Introduction: The Experiment Nobody Asked For (But Some People Actually Want)

Imagine getting a 55-inch 4K TV for completely free. Sounds too good to be true, right? That's exactly what Telly promised when it launched its radical experiment in ad-supported televisions. The pitch was simple but polarizing: ditch the $400-600 price tag, accept ads on a secondary companion screen, and suddenly everyone can afford premium video quality.

But here's where it gets weird. The reality hasn't matched the hype. Telly's user numbers are nowhere near the astronomical projections the startup threw around at launch. The device itself has faced skepticism, supply chain hiccups, and the kind of tech-community backlash you'd expect when you try to turn a TV into an advertising vector. Yet somehow, the company is generating actual revenue, customers are actually keeping their units, and a niche but genuine audience has embraced the model. According to Ars Technica, Telly's ad-based TVs are indeed making notable revenue.

This is a story about a business model that shouldn't work in theory but functions in practice. It's about the future of affordable consumer electronics and the price consumers are willing to pay for hardware. And it's a reminder that sometimes the best ideas come wrapped in the least palatable packaging.

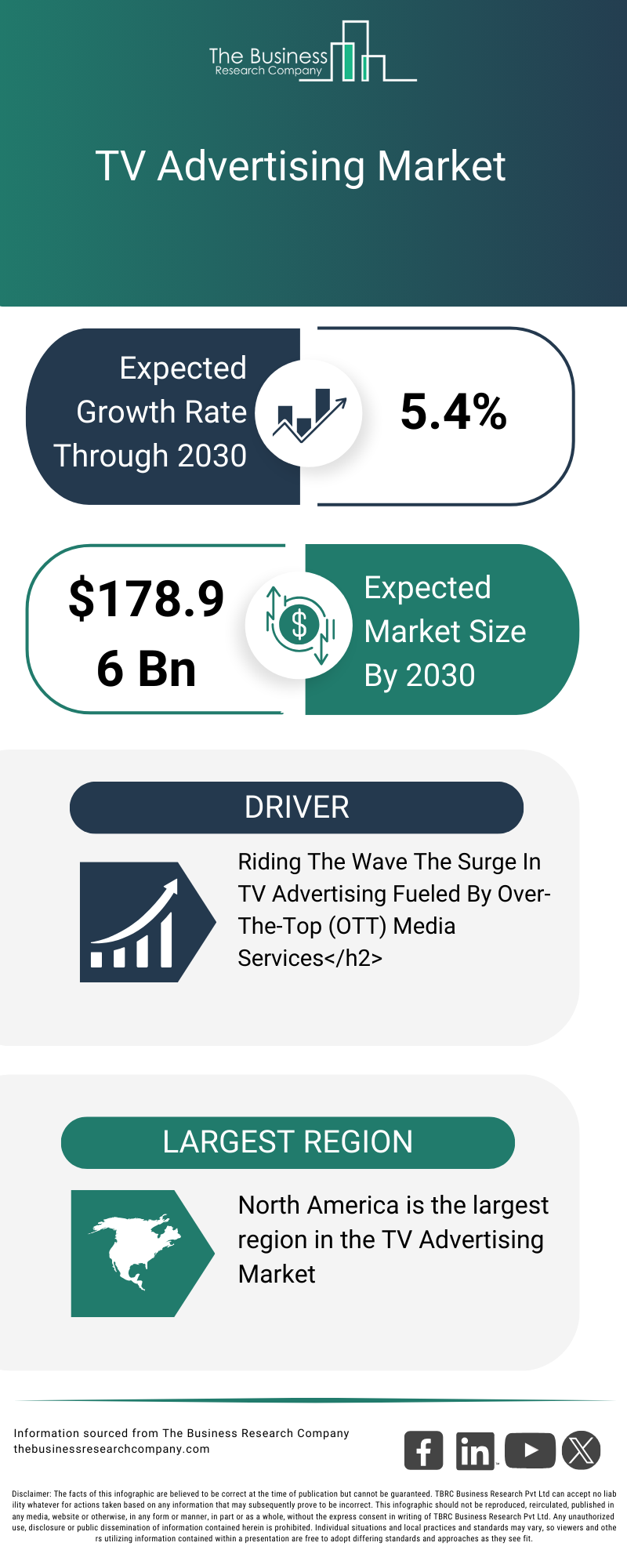

Telly exists at the intersection of consumer electronics, advertising technology, and pure economic necessity. Millions of people still can't afford a decent 4K television. Streaming platforms and advertisers are desperate for more inventory to push content. And startups are willing to bet hundreds of millions that advertising subsidies can bridge that gap. Whether that bet pays off is still an open question, but the early data suggests it's not as crazy as it first appeared.

TL; DR

- The Core Model: Telly offers completely free 4K TVs subsidized entirely by advertising revenue from a secondary companion screen.

