Netflix Vertical Video Mobile App Redesign: What's Coming in 2025-2026

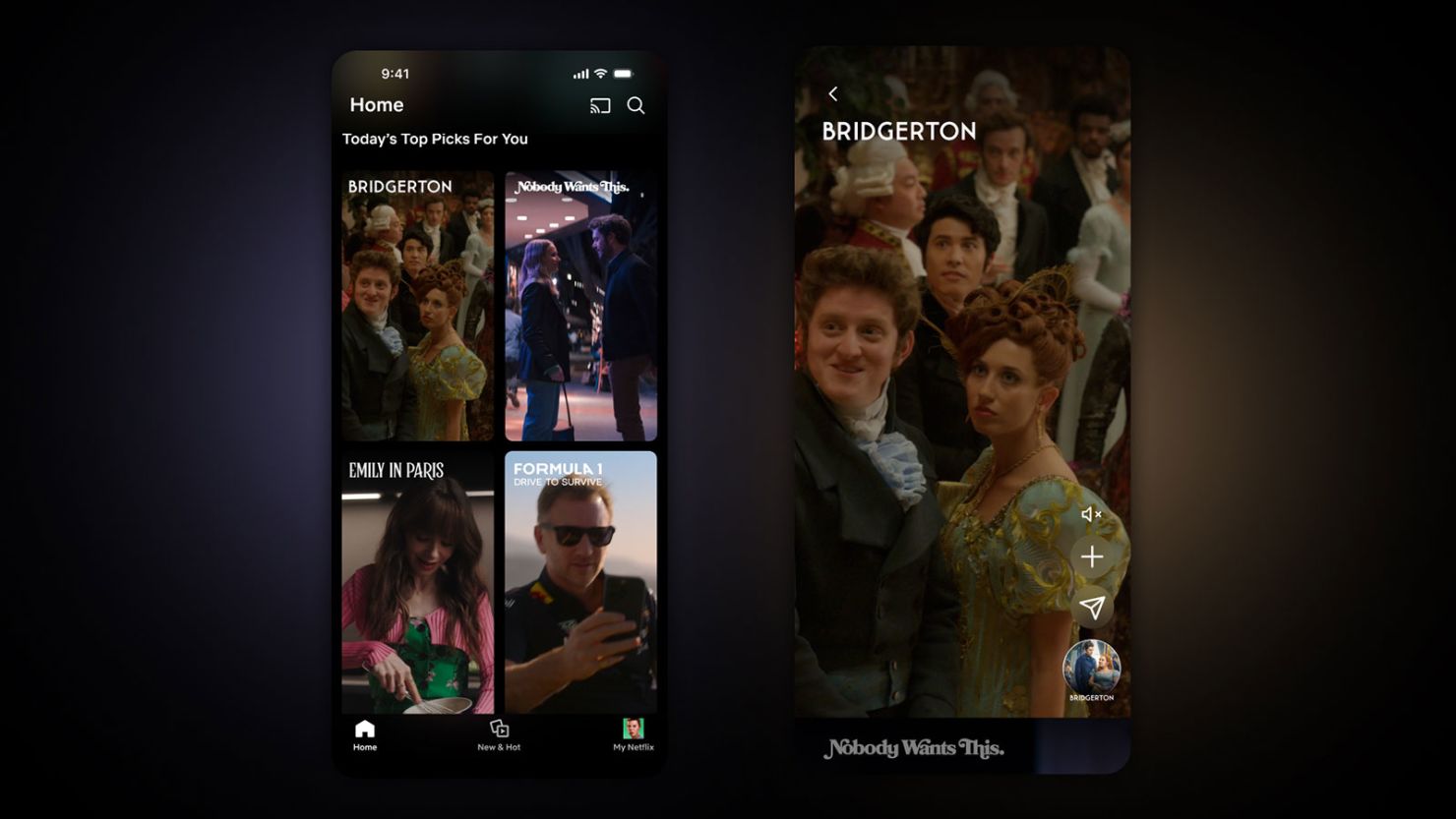

Netflix has been quietly testing one of the most significant shifts in how we consume streaming content. After six months of testing, the company confirmed it's bringing vertical video integration deeper into its mobile experience sometime in 2026. But this isn't just a cosmetic update or a minor feature addition. This is Netflix fundamentally reimagining how mobile users discover, engage with, and consume its content as reported by TechCrunch.

If you've used TikTok, YouTube Shorts, or Instagram Reels, you already understand the appeal. Vertical video is native to how we hold our phones. It's frictionless. You swipe. Content appears. You're engaged. Netflix executives know this better than almost anyone. And they're betting that vertical video—combined with emerging content types like video podcasts—will keep viewers scrolling, watching, and staying subscribed according to Engadget.

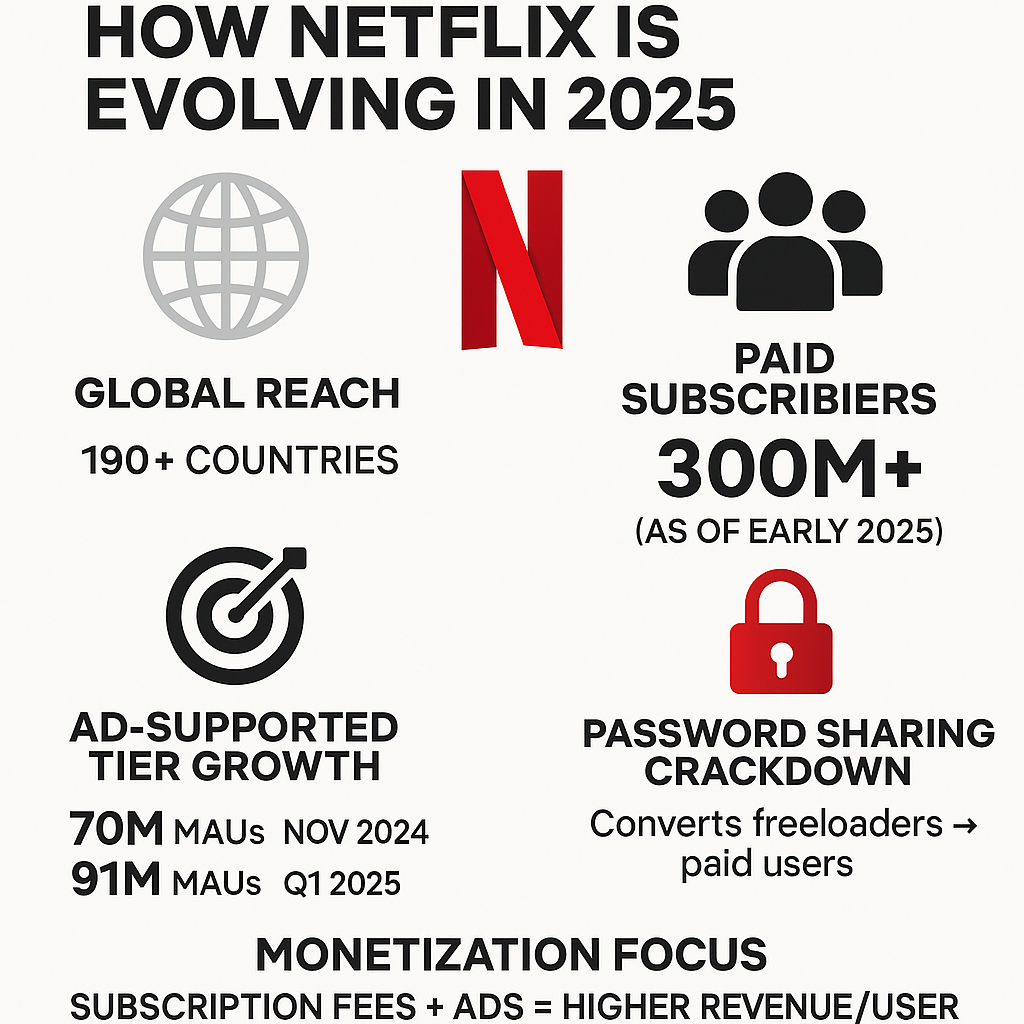

The stakes are enormous. Netflix has 325 million paid subscribers globally as of early 2025, with revenue hitting

In this comprehensive guide, we'll break down what Netflix's vertical video redesign means, how it works, why the company is doing this, what the competition looks like, and what this signals about the future of streaming.

TL; DR

- Vertical video arrives in 2026: Netflix is integrating short-form vertical video deeper into its mobile app, moving beyond the testing phase that started in 2024 as reported by The Hollywood Reporter.

- Swipe-based discovery: The new feed displays clips from Netflix films and TV shows using TikTok-style swiping, making content discovery more engaging according to TechCrunch.

- Video podcasts are the real play: Netflix is using vertical video to promote and integrate video podcasts, positioning itself against YouTube's dominance in podcast hosting as discussed in Fortune.

- Mobile-first redesign: The company is acknowledging that mobile isn't secondary anymore—it's primary, and the UI/UX needs to reflect that reality as noted by Business.com.

- 325 million subscribers at stake: With massive competition from YouTube, TikTok, and other platforms, Netflix needs to keep viewers engaged on mobile or risk losing them according to The Hollywood Reporter.

