The Mobile App Paradox: Fewer Downloads, Record Revenue in 2025

Something genuinely unexpected is happening in the mobile app economy, and it's rewriting everything we thought we knew about how digital products make money.

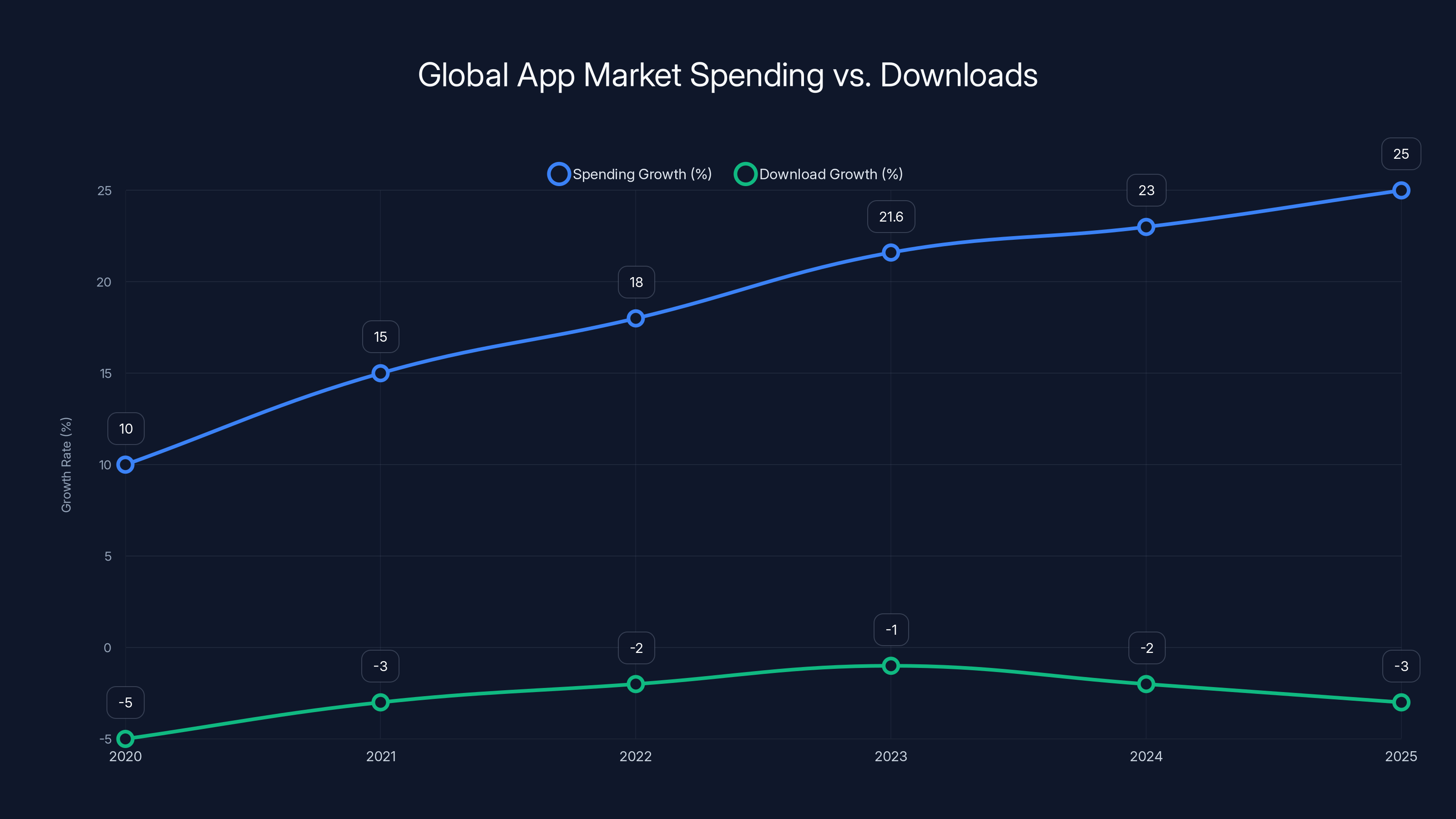

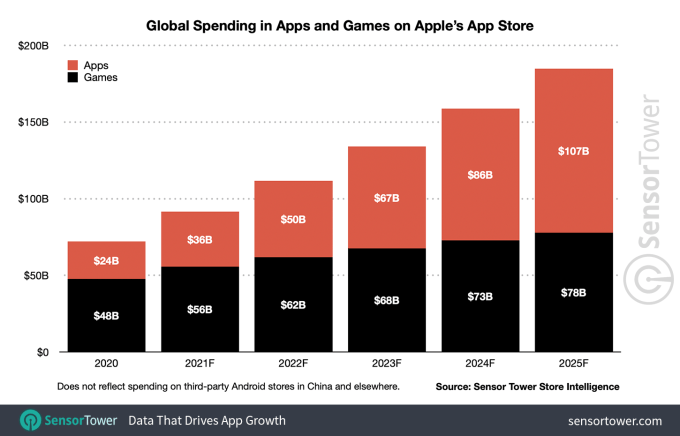

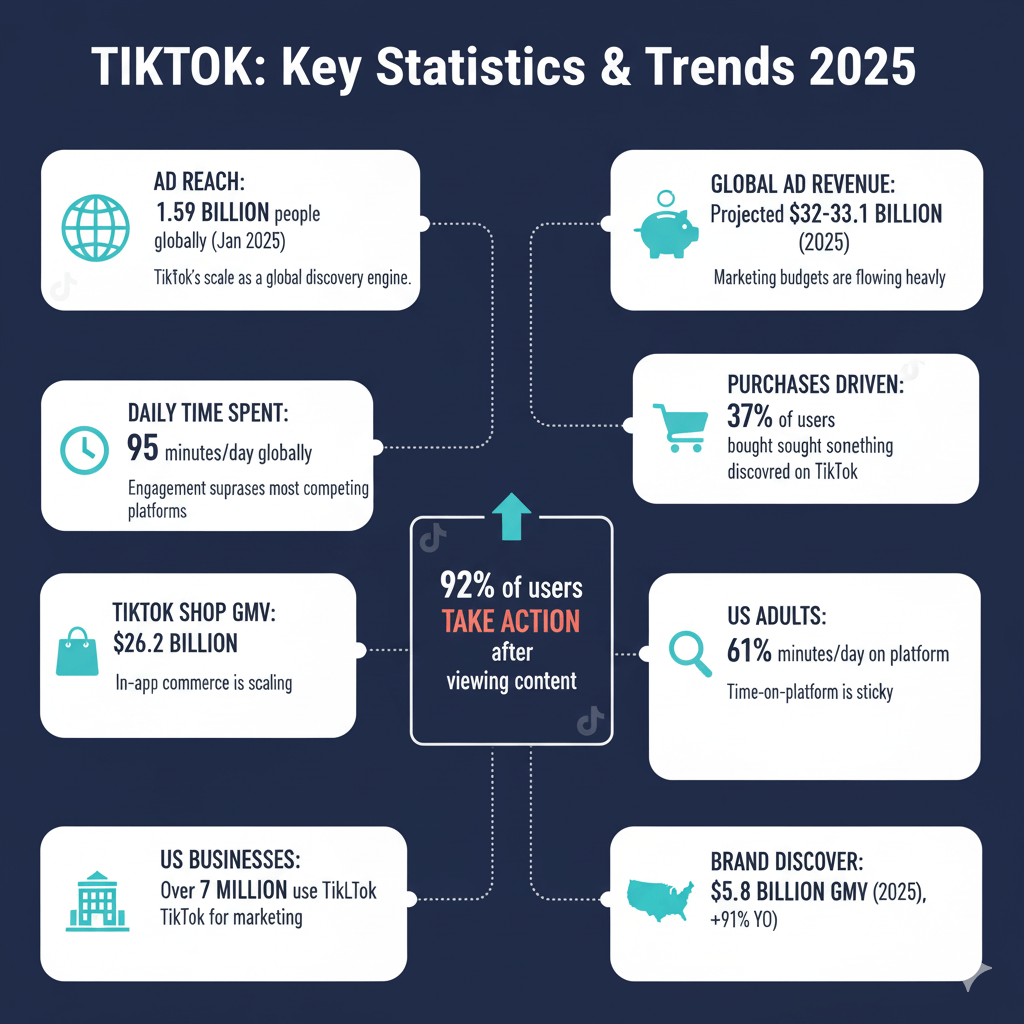

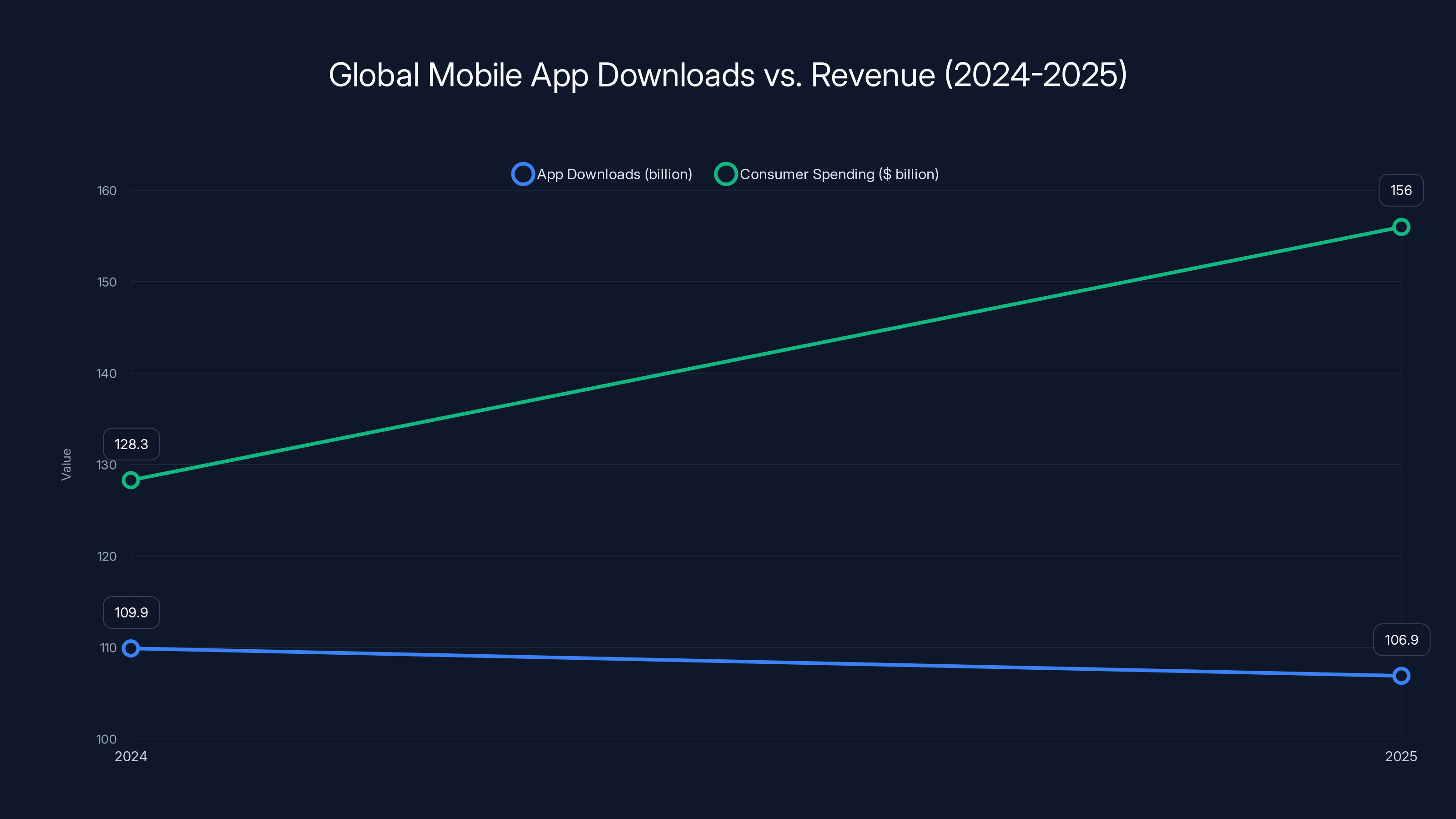

For the fifth year straight, global app downloads are declining. Fewer people are installing apps. The numbers show it clearly: 106.9 billion downloads in 2025, down 2.7% from 2024. But here's where it gets interesting. Consumer spending on those apps? That climbed 21.6% to hit nearly $156 billion. Let that sink in for a second.

We're in the middle of a fundamental shift in how the app economy works. It's not about capturing more users anymore. It's about extracting more value from the users you already have.

This isn't some academic observation either. This is reshaping how billions of dollars flow through the digital economy. Subscription services, in-app purchases, premium tiers—these aren't afterthoughts bolted onto apps anymore. They're the entire business model. And they're working.

The data comes from Appfigures, an app intelligence firm that tracks the mobile app ecosystem with serious rigor. They publish annual reports that have become essential reading for anyone who wants to understand where the digital economy is actually headed. And what they found in 2025 is genuinely telling us something important about the future of software business models.

When you look at the numbers in detail, you see a market that's fundamentally restructured itself. The old growth playbook—acquire users at scale, figure out monetization later—is dead. What's emerged is something far more sophisticated and, frankly, far more lucrative for companies that get it right.

