Play Station in 2025: Sony's Strategic Pause and What's Next

TL; DR

- Sony's comfortable position: Play Station 5 maintains market leadership despite a quieter exclusive lineup in 2025 compared to previous years, signaling strategic confidence rather than complacency.

- Portal success: The Play Station Portal evolved dramatically with cloud gaming integration, becoming a genuine alternative to owning a PS5 for casual players without requiring additional hardware investment.

- Live-service struggles: Sony's aggressive pivot to live-service games stalled badly, with major cancellations like Fairgame$ and Bungie's declining player counts, forcing a strategic reckoning about the studio's future autonomy.

- PC expansion accelerates: Play Station exclusives migrating to PC (Spider-Man 2, The Last of Us Part 2 Remastered, Stellar Blade) signals a shift toward platform agnosticism and broader revenue diversification beyond hardware.

- Leadership pipeline concerns: Over 1,500 layoffs across Play Station studios in recent years raises questions about whether Sony has the creative firepower to compete against emerging competitors like Nintendo Switch 2.

- Bottom line: 2025 proved Sony doesn't need to innovate frantically—it's harvesting the benefits of years of exclusive development while quietly consolidating its position for the next console generation.

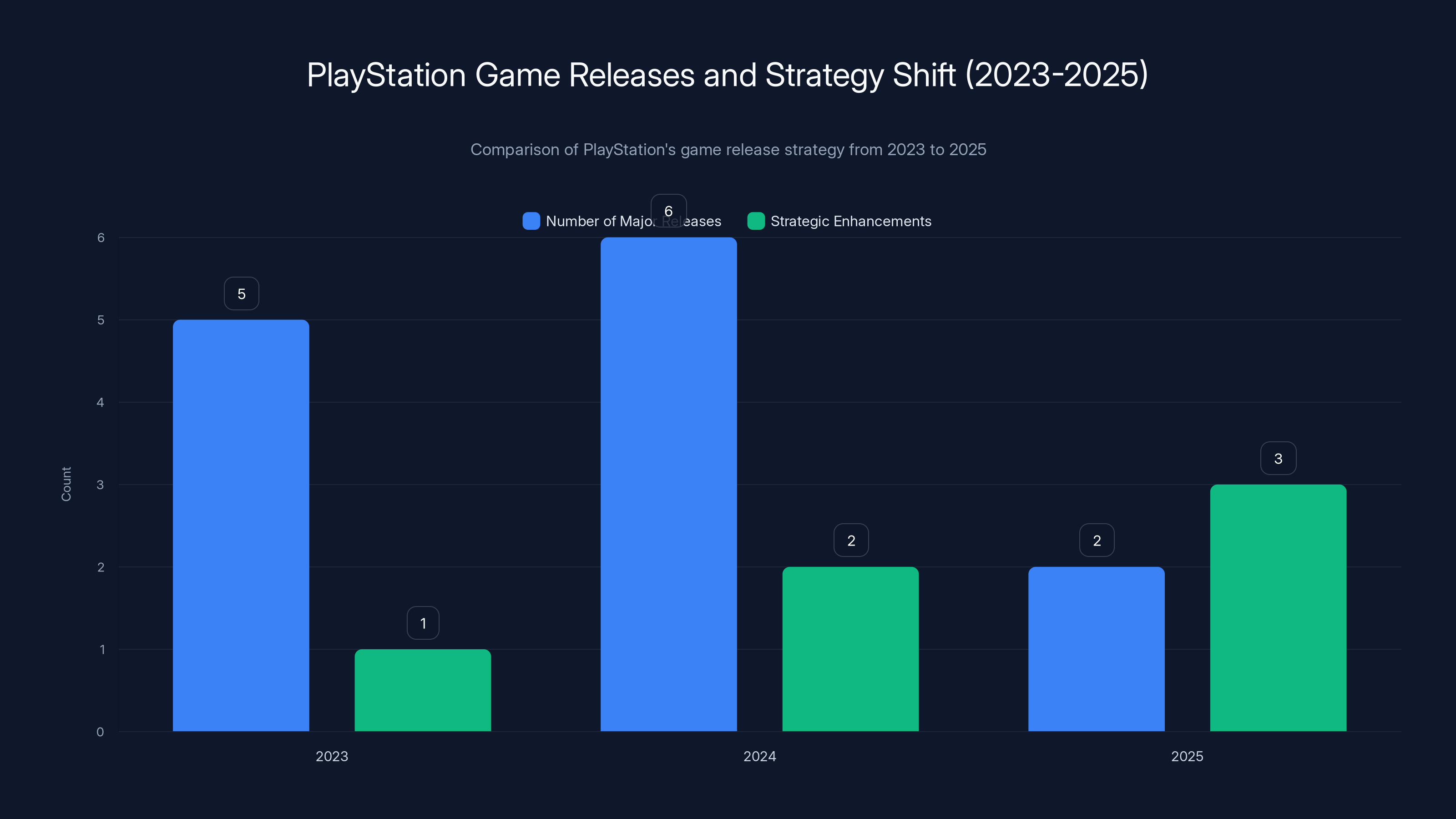

In 2025, PlayStation shifted from numerous major releases to fewer, quality-focused titles, enhancing strategic ecosystem features. Estimated data.

Introduction: The Year of Strategic Silence

When you own the market, you don't have to scream about it.

That's essentially what Play Station's 2025 looked like—a year where Sony sat back, let competitors stumble over their own announcements, and quietly reinforced its dominance without breaking a sweat. While Microsoft struggled with Xbox Game Pass price hikes and the organizational chaos of integrating Activision Blizzard, and while Nintendo prepared the Switch 2 bombshell, Play Station just... existed. It was there. It was competent. It was enough.

But here's the thing: being enough when you're already in first place isn't a luxury—it's a privilege. And privileges come with hidden costs.

This year revealed something important about where Sony sits in the gaming landscape. The company that once defined console ambition with the PS2 and PS3 era is now managing a different kind of strategy altogether. It's not about pushing technological boundaries or flooding the market with exclusive franchise after franchise. It's about optimization, consolidation, and frankly, making sure the machine keeps printing money without overextending itself.

