Tesla's Q4 2025 Sales Collapse: Inside the Numbers That Shocked Wall Street

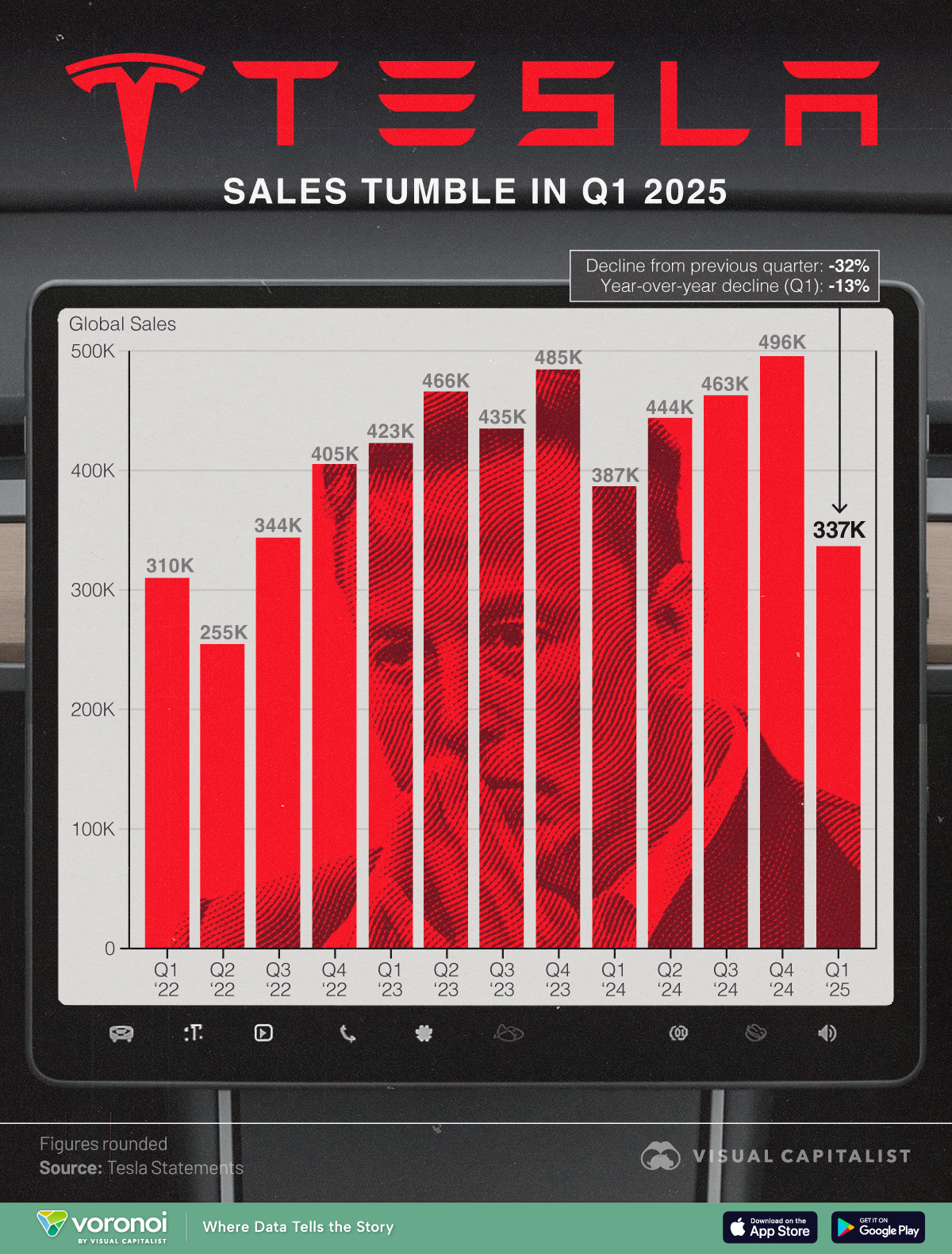

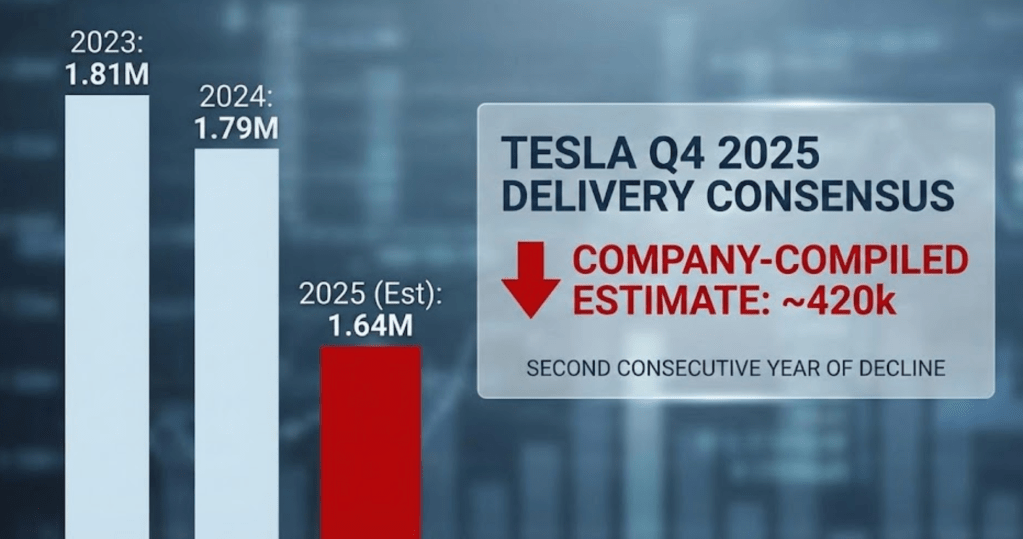

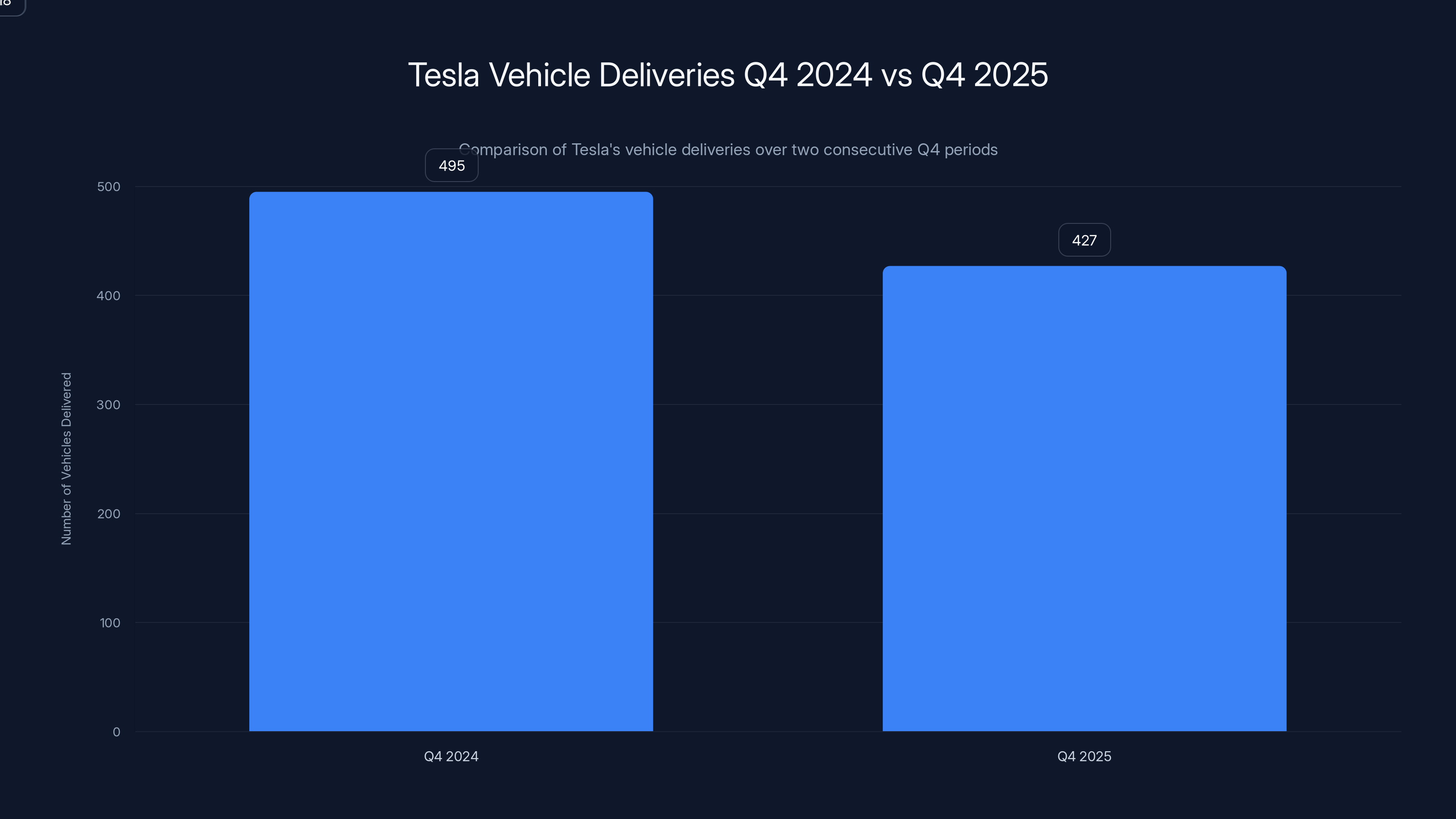

Tesla just reported its worst quarter in years, and the numbers tell a story that's way more complicated than simple market competition. On paper, it looks bad: 418,227 vehicle deliveries in Q4 2025, down 15.6% from the same quarter in 2024. Analysts expected around 422,850 deliveries. Tesla missed by about 4,600 cars. That doesn't sound massive until you realize this represents a major stumble for a company that built its entire valuation on growth and disruption.

But here's what makes this number genuinely alarming. This wasn't one quarter. Tesla sold 1,636,129 vehicles for the entire year 2025, an 8.5% decline year-over-year. For a company that spent the last decade bragging about doubling production capacity every couple of years, two straight years of sales decline signals a fundamental shift in the EV landscape. The company produced 434,358 vehicles in Q4 (down 5.8% YoY) and 1,654,667 for the year (down 6.7% YoY). That production-to-delivery gap—inventory sitting in parking lots—tells you Tesla's making cars faster than people want to buy them.

What's really interesting is what happened to the Cybertruck. Remember when that angular stainless steel truck was supposed to be the next big thing? Tesla delivered only 11,642 "other" vehicles (which includes Cybertruck, Model S, and Model X combined) in Q4. That's a 50.7% drop year-over-year. The Cybertruck alone has essentially flatlined. This is the vehicle that Elon Musk promised would rake in hundreds of billions in revenue. Instead, it's become a punchline on social media, derided for build quality issues, missed deadlines, and that wildly unrealistic $25,000 base price that never materialized.

