | $150,000 | $25,000 | $0 | $325,000 | $46,400 |

Winner: Tape by 14x vs. Cloud, 1.9x vs. SSD

Scenario 3: Enterprise Organization, 10PB, 10-Year Retention

| Storage Type | Hardware | Annual Facility | Retrieval | Total 10-Year Cost | Annual Cost |

|---|---|---|---|---|---|

| Tape | $1,500,000 | $50,000 | $50,000 | $2,000,000 | $200,000 |

| Cloud (Glacier) | $0 | $0 | $500,000 | $24,500,000 | $2,450,000 |

| SSD | $1,500,000 | $200,000 | $0 | $3,500,000 | $350,000 |

Winner: Tape by 12x vs. Cloud, 1.75x vs. SSD

The pattern is clear: as data volume and retention period increase, tape's advantage grows exponentially. Cloud is unbeatable for active, frequently-accessed data. For long-term archival of rarely-accessed data, tape wins decisively.

These calculations assume:

- Cloud Glacier pricing: 0.01/GB retrieval

- SSD: $15/TB hardware, 5-year lifecycle

- Tape: $30/TB capacity, 3-year hardware lifecycle, climate-controlled facility

- No ransomware incidents or compliance audits requiring recovery

Add ransomware recovery scenarios (restoring 500TB from cloud costs ~$5,000 in retrieval alone), and tape's advantage widens further.

Future of Tape: What's Coming After LTO-10

The roadmap is clear, but worth discussing because it informs infrastructure decisions today.

LTO-11 (Projected 2028) Estimated 48TB native capacity. Likely improvements in transfer rate (possibly 600+MB/sec native). The Consortium hasn't published formal specifications yet, but industry discussions suggest LTO-11 is coming.

LTO-12 (Projected 2030) Estimated 65TB native capacity. This represents another major capacity milestone—the technology's 30-year trajectory will have delivered a 6.5x increase in a single generation (30TB to 65TB).

Beyond LTO-12, the roadmap becomes speculative, but analysts generally expect LTO-13 (2032) and beyond to continue the trajectory of roughly 50% capacity increases per generation.

What's remarkable is that this roadmap doesn't require revolutionary technology. It requires steady engineering improvements in magnetic particles, substrate materials, and recording techniques—all within reach of current manufacturers.

Investments in tape infrastructure today remain viable for decades:

- LTO-10 drives purchased in 2025 will read data through 2045 at minimum

- Cartridges written today will remain readable in future-generation drives

- The standardization ensures no vendor lock-in

This contrasts sharply with cloud storage (pricing and features change constantly) or proprietary systems (vendors discontinue support, forcing costly migrations).

Emerging Research Research labs are exploring tape technologies beyond the current roadmap:

- Helical scan improvements: Increasing track density without sacrificing signal integrity

- Advanced particle engineering: Barium ferrite variants that support higher coercivity

- Substrate innovations: Polymer films that support thinner coatings with less mechanical distortion

None of this is commercially available yet, but it suggests tape's technology ceiling is still far away.

Addressing the Skepticism: Why Elon Musk and Others Say Tape Is Dead

Okay, let's talk about the elephant in the room.

Elon Musk and other tech figures have publicly stated that tape storage is obsolete, a relic of the 20th century that has no place in modern computing. Musk's critique came in the context of Tesla's infrastructure discussions, where he argued that tape creates operational friction and that cloud-native systems eliminate the need for offline storage.

Is he wrong?

Not entirely. For specific use cases, he's right:

- High-performance computing: If you need sub-millisecond data access, tape is terrible

- Cloud-native operations: If you're running entirely in public clouds, tape adds operational complexity

- Real-time data pipelines: Tape sequential access doesn't work for random-access workloads

- Cutting-edge startups: If your entire business is cloud-native, tape might not be necessary

But Musk's critique conflates two different things:

- "Tape isn't suitable for active workloads" (correct)

- "Tape is dead and shouldn't exist" (incorrect)

Tape solves a specific problem: long-term offline archival at lowest cost. That problem exists whether Musk acknowledges it or not. Every enterprise with historical data, compliance obligations, or ransomware concerns has that problem.

Musk's view reflects his experience building companies in the cloud-native era, where applications are designed around cloud infrastructure. But the vast majority of enterprise computing isn't cloud-native. It's hybrid. Data exists on-premises, in multiple clouds, and in offline archives. Tape fits that reality.

