The Historic Shift: When David Actually Defeated Goliath

For over a decade, Tesla owned the electric vehicle narrative. Elon Musk was the visionary. Tesla was the innovation engine. Everyone else was playing catch-up.

Then, quietly and without much fanfare in Western media, something fundamental changed.

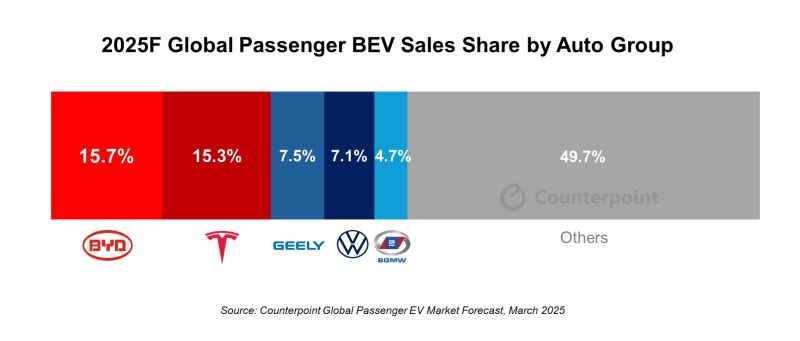

In 2025, BYD—a Chinese automaker most Americans couldn't locate on a map three years ago—officially dethroned Tesla as the world's largest EV manufacturer. Not by a little bit. Not by a razor-thin margin. By crushing it.

