The Television Technology Inflection Point: What CES 2025 Revealed

The television industry stands at a critical juncture. For years, manufacturers competed fiercely to drive down OLED television prices, making premium display technology accessible to mainstream consumers. Budget OLED models at $800-1,500 became the victory flag for affordability advocates. But CES 2025 sent a clear message: that era is ending.

Instead of continuing the race to the bottom on pricing, major television manufacturers—Samsung, LG, TCL, and others—unveiled two competing technologies poised to reshape the market: RGB mini-LED displays and ultra-thin wallpaper OLEDs. These aren't incremental improvements. They represent fundamental reimagining of how televisions balance performance, cost, and design.

The shift makes economic sense. Producing cheap OLED panels requires massive manufacturing scale and razor-thin margins. Manufacturers struggled to maintain profitability while competing on price alone. Meanwhile, mini-LED technology, refined over several generations, offers a path to premium performance without sacrificing margins. Wallpaper OLEDs, by contrast, address a different market segment entirely—consumers willing to pay substantially more for design innovation and true portability.

What makes this transition significant isn't merely technological advancement—it's strategic repositioning. Manufacturers are abandoning the budget OLED segment to focus on either massive volume plays (affordable mini-LED) or ultra-premium experiences (wallpaper OLED). This creates an unusual market vacuum: the "sweet spot" of reasonably-priced high-quality OLED TVs will largely disappear within 18-24 months.

For consumers currently shopping for televisions, understanding these emerging technologies becomes crucial. The decisions manufacturers make at CES 2025 will determine what options exist when you're ready to upgrade. Whether this transition benefits or disadvantages consumers depends entirely on which category you fall into: the budget-conscious viewer, the performance enthusiast, or the design-focused adopter.

Understanding RGB Mini-LED Technology: A Practical Revolution

The Technical Foundation of RGB Mini-LEDs

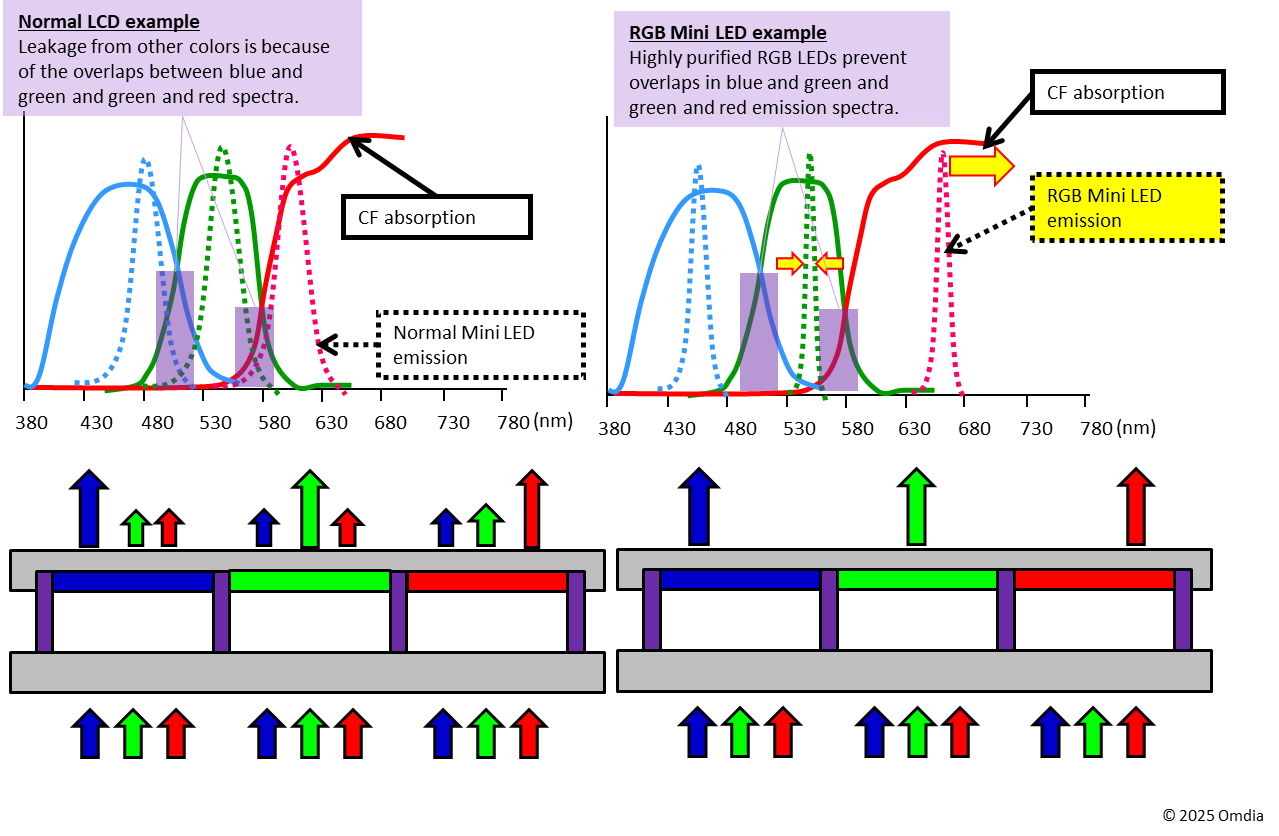

RGB mini-LED technology represents a sophisticated evolution of traditional LED backlighting. Rather than using a single color temperature of LEDs (typically white) distributed sparsely across the screen, RGB mini-LEDs employ three separate LED colors—red, green, and blue—distributed in a vastly denser grid across the display panel.

The architecture matters significantly. A conventional full-array LED backlight might use 500-1,000 dimming zones across a 65-inch television. An RGB mini-LED implementation uses 10,000-50,000 individual LEDs of varying colors. This dramatic increase in density and granularity enables unprecedented local dimming precision and color accuracy.

When displaying a scene with a bright red object against a dark background, traditional LED backlights struggle with this exact scenario. The backlight zone containing that red object illuminates, but doing so affects surrounding areas, creating blooming and halo artifacts. RGB mini-LED systems, by contrast, activate only the specific red LEDs in that region while keeping adjacent blue and green LEDs dark, producing sharp color transitions without light bleeding.

The color accuracy improvements prove equally compelling. By independently controlling red, green, and blue channels at the LED level, manufacturers achieve wider color gamuts and more precise color reproduction than white-LED systems. This mirrors how OLED displays work—where every pixel emits its own light—but accomplishes it through intelligent backlighting rather than individual pixel control.

Real-World Performance Advantages

In practical viewing scenarios, RGB mini-LED displays demonstrate several concrete advantages over conventional LED-backlit LCDs. Contrast ratios improve dramatically—not to OLED levels, but to performance levels that would have required spending $3,000+ just three years ago.

Consider sports broadcasting. A football stadium scene requires reproducing bright grass under stadium lights while maintaining dark shadow details in the crowd. RGB mini-LED's precise local dimming handles this scenario with minimal blooming around the bright light sources. The visual result appears almost OLED-like to casual viewers, though technical measurements reveal subtle differences.

Movie watching benefits similarly. Dark cinema content—a common test case for display technology—shows marked improvement with RGB mini-LED. The backlight can achieve near-perfect blacks in isolated areas while simultaneously maintaining bright highlights elsewhere on screen. This capability matters because most television watching involves mixed brightness content rather than full-screen uniform colors.

Motion handling also improves. RGB mini-LED backlights reduce motion blur artifacts by providing faster response times in the backlight system. While LCD panels themselves don't match OLED pixel response times, the enhanced backlighting creates a visual impression of crisper motion.

The Manufacturing Economics

Why are manufacturers betting heavily on RGB mini-LED despite OLED's technical superiority? The answer lies in production economics. Manufacturing OLED panels requires specialized facilities, precise organic material deposition, and rigorous quality control. Each panel that fails quality testing represents a manufacturing loss. Yields for OLED production hover around 60-75%, meaning 25-40% of produced panels become scrap.

LED manufacturing, by contrast, benefits from decades of optimization and massive existing capacity. LED chips themselves cost substantially less than OLED panels. The assembly process, while intricate, uses proven manufacturing techniques. Yields exceed 95% in mature LED production lines.

This economic reality explains manufacturer strategy. For a

Capacity constraints also factor in. OLED panel production faces fundamental limitations in how quickly manufacturers can increase output. Building new OLED fabs requires billions in capital investment and years of construction. LED component manufacturing can scale up relatively quickly by expanding existing facilities or bringing additional production lines online.

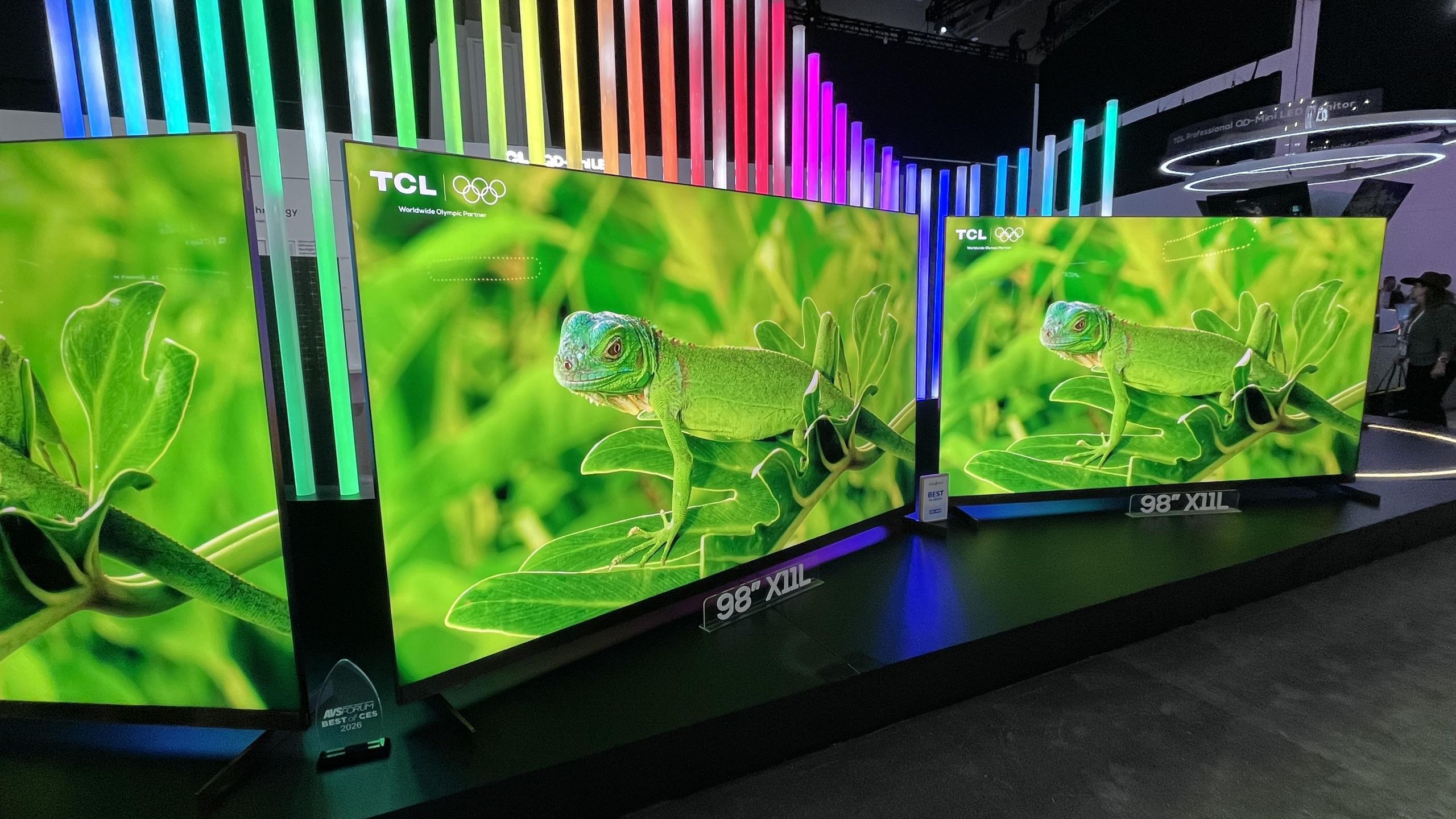

Current Market Implementations

Several manufacturers have already demonstrated advanced RGB mini-LED implementations. Samsung's latest QN90D and QN95D series showcase the technology at increasingly affordable price points. These displays, hitting retail prices around

TCL's QM251D series brought RGB mini-LED technology to the $1,200-1,500 segment. While not achieving the absolute peak performance of Samsung's premium offerings, these displays demonstrate that the technology has begun trickling down the price ladder—exactly what happened with OLED years ago.

