Why NVIDIA's High-End GPUs Are Quietly Disappearing From Shelves

It's one of the strangest decisions in gaming hardware in years. Two of NVIDIA's most powerful consumer graphics cards, the RTX 5070 Ti and 5060 Ti 16GB, are being quietly ushered out the door. Not with a press release or official announcement. Just a whisper from YouTube channels covering hardware news, followed by confirmation from board partners like ASUS. According to Engadget, ASUS has stopped producing these models, citing they have reached end-of-life status.

Hardware Unboxed broke the story after speaking directly with ASUS engineers. The conversation revealed something that's been simmering beneath the surface of the GPU market for months: memory is the new bottleneck. Not processing power. Not architecture. Memory.

ASUS explicitly told Hardware Unboxed that the RTX 5070 Ti is facing a supply shortage so severe that the company has placed it into "end of life status." Translation: they're done making it. The 5060 Ti 16GB variant is "almost done as well," with ASUS confirming no future production plans. Australian retailers reported the 5070 Ti is already unavailable through partners and distributors, with expectations that situation will persist through at least Q1 2025, as noted by PC Gamer.

But here's what makes this truly significant: both discontinuation announcements were buried. No grand statement from NVIDIA. No formal press release. Just a YouTube channel asking the right questions and getting honest answers from the people actually building these cards.

This wasn't a strategic decision to push consumers toward newer models. This wasn't planned obsolescence. This is pure economic desperation driven by a memory supply crisis that's reshaping the entire computer hardware industry.

The AI Boom Broke the GPU Supply Chain

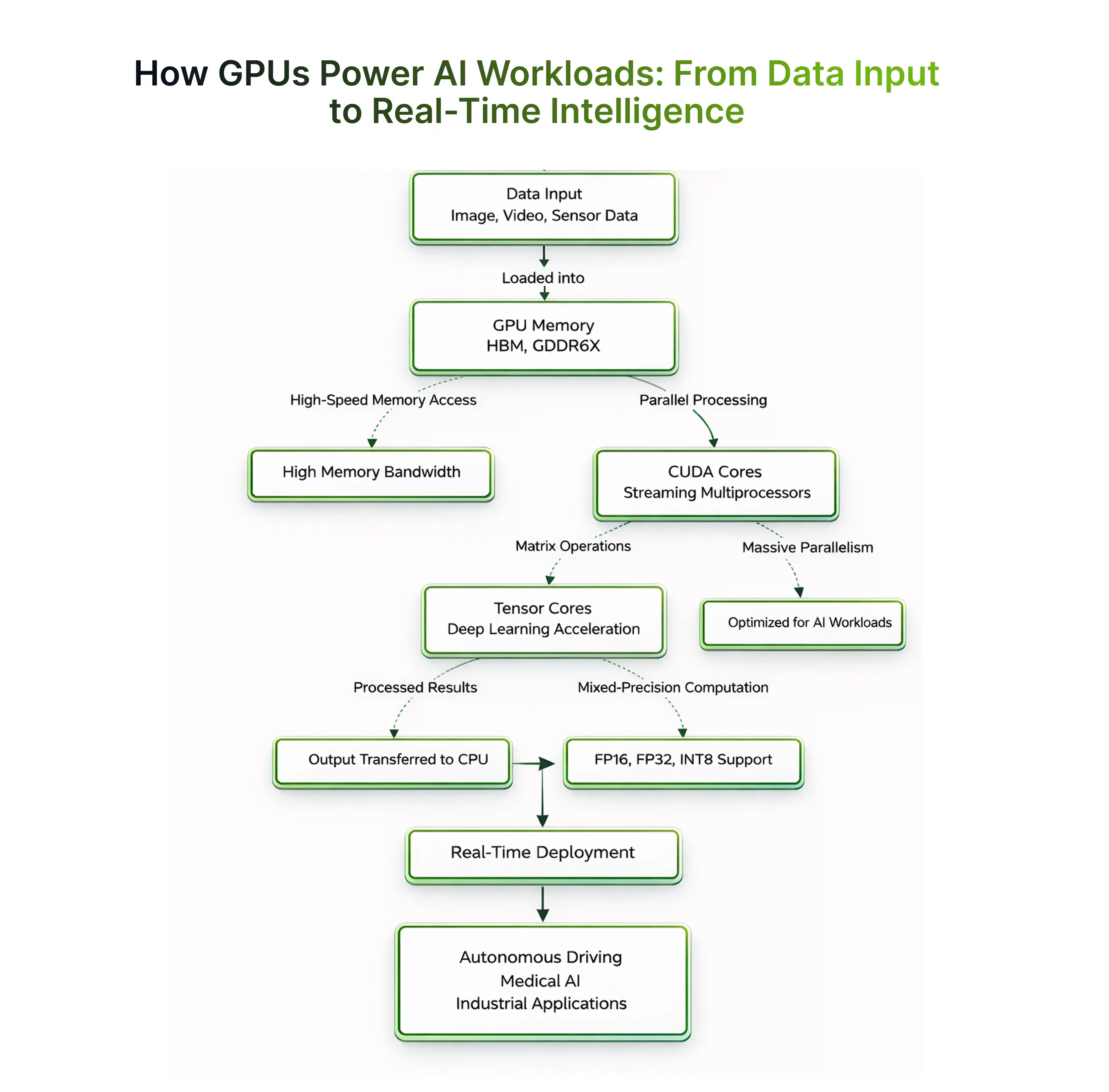

The root cause sits in a handful of semiconductor fabs across Taiwan and South Korea, where something fundamental shifted in late 2023. Data center companies training massive AI models needed memory. Specifically, high bandwidth memory (HBM). Lots of it.