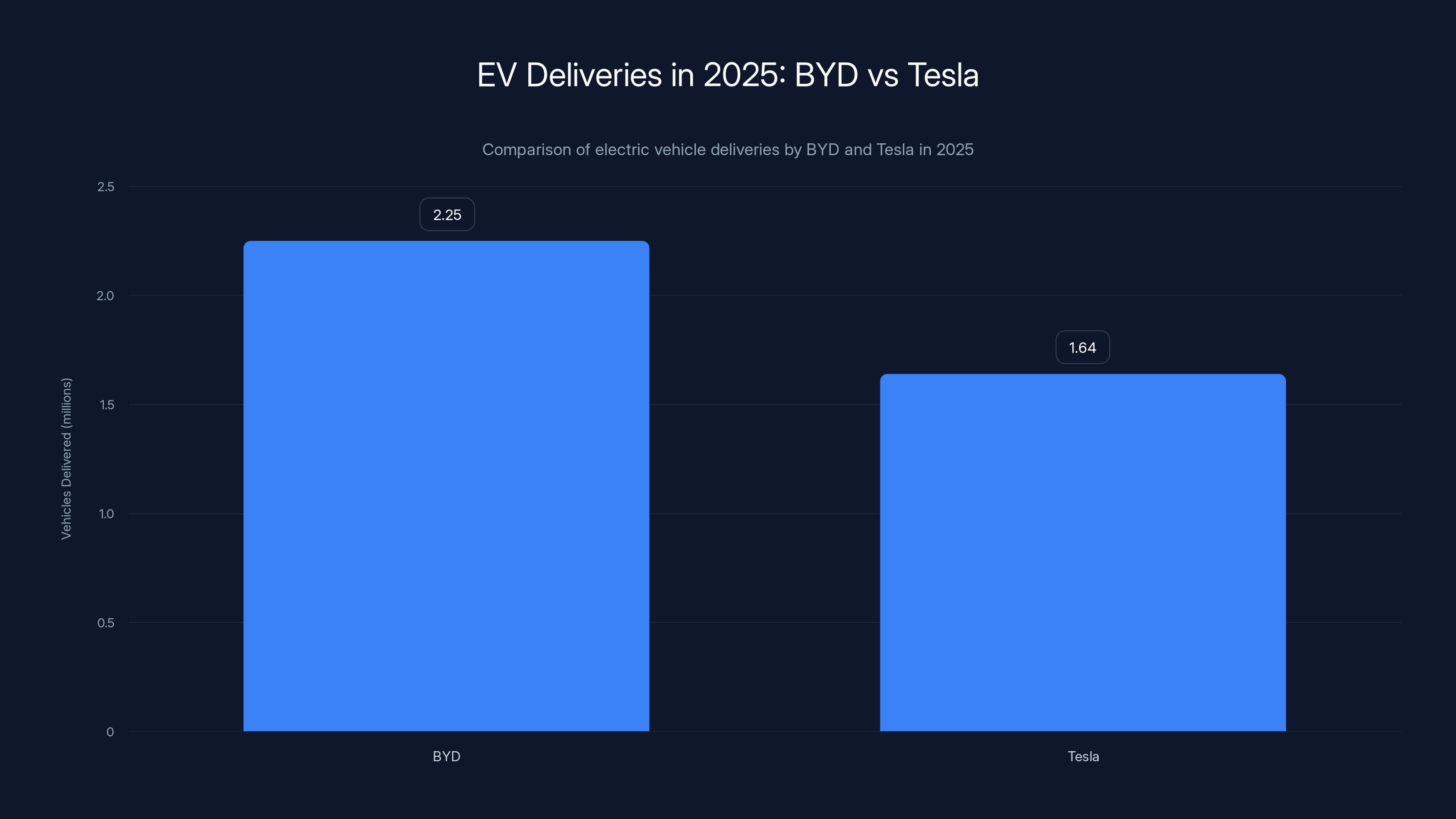

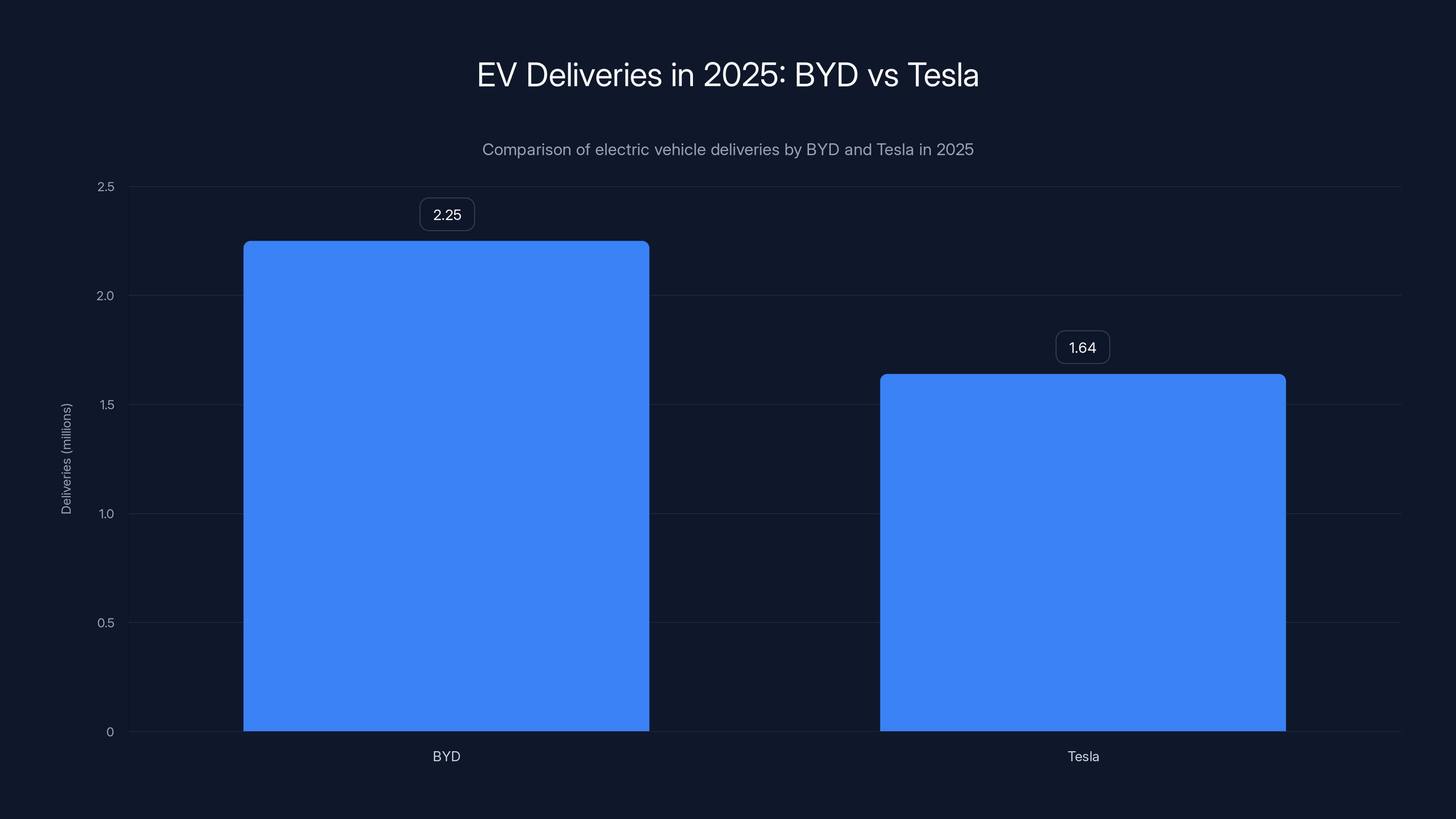

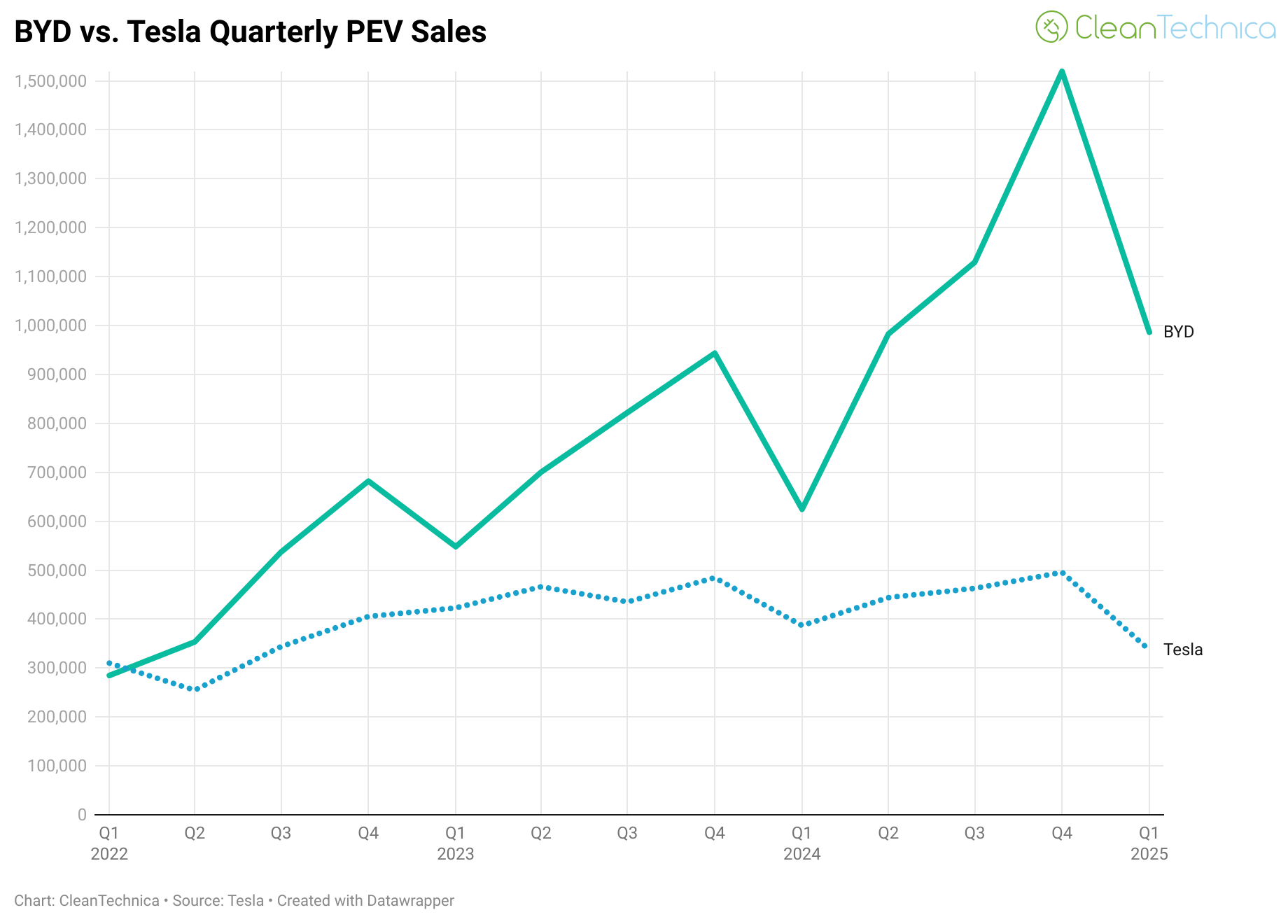

BYD delivered 2.25 million electric vehicles in 2025, a 28% year-over-year increase. Tesla? It announced 1.64 million vehicles delivered, marking its second consecutive annual decline and a painful 16% drop in the fourth quarter alone. That's not a blip. That's a trend line pointing in the wrong direction.

But here's what makes this story genuinely significant: it's not just about sales numbers or quarterly reports. It's about the fundamental restructuring of the automotive industry happening in real-time. Tesla built the EV category from scratch. It deserves credit for that. But it also built that category in a very specific way, optimized for a very specific market, with a very specific playbook. That playbook is breaking down. And BYD, along with a dozen other competitors, is demonstrating there's more than one way to dominate the EV future.

The question isn't whether Tesla is finished. It's not. But the question of whether Tesla can maintain dominance? That's answered now. And the answer is no.

Understanding BYD: From Battery Company to Global Giant

Most Western consumers don't know BYD's origin story, and that's a problem. Because understanding where BYD comes from explains everything about why it's beating Tesla.

BYD started in 1995 as a battery manufacturer. Not cars. Batteries. The company built rechargeable batteries for consumer electronics, and it became really good at making them cheaply and reliably. When the electric vehicle revolution started gaining momentum in the 2000s, BYD had an enormous advantage: it already knew batteries better than almost anyone on earth.

While Tesla had to source batteries from other manufacturers early on, BYD could build its own. That vertical integration—controlling the entire supply chain from raw materials to finished product—became a massive strategic advantage. BYD could iterate faster, reduce costs more aggressively, and maintain margins that competitors simply couldn't match.

