Spotify's Unexpected Move Into the Book Business

Here's something you probably didn't expect when you opened Spotify this morning: the music streaming giant is now selling you books.

Not audiobooks—though they already dominated that space. Actual physical books. The kind you hold, flip through, and eventually leave on a shelf collecting dust. It's a move that caught industry watchers off guard, but when you think about it, Spotify's logic is almost too obvious. They've already got hundreds of millions of users scrolling through their app every single day. They've cracked the subscription model. They understand digital-first consumers better than almost anyone on the planet.

So why not sell them books?

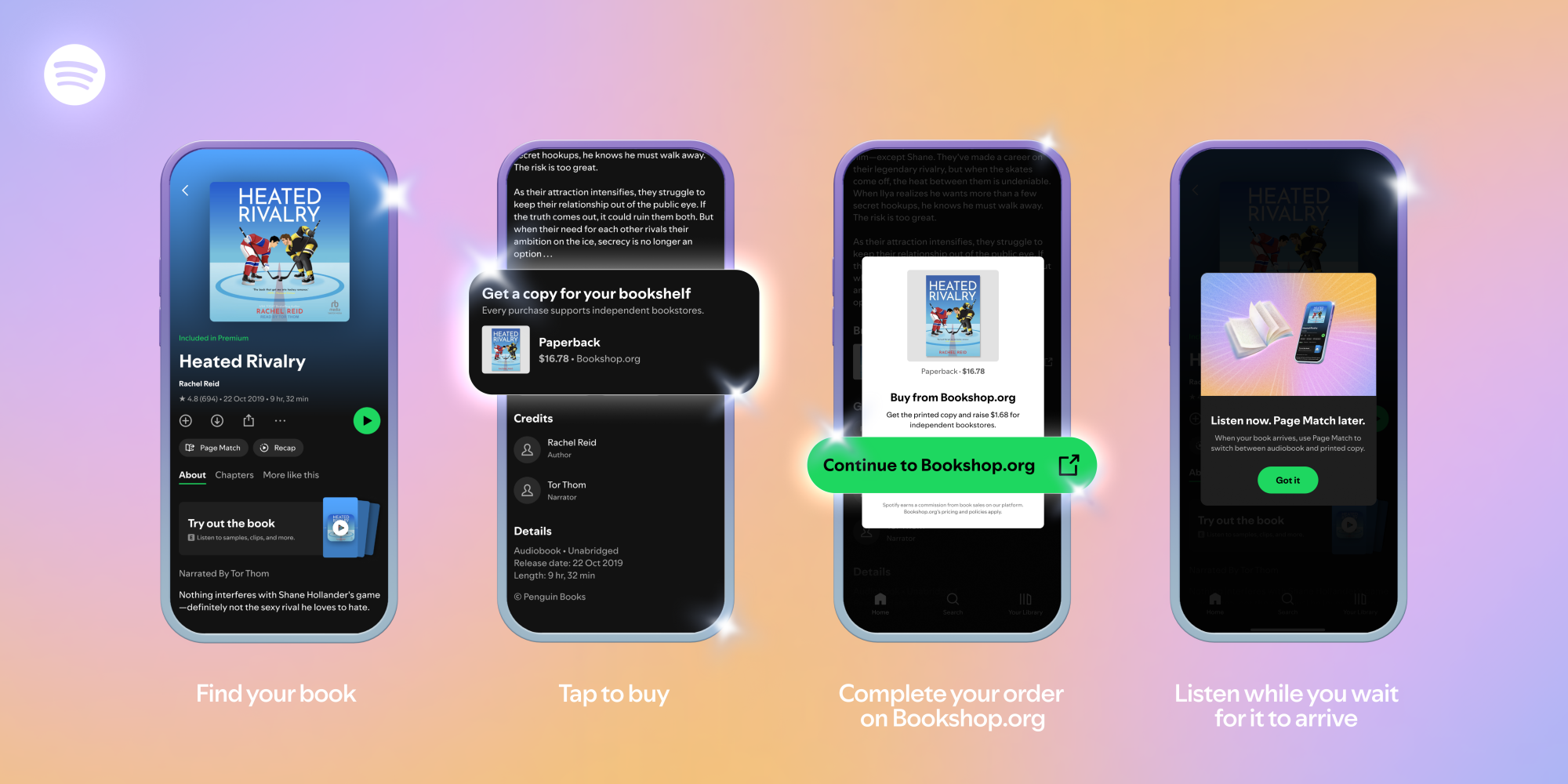

But here's where it gets interesting. Spotify didn't just add a books category and call it a day. They introduced something called Page Match, a genuinely innovative tool that does something the publishing industry has been struggling with for years: it seamlessly synchronizes your audiobook with your physical book in real-time. You're listening to the narrator read Chapter 7, and your ebook automatically opens to the exact page you're hearing. Sounds simple? It should be. But somehow, no major platform has nailed this until now.

This move signals something bigger than a new revenue stream. It's Spotify taking a page from Amazon's playbook—literally and figuratively. And it raises a question that's probably keeping executives at Amazon awake at night: Is Spotify about to become the new Amazon?

The Book Market That Amazon Built (And Spotify Wants to Disrupt)

Let's set the stage. Amazon controls approximately 50% of the U.S. print book market and roughly 65-67% of the ebook market. Those aren't just numbers—they're a near-monopoly in one of the few remaining cultural industries that still matter. Through Kindle, Audible, and its physical retail footprint, Amazon has essentially made itself the gatekeeper between readers and writers.

Publishers hate this. Authors hate this. Independent booksellers definitely hate this. But readers? Most of them just accept it because Amazon's ecosystem works. Buy a book on Kindle, listen to it on Audible, maybe grab the physical copy for your shelf. Everything's synced. Everything's convenient.

The problem is that Amazon takes its cut at every stage. Publishers earn less per unit sold. Authors get squeezed from above and below. And readers end up paying premium prices for convenience they basically take for granted now.

Spotify's move into physical books isn't just about revenue diversification. It's about recognizing a structural weakness in how the book market operates. Readers want a unified experience—the ability to switch between formats seamlessly, to pick up where they left off, to feel like they're using one cohesive platform instead of three separate silos.