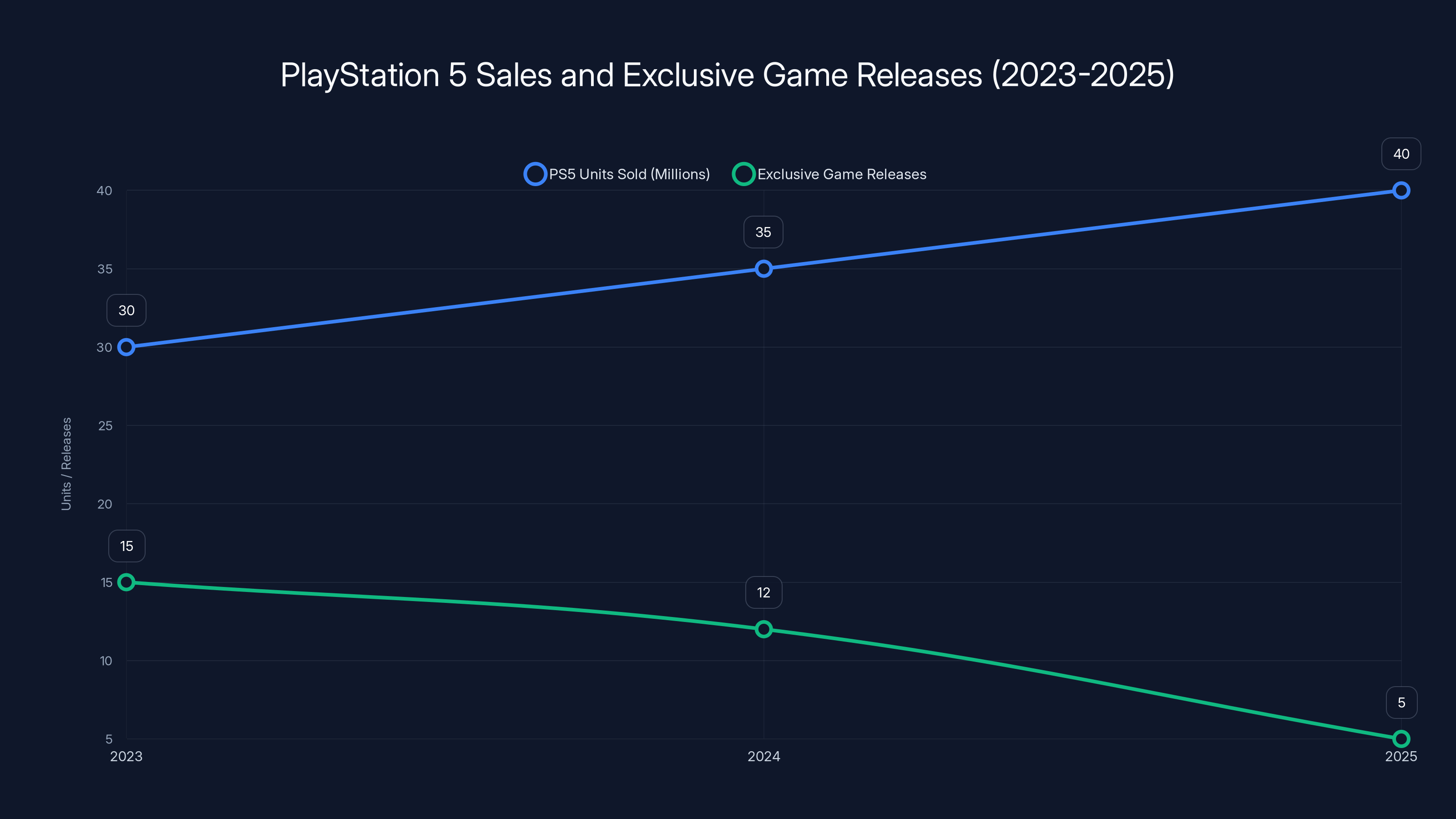

The numbers tell part of the story. Play Station 5 sales continue to be strong. The system has shipped over 40 million units since launch, and the install base keeps growing. But the exclusive game releases dwindled significantly in 2025 compared to the launch-heavy years of 2023 and 2024. Major franchises like God of War, The Last of Us, and Uncharted sat idle. New IP was sparse. What you got instead was a carefully curated selection of sequels, third-party masterpieces, and hardware tweaks.

Was it boring? For some, absolutely. Was it smart? That's the more interesting question.

Sony's strategy in 2025 revealed something about the maturation of console gaming itself. When a platform has been on the market for nearly a decade, the dynamics change. You're not building an audience anymore—you're maintaining one. You're not proving you can deliver experiences—you've already done that. What matters is keeping people engaged without burning through your studio resources or betting everything on live-service games that might collapse (which, spoiler alert, a lot of them did in 2025).

This deep dive examines what Play Station's 2025 actually meant. We're not here to argue whether it was "good" or "bad"—that's too binary. Instead, we're looking at the strategic decisions, the hardware moves, the software philosophy, the corporate pain points, and what it all signals about where Play Station wants to go next. Because for all the quiet of 2025, there's actually quite a lot to unpack.

Estimated data shows PlayStation leading in consumer perception due to steady strategy amidst Xbox's chaotic changes and Nintendo's suspenseful build-up.

The Console Wars Reality Check: Microsoft's Self-Inflicted Wounds

You want to understand why Play Station's quiet year felt like a victory lap? Look at what Microsoft was doing.

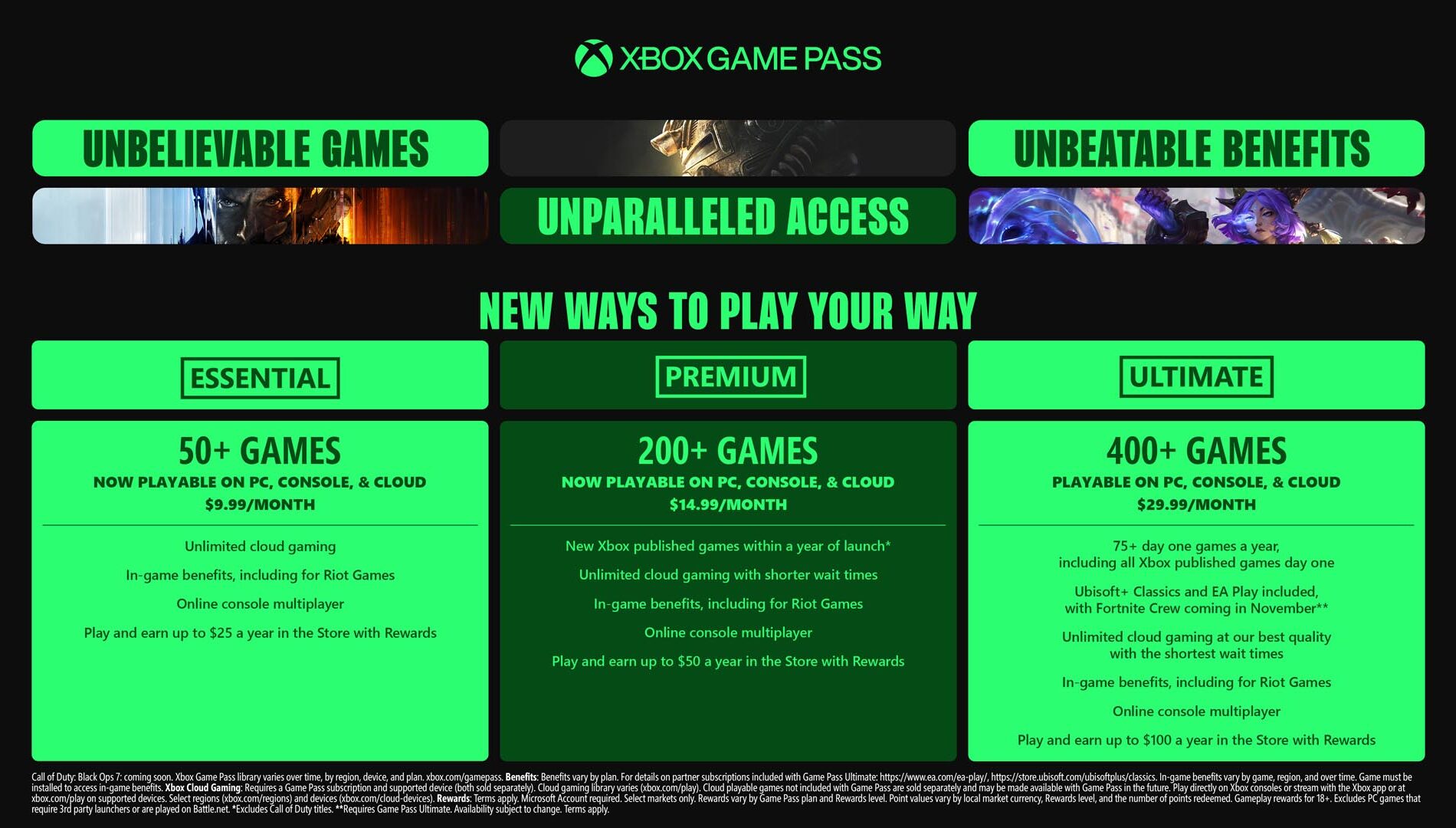

The entire context of 2025's console conversation shifted because Xbox Game Pass underwent fundamental changes that frustrated core subscribers. The service, which had been positioned as gaming's best deal since its launch, started hitting players with new tiers, price increases, and eventually the removal of day-one first-party game releases from the standard tier. This wasn't a subtle adjustment—it was a seismic shift in the value proposition that had defined Game Pass for eight years.

At the same time, Microsoft was integrating Activision Blizzard, an acquisition that was supposed to be transformative but instead felt chaotic. The company had to deal with studio consolidations, unclear strategic directions, and continued questions about Xbox Series X and S's actual competitive advantage. The hardware is capable, sure, but what are you actually buying it for?

Nintendo, meanwhile, played it differently. The company was building suspense around the Switch 2, leaking specs and features carefully, maintaining mystery, and positioning the next console as a natural evolution rather than a desperate reinvention. This is the opposite of a company in crisis—it's a company that knows people want what it's making.