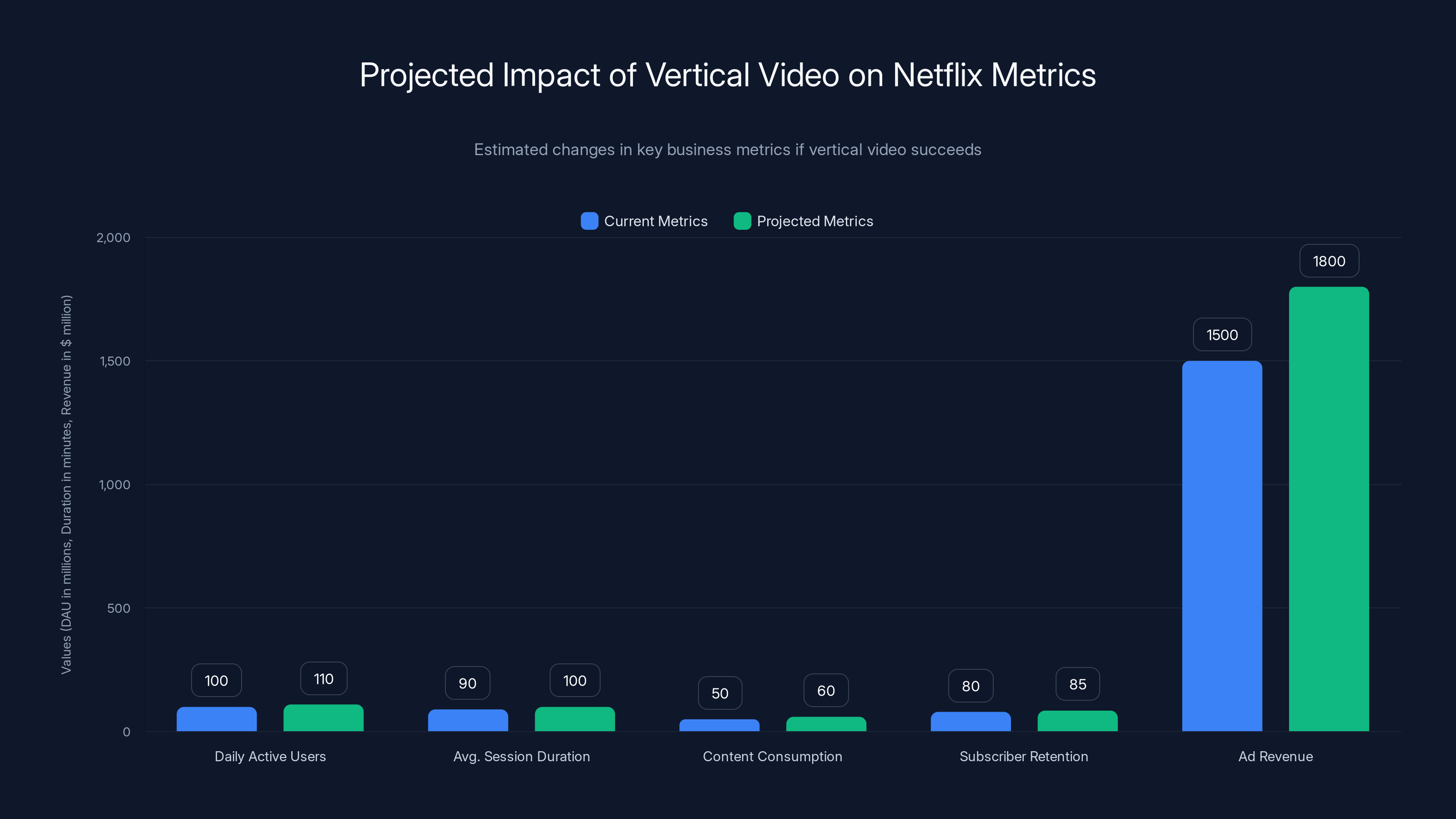

Estimated data shows potential 10% increase in DAU and session duration, with significant ad revenue growth if vertical video succeeds.

The Current State of Netflix's Vertical Video Testing

Netflix didn't invent vertical video—not even close. YouTube Shorts, TikTok, Instagram Reels, and Snapchat Stories have been dominating vertical consumption for years. But Netflix's approach is different because Netflix has something those platforms don't: a massive library of professionally produced content, committed subscribers paying monthly fees, and a content ecosystem worth tens of billions of dollars as highlighted by Engadget.

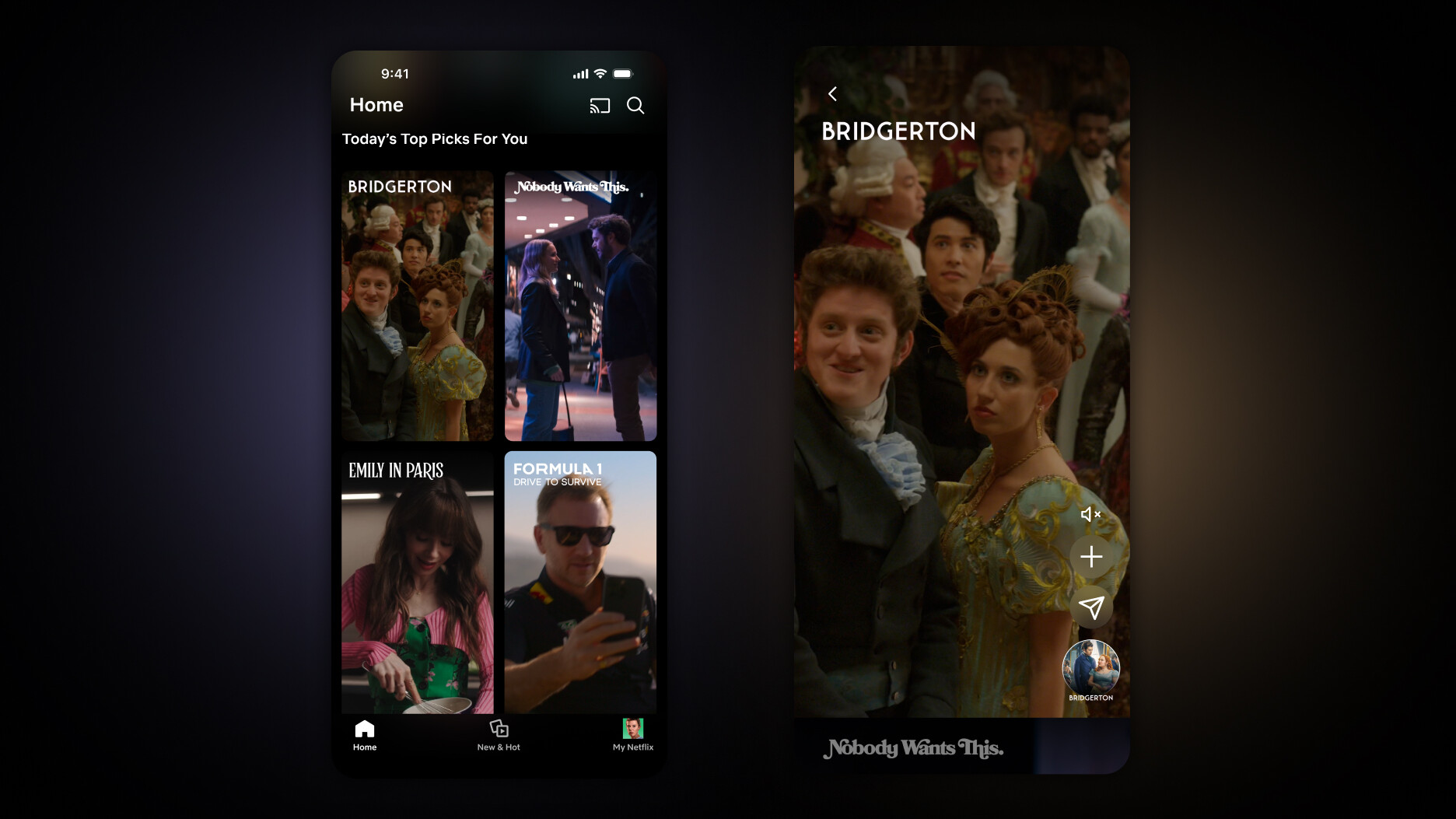

For the past six months, Netflix has been testing vertical video feeds on its mobile app. The concept is straightforward: short clips from Netflix movies and TV shows are presented in a vertical, swipe-to-advance feed. Think Instagram Stories meets Netflix catalog. Users see a 15-second clip from a movie, swipe up, and get another clip from a different show. It's designed to promote content, create discovery moments, and keep mobile users engaged as reported by The Hollywood Reporter.

The key insight here is that this isn't about Netflix creating vertical content from scratch. Instead, they're repurposing existing content—trailers, clips, behind-the-scenes footage—and reformatting it into bite-sized vertical pieces. Netflix already has the content. They just need to present it differently according to TechCrunch.

What makes this different from previous efforts is the integration depth. Netflix isn't adding vertical video as a separate app section or Easter egg. Co-CEO Greg Peters indicated on the earnings call that vertical video will be deeply woven into the mobile experience. This suggests it could appear throughout the app: in the main feed, as a discovery mechanism, in notification prompts, and potentially even as a replacement for some existing browse functions as discussed in Fortune.

The testing phase has given Netflix crucial data. They've learned which types of clips perform best. They've seen how users interact with vertical feeds versus horizontal carousel browsing. They've measured watch-through rates, click-through rates to full content, and ultimately, whether vertical video actually drives meaningful engagement as reported by The Hollywood Reporter.

From a product perspective, this is Netflix using data to make a strategic bet. If vertical video testing had failed, we wouldn't be seeing a 2026 rollout. The fact that Greg Peters publicly announced this feature means the metrics supported it according to TechCrunch.

Why Netflix Is Making This Move Now

Understanding Netflix's motivation requires understanding the broader context of streaming in 2025-2026. The era of easy growth is over. Every streaming service has competed heavily on exclusive content. Prices have risen. Password sharing crackdowns have squeezed new subscriber acquisition. The focus has shifted from "how do we get more subscribers" to "how do we keep them engaged and monetize better" as discussed by Business.com.