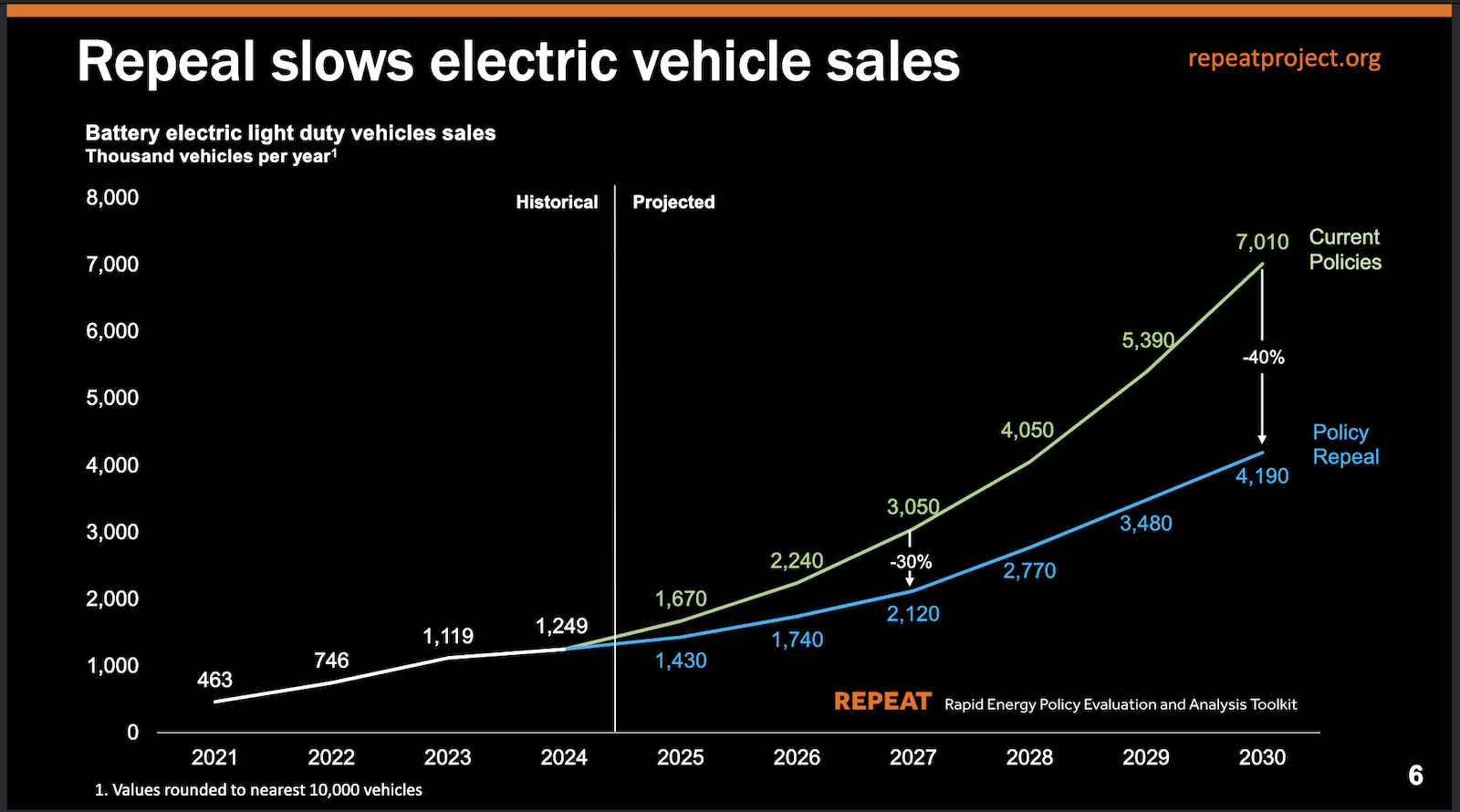

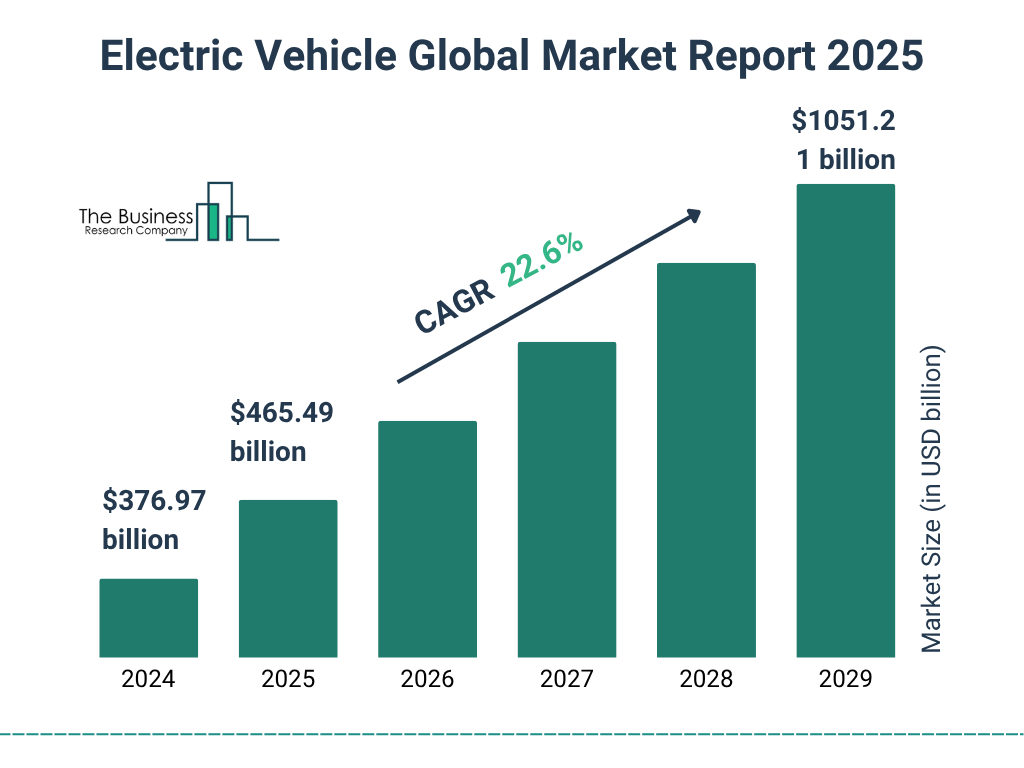

The bigger picture? Tesla's facing a perfect storm that no amount of marketing can fix. Rising competition from established automakers, the expiration of federal tax credits, shifting consumer sentiment, and an aging product lineup are all colliding at once. And the company's leadership isn't helping matters.

The Tax Credit Cliff: How $7,500 Disappeared Overnight

Let's talk about the elephant in the room first. The federal EV tax credit didn't just get smaller—it basically vanished for Tesla. Originally, the Biden administration capped the

Tesla's Model 3 and Model Y—the company's bread-and-butter vehicles—became ineligible. Why? Battery sourcing issues, primarily related to cobalt and nickel coming from overseas, combined with assembly plant constraints. For consumers, this meant a sudden jump in the effective price of a Tesla. A Model Y that cost

The timing couldn't have been worse. As Tesla entered 2025, it was already dealing with the hangover from 2024's price wars. CEO Elon Musk had spent much of 2023 slashing prices aggressively, cutting Model 3 and Model Y prices by 20-30% in some cases. That move crushed margins but was meant to stimulate demand and lock in market share ahead of the assumption that competitors would eventually catch up. The tax credit cliff just multiplied that pressure.