When NVIDIA released the H100 and subsequently the H200 GPU accelerators, enterprise customers ordered them by the thousands. Each one required multiple HBM stacks. The data center boom created an insatiable appetite for a component that memory manufacturers could barely produce fast enough.

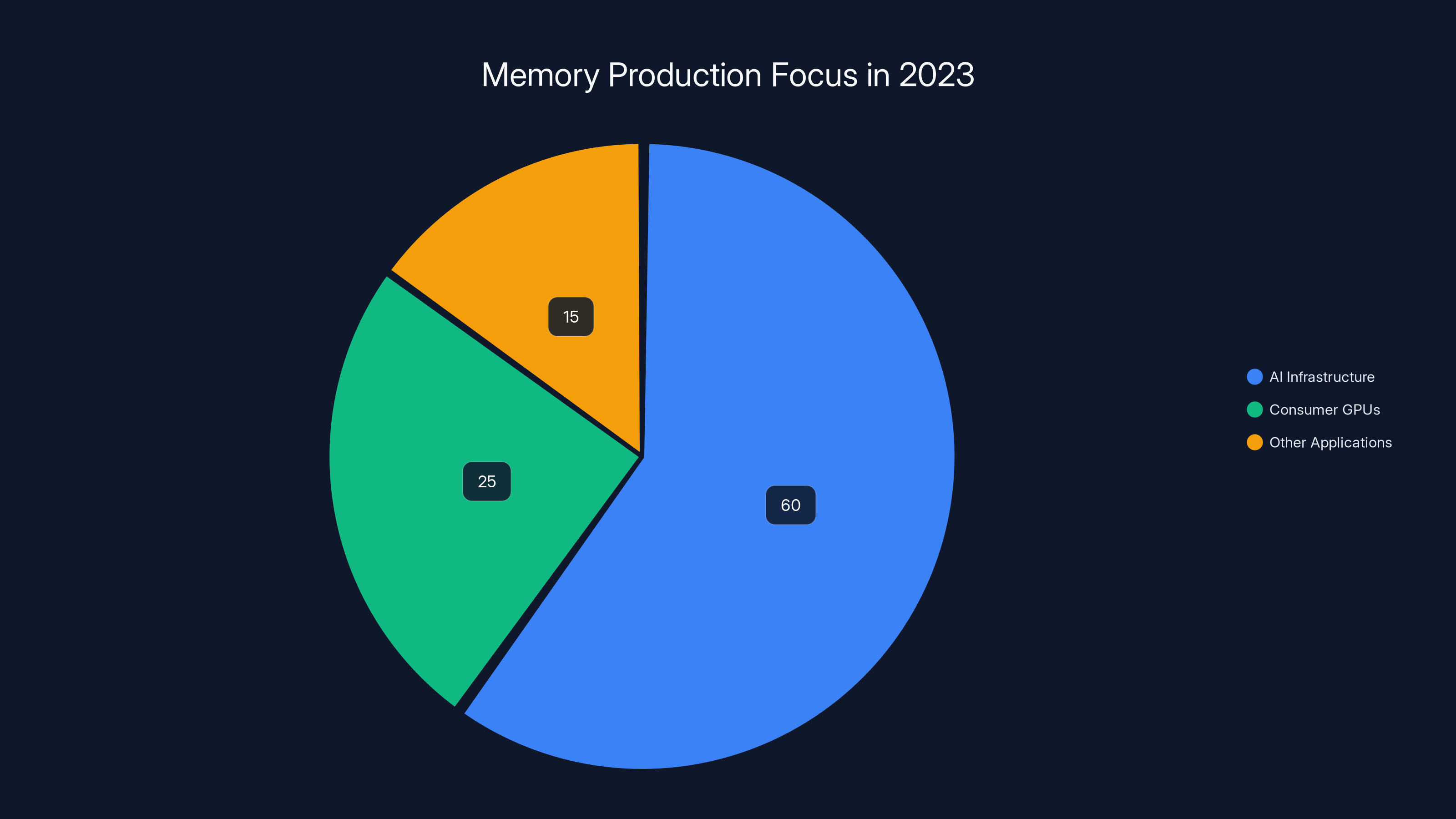

Memory manufacturers—companies like SK Hynix, Samsung, and Micron—faced a choice. They could maintain production lines for consumer RAM, consumer GPUs, and other regular hardware. Or they could shift capacity to the exploding AI market where margins were higher and demand seemed infinite. According to Tom's Hardware, NVIDIA's shipments of H200 to China highlight the growing demand for AI-focused hardware.

They chose the latter. By mid-2024, major memory suppliers had begun deliberately winding down consumer-focused operations. In December 2024, Micron Technology made the decision explicit: the company announced it would completely wind down its consumer-facing Crucial brand to focus exclusively on providing components to AI infrastructure companies, as reported by Tom's Hardware. This wasn't a temporary pause. This was a formal shutdown of a consumer business that had operated for decades.

