Saa Str AI 2026: How Budget Migration Changed B2B Strategy 132% — The Real Story Behind the Numbers

Introduction: The Paradox of Growth in an AI-Driven Market Transition

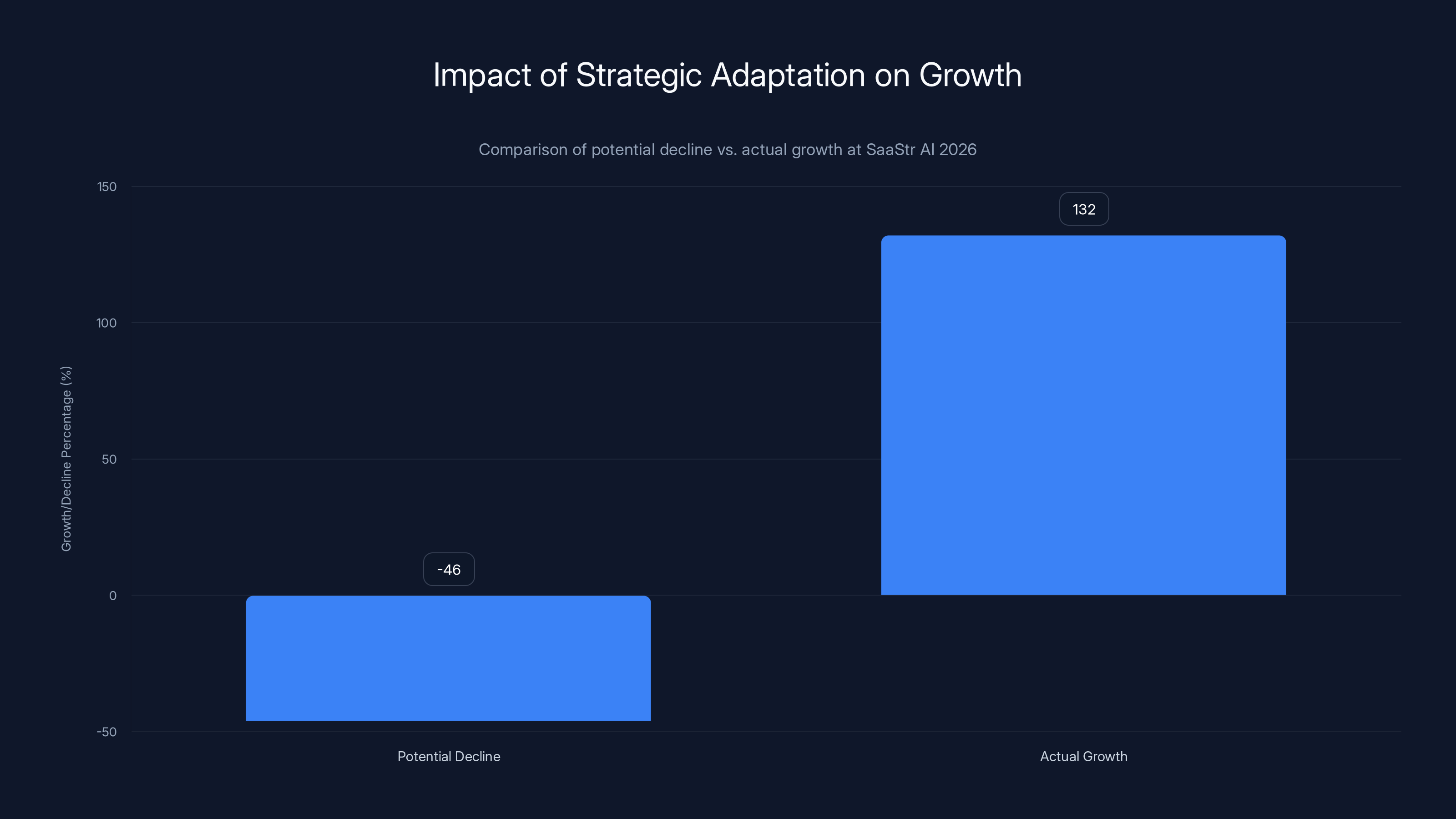

When you see a headline announcing 132% year-over-year growth at a major industry conference, your first instinct is celebration. Tickets sold? Up. Sponsorships secured? Up. Attendance numbers climbing? Up across the board. But what happens when you dig deeper into the actual mechanics of that growth—and discover that without fundamental strategic pivots, the same business would have contracted by 80% in sponsor revenue and 50% in attendees—the narrative transforms from simple success story into something far more revealing about the current state of B2B software markets.

This is exactly what happened with Saa Str AI 2026, and the story behind these numbers offers a masterclass in strategic adaptation that extends far beyond one conference. The gap between what actually happened (+132%) and what could have happened (-46% or worse) represents one of the most significant market transitions in B2B software history: the wholesale migration of corporate budgets from traditional enterprise software spending toward artificial intelligence infrastructure and application development.

For founders, revenue leaders, marketers, and anyone responsible for growth in the B2B space, this represents something critical: the traditional playbooks for B2B go-to-market are fundamentally broken in 2026. Not slightly outdated. Not in need of minor adjustments. Broken. And the companies that understand why Saa Str AI achieved 132% growth—rather than assuming it was simply better execution—will be the ones positioned to thrive in this new era.

The transformation didn't happen because Saa Str suddenly became better at selling sponsorships. It happened because the entire ecosystem of who has budget, where that budget lives, and what they're willing to spend it on has undergone a tectonic shift. Traditional B2B software vendors that once reliably purchased premium sponsorship packages at industry conferences pulled out almost entirely. Not because of budget cuts—though many faced those—but because the strategic calculus of corporate spending has fundamentally changed. Meanwhile, AI-native companies, infrastructure providers, and transformation teams are spending at unprecedented levels, but they're a different buyer with different motivations, different organizational homes for their budgets, and different definitions of success.

Understanding this transition is essential for anyone building or scaling a business in 2026. The question isn't just "How do we grow 132%?" It's "How do we identify where the actual budget is, who controls it, how to reach them, and what value proposition actually resonates in an AI-transformed landscape?" This article explores those questions in depth, examining not just what happened at Saa Str AI 2026, but what it reveals about broader market dynamics and how your business should adapt.

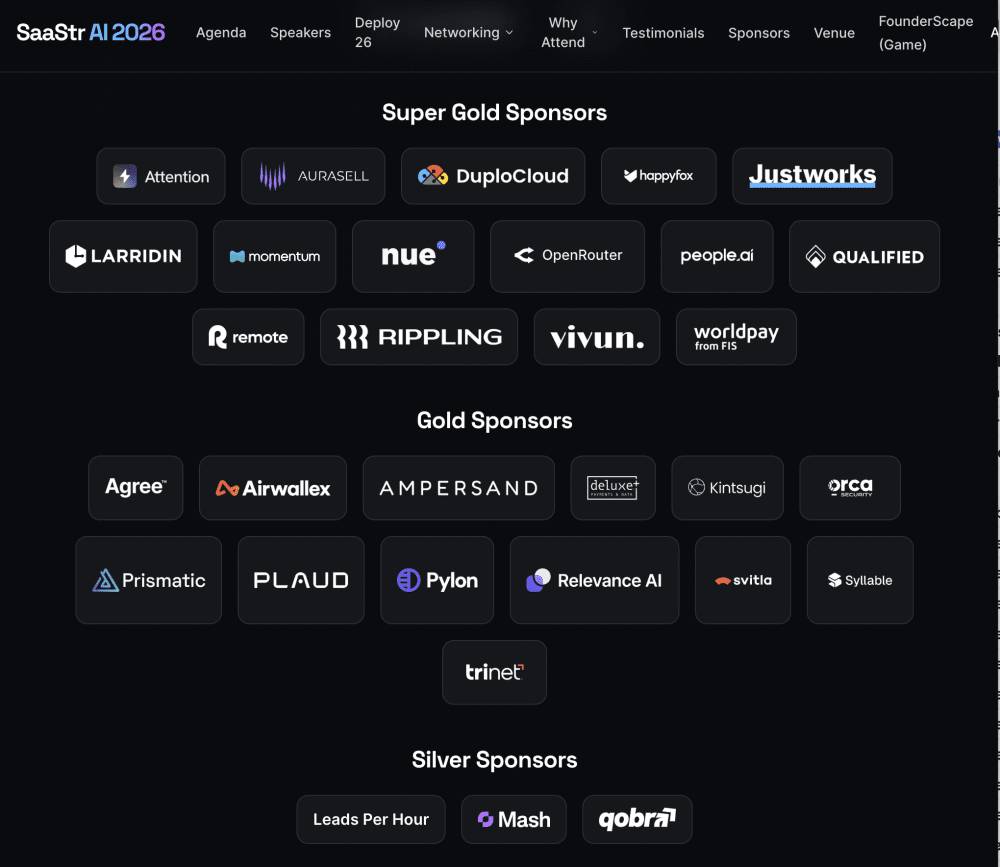

In 2025-2026, AI budgets were primarily allocated to new structures such as Chief AI Officer teams and strategic initiative funds, highlighting a shift in budget control. (Estimated data)

Part 1: The Collapse of the Traditional B2B Sponsorship Model

The 100% Sponsor Erosion: When Yesterday's Core Customers Disappear

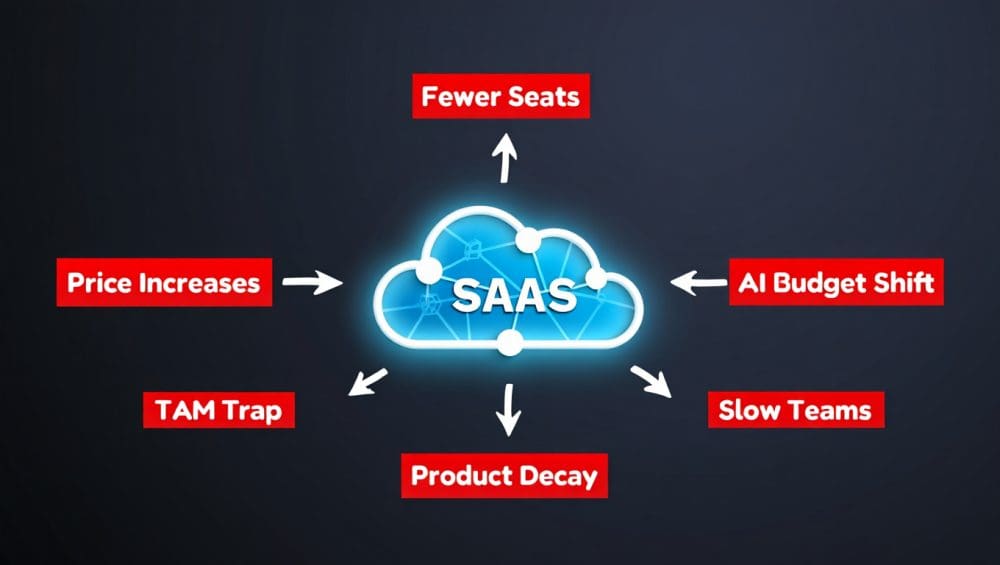

Let's start with the starkest number in this entire story: Saa Str lost almost 100% of its non-AI sponsors from the 2018-2023 era. This wasn't a gradual decline. This wasn't a segment that reduced spending by 30% or 40% and remained part of the mix. This was near-complete withdrawal.

