Nintendo Switch Surpasses DS to Become the Best-Selling Console in Company History

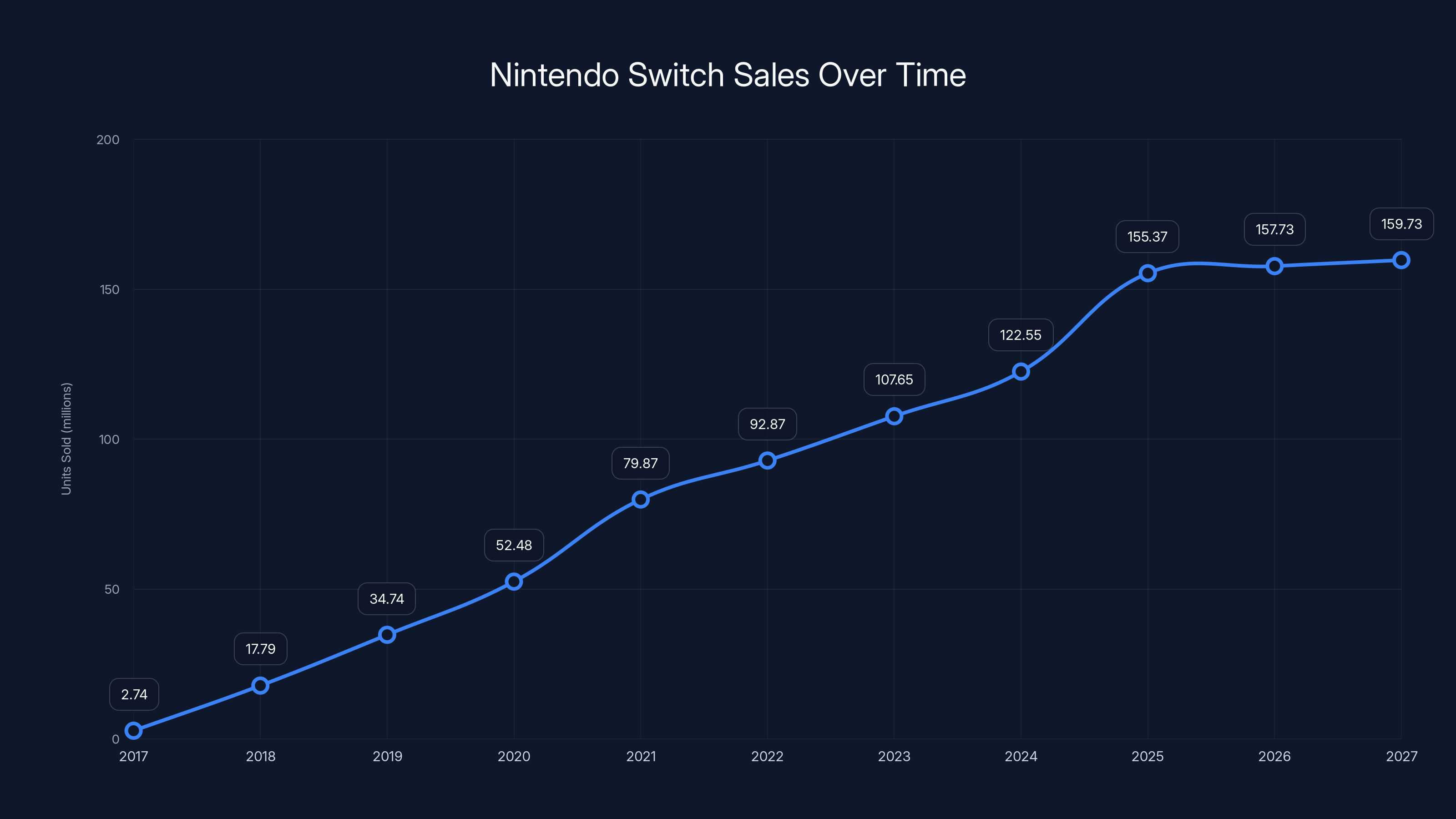

On December 31, 2025, Nintendo achieved a historic milestone. The original Switch crossed the finish line at 155.37 million units sold, officially dethroning the Nintendo DS and claiming its place as the company's best-selling console of all time. This wasn't just a number on a spreadsheet. It represented nearly two decades of gaming culture, portable revolution, and a device that fundamentally changed how people thought about hybrid gaming. According to VGChartz, the Switch's sales figures are a testament to its enduring popularity.

The DS held the record since its run ended in 2011, with 154.02 million units shipped across its nine-year lifespan. The Switch didn't just barely edge it out. It surpassed the milestone with room to spare, and more importantly, it did so while the Switch 2 launched right alongside it, fundamentally reshaping Nintendo's hardware strategy for the decade ahead. This achievement marks more than a sales victory. It signals the triumph of a specific gaming philosophy: portability, accessibility, and the radical idea that you could play serious games anywhere, anytime.

But here's what makes this story even more interesting. The Switch accomplished this feat while facing competition from two of the most powerful gaming platforms ever created. The Play Station 5 and Xbox Series X both launched during the Switch's prime selling years, yet the Switch maintained its momentum. That doesn't happen by accident. It happens because a device genuinely solves a problem people didn't know they had.

The Switch's journey to this record wasn't linear. It faced predictions of failure. Gaming analysts in 2016 were skeptical. A hybrid console? With a modest processor? How could it compete with dedicated home consoles offering superior graphics and performance? Yet by 2017, the Switch had already proven the skeptics wrong. It moved 2.7 million units in its first month, breaking Nintendo's internal sales records for console launches, as reported by VGChartz.

Now, with 155.37 million units across multiple hardware revisions—the original model, the Switch Lite, and the Switch OLED—the console stands as a monument to strategic product design and understanding consumer needs. Yet it's not the best-selling console of all time. That distinction belongs to something else entirely, and understanding why reveals important truths about gaming history and market dynamics.