Into this chaos stepped Play Station, which... didn't really do much. No massive announcements. No dramatic price moves. No controversial service restructuring. Just steady releases, hardware refinements, and a general "we're good where we are" energy.

The genius of this approach became apparent by year's end. Play Station benefited enormously from the chaos around it without having to do anything particularly special. When subscribers felt burned by Game Pass changes, the Play Station ecosystem looked reasonable by comparison. When Xbox's future direction felt unclear, Play Station's multi-year exclusive roadmap (Wolverine, Phantom Blade 0, Saros, 007: First Light) felt refreshingly coherent.

This is the advantage of having already won. You don't need to win again—you just need to not lose.

The Play Station Portal Transformation: Cloud Gaming Finally Works

Here's something that surprised people: the Play Station Portal, a device that was essentially a PS5 Remote Play screen, became genuinely useful in 2025.

When the Portal launched, it was a niche product. It was a handheld screen that let you play PS5 games remotely, but you needed a PS5 running at home and a good internet connection. It was useful for specific situations—playing while someone else watches TV, streaming from another room—but it wasn't revolutionary. Critics called it expensive and limited. Fair points all around.

But then something changed. Sony added cloud gaming support, and that changed the entire value proposition. Suddenly, you didn't need a PS5 at home. You could play directly from Sony's servers. It was still locked behind Play Station Plus Premium, the priciest tier of the subscription service, but it meant the Portal could work as a standalone device for casual players who didn't want to invest in a full console.

The timing of this pivot is interesting. Cloud gaming has been promised for years as the future of the industry. Microsoft has been pushing Game Pass Cloud Gaming. Amazon built Luna. Google invested in Stadia before abandoning it. Nintendo's doing something with cloud saves. But cloud gaming adoption has been slower than predicted because the technology needs to be genuinely better than local hardware, and it needs to be priced right. Most people would rather own hardware than rent access to computation.

Sony's angle with the Portal is different. You're not replacing your PS5—you're expanding where you can use Play Station. The Portal becomes a second screen, a way to access your library without needing the full console in every room. For someone who already has Play Station Plus Premium (which they might be paying for anyway for other benefits), it's not actually a huge additional investment.

By November 2025, cloud gaming became available to all Portal users, not just beta testers. That's the moment it stopped being a novelty and became actual infrastructure. Suddenly, every Play Station Plus Premium subscriber could theoretically access games on any device with a screen.

What's particularly clever about this approach is that it solved a real problem without creating new hardware requirements. Game streaming works best when the barrier to entry is low. You don't need a specific device—you need a screen and a controller. Sony already makes both. Adding software support costs essentially nothing and opens up the potential user base exponentially.

Is cloud gaming perfect? No. There's still latency to consider, internet bandwidth requirements are real, and some games (competitive multiplayer, precision action games) suffer on streams. But for single-player campaigns, story-driven experiences, and casual games, it works fine. And the Portal became the cheapest entry point to Play Station ecosystem without owning the full hardware.

This move also revealed something about Sony's strategic direction: ownership of hardware is less important than ownership of the ecosystem. If people play Play Station games on their phones, tablets, or cheap handheld devices via cloud, that's fine. They're still in the Play Station ecosystem. They're still buying games. They're still potentially upgrading to a full console later.

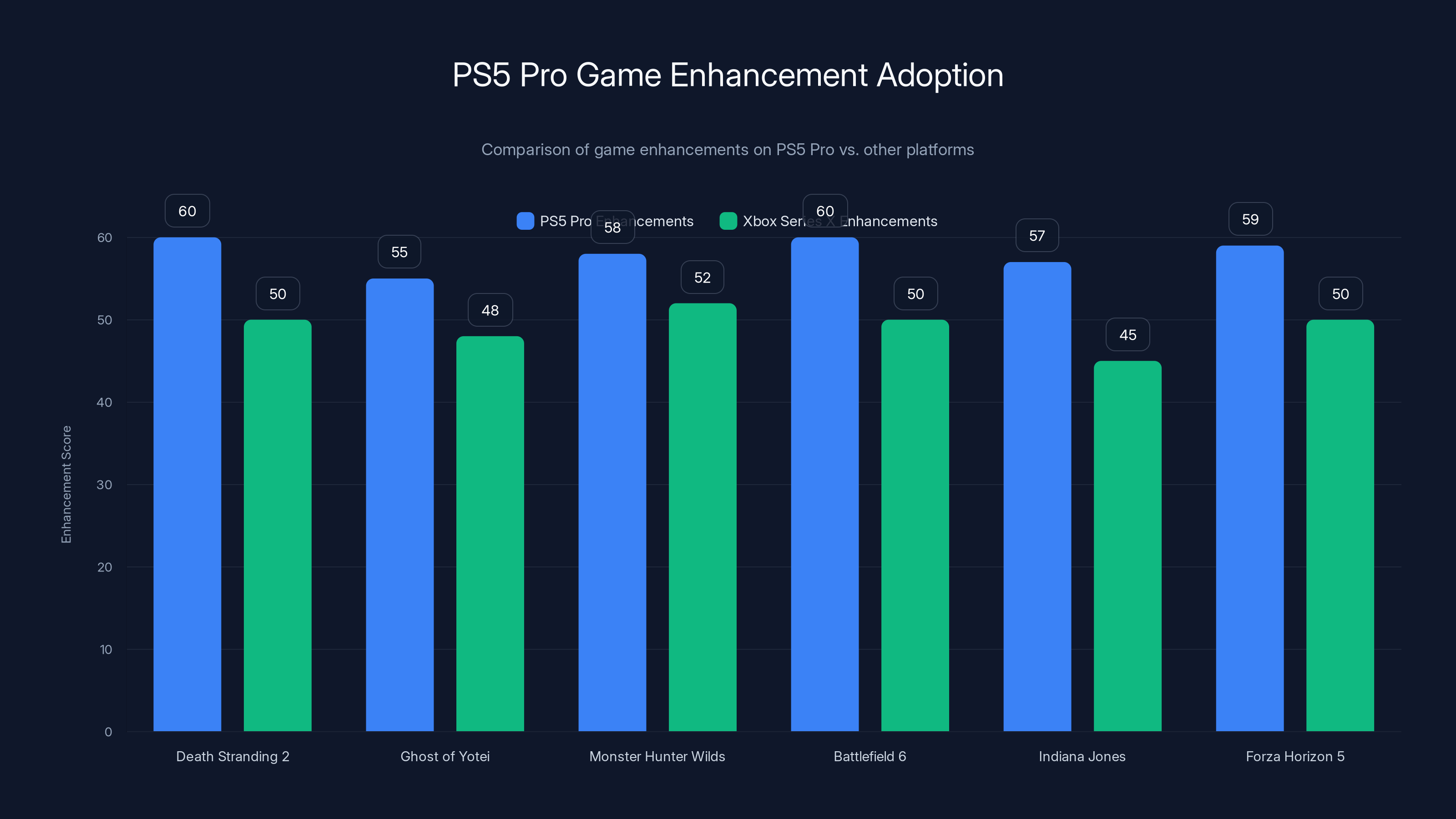

PS5 Pro enhancements show significant performance gains over Xbox Series X, with higher frame rates and better optimization. Estimated data based on typical enhancements.

PS5 Pro Enhancement Ecosystem: Winning Without Revolutionary Hardware

Last year Sony released the PS5 Pro, an upgraded version of the Play Station 5 with enhanced GPU, faster storage, and better cooling. This year, we saw what that really meant in practice.

The interesting part wasn't the Pro itself—it's how developers embraced it. Death Stranding 2: On the Beach, Ghost of Yotei, Monster Hunter Wilds, and Battlefield 6 all received Pro-specific enhancements within months of the hardware's launch. These weren't minor tweaks either. We're talking about higher frame rates (up to 60fps instead of 30fps for some games), improved ray tracing, faster load times, and generally cleaner visuals.

But here's where it gets wild: Microsoft's own games started supporting PS5 Pro enhancements. Indiana Jones and the Great Circle and Forza Horizon 5 both got PS5 Pro optimization, making them run better on Sony's hardware than on Xbox Series X. Let that sink in for a moment. A company's competitors are prioritizing support for your updated hardware over supporting their own platform. That's not coincidence—that's market pressure.