The contrast is telling: Musk insists tape is dead. Meanwhile, Fujifilm, IBM, and Quantum are investing in next-generation tape manufacturing, the LTO Consortium continues standardization roadmaps, and enterprises continue buying tape cartridges in record volumes.

It's possible that both things are true: tape is wrong for cloud-native startups and tape is essential for enterprises. Which perspective is correct depends entirely on your business model and infrastructure requirements.

Making the Decision: Should Your Organization Adopt Tape?

If you're evaluating whether tape makes sense for your organization, ask these questions:

1. Do you retain data longer than 3 years?

If yes, tape economics become favorable. If no, cloud or SSD might be more practical.

2. Do you need offline, air-gapped backups for ransomware resilience?

If yes, tape is hard to beat. If your security model relies entirely on cloud immutability features or automated recovery, tape might be unnecessary.

3. Do you have data with regulatory retention requirements (HIPAA, FINRA, SOX)?

If yes, tape simplifies compliance demonstration. You maintain physical cartridges with clear labeling and chain of custody.

4. Is your data volume growing faster than your budget?

If yes, tape's cost-per-gigabyte advantage becomes critical. If your data volume is stable, cost differences matter less.

5. Can you commit to operational discipline (testing, documentation, climate control)?

If yes, tape is reliable and straightforward. If your organization struggles with operational consistency, tape might create more problems than it solves.

6. Do you need instant recovery for this data?

If yes, tape isn't suitable (recovery takes hours/days). If recovery can be planned and methodical, tape works fine.

Decision Framework:

- Adopt tape if: Your organization operates at significant scale (100TB+), retains data 3+ years, needs air-gapped backups, and can maintain basic operational discipline

- Skip tape if: You're cloud-native, data retention is short-term, you need instant recovery, and compliance requirements are minimal

- Hybrid approach: Most enterprises adopt both—tape for long-term archival, cloud for active backups, SSD for hot data

The Verdict: Tape Isn't Dead, It's Optimized

Fujifilm's 40TB LTO Ultrium 10 cartridge isn't revolutionary. It's evolutionary—the next logical step in a technology roadmap that's been running reliably for three decades.

But evolution in the context of repeated death proclamations is worth acknowledging. Every ten years, industry analysts predict tape will finally die. Every ten years, tape proves them wrong by doing exactly what it's supposed to do: storing massive amounts of data cheaply and reliably for the long term.

The 40TB cartridge represents several realities:

- Tape is economically dominant for archival at scales and retention periods that matter to most enterprises

- Ransomware has made offline storage strategically important after years of being a compliance checkbox

- AI workloads are generating data volumes that tip the economics decisively in tape's favor

- The LTO standard continues delivering capacity increases without forced format migrations or vendor lock-in

- Enterprises trust tape because it's proven, understood, and supported by multiple vendors

Tape won't become trendy. Cloud is trendy. SSDs are trendy. Tape is practical, and practicality is how mature technologies survive.

The future of tape is quiet growth—unnoticed by tech media, unremarked by tech celebrities, but directly supporting the infrastructure that enterprises depend on. That's exactly how tape has always worked. And Fujifilm's 40TB cartridge suggests it will keep working that way for at least another decade.

FAQ

What is LTO tape storage?

LTO (Linear Tape-Open) is an open-standard magnetic tape format designed for enterprise data archival and backup. Cartridges store data sequentially on magnetic tape, offering extremely low cost per gigabyte for long-term retention. The LTO standard is maintained by the LTO Consortium (jointly governed by Hewlett Packard, IBM, and Quantum) to ensure compatibility across manufacturers and prevent vendor lock-in.

How does tape storage compare to cloud storage?

Tape excels at offline archival where data is accessed rarely. Cloud storage costs

Why do enterprises choose tape over SSDs for archival?

Tape wins on long-term cost and operational simplicity. A 500TB dataset costs roughly

Is tape secure for sensitive data?

Tape's offline nature (physically disconnected from networks) provides strong security against cyber attacks. Ransomware cannot encrypt or access cartridges that aren't connected to infected systems. Physical security and climate control protect against environmental damage. However, tape security depends on proper handling procedures—cartridges must be labeled, tracked, and stored in controlled facilities.

How long can data stay on tape cartridges?

