The Next Generation Gaming Crisis: How RAM Scarcity Is Reshaping Console Timelines

You've probably heard the rumors. Play Station 6 might not arrive until 2028 or 2029. Nintendo's Switch 2 could cost significantly more than anyone expected. And it's not because of some deliberate marketing strategy or product refinement delay. It's because of RAM.

The global memory market has become a battleground. Generative AI companies are buying up semiconductor capacity faster than manufacturers can produce it, creating an unprecedented shortage of RAM and driving costs to levels that console makers haven't seen in years. This isn't some distant problem happening in a lab somewhere. It's affecting the actual hardware timelines and pricing strategies of two of the world's largest gaming companies right now.

What started as a supply chain whisper has turned into something major. Reports from IGN indicate that Sony is actively considering pushing the PS6 back to 2028 or even 2029, which would represent a nine-year gap between the PS5 and PS6 launch. That's longer than any previous console generation gap in Play Station history. Meanwhile, Nintendo's president publicly acknowledged the RAM cost issue but downplayed immediate earnings impact, though leaked reports suggest Switch 2 pricing could jump significantly.

Here's the thing: this isn't just about delayed consoles or slightly higher prices. This is about fundamental shifts in how hardware manufacturers plan their business. When AI demand can influence the availability and cost of basic components, everyone from Sony to Nintendo has to rethink their entire launch strategy. The ripple effects touch everything from hardware design decisions to profit margins to consumer pricing.

Let's break down what's actually happening, why it matters, and what gamers should realistically expect.

Understanding the RAM Shortage: AI's Unexpected Consequence

The RAM shortage isn't a mysterious phenomenon. It's the direct result of explosive demand for artificial intelligence infrastructure. Companies building large language models, training data centers, and AI chips need massive amounts of high-bandwidth memory (HBM) and DDR5 RAM. When Open AI scales Chat GPT, when Meta trains Llama 3, when Google expands Gemini infrastructure, they're competing for the same memory chips that console manufacturers need.

Memory manufacturers have limited production capacity. Building a new fabrication plant costs billions of dollars and takes years to come online. You can't just snap your fingers and produce more RAM. The plants that exist are running at or near full capacity, selling to whoever offers the highest price. And right now, AI companies are offering very high prices.

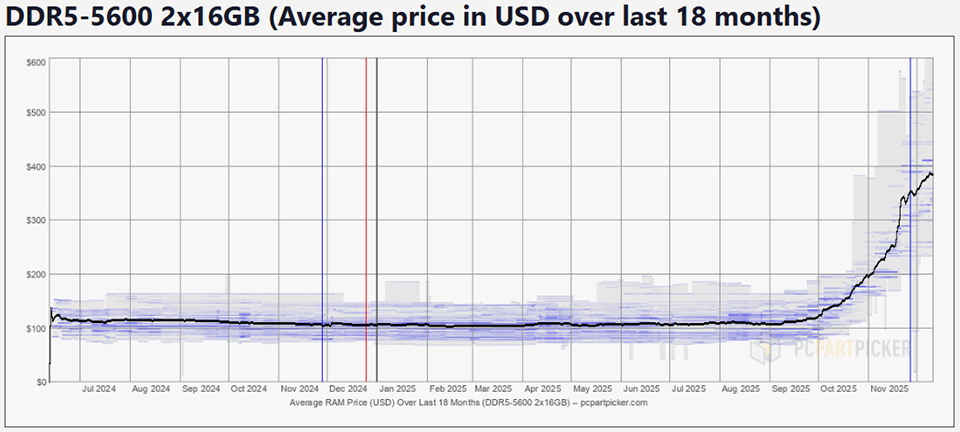

Console makers used to have predictable RAM costs baked into their financial models. They'd lock in supplier contracts years in advance, securing capacity at agreed-upon prices. That system worked fine when demand was stable. But AI changed everything. Suddenly, the same memory chips that cost $X per unit in 2023 cost significantly more in 2025. Those locked-in contracts become less valuable as memory becomes scarce.

The cost increases aren't marginal. We're talking about double-digit percentage increases year-over-year. For a console that might require

Sony and Nintendo don't have unlimited margins they can absorb. They operate on relatively thin profit margins on hardware, expecting to make money through software sales and subscriptions. When component costs spike unexpectedly, it forces hard decisions: launch with higher prices, delay the launch to negotiate better contracts, or reduce the specification of the hardware itself.