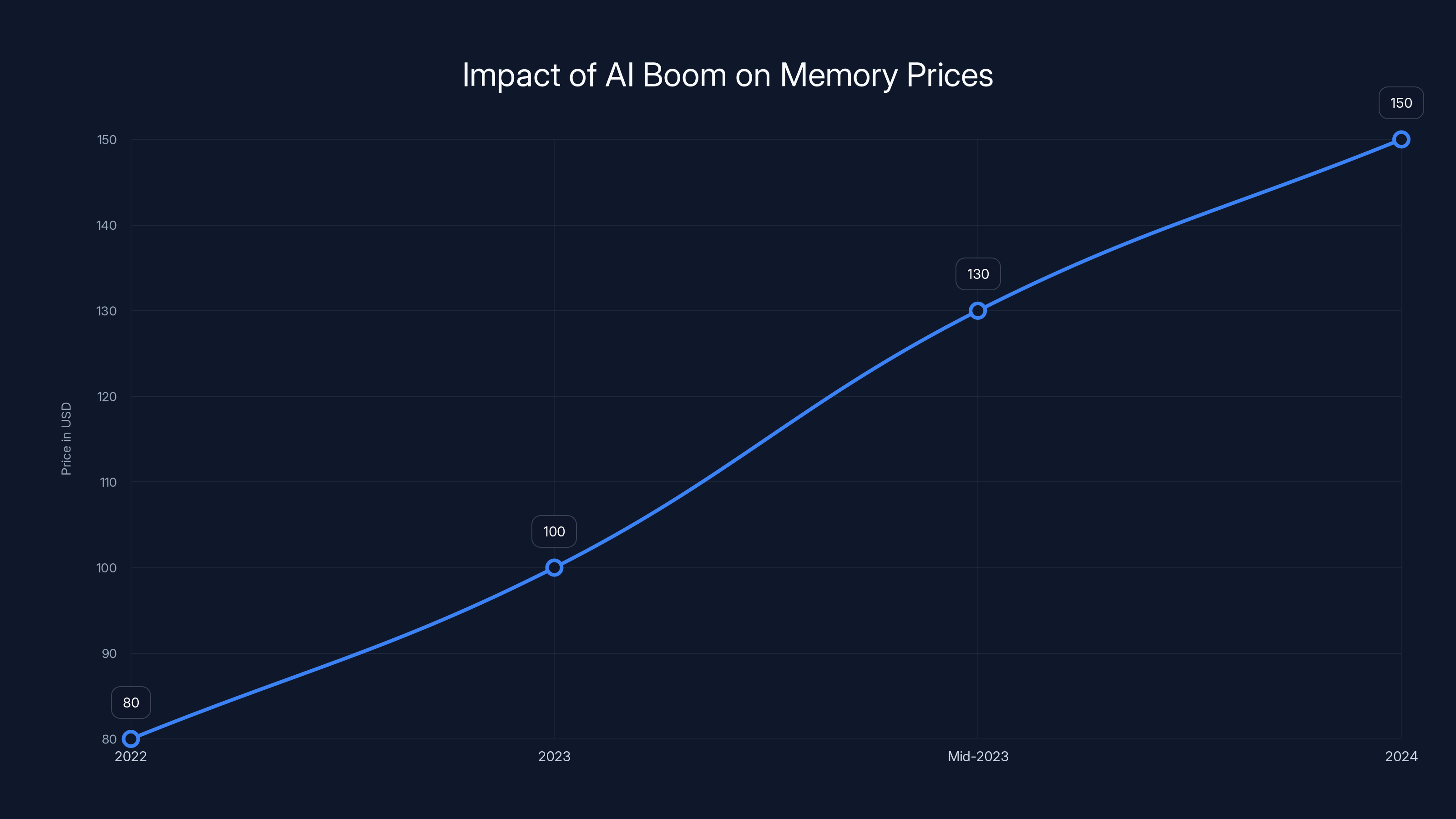

The ripple effects hit immediately. Memory prices for consumer products skyrocketed. RAM kits that cost

Estimated data suggests that 60% of memory production is focused on AI infrastructure, leaving only 25% for consumer GPUs, contributing to the discontinuation of models like the RTX 5070 Ti.

Why 16GB Models Became Targets for Discontinuation

The 5070 Ti and 5060 Ti 16GB variants weren't random victims. They were specifically targeted because of their memory configurations.

Here's the economics: an RTX 5060 Ti with 8GB of GDDR7 costs significantly less to produce than the 16GB variant. The memory itself isn't the expensive part—it's the additional PCB space, the additional memory controllers, the voltage regulation, and the increased complexity. When memory costs spike, these factors become brutal.

