SaaS Revenue Durability Crisis 2025: AI Agents, Private Capital Exhaustion, and What Comes Next

Introduction: When the Private Capital Well Runs Dry

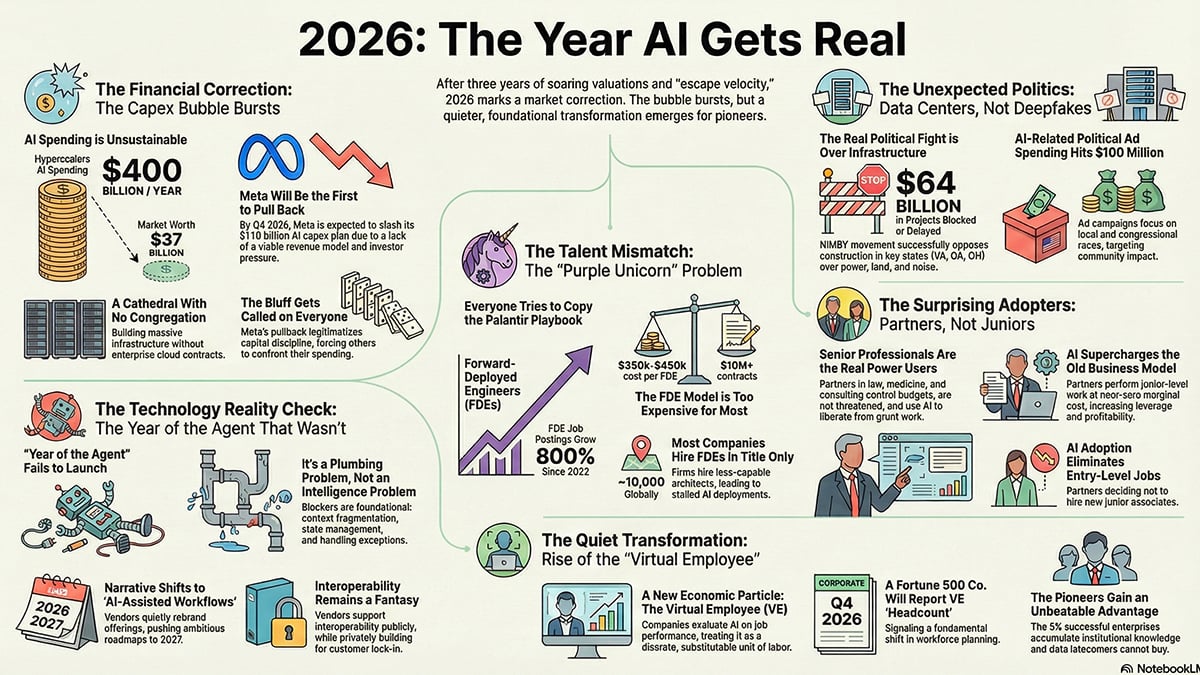

We are witnessing a fundamental shift in how technology capital flows through the market. In early 2025, the tech industry hit an inflection point that few saw coming, despite years of warnings from skeptics. The assumptions that powered the last decade of private company valuations—infinite capital, "stay private forever" mentality, and the durability of software-as-a-service revenue—have all cracked simultaneously.

The numbers are staggering. Public software stocks have declined 30-40% in a five-week span. Microsoft lost

But beneath this macro chaos lies something more profound: the emergence of distributed AI agent networks that fundamentally challenge how we think about software competition, pricing power, and sustainable revenue. Moltbook, an experimental platform, connected 1.5 million AI agents in a social network—mostly speculative, filled with security vulnerabilities and human-prompted responses, yet potentially more consequential than any announced product of the past three years.

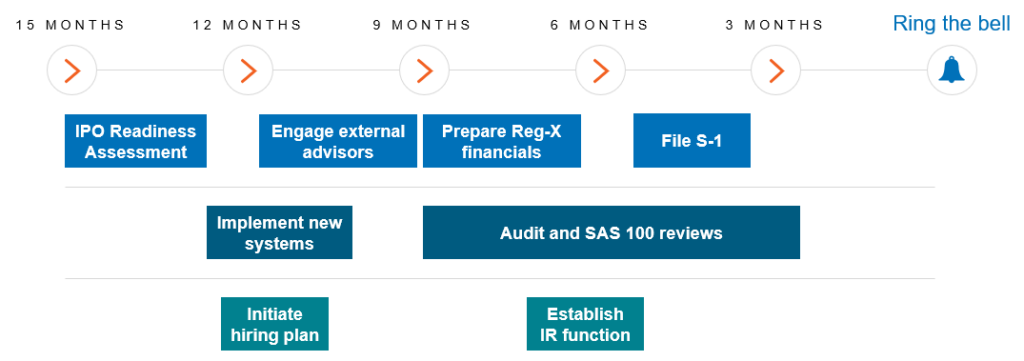

This article analyzes the convergence of three critical trends: private capital exhaustion, B2B software revenue durability under siege, and the emergence of agent-to-agent networks that will reshape software economics. We'll examine why the IPO bar has jumped to $4 billion revenue growing 50%+, what this means for founders below that threshold, and why the definition of a defensible software business is being rewritten in real-time.

For developers and teams building modern applications, understanding these shifts is essential. This isn't about market timing—it's about recognizing which business models will survive the transition and which new tools (including distributed, AI-powered automation platforms) will define the next era of software productivity.