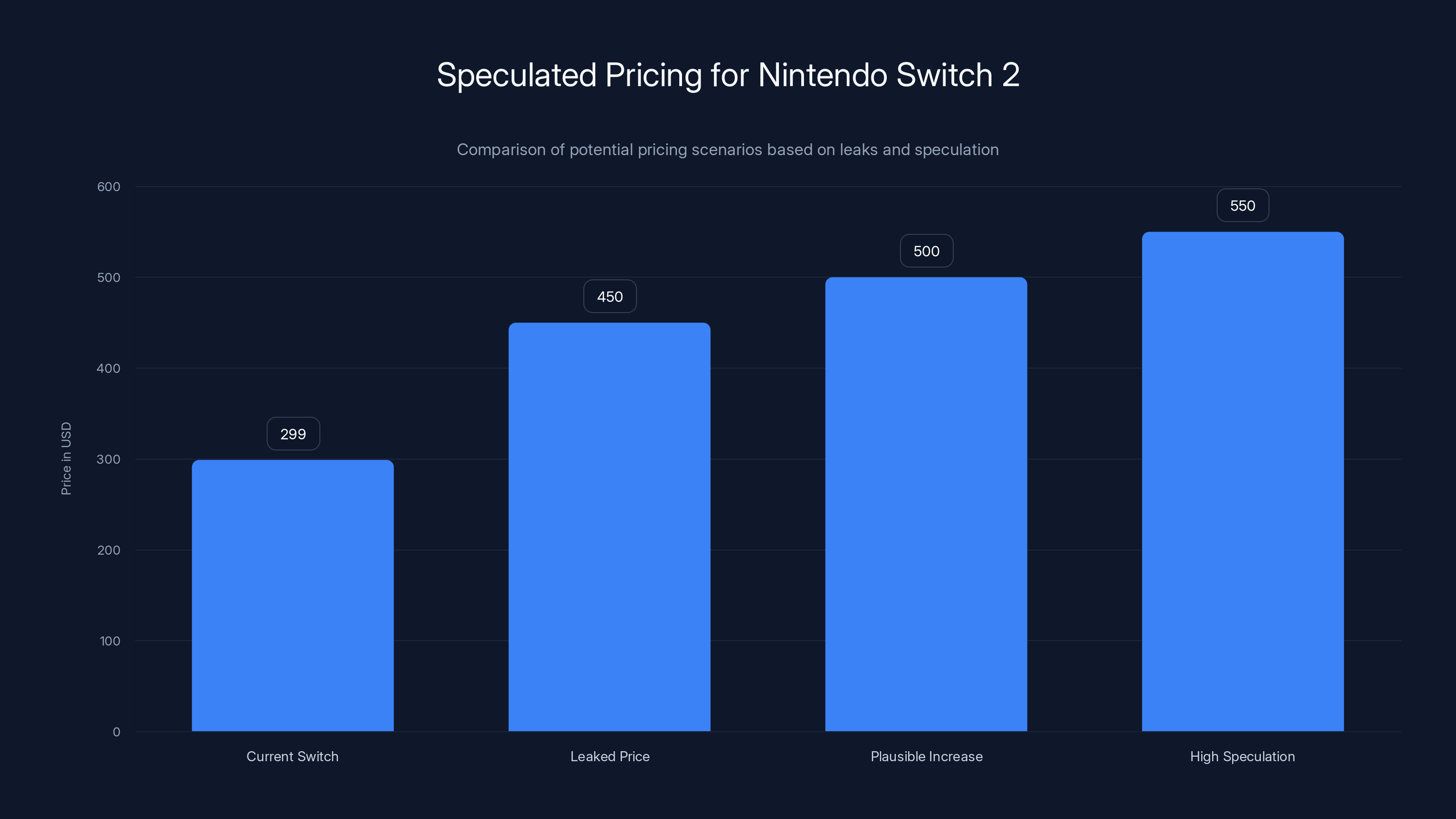

Speculated pricing for the Nintendo Switch 2 ranges from

Play Station 6: A Nine-Year Wait or Strategic Recalibration?

Sony's alleged consideration of delaying the PS6 until 2028 or 2029 raised eyebrows across the gaming industry. Depending on which timeline ultimately happens, this would be either seven or nine years after the PS5's November 2020 launch. For context, the gap between PS4 and PS5 was seven years. The gap between PS3 and PS4 was similar. Play Station has typically refreshed every six to eight years.

But here's the nuance: a delay doesn't necessarily mean executives are sitting around hoping things improve. It's a calculation. Sony's leadership likely ran projections showing that launching in 2026 or 2027 at a significantly higher price point would damage sales and market share, particularly in emerging markets where price sensitivity is critical. They weighed that against the option of waiting a couple more years for memory costs to stabilize and potentially recover some margin.

Console launches are incredibly expensive from a business perspective. You've got manufacturing ramp-up, supply chain coordination across dozens of suppliers, marketing campaigns, first-party software development, third-party developer relations. Once you commit to a launch date, you're committed. Delay it, and you've burned months of preparation work. Launch on time with higher costs, and you might face lower-than-expected sales at a thinner margin.

The Play Station 6 would need to be a significant hardware upgrade to justify the wait and presumably higher price. We're likely talking about cutting-edge GPU performance, massive RAM pools for AI-driven game features, and potentially new technology that justifies premium pricing. If Sony's planning a genuine leap forward, not just an incremental refresh, then waiting a couple extra years might make sense from both a technical and market readiness perspective.

What nobody's saying out loud but everyone knows: console launches are becoming less predictable. The variables have multiplied. It's not just about Sony's internal roadmap anymore. It's about global memory availability, geopolitical supply chain factors, currency fluctuations, and competitive pressure from Microsoft and Nintendo.

Nintendo Switch 2: The Unexpected Price Conversation

The Nintendo Switch 2 was already expected to cost around

Nintendo's approach is different from Sony's. Nintendo made the console world look foolish with the original Switch by focusing on innovation and hybrid gameplay rather than raw processing power. The Switch 2 doesn't need to be a graphics powerhouse. It needs to be a capable, handheld-first device that can also dock to a TV. That actually gives Nintendo more flexibility in design choices than Sony has.

What we know from Nintendo president Shuntaro Furukawa's statement is that the company is "monitoring" the memory situation closely and that there's "no immediate impact on earnings." Translation: they're not panicking, but they're taking it seriously. The fact that they mentioned it at all in an earnings call suggests it's a material concern, otherwise they wouldn't bother discussing it.

The

Nintendo's genius has always been hitting the sweet spot between price and capability. They underspend on raw horsepower but overspend on game design and user experience. That formula has worked for two decades. If they're forced into a corner where memory costs eat into margins, they have options Sony doesn't have: they could reduce RAM specifications (since they don't need cutting-edge specs for their game design philosophy), they could delay to negotiate better contracts, or they could absorb some cost and take a smaller margin, betting that Switch 2 software sales will make up the difference.

The leaked reports about potential price hikes are exactly that—leaked speculation. Nintendo hasn't confirmed any specific price change. But the fact that multiple sources are reporting it suggests there's real internal discussion about how to handle the situation.