Here's the math. A consumer in December 2024 could buy a Model Y for

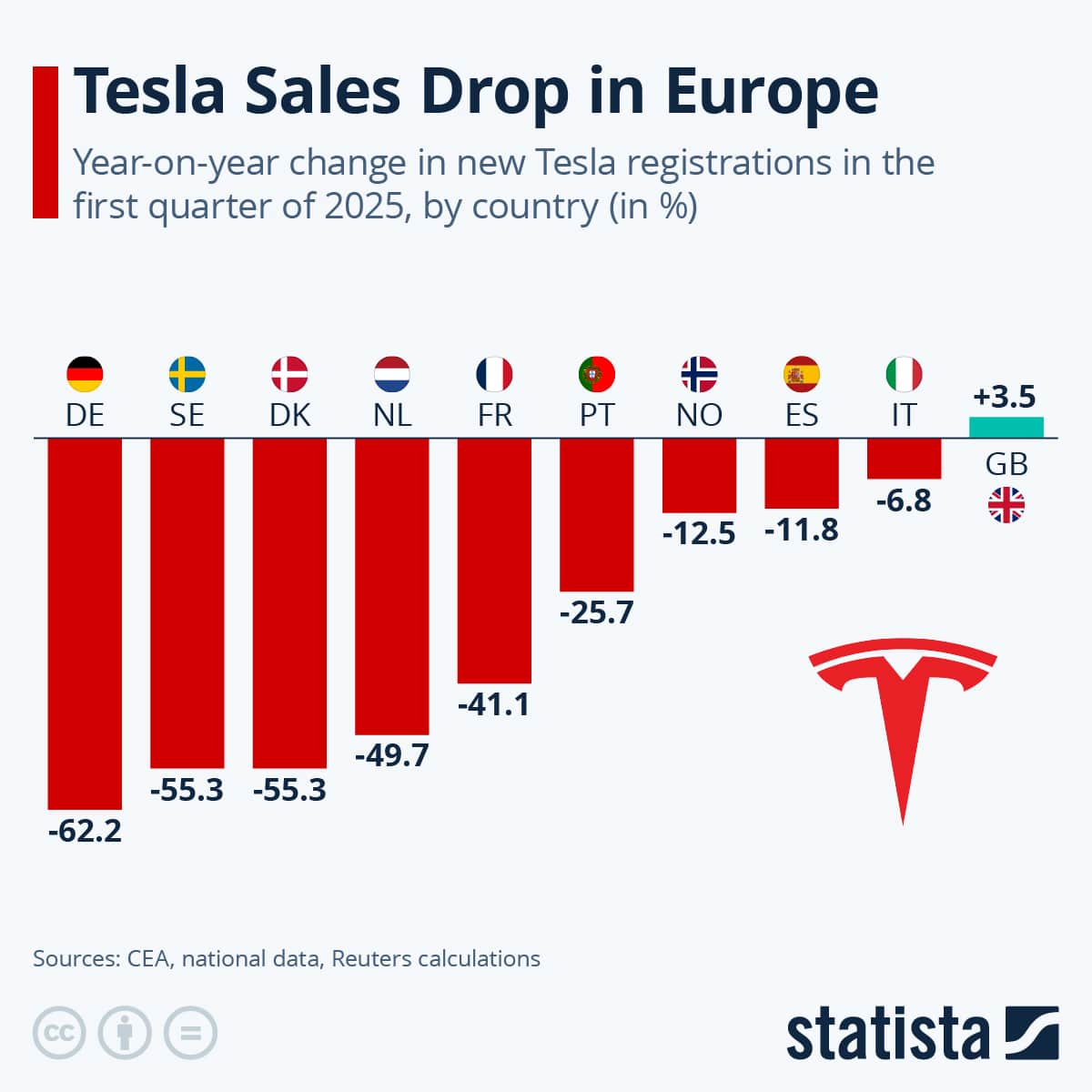

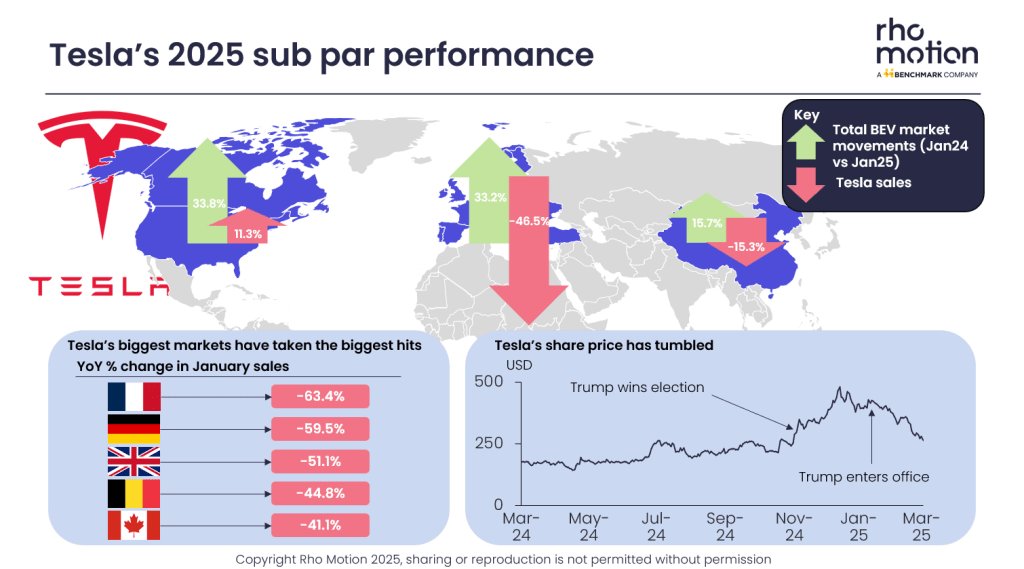

The European market faced similar headwinds, though for different reasons. The EU's tariffs on Chinese-made EVs and regulatory pressure on traditional automakers created a weird dynamic where legacy manufacturers suddenly got serious about EVs. Volkswagen, BMW, and Mercedes-Benz all launched competitive electric models with price points that undercut Tesla in markets where Tesla had no manufacturing presence.

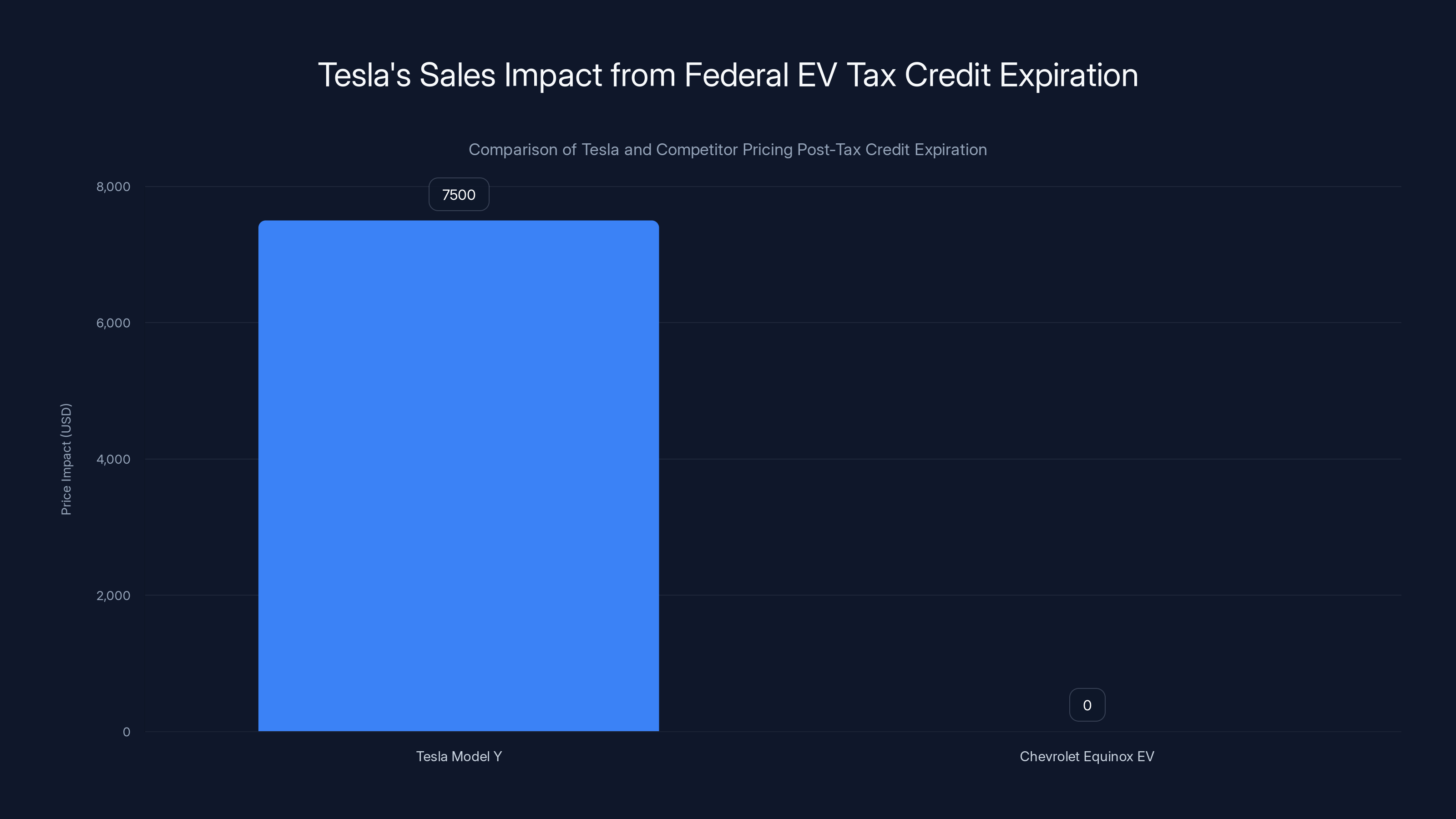

The expiration of the federal EV tax credit added approximately $7,500 to the effective price of Tesla vehicles, while some competitors like Chevrolet remained eligible, creating a significant pricing advantage.