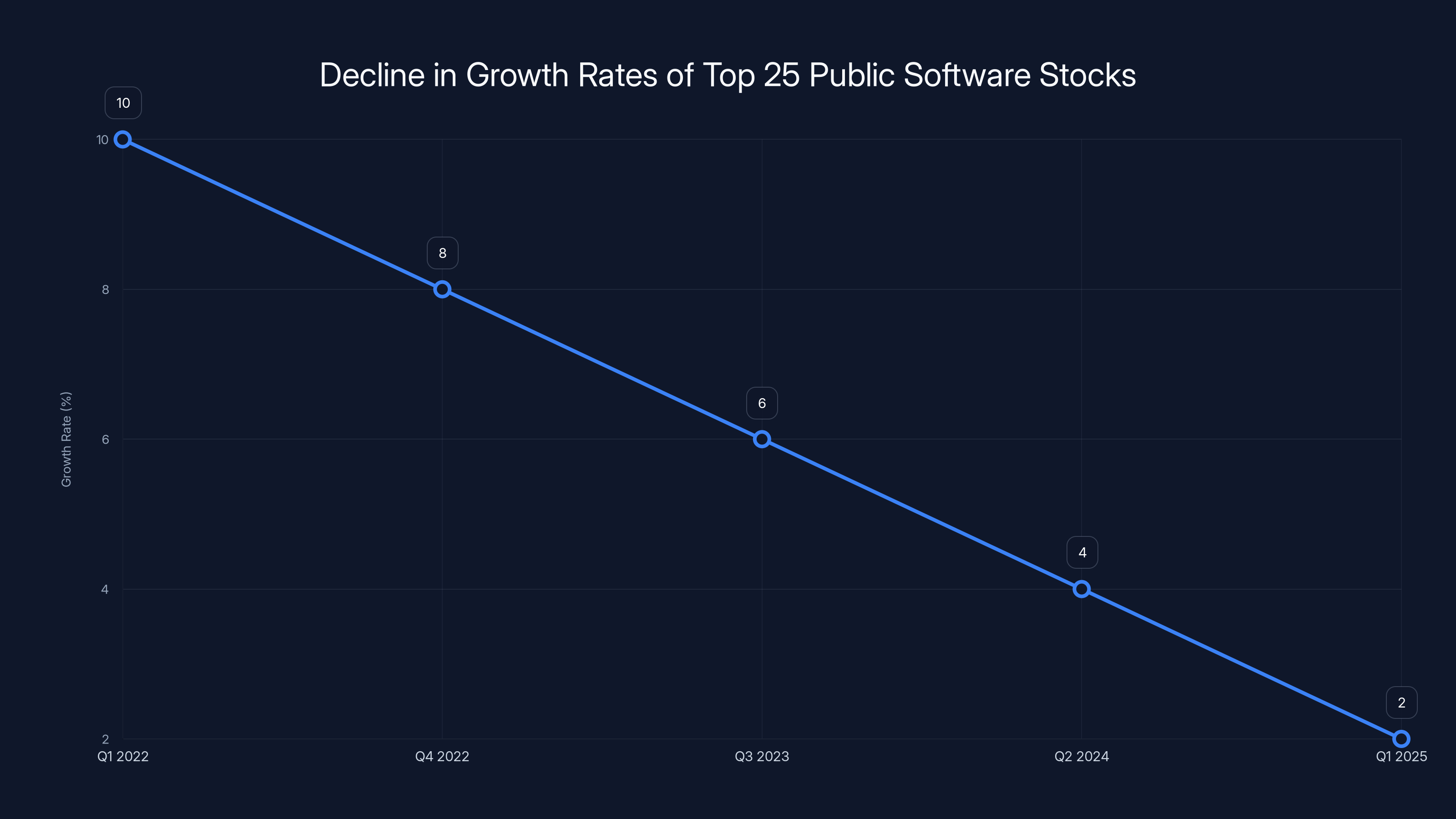

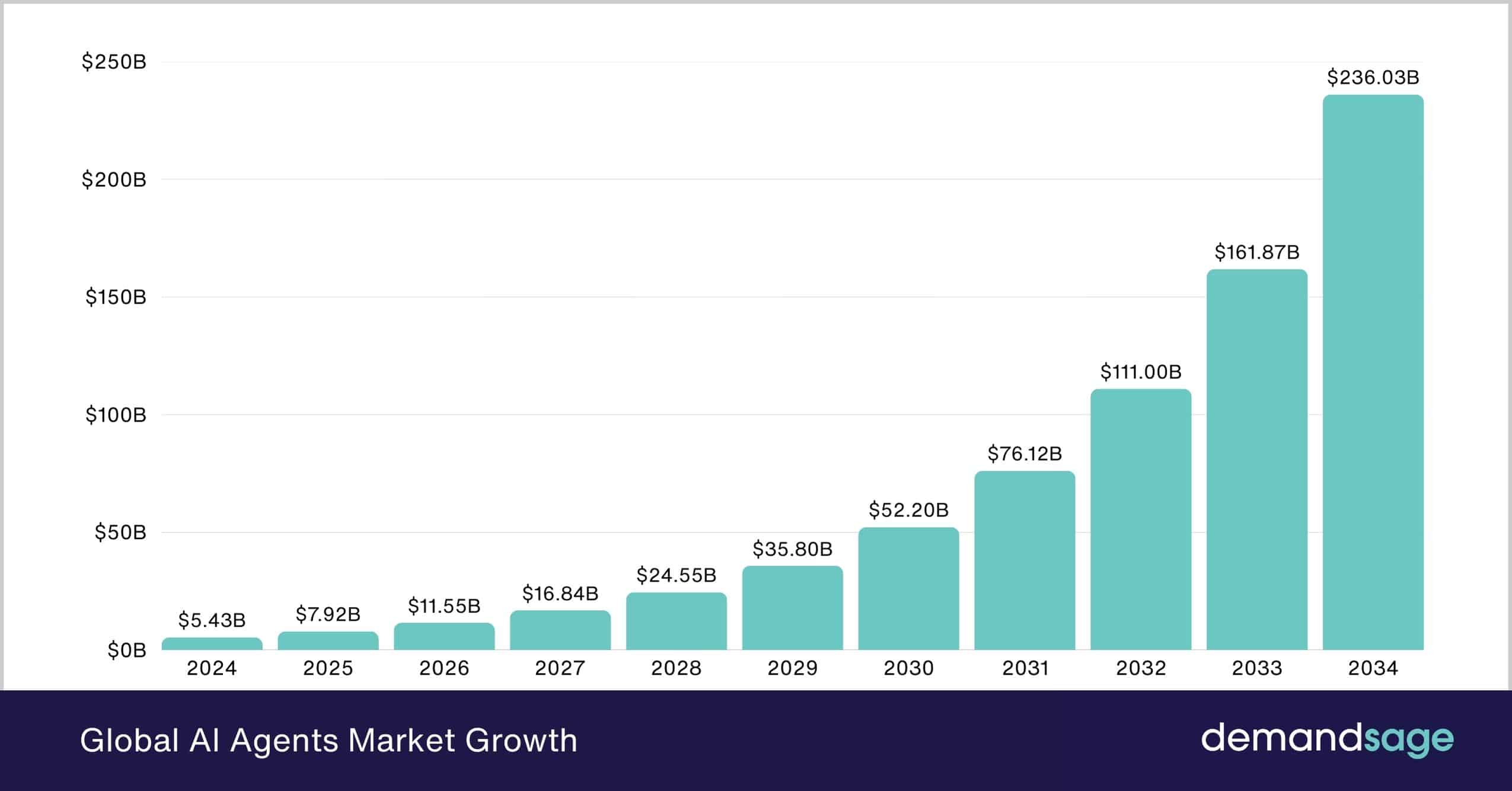

The growth rates of the top 25 public software stocks have consistently declined each quarter from Q1 2022 to Q1 2025, indicating a structural shift in the SaaS market. Estimated data.

Part 1: The Collapse of "Stay Private Forever"

The Death of the Perpetual Private Company

For over a decade, the narrative was consistent: stay private as long as possible. Avoid public markets with their quarterly reporting requirements, Wall Street pressure, and regulatory burdens. Raise from venture capitalists who understood your vision, move faster than public companies ever could, and dominate your market before going public—if at all.

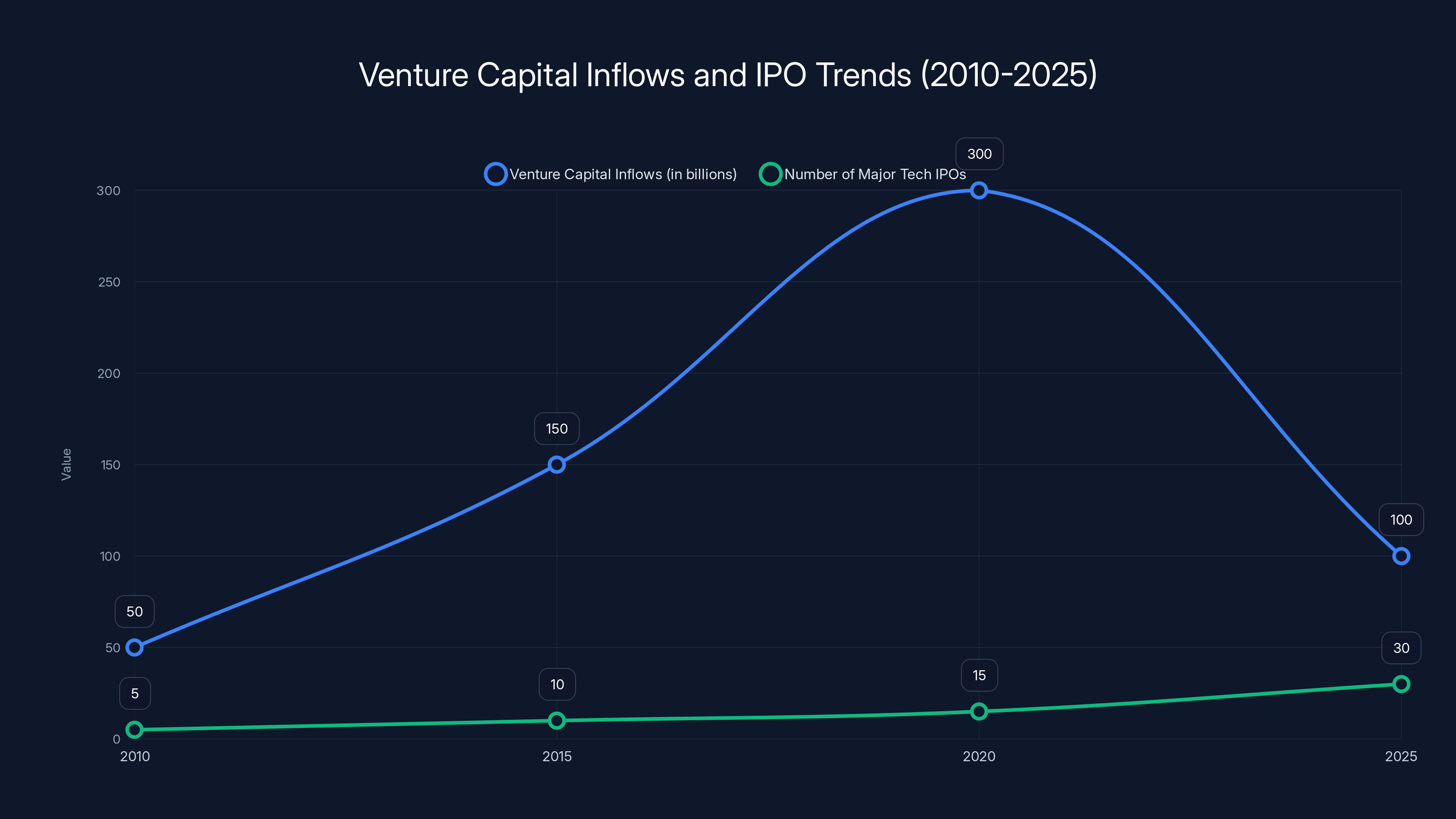

This philosophy worked when capital was abundant. Between 2010 and 2021, venture capital inflows exploded, fueled by low interest rates, institutional FOMO, and the proven scalability of software. Companies like Stripe, Databricks, and others could raise at ever-higher valuations while remaining private indefinitely.

That era ended abruptly in 2025. The proof is unmistakable: every major AI company is now racing toward public markets. Anthropic, which valued itself at

The mathematical logic is straightforward: when the cost of private capital exceeds the cost of going public (accounting for dilution, regulation, and scrutiny), the choice becomes obvious. Private investors are demanding 8-12% annual equity returns just to cover their cost of capital. Going public, even with near-term stock volatility, provides cheaper capital for companies burning $10 billion+ annually on compute infrastructure.

This isn't irrational founder behavior. It's rational actors responding to scarcity signals. In 2004, Jesse Livermore observed the same pattern: smart money began accelerating capital raises, suggesting the available pool was finite. The quote that applies today: "I better get mine." When founders and investors realize capital isn't infinite, they act immediately.

The New IPO Bar: $4B Revenue, 50%+ Growth

The rehabilitation of the IPO brings with it a brutal new gatekeeping mechanism. The market has established a clear threshold: to go public successfully in 2025, you need approximately $4 billion in annual revenue growing at least 50% year-over-year.

Look at the winners and losers among public SaaS in recent quarters:

Winners (at or above the bar):

- ServiceNow: $8.8B revenue, 30%+ growth, trading at 12x revenue

- Salesforce: $37B revenue (platform scale), trading at 8x revenue

- Palantir: $2.7B revenue, 25%+ growth, commanding 28x revenue multiple

- EquipmentShare: $8.3B revenue, 45% growth, recently IPO'd successfully

Losers (below the bar):

- Atlassian: $3.2B revenue, 25% growth, down 67% in 12 months, trading at 3.2x revenue

- HubSpot: $2.4B revenue, 18% growth, down 45%, trading at 2.8x revenue

- Monday.com: $800M revenue, 30% growth (strong!), down 60%, trading at 5x revenue

- Shopify: $7.2B revenue, 22% growth, down 25%, trading at 6x revenue

The pattern is clear: growth premium has replaced scale preference. A

For founders building below

Why the

The Cascade: Why Mid-Market SaaS Got Crushed

The logic of the

These companies—the successful "mid-market" SaaS businesses that seemed like obvious billion-dollar acquisitions three years ago—are now trapped. Their investors demand returns, but the exit options have collapsed:

- IPO: Requires $4B revenue or 50%+ growth. Most don't qualify.

- Acquisition by Bigger Public Company: Predators like Microsoft, Salesforce, and Adobe are consolidating down-market, but valuations have collapsed. A company that might have sold for 8-10x revenue in 2022 now trades at 3-4x revenue.

- Acquisition by Private Equity: PE firms are opportunistically buying distressed SaaS, but they're acquiring for cash flow, not growth. Founders often lose most upside in these deals.

- Stay Private and Slow Growth: Venture investors withdraw support, companies are forced to become profitable at lower revenue levels, and the path to $4B becomes a 20+ year grind.

This dynamic explains the desperation visible in Q4 2024 and Q1 2025 boardrooms. M&A activity accelerated not because of strategic vision, but because staying independent became unsustainable. The capital formation system itself broke.

Part 2: The B2B Software Revenue Durability Crisis

The Data That Changed Everything

For 20+ years, the SaaS investment thesis rested on a single foundational belief: software revenue is durable. Once a customer commits to a system of record—an ERP, CRM, accounting platform, or critical operational tool—switching costs become so high that churn approaches zero. Renewal rates of 90-95% became table stakes. Gross margins above 75% became expected. The compounding effect of annual recurring revenue (ARR) meant that successful SaaS businesses could hit $100M revenue with modest customer acquisition costs and predictable economics.