The companies that historically represented the bread-and-butter of B2B conference sponsorships—mid-market and enterprise software vendors with mature go-to-market motions built on events, content marketing, and community engagement—essentially stopped spending. Not on Saa Str alone, but across the entire conference ecosystem. The rationale wasn't irrational cost-cutting. It was strategic reallocation.

These traditional B2B vendors (sales enablement platforms, customer success software, marketing automation tools, analytics platforms) built their entire buyer acquisition machinery around events. The formula was proven: sponsor a top-tier conference, activate your sales team to work the booth, generate pipeline, close deals. It worked for years. The ROI math was straightforward and defensible to finance. In some cases, these sponsors had five-, ten-, or even fifteen-year relationships with major conferences.

But in 2023-2025, something broke. Growth rates at these traditional vendors slowed. In many cases, not because they were poorly managed companies, but because the buying behavior of their customers changed. As enterprise customers became increasingly focused on AI readiness—evaluating AI infrastructure, considering AI-native alternatives to existing solutions, redirecting budget toward transformation initiatives—they stopped prioritizing incremental improvements to existing software categories. A VP of Sales considering whether to renew her team's sales enablement platform suddenly had a very different question on her mind: "Do we need a completely different approach to how we sell in an AI world?"

When enterprise customers pull back on evaluation activity for traditional software categories, the sponsorship ROI for vendors in those categories collapses. Why spend $250,000 to sponsor a conference when the decision-makers you need to reach have become passive buyers, waiting to see how AI shakes out before making major commitments? The answer: you don't. You redeploy that budget toward product transformation, AI capability building, or cost reduction.

Why Traditional Vendors Couldn't Just Pivot

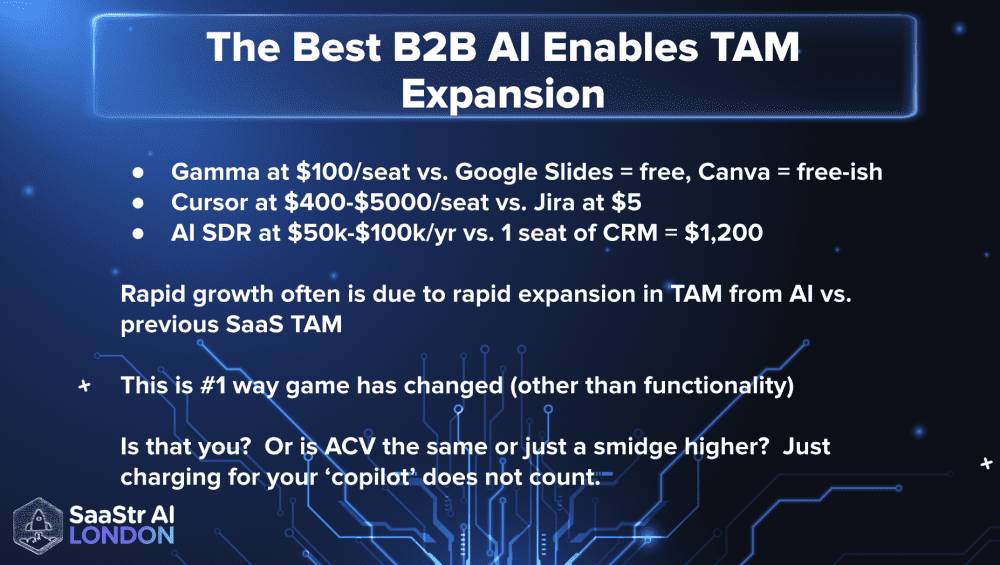

One might ask: couldn't these traditional vendors simply reposition themselves as "AI-powered" and continue sponsoring? The answer is more complicated than it appears. While many of them added AI features to their products (which became almost mandatory by 2025), they faced a fundamental credibility problem. An AI feature bolted onto a platform originally built without AI at its core couldn't compete head-to-head with companies where AI infrastructure and AI-first design were foundational architectural decisions.

Moreover, many of these vendors faced real resource constraints. Companies whose growth had slowed or plateaued in 2023-2024 faced pressure to improve profitability. When you're a public company whose stock has declined 40-60% (a common occurrence for mature Saa S vendors in 2023-2024), you don't start investing aggressively in new market positioning and AI transformation. You optimize, you consolidate, and you reduce discretionary spending—which includes conference sponsorships with uncertain ROI.

The strategic math became clear: sponsoring traditional B2B conferences was increasingly a mature marketing tactic for mature companies in defensive positions. Those companies chose to preserve cash rather than make bets on visibility at events where the buyer base was increasingly distracted by AI considerations.

The Ripple Effect: What Disappeared Beyond Just Sponsorships

The impact extended beyond sponsorship budgets. When these traditional vendors pulled back from conferences, they also reduced:

- Speaking submissions and thought leadership presence — Fewer speakers meant less content creation, fewer reasons for their customers to attend

- Booth activation budgets — Teams that weren't staffed for the event

- Partner activation and ecosystem collaborations — The complex web of partnerships that made conferences valuable for deal creation

- Media and analyst briefings — Entire programs built around connecting these vendors with journalists and influencers

In essence, Saa Str lost not just the revenue from sponsor badges and booth fees, but the entire infrastructure of attendee gravity that these vendors represented. When a major enterprise software vendor shows up to a conference with a large team, it creates a magnet effect: their customers attend to see them, partners show up to meet with them, investors track which vendors are getting the most attention. Lose that vendor entirely, and you lose multiple layers of attendance and engagement.

Quantifying the Real Impact: From Sponsorship Loss to Attendance Decline

This is the critical connection that many observers missed: the loss of traditional sponsors wasn't just about revenue. It was about the entire conference value proposition. Without these vendors present and activating, existing attendees had fewer reasons to attend. Why would a VP of Customer Success at a Series B company fly to San Francisco if the vendors they wanted to see had decided to sit out?

This meant Saa Str faced a compounding problem:

- Sponsor loss → Revenue decline

- Sponsor loss → Reduced conference gravity and content relevance for traditional buyers

- Reduced gravity → Attendance decline

- Attendance decline → Further sponsor loss (conferences with declining attendance become less valuable sponsorships)

Without intervention, this becomes a death spiral. And it's a spiral that actually happened to numerous industry conferences starting in 2023-2024. Conferences that failed to recognize and adapt to this dynamic found themselves with both declining sponsorships and declining attendance, creating a downward cycle that proved difficult to reverse.