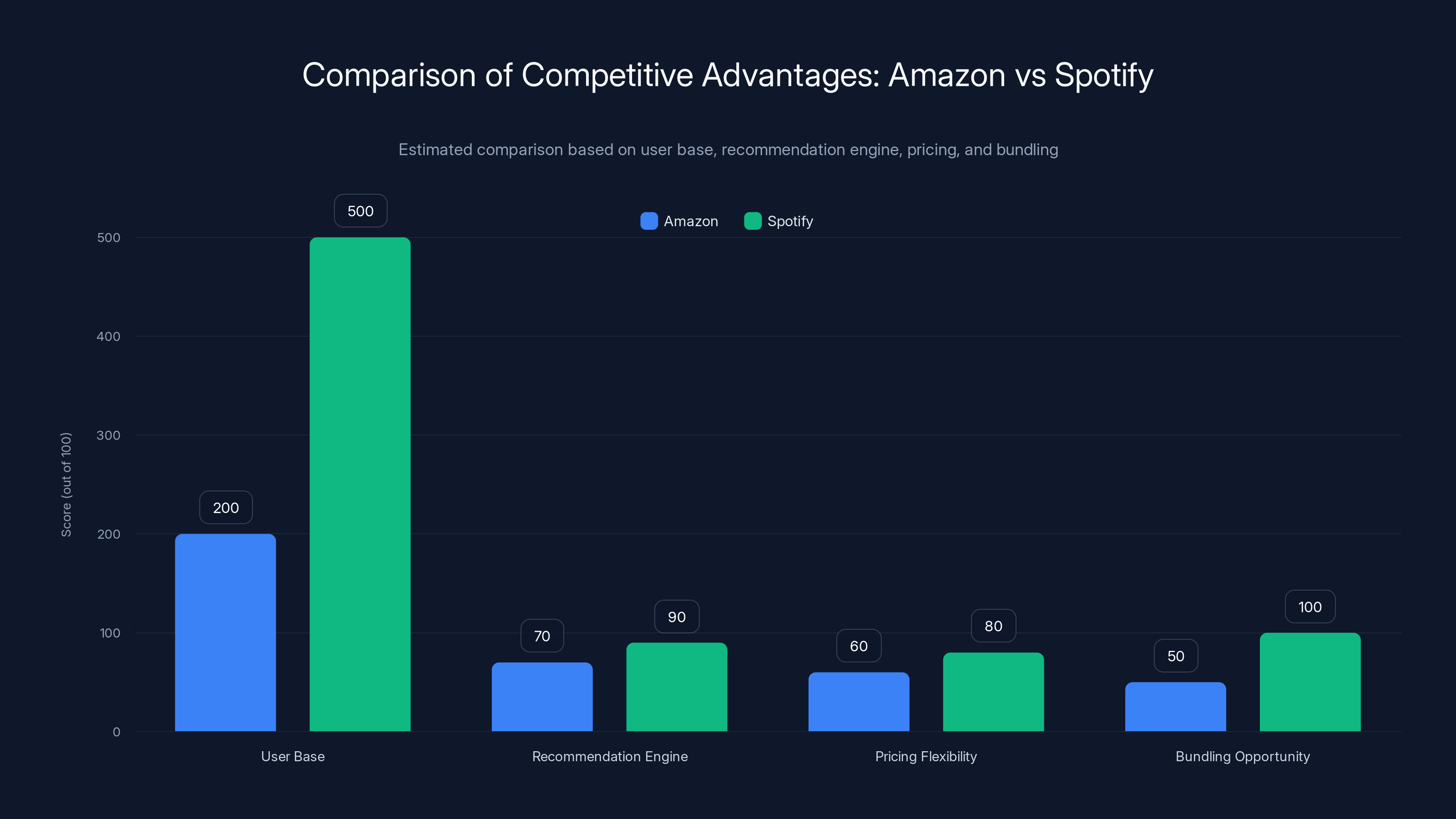

Amazon created that ecosystem first, which gave them a massive advantage. But Spotify has something Amazon doesn't: 500+ million monthly active users who already trust the platform with their entertainment time. They've already got the payment infrastructure, the recommendation algorithms, and the subscription model baked in.

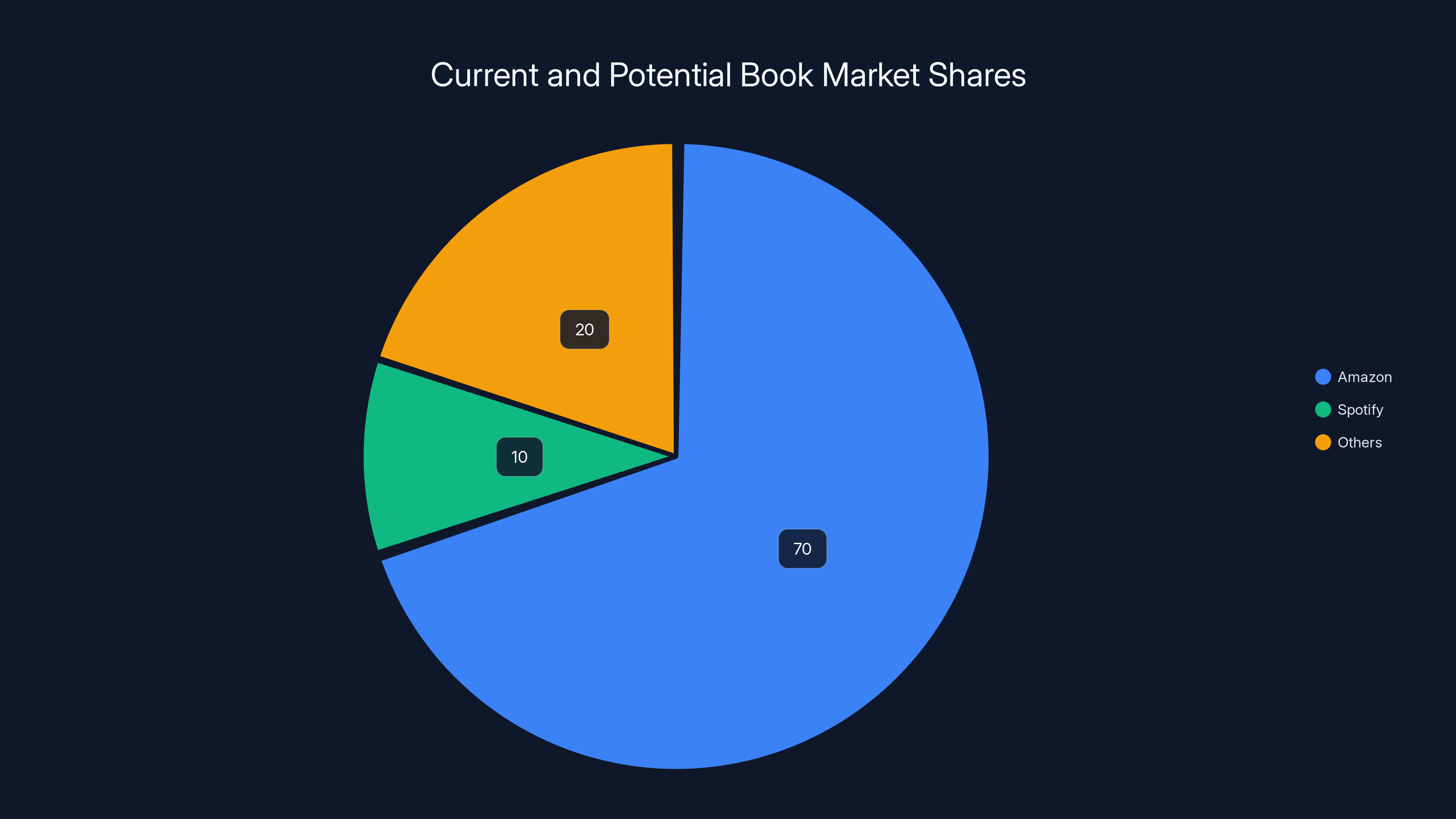

Spotify holds a significant edge in user base and bundling opportunities, posing a competitive threat to Amazon's Kindle and Audible divisions. Estimated data.