LG and other manufacturers continue refining their mini-LED approaches, working toward even denser LED arrays and improved algorithmic control. The competitive pressure from Samsung's QD-LED (Quantum Dot LED) implementations drives innovation across the industry.

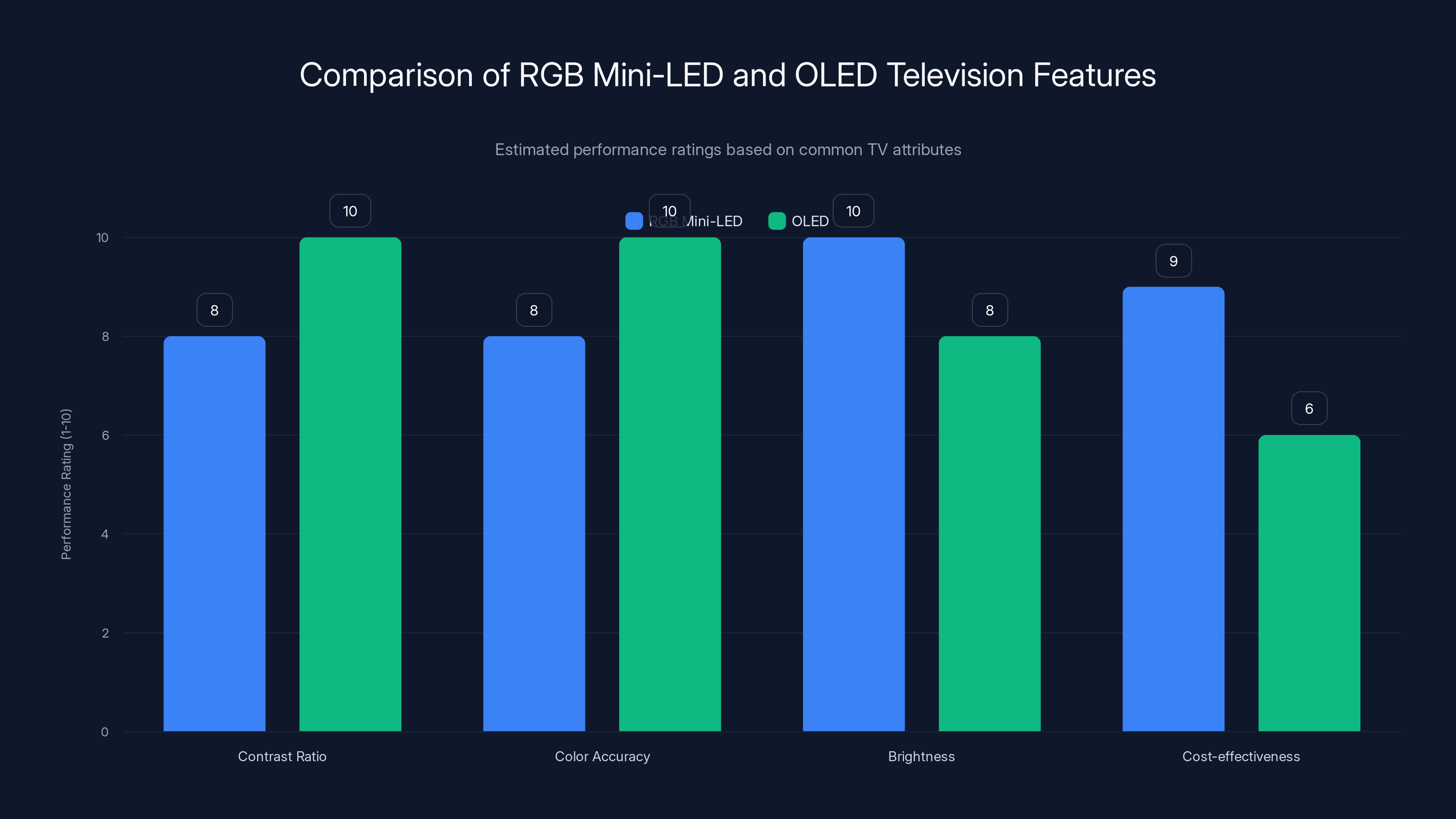

RGB Mini-LED TVs offer superior brightness and cost-effectiveness, while OLEDs excel in contrast and color accuracy. Estimated data based on typical performance.

Wallpaper OLED: The Ultra-Premium Segment

Design Philosophy and Technical Innovation

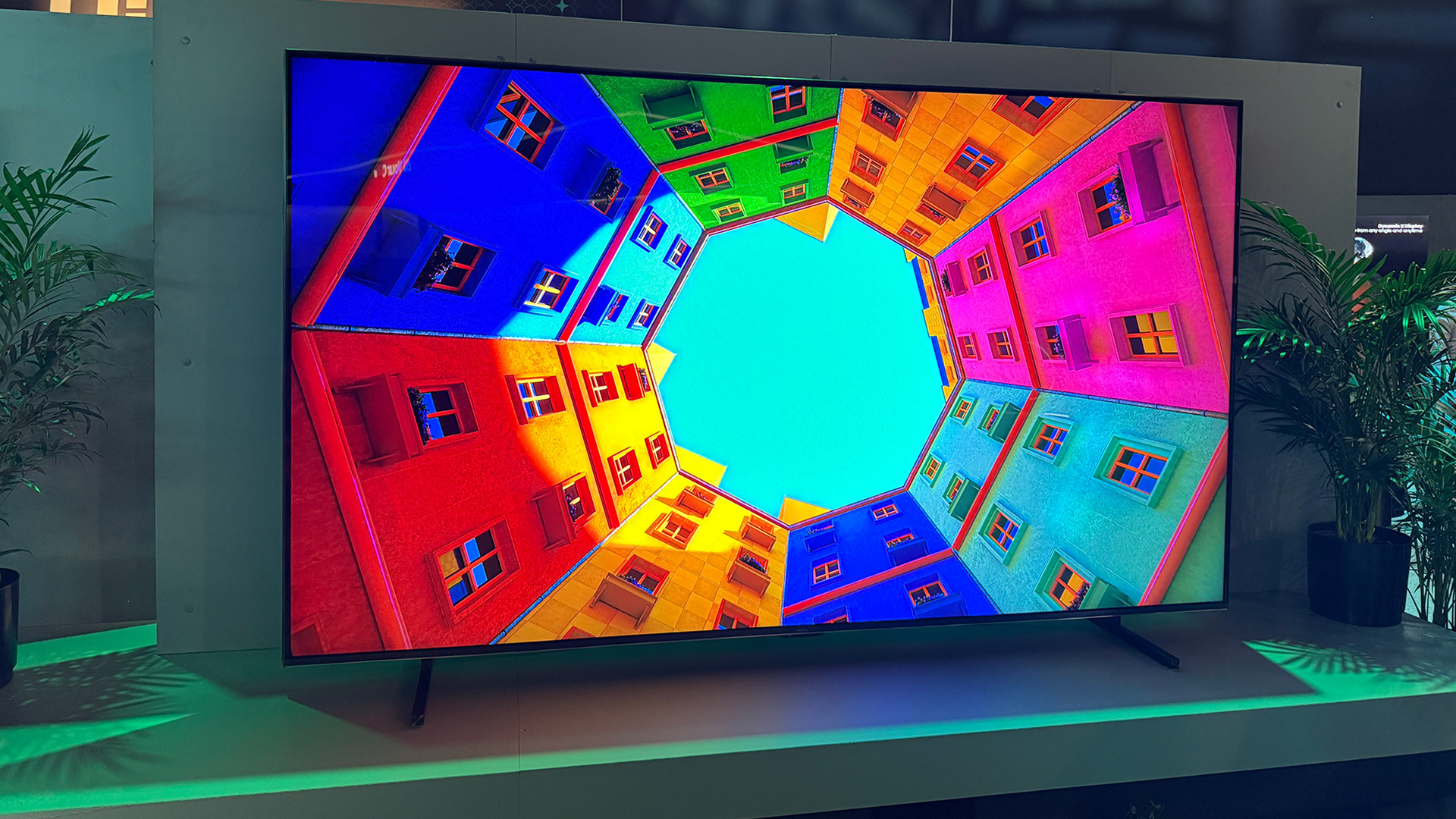

Wallpaper OLED televisions represent an entirely different product category. Rather than pursuing the commodity market through price optimization, manufacturers are creating statement pieces for consumers for whom display quality and design merit premium pricing.

The defining characteristic of wallpaper OLEDs is their extreme thinness. Traditional OLED TVs, while thinner than LED-backlit models, still require 2-3 inches of depth for internal components and cooling systems. Wallpaper OLEDs reduce this to approximately 2.5mm at their thinnest point—essentially the thickness of a credit card or thin tablet.

Accomplishing this feat required fundamental rethinking of thermal management and component placement. Engineers developed innovative cooling systems that disperse heat without requiring the substantial heatsinks traditional displays need. They relocated processing components to external modules, often integrated into premium mounting solutions that don't detract from the paper-thin display appearance.

The aesthetic impact proves substantial. A wallpaper OLED mounted flush against a wall becomes nearly indistinguishable from an actual piece of art. This positioning possibility appeals to interior designers and consumers for whom the television's physical presence matters as much as its image quality. Rather than being the dominant focal point in a room, a wallpaper OLED becomes integrated into the wall itself—literally integrated, in some implementations where the display adheres to walls without traditional mounts.