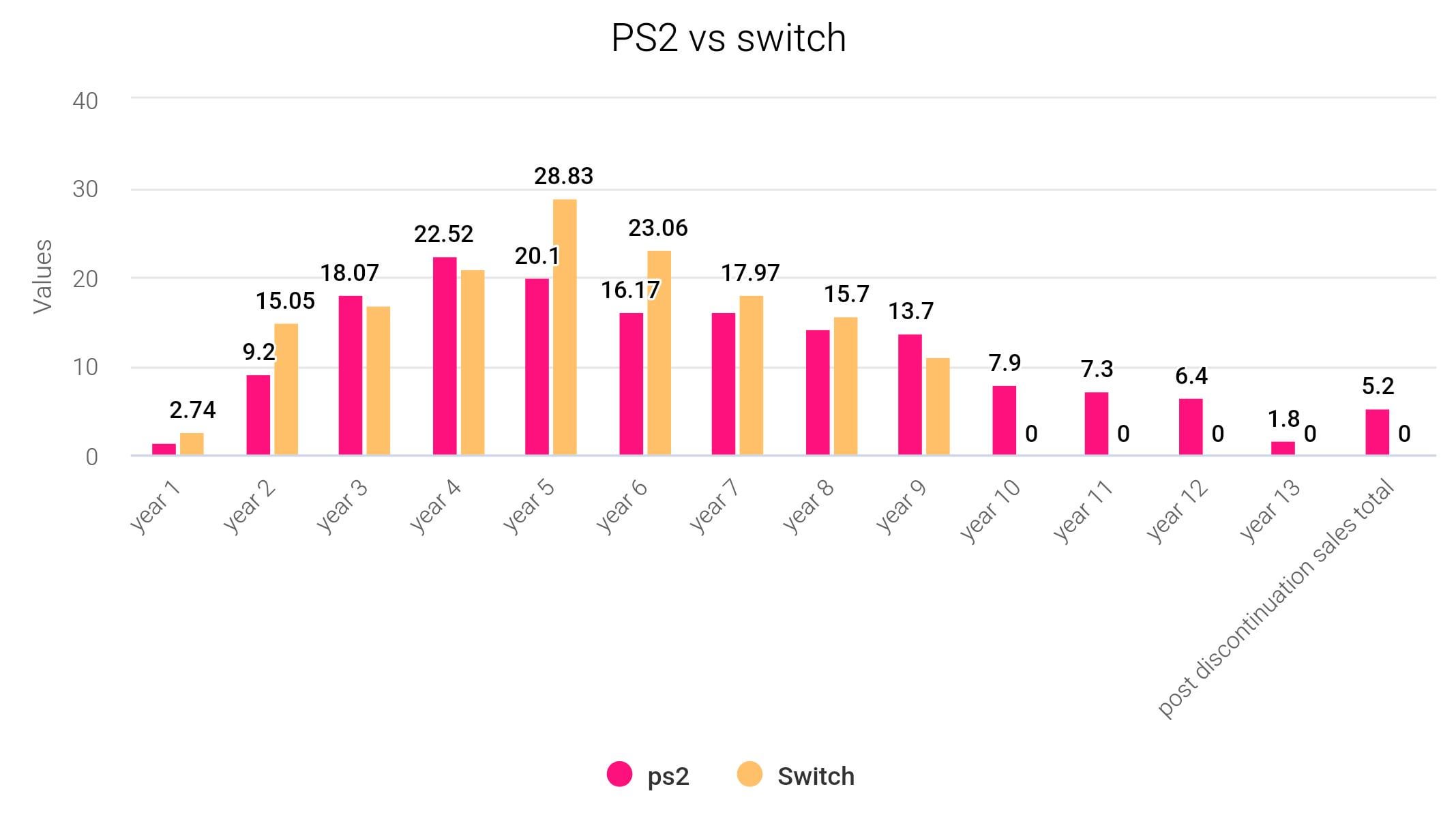

The PS2 Still Reigns: Why the Switch is 5.27 Million Units Behind

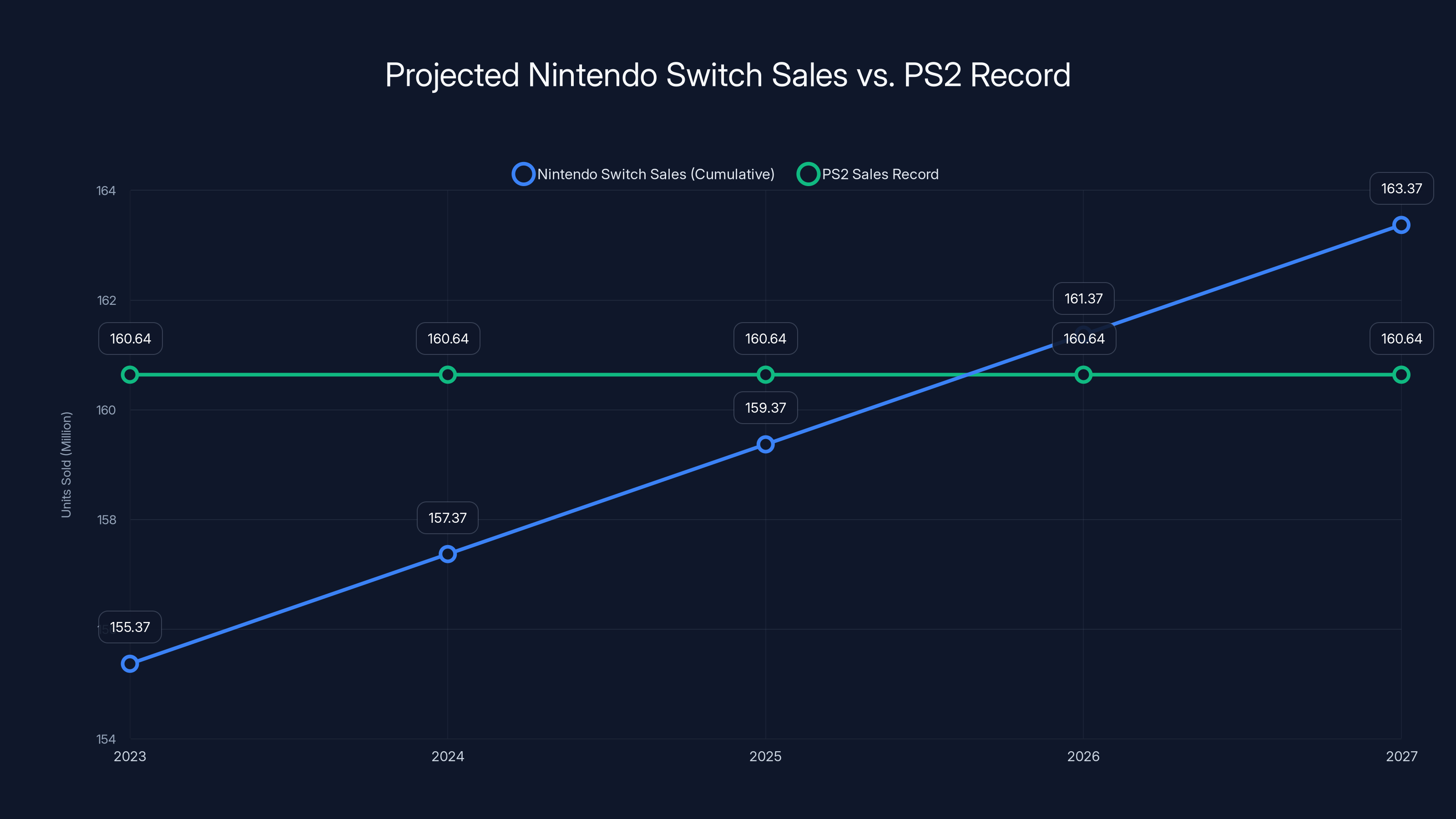

Here's a sobering fact for Nintendo fans celebrating the Switch's achievement: the console isn't number one across all gaming history. That crown belongs to Sony's Play Station 2, which sold approximately 160.64 million units between 2000 and 2013. The Switch currently sits 5.27 million units behind that record.

The PS2's dominance during the early 2000s was staggering. It benefited from several advantages the Switch didn't have. First, there was the DVD player integration. In 2000, DVD players cost

But here's where the conversation gets interesting. If Nintendo maintains current Switch sales rates—even the reduced pace of 1.36 million units in Q3 of fiscal year 2026—the Switch could theoretically surpass the PS2 within two to three years. The math looks like this:

Assuming an average of 2 million Switch units per year going forward:

This projection assumes Nintendo maintains at least half its current sales pace through 2028. Given that the original Switch is seven years old and still moving over a million units quarterly despite the Switch 2's launch, this isn't an unrealistic scenario. The DS maintained decent sales for years after the 3DS launched. History suggests Nintendo's older hardware often has a long tail.

What's particularly notable is that the Switch achieved this milestone across three different hardware variants. The original model, the Switch Lite (a cheaper, portable-only version), and the Switch OLED (a premium revision) all contributed to this total. This diversification strategy allowed Nintendo to capture different market segments: players who wanted the full experience, budget-conscious gamers, and those seeking the best display possible.

The PS2, by contrast, had fewer hardware variants. It had the original model, a slimline revision, and a network adapter option, but essentially, consumers were choosing between one or two versions. The Switch's multiple SKUs might have actually helped its sales trajectory by making the platform accessible at different price points.