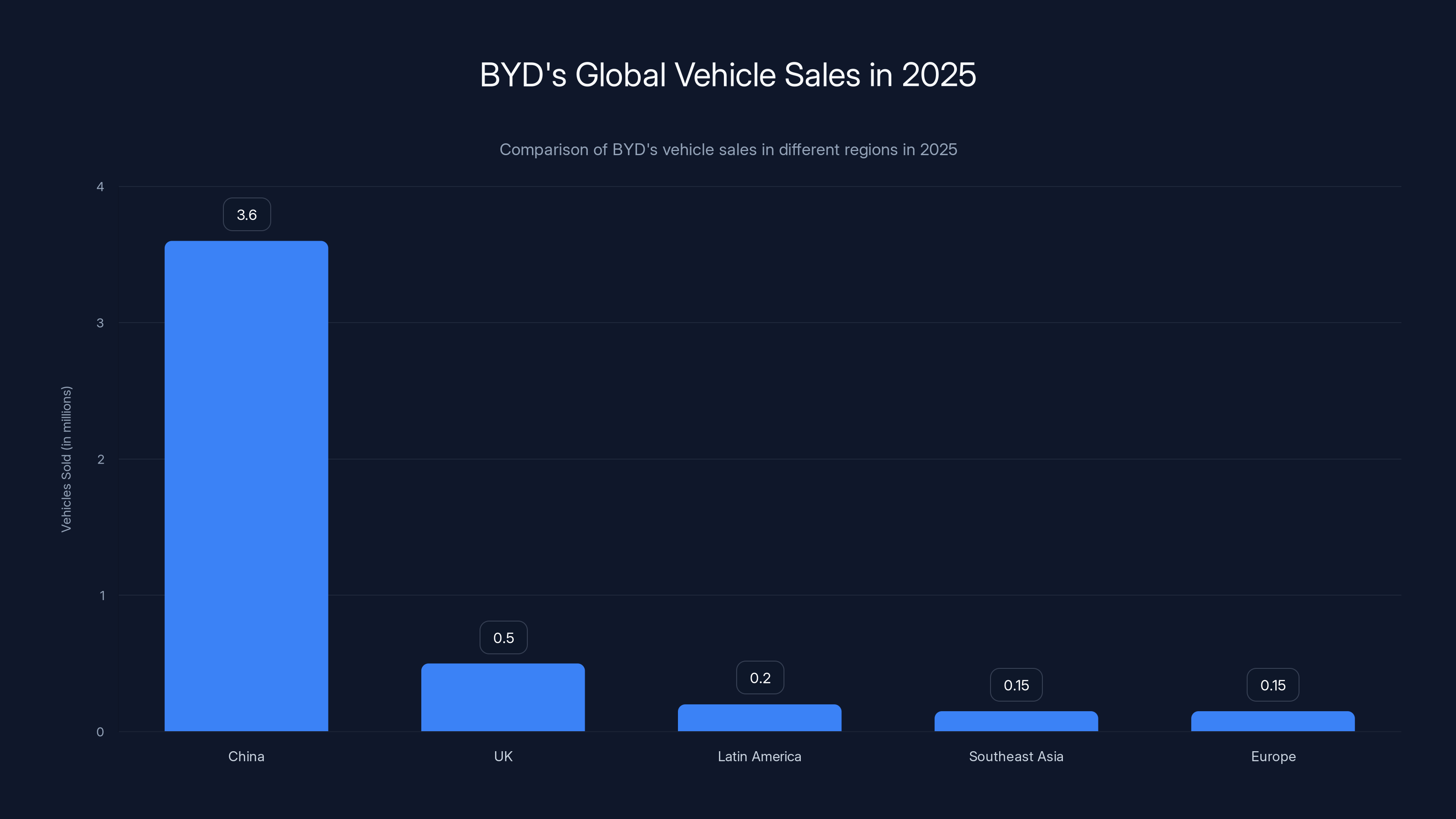

In 2025, BYD sold 4.6 million "new energy vehicles" globally, which includes both full electric vehicles and plug-in hybrids. More than a million of these were exported vehicles. That export growth was particularly instructive: passenger vehicle exports from BYD jumped 145% year-over-year. This isn't a company that's successful just in its home market. It's expanding rapidly into Latin America, Southeast Asia, and Europe, despite significant tariff barriers and protectionist policies.

Take the UK market as an example. In 2025, the UK became BYD's largest market outside of China. Sales there skyrocketed 880% compared to the previous year. Now, that was from a lower base, but the trajectory is undeniable. The company is moving aggressively into markets where Tesla has been complacent.

The company's expansion strategy is different from Tesla's. While Tesla focused on premium models first, BYD is simultaneously attacking multiple price points and vehicle categories. It makes affordable models for mass markets, luxury EVs, SUVs, sedans, and even a 3,000-horsepower electric hypercar called the Yangwang U9 Xtreme that in September set a speed record of 308.4 mph, becoming the world's fastest production vehicle—electric or gas.

That hypercar stunt wasn't about selling cars. It was about narrative. It was about proving BYD could compete and win on any dimension. When you're a Chinese company facing skepticism in Western markets about quality and innovation, demonstrating record-breaking capability changes the conversation.

In 2025, BYD delivered 2.25 million EVs, surpassing Tesla's 1.64 million deliveries. BYD's growth was driven by a superior cost structure and broader market presence.

Tesla's Year of Decline: From Dominance to Desperation

Tesla didn't lose the EV crown because BYD suddenly became amazing. Tesla lost it because Tesla stumbled badly.

2025 was a disaster year for the company, in nearly every dimension that matters for long-term growth. Sales declined. Growth stalled. New products flopped. And the company's leadership spent enormous energy chasing political favor instead of fixing fundamental business problems.

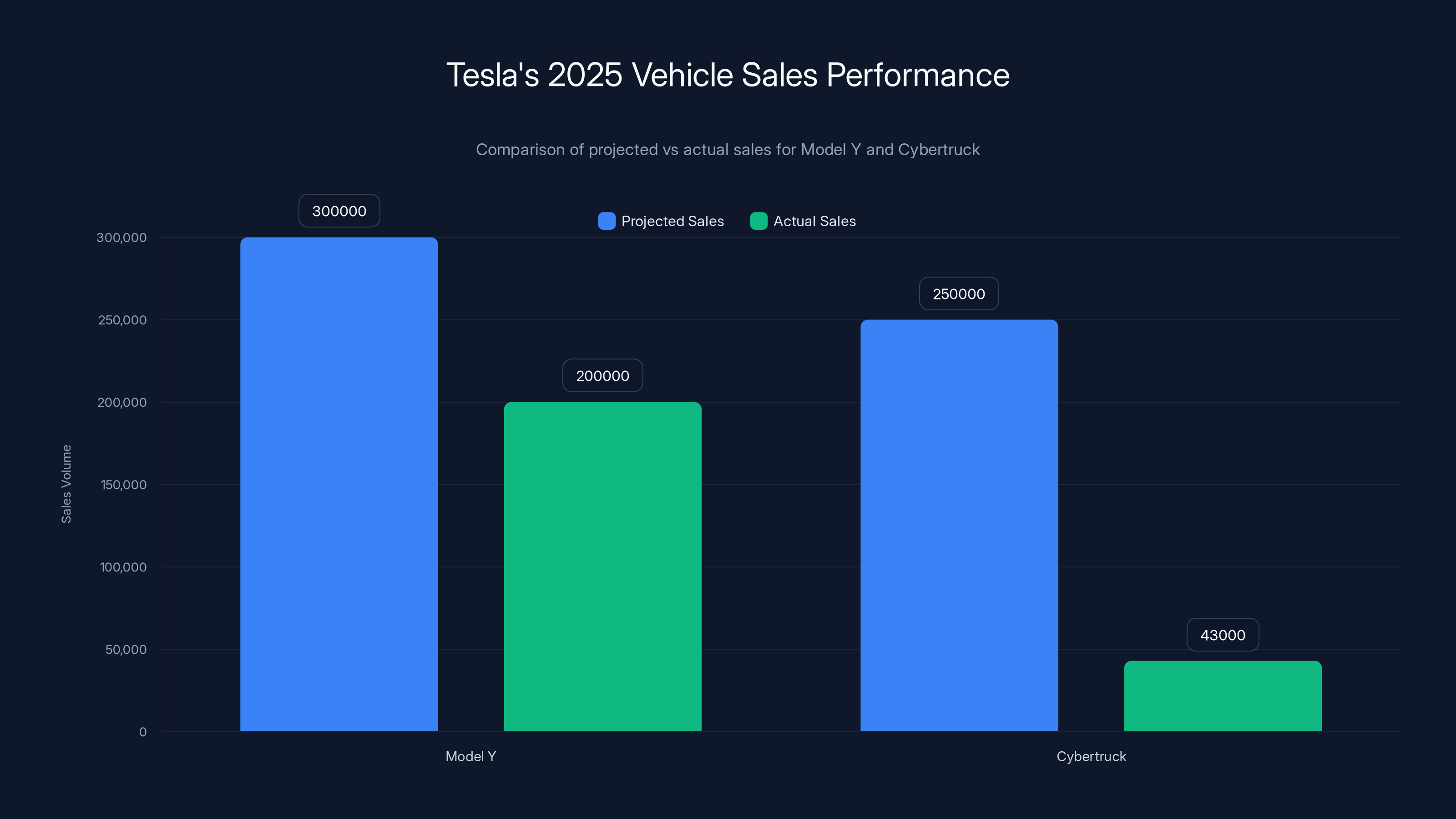

Let's start with the vehicles people actually care about: the Model Y.