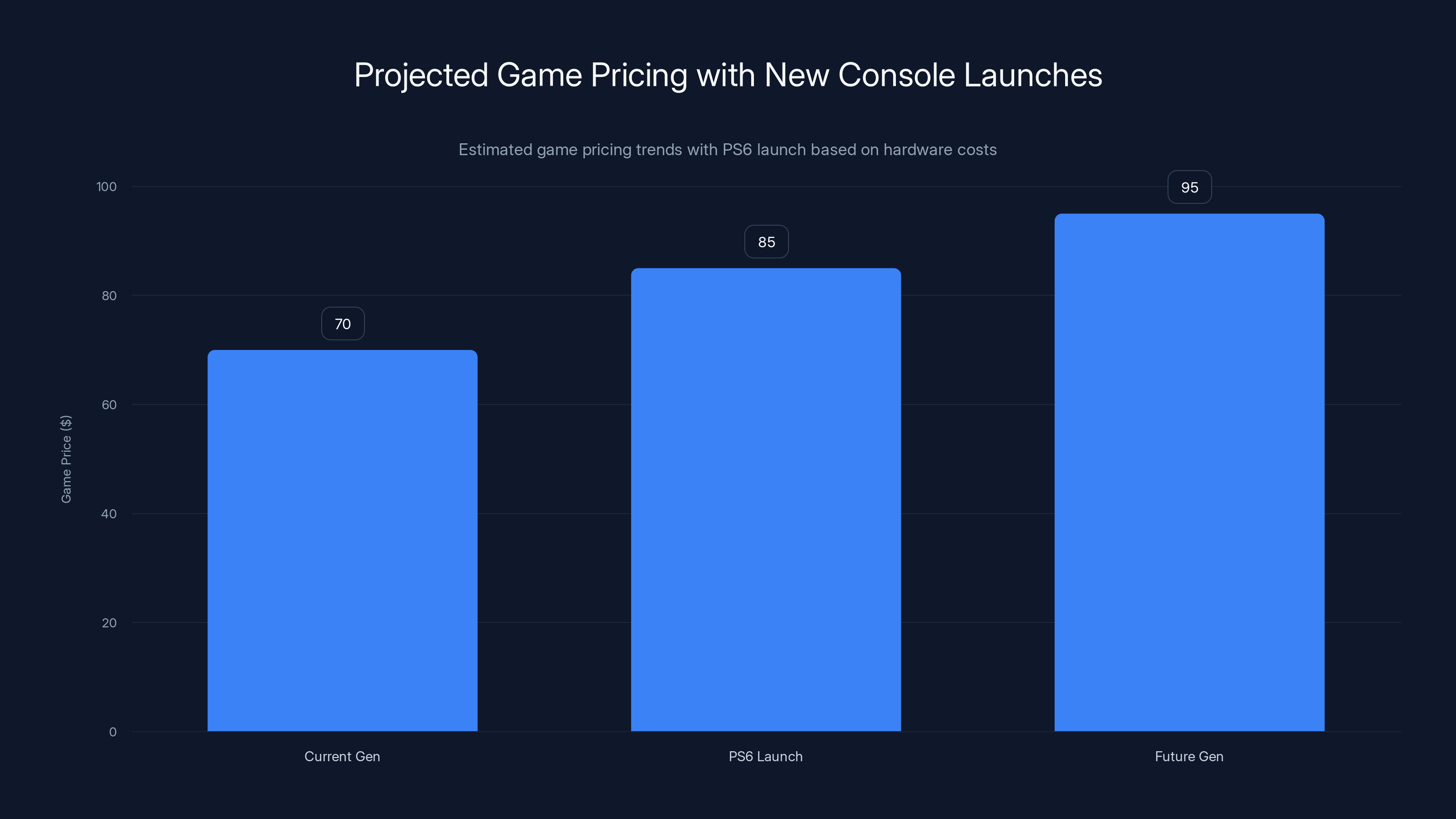

Estimated data suggests game prices could rise to

The Semiconductor Supply Chain Breakdown

To understand why this matters, you need to grasp how the semiconductor supply chain actually works. It's not like ordering from a factory catalog. It's a complex web of long-term contracts, capacity planning, and geopolitical considerations.

Memory chip manufacturers like Samsung, SK Hynix, and Micron plan their production years in advance. They build plants to match anticipated demand. When demand spikes unexpectedly, they can't just ramp up quickly. They can increase utilization of existing capacity, but they're limited by physical plant constraints. And adding capacity takes time and money.

AI demand came so fast that memory manufacturers couldn't adjust quickly enough. In 2023, nobody predicted that AI infrastructure would consume such a massive percentage of available memory capacity. By 2024, it was obvious. By 2025, it's a permanent structural feature of the memory market. This isn't a temporary shortage that'll resolve in six months. This is a new normal where AI companies have permanently increased their share of semiconductor consumption.

Console makers typically lock in memory contracts well in advance, sometimes 2-3 years before a launch. Those contracts specify pricing and allocation. But if a contract was signed in 2022 for components to be delivered in 2025, and memory prices doubled since then, the supplier is losing money on that contract while other buyers are offering spot market prices that are much higher. Suppliers become incentivized to find reasons to reduce allocation or demand contract renegotiation.

Sony and Nintendo are major buyers, so they have leverage. But they're not big enough to dictate terms against the collective demand of the entire AI industry. That's the core dynamic that's forcing the difficult choices on console launches and pricing.

Historical Console Launch Timelines and What's Normal

Let's zoom out and look at console history to understand if a delay to 2028-2029 is actually that unusual.