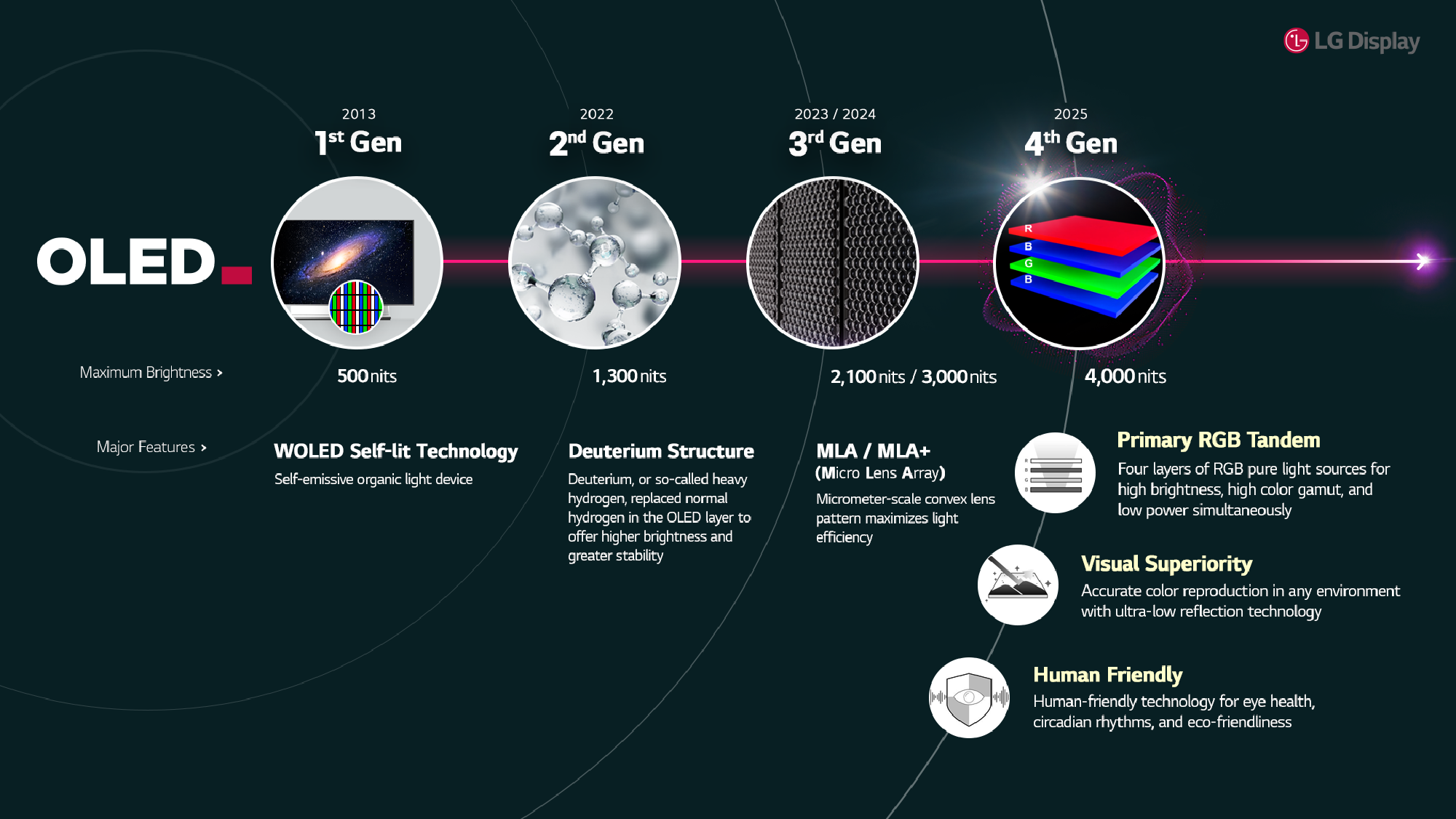

OLED Advantages in the Ultra-Premium Market

Wallpaper OLEDs leverage all the inherent advantages of OLED technology without the manufacturing constraints that make affordable OLEDs economically problematic. Each pixel produces its own light, enabling perfect blacks (pixels emit nothing), infinite contrast ratios, and instantaneous pixel response times.

Color accuracy reaches professional standards. Without a backlight creating color temperature variations, OLEDs deliver consistent color across the entire screen. This matters particularly for premium content creators who need reliable color representation or for consumers who value cinematic accuracy.

Motion handling becomes near-perfect. OLED pixels can change state in microseconds, eliminating motion blur entirely. Sports, action movies, and fast-motion content appear with pristine clarity and smoothness.

Wide viewing angles, another OLED strength, become particularly valuable in premium installations where viewing occurs from diverse positions rather than directly in front of the display.

Burn-In Concerns and Mitigation Strategies

The elephant in the wallpaper OLED room is the burn-in risk. OLED pixels degrade with use—bright colors used extensively in a particular screen location eventually lose brightness compared to surrounding pixels. This creates permanent image ghosting.

Manufacturers have invested substantially in burn-in mitigation. Modern OLED displays use pixel-shifting algorithms that subtly move static images around the screen, distributing pixel wear evenly. They employ brightness limiting algorithms that cap the brightness of static content. Some models include screen rotation features—physically or digitally rotating content periodically to distribute wear patterns.

Real-world burn-in risk depends heavily on usage patterns. Displaying news tickers, static logos, or static UI elements for 8+ hours daily creates significant risk. Watching varied content with different images and colors throughout the day creates minimal risk. Consumer reports and long-term testing suggest that with normal television viewing patterns, modern OLEDs should remain burn-in free for 7-10 years of ownership.

Premium wallpaper OLED owners, typically viewing their displays as long-term investments, tend to adopt viewing habits that minimize burn-in risk. The technology suits their premium positioning: users who care enough to pay $4,000-6,000 for a wallpaper OLED typically employ more careful viewing habits than budget-conscious consumers.

Market Positioning and Target Demographics

Wallpaper OLEDs target a distinct demographic: wealthy consumers for whom the $4,000-7,000 price premium makes sense when combined with furniture-quality design and superior performance. This segment purchases high-end audio equipment, luxury furniture, and art. For them, a television isn't merely an appliance—it's a statement piece requiring aesthetic integration into their living space.

Interior designers increasingly specify wallpaper OLEDs for premium residential projects. The displays' paper-thin profiles enable design possibilities impossible with traditional televisions. In luxury hotels, premium residential installations, and high-end retail environments, wallpaper OLEDs have begun appearing as architectural elements rather than furnishings.

This positioning differs fundamentally from budget OLED televisions, which target mainstream consumers seeking the best performance-to-price ratio. Wallpaper OLEDs abandon price competitiveness entirely, instead emphasizing design, engineering, and premium positioning.

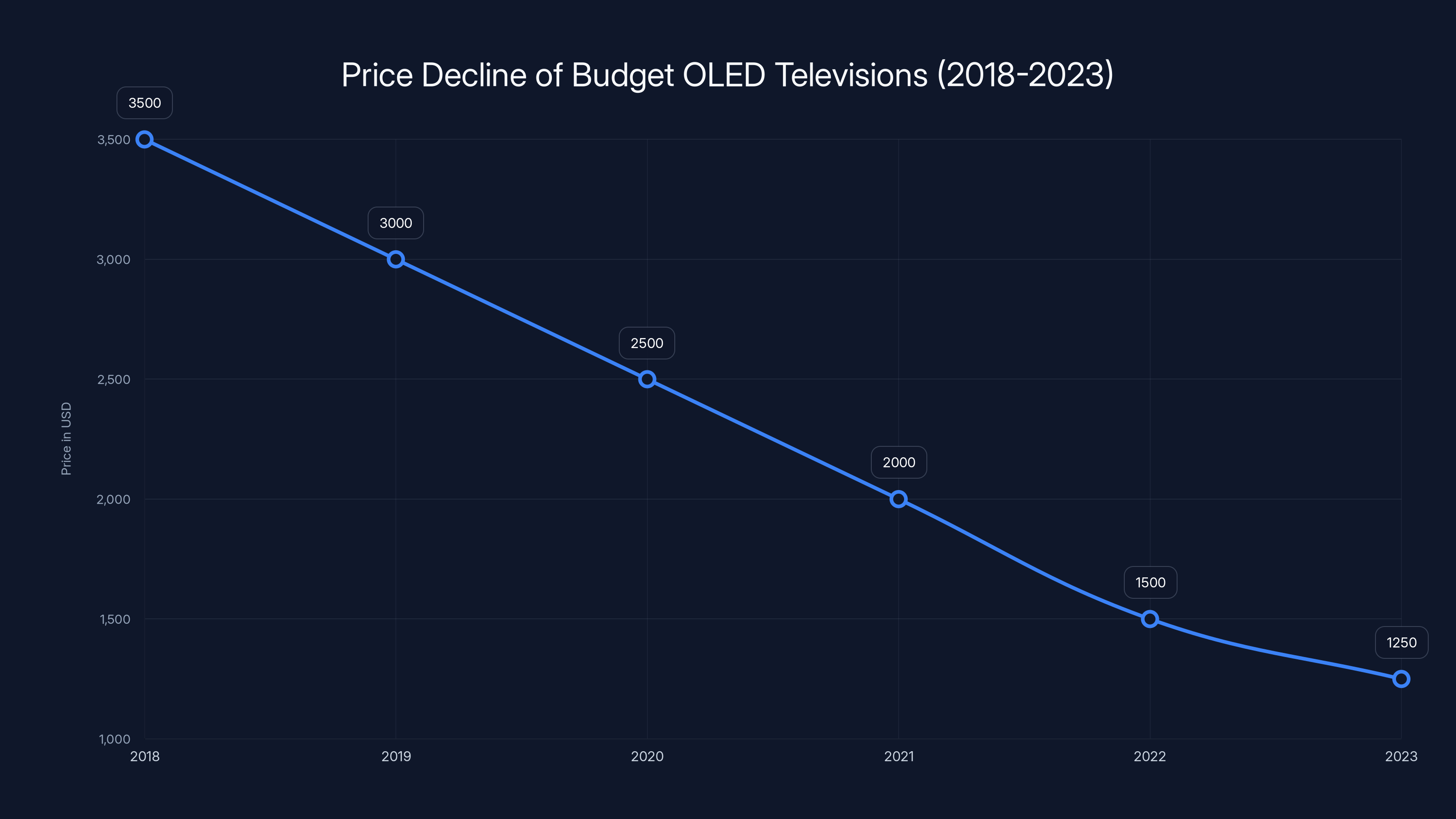

Estimated data shows a significant decline in OLED TV prices from

The Declining Role of Budget OLED Television Models

Why Manufacturers Are Exiting the Budget OLED Segment

The erosion of budget OLED television availability stems from a fundamental mismatch between manufacturing reality and consumer pricing expectations. For the past 3-4 years, manufacturers pushed aggressively to lower OLED television prices, believing that volume sales would compensate for lower per-unit margins.

The strategy partially succeeded. OLED television prices fell from

Corporate earnings reports from LG Display and Samsung Display—the primary OLED panel manufacturers—revealed the profitability strain. LG Display's television panel division posted consecutive years of losses or minimal profits despite record OLED panel shipments. The manufacturing economics simply didn't work at aggressive price points.

Meanwhile, RGB mini-LED technology matured. Early implementations were expensive and complex. By 2023-2024, manufacturers had refined processes, sourced LEDs from multiple suppliers at competitive prices, and developed algorithms optimizing visual performance. The cost structure for mini-LED displays became more favorable than OLED at the budget-to-mainstream price points.

CES 2025 represented manufacturers' collective pivot. Rather than continuing to bleed margins on budget OLEDs, they announced strategic focus on two segments: RGB mini-LED (competing on value and performance) and ultra-premium wallpaper OLED (competing on design and positioning). The mid-range budget OLED niche would be abandoned.

The Inventory Transition Period

Budget OLED televisions haven't disappeared overnight. Remaining inventory will continue selling through retail channels and online marketplaces for months or potentially years. Early 2025 presents a unique opportunity—consumers can still purchase true budget OLED displays while supply lasts, before inventory completely transitions to mini-LED alternatives.

Retailers still maintaining OLED inventory often discount aggressively to clear stock. A 65-inch OLED television that retailed for

Refurbished and open-box inventory provides additional opportunities. As new mini-LED models fill retail shelves, budget OLED stock moves to secondary channels. These channels often offer 15-25% discounts from retail prices, making premium OLED technology accessible at genuine bargain prices.