Why does this matter? Because it proves the PS5 Pro actually represents meaningful performance gains, not just marketing theater. Developers don't invest in optimization for incremental improvements. When multiple studios independently decided to patch their games for PS5 Pro support, they were essentially validating that the upgraded hardware was worth supporting.

The formula is simple: **

Sony also made a lighter, cooler-running version of the PS5 Pro in 2025. Thermal engineering improvements matter more than people realize. A cooler console is quieter, uses less power, and lasts longer. These are quality-of-life improvements that don't make headlines but affect user satisfaction directly.

The bigger picture: Sony is proving that mid-cycle hardware refreshes can actually work if they represent genuine performance gains and if the software ecosystem embraces them. The PS5 Pro succeeded not because it was revolutionary, but because it was competent and supported.

The Exclusive Lineup: Quiet, But Strategic

Let's talk about what people actually cared about: the games.

2025 was not a blockbuster year for Play Station exclusives. Everyone agrees on this. The studio that once delivered God of War, Uncharted, Horizon, and The Last of Us in tight succession suddenly had major franchises sitting idle. God of War Ragnarök was 2023. The Last of Us Part 2 Remastered came to PC and PS5 this year, but that's a remaster, not new content. Uncharted is in limbo. Horizon Forbidden West got DLC but no sequel announced.

What Play Station delivered instead was more selective. Hideo Kojima's Death Stranding 2: On the Beach is a weird, ambitious thing—the kind of project that wouldn't exist without Sony's backing. If you liked the first game's meditation on isolation and connection, the sequel deepens those themes. If you thought the first was tedious, the second probably won't change your mind. It's not trying to be popular; it's trying to be interesting.

Ghost of Yotei, the sequel to 2020's Ghost of Tsushima, is the more traditional win here. Sucker Punch's samurai epic was universally praised, and the sequel maintains that quality while exploring new territory in 1603 Japan. It's the kind of game that reminds you why Play Station's exclusive strategy worked in the first place: deep, polished, visually stunning open worlds that take half a year to complete.

Outside of those, though, the exclusive cupboard was more bare than expected. Major anticipated titles shifted to other platforms or got delayed. Sony's aggressive live-service push, which was supposed to compensate for slowing traditional game releases, largely collapsed.

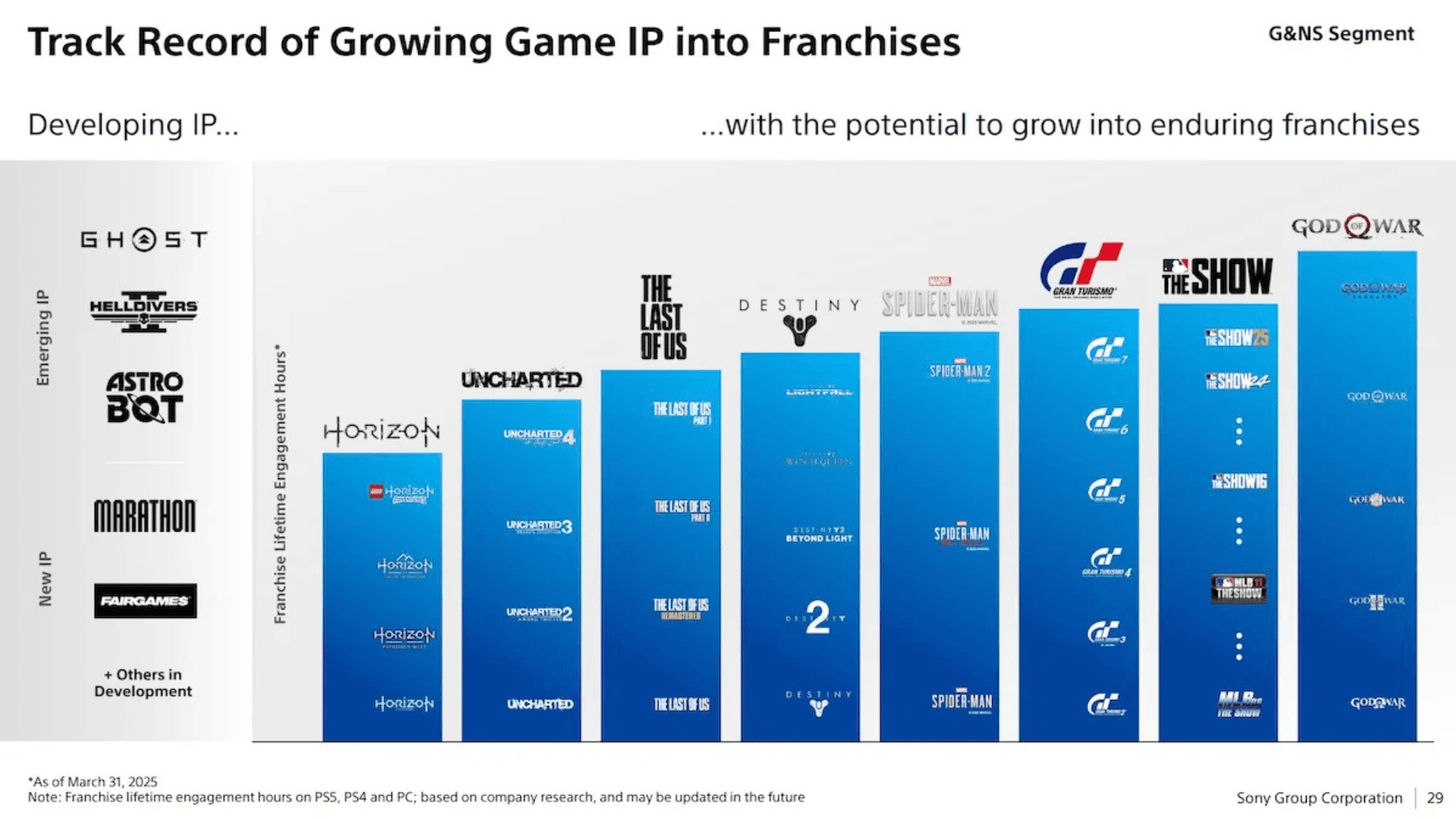

This is where the strategy becomes visible. Sony has so many franchises in its back pocket that it can afford to rotate them. God of War, Uncharted, The Last of Us, Horizon, Destiny, Gran Turismo, Spider-Man, Sackboy, Ghost of Tsushima—the studio has more IP than it can release annually. So the company made a calculated decision: instead of rushing games out to fill years, space them out. Make sure each release is genuinely ready. Don't oversaturate the market.

This is actually the opposite of what Microsoft did. Xbox tried to flood Game Pass with quantity, emphasizing the number of games over the impact of each individual release. Play Station went the opposite direction: fewer games, but each one crafted carefully.

Will this strategy work long-term? That depends entirely on whether Sony's upcoming pipeline delivers. Marvel's Wolverine, Phantom Blade 0, and Saros are all coming, plus 007: First Light. These are significant projects from proven studios. If they're as polished as Ghost of Yotei, the strategy pays off. If they're delayed or underwhelming, Sony has a real problem.