The Model Y is Tesla's volume driver. It's the car that pays the bills. In 2025, Tesla gave the Model Y a refresh that, by most accounts, missed the mark. The redesign was underwhelming. It didn't address fundamental criticism about the vehicle's interior quality or design language. Buyers, it turns out, noticed. Sales momentum evaporated. The Model Y refresh was supposed to reinvigorate demand. Instead, it proved that Tesla's design innovation pipeline might be running dry.

Then there's the Cybertruck, which was supposed to be Tesla's next blockbuster.

Elon Musk promised investors that Tesla would sell 250,000 Cybertrucks annually. The company was so confident in this vehicle that the model's extreme design was justified as a necessary bet on future-forward thinking. Customer deliveries began in late 2023. By March 2025, less than 14 months later, Tesla had sold fewer than 50,000 units total. That's not a successful product launch. That's proof the market rejected the concept at scale.

Let's do the math: Musk promised 250,000 per year. Actual delivery was about 50,000 in 14 months, or roughly 43,000 per year at current run rate. The company is off by 82% from its projections. For perspective, that's like a restaurant promising 1,000 customers per day and actually serving 180.

The Cybertruck problem got so severe that by June 2025, there were reports that Musk was planning to sell his personal Model S Plaid, the car Trump had promised to drive. Why? Because in the court of public opinion, even the president seemed to be getting exhausted with Tesla drama.

But here's where the story gets really weird: Space X, also owned by Musk, apparently purchased tens of millions of dollars worth of Cybertrucks that Tesla couldn't sell to the public. That move would have propped up Tesla's fourth-quarter financials. And yes, that arrangement is real, documented, and happened.

Think about what that represents. A parent company buying worthless inventory from its subsidiary to artificially inflate financial results. It's not illegal, but it reveals desperation. Tesla couldn't sell its flagship new product to actual customers, so the solution was to shuffle money between Musk-owned entities.

The Robotaxi Bet: Promising Everything, Delivering Nothing

Faced with declining vehicle sales, Musk made a strategic pivot that, charitably, is extremely optimistic.

Tesla is betting its future on two products that don't exist yet: the Robotaxi and the Optimus humanoid robot. Musk claims Tesla will produce a million Optimus robots over the next decade. He says Robotaxi will revolutionize transportation. He says these products will generate profit margins that make current Tesla vehicles look primitive.

The problem is that neither product is anywhere close to ready. And neither product, even if successful, solves Tesla's current problem of declining sales.

The Robotaxi launched in limited form in Austin, Texas, in June. Coverage of the launch was... mixed. The service had significant limitations. The technology wasn't reliable. And most crucially, Waymo—which barely anyone talks about in mainstream media—has been running a more sophisticated autonomous vehicle service in multiple cities for longer. Waymo's technology appears more mature, more reliable, and more investable.

As for Optimus, footage continues to emerge of the robots being remote-controlled by humans, not operating autonomously. Musk promised autonomous humanoid robots. What's been delivered are very expensive puppets. There's a massive gap between those two things.

Here's the harsh reality: even if Tesla's Robotaxi technology works perfectly tomorrow, it won't solve the problem of needing to sell more cars today. Investors need growth now, not promises of profitability in 2030. And customers need vehicles that work reliably, not vaporware dressed up as strategy.

Musk's recent claims that Tesla should shift away from EVs entirely and focus on robots are essentially admissions that the EV business is harder than anticipated. The company can't compete on price. It can't compete on feature-richness. It's trying to compete on brand and innovation, but both of those advantages are eroding.

In 2025, BYD sold 4.6 million vehicles globally, with significant growth in the UK market, where sales increased by 880% from the previous year.

China's Manufacturing Dominance: Why BYD Wins on Economics

This is the unsexy but crucial part of the story: BYD beats Tesla because of economics and manufacturing efficiency, not because of brand coolness or visionary leadership.

BYD manufactures vehicles at a cost structure that Western automakers simply cannot match. This isn't about cutting corners or lower quality. It's about systematic advantages in labor costs, supply chain organization, manufacturing efficiency, and scale.

When BYD builds a battery, it controls every step of that process. It mines the materials. It processes them. It manufactures the cells. It assembles them into packs. It integrates those packs into vehicles. That vertical integration allows the company to optimize every step for cost, quality, and reliability.

Tesla, by contrast, outsources many components. It negotiates with suppliers. It deals with supply chain complexity. And yes, Tesla has gotten better at manufacturing efficiency over the years. But BYD's structural advantages are geometric.

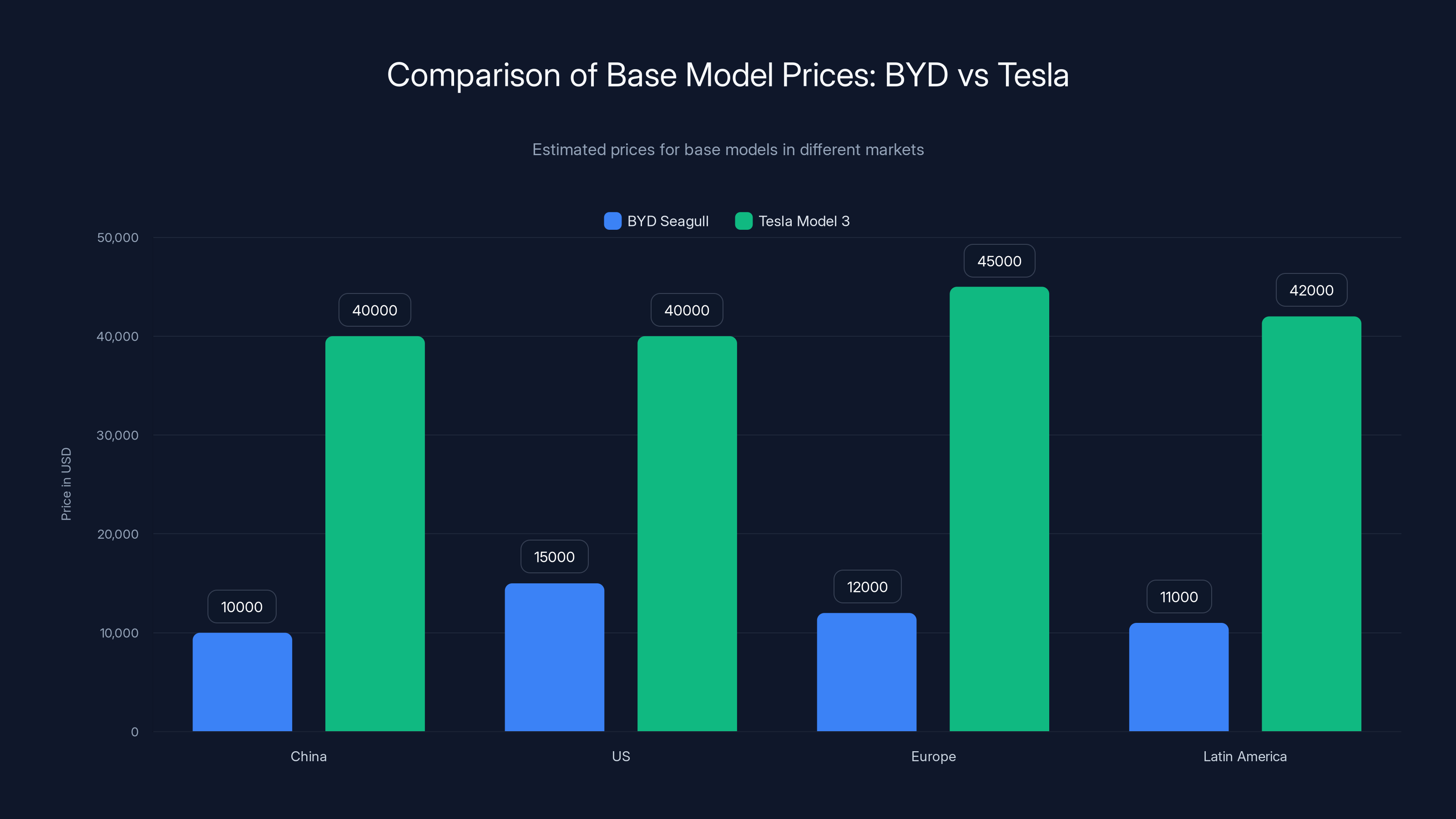

Here's a concrete example: the base-model BYD Seagull sells for about

Now, regulatory and tariff barriers prevent BYD from selling these ultra-cheap vehicles in the US market directly. But they're already available in much of Latin America, Southeast Asia, and increasingly in Europe. That's 2 billion people in markets where BYD vehicles are becoming the default affordable option.