Secondary markets, including online marketplaces and wholesale operations, will likely maintain some budget OLED inventory longer than traditional retail. Consumers patient enough to source from these channels may find deals continuing into late 2025 or early 2026.

What This Means for Current OLED Owners

Existing budget OLED television owners should feel reassured about their purchases. These displays deliver exceptional performance and should remain functional and visually satisfying for 7-10 years of normal use. The transition to RGB mini-LED and wallpaper OLED doesn't diminish the performance of existing budget OLED sets.

Resale value for budget OLED televisions will likely stabilize as the transition completes. Currently, used OLED TVs command strong resale prices relative to other consumer electronics. As new mini-LED options become ubiquitous, the resale premium for OLED may compress—but this represents a gradual transition over 12-24 months rather than an immediate value collapse.

Warranty and support services for budget OLEDs should continue functioning normally. Manufacturers won't abandon existing customers after sale merely because they've discontinued new model production. Repair facilities will maintain technical expertise, and parts availability should remain adequate for several years.

RGB Mini-LED vs. Budget OLED: A Technical Comparison

Contrast Ratio and Black Level Performance

Contrast ratio—the difference between the brightest whites and deepest blacks a display can produce—represents the primary technical differentiation between these technologies. OLED displays achieve theoretically infinite contrast ratios because they can turn off individual pixels entirely, producing absolute blacks while simultaneously displaying bright content.

RGB mini-LED displays, despite advanced local dimming algorithms, cannot achieve true blacks because the backlight system prevents pixels from becoming completely dark. Even in regions where local dimming minimizes LED brightness, residual light remains. This creates contrast ratios typically in the 50,000:1 to 150,000:1 range—exceptional by traditional standards, but mathematically inferior to OLED's infinite ratio.

In practical viewing, this difference manifests clearly in dark cinema content. A black frame in OLED produces absolutely no light—viewers see pure black. The same frame on RGB mini-LED produces very dark gray—the distinction becomes obvious in dark rooms. For movie enthusiasts and cinema purists, this difference justifies OLED's premium, even at budget price points.

However, for typical television viewing—sports, comedy, documentaries, and bright programming—this technical advantage matters less. Most content includes sufficient backlighting that both technologies appear nearly equivalent to casual viewers.

Color Accuracy and Gamut Coverage

Modern RGB mini-LED implementations achieve color accuracy metrics competitive with budget OLED displays. Both technologies can reach 98-99% coverage of the DCI-P3 color gamut, representing professional-grade color accuracy.

The key difference lies in consistency. OLED displays, lacking a variable backlight, maintain identical color accuracy across the entire screen and across various brightness levels. Pixel output correlates directly to the input signal with minimal variance.

RGB mini-LED displays introduce backlight variability. As local dimming zones adjust brightness independently, subtle color shifts occur across the display. Advanced algorithmic compensation minimizes these shifts, but perfect consistency remains challenging. A color-critical viewer examining both displays side-by-side might detect these subtle variations on RGB mini-LED.

For content creators and professionals requiring guaranteed color accuracy, OLED's consistency provides measurable advantage. For consumer viewing, the difference typically remains imperceptible.

Brightness Capabilities

RGB mini-LED displays achieve notably higher peak brightness than OLED alternatives at equivalent price points. Budget OLED televisions typically peak around 500-600 nits of brightness in HDR mode. Advanced RGB mini-LED implementations reach 1,500-2,500 nits in bright regions.

This brightness advantage matters substantially for bright environments. In a room with significant window glare or bright ambient lighting, the higher brightness of RGB mini-LED helps maintain image visibility. OLED displays, while visually capable in dark rooms, can appear washed out in very bright conditions.

HDR (High Dynamic Range) content particularly benefits from mini-LED's brightness capability. HDR content includes peaks of 1,000+ nits representing very bright content. RGB mini-LED can reproduce these peaks more closely to the content creator's intent, while budget OLED must compress these peaks, slightly reducing perceived brightness impact.

For dark room viewing and cinema content, OLED's lower peak brightness poses no disadvantage. For daytime viewing and bright environments, mini-LED's brightness advantage becomes practically significant.

Motion Handling and Response Times

Both technologies handle motion effectively, though through different mechanisms. OLED pixels respond to input changes in microseconds—among the fastest response times possible. This instantaneous response eliminates motion blur entirely. Fast-moving content appears pristine and clear.

RGB mini-LED, using LCD panels, has slower pixel response times—typically 1-5 milliseconds. However, modern implementations add backlighting acceleration. As the backlight dims rapidly in certain regions, it reduces the visual persistence, creating an impression of faster motion rendering than the pixel response time alone would suggest.

In side-by-side comparison, OLED demonstrates slightly crisper motion. Sports broadcasts and action content appear marginally sharper on OLED. However, most viewers find both technologies satisfactory for motion reproduction. The difference, while measurable, rarely affects viewing satisfaction in real-world scenarios.

Longevity and Degradation Concerns

OLED displays suffer from pixel degradation over extended use. Organic materials gradually lose efficiency, causing brightness to decline and potential color shifts over years of use. A five-year-old OLED display might show 10-20% brightness reduction compared to its initial state.

RGB mini-LED displays experience LED degradation as well, but the distributed nature of 10,000+ LEDs means individual LED degradation distributes its impact across the entire display. A 10% decline in overall brightness remains largely imperceptible because all regions degrade proportionally.

From a longevity perspective, RGB mini-LED displays should maintain more consistent appearance over 10+ years compared to budget OLED televisions. However, both technologies remain perfectly functional after 7-8 years, which represents the typical ownership period before consumers upgrade.

Warranty differences reflect these concerns. Premium OLED displays come with stronger warranties addressing brightness retention. RGB mini-LED displays typically include standard warranties, reflecting confidence in their stability.

Estimated data showing the distribution of innovative solutions in Wallpaper OLED manufacturing. Phase-change materials and external modules are among the most adopted solutions.

The Premium Wallpaper OLED Market: Ultra-Premium Positioning

Manufacturing Challenges and Solutions

Creating a 2.5mm-thick OLED display required engineering solutions previously considered impossible. Thermal management presented the primary challenge. OLED pixels generate heat during operation. Traditional cooling systems rely on heatsinks—metal structures that absorb and dissipate heat. A 2.5mm-thick display permits no space for traditional heatsinks.

Manufacturers developed innovative solutions. Some implement phase-change materials within the display chassis—materials that absorb heat through phase transitions, distributing thermal load across larger surface areas. Others use graphene layers or advanced composite materials providing excellent thermal conductivity at minimal thickness.

Component miniaturization proved equally critical. Traditional televisions house processors, power supplies, and signal processing circuitry within the television chassis. Wallpaper OLEDs relocate these components to external modules—separate boxes connected via cables that attach to the wall mounting system or sit nearby on furniture.

This modular approach solved multiple problems simultaneously. It enables thin displays while maintaining upgradeability—the external processing module can be updated independently of the display. It improves thermal management by moving heat-generating components away from the thin display shell. It even enables future technology updates without requiring display replacement.

Adhesive technology also advanced significantly. Early wallpaper OLEDs required mounting to prepared wall surfaces. Modern implementations use proprietary adhesive systems allowing installation on most wall types without permanent damage. Some implementations use magnetic mounting, enabling display repositioning without wall damage.

The Aesthetic and Interior Design Impact

Wallpaper OLEDs transcend the category of television to become genuine furniture and interior design elements. When mounted properly against a wall, they appear as flat artworks—canvas-mounted photographs or abstract art rather than entertainment technology.

This positioning opens design possibilities impossible with traditional televisions. Interior designers can integrate wallpaper OLEDs into custom wall treatments, incorporating them into accent walls with architectural details. Some high-end installations position wallpaper OLEDs in dedicated alcoves with custom lighting, creating focal points that appear architectural rather than electronic.

The ultimate expression of this positioning came from LG's recent prototype: an OLED display with a smart surface that displays artwork, weather information, or news when inactive, and transitions to full television functionality when activated. The display appears as a decorative wall element most of the time, activating for entertainment as needed.

This design philosophy appeals to a specific consumer mentality—individuals for whom technology should integrate elegantly into living spaces rather than dominate them. This positioning fundamentally differs from traditional televisions, which accept their role as focal points and compete on performance rather than design integration.

Pricing and Target Market Positioning

Wallpaper OLED televisions carry price tags in the $4,000-7,000 range for 55-65 inch models. This positioning places them firmly in luxury territory—comparable in price to high-end furniture, art pieces, or luxury audio equipment rather than conventional televisions.

The target demographic includes high-net-worth individuals, luxury homeowners, interior designers specifying premium installations, and luxury hospitality venues. For someone spending

This premium positioning enables higher per-unit margins for manufacturers compared to volume-focused commodity television segments. A single wallpaper OLED sale provides comparable profit to selling dozens of budget televisions. Manufacturers willingly sacrifice volume to achieve profitability through premium positioning.

Market research suggests this segment should grow 15-25% annually through 2027 as more affluent consumers discover the technology and design possibilities expand. While absolute volumes remain small (perhaps 500,000-1,000,000 units annually globally), profit contributions prove substantial.

Integration with Smart Home Ecosystems

Wallpaper OLEDs increasingly integrate sophisticated smart home functionality. Beyond serving as televisions, they function as control panels for entire home automation systems. Advanced implementations include gesture recognition, voice control, and contextual display adjustments based on time of day and ambient lighting.

Some implementations enable the display to show relevant information based on room occupancy and usage patterns. In the morning, the display might show news and weather. During the evening, it transitions to entertainment. When inactive, it displays curated artwork or photography. This fluid functionality transforms the wallpaper OLED from occasional entertainment device to always-relevant home interface.

Integration with high-end audio systems, smart lighting, climate control, and security systems creates unified home experiences. Users control every aspect of their environment through voice commands or mobile interfaces, with the wallpaper OLED serving as the visual centerpiece of the entire system.

This smart home integration adds perceived value and justifies premium pricing for tech-forward consumers who view their homes as integrated technological ecosystems rather than collections of individual devices.

The RGB Mini-LED vs. Wallpaper OLED Positioning Strategy

Market Segmentation and Target Audiences

Manufacturers' strategy clearly segments the market into distinct buyer personas. RGB mini-LED targets mainstream consumers seeking best value and performance at accessible prices—the $1,200-2,500 segment historically served by budget OLED models. Wallpaper OLED targets affluent, design-conscious consumers willing to pay premium prices for aesthetic integration and maximum performance.

This bifurcation abandons the middle ground. The consumer seeking to maximize performance-to-price ratio—historically the budget OLED buyer—now faces choosing between RGB mini-LED (better value, acceptable performance) or saving more and leaping to wallpaper OLED (exceptional performance, excellent design, premium price). Few options bridge this gap.

The strategic rationale makes sense from a manufacturer perspective. The budget OLED segment offered poor profitability despite significant volume. By exiting this segment, manufacturers free manufacturing capacity and financial resources for segments offering better returns. RGB mini-LED provides volume and decent margins. Wallpaper OLED provides premium margins despite lower volume. Between them, profitability improves substantially compared to spreading efforts across unprofitable budget OLED production.

However, from a consumer perspective, this strategy potentially creates disadvantage. The previous availability of $1,200-1,500 OLED televisions offered exceptional value and true performance premium over non-OLED alternatives. As these products disappear, consumers in this price range face choosing between upgraded mini-LED (better performance than before but not OLED-level) or significantly increasing budget to access wallpaper OLED. This middle ground narrowing potentially disadvantages mainstream consumers.

