NVIDIA RTX 3060 Comeback: Why 2021 GPUs Return to Fight AI Shortage

Something strange happened in the GPU market. The future became expensive enough that manufacturers started selling the past.

According to leaker Hongxing 2020, NVIDIA is planning to bring back the RTX 3060, a graphics card released in early 2021. Not as a discontinued product gathering dust in a warehouse—but as a deliberate re-entry into production, likely hitting shelves within months. For anyone who remembers the crypto mining chaos and the scalper apocalypse of the early 2020s, this feels almost surreal.

But this isn't about nostalgia or corporate whimsy. This is about scarcity, economics, and the simple reality that AI has fundamentally broken the GPU market for everyone else.

TL; DR

- NVIDIA plans to revive the RTX 3060 from 2021 as a stopgap for gamers facing newer GPU shortages

- AI workloads are consuming 70-80% of new GPU production, leaving mainstream gamers stuck with limited options

- The RTX 3060 originally cost $329 but pricing in 2025 remains uncertain given current market distortions

- GDDR7 RAM scarcity makes newer RTX 5060 cards difficult to manufacture at scale

- This trend signals a structural shift in how hardware manufacturers prioritize AI customers over consumer gaming markets

The RTX 3060's original MSRP was

The GPU Market Collapse Nobody Planned For

Five years ago, if you told a PC gamer that NVIDIA would resurrect a four-year-old graphics card because newer models were impossible to buy, they'd think you were describing a fever dream.

Yet here we are in 2025, watching that nightmare unfold in real time.

The problem isn't manufacturing capacity. NVIDIA's fabs and partners have more production lines than ever. The problem is that AI companies are buying everything before it reaches retail shelves. When Anthropic needs 10,000 H100s for training. When Meta is building data centers that consume thousands of GPUs monthly. When every startup in Silicon Valley is racing to secure GPU inventory before their competitors do. Well, your GTX 4090 pre-order doesn't stand a chance.

This creates a perverse economic incentive. A new RTX 5090 sells for

The result? Gamers, content creators, and smaller businesses face a binary choice: wait months for inventory, pay 2-3x MSRP on secondary markets, or accept last-generation hardware. NVIDIA's decision to revive the 3060 is essentially an admission that the company has stopped trying to serve the traditional gaming market entirely.

Which, honestly, makes sense from a business perspective. Cold, but sensible.