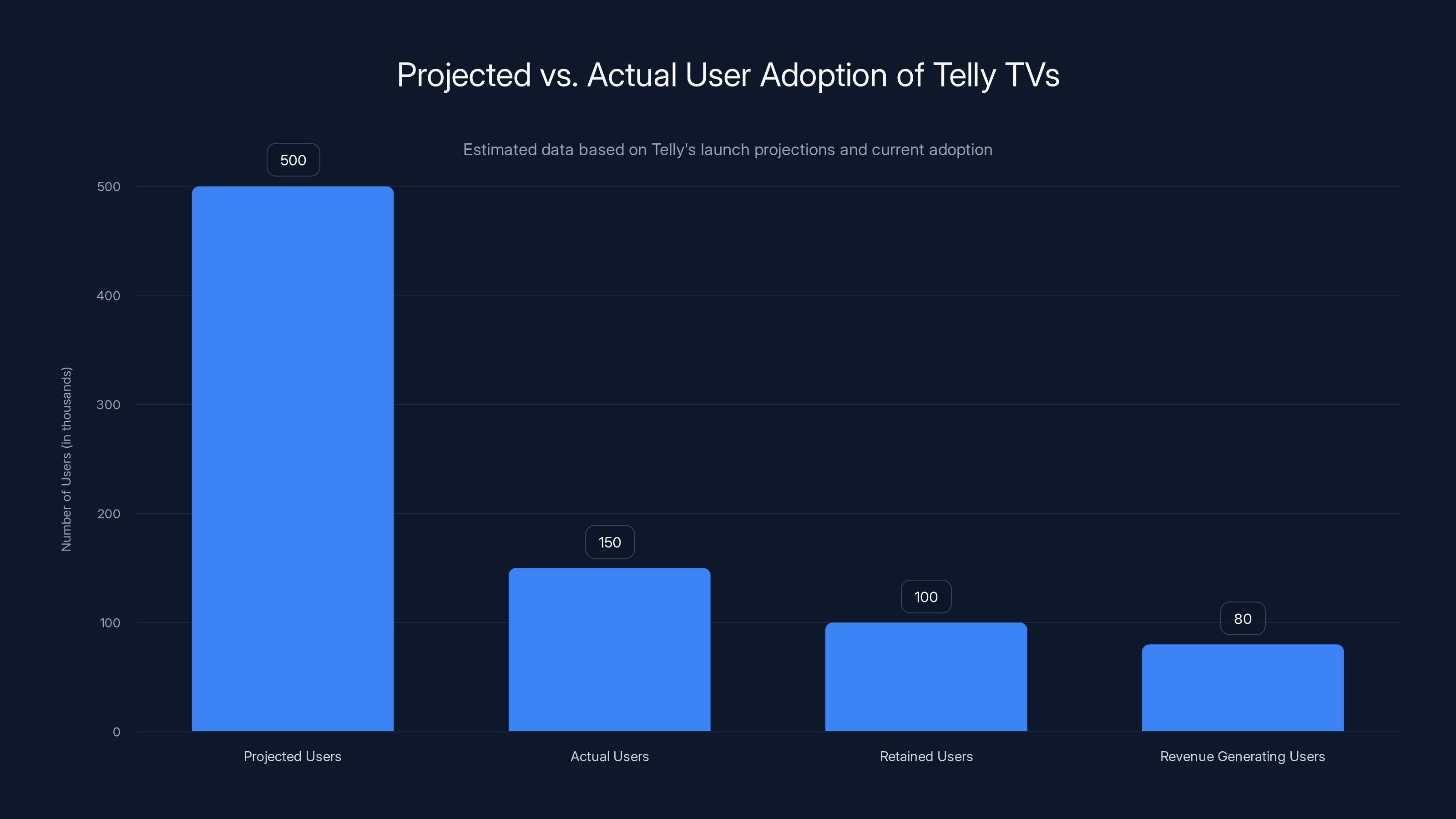

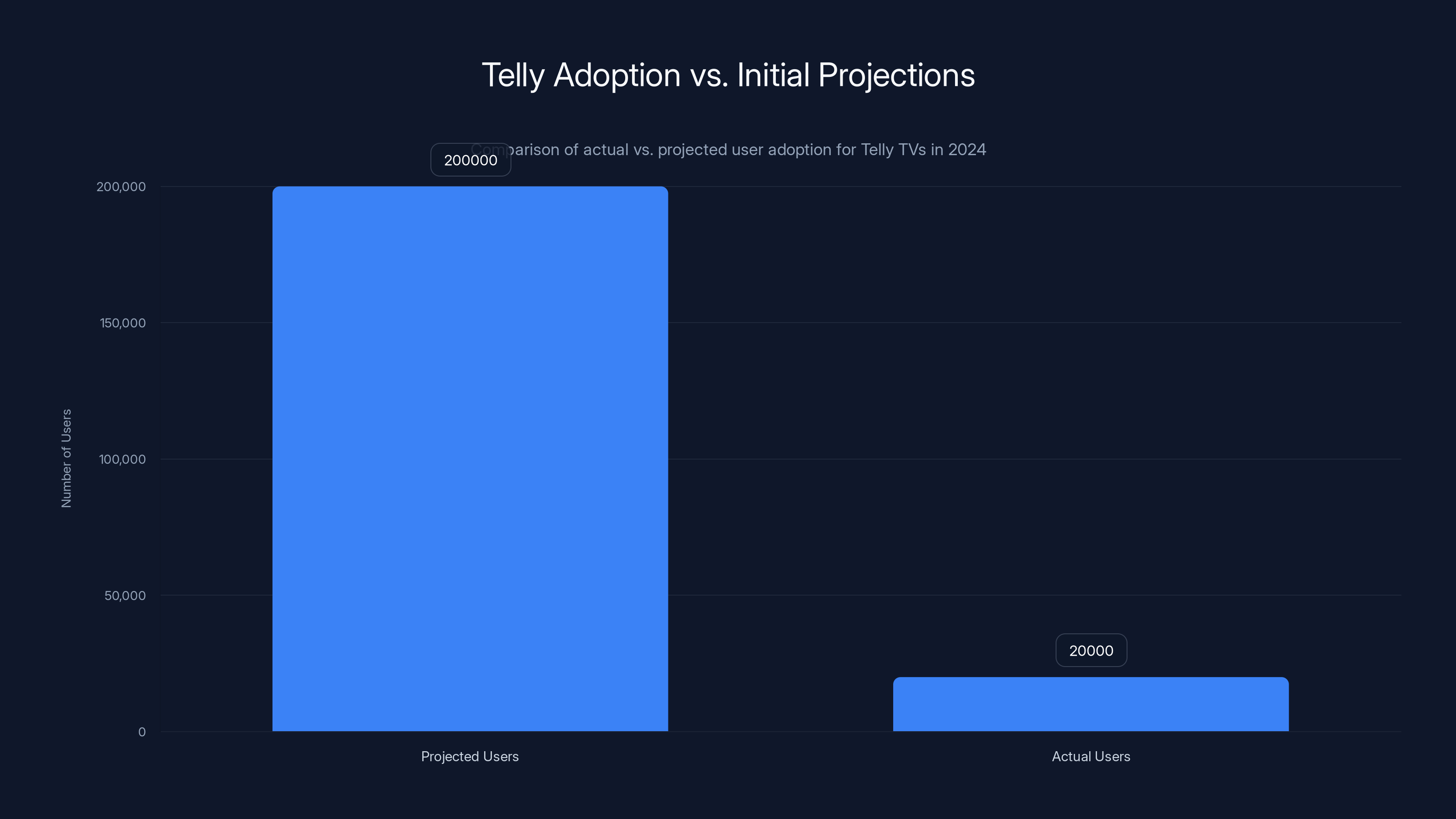

- Adoption Reality: Thousands of users have activated units, but far below the tens of thousands initially projected, signaling slower market acceptance than anticipated.

- Revenue Proof: The company is demonstrating that ad-supported hardware can generate sustainable income, even without massive scale.

- The Catch: Users tolerate an always-on advertisement screen, privacy concerns, and operational complexity in exchange for zero hardware cost.

- Market Trend: Ad-supported hardware represents a legitimate future for electronics manufacturers targeting price-sensitive segments.