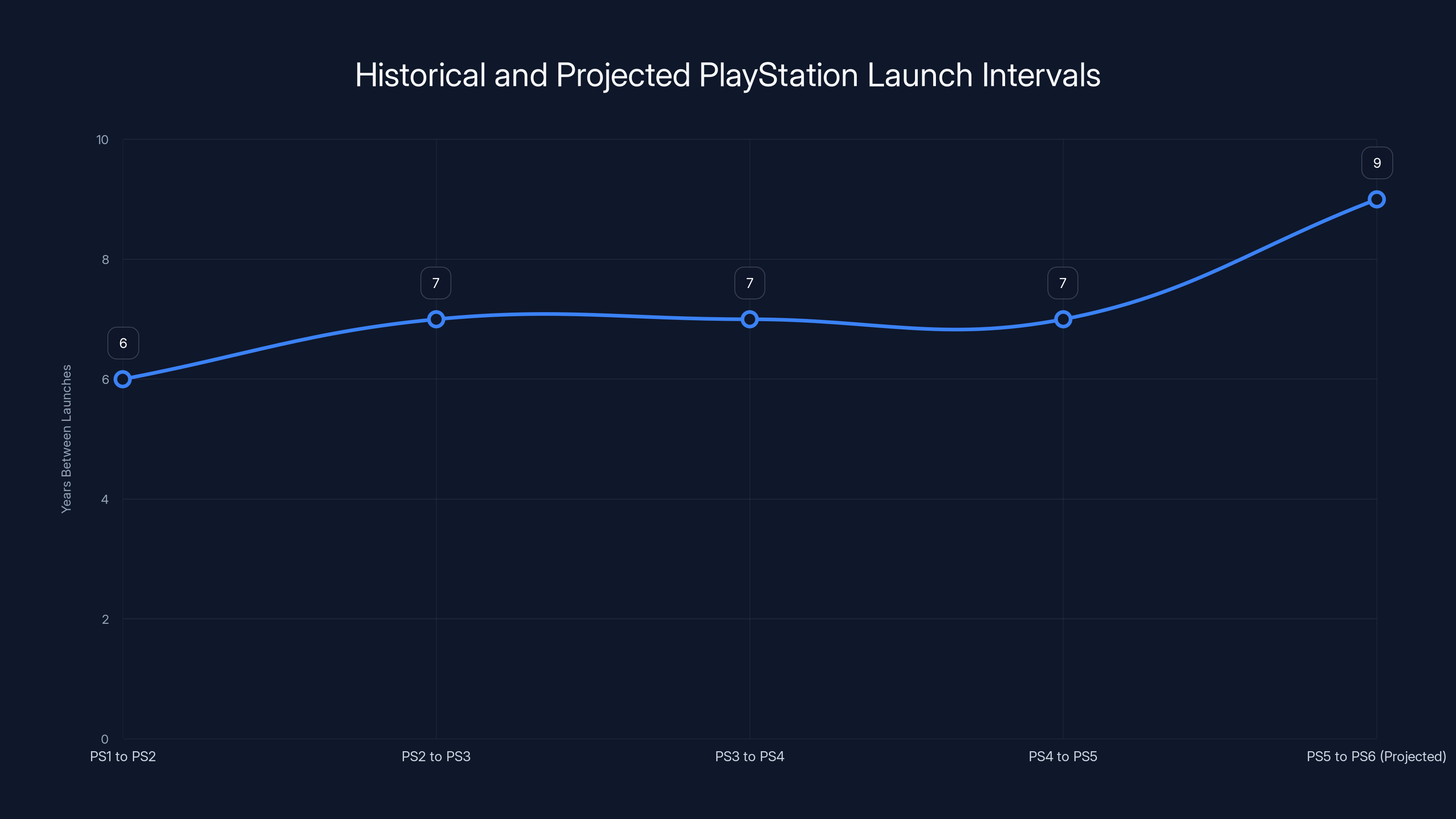

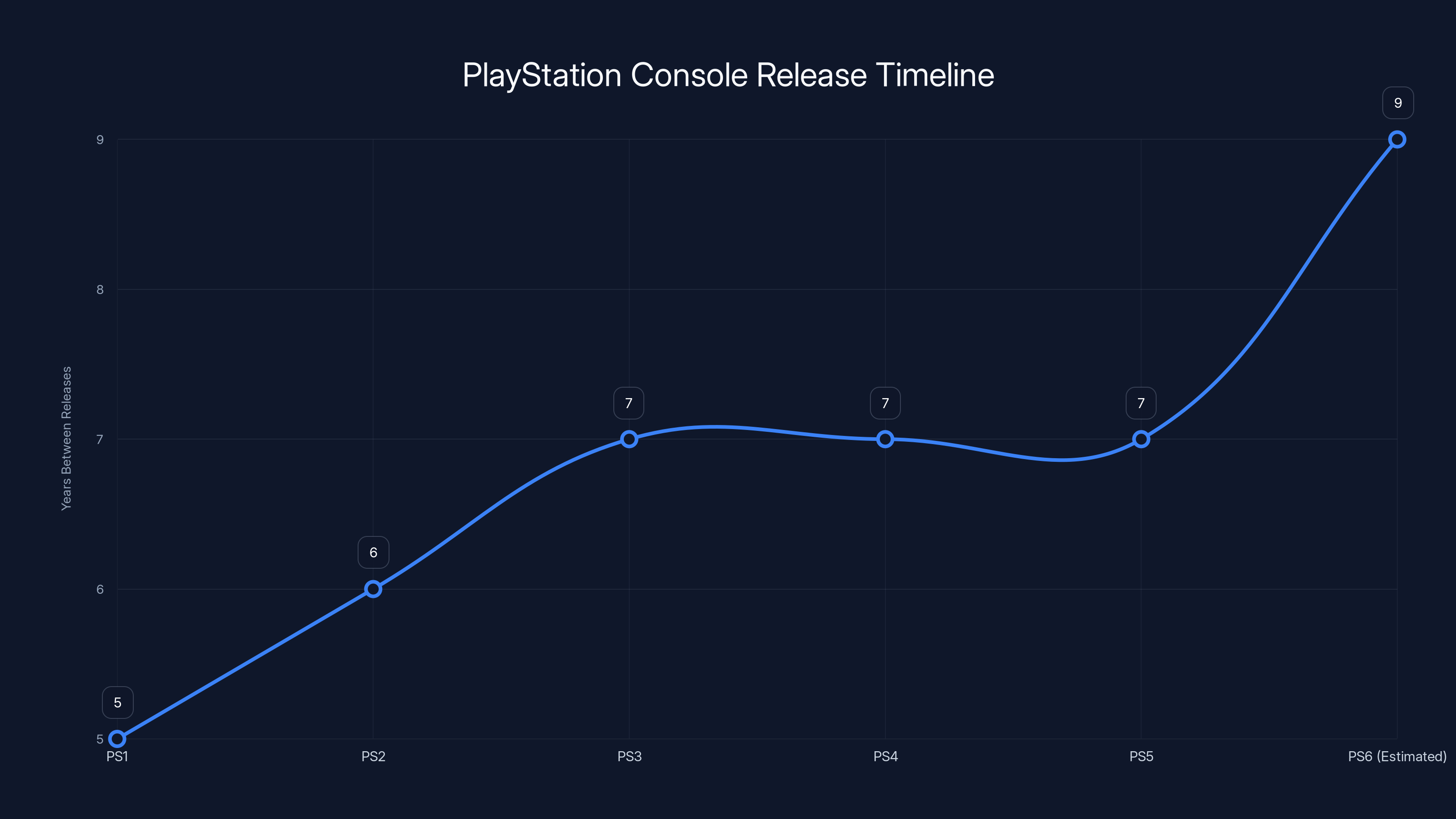

Play Station 1 launched in 1994. Play Station 2 arrived in 2000. That's six years. PS2 to PS3 was seven years (2006). PS3 to PS4 was seven years (2013). PS4 to PS5 was seven years (2020). The pattern is consistent: roughly every seven years, Sony refreshes the platform. Most gamers consider a seven-year refresh cycle standard.

A delay pushing PS6 to 2028 would be eight years after PS5, which is barely outside the norm. A delay to 2029 would be nine years, which is unusual but not unheard of. Nintendo's consoles have different patterns. The original Game Boy lasted over a decade. The Wii lasted five years before the Wii U, but that was an anomalous generation. The Switch launched in 2017, so 2025-2026 makes sense for Switch 2.