Understanding Page Match: The Technology That Changes Everything

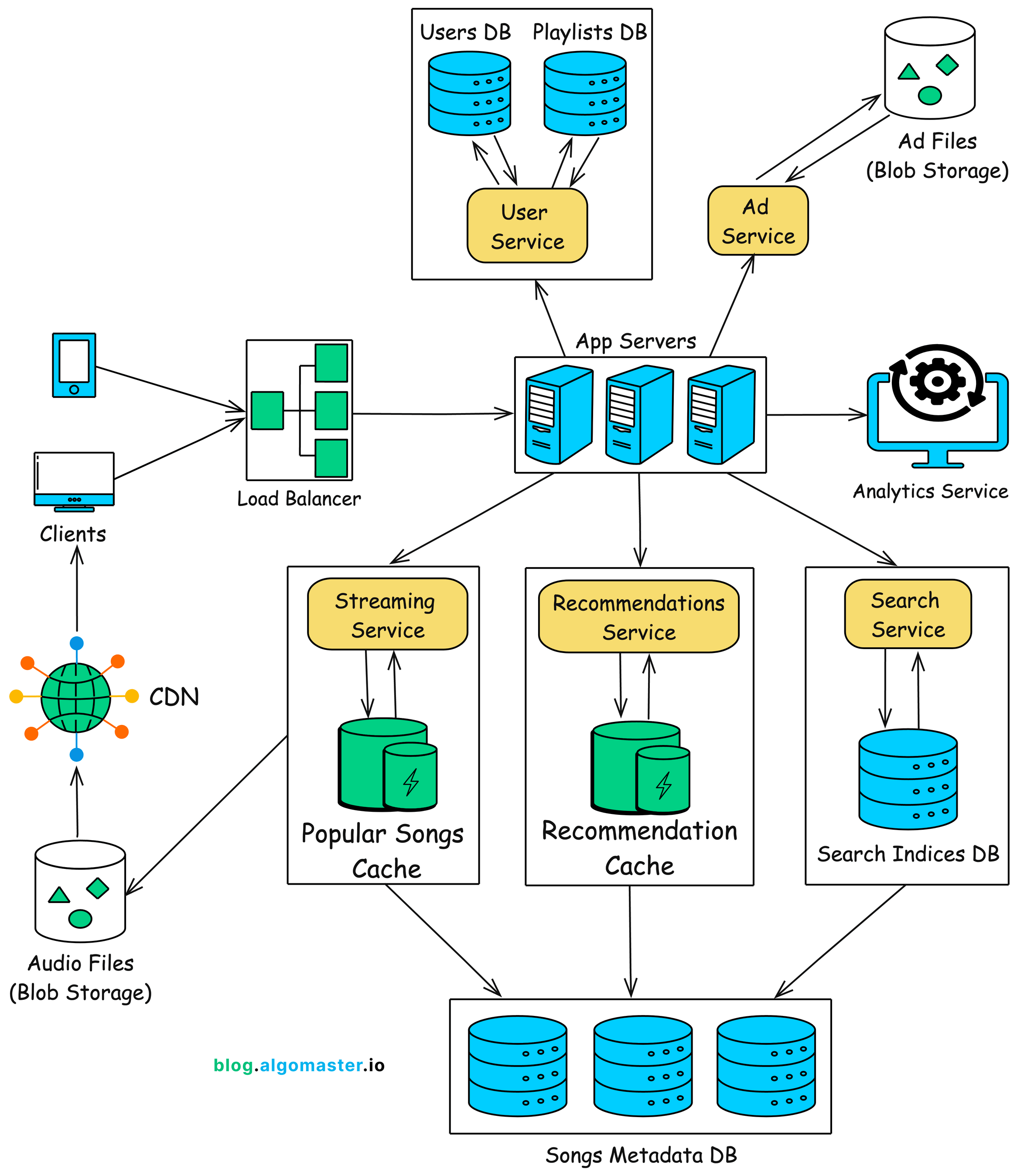

Let's talk about Page Match, because this is the actual innovation that matters.

If you've ever tried reading a physical book while listening to the audiobook, you know the problem. The narrator reads at a different pace than you read silently. They might add dramatic pauses or expressiveness that throws off the timing. You finish a chapter, but you're not sure which page the narrator just reached. You want to switch back to the physical book and continue reading, but where do you start? Page 247? Page 251? You've lost your place.

Page Match solves this using a combination of audio fingerprinting and OCR (optical character recognition) technology. When you're listening to an audiobook through Spotify, the app continuously analyzes the audio content. Simultaneously, if you're reading the physical book, the app is tracking which pages you're on through the digital version.

Here's how it works:

- You start listening to the audiobook through Spotify

- The audio fingerprinting algorithm identifies the exact position in the narration

- The system cross-references this with the digital text of the book

- Your ebook or physical book displays automatically jumps to the corresponding page

- As the narrator speaks, your visual reading stays perfectly synchronized

The technical challenge here is massive. Audiobook recordings aren't always perfectly aligned with published editions. Narrators might add pauses, change pacing, or interpret punctuation differently than how the text appears on the page. Different editions of the same book (hardcover, paperback, audiobook recording) can have slightly different pagination. The algorithm needs to account for all of this.

From a user experience perspective, Page Match is genuinely elegant. You're not thinking about the technology. You're just reading and listening seamlessly, which is exactly how good technology should feel.

From a business perspective, Page Match is brilliant. It creates a reason to stay in Spotify's ecosystem. If you buy a physical book through Spotify and listen to the audiobook through Spotify, Page Match becomes a stickiness mechanism. You're less likely to jump to Audible, less likely to buy from Amazon, less likely to use multiple platforms.

Amazon has Whispersync—their own synchronization tool for Kindle and Audible. But Whispersync only works with Kindle devices and Audible, not with physical books. Page Match works across physical, digital, and audio formats simultaneously. That's the competitive advantage.

Estimated data shows Spotify could earn

Why Spotify Decided to Sell Physical Books

On the surface, it seems odd. Spotify is a streaming company. Their entire business model is built on fighting physical media. They don't manufacture CDs. They don't press vinyl (well, they partner with other companies, but they don't own the factories). So why would they suddenly want to deal with the logistics nightmare of shipping physical books?

The answer is in the data. Spotify's algorithm team has access to insights that most companies would kill for. They know which books are trending. They know which genres are gaining momentum. They know which demographic groups are searching for book content.

And what that data probably told them is that audiobook listeners aren't just listening to books—they're also buying them. They're buying them on Amazon, they're buying them from independent booksellers, they're buying them everywhere except Spotify. That's millions of dollars in transactions happening on competitor platforms.

By adding physical books to Spotify's marketplace, they're not trying to become Amazon. They're trying to capture the incremental revenue from users who are already engaged with Spotify for audio content. It's a natural extension of the existing ecosystem.

There's also a publishing strategy at play. Publishers have been looking for alternatives to Amazon for years. They don't want to be dependent on a single retailer controlling 50% of their sales. Spotify offers diversification. If Spotify can capture even 5-10% of physical book sales, that's enough to give publishers meaningful negotiating leverage with Amazon.

For Spotify, even a 5% market share would be substantial. That's roughly

The Competitive Threat to Amazon

Let's be direct: this is a threat to Amazon, specifically to their Kindle and Audible divisions.

Amazon's book business works because of network effects and switching costs. Once you've bought hundreds of books on Kindle, you're not switching platforms. You've got highlights, notes, bookmarks, and reading progress all tied to your Amazon account. Audible's catalog is unmatched. The integration between Kindle and Audible is seamless.

But those advantages erode if a competitor can offer something better or more convenient. Spotify's advantages are different but substantial:

User base advantage: Spotify has 500+ million monthly active users. That's more than double the number of active Kindle users. If even 10% of Spotify's music subscribers also buy books, that's 50 million potential customers.

Recommendation engine: Spotify's algorithm is arguably the best in the business. They know what music you like, they know what podcasts you listen to, they can infer your reading tastes with frightening accuracy. A Spotify recommendation for a book is probably more useful than an Amazon recommendation.

Pricing flexibility: Amazon uses agency pricing for ebooks, which means publishers set the price and Amazon takes a commission. Spotify might offer better author/publisher economics, which could convince independent publishers to market books through Spotify.