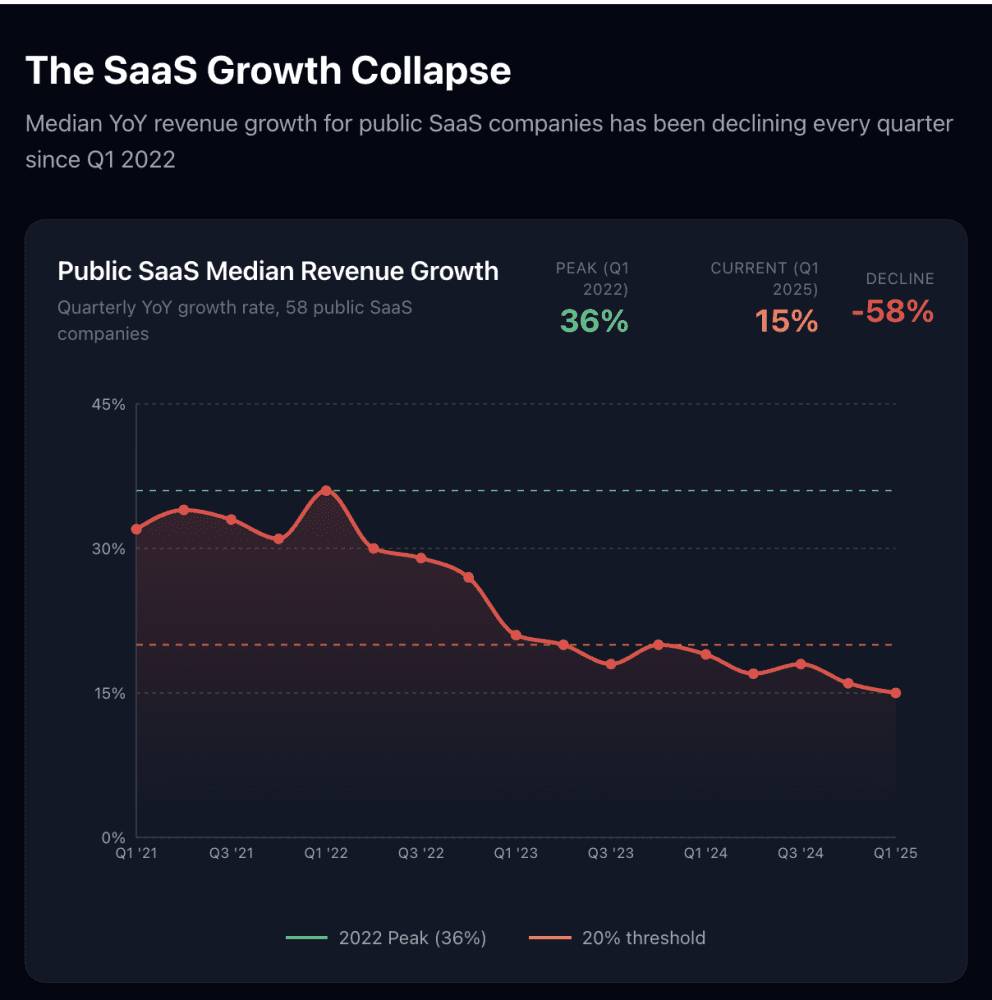

This thesis held for 18 years straight. From 2004 to 2022, public SaaS companies consistently demonstrated revenue durability: they grew revenues smoothly, expanded margins reliably, and delivered predictable earnings.

In 2022, the thesis cracked. And in 2024-2025, it shattered.

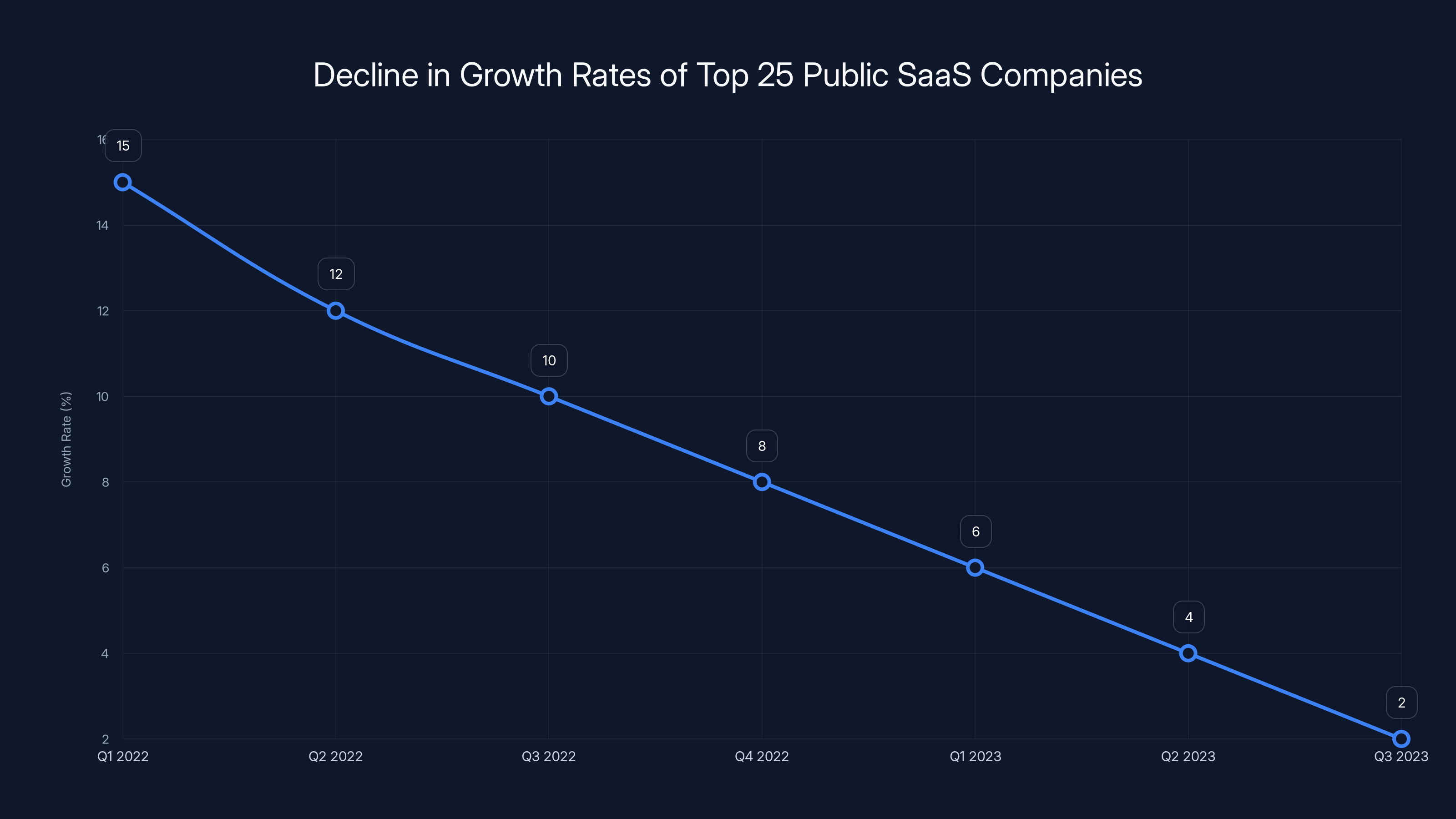

The data is now irrefutable: every quarter since Q1 2022, the growth rates of the top 25 public software stocks have declined. Not stalled—declined. Continuously lower growth rates, quarter after quarter, for three consecutive years. This isn't cyclical; this is structural.

Jason Lemkin, co-founder of SaaStr and veteran of over 500 SaaS investments, stated it plainly: "I don't believe in SaaS revenue durability anymore. I see everything decaying that isn't growing at abnormal rates. I smell it in leads. I see it in close rates going down. I see it in an inability to charge more when your agent competitors are charging 10x as much."

This wasn't hyperbole—it was a pattern observation from someone who has watched the SaaS market closer than almost anyone alive.

Why Durability Broke: The Three Pressures

Pressure 1: CIO Budget Redirection

Historically, IT budgets grew reliably. A CIO of a Fortune 1000 company would allocate a budget to "systems and tools," and vendors would compete for share within that bucket. The total spend was relatively fixed; the battle was over whose software got selected.

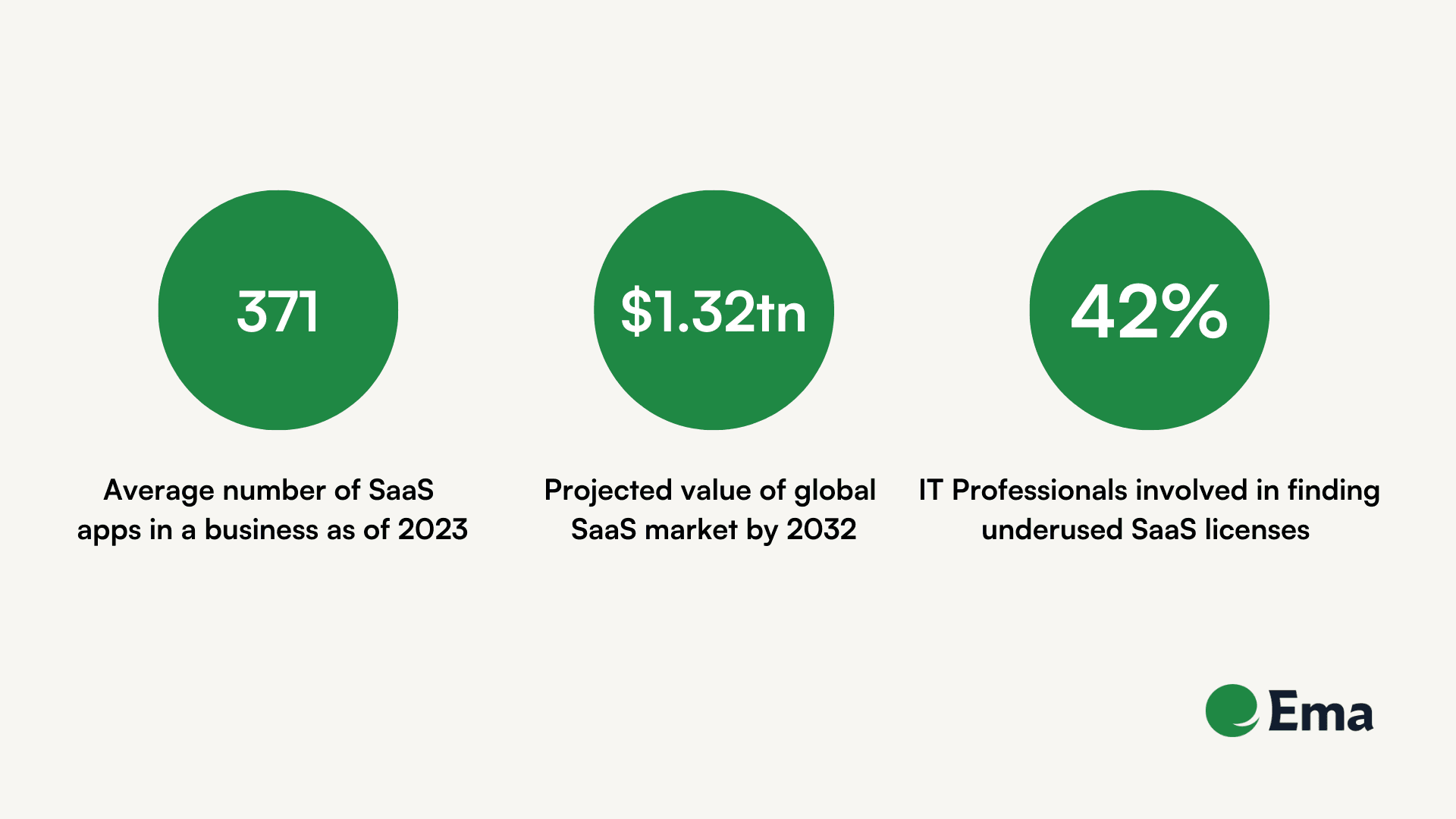

In 2023-2025, CIO budgets faced a different pressure: the AI imperative. Every CIO received board pressure to "do something with AI." This meant that a growing percentage of IT budgets—conservatively 15-25% annually—was being redirected toward AI infrastructure, fine-tuning, and agent deployment.

That money came from somewhere: legacy software budgets. A CIO with a flat or declining total IT budget had to make hard choices. HubSpot lost renewal budgets not because the platform became worse, but because the CIO needed to fund internal AI infrastructure instead. ServiceNow's growth slowed not because its core platform was disrupted, but because renewal conversations now included: "We only need 70% of the seats we had last year—the rest will be handled by AI agents."