The headline "Sony delays PS6 to 2029" sounds shocking. The reality is: it might be a year or two longer than average, but it's not unprecedented. And there's a legitimate business case for it: console launches are expensive, RAM costs are high, and waiting for cost normalization makes financial sense.

Xbox Series X|S and the Collateral Damage

It's not just Sony and Nintendo feeling the squeeze. Microsoft's Xbox team faces similar pressures, though they've been less vocal about it. Reports from industry analysts have suggested that Xbox Series X and Series S could also face price increases due to memory costs.

Microsoft has a different problem: they're in third place in the home console market, behind Sony and Nintendo. Price hikes hurt them more proportionally because price-conscious consumers (which is most consumers) will gravitate toward Play Station or Switch. Increasing Xbox prices when you're already losing the hardware battle is a difficult move.

However, Microsoft's long-term strategy is different. They're betting on Game Pass and cloud gaming rather than hardware-centric business models. They might absorb memory cost increases more readily than Sony, knowing that their margin comes from subscription services, not hardware sales. That could actually give them a strategic advantage if they can keep prices stable while competitors raise prices.

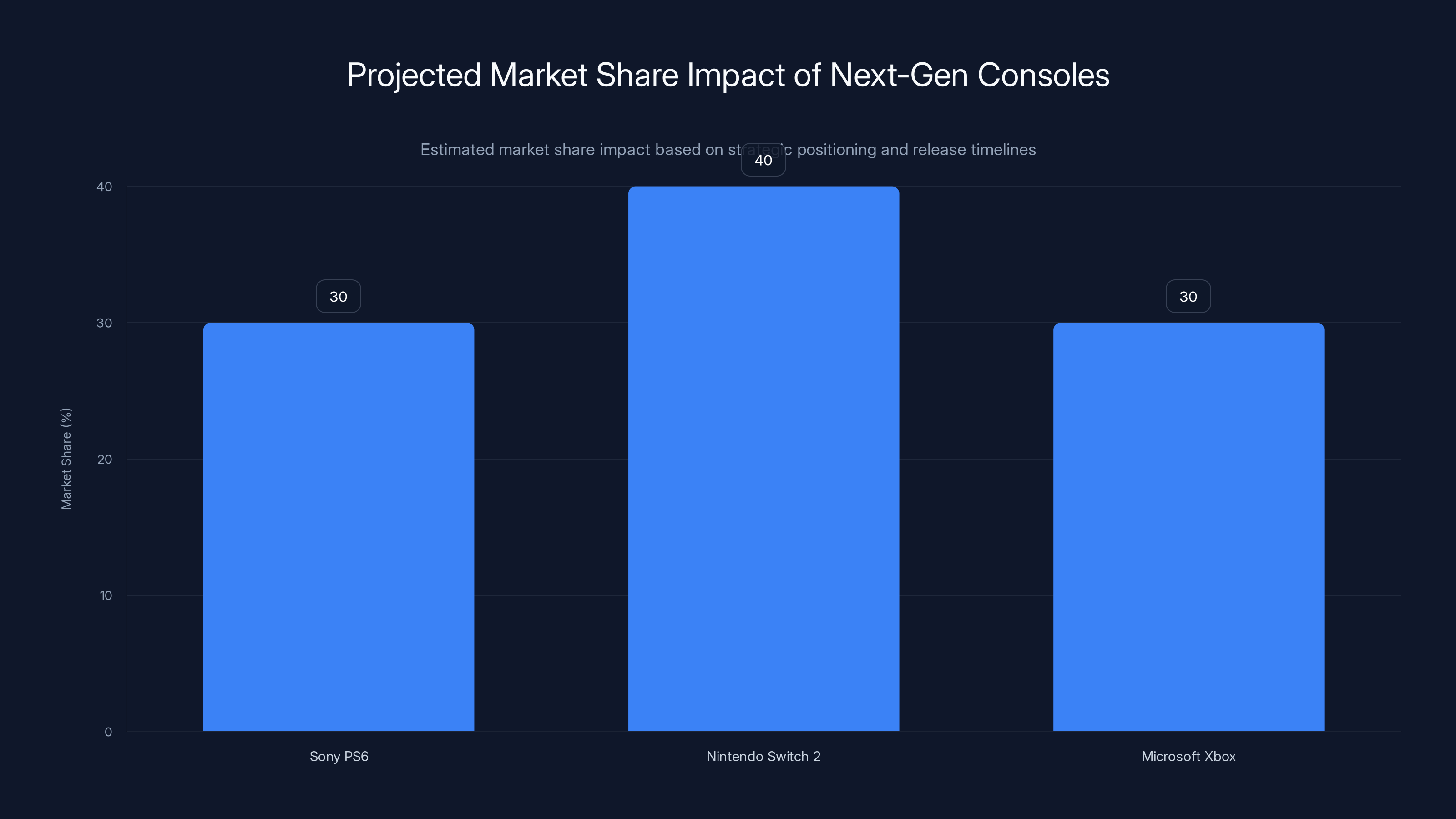

The broader dynamic is that memory shortage impacts everyone, but it impacts them differently based on their market position and business model. Nintendo can raise prices because of the Switch's cultural dominance. Sony can delay because they're the market leader. Microsoft needs to be more creative, potentially using hardware pricing stability as a competitive advantage.