Bundling opportunity: Here's the killer advantage. Imagine Spotify saying: "Listen, for $9.99/month, you get unlimited music, podcasts, and access to our book catalog." Amazon can't match that because books are a separate business unit with separate economics. Spotify could theoretically bundle books into their premium subscription at minimal additional cost, since distribution of digital files is cheap.

The question isn't whether Spotify can compete with Amazon in books. The question is whether Amazon will feel threatened enough to respond aggressively.

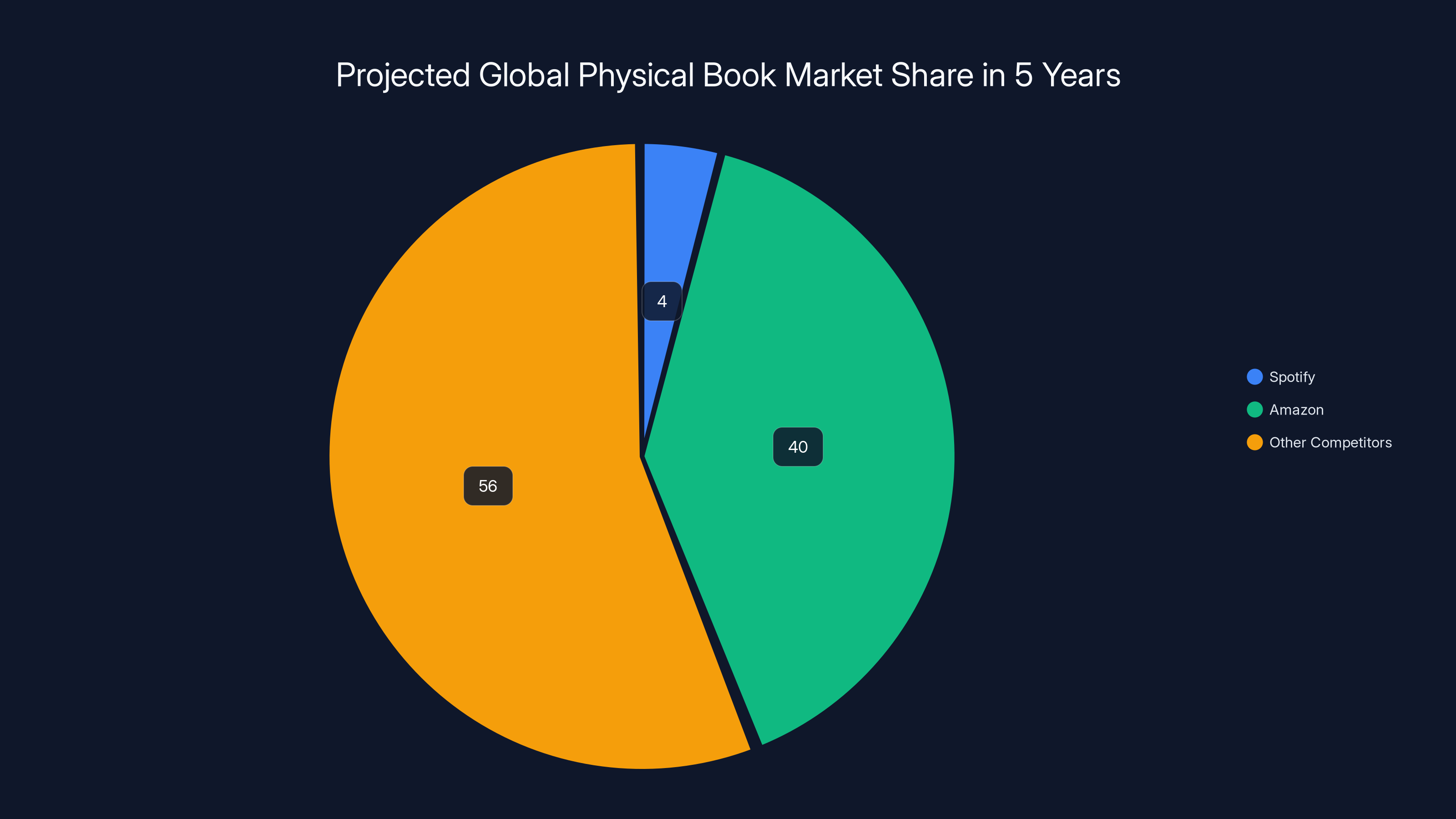

Spotify is projected to capture 3-5% of the global physical book market within 5 years, while Amazon maintains a dominant 40% share. Estimated data.

How Publishers Benefit From Spotify's Entry Into Books

Publishers are stuck in a difficult position. They need Amazon because Amazon controls distribution. But they hate Amazon because Amazon controls distribution. That's not a stable long-term relationship.

Spotify's entry into books gives publishers leverage they haven't had in years. Suddenly, they have an alternative channel. Spotify also has relationships with music labels, so they understand the dynamics of working with creative industries. They understand IP licensing, revenue sharing, and long-term partnership structures.

For independent publishers especially, Spotify could be transformative. Right now, a small publisher has two options: sell through Amazon's platform at Amazon's terms, or build their own direct-to-consumer sales channel (which is expensive and doesn't reach customers effectively).

Spotify offers a third option: sell through a platform with massive user reach and sophisticated recommendation algorithms, at potentially better terms than Amazon offers.

There's also the marketing angle. Spotify could feature book recommendations on radio playlists. A "Great Reads" playlist could include physical books for purchase. A podcast about science could automatically link to relevant science books. These cross-promotional opportunities don't exist on Amazon's platform because Amazon's different business units operate in silos.