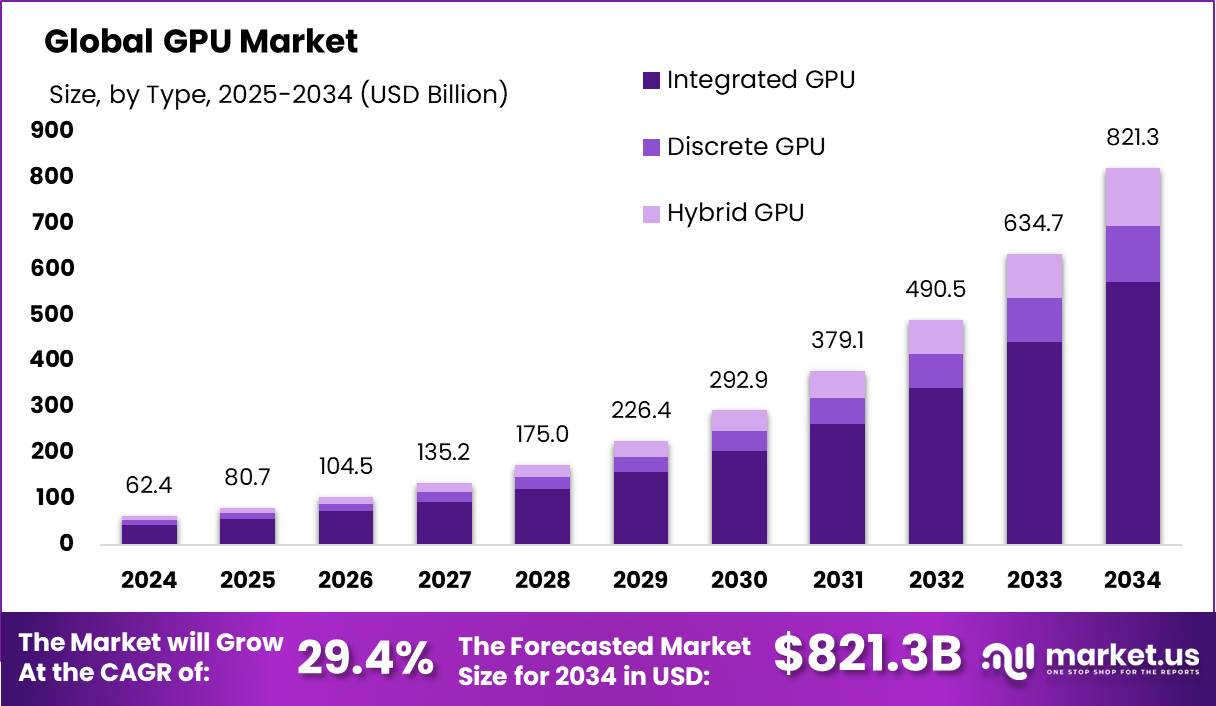

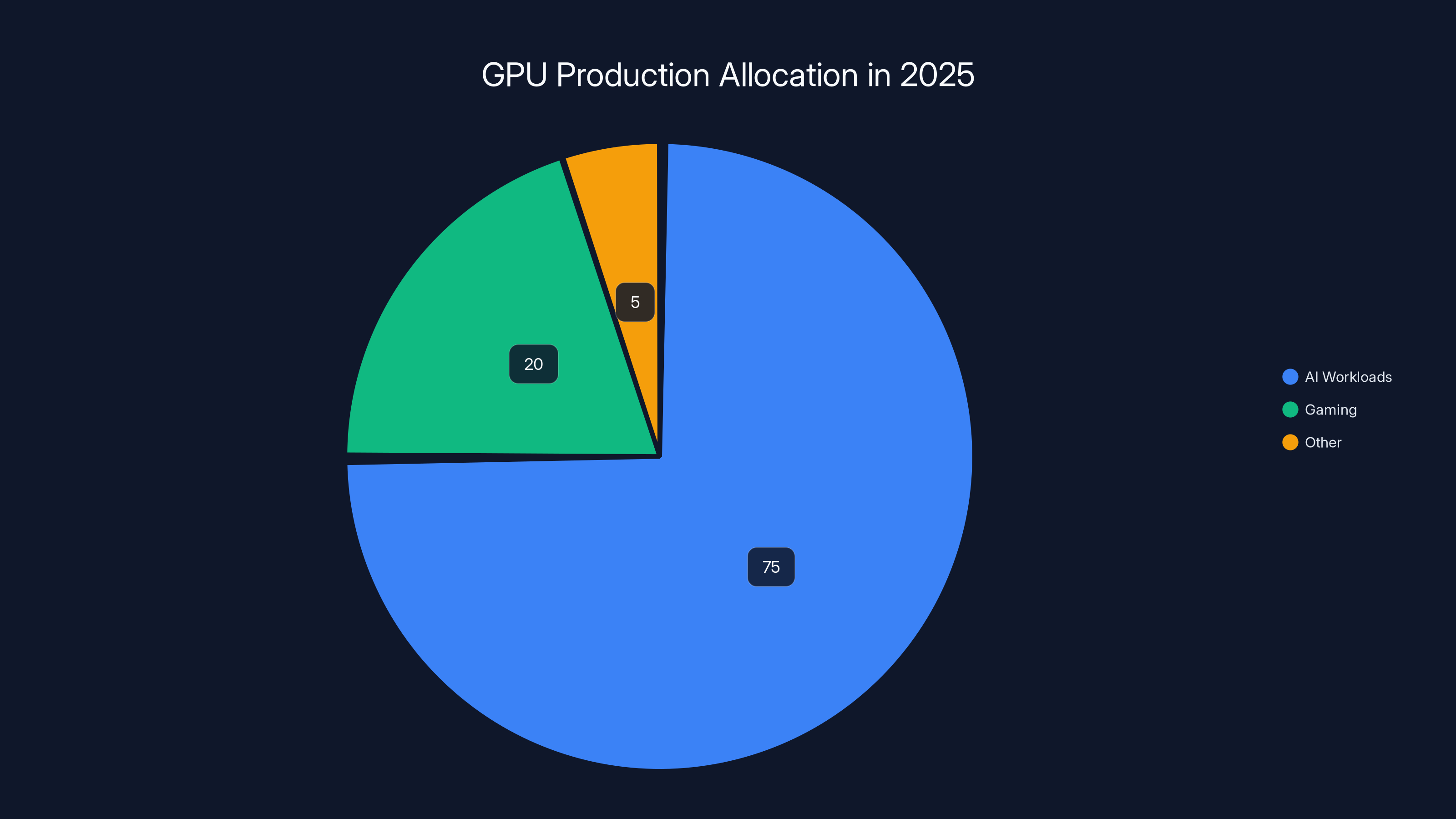

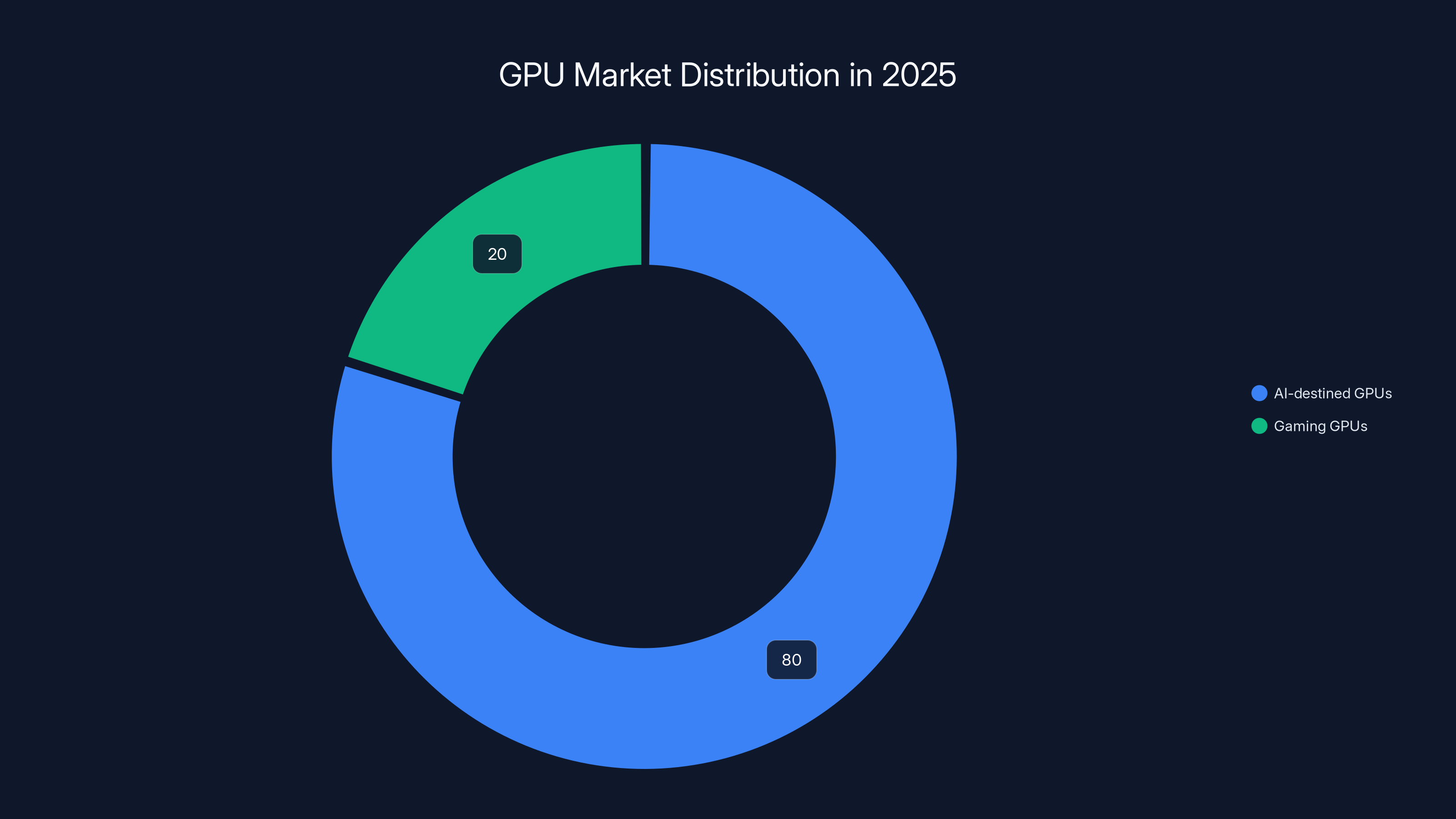

AI workloads are estimated to consume 75% of GPU production in 2025, leaving only 20% for gaming and 5% for other uses. Estimated data.

Why the RTX 3060 Never Really Died

When NVIDIA officially discontinued the RTX 3060 in 2024, nobody celebrated. In fact, the opposite happened.

The 3060 became a ghost product—still available in some channels, still performing reliably for the games people actually play, and still wanted by users who realized that buying used was the only option left. Secondary markets on eBay, Amazon Marketplace, and regional retailers kept the card alive through sheer demand inertia.