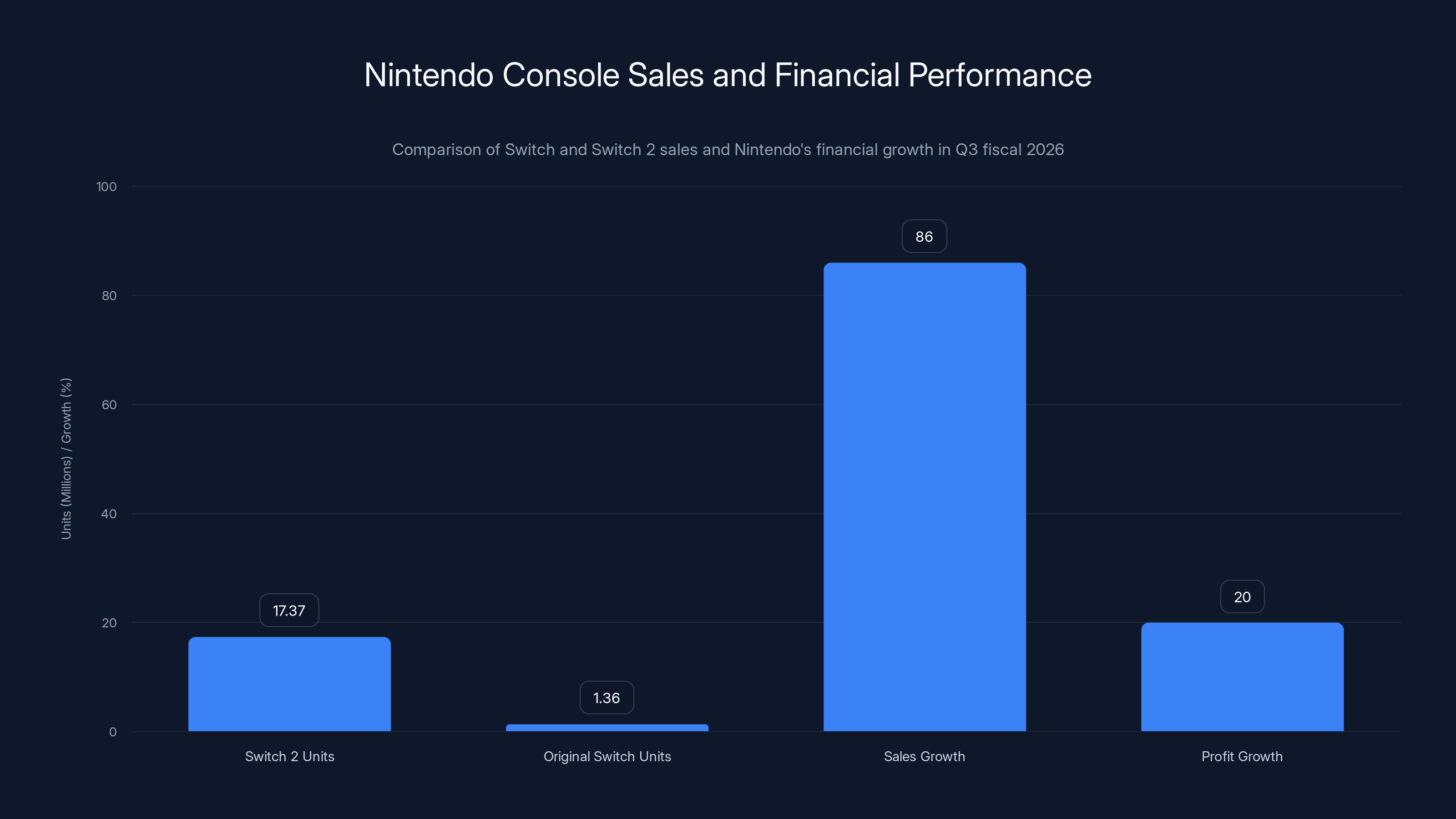

Nintendo's dual-console strategy led to 17.37 million Switch 2 units sold and a significant 86% sales growth in Q3 fiscal 2026, showcasing the effectiveness of their hardware strategy.