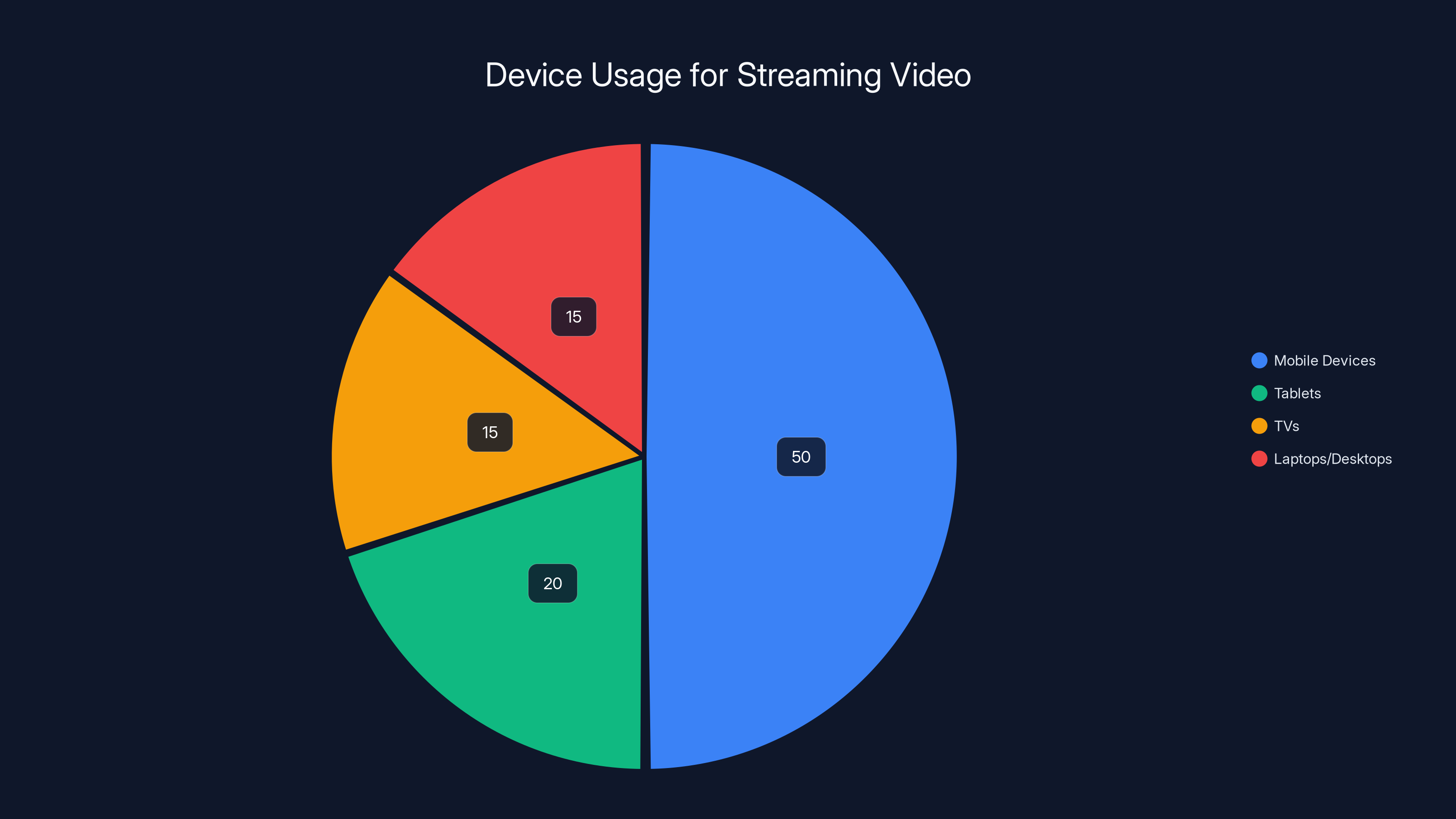

Mobile engagement is the battleground. According to usage data, most Netflix viewing happens on mobile devices—tablets, smartphones, laptops. If Netflix can increase the time people spend in the mobile app, they increase the likelihood of binge-watching, they improve their recommendation algorithm's effectiveness, and they create more opportunities to surface premium content and paid tiers as highlighted by Engadget.

Vertical video is a mechanism to solve a fundamental problem: discovery friction. Today, when you open Netflix, you're presented with a grid of thumbnails. You scroll. You see something interesting. You click. You watch. It works, but it's not frictionless. Vertical video removes friction. Swipe. Watch. Swipe. It's the same behavior that's made TikTok incredibly effective at keeping users engaged according to TechCrunch.

The second driver is competition. YouTube has become a serious threat to Netflix's streaming dominance. YouTube Shorts get billions of daily views. YouTube Premium subscribers watch YouTube almost as much as they watch Netflix. YouTube's algorithm is arguably better at understanding what users want to watch next. Netflix needs to offer something that YouTube doesn't: a vertical discovery experience powered by Netflix's premium content library as discussed in Fortune.

TikTok is an even bigger threat on the engagement front. TikTok's average session is nearly an hour. Users open TikTok and disappear into a vortex of recommendations. Netflix needs to create a similar gravitational pull, but for Netflix content. Vertical video is part of that solution as noted by Techloy.

The third driver is emerging content types. Netflix is expanding beyond traditional TV shows and movies. Video podcasts are the new frontier. Greg Peters mentioned that vertical video could promote "new content types, like video podcasts." This is the real strategy. Netflix is betting that video podcasts will become a significant consumption category, and vertical video feeds are the ideal way to promote and surface them as reported by The Hollywood Reporter.