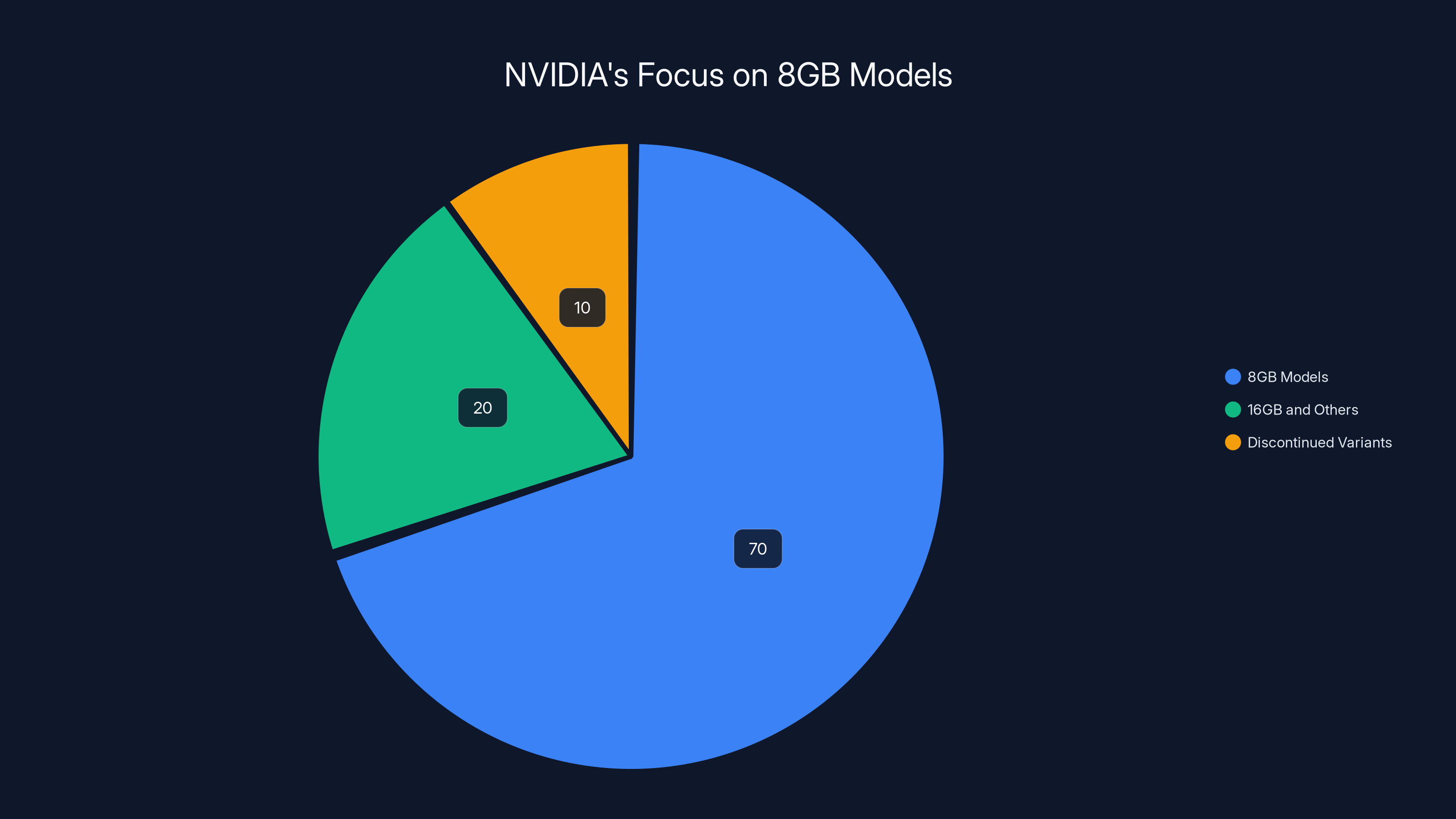

An 8GB configuration means lower production costs, smaller physical cards, and simpler board designs. A 16GB configuration means higher costs at a time when margins are already compressed. From a manufacturer's perspective, discontinuing the 16GB variants while keeping the 8GB models allows them to maintain profit margins and redirect resources to products that don't lose money on each sale.

ASUS, as one of NVIDIA's primary add-in board partners, manufactures the majority of consumer GPUs people actually buy. When ASUS makes this call to discontinue a product line, it signals that the underlying economics have become unsustainable. And if ASUS has reached this point, you can bet that other board partners like Gigabyte, MSI, EVGA, and PNY are facing similar pressures, as noted by TweakTown.

This creates a cascade effect. When multiple board partners stop producing high-memory variants, consumer choice narrows. Availability plummets. Prices for remaining 16GB models spike. The least viable product disappears from the market entirely.

NVIDIA's strategic focus on 8GB models is estimated to capture 70% of their market share, with 16GB and other configurations making up the rest. Estimated data.

The Memory Shortage That Went Unnoticed by Most Gamers

Consumer awareness of this memory crunch has been surprisingly low. Most people see GPU prices rising and assume it's normal market dynamics or supply chain delays. But the actual bottleneck is far more specific.

Memory chip manufacturing is among the most complex processes in the world. A single memory fab represents a multi-billion dollar investment and requires years to reach full production capacity. These aren't facilities that can simply "add more shifts" to increase output. The process is constrained by physics, by equipment availability, and by the fundamental limits of semiconductor fabrication.

When SK Hynix, Samsung, and Micron collectively decided to shift capacity toward HBM for AI data centers, they didn't shut down consumer lines entirely. What they did was redirect new capacity and skip planned expansions. Investment capital that would have gone into expanding consumer memory production instead flowed into AI-focused facilities, as detailed by CNBC.

This manifested as increasing prices without obvious supply disruptions. Consumers could still buy RAM and GPUs—they just cost 30-50% more. For gaming enthusiasts and PC builders, this price hike was painful but not catastrophic. The real casualty was product diversity.

Manufacturers like ASUS had to make triage decisions. Keep producing everything and accept massive losses, or streamline the product line to focus on higher-volume, lower-cost configurations. The 16GB GPU market is niche compared to mainstream 8GB models. Losing a small niche is easier than losing money on every unit sold.