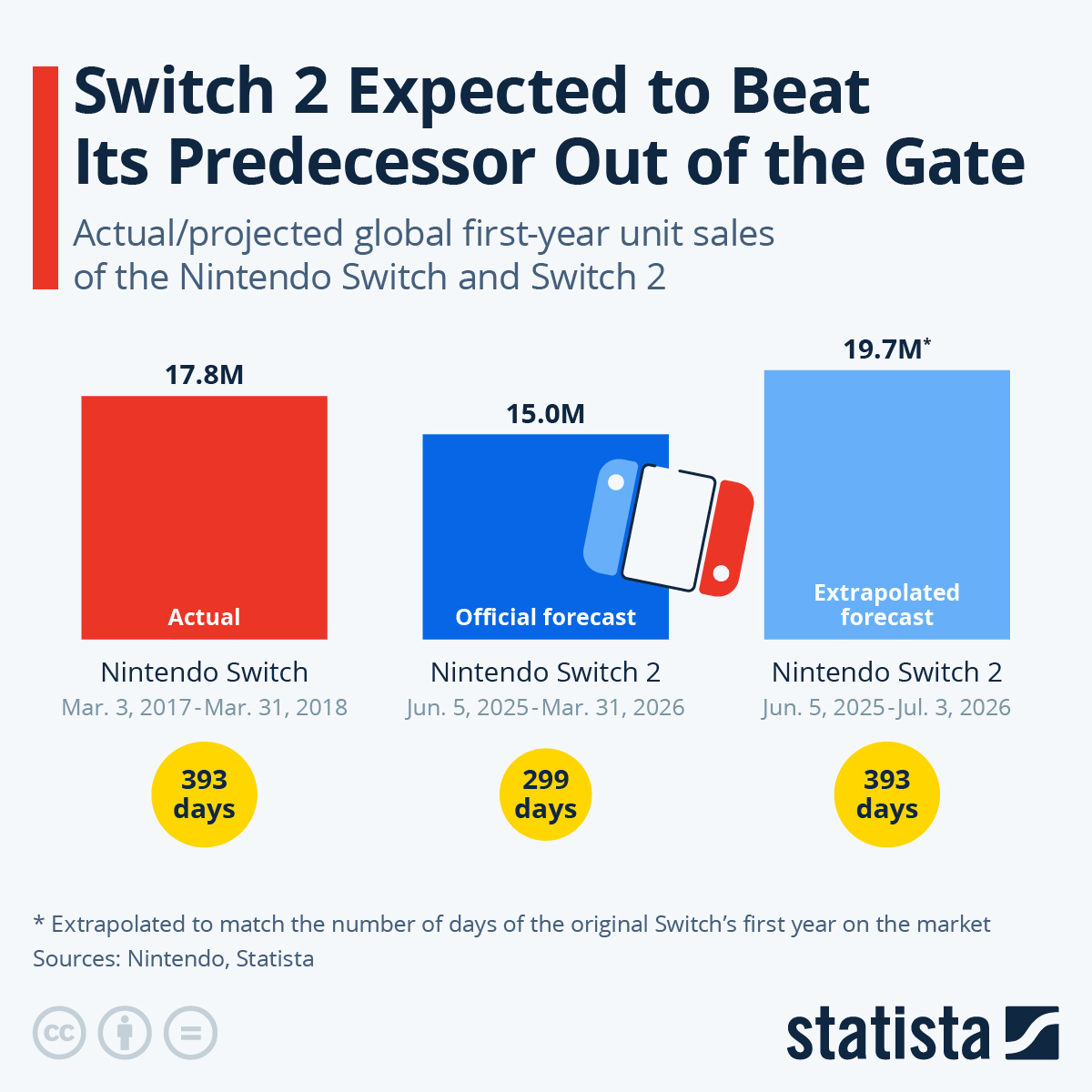

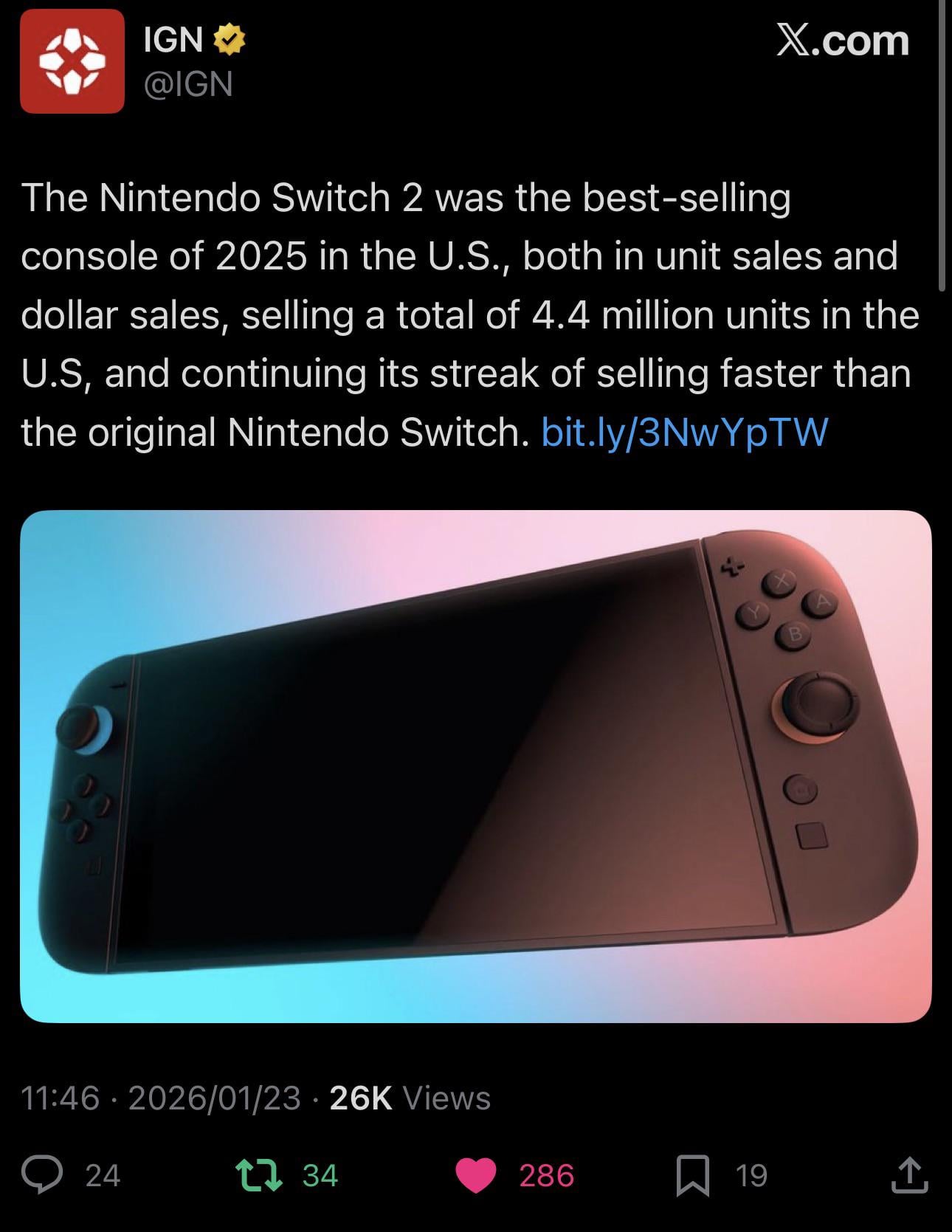

The Switch 2's Explosive Launch: A Faster Start Than Any Nintendo Hardware

While the original Switch was busy reaching its historic milestone, the Switch 2 was writing its own record-breaking story. With 7.01 million units sold during the Q3 2025 holiday season alone, and 17.37 million units moved through Q3 of fiscal year 2026, the Switch 2 has established itself as the fastest-selling dedicated video platform Nintendo has ever released, as noted by Video Games Chronicle.

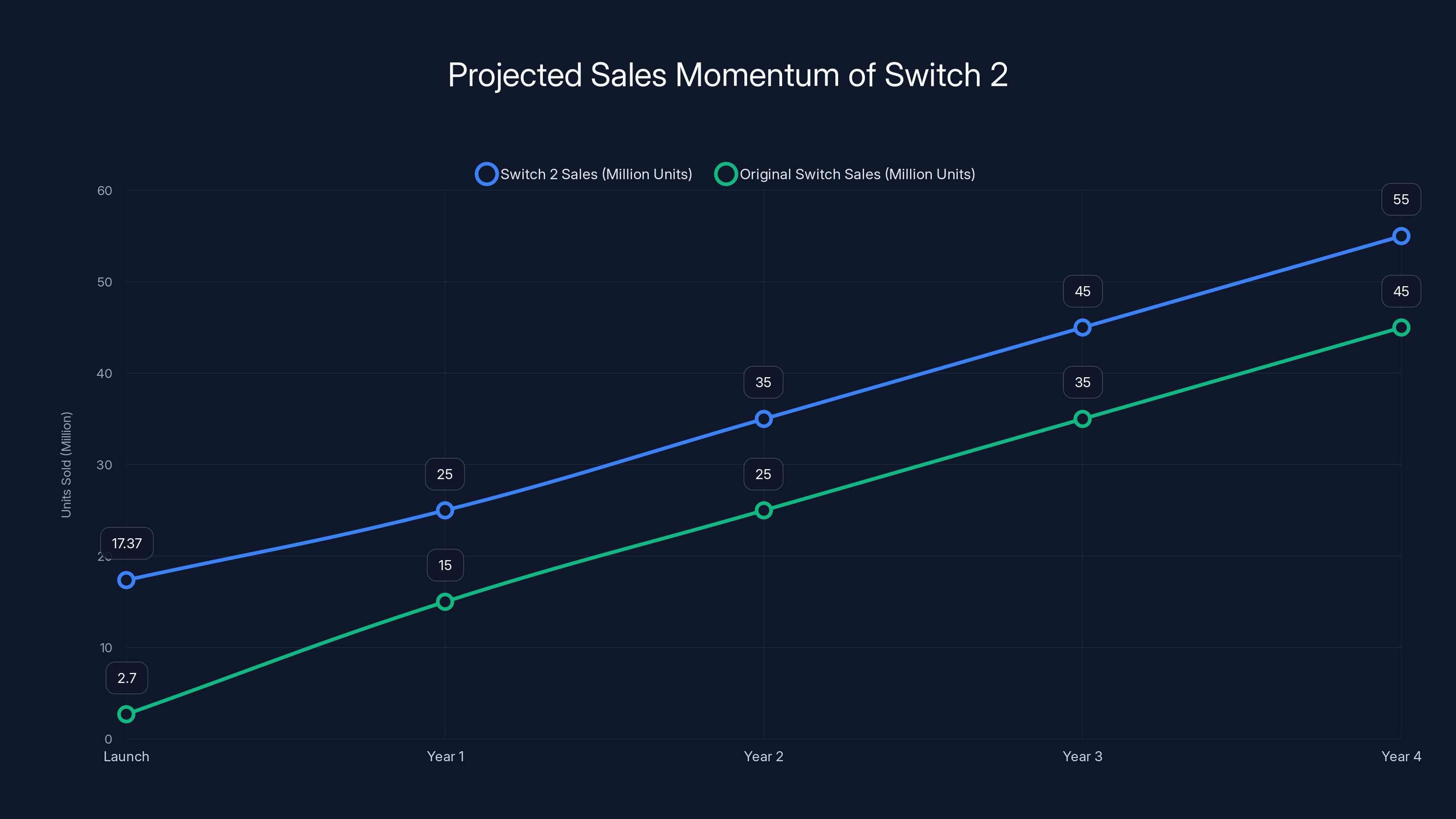

Let's put that in perspective. The original Switch sold 2.7 million units in its first month. The Switch 2 hit 7.01 million in Q3 alone (October through December 2025). That's a massive acceleration. Nintendo initially forecasted 15 million Switch 2 units for fiscal year 2026 (ending March 31, 2026). By Q3, it had already moved 17.37 million. That means the company exceeded its annual forecast before the fiscal year even ended.

Why is the Switch 2 resonating so strongly? Several factors are at play. First, there's the proven track record of the original Switch. Consumers knew what they were getting. They understood the hybrid concept. There was no learning curve about whether a console that's also a handheld could actually work. Second, the hardware improvements are significant enough to justify the upgrade without being so radical that they alienate the existing playerbase.

Third—and this is crucial—launch game lineup matters enormously, and Nintendo understood this lesson well. Mario Kart World hit 14 million units sold since the Switch 2's launch. That single title has sold more copies than some entire console lifecycles. Donkey Kong Bananza added another 4.25 million units. These aren't modest numbers. For context, the original Switch's launch title, The Legend of Zelda: Breath of the Wild, eventually sold 31.2 million units, but it took six years to reach that number. Mario Kart World achieved 14 million in weeks.

The Switch 2's success raises important questions about the nature of console launches in 2025. The industry had become somewhat cynical about launch windows. The PS5 and Xbox Series X launched with relatively thin exclusive lineups. Both platforms spent their first two years relying heavily on cross-generation releases. Nintendo learned from that approach and did the opposite. The Switch 2 launched with software ready to showcase its capabilities.

This strategy appears to be paying dividends. Nintendo revised its forecast upward from 15 million to what will likely be 20-22 million units by March 31, 2026. That would make the Switch 2 one of the most successful console launches in history by quantity shipped in a single fiscal year.