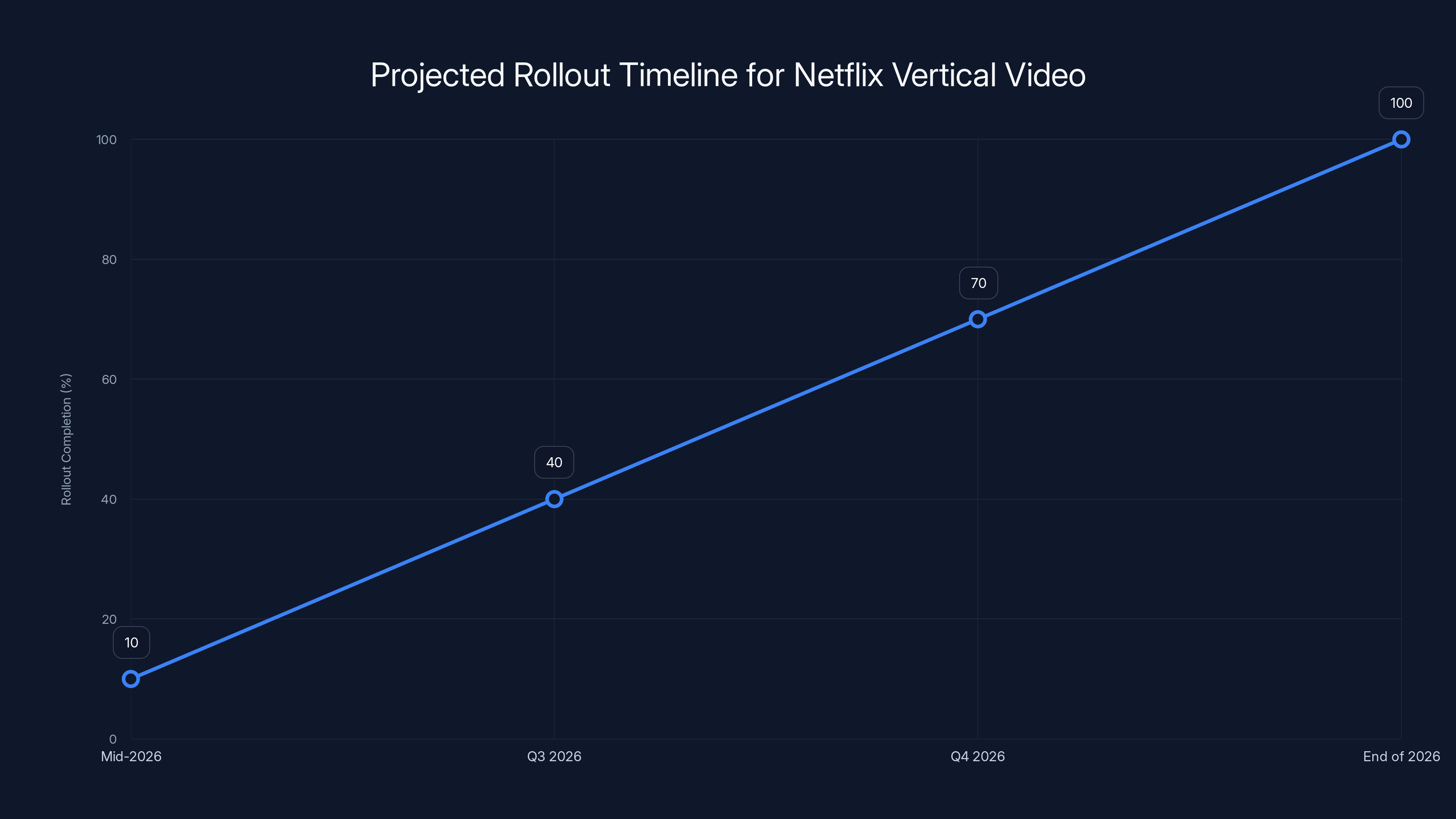

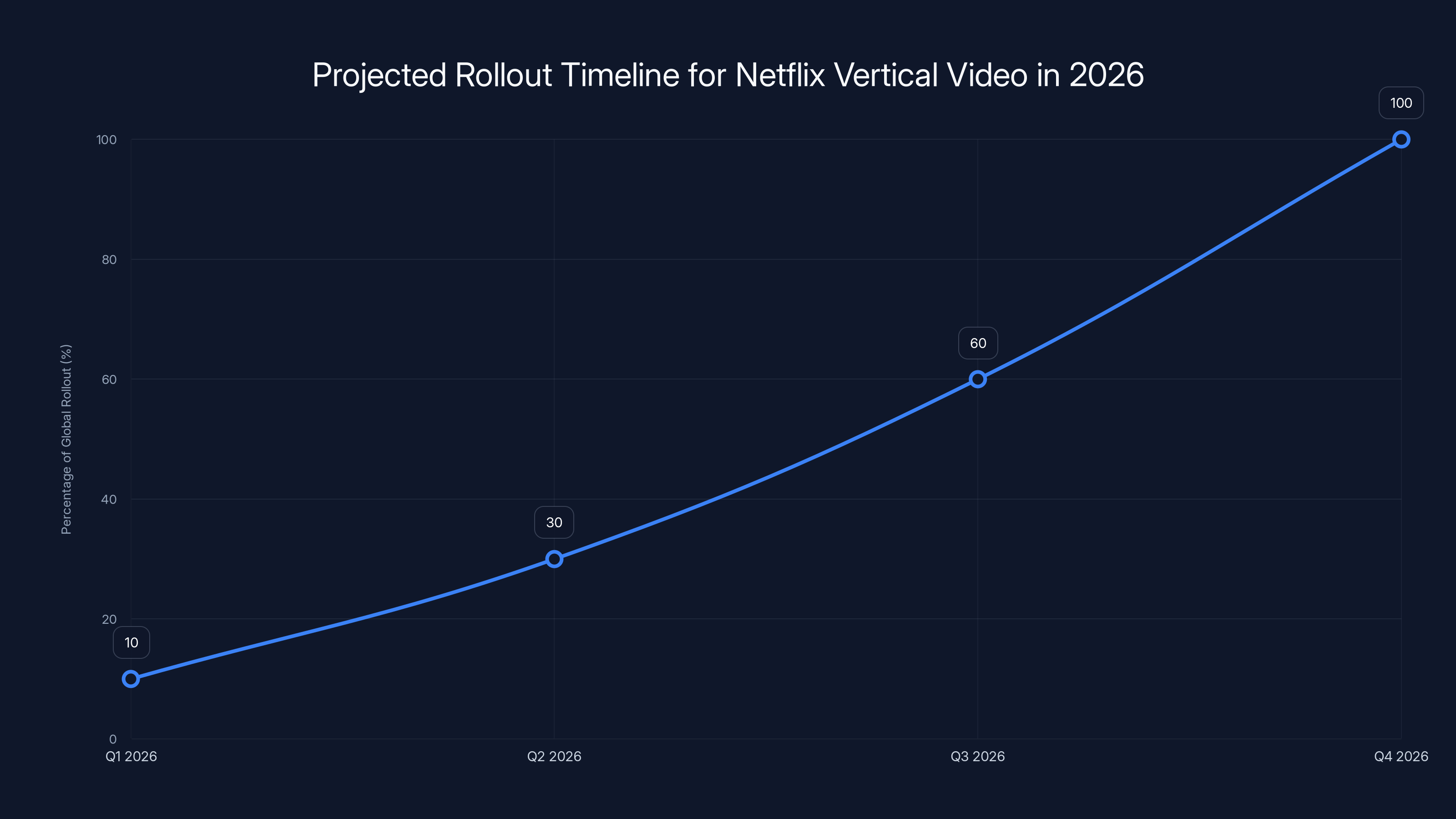

Estimated data suggests Netflix's vertical video feature will gradually roll out, starting mid-2026 and reaching full availability by the end of 2026.

Netflix's Video Podcast Strategy and Vertical Video

In early 2025, Netflix debuted its first original video podcasts. The slate includes shows from sports commentator Michael Irvin, comedian Pete Davidson, and hosting arrangements with The Ringer (featuring Bill Simmons) and other established podcast networks. This isn't Netflix casually entering podcasting. This is a strategic investment to own content that wasn't available on Netflix before as reported by The Hollywood Reporter.

Video podcasts represent a new revenue stream and a new reason for people to maintain their Netflix subscription. If you subscribe to Netflix solely for "The Crown" but discover you also love the Michael Irvin podcast, Netflix's hold on your subscription strengthens. You're now paying for multiple content types, not just scripted entertainment as discussed in Fortune.

But here's the challenge: how do you surface a three-hour video podcast to users who are conditioned to expect 40-minute TV episodes and 90-minute movies? Vertical video solves this. A 30-second clip from a podcast—Michael Irvin discussing a controversial football call, for instance—appears in your vertical feed. You watch the clip. You're intrigued. You click to watch the full episode according to TechCrunch.

This is Netflix using vertical video as a discovery and promotion mechanism for content that doesn't fit traditional Netflix discovery patterns. It's brilliant product strategy because it creates a path to podcast consumption that feels native to mobile, rather than asking users to change their behavior as highlighted by Engadget.

Netflix is also positioning itself against YouTube's dominance in podcast hosting. YouTube has a massive advantage: creators like Joe Rogan, Lex Fridman, and hundreds of others have already built audiences there. Netflix can't replicate that overnight. But Netflix can create new podcast content exclusively, market it exclusively, and eventually, build podcasting into a material part of the Netflix value proposition as discussed in Fortune.

The vertical video integration is the marketing engine for that strategy. Every Netflix subscriber will see podcast clips in their feed. Some will convert to viewers. Some viewers will become regular listeners. Regular listeners become more committed subscribers who are less likely to churn as reported by The Hollywood Reporter.

How the Vertical Video Feed Actually Works

While Netflix hasn't released exhaustive technical documentation, we can infer how the vertical video feed will function based on similar implementations at TikTok, YouTube, and Instagram.

When you open the vertical video feed (likely accessible from the main Netflix mobile menu or home screen), the app loads a series of short clips. Each clip is formatted vertically, optimized for phone screens, and typically between 15 and 45 seconds long. The initial clip auto-plays with sound or captions according to TechCrunch.

You have several interaction options: swipe up to see the next clip, tap the clip to navigate to the full content (the movie trailer, the podcast episode, etc.), double-tap to like, or scroll down to return to the main Netflix interface as highlighted by Engadget.

Under the hood, Netflix's recommendation algorithm determines which clip you see next. The algorithm considers your watch history, your ratings, content genres you've engaged with, time of day, and dozens of other signals. The goal is simple: show you clips of content you're likely to watch as discussed in Fortune.

Netflix's infrastructure already handles this type of algorithmic ranking—it powers the main feed, custom rows, and personalized recommendations. The vertical video feed is essentially a new presentation layer on top of existing recommendation engines as reported by The Hollywood Reporter.

One interesting technical challenge is video encoding. Vertical video requires different aspect ratios (typically 9:16) compared to Netflix's standard 16:9 widescreen content. Netflix will need to either re-encode existing clips or create vertical-optimized versions. Given Netflix's massive technical infrastructure and content production capabilities, this is solvable but not trivial according to TechCrunch.

The feed will likely include metadata below or beside the video: the show or movie title, a brief description, user ratings, or a "Watch Now" button. Some versions might include interactive elements—polls, quizzes, or calls-to-action that drive engagement as highlighted by Engadget.

The feed will be available on all Netflix mobile platforms: iOS, Android, tablets, and potentially mobile web browsers. Netflix will probably prioritize smartphones because that's where most users consume vertical content, but the experience should be consistent across devices according to TechCrunch.

One crucial design decision Netflix hasn't publicly detailed: how will vertical video coexist with traditional Netflix browsing? Will the vertical feed be opt-in or opt-out? Will it replace the current main feed or complement it? These decisions will significantly impact user experience and adoption as discussed in Fortune.

Comparing Netflix's Approach to TikTok, YouTube Shorts, and Instagram Reels

Netflix isn't inventing vertical video consumption, but its implementation will differ in important ways from existing competitors. Let's break down the landscape.

TikTok's Dominance: TikTok essentially perfected the vertical video discovery engine. The algorithm is exceptional at understanding user preferences and serving addictive content. TikTok's average session is 52 minutes—users lose track of time. The platform has no inherent content type restrictions. You might watch a comedy sketch, then a cooking tutorial, then a dance trend, all in one session as noted by Techloy.

Netflix's approach is narrower. The content in the vertical feed will be exclusively Netflix original content and licensed shows/movies. Users won't see user-generated content, comments from strangers, or viral trends. It's a curated experience, not an open ecosystem. This is both a limitation (less diversity) and a feature (higher quality baseline) as highlighted by Engadget.

YouTube Shorts' Growing Threat: YouTube is Netflix's most direct competitor in professional video content. YouTube Shorts are embedded within YouTube's broader ecosystem—you might watch a 45-minute video essay followed by a 60-second Short. YouTube's algorithm integrates Shorts recommendations throughout the platform as discussed in Fortune.

YouTube Shorts also host podcasts. Major creators like Joe Rogan upload podcast clips to Shorts, driving discovery to their full-length podcast videos. Netflix is attempting to replicate this dynamic, but Netflix's content is exclusive to Netflix. You can't watch a Netflix podcast clip on TikTok or YouTube—you have to use Netflix to see it as reported by The Hollywood Reporter.

Instagram Reels' Positioning: Instagram Reels feel like Instagram's answer to TikTok, but they're less effective at pure discovery. Reels rely heavily on accounts you already follow. The algorithm is good but not as sophisticated as TikTok's. Instagram Reels drive engagement within existing social relationships rather than pure recommendation-based discovery as noted by Techloy.