Pressure 2: Pricing Power Evaporation

For decades, SaaS companies could raise prices on renewals. The logic was simple: switching costs were high, and value creation was real. A company could negotiate 10-15% annual price increases on renewal, confident that churn would remain low.

That leverage disappeared in 2024. Why? Because founders offering AI-powered alternatives began pricing at 1/10th the cost of legacy systems. If HubSpot costs

The pricing collapse was especially brutal for seat-based models. Monday.com, HubSpot, and Atlassian all rely on per-user economics: 100 people on Monday costs more than 50 people. But in renewal conversations, CIOs began stating the obvious: "We need 50 seats because 50 people will manage the tool. The other 50 will be replaced by AI agents."

This creates a negative compounding loop: lower prices per seat, fewer seats, lower overall ARR, reduced profitability, forced consolidation or acquisition.

Pressure 3: Market Saturation and the "Good Enough" Threshold

The third pressure is less discussed but equally important: maturity of the SaaS market. By 2024, most companies with addressable SaaS tools already had them installed. New customer acquisition became more expensive because:

- Greenfield markets disappeared: The number of companies without a CRM is near zero. The number without project management software is also near zero. New customer acquisition meant displacing incumbents, requiring higher sales costs.

- Consolidation of buyer preference: More companies were asking "Do we need a specialized tool, or is an AI agent trained on our data sufficient?" The answer increasingly was the latter.

- The "good enough" threshold crossed: Legacy software became "good enough" to operate. Companies stopped paying premiums for incremental innovation when that same money could fund AI capabilities.

Which SaaS Survives? The System-of-Record Hierarchy

Not all software revenue is equally durable. Rory O'Driscoll, from the 20VC-SaaStr discussion, articulated a crucial distinction:

Tier 1 (Highly Durable): Systems of Record with Financial Gravity

- SAP, Oracle, Salesforce backend, core accounting systems

- Why durable: They roll directly into financial statements. You can't change ERP vendors without auditor sign-off. Switching costs are measured in millions of dollars and years of time.

- Growth impact: Minimal. These grow with customer revenue, not with new adoption. Churn is close to zero.

- Example: SAP has survived three technology transitions (mainframe → client-server → cloud → AI) and will likely survive the AI transition because it's too embedded in financial processes.

Tier 2 (Moderately Durable): Systems of Work with Moderate Switching Costs

- Atlassian (Jira, Confluence), ServiceNow, Workday, Salesforce CRM

- Why moderately durable: They're operational systems, not financial systems. Switching is painful but not forbidden. AI agents can replicate 70-80% of functionality.

- Growth impact: Significant pressure. HubSpot and Monday.com are Tier 2, and both face severe headwinds.

- Example: A company can move from Jira to an AI-powered task management system over 18 months. It's painful but not impossible.

Tier 3 (Low Durability): Point Solutions and Productivity Tools

- Point tools in sales, recruiting, content management, design, analytics

- Why low durability: An AI agent or internal system can replicate functionality in weeks. Switching costs are measured in days or hours.

- Growth impact: Catastrophic. Conversion rates are collapsing, churn is accelerating, and pricing power is gone.

- Example: A recruiting team can move from a specialized recruiting platform to an AI agent trained on their hiring data in weeks. The ROI flip is immediate.

The hierarchy explains recent stock performance:

| Company | Tier | Revenue | Growth | Stock YTD | Issue |

|---|---|---|---|---|---|

| SAP | 1 | $37B | 12% | +8% | Mature, stable |

| Salesforce | 1 | $37B | 14% | -12% | CIO budget redirection |

| ServiceNow | 1.5 | $8.8B | 30% | +18% | Strong, but growth slowing |

| Atlassian | 2 | $3.2B | 25% | -67% | AI threat significant |

| HubSpot | 2 | $2.4B | 18% | -45% | Seat compression, pricing pressure |

| Monday.com | 3 | $800M | 30% | -60% | Point solution vulnerability |

The winners are Tier 1 systems that can either (a) remain Tier 1, or (b) evolve into AI-powered Tier 1 systems. ServiceNow is doing this successfully—embedding AI agents into their workflow platform, not replacing the platform with agents. Salesforce is attempting this less successfully, having built ChatGPT features that don't replicate the compounding value of the core CRM.

The losers are companies trapped in Tier 3 trying to be Tier 2.

Estimated data shows a consistent decline in growth rates for the top 25 public SaaS companies from Q1 2022 to Q3 2023, highlighting the SaaS revenue durability crisis.

Part 3: The Emergence of AI Agent Networks

Moltbook and 1.5 Million Connected Agents

While everyone debated SpaceX valuations and SaaS stock collapse, something strange happened on a platform called Moltbook: 1.5 million AI agents were connected in a social network.

Most observers dismissed it. The agents weren't intelligent in the way we traditionally measure intelligence. Many were largely randomized, responding to human prompts with scripted or crypto-scam-adjacent responses. The network had obvious security vulnerabilities. It was, by most metrics, a failed experiment.

Yet it might be the most consequential event of 2025 for understanding the future of software.

Why? Because it demonstrated, for the first time in production, the feasibility of large-scale agent-to-agent coordination without centralized control. It showed that even with bad actors, security holes, and limited agent sophistication, the network didn't collapse. It persisted. It found equilibrium.

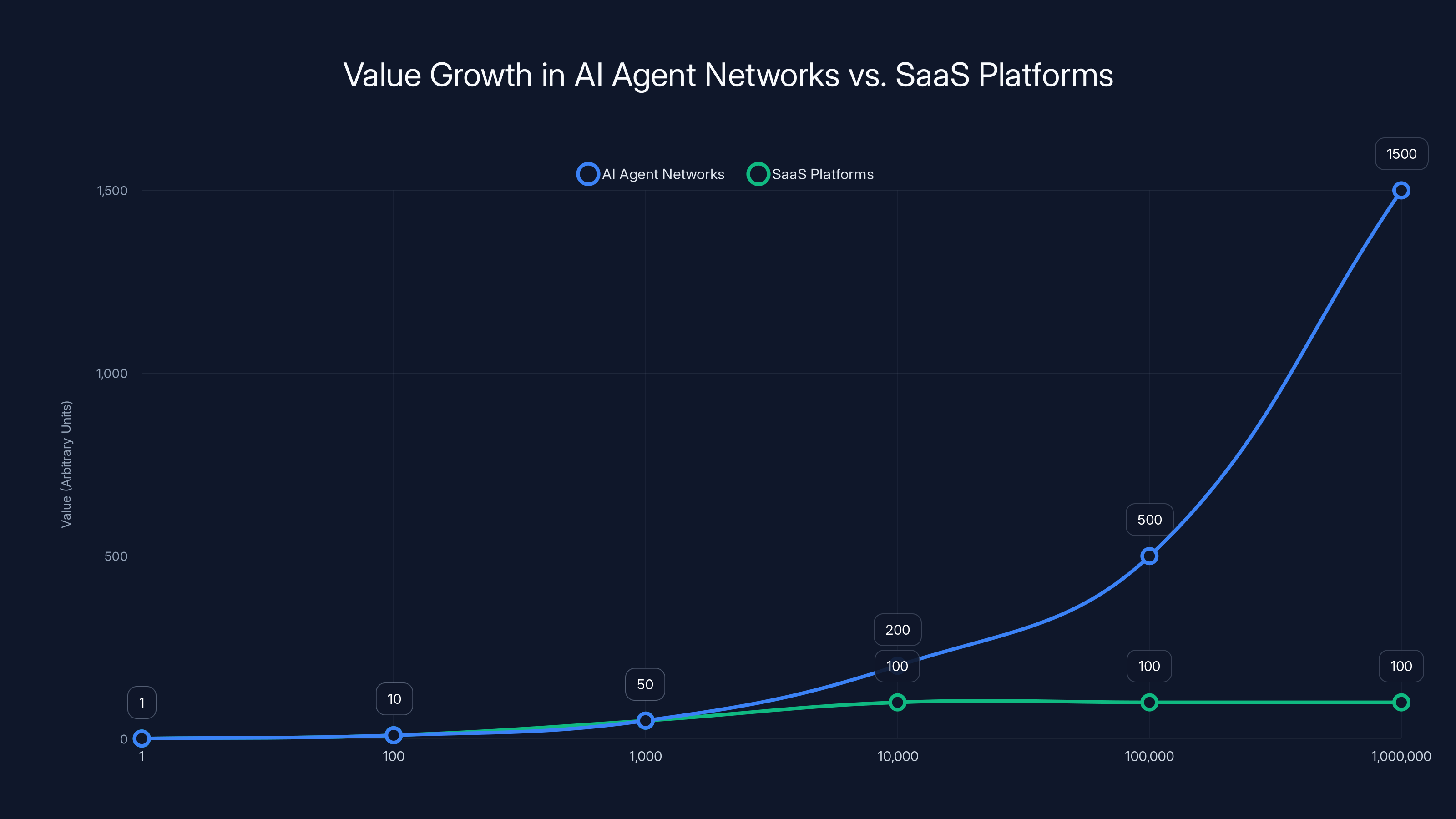

Most importantly, it revealed a truth that venture capitalists and founders have been slow to accept: the marginal value of another SaaS user is zero, but the marginal value of another agent in a network is positive.

When you add the 1,000,001st person to Slack, Slack doesn't become meaningfully more valuable for the existing 1,000,000 users. The network effects plateau quickly (they improve with the first 100-1,000 users, then flatten). But when you add the 1,000,001st agent to a network, the entire system becomes more capable. More workflows can be routed. More optimization opportunities emerge. The value curve bends upward, not upward-then-flat.

Why Agent Networks Are Fundamentally Different from SaaS

SaaS grew on the thesis of centralized value creation. A company builds software, sells it to companies, and captures value through licensing fees. Value flows one direction: vendor → customer.

Agent networks operate on a fundamentally different model: distributed value creation and capture. An agent solves a problem for a human or another agent. That solution is immediately visible to other agents in the network. Those agents can adapt, copy, or build on that solution. Value compounds through the network, not through a single vendor.

The implications are staggering:

SaaS Economics:

- 1,000/year = $1,000 revenue

- 100 customers × 100,000 revenue

- Sales, marketing, and support costs scale with customer count

- Churn is a constant pressure; expansion only happens through upselling features

Agent Network Economics:

- 1 agent × 1 solution = 1 contribution

- 1,000 agents × 1 solution = 1,000 copies of that solution + 1,000 variations

- 1,000,000 agents × 1 solution = exponential capability growth with minimal incremental cost

- Churn is less relevant; if an agent is not productive, it's automatically replaced

- Expansion happens organically through network capability increases

This is why the emergence of agent networks represents an existential threat to traditional SaaS pricing models. You can't charge per-agent (there are no agents owned by a single company). You can't charge per-user (users don't directly interface with agents). You can't charge per-workflow (workflows are distributed, not centralized).

So how do you monetize? That's the open question. Possible models:

- Compute consumption: You pay for the compute required to run your agents (similar to AWS pricing). This is pure commodity pricing with 10-15% gross margins.

- Network facilitation: You become the platform that hosts and coordinates agents, taking a small percentage of transactions or value flows. This is a platform play with 20-30% gross margins.

- Specialized agent licensing: You build specialized agents (industry-specific, function-specific) and license them at higher margins, but this devolves into traditional SaaS for agent subscriptions.