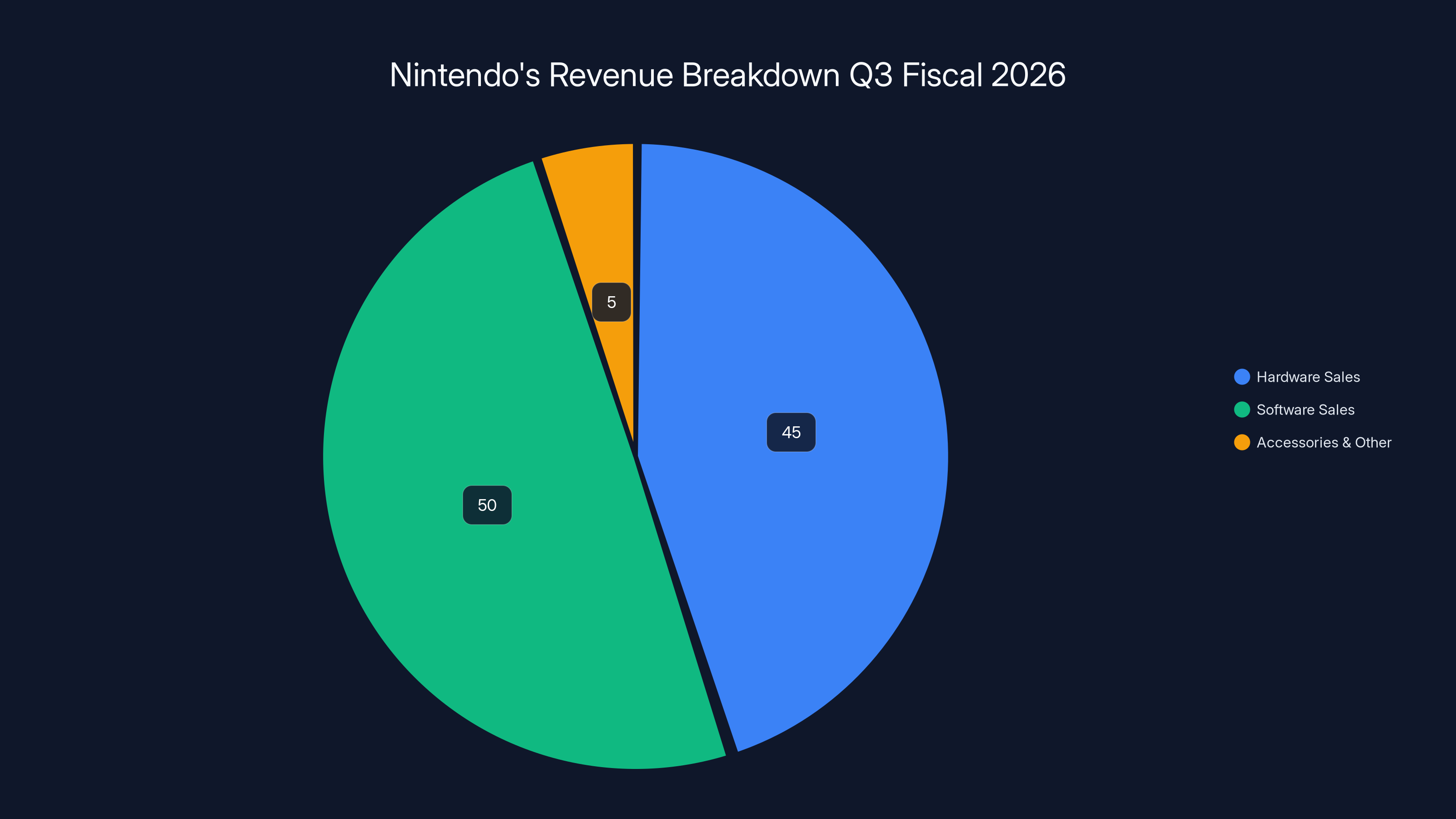

Hardware and software sales dominate Nintendo's revenue, with software slightly leading. Estimated data based on typical distribution.

Understanding Nintendo's Hardware Strategy: Why Two Consoles Coexist

Nintendo's approach of simultaneously supporting two console generations is unusual in the industry, yet it's working brilliantly. At the end of Q3 fiscal year 2026, the company had roughly 17.37 million Switch 2 units in circulation while the original Switch was still moving 1.36 million units quarterly. This is a deliberate strategy, not a mistake or oversight.

The economics make sense. The original Switch has proven successful at a lower price point. Nintendo sells the Switch Lite for

This two-tiered approach accomplishes several things simultaneously. First, it captures price-sensitive consumers who might otherwise wait for price drops or look at other platforms. Second, it maintains software compatibility and ecosystem unity. You can play Switch 2 games on the original Switch (with reduced graphical fidelity, but the same experience). Third, it extends the life of an existing customer base. Someone who bought a Switch in 2017 now has the option to upgrade without abandoning their game library.

Nintendo's financial results reflected this strategy's success. The company reported 803.32 billion yen (

However, the company noted that Q3 profits were "a bit less than expected." This suggests Nintendo had internal forecasts for even higher profitability, possibly due to hardware shortage constraints or supply chain inefficiencies. The fact that the company exceeded sales forecasts while slightly missing profit targets indicates that demand exceeded the company's ability to manufacture hardware at planned margin levels.

Historically, Nintendo has managed transitions between console generations more smoothly than its competitors. The Wii had a shorter lifespan before the Wii U (which was a disaster), but even then, third-party developers continued supporting the Wii for years. The DS-to-3DS transition was similarly gradual. Nintendo understands that hardware transitions don't have to be abrupt. You can offer choice without fragmenting your audience.

The Software Engine: Game Releases Driving Hardware Adoption

Nintendo's success with the Switch 2 would be impossible without strong software. And that software engine is purring magnificently. We've already mentioned Mario Kart World's 14 million units and Donkey Kong Bananza's 4.25 million, but the upcoming pipeline is equally impressive.

Two major titles are scheduled for early 2026:

Mario Tennis Fever is expected February 12, 2026. The Mario tennis franchise has a dedicated audience, and it's a natural fit for the Switch 2's improved hardware. Better graphics, more players on screen, more responsive controls—all the elements that make a sports game feel better benefit from the generational leap.

Pokemon Pokopia is arriving in March 2026. This is the heavyweight. Pokemon games drive Nintendo console adoption like nothing else. The franchise generates over $100 billion in annual revenue across all merchandise, games, and media. A new mainline Pokemon release on the Switch 2 will be a massive system driver.

The question isn't whether these games will sell. They will. The question is how many Switch 2 units they'll drive. If Mario Tennis Fever achieves even 3 million units, that's 3 million more people who need a Switch 2. If Pokemon Pokopia hits 20 million (which is realistic given that Pokemon Sword and Shield sold 26.5 million), that's 20 million reasons to buy Nintendo's newest hardware.

Nintendo learned an important lesson from the Wii U era. That console failed not because of the hardware concept but because the software pipeline was inconsistent. There were three-month, six-month, even nine-month stretches with no major releases. Developers abandoned the platform. Third-party support evaporated. The Wii U died not with a bang but with a whimper.

The Switch's success was partly due to remarkable third-party support. Games like The Witcher 3, DOOM, Fortnite, and Minecraft proved that the hardware could run serious software. Developers saw a willing audience and continued supporting the platform. The Switch 2 is repeating this formula but with the advantage of being more powerful, meaning developers can bring even more ambitious ports and exclusives.

The Nintendo Switch is projected to surpass the PS2's sales record by 2026, assuming a steady sales pace of 2 million units per year. Estimated data.

The Broader Gaming Landscape: How Did the Switch Win?

To understand the Switch's achievement, we need to zoom out and look at what else was happening in gaming during the Switch's nine-year reign as Nintendo's newest platform. The Switch launched in 2017 alongside competitors that seemed superior on paper: the Play Station 4 and Xbox One were mid-generation, still getting strong exclusive titles. The Nintendo Wii U was barely three years dead, and skeptics were wondering if anyone would buy another Nintendo console.

Yet the Switch thrived. Why? Several factors converge:

Portability was underrated. The gaming industry had evolved toward increasingly powerful home consoles with increasingly expensive graphics. Meanwhile, handheld gaming had been declining. Nintendo identified a market opportunity: people wanted to play serious games anywhere. The Switch proved this market existed and was larger than anyone expected.

Price accessibility mattered. The Switch OLED launched at

The library was exceptional. The Switch benefited from a staggering lineup of games. Mario, Zelda, Pokemon, Donkey Kong, Mario Kart, Splatoon, Fire Emblem, Animal Crossing, and countless third-party titles. The breadth and depth of the Switch's software library is legitimately one of the best of any Nintendo console ever.

The design philosophy was sound. The ability to play in docked mode, handheld mode, or tabletop mode appealed to different use cases. Parents could let kids play on the toilet before bed. Commuters could play during transit. Friends could play together at a coffee table. This flexibility was a feature, not a bug.

Durability and longevity were real. The Switch launched in 2017. It's now 2026. The same hardware is still receiving firmware updates, security patches, and new software. That's nine years of support for a platform. Most consoles see five to six years of active support before becoming legacy platforms.

Compare this to the Play Station 4 and Xbox One, which both became legacy platforms by 2020-2021 when the PS5 and Series X launched. Within three to four years, new multiplatform games started shipping in "next-generation only" versions. Publishers stopped supporting old hardware.