Competition Got Real, Really Fast

For years, Tesla had a head start. The company was shipping millions of vehicles to countries where competitors were still arguing about EV strategy in boardrooms. But something changed in 2024-2025. The legacy automakers stopped talking and started shipping.

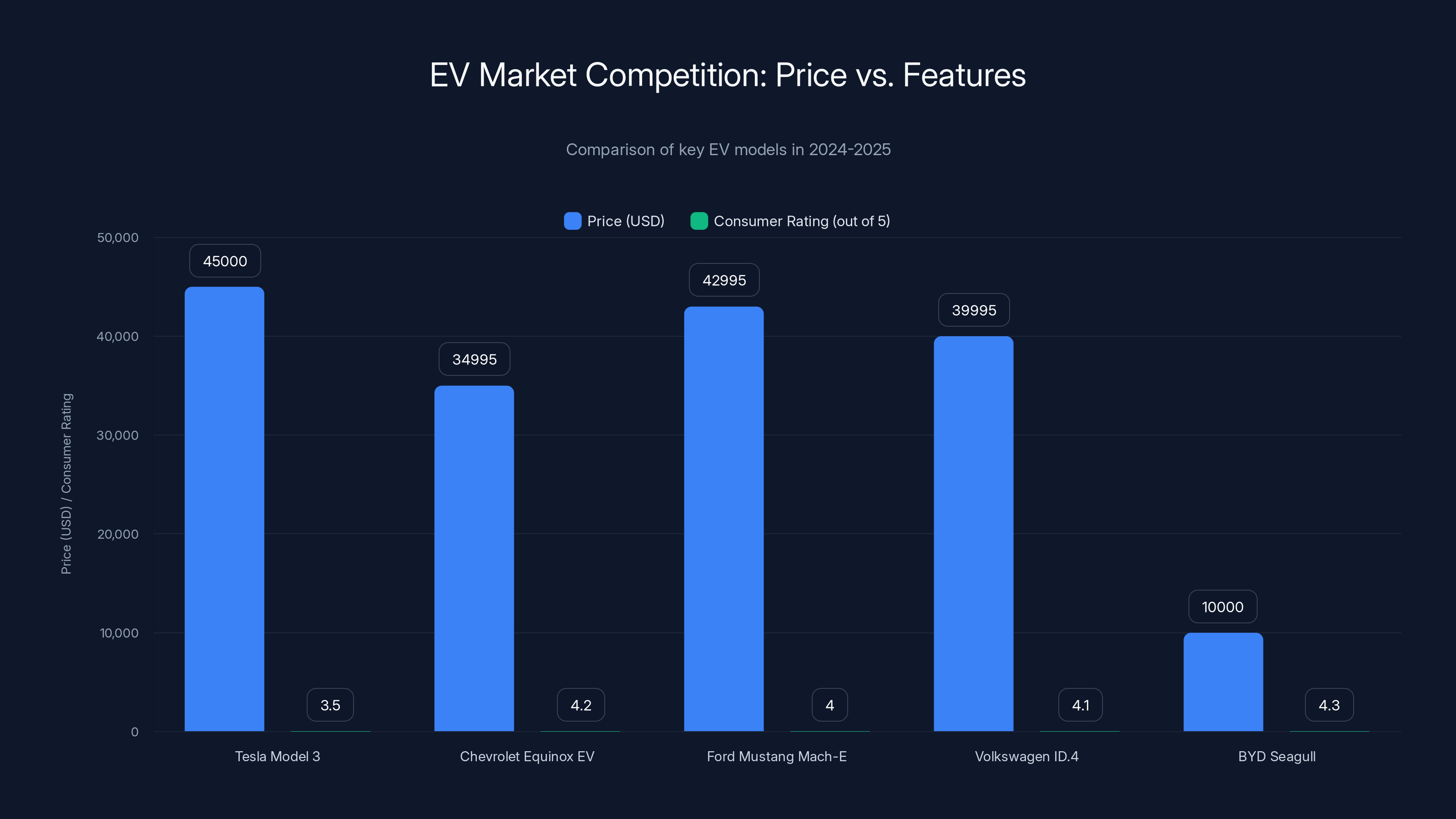

Chevrolet's Equinox EV hit the market at $34,995 and suddenly became one of the best-selling EVs in America. It's not as fast as a Model Y. The acceleration isn't as fun. But it starts and stops reliably, has good interior materials, and costs less than a Model 3. For families who want an EV as a practical appliance—not a status symbol or tech gadget—the Equinox made perfect sense. Ford's Mustang Mach-E and Volkswagen's ID.4 both undercut Tesla on price while matching or beating it on range and charging infrastructure.

In China, it's even worse. BYD, NIO, XPeng, and Li Auto have all launched credible EV competitors with prices starting at

The quality gap that Tesla once enjoyed has completely closed. Consumer Reports, J. D. Power, and other rating agencies no longer crown Tesla as the clear quality leader. Build quality issues that were excused as "growing pains" five years ago are now deal-breakers. Tesla's fit-and-finish problems, panel gaps, and electronic glitches are now par for the course at a $45,000 price point. Competitors offer more polished interiors, better sound systems, more intuitive infotainment systems, and fewer warranty claims.

Pricing power completely evaporated. Tesla could once charge premium prices for being the only game in town. Now, every decision to raise or lower prices is met with immediate competitive responses. That's the definition of a commoditized market, and Tesla isn't positioned to win on price. The company's manufacturing advantages have been copied, margins are compressed, and brand loyalty is thinner than investors realize.

The Model 3 refresh was supposed to be a game-changer. Cheaper, simpler, updated design. But the refresh didn't include the major mechanical redesigns that would genuinely differentiate it from competitors. It was mostly a visual update. Production delays meant the revised model didn't start shipping in volume until mid-2025, leaving a crucial gap in the product cycle.