- Data/training: You monetize the ability to train agents on proprietary data or workflows. This is a services business, not a products business.

None of these generate the 70%+ gross margins or 10x+ revenue multiples that public SaaS investors have grown accustomed to.

The Timing Question: When Do Agents Replace SaaS?

A natural question: if agent networks are so much more efficient, why are we still discussing SaaS at all? Why hasn't Salesforce been completely disrupted already?

The answer lies in capability gap and organizational inertia.

Today, an AI agent can handle 60-75% of workflows that a CRM handles: logging calls, summarizing emails, managing contact information, scheduling follow-ups. It cannot handle the complex judgment required for deal scoring, competitive analysis, or strategic account planning in the way a seasoned sales director can.

In 3-5 years, that gap closes to 85-90%. An agent system trained on sales best practices and historical data might handle deal scoring and competitive intelligence better than human judgment.

In 10 years, the gap is negligible. The remaining 10% is handled by specialized human decision-making, not by the CRM software.

But organizational inertia slows adoption. Companies with $50M invested in a Salesforce implementation will not rip-and-replace for a 15% capability improvement. They'll migrate gradually, layer agents on top of Salesforce, and eventually (when the next CTO arrives or in 7-10 years) migrate to a pure-agent architecture.

This is why ServiceNow and Salesforce are aggressively embedding AI agents into their platforms—not to innovate, but to avoid becoming irrelevant during the migration window. If they can convince customers that "Salesforce + AI agents = the future," they extend the runway by 5-7 years.

Part 4: What This Means for Founders and Teams

The New Venture Capital Reality

If you're raising a Series A in 2025, the venture capital market is bifurcated more severely than ever before:

Path 1: The Extreme Growth Play ($50M+ ARR in 5 years)

- Target growth: 100%+ year-over-year

- Business model: Venture typically targets 3-year paths to $100M ARR

- Capital available: $20-50M Series A rounds are still available

- Investor thesis: We're betting on AI being 10x better than legacy SaaS. You need to capture 10% of Salesforce's market share within 5 years.

- Risk: Execution and distribution

- Downside: If you hit $20-30M ARR by year 5, you're below the IPO threshold and face acquisition pressure

Path 2: The Profitability Play ($2-5M ARR sustainable indefinitely)

- Target growth: Profitable in 18-24 months, then slow 10-20% growth

- Business model: Niche tools, industry-specific solutions, internal tools that generate enough margin to be self-sustaining

- Capital available: Micro-VCs and angel capital for $2-5M Series A

- Investor thesis: We're betting on sustainable, profitable software companies being more valuable than growth-at-all-costs

- Risk: Niche market size limitation

- Downside: Limited upside; you might hit $20-30M ARR and plateau

Path 3: The Application Layer (Venture Graveyard)

- Target growth: Moderate 30-50% growth

- Business model: Horizontal tools, productivity software, point solutions

- Capital available: Almost none

- Investor thesis: This used to work, but it doesn't anymore

- Risk: Existential; you're being directly competed against by AI agents

- Downside: Acquisition pressure at 2-3x revenue, or struggling to find buyers

The brutal truth: Path 3 is currently the graveyard. If you're building a horizontal tool that's "better than what exists," you've already lost to the venture capital market's repricing. The investors who would have funded you in 2022 are now asking: "Why wouldn't I just fund an AI agent company instead?"

For Developers: Where Should Your Energy Go?

For individual developers and small teams, the opportunity structure has shifted dramatically:

High Opportunity: Build Specialized Agents

- The market will reward industry-specific AI agents. A sales AI agent trained on Gong call transcripts and Salesforce data is more valuable than a generic sales assistant.

- Potential monetization: Per-company licenses, per-transaction fees, training data licensing

- Time to revenue: 6-12 months for a minimal viable agent

- Capital required: 2M (compute + team)

High Opportunity: Build on Top of Agent Networks

- Once agent networks mature (2-3 years), building apps that coordinate or optimize agent behavior will be valuable

- Example: An app that routes sales questions to the best agent (in-house vs. network), balancing cost and quality

- Potential monetization: Take a small percentage of the value created

- Time to revenue: 12-24 months (network needs to mature first)

- Capital required: $1-5M

Medium Opportunity: Build or Manage Internal Tools

- Organizations will need tools to manage their agent fleets, monitor performance, adjust training data, and handle edge cases

- This is not SaaS-style business; it's services/consulting that could scale

- Potential monetization: Service fees, management fees, training

- Time to revenue: 3-6 months

- Capital required: 500K

Low Opportunity: Build Horizontal SaaS Tools

- Unless you have a path to $4B revenue and 50%+ growth (you don't), horizontal tools are a graveyard

- Better to sell your team, IP, or customer base to a larger player than to try to grow independently

- Time to revenue: Irrelevant; revenue will plateau at $2-5M

- Capital required: Venture won't fund this anymore; rely on profitability or acquirers

For Team Building: The Infrastructure Transition

As agent networks emerge, the types of engineers and team structures that matter are shifting:

2024 SaaS Team (Legacy)

- Product engineers (building feature parity)

- Infrastructure engineers (managing deployment, scaling)

- Dev Rel/Developer advocacy (marketing to developers)

- Sales engineers (closing deals)

- Customer success (retention and churn management)

2026+ Agent Network Team (Emerging)

- Agent architects (designing agent behavior, workflows, coordination)

- ML/fine-tuning engineers (adapting agents to specific domains)

- Network engineers (optimizing agent routing, discovering bottlenecks)

- Security/governance engineers (preventing bad actor agents, managing risk)

- Economics engineers (designing incentive structures for agent contribution)

- Human-in-the-loop specialists (managing edge cases agents can't handle)

The shift is from building better software to managing distributed systems of agents. The skill gap is real, and few engineers have been trained in this paradigm.

Teams hiring in 2025-2026 should prioritize agent architecture expertise over traditional SaaS product skills. The return on investment is dramatically higher.

Part 5: The IPO Market Reset and What Comes After

Why the IPO Is Making a Comeback

Counter to the "venture capitalism has won" narrative of the 2020s, the IPO is actually making a comeback. But the comeback is selective and brutal. Only companies meeting the $4B revenue / 50%+ growth threshold can access it.

Why is this happening? Three factors:

1. Compute costs have become prohibitive OpenAI, xAI, and Anthropic are spending $10-20 billion annually on compute infrastructure alone. No venture fund, no matter how large, can sustain this burn rate indefinitely. Going public provides access to cheap capital (through equity raises and debt markets) that private companies simply cannot access.

2. Venture returns have compressed In 2022, venture capitalists expected a

When venture returns collapse, limited partners pressure funds to return capital, which means:

- Fewer mega-rounds for private companies

- Faster pressure to exit (IPO or acquisition)

- Less patience for long-term, capital-intensive plays

3. Strategic necessity For companies like OpenAI and Anthropic, going public isn't about capital optimization—it's about strategic necessity. If you're betting the company on building the next foundational AI model, and that requires $20B in capital, the only sources are (a) governments, or (b) public markets. Venture capital is too conservative.

The $4B Revenue Threshold: A Hard Edge

The market has set a clear floor: $4 billion in annual revenue growing at least 50% year-over-year.

Why this specific threshold? It relates to market structure:

- Below $500M revenue: Public markets see you as speculative. Valuations are compressed. Volatility is high. Difficult IPO.

- 2B revenue: The "Goldilocks zone" where companies have proven business models but haven't reached scale. This is the hardest zone in 2025—too large to raise venture capital efficiently, too small to access public capital easily.

- 4B revenue: The zone where IPOs are theoretically possible, but pricing is tricky. Depends on growth rate. A3B company growing 15% likely won't.

- $4B + revenue: IPO threshold is clear. Market will allocate capital at reasonable multiples.

Historically, this threshold was lower. In 2017-2019, companies with

The threshold has shifted because:

- Institutional investor requirements: Large institutional investors (pension funds, insurance companies) prefer larger-cap issues. A 30-50B market cap, making it interesting to them. A5-8B, which is often below their minimum position size.

- Analyst coverage: Equity research teams at banks need sufficient trading volume and market cap to justify covering a stock. Below $20B market cap, analyst coverage drops dramatically.

- Volatility tolerance: Larger-cap companies see better price stability, attracting index funds and passive investors who can't tolerate 30-50% daily swings.

The $4B threshold isn't arbitrary—it's the point where public market infrastructure kicks in fully.

What Happens to Companies Stuck at $1-3B Revenue?

This is the tragedy of the 2025 market. Thousands of companies will reach $1-3B in revenue (an objectively successful milestone!) and find themselves trapped:

- Can't IPO: Below the market's threshold

- Can't raise venture: Growth is good (20-30%) but not extraordinary (50%+)

- Hard to acquire: Strategic buyers are consolidating down-market at 3-4x revenue instead of the 6-8x multiples paid in 2021

- Can't stay private: Investors expect returns; capital becomes expensive

The outcome for most of these companies: Forced consolidation or acquisition at discount prices.

Examples we're already seeing:

- Smaller SaaS tools being acquired by Microsoft, Salesforce, or other giants at 3-4x revenue

- Founders and employees taking significant haircuts on exit valuations

- Investors writing down valuations in secondary markets

This creates a new founder playbook: either build to

AI agent networks demonstrate increasing value with each additional agent, unlike SaaS platforms where value plateaus after a certain number of users. Estimated data.

Part 6: Strategic Responses for SaaS Leaders

The Salesforce Bet: Embed AI and Hope

Salesforce's response to the durability crisis: embed AI agents into Salesforce, not replace Salesforce with agents.

The bet is elegant: if we can convince CIOs that "Salesforce + Einstein AI = the future," we extend our runway by 5-7 years. By the time agents are clearly superior, we hope to have:

- Trained a generation of CIOs on agent-based workflows within the Salesforce ecosystem

- Integrated Salesforce data so deeply with AI that switching costs actually increase

- Moved enough revenue to the cloud that hybrid on-premise systems become irrelevant

The risk: If agents become clearly superior before embedding is complete, the bet fails. The opportunity cost might be $50-100 billion in shareholder value.

The probability: Maybe 60% this works. The embedded AI strategy is sound if executed well, but execution is notoriously difficult for large companies.

The ServiceNow Play: Become the Workflow OS for Agents

ServiceNow is making a different bet: become the operating system for agents, not the application.

They're positioning their platform as the layer that orchestrates, governs, and coordinates AI agents across an enterprise. Rather than compete with agents, they become the infrastructure that agents run on.

The bet is similar to how Microsoft positioned Windows: not the best word processor (that was WordPerfect), not the best spreadsheet (that was Lotus 1-2-3), but the platform on which all applications run.

If this works, ServiceNow becomes the "workflow OS" that agents depend on. They take a small percentage of workflow value but across a massive volume.

The risk: If agents develop their own coordination layer (similar to how Linux became the OS for the internet), ServiceNow's platform becomes just another vendor.

The probability: Maybe 70% this works, higher than Salesforce's bet, because infrastructure plays are generally stronger than application plays during transitions.

The Acquisition-as-Defence Strategy: Buy Up AI Capabilities

Smaller SaaS platforms are responding with acquisition, consolidating features and capabilities before agents make them obsolete.