Nintendo took a different approach. The Switch 2 is coming, yes, but Nintendo is maintaining the original Switch as a viable platform. This decision means the installed base continues being valuable to publishers. They can develop for both platforms. The addressable market stays large.

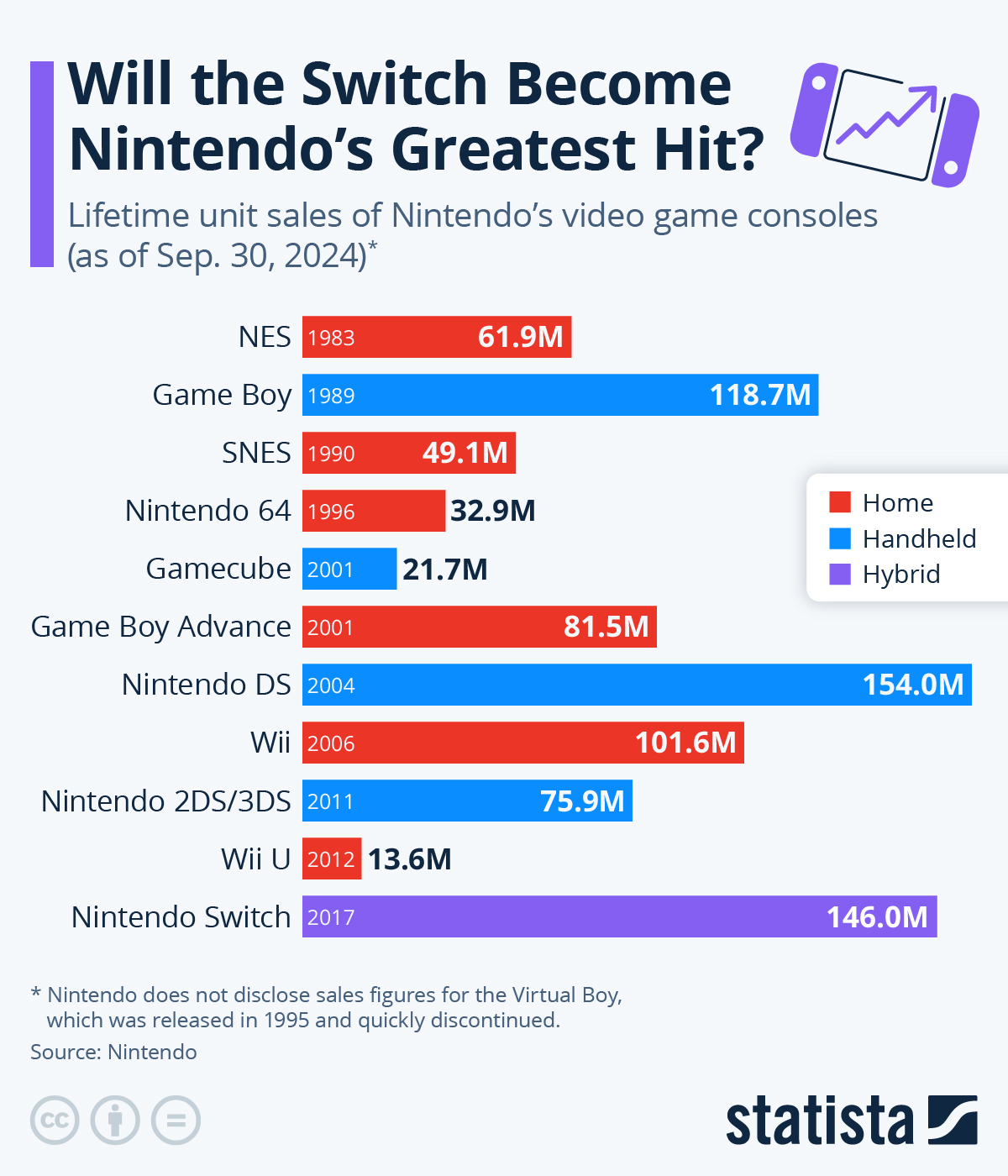

Historical Context: How Does the Switch Compare to Gaming Titans?

Let's put the Switch's 155.37 million units into historical context. Here's how it stacks against other best-selling gaming platforms:

| Platform | Units Sold | Launch Year | End of Life | Years Active |

|---|---|---|---|---|

| Play Station 2 | 160.64M | 2000 | 2013 | 13 years |

| Nintendo DS | 154.02M | 2004 | 2011 | 7 years |

| Nintendo Switch | 155.37M | 2017 | TBD | 9+ years (ongoing) |

| Game Boy/Game Boy Color | 118.69M | 1989 | 2008 | 19 years |

| Play Station | 102.49M | 1994 | 2006 | 12 years |

| Nintendo Wii | 101.63M | 2006 | 2013 | 7 years |

| Play Station 3 | 87.4M | 2006 | 2017 | 11 years |

| Xbox 360 | 85.6M | 2005 | 2016 | 11 years |

What jumps out from this data? The most successful platforms are those that either lasted an exceptionally long time (Game Boy's 19 years) or captured a unique moment in market history (PS2's DVD-player integration during the DVD boom, DS's touchscreen novelty).

The Switch accomplished something different. It didn't have a hardware gimmick like the DS or Wii. It had a strategic insight: people would buy a console that bridges portable and home gaming. That insight turned out to be correct on a massive scale.

The Switch also benefited from being released at the right time. Mobile gaming had matured by 2017. The novelty of smartphones had worn off. People were looking for deeper gaming experiences. Meanwhile, home consoles were becoming increasingly expensive ($400+ for the PS4 Pro or Xbox One X). The Switch offered a middle path: real Nintendo games, playable anywhere, for less money.

The Nintendo Switch has shown strong sales growth since its launch in 2017, with projections indicating it will surpass the PS2's all-time sales record by 2027. (Estimated data for 2026-2027)

Regional Breakdowns: Where Were These 155 Million Switches Sold?

While Nintendo hasn't provided a detailed regional breakdown in recent earnings reports, historical data suggests the distribution of Switch sales has been fairly global, unlike some previous Nintendo platforms.

The original DS dominated in every region, but it was particularly strong in Asia, especially Japan and South Korea. The Wii was also a global phenomenon, with particularly strong adoption in North America and Europe among casual gamers.

The Switch appears to have achieved more balanced regional distribution. Japan remains a core market (Nintendo's home console base is always strong domestically), but the Switch has achieved significant penetration in North America and Europe as well. Third-party developer adoption in Western markets has been stronger than with any previous Nintendo console.

This global appeal is significant. It means the Switch's success wasn't dependent on any single region's preferences or trends. It was genuinely appealing across different gaming cultures and demographics.

The Hardware Revisions: How Multiple Versions Built 155 Million Sales

One often-overlooked aspect of the Switch's success is the multiple hardware revisions. Let's break them down:

Original Nintendo Switch (2017) Launched at $299, this version included the dock, the TV adapter, and the complete experience. It's the most capable of the three versions and remained the premium option throughout the Switch lifecycle.

Nintendo Switch Lite (2019) Launched at $199, the Lite was a handheld-only version that dropped the docking station, removed the TV capability, and had a smaller screen. It was marketed at budget-conscious consumers, younger players, and people who wanted a secondary Switch for playing in bed or on the road.

Nintendo Switch OLED (2021) Launched at $349, the OLED model featured a larger, more vibrant display, better speakers, improved kickstand, and more internal storage. It was marketed at premium customers willing to pay extra for a better experience.