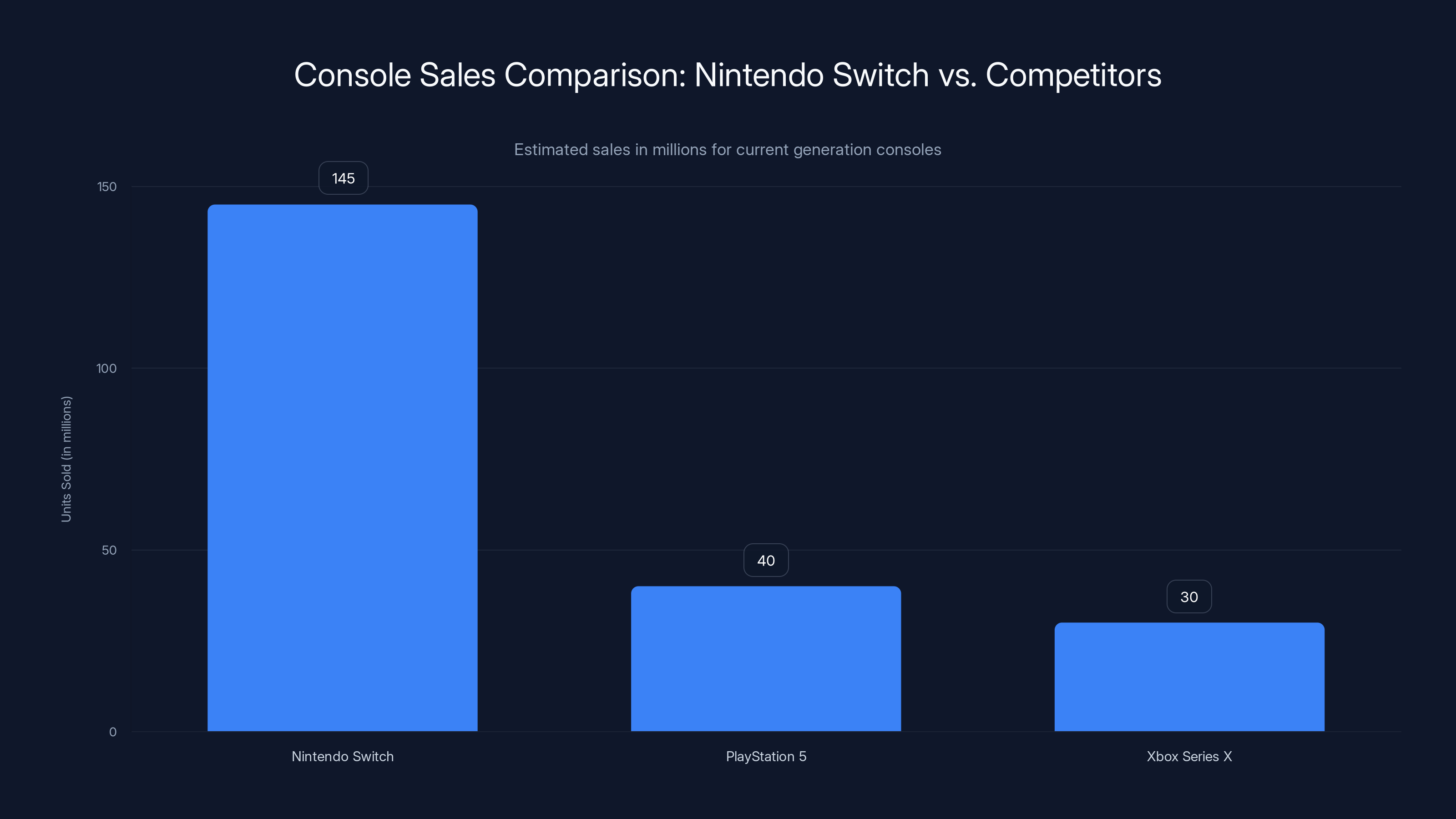

The Nintendo Switch leads the current generation console sales with over 145 million units, significantly outpacing both the PlayStation 5 and Xbox Series X. Estimated data for PS5 and Xbox Series X sales.

Live-Service Implosion: The Strategy That Failed

This is the dark part of Sony's 2025.

Sony bet big on live-service games as the future of Play Station revenue. The company announced multiple live-service projects, invested in studios, and positioned the platform as a competitor to Fortnite and Call of Duty. The vision was clear: subscription revenue plus ongoing monetization through cosmetics and battle passes equals stable, recurring income.

The problem: the market is crowded, the execution is hard, and gamers have shown they'll only invest in live-service games that genuinely earn their attention.

Fairgame$ was supposed to be one of Sony's big bets—a new IP from Firewalk Studios focusing on extraction-based gameplay. It was supposed to launch in 2024, then slipped to 2025. Then Jade Raymond, the studio founder and veteran game developer, left before the game even shipped. That's not a good sign. Departures like that signal either creative differences or the person in charge recognizing the project won't work.

Bungie, which Sony acquired in 2022, became the most visible failure. Bungie had been running Destiny since 2014, building one of the most engaged communities in gaming. But by 2025, player counts were declining, the expansion model (two major updates per year) felt creatively exhausting, and the studio was burning money.

Destiny 2's 2025 expansion, The Edge of Fate, was a critical step down from 2024's The Final Shape. Player engagement plummeted. The December expansion, Renegades, attempted a course correction with new seasonal content, but the damage was done. Bungie had proven it needed help—and not the kind that came from Sony's corporate oversight.

By year's end, reports indicated Sony was considering absorbing Bungie directly, removing its autonomy. Bungie started as an independent studio, became Microsoft's, then joined Sony. Each transition meant losing independence. This next one could be its final step before becoming just another Sony studio.

There's also Marathon, Bungie's new extraction shooter that was supposed to launch in 2025. It slipped to March 2026 after accusations of plagiarism regarding artwork in the game's world. This wasn't a minor delay—it represented a significant embarrassment that forced the entire project to pause for reevaluation.

The broader pattern is clear: Sony's live-service strategy is in crisis. Multiple canceled games, studio struggles, declining engagement in active titles, and uncertain future direction. The company spent years trying to build a Fortnite competitor and instead created a graveyard of failed projects.

What went wrong? Partly, it's a crowded market. Partly, it's execution issues. Partly, it's that live-service games require different mentality than traditional game development—you need ongoing updates, community management, and the ability to pivot based on player feedback. Some studios have this DNA; others don't.

Sony's approach was to throw money and studio resources at the problem. That didn't work. The company discovered what Microsoft learned years ago: having talented developers doesn't automatically mean they can build successful live-service games.

The 1,500 Layoff Elephant: Creative Firepower Questions

There's a number that haunts 2025's Play Station narrative: 1,500+.

That's how many developers across Play Station studios have been let go over the past few years, culminating in multiple rounds of cuts in 2024 and 2025. The reasons vary—some studios consolidated, some projects canceled, some roles deemed redundant. But the aggregate effect is real: Sony reduced its creative workforce significantly.

This matters more than it might seem. Game development is fundamentally a human-capital business. You can't download talent. When you lose experienced developers, you lose institutional knowledge, creative perspective, and the ability to execute on ambitious projects.

The Play Station Visual Arts Group took hits in 2025 following live-service cancellations. Other studios absorbed cuts as well. By year's end, the question became unavoidable: does Sony have enough creative firepower to maintain its exclusives pipeline going forward?

The answer is complicated. Sony still owns incredibly talented studios. Naughty Dog, Insomniac Games, Sucker Punch, Guerrilla Games, Santa Monica Studio—these are world-class teams. But they're also smaller than they were three years ago. The upcoming games in Sony's pipeline might be amazing, but what happens after they launch? Can these studios maintain the cadence people expect?

There's also the question of culture. Game development is increasingly an industry where crunch, stress, and overwork lead to departures. Some of the cuts were probably resignations, not layoffs. The company is likely smaller partly by choice and partly because people left. Either way, the impact is the same: less creative capacity.