But there's more complexity here than just the headline numbers. Different app categories are behaving completely differently. Games are crashing while non-game apps are soaring. The U.S. market tells a different story than the global picture. And the businesses being built on top of this shift are themselves massive opportunities.

Let's dig into what's actually happening.

Global App Landscape: The Numbers Behind the Shift

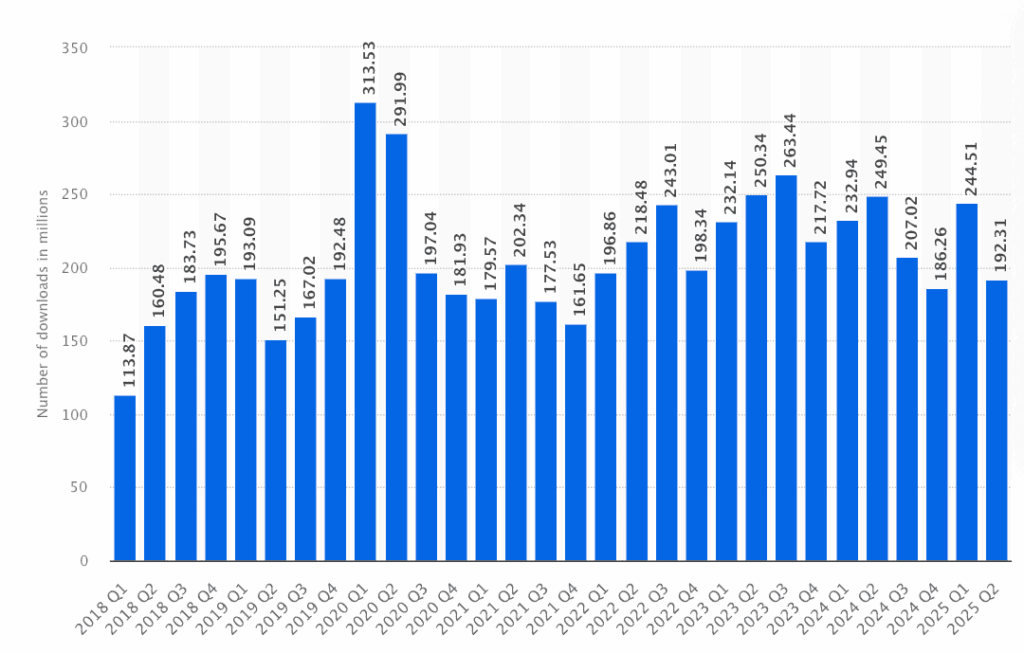

The 106.9 billion downloads figure represents a meaningful decline, but the context matters enormously. In 2020, during the pandemic lockdowns, downloads hit an all-time peak of 135 billion. People were trapped at home. Smartphones became the primary interface with the outside world. App stores exploded.

But that was an anomaly. What we're seeing now is more like a normalization. The smartphone market is mature. Most people who want a smartphone have one. Most people who want to try apps have downloaded the ones they actually care about. The pool of new users is shrinking, which is why download growth flattened starting around 2021.

The year-over-year decline of 2.7% in 2025 actually suggests the market is stabilizing rather than collapsing. The 3.3% decline from 2023 to 2024 was bigger. So maybe we're hitting a floor where downloads plateau rather than disappear entirely.

But the spending number is the real story. $155.8 billion is an absolutely staggering figure. To put it in perspective, that's comparable to the entire annual revenue of major tech companies. And it's growing at 21.6% year-over-year.