Part 2: The AI Budget Emerges—And It's Not Where You Think It Is

Understanding the Budget Migration: Where AI Money Actually Lives

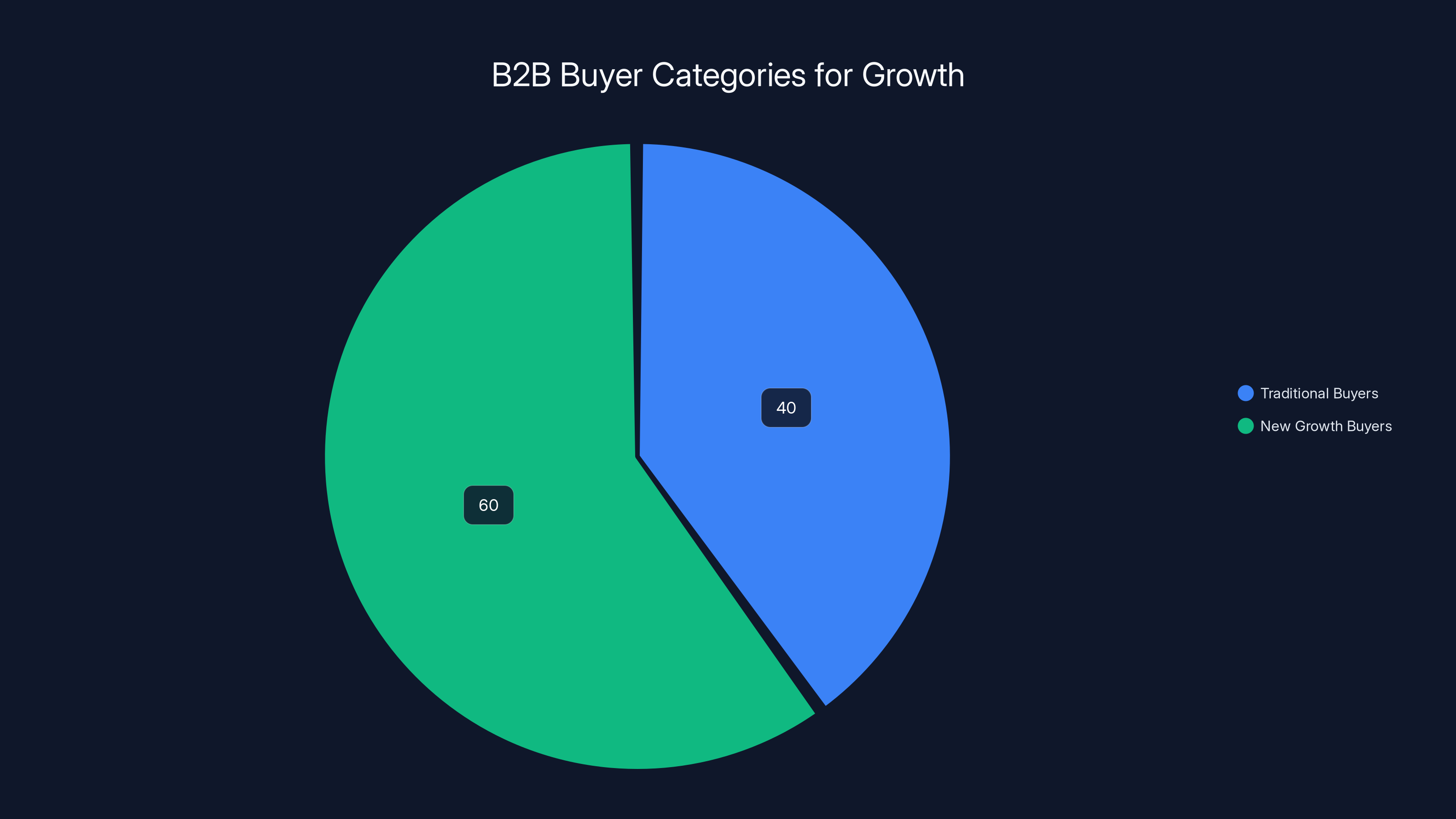

The crucial insight that separates companies that thrived in 2025-2026 from those that struggled is this: the appearance of AI budgets didn't come from reallocating existing marketing or software budgets. It came from entirely new sources, often housed in organizational structures that traditional B2B vendors had never needed to reach before.

In many enterprises, when AI became a strategic priority, companies didn't simply hand AI transformation responsibilities to existing departments. Instead, they created new structures:

- Chief AI Officer roles and dedicated AI transformation teams — Reporting directly to the CEO or Chief Technology Officer, separate from existing IT/software procurement processes

- Strategic initiative funds — Often under direct CEO or Board level control, with budgeting independent of normal departmental processes

- Venture capital and innovation arms within enterprises — Many large corporations created dedicated investment vehicles to explore and acquire AI capabilities

- Transformation budgets — Separate from Op Ex software budgets, these funds were allocated specifically for organizational change initiatives related to AI

This matters enormously because it means the budget holders are different people in different positions with different reporting structures, different approval processes, and different success metrics than the traditional software buyers that companies like Saa Str had been reaching for decades.

A VP of Sales doesn't control the Chief AI Officer's budget. A VP of Customer Success doesn't have influence over transformation funds. The organizational chart matters in ways that had been invisible to traditional B2B vendors for years.

New Money + New Buyers + New Motivations = Completely Different Sales Problem

When Saa Str approached companies about sponsoring Saa Str AI 2026, they weren't reaching the same person from the same company with the same budget as they would have in 2023. They were reaching:

AI-native companies with venture capital and early revenue that's being funneled directly into go-to-market and visibility. Companies like Databricks, Replit, and others that appeared as sponsors didn't exist or didn't have meaningful budgets five years ago. These companies are spending aggressively on brand building and market presence because they're trying to establish themselves in a rapidly growing category before the market consolidates.

Infrastructure providers that have entered a new growth phase because AI infrastructure is now central to enterprise technology spending. Google Cloud, which doubled down as an AI infrastructure platform sponsor, wasn't necessarily increasing its overall software conference budget—it was reallocating where within its portfolio that budget went, and increasingly that meant AI-focused events.

Transformation leaders and enterprise CTOs who suddenly have budget authority related to AI capabilities and want to understand how to evaluate and implement solutions. These buyers might work at the same companies that lost sponsorship power (a Fortune 500 enterprise), but they're different people with different budgets.

Incumbents with dedicated AI transformation budgets like major cloud providers and enterprise software vendors that realized they had to compete in the AI space or risk irrelevance. These companies understood that reaching "the people building and deploying AI in B2B" was a different marketing challenge than reaching traditional software buyers.

Each of these buyer segments had budget available. Each had motivation to learn about AI-native companies, infrastructure options, and transformation approaches. Each needed something different from a sponsorship relationship.

The Organizational Budget Realities That Nobody Talks About

Here's something that rarely gets discussed openly in business literature: in many companies, people are not actually deciding between Option A and Option B from the same budget bucket. They're making decisions where Budget A exists in one department, Budget B exists somewhere else, and the two are essentially invisible to each other.

A Chief Marketing Officer might have frozen events spending in 2024 (your traditional sponsorship buyer). Meanwhile, the Chief AI Officer or transformation leader at the same company might have an untapped $5 million AI transformation budget sitting there. These are not competing allocations from the same pie—they're entirely separate resource pools.

For traditional B2B vendors trying to reach "the enterprise customer," this created a crisis. The people they had relationships with (VP of Sales, VP of Customer Success) were increasingly operating under constrained budgets and less strategic urgency. Meanwhile, new budget holders with significant resources were operating under the radar of traditional vendor relationships.

Saa Str's strategic adaptation involved recognizing this reality and building an entirely different sponsorship narrative, targeting a different set of buyers, and communicating a different value proposition to justify sponsorship spending from these new budget sources.

Quantifying New Budget Availability

While there's no single industry-wide survey on "total AI transformation budgets in enterprises," various signals point to substantial reallocation:

- Gartner reported that 72% of executives increased their AI budgets in 2024-2025, even as overall IT budgets remained relatively flat

- McKinsey's State of AI found that companies allocating dedicated transformation budgets for AI have budgets 2-3x larger than companies trying to fit AI into existing departmental budgets

- Enterprise software vendors reported that customers are increasingly using separate purchasing channels and approval processes for AI-related initiatives — suggesting distinct budget categories rather than reallocations from existing spending

These data points suggest something important: the total amount of budget available for Saa Str sponsorship in 2026 might actually be higher than it was in 2023, despite the collapse of traditional vendor spending. But accessing it requires reaching different people in different departments through different value propositions.

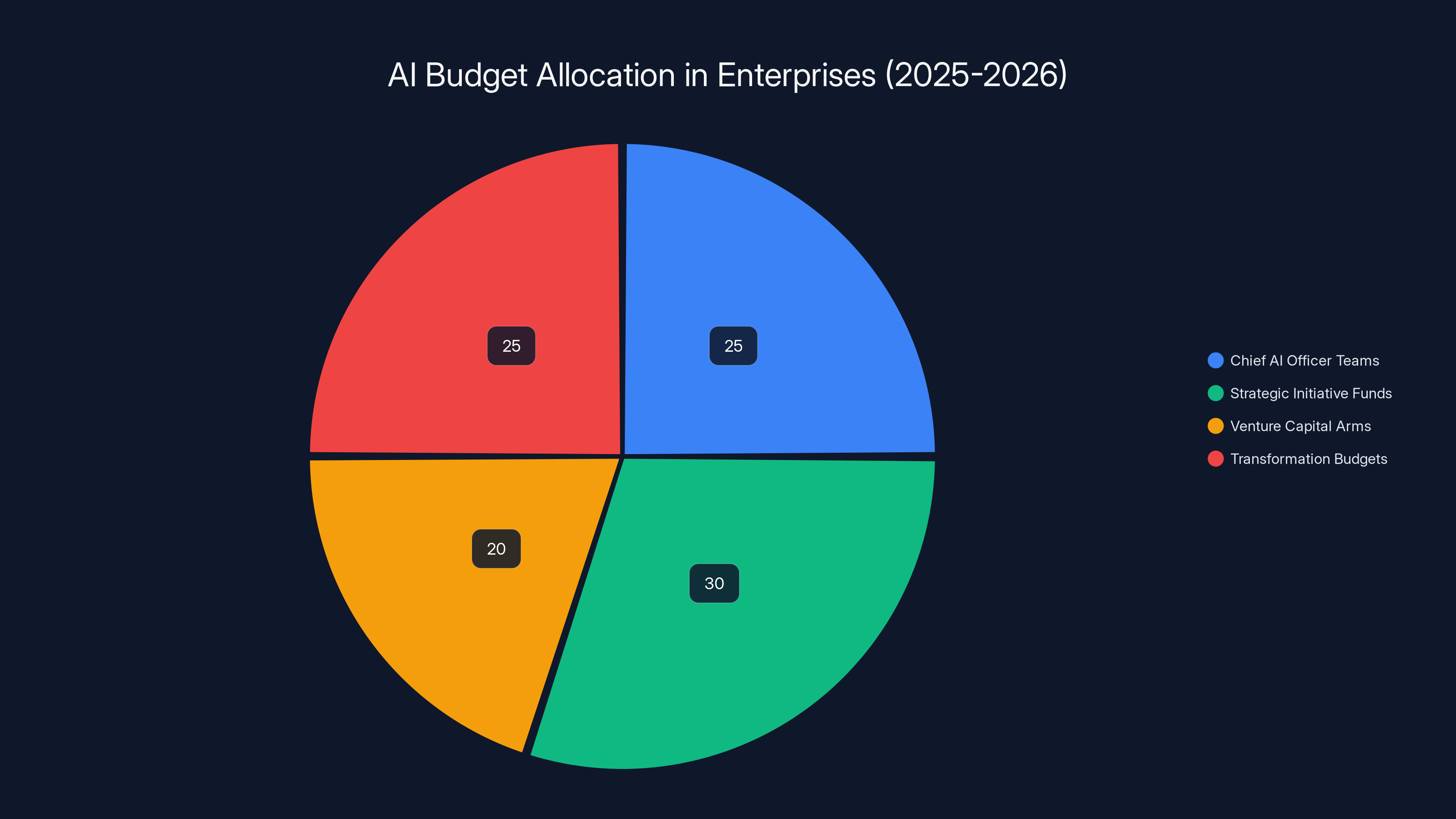

Estimated data suggests that new growth buyers account for 60% of potential growth, highlighting the need for B2B companies to shift focus from traditional buyers.