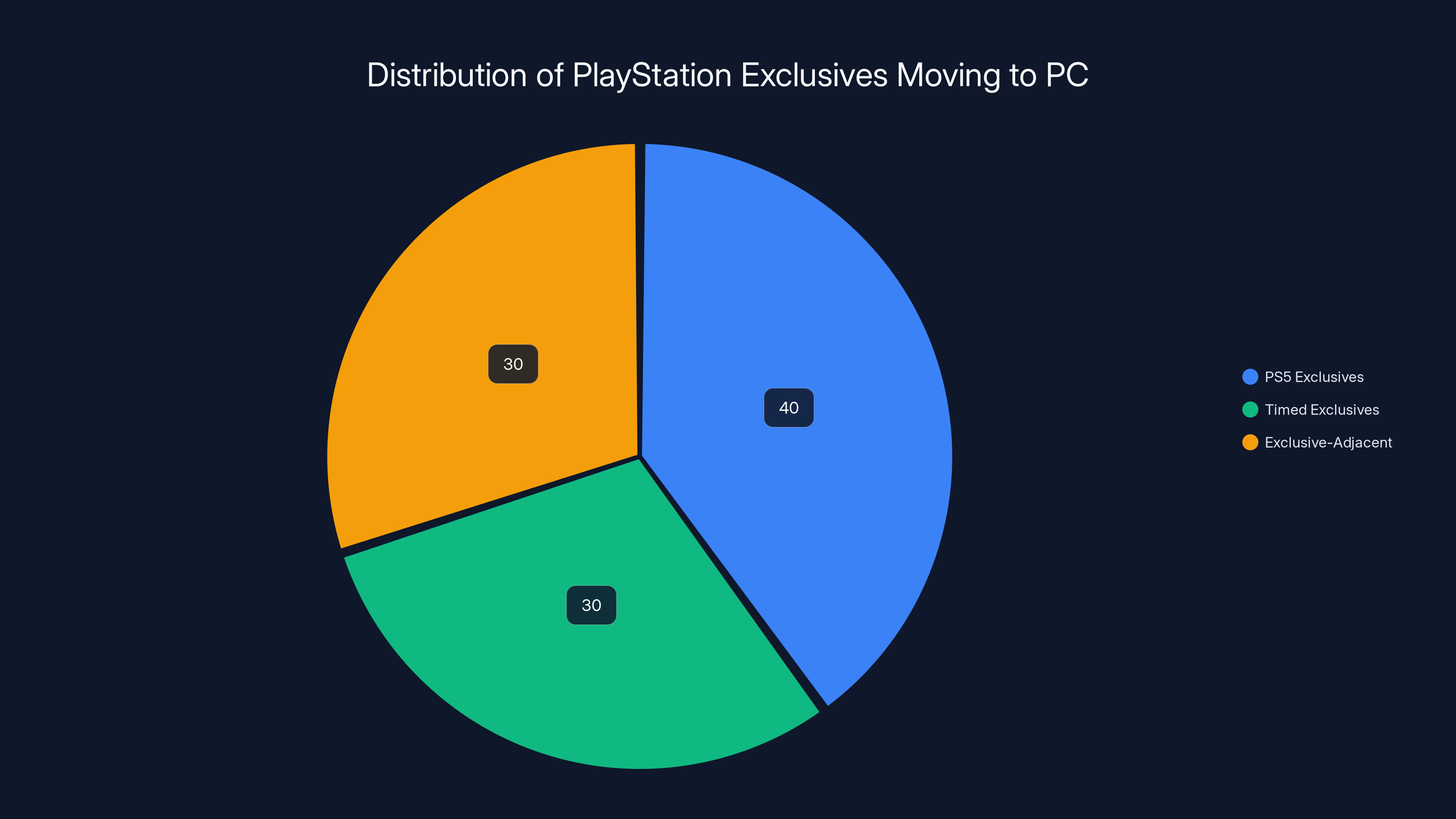

Estimated data suggests a balanced distribution of PlayStation exclusives moving to PC, reflecting a strategic shift towards platform agnosticism.

PC Expansion: The Platform-Agnostic Shift

Want to know what Sony's real strategy is? Watch where Play Station exclusives end up.

This year, multiple Play Station exclusives or exclusive-adjacent games moved to PC. Stellar Blade, which launched on PS5 with exclusivity, came to PC. The Last of Us Part 2 Remastered, a PS5 exclusive from 2020, launched on PC. Spider-Man 2, the 2023 PS5 exclusive, is coming to PC in 2025. Lost Soul Aside, a timed exclusive, is making the PC jump.

This isn't a mistake or a desperation move. It's deliberate strategy.

PC is where the money is. Steam has 140+ million active users. Epic Games Store is pushing hard on exclusive deals and revenue sharing. The PC gaming market is larger than console gaming. If Sony's goal is to maximize revenue from its games, PC expansion is logical.

But there's another angle: platform exclusivity is becoming less of a competitive weapon. The idea that you need to own a console to play console games is increasingly outdated. People don't need a PS5 to play Spider-Man anymore. They need to own the game, and they can play it wherever they want.

Sony recognized this before Microsoft did. Game Pass forced Microsoft to think about distribution differently, but Sony's PC strategy is more fundamental. The company is saying: "Our advantage isn't controlling the hardware—it's controlling the software." If people play Play Station games on PC, they're still in the Play Station ecosystem. They're still paying for games. They're still potentially buying PS5s for exclusive experiences.

This also explains why the PS5 Pro exists. If your games are on PC, the console needs to offer something special to justify purchase. Better performance, exclusive features, integrated ecosystem—these become the value props. Owning the hardware means a better experience with your software.

The long-term implication is radical: Play Station might become a software platform rather than a hardware platform. Imagine buying "Play Station" as a subscription that works on your phone, tablet, PC, and optional hardware. That's the direction this strategy points.

Right now, it's just starting. But watch this space, because it represents a fundamental shift in how Sony thinks about console gaming.

Hardware Ecosystem: Accessories and Quality of Life

While exclusives get the headlines, Sony's actual competitive advantage this year was more subtle.

The company released multiple new Dual Sense colors, updated controllers with improved ergonomics, announced the Flex Strike fight stick for 2026, and released its own speaker system coming in 2026. These aren't flashy, but they're important.

The Dual Sense controller is genuinely good hardware. Haptic feedback and adaptive triggers set it apart from competitors. When developers implement these features well, the difference is noticeable. Sony recognized this and kept iterating on the controller design rather than abandoning it.

The fight stick announcement is interesting because arcade sticks have become niche. Street Fighter 6 revived interest, but most modern games use standard controllers. By releasing official Sony fight sticks, the company is making a bet that premium input devices matter for specific communities. This is vertical integration done right—offering solutions for specific use cases rather than trying to be everything to everyone.

The speaker system launch in 2026 signals Sony's continuing commitment to audio quality. Gaming audio has become a competitive feature. Better speakers, spatial audio, and integrated sound systems matter more with each generation. By releasing integrated solutions, Sony is betting people will want to upgrade their entire entertainment setup to Play Station standards.

These moves seem minor individually. Collectively, they show a company thinking about the entire ecosystem—not just the console, but everything around it. The person who owns a PS5 Pro, uses premium Dual Sense controllers, plays on a new Sony speaker system, and streams through the Portal is fully invested in the Play Station ecosystem. Moving that person to another platform becomes expensive and painful.

This is network effects in hardware form.

PlayStation 5 sales continued to grow steadily, reaching over 40 million units by 2025, while exclusive game releases decreased significantly, highlighting Sony's strategic shift towards optimization and consolidation. Estimated data.

PSVR2: The Abandoned Frontier

Probably the most telling move of 2025 was what Sony didn't do with Play Station VR2.

PSVR2 is an exceptional piece of hardware. It's a massive step up from the original PS4 VR, with better resolution, better tracking, more comfortable design, and genuine technical innovations. Yet Sony has essentially abandoned it.

Sure, some new games came out. Hitman and Demeo x Dungeons & Dragons: Battlemarked are solid titles. But the pipeline is thin, the investment level is low, and the overall vibe is clear: Sony tried VR, it didn't achieve the scale they wanted, so they're moving on.

VR gaming has consistently underperformed expectations. Millions of dollars in investment across the industry have produced passionate communities but small markets. Oculus (now Meta) owns the VR space, and they've made it clear they're prioritizing Quest's ease of use over technical specs. Sony's approach of "build the best hardware and developers will come" didn't work.

The decision to step back from VR is pragmatic. Game development is expensive and risky—why invest in a platform with a smaller audience when you could invest in traditional games? VR might be the future, but it's not the present, and developers are rational actors. They follow the money. Sony moving away from VR investment means fewer developers are motivated to build for it.

This is actually fine. VR will come back when the technology becomes more accessible and natural. Glasses-based AR is probably more exciting anyway. But it's worth noting that Sony, a company with significant VR patents and expertise, decided the ROI didn't justify continued investment. That's a statement about the market, not about the technology.

The Grand Theft Auto 6 Marketing Coup

Here's something that happened quietly but with enormous implications: Play Station secured marketing rights for Grand Theft Auto 6.

GTA6 is shaping up to be the biggest game release in years. It's been in development longer than some console generations. The hype is real. And when it launches, if you see advertisements, if you watch previews, if you see streaming showcases, they'll say "Experience it first on Play Station."

That phrase, "experience it first," matters. It doesn't mean exclusive—GTA6 will absolutely come to Xbox and PC. But it means Play Station gets the marketing spotlight, the launch window attention, and the perception of being the optimal platform.