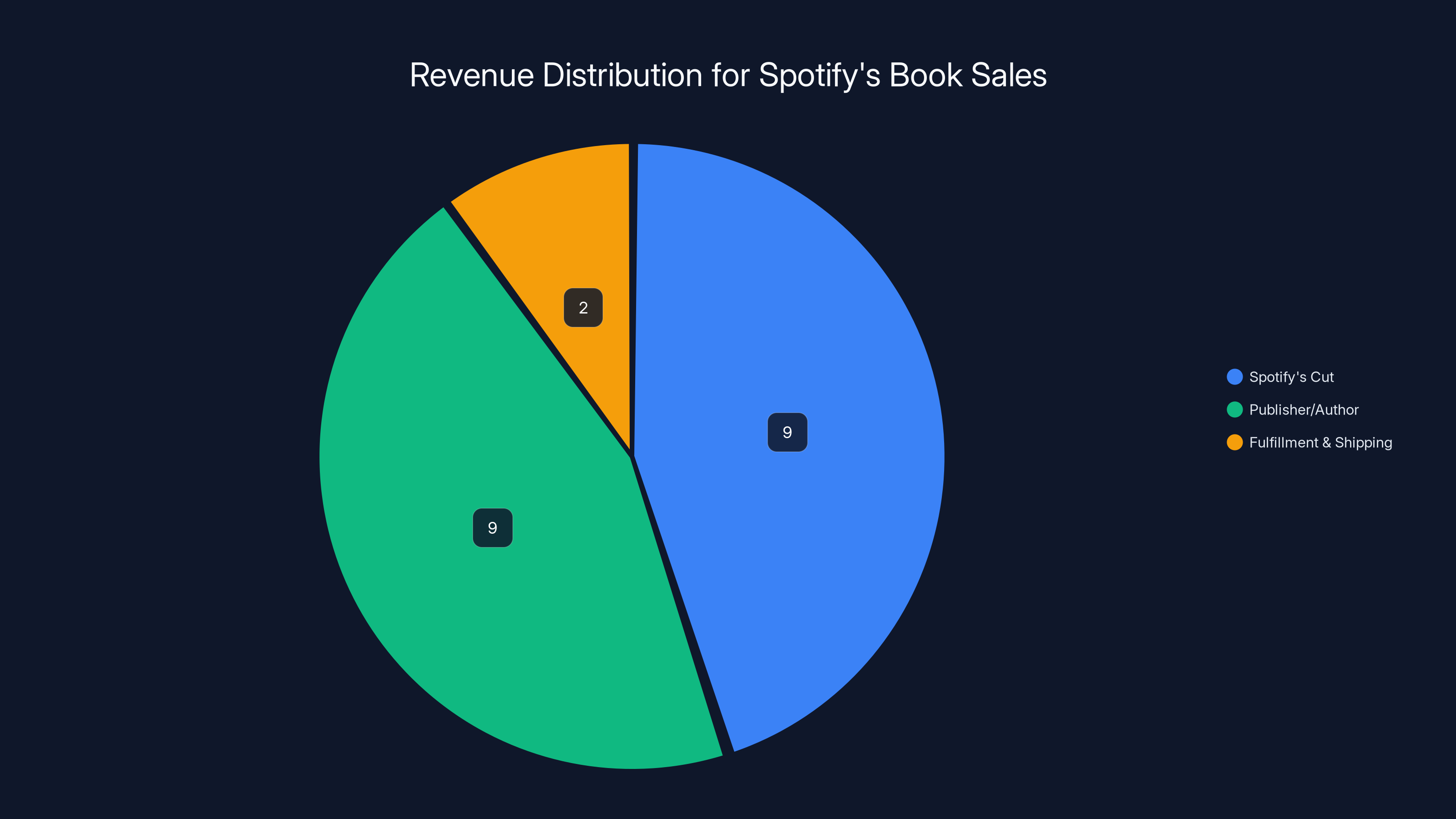

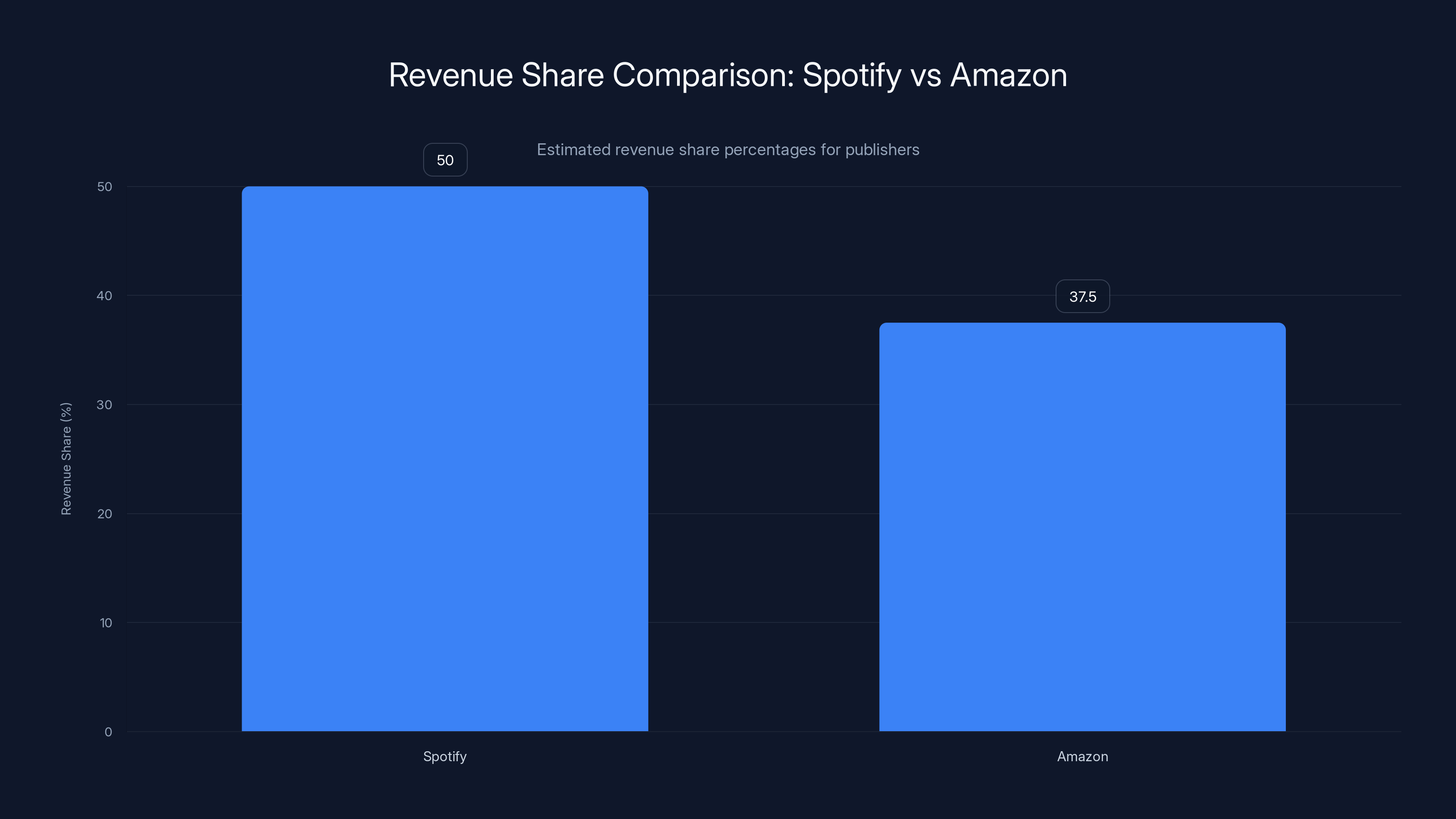

The revenue split is crucial. Publishers need to know that Spotify won't become another Amazon—taking such a large cut that the business barely pencils out. If Spotify offers 50% of sales to publishers (versus roughly 35-40% that Amazon typically provides), that's meaningful. Publishers can reinvest that revenue into marketing and author advances.

The Reader Experience: Multiformat Consumption Becomes Standard

For readers, this is just convenient. That's kind of the point.