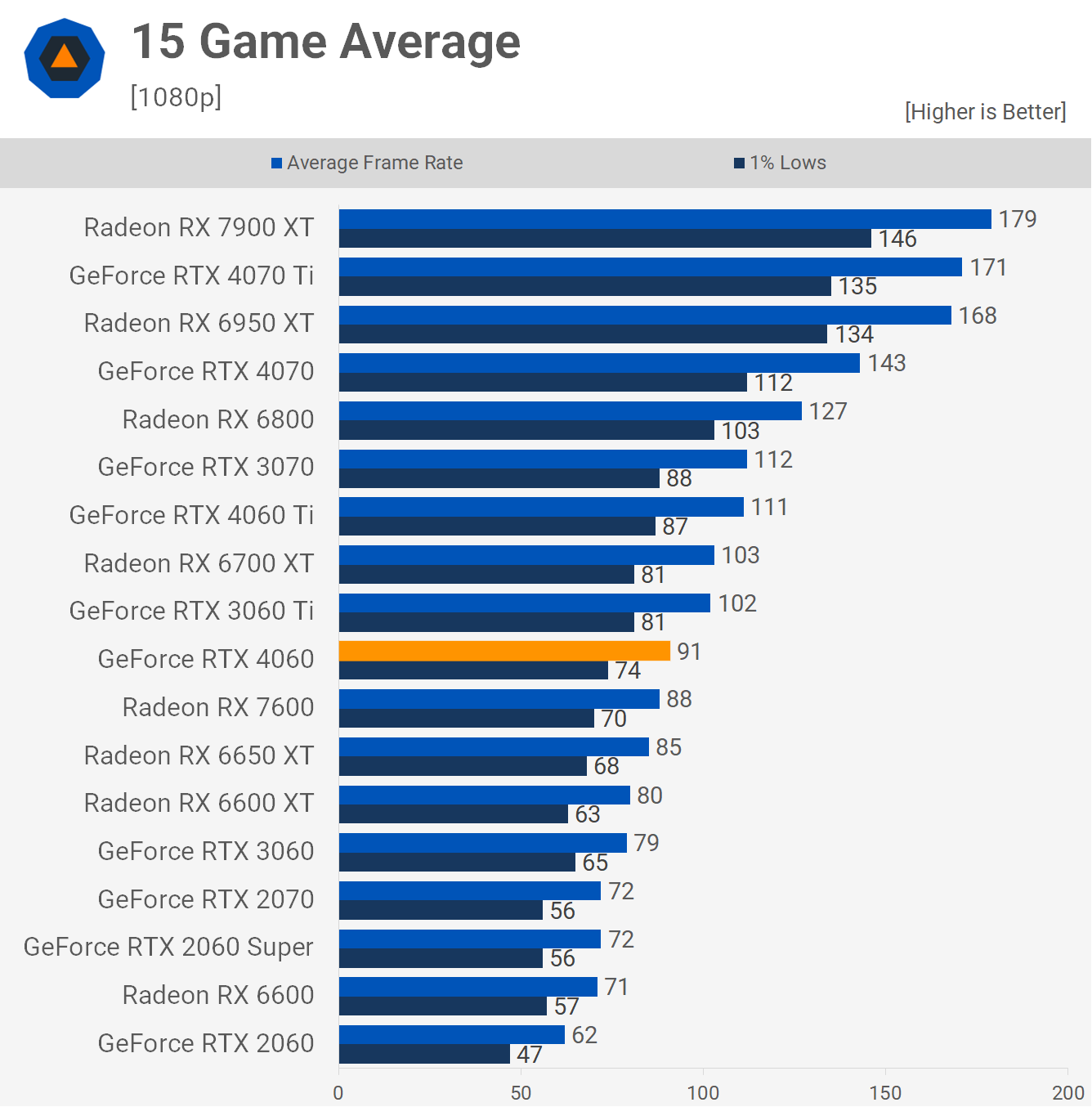

This is important because it tells us something about GPU longevity that the industry doesn't like to admit: a 2021 graphics card is still perfectly functional for 95% of actual gaming workloads in 2025. You're not playing Cyberpunk 2077 on max settings at 4K with ray tracing if you're using a 3060. But you're playing it. Competently. At reasonable settings. On a 1440p monitor with decent frame rates.

The 3060 brings 12GB of GDDR6 memory, 3,584 CUDA cores, and a thermal envelope that doesn't require a power plant to run. For esports titles, strategy games, and even modern AAA games at medium-high settings, the 3060 is a known quantity. Developers have three years of optimization experience with this exact hardware. The community has thousands of forum posts optimizing settings. It's comfortable, familiar, and most importantly, it's available.

When NVIDIA phased out production in 2024, they probably didn't anticipate this exact scenario. They assumed newer cards like the RTX 4060 and 5060 would fill the gap. But those newer cards face a different problem entirely: component scarcity at the lower end of the market.

The GDDR7 RAM Bottleneck Nobody Saw Coming

Here's where this story gets genuinely interesting from a supply chain perspective.