What NVIDIA's Add-In Board Partners Are Actually Saying

ASUS was first, but the underlying admission is damning. The company explicitly told Hardware Unboxed that it "no longer plans to produce" the 5070 Ti and 5060 Ti 16GB. This wasn't speculation. This wasn't "supply is constrained." This was a formal end-of-life decision.

The terminology matters. "End of life" in hardware manufacturing is distinct from "out of stock." Out of stock means supply will eventually return. End of life means production has ceased and won't resume. It's a one-way door.

When a board partner places a product into end of life status, they're signaling several things to the market. First, they've exhausted their inventory of components needed to build that product. Second, they've calculated that the economics of bringing that product back don't justify the effort. Third, they're not expecting demand to shift in a way that would make the product viable again soon.

The fact that ASUS is the first board partner to formally comment on this situation doesn't mean other partners haven't made similar decisions. It likely means ASUS was simply more forthcoming with YouTube channels asking the right questions. Gigabyte, MSI, EVGA, and PNY probably made the same calls—they just haven't announced them publicly, as suggested by IGN.

Consumer RAM prices surged from

How This Impacts PC Gamers in 2025

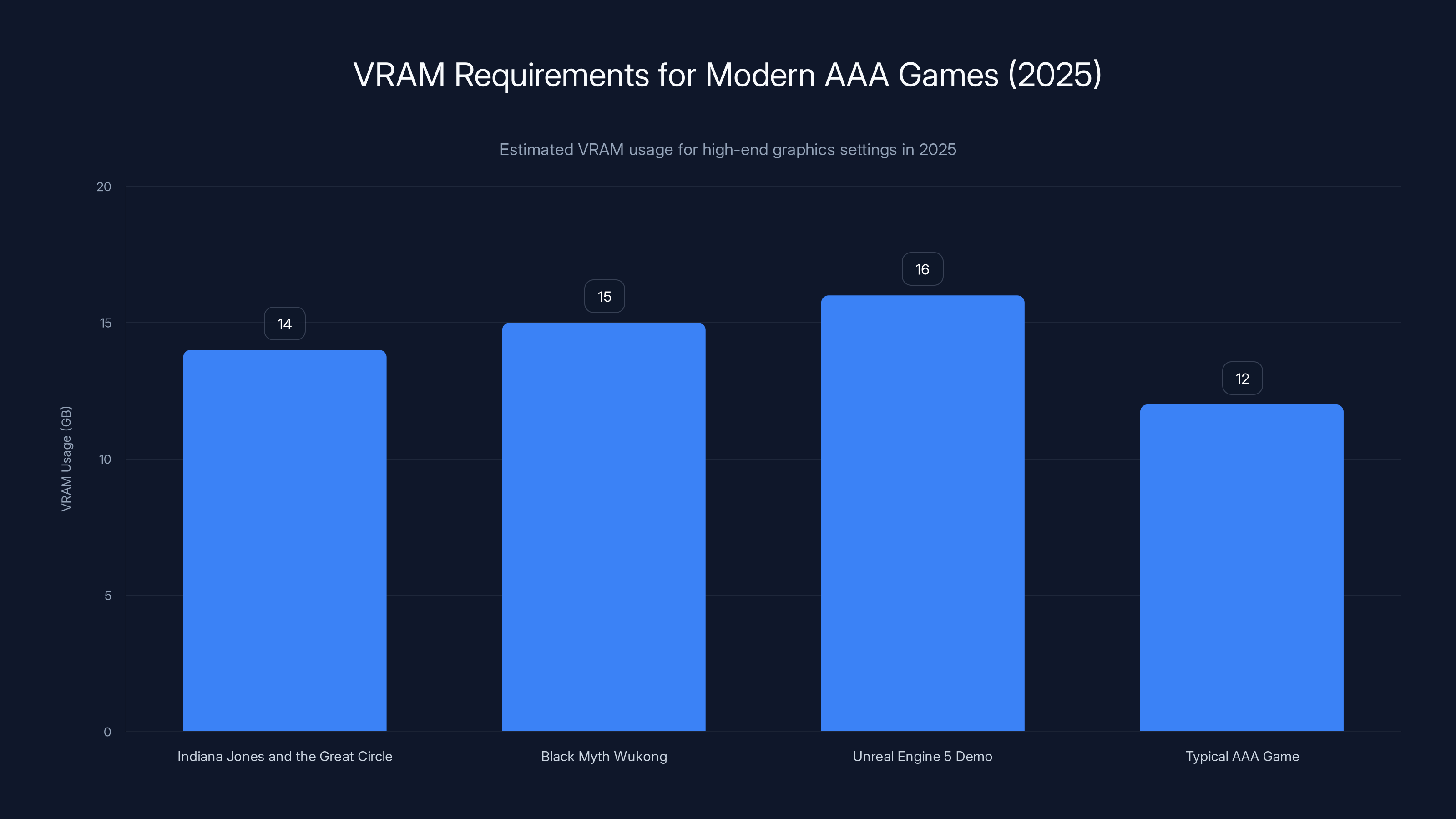

For someone building or upgrading a gaming PC right now, the discontinuation of RTX 5070 Ti and 5060 Ti 16GB models creates a genuine problem. Modern AAA games have become increasingly demanding of VRAM. A title released in 2024 or 2025 that targets high-end graphics settings often requires 12-16GB of VRAM, not 8GB.