The cost advantage also means BYD can undercut competitors on price, maintain healthier margins, and reinvest more heavily in new product development. Tesla is stuck in a margin-squeeze situation where it can't drop prices dramatically without hurting profitability, but it can't maintain prices without losing volume. BYD has the flexibility to play both games simultaneously.

The Tariff Problem: How Politics Failed Tesla

Elon Musk spent considerable political capital in 2025, primarily because Tesla faced a massive problem that no amount of innovation could solve: tariff barriers.

When Trump took office in January 2025, Musk saw opportunity. He cultivated a close relationship with the administration, made public endorsements, and positioned himself as a trusted business advisor. At one point, Trump apparently promised to purchase a Tesla Model S Plaid, turning the White House South Lawn into a makeshift showroom.

But here's the thing: tariffs and trade barriers are structural problems. They can't be solved with political relationships alone. The US imposed steep tariffs on Chinese EVs specifically to protect domestic manufacturers. Those tariffs make it impossible for BYD to enter the US market directly, which it desperately wants to do. They also make it harder for Tesla to manufacture globally and import components efficiently.

By June, reports emerged that Trump and Musk were no longer on good terms. The personal friendship couldn't overcome fundamental business disagreements and political drama. Tesla still didn't have a solution to its core problems.

What tariffs did accomplish: they protected legacy automakers like Ford, GM, and Stellantis from being completely overwhelmed by BYD's cheap vehicles. But they didn't help Tesla. Tesla was already in the US market. It needed demand growth, not protectionism from competitors. And tariffs made it more expensive for Tesla to source components globally.

Meanwhile, BYD continued expanding into unprotected markets. Latin America saw massive BYD investment. Europe gradually opened to Chinese EVs despite political resistance. Southeast Asia became a BYD stronghold. The company's strategy was brilliant: attack markets where Western protectionism doesn't exist.

Global EV Sales: The Bigger Picture

Tesla's decline and BYD's rise need context. The overall EV market is still growing. It's not like everyone stopped buying electric vehicles.

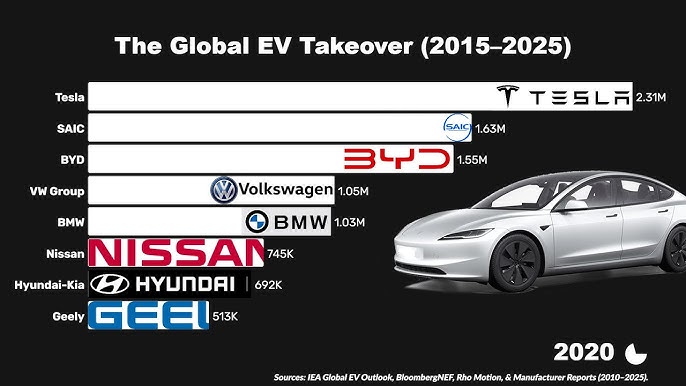

Global EV sales in 2025 increased moderately but from a much larger base. The market is becoming less Tesla-centric and more fragmented. Traditional automakers like BMW, Audi, Volkswagen, and Geely (which owns Volvo) have competitive EV products. BYD's Yangwang brand competes in the luxury segment. Nio and XPeng are producing compelling vehicles. Even Geely's Geometry brand is gaining traction.

What's happening is market maturation. When Tesla started, it had virtually no EV competition. Customers chose Tesla because it was the only real option for premium EVs. Now, there are dozens of excellent options. The market is normalizing, which means Tesla's brand premium is compressing. It no longer commands 80% margins on new vehicles because customers have alternatives.

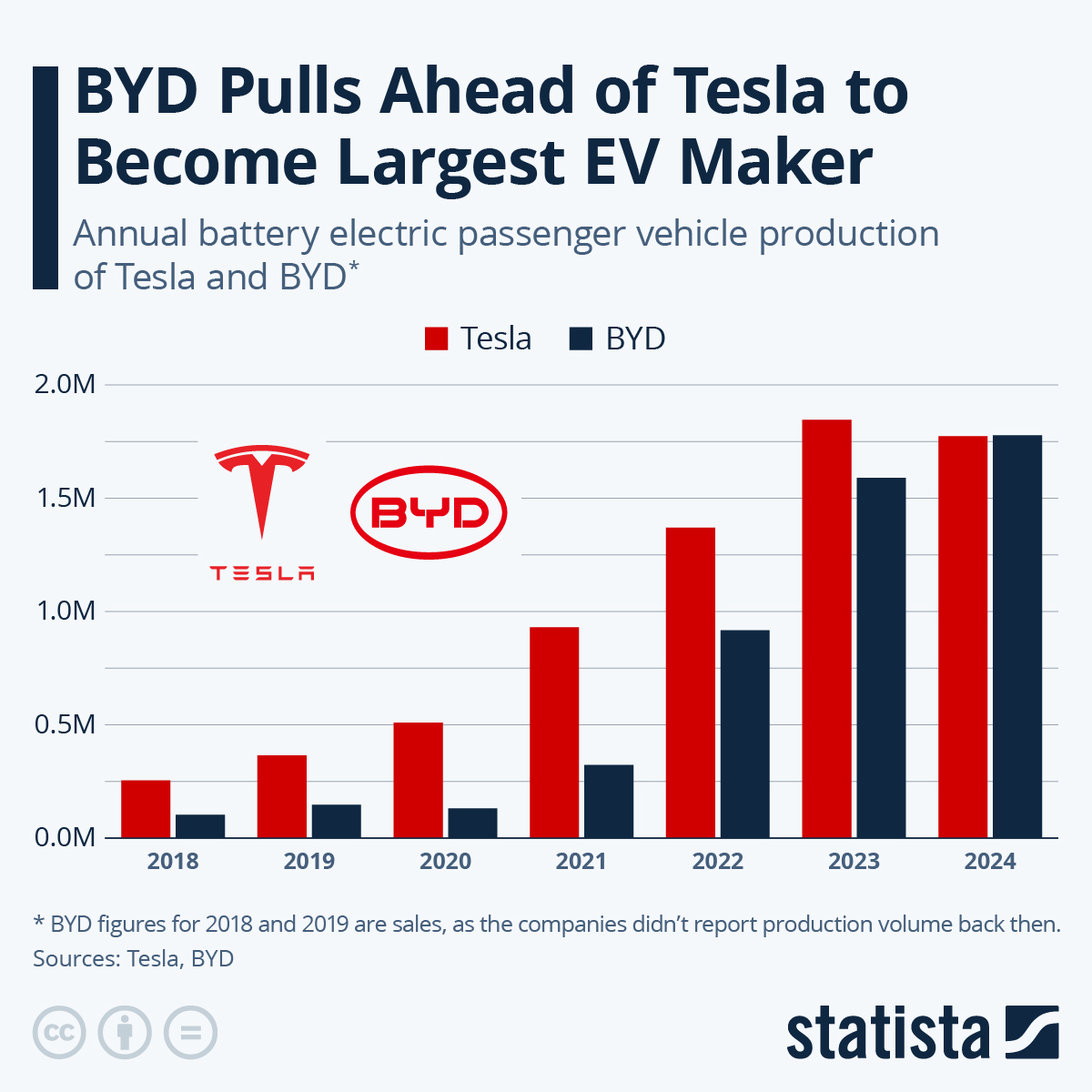

BYD's 28% growth rate, while impressive, also represents growth deceleration compared to previous years. The company is hitting saturation in some markets and increasing competition from domestic players in China. The phrase "weakest growth in five years" appeared in industry analysis of BYD's 2025 results. Growth is slowing but still positive. For Tesla, growth turned negative.