How is that possible if downloads are falling? The answer is brutal efficiency in monetization.

Think about your own phone right now. Almost every app you use regularly either costs money, shows ads, or has some kind of in-app purchase. This is intentional. Developers and publishers have basically decided that the free app model doesn't work anymore. You can't build sustainable software on the backs of millions of tiny ad impressions. So they've shifted to direct monetization.

The subscription model specifically has become the engine of this growth. Apps like Spotify, Netflix, Disney Plus, Apple Fitness Plus, Notion, Dropbox, 1Password—these are the apps people pay for directly and renewably. Every month, money automatically comes out of your account. It's predictable revenue. It's defensible. And it scales efficiently.

In-app purchases add another layer. A free game that converts even 1-2% of players into paying customers can be enormously profitable. A social app that charges for cosmetics, filters, or enhanced features creates multiple revenue streams from the same user base.

The math is straightforward but the execution is brutal. If you're managing an app portfolio, you need to optimize for lifetime value per user, not raw acquisition numbers. That changes everything about how you build, market, and operate a product.

The app market is experiencing a shift towards spending growth, projected to increase by 25% by 2025, while downloads are expected to continue declining. (Estimated data)

Games vs. Non-Games: A Story of Complete Reversal

Here's where the data gets really interesting. Games and non-games are diverging dramatically, and if you're building in the app space, understanding this divergence is crucial.

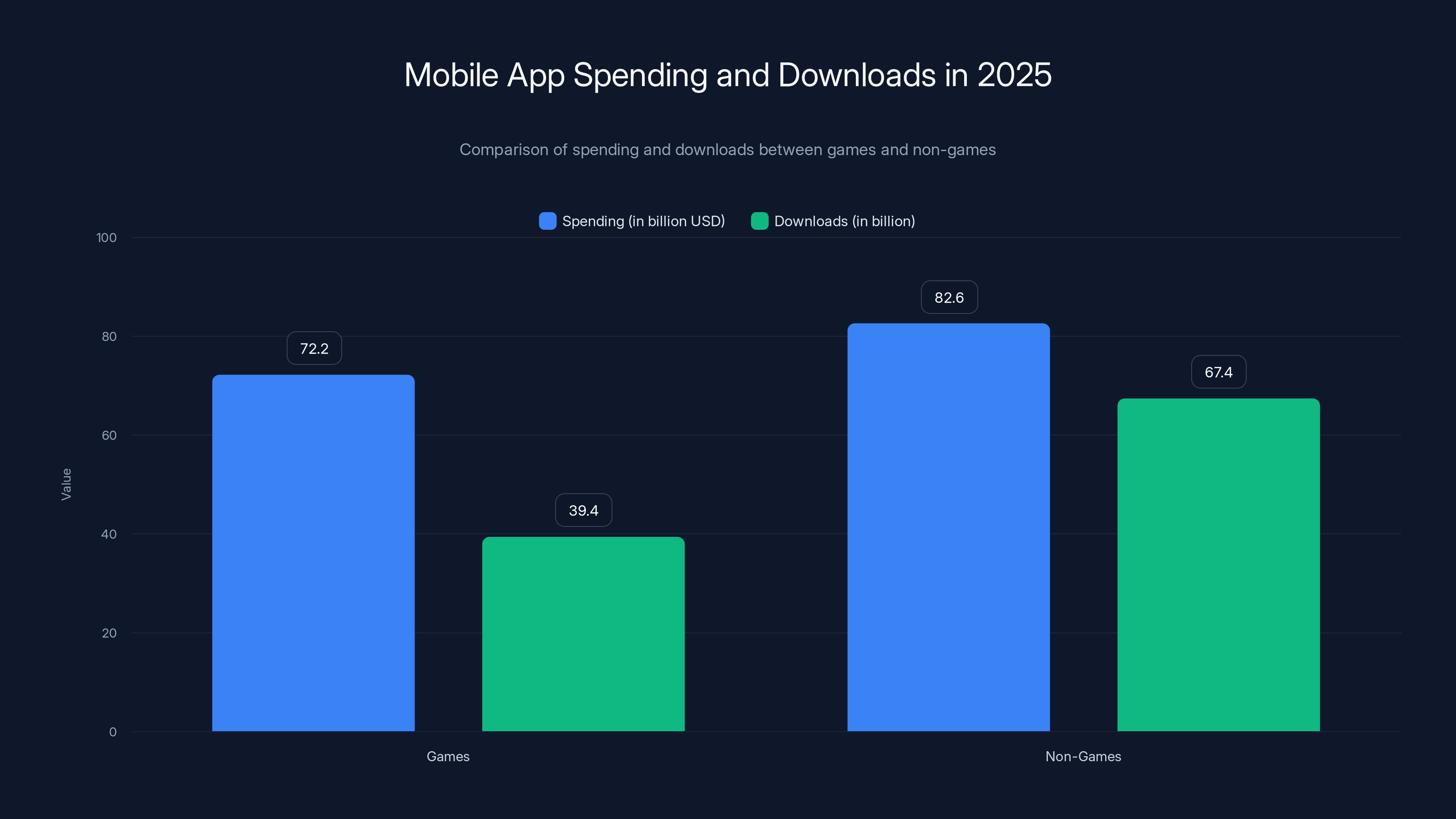

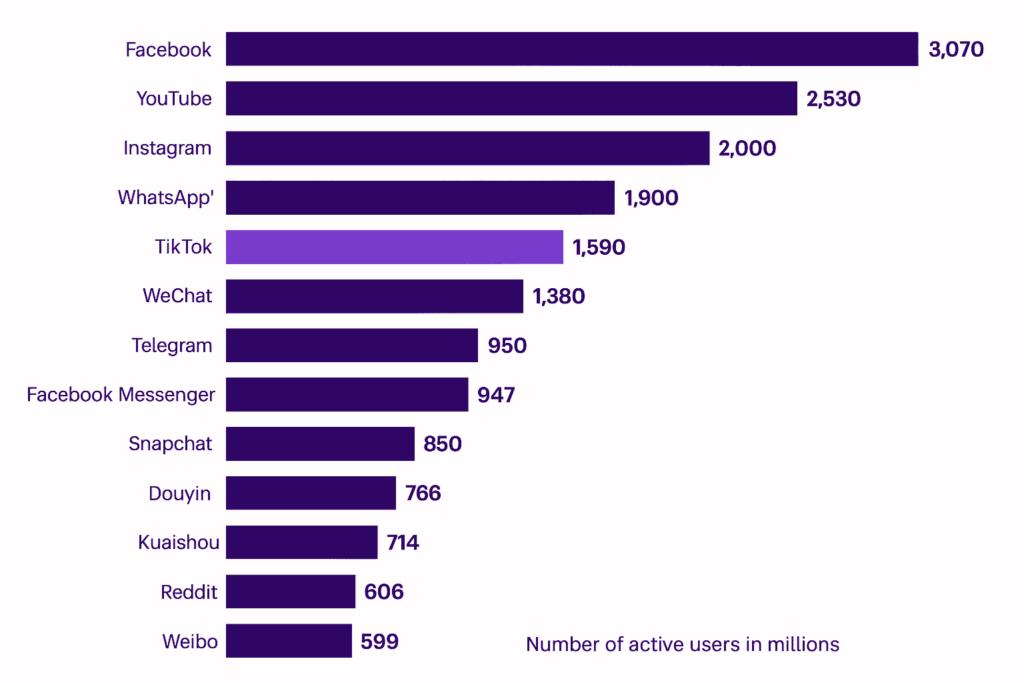

In 2025, consumers spent $72.2 billion on mobile games. That's up 10% year-over-year. Sounds solid, right? Except games only accounted for 46% of all app spending. That's the lowest percentage in years.

Meanwhile, non-game apps generated $82.6 billion, up 33.9% year-over-year. This is the real growth story. Productivity apps, communication tools, banking apps, fitness trackers, weather apps, navigation apps—all the categories outside of games are absolutely accelerating in terms of revenue.

The download data tells an even more dramatic story. Mobile games were downloaded 39.4 billion times in 2025, down 8.6% year-over-year. That's a significant decline. And it follows a 6.6% decline from 2023 to 2024. Games are contracting on the download side.

Non-game apps? Essentially flat. 67.4 billion downloads, up just 1.1% year-over-year. The downloads aren't growing, but they're not declining either.

Yet spending on non-games is growing 34% while download growth is 1%. That's the monetization story right there. People aren't downloading more non-game apps, but the apps they already have are successfully converting them into paying users.