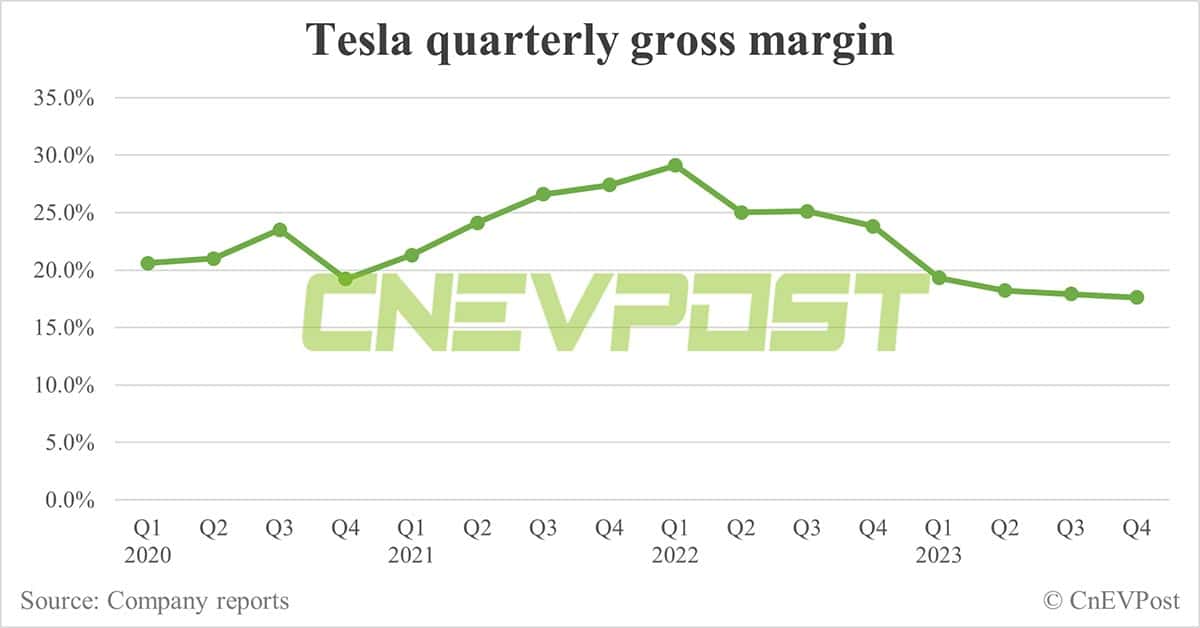

Tesla's gross margin dropped from 30% in 2022 to approximately 14% by Q4 2024 due to aggressive price cuts and competitive pressures. Estimated data.

The Elon Problem: Brand Damage and Political Backlash

Let's address this directly because it matters and Wall Street still doesn't know how to quantify it. Elon Musk, CEO of Tesla, spent 2024 and early 2025 embracing a controversial political identity. He became deeply involved with the Trump administration, heading the Department of Government Efficiency (DOGE), and used his X platform (formerly Twitter) to promote right-wing conspiracy theories, racist content, and incendiary political messaging.