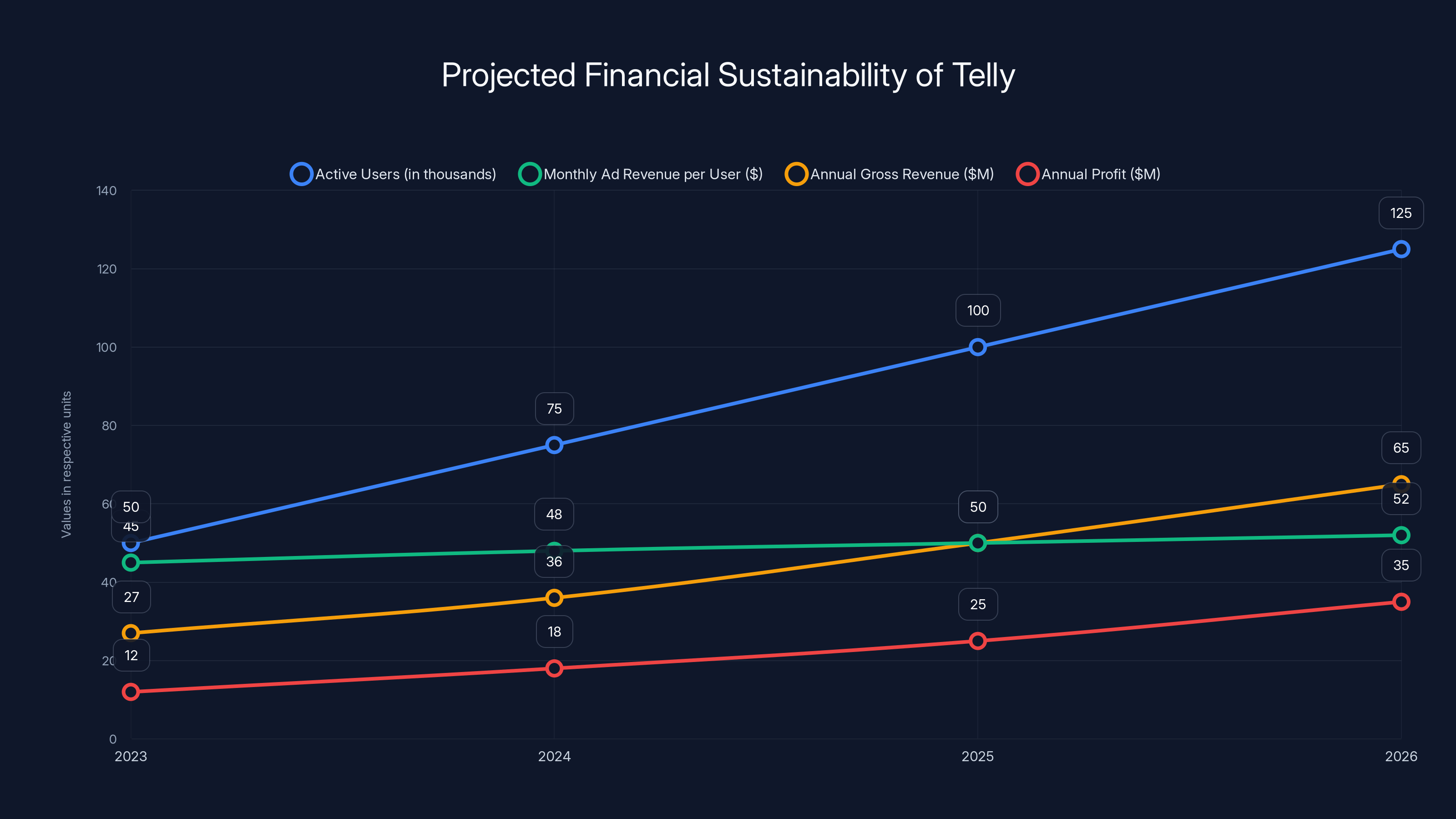

Estimated data shows Telly's potential growth in users and revenue, projecting a sustainable business model by 2026 if key metrics are achieved.

What Is Telly, Exactly? Understanding the Hardware

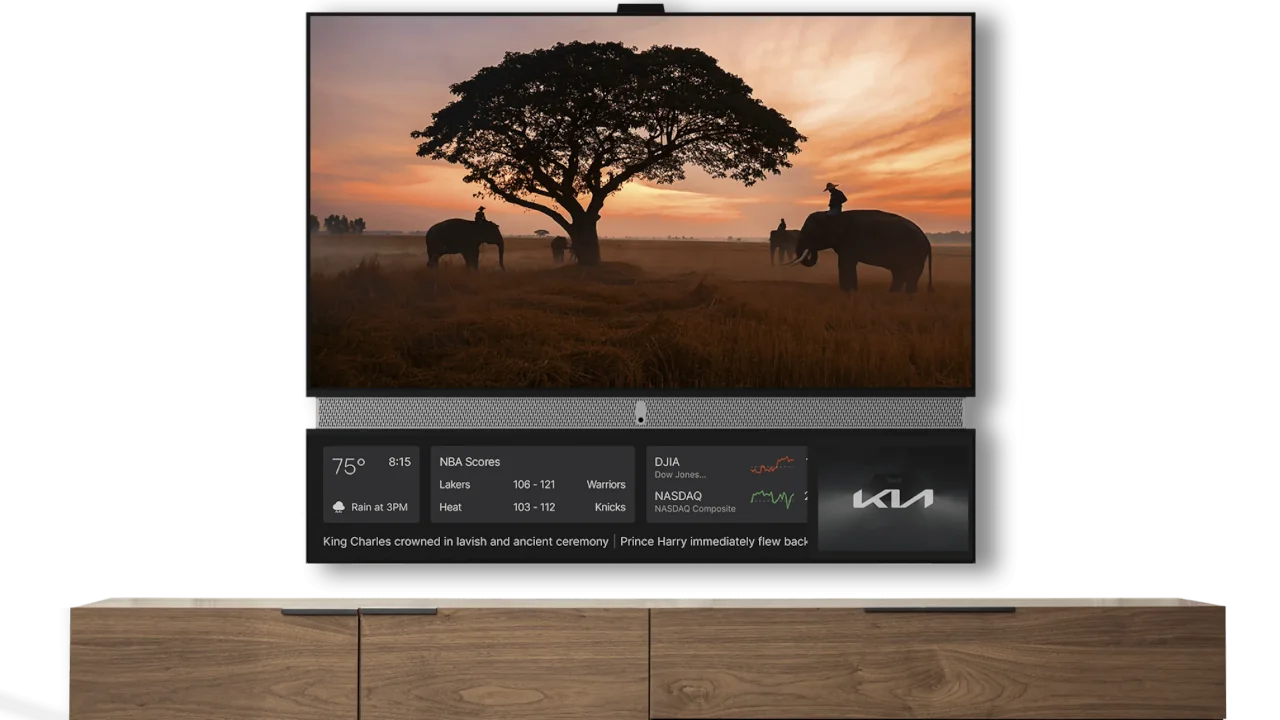

Telly is fundamentally a reimagining of the television as a platform rather than just a display. The company launched with a specific product: a 55-inch 4K LED television that costs absolutely nothing to purchase. This isn't a limited-time promotion or a loss-leader strategy. It's the actual business model.

The physical hardware itself is competent but unspectacular. The 55-inch 4K panel delivers standard LED-backlit performance, with reasonable color accuracy and brightness levels. It's not going to blow away anyone coming from a premium OLED or Mini-LED flagship, but it's genuinely functional 4K at a price point where nothing else exists. The build quality is acceptable—solid bezels, reasonable stand design, nothing that screams "cheap."

But the TV is only half the story. The other half is the mandatory companion device, a second screen that sits permanently on top of the main television. This secondary display shows advertisements continuously. We're talking full-screen ads, not just banner notifications. They rotate, refresh, and update throughout the day. When you're watching your main TV, those ads are running right there in your peripheral vision.

This is where Telly's value proposition gets genuinely uncomfortable for average consumers. You get a free TV, but you sacrifice the visual serenity of a clean living room. That secondary screen is always there, always advertising something, whether you're actively watching content or not.