This three-tier strategy was brilliant. It allowed Nintendo to capture consumers across the entire price range and preference spectrum. Someone with

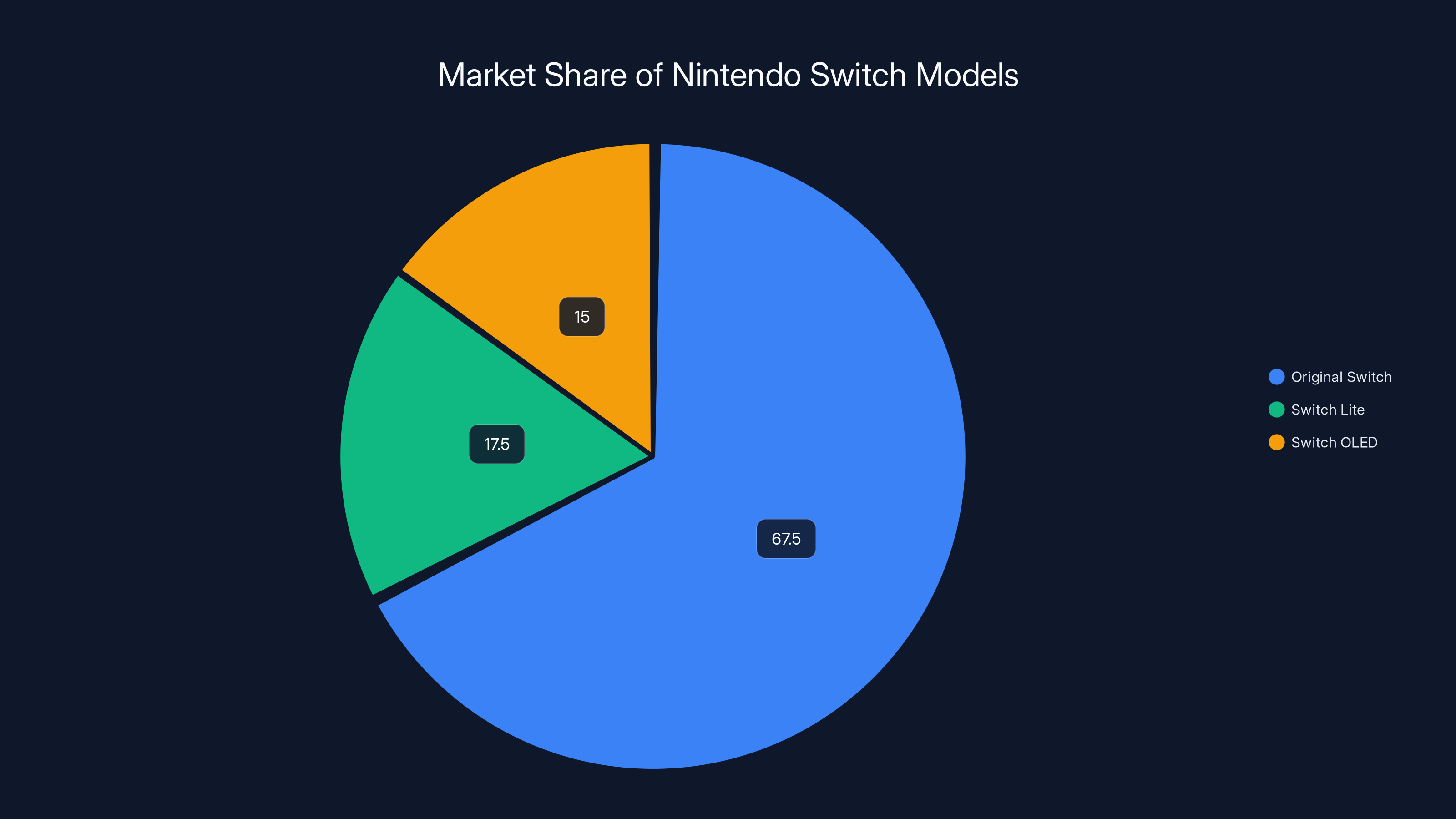

Estimates suggest the original Switch accounts for roughly 65-70% of all unit sales, with the Lite capturing 15-20% and the OLED taking 10-15%. These aren't official numbers from Nintendo, but they're reasonable approximations based on production rumors and market analysis.

The strategy also created upgrade paths. Someone who bought a Switch Lite could later upgrade to the OLED if they wanted a larger screen. Someone with an original Switch could buy a Lite as a secondary device for travel or gifting.

The original Nintendo Switch dominates with an estimated 67.5% of sales, while the Lite and OLED models capture 17.5% and 15% respectively. Estimated data based on market analysis.

Switch's Impact on Third-Party Development and Ecosystem Growth

One of the most underestimated factors in the Switch's success was how it changed third-party development. Before the Switch, Nintendo platforms were often seen as secondary choices for third-party developers. The Wii U barely got any third-party support. The 3DS got some, but not much compared to mobile or other platforms.

The Switch changed this calculus. Suddenly, you had a successful home console that was also portable. Developers realized they could make games for the Switch that weren't possible elsewhere. They could develop once and release the same game to players anywhere in the world, in any mode they preferred.

This led to phenomena like The Witcher 3 running on the Switch, Fortnite reaching 250 million players partially through Switch distribution, Minecraft becoming a ubiquitous title across all platforms, and indie developers discovering that the Switch was an incredibly receptive platform for smaller games.

The ecosystem grew to include thousands of games. By 2025, the Switch's e Shop library exceeded 6,000 titles. For context, that's more games than the Wii had in its entire lifecycle. The library had depth, breadth, and quality across multiple genres.

This ecosystem effect was self-reinforcing. More games meant more reasons to buy the console. More consoles sold meant more reason for developers to support the platform. More support meant more games. This virtuous cycle continued from 2017 through 2025.

Financial Performance: What 155 Million Units Meant for Nintendo

Nintendo's financial performance during the Switch era was remarkable. The company went from being perceived as struggling after the Wii U disaster to being one of the most profitable gaming companies in the world.

Let's look at the actual numbers from Q3 fiscal 2026:

- Sales: 803.32 billion yen ($5.2 billion)

- Year-over-year increase: 86%

- Profit: 159.93 billion yen ($1.03 billion)

- Profit increase: 20% year-over-year

These were driven largely by Switch 2 launch momentum combined with Switch 1 legs. For context, Nintendo's entire annual revenue in 2009 (during the Wii's peak) was approximately

Breaking down revenue, hardware sales (consoles) typically generate 40-50% of Nintendo's gaming revenue, while software (games) generates 45-55%. Accessories and other hardware generate the remainder. The Switch 2's launch meant hardware revenue spiked, but software was also performing exceptionally with Mario Kart World and Donkey Kong Bananza driving attach rates.

The company's margin profile is healthy. Nintendo maintains hardware margins of 25-30%, meaning for every Switch 2 sold at

Estimated data suggests Switch 2 could surpass the original Switch's sales trajectory if key factors like game releases and third-party support are maintained.

The Future: Can the Switch 2 Maintain This Momentum?

With the Switch 2 launching at 17.37 million units through Q3 fiscal 2026, the question is whether it can maintain momentum. The original Switch grew from 2.7 million in month one to double-digit million-unit years for several years in a row. The Switch 2 is already ahead of that pace.

Several factors will determine whether the Switch 2 sustains its success:

Game releases are paramount. We mentioned Mario Tennis Fever and Pokemon Pokopia coming in early 2026, but the long-term pipeline matters. If Nintendo maintains a consistent release schedule of major titles every 3-4 months, the platform should remain compelling. If there are six-month droughts with no major releases, momentum will stall.

Third-party support needs to continue. The Switch benefited from Fortnite, Minecraft, The Witcher 3, and thousands of other games. If third-party developers continue supporting the Switch 2 with AAA and indie titles, the platform has runway. If they skip it in favor of PS5 and Xbox Series exclusives, growth could plateau.

Hardware availability matters during launch windows. Nintendo noted that Q3 profits were lower than expected despite exceeding sales forecasts. This suggests supply constraints. If the company can't manufacture enough Switch 2 units to meet demand, it might leave sales on the table. Conversely, if the company overshoots and manufacturing costs exceed projections, margins could erode.

Competitive landscape is changing. The Play Station 5 and Xbox Series X are not getting cheaper. Microsoft is pushing Game Pass aggressively. Sony is doubling down on live-service games. Nintendo's approach—premium hardware with premium games—works, but only if the company maintains software quality and release consistency.

Price pressure could eventually emerge. If Nintendo wants to push beyond the Switch's record, it might need to drop Switch 2 prices at some point. The original Switch did this around year three (2020). The question is whether Nintendo believes the Switch 2's 9-10 year lifespan is long enough to justify premium pricing throughout or whether price reductions are coming in 2027-2028.

Industry Implications: What the Switch's Success Teaches the Gaming Industry

The Switch's 155.37 million units sold is more than a personal victory for Nintendo. It's a lesson for the entire gaming industry.

Lesson 1: Portability is undervalued. The gaming industry had largely abandoned handheld platforms by 2016. Mobile gaming had supposedly killed the market for dedicated handhelds. The Switch proved otherwise. People don't just want games on their phones. They want serious, complex games they can take anywhere. This lesson applies beyond gaming to any interactive media.

Lesson 2: Power isn't everything. The PS4 and Xbox One had more powerful hardware than the Switch. Yet the Switch outsold both. Power matters for graphics, resolution, and frame rates. But power doesn't sell consoles. Games, price, and innovation do.