Why the divergence? A few things are happening simultaneously.

First, the games market is saturated. There are literally millions of games on the App Store and Google Play. Most of them are terrible. The barrier to download a game is now incredibly high because users have been conditioned to expect quality, engaging experiences. Mediocre games don't get installed. The download curve for games is contracting because the market is consolidating around a smaller number of hit titles.

Second, non-game apps are solving real problems in people's daily lives. They have structural reasons to exist beyond entertainment. A productivity app helps you get work done. A fitness app tracks your health. A banking app manages your money. These aren't discretionary entertainment choices; they're utility tools that integrate into your workflow.

Third, the monetization models for non-games are different and often less hostile. A subscription to a productivity tool at

This has major implications for anyone building mobile products. If you're thinking about building a game, you need a genuinely exceptional concept with strong fundamentals. The easy money in games is gone. If you're building a non-game app, the opportunity is still substantial because the monetization flywheel is still accelerating.

In 2025, non-game apps surpassed games in both spending (

The U.S. Market: Where the Money Really Concentrates

Global numbers tell one story, but the U.S. market tells a more granular one. And if you're building products, the U.S. is where the real money is.

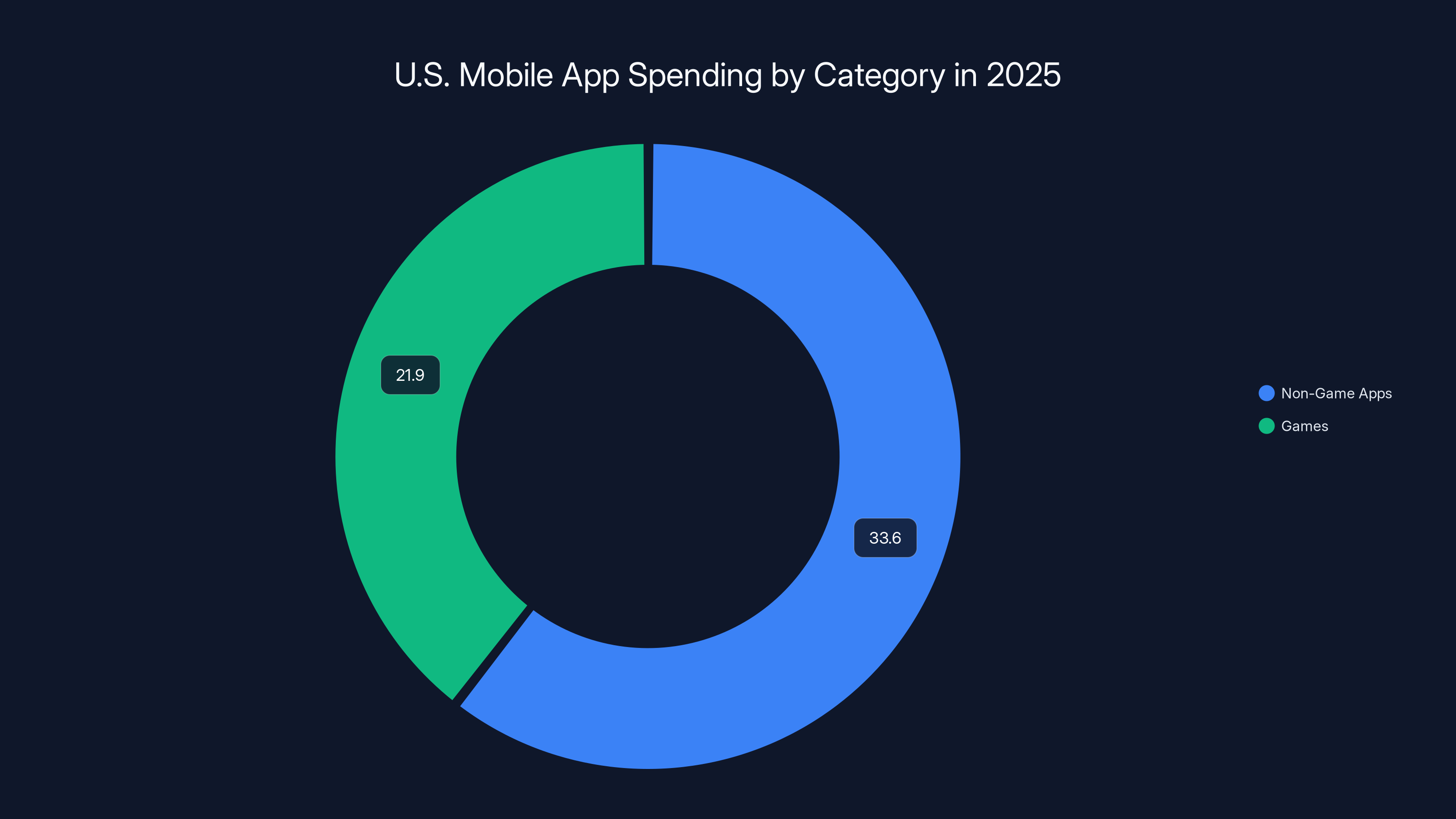

In the United States specifically, consumers spent

With a U.S. population of about 330 million people, that means roughly $168 per person per year spent on apps. That's higher than most other countries because Americans have higher disposable income and greater smartphone adoption.

Downloads in the U.S. reached 10 billion in 2025, down 4.2% from 10.4 billion in 2024. The decline is slightly steeper than the global 2.7%, which suggests the U.S. market is even more mature and saturated than the global average.

Breaking down U.S. spending by category: consumers spent

So in the U.S., non-games represent about 60% of spending while games represent about 40%. Globally, it's more like 53% non-games and 47% games. The U.S. is further along in the shift away from games toward productivity and utility apps.

This makes sense geographically and culturally. The U.S. has strong software traditions in productivity, work-related tools, and business applications. Apps like Slack, Notion, Figma, and Canva all have outsized adoption in the U.S. These are high-value, premium-priced tools that people and companies pay serious money for.

U.S. non-game app downloads totaled 7.1 billion, while games were downloaded 2.9 billion times. Games represent only about 29% of total app downloads in the U.S., but a much higher percentage of revenue. That shows games have higher monetization per download—each game installation is more likely to generate spending than each non-game app installation.

But the trend is still clear: the U.S. app economy is moving away from games and toward productivity and utility applications.

The Subscription Economy as Growth Engine

The single biggest driver of app revenue growth is the shift to subscription models. This isn't speculative; you can see it playing out in real-time across every major app category.

Subscriptions are transformable because they create predictable recurring revenue. A company that converts 10% of its users to $5/month subscribers has a massively different cash flow profile than a company trying to extract revenue through sporadic in-app purchases.

From a user perspective, subscriptions align incentives differently. If you pay $4.99/month for an app, you expect it to be regularly updated, improved, and supported. You expect customer service. You expect the company to care about your experience because you're giving them money every month.

Compare that to a free app with aggressive ads or microtransactions. That app has incentives to maximize engagement and monetization per session, even if it hurts the user experience. The business models are fundamentally different.

The subscription shift is also creating new business categories. Revenue management platforms, subscription analytics tools, payment processing specialized for recurring billing—these are entire categories of software that didn't exist before the subscription economy matured.

RevenueCat is a perfect example. It's a platform that helps mobile app developers manage subscriptions across iOS, Android, and web. Instead of building subscription infrastructure from scratch, developers can plug into RevenueCat and let them handle the complexity.

In 2024, RevenueCat raised $50 million in Series C funding. That's serious capital. And the company is valuable because it's solving a real problem: subscription management at scale is genuinely hard, and developers are willing to pay for solutions that simplify it.

Appcharge is another example. They focus specifically on mobile game monetization, helping games optimize their in-app purchase offerings. They raised $58 million in Series B funding in August 2024, which shows investors see enormous opportunity in helping games monetize more effectively.

Liftoff Mobile, which helps companies market and monetize apps, actually filed for an IPO in early 2025. That's a significant signal. The company provides user acquisition and monetization services for app developers, and the fact that it's going public shows the market believes this category is mature and valuable enough for public markets.

What all these businesses have in common is they're all serving the subscription and monetization infrastructure layer. They exist because app developers need help with the business side of their products, not just the technical side.

If you're building a mobile app and you're not thinking deeply about subscription pricing, you're probably leaving money on the table. The economics of the app business have fundamentally shifted. Subscriptions work.