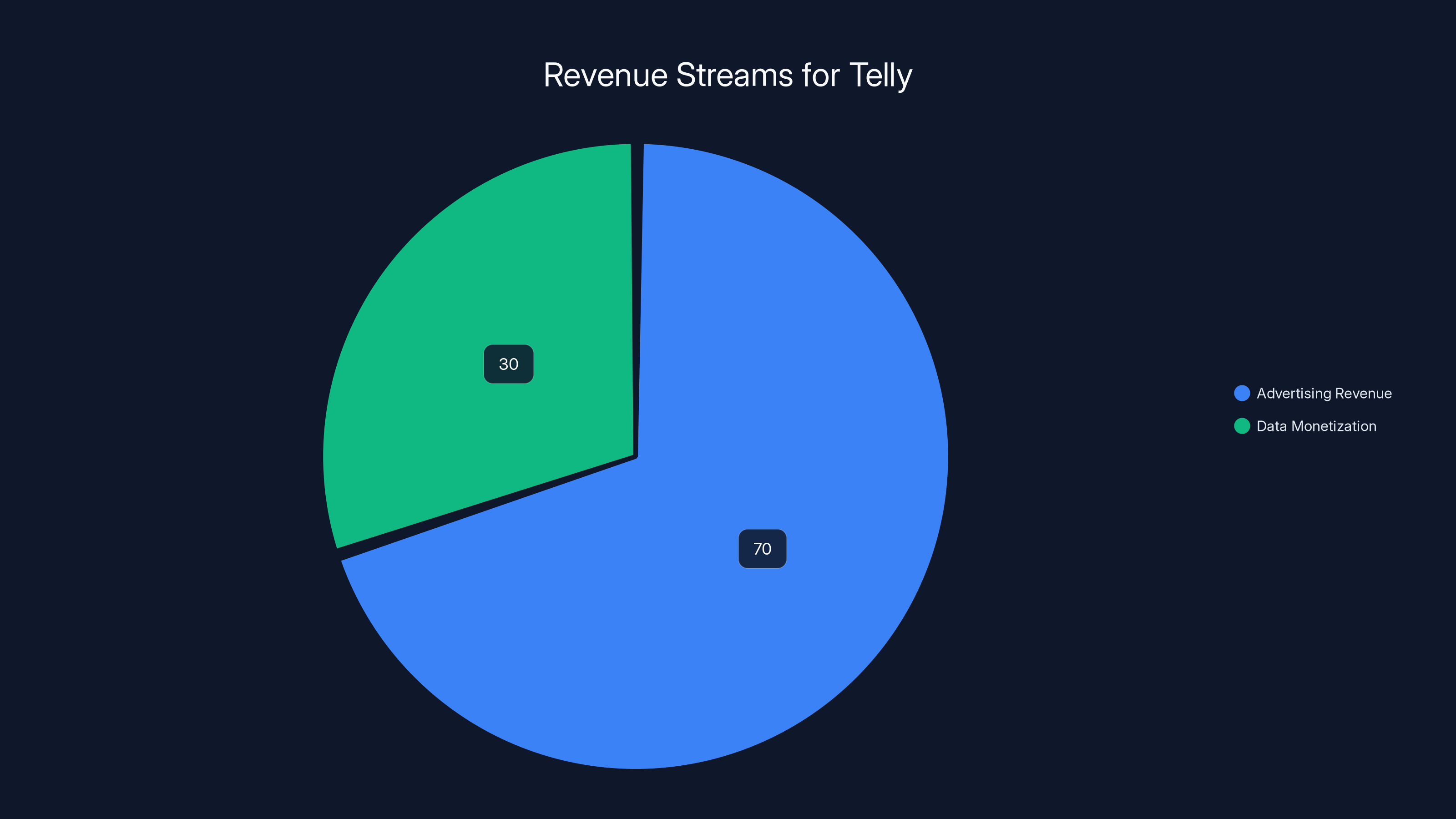

Telly's revenue is primarily driven by advertising (70%), with data monetization contributing 30%. Estimated data.

The Business Model: How Advertising Actually Subsidizes Hardware

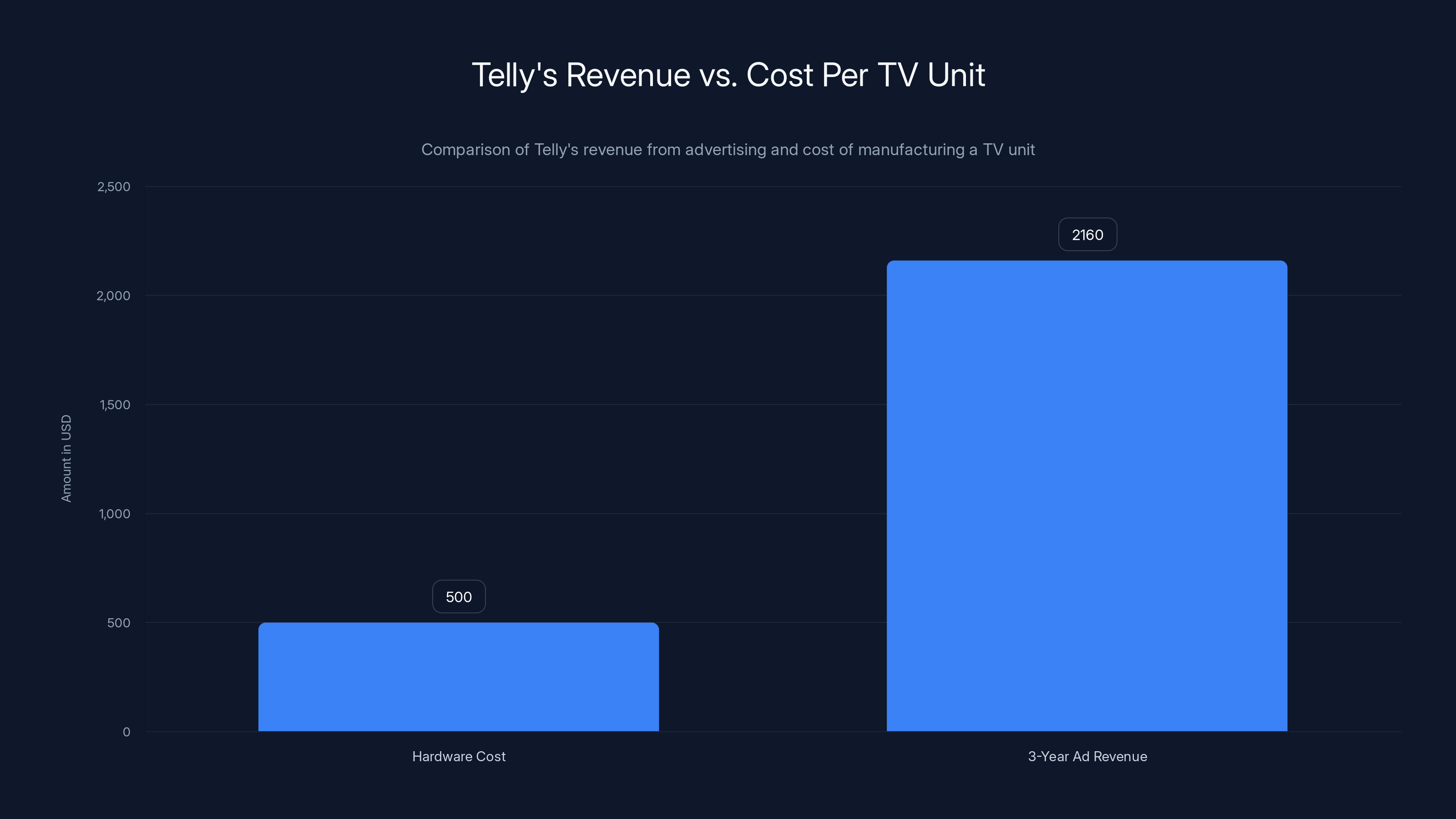

Understanding Telly's financial structure requires understanding the fundamental economics of modern consumer electronics. A quality **55-inch 4K LED panel costs approximately

Traditional TV manufacturers sell these same units for $600-1,000 retail, pocketing that margin for profit, operating costs, and shareholder returns. Telly instead absorbs that entire cost and bets that advertising revenue will compensate.

The math requires serious advertising yield. Telly needs to generate enough revenue per unit to:

- Recoup hardware costs ($450-550 per TV)

- Cover operations, support, and infrastructure (servers, logistics, customer service)

- Actually make profit (otherwise why exist?)

Advertisers pay Telly based on impressions, clicks, or outcomes. The company hasn't disclosed exact rates, but industry standard CPM (cost per thousand impressions) for connected TV advertising typically ranges from **

Over three years (a typical TV lifespan), that's **

The Rough Start: Why Adoption Fell Short

Telly launched with enormous ambitions. The company raised over $70 million in venture capital from respectable investors. The press coverage was intense—everyone from tech journalists to mainstream media outlets covered this "free TV" angle. The narrative was compelling: finally, an affordable path to 4K quality.

But actual adoption tells a humbler story.

The company shipped its first units in late 2023 and has distributed somewhere in the low tens of thousands of units through 2024. That sounds meaningful until you realize the company initially projected it would reach hundreds of thousands of users within the first year. By that measure, Telly is running at maybe 10-20% of projections.

Several factors created this adoption headwind. First, there's the psychological friction of the secondary advertising screen. Articles describing Telly often used words like "nightmarish" because the visual reality of a TV with constant ads running on top of it hits differently than the concept. It's one thing to intellectually accept that your TV is subsidized by ads. It's another to live with that reality in your living room.