GTA6's target demographic skews toward younger players and console gamers. These are people highly influenced by marketing. When promotional material emphasizes Play Station, it subtly reinforces the idea that Play Station is where GTA belongs, even if objectively the games are identical on all platforms.

This is an underrated advantage. The number of people who will buy based purely on gameplay doesn't reach zero, but it's smaller than you'd think. Platform choice, social circles, marketing exposure, and perception matter enormously. When your game is prominently associated with one platform, people buy that platform.

Rockstar and Take-Two clearly decided Play Station was the best partner for this marketing arrangement. That's a vote of confidence in Play Station's market position and audience size. It's also guaranteed revenue for marketing rights—money Sony didn't have to spend on game development, just accepted for letting someone else advertise on their platform.

GTA6's 2025 announcement and subsequent delay to 2026 gave Play Station a year of free marketing association. By the time the game launches, people will reflexively think "Play Station" when they think about it.

The Bungie Crisis and Studio Autonomy Questions

Bungie's situation in 2025 is worth examining closely because it reveals something about how Sony manages acquisitions.

Bungie was independent, then Microsoft acquired it, then Sony acquired Bungie from Microsoft. Each transition was supposed to offer something: resources, support, creative freedom. Each transition also meant losing some independence.

Under Sony, Bungie was supposed to be autonomous. It was supposed to maintain its culture while gaining access to Sony's resources. That was the promise. The reality proved messier.

Destiny's player base was already showing fatigue by the time Sony took over. The expansion model (two major updates per calendar year) seemed sustainable until it wasn't. The live-service economics are brutal: you have to continuously deliver content good enough that players keep paying, but not so frequently that you burn out developers.

Bungie couldn't find that balance in 2024-2025. The studio was burning money, players were unhappy, and leadership was unstable. Jade Raymond's departure as CEO, followed by restructuring and layoffs, indicated the company was in serious trouble.

By 2025, reports emerged that Sony was considering full integration of Bungie into Sony's corporate structure, ending its autonomous status. This is the endgame of failed acquisitions. You buy a studio thinking you're getting their talent and independence. When that doesn't work out, you either shut it down or fully absorb it.

Sony will probably absorb Bungie, which means Destiny might eventually become one of several live-service games under Sony's broader live-services umbrella. That's not necessarily bad—it might stabilize the game and reduce pressure on the team. But it's a failure of the original promise: Bungie wanted to remain independent while accessing Sony resources. Instead, it's likely losing independence anyway.

The lesson: acquiring a talented, independent studio doesn't guarantee success. Culture matters. Leadership matters. Market conditions matter. Bungie's story in 2025 was largely one of learning those lessons the hard way.

Developer Wellbeing and the Crunch Cost

Beneath all the strategic discussions lies a human cost that rarely gets adequate attention: game developers are exhausted.

The 1,500+ layoffs across Play Station studios don't capture the full picture. Behind that number is burnout, crunch, missed launches, canceled projects, and people leaving because the industry's human cost got too high.

Game development has always been demanding. But 2024-2025 represented a tipping point. Massive projects in development purgatory for 5-7 years, working 60+ hour weeks, undefined shipping dates, constant scope creep, and uncertain job security—these conditions lead to departures.

Some of Sony's "layoffs" were probably resignations. People burned out, quit, and the company didn't replace them. Others were actual cuts, sometimes strategic, sometimes due to project cancellations. Either way, the studios are smaller and probably more tired.

There's also the psychological impact of canceled projects. You spend three years developing something, building a vision, and then leadership decides to cancel it. You're out of a job, and everything you built is deleted. That happens multiple times in your career, and you start looking for work in a less painful industry.

Sony isn't unique in this—it's an industry-wide problem. But companies making record profits while laying off employees is its own special flavor of painful.

The Nintendo Switch 2 Wild Card

Everything Sony did in 2025 happened in the shadow of something it couldn't directly control: Nintendo preparing the Switch 2.

We don't know everything about it yet, but the rumors paint a picture of a hybrid console with better hardware, improved screen, and backward compatibility. Nintendo hasn't confirmed specifications, but the strategic intent is clear: maintain the hybrid market they created while providing technical improvements that convince existing Switch owners to upgrade.

Why does this matter for Play Station? Because it introduces a variable Sony can't control.

The Switch is the best-selling home console of this generation. It's sold over 145 million units. More people own a Switch than own a PS5 or Xbox Series X. If the Switch 2 is even 80% as successful as the original, it becomes a legitimate competitor for gaming entertainment spending.

Sony's response has been... basically nothing. No anti-Nintendo strategy, no pricing moves, no exclusive rush. The company is acting like the Switch doesn't exist, which might actually be the smartest move.

Here's the thing: Play Station and Switch appeal to different audiences in significant ways. The Switch is for people who want portable, social, Nintendo's IP. Play Station is for people who want graphically intense, story-driven, cinematic experiences. These audiences have overlap but aren't identical.

Sony's strategy seems to be: "Let Nintendo do Nintendo. We'll dominate the high-end graphics/story gaming space." This is rational. You can't beat Nintendo at Nintendo's game. But you can own a different space.

That said, Switch 2 represents threat in some downstream way. If Switch 2 captures a broader audience (which it might, given Nintendo's casual appeal), people with finite gaming budgets might choose Switch 2 over PS5. Sony can't prevent that. It can only hope its exclusive games are compelling enough to justify both.

What 2026 and Beyond Will Test

Every strategic move Sony made in 2025 will be validated or invalidated by 2026 onward.

Marvel's Wolverine is coming, and it needs to be spectacular. The Spider-Man and X-Men games were excellent. Wolverine should be at least as good. If it underperforms, questions about Sony's creative pipeline become urgent.

Phantom Blade 0 is coming to PC and Play Station, from a studio Gemini Awakening. If it finds an audience, it validates Sony's multi-platform strategy. If it flops, it's a waste of marketing investment.

Saros is in development, and frankly, nobody knows much about it. It could be amazing or it could be the next Concord (the hero shooter Sony released and immediately killed). The mystery is both exciting and concerning.

007: First Light (working title) is supposedly in development at Asobo Studio. A James Bond game that's actually good would be a huge win. Bond games have been disappointing for years.

GTA6 is coming in Fall 2026, and Play Station has marketing rights. If the game launches successfully and PS5 is perceived as the best place to play it, that's a massive win for hardware sales. If it launches with major problems or Xbox gets parity, the marketing advantage evaporates.

Each of these represents a test of whether Sony's 2025 strategy of quality over quantity actually works. The company is betting that fewer, more polished games and a mature ecosystem will sustain Play Station's market position. That's a reasonable bet, but it's not guaranteed.

The Switch 2 launches in 2026 or 2027. That'll be the year we learn if Nintendo's new hardware can actually threaten Play Station's dominance. Probably not, but Nintendo has surprised people before.

The AI Question Nobody's Asking Sony Yet

One thing notably absent from Sony's 2025 is significant AI integration into gaming.

While other tech companies are scrambling to integrate AI into everything, while game studios are experimenting with AI-generated content and AI-powered NPCs, Sony has been mostly quiet. There's been talk, sure, but no major announcements about AI-powered game development tools, AI-generated assets, or AI-enhanced gameplay.

This might be intentional. Game development is fundamentally a human creative activity. The moment you introduce AI automation, you're changing the nature of the work. Voice acting, environmental art, quest dialogue—these things could be AI-generated, but should they be?

There's also a legal and ethical minefield. AI training requires source material. Using artist work to train AI without permission or compensation is ethically fraught. Using AI-generated content that might infringe on copyrights is legally risky.

Sony's silence might actually be strategic restraint while the industry figures out the right way to integrate AI without destroying what makes games valuable: human creativity.

But eventually, this question will become urgent. Competitors will figure out ways to use AI to accelerate development, reduce costs, or enhance gameplay. At that point, Sony will need to decide: embrace the technology, compete on quality and artistry, or some hybrid approach.

For 2025, Sony dodged the question. That might not last.

The Takeaway: Stability as Strength

If you zoom out, 2025 was the year Play Station proved something important: you don't need constant innovation to maintain dominance.

Microsoft innovated with Game Pass, reorganized its studios, tried to transform the industry. Then it stumbled with pricing. Nintendo innovated with the Switch concept, is innovating again with Switch 2. Sony... did competent, solid, slightly boring things. And it won.