Part 3: The Shift in Attendee Composition—What Conference Growth Actually Means

Not All Growth Is Equal: The Attendee Transformation

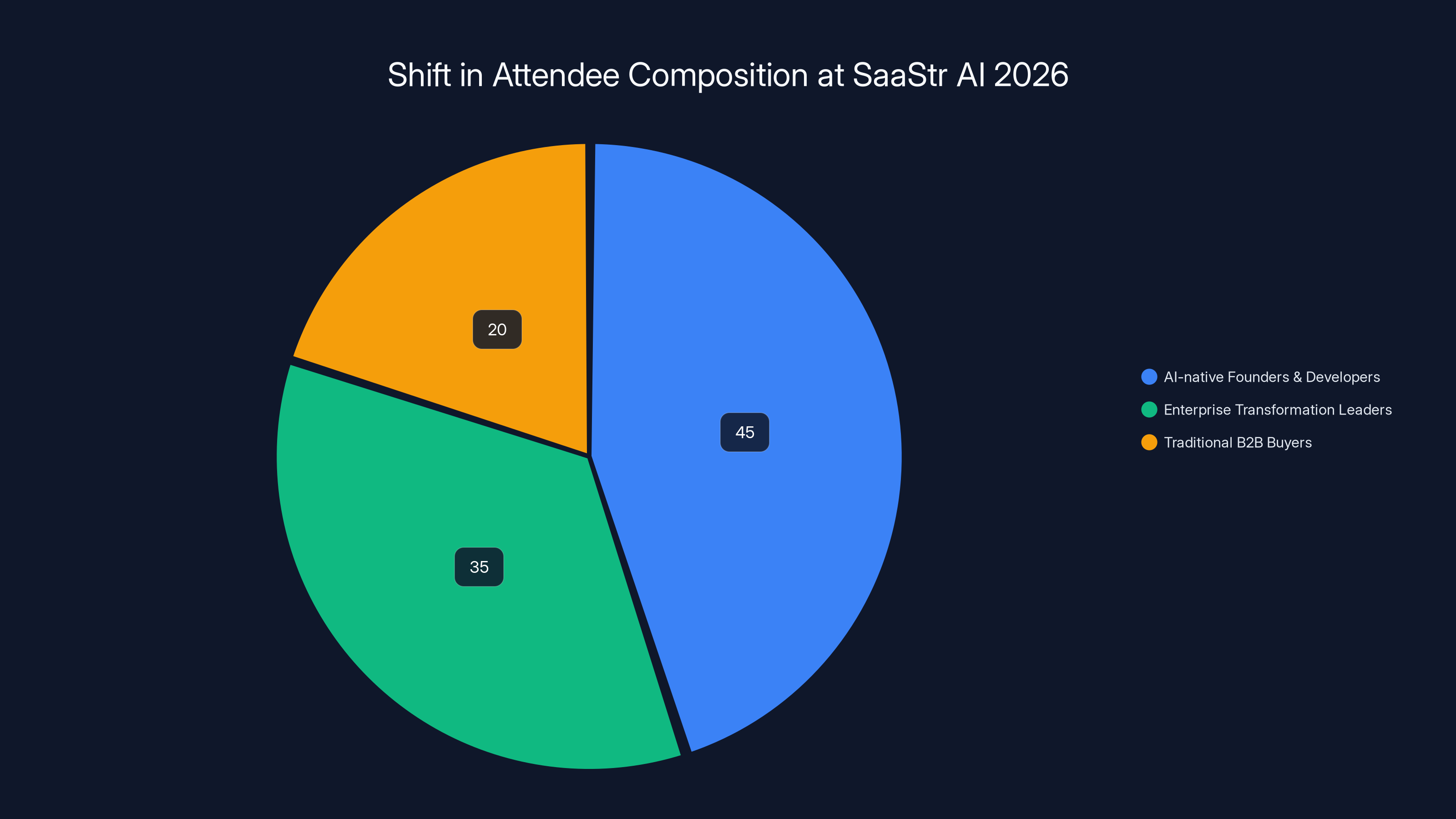

When Saa Str AI 2026 achieved 132% attendance growth compared to the previous year, the headline seems unambiguously positive. More people, more energy, larger impact. But the actual story is considerably more nuanced: while total attendance went up 132%, attendance from traditional B2B buyers went down materially.

This is perhaps the most important and least understood aspect of the conference ecosystem transformation. A 132% increase in total attendees coupled with a significant decrease in legacy buyer attendance means the conference attracted a completely different audience. The question isn't just "Did we grow?" but "Did we grow with the people we need to reach?"

For Saa Str, the answer was strategically positive but operationally challenging. The new attendees—AI-native founders, developers, transformation leaders, infrastructure-focused operators—are exactly the people who care most about the latest AI developments, who are making decisions about AI-powered solutions, and who have budget to spend. But they bring different expectations, different levels of expertise, and different definitions of conference value than traditional B2B software buyers.

Who Shows Up When Traditional Buyers Disappear

The 2026 Saa Str AI attendee base shows meaningful representation from:

AI-native founders and developers — People building AI-powered applications, infrastructure, and tools. They're attending because Saa Str provides visibility into market opportunities, investor presence, and peer networks for AI-first companies. They're younger on average, more technical, and increasingly important to enterprise buyer decisions (because enterprises now listen to developers when making AI infrastructure decisions in ways they didn't for traditional software categories).

Enterprise transformation leaders and innovation teams — CIOs, CTOs, Chief AI Officers, and heads of digital transformation at large enterprises. They're attending to understand what's available, who's innovating, and how their organizations should position themselves in an AI-transformed landscape. This is a growing attendee category at AI-focused conferences and represents genuine enterprise budget holders.

Operators trying to evaluate AI implementation options — VPs of Product, Product Managers, and operational leaders at existing companies trying to figure out how to integrate AI into their products, processes, and go-to-market strategies. This is perhaps the most commercially important attendee category (these people make purchasing decisions), but also the most uncertain about their own needs (they don't yet know what AI-powered features they actually need or how to evaluate solutions).

Infrastructure and platform providers — Teams from Google Cloud, AWS, Azure, and other players trying to connect with developers and architects who will drive adoption. These companies send larger delegations to AI-focused conferences than they might send to traditional B2B conferences, further boosting total attendance numbers.

Investors increasingly focused on AI opportunities — VCs, angels, and corporate development teams looking for portfolio companies, acquisition candidates, and investment theses. The presence of investors increases the prestige and strategic importance of the conference in ways that matter to founders and company leaders.

Why Traditional Buyer Absence Matters Despite Growth

This is a critical subtlety that can be missed: attending the conference might still be important, but for different reasons than it was in 2022.

For a traditional software vendor in 2022, attending Saa Str made sense because:

- Their target buyers (VPs of Sales, Customer Success leaders) would be present

- Competitors would be there, creating urgency

- Industry thought leaders would be speaking

- Their own customers would be in attendance

These conditions created a self-reinforcing attendance dynamic. Fewer of these conditions exist in 2026.

A VP of Sales at a Series B company might still value attending Saa Str, but the value proposition changed. The attendees they want to network with have changed (fewer sales ops peers, more AI-focused operators). The content that matters to their role has shifted (less about sales methodology, more about AI-powered selling). The sponsors they want to connect with have shifted (fewer sales enablement vendors, more AI infrastructure companies).

This creates a legitimate challenge for companies serving traditional software categories: if their target buyers show up in smaller numbers, and they're less engaged (because the conference content is increasingly focused on AI), what's the ROI of attendance? A conference where attendance grew 132% but your primary buyer category appears in smaller numbers is actually worse for your go-to-market than a conference where attendance was flat but your buyer concentration was strong.

The Positive Externality: Growth in the Right Directions

That said, for Saa Str specifically, the growth in AI-native founders, transformation leaders, and infrastructure-focused attendees was strategically valuable. These attendees have several characteristics that make them valuable conference participants:

- High business-forming potential — The probability that meeting Person A and Person B at a conference leads to a business relationship is higher in the AI community than in mature, established categories

- Budget influence and deployment — Transformation leaders are often involved in purchase decisions with budgets that include sponsorships and vendor relationships

- Long-term strategic importance — Many companies making decisions about AI infrastructure in 2026 are still in early phases of AI deployment and will be expanding those programs for years

So while traditional buyer absence is real and represents a challenge, the growth in these other segments wasn't just a numerical gain—it was growth in segments that offered genuine strategic value to the conference and its remaining sponsors.

Part 4: The New Sponsor Profile—Who's Spending in 2026

AI Companies as the Core Sponsor Base: A Structural Shift

Examine the 2026 Saa Str AI sponsor list and one pattern becomes immediately obvious: almost all remaining major sponsors are companies that have, in some way, become AI companies. Databricks, Replit, Google Cloud, Artisan, Monaco—these are not traditional software vendors with AI features. They're infrastructure-first, AI-native, or AI-infrastructure companies.

This represents a fundamental shift in the value equation for conference sponsorships. In previous eras, sponsoring a B2B conference made sense if it allowed you to reach and influence your target buyer. Saa Str in 2023 made sense for sales enablement vendors because sales and sales operations leaders would be in the room.

But the 2026 value proposition for sponsors is entirely different. Google Cloud, for instance, is not sponsoring Saa Str AI primarily to reach sales operations leaders (though that would have been the dynamic in 2023). Google is sponsoring to:

- Establish infrastructure dominance — Reach developers and architects who are evaluating cloud and AI infrastructure options

- Position transformation narrative — Show enterprises that Google understands and can enable AI transformation

- Build developer mindshare — Investment in the developer community because developers now influence cloud infrastructure decisions in ways they didn't five years ago

- Signal seriousness about AI — Market presence at top AI conferences has become a brand requirement for companies that want to be perceived as AI leaders

Each of these rationales is different from traditional B2B sponsorship thinking, and each implies different expectations for what a sponsorship should deliver.