Second, supply chain complexity derailed early rollout. Telly committed to shipping in waves through specific regional partners rather than traditional retail, which meant consumers couldn't simply walk into a Best Buy and claim a unit. The distribution model was clunky—you had to apply for access, wait for approval, and then navigate shipping logistics.

Third, skepticism abounded. Tech communities questioned the longevity of the company and the sustainability of the model. Would Telly still offer free TVs in three years? What happens to your TV if the company goes bankrupt? These concerns, while logical, created inertia.

Telly needs to grow from an estimated 20,000 active users to 100,000 to achieve profitability. Estimated data based on industry standards.

Revenue Reality: The Model Actually Works

Despite the adoption slowdown, Telly has demonstrated genuine commercial traction. The company has disclosed that it's generating actual recurring revenue from advertising partners. This isn't projection or theoretical potential—advertisers are paying to place content on the secondary screens.

The proof comes from the company's own statements and the continued operation of the service. If the advertising wasn't generating substantial revenue, Telly would have pivoted or shut down. Instead, the company has continued accepting new users, refining the advertising experience, and optimizing the platform. That only happens when money is flowing.

Advertisers are apparently finding value in the inventory. The secondary screen placement is actually superior to many other advertising channels because it guarantees eyeballs. You can't skip it, mute it, or close it like a pop-up ad. If you own a Telly TV, that advertising screen exists in your space continuously.

This forced engagement creates genuinely valuable data for advertisers. Telly can track viewing patterns, dwell time, when ads are visible versus obscured, and which creative formats drive engagement. That behavioral data has value beyond just the immediate ad revenue—it becomes a dataset for advertisers optimizing campaigns.

The financial model also benefits from unit economics that improve with scale. The fixed costs of the platform (servers, customer support, platform development) spread across a growing user base, making each additional TV slightly more profitable than the last. Telly's path to profitability doesn't require hockey-stick growth; it just requires steady expansion and retention.

The User Experience: What It Actually Feels Like to Own a Telly

Owning a Telly TV is a compromise between two competing interests: your desire for quality video content, and the company's need to monetize that hardware.

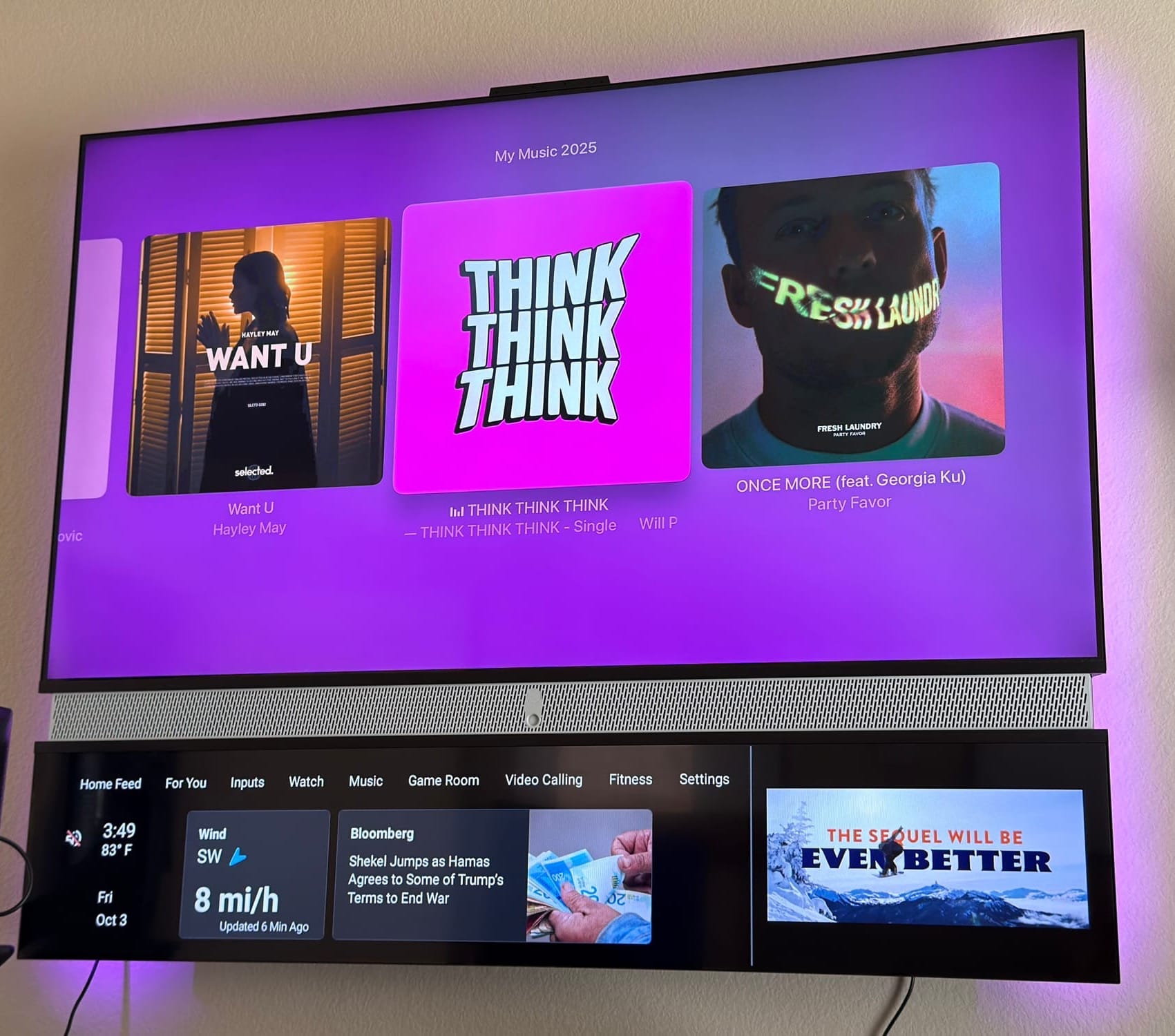

On the main screen, the experience is standard modern television. You access apps—streaming platforms like Netflix, Disney+, Prime Video are all available. The TV runs its own software, connects to Wi Fi, and functions as a conventional smart TV would. There are no ads interrupting your actual content viewing experience (which is a relief, honestly).

The secondary display is where the divergence happens. This screen, mounted on top of your primary TV, cycles through full-screen advertisements continuously. The ads are curated to some degree based on your viewing patterns and demographic profile. If you watch cooking shows, you might see more kitchen appliance ads. If you stream action movies, you might see fitness equipment or streaming service promotions.

Users report that the secondary screen becomes mentally invisible after a while, like ambient environmental noise that your brain stops processing actively. You're aware it's there, but you stop actively noticing it when you're engaged with your main content.

The real friction point is setup and ongoing management. The TV requires account creation, Wi Fi connection, and periodic software updates. Like all internet-connected devices, it occasionally glitches. Some users have reported issues with app crashes or the secondary display becoming unresponsive. Customer support has been functional but not exceptional—appropriate for a free product, but not premium-tier.

Telly generates an estimated

Privacy Concerns: The Hidden Cost

Free hardware always comes with an implicit understanding: if you're not paying, you're the product. Telly users accept this trade-off explicitly, but the privacy implications deserve serious examination.

The secondary screen obviously collects data about what you're viewing. Telly tracks which apps you open, which content you watch, and for how long. This behavioral data becomes valuable to advertisers and, presumably, to data brokers or other third parties. The company has stated it takes privacy seriously, but the fundamental architecture of the service requires continuous data collection.

Additionally, the TV itself—like all modern smart TVs—collects interaction data. Every remote button press, every app launch, every search term you enter goes into a data stream somewhere. Telly's privacy policy is reasonably transparent about this, but transparency doesn't eliminate the concern.