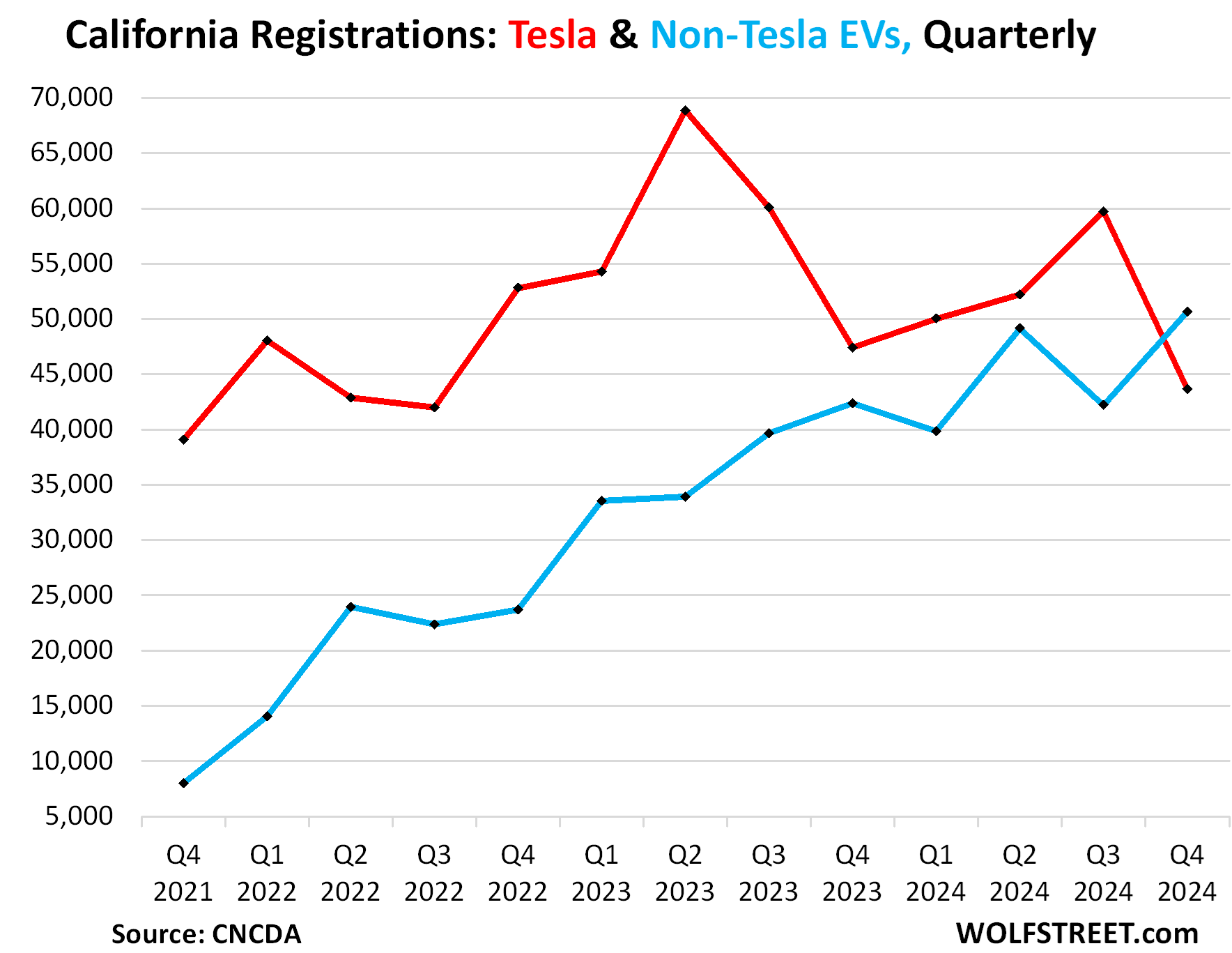

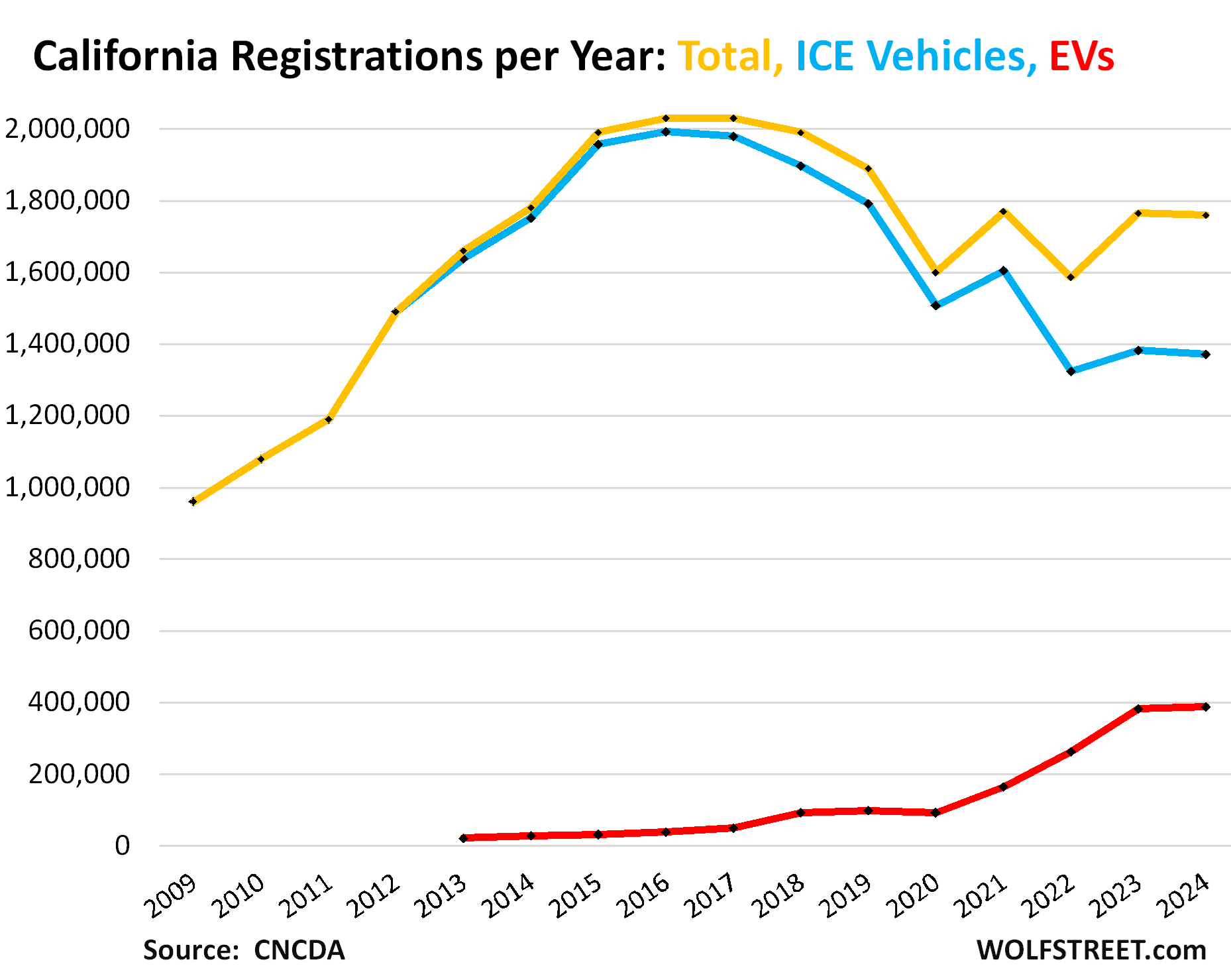

For a car company built on sustainability, futurism, and tech culture—demographics that skew left-leaning on the political spectrum—this created genuine brand friction. Tesla's core customer base in California, New York, and other blue states was explicitly at odds with the company's public face.

We can't quantify exactly how many people didn't buy a Tesla because of Musk's politics. But we know from market research that brand trust matters in EV purchasing decisions. EV buyers are typically early adopters with higher income and education levels. They're more likely to research and understand the values of companies they give money to. Surveys from the second half of 2024 showed a noticeable uptick in customers citing "brand values" as a reason to choose competitors like BMW, Volkswagen, or Chevrolet over Tesla.

There's also the simple reality of social friction. If you bought a Tesla in 2024, people noticed. Depending on your social circles, you might face awkward conversations about what you're implicitly supporting. That's not something Tesla had to deal with from 2015-2022, when the company was seen as purely good for the environment.

Musk himself acknowledged this in recent interviews, saying the company is headed for "a few rough quarters." But instead of walking back political rhetoric, his response has been doubling down on bold promises about robotaxis, humanoid robots, and "general intelligence" breakthroughs. These promises have worked as valuation props before, but when the actual business is contracting, forward-looking promises lose their power.

The timing is terrible. Tesla needs to rebuild brand trust and refocus on the core business of selling quality EVs. Instead, leadership is distracted and divisive. The company would benefit tremendously from a CEO who could appeal to the broadest possible consumer base. Musk is doing the opposite.

The Model Price-Down Spiral and Margin Compression

Let's look at what happened to Tesla's actual profit per vehicle, because that's where the real story lives. In 2022, Tesla's gross margin was around 30%. By Q4 2024, it had dropped to approximately 14-15%. That's not just a normal cyclical compression. That's a structural collapse in pricing power.

Why did this happen? Tesla cut prices dramatically throughout 2023 and early 2024. The Model 3 and Model Y were slashed by

That's not what happened. Instead, competitors saw Tesla's pricing and matched it (or undercut it). Volume increased minimally. And gross margins stayed compressed. Tesla's cost structure—particularly for raw materials, labor, and battery cells—didn't decline fast enough to offset the price cuts.

Here's the additional problem: margins at those levels barely cover overhead. Tesla's selling, general, and administrative expenses are roughly 8% of revenue. Add in depreciation and amortization, and the company is barely breaking even on current operations. The entire valuation is dependent on future robotaxis and robots that don't exist yet.

The cheaper Model 3 and Model Y variants that launched in late 2024 and rolled through 2025 didn't reverse this. Sure, they attracted more customers, but at lower average selling prices and even thinner margins. It's a volume-over-profit equation that only works if you can get volume to grow 30-40% year-over-year. Tesla's doing the opposite.

Competitors learned the wrong lesson from Tesla. Legacy automakers saw Musk's aggressive pricing as tactical, not strategic. They assumed he could sustain it because of superior manufacturing. What they didn't understand is that Tesla was partly doing it because of pressure from investors and the need to justify a sky-high valuation. When the math didn't work anymore, Tesla got stuck with thin margins and an aging product lineup. Now competitors—who have lower fixed costs in some segments—can undercut Tesla and still make money.

The production-to-delivery ratio tells you everything. Tesla made 1.654 million cars but delivered 1.636 million. That's 18,000 cars sitting in inventory that have to be sold eventually, likely at deep discounts or to rental companies at wholesale prices. That's dead capital. That inventory is a margin killer.