That's not boring from Sony's perspective. It's winning through patience. The company has a 40+ million user install base, a deep library of beloved franchises, exclusive games on the horizon, a maturing hardware ecosystem, and no major controversies. That's the winning position to be in.

The risk is complacency. When you're winning, it's easy to stop trying. Sony has to avoid that trap. The exclusive games have to deliver. The hardware ecosystem has to feel worth upgrading to. The PC strategy has to expand Play Station presence, not replace it.

For 2025, Sony managed the balance. It was quiet, but competent. Boring, but profitable. The year of cruise control. As long as the road ahead is straight, that's fine. But roads aren't always straight, and 2026 will test whether Sony's strategy is actually sustainable or just deferred.

FAQ

What made 2025 different for Play Station compared to previous years?

2025 marked a deliberate shift from high-volume exclusive releases to quality-focused, spaced-out game launches. While 2023-2024 featured major releases like Final Fantasy VII Rebirth and Final Fantasy XVI, 2025 relied on fewer exclusives (primarily Death Stranding 2 and Ghost of Yotei) paired with strategic ecosystem enhancements like Portal cloud gaming expansion and PS5 Pro optimization support. The strategy prioritizes developer health and game polish over meeting annual release quotas, betting that fewer quality titles maintain player engagement better than rushed releases.

How did Play Station's Portal cloud gaming feature change the value proposition?

The Portal evolved from a remote play device requiring a home PS5 to a standalone cloud gaming handheld after Sony added cloud support in November 2025. Play Station Plus Premium subscribers can now play PS5 games directly through Sony's servers without owning console hardware, making the Portal accessible to casual players and travelers. This transformation essentially created a lower-cost entry point into the Play Station ecosystem while reinforcing Sony's pivot from hardware-exclusive to software-ecosystem-based thinking.

Why did Sony's live-service gaming strategy largely fail in 2025?

Sony invested heavily in live-service games through acquisitions (Bungie, Haven Studios) and newly greenlit projects expecting recurring revenue. However, execution challenges plagued major titles: Fairgame$ shipped late without its founders intact, Destiny 2 saw declining player engagement despite the Edge of Fate expansion, and Marathon slipped to 2026 after plagiarism accusations. The company underestimated the operational and creative complexity of maintaining live-service ecosystems, discovering that talented developers alone don't guarantee live-service success without specialized expertise in ongoing community management, monetization design, and content scheduling.

How did Microsoft's missteps benefit Play Station's market position?

Microsoft's 2025 struggles with Game Pass restructuring (introducing price tiers, removing day-one first-party releases from standard tier) frustrated core subscribers and undermined the service's core value proposition. Simultaneously, Xbox Series X and S lacked a compelling exclusive roadmap, leaving hardware without obvious purchase rationale. Play Station benefited not by being better but by being stable and uncontroversial—when subscribers felt burned by Game Pass changes, Play Station's ecosystem looked reliable by comparison, creating a perception advantage without requiring major new investments.

What does Play Station's PC strategy mean for the console's future?

Sony's deliberate move to release Play Station exclusives on PC (Spider-Man 2, The Last of Us Part 2 Remastered, Stellar Blade) signals a fundamental shift toward platform-agnostic software distribution. Rather than treating console hardware as the only way to access Play Station games, Sony is accepting that PC distribution expands market reach and maximizes game revenue. This strategy implies Play Station's future competitive advantage lies in exclusive software quality and ecosystem stickiness rather than hardware exclusivity, with the PS5 Pro succeeding by offering superior performance for players who want the best technical experience rather than being the only way to play.

What are the implications of 1,500+ Play Station studio layoffs for future game development?

The cumulative layoffs across multiple studios (particularly the Play Station Visual Arts Group) reduced Sony's creative workforce and raised questions about sustaining the exclusives pipeline. While Sony retains world-class studios like Naughty Dog and Insomniac, smaller teams have less capacity for simultaneous projects, potentially extending development cycles or forcing harder prioritization choices. The layoffs also reflect industry-wide crunch and burnout, suggesting some departures were resignations rather than terminations. The real test comes when upcoming games like Wolverine and Saros launch—their reception will determine whether reduced team sizes maintained creative quality or compromised ambition.

How does the Play Station Portal's cloud gaming compete with other services like Xbox Cloud Gaming?

Play Station Portal with cloud gaming occupies a unique position: it's hardware-specific (requires Sony's Portal device) but doesn't require owning a PS5. Xbox Cloud Gaming integrates into Game Pass and works on any device with a browser or app. Play Station's approach prioritizes hardware control and unified ecosystem experience, appealing to players already invested in Play Station who want expanded convenience. Microsoft's approach maximizes accessibility across devices. For Play Station Plus Premium subscribers, the Portal represents reasonable value ($199 hardware + existing subscription). For Xbox Game Pass subscribers, Cloud Gaming is already included. The strategic difference reflects Sony's hardware-centric vs. Microsoft's software-centric philosophies.

What does Bungie's declining autonomy under Sony indicate about acquisition strategy?

Bungie's situation—from independent studio to Microsoft acquisition to Sony acquisition to potential full integration into Sony—demonstrates risks of acquiring autonomous creative teams. Sony's promise of supporting Bungie's independence conflicted with reality when Destiny's live-service economics proved unsustainable. By 2025, reports suggested full integration into Sony proper, essentially ending Bungie's autonomous status. The pattern reveals that acquisition success requires either radical hands-off management (accepting you're buying people, not control) or full integration from day one. Hybrid approaches where acquired studios maintain superficial independence while losing actual autonomy create worst-case scenarios—all the culture loss without the operational benefits of integration.

Why is the Switch 2 announcement significant for Play Station's 2025 strategy?

The Switch 2 represents the only genuine competitive threat to Play Station's market position, not through direct specs but through audience reach and Nintendo's proven ability to create must-own exclusive games. Nintendo's hybrid console approach captured audiences Play Station never quite reached (casual players, families, portable-first gamers). Switch 2 launching in 2026-2027 with rumors of improved hardware and backward compatibility could significantly impact hardware sales and gaming entertainment budgets. Sony's 2025 strategy of assuming Play Station's dominance in graphically intensive, story-driven gaming might face challenges if Switch 2 captures broader audiences than the original Switch. The strategic implication: Sony is betting on audience segmentation rather than direct competition with Nintendo.

What Comes Next

Sony's 2025 proved one fundamental truth about console dominance: when you're winning, you don't need to revolutionize—you need to maintain and optimize.

The company sat comfortably atop the market, released quality (if sparse) exclusives, refined its hardware ecosystem, expanded into PC, and let competitors stumble on their own. The strategy worked. But strategies built on stability require constant feeding—they can't coast forever.

The upcoming Wolverine, the GTA6 marketing partnership, the Portal's cloud expansion, and the eventual answers about Bungie's future will determine whether 2025's quiet approach leads to sustained dominance or complacency.

For players, 2025 was the year to understand that the best gaming experiences don't always come from flashy announcements. They come from companies that know their strengths, play to them patiently, and refuse to panic when competitors make noise. Sony learned that lesson in 2025. Whether it can sustain it in the noisier years ahead is the real question.

Key Takeaways

- PlayStation's 2025 proved that market dominance doesn't require constant innovation—stability and competent execution are powerful weapons when you're already winning

- The Portal's transformation into a cloud-capable device shifted Sony's strategy from hardware exclusivity to software ecosystem dominance, potentially reshaping how console gaming is distributed

- Sony's live-service pivot largely failed in 2025, with major cancellations and declining player engagement suggesting the company misjudged developers' ability to maintain ongoing games

- Over 1,500 layoffs across PlayStation studios raised legitimate questions about creative firepower for future exclusives, despite assurances from upcoming titles like Wolverine

- PlayStation exclusives expanding to PC signaled Sony's acceptance that platform boundaries matter less than ecosystem loyalty and that game revenue matters more than hardware lock-in

![PlayStation in 2025: Sony's Strategic Pause and What's Next [2025]](https://tryrunable.com/blog/playstation-in-2025-sony-s-strategic-pause-and-what-s-next-2/image-1-1766681058202.jpg)