Netflix's vertical video feed will be more like TikTok (algorithm-driven discovery) than Instagram (relationship-based). This makes sense given Netflix's positioning as a content destination, not a social platform as discussed in Fortune.

The Key Differentiator: Netflix has something competitors don't have at scale: a massive, professionally produced, exclusive content library. When Netflix shows you a clip, you know it's from a show or movie you can actually watch on Netflix. You don't have to navigate to a different platform or creator's YouTube channel. The friction between discovery and consumption is minimal as highlighted by Engadget.

TikTok content is often viral moments designed for TikTok. YouTube Shorts are often teasers or standalone content designed for that platform. Netflix vertical clips will be teasers for content that exists exclusively on Netflix. The funnel from discovery to consumption is closed within Netflix's ecosystem as reported by The Hollywood Reporter.

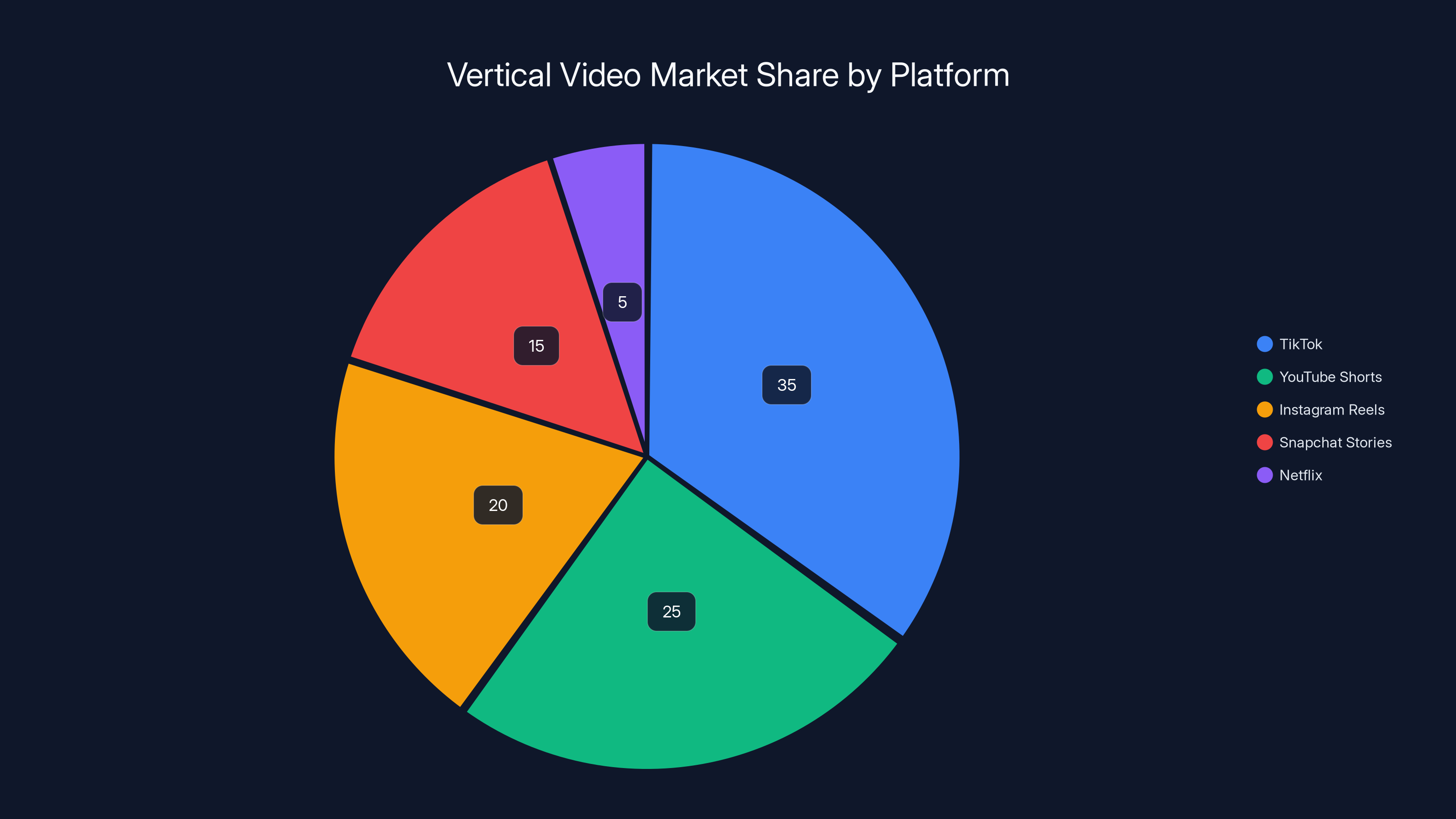

TikTok leads the vertical video market with an estimated 35% share, while Netflix's new entry is projected to capture around 5% of the market. Estimated data.

Why Vertical Video Matters for Mobile-First Streaming

The shift to vertical video reflects a deeper truth about how people use mobile devices: vertically. We hold phones upright. We scroll vertically. We think in vertical terms. Horizontal video (the traditional 16:9 widescreen format) requires us to rotate our phones, which introduces friction according to TechCrunch.

For years, streaming apps resisted vertical video because they were designed around TV viewing experiences. Netflix's interface was essentially a digital cable guide translated to mobile. You browse horizontally arranged thumbnails. You click to watch full-screen content as highlighted by Engadget.

But mobile consumption isn't a translation of TV consumption—it's a different behavior entirely. Mobile viewers have different expectations: more control, faster content switching, less commitment to watching full episodes. They're more likely to sample content than to commit to a 45-minute episode as discussed in Fortune.

Vertical video acknowledges this reality. It says: "We know you use your phone vertically. We're designing for that." It's not revolutionary thinking, but it's a significant shift for a company that built its empire on the TV experience as noted by Business.com.

From a technical standpoint, vertical video is more efficient. Vertical clips auto-fill the phone screen without letterboxing (black bars on the sides). The viewer's attention is focused entirely on the content. There's no wasted screen space, no distractions according to TechCrunch.

Mobile-first thinking is also about speed. Traditional Netflix browsing requires multiple steps: launch app, navigate to section, find content, watch trailer, commit to viewing. Vertical video reduces this: launch app, see video immediately, swipe, decide. It's faster, more spontaneous, more aligned with mobile behavior as highlighted by Engadget.

For Netflix's 325 million subscribers, this shift could have enormous implications. If the vertical feed increases average session duration by even 10%, that translates to millions of additional hours watched, better algorithmic data, and increased monetization opportunities through advertising and content engagement as discussed in Fortune.

The Advertising Angle: Why Vertical Video Matters for Revenue

Netflix's advertising business is growing rapidly. In 2025, the company generated $1.5 billion from its ad-supported tier, but this is early days. The advertising tier still represents a small percentage of overall revenue, but the growth trajectory is steep as noted by The Hollywood Reporter.

Vertical video creates new advertising opportunities. In traditional Netflix browsing, ads appear before content or as banner promotions. In a vertical feed, ads can be inserted seamlessly between content clips. They look and feel like organic content. This improves click-through rates and engagement compared to traditional ad formats as highlighted by Engadget.

Advertisers will pay premiums for attention-capturing placements. A 15-second vertical ad in a Netflix feed (surrounded by non-skippable content clips) is valuable real estate. Advertisers want their products shown in contexts where users are actively engaged according to TechCrunch.

Netflix's advertising approach has historically been premium and brand-safe. Netflix ads aren't intrusive. They fit the Netflix aesthetic. This premium positioning allows Netflix to charge higher ad rates than competitors like YouTube or social media platforms as reported by The Hollywood Reporter.

Vertical video advertising enhances this value proposition. Ads in the vertical feed are native to the experience, high-impact, and surrounded by premium content. Brands benefit from association with Netflix's exclusive originals as discussed in Fortune.

For Netflix's financial model, advertising is crucial. Subscription growth is slowing. Price increases are hitting limits. Advertising provides a path to revenue growth without requiring subscriber acquisition or price hikes. Every increment in ad monetization directly improves Netflix's bottom line as noted by The Hollywood Reporter.

Vertical video is a mechanism to increase ad inventory and improve ad monetization. More video impressions mean more ad opportunities. Better engagement means better ad performance according to TechCrunch.

Competition From YouTube's Podcast Expansion

Greg Peters specifically mentioned video podcasts as a use case for vertical video, which signals that Netflix sees podcasting as a critical growth area. But Netflix isn't starting from zero—YouTube already dominates podcast hosting as discussed in Fortune.

YouTube's advantages in podcasting are substantial. The platform has hosted major creators for years. Joe Rogan's podcast moved to Spotify in 2020, but countless other creators chose YouTube as their primary platform. The audience is already there as reported by The Hollywood Reporter.

YouTube's algorithm is exceptional. Users discover podcasts through recommendations, trending sections, and suggested next episodes. YouTube's infrastructure supports long-form video better than anyone. A three-hour podcast plays smoothly on YouTube. Comments, community posts, and engagement tools enhance the experience according to TechCrunch.

But YouTube has a disadvantage Netflix might exploit: YouTube is a platform, not a destination. Users come to YouTube to watch the creator's content, not because they're subscribed to "YouTube Premium" or "YouTube Original Podcasts." When you finish a podcast on YouTube, the algorithm might recommend another podcast or a music video or a tutorial. The experience is fragmented as discussed in Fortune.

Netflix's approach is different. Netflix is a subscription destination. If you subscribe to Netflix for podcasts, you're paying Netflix a monthly fee. The entire Netflix interface is optimized for Netflix content. There's no algorithmic friction pulling you toward competitor content as reported by The Hollywood Reporter.

Netflix also has production resources. They can fund original podcast shows, pay top creators for exclusives, and market podcasts heavily within the Netflix ecosystem. The vertical video feed becomes the primary discovery mechanism according to TechCrunch.