The broader trend is that EV adoption continues accelerating globally, but the winner isn't necessarily the company with the best vision or the coolest cars anymore. The winner is the company that can deliver reliable vehicles at scale at price points where actual customers want to buy them. That describes BYD perfectly. It's not Tesla anymore.

In 2025, BYD delivered 2.25 million EVs, surpassing Tesla's 1.64 million, marking a significant shift in the EV market leadership.

New Vehicle Launches: BYD's Aggressive Strategy vs Tesla's Delays

Looking forward to 2026, the product roadmap tells the story.

BYD has multiple new vehicle launches planned across different categories and price points. The company is approaching the market systematically: affordable vehicles for mass adoption, mid-premium vehicles for mainstream customers, and ultra-premium vehicles for wealthy buyers. That vertical integration of the product line ensures BYD can capture revenue at every level.

Tesla's 2026 roadmap is substantially thinner. The company promises the Cybercab (a robotaxi) and a new semi-truck. Both are "if they arrive on time" products, which is corporate-speak for "we're not confident about the timeline." Tesla's historically struggled with vehicle launch timelines, and there's no reason to expect 2026 will be different.

The Cybercab is particularly interesting because it's not a traditional product. It's not a vehicle you buy and own. It's a service offering. If it works, it's genuinely revolutionary. But if it doesn't work—and there's significant evidence it won't work in 2026—then Tesla has given away valuable engineering resources and time that could have been spent improving existing products.

Meanwhile, BYD will be introducing multiple new models in segments where demand is proven. The company isn't betting the company on unproven future technology. It's executing consistently in markets where it already has presence and credibility.

This is the crucial difference in philosophy. Tesla is betting everything on the next big innovation. BYD is executing methodically across a broad market. When you're losing market share, methodical execution beats moonshots.

The Human Story: How Perception Changed

What's remarkable about Tesla's decline isn't the sales data. It's how quickly the narrative flipped.

Five years ago, Tesla was invincible. Elon Musk was the visionary every business article wanted to profile. Tesla was the company everyone wanted to work for. The stock price was climbing. Customers had multi-year waiting lists for new Teslas. The brand was synonymous with "future."

Fast-forward to 2025. Musk spent much of the year enmeshed in political drama. The company faced public criticism about vehicle safety, quality, and reliability. Multiple recalls were announced. The Cybertruck became a punchline. And employees increasingly reported that Tesla's work culture, once mythologized as intense and meritocratic, had become chaotic and directionless.

Meanwhile, BYD's brand perception shifted from "cheap Chinese knockoff" to "serious global competitor." The Yangwang hypercar speed record was a brilliant marketing move. The company's expansion into Europe and Latin America signaled genuine global ambitions. And most importantly, the vehicles got better. BYD's entry-level models are legitimately good values. The company's mid-range products offer more features than comparable Teslas at lower prices.

Customers, it turns out, care about value. They care about reliability. They care about warranty support. They care about whether the company is focused on making them happy or focused on CEO celebrity. BYD excels at the former. Tesla has become famous for the latter.

Manufacturing Capacity: Scale as Competitive Moat

BYD's manufacturing capacity in 2025 exceeded Tesla's by significant margins. The company operates more gigafactories globally than Tesla, produces more batteries, and has greater flexibility to adjust production based on demand.

In recent years, BYD added manufacturing capacity in Thailand, Brazil, Hungary, and Mexico, directly positioning itself for major markets. These weren't speculative ventures. They were responding to concrete demand signals and tariff realities.

Tesla, meanwhile, consolidated. The company's Berlin factory and Austin factory came online but faced regulatory hurdles and supply chain challenges. The company scaled back expansion plans as growth stalled.

When demand is uncertain, having excess capacity is a liability. You're paying for factories that aren't fully utilized. But as BYD's experience shows, having capacity ready when demand materializes is a massive advantage. The company could respond to growth opportunities in new markets because it had manufacturing ready to go.

BYD's base model Seagull is significantly cheaper than Tesla's Model 3 across various markets, highlighting BYD's cost efficiency. (Estimated data)

The Price War: Economics Determine Winners

Throughout 2025, Tesla engaged in price cuts to maintain volume. The company cut prices multiple times to defend market share against competitors offering better value.

BYD, meanwhile, maintained pricing discipline. The company could cut prices and still remain profitable because its cost structure is so much better. This is the ultimate competitive advantage in a commoditizing market: being able to sell at lower prices while maintaining margin.

Tesla's pricing moves were tactical desperation. BYD's pricing discipline was strategic confidence. That distinction matters. When you're cutting prices to survive, you're losing. When you're cutting prices because you can afford to, you're winning.

The price war benefited consumers. EV prices dropped across the board as competition intensified. But for Tesla shareholders, each price cut was a step toward lower returns. For BYD shareholders, price discipline meant maintaining profitable growth.

Market Analysis: Where Is the EV Industry Heading?

The EV market is now bifurcating in important ways.

In the premium segment, Tesla still has legitimate competition but no longer dominance. Porsche's Taycan, BMW's i7, Audi's e-tron GT, and Mercedes' EQE are all competent luxury EVs. They're priced similarly to Tesla's premium models. Customers are spoiled for choice.

In the mass market, BYD and other Chinese manufacturers have overwhelming advantages. Their vehicles are good enough, priced right, and backed by warranty support. Tesla doesn't have anything in this segment except older Model 3 and Model Y variants that lack competitive pricing.

In the ultra-luxury segment, BYD's Yangwang proves that Chinese manufacturers can compete on premium positioning. The brand is building cachet and capability that Tesla assumed was its birthright.

The consequence: Tesla is slowly being squeezed into a narrower market position. It's not going away. It will continue selling EVs. But it won't dominate. It will compete alongside dozens of other automakers in a fragmented market where price, reliability, and execution matter more than brand mythology.

What About EV Adoption Overall? The Encouraging News

Amidst Tesla's decline, there's genuinely good news: electric vehicles are winning the broader battle.

EV adoption continues accelerating. In Europe, EVs represented about 25% of new car sales in 2025, up from roughly 18% the previous year. In China, EVs and plug-in hybrids represented over 60% of new sales. Even in the United States, where EV adoption has been slower, the share reached 13-14% by late 2025.

These numbers matter because they show the EV transition is real and accelerating. It's not about Tesla anymore. It's about a fundamental shift in how humans will power transportation.

For consumers, this is fantastic. The competition benefits everyone. More choices. Better vehicles. Lower prices. Stronger warranty support. Better charging infrastructure because multiple companies are invested in it.

For investors, this requires a recalibration. The EV industry isn't a growth story anymore in the sense of "grow with any EV company and get rich." It's a competitive industry where some companies will thrive and others will stagnate. Being in the EV space is no longer sufficient. You need competitive advantage, manufacturing excellence, and realistic management. That describes BYD in 2025. It does not describe Tesla.