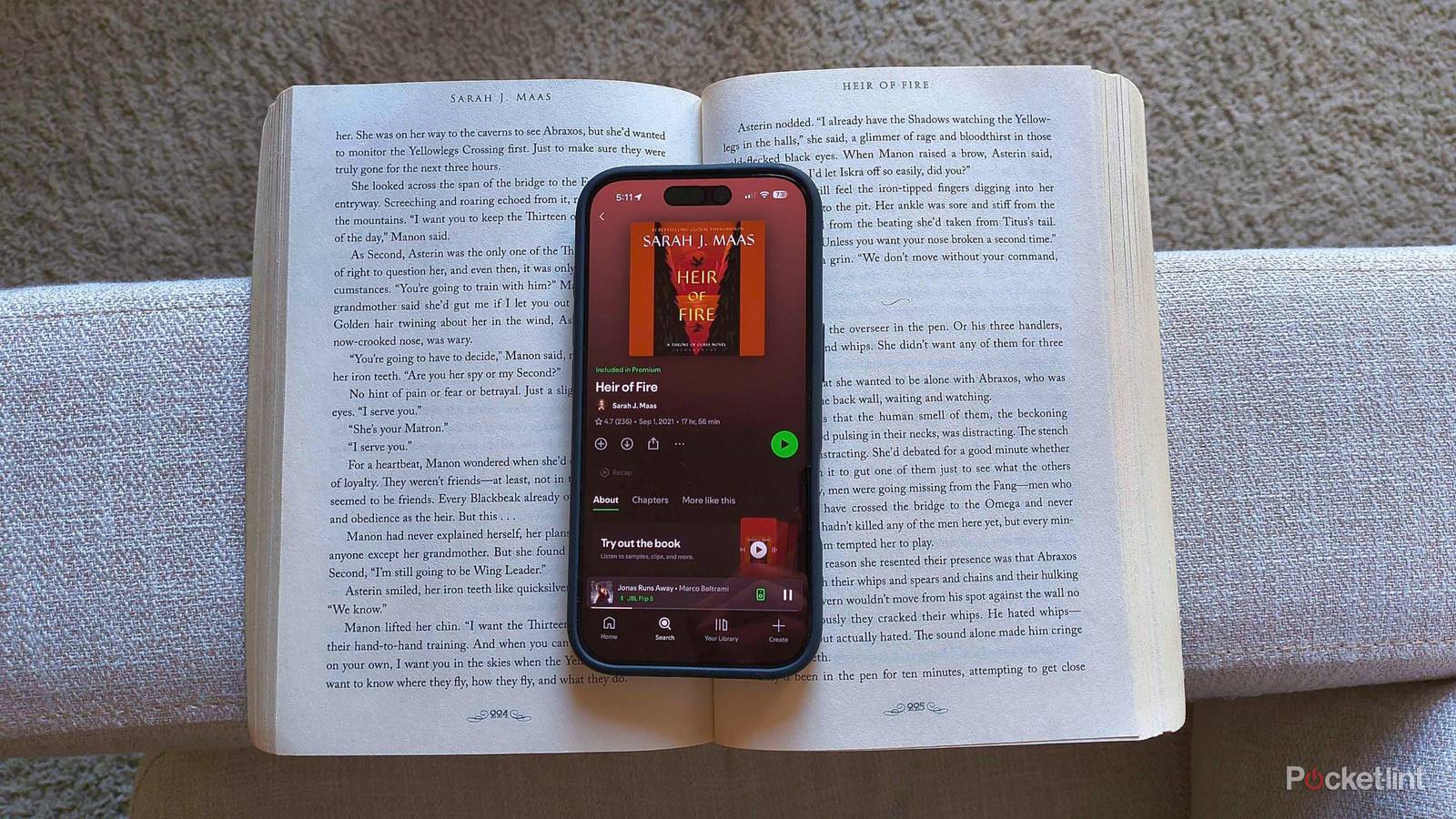

Consider a typical reading behavior: you're commuting, so you listen to an audiobook. You get to the office, you want to switch to reading physically because it feels more productive than wearing earbuds. With Page Match, you don't lose your place. You don't have to remember which chapter you were on or guess the page number.

Or imagine this scenario: you're at the gym, listening to a fitness book through Spotify. You come home, you want to highlight some key passages so you can reference them later. You open the physical book, Page Match loads it to exactly where the narrator left off, and you spend 15 minutes highlighting and annotating.

That's a reading experience that Amazon cannot currently offer. Whispersync works between Kindle and Audible, but not with physical books. If you're listening to an Audible book and want to read the physical version, Whispersync can't help you. You have to manually find your place.

Spotify's physical book sales enable Page Match to work across all three formats—audiobook, ebook (presumably), and physical book. That's a material improvement over existing solutions.

The convenience factor becomes especially important for genres like self-help, business books, and educational content. These are books where readers frequently want to reference passages, highlight key insights, and switch between formats. A reader might listen to a business book during a commute, then read specific chapters more carefully at their desk, then flip through sections at home. With Page Match, all of that is seamless.

Spotify potentially offers a higher revenue share (50%) to publishers compared to Amazon's typical 35-40%, providing a more favorable option for publishers. Estimated data.

The Logistics Question: Can Spotify Actually Execute?

Here's the skeptical take: executing a physical goods business is nothing like running a digital platform.

Spotify has no experience with warehouses, inventory management, returns, shipping logistics, or any of the operational complexity that comes with physical retail. Amazon has spent 30 years building this infrastructure. They've created a machine that can ship millions of packages daily with extraordinary reliability.

Spotify would need to either build this infrastructure from scratch (extremely expensive and time-consuming) or partner with existing logistics providers (which eats into margins and complicates the user experience).

One likely scenario: Spotify partners with a third-party fulfillment service or existing bookseller infrastructure. They could integrate with Ingram (the major wholesale distributor for books) or even partner with Amazon for fulfillment (awkward, but possible). The economics might look like:

- Customer buys a physical book through Spotify: $20

- Spotify's cut: $8-10 (40-50%)

- Publisher/author: $8-10

- Fulfillment, shipping, returns: $2-4

Those margins are reasonable, but they're not spectacular. Spotify's music streaming margins are probably lower. But the book business could actually be more profitable than music, since there are no per-stream royalties—just a simple revenue split.

The bigger question is customer acquisition cost. Spotify already owns the relationship with the customer. Adding a book purchase to their ecosystem has minimal marketing cost. That's a huge advantage over Amazon, which has to continually pay for customer acquisition.

Publishers vs. Amazon: The War for Independence

Meanwhile, publishers are watching this with genuine interest. For 15+ years, Amazon has steadily increased their control over the book market. They've used that control to push for lower prices, restrict distribution, and extract maximum value from each sale.

The Penguin Random House/Simon & Schuster merger fight (which Amazon opposed) highlighted just how much power Amazon has. The company can essentially veto mergers they believe might consolidate publishing power in a way that hurts their interests.

Spotify's entry into books could be the beginning of a power shift. If Spotify captures 10% of the book market—just 10%—that's enough to change the dynamics. Suddenly, publishers have an alternative. They can push back against Amazon's terms because they have somewhere else to go.

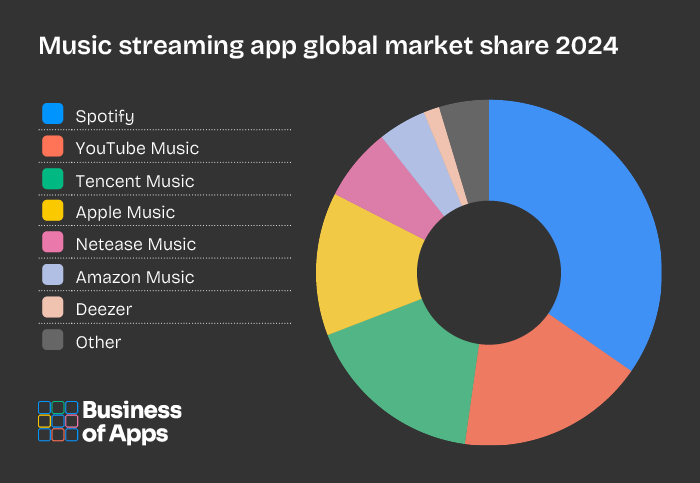

This is happening in music right now. Spotify accounts for roughly 35% of music streaming revenue, but artists and labels also distribute through Apple Music, Amazon Music, YouTube Music, and others. That competition keeps Spotify's royalty rates from dropping further (though artists still complain they're too low).

If the same dynamic emerges in books, publishers benefit. Authors benefit. Smaller presses and independent publishers especially benefit. Amazon still controls the majority of the market, but they're no longer the only game in town.