The risk for Netflix is that podcasting is a new category for the platform. Podcasters and podcast audiences might resist a Netflix-exclusive model. YouTube's openness is appealing to creators. But for Netflix subscribers, the convenience of having podcasts available alongside movies and TV shows might be compelling enough to shift behavior as discussed in Fortune.

Estimated data suggests Netflix will progressively roll out vertical video, starting in select markets and aiming for global availability by Q4 2026.

User Experience Implications and Potential Challenges

While vertical video seems straightforward, the UX implementation involves multiple decisions that will impact adoption and satisfaction.

First, the placement question: Where does the vertical feed live in the Netflix app? Is it a tab at the bottom of the screen alongside "Home," "Search," and "Downloads"? Is it a section within the existing home feed? Is it accessible through a button or gesture? The more prominent the placement, the higher the awareness and adoption. But too much prominence might alienate users who prefer traditional Netflix browsing according to TechCrunch.

Second, the opt-in/opt-out dynamic: Can users disable the vertical feed? Netflix's data shows the feature performs well, but individuals have different preferences. Some users might find vertical video distracting. Some might believe it trivializes Netflix's premium content positioning. Netflix will need to balance mandatory adoption with user choice as discussed in Fortune.

Third, the algorithm calibration: The vertical feed algorithm must be accurate enough that users feel the recommendations are relevant. If the feed shows clips from content you've already watched or content that's completely misaligned with your preferences, users will abandon it. Netflix's recommendation engine is sophisticated, but a new feed type introduces new variables and new opportunities for misalignment as highlighted by Engadget.

Fourth, the content inventory challenge: Vertical video requires clip content. Netflix has trailers and teasers, but creating the volume of short clips needed to power an infinite vertical feed requires more content production. Netflix will need to extract clips from existing movies and shows, or create new short-form content designed for the vertical feed. This is resource-intensive as reported by The Hollywood Reporter.

Fifth, the discoverability impact on traditional content: If vertical video becomes the primary discovery mechanism, will traditional Netflix browsing become secondary? This could actually hurt discoverability for certain content types. Niche shows or international content might be underrepresented in a vertical feed optimized for broad appeal according to TechCrunch.

Netflix will likely test various implementations and refine based on user feedback and metrics. The 2026 rollout date provides runway for refinement. By the time the feature launches publicly, Netflix should have addressed most UX concerns as discussed in Fortune.

The Broader Streaming Wars Context

Netflix's vertical video redesign doesn't happen in isolation. It's a move in a much larger strategic game involving multiple players: Amazon Prime Video, Disney+, Hulu, Max, Apple TV+, and YouTube.

Streaming is now a mature market. The easy subscriber acquisition phase is over. Churn is rising as consumers consolidate subscriptions. Price sensitivity is higher. The competitive differentiation increasingly comes from engagement, not content volume as noted by Business.com.

Amazon Prime Video (part of Prime membership, so lower financial commitment) and YouTube (ad-supported, free) have structural advantages. Netflix's subscription-only model is increasingly challenged. This is why Netflix introduced the ad tier in 2022 and why they're now expanding advertising as a core business as noted by The Hollywood Reporter.

But engagement is another axis of competition. If Netflix can increase average session duration and daily active users, the platform becomes stickier. Vertical video is a lever to pull in this direction according to TechCrunch.

Disney+ and Hulu (now bundled with Disney+) have some advantages: massive IP libraries, theatrical movie releases, sports through ESPN+. But Disney's streaming strategy has been hampered by fragmentation across multiple apps. Disney is slower to innovate on features like vertical video as noted by Techloy.

YouTube has the engagement advantage. YouTube's vertical video, Shorts, and recommendations engine are all best-in-class. YouTube's integration of podcasts, music (YouTube Music), and traditional video is seamless. But YouTube's premium offering (YouTube Premium) lacks the cultural cachet of Netflix as discussed in Fortune.

Netflix's vertical video move is an attempt to close the engagement gap with YouTube while reinforcing Netflix's positioning as the premium streaming destination. It's a defensive move (keep users in the app longer) and an offensive move (compete with YouTube for podcast attention) as reported by The Hollywood Reporter.

How Netflix's Vertical Video Affects Content Strategy

Netflix's shift toward vertical video will influence how Netflix produces and acquires content going forward.

First, content teams will need to consider vertical video potential when evaluating projects. A documentary that translates well to short clips is more valuable than one that doesn't. A podcast-style show is inherently better suited to vertical promotion than a pure drama series as highlighted by Engadget.

Second, Netflix might increase investment in content types that perform well in vertical feeds: stand-up comedy, sports content, podcasts, reality shows with dramatic moments, music performances. These content types naturally break into shareable clips according to TechCrunch.

Third, Netflix's production teams will likely create more short-form content explicitly designed for vertical feeds. This could mean creating clip compilations, behind-the-scenes content, or short documentary pieces designed as vertical videos. Some of this content might be unavailable anywhere else, driving traffic to the vertical feed as discussed in Fortune.

Fourth, Netflix will place greater emphasis on "clippable moments" when evaluating content. A scene from a show that generates strong engagement in the vertical feed is now considered a success metric during content reviews as reported by The Hollywood Reporter.

This creates a potential risk: if vertical video becomes too dominant in content strategy, Netflix might shift toward content optimized for virality over artistic merit. This could dilute the Netflix brand positioning as a premium content destination as noted by Business.com.

Netflix will need to balance these forces. The company needs the engagement uplift from vertical video, but Netflix also needs to maintain its reputation for quality originals. Too much emphasis on vertical-friendly content could alienate core subscribers who value Netflix as a home for prestige television and film as discussed in Fortune.

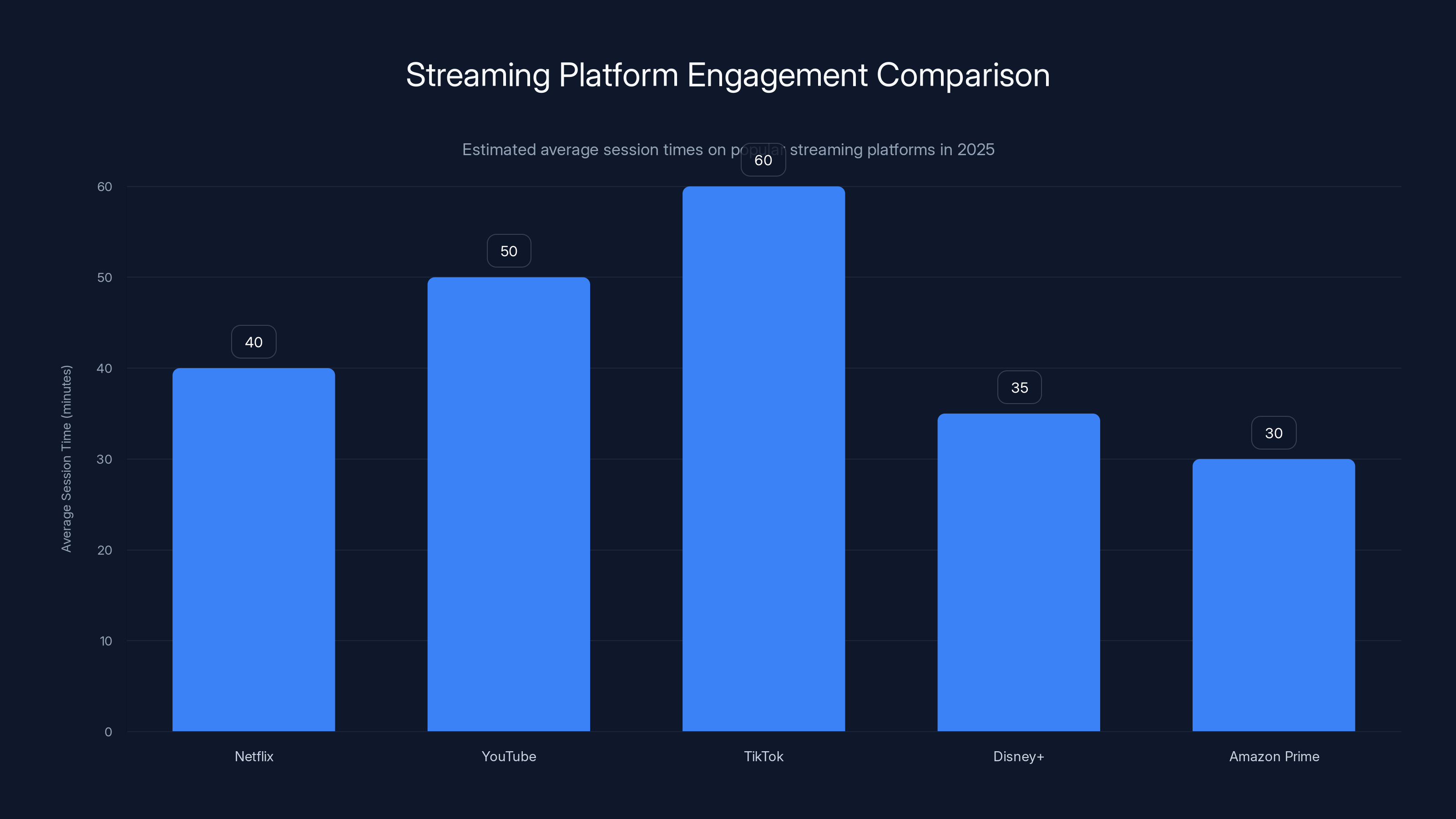

Estimated data suggests TikTok leads in user engagement with an average session time of 60 minutes, surpassing Netflix and other platforms. Estimated data.