Games like Indiana Jones and the Great Circle, Black Myth Wukong with maximum settings, and the Unreal Engine 5 tech demos can easily exceed 8GB usage at 4K resolution. Many of these games actually run better—with higher frame rates and better stability—on 12GB or 16GB variants. The additional memory isn't a luxury. It's a functional requirement for the visual quality that modern gaming has come to expect, as highlighted by The Motley Fool.

With 16GB NVIDIA variants disappearing, gamers have limited options. They can buy older generation cards that still have 16GB stock (like some RTX 4000-series variants), accept the 8GB limitation and deal with reduced visual quality or lower frame rates, or turn to AMD's offerings. AMD still produces 16GB variants of their high-end GPUs, but availability is also constrained by similar memory supply issues.

The price differential between 8GB and 16GB models has historically been

The Ripple Effect: What Other Hardware Will Be Discontinued Next?

If NVIDIA and board partners have already discontinued the 5070 Ti and 5060 Ti 16GB, what's next? The pattern suggests we should be watching several other 16GB and 12GB configurations closely.

The RTX 5070 with 12GB is reported to be safe "for now," according to Hardware Unboxed's reporting, but that doesn't mean it's guaranteed long-term. If memory costs remain elevated or decline only slowly, even 12GB configurations could become economically unviable for lower-end models.

AMD is facing identical pressures. The company's Radeon RX 7700 XT and RX 7800 XT both ship with 12GB configurations, and if memory costs spike further, AMD board partners might face similar discontinuation decisions.

Beyond GPUs, memory-intensive products across the entire PC hardware ecosystem are at risk. High-capacity RAM kits are seeing reduced production. Large-capacity SSDs (2TB and above) are becoming scarcer. Even high-end motherboards with extra power delivery and memory slots face reduced demand when the actual memory you can buy for them has become prohibitively expensive, as analyzed by IDC.

The AI boom has created a gravitational pull on memory production that won't reverse quickly. Even if AI demand plateaus or declines, the infrastructure built to serve it won't disappear. Memory manufacturers will continue prioritizing high-margin data center products over lower-margin consumer hardware.

Estimated data shows GPU prices increased by approximately 40% during the memory shortage, highlighting the indirect impact of redirected manufacturing capacity.

NVIDIA's Strategy: Focus on 8GB Models and Consolidation

NVIDIA's response to this supply crunch reveals a lot about where the company sees the market heading. According to Hardware Unboxed, NVIDIA is actively encouraging board partners to focus on 8GB models: the RTX 5050, RTX 5060, and the RTX 5060 Ti 8GB variant.

This is a strategic consolidation. Rather than supporting a wide range of memory configurations, NVIDIA is narrowing the product portfolio to configurations that are economically viable given current memory constraints. The 8GB sweet spot is defensible because it's the lowest memory configuration that still satisfies most gaming workloads (albeit not all), and it's the most cost-effective to manufacture.

This strategy makes sense from NVIDIA's perspective. By consolidating around 8GB models, the company maintains pricing power—without 16GB competitors, 8GB models can command higher prices—while reducing the complexity of the supply chain. It's not about consumer choice or market diversity. It's about sustainable margins.

But this strategy has consequences for consumers. A consolidated product line means less optionality. It means gamers with specific memory needs can't find products that match their requirements. It means the GPU market is actively shrinking in terms of choice, even as NVIDIA's market share and financial performance remain strong.

The Broader Context: How AI Is Reshaping Consumer Hardware

The discontinuation of the RTX 5070 Ti and 5060 Ti 16GB isn't an isolated incident. It's one visible symptom of a much larger shift in the technology industry: AI demand is reshaping what consumer hardware even gets manufactured.

This isn't the first time a computing trend has redirected resources from consumer to enterprise. In the early 2010s, GPU manufacturing shifted toward data centers and HPC (high-performance computing) applications. But that shift happened gradually and consumer GPUs still maintained their own dedicated production capacity.

The current AI boom is different. The demand is so voracious and the margins so attractive that memory manufacturers are actively deprioritizing consumer production. It's not just a reallocation of existing capacity—it's a fundamental change in what gets built and what gets left for consumers to figure out on the secondary market.

Micron's decision to shut down Crucial entirely is the clearest indicator of this shift. The company isn't saying "we'll produce less consumer RAM while we ramp up data center components." They're saying "consumer RAM doesn't fit in our strategy anymore, period."

If other memory manufacturers follow suit—and they likely will as they see Micron's margins improve by exiting the consumer business—we could see a scenario where consumer-grade memory becomes scarce and expensive for years.

Estimated data shows that modern AAA games in 2025 require between 12GB and 16GB of VRAM for optimal performance at high settings, highlighting the challenge for gamers with only 8GB VRAM cards.

How This Affects Gaming in the Next 12-24 Months

Shorty-term, the discontinuation of RTX 5070 Ti and 5060 Ti 16GB models means reduced options and potentially higher prices for remaining 16GB inventory. Retailers sitting on this stock might keep them longer, waiting for prices to rise as availability shrinks. Some might liquidate them quickly to clear shelf space. Market dynamics will be messy.

For gamers planning to upgrade or build new systems, the practical impact is constraint. If you want 16GB of VRAM in a new NVIDIA GPU, you'll need to step up to more expensive tiers. The 5070 Ti or 5080 with 16GB options simply won't exist. You'll either accept 8GB, spend more for a 12GB model, or go significantly higher in the product stack.