Competitive Dynamics Between Technologies

RGB mini-LED and wallpaper OLED compete in marketing narrative as much as technical specifications. Each technology claims benefits and emphasizes competitor weaknesses.

Mini-LED manufacturers emphasize brightness, color accuracy, and reliability. They highlight wallpaper OLED's burn-in risk, viewing angle requirements, and significantly higher cost. Marketing messages position mini-LED as the sensible choice for mainstream consumers—exceptional performance at reasonable prices.

Wallpaper OLED manufacturers emphasize design, performance peaks, and premium positioning. They highlight mini-LED's contrast ratio limitations, local dimming artifacts, and inability to match OLED's visual perfection. Marketing positions wallpaper OLED as the ultimate choice for consumers who refuse to compromise—justifying premium pricing through uncompromising performance.

Both narratives contain truth. RGB mini-LED does offer superior brightness and value. Wallpaper OLED does offer superior contrast and design. The competition plays out in consumer perception, with budget-conscious buyers favoring mini-LED and premium buyers favoring wallpaper OLED—exactly as manufacturers intended.

Impact on Television Buying Decisions

This strategic shift will substantially impact consumer television purchases throughout 2025-2026. Shoppers previously comfortable purchasing $1,200-1,500 OLED televisions now face difficult choices.

Those prioritizing performance may upgrade to wallpaper OLED, accepting the $2,500+ premium for uncompromising quality. Those prioritizing value may accept RGB mini-LED at similar prices to previous OLED options, gaining acceptable performance and better reliability. A third group may delay purchases, hoping residual budget OLED inventory provides opportunities for deals in coming months.

Retail dynamics will evolve accordingly. Retailers previously devoted significant floor space and marketing to budget OLED options now shift emphasis to mini-LED and wallpaper OLED. This shift affects consumer experience—fewer options to compare at the budget price point, more choices at premium and value segments.

Marketing messaging will emphasize value performance of mini-LED and lifestyle positioning of wallpaper OLED, with minimal discussion of budget OLED alternatives that no longer exist. This gradual market transition will be imperceptible to casual shoppers but represents significant strategic repositioning.

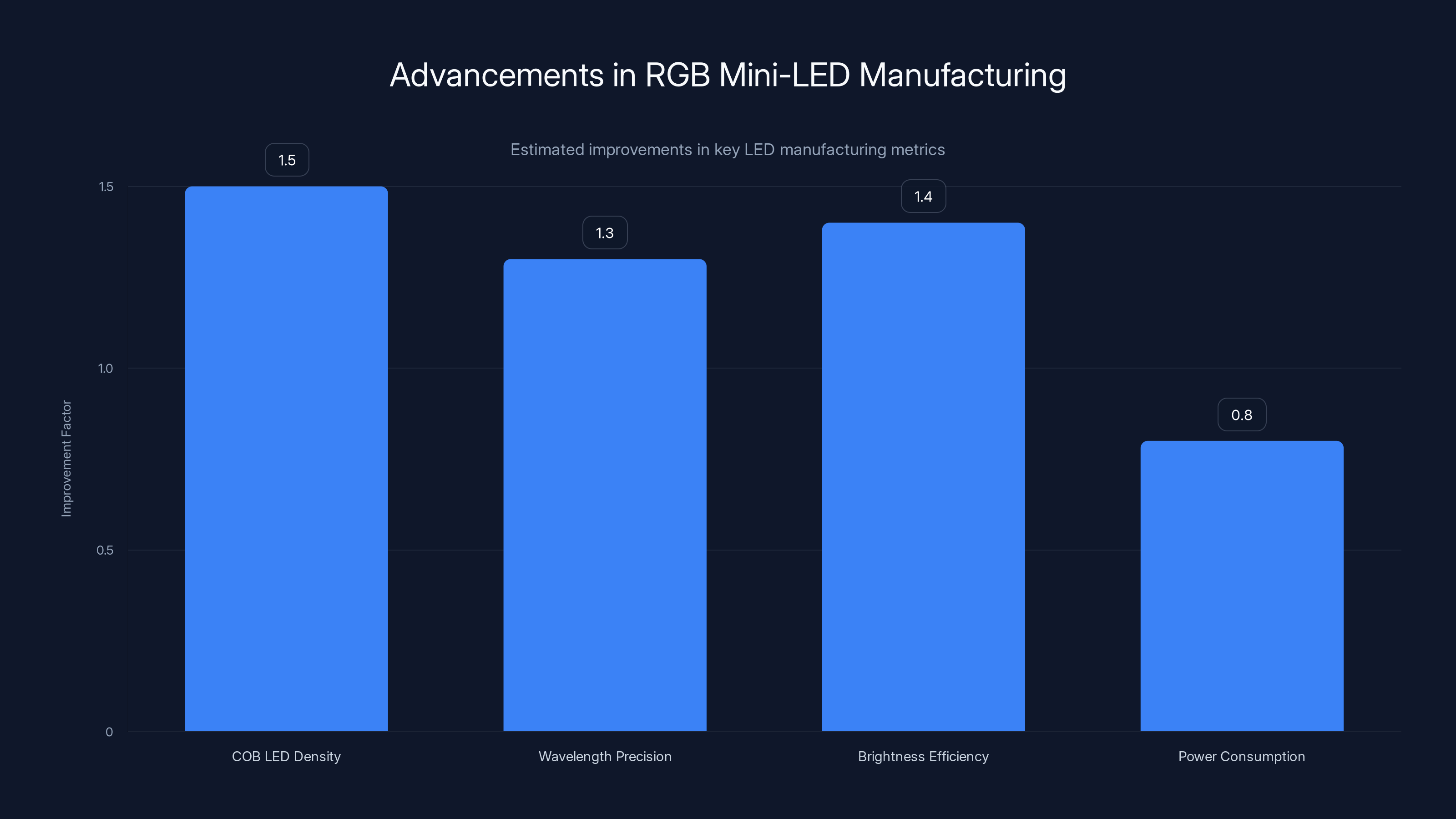

Estimated data shows significant improvements in LED density, wavelength precision, and brightness efficiency, with a reduction in power consumption due to recent manufacturing advances.

Technical Advances in RGB Mini-LED Manufacturing

LED Component Innovations

Recent advances in LED manufacturing have accelerated the move toward RGB mini-LED adoption. Chip-on-board (COB) LED technology, previously expensive and difficult to manufacture at scale, has become economically viable through manufacturing innovation and expanded production capacity.

COB technology bonds individual LED chips directly to circuit boards without requiring individual component casings. This approach reduces material costs, improves heat transfer, and enables denser LED arrays. A single COB unit might incorporate 500+ LED chips in a package smaller than traditional discrete LED components.

Red-green-blue wavelength optimization has also advanced. Early RGB mini-LED implementations required compromise between wavelength precision and manufacturing efficiency. Modern LED fabs produce LEDs with precisely optimized wavelengths for television applications—exact peak wavelengths matched to standard display color spaces. This optimization improves color accuracy and efficiency simultaneously.

Brightness per LED has increased substantially. Modern high-efficiency LEDs produce more photons per electrical watt than previous generation components. This improvement reduces power consumption while enabling higher peak brightness, improving the energy efficiency of RGB mini-LED displays compared to earlier implementations.

Algorithmic and Software Optimization

Beyond hardware improvements, software algorithms controlling LED behavior have advanced dramatically. Machine learning models now optimize local dimming in real-time, analyzing incoming video content and predictively adjusting LED brightness thousands of times per second.

These algorithms identify content patterns and optimize LED control to enhance perceived contrast while minimizing artifacts like blooming or halo effects around bright objects. Advanced implementations use predictive algorithms that anticipate scene changes and pre-adjust LED brightness, reducing temporal artifacts.

Dithering algorithms distribute brightness across multiple frames temporally rather than displaying all brightness adjustments in a single frame. This temporal distribution reduces perceptible banding artifacts and creates smoother gradations in brightness and color.

Calibration algorithms automatically adjust for manufacturing variations in individual LED components. Since manufacturing 50,000 LEDs with perfect uniformity proves impossible, software compensates for component variations, equalizing brightness and color across the display.

These algorithmic advances represent intellectual property advantages—different manufacturers implement different optimization strategies, creating performance differentiation even with similar hardware specifications. Samsung's approach differs from TCL's, which differs from LG's, creating genuine performance differences despite using similar LED components.

Manufacturing Scale and Cost Reduction

As RGB mini-LED adoption accelerates, manufacturers achieve manufacturing scale previously reserved for standard LED components. LED suppliers globally increased RGB mini-LED production capacity 200%+ from 2023 to 2025.

This scaling reduced per-unit LED costs significantly. RGB mini-LEDs that cost

Second-source suppliers entering the RGB mini-LED market further increased competition and accelerated cost reduction. Where previously only a handful of LED manufacturers offered television-grade RGB LEDs, now dozens of suppliers globally produce compatible components, preventing any single supplier from maintaining premium pricing power.

Wallpaper OLED Manufacturing Challenges and Breakthroughs

Thermal Management Innovations

Creating a television display measuring 2.5mm thick while maintaining acceptable operating temperatures required fundamental innovation in thermal management. Traditional televisions accept temperatures reaching 50-60°C in operational areas—higher than ideal but within acceptable parameters. Wallpaper OLEDs required reducing thermal load and temperatures to enable miniaturization.

Innovative heat spreading layers distribute thermal energy across larger surface areas. Graphene composite materials, with exceptional thermal conductivity, transport heat from the OLED panel to the television chassis. Aluminum alloys, optimized for thermal conductivity, form the chassis structure. Together, these materials dissipate heat efficiently without requiring traditional heatsinks.

Some implementations use passive radiative cooling—special surface coatings that emit infrared radiation more efficiently than standard materials. This technique, borrowed from satellite technology, enables objects to cool below ambient temperature through radiative heat dissipation. Applied to wallpaper OLEDs, it reduces reliance on traditional cooling components.

Active cooling through controlled airflow in the mounting cavity provides supplemental cooling in some implementations. Rather than fans inside the display, air circulation in the mounting area improves thermal exchange with ambient air. This approach remains invisible to users while significantly improving thermal performance.

Component Miniaturization and Modular Design

Wallpaper OLEDs externalize virtually all components except the display panel itself. Processors, power supplies, signal processing electronics, and amplification circuits reside in external modules—separate boxes connected via thin cables. This modular approach enables thin displays while maintaining all functionality.

Some implementations house external modules within the wall-mounting system itself—essentially creating a complete television system that mounts flush to walls, with all electronics contained within the mounting structure. This arrangement provides complete wall integration while maintaining accessibility for servicing and upgrades.

Others place external modules in separate enclosures positioned nearby—on shelves or built into furniture. These implementations provide complete separation between the display and electronics, treating the display as a true wall-mounted artwork with separate electronics.

This modularity enables future upgrades without display replacement. A display remaining perfect after five years can connect to upgraded external processing modules, extending useful life and improving sustainability. This upgrade path justifies premium wallpaper OLED pricing as long-term investments rather than short-term consumer products.

Manufacturing Complexity and Yield Challenges

Wallpaper OLED manufacturing is extraordinarily complex. The thin form factor permits zero tolerance for component failures or manufacturing defects. Quality control standards far exceed normal television manufacturing requirements.