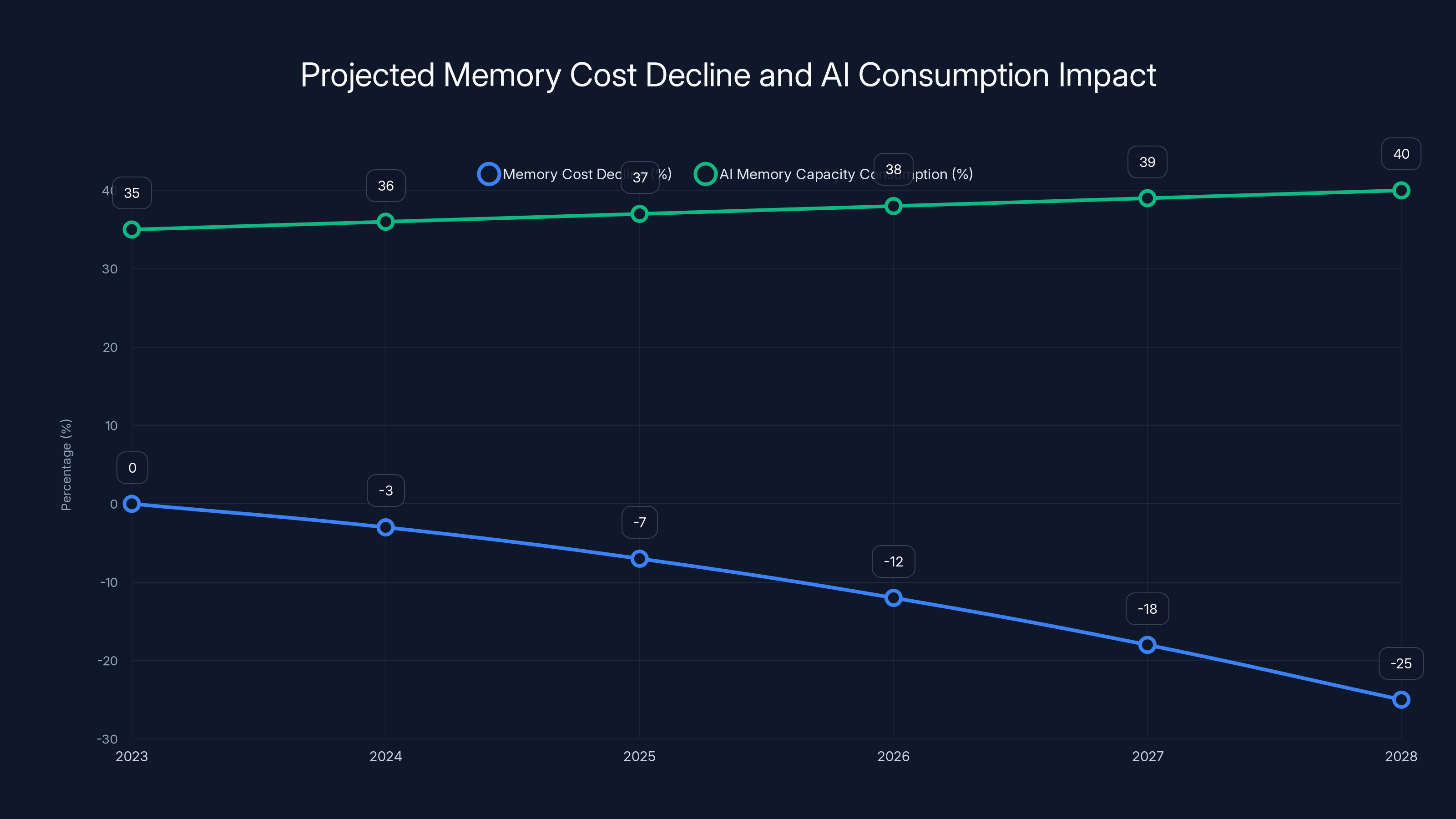

Analysts predict a 15-25% decline in memory costs by 2028, while AI's share of memory capacity will stabilize around 35-40%. Estimated data reflects industry trends.

Manufacturing Cost Implications: The Math Behind the Delays

Let's talk specifics about what drives these decisions. Console manufacturing costs matter enormously because they determine whether a console can be profitable at a given retail price.

A typical console might retail for

Memory is a significant portion of those manufacturing costs. Not the majority (processors, displays, and power supplies also matter), but a meaningful chunk. If memory costs spike by 20%, the manufacturing cost on a

Sony and Nintendo's profit margins aren't that fat. A $200 million impact to costs is material enough to trigger strategic discussions about delays or price increases.

The math gets even more interesting when you consider that memory prices might be expected to decline over a console's lifecycle. Launch at a high-cost moment, and you've locked in expensive manufacturing for the first year. Wait a couple years for costs to normalize, and you could launch at the same price point with much better margins. That's the bet both Sony and Nintendo are making: wait for cost improvement rather than launch into a cost spike.

The AI Demand Factor: Why Generative AI Changed Everything

You can trace this entire situation back to one decision: companies like Open AI, Google, and Meta decided to scale AI models to unprecedented sizes. Training and running models with hundreds of billions of parameters requires astronomical amounts of memory.

GPT-4 requires memory measured in terabytes. Llama 3 needs similar capacities. When you're running inference (actually using the model), you need memory pools to store model weights, intermediate computations, and user context. Each concurrent user requires additional memory allocation. Scale this to millions of users globally, and you're talking about memory requirements that dwarf anything else in the tech industry.

Memory manufacturers responded by ramping production, but supply couldn't keep up with the explosive growth. And here's the kicker: AI companies pay premium prices. They'll buy memory at

This isn't a temporary AI bubble either. AI infrastructure is becoming foundational to cloud computing, search engines, productivity tools, and enterprise software. The memory demand from AI is structural and likely permanent. Console makers aren't waiting for a shortage to end. They're adapting to a new normal where memory is more expensive and less reliably available.

Some industry observers suggest this could accelerate consolidation in gaming. Smaller publishers and manufacturers might struggle with higher component costs. Larger players like Sony, Nintendo, and Microsoft can absorb the costs or delay launches to negotiate better terms. Smaller competitors don't have that luxury.

What a 2028-2029 PS6 Launch Actually Means

If Sony commits to a 2028-2029 launch, what does that imply?

First, the PS5 will receive an extended software support cycle. That's not necessarily bad. The PS4 got games released well into 2024, eight years after launch. A PS5 that stays current through 2029 gives developers more time to mature the platform and build experiences that really showcase what the hardware can do.

Second, it gives Sony time to develop PS6 technology without rushing. A nine-year development cycle (counting from PS5 launch) allows for careful planning around next-generation features. Maybe the PS6 includes neural processing units optimized for AI, or custom memory configurations that take advantage of cost improvements, or revolutionary architecture that wouldn't have been feasible on a shorter timeline.

Third, it affects the competitive landscape. Microsoft's Xbox strategy revolves around Game Pass and service-oriented gaming. If Play Station delays, that's a window where Xbox Game Pass potentially gains market share. Nintendo's Switch 2 launches earlier, giving Nintendo the "newest" hardware claim. Both competitors get breathing room.

Fourth, it's a signal to publishers about the development timeline. If PS6 launches in 2028, publishers start developing for it in 2026 or 2027. Games don't arrive immediately at launch. The early PS6 software library might not be compelling for a couple years. This reinforces the idea that a delay actually extends the PS5's useful lifespan.

Estimated data suggests Nintendo Switch 2 could gain a competitive edge with early release, while Microsoft's pricing strategy may help maintain or grow its market share.