Why AI-Native Companies Are Spending at Scale

AI-native companies (Databricks, Replit, etc.) have their own sponsorship logic, and it's rooted in very different business circumstances:

These companies typically have:

- Significant venture capital funding specifically allocated to go-to-market

- Urgent need to establish market presence before the category consolidates (which it will)

- Developer-focused buyer motions where community events and conference presence drive adoption

- Need to build brand in a category where brand awareness is still being formed

For these companies, conference sponsorships aren't defensive moves (protecting existing relationships) or efficiency plays (extracting maximum ROI from limited marketing budgets). They're aggressive growth investments in a market where first-mover presence matters.

This means AI-native companies will typically spend more per sponsorship, activate more heavily, and expect different ROI metrics than traditional vendors would. They're comfortable with longer sales cycles and indirect impact because they're optimizing for market position and mindshare, not for immediate pipeline generation.

The Incumbents' New Playbook: Infrastructure Companies Competing

For large incumbents like Google Cloud, Amazon Web Services, and Microsoft Azure, the sponsorship rationale is nuanced. These companies have:

- Massive resources to support multiple go-to-market strategies simultaneously

- Deep understanding of the value of enterprise relationships, including the importance of developer and architect influence

- Specific strategic goals around AI infrastructure adoption and cloud-native deployment

- Ability to monetize sponsorship relationships across multiple business lines (if an architect becomes an AWS evangelist, that's valuable across many customer relationships)

What's notable is that these companies aren't necessarily spending more in absolute terms than they did in 2023. Instead, they're reallocating where within their enormous marketing budgets they're investing. They're doubling down on AI-focused conferences while potentially reducing spending at traditional software conferences.

This reallocation is particularly important because it suggests that infrastructure companies aren't trying to compensate for traditional vendor withdrawal—they're capitalizing on it. As traditional competitors withdraw from the conference ecosystem, infrastructure players can increase their presence without spending dramatically more, because there's less competition for sponsorship inventory and attendee mindshare.

Why This Sponsor Composition Creates Risks and Opportunities

The new sponsor base creates both opportunities and vulnerabilities for Saa Str and conferences like it:

Opportunities:

- AI-native and infrastructure companies typically have better unit economics and higher growth rates than traditional software vendors, suggesting more sustainable sponsorship relationships

- These companies are more likely to be growth-stage, suggesting multi-year sponsorship relationships as they scale

- Different sponsorship base means different sponsor requirements and value propositions, creating opportunities to innovate sponsorship packages

Risks:

- AI-native companies face higher failure rates—some of today's sponsors may not exist in three years

- Infrastructure companies can lose interest in conferences as categories mature (e.g., when cloud infrastructure became commoditized, cloud company sponsorship at developer conferences declined)

- Concentration risk—if sponsorship base becomes too concentrated in AI-native and infrastructure companies, the conference becomes vulnerable if that market segment consolidates or cools

Part 5: Recasting the Value Proposition—What Sponsorship Actually Means in 2026

From "Reach Saa S Buyers" to "Reach AI Builders"

One of the most consequential strategic decisions Saa Str made was completely reframing what sponsorship means. This wasn't about changing colors on the sponsorship brochure or updating logo placement. It was about fundamentally changing what the conference promises sponsors.

2023 Sponsorship Value Proposition: "Reach key decision-makers at Saa S companies including VP of Sales, VP of Customer Success, CFO, and VP of Marketing. These are the people who evaluate, purchase, and deploy software solutions in their organizations. Booth presence creates opportunities for direct meetings, pipeline generation, and relationship building."

2026 Sponsorship Value Proposition: "Reach the people building and deploying AI in B2B companies and AI-native organizations. This includes developers and architects making infrastructure decisions, transformation leaders evaluating AI capabilities, founders and teams building AI-powered products, and enterprise leaders setting AI strategy. Engagement happens through product demonstrations, technical workshops, networking with peers, and access to decision-makers evaluating AI solutions."

These sound similar on the surface, but they're actually addressing entirely different buyer segments, with different decision-making processes and different definitions of success. A sales enablement vendor needs VP of Sales presence. An AI infrastructure company needs architects and developers who influence technology decisions. A transformation consulting company needs Chief AI Officers and innovation leaders.

The shift matters because it means:

- Different messaging required — Companies can't use the same sponsorship materials to appeal to multiple sponsor segments

- Different expectations — Sponsors are evaluating value through different lenses (pipeline metrics, market positioning, developer engagement, brand awareness, etc.)

- Different activation requirements — What a successful sponsorship looks like for a developer-focused company is different from what success looks like for a vendor selling to C-suite buyers

- Different content and programming — The conference itself needs to attract the right attendees through content and speakers that resonate with these new buyer profiles

The Budget Holder Shift: Reaching Different Purchasers

Beyond the attendee shift, there's a critical organizational shift in who actually makes the sponsorship decision. In 2023, sponsorship decisions at enterprises were made by:

- Chief Marketing Officers — With budgets allocated through marketing department processes

- VP of Demand Generation — Often responsible for events as a demand generation channel

- VP of Corporate Communications — For brand and thought leadership sponsorships

These people had relatively limited budgets and clear expectations about ROI (pipeline, leads, brand awareness, thought leadership positioning). Their approval processes typically involved clear metrics and relatively short decision cycles.

In 2026, new budget holders emerged:

- Chief Technology Officer or Chief AI Officer — With budgets allocated for transformation or strategic initiatives, often larger than marketing allocations

- Head of Developer Relations or Developer Advocacy — With specific budget for engaging developer communities

- VP of Strategic Partnerships or Innovation — With responsibility for evaluating external vendors, partners, and community engagement

- Chief Innovation Officer or similar role — Responsible for exploring new technologies and approaches

These decision-makers have:

- Larger budgets — Strategic/transformation budgets often exceed traditional marketing budgets

- Different approval processes — May require fewer sign-offs or operate with different governance

- Longer evaluation cycles — These are strategic decisions, not tactical ones

- Different success metrics — ROI might be measured in team learning, relationship building, market intelligence, or strategic positioning rather than immediate pipeline

Reaching these budget holders requires different tactics than reaching CMOs and demand gen VPs. You can't run a sponsorship sales process the same way across both cohorts. Saa Str's 2026 success partly came from recognizing these organizational differences and building sponsorship sales approaches that work for both traditional marketing decision-makers (who still exist and still have budgets) and new strategic decision-makers (who have even larger budgets but work differently).

Creating Multiple Value Narratives for the Same Conference

This is where Saa Str's innovation becomes particularly clear: they didn't create one sponsorship message and blast it out. They created multiple value narratives, each tailored to different types of potential sponsors:

For AI-native companies: "Reach developers, founders, and investors who are evaluating and investing in AI technology. Position your company as the go-to platform/tool for [specific use case]. Build community and mindshare with the people most likely to become users and advocates."

For infrastructure providers: "Reach architects and developers making infrastructure decisions. Demonstrate your platform's capabilities for AI workloads. Build enterprise relationships through direct engagement with the decision-makers and influencers."

For transformation leaders and consulting firms: "Reach C-suite executives and innovation leaders responsible for AI transformation strategy. Position your expertise and services as the go-to partner for AI implementation and strategy. Participate in thought leadership discussions that shape enterprise AI direction."

For enterprise software vendors: "Connect with peers and customers navigating AI transformation. Demonstrate how your product is evolving for the AI era. Position your company as a thoughtful player in AI evolution rather than a legacy vendor playing catch-up."

Each narrative emphasizes different aspects of the same conference (different attendee segments, different types of interactions, different outcomes). By tailoring messaging to different sponsor profiles, Saa Str was able to appeal to multiple budget holders and budget categories simultaneously.

This approach is particularly clever because it allows the conference to grow sponsorship revenue without requiring dramatic increases in conference size or quality. Instead, it diversifies the sponsor base across multiple buyer segments, each of which has different expectations and different definitions of value.

Estimated data shows a significant shift in budget allocation towards AI transformation and strategic initiatives, reflecting changing business priorities.

Part 6: What This Means for B2B Go-to-Market Strategy

Lesson 1: Your Traditional Buyers Might Not Be Your Growth Buyers

The most important takeaway from Saa Str's transformation is this: the people who bought from you in 2022 might not be the people who drive growth in 2026. This isn't because your existing customers are irrelevant. It's because the growth opportunities have shifted.

For Saa Str, the traditional B2B software vendors (the existing sponsor base) still might use the conference, but they're not the growth lever anymore. The growth comes from completely different buyers with completely different motivations and budget sources.

For B2B companies selling solutions, this has direct implications:

- Your existing buyer persona might be less strategic than you think — If the people you've been targeting historically are under budget pressure and making conservative decisions, while new categories of buyers are in expansion mode, it might be time to shift your messaging and targeting

- You might need to build entirely new sales and marketing motions — Reaching traditional buyers and reaching new growth buyers might require different approaches, different teams, and different channels

- Your content might be optimized for the wrong audience — If your marketing content was built to address traditional buyer concerns (ROI, integration, implementation), but your actual growth buyers are concerned with strategic transformation and organizational change, your content isn't optimized

For companies building in the B2B space, the pattern looks like this: identify where budget is actually available and who controls it (it might not be who you thought). Build messaging and go-to-market strategies designed specifically for those buyers. Maintain relationships with existing buyers, but recognize that growth often comes from expanding into new buyer categories rather than squeezing more value from existing ones.

Lesson 2: Budget Categories Matter More Than Budget Size

Traditional B2B sales thinking focused on company size and revenue as proxies for budget availability. Larger companies = more budget. But the Saa Str story suggests a more nuanced reality: what matters is whether budget is available in a category relevant to your solution.

A Fortune 500 company might have a CMO with a

This has profound implications for prospecting and sales strategy:

- Research budget categories, not just company size — Understand the organizational structures at your target accounts and which budget holders actually fund solutions in your category

- Map to multiple buyer profiles — The same company might have multiple decision-makers with different budgets relevant to your solution

- Tailor messaging to budget reality — A Chief AI Officer considering your solution will have different concerns, different approval processes, and different success metrics than a VP of Sales would. Your messaging should address those differences

Lesson 3: Market Timing and Category Maturity Drive Sponsorship Value

The Saa Str story also illustrates something often overlooked: sponsorship value and conference growth can be driven by where a market is in its adoption cycle.