For cost-conscious consumers, this is an acceptable trade-off. The financial value of a free 55-inch 4K TV (roughly $500-600) substantially exceeds the privacy cost most people are willing to tolerate. However, privacy-conscious users or those in households with sensitive information should understand what they're signing up for.

Telly has positioned itself carefully here, offering opt-out options for certain data collection where legally possible, while maintaining that some data collection is necessary for the service to function. This is a reasonable stance, but users should go in with eyes open.

Competitive Landscape: Where Telly Fits

Telly isn't operating in a vacuum. The traditional TV market has major players—Samsung, LG, TCL, Hisense—all offering increasingly cheap 55-inch 4K units. A basic TCL or Hisense 4K TV regularly sells for $300-400 on sale. That's not free, but it's cheap enough that Telly's value proposition needs justification.

The real competitive threat isn't other TV manufacturers; it's economic reality. If someone has

That's a real market. Millions of households in North America, Europe, and globally still rely on older 1080p TVs or no TV at all because modern displays feel unaffordable. Telly addresses genuine demand from this segment. But reaching them requires solving the awareness and distribution problem, which Telly has struggled with.

Other ad-supported TV initiatives exist or have existed. Roku offers TVs with a Roku interface heavy on promotional content. Amazon Fire TV editions exist. But none have made the secondary advertising screen as central to the value proposition as Telly has. Most other approaches integrate ads into the main viewing experience, which is arguably worse from a user perspective.

Telly's differentiation is that advertising stays visually separate from entertainment. That might sound like a small thing, but it's actually a significant UX advantage that could become more apparent as the product gains awareness.

Telly's actual user adoption is significantly lower than projected, but a substantial portion of users are generating revenue. Estimated data.

The Path to Profitability: What Success Looks Like

For Telly to validate its business model and justify the investor capital, the company needs to reach profitable scale. The exact number is unclear, but industry math suggests 100,000 active users generating consistent ad revenue would establish genuine sustainability.

Currently, Telly is likely in the $10,000-30,000 active user range based on indirect indicators. That's not nothing, but it's a long way from 100,000. The path forward requires solving several problems simultaneously:

1. Awareness and Trust: Most consumers have never heard of Telly. The company needs to build credibility that this isn't a scam or a privacy nightmare. That takes marketing spend, media coverage, and word-of-mouth validation. Telly is slowly gaining this, but it's a multi-year effort.

2. Distribution Accessibility: The application-and-wave process works fine for early adopters willing to navigate friction, but mass adoption requires easier access. Partnerships with retailers, Amazon, or other platforms would accelerate this substantially.

3. Regional Expansion: Telly currently operates primarily in the United States. International expansion into Europe, Latin America, and Asia would unlock massive additional volume, but requires localized advertising partnerships and supply chain optimization.

4. Product Evolution: The secondary screen concept is novel, but it may not be the final form. Telly could experiment with different advertising formats, interactive elements, or integration with the main viewing experience to optimize engagement and revenue per user.

5. Advertising Revenue Optimization: As the platform matures, Telly can implement more sophisticated ad targeting, higher-value inventory bundles, and better measurement tools. This could increase advertiser spending without requiring more users.

None of these problems are impossible to solve. They're standard business challenges that execution-focused companies solve all the time. Telly has capital and credibility to tackle them.

Ad-Supported Hardware as a Category: Is This the Future?

Telly is betting on a bigger trend: that ad-supported hardware becomes a legitimate category for consumer electronics. It sounds radical, but the economics are compelling and the historical precedent exists.

Consider smartphones. The original iPhone was a luxury item at $599 (in 2007 dollars). Today, ad-supported Android phones subsidized by Google's ad platform dominate global markets. Most smartphone users worldwide actually use ad-supported devices because the economics work better for the manufacturer and the end consumer.

The same logic applies to larger displays. If manufacturing costs remain constant but consumer purchasing power doesn't grow proportionally, subsidization through advertising becomes increasingly necessary. Over the next decade, we might see:

- Laptop manufacturers offering free or heavily subsidized systems through advertising-supported models

- Tablet manufacturers shifting toward ad-subsidized variants for emerging markets

- Monitor manufacturers experimenting with ambient advertising on secondary screens (like Telly's model)

- Projector manufacturers offering free or cheap devices sustained by promotional content

Each category has different economics and different advertising opportunities. A laptop secondary screen might display productivity app promotions. A projector might show entertainment service recommendations. But the underlying principle—hardware subsidized by ad revenue—becomes increasingly viable.

The counterargument is that consumers actively dislike advertising and will consistently choose to pay rather than tolerate ads. That's partially true—premium segments will always exist where people pay to eliminate ads. But the price-sensitive majority, especially in emerging markets, will likely accept ad-supported hardware if the price difference is meaningful.

Telly isn't necessarily going to be the definitive player in this category. But it's proving the concept works at meaningful scale. That matters for the industry.

Telly's actual user adoption in 2024 was significantly lower than projected, reaching only 10-20% of the expected hundreds of thousands of users. Estimated data based on narrative.

User Demographics: Who Actually Buys a Free TV?

Telly's user base offers interesting insights into who values this trade-off. Based on available indicators, Telly users skew toward:

1. Price-Conscious Households: People for whom $400-600 represents a meaningful portion of discretionary spending. These are likely middle-to-lower income households without premium TV access currently.

2. Early Adopters and Tech Enthusiasts: Ironically, some tech-savvy users are interested in Telly specifically because it's novel and because they appreciate the transparency about the advertising model. This segment is smaller but vocally positive.

3. Apartment Dwellers and Renters: People who don't want to invest heavily in furnishings because they might move. A free TV means less sunken cost if you relocate.

4. Secondary TV Buyers: Some households apply for Telly TVs not as their primary display, but as a secondary unit for a bedroom, kitchen, or basement. The trade-off of advertising is more acceptable for non-primary usage.

What's notable is that Telly hasn't strongly penetrated the luxury or premium segments (obviously), but it also hasn't reached deep into the absolute lowest-income households. Some friction still exists—you need decent Wi Fi, you need to complete an application process, you need to accept technological sophistication. Telly targets the accessible price-conscious market, not the most economically constrained consumers.

Geographically, Telly's US adoption is uneven. Early rollout favored major metropolitan areas where advertising partners have better infrastructure. Rural adoption has been slower, which makes sense given that rural areas often have weaker Wi Fi infrastructure, less sophisticated advertising markets, and different viewing preferences.

What Went Wrong (And What Went Right)

Telly's rollout has been messier than ideal, but the company learned important lessons that inform future strategy.

What Went Wrong:

- Overpromising scale: Initial projections of hundreds of thousands of users by 2024 created expectations the company couldn't meet. This damaged credibility with investors and media observers.

- Supply chain complexity: Distributing consumer electronics is harder than software, and Telly underestimated this. Wave-based rollout created frustration and perception of scarcity.

- Insufficient marketing: The company relied heavily on organic media coverage, which proved insufficient for reaching the actual target market (price-conscious, less-engaged consumers).

- Privacy skepticism: Tech media amplified privacy concerns extensively, creating a narrative that discouraged adoption even among people who might have accepted the trade-off.

- Minimal offline presence: Telly only exists online, without retail partnerships that could build physical credibility and accessibility.

What Went Right:

- Product actually works: The TV itself functions reliably. When shipped and set up correctly, customers keep the units and use them. Churn has been lower than skeptics expected.

- Revenue materializes: Advertisers actually pay for the inventory, proving the advertising model has legs. This was the biggest validation—not everyone believed Telly would actually monetize.