OLED panel production itself remains challenging—wallpaper OLEDs use cutting-edge OLED technology with cutting-edge yields. Small production volumes compared to mainstream OLED or mini-LED manufacturing mean limited economies of scale. Component cost and manufacturing cost remain substantially higher than volume products.

Assembly complexity also increases manufacturing cost. The integration of thin-profile components, adhesive mounting systems, and modular connections requires precision assembly and testing. Yields of fully functional units hover around 80-85%, with 15-20% of produced units requiring rework or becoming scrap.

These manufacturing challenges directly translate to premium pricing. A $5,000 wallpaper OLED doesn't price at that level merely because consumers will pay it—it reflects genuine manufacturing complexity and cost. Profitability margins, while higher per unit than budget televisions, remain reasonable when accounting for manufacturer overhead and retail margins.

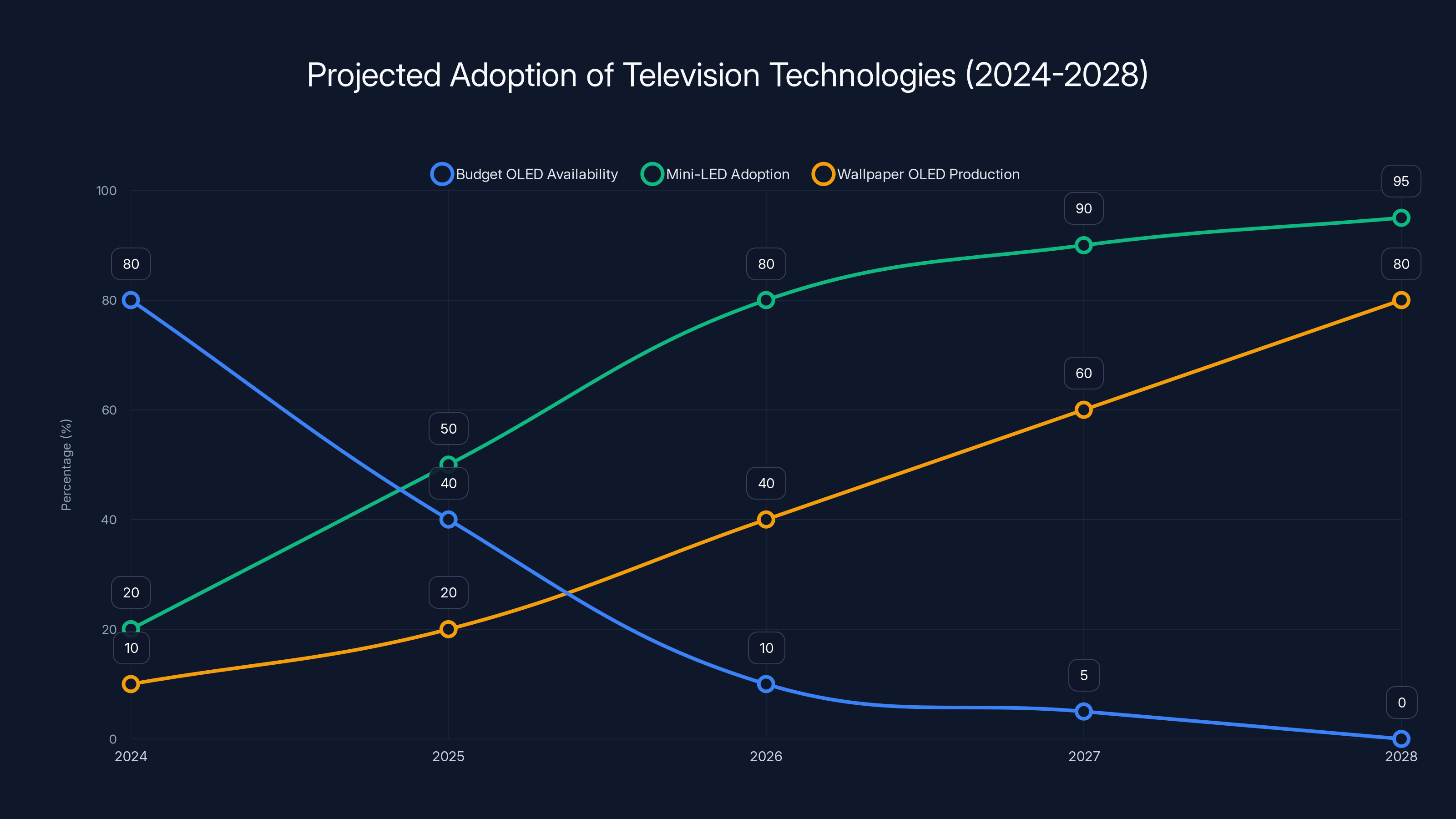

The transition from budget OLED to mini-LED and wallpaper OLED is expected to accelerate, with mini-LED becoming dominant by 2026. Estimated data.

The Future Trajectory: What Happens Next

Market Transition Timeline

The transition from budget OLED to mini-LED and wallpaper OLED will unfold gradually over 18-24 months. Current projections suggest that by end of 2025, budget OLED television availability will be limited to clearance inventory and secondary market sources. By 2026, budget OLED televisions will be essentially unavailable in primary retail channels.

RGB mini-LED adoption will accelerate through 2025-2026, becoming the dominant technology in the $1,200-2,500 segment by mid-2026. Refinements in mini-LED implementation will continue, with manufacturers claiming 10-15% annual performance improvements through algorithmic and hardware optimization.

Wallpaper OLED will remain exclusive and premium through this period, with production volumes potentially doubling but remaining a niche product. As manufacturing matures and yields improve, prices may gradually decline from current

The transition won't be uniform globally. Regions with strong mini-LED supply chains—primarily Asia—will complete the transition faster. Markets with strong OLED purchasing patterns may see extended availability of existing models into 2026.

Impact on Television Technology Road Maps

This strategic shift dramatically alters television technology development priorities. Research and development budgets previously split among OLED, mini-LED, and other technologies increasingly focus on mini-LED refinement and wallpaper OLED optimization.

Fundamental OLED research won't cease—wallpaper OLED development requires cutting-edge OLED innovation. However, development of budget OLED specifically will decline. The cost reduction pathway that made affordable OLED production possible will receive diminished investment as manufacturers redirect resources toward mini-LED and premium OLED.

This shift has implications for alternative technologies. Micro LED, often positioned as the "next generation" of display technology, sees reduced urgency in television applications as manufacturers achieve competitive performance through mini-LED and OLED. Micro LED may find its primary adoption in specialty applications (premium boutique displays, commercial signage) rather than mainstream consumer televisions.

Quantum dot technology (QD) continues advancing but increasingly becomes integrated into mini-LED implementations rather than standalone technology. QD-LCD and QD-mini-LED hybrids represent the natural evolution of quantum dot television technology through this transition period.

Potential Consumer Backlash and Alternatives

The disappearance of affordable OLED options will likely generate consumer dissatisfaction. Online communities and consumer electronics forums will prominently feature discussions about the "death" of budget OLED and the shrinking middle-ground options.

This sentiment might drive demand for alternative products. Consumer preference for previous-generation televisions (higher-end 2023-2024 models) may lead to extended secondary market activity. Used OLED televisions may command stronger pricing than historical norms as consumers seek true OLED performance without premium wallpaper pricing.

Internet-connected retailers and secondary market sellers will benefit from consumer frustration with primary retail offerings. Consumers unable to find preferred options through traditional channels increasingly purchase refurbished, open-box, or warehouse clearance items through online channels.

Some consumer advocacy groups may criticize the transition as manufacturers limiting consumer choice and forcing consumers toward either less-optimal mini-LED or expensive wallpaper OLED options. This criticism, though justified from a consumer choice perspective, won't fundamentally alter manufacturer strategy—profitability concerns override consumer preference for broader choice.

Alternative Display Technologies Gaining Attention

As traditional OLED and mini-LED dominate market discussion, alternative technologies increasingly attract attention and investment. Micro LED, previously considered too immature and expensive, attracts renewed interest from manufacturers seeking genuine long-term differentiation.

Micro LED uses thousands of microscopic LEDs to directly emit light for each pixel—similar to OLED's pixel-level control but using LEDs instead of organic materials. This approach combines OLED's contrast performance with LED reliability. Manufacturing Micro LED at television scale remains extraordinarily challenging and expensive, but technical progress accelerates.

China-based manufacturers, particularly BOE and China Star Optoelectronics Technology, increase Micro LED research investment and commercialization timelines. Some projections suggest Micro LED televisions becoming viable products by 2026-2027 in premium segments.

Other emerging technologies receive research attention, though remain years from commercialization: Micro-OLED (smaller OLED displays scaled using advanced manufacturing), Quantum dot LED (combining quantum dots with LED principles), and Electrophoretic displays (similar to e-ink but for television-scale applications). None represent imminent threats to mini-LED or OLED dominance, but represent the technological frontiers manufacturers explore.

Practical Considerations for Television Shoppers

When to Buy in This Transition Period

For consumers actively shopping for televisions in early 2025, the transition presents both opportunities and challenges. Those with strong OLED preferences face narrowing options and should evaluate purchasing decisions carefully.

Consumers with extended budgets should strongly consider wallpaper OLED if aesthetic integration and premium performance matter. These products won't become more affordable or available in the near term, and early adoption provides years of use before technology advances warrant upgrade.

Those with moderate budgets should evaluate mini-LED options carefully. Modern RGB mini-LED televisions deliver exceptional performance and reliability. For consumers accepting that perfect blacks from OLED may not be essential, mini-LED represents excellent value. Comparison shopping between current mini-LED models and previous-generation OLED clearance inventory becomes essential.

Consumers with tight budgets might delay purchases 6-12 months, hoping that residual OLED inventory will provide deals unavailable currently, or that mini-LED prices will decline further as competition intensifies. Delayed purchases carry risk if current television equipment fails unexpectedly.

Evaluation Framework for Current Shoppers

Comparing mini-LED and OLED options requires understanding what features matter for your specific use case. Home theater enthusiasts valuing perfect blacks and cinema accuracy should prioritize OLED options, accepting premium pricing if necessary. Gamers prioritizing motion response time and low input lag benefit marginally from OLED but find mini-LED highly acceptable.

Sports enthusiasts in bright rooms benefit substantially from mini-LED's brightness advantage. Daytime television viewing and well-lit rooms present scenarios where mini-LED's high peak brightness provides practical advantages over OLED's more limited brightness.

Content creators and color-critical professionals should strongly prefer OLED's superior color consistency, accepting cost premium as professional tool investment. For general entertainment consumption, both technologies provide excellent color accuracy.

Room lighting conditions significantly impact technology choice. In dark rooms or dark-room viewing environments, OLED's perfect blacks and contrast ratio advantage becomes most apparent. In bright rooms or mixed lighting conditions, mini-LED's brightness advantage grows in importance.

Hedging Strategies and Future-Proofing

The rapid technology transition makes future-proofing difficult. Buying a television today on expectation of use for 8-10 years requires accepting that your technology choice represents a particular point in television evolution.

Maintaining connections to current and emerging media formats helps hedge against format obsolescence. Support for streaming standards (HDMI 2.1 for newer gaming and streaming devices) and future-proof processing (powerful processors capable of supporting emerging content standards) improve long-term usefulness.

Warranty coverage beyond standard 1-2 years provides some insurance against unexpected failures. Extended warranties, while controversial for many electronics, provide peace of mind for expensive purchases in rapidly evolving markets.

Considering manufacturer reputation and service support helps ensure that issues emerging after purchase find adequate remediation. Manufacturers with strong service networks and parts availability minimize risk of orphaning expensive televisions if manufacturing or service relationships change.