Technical Infrastructure Required for Scale

Vertical video integration at Netflix's scale requires significant technical infrastructure.

First, video encoding. Netflix needs to optimize clips for vertical aspect ratios (9:16) and various screen sizes (small phones through large tablets). Netflix's existing transcoding pipelines handle this, but vertical video introduces new requirements according to TechCrunch.

Second, recommendation systems. The vertical feed algorithm must handle infinite scroll efficiently. As users swipe through clips, the recommendation engine must rapidly generate next suggestions. This requires real-time algorithmic processing and caching strategies. Netflix's AI/ML infrastructure is world-class, but scaling recommendations to billions of vertical swipes per day is non-trivial as discussed in Fortune.

Third, content storage and delivery. Vertical video clips are smaller files than full episodes, but the volume is enormous. Netflix operates a global CDN (content delivery network) to serve videos efficiently. Vertical video increases the total content volume, requiring more storage and delivery infrastructure as reported by The Hollywood Reporter.

Fourth, analytics and monitoring. Netflix needs to track user behavior in the vertical feed: which clips generate views, which generate clicks-through to full content, which generate engagement (likes, shares, etc.). This data feeds back into recommendations and product decisions according to TechCrunch.

Fifth, metadata management. Each vertical clip needs metadata: title, description, genre, content rating, associated full-length content, etc. At scale, managing this metadata across millions of clips requires sophisticated systems as discussed in Fortune.

Netflix has been investing in these infrastructure capabilities for years. The company spends billions annually on technology and infrastructure. Vertical video is achievable within Netflix's current capabilities, though it requires careful engineering and planning as highlighted by Engadget.

Timeline and Rollout Expectations for 2026

Greg Peters confirmed vertical video would arrive "sometime later in 2026," which provides a nine-month window. This is a relatively short development timeline for a feature this complex, suggesting Netflix has already completed much of the technical work during the testing phase as discussed in Fortune.

Expect the following rollout pattern: First, Netflix will likely roll out to select markets (probably English-speaking regions: US, UK, Canada, Australia). They'll monitor performance metrics, gather user feedback, and refine the algorithm according to TechCrunch.

Second, if initial rollout shows positive results, Netflix will expand to additional markets. By Q4 2026, vertical video might be available globally, though implementation might vary by region as reported by The Hollywood Reporter.

Third, Netflix will iterate rapidly. The 2026 launch isn't the final form of vertical video. Netflix will adjust the algorithm, UI, content mix, and features based on user data as discussed in Fortune.

Expect to see vertical video integrated with other Netflix initiatives throughout 2026: deeper podcast integration, expanded advertising placements, potential integration with social sharing (allowing users to share vertical clips to Instagram Stories or TikTok) according to TechCrunch.

What This Means for Netflix Subscribers

For the average Netflix subscriber, vertical video arrives as a new way to discover content. If you use Netflix primarily on mobile (which most subscribers do), you'll see a new section or tab in your app sometime in 2026 as highlighted by Engadget.

You'll either find the vertical feed useful and adopt it enthusiastically, or you'll ignore it and continue using Netflix as you have been. Netflix won't force vertical video on you, though the company will likely make it prominent enough that awareness is high according to TechCrunch.

If you're interested in Netflix's original podcasts or curious about shows you've never heard of, the vertical feed offers a low-friction discovery mechanism. You can sample content rapidly without committing to a full episode as discussed in Fortune.

The vertical feed might also improve content recommendations overall. As Netflix gathers more data about which clips you engage with, the recommendation algorithm becomes more sophisticated. This benefits all Netflix users, not just vertical feed users as reported by The Hollywood Reporter.

For price-sensitive subscribers, vertical video doesn't change pricing. It's a feature addition, not a premium tier. For ad-tier subscribers, vertical video might include more advertising, so be aware of that potential change according to TechCrunch.

For long-time Netflix users, vertical video is part of a larger evolution. Netflix is shifting from a TV-like experience to a mobile-first experience. Over the next few years, expect more mobile-specific features, more social integration, and more video podcast content as discussed in Fortune.

Estimated data shows that mobile devices dominate streaming video consumption, highlighting the importance of vertical video for mobile-first platforms.

Predicting the Impact on Netflix's Business Metrics

If vertical video performs as Netflix management expects, we should see measurable impacts on key metrics.

Daily Active Users (DAU): Vertical video should increase engagement among existing subscribers. If the feed is sticky and addictive, Netflix might see higher DAU. More users opening the app more frequently means more opportunities for advertising exposure and more potential for new subscription signups as noted by The Hollywood Reporter.

Average Session Duration: This is the critical metric. TikTok's 52-minute average session crushes most other platforms. If Netflix can increase average session duration from, say, 90 minutes per day to 100+ minutes per day, that's a 10% uplift in engagement. Applied across 325 million subscribers, that's enormous volume as discussed in Fortune.

Content Consumption Patterns: Vertical video might change how users discover and watch content. We might see increased consumption of content that performs well in vertical feeds (podcasts, stand-up, short-form content) and potentially decreased consumption of niche content according to TechCrunch.

Subscriber Retention (Churn): Higher engagement typically correlates with lower churn. If vertical video keeps users more engaged, Netflix should see measurable improvements in monthly and annual churn rates as reported by The Hollywood Reporter.

Ad Inventory and Revenue: More video impressions mean more ad inventory. Netflix can sell more ads or increase prices for existing ad inventory. This directly impacts the $1.5 billion ad revenue and the path to higher advertising revenue as noted by The Hollywood Reporter.

Content Investment Decisions: If vertical video performs well, Netflix will likely increase investment in vertical-friendly content types. More budgets for podcasts, reality shows, and short-form content. Fewer resources for niche prestige dramas as discussed in Fortune.

Quantifying these impacts requires time. Netflix will likely discuss vertical video performance in earnings calls 12-18 months after launch. Watch Q3 or Q4 2026 earnings for more specific data according to TechCrunch.

Potential Risks and Challenges for Netflix

While vertical video seems like a strong strategic move, significant risks exist.

Cannibalization Risk: Vertical video might cannibalize traditional Netflix browsing. If the vertical feed drives the majority of engagement, other discovery mechanisms (genre categories, personalized rows, search) might atrophy. This reduces the discoverability of content that doesn't perform well in vertical feeds, potentially creating a narrower content recommendation landscape as reported by The Hollywood Reporter.

Brand Perception Risk: Netflix has positioned itself as a premium destination. Vertical video, especially when filled with short clips and rapid-fire content, might feel less premium. Users might perceive Netflix as desperate to compete with TikTok rather than leading the streaming space according to TechCrunch.

Algorithm Bias Risk: Vertical video algorithms, like all recommendation algorithms, can develop biases. They might over-represent certain creators, genres, or content types while under-representing others. This could fragment Netflix's catalog into winners and losers in ways that seem arbitrary as discussed in Fortune.

Engagement Trap Risk: If Netflix succeeds too well at creating addictive vertical video, the company risks creating a moral hazard situation. Critics might point to Netflix as contributing to mobile addiction and unhealthy media consumption habits. This could invite regulatory scrutiny as reported by The Hollywood Reporter.

Podcasting Competition Risk: Netflix's bet on podcasts is unproven. Entering a space where YouTube already dominates is risky. If podcast exclusives don't drive meaningful subscriber growth or engagement, Netflix's investment will be viewed as a strategic misstep according to TechCrunch.

Technical Execution Risk: Launching a feature of this complexity at scale requires flawless technical execution. If vertical video launches buggy or performs poorly, Netflix's reputation suffers and the rollout is delayed further as discussed in Fortune.

These risks are real, but Netflix's track record suggests management has thought through these issues. Expect Netflix to execute carefully and adjust based on early results as highlighted by Engadget.

How Vertical Video Fits Into the Broader Streaming Ecosystem

Netflix's vertical video move signals a broader shift in how streaming platforms think about content discovery and consumption.

Traditionally, streaming platforms replicated TV experiences: browse, select, watch full episodes. This worked when streaming was new and users were happy to have convenient access to content. But that era is ending as noted by Business.com.

Now, platforms are competing for attention and engagement. TikTok and YouTube have proven that recommendation-driven, endless-scroll experiences are engagement superpowers. Netflix, Amazon, Disney, and others are learning this lesson and adapting as discussed in Fortune.

Expect to see vertical video or similar infinite-scroll feed features across all major streaming platforms within the next 2-3 years. Amazon Prime Video will likely implement something similar. Disney+ might integrate vertical video into its sports and entertainment content. Even Apple TV+ could experiment with vertical video for discovery as noted by Techloy.

But Netflix is getting ahead of the curve by launching in 2026. First-mover advantage in this space is significant. Netflix can learn from early implementation and iterate quickly. By the time competitors copy the feature, Netflix will have already optimized the algorithm and UX according to TechCrunch.

Vertical video is also part of a larger trend: streaming platforms becoming more social and more entertainment-driven. Podcasts, live events, interactive content, and social sharing features are all becoming more central to streaming platforms as discussed in Fortune.

The days of streaming platforms being simple content libraries are ending. The future is engagement engines powered by AI, social features, and interactive content as reported by The Hollywood Reporter.

Conclusions and Future Predictions

Netflix's vertical video integration represents a significant strategic pivot toward mobile-first, engagement-focused content discovery. The feature arrives in 2026 as the culmination of six months of testing and the foundation for deeper podcast integration.

The move is defensive and offensive simultaneously. Defensively, Netflix is protecting its mobile engagement against TikTok and YouTube. Offensively, Netflix is positioning itself to compete in the podcast space and create new reasons for subscribers to engage with the platform according to TechCrunch.

Technically, Netflix is well-positioned to execute this feature. The company's infrastructure, recommendation algorithms, and mobile apps are mature enough to support vertical video at scale as discussed in Fortune.