- User satisfaction: Net Promoter Scores and user retention metrics are respectable for a free product. This suggests the value proposition resonates with the target demographic.

- Capital durability: Telly still has runway and investor backing. The company hasn't needed to pivot to paid models or raise emergency financing, suggesting the economics are holdable.

These contrasts suggest Telly's problem is primarily go-to-market and scaling, not fundamental product or business model failure.

International Expansion: The Real Opportunity

Telly's greatest opportunity might not be deeper penetration in North America, but rather expansion into international markets where 4K TV adoption is lower and purchasing power constraints are stronger.

In Europe, markets like Poland, Hungary, and Bulgaria still have significant populations without 4K access. Telly could partner with local advertisers and streaming services to create region-specific versions of the platform. European data protection laws (GDPR) create friction, but they're not insurmountable.

In Latin America, 4K TV adoption is substantially lower than in North America, and per-capita income makes even $300-400 TVs genuinely expensive. Telly's model could have profound impact here if distribution challenges are solved.

In Southeast Asia, countries like Indonesia, the Philippines, and Vietnam have massive populations with limited premium electronics access but growing smartphone and streaming adoption. An ad-supported TV could unlock massive new markets for both Telly and the advertising ecosystem.

The challenge is that each market requires localized advertising partnerships, localized software (languages, regional apps), and understanding of local consumer preferences. That's expensive and complex, but the addressable market is massive—billions of people globally without access to modern displays.

If Telly can successfully navigate even one or two international markets, it becomes not just an interesting US experiment, but a meaningful global company.

The Broader Implications: What Telly Teaches Us

Beyond the specific product, Telly's experience offers insights into how consumer electronics will evolve.

First, affordability through subsidization is real and viable, not just theoretical. Companies can successfully offer premium hardware at zero cost if advertising revenue models work. This removes a ceiling on how cheap consumer electronics can become.

Second, consumer willingness to accept advertising is higher than tech enthusiasts assume. The audience that actively refuses advertising is real, but smaller than the percentage of consumers willing to make the trade-off for meaningful savings. Market segmentation around this willingness is commercially viable.

Third, distribution and go-to-market matter more than product quality for consumer electronics. Telly's product is fine, but getting it into people's hands and building awareness has been harder than anticipated. This suggests that traditional manufacturers with retail relationships have advantages that are hard for new entrants to overcome.

Fourth, trust and credibility require time to build. Telly encountered skepticism not because the model is obviously broken, but because consumers are (rightfully) skeptical of new companies making bold claims. This is overcome through execution, consistency, and word-of-mouth over years, not months.

Finally, the price-conscious consumer market is real and large, but hard to reach through traditional tech channels. Telly's early adopters were largely tech enthusiasts who heard about the company through tech media. But the actual opportunity is reaching ordinary consumers who don't follow tech blogs and don't think about product innovations—they just know they want a TV and can't afford one. That market requires different messaging, different distribution, different everything.

Alternatives and Competitors: Other Paths to Affordable Displays

Telly isn't the only approach to solving expensive TVs. The market offers alternatives with different trade-offs.

Budget TV Brands (TCL, Hisense, Insignia) offer affordable 4K displays at $300-450 without advertising trade-offs. This is the traditional approach and still dominates the market. The advantage is simplicity and no ongoing compromise. The disadvantage is you still have to pay.

Subscription TV Services with ad tiers (Netflix, Disney+, Prime Video) offer free or cheap content access, but not free hardware. You still need to own a TV to watch. This addresses content affordability, not display affordability.

Used and Refurbished Markets allow consumers to buy quality 4K displays for $200-300 if they're willing to purchase second-hand. This is economically equivalent to Telly in some ways, but requires more effort and comes with less warranty protection.

Rental Models: Some regions offer TV rental programs where you pay monthly for hardware access. This spreads cost over time but ultimately costs more than buying, making it generally worse economics than either cheap TVs or free ad-supported options.

Manufacturer Direct Sales with financing options (Samsung, LG offering 24-month payment plans) reduce upfront cost but don't eliminate it. Interest costs often make this the most expensive long-term approach.

Compared to these alternatives, Telly's advantage is simplicity—you get a quality 4K TV with zero payment and no long-term commitment. The disadvantage is living with advertising. For the right consumer segment, that's a compelling offer.

The Financial Sustainability Question: Can This Actually Work Long-Term?

The biggest question hanging over Telly is whether the business is fundamentally sustainable or just buying time with venture capital.

The math suggests it's sustainable. With even modest scale—say 50,000 active users generating average

The challenge is reaching that scale and maintaining it. Telly needs:

- Consistent user acquisition (1,000-2,000 new activated units monthly)

- Low churn (less than 3% monthly deactivation)

- Stable or growing advertiser commitment (as platforms mature, ad spend can increase or decrease)

- Operational efficiency (keeping per-unit costs low as volume grows)

Any of these could break. If churn exceeds 5% monthly, the business dies. If advertiser interest evaporates when novelty wears off, revenue collapses. If operational costs don't decrease with scale, margins disappear.

But none of these are predetermined failures. They're normal business challenges. Telly's advantage is that early signs suggest all of them are moving in the right direction. Churn appears acceptable, advertisers are actively participating, and the company is finding operational efficiencies.

The real test comes in 2025-2026. If Telly can reach 100,000+ active users, achieve single-digit monthly churn, and demonstrate $50+ monthly ad revenue per user, the model becomes genuinely validated. Failure in any of these metrics signals deeper problems.

What Happens If Telly Succeeds?

Success for Telly would reverberate through the consumer electronics industry.

If Telly reaches 200,000 active users and generates sustained profitable revenue, you'll immediately see:

- Samsung, LG, and other incumbents launching ad-supported TV lines to compete for price-sensitive markets

- Amazon and Google developing their own ad-supported TV hardware, leveraging their existing ad platforms

- Cable and satellite providers exploring ad-supported TV hardware to reduce subscriber acquisition costs

- Monitor and display manufacturers creating ad-supported versions of productivity displays

Once the category is validated, competition becomes inevitable. The incumbents have advantages—manufacturing scale, retail relationships, brand trust—that could allow them to execute better than Telly. But Telly would deserve credit for proving the concept.

Investor capital would flow into adjacent spaces. You'd see ad-supported laptops, tablets, and appliances. The subsidization model becomes not niche, but mainstream.

Consumer behavior would shift. People would become accustomed to accepting advertising in exchange for affordability. Future generations might find it perfectly normal to have secondary advertising screens in their living rooms, just as they find it normal to scroll through Instagram ads or watch YouTube with advertisements.

The dark side of this scenario is that advertising becomes more intrusive, more pervasive, and more normalized. Your entire home becomes a potential advertising vector. Privacy erosion accelerates. The trade-off between affordability and surveillance becomes more extreme.

But consumers would benefit from access to quality hardware at zero marginal cost. The democratization of technology—making premium displays affordable to billions of people who currently can't access them—would be a meaningful improvement in global equity.

What happens in the next 18-24 months determines whether this positive future scenario is even possible.

FAQ

What exactly is Telly?

Telly is a startup that manufactures and distributes completely free 55-inch 4K LED televisions subsidized entirely by advertising revenue. The TV itself functions like any modern smart TV with access to streaming apps, but includes a mandatory secondary display screen mounted on top that shows advertisements continuously. There are no hidden fees, subscription costs, or payment obligations—the TV is truly free in exchange for accepting the advertising trade-off.

How does Telly make money if the TV is free?

Telly generates revenue from the secondary advertising screen and user behavioral data. Advertisers pay Telly based on impressions (typically $20-40 CPM or cost per thousand impressions) to display content on the companion screen. Additionally, Telly collects data about your viewing habits, app usage, and content preferences, which has value to advertisers for targeting and analytics. The combination of direct advertising revenue and data monetization is sufficient to offset hardware costs and fund operations, with profit remaining.