Example: A project management company might acquire an AI-powered time-tracking tool, a resource planning AI, and an automation workflow builder. By bundling capabilities, they create switching costs through feature density rather than by superiority of any single feature.

The bet: if we have 15 integrated features, agents have to replicate 15 behaviors simultaneously to dethrone us. If we have 1 core feature, agents need to replicate 1 behavior.

The risk: Integration complexity increases exponentially with acquisitions. A 10-feature bundled platform might have the velocity and reliability of a 2-feature focused platform.

The probability: Maybe 50% this works long-term, because it's a defensive play that doesn't create new value—it just delays the inevitable.

Part 7: The Architecture of Distributed AI Agent Systems

How Agent Networks Actually Work

Moltbook's connection of 1.5 million agents wasn't magic—it was a simple but elegant architecture:

Layer 1: Agent Substrate

- Each agent has a persistent identity (encrypted ID, cryptographic signing capability)

- Agents can execute basic tasks: generating text, processing data, making decisions based on prompts

- Agents can publish results to a shared ledger or broadcast channel

Layer 2: Coordination Mechanism

- Agents can discover other agents through a registry or broadcast system

- When agent A's task requires agent B's capability, A can broadcast a request

- B can respond if it has the capability; multiple agents can compete to handle the request

- Results are verified and logged

Layer 3: Value Capture and Incentives

- Agents that produce high-quality results get prioritized for future tasks

- Agents that waste computational resources or produce garbage get deprioritized

- The system self-organizes: good agents get more work, bad agents get starved out

Layer 4: Security and Governance

- Bad actors (agents that try to scam others, steal data, or execute malicious tasks) are identified

- These agents are isolated or kicked out of the network

- The system is not perfect, but it's self-healing

The elegance of this architecture is that it doesn't require centralized control. No company owns it. No administrator manages it. It's a distributed system that finds equilibrium through incentives and feedback.

Why This Is Fundamentally Different From SaaS

SaaS Architecture:

Company A → [Vendor Software] ← Company B

Company C → [Vendor Software] ← Company D

Value flows from each company to the vendor. The vendor monetizes by charging each company separately.

Agent Network Architecture:

Agent A ↔ Agent B ↔ Agent C

↓ ↓ ↓

Agent D ↔ Agent E ↔ Agent F

↓ ↓ ↓

Agent G ↔ Agent H ↔ Agent I

Value flows peer-to-peer. No central company captures all the value. The network as a whole becomes more valuable as more agents join.

The economic implications are profound:

- SaaS monetization: Vendor captures $X per customer, per transaction, or per seat

- Agent network monetization: Unclear. Maybe 1-2% of transaction value? Maybe compute consumption? Maybe data licensing?

This is why agent networks represent a genuine discontinuity. They're not a better version of SaaS; they're a fundamentally different value structure.

The Bridge: Hybrid Systems (2025-2030)

For the next 5-10 years, we'll see hybrid systems:

Hybrid Model 1: SaaS as Agent Orchestrator

- Traditional SaaS companies offer a "control layer" where humans manage agents

- Example: HubSpot offers a dashboard where sales managers see and manage AI agents handling customer conversations

- Monetization: Subscription to the control layer + compute consumption for agents

- Transition risk: If management layer becomes unnecessary, the subscription becomes redundant

Hybrid Model 2: Agent Network with Guard Rails

- Open agent network, but with a company-provided guard-rail layer that ensures safety, compliance, and quality

- Example: An enterprise might deploy 1,000 sales agents to an open network, but with a compliance layer that prevents certain actions

- Monetization: Fees for safety/compliance infrastructure

- Transition risk: If safety/compliance becomes automated (agents policing agents), this layer becomes unnecessary

Hybrid Model 3: Vertical SaaS Hosting Agents

- Industry-specific SaaS platforms that don't compete with agents, but rather host them

- Example: A vertical SaaS for insurance might provide agents trained on insurance data

- Monetization: Hosting fees + data licensing + per-transaction percentage

- Transition risk: If agents can be hosted anywhere and trained on any data, why use the SaaS layer?

These hybrid models are all essentially "band-aids" delaying the transition to pure agent networks.

Part 8: Cost Economics of AI Agents vs. SaaS

The Cost Comparison That Keeps Investors Awake

Let's do the math on a typical SaaS tool vs. an AI agent replacement:

Scenario: Customer Relationship Management

Traditional SaaS (Salesforce CRM)

- Cost per user: $165/month (Sales Cloud, mid-tier)

- Typical company: 50 sales reps, 100 total CRM users

- Monthly cost: 100 × 16,500

- Annual cost: $198,000

- Implementation + training: 150,000 (one-time)

- Total first-year cost: 348,000

AI Agent Replacement (Agent-as-a-Service)

- Cost per agent: $100-200/month (hosting + fine-tuning + API calls)

- Typical deployment: 50 specialized sales agents + 20 support agents = 70 agents

- Monthly cost: 70 × 10,500

- Annual cost: $126,000

- Fine-tuning + training: 50,000 (one-time)

- Total first-year cost: 176,000

Comparison:

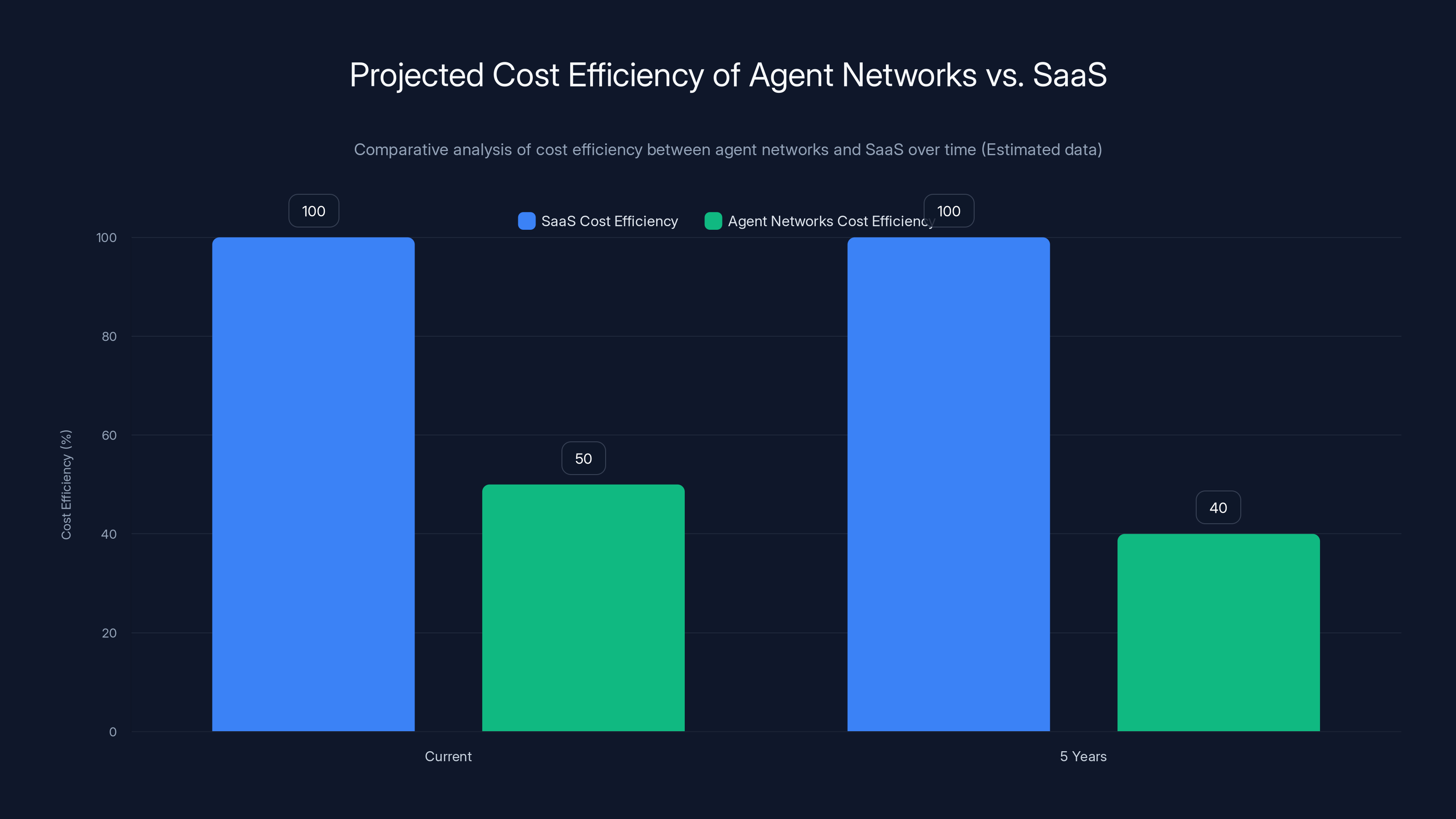

- Agents are 25-50% cheaper in year 1

- Agents are 33% cheaper in steady state (years 2+)

- Agents require less upfront training (agents adapt; humans don't)

- Agents have lower ongoing support costs (agents auto-scale; humans need management)

This is the economics that keep SaaS executives awake at night. The math is brutal: agents are cheaper, faster to deploy, and more scalable. The only advantage SaaS has is proven reliability and integration—not competitive advantages, but inertial advantages.

When Agents Become Dramatically Cheaper

The cost advantage increases as:

- Compute becomes cheaper: AWS and Azure are in constant price wars. When compute drops 50%, agent costs drop 30-40%.

- Agents improve in capability: As agents handle more tasks, the cost per task drops exponentially.

- Scale increases: A platform hosting 1 million agents can negotiate better compute rates and achieve better resource utilization than a platform hosting 1,000 agents.

Within 5 years, expect agent costs to be 60-70% cheaper than SaaS equivalents. Within 10 years, expect 10x cheaper for equivalent capabilities (agents doing work, not charging for access).

This is the cost curve that makes the durability crisis inevitable.

Agent networks are projected to perform 60-75% of SaaS workflows at 25-50% of the cost currently, with the gap widening to 70-80% capability at 60% less cost in 5 years. Estimated data.

Part 9: The Talent Market Shift and Skill Premium

What Skills Command Premiums in 2025+

The technical job market is already responding to these trends:

High Demand (30-50% salary premiums):

- Agent architecture and design: Building systems where agents coordinate effectively

- Fine-tuning and RLHF: Training agents on domain-specific data

- Prompt engineering at scale: Writing and managing thousands of prompts for different agent roles

- Agent security and governance: Preventing bad actors, managing permissions, ensuring compliance

- Multi-agent coordination: Managing dependencies between agents, resolving conflicts

Medium Demand (10-30% premiums):

- Traditional machine learning: Still valuable for specialized tasks, but declining

- Traditional SaaS product management: Not dying, but growing slower

- Cloud infrastructure: Still valuable, but less exotic

Low Demand (0-10% premiums or declining):

- Traditional software engineering: Commoditized

- QA and testing: Agents handle much of this

- Business analysis: Being replaced by agent analysis

For developers, this is strategic: skills in agent architecture and fine-tuning are worth 50-100% premiums over traditional SaaS skills. The ROI on learning agent systems is extraordinarily high.

The Educational Lag

Universities and coding bootcamps are 2-3 years behind the industry's needs. Most computer science programs still teach traditional software engineering, not agent systems or distributed coordination.