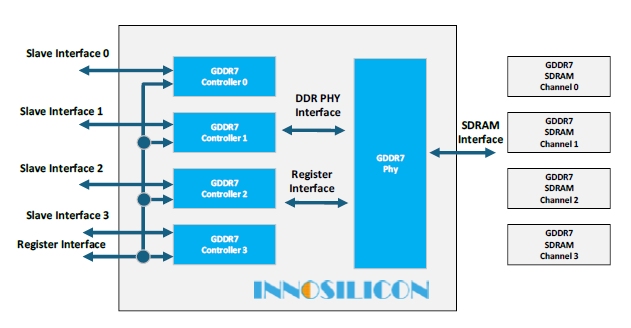

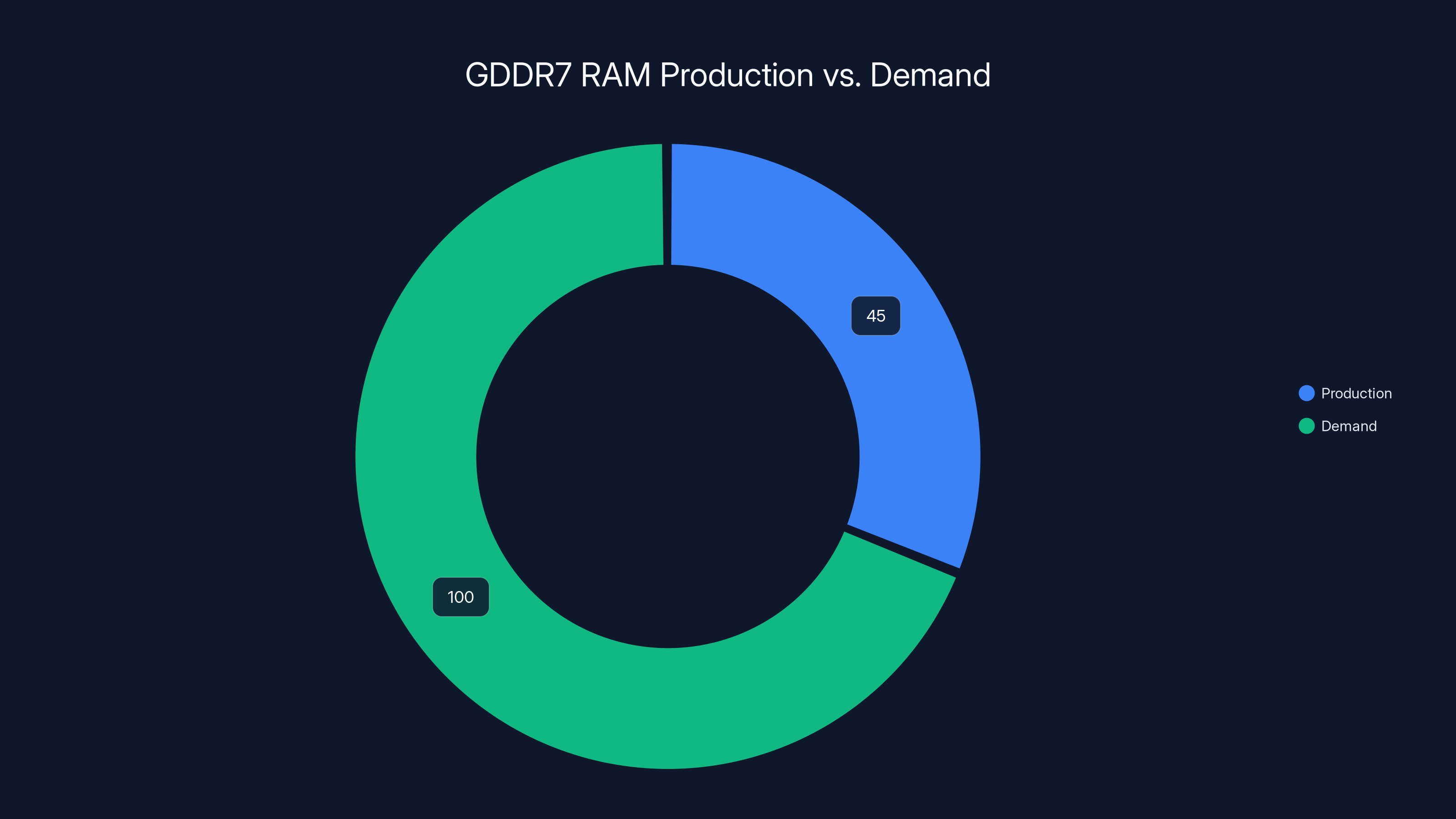

The RTX 5060, NVIDIA's spiritual successor to the 3060, requires GDDR7 memory. This is faster, more efficient, and theoretically better than the GDDR6 in the 3060. Theoretically. In practice, GDDR7 RAM production is running 40-60% behind demand forecasts. Only three manufacturers produce GDDR7 at scale—Samsung, SK Hynix, and Micron—and all three are prioritizing high-margin enterprise contracts over gaming GPU memory.

Micron famously had to shutter operations at one facility specifically because the economics of gaming RAM couldn't compete with data center demand. When your choice is producing GDDR7 for an RTX 5060 that sells for

This creates a chokepoint. The RTX 5060 can't be manufactured in volume because the memory isn't available. The RTX 4060 still uses GDDR6, but NVIDIA is actively phasing out that design. And gamers are left wondering why newer generations cost more and deliver smaller inventory.

The 3060, however, uses GDDR6—and GDDR6 production is... fine. Not abundant. But sufficient. The memory supply chain for older-generation DDR is stable because it's had five years to mature and optimize. You can manufacture the 3060 without hitting the same supply constraints that plague newer designs.

It's an elegant market solution to a supply problem, if we're being charitable. Or it's NVIDIA admitting that their roadmap for newer cards is fundamentally broken. Probably both.

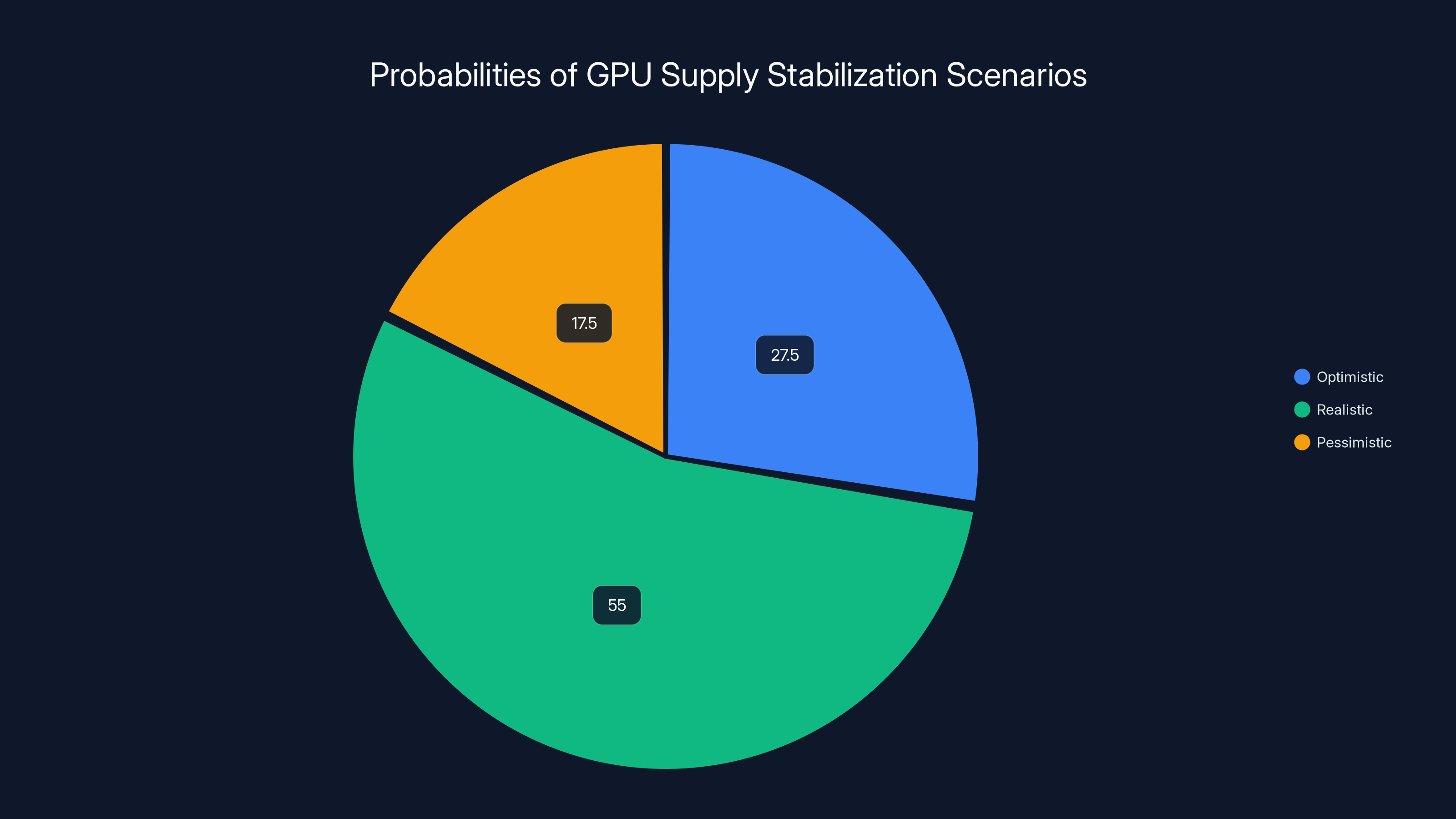

The realistic scenario, with a 55% probability, suggests that GPU supply will remain constrained for 2-3 years, with prices stabilizing at a premium. Estimated data based on market trends.