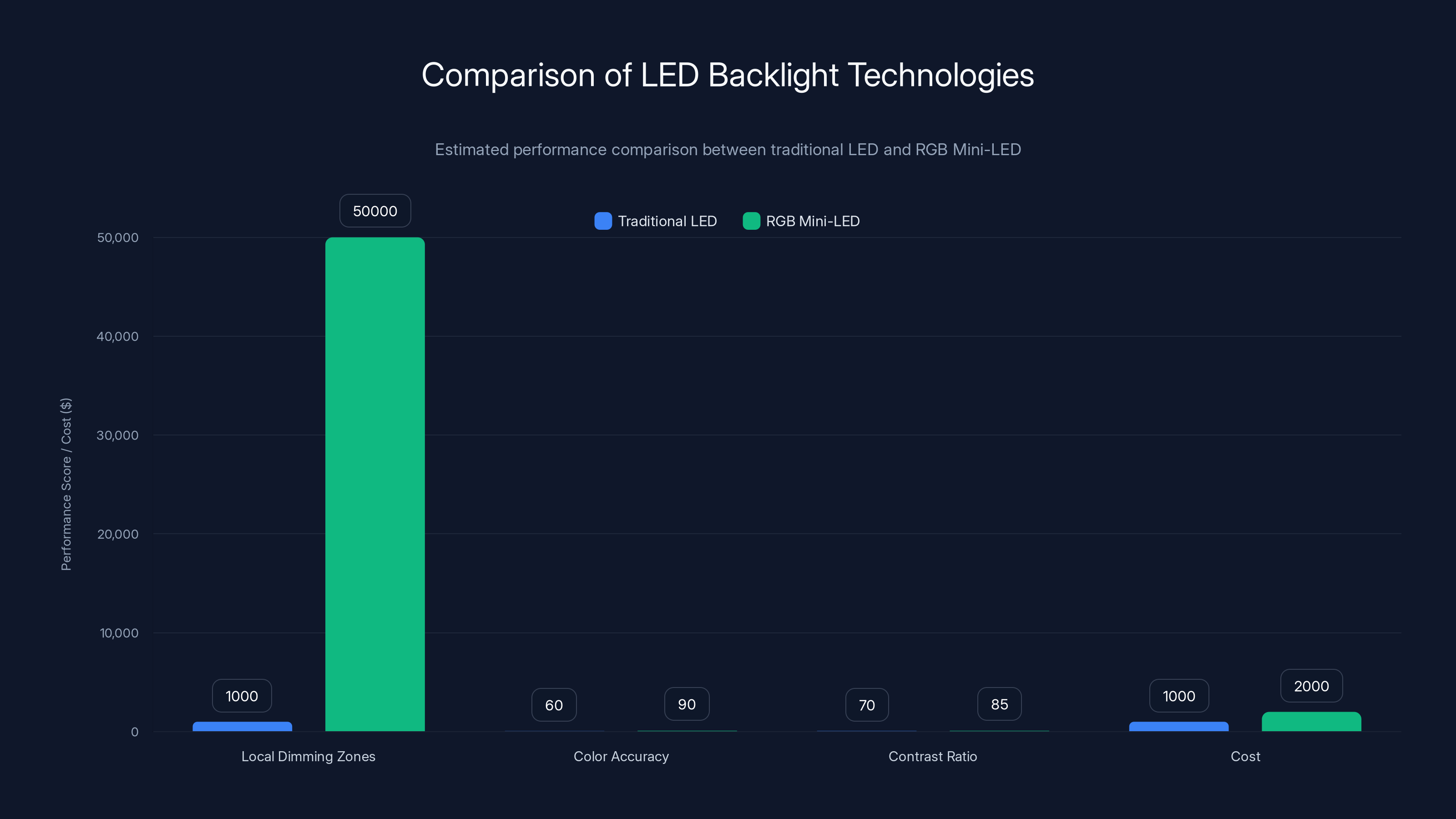

RGB Mini-LED technology offers significant improvements in local dimming zones and color accuracy over traditional LEDs, albeit at a higher cost. Estimated data.

Common Misconceptions About the Technology Transition

Myth 1: RGB Mini-LED Will Fully Replace OLED

While RGB mini-LED will dominate mainstream television markets, OLED absolutely won't disappear. Wallpaper OLED represents premium segment evolution, and premium OLED implementations (65-inch and larger displays) will continue serving professional and enthusiast markets.

OLED technology undoubtedly continues advancing. Research into cost reduction, manufacturing automation, and yield improvement continues, even if budget OLED television production ends. Premium OLED will persist as a distinct market segment.

Moreover, OLED finds increasing application in other display categories: computer monitors, portable displays, and specialized applications where OLED's superior performance justifies premium costs. The "end of budget OLED televisions" doesn't constitute the "end of OLED" broadly.

Myth 2: Budget OLED Televisions Becoming Instantly Obsolete

Current budget OLED televisions will remain perfectly functional and visually satisfying for their owners regardless of technology transitions. The announcement of superior technologies doesn't diminish the performance of existing displays.

Those who purchased budget OLED televisions when prices started declining should feel satisfied with their purchases. These televisions will provide excellent performance throughout their useful lives, unaffected by new technology announcements.

Comparable performance from replacement technologies coming at higher price points (wallpaper OLED) or with different tradeoffs (mini-LED) doesn't retroactively diminish existing OLED television quality.

Myth 3: RGB Mini-LED Completely Matches OLED Performance

While RGB mini-LED achieves remarkable performance improvements compared to standard LED-LCD, claiming perfect equivalence with OLED understates the remaining technical differences. Perfect blacks, infinite contrast ratios, and pixel-perfect color consistency remain exclusive to OLED.

For consumers for whom these qualities matter significantly, accepting mini-LED as equivalent involves genuine compromise. This isn't to say the compromise proves unacceptable—for many consumers, mini-LED's advantages in brightness, reliability, and cost outweigh OLED's contrast advantages. But claiming technical equivalence misleads.

However, for many viewing scenarios and content types, the differences become imperceptible to consumers without display measurement equipment. Most viewers won't detect technical differences in practical viewing situations—which is entirely different from claiming the technologies are technically equivalent.

Myth 4: Wallpaper OLED Will Quickly Drop to Mainstream Prices

Wallpaper OLED will almost certainly become less expensive over time as manufacturing matures and volumes increase. However, expecting wallpaper OLED to drop to $1,500 in 2-3 years represents unrealistic optimism.

The manufacturing complexity of wallpaper OLED creates fundamental cost floors. Even with 5-year volume increases, wallpaper OLED will likely remain in the $2,500-4,000 range—never reaching the budget pricing that made early OLED televisions accessible.

Manufacturers maintain premium positioning on purpose. Once a technology establishes premium market positioning, manufacturers resist aggressive price cuts that would damage brand perception and margins. Wallpaper OLED will evolve toward lower prices within premium segments rather than becoming mainstream consumer electronics.

Expert Perspectives and Industry Analysis

Display Manufacturer Strategies

Display panel manufacturers (LG, Samsung, etc.) recognize the profit opportunity in wallpaper OLED. These ultra-premium products command margins enabling favorable profitability even in limited volumes. Strategic investment in wallpaper OLED production and technology development will intensify.

Conversely, budget OLED investment declines as profitability questions persist. Manufacturers will harvest remaining budget OLED production capacity rather than invest in expanding it. Some may eventually shutter budget OLED production entirely, redirecting manufacturing lines toward mini-LED components or other products.

TV manufacturer strategies emphasize positioning rather than volume. Companies like LG Electronics will promote wallpaper OLED as aspirational products while aggressively competing on RGB mini-LED value, creating a two-tier strategy addressing distinct customer segments.

Industry Analyst Perspectives

Market research firms including IDC, Gartner, and Canalyst recognize the transition as significant strategic repositioning. Analysis suggests RGB mini-LED will capture 35-40% of television market volume within 2 years, while OLED (including wallpaper OLED) will comprise 20-25% of units but 40-45% of revenue due to premium pricing.

Profitability analysis indicates the transition benefits manufacturers substantially. Revenue concentration on higher-margin products improves corporate profitability even as total unit volume declines in premium segments.

Wallpaper OLED adoption timelines face uncertainty. Some analysts project rapid adoption among affluent demographics and professional installations. Others expect more gradual adoption, with wallpaper OLED remaining primarily in ultra-luxury and commercial applications through 2027.

Consumer Preference Signals

Consumer research shows continued strong preference for OLED technology among enthusiasts and premium consumers. Awareness of perfect blacks, infinite contrast, and superior response times drives continued OLED interest.

However, price sensitivity remains substantial. Consumer surveys indicate most television shoppers will accept mini-LED alternatives if pricing provides compelling value relative to OLED. The perceived performance premium of OLED doesn't universally justify 30-50% price premiums in consumer perception.

Design-conscious consumers show strong interest in wallpaper OLED aesthetic. Interior design professionals increasingly specify wallpaper OLED in premium residential and commercial projects, signaling growing professional adoption.

The Broader Context: Television Market Evolution

Commoditization of Standard Television Technology

The transition reflects broader commoditization of standard television technology. Standard LED-LCD televisions, dominant 10 years ago, have become commodity products with minimal differentiation. Price competition on standard LCD became unsustainable, driving manufacturers toward technologies offering genuine differentiation.

RGB mini-LED and wallpaper OLED represent manufacturer responses to commoditization. Rather than compete solely on price in increasingly commoditized LED-LCD segment, manufacturers pursue differentiation through advanced technologies commanding premium pricing.

This evolution mirrors patterns across consumer electronics. Smartphones moved from feature competition to design and ecosystem positioning. Audio equipment moved from raw power to design and positioning. Television evolution follows comparable patterns—technology maturation forcing focus on differentiation and positioning rather than raw feature comparison.

Shifts in Display Technology Investment

Capital investment in display manufacturing increasingly concentrates on advanced technologies rather than volume commodity products. Investments in RGB mini-LED and OLED manufacturing dwarfs investment in standard LCD expansion.

China-based manufacturers investing heavily in advanced display technology create competitive pressure on established players. BOE's aggressive mini-LED and OLED investment forces Samsung and LG to maintain technological pace.

This investment shift suggests the television industry recognizes that commodity display competition is unsustainable. Future television differentiation rests on advanced display technology, smart features, and design rather than pursuing volume in commoditized segments.

Environmental and Sustainability Considerations

The transition carries environmental implications. RGB mini-LED manufacturing, utilizing existing LED production infrastructure, benefits from mature supply chains and established environmental standards. Expanding mini-LED production is straightforward from environmental logistics perspective.

OLED manufacturing and wallpaper OLED manufacturing involve complex chemical processes and specialized materials with environmental considerations. However, OLED production concentrated in limited facilities enables better environmental control compared to distributed manufacturing.

Electronic waste considerations affect both technologies. Mini-LED displays should have longer operational lifespans than previous LCD technology due to LED reliability. Wallpaper OLED's modular design enables component replacement and upgrades, theoretically extending overall system lifespan despite potential OLED panel degradation.

Energy consumption characteristics slightly favor mini-LED in bright-room scenarios (lower brightness consumption), but favor OLED in dark-room viewing (perfect black means zero backlight power in dark regions). Real-world energy consumption depends entirely on viewing conditions and habits.