Lesson 3: Software matters as much as hardware. The Wii U had a similar concept to the Switch but failed spectacularly. The difference wasn't the hardware; it was the software. Nintendo ensured the Switch had games worth playing from day one. The Wii U didn't.

Lesson 4: Consistency builds loyalty. Nintendo maintained steady support for the Switch for nine years. The company didn't abandon it when the Switch 2 launched. This consistency meant the installed base never felt disposable. Owners knew their hardware and games would remain supported.

Lesson 5: Understand your market. Nintendo identified an underserved market segment: people who wanted serious games they could play anywhere. The company didn't try to out-power the PS4. It didn't try to compete with mobile's convenience. It identified a unique position and owned it completely.

Looking Back: The Journey from DS to Switch

The progression from the DS to the Switch is interesting from a product evolution perspective. The DS (2004-2011) was a dual-screen handheld that revolutionized gaming by making touch controls mainstream. It sold 154.02 million units and was the best-selling Nintendo platform for 14 years.

Then came the 3DS (2011-2020), which added 3D glasses-free gaming. The 3DS was a decent platform but never achieved the cultural phenomenon status of the DS. It sold approximately 75 million units.

Meanwhile, the Wii U (2012-2017) was Nintendo's console offering. It was a confusing hybrid between a console and a handheld with a touchscreen controller. It was poorly explained, had weak software support, and sold only 13.5 million units.

The Switch (2017-present) essentially took the lessons from all three platforms and synthesized them into something greater than the sum of its parts. It had the portability of the DS, the hybrid nature of the Wii U (but explained clearly and executed better), and the software support that the Wii U lacked.

This progression shows how Nintendo learned and iterated. The company didn't just stumble into the Switch's success. It was the culmination of seven years of learning what worked, what didn't, and what gamers actually wanted.

The Competition Never Caught Up

It's worth noting that Sony and Microsoft never seriously attempted to compete with the Switch's portability. The PS Vita, Sony's handheld, launched in 2011 and died a quiet death by 2019. Microsoft never made a handheld. Google attempted Stadia, a cloud-gaming service, but that spectacularly failed. Amazon's Luna exists but barely registers commercially.

The gaming industry seemed to accept that mobile gaming had won the handheld war. Nintendo looked at the same data and came to a different conclusion: people didn't want more games on their phones. They wanted their console games everywhere.

This insight, combined with flawless execution, resulted in 155.37 million units sold and an empire that will likely extend well into the 2030s.

What Comes Next: The Switch 3 and Beyond

Nintendo will eventually release a Switch 3, probably in 2026-2027 based on current rumors and speculation. The Switch 2 won't have a nine-year lifespan like the original Switch. Consoles are following shorter cycles as hardware capabilities advance more rapidly.

When the Switch 3 launches, Nintendo will face the same challenge it's facing with the Switch 2: can it convince people to upgrade from a console that works fine? The Switch 2 solved this by being significantly more powerful. The Switch 3 will need to offer something compelling enough to justify another $300+ expenditure.

The good news for Nintendo: it has nine years of data showing what works, what doesn't, and what customers want. The company has proven it understands the market. Whatever comes next will probably be thoughtfully designed based on that accumulated wisdom.

Conclusion: 155 Million Units of Cultural Impact

The Nintendo Switch becoming the company's best-selling console ever is more than a sales milestone. It's validation of a specific approach to gaming: portability without sacrifice, accessibility without compromise, and software quality as the primary driver of success.

155.37 million units means roughly one in fifty people on Earth owns a Switch. That's extraordinary penetration. It means the Switch has touched lives across continents, languages, and cultures. A Japanese console is being played by kids in Brazil, adults in Europe, and seniors in Australia.

The Switch didn't become the best-selling console in Nintendo history by being the most powerful. It didn't achieve this by having the most expensive games or the most restrictive ecosystem. It became the best-selling Nintendo console by understanding that gaming had evolved. People wanted flexibility. They wanted to play at home and on the go. They wanted quality games at reasonable prices. The Switch delivered on all fronts.

The Switch 2 is already breaking records and on track to become the fastest-selling Nintendo console ever. That's exciting for Nintendo shareholders and developers. But the more important story is the original Switch's journey: from a wild gamble in 2017 to a proven platform that changed gaming forever.

By 2028, the Switch might have 160+ million units sold, surpassing even the legendary PS2. That would be a fitting legacy for a console that took risks, listened to its audience, and executed a vision with remarkable consistency. For Nintendo, for the industry, and for the hundreds of millions of players around the world, the Switch's achievement is something to celebrate.

FAQ

How many units has the Nintendo Switch sold?

The original Nintendo Switch has sold 155.37 million units as of December 31, 2025, surpassing the Nintendo DS's 154.02 million units. This makes the Switch Nintendo's best-selling console of all time. The figure includes sales across all hardware variants: the original Switch, the Switch Lite, and the Switch OLED.

Is the Switch still being sold in 2026?

Yes, the original Switch remains in production and continues selling despite the Switch 2's launch. Nintendo reported 1.36 million Switch units sold in Q3 of fiscal year 2026, demonstrating sustained demand for the older, cheaper hardware. The company maintains multiple hardware options to serve different customer segments and price points.

What is the fastest-selling Nintendo console?

The Nintendo Switch 2 is now the fastest-selling dedicated video platform Nintendo has ever released, with 17.37 million units shipped through Q3 of fiscal year 2026. This compares to the original Switch's 2.7 million units in its first month and demonstrates significantly accelerated adoption for the newer console.

Will the Switch surpass the PS2's record?

Yes, it's very likely. The PS2 currently holds the all-time record with approximately 160.64 million units sold. The Switch is 5.27 million units behind. If the Switch maintains current sales rates of approximately 2 million units annually, it could surpass the PS2 within two to three years, likely by 2027-2028.

Why is the Switch so successful?

The Switch's success stems from multiple factors: it addressed an underserved market for portable serious gaming, offered flexible play modes (docked, handheld, tabletop), maintained an excellent software library, and featured multiple hardware SKUs at different price points (

What games have driven Switch 2 adoption?

Mario Kart World and Donkey Kong Bananza have been the primary drivers of early Switch 2 adoption, selling 14 million and 4.25 million units respectively since launch. Upcoming titles including Mario Tennis Fever (February 12, 2026) and Pokemon Pokopia (March 2026) are expected to further accelerate hardware sales as these franchises have dedicated global audiences.

How long will the Nintendo Switch be supported?

Nintendo has maintained support for the original Switch for nine years and counting, even as the Switch 2 launches. Historically, Nintendo supports multiple console generations simultaneously for several years. The original Switch will likely continue receiving software updates and game releases through at least 2027-2028, ensuring the installed base remains valuable to developers and publishers.

Key Takeaways

- The original Nintendo Switch surpassed the Nintendo DS with 155.37 million units sold as of December 31, 2025, becoming Nintendo's best-selling console ever.

- The Switch 2 is Nintendo's fastest-selling console with 17.37 million units through Q3 fiscal 2026, already exceeding the company's 15 million-unit forecast.

- The PS2 remains the all-time best-selling console with 160.64 million units; the Switch is only 5.27 million units behind and could surpass it by 2027-2028.

- Multiple hardware SKUs at different price points (349) were crucial to the Switch's success, allowing Nintendo to capture different market segments.

- Strong software lineup including Mario Kart World (14 million units), Donkey Kong Bananza (4.25 million units), and upcoming Pokemon Pokopia drove hardware adoption.

- Nintendo maintained support for the original Switch even after launching the Switch 2, with the older console still moving 1.36 million units in Q3 fiscal 2026.

- Nintendo's hybrid portability innovation addressed an underserved market that mobile gaming and traditional home consoles weren't serving effectively.

Related Articles

- Nintendo Switch: Best-Selling Console of All Time [2025]

- Apex Legends Nintendo Switch Sunset: What Players Need to Know [2025]

- Why Sony Is Pushing PS4 Players to PS5 Right Now [2025]

- Abxylute N9C Switch 2 GameCube Controller: Design, Features & Review [2025]

- Dragon Quest VII Reimagined: Complete Review & What Makes It Great [2025]

- Hori Puff Pouch Nintendo Switch 2 Review: Complete Guide [2025]

![Nintendo Switch Becomes Best-Selling Console Ever [2025]](https://tryrunable.com/blog/nintendo-switch-becomes-best-selling-console-ever-2025/image-1-1770109659492.jpg)