Fujifilm estimates 30+ years for LTO-10 cartridges in proper conditions (18-25°C, 40-60% humidity). Real-world data suggests well-maintained cartridges remain readable for 40+ years. Tape is more reliable for ultra-long-term storage than SSDs, which risk data loss after 5-10 years in cold storage due to charge leakage. This makes tape ideal for regulatory retention requirements spanning decades.

What's the difference between native and compressed capacity?

Native capacity (40TB for Fujifilm's LTO-10) is the guaranteed data you can store without compression. Compressed capacity (100TB) assumes data compresses at 2.5:1 ratio. Typical enterprise data (databases, logs, documents) does compress at these ratios, but you should plan using native capacity unless you've verified your data compression. Marketing often overstates compressed capacity.

Can you access files randomly on tape like you would an SSD?

Not easily—tape is sequential. However, LTFS (Linear Tape File System) enables drag-and-drop file access on modern LTO-9 and LTO-10 cartridges, making tape behave more like traditional storage. Still, sequential access makes tape slower for random-access workloads. Tape works best for write-once, archive-and-forget scenarios.

What happens if a tape manufacturer stops supporting their drives?

The LTO Consortium guarantees this won't happen due to the open standard. Multiple manufacturers (Fujifilm, IBM, Quantum) produce compatible cartridges and drives. If one manufacturer exits, others continue supporting the format. This is exactly why the LTO standard was created—to prevent vendor lock-in.

How do enterprises test that tape backups will actually work for recovery?

Best practice is quarterly recovery testing: physically load a sample cartridge, read the data back, and confirm it's accessible. Many organizations skip this and discover during actual recovery that drives have failed or cartridges are unreadable. Verification should be automated using software like Symantec Net Backup or Quantum's Stor Next to ensure consistency.

Should we move our cloud backups to tape to reduce costs?

Not necessarily. Cloud backups serve active recovery scenarios where you need data in hours or minutes. Tape is for long-term archival where recovery in days is acceptable. The ideal strategy is hybrid: recent backups (1-30 days) on cloud or SSD, intermediate archives (1-2 years) on HDD or cloud archive tiers, and long-term archives (3+ years) on tape. Each tier optimizes for its access pattern.

Conclusion: Tape's Quiet Reign Continues

Fujifilm's 40TB LTO Ultrium 10 cartridge won't make headlines beyond tech publications. It won't generate venture capital or IPO excitement. No startup will be founded to "disrupt" tape with some cloud-based alternative. Tape simply works, costs less, and enterprises keep buying it.

That's the mark of a mature technology that has won its niche. Not dominating all of computing, but absolutely essential where it matters. Tape storage is one of the last true monopolies in that sense—nothing else does offline archival at scale and cost that tape does.

The cartridge's expansion to 40TB matters because it extends tape's applicability further. Organizations that previously needed 30 cartridges now buy 20. Infrastructure costs drop. Operational complexity decreases. Tape becomes even more economically attractive.

If you manage enterprise data, especially in finance, healthcare, legal, or government, this matters to your infrastructure strategy. If you're still relying on cloud-only archival for compliance retention, you're probably overpaying. If you're not testing your offline backups, you're gambling with recovery scenarios that may never work when you need them.

Tape isn't trendy. But for the specific problems it solves—affordable long-term archival, ransomware-resistant backup, regulatory compliance—tape is simply the right tool. Fujifilm's new cartridge makes it an even better tool. And despite what tech celebrities say, enterprises will continue quietly buying them for years to come.

That's not a prediction. That's just how competitive advantage works when something truly is better for the job.

Key Takeaways

- Fujifilm's 40TB LTO-10 cartridge (100TB compressed) launches January 2026, extending tape's capacity advantage and addressing AI data retention needs

- Tape economics overwhelmingly favor archival: 0.048+ for cloud, delivering 10-20x cost savings over 7-year retention periods

- Ransomware resilience drives enterprise tape adoption—offline, physically disconnected cartridges cannot be encrypted or accessed remotely, unlike network-connected storage

- LTO Consortium's published roadmap guarantees backward compatibility and capacity growth through 2030 (65TB projected), enabling confident infrastructure planning without vendor lock-in

- Multi-tiered storage architecture (SSD hot, HDD warm, cloud cool, tape archive) represents standard enterprise practice, with tape optimized for data retention beyond 3-5 years

![LTO Tape Storage: Why 40TB Cartridges Matter for Enterprise Data [2025]](https://tryrunable.com/blog/lto-tape-storage-why-40tb-cartridges-matter-for-enterprise-d/image-1-1766830098213.jpg)