Mid-term (6-12 months), we might see some relief if memory production capacity begins to shift. But that only happens if AI infrastructure spending slows or if memory manufacturers decide that consumer demand justifies new production lines. Neither seems likely in the current trajectory.

Long-term, the gaming hardware market might stabilize around predominantly 8GB configurations as the standard, with 16GB becoming a specialty product reserved for professional workstations or extreme high-end gaming. This would represent a permanent shrinkage in consumer choice driven entirely by economic factors beyond anyone's control.

What This Tells Us About the Future of AI's Impact on Consumer Tech

The quiet discontinuation of these GPU models sends a clear message: AI demand is reshaping consumer technology in ways that manufacturers aren't particularly trumpeting. This isn't a bug in the system. It's a feature of a market where enterprise demand for AI infrastructure is so compelling that consumer products become secondary priorities.

We should expect this pattern to repeat in other hardware categories. When memory supply is constrained, manufacturers prioritize high-margin products. Data center GPUs, AI chips, and HBM memory will continue to take precedence. Consumer products that rely on the same components will face allocation pressure, discontinuations, and reduced choice.

This isn't necessarily permanent. If memory production capacity expands faster than AI demand grows, the crunch could ease. But based on current trends, that seems unlikely for at least the next 18-24 months.

What we're witnessing is a market reallocation happening below the surface. No crisis, no drama, just product discontinuations announced quietly to YouTube channels rather than the gaming media. It's how markets adjust when one segment's demand simply overwhelms another's.

For consumers and enthusiasts, it's a reminder that hardware ecosystems are fragile. When supply chains get constrained, the products that suffer first are the niche ones, the specialty variants, the configurations that don't align with the highest-margin use cases. Gaming GPUs with 16GB memory are now in that category—legitimate products that served real needs, quietly phased out because that market segment doesn't matter compared to data center AI infrastructure.

The Bigger Question: What Happens When Gamers Can't Get What They Need?

Historically, when consumer hardware becomes constrained, the market has adapted. Users shift to second-hand markets, they accept older models, they make do with less capable hardware. But there's a breaking point where unavailability translates to market exit.

If gaming GPUs with adequate VRAM become difficult to find and expensive when available, some segment of potential customers will simply not upgrade. They'll hold onto older hardware longer. They'll accept reduced visual quality. They might even migrate to consoles or cloud gaming services where the hardware constraints are someone else's problem.

That customer attrition doesn't hurt NVIDIA short-term—the company is printing money from data center AI products—but it does reshape the long-term market dynamic. A generation of PC gamers priced out or unable to upgrade becomes a generation that might not come back when supply finally normalizes.

FAQ

Why did NVIDIA and ASUS discontinue the RTX 5070 Ti and 5060 Ti 16GB?

Both models require 16GB of GDDR7 memory, which has become extremely expensive and constrained due to data center companies prioritizing memory production for AI infrastructure. Memory manufacturers like SK Hynix, Samsung, and Micron have shifted production capacity toward high-bandwidth memory (HBM) for AI accelerators because the margins are superior and demand is seemingly unlimited. When memory costs spike, producing 16GB consumer GPU variants becomes economically unviable. ASUS and NVIDIA made the decision to discontinue these products rather than operate at a loss.

Will NVIDIA bring back the RTX 5070 Ti 16GB variant?

Hardware Unboxed reporting suggests both models are unlikely to return, at least through the first quarter of 2025 and likely beyond. Both companies explicitly stated they no longer plan to produce these models going forward. However, the future depends entirely on memory supply dynamics. If memory costs drop significantly or production capacity expands to meet consumer demand, a revival is theoretically possible. But based on current AI infrastructure trends and manufacturer statements, that seems unlikely within the next 12-24 months.

What should I do if I need a GPU with 16GB of memory?

Your options are limited but not non-existent. You can purchase older generation cards like RTX 4000-series models that still have 16GB configurations in secondary market inventory. You can accept stepping up to more expensive NVIDIA models with 16GB (like higher-tier 5080 variants). You can explore AMD's Radeon lineup, which still produces some 16GB models, though they face similar supply constraints. Or you can reassess your actual VRAM needs—many gamers overestimate the memory they truly require, and 8GB might be adequate for your specific use case.

How does the memory shortage affect AMD GPU availability?

AMD is experiencing similar supply pressures for memory-intensive products. The company's Radeon RX 7800 XT and other higher-capacity variants face comparable constraints. AMD board partners might make similar discontinuation decisions for 16GB models if memory costs remain elevated. However, AMD hasn't yet formally announced discontinuations, so current 16GB inventory might remain available longer than NVIDIA options, though at elevated prices.

Is this a permanent shift in the GPU market?

It could be, depending on how long memory supply remains constrained and whether manufacturers decide to maintain distinct consumer and enterprise product lines. If memory remains expensive and scarce for years, manufacturers might permanently shift to emphasizing 8GB configurations as the consumer standard. This would represent a permanent reduction in consumer choice and memory availability, driven by economic factors rather than technical limitations. The market might stabilize around this new normal.

What does this mean for building a gaming PC in 2025?