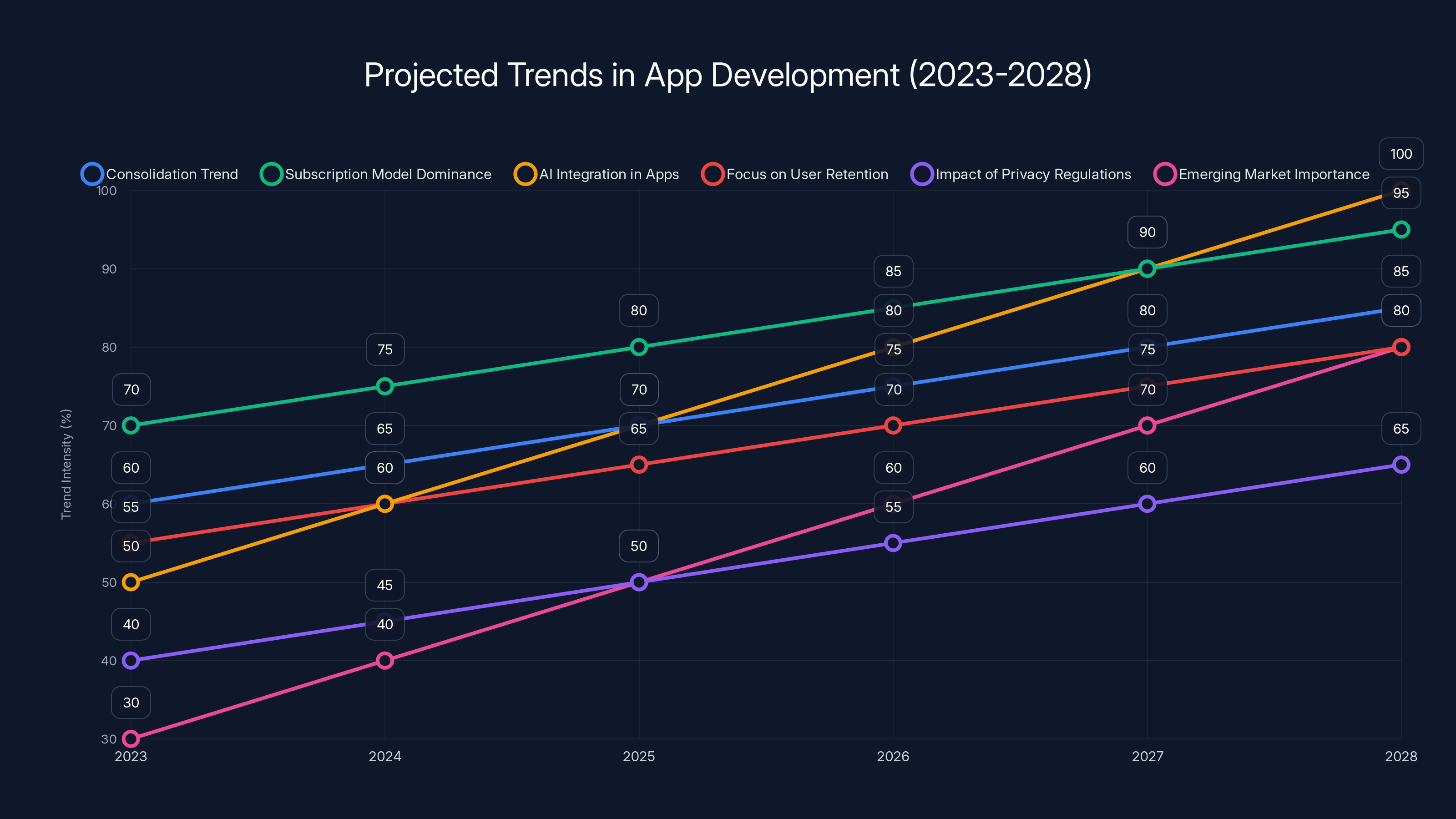

The next five years will see increased consolidation, subscription model dominance, AI integration, and a focus on user retention in app development. Estimated data based on current trends.

Why Downloads Keep Declining: The Maturation Curve

The smartphone market is mature. That's the core reality underlying the download declines. Let's think about what maturation looks like across different product categories.

When smartphones first became ubiquitous around 2010-2012, you had explosive growth. New users every quarter. New devices entering the market. Entire categories of apps that didn't exist yet. That was the growth phase.