The AI Takeover of GPU Production

Let's talk about the elephant in the server room: artificial intelligence has consumed the GPU market.

When generative AI exploded in 2023, nobody anticipated how resource-hungry these systems would actually be. Chat GPT alone requires millions of GPU-hours monthly just to handle inference requests. Training the next generation of models? That's thousands of GPUs running continuously for weeks or months. Multiply that across every major tech company, every AI startup, every enterprise trying to build proprietary models, and you're looking at GPU demand that makes cryptocurrency mining look like a hobby.

The numbers are staggering. Industry analysts estimate that 70-80% of new GPU production is now flowing to data centers, AI infrastructure, and enterprise deployments. That leaves 20-30% for everything else—gaming, creative workloads, research, small business computing, software development. All of those use cases are fighting over crumbs.

But here's the thing that really matters: this isn't temporary. This isn't a bubble that will pop next year. We're watching a fundamental restructuring of how GPUs are manufactured and distributed. The consumer market—which was the core of GPU sales for 20 years—is now a secondary market. Enterprise is primary. AI is permanent. Gamers are... well, they're on the waiting list.

NVIDIA's solution—reviving the 3060—is a Band-Aid on a much larger wound. It temporarily addresses the availability problem without actually solving the underlying allocation problem. You can bring back older cards, but if AI demand keeps growing at 40-50% annually, you'll need to resurrect even older hardware within 12-18 months. At some point, you run out of past generations to recycle.

Pricing: The Real Mystery

Here's what we don't know yet: how much will the resurrected RTX 3060 cost?

The original MSRP was

But NVIDIA has absolutely no obligation to honor 2021 pricing in 2025. The company has made it abundantly clear that it will charge whatever the market will bear. The RTX 4090 was supposed to cost

So when NVIDIA brings back the 3060, will it be

There's also the possibility that NVIDIA prices it aggressively low to clear inventory and maximize volume—a classic "we're not going to make much margin on this, but we want to sell millions" strategy. But given the company's recent track record of prioritizing margin over volume, I'm skeptical.

In 2025, the GPU market is heavily skewed towards AI applications, with AI-destined GPUs making up 80% of sales compared to just 20% for gaming GPUs. (Estimated data)

Market Scarcity as a Structural Shift

This situation reveals something important about how hardware markets actually work when you strip away the marketing.

For decades, PC gaming drove GPU architecture and production. If you wanted a GPU optimized for gaming, you went with NVIDIA or AMD because those markets were large enough to justify R&D investments. Enterprise customers bought the same hardware and adapted it for server use. It was a consumer-led market with enterprise following.

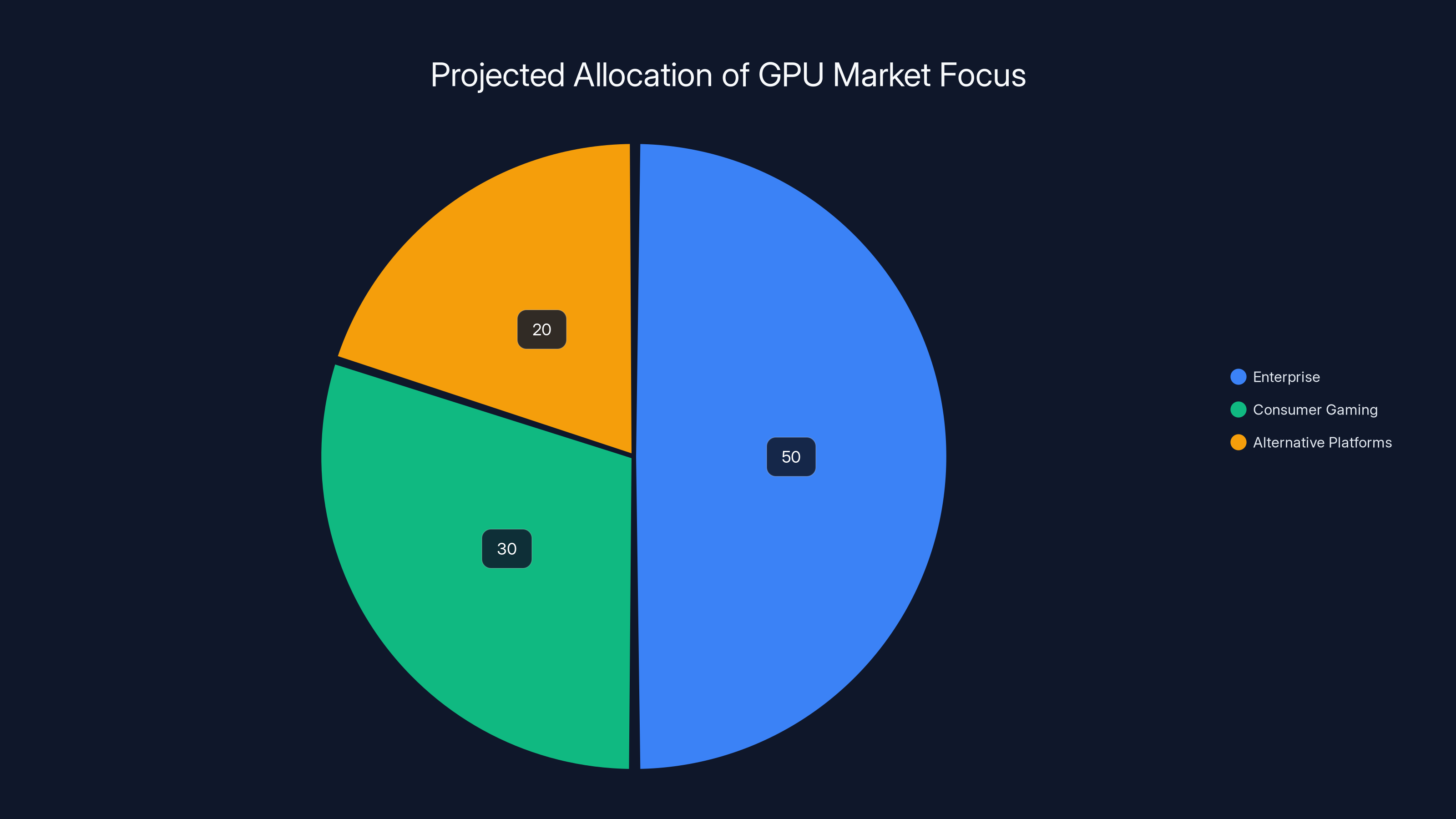

That dynamic has completely inverted. Enterprise AI is now the lead market. Consumer gaming is the tail. Manufacturers design for data centers first, then figure out how to adapt those designs for gamers second.

This has massive implications. It means GPU roadmaps will be driven by AI training requirements, not gaming performance. It means memory specs will prioritize enterprise workloads. It means the entire architecture of graphics cards will continue to diverge from what gamers actually need.

The RTX 3060 comeback is a symptom of this shift, not a reversal of it. NVIDIA isn't bringing back old hardware because they want to—they're doing it because newer hardware can't be manufactured in sufficient quantity to serve gaming demand. It's a stopgap, a temporary fix, a Band-Aid on a structural problem that won't heal.