Switch 2 Pricing: What We Actually Know vs. Speculation

Everything about Switch 2 pricing should be treated as provisional. Nintendo hasn't officially confirmed a price. The $450 figure comes from multiple leakers, but it's not an official number. Any price increase beyond that is even more speculative.

What we do know: Nintendo president Furukawa mentioned memory costs as a concern. Nintendo is probably paying more for memory than they did for Switch 1. The question is whether they pass that cost to consumers or absorb it internally.

Nintendo has historically been conservative with price increases. When memory costs rose in the past, Nintendo sometimes absorbed the cost because they prioritized sales volume and market penetration over maximum margins. But they also understand that

Leaked reports of potential

Most realistic scenario: Switch 2 launches at $449-499, with Nintendo absorbing some memory cost increases and passing others to consumers. This positions it as a premium handheld but still competitive with other gaming platforms.

Supply Chain Vulnerability and Future Hardware Design

This whole situation exposes how fragile consumer hardware supply chains have become. Memory shortage, processor shortage, or any critical component shortage can derail a carefully planned launch.

Console makers are probably redesigning their approach to component selection. Instead of locking in specific memory configurations years in advance, they might design hardware with some flexibility. Build the PS6 to work with different memory types or configurations. Design Switch 2 to function with memory that's more readily available. These design choices cost engineering time but provide supply chain resilience.

Alternatively, they might pursue vertical integration. Sony could invest in memory manufacturing capacity. Nintendo could secure long-term exclusive contracts with multiple suppliers. Microsoft could do both. The cost is significant, but so is the risk of missing a launch window or launching with uncompetitive hardware.

This is part of a broader trend: major tech companies are reshoring manufacturing and securing critical component supplies. Apple secured memory capacity for i Phones. Tesla ramped battery production. Microsoft and Amazon are investing in chip design and manufacturing. Console makers might follow suit, ensuring they're not held hostage by external supply constraints.

Market Impact: What Gamers and Investors Should Understand

From a consumer perspective, the practical impact is straightforward: expect higher next-gen console prices and potentially longer wait times.

For Play Station enthusiasts, a 2028-2029 PS6 means PS5 games will still be coming for several more years. The investment in PS5 remains valuable. Used PS5 prices might decline as the platform matures, presenting opportunities for budget-conscious buyers.

For Nintendo fans, Switch 2 at $450-500 is expensive but not unreasonable given the hardware improvements and the Switch's cultural dominance. Many Switch 1 owners will upgrade because the ecosystem and software are valuable to them.

For investors in gaming stocks, this signals challenges ahead. Hardware manufacturers face margin pressure. Publishers might need to adjust game pricing if console hardware becomes less affordable. But it also suggests that the next generation will be more profitable once launched, since memory costs should improve over time.

The bigger market story is the AI-induced structural change to the semiconductor industry. This isn't just affecting gaming. Every device that uses memory is potentially affected. Companies need to plan accordingly.

The potential delay of the PS6 to 2029 would result in a nine-year interval from PS5, the longest in PlayStation history. Estimated data for PS5 to PS6 based on current projections.

Memory Cost Projections: Will Prices Stabilize?

Memory industry analysts have varying predictions about when costs stabilize. Some suggest 2026-2027. Others think 2027-2028. A few outliers claim memory costs could stay elevated indefinitely.

The most likely scenario is gradual normalization. Memory manufacturers will bring new capacity online over the next couple years. AI growth will continue but at a slower rate than the explosive 2023-2025 period. Supply and demand will rebalance, bringing costs down from current peaks but keeping them higher than pre-AI levels.

This supports the delay theory. Waiting until 2028-2029 allows memory costs to decline from their current peaks while remaining elevated compared to historical norms. By launching then, Sony avoids the worst of the current shortage while still launching into a market where component costs have improved substantially.

Memory manufacturers are also investing in new technologies like HBM3 and DDR6, which offer higher capacity and performance. These newer memory types are expensive initially but cost less per unit of performance than current standards. Console makers could leapfrog to new memory standards, actually getting better performance while managing cost.

The next-generation console specifications will probably reflect this evolution. Expect higher memory capacity paired with newer memory types. The PS6 might have more memory than the PS5 despite similar or slightly lower manufacturing costs, simply because memory technology improved.

Industry Analyst Perspectives and Predictions

Wall Street analysts covering gaming hardware have published reports about these supply chain issues. The consensus seems to be:

Morgan Stanley and JP Morgan reports suggest that console hardware margins will be pressured through 2027-2028 but should recover as new capacity comes online. They predict memory costs will decline 15-25% by 2028 compared to current levels.

Gartner's semiconductor division forecasted that AI will consume 35-40% of premium memory capacity indefinitely, establishing a new market floor for memory pricing. They suggest hardware manufacturers should plan for permanently elevated memory costs.

IDC reports indicate that console launches are increasingly dependent on supply chain factors rather than technology readiness. They recommend longer development and ramp cycles to secure supply agreements and manage costs.

These analyst reports matter because they inform investor expectations and company strategy. When an analyst suggests PS6 will have margin challenges if launched before 2028, that carries weight with Sony's board. Similarly, Nintendo's decisions about Switch 2 pricing are informed by analyst guidance about memory availability.

Investor pressure also plays a role. Institutional investors want predictable earnings. If Sony launches PS6 into a memory shortage at compressed margins, that hurts near-term profitability. Delays are actually Wall Street-friendly if they result in better long-term margins.

The Ripple Effects: Games, Pricing, and Business Models

Higher hardware costs and prices don't exist in isolation. They ripple through the entire gaming industry.

First-party software development: Sony and Nintendo will want strong software at launch to justify higher hardware prices. This puts pressure on internal studios to deliver killer apps. The PS6 launch window probably features more ambitious first-party titles than typical launches.

Game pricing: If hardware is more expensive, publishers might justify higher game prices. We're already seeing

Subscription services: Play Station Plus, Nintendo Online, and Game Pass become more valuable. A consumer paying $500+ for hardware is more likely to subscribe to get immediate software value. Subscription prices might increase accordingly.

Backwards compatibility: Expect strong backwards compatibility with PS5 and Switch 1 games. This adds value to new hardware and justifies upgrades among existing user bases.

Used hardware markets: With hardware more expensive, used console prices might remain elevated longer. A used PS5 could retain value better than previous generations.