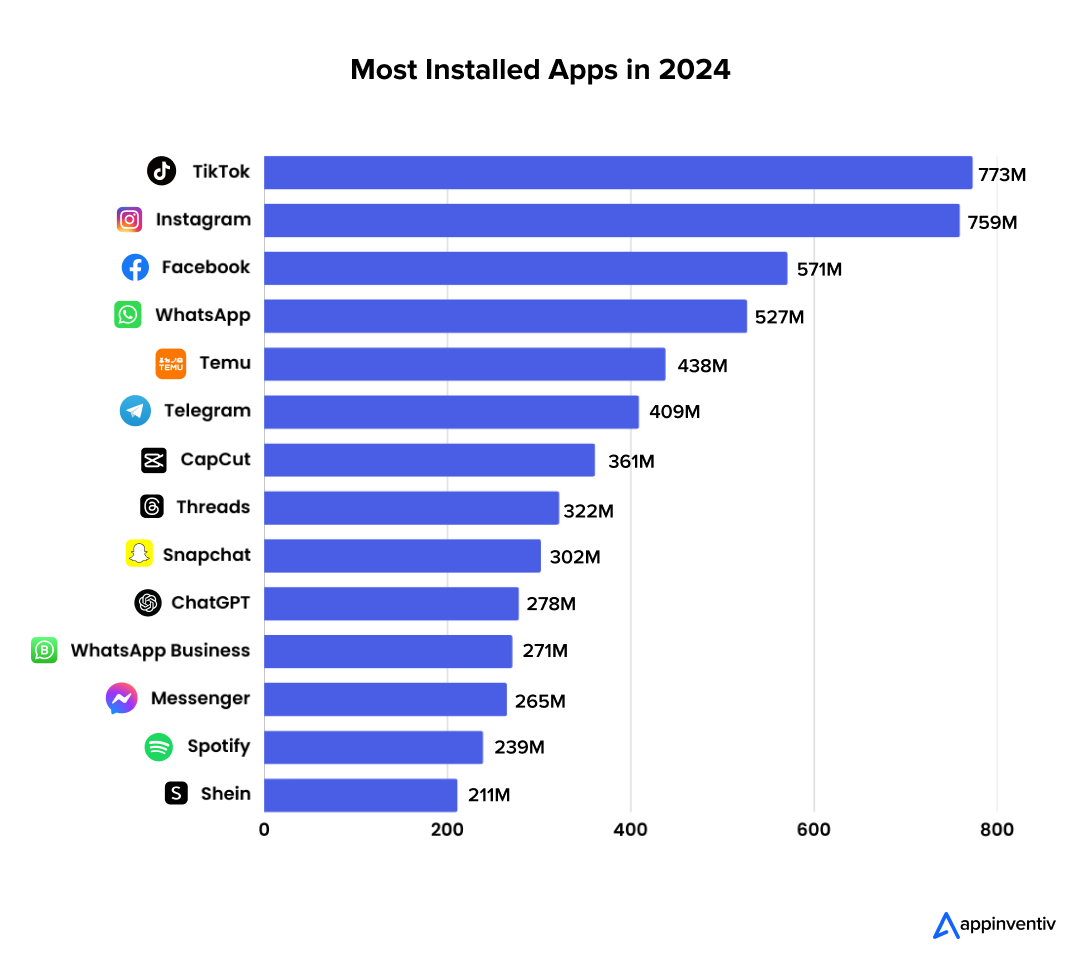

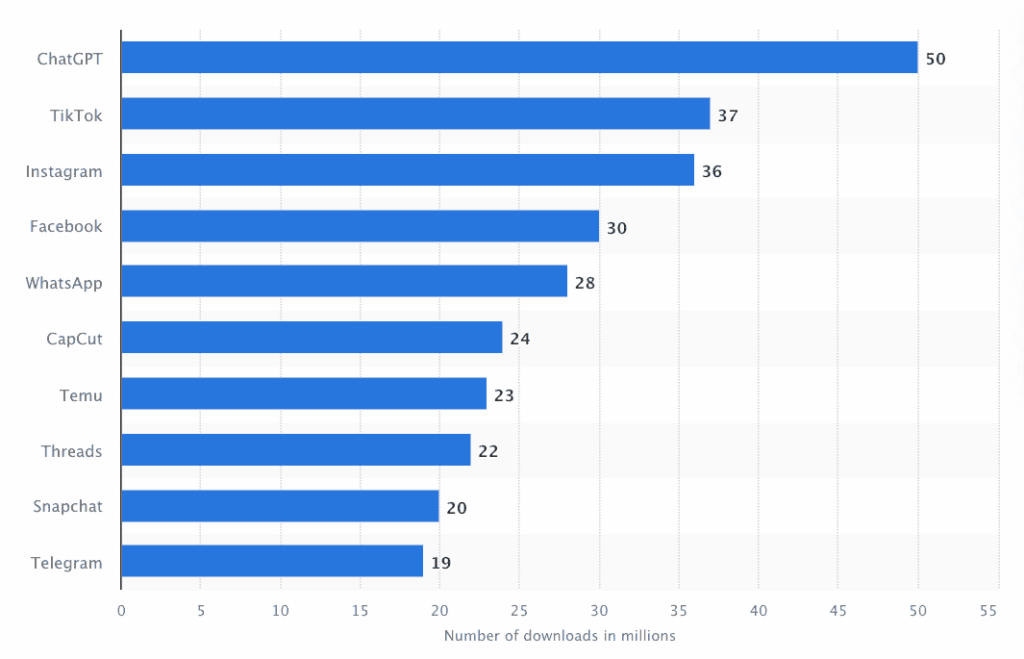

By 2015-2017, most people who wanted a smartphone had one. The installed base was enormous and growing slowly. Apps in major categories had already achieved dominance: Facebook, Instagram, Snapchat, Google Maps, Uber, Lyft, Spotify, Netflix. These were the winners.

From 2018 onward, growth became about replacement cycles and geographic expansion into emerging markets. But the replacement cycle is slow. Your phone lasts 3-4 years. And emerging markets have different dynamics around smartphone adoption.

The download curve flattens when you hit maturation. It's the same pattern you see with automobiles, television, internet access, or any other technology that becomes ubiquitous.

At maturation, growth comes not from more users, but from more engagement and monetization from existing users. That's exactly what we're seeing in the app economy. Downloads are flat or declining slightly, but spending is accelerating.

It's worth noting that these are global figures that aggregate very different markets. In the United States and Western Europe, smartphone penetration is approaching 100%. But in Asia, Africa, and Latin America, there's still significant growth in new user acquisition.

So the global download decline partly reflects the U.S. and Western Europe hitting saturation first. Growth in emerging markets isn't enough to offset the stagnation in developed markets.

For app developers and companies building in this space, the implication is clear: stop thinking about growth through acquisition. Think about how to extract more value from your existing user base. That's where the money is.

The Shift from User Acquisition to Monetization Optimization

Because downloads are declining, the entire business model of the app industry had to shift. And it did, dramatically.

Five years ago, the playbook was: acquire users at any cost, achieve scale, figure out monetization. User acquisition spending was enormous. Companies like Glu Games, Playrix, and others would spend $50 million annually on user acquisition to get players into their games.

That model doesn't work anymore. If downloads are flat or declining, spending aggressively on acquisition just gets you lower-quality users who have less lifetime value.

So the industry shifted. Now the playbook is: be very selective about which users you acquire, and once you have them, relentlessly optimize monetization.

This shows up in how successful apps think about their funnel. Instead of a wide funnel trying to capture as many downloads as possible, you get a narrower funnel focusing on high-intent users who are likely to engage and pay.

It also shows up in product decisions. Features that improve monetization are prioritized over features that improve engagement. Battle pass systems in games, tiered pricing in productivity apps, premium cosmetics in social apps—these are all direct monetization optimization.

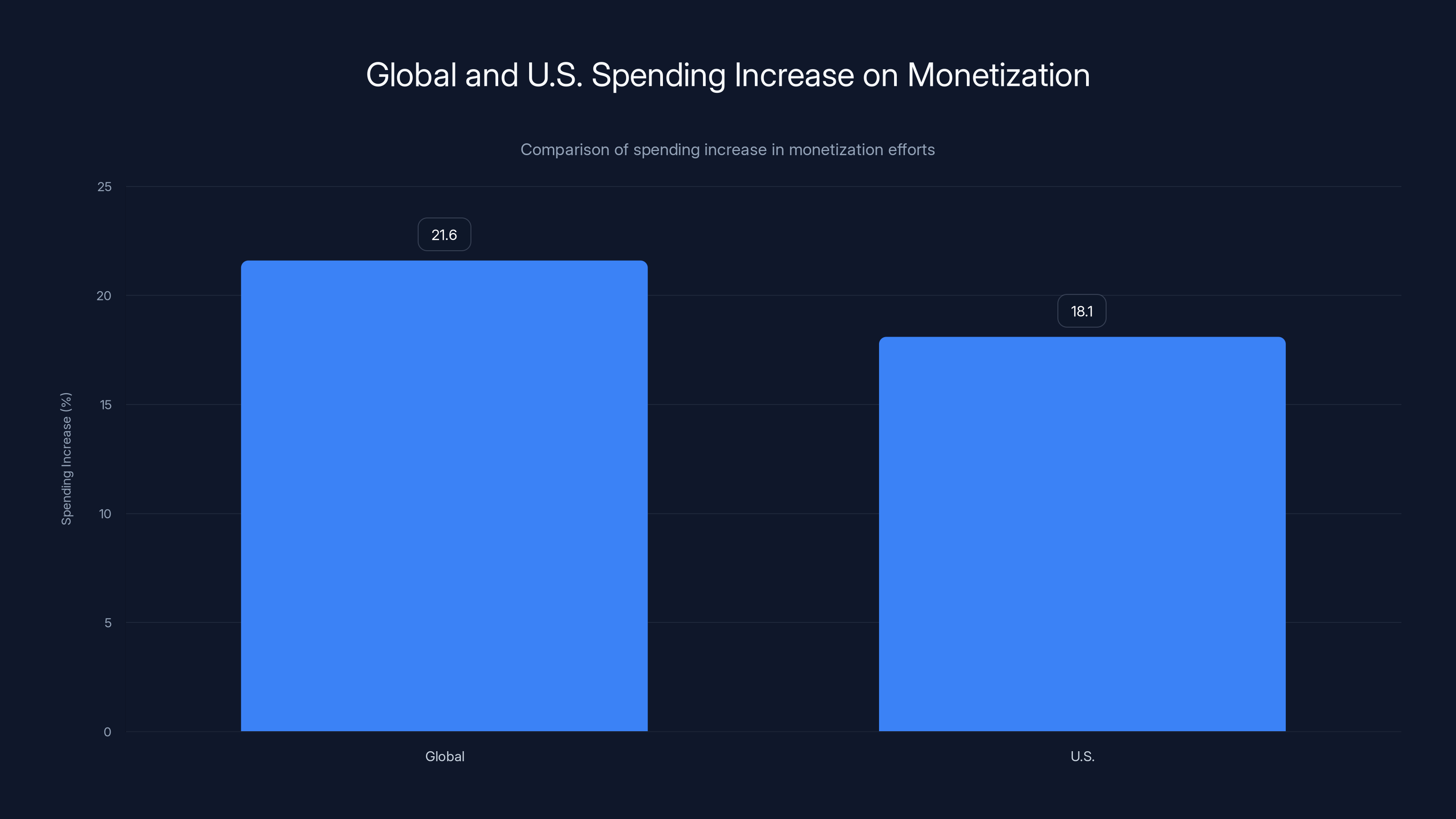

The data supports this shift being successful. Spending is up 21.6% globally and 18.1% in the U.S., even as downloads decline. That doesn't happen by accident. It happens because companies are systematically getting better at monetization.

This has second-order effects on how apps are designed. Games that used to try to appeal to everyone now target narrow demographics with specific mechanics optimized for monetization within that demographic. Productivity apps that used to offer free tiers increasingly require payment. Social apps that used to be free now have subscriptions.

Users, inevitably, complain about this. The general sentiment is that every app now has some kind of paywall or aggressive monetization. And that's accurate. But from a business perspective, it's a rational response to the reality of a mature market.

Spending on monetization optimization has increased by 21.6% globally and 18.1% in the U.S., indicating a successful shift from user acquisition to monetization strategies.

Non-Game App Categories Leading Growth

Within the non-game app category, some segments are growing faster than others. Understanding which categories are accelerating tells you where the money is moving.