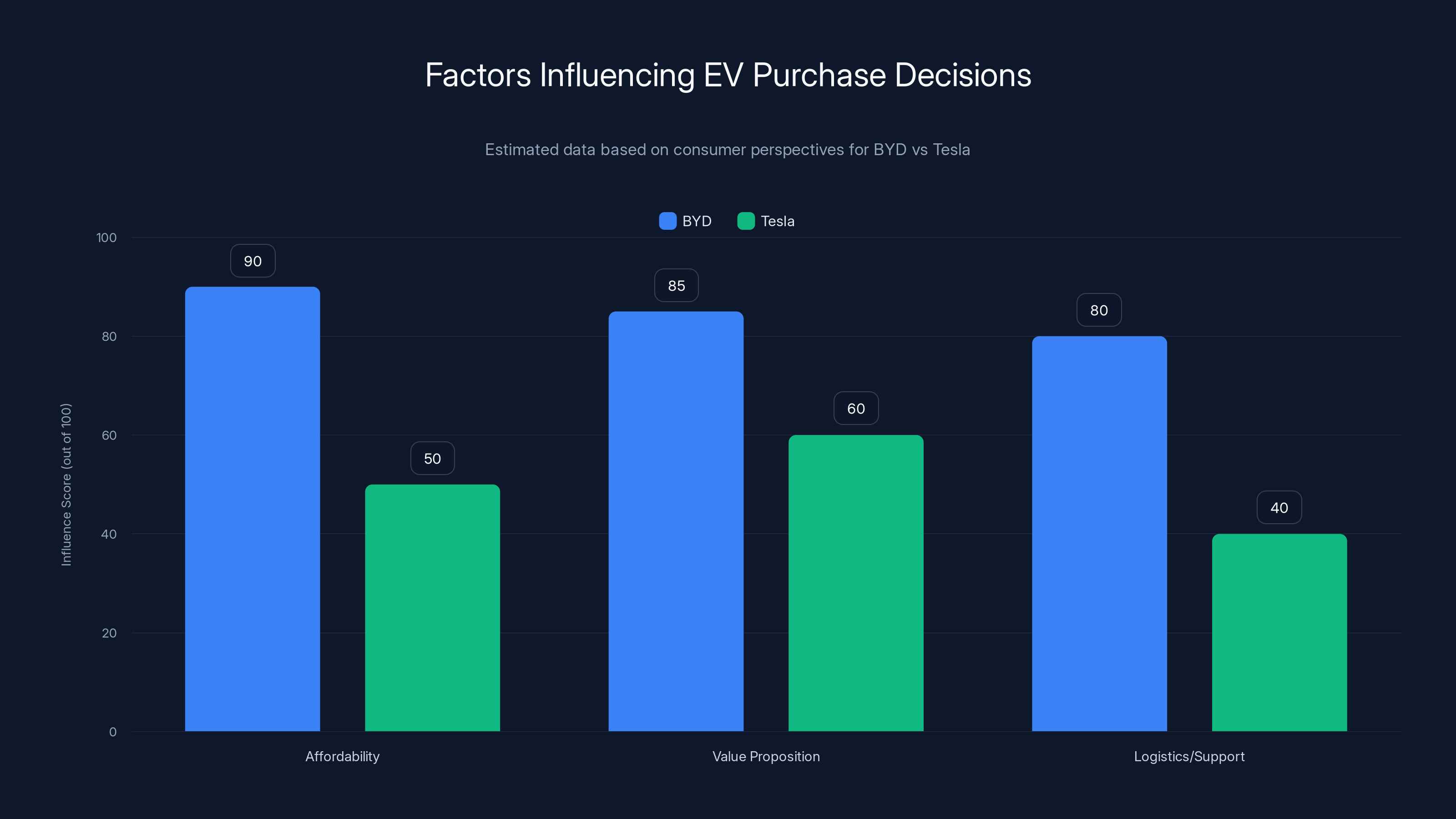

Estimated data shows BYD outperforms Tesla in affordability, value, and logistics support, influencing consumer choices.

The Autonomy Question: Tesla's Biggest Unfinished Promise

Throughout its existence, Tesla has promised autonomous vehicles. In 2023, Musk promised "we could be shipping 500,000 to a million" units by 2025. It's now 2025, and Tesla's autonomous vehicles are... still in beta testing in limited form.

Meanwhile, Waymo is actually running commercial autonomous vehicle services in Phoenix, Los Angeles, and San Francisco. The company's technology appears more mature and reliable. Waymo's not trying to bolt full autonomy onto existing vehicles; it's purpose-building vehicles for autonomy with specialized hardware and software.

This matters because autonomous vehicles represent the last remaining Tesla narrative advantage. If Musk can claim Tesla will dominate autonomy, maybe that justifies Tesla's premium valuation even as current sales decline. But Waymo's progress relative to Tesla's suggests that claim is weakening.

Tesla's autonomous software also faces a credibility problem. The company has been hit with multiple recalls related to Autopilot problems. Regulators in multiple jurisdictions have questioned the safety of Tesla's autonomous features. And footage continues to emerge of drivers needing to take over when Tesla's autonomous system fails.

Waymo, by contrast, has decades of Google backing, and the technology works reliably in the specific geographic areas where it's deployed. It's not perfect, but it's dramatically better than Tesla's current offering.

Geopolitics: The Invisible Hand Reshaping the Market

Underlying everything is geopolitics. The US and China are locked in technological and economic competition. That competition directly impacts EV markets.

China views EV dominance as a strategic priority. The government has supported domestic manufacturers through incentives, infrastructure investment, and protective tariffs. BYD benefits from all of this. The company also operates in an ecosystem with dozens of specialized suppliers, researchers, and competitors that constantly push each other to improve.

The US, by contrast, is trying to protect legacy automakers and domestic manufacturers through tariff barriers. Those barriers keep BYD out of the US market but don't help Tesla. Tesla would actually benefit from being able to import Chinese components cheaply or to expand manufacturing in China without political complications.

Instead, Tesla faces a contradictory situation: it's the American EV company but can't compete on cost like American legacy automakers can. It's caught between markets. It can't enter new markets easily due to geopolitics. And its manufacturing costs remain higher than competitors in lower-cost jurisdictions.

This is why Musk spent energy cultivating political relationships in 2025. He was trying to solve structural problems with political solutions. It didn't work because the problems are structural, not political. The EV industry is shifting to regions with cost advantages. Tesla's located in the wrong region for a price-competitive industry.

The Future for Tesla: Three Possible Scenarios

Looking ahead, Tesla has three realistic paths:

Scenario One: The Tech Company Pivot. Musk doubles down on robotics and autonomy. Tesla becomes less of a carmaker and more of a technology company. This could work if the technology breakthroughs happen and if customers actually want Robotaxis. But it abandons the core business in pursuit of moonshots. High risk.

Scenario Two: The Niche Player. Tesla accepts that it can't dominate the broad EV market and instead focuses on premium and ultra-premium segments where it still has brand appeal. The company maintains respectable sales, healthy margins, and stops chasing growth. This is probably the most realistic scenario. Tesla becomes more like Porsche than like GM.

Scenario Three: The Slow Decline. Tesla loses share steadily as competitors improve and Tesla's brand value erodes. The company doesn't pivot effectively. Management becomes increasingly distracted by political drama and side projects. Over time, Tesla becomes a mid-sized automaker competing in a commoditized market it invented but can't dominate. This is the warning scenario.

Which path Tesla chooses will determine its future. The market will provide feedback, but execution will determine outcomes.

In 2025, Tesla's Model Y and Cybertruck both underperformed against sales projections, with the Cybertruck missing its target by 82%. Estimated data for Model Y sales.

What Tesla Did Right (and Why Dominance Was Temporary)

To be fair to Tesla, the company deserves enormous credit for creating the modern EV market.

Twenty years ago, EVs were jokes. Golf carts with pretensions. Tesla proved they could be desirable. The original Roadster was genuinely revolutionary. The Model S was a legitimate contender against German luxury sedans. The Model 3 proved EVs could be mass-market vehicles. These accomplishments were real and important.

Tesla's vertical integration strategy, particularly in battery manufacturing, was visionary. The company understood that controlling the supply chain was crucial. BYD copied this playbook because Musk proved it works.

Tesla's Supercharger network was also transformative. It removed the psychological barrier to EV adoption for many consumers. Knowing you could charge quickly on long road trips made EVs viable. Other companies are playing catch-up on this front.