Commercially, vertical video creates new advertising opportunities and improves subscriber engagement metrics. If the feature performs as Netflix expects, it should contribute materially to the company's financial performance as noted by The Hollywood Reporter.

Culturally, vertical video represents Netflix acknowledging how people actually use mobile devices. Instead of forcing the TV experience onto phones, Netflix is designing for phone behavior. This is a fundamental shift in product thinking as noted by Business.com.

For subscribers, vertical video is one of many features that will gradually transform Netflix from a TV-replacement service into a mobile-first engagement platform. Over the next few years, expect more changes: deeper social integration, more live events, more interactive content, and more emphasis on engagement metrics over content volume according to TechCrunch.

The streaming wars are intensifying. Vertical video is Netflix's move to stay ahead of the competition. Whether it succeeds will depend on execution, algorithm quality, and content quality. But the strategic direction is clear: Netflix is betting on engagement, mobile-first design, and new content types like podcasts as discussed in Fortune.

If you're a Netflix subscriber, vertical video is coming in 2026. If you're a content creator, Netflix's vertical video success might open new opportunities. If you're an investor in Netflix or competing platforms, vertical video is a signal that the streaming strategy is shifting toward engagement and away from simple content volume as reported by The Hollywood Reporter.

The future of streaming is vertical, algorithm-driven, and mobile-first. Netflix's redesign is the company's way of saying: we understand this evolution. We're ready according to TechCrunch.

FAQ

What exactly is Netflix vertical video, and how does it differ from traditional Netflix browsing?

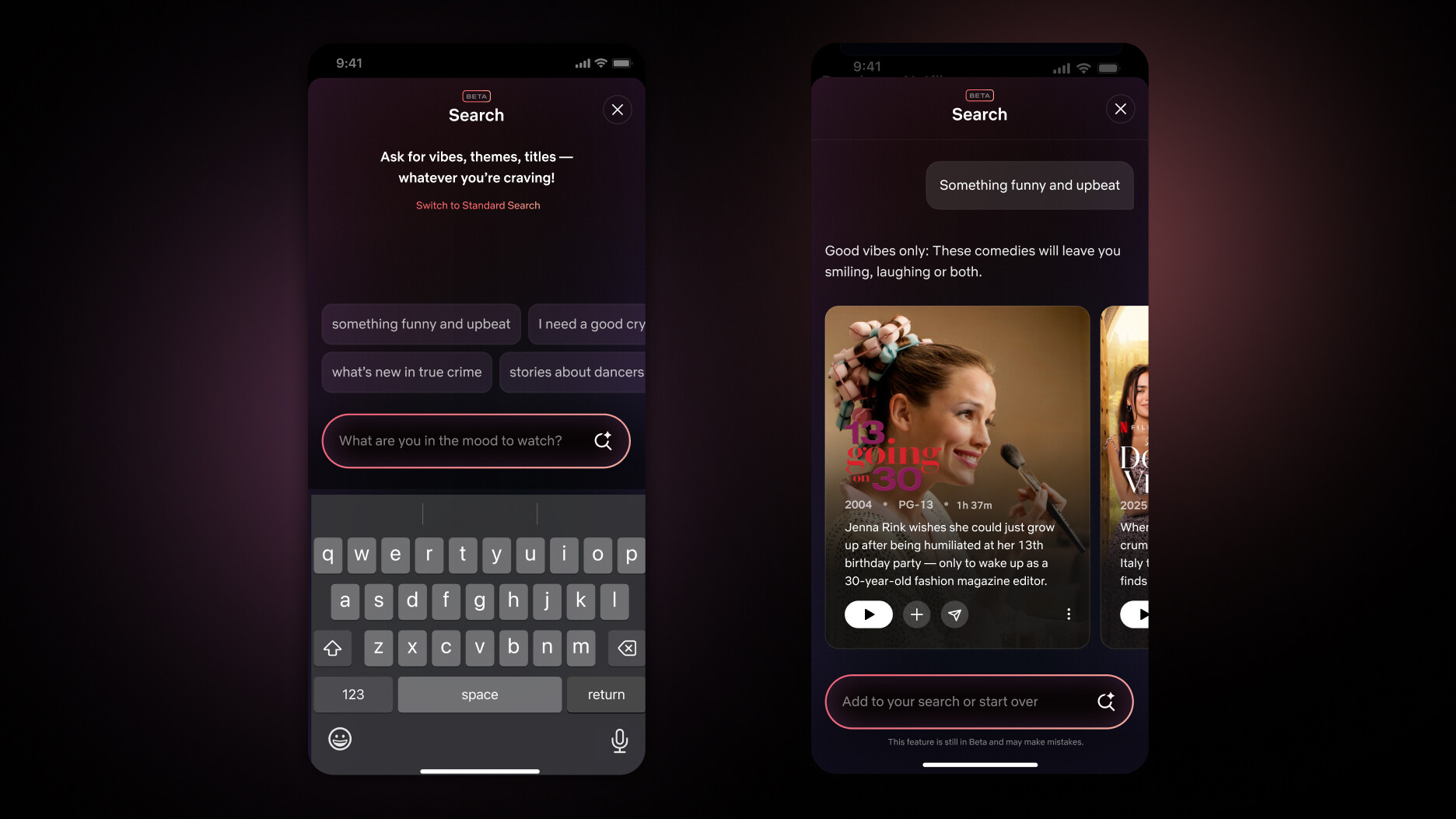

Netflix vertical video is a new feed feature that displays short clips from Netflix movies, TV shows, and podcasts in a vertical, swipe-based interface similar to TikTok or Instagram Reels. Unlike traditional Netflix browsing where you scroll through horizontal grids of content thumbnails, vertical video optimizes for how you naturally hold your phone—vertically—and uses a recommendation algorithm to serve you a personalized stream of clips. You swipe up to see the next clip, creating a faster, more frictionless discovery experience as highlighted by Engadget.

When exactly will Netflix vertical video launch, and which countries will get it first?

Greg Peters, Netflix's co-CEO, confirmed that vertical video will arrive "sometime later in 2026," but Netflix hasn't announced a specific launch date. Historically, Netflix rolls out new features in phases, starting with English-speaking markets (likely the US, UK, Canada, and Australia) before expanding globally. You can expect to see the feature in your app sometime between mid-2026 and December 2026, though initial rollout may be limited to certain regions as discussed in Fortune.

How will vertical video impact Netflix's advertising business and pricing?

Vertical video creates new advertising inventory for Netflix's ad-supported tier. More video impressions mean more ad opportunities. Netflix will likely integrate ads into the vertical feed, similar to how Instagram or TikTok display ads within content streams. However, this doesn't necessarily mean increased pricing for subscribers. Netflix's free tier won't exist (Netflix requires subscription), but ad-tier subscribers should expect more ads. Premium subscribers on ad-free plans won't see additional advertising according to TechCrunch.

Is Netflix creating new vertical-format content, or just reformatting existing clips?

During the testing phase, Netflix has primarily reformatted existing trailers and clips into vertical format. However, as the feature rolls out and proves successful, Netflix will likely invest in creating original short-form content designed specifically for vertical feeds. This could include behind-the-scenes footage, clip compilations, interviews, and content designed as standalone vertical pieces. Netflix is also using vertical video to promote their new video podcasts, which are inherently suited to vertical format as reported by The Hollywood Reporter.

How will Netflix's vertical video compete with YouTube Shorts and TikTok?

Netflix's vertical video has different advantages and constraints compared to TikTok and YouTube Shorts. Unlike TikTok (which features mostly user-generated content) or YouTube Shorts (which is open to all creators), Netflix vertical video will exclusively feature Netflix's professionally produced content and original shows. This ensures higher quality baseline content but sacrifices the diversity and unpredictability that makes TikTok addictive. Netflix's advantage is that every clip promotes content you can immediately watch on Netflix—the funnel from discovery to consumption is closed within Netflix's ecosystem. The tradeoff is that Netflix vertical video is curated and premium rather than open and algorithmic as discussed in Fortune.

Will using vertical video be optional, or will Netflix force it onto all users?

Netflix hasn't confirmed whether vertical video will be opt-in or opt-out, but based on how Netflix has rolled out previous features, it will likely be opt-in initially. You'll probably see a new section or tab in your app where you can access the vertical feed, but Netflix won't mandate its use. However, as the feature proves successful internally, Netflix may increase its prominence in the app, making it harder to ignore. Eventually, vertical video might become the default discovery mechanism, similar to how algorithmic feeds replaced chronological feeds on social media platforms according to TechCrunch.

What does Netflix's focus on vertical video mean for video podcasts?

Vertical video is primarily a discovery and promotion mechanism for Netflix's emerging video podcast offerings. Greg Peters specifically mentioned that vertical video will help surface video podcasts to Netflix subscribers. Netflix is positioning itself as a podcast destination to compete with YouTube, Spotify, and Apple Podcasts. Vertical video clips from podcast episodes (a 30-second highlight from a 2-hour conversation, for example) will appear in your feed, drive you to the full episode. This is Netflix's strategy to make podcasts a material part of the Netflix value proposition and differentiate itself from pure-play streaming services <a href="https://fortune.com/2026/01/09/netflix-future-of-streaming

![Netflix Vertical Video Mobile App Redesign: What's Coming in 2025-2026 [2025]](https://s.yimg.com/uu/api/res/1.2/SaBF.GHbd1i1hfIcI8Vh0Q--~B/aD02MjA7dz05ODA7YXBwaWQ9eXRhY2h5b24-/https://d29szjachogqwa.cloudfront.net/images/user-uploaded/Netflix%20vertical%20videos%20coming%20to%20mobile%20app)