Productivity and business apps are probably the biggest growth driver. Tools like Notion, Monday.com, Figma, Asana, and Slack have become essential infrastructure for knowledge workers. These aren't cheap apps. Many cost $10-20+ per month per user. But professionals and companies pay because these tools directly impact how they work.

The growth in this category reflects several trends. Remote work became normalized post-pandemic, increasing the value of collaboration and productivity tools. Artificial intelligence is being integrated into these tools, adding genuine value and justifying premium pricing. And the overall shift toward subscription models in enterprise software is cascading down to SMB and consumer tools.

Fitness and health apps are another growth category. Apple Fitness Plus, Peloton, Strava, MyFitnessPal, Strong, Trello Fitness, and dozens of others have achieved significant adoption. These apps benefit from the broader wellness trend and the fact that health is something people are willing to pay for.

Finance and banking apps are growing as well. Mobile banking has become the default way people interact with financial institutions. Apps like Revolut, Wise, Mercury, and others are building alternative financial services entirely on mobile. And people are willing to pay for premium features around financial management.

Streaming and entertainment apps continue to grow, though with varying fortunes. Netflix, Disney Plus, YouTube Premium, Apple TV Plus—these are all substantial revenue generators. But the category is also getting crowded, which is squeezing margins.

The common thread across all growing categories is they're solving real problems or delivering genuine value. Apps that exist just to exist, or that try to monetize through aggressive advertising or manipulative mechanics, are struggling.

The Games Category: Consolidation and Market Contraction

Mobile games are contracting, and it's worth understanding why because it has broader implications for the app economy.

The mobile games market is winner-take-most. The top 100 games probably capture 80% of spending. Titles like PUBG Mobile, Candy Crush, Clash of Clans, Honor of Kings, and a few others dominate. The long tail of games, millions of titles struggling for attention, generates relatively little revenue.

This creates a brutal dynamic for indie game developers or mid-tier studios. The production budgets required to create competitive games have increased substantially. The user acquisition costs for games have also increased. And the payoff is uncertain unless you hit the winner category.

So what happens is consolidation. Large publishers with substantial capital and expertise in game monetization dominate. Smaller developers either specialize in niche categories or give up entirely.

The 8.6% download decline for games year-over-year reflects this consolidation. Fewer new games are being downloaded because fewer new games are worth downloading. The ones that succeed do so with enormous marketing budgets and exceptional core gameplay.

Casual games, which used to be a significant category, have been squeezed the hardest. A match-3 game or a simple puzzle game now faces competition from hundreds of similar titles. Unless you can differentiate through exceptional design, licensed IP, or novel mechanics, success is unlikely.

Hyper-casual games, which used to be a thing, are basically extinct as a profitable category. The business model of simple games with ad monetization doesn't work when user acquisition costs are high and retention is low.

Hardcore games—games targeting serious gamers with depth and complexity—continue to perform well. Genshin Impact, Diablo Immortal, Lost Ark, and similar titles attract dedicated audiences willing to spend significant money. But these are expensive to develop and maintain.

Mobile esports games are an interesting category. Games that support competitive play and tournaments create engagement opportunities that extend far beyond casual gameplay. But again, these require serious investment.

The future for games appears to be continued consolidation around premium titles with high production values, strong IP, and robust monetization mechanics. Indies will survive in niche categories but won't be able to compete in mainstream segments.

In 2025, U.S. consumers spent

The Monetization Infrastructure Boom: New Opportunities

Because the app economy is becoming increasingly sophisticated around monetization and subscriptions, an entirely new layer of business opportunity has emerged. Companies building infrastructure for other companies to monetize better are attracting serious capital.

Revenue optimization platforms are probably the most important category. These help app developers manage subscriptions, in-app purchases, pricing strategies, and analytics around monetization. RevenueCat raised $50 million; the market validated that this is a meaningful category.

Payment processing for apps has specialized significantly. Services like Stripe, Paddle, and others have developed specific offerings for app monetization. They understand the unique challenges around trial conversions, churn management, and cross-platform billing.

Analytics and attribution tools help apps understand where their paying users come from and how to optimize user acquisition. Tools in this space help companies avoid wasting money on low-value user acquisition channels.

Marketing platforms specifically built for apps, like Liftoff Mobile, help companies promote their apps to relevant audiences. The value isn't generic marketing; it's app-specific marketing that understands the dynamics of app discovery and user acquisition.

Monetization consulting is another growing category. Companies like App Annie (now data.ai) sell strategic advice to app companies about how to improve their monetization. The fact that this is a substantial business shows how serious companies are about optimization.

Subscription management platforms are cropping up in every category now. Notion has subscription features. Slack has subscription features. Even apps that weren't initially subscription-based are adding them. Companies managing complex subscription ecosystems need tools.

The fact that Liftoff Mobile filed for an IPO signals that the market believes these infrastructure companies are sustainable, valuable, and worth public investment. That's significant validation.

Emerging Markets and Geographic Variation

The global numbers mask significant regional variation. Download growth and spending patterns look very different depending on where you look geographically.

In the United States and Western Europe, the market is mature. Smartphone penetration is near-universal. Downloads are flat or declining. But spending is growing because monetization is sophisticated. This is the most developed market.

In Asia-Pacific, including China, India, Southeast Asia, you have a different dynamic. China's app market is enormous and sophisticated, with companies like Tencent and Alibaba dominating. India has rapidly growing smartphone adoption and emerging monetization opportunities. Southeast Asian markets like Indonesia, Philippines, and Vietnam have huge young populations adopting smartphones.

The growth opportunities in emerging markets are substantial, but they come with specific challenges. Average revenue per user is lower. Payment infrastructure is less developed. Competition is intense. But the user base is enormous and growing.

Latin America and Africa are the next frontiers. Smartphone adoption is accelerating in both regions. But the app market is less developed. Monetization is limited partly because fewer people have access to payment methods and partly because average disposable income is lower.

For global companies, the strategy is often to build for mature markets first to understand product-market fit and monetization, then scale to growth markets. For companies starting fresh, emerging markets offer bigger addressable audiences but more execution risk.

The download decline in developed markets is partially offset by download growth in emerging markets. But developed markets contribute disproportionately to spending, so the total spending still grows even as downloads decline.

Despite a 2.7% decline in app downloads from 2024 to 2025, consumer spending surged by 21.6%, reaching $156 billion. This highlights a shift towards monetizing existing users more effectively.

Future Outlook: What Happens Next

Based on the trends we're seeing, a few things seem likely to continue over the next few years.

First, the consolidation trend will continue. Large publishers with capital, expertise, and distribution will get stronger. Smaller players will struggle unless they find very specific niches. This isn't unique to apps; it's the pattern across software.

Second, subscriptions will continue to be the dominant monetization model. Every major app category is moving in this direction. Free apps will become increasingly rare. When free apps do exist, they'll likely be ad-supported, which is also a form of monetization.

Third, AI will increasingly be integrated into apps as a value-add. We're already seeing this with AI-powered features in productivity tools, writing assistants, image generators, and more. As AI becomes cheaper and more capable, apps that don't incorporate it will seem outdated. This will also unlock new pricing tiers and monetization opportunities.

Fourth, the shift from user acquisition to retention and monetization optimization will accelerate. Companies will spend less on acquiring new users and more on keeping and monetizing existing users.

Fifth, privacy and data regulations will continue to create headwinds for app developers trying to optimize user acquisition. iOS's App Tracking Transparency has already made app-to-app tracking harder. Continuing regulatory pressure will likely make this worse. Apps will need to rely more on owned data and direct response channels.

Sixth, we'll likely see further market consolidation in specific categories. The winner-take-most dynamics in social, dating, and entertainment apps will probably continue. But in productivity and utility categories, there might be more room for multiple successful players.

Seventh, emerging markets will become increasingly important. As developed markets mature, growth will come from emerging market expansion. Companies successful in developed markets will expand internationally.

Key Takeaways for App Developers and Entrepreneurs

If you're building an app or app-based business, the data points to some clear conclusions.

First, don't chase downloads. Downloads are table stakes. If you can't get people to install your app, you've failed. But massive download numbers don't correlate with success anymore. What matters is how much revenue each user generates over their lifetime.

Second, build subscription pricing into your DNA from day one. Don't launch with a free product and plan to monetize later. Think about what you're offering and what it's worth. Price accordingly. If your app is worth something, charge for it. Users respect that more than they respect ads or manipulative in-app purchases.

Third, focus on retention and engagement. In a mature market, keeping users engaged is more valuable than acquiring new ones. Build your product around the needs of your core users. Refine based on feedback. Create genuine value.