This creates a massive opportunity for self-taught engineers and small specialized training programs. Engineers who invest 6-12 months in deep learning agent systems will have massive career advantages for the next 5-10 years.

Part 10: The Acceleration of SaaS to Agent Transition

The Timeline We're Looking At

When will agent systems actually replace SaaS at scale? The timeline depends on agent capability improvements:

2025-2026 (Current State)

- Agents handle 50-70% of workflows in traditional SaaS

- Agents are 25-35% cheaper than SaaS equivalents

- Adoption: Early adopters, startups, cost-sensitive industries

- SaaS impact: Moderate—mostly affecting Tier 3 (point solutions)

2027-2028 (Transition Phase)

- Agents handle 80-85% of workflows

- Agents are 40-50% cheaper

- Adoption: Mainstream companies, all industries

- SaaS impact: Severe—Tier 2 solutions (systems of work) facing existential pressure

- Market response: SaaS companies either go public, get acquired, or consolidate

2029-2032 (Dominance)

- Agents handle 90-95% of workflows

- Agents are 60-75% cheaper

- Adoption: Ubiquitous; agent systems are the default

- SaaS impact: Legacy SaaS becomes niche; only Tier 1 systems survive independently

- Market response: Most SaaS companies have been acquired, shut down, or pivoted

2033+ (Mature Agent Economy)

- Agents handle 99% of routine workflows

- Cost per task approaches marginal cost of compute

- Adoption: Every organization has internal agent fleet + network participation

- SaaS: Only exists as specialized consulting or managed services

This timeline isn't predicted—it's observable in the technology adoption curves we've seen with previous transitions (mainframe → client-server → cloud → mobile).

Why Some SaaS Survives

Not all SaaS will disappear. Tier 1 systems of record will survive because:

- Switching costs are regulatory, not technical: Moving from SAP requires auditor approval, not technical capability

- Integration is financial: These systems touch financial statements; agents can't replace them without regulatory approval

- Consolidation: Future agents will embed Tier 1 systems (SAP, Oracle, NetSuite) rather than replace them

Think of it like the cloud transition: we didn't eliminate servers when moving to the cloud; we abstracted them. Similarly, we won't eliminate Salesforce backends; we'll abstract them as agents.

Part 11: Advice for Different Founder Archetypes

For SaaS Founders at Series B/C (Pre-Product Market Fit)

Reality Check: Your venture capital funding trajectory has likely changed. What would have been a

If you're a horizontal tool: You're in trouble. Your venture capital runway has shortened, and your exit options have collapsed. Consider:

- Pivot to an industry-specific play (vertical SaaS is more defensible)

- Pivot to an agent play (build the agent layer rather than the SaaS layer)

- Get acquired quickly (take the bird in hand before your valuation drops further)

If you're an industry-specific tool: You're okay but under pressure. Focus on:

- Reaching positive unit economics as quickly as possible (you may need to run lean)

- Building integrations with larger platforms (become an add-on rather than a core system)

- Developing agent capabilities (add agents to your offering rather than replacing it)

For Startup Founders (Pre-Series A)

Reality Check: Capital is more abundant than ever for the right ideas, but the bar for "right idea" has shifted dramatically.

If you're building an AI agent: You have a 18-24 month window where venture capital will fund you. Build quickly and get to $100K+ MRR before that window closes. Focus on:

- Specialized agents in high-margin industries

- Speed of deployment over feature completeness

- Clear path to positive unit economics (agents should be self-supporting)

If you're building SaaS: You're swimming upstream. Consider whether your idea is:

- Tier 1: Systems of record with financial gravity (rarely true for new companies)

- Vertical SaaS: Industry-specific enough to have 10 years before agents catch up

- Agent infrastructure: Hosting, coordination, governance for agents

If none of these apply, seriously consider a different idea.

For Teams Inside Larger Companies

If you're building productivity tools: You're being disrupted. The team should:

- Develop agent capabilities for your core offering

- Become the workflow orchestrator for agents rather than the application

- Plan for a 40-50% headcount reduction (agents will handle work humans used to do)

If you're building systems of record: You're relatively safe. Focus on:

- Integrating agent capabilities into your platform

- Positioning your platform as the system agents coordinate around

- Developing switching cost advantages (make it harder to replace you, not easier)

The Extreme Growth path targets 100%+ growth with significant capital, while the Profitability path focuses on sustainable growth with limited capital. The Application Layer faces minimal capital availability and high competition risks. Estimated data.

Part 12: What Investors Should Understand

The Repricing of SaaS Multiples

Public SaaS multiples have repriced from 10-15x revenue (2021) to 3-8x revenue (2025). This isn't a temporary market adjustment—it's a permanent repricing based on new durability assumptions.

The new formula for SaaS valuation:

Where:

- Revenue is current ARR

- Growth Rate is YoY growth

- Durability Factor is the investor's belief in the revenue's persistence (0.0-1.0)

For Tier 1 systems, Durability Factor is 0.9-1.0 (revenue is very likely to persist). For Tier 2 systems, Durability Factor is 0.5-0.7 (revenue will face 30-50% pressure from agents). For Tier 3 systems, Durability Factor is 0.1-0.3 (revenue will face 70-90% pressure from agents).

This explains why Monday.com, growing at 30%, trades at 5x revenue, while Salesforce, growing at 15%, trades at 8x revenue. The growth rate doesn't matter if the revenue isn't durable.

The IRR Collapse

Venture capital returns have compressed dramatically:

2015-2021 (The Golden Era)

- Exit: 10x return on a $100M Series A

- Timeline: 7 years

- IRR: 40-50%

- Expected losers: 30% of portfolio

- Expected winners (10x+): 10% of portfolio

2022-2025 (The Reset)

- Exit: 3-5x return on a $100M Series A

- Timeline: 5-7 years

- IRR: 20-30%

- Expected losers (0-1x): 40-50% of portfolio

- Expected winners (10x+): <5% of portfolio

This is why venture firms are being forced to:

- Raise smaller funds (1B+)

- Return capital to LPs (acknowledging that dry powder doesn't create returns)

- Consolidate into mega-firms (returns to scale matter more)

- Specialize more (generalist firms are dying)

What Smart Investors Are Doing

Smart Venture Investors:

- Doubling down on agent infrastructure (the picks and shovels play)

- Investing in Tier 1 system integrations (companies that position legacy software as agent infrastructure)

- Building specialized agent teams (industry-specific agents in healthcare, finance, legal)

- Avoiding generalist horizontal tools (the graveyard)

Smart Corporate VCs:

- Acquiring agent startups before they scale

- Investing in agent infrastructure that makes their existing platforms more valuable

- Divesting SaaS tools that don't have clear paths to Tier 1 status

Part 13: Practical Tools for Teams Building Modern Applications

Automation Platforms for Agent Coordination

As companies move from SaaS to agent architectures, they need platforms to coordinate, monitor, and manage agent fleets. This is where platforms like Runable fit into the emerging landscape.

Runable provides AI-powered automation tools designed for developers and teams building modern applications. Unlike traditional SaaS, which typically charges per-user or per-seat, Runable's approach aligns with the new economics: it focuses on workflow automation and content generation through AI agents, priced at $9/month for individuals and small teams.

Key capabilities that matter for agent-based development:

- AI-powered content generation (AI docs, slides, reports): Useful for generating agent prompts, documentation, and coordination frameworks

- Automated workflows: Essential for coordinating multiple agents and managing dependencies

- Developer-focused design: Built for engineers implementing agent systems, not business users

- Cost efficiency: At $9/month, aligned with the agent economy's preference for low-cost, high-volume tools

For teams transitioning from SaaS to agent architectures, low-cost automation platforms are more valuable than ever. You're not paying for enterprise features or per-seat licensing; you're paying for the ability to automate repetitive tasks and coordinate distributed systems.

Runable and similar platforms represent the infrastructure layer that agents depend on—not replacements for agents, but enablers of agent deployment and management.

Building Blocks for Agent Systems

Practical architecture patterns for 2025:

Pattern 1: Agent + Orchestrator + SaaS Bridge

Agent Fleet → Orchestration Layer → Legacy SaaS Data

Agents handle tasks; an orchestrator manages their coordination; the SaaS layer provides data integration (temporary, until fully migrated).

Pattern 2: Multi-Tier Agent Deployment

Specialized Agents → Coordination Agents → Human Oversight Layer

Some agents handle domain-specific tasks; others coordinate between them; humans handle exceptions and governance.

Pattern 3: Agent + Automation Platform Hybrid

Agents → Automation Rules Engine → Workflow Execution

Agents make decisions; automation platforms execute decisions at scale.

For development teams, understanding these patterns is essential. The technical challenges in 2025+ aren't about building better SaaS—they're about coordinating distributed systems of agents while maintaining governance, security, and human oversight.

Part 14: Risk Scenarios and Mitigations

Risk 1: What If Agents Don't Improve as Fast as Expected?

Scenario: Agent capability plateaus at 70% of human capability. The remaining 30% requires expensive human judgment.

Probability: 25-30%

Impact: SaaS durability concern eases; traditional SaaS has more runway; IPO threshold might lower to $2-3B revenue

Mitigation: For founders, don't bet entirely on agent disruption. Assume SaaS will survive for 10+ years, but be prepared to migrate to agent architectures if capabilities improve faster.

Risk 2: What If Governance Failures Cause Agent Networks to Collapse?

Scenario: A major security breach or agent misbehavior event causes enterprise customers to abandon agent deployments, causing a loss of confidence in distributed systems.

Probability: 20-25%

Impact: Agent adoption slows; SaaS durability improves; centralized platforms gain credibility

Mitigation: For investors, watch governance developments closely. Companies that can provide trustworthy agent governance (compliance, security, auditing) will be valuable regardless of agent capability improvements.

Risk 3: What If a New Technology Leap-Frogs Agents?

Scenario: A different AI paradigm (quantum computing for ML, new training methods, etc.) emerges that is 10x more efficient than current agents, making both SaaS and agent networks obsolete.

Probability: 15-20% (unlikely but not impossible)

Impact: All bets are off; the entire enterprise software market reprices again

Mitigation: For teams, stay flexible. The specific technologies matter less than the underlying principles: distribution, efficiency, and automation.

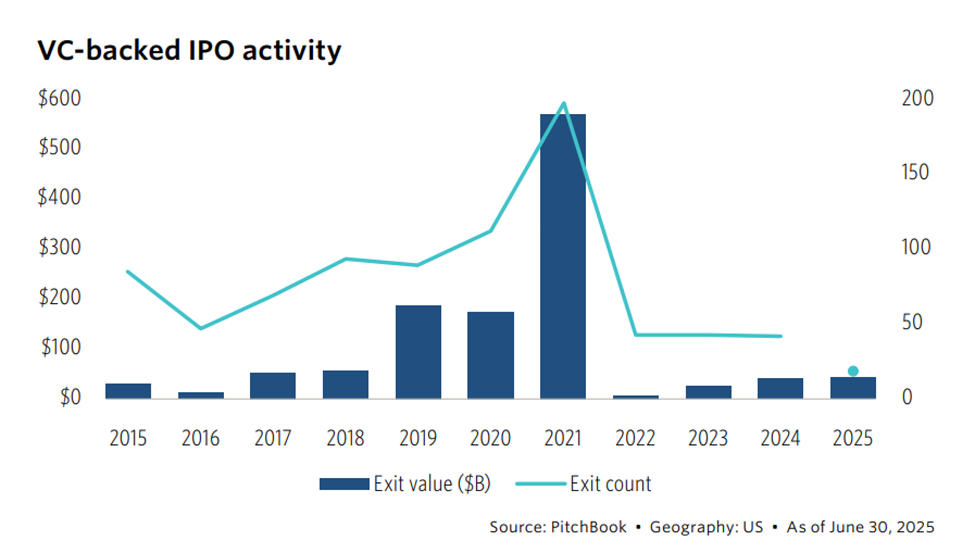

Estimated data shows a peak in venture capital inflows around 2020, followed by a decline as major tech companies shift towards IPOs by 2025.