In 2022-2023, the traditional software conference space was in mature equilibrium. Sponsorship value was stable because buyer behavior was predictable. Budget allocation was predictable. The market wasn't transforming.

By 2025-2026, AI had become a strategic priority for most enterprises, but adoption and implementation were still in relatively early phases. This moment of transformation created urgency, which drove:

- New budget allocation — Budget moved into new categories

- New buyer involvement — New people with responsibility for AI decisions

- New value in thought leadership and community — Companies wanted to understand how peers were approaching AI transformation

- Conferences focused on transformation — These became more valuable because they addressed the question "What should we do about AI?"

For B2B companies, this suggests an opportunity pattern: markets in the midst of transformation often have more available budget, more receptive buyers, and more value in community and thought leadership than mature, stable markets. Timing your entry or growth investments based on where markets are in adoption cycles can significantly impact growth rates.

Lesson 4: Your Go-To-Market Playbook Needs to Evolve When Markets Shift

This might be the most important meta-lesson: companies that achieved 132% growth didn't get there by executing the "playbook" from 2023 better. They got there by recognizing the playbook was broken and building a new one.

Saa Str didn't grow 132% by:

- Selling sponsorships harder

- Running the same sales process with more efficiency

- Asking existing sponsors to increase spending

- Pushing more marketing toward the traditional vendor audience

They grew 132% by:

- Recognizing budget had moved to new sources

- Identifying new buyer personas and building sponsorship narratives tailored to them

- Understanding that conference value had shifted from "reach our traditional buyers" to "reach the people building AI"

- Making intentional decisions about which buyer segments to pursue and which to accept would shrink

For your business, the relevant question is: Which aspects of your current go-to-market playbook are dependent on market conditions that might be changing? What happens to your business if the buyers you've traditionally reached become passive? What new buyer segments might be emerging that you haven't yet reached? What new budget categories might be appearing?

The companies that thrive in periods of market transition are the ones that can answer these questions and adapt before they're forced to.

Part 7: Practical Frameworks for Identifying Where Budget Actually Lives

Framework 1: The Budget Location Matrix

One way to systematically think about where budget is available is to map it across two dimensions:

Dimension 1: Budget Category

- Operational software budgets (IT department, managed by procurement)

- Marketing and go-to-market budgets (CMO/VP Marketing, managed through demand gen or brand)

- Transformation/strategic initiative budgets (CEO, CFO, CTO level, often outside normal budget cycles)

- Venture/growth budgets (VC-backed companies, innovation arms of enterprises)

- Operational efficiency/cost reduction budgets (COO, CFO)

Dimension 2: Strategic Priority Alignment

- Core to business strategy (high likelihood of budget availability)

- Important but not core (moderate likelihood of budget availability)

- Nice-to-have or defensive (low likelihood of budget availability)

Your solution maps onto specific intersections in this matrix. Sales enablement software maps to "marketing budgets + important but not core." AI infrastructure maps to "strategic initiative budgets + core to strategy." Understanding where your solution lands helps you understand:

- Who actually has budget — Different roles control different budget categories

- How available that budget is — Strategic priorities have more available budget than nice-to-have categories

- What the approval process looks like — Transformation budgets have different approval criteria than operational budgets

- What success metrics matter — Different budget categories use different ROI frameworks

Framework 2: The Buyer Hierarchy Map

Instead of assuming one buyer per company, create a map of all potential buyers for your solution and understand:

For each buyer profile:

- What's their title and organizational role?

- What budget category do they control or influence?

- What's the size of that budget?

- What problem are they trying to solve?

- What success metrics matter to them?

- What information do they need to make a decision?

- How long is their decision cycle?

For example, let's say you sell data infrastructure software. Your buyer hierarchy might look like:

| Buyer Profile | Budget Category | Budget Size | Problem Statement | Timeline |

|---|---|---|---|---|

| VP of Data Engineering | Operational IT | $2-5M | Improve data pipeline efficiency | 6-9 months |

| Chief Data Officer | Strategic/Transformation | $10-20M | Build data-driven competitive advantage | 3-6 months (urgent) |

| VP of Analytics | Marketing/Analytics | $1-2M | Improve report generation and dashboards | 9-12 months |

| CTO | Strategic/Infrastructure | $5-10M | Modernize technical architecture | 6-12 months |

Understanding this full landscape prevents you from optimizing your sales and marketing motion around one buyer (VP of Data Engineering) when the Chief Data Officer might be a faster, larger deal. It also helps you understand why the same company might have multiple buying processes happening simultaneously through different channels.

Framework 3: The Budget Migration Detector

As markets shift and transform, budget flows from old categories to new ones. You can detect these migrations by monitoring:

Organizational signals:

- New executive roles being created (Chief AI Officer, Chief Transformation Officer)

- New departments or teams being formed (AI governance, Digital transformation office)

- Reporting line changes (Data moving from IT to Business, for example)

- New committees or governance structures

Spending signals:

- Conference and event attendance patterns (What conferences are companies now sponsoring? What changed from last year?)

- Hiring patterns (What roles are being hired? What departments are growing?)

- Acquisition and partnership activity (What types of companies are being acquired or partnered with?)

- Analyst report reads and searches (What are customers researching?)

Language signals:

- Executive communications about strategic priorities

- Quarterly earnings calls and investor updates

- Job postings and organizational announcements

- RFP language and evaluation criteria

By monitoring these signals, you can identify emerging buyer segments and budget categories before they become obvious to competitors.

Part 8: The Organizational Changes That Enabled the Shift

Why Organizational Structure Matters More Than Most Realize

One of the overlooked factors in Saa Str's 2026 success was organizational change. The conference had to evolve not just its sales approach and messaging, but its internal structure to actually execute against these new buyer segments.

Specifically, Saa Str likely needed to:

Expand its sponsorship sales team with people who understand and can credibly reach:

- Infrastructure company procurement and marketing teams

- Chief AI Officer offices

- Innovation and transformation teams at enterprises

These teams operate differently from traditional software vendor marketing departments. Someone skilled at selling sponsorships to VP of Marketing at a sales software company might struggle to sell to a Chief AI Officer or a developer relations team at Google Cloud because the language, value proposition, and approval process are completely different.

Evolve event programming to attract new attendee segments. This means:

- Content specifically designed for developers and architects

- Programming for transformation leaders and change management professionals

- Networking opportunities designed for founders and VCs

- Hands-on technical workshops and demonstrations

Build new conference value beyond traditional sponsorship. This includes:

- Developer community engagement programs

- Startup showcases and demo areas

- Specialized tracks and summits within the conference

- Community partnerships and collaborations

Revamp measurement and success metrics to reflect new sponsor expectations. Different sponsors need different KPIs:

- Vendor sponsors might want pipeline metrics

- Founder sponsors might want brand awareness and community metrics

- Infrastructure sponsors might want developer engagement and relationship metrics

Conferences that tried to achieve growth without making these organizational changes typically failed. They'd try to attract new sponsors while still operating as if they were primarily serving traditional B2B vendors. The mismatch would become obvious—new sponsors would attend and find the conference wasn't designed for them, wouldn't deliver on their value proposition, and wouldn't come back.

The Internal Resistance to Strategy Shifts

It's important to acknowledge that executing these organizational changes is genuinely difficult. When you've spent a decade building relationships with and understanding traditional software vendors, it's professionally risky to suddenly shift strategy toward new buyer segments that are less familiar.

Internal resistance typically comes from:

Historical knowledge and relationships — "We've built great relationships with software vendors. Why risk those by targeting new segments?"

Execution comfort — "We know how to sell to CMOs and VPs of Marketing. We don't know how to sell to Chief AI Officers and infrastructure companies."

Risk aversion — "What if we alienate our existing sponsor base? What if we overestimate demand from new segments?"

These concerns are real and valid. But the Saa Str case study shows that the risk of not adapting was actually higher than the risk of adapting. Without the strategy shift, Saa Str would have faced:

- Declining sponsorship revenue (as traditional vendors continued to withdraw)

- Declining attendance (as attendee base shifted away from traditional buyers)

- Declining relevance in an increasingly AI-focused market

The companies that don't adapt to market shifts often find themselves managing decline, not growth.

SaaStr experienced a near-total loss of non-AI sponsors from 2018 to 2023, reflecting a strategic shift in B2B vendor priorities towards AI initiatives. Estimated data.

Part 9: How This Applies to Enterprise Sales and Customer Success Motion

The Sales Implications: Your Existing Motion Might Be Optimized for Yesterday's Problem

If you're running a B2B sales organization, the Saa Str story has direct application to your sales and prospecting strategies. Specifically, it highlights how easy it is to optimize a sales process for one set of buyers while missing growth opportunities with emerging buyer segments.

Consider a traditional sales enablement vendor in 2024. Its sales team was likely:

- Prospecting VPs of Sales who had historically been the buyer

- Using case studies about sales process optimization and rep productivity

- Positioning ROI around sales cycle velocity and close rates

- Selling through a 6-9 month enterprise sales cycle to budget-conscious buyers

This sales motion was highly optimized for the traditional buyer. Reps could quickly identify who had budget (VP of Sales), what they cared about (rep productivity), what success looked like (higher close rates), and how to position solutions. The motion worked well for that buyer.

But in 2024-2025, the real growth opportunity wasn't with VPs of Sales (who were making conservative decisions). It was with:

- Chief AI Officers wanting to understand AI-powered selling approaches

- Transformation leaders trying to reimagine sales processes for an AI-native world

- Founders and early-stage companies building sales processes from scratch with AI at the core

Vendors that shifted their sales strategy to pursue these segments earlier were able to capture growth. Those that continued optimizing around the traditional VP of Sales motion found growth slowing as that buyer segment became less available.

Reprogramming Your Sales Team for New Buyer Segments

Here's the challenge that often stops companies from adapting: reprogramming a sales team for new buyer segments is operationally difficult and organizationally contentious.

You've hired sales reps with specific skills (often based on how they perform against your traditional buyer). You've built compensation structures around specific sales cycles. You've created enablement materials and playbooks targeting specific buying processes. All of this is now being asked to shift.