What happens in 2026? If AI demand continues growing—which it will—then the shortage will only worsen. Do they bring back the RTX 2060? The original GTX 1060 from 2016? At some point, reviving ancient hardware becomes impractical. But by then, maybe the market will have adapted. Maybe gamers will switch to cloud gaming services run on those enterprise data centers. Maybe the entire consumer GPU market will collapse and reconstitute itself as a niche.

Or maybe—and this is the scenario NVIDIA is probably hoping for—AI demand will stabilize, new fabs will come online, and supply will finally catch up to demand. In that scenario, the 3060 revival is just a one-off event, a minor curiosity in GPU history.

Based on current trends, I'd give that scenario about a 30% probability.

The Economics of Legacy Hardware

From a pure manufacturing standpoint, bringing back the 3060 actually makes financial sense in ways that might surprise you.

Retooling a production line to manufacture an older design is expensive—typically $50-200 million depending on the complexity. But here's the advantage: all the design work is already done. The tooling is documented. The supply chains are established (mostly). The yield rates are optimized after years of production. You're not designing a new product—you're restarting an assembly line.

Compare that to designing an entirely new GPU for the gaming market. That's a 2-3 year process with billions in R&D, all for a market that's now secondary to enterprise. It doesn't make economic sense. You're better off reviving an old design that you know will sell.

There's also the question of wafer allocation. NVIDIA's production at TSMC is limited—there's only so many high-end process nodes available. Those nodes are reserved for the RTX 5090, the H200, the latest enterprise chips. You can't add more gaming GPUs without reducing enterprise capacity, and NVIDIA will never do that. But older designs like the 3060 used older process nodes—16nm or older. Those nodes are less contested. There's more available capacity. So from a manufacturing perspective, the 3060 doesn't cannibalize any enterprise production. It uses entirely different manufacturing resources.

From NVIDIA's perspective, this is optimal. They get to serve an underserved market (desperate gamers) without sacrificing a single GPU worth of enterprise production. They reactivate an old supply chain. They potentially margin-stack by pricing legacy hardware at current-market rates instead of historical rates.

It's actually quite clever, if a bit cynical.

GDDR7 RAM production is currently estimated to be 40-60% behind demand, causing a significant supply bottleneck for the RTX 5060. Estimated data.

Impact on PC Gaming's Future

What does all of this mean for PC gaming as a platform?

Nothing good, if we're honest. The revival of the RTX 3060 is essentially an admission that NVIDIA has given up on serving the gaming market with cutting-edge hardware. Gamers don't get the newest technology. They get the older tech that's easier to manufacture when times are tough.

But there's a silver lining buried in here somewhere. The 3060 is actually a legitimately good GPU for gaming in 2025. It's not cutting-edge. It won't max out every setting in every new AAA title. But it will play modern games competently at reasonable settings. That's not nothing. For a market segment that has been completely abandoned by manufacturers, having access to a known-good, reliable piece of hardware is actually progress.

It also raises questions about what "next-generation" gaming even means anymore. For decades, PC gaming was about playing the latest games with the latest graphics hardware. But if you can't get the latest hardware because it's all reserved for AI, then maybe PC gaming evolves into something else. Maybe it becomes about playing games well with older hardware. Maybe it becomes about efficiency and optimization rather than raw power.

We're already seeing this happen in indie games and esports titles. Those markets have largely moved past the "I need the newest GPU to play" mindset. They've adapted to 2021-era hardware because that's what was available. The RTX 3060 revival might be the official acknowledgment that this is the future of PC gaming.

Which, again, isn't ideal. But it's the market we're living in.

The Broader Supply Chain Crisis

The GPU shortage isn't happening in isolation. It's part of a much larger supply chain problem that has been building for three years.

Ram prices have skyrocketed because AI data centers need massive amounts of high-bandwidth memory. Crucial, one of the world's largest RAM manufacturers, actually shut down divisions specifically because they couldn't compete with enterprise contracts. Power supplies are increasingly expensive because high-end GPUs demand 450W-600W from the wall. SSD prices have inflated because of the same enterprise hoarding that affects GPUs.

The entire PC hardware ecosystem is getting squeezed because one market segment (AI) has effectively captured most of the manufacturing capacity and supply chain resources. It's not sustainable long-term. But "long-term" might be 3-5 years away.

In the near term, this squeeze will only tighten. More components will become scarce. Prices will continue rising. Older generations of hardware will be the only things available at reasonable prices. And PC gaming will increasingly become the domain of people with either unlimited budgets or extreme patience.

The RTX 3060 is a canary in this particular coal mine. It's the first sign that the entire PC gaming market might be deprioritized in favor of the AI economy. It probably won't be the last.

Estimated data suggests enterprise holds 50% of the GPU market focus, with consumer gaming at 30% and alternative platforms at 20%. This reflects a shift towards enterprise dominance.

When Will Supply Actually Stabilize?

Here's the million-dollar question: when does this end?

Optimistic scenario: New manufacturing capacity comes online in late 2025 and early 2026. Samsung, TSMC, and Intel all have new fabs opening. If that capacity is allocated toward consumer GPUs, supply could improve significantly. Combined with potential slowdown in AI training (because the models hit performance plateaus), we might see something resembling balance in 2026-2027.

Probability: Maybe 25-30%.

Realistic scenario: AI demand remains strong, new manufacturing capacity is reserved for enterprise/data center applications, and consumer GPU supply remains constrained for another 2-3 years. We see periodic revivals of older hardware as needed. Gamers adapt to limited options and older technology. Prices stabilize at a premium to pre-2023 levels but don't increase further.

Probability: Maybe 50-60%.

Pessimistic scenario: AI continues accelerating. New fabs are built specifically for AI workloads. Consumer GPU production continues declining as a percentage of total manufacturing. In five years, consumer gaming GPUs are manufactured in the same volumes as high-end workstations today—barely enough to serve the market.

Probability: Maybe 15-20%.

The most likely scenario is somewhere in the middle. Supply improves, but never returns to the pre-2023 abundance that gamers enjoyed. GPU prices stabilize at a new equilibrium that's 30-50% higher than historical prices. Consumers adapt to older-generation hardware being the norm.

And every couple of years, NVIDIA or AMD brings back another legacy GPU to fill gaps in the market.

Alternatives for Gamers Right Now

If you're a gamer in 2025 trying to upgrade, you have actual options despite the shortage.

Used Market: The secondary market for 2020-2022 era GPUs is robust and prices have stabilized. You can find RTX 3060s, 3070s, and even 2070s at prices that make sense. The warranty is gone, but the hardware is reliable.

AMD Hardware: NVIDIA gets all the attention, but AMD's RDNA3 lineup is less coveted by AI workloads and therefore more available. An RX 6750 XT is a viable alternative to an RTX 3060, available in some markets, and often cheaper.

Previous-Gen NVIDIA Cards: The RTX 4060 is slowly becoming available as stockpiles clear. It's more powerful than the 3060 and uses the same GDDR6 memory, so it's more manufactureable than the 5060.

Intel Arc: Intel's Arc GPU line is criminally underrated and significantly cheaper than NVIDIA equivalents. The drivers are improving, game compatibility is good, and they're actually in stock in most places.