Who should actually get a Telly TV, and is it worth it?

Telly makes sense for consumers who prioritize cost over privacy and aesthetics. If you cannot afford a $400-600 4K television but want quality video access, the trade-off is economically favorable. It's best suited for price-conscious households, secondary TV buyers (for bedrooms or kitchens), and early adopters comfortable with advertising. If you value visual serenity, strong privacy protection, or don't want data collection, traditional TV purchases remain better despite higher cost.

Is my data safe with Telly?

Telly collects substantial behavioral data—what you watch, when you watch, what apps you use, search terms, and viewing duration. The company's privacy policy is transparent about this collection, and they've implemented some privacy controls. However, continuous data collection is fundamental to how ad-supported hardware works. Your data is reasonably protected from public exposure, but it's actively used for advertising targeting and sold to data partners. If privacy is your primary concern, a traditional paid TV is safer despite higher cost.

Can you use a Telly TV just like a normal TV without the ads?

No, not practically. The secondary advertising screen is always active and displays advertisements continuously. You cannot disable it, minimize it, or eliminate it entirely. This is how Telly finances the hardware. That said, many users report the secondary screen becomes mentally invisible after a few weeks of use, similar to how you stop noticing background noise. But if you find advertising intrusive or visually distracting, Telly is fundamentally incompatible with your preferences.

How many people actually own Telly TVs?

Telly has not disclosed exact active user numbers, but based on available indicators, the company has likely activated somewhere in the range of 10,000-30,000 units as of 2024. This is substantially below early projections of hundreds of thousands, suggesting slower adoption than anticipated. However, for a product less than two years old, this represents meaningful traction in a niche segment.

Is Telly still operating, and is the business sustainable?

Yes, Telly is actively operating and continues accepting new user applications. The company has demonstrated that advertising revenue is materializing, with advertisers actively paying for inventory on the platform. Based on disclosed financial information and ongoing operational status, the business appears sustainable at current scale. Whether it achieves the growth required for venture capital to achieve returns is still an open question, but fundamental business viability appears proven.

Will Telly expand internationally, or is it US-only?

Telly currently operates primarily in the United States, with limited presence in select other markets. International expansion is certainly planned, but the company has prioritized establishing strong product-market fit and unit economics domestically first. European expansion is likely in 2025-2026, followed by potential Latin American and Asian markets. Each region requires localized advertising partnerships, software translations, and regulatory compliance, making international rollout a multi-year effort.

What's the catch? Why would anyone trust a startup giving away free TVs?

Legitimate questions exist about company longevity and service continuity. If Telly fails as a business, you retain the TV hardware, but secondary screen functionality and software updates would cease. The company has raised substantial venture capital and demonstrated revenue traction, which provides some security. However, this is inherently riskier than buying from established manufacturers. The catch is ultimately the advertising and data collection—that's how the business model closes financially.

Could traditional TV manufacturers compete with Telly's ad-supported model?

Absolutely. Samsung, LG, and other incumbents could launch ad-supported TV lines if market demand justified it. They have advantages including manufacturing scale, retail relationships, and consumer trust. However, they also have less urgency to cannibalize their existing premium TV sales with free ad-supported alternatives. Telly's advantage is that it faces no cannibalization concerns—its entire business model depends on ad-supported hardware. If Telly proves the category works at scale, traditional manufacturers will likely respond with competitive offerings.

Conclusion: A Viable Glimpse Into Consumer Electronics' Future

Telly's journey so far is a masterclass in how a genuinely innovative business model can function in practice despite significant skepticism. The company set out to prove that free hardware subsidized by advertising is viable, and early results suggest it's working—just more slowly and messily than optimists expected.

The product itself is competent. Users who receive Telly TVs generally keep them and use them. The secondary advertising screen, while undeniably uncomfortable as a concept, becomes functionally tolerable for most users because the financial value of a free 4K television is substantial enough to justify modest compromise. That's not romantic, but it's real.

The business model—advertising revenue generating sufficient returns to subsidize hardware—has been mathematically validated. Advertisers are paying real money to place content on Telly's platform. The company is generating revenue, not just burning capital. This is the single biggest validation because it proves the core assumption was sound.

The challenge remaining is scaling adoption without destroying unit economics. Telly's path to meaningful success requires reaching 100,000+ active users while maintaining single-digit monthly churn and advertising yield. That's achievable but not inevitable. The company needs execution on distribution, marketing, product refinement, and operational efficiency. Execution is where most ambitious startups stumble.

What makes Telly culturally significant is the precedent it establishes. If the company succeeds, it proves that consumer electronics manufacturers can offer premium hardware at zero upfront cost through advertising subsidization. This model then spreads to monitors, laptops, tablets, and other product categories. The consumer electronics industry fundamentally transforms.

The privacy and advertising implications are real concerns. A world where advertising permeates more of your physical environment is not unambiguously better. But the democratization benefit is also real. Billions of people globally lack access to quality displays because cost is prohibitive. Telly offers a path to changing that.

The next 18-24 months matter enormously. If Telly reaches 100,000 active users by 2026 while maintaining profitable unit economics, the model becomes genuinely validated and competition from larger players inevitably follows. If the company stalls or declines, it becomes a cautionary tale about distribution and go-to-market challenges.

Most likely, Telly succeeds at a smaller scale than its backers hoped, but sufficient scale to prove the concept works. Some percentage of price-conscious consumers genuinely prefer free hardware with advertising to paid hardware without it. That segment exists, is profitable to serve, and represents a new category in consumer electronics.

That's not the nightmarish future some feared, nor the revolutionary transformation optimists projected. It's the realistic middle ground where a genuinely useful business model serves a real market need, even if adoption is slower and scale is smaller than hyperoptimistic projections suggested.

For consumers unable to afford quality displays, Telly represents meaningful opportunity. For the consumer electronics industry, it represents an unexplored growth vector. For the advertising industry, it's new inventory with genuinely captive audiences. And for investors, it's a bet on whether that value creation justifies the capital deployed.

The fact that Telly is still operating, still generating revenue, and still acquiring new users suggests the answer might actually be yes.

Key Takeaways

- Telly successfully proved that advertising-subsidized hardware can generate real revenue, with thousands of active users retaining their free TVs and advertisers actively paying for secondary screen inventory.

- User adoption has been significantly slower than projected (20,000 actual vs 300,000+ projected), indicating go-to-market challenges despite product viability.

- The business model economics work mathematically if monthly ad revenue reaches $40-60 per user, which early data suggests is achievable at current scale.

- Privacy and data collection are fundamental costs, with Telly continuously harvesting viewing behavior, but this trade-off appears acceptable to the target price-conscious demographic.

- If Telly reaches 100,000+ profitable active users, incumbent manufacturers will likely launch competing ad-supported product lines, transforming the consumer electronics industry.

Related Articles

- Apple AirTags 2 [2025]: Next-Gen Tracking with Enhanced Range & Louder Speaker

- Apple AirTag 2025: Enhanced Range, Louder Speaker, Better Tracking [2025]

- LG B5 OLED TV Deal: Why $549.99 Is an Unbeatable Price [2025]

- Best Home Theater Gear to Transform Your Living Room [2025]

- Samsung's QD-OLED Brightness Breakthrough: Why It Still Falls Short [2025]

- Best Tech Deals This Week: Travel Adapters, MicroSD Cards, and More [2025]

![Telly's Free 4K TV with Ads: Why It's Struggling (But Still Making Money) [2025]](https://tryrunable.com/blog/telly-s-free-4k-tv-with-ads-why-it-s-struggling-but-still-ma/image-1-1769451174543.jpg)