What actually works:

Parallel motion approach — Instead of abandoning your traditional sales motion entirely, run both simultaneously:

- Keep existing reps prospecting traditional buyers (they know how to do this, relationships exist)

- Create a specialized team focused on new buyer segments

- This allows the company to maintain revenue from existing motion while building new motion

Segment-specific packaging and positioning — Don't try to sell the same product the same way to both segments:

- For traditional buyer: "Improve your sales team's efficiency"

- For new buyers: "AI-native sales infrastructure for modern go-to-market"

- Different messaging, different sales cycle, different success metrics

New team leadership with relevant expertise — Bringing in leaders who have actual experience selling to the new buyer segments (rather than trying to teach existing leaders) accelerates time-to-competency

Specialized enablement and compensation — Sales reps pursuing new buyer segments need different training, different KPIs, and possibly different comp structures that reflect longer sales cycles or different success metrics

Companies that successfully navigate buyer segment shifts typically do so by running parallel sales motions for a period of time, proving out the new motion before potentially reallocating resources away from declining segments.

Customer Success Implications: Different Buyers Might Need Different Support

The buyer shift also affects customer success and account management. New buyer segments often have:

Different implementation needs — A vendor buyer might want to quickly integrate solutions into existing workflows. An AI-focused transformation leader might want extensive strategic advisory and change management support.

Different success metrics — A traditional software buyer might measure success by "time to value" or "user adoption." A transformation leader might measure success by "organizational capability change" or "strategic initiative progress."

Different stakeholder ecosystems — Selling to one VP of Sales is relatively straightforward. Selling to (and supporting) a Chief AI Officer often involves multiple internal stakeholders, steering committees, and strategic initiatives.

Different engagement models — Traditional software customers might need quarterly business reviews. Strategic transformation customers might need monthly advisory engagement with C-suite stakeholders.

Successful companies often segment their post-sale experience based on buyer segment, with specialized teams handling strategic transformation customers versus operational software customers. This allows CS teams to align their approach with customer expectations and outcomes.

Part 10: The Role of Market Positioning and Narrative

Why Conference Sponsorship Is Ultimately About Narrative

When you strip away all the complexity, conference sponsorship (and much of B2B go-to-market) is fundamentally about narrative. It's about telling a story that matters to a specific audience.

In 2023, the dominant narrative at B2B software conferences was: "We help you do your job better." This narrative worked because:

- Software buyers were buying solutions to specific operational problems

- The value proposition was incremental (faster, better, cheaper)

- The timeline was relatively fast (quarterly or annual buying cycles)

By 2025-2026, the dominant narrative had shifted to: "We help you transform your business for the AI era." This narrative works better for current market conditions because:

- Buyers are trying to solve existential questions (how do we survive AI disruption?)

- The value proposition is transformational, not incremental

- The timeline is strategic (multi-year transformation initiatives)

Companies and conferences that successfully shifted their narrative were rewarded with attention and budget. Those that tried to maintain the old narrative (or attempted to shoehorn new concepts into old frames) found their messaging less resonant.

Narrative Shifts in Practice: From "Software Vendor" to "Transformation Partner"

Let's look at a real example. Google Cloud's positioning shift illustrates how narrative change works:

Pre-2024 Narrative: "Google Cloud is an infrastructure provider offering compute, storage, and data services. We help enterprises migrate to the cloud and modernize their infrastructure. We compete with AWS and Azure on price, performance, and breadth of services."

This narrative was accurate and had worked well. But it positioned Google Cloud as a commodity infrastructure vendor competing on technical specifications.

2025+ Narrative: "Google Cloud is an AI infrastructure platform company. We help enterprises navigate AI transformation by providing the infrastructure, tools, and expertise required to build and deploy AI at scale. We understand that AI is reshaping every business, and we're the partner that helps you lead that transformation."

This narrative is also accurate, but it reframes the entire value proposition. It's not about compute or storage anymore—it's about transformation. It positions Google Cloud as a strategic partner solving business transformation problems, not a technical vendor offering infrastructure services.

This narrative shift is reflected in:

- Sponsorship positioning (positioning at AI-focused conferences, not just infrastructure conferences)

- Sales messaging (talking to Chief AI Officers and CIOs about transformation, not talking to Infrastructure VPs about compute performance)

- Product development (building AI-specific services and capabilities)

- Thought leadership (publishing on AI transformation, not cloud infrastructure)

- Partnerships and ecosystem (partnering with transformation consultants and AI-native companies, not just infrastructure tools)

The company didn't fundamentally change what it does or who it sells to. But it changed how it describes what it does and what problems it positions as most important. This narrative shift is what allowed it to be relevant to an expanded set of buyers with different strategic priorities.

Narrative Consistency Across Channels

For this narrative shift to actually work, it needs to be consistent across all customer touchpoints:

- Sales messaging aligns with marketing positioning

- Product design reflects the stated value proposition

- Customer success programs are structured around the promised transformation

- Thought leadership and content support the narrative

- Partner ecosystem reinforces the narrative

- Organizational structure (organizational design, executive focus) reflects the narrative

Companies where narrative is aspirational ("We're a transformation partner") but execution is still transactional (sales team is still optimized for short-cycle deals, customer success is still focused on quick time-to-value) find that the narrative falls flat. Customers sense the misalignment and trust erodes.

Conversely, when narrative is consistent across the organization, it becomes powerful. Customers experience the same story from first interaction through implementation through ongoing partnership. This consistency creates credibility and enables the company to attract and retain the right customers.

Part 11: Risk Management When Budget Migration Occurs

The Risk of Over-Committing to New Segments

While identifying and pursuing new buyer segments is clearly important, there are real risks in overcommitting to new segments at the expense of existing segments:

Relationship erosion — If traditional sponsors or customers feel like they're being deprioritized in favor of new segments, relationships can deteriorate. This is particularly risky if your company is still heavily dependent on revenue from these segments.

Execution complexity — Running multiple go-to-market motions simultaneously is organizationally complex. If you try to do this with limited resources, you might execute neither motion well.

Market timing risk — New segments might seem hot when you're entering, but markets shift. Over-indexing on a hot segment and underinvesting in your core business can leave you vulnerable if the market cools.

Credibility questions — If you're trying to position as a transformation partner but still executing primarily on traditional software metrics and motions, customers will notice the misalignment.

Successful companies manage these risks by:

Maintaining financial discipline — Don't reduce investment in existing profitable segments unless data clearly supports that those segments are in structural decline. Maintain revenue-generating motion while building new motion.

Clear resourcing and sequencing — Decide what percentage of resources goes to new segments versus existing segments, and be intentional about the sequence (build capability in new segment, prove model works, then reallocate if justified).

Honest assessment of dependencies — Don't pretend that new segment growth is viable unless you've actually proven it. Wishful thinking about new revenue sources while existing revenue declines is how companies get into trouble.

Regular re-assessment — Market conditions change. What looked like a structural shift in 2025 might look different in 2027. Regular assessment of whether the investment in new segments is paying off and whether existing segments are really in decline allows for course corrections.

The Opposite Risk: Missing Inflection Points

While over-committing to new segments carries real risk, so does under-committing. Companies that see structural market changes but resist investing in new segments often find that by the time they realize they need to adapt, they've fallen too far behind.

The painful reality is this: by the time a market shift is unambiguous to everyone, it's often already too late for companies that didn't invest early.

Companies need to:

Make bets with imperfect information — You probably won't be 100% certain that a market shift is real before committing significant resources. Companies that wait for certainty often miss the opportunity window.

Invest proportionally to conviction — If you're moderately convinced about a market shift, make a moderate investment. This allows you to prove out a hypothesis without betting the company.

Stay curious about early signals — What patterns are you seeing in your market that might signal a transition? Unusual customer requests? New buyer personas emerging? New competitors entering? Early investment in understanding these signals positions you to act faster.

The companies that handle market transitions most successfully are the ones that make bigger bets earlier than their competitors feel comfortable with, knowing they'll make some mistakes, but betting that getting ahead of the trend is worth some execution risk.

Estimated data shows a shift towards AI-native founders and enterprise leaders, with traditional B2B buyers representing a smaller portion of attendees.

Part 12: Metrics and Measurement for Tracking Budget Migration

Key Metrics for Detecting Segment Shift

How do you know if a market shift is actually happening versus a temporary fluctuation? Use these metrics:

Sales pipeline composition — What percentage of your open pipeline comes from each buyer segment? If it's shifting materially from one segment to another, that's a signal.

Close rate and deal size by segment — Are new segments closing faster/slower than traditional segments? Do deal sizes differ? This affects whether new segment growth is actually as valuable as it appears.

Marketing engagement by segment — Which buyer personas are engaging with your marketing? If you're seeing engagement shift toward new segments and away from traditional segments, that validates the shift.

Customer retention by segment — Are new segment customers stickier or more volatile than traditional segment customers? A hot new segment with churn rate of 30% per year is less valuable than a stable existing segment, even if acquisition is strong.

Win/loss patterns — Are you losing deals to new competitors in new segments? Are you winning deals from traditional competitors? This indicates where the competition and market activity are actually concentrating.

Hiring and resource allocation — Where is your company actually allocating resources? If you're saying new segments are a priority but allocating the same percentage of resources to new segment motions as three years ago, that's telling.

Forecasting and Planning Based on Segment Shift

Once you detect a segment shift, you need to forecast implications:

Revenue impact modeling — If Segment A (your traditional segment) is declining 20% per year and Segment B (new segment) is growing 60% per year, what does your business look like in 2, 3, and 5 years if this continues? At what point does Segment B exceed Segment A? What's your financial requirement to weather the transition?

Runway and investment needs — If your traditional segment is declining faster than you can ramp new segments, you might need external funding or need to make more aggressive cost cuts than you'd like. Forecasting these scenarios early allows you to address them before they become crises.

Capability gaps — What capabilities do you need to serve new segments effectively? What's the timeline and cost to build them? Is it faster to hire, partner, or acquire?