The question is whether Spotify has the patience and capital to build this out. Entering a new business category is expensive. Competing with Amazon is even more expensive. Spotify's stock price depends partly on showing growth, but investors also want to see profitability. A books business that loses money for 2-3 years might not be welcomed by shareholders.

Amazon currently dominates with an estimated 70% market share. If Spotify captures 10%, it could significantly alter market dynamics. (Estimated data)

What Amazon Might Do In Response

Amazon isn't stupid. They see the threat. Here's what they might do:

Improve integration between Kindle and Audible: Amazon could make Whispersync work better. They could add features that Spotify's Page Match doesn't have. They could offer better pricing or bundling.

Expand Kindle publishing tools: Amazon could make it even easier for self-published authors to reach readers through Kindle Direct Publishing. More authors on the platform = more content = more reason to stay.

Aggressive pricing on physical books: Amazon could cut prices on physical books sold through their site, making them cheaper than Spotify. They have the margin to do this for a few years if needed.

Counter-bundling: Amazon could bundle Kindle, Audible, and Prime membership into a single premium tier, making the combined offering more compelling than what Spotify can do.

Acquisition of Spotify or major investment: This is unlikely but not impossible. Amazon has the capital. They're probably more likely to partner with Spotify or let Spotify take incremental market share.

Most likely, Amazon will upgrade their Kindle and Audible experience while quietly monitoring Spotify's growth. If Spotify starts taking significant market share, Amazon will respond more aggressively.

The Audiobook Market: Spotify's Existing Advantage

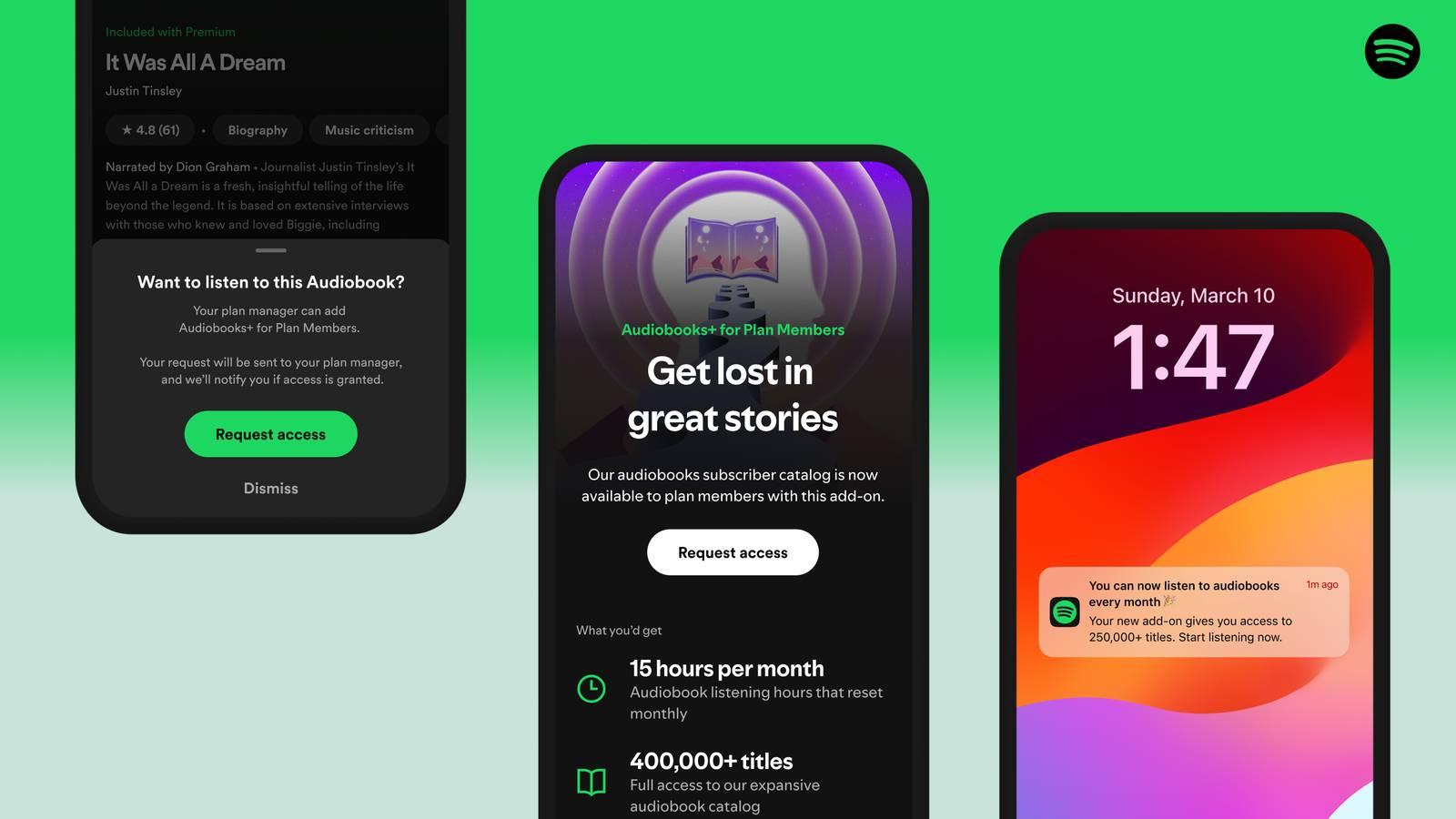

Let's zoom back out. Spotify has already been winning in audiobooks for the past few years.

When Spotify added audiobooks to their platform (in 2022 in some markets, 2023 more broadly), industry observers were skeptical. How could Spotify compete with Audible, which has 40+ years of content, established relationships with narrators, and a massive listener base?

But Spotify has done something clever: they've bundled audiobooks into their existing subscription. If you have a Spotify Premium account, you get access to audiobooks. No additional charge (beyond a limited number of hours per month, depending on the tier). That's fundamentally different from Audible's model, where audiobooks are a separate subscription.

For casual audiobook listeners, Spotify's model is better. For hardcore audiobook consumers, Audible's unlimited model is still competitive.

The result: Spotify has started capturing market share from Audible. Not dramatically—Audible still dominates the audiobook market. But the trend is clear. More people are trying audiobooks on Spotify because it's bundled with music, and some of those people are sticking with Spotify even after they try Audible.

Adding physical book sales is a natural extension of this strategy. It strengthens the value proposition: Spotify is no longer just a music app with audiobooks bolted on. It's becoming an all-in-one entertainment and reading platform.

Market Segmentation: Who Buys Books Through Streaming Services?

Let's think about who actually buys books through their music streaming app. The answer might surprise you.

It's not everyone. Hardcore book lovers probably still use Amazon or their local bookstore. People who primarily read ebooks probably still use Kindle. But there's a substantial segment of casual readers who consume books through an entertainment lens—they listen to audiobooks while exercising or commuting, they read before bed, they're looking for recommendations alongside their music and podcasts.

For those users, Spotify's integration is genuinely useful. They're already in the app multiple times per day. Adding the ability to buy a book (or add it to a wishlist) without leaving the app reduces friction.

Spotify's demographic skews younger than Amazon's Kindle user base. That's useful for publishers trying to reach Gen Z and younger millennial readers. It also means Spotify's users are more accustomed to subscriptions and digital-first consumption. They're comfortable buying directly in an app.