Cloud Gaming: Services like Ge Force Now, PS Plus Premium streaming, and Xbox Game Pass for PC let you play new games without owning hardware. It's not perfect, but it's a legitimate alternative to buying a $500-1000 GPU.

Lower Resolution Gaming: Gaming at 1080p instead of 1440p, using high refresh rates instead of max graphics, prioritizing 144 Hz at medium settings instead of 60 Hz at ultra settings—these are all adaptations the gaming community is increasingly making.

None of these are ideal. But they're real alternatives that exist right now.

NVIDIA's Strategic Priorities

The RTX 3060 revival tells us a lot about how NVIDIA currently views its market priorities.

Enterprise first. Gaming second. Everything else third. The company will do whatever makes the most financial sense—and right now, that means maximizing enterprise GPU production, filling gaps with revived legacy hardware when necessary, and letting the consumer gaming market adapt as best it can.

This isn't necessarily bad strategy. Enterprise contracts are large, multi-year, high-margin, and stable. A single data center contract might represent more revenue than 100,000 consumer GPU sales. From a business perspective, prioritizing that market makes complete sense.

But it does mean the gaming market should expect to be deprioritized. Your upgrade cycle will be longer. Your choices will be more limited. The hardware you want will be harder to find. These aren't bugs in NVIDIA's strategy—they're features. They're the intended outcome of a company that has decided to optimize for enterprise revenue rather than consumer volume.

For the next few years, this is just something gamers have to accept. NVIDIA has all the leverage. They own the market. There's no credible alternative. So they can be candid about their priorities, and gamers have to adapt.

The RTX 3060 revival is that candor made tangible. It's NVIDIA saying: "We're not prioritizing you anymore. But here's something from five years ago that still works. You're welcome."

And you know what? It probably will sell. Desperately.

What About AMD and Intel?

It's worth asking: could AMD or Intel swoop in and capture the gaming market that NVIDIA is abandoning?

Theoretically, yes. AMD's RDNA3 architecture is competitive. Intel's Arc is improving rapidly. There's market opportunity here for a competitor to grab significant share.

In practice, probably not. AMD has the same supply chain issues as NVIDIA. They're also being pulled into AI workloads. Intel's Arc is cheaper and available, but driver support is still inconsistent and many games don't run optimally. Neither company has the market power or installed base to disrupt NVIDIA's dominance in gaming.

Besides, NVIDIA controls the narrative. CUDA is the dominant compute architecture for machine learning. Phys X is deeply integrated into gaming. NVIDIA's software ecosystem is decades ahead of competitors. Even if AMD had perfect hardware, they'd struggle with the software moat NVIDIA has built.

So no—I don't expect to see AMD or Intel meaningfully disrupt NVIDIA's gaming market share in the next 2-3 years. The 3060 revival isn't NVIDIA being forced to serve gamers by competition. It's NVIDIA serving gamers because it costs almost nothing to do so and it maintains user loyalty. Cynical, but strategic.

Historical Context: This Has Happened Before

Here's something interesting: GPU revivals aren't actually unprecedented. This has happened at smaller scales before.

In 2017-2018, when cryptocurrency mining was consuming GPUs like crazy, AMD revived production of older Radeon cards to meet demand from gamers who couldn't get new hardware. It didn't become a major thing—just an interim solution until the mining bubble burst. But the playbook exists.

Similarly, during the 2020-2022 chip shortage (which was a different problem but had similar effects), manufacturers occasionally restarted production of older silicon to maintain product availability.

What's different now is the scale and permanence. Previous revivals were temporary fixes to temporary problems. The RTX 3060 resurrection looks like it might be permanent—or at least semi-permanent. This isn't a one-time event to weather a crisis. This is a new business practice: when newer products are unavailable due to structural supply constraints, older products get resurrected.

It's an adaptation to a market that fundamentally changed in 2023.

The Philosophical Question

There's something almost sad about all of this, if you think about it philosophically.

For 30 years, PC gaming drove innovation in graphics hardware. Game developers pushed boundaries. GPU manufacturers responded with more power, more features, more cutting-edge technology. It was a virtuous cycle. Gamers benefited from cutting-edge research because they were the market that justified R&D investment.

That era has ended. Artificial intelligence is now the primary driver of GPU innovation. Everything else—gaming, graphics, creative workloads—is secondary.

It's not necessarily wrong. It's not even necessarily bad. AI research is important. Data centers need good hardware. The economic logic is sound. But it does represent the end of an era where consumers were important enough to drive technical innovation.

You can see this shift reflected in every product launch, every allocation decision, every design choice. And the RTX 3060 revival is a symbol of it. We're not getting tomorrow's technology. We're getting yesterday's, because yesterday's technology doesn't compete with tomorrow's enterprise workloads.

It's the future, and it's weird.

Looking Forward: The Next 18-24 Months

If I had to predict the next 18-24 months of GPU market dynamics, here's my best guess.

Q1-Q2 2025: RTX 3060 production ramps. Users are excited initially because it's an available option. Prices are

Q3-Q4 2025: TSMC's new capacity comes online, dedicated mostly to enterprise and next-gen consumer chips. Some relief in RTX 5060 availability, but not dramatic. RTX 3060 remains the most accessible gaming GPU. Used GPU prices stabilize as the market adapts to long upgrade cycles.

Q1-Q2 2026: Next-generation AI accelerators arrive, pulling production focus away from gaming once again. We might see rumors of RTX 4060 revival. Gamers start seriously looking at cloud gaming services as a partial alternative. AMD and Intel try positioning their mid-range cards as the "available" option, with mixed results.

Q3-Q4 2026: Stabilization begins. Supply catches up somewhat. Prices stop rising but don't fall significantly. The "new normal" becomes clear: budget and midrange gaming GPUs are hard to get, high-end cards go to enterprises first, and consumer availability depends on legacy hardware revivals.

This assumes no major surprises—no new AI algorithms that suddenly require 10x more compute, no geopolitical disruption to chip manufacturing, no breakthrough in alternative architectures.

If any of those happen, all bets are off.

Conclusion: The GPU Market Permanently Changed

The RTX 3060 comeback isn't really about a graphics card from 2021. It's about the recognition that the GPU market has fundamentally restructured, and that restructuring is permanent.

AI has won the resource war. Enterprise has won it against consumer. And manufacturers have decided to optimize their businesses accordingly. The RTX 3060 is just the visible manifestation of that change.

For gamers, this means adaptation. Lower expectations about hardware availability. Longer upgrade cycles. Prioritizing reliability and proven performance over cutting-edge specs. Potentially migrating to alternative gaming platforms or cloud services. It's not ideal, but it's the market we're in.

For NVIDIA, this means profitability through enterprise dominance while maintaining enough consumer presence to justify their claims of being the world's most valuable company. They're not abandoning gaming—they're deprioritizing it. That's a crucial distinction. Gamers still matter, just not as much as data centers.

For the broader tech industry, this signals a permanent shift in how resources are allocated. AI isn't a temporary fad that will recede. It's a genuine restructuring of computing priorities that will affect hardware markets, software development, educational focus, and technical career paths for the next 5-10 years.