Where Tesla failed was in execution at scale. Creating a category is easier than dominating a mature category. Tesla built a luxury EV company but tried to be a mass-market EV company. It designed vehicles for enthusiasts but tried to sell them to regular people. It promised autonomous vehicles but couldn't deliver. It promised production numbers it couldn't meet.

The company's culture also became a liability. Tesla's extreme work intensity, lack of process discipline, and Musk's unpredictability scared away conservative customers who wanted reliable, boring transportation. BYD understood that most people buying EVs want dependable vehicles, not experimental platforms.

Industry Consolidation: Where's This Heading?

The EV industry is consolidating. Smaller players without sufficient capital or manufacturing scale are struggling. Geely, backed by Chinese investors, acquired Volvo and is now a credible competitor. Nio and XPeng have massive backing. Lucid and Rivian are burning billions trying to prove they can execute.

In 10 years, the EV industry will probably look like this: China-based manufacturers dominating volume and mid-range segments. Legacy automakers (BMW, Mercedes, Audi, Porsche) maintaining premium positions. Tesla holding a shrinking premium niche. American legacy automakers (Ford, GM) struggling in EVs but protected by tariffs. And a handful of specialists like Rivian (if it survives) for specific segments.

BYD will probably face pressure from its own domestic competitors. Growth rates will slow further as the market matures. But the company has structural advantages that are difficult to overcome: cost structure, manufacturing scale, supply chain control, and proven execution.

Tesla's challenge is that being first is no longer an advantage. Being best at consistent execution is what matters now. And that's not Tesla's strength.

The Consumer Perspective: Why People Are Choosing BYD Over Tesla

Let's think about actual customers making actual purchase decisions.

A family in Brazil considering an EV sees a BYD Seagull at

A tech worker in Germany considering an EV sees a BYD Yuan Plus with excellent features, good warranty, and a lower price than the Tesla Model Y. They buy BYD. Not because they're patriotic. Because the value proposition is superior.

A family in Mexico considering an EV sees two options: a Tesla dealership hundreds of kilometers away with limited support, or a growing network of BYD dealerships with spare parts readily available. They buy BYD. Not because they've given up on Tesla. Because practical logistics matter.

These are the decisions reshaping the market. Not brand mythology. Not innovation rhetoric. Not CEO cults of personality. Practical decisions made by regular people evaluating value, reliability, support, and affordability.

BYD wins most of these comparisons decisively. That's why BYD is winning the market.

Comparing BYD and Tesla: A Direct Assessment

| Dimension | BYD | Tesla |

|---|---|---|

| Cost Structure | Excellent (vertical integration) | Above-average (outsources batteries) |

| Product Range | Broad (all segments, all price points) | Narrow (premium focus, gaps at low-end) |

| Manufacturing Capacity | Expansive (multiple locations globally) | Limited (three main factories) |

| Global Sales | 2.25M EVs in 2025 | 1.64M vehicles in 2025 |

| Growth Rate | +28% year-over-year | -16% year-over-year |

| Export Growth | +145% passenger exports | Negative growth in most markets |

| Supply Chain Control | Vertical integration (batteries, materials) | Dependent on suppliers |

| Brand Perception | Rising (serious competitor) | Declining (execution issues) |

| Autonomous Tech | Under development | Overpromised, underdelivered |

| Profit Margins | Healthy (13% of revenue) | Compressed (single digits) |

There's no dimension where Tesla currently has advantage except perhaps brand recognition in the US market. And even that advantage is eroding as BYD's brand strengthens.

What BYD Needs to Watch For

BYD isn't invincible. The company faces real challenges.

Domestic Chinese competition is intensifying. Nio, XPeng, and Geely are all improving rapidly. They're backed by significant capital. They understand the Chinese market. BYD has growth, but that growth is slowing, and profit margins are compressing in parts of the Chinese market due to competition.

International expansion is hard. BYD is facing tariff barriers in the US. European markets are imposing restrictions. Infrastructure (charging networks, service centers) remains thin outside China. The company's brand is improving but starting from a weak position in Western markets.

Technology risk is real. If autonomous vehicles actually arrive and Tesla or Waymo leads the way, that would be a significant game-changer. BYD would have to acquire or develop this capability quickly. So far, BYD's autonomous ambitions are less developed than Tesla's or Waymo's.

Geopolitical risk is significant. If US-China relations deteriorate further, it could impact BYD's ability to operate globally, access capital markets, or export vehicles freely.

Supply chain risk exists. BYD relies on commodity inputs like lithium and cobalt. If prices spike due to geopolitical disruption, it would impact profitability across the industry.

But none of these challenges suggest BYD will lose its position as the world's largest EV manufacturer. The company is executing well, improving systematically, and positioned well for continued growth.

The Broader Lesson: Innovation Isn't Enough

Tesla's story teaches an important lesson about competitive advantage.

Innovation and visionary leadership get you to the party. But execution, consistency, and understanding what customers actually want determines whether you stay dominant. Tesla was innovative. But it wasn't disciplined about execution. It wasn't honest about timelines. And it didn't listen carefully to what customers were asking for.

BYD, by contrast, might not be the most innovative company, but it's incredibly disciplined about execution. It delivers vehicles on schedule. It maintains quality. It listens to market feedback and iterates. It offers competitive pricing without sacrificing margins. It builds infrastructure systematically.

In the long run, consistency beats brilliance. BYD is the proof.

Looking Forward: The EV Market in 2026 and Beyond

The EV market in 2026 will be defined by four trends:

First: Continued price competition. EV prices will drop further as manufacturing scales and competition intensifies. This is good for consumers, bad for margins. Manufacturers with cost advantages (BYD, established Asian brands) will thrive. Premium-priced manufacturers (Tesla, Lucid, Rivian) will struggle.

Second: Platform and component consolidation. Dozens of EV manufacturers will eventually rely on a handful of battery suppliers and semiconductor providers. BYD's vertical integration is increasingly a competitive moat. Companies that don't own their supply chain will be dependent on suppliers with leverage.

Third: Autonomous vehicles will remain a promise, not a reality. Waymo's making progress in specific geographies. Tesla's struggling to deliver. Most companies aren't trying. The autonomous revolution will take longer than anyone expected. Companies banking on autonomy for profitability will disappoint.

Fourth: Geography will determine winners. China's EV market is maturing but vast. Europe is growing rapidly. India is emerging. The US is slowing but stable. Companies that understand regional preferences and can serve multiple markets simultaneously will outperform. Global strategies matter.

BYD is positioned well for all four trends. Tesla is poorly positioned for three of them.

Final Thoughts: When Dominance Ends, What Remains?

Tesla's loss of the EV crown doesn't mean Tesla is finished. The company will continue operating as a significant player in the automotive industry. It will sell millions of vehicles annually. It will remain profitable (albeit less so than before). But it will no longer dominate. That era is over.

What happened isn't unusual historically. General Motors dominated US car manufacturing until Toyota proved better execution wins. Nokia dominated mobile phones until Apple proved design and user experience matter more than market share. Kodak dominated photography until digital technology shifted the playing field.

Failing to dominate isn't failure. It's simply the natural progression of markets from growth stages to competitive stages. Tesla succeeded in creating the EV market. Now the market is open to all competitors, and Tesla isn't winning.

BYD's rise is the proof that different strategies can work. You don't need Elon Musk's charisma. You don't need to promise Robotaxis or humanoid robots. You don't need to cut prices then praise price increases. You just need to build good vehicles, charge fair prices, and execute consistently.

For the EV industry, that's actually the best outcome. Boring execution beats exciting promises. Sustainable margins beat dramatic pivots. Actual products beat vaporware. BYD is teaching the industry what success looks like in a mature market. Tesla is learning what irrelevance feels like when you stop executing.

![Tesla Loses EV Crown to BYD: Market Shift Explained [2025]](https://tryrunable.com/blog/tesla-loses-ev-crown-to-byd-market-shift-explained-2025/image-1-1767368894988.jpg)