Fourth, understand your unit economics. How much does it cost to acquire a user? How long do they stay? How much do they spend? These metrics tell you whether your business model is sustainable. If it's not, you need to fix it immediately.

Fifth, specialize rather than generalize. The era of massive, everything-to-everyone platforms for consumers is mostly over. The successful apps are usually good at one thing. Master that thing and then consider expanding.

Sixth, if you're building for games, understand that the market is brutal. You need exceptional core gameplay, significant marketing budgets, and likely some form of licensed IP or unique hook. If you're not confident in all three, the odds are very low.

Seventh, if you're building non-game apps, the opportunity is still substantial. The category is growing at 33.9% year-over-year in spending. But competition is increasing. You need to solve a real problem and do it better than existing solutions.

Eighth, don't dismiss emerging markets. The users are there. The spending potential is lower per user, but the scale is enormous. If you can figure out how to profitably serve emerging markets, you have access to billions of potential users.

Ninth, stay informed about changes to platform policies. Apple and Google can fundamentally reshape your business through policy changes. App Tracking Transparency is the most recent example. Stay ahead of regulatory changes and policy shifts.

Tenth, consider building infrastructure or tools for other app developers. If you understand the app business deeply, helping other developers monetize better is a valuable business. The venture market clearly believes in this category.

The Bigger Picture: What This Means for the Digital Economy

Zoom out and the picture becomes even clearer. The app economy's shift from growth to monetization is symptomatic of a broader digital economy maturation.

Software has stopped being about user count and started being about profit. That's not cynicism; that's maturity. When everything is new, metrics like downloads and active users matter because growth is the primary signal of success. But once markets mature, profitability matters more.

We've seen this pattern before. Social media went through a similar evolution. Early stage was all about user acquisition and engagement metrics. Later stage became about monetization and profitability. Facebook almost died as a business in the early-to-mid 2000s before figuring out ad targeting.

The app economy's shift is faster because the creators have the benefit of learning from other digital platforms' evolution. They're not waiting for the market to force the issue; they're proactively optimizing for monetization.

This also signals that the venture capital model for funding app companies is changing. The old model was: fund growth at any cost, get to scale, find monetization later. That model worked when markets were expanding. It doesn't work when markets are mature.

The new model is more focused on unit economics from day one. VCs are asking harder questions about how companies will make money. Founders are building with monetization in mind from the beginning.

This is healthier for the ecosystem, honestly. It means more apps will be built with sustainable business models. Fewer apps will launch with unsustainable unit economics and burn through capital before running out of funding.

It also means consolidation and winners. Some companies will win and grow to enormous scale. Many will stay small and profitable. Some will fail. That's the pattern in mature markets.

But the overall market is expanding. Nearly $156 billion in consumer spending is enormous and growing. The app economy isn't dying; it's evolving.

FAQ

What caused the shift from downloads to spending growth in the app market?

The shift reflects market maturation. As smartphone penetration approaches 100% in developed markets, new user acquisition becomes increasingly difficult and expensive. Companies responded by focusing on extracting more value from existing users through subscriptions, in-app purchases, and premium features. This strategy has proven successful, with spending growing 21.6% globally despite declining downloads.

Why are mobile game downloads declining faster than non-game app downloads?

The games market is experiencing winner-take-most consolidation. The top 100 games capture most spending, leaving millions of other games fighting for attention. User acquisition costs for games are high, and production budgets required to compete have increased substantially. Non-game apps, which solve specific utility problems, have higher structural demand and face less direct competition from similar solutions.

How are subscription models changing app development strategies?

Subscription models are becoming the default monetization approach across all app categories. This changes product development priorities, with features that improve retention and encourage recurring payment often prioritized over features that increase engagement. It also attracts venture capital to infrastructure companies that help app developers manage subscriptions and optimize monetization.

What does the decline in downloads mean for app developers in 2025?

Declining downloads mean that user acquisition becomes secondary to retention and monetization optimization. Developers should focus on converting existing users to paying customers rather than spending aggressively on acquiring new users. Success increasingly depends on understanding unit economics, optimizing for lifetime value, and building genuinely valuable products that justify subscription pricing.

Which app categories are seeing the strongest growth in consumer spending?

Non-game apps are experiencing the strongest growth, up 33.9% year-over-year in spending. Within this category, productivity and business tools, fitness and health apps, and finance and banking apps are particularly strong. These categories appeal to users with specific problems to solve and higher willingness to pay for solutions.

How are emerging markets different from developed markets in app economics?

In developed markets like the U.S. and Western Europe, downloads are flat and monetization is sophisticated. In emerging markets, smartphone adoption is still growing, offering access to billions of new potential users. However, average revenue per user is lower due to lower disposable income and less developed payment infrastructure. Companies often launch in developed markets first to optimize product and monetization before expanding to emerging markets.

Why are companies investing in app monetization infrastructure startups?

As the app economy becomes more focused on monetization, developers need tools to manage subscriptions, optimize pricing, handle payment processing, and analyze user behavior around spending. These infrastructure companies solve real problems and help developers maximize revenue. The venture market's validation—evidenced by companies like RevenueCat raising $50 million and Liftoff Mobile filing for IPO—shows investors believe this category will have sustained long-term value.

What percentage of app spending is concentrated in the top games?

The top 100 mobile games capture approximately 80% of all mobile game spending, despite representing less than 0.01% of available games. The top 10 games alone generate $4-5 billion in annual revenue. This extreme concentration reflects the winner-take-most dynamics in the games market and explains why indie game development is increasingly difficult.

How does the U.S. app market differ from the global market?

The U.S. represents the most mature market segment, with higher spending per capita ($168/year) and a stronger shift toward non-game apps (60% of spending vs. 53% globally). U.S. downloads have declined 4.2% year-over-year, slightly steeper than the global 2.7%, indicating the U.S. market is further along in saturation. However, the U.S. continues to generate disproportionate revenue relative to its population size.

What should app developers focus on in 2025 given these trends?

Developers should prioritize understanding their unit economics, build subscription pricing into products from day one, focus on retention over acquisition, specialize rather than generalize, and consider emerging markets for growth. If building games, be aware that competition is severe and success requires exceptional core gameplay, significant marketing budgets, and likely some form of differentiation through IP or unique mechanics. For non-game apps, the opportunity remains substantial but competition is increasing.

How is artificial intelligence expected to impact app monetization?

AI features are being integrated into apps as value-adds that enable premium pricing tiers. Productivity tools with AI writing assistants, image generators with AI capabilities, and analytics tools with AI-powered insights all create opportunities for premium subscriptions. As AI becomes cheaper and more capable, apps without AI features may struggle to justify their pricing, making AI integration increasingly essential for competitiveness in many categories.

Conclusion

The mobile app economy in 2025 tells a story of fundamental maturation and strategic transformation. Fewer downloads don't indicate decline; they indicate a shift in how the software business works at scale.

We're witnessing the evolution from a growth-obsessed market, where user acquisition at any cost was the priority, to a profitability-focused market, where extracting value from existing users is paramount. This evolution benefits sustainable businesses and hurts companies built on unsustainable unit economics.

The numbers support this interpretation completely. Downloads down 2.7% while spending grows 21.6% isn't a contradiction; it's the perfect illustration of a market transitioning from growth metrics to monetization metrics.

For app developers, this creates both challenges and opportunities. The challenge is that acquiring new users is harder and more expensive. The opportunity is that users willing to pay are increasingly available, and the business models to capture that willingness are now proven and scalable.

For infrastructure companies, the opportunity is enormous. Developers need help managing subscriptions, optimizing pricing, handling payments, and understanding user behavior. These are valuable problems, and the venture capital market is clearly betting that companies solving them will be worth billions.

For consumers, it means nearly every app will have some form of monetization. That's not inherently bad if the pricing is fair and the value is clear. The apps that will win are those that build genuine value and price accordingly, not those trying to manipulate users into spending through dark patterns and aggressive mechanics.

The app economy isn't slowing down or dying. It's just growing up. And that growth is manifesting as spending, not downloads. Understanding that distinction is critical for anyone building, investing in, or using software on mobile devices.

The next few years will show which companies understood this transition early and which ones missed it. The ones that did will likely dominate the app economy for the next decade.

![Mobile App Downloads Drop Again, But Consumer Spending Hits $156B [2025]](https://tryrunable.com/blog/mobile-app-downloads-drop-again-but-consumer-spending-hits-1/image-1-1768423155549.jpg)