The RTX 3060 is a window into that future. It's not a happy future where everyone gets the hardware they want. But it's a real future that's arriving faster than anyone expected.

The question now isn't whether the GPU market has changed. It clearly has. The question is whether gamers can adapt quickly enough to stay in the market at all.

Based on current trends, I'd give that odds of about 60-70%. There's enough residual gaming market, enough alternative products, and enough demand to keep consumer GPU gaming alive. But it won't look like it did in 2020. It will look more like gaming in 2013—a legitimate market, but not the dominant force driving hardware innovation.

And the RTX 3060? It'll be the bridge between those two worlds. A 2021 card coming back in 2025 to serve a gaming market that got stranded when the future decided it had more important things to do.

FAQ

What is the RTX 3060 and why is NVIDIA bringing it back?

The RTX 3060 is a graphics processing unit released by NVIDIA in early 2021 as a mid-range consumer gaming GPU. The company is bringing it back to production in 2025 because newer GPU models (like the RTX 5060) are facing critical supply constraints, particularly due to GDDR7 memory scarcity. The revival serves as a stopgap solution to meet gaming demand while enterprise and AI applications consume the majority of newer, more cutting-edge hardware production.

Why has AI demand created such a severe GPU shortage?

Artificial intelligence systems, particularly large language models and training infrastructure, require massive computational resources. Enterprise customers are purchasing 70-80% of new GPU production for AI training, inference, and data center applications. These contracts offer significantly higher margins and longer-term commitments than consumer gaming sales, making them the priority for manufacturers. This has created a structural imbalance where gaming demand can no longer be served by the remaining 20-30% of available production capacity.

How much will the revived RTX 3060 cost compared to its original price?

The original NVIDIA MSRP for the RTX 3060 in 2021 was

Is the RTX 3060 still capable for 2025 gaming standards?

Yes, the RTX 3060 remains competent for contemporary gaming in 2025. It can handle modern AAA titles like Cyberpunk 2077, Starfield, and Dragon's Age: The Veilguard at 1440p resolution with medium-to-high settings and 60+ frames per second. It excels at esports titles, indie games, and strategy games. The limitation is that it won't achieve maximum settings with full ray tracing at 4K, but for mainstream gaming expectations, it's still a viable choice.

Why can't NVIDIA just manufacture more of the newer RTX 5060 instead of reviving old cards?

The RTX 5060 uses GDDR7 memory, which is facing severe production bottlenecks. Only three companies manufacture GDDR7 at scale (Samsung, SK Hynix, and Micron), and all are prioritizing enterprise contracts over consumer gaming applications due to higher margins. The RTX 3060 uses GDDR6, which has mature, stable supply chains with adequate production capacity. From a manufacturing perspective, reviving the 3060 doesn't compete for constrained resources like GDDR7 does, making it a more feasible solution.

What does this mean for PC gaming's future?

The RTX 3060 revival signals a structural shift in how GPU manufacturing prioritizes different markets. It indicates that enterprise AI applications will remain the primary driver of GPU production and innovation for at least the next 3-5 years. For gamers, this means longer upgrade cycles, limited availability of cutting-edge hardware, higher prices, and increased reliance on previous-generation equipment. PC gaming will remain viable, but it will become increasingly secondary to enterprise and AI workloads.

Are there alternatives to NVIDIA cards if supply remains constrained?

Yes, several alternatives exist. AMD's RDNA3 architecture is less coveted by AI workloads and sometimes more available. Intel's Arc GPUs are cheaper, more accessible, and improving steadily. The secondary market for used 2020-2022 era GPUs (RTX 2070, 3070, 3080) offers stable pricing and reliable hardware. Cloud gaming services like NVIDIA Ge Force Now, Play Station Plus Premium, and Xbox Game Pass for PC provide streaming alternatives. Additionally, gaming at 1080p instead of 1440p or prioritizing 144 Hz medium-settings gaming instead of max-settings 60 Hz gameplay extends the viability of older hardware.

When will GPU supply actually normalize and prices stabilize?

Full normalization is unlikely in the near term. Industry analysts project that GPU supply will gradually improve through 2025-2026 as new manufacturing facilities come online, but these new fabs will likely be prioritized for AI and enterprise applications. Realistic expectations suggest supply will stabilize at 2024-2025 levels by late 2026, with prices settling 30-50% higher than pre-2023 pricing. Complete return to 2020-2021 supply abundance is unlikely within the 5-year planning horizon.

Could AMD or Intel disrupt NVIDIA's market dominance with this opportunity?

While AMD and Intel have competitive products, they face the same supply chain constraints and enterprise pull-toward-AI as NVIDIA. Additionally, NVIDIA has decades of software ecosystem advantages through CUDA, Phys X integration, and driver optimization that create switching costs for consumers and developers. Though AMD and Intel may capture marginal market share among price-conscious buyers, neither company has the position to meaningfully disrupt NVIDIA's dominance in gaming or enterprise in the next 2-3 years. Market opportunity exists, but execution barriers are substantial.

The Bottom Line

We're living through a fundamental restructuring of the computing hardware market, and the RTX 3060 revival is just the most visible symbol of that change. AI isn't a temporary phenomenon that will recede. It's a permanent priority that will shape hardware allocation decisions for the next 5-10 years. Gamers, creators, and other consumer workloads will need to adapt to a world where yesterday's technology is today's solution, and where supply constraints are treated as the normal state of affairs rather than a temporary crisis.

The future of PC gaming is older, less powerful, and more expensive. But it's also real, available, and better than the alternative of having nothing at all.

Key Takeaways

- NVIDIA is bringing back the RTX 3060 from 2021 because AI applications have consumed 70-80% of GPU production capacity, leaving consumer gaming severely constrained

- GDDR7 memory scarcity prevents mass production of newer RTX 5060 cards, making older GDDR6-based 3060 revival the path of least manufacturing resistance

- Enterprise and data center markets now drive GPU pricing, production allocation, and design priorities, permanently deprioritizing consumer gaming

- The RTX 3060 revival signals a structural shift where legacy hardware revivals may become the standard solution for gaming during the AI boom

- Gamers should expect longer upgrade cycles, higher prices, and reliance on older technology as manufacturers optimize exclusively for high-margin enterprise contracts

Related Articles

- Hyperkin Competitor Controller Review: Features, Performance & Alternatives 2025

- 8BitDo Ultimate 3E Xbox Gamepad: Modular Design & Performance [2025]

- 8BitDo Ultimate 3E Xbox Controller: Swappable Switches & Customization [2025]

- RGB Stripe OLED Gaming Monitors: The Next Gaming Display Revolution [2025]

- Hollow Knight: Silksong Dominates Steam Awards Game of the Year [2025]

- CES 2026: The Ultimate Guide to Tech's Biggest Show [2026]

![NVIDIA RTX 3060 Comeback: Why 2021 GPUs Return to Fight AI Shortage [2025]](https://tryrunable.com/blog/nvidia-rtx-3060-comeback-why-2021-gpus-return-to-fight-ai-sh/image-1-1767643591352.png)