It means accepting constraints you wouldn't have faced five years ago. High-memory GPU variants are disappearing, memory prices are elevated, and product choice is shrinking. If you're building a gaming system now, you'll likely need to either accept 8GB of VRAM (which might limit visual quality in demanding games), spend significantly more for premium models with 12GB or more, or purchase older generation hardware from the secondary market. Plan your budget assuming memory-constrained options and potentially higher costs than historical pricing would suggest.

How long will memory supply remain constrained?

Memory manufacturers have already committed significant capital to AI-focused production capacity through 2026 and beyond. SK Hynix, Samsung, and Micron's strategic decisions suggest memory prioritization for data center products will continue for at least 18-24 months. After that, the trajectory depends on whether AI infrastructure demand continues at current pace or slows. Even optimistic scenarios suggest consumer memory will remain a lower priority than enterprise/AI applications through 2026 and possibly beyond.

Can I still buy an RTX 5070 Ti or 5060 Ti 16GB?

Yes, but availability is rapidly depleting. ASUS inventory in Australia and other regions is already minimal, with expectations that availability will remain constrained throughout Q1 2025. Remaining stock is concentrated with retailers that haven't yet liquidated inventory. Prices for remaining units will likely climb as scarcity becomes more apparent. If you must have these specific models, searching regional retailers and third-party marketplaces now is advisable before inventory expires completely.

Why didn't NVIDIA announce these discontinuations officially?

Manufacturers often avoid formal discontinuation announcements because they complicate relationships with board partners, retailers, and consumers. Quietly letting products reach end-of-life while focusing communications on remaining available models creates less PR friction than explicitly stating "this product no longer exists." Hardware Unboxed's reporting essentially forced the issue by asking ASUS directly and receiving honest answers. Most discontinuations happen this way—subtly, without press releases, discovered after the fact rather than announced in advance.

Conclusion: A Market Reorganizing Around AI Demand

The discontinuation of the RTX 5070 Ti and 5060 Ti 16GB isn't a failure or a mistake. It's a rational response to market economics that have fundamentally shifted. Memory that would have gone into consumer GPUs is now more valuable for data center AI accelerators. Manufacturers are making triage decisions based on profit margins and sustainable production economics.

What's striking is how quietly this happened. No drama, no official statements, just a YouTube channel asking the right questions and discovering that two significant GPU variants were being discontinued. That's how modern markets adjust—not with fanfare but with whispers, product delistings, and gradually tightening availability.

For gaming enthusiasts and PC builders, the practical impact is real: fewer options, limited high-memory configurations, and prices that reflect the constraints. The market will adapt. Gamers will adjust expectations or find workarounds. Some will hold onto older hardware longer. Some will accept reduced visual quality. The ecosystem reorganizes around what's actually available rather than what consumers ideally want.

But there's a longer-term question embedded in this situation. If AI infrastructure demand continues to reshape the availability of consumer hardware, at what point does the consumer market fragment? When essential products become difficult to find and expensive when available, purchasing power eventually shifts. Gamers might migrate to cloud gaming services. They might embrace consoles. They might simply accept that PC gaming at high visual quality becomes a premium option reserved for those who can afford the premium hardware tax imposed by constrained supply.

That outcome isn't inevitable. If memory supply expands faster than AI demand grows, if manufacturers decide consumer market diversity is worth supporting, if competitive pressure encourages board partners to maintain high-memory options despite margin pressure, the market could stabilize in a more consumer-friendly equilibrium. But based on current trends and manufacturer statements, that seems unlikely for at least the next couple of years.

For now, the message is clear: if you need a GPU with 16GB of VRAM, start looking now. Because the products that could fill that need are actively disappearing, and what replaces them won't be cheaper or more convenient. The AI boom is reshaping consumer hardware in real time, and we're only beginning to see the downstream effects.

Key Takeaways

- ASUS has formally discontinued the RTX 5070 Ti and 5060 Ti 16GB due to memory cost constraints driven by data center AI demand

- Memory manufacturers have redirected production capacity away from consumer products toward AI infrastructure, with Micron shutting down Crucial consumer brand entirely

- 16GB GPU variants are becoming economically unviable to manufacture, forcing consolidation around 8GB configurations that offer lower margins but sustainable economics

- Modern AAA games increasingly demand 12-16GB of VRAM, meaning the discontinuation of 16GB variants directly impacts gaming performance and visual quality for enthusiasts

- This market realignment will likely persist through 2026 and beyond unless memory supply expands faster than AI infrastructure demand grows

- Gamers have limited options: accept 8GB constraints, step up to significantly more expensive models, or purchase older generation hardware from secondary markets

- This represents a permanent shift in consumer hardware availability driven by enterprise demand rather than planned obsolescence or technical limitations

Related Articles

- ExpressVPN for Teams Takes on NordLayer [2025]

- Samsung S95H OLED TV: Complete Specs, Features & Price Guide [2025]

- NYT Connections: Master the Puzzle Daily [2025 Guide]

- Bully Online Mod Shutdown: Why Rockstar Killed the Viral Game [2025]

- Best Budget Phones [2026]: Top Picks Under $600

- Best Smart Scales of 2025: Why Renpho Dominates with 350K Reviews

![NVIDIA RTX 5070 Ti and 5060 Ti 16GB Discontinued: What It Means [2025]](https://tryrunable.com/blog/nvidia-rtx-5070-ti-and-5060-ti-16gb-discontinued-what-it-mea/image-1-1768494961675.jpg)