Making Your Decision: A Comprehensive Buying Guide

Step 1: Assess Your Viewing Conditions

Begin by honestly evaluating your viewing environment. Room lighting conditions significantly impact technology choice. Consumers in dark rooms with carefully controlled lighting benefit most from OLED's superior contrast. Those in bright rooms with windows or ambient lighting benefit from mini-LED's brightness advantage.

Room dimensions and typical viewing distance also matter. Large dark rooms (where you sit far from the screen) benefit more from OLED's pixel-level control. Standard living rooms with mixed lighting become technology-neutral, with either option performing well.

Consider your viewing habits. Do you watch sports and action content where brightness and motion handling matter? Do you watch cinematic content where contrast and color consistency matter? Do you use your television as always-on ambient display? Each scenario suggests different technology preferences.

Step 2: Define Your Performance Requirements

Identify which performance metrics genuinely matter to you. Some consumers obsess over contrast ratios and black levels. Others prioritize brightness and color gamut. Gaming enthusiasts prioritize response time and input lag. Understanding your genuine priorities guides technology selection.

Consider whether you want true OLED performance or whether high-quality mini-LED suffices. This decision involves honest self-assessment about whether technical performance differences matter in your actual viewing situations or whether they matter primarily in theoretical comparisons.

Research specific models thoroughly. Performance varies significantly between manufacturers. A premium RGB mini-LED from leading manufacturers delivers superior performance compared to budget OLED from lesser-known brands. Model-specific reviews matter more than technology choice.

Step 3: Evaluate Budget and Constraints

Determine your budget ceiling before shopping. This simple step prevents emotional spending decisions and guides your shopping process.

Within your budget, identify available options from reputable manufacturers. Compare specific models rather than technology categories. A specific Samsung mini-LED model may outperform a specific LG OLED model from previous generation, making technology type less important than actual model selection.

Consider total cost of ownership including potential warranty extensions, mounting costs, and delivery/installation. These costs, often overlooked, frequently total $300-600 and affect effective budget allocation.

Step 4: Assess Longevity and Future Needs

How long do you plan keeping your television? For 4-5 year ownership, technology choice matters less—both mini-LED and OLED will function perfectly. For 8-10 year ownership, considering degradation patterns and future technology becomes important.

Will you want to upgrade to future technologies? Modular designs (external processing components) improve future upgradeability. Proprietary designs complicate future technology adoption.

Consider manufacturer track record for support. Established manufacturers maintain service for older models longer than newer entrants. Long-term ownership comfort increases with manufacturers offering strong after-sale support.

Step 5: Make Your Purchase Decision

After assessment, your decision should become clear. If dark-room viewing and perfect contrast justify premium spending, consider wallpaper OLED or premium non-budget OLED. If value and reliable performance matter most, RGB mini-LED from quality manufacturers offers excellent choice.

Don't hesitate to view comparison models in-store if possible. While controlled showroom lighting doesn't match your home environment, side-by-side comparisons reveal technical differences. Talk with sales staff about your specific viewing conditions and use cases—knowledgeable staff can guide you toward appropriate technology choices.

Once decided, avoid second-guessing. Television purchase anxiety is common. Recognize that both RGB mini-LED and OLED offer excellent performance and both will provide years of satisfying viewing.

Conclusion: Navigating the Television Technology Transition

CES 2025 signaled a fundamental shift in television technology strategy. The era of budget OLED televisions is ending, replaced by strategic bifurcation into RGB mini-LED value segment and ultra-premium wallpaper OLED segment. This transition reflects broader industry dynamics: commoditization of standard television technology, manufacturing economics favoring advanced technologies, and consumer willingness to pay premium prices for design and performance differentiation.

For manufacturers, this strategy makes excellent sense. Budget OLED television production margins never justified investment. RGB mini-LED offers better margins with sufficient performance to satisfy mainstream consumers. Wallpaper OLED offers exceptional margins serving premium segments. Together, these focus areas improve overall profitability compared to previous approaches.

For consumers, the transition creates both opportunities and challenges. Those with strong OLED preferences will pay premium prices or source remaining budget OLED inventory before it disappears. Those willing to accept excellent mini-LED performance gain access to outstanding value. Those desiring premium everything can aspire to wallpaper OLED.

The middle ground—accessible OLED at reasonable prices—disappears. This represents genuine consumer disadvantage compared to the previous market reality where that category thrived. However, the transition isn't reversible. Manufacturer economics won't permit sustained budget OLED production.

For consumers making television purchases in 2025, understand that this transition period offers unique opportunities. Previous-generation OLED inventory provides genuine deals on proven technology. Established RGB mini-LED models demonstrate mature technology with meaningful performance improvements over older LCD options. Early wallpaper OLED adoptions enjoy cutting-edge technology and design.

Within 12-24 months, the transition will complete. Budget OLED will become historical technology. RGB mini-LED will dominate mainstream segments with continuous refinement and improvement. Wallpaper OLED will establish as luxury standard in premium segments.

Ultimately, the most important decision isn't technology choice—it's honest self-assessment of your viewing conditions, performance requirements, and budget constraints. With these clearly defined, technology selection becomes straightforward. Choose OLED if dark-room viewing and perfect contrast justify premium cost. Choose mini-LED if value and reliable performance serve your needs. Choose wallpaper OLED if design and premium positioning matter more than other considerations.

The television market evolution continues. This transition, significant as it appears today, represents merely another chapter in display technology's ongoing evolution. Future technologies—micro LED, advanced quantum dots, and technologies not yet commercialized—will eventually displace today's favorites. For now, understanding the current transition helps you make decisions optimized for your specific situation.

FAQ

What exactly is RGB mini-LED technology and how does it differ from standard LED televisions?

RGB mini-LED technology uses thousands of independent red, green, and blue LEDs distributed in a dense grid behind LCD panels, enabling precise local dimming with color-specific control. Unlike standard LED-backlit televisions using hundreds of white LEDs with coarse dimming zones, RGB mini-LED's granular control produces superior contrast, color accuracy, and overall visual performance that approaches OLED quality at substantially lower cost.

How do wallpaper OLEDs achieve their ultra-thin 2.5mm profile?

Wallpaper OLEDs relocate processors, power supplies, and other heat-generating components to external modules separate from the display itself, use advanced thermal materials like graphene composites for efficient heat dissipation, and employ innovative adhesive mounting systems rather than traditional television frames. This modular approach enables wall-mounting flat against walls without visible bezels or depth, creating appearance more similar to framed artwork than traditional televisions.

Will RGB mini-LED televisions eventually match OLED image quality?

While RGB mini-LED technology continues advancing and achieving impressive performance, it cannot perfectly replicate OLED's infinite contrast ratios, perfect black levels, or pixel-perfect color consistency. RGB mini-LED remains superior in brightness, reliability, and cost-effectiveness, but maintains technical limitations compared to true OLED performance. For most viewing scenarios, the differences prove imperceptible, but cinema enthusiasts and color professionals will detect distinction between technologies.

Why are manufacturers discontinuing budget OLED television production?

Budget OLED production proved economically unsustainable. Manufacturing OLED panels requires specialized facilities, precise production processes, and manages yield rates (percentage of produced panels meeting quality standards) around 60-75%, meaning significant production losses. Combined with competitive pricing pressure, OLED manufacturers struggled to maintain profitability at budget price points. RGB mini-LED offers comparable performance with better manufacturing economics, enabling healthier margins.

What is the burn-in risk with wallpaper OLED displays?

OLED pixels degrade with extended use, with bright colors showing degradation faster than dark colors, potentially creating permanent image ghosting in areas displaying static content long-term. Modern OLED displays include burn-in mitigation through pixel-shifting algorithms, brightness limiting on static content, and screen rotation features. For typical television viewing with varied content, burn-in risk remains minimal over 7-10 year ownership periods.

Should I purchase a budget OLED television now or wait for RGB mini-LED options?

Your decision should reflect viewing priorities and budget constraints. If dark-room viewing and perfect contrast fundamentally matter and remaining OLED inventory offers compelling pricing, purchasing budget OLED while available represents reasonable choice. If value and reliability matter most, modern RGB mini-LED options deliver excellent performance at competitive pricing. If undecided, researching specific models in your budget range and comparing their measured performance helps guide your decision.

How long before wallpaper OLED prices become affordable for mainstream consumers?

Wallpaper OLED pricing will likely decline gradually within premium segments (perhaps

What should I prioritize: brightness, contrast, color accuracy, or response time?

Your priority should reflect your actual viewing habits and content preferences. Sports and bright-room viewers should prioritize brightness (mini-LED advantage). Dark-room movie watchers should prioritize contrast (OLED advantage). Color-critical professionals should prioritize consistency (OLED advantage). Gamers should prioritize response time (OLED advantage). Identify which performance characteristic genuinely affects your viewing satisfaction most frequently, as this should guide your technology and model selection.

Are there alternative television technologies I should consider besides mini-LED and OLED?

Micro LED technology represents the most significant emerging alternative, offering pixel-level light emission like OLED but using LEDs instead of organic materials, providing superior reliability at the cost of significantly higher manufacturing complexity and cost. Some manufacturers explore quantum dot enhancements and hybrid technologies, but these remain variations on mini-LED and OLED rather than truly alternative approaches. Micro LED remains years away from mainstream consumer television availability despite promising technical potential.

How do I know if an RGB mini-LED display is quality versus budget-oriented implementation?

Evaluate LED array density (more zones indicate better performance), measured local dimming algorithm sophistication (read professional reviews), color accuracy metrics, and peak brightness specifications. Premium implementations use denser LED arrays (10,000+ LEDs), sophisticated algorithmic control, and achieve measured performance approaching OLED in many respects. Budget mini-LED implementations use simpler algorithms and fewer LEDs. Reviewing professional test measurements and comparisons from reliable sources helps distinguish quality implementations from budget efforts.

Key Takeaways

- CES 2025 signals end of budget OLED TV production as manufacturers pivot to RGB mini-LED and wallpaper OLED

- RGB mini-LED technology achieves near-OLED performance at lower costs through thousands of individual red, green, blue LEDs

- Wallpaper OLEDs represent ultra-premium segment with 2.5mm thickness enabling artistic wall integration at $4,000-7,000 prices

- Manufacturing economics drove the transition: OLED yields around 60-75% make budget pricing unsustainable while mini-LED yields exceed 95%

- RGB mini-LED excels in brightness and value while OLED maintains superior contrast and black levels

- The middle-ground affordable OLED market segment disappears, forcing consumers toward either value mini-LED or premium wallpaper OLED

- Early 2025 offers opportunity to purchase remaining budget OLED inventory before complete market transition

- Wallpaper OLED targets design-conscious affluent consumers willing to pay premium for aesthetic integration

- RGB mini-LED technology will dominate mainstream television markets by 2026 with continuous refinement expected

- Technology transition reflects broader commoditization of standard televisions requiring focus on differentiation through advanced technologies

Related Articles

- Art TVs 2025: The Complete Guide to Frame & Gallery Models

- Sony Bravia 8 II OLED TV: Complete Review & Premium TV Alternatives [2025]

- CES 2026: Complete Guide to All Major Tech Announcements

- Micro RGB TVs 2026: Complete Guide, Technology Comparison & Buyer's Guide

- OnePlus Watch 3: Revolutionary Battery Tech & Smart Alternatives

- Best Noise-Canceling Headphones 2026: Complete Buyer's Guide

![RGB Mini-LED & Wallpaper OLEDs: The End of Budget OLED TVs [2025]](https://tryrunable.com/blog/rgb-mini-led-wallpaper-oleds-the-end-of-budget-oled-tvs-2025/image-1-1768591098188.jpg)