Part 15: The Integration of AI Automation in Modern Development

How AI Automation Platforms Enable the Transition

As teams move from traditional SaaS to agent-centric architectures, they need tools that bridge the gap. AI automation platforms serve a critical role: automating the repetitive tasks that developers waste time on, freeing up capacity to build agent infrastructure.

For developers specifically:

Current bottlenecks (2025):

- Writing documentation and specifications: 20-30% of dev time

- Generating boilerplate code: 15-20% of dev time

- Creating project reports and status updates: 10-15% of dev time

- Automating repetitive build/deploy tasks: 10-15% of dev time

Total time wasted on non-coding tasks: 55-80% of a developer's week

This is where automation platforms become valuable. A tool like Runable that can automatically generate documentation, create presentation slides, and automate repetitive workflows at a very low cost ($9/month) creates immediate ROI by freeing up developer time.

The math is simple:

- Average developer salary: 72/hour

- Runable cost: 0.005/hour

- ROI: If Runable saves just 1 hour per month, it pays for itself 14,000x over

For teams building agent systems, this ROI is even higher because agent development is more documentation-intensive than traditional software. Agents need clear prompts, behavioral specifications, and coordination rules—all of which benefit from automated documentation generation.

Part 16: Future of Revenue Models in the Agent Era

Revenue Model Evolution

Traditional SaaS (2010-2024):

- Per-user pricing

- Per-feature pricing

- Per-transaction pricing

- All with 70-85% gross margins

Hybrid (2025-2028):

- Per-user pricing for human users

- Per-agent pricing for AI agents (lower rate)

- Blended model trying to maintain gross margins

Agent Native (2029+):

- Per-compute-unit pricing (similar to AWS)

- Network fee (small percentage of transaction value)

- Data licensing (selling training data/insights to other agents)

- Gross margins compress to 20-40%

The dramatic margin compression is why SaaS investors are panicking. A software company making 75% gross margins cannot compete with a system that makes 30% margins but is 10x cheaper to operate.

Margins matter less in agent economies because volume is so much higher and acquisition is so much lower.

Part 17: Global Implications and Market Shifts

Which Geographies Are Most Affected?

Most Affected (Developed Markets with Mature SaaS):

- United States: Home of most SaaS companies, most vulnerable

- Western Europe: Mature SaaS markets facing durability pressure

- Partial impact in 2-3 years; severe impact in 5-7 years

Less Affected (Emerging Markets with Low SaaS Penetration):

- India: Lower SaaS spending; leapfrogging directly to agents

- Southeast Asia: Similarly leapfrogging opportunities

- Potential advantage: Can build agent-first systems without legacy debt

Wild Card (China):

- Banning of foreign software increases demand for domestic alternatives

- Could develop agent-based alternatives that are 15-20 years ahead of Western stacks

- If Chinese companies get agent coordination right first, it's a geopolitical advantage

Impact on Developer Outsourcing

The SaaS durability crisis has another implication: demand for custom software development is dropping.

Historically, companies paid for:

- Licensed SaaS (Salesforce, ServiceNow, etc.)

- Custom development to integrate and customize SaaS

- Staff to manage all of it

With agents, companies can:

- Deploy agents (maybe buy a platform, maybe not)

- Fine-tune agents (maybe hire ML engineers, maybe not)

- Manage agents (AI handles most of it)

This means software development outsourcing demand drops 30-40%, affecting:

- Software development agencies

- Outsourcing companies in India, Eastern Europe, Latin America

- Internal IT teams at large enterprises

The transition is brutal but unavoidable.

Part 18: Building Your Competitive Moat in 2025+

Traditional Moats (Now Broken)

Network Effects

- Used to matter: More users = more value

- Now broken: More agents ≠ necessarily more value if they're not coordinated

- New interpretation: Network effects only matter if your platform coordinates agents better than alternatives

Switching Costs

- Used to matter: Entrenched in customer workflows

- Now broken: Agents can replicate workflows in weeks

- New interpretation: Switching costs only matter for Tier 1 systems; Tier 2 and 3 systems have near-zero switching costs

Brand

- Used to matter: Salesforce brand meant enterprise credibility

- Still matters, but weaker: Brand gets you in the door, but agents determine if you stay

- New interpretation: Brand buys you 2-3 years, but not a decade

New Moats (2025+)

Data Moats

- What it is: Proprietary data that agents are trained on

- Example: A healthcare platform that has trained agents on 10 years of patient data has agents that outperform generic agents by 30-50%

- Durability: 5-10 years (until agents can be trained faster or data becomes generic)

Agent Coordination Moats

- What it is: Ability to orchestrate multiple agents better than alternatives

- Example: A platform where 1,000 agents can coordinate on a complex workflow has value; one where they can't doesn't

- Durability: 3-7 years (until coordination becomes commoditized)

Regulatory Moats

- What it is: Compliance and governance that competitors can't replicate quickly

- Example: A financial services platform that can guarantee compliance with all banking regulations has value; agents can't operate in regulated industries without it

- Durability: 10+ years (regulatory advantage is sticky)

Specialized Agent Moats

- What it is: Agents that are so tuned to a specific industry/task that they're 5-10x better than generic agents

- Example: A claims-processing agent trained on 100,000 insurance claims is dramatically better than a generic AI assistant

- Durability: 3-5 years (until agents improve or industry data becomes more available)

Companies building sustainable moats in 2025+ need to focus on data, coordination, regulation, or specialization—not on feature differentiation or pricing power.

Part 19: Preparing Your Organization for the Transition

For CIOs and IT Leaders

Immediate (Next 6 Months):

- Audit your SaaS portfolio: Categorize by Tier (1 = durable, 3 = at risk)

- Identify Tier 3 risks: What point solutions could be replaced by agents in the next 2-3 years?

- Plan agent pilots: Pick 1-2 low-risk processes and test agent replacements

- Hire or contract: You need ML engineers and agent architecture expertise

Medium-term (6-18 Months):

- Consolidate redundant SaaS: If you have 3 tools doing similar things, agents might handle all 3

- Plan integrations: Start integrating agents into critical workflows alongside existing SaaS

- Develop governance: Build policies for agent deployment, monitoring, and security

- Budget reallocation: Shift IT budget from SaaS licensing to agent infrastructure and compute

Long-term (18+ Months):

- Major platform transitions: Plan migrations from Tier 3 SaaS to agent systems

- Organizational restructuring: Some IT roles will be eliminated; others will be created

- Build vs. Buy decisions: Should you host your own agents or use third-party platforms?

- Compliance and governance: Establish agent policies that satisfy regulators and auditors

For Engineering Leaders

Build the Skills:

- Agent architecture (how to design systems where agents coordinate)

- Fine-tuning and RLHF (training agents on your data)

- Prompt engineering at scale (managing thousands of prompts)

- Agent security (preventing bad actors and malicious agents)

Build the Infrastructure:

- Agent registry/discovery system (how agents find each other)

- Agent monitoring and logging (understanding what agents are doing)

- Agent version control (managing agent updates and rollbacks)

- Agent testing framework (validating agent behavior)

Build the Organization:

- Agent teams (specialists in agent development)

- Coordination teams (managing dependencies between agents)

- Governance teams (compliance and policy enforcement)

- Smaller application teams (less needed for traditional software dev)

Part 20: The Bottom Line and What Comes Next

What We Know for Certain

-

Private capital has a ceiling: Every major AI company is racing to public markets because the private well is dry. This isn't speculation; this is observable fact.

-

B2B software revenue durability has cracked: Every quarter for three years, growth rates have declined. Churn is accelerating for Tier 2 and 3 SaaS. This isn't temporary; this is structural.

-

Agent networks are emerging: Moltbook connected 1.5 million agents and didn't collapse. The architecture works. The question isn't whether agent networks emerge; it's when they reach capability parity with SaaS.

-

Agents will be dramatically cheaper: The economics are undeniable. Agents can perform 60-75% of workflows that SaaS performs at 25-50% the cost. In 5 years, that gap widens to 70-80% capability at 60% less cost.

-

The IPO bar is now $4B / 50%+ growth: Below that, you're trapped between venture capital (which won't fund slow growth) and public markets (which won't list you). This is a hard constraint, not a guideline.

What We Don't Know

-

Timeline: Will agent adoption accelerate in 18 months or 5 years? The capability gap is closing, but organizational inertia is real.

-

Which companies survive: Will Salesforce's "embed AI and hope" strategy work? Will ServiceNow's "become the OS" strategy succeed? Too early to know.

-

New business models: How will companies monetize agent networks? The answer will surprise us. It probably isn't simple per-compute pricing or per-transaction fees.

-

Geopolitical outcomes: Will US companies maintain advantage in agent development? Will China leapfrog with a better approach? Will regulations hobble adoption?

The Founder Playbook for 2025+

If you're building SaaS: Ask yourself: Can this reach $4B revenue growing 50%+ in the next 5-7 years? If yes, go all-in. If no, either:

- Pivot to an agent play

- Build a Tier 1 system (financial gravity)

- Become a niche vertical (10+ year runway)

- Optimize for early profitability and manage for cash flow

If you're building agents: Focus on speed and specialization. You have 18-24 months before venture capital reprices. Get to $100K+ MRR before that window closes. Build industry-specific agents, not horizontal ones.

If you're building agent infrastructure: You're playing the right game. There will be massive demand for tools that enable agent deployment, coordination, governance, and monetization. Build for the distributed future.

If you're inside a larger company: Start planning now for the transition. Your legacy SaaS won't disappear, but the revenue will be under pressure. Plan for 30-40% gross margin compression over the next 5-10 years. Invest in agent capabilities before you're forced to.

The Honest Truth

We're at an inflection point. The "stay private forever" era is over. The assumption that B2B software revenue is durable is broken. The architecture of how organizations consume software is shifting from licensed SaaS to distributed agent networks.

This transition will create massive winners and massive losers:

Losers: SaaS companies in Tier 2-3 without clear paths to either defend their position or transition to agent architectures. This is 60-70% of the SaaS market.

Winners: Founders and engineers who understand the agent economy and position themselves for it. Companies that develop sustainable data, coordination, regulatory, or specialization moats. Platforms that enable agent deployment and orchestration.

The transition will take 7-10 years to complete. SaaS won't disappear overnight. But the direction is clear, and the momentum is undeniable.

For teams building modern applications, the lesson is simple: invest in understanding and building agent systems now. The return on that investment is extraordinarily high, and the window to build competitive advantage is closing.

FAQ

What is the SaaS revenue durability crisis?

The SaaS revenue durability crisis refers to the breakdown of the long-held assumption that software-as-a-service revenue is inherently durable and predictable. Since Q