Contingency planning — What if your forecast is wrong? What if the new segment transitions more slowly than you expect? What if it cools off? Having contingency plans for different scenarios allows you to react faster if conditions change.

Part 13: Building Your Adaptation Plan—A Practical Framework

Step 1: Honest Assessment of Current State

Before building an adaptation plan, you need to understand where you actually are:

- What are your current revenue streams by customer segment? Quantify, don't estimate.

- How are growth rates and deal characteristics different across segments? Pipeline, close rate, deal size, CAC, LTV.

- What's your current go-to-market motion optimized for? Who are you best at reaching? What value proposition resonates most?

- Where do you have competitive advantages? What makes you uniquely good at serving current segments?

- What's your risk exposure? How much of your business is dependent on specific segments, buyer types, or budget categories?

Step 2: Environmental Scan for Emerging Opportunities

Next, look outward at what's changing in your market:

- What new buyer segments are emerging that weren't present 2-3 years ago? New roles? New organizations?

- Where is customer interest concentrating that's different from historical patterns? What are customers asking about that's new?

- What new competitors are entering your market? Often new competitors signal emerging segments.

- Where is venture capital flowing? VC money often goes to segments with high growth potential.

- What organizational changes are your customers making? New roles being created, budget migrations, strategic initiative launches?

Step 3: Hypothesis Development

Based on current state and environmental scan, develop hypotheses about potential market shifts:

- H1: New buyer segment X is emerging with significant budget and different needs than our traditional buyer

- H2: Traditional buyer segment Y is in structural decline because of market shift Z

- H3: Budget in category A is migrating from B to C, which changes who has decision authority

Each hypothesis should have:

- Evidence supporting why you believe it

- Implications if true (revenue opportunity, threat to existing business, competitive landscape change)

- Tests you can run to validate or invalidate the hypothesis

Step 4: Low-Risk Exploration and Validation

Before committing major resources, run experiments to test hypotheses:

- Pilot sales program — Assign a small sales team to focus on the new segment for 90 days. See if they can build pipeline, close deals, and identify patterns.

- Content and messaging experiments — Create positioning and messaging tailored to the new segment. Measure engagement compared to current messaging.

- Customer interviews and research — Talk directly to potential buyers in new segments to validate that the problems you think they have actually exist and matter to them.

- Pricing and packaging experiments — Test different ways of packaging and pricing your solution for new segments.

These experiments should be:

- Time-limited (90 days, 6 months maximum)

- Resource-constrained (allocate a small team, not a massive investment)

- Measurement-focused (clear success metrics that validate or invalidate the hypothesis)

- Low-stakes (structured so failure doesn't threaten the core business)

Step 5: Scale Based on Validation

If experiments validate hypotheses, then you can make decisions about scale:

- If new segment validation is strong: Invest in building capability and go-to-market motion for that segment

- If traditional segment decline is validated: Develop transition plan to shift resources toward healthier segments

- If neither validation is strong: Stay focused on current motion while continuing to monitor and test

The key is that resource allocation decisions are driven by evidence, not hope or fear.

Step 6: Organizational Adaptation

Once you've committed to serving new segments, adapt your organization:

- Hire for new segment expertise — Bring in people with credibility and experience in new segments

- Create segment-specific motions — Sales teams, marketing campaigns, product roadmaps tailored to segments

- Measure and compensate accordingly — Different segments often have different sales cycles and success metrics. Make sure compensation aligns.

- Communicate the strategy — Make sure the entire organization understands why this shift is happening and what success looks like

Part 14: Technology and Tools for Adaptation

CRM and Sales Tools: Segment Tracking and Management

As you expand into new segments, your technology infrastructure needs to support different sales motions:

Segment visibility — Your CRM should clearly identify which segment each opportunity belongs to, allowing you to track pipeline composition and see shifts over time.

Segment-specific workflows — Different segments often have different sales processes (deal progression, approval cycles, stakeholders involved). Your system should support different workflows for different segments.

Measurement by segment — You need robust reporting on segment-specific metrics (close rate, deal size, sales cycle length, CAC, LTV, churn rate). This allows you to compare segment performance and identify which are worth increasing investment in.

Marketing Automation and Personalization

As you target multiple buyer personas and segments, marketing automation becomes critical:

Segment-specific email campaigns — Different segments respond to different messaging. Your system should allow you to segment your audience and deliver tailored messaging.

Content recommendations and personalization — Different persona types care about different content. Personalizing content recommendations to segment increases engagement.

Landing page and messaging personalization — Different segments should see messaging tailored to their specific problems and use cases.

Analytics and Business Intelligence

Tracking business performance across multiple segments requires robust analytics:

Cohort analysis — Understand how different customer cohorts (by acquisition segment, product, use case) compare on key metrics (retention, expansion revenue, etc.)

Funnel analysis by segment — How many leads do you need to generate from each segment to hit revenue targets? Where in the funnel do different segments get stuck?

Attribution modeling — Which marketing and sales activities are actually driving results for different segments? Where should you allocate budget?

The strategic adaptation at SaaStr AI 2026 led to a 132% growth, avoiding a potential -46% decline. Estimated data highlights the critical role of market adaptation.

Part 15: The Role of Product in Serving New Segments

Product Feature Prioritization by Segment

As you expand into new segments, you'll often find that different segments prioritize different features:

Traditional segment emphasis (sales software example):

- User adoption and ease of use

- Integration with existing tools

- Incremental efficiency gains

New segment emphasis (AI-native customers):

- API and platform capabilities

- Customization and extensibility

- Scalability and performance

- Community and ecosystem support

Balancing feature prioritization across segments becomes a critical product decision. Some approaches:

Parallel product development — Allocate some portion of the engineering team to build features specific to new segments while maintaining core product for existing segments.

Platform architecture — Build a platform architecture that allows different customer types to use the product in different ways. This allows you to serve multiple segments without completely forking the product.

Strategic choices — Accept that you can't equally serve all segments. Choose which segments are strategic and build product accordingly.

Product Messaging and Packaging

Beyond features, how you package and position the product matters:

Different product positioning for different segments — The same product can be positioned as a "sales efficiency tool" for one segment and a "AI infrastructure platform" for another segment. Different packaging, different positioning, same underlying capabilities.

Pricing and packaging by segment — Different segments often have different willingness-to-pay and different metrics for value. Segment-specific pricing can maximize revenue while ensuring customers feel they're paying fair value.

Product documentation and learning resources — Different segments learn differently. Creating segment-specific documentation, tutorials, and learning resources improves customer success.

Part 16: Managing Organizational Change and Resistance

Why People Resist Strategic Shifts

When you decide to pursue new segments and potentially de-emphasize traditional segments, you inevitably encounter organizational resistance. Understanding the sources of this resistance helps you address it:

Identity and expertise — People's professional identities are often tied to their expertise. If you're saying "we need to build expertise in a new area," you're implicitly saying "your current expertise is less valuable than it was." This is threatening.

Relationship value — Sales reps who have built relationships with traditional buyers over years worry those relationships will be devalued if the company shifts focus.

Process knowledge — People who have built institutional knowledge about "how we sell to traditional buyers" worry that knowledge becomes irrelevant.

Risk aversion — Strategic shifts carry real risk. People might reasonably worry that the shift is a mistake and want to avoid being associated with a failed strategy.

Managing Resistance and Building Buy-In

Addressing resistance requires both honesty and empathy:

Be honest about the market shift — Explain the data and reasoning behind the strategic shift. Help people understand why continuing with the traditional motion alone puts the company at risk.

Acknowledge value of existing expertise — Existing expertise is still valuable. Existing relationships and institutional knowledge don't disappear. But recognize that the market is shifting and new capabilities are needed alongside existing ones.

Create paths for people to succeed in the new reality — Some people will want to learn new segments and build expertise there. Some people will want to continue focusing on existing segments. Both are valuable. Create career paths in both directions.

Celebrate early wins in new segments — As you start winning in new segments, celebrate those wins loudly. This builds credibility that the shift is real and valuable.

Invest in development and training — Help people build skills and expertise in new segments. This shows that you're serious about success and signals that you want people to grow with the company.

Leadership Alignment

Most importantly, leadership needs to be aligned on the shift. If the CEO is excited about new segments but the VP of Sales is skeptical, that misalignment will be felt throughout the organization and will undermine execution.

Building alignment requires:

- Data and evidence about the market shift

- Clear vision about what success looks like

- Resource commitment showing the shift is real, not just aspirational

- Willingness to make hard decisions about which investments to increase and which to decrease

Part 17: Practical Examples—How Different Industries Are Adapting

Example 1: Sales Enablement Vendors Adapting to AI Era

Traditional sales enablement vendors built success by serving VP of Sales buyers. In the AI era, they're adapting by:

- Building AI-powered features into their platforms (AI-powered call analysis, AI-powered coaching, etc.)

- Creating new messaging around "AI-powered sales" and "Sales for the AI era"

- Targeting new buyers including Chief AI Officers, Sales Leaders evaluating AI selling, and founders of AI-native sales companies

- Building community and thought leadership around AI selling to position as experts in this emerging area

- Acquiring or partnering with AI-focused sales tools to build credibility and capability in the new space

The winners in this space are vendors that:

- Maintained existing VP of Sales relationships while simultaneously building new relationships with Chief AI Officers

- Built genuine AI product capability rather than just adding "AI" to marketing materials

- Created distinct positioning and messaging for AI era selling while maintaining relevance to traditional sales buyers

- Invested in people and expertise in AI and sales transformation

Example 2: Data Infrastructure Companies Adapting to Gen AI

Data infrastructure companies historically served data engineers and analytics teams. With generative AI, they're adapting by:

- Building AI/ML-focused features into their platforms

- Positioning toward Chief AI Officers and transformation leaders in addition to data engineering teams

- Creating new use cases around AI data preparation, training data management, etc.

- Building partnerships with generative AI companies and platforms

- Developing thought leadership around data for AI

These companies are finding that:

- The data infrastructure market is expanding, not declining (enterprises need robust data infrastructure to power AI)

- New budget holders (Chief AI Officers) are making infrastructure decisions that would have been made by CIOs or VPs of Infrastructure in the past