Global pricing disparities: Memory costs are global, but labor costs and distribution vary by region. We might see larger price gaps between developed and developing markets. A PS6 might cost

The potential delay of the PS6 to 2028 or 2029 would mark the longest gap between PlayStation console releases at nine years, indicating a strategic recalibration by Sony. Estimated data.

What Doesn't Get Discussed: The Competitive Advantage Angle

Here's a detail most reporting misses: delays and price increases actually create competitive opportunities.

If Sony delays PS6 to 2028-2029 and Nintendo launches Switch 2 in 2025-2026, Nintendo dominates the "newest hardware" narrative for several years. That matters for mindshare and developer attention. While PS5 maintains a larger installed base, Switch 2 owners feel like they're on the latest platform. This could drive strong software adoption for Switch 2.

Microsoft could position Xbox differently entirely. Imagine Xbox announcing "we're keeping current-gen pricing stable despite component costs because we believe in value for consumers." That's a compelling narrative, especially if competitors are raising prices. Microsoft might actually gain market share through pricing leadership, even though they're in third place overall.

Nintendo's price increase gambit only works if Switch 2 is perceived as worth premium pricing. The original Switch succeeded because it offered unique value at accessible pricing. Switch 2 at $450+ needs to deliver obvious hardware improvements and an incredible software lineup to justify the cost. If Nintendo nails that, the price increase becomes a non-issue. If Switch 2 feels like an iterative update, the higher price becomes a problem.

These dynamics suggest that the next console generation might be more competitive than the current one, even with longer timelines. Delays and price pressure force each manufacturer to articulate their unique value. That competition benefits consumers through more interesting hardware choices and potentially better software.

Timeline Predictions: When We'll Actually Know

Sony hasn't officially announced PS6 timing. Nintendo hasn't confirmed Switch 2 pricing. Microsoft hasn't made dramatic statements about Xbox Series Y or whatever they're calling the next generation.

Here's the realistic timeline for official clarity:

2025 (Now): Earnings calls and shareholder reports continue to acknowledge supply chain challenges but provide limited concrete information. Analyst estimates diverge widely. Rumors and leaks continue.

2026-2027: Console manufacturers begin formally announcing next-gen hardware. They reveal processor specs, memory configurations, and preliminary launch windows. Pricing announcements typically come 6-12 months before launch.

2027-2028: First hardware reveals happen at major gaming events. Developers discuss next-gen hardware and software pipelines publicly. Market sentiment begins to crystallize.

2028-2029: Official launch announcements with confirmed pricing and dates. Manufacturing ramp-up occurs.

2029-2030: Actual launches in the market.

This timeline suggests that waiting for official confirmation is probably wise. Rumors and speculation will persist, but actual details won't be confirmed for 2-3 years. By then, memory costs will have evolved, giving us real data about whether delays were actually necessary.

The Bigger Picture: Hardware Industry Maturity

Zoom out even further, and this situation reflects broader maturity in the gaming hardware industry.

Consoles were once the primary driver of gaming hardware innovation. They pushed processor design, graphics architecture, and peripheral innovation. But that era has shifted. Gaming PCs and mobile devices are now the primary innovation frontiers. Consoles are important but no longer the sole drivers of hardware progress.

This maturity means console releases matter less to overall market trajectory. A delayed PS6 doesn't harm gaming. Play Station's software ecosystem continues thriving. Mobile and PC gaming advance regardless of console timelines. The industry is less dependent on any single platform.

Memory shortages actually reveal this healthy ecosystem diversity. Twenty years ago, a memory shortage would have been catastrophic for gaming. Today, it's an inconvenience that companies solve through delays and price adjustments. The market absorbs the disruption because there are multiple gaming channels.

Long-term, this suggests we're moving toward a world where "console generations" matter less. Hardware becomes more continuous and incremental. A PS6 arriving in 2029 isn't a dramatic event but another step in hardware evolution. That's actually healthier for the industry than the old boom-and-bust cycle of generational transitions.

Consumer Advice: What Should You Do Right Now?

If you're considering a gaming hardware purchase in the next year or two, here's realistic guidance:

For Play Station fans: Buy a PS5 Pro if you want top-tier performance now. Enjoy the 2-3 years of excellent upcoming software. Don't wait for PS6. The PS5's value only improves as the library matures and used prices decline.

For Nintendo fans: Wait for official Switch 2 pricing if you can. If the price is $450-500, that's expensive but not unreasonable for what's likely a capable handheld. The launch software library matters more than the exact hardware launch date.

For Xbox players: Monitor Game Pass and current-gen Xbox value. Microsoft's subscription strategy might make current-gen Xbox increasingly valuable even as new hardware approaches.

For PC gamers: Your platform is unaffected by console timelines. Continue playing and upgrading as you see fit.

For casual gamers: Budget your purchase for 2026-2027. By then, Switch 2 will be established with a software library, and next-gen hardware costs might have improved.

The key principle: don't let rumors about future hardware paralyze your current purchasing decisions. Good hardware has value today. Enjoyment is real now. Speculation about 2028-2029 launches shouldn't prevent you from gaming in 2025.

The Bottom Line: Structural Changes to Hardware Industry

When historians look back at 2024-2025, they'll recognize this as an inflection point. AI demand fundamentally changed semiconductor markets. That change will persist for decades.

Console makers are adapting intelligently to this new reality. Delays aren't failures. They're evidence of mature business decision-making under uncertain conditions. Raising hardware prices is annoying but understandable given cost pressures.

What matters long-term is that the industry continues delivering great games and experiences. A PS6 arriving in 2028 or 2029 instead of 2027 doesn't fundamentally change gaming. Better hardware eventually arrives. Better games get made. Developers and players adapt.

The console industry will navigate memory shortages, supply chain disruptions, and price pressures. It always has. The specific details about PS6 delays and Switch 2 pricing are interesting but not definitive. What's actually important is that gaming continues to evolve, players have access to great hardware and software, and the industry remains competitive and innovative.

Expect announcements over the next couple years that clarify timelines. Until then, enjoy current hardware, play great games, and don't stress about speculation from sources claiming insider knowledge. These leaks are sometimes accurate, sometimes wildly wrong. The actual truth will emerge through official company statements and concrete product announcements.

The next generation of consoles is coming. When they arrive, they'll be worth the wait.

![PS6 Delayed to 2029, Switch 2 Price Hike: RAM Shortage Impact [2025]](https://tryrunable.com/blog/ps6-delayed-to-2029-switch-2-price-hike-ram-shortage-impact-/image-1-1771328196674.jpg)