The early adopters for Spotify's book sales will probably be:

- Audiobook listeners who want to revisit books in physical form

- Podcast enthusiasts who want to read books recommended in podcasts

- Spotify Premium subscribers who see book recommendations in their feed

- People under 35 who trust Spotify's recommendation algorithm more than Amazon's

- International users in markets where Amazon's book presence is weaker

These segments are probably smaller than the total addressable market, but they're meaningful. If Spotify converts even 5% of its active users to book buyers (25 million people), that's a substantial business.

The International Angle: Where Spotify Might Have the Biggest Advantage

Amazon dominates in English-language book markets, especially the U.S. and U.K. But globally, Amazon's position is weaker. In some European countries, local booksellers and publishing houses still control significant market share.

Spotify's international presence is deeper than Amazon's in many markets. Spotify operates in 180+ countries. Amazon's book business is concentrated in a handful of major markets.

If Spotify can establish book sales channels in international markets where Amazon's presence is weak, they could build substantial business without directly competing with Amazon in the U.S. A strong book business in Germany, Spain, Italy, and Scandinavia could be extremely profitable.

This is probably part of Spotify's strategy, even if they don't talk about it publicly. Build the service in the U.S. and U.K. first (where Amazon is strongest, so the competition validates the market), then expand to international markets where you have distribution advantages.

The Future: What Happens Next?

Honestly, nobody knows for certain. But here's a reasonable prediction:

Spotify's physical book sales will grow slowly but steadily. They'll capture market share from Amazon, particularly among younger readers and in international markets. Page Match will become the killer feature that keeps people using Spotify for books, even if prices are competitive with Amazon.

Within 5 years, Spotify probably captures 3-5% of the global physical book market. That's roughly $1-2 billion in annual sales. Most of that comes from existing Spotify users, not new customers acquired specifically for books.

Amazon's response will be measured. They'll improve Kindle and Audible, bundle them more aggressively, and probably accept some market share loss. They don't need to compete for every segment. They'll focus on maintaining their core reader base and pushing deeper into self-publishing (where they have huge advantages).

Publishers benefit modestly. They get a new distribution channel, slightly better terms, and more leverage in negotiations with Amazon. But Amazon still controls more than 40% of their business, so they can't ignore the company or play hardball.

Readers definitely benefit. More competition drives innovation. Better features. Better pricing in some segments. More personalization. Page Match becomes standard. Other platforms start offering similar features.

The long-term question: does Spotify ever become Amazon-sized in books? Probably not. But could they become a top-3 player globally? Absolutely.

Strategic Implications: The Bigger Picture

Zoom out even further. This move signals something important about how digital platforms evolve.

For 20 years, the strategy was specialization. Music streaming companies focused on music. Ebook retailers focused on ebooks. Podcast apps focused on podcasts. The assumption was that narrow focus creates expertise and better products.

But Spotify, Netflix, Amazon, and YouTube have all discovered the same thing: bundling works. Users want one app for all their entertainment consumption. Recommendations become more powerful when the algorithm understands not just your music taste but your reading taste, your viewing taste, your podcast preferences.

Spotify's move into books is part of a broader trend toward entertainment supermarkets. One app for everything. One recommendation engine. One subscription billing. One user interface.

Amazon already has this with Prime Video, Kindle, Audible, Music, and physical retail. Netflix is exploring gaming. YouTube is everything to everyone. Even Meta is trying to be an entertainment platform (though they're failing).

Spotify entering books is them saying: "We're not going to be the music company anymore. We're going to be the entertainment company that happens to have music as a core offering."

That's a strategic shift with implications far beyond books. It suggests Spotify might enter other entertainment categories. Movies? Podcasts are already there. Books are here. What's next—theater productions? Comedy specials? Educational content?

The endgame isn't clear. But the trajectory is obvious. Platforms want to be bigger. Bundling drives engagement. Engagement drives advertising and subscription revenue. And market dominance requires reaching users across multiple entertainment categories.

Spotify's entry into physical books isn't a gimmick. It's a signal that they're playing for long-term dominance in entertainment, not just music streaming.

FAQ

What is Page Match technology?

Page Match is Spotify's synchronization tool that automatically aligns your audiobook listening with your physical or digital reading. When you're listening to a Spotify audiobook, the app identifies your position in the narration and automatically displays the corresponding page in your physical or digital book, keeping your place perfectly synchronized as the narrator reads.

How does Spotify's physical book sales model work?

Spotify allows users to purchase physical books directly through the app. These books are then shipped to you through fulfillment partners (likely Ingram or similar distributors). The books are available for purchase alongside Spotify's audiobook and digital book offerings, creating a unified storefront for different book formats.

What are the benefits of buying books through Spotify instead of Amazon?

Benefits include seamless synchronization between audiobooks and physical books through Page Match, access to book recommendations integrated with your music and podcast preferences, potentially more competitive pricing from publishers seeking Amazon alternatives, and the convenience of purchasing books without leaving the Spotify app you already use daily.

How does Page Match technically synchronize audiobooks with physical books?

Page Match uses audio fingerprinting technology to identify the exact position in an audiobook narration. The system cross-references this position with the digital text of the book and automatically displays the corresponding page. The algorithm accounts for variations in narration pacing and different editions' pagination to maintain accurate synchronization.

Will Spotify's entry into books hurt Amazon's business?

Spotify's entry represents a competitive threat to Amazon's Kindle and Audible divisions, particularly among younger readers and in international markets. However, Amazon's established ecosystem, 17-year head start, and extensive infrastructure mean they'll likely maintain market dominance while accepting some share loss to Spotify.

Can I use Page Match with books I buy from other retailers?

Page Match functionality is designed for books purchased through or registered within Spotify's ecosystem. For maximum effectiveness, you'll want to purchase both the audiobook and physical book through Spotify to ensure proper synchronization and feature access.

What genres are available in Spotify's physical book marketplace?

Spotify has focused initially on genres that perform well in audiobook format, including fiction, self-help, business, biography, and educational content. Availability may vary by region, with broader selection likely in U.S. and U.K. markets.

How does this affect independent publishers and authors?

Spotify's platform provides independent publishers and authors with a distribution alternative to Amazon, potentially offering better revenue terms. The massive Spotify user base and recommendation algorithm exposure could significantly increase discoverability for independent titles without requiring Amazon dependency.

What's Spotify's long-term strategy with books?

Spotify is positioning books as a core component of becoming a comprehensive entertainment platform, not just a music streaming service. This move signals expansion into multiple entertainment categories and suggests Spotify intends to compete with Amazon's ecosystem dominance through bundled entertainment offerings and superior personalization.

How does Page Match compare to Amazon's Whispersync?

Whispersync synchronizes between Kindle devices and Audible but doesn't work with physical books. Page Match works across audiobooks, ebooks, and physical books simultaneously, providing a superior multiformat reading experience that Whispersync cannot currently match.

Key Takeaways

- Spotify is entering the physical book market with integrated sales directly in their app, challenging Amazon's 50% market dominance in print books

- Page Match technology automatically synchronizes audiobooks with physical books in real-time using audio fingerprinting and OCR, solving a problem Amazon's Whispersync cannot handle

- This move gives publishers a meaningful alternative to Amazon's terms and could reshape long-term publishing economics and market dynamics

- Spotify's 500+ million users and superior recommendation algorithms provide structural advantages in book discovery that Amazon cannot easily match

- The audiobook market is projected to grow from 15 billion by 2030, making books an increasingly important revenue category for streaming platforms

![Spotify Now Sells Physical Books: How Page Match Syncs Audiobooks [2025]](https://tryrunable.com/blog/spotify-now-sells-physical-books-how-page-match-syncs-audiob/image-1-1770298676593.png)