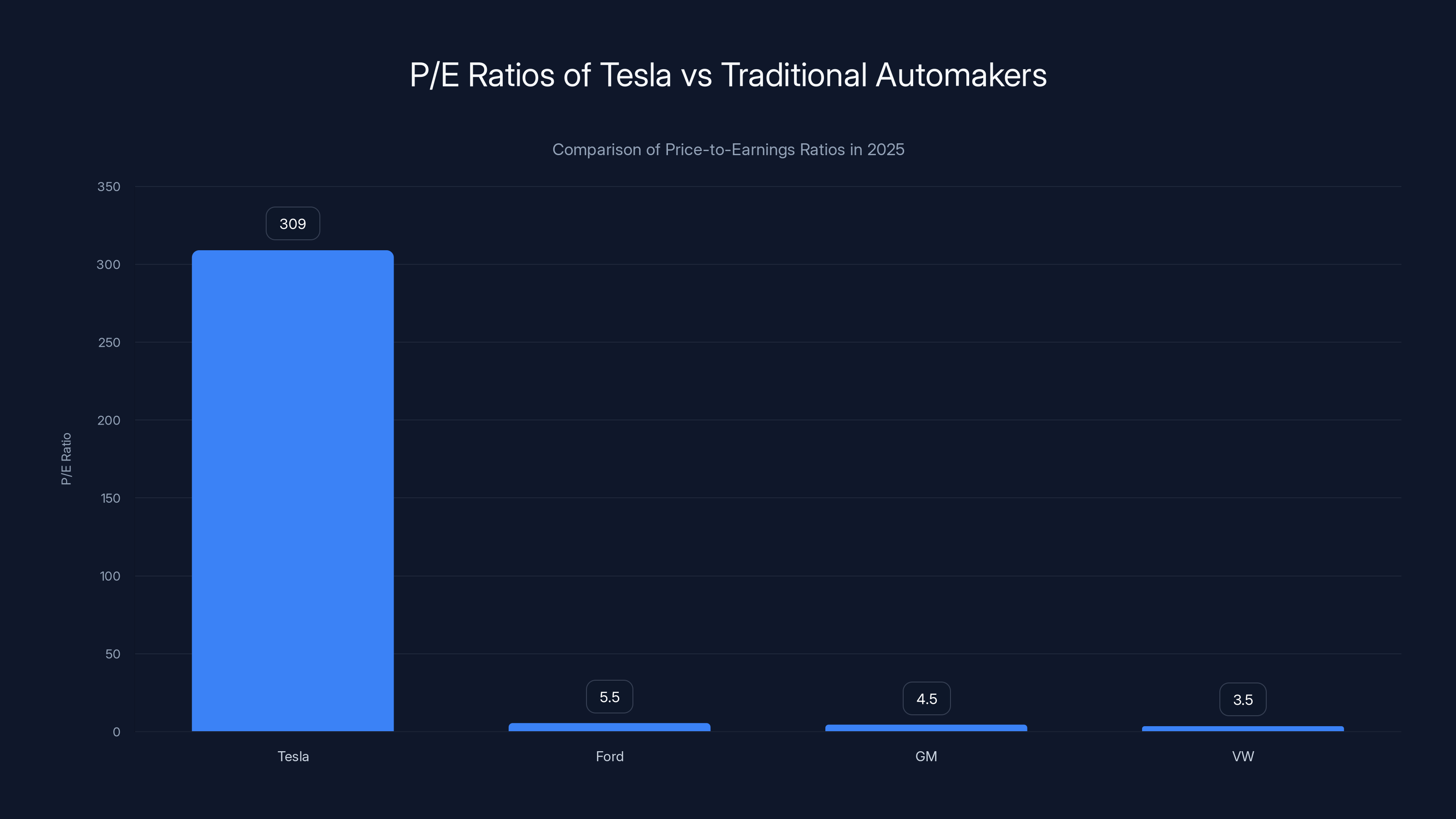

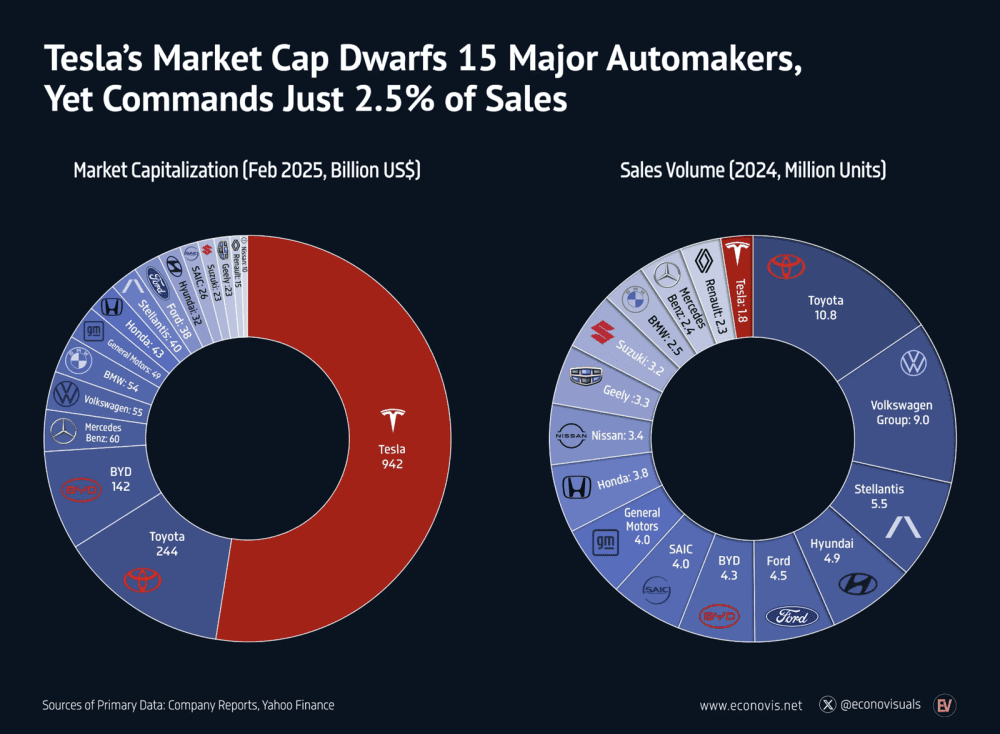

Tesla's P/E ratio of 309 is significantly higher than traditional automakers like Ford, GM, and VW, reflecting high investor expectations for future growth.

The Cybertruck Bet That Didn't Pay Off

Let's talk about the Cybertruck because it's Tesla's clearest strategic failure. The vehicle launched in November 2023 with massive hype and unrealistic promises. Musk had promised a

The vehicle is objectively interesting. The exoskeleton stainless steel design is unique. The minimalist interior has some appeal. The acceleration and range are impressive. But the execution has been plagued with issues: misaligned panels, inadequate weatherproofing, rust appearing within months, infotainment glitches, and a steering yoke design that's genuinely difficult to use in tight spaces.

More importantly, there's a question of product-market fit. The Cybertruck costs more than a Rivian R1T or Ford Lightning. It has less interior space than traditional trucks. It's harder to work with due to the angular design. For contractors and truck owners—the core truck market—the Cybertruck doesn't make sense. For tech enthusiasts and Tesla fans, it's a cool collectible but impractical. It's the worst of both worlds.

Tesla's problem is that it designed the Cybertruck as a tech product, not as a truck. A real truck is supposed to be a tool. The Cybertruck is a statement. Those are different categories. The truck market is built on practicality and reliability. The Cybertruck is built on spectacle and future promises.

The company diverted enormous engineering resources, manufacturing capacity, and capital to bring the Cybertruck to market. In a year when Tesla needed efficiency and focus, instead it got distraction. The factories that could have produced higher-margin Model S/X vehicles or improved Model 3/Y designs were tied up with Cybertruck production.

Honestly, the Cybertruck might go down as one of the most expensive mistakes in automotive history. Not because the vehicle is bad—it's genuinely novel—but because it represented a profound misalignment between what customers actually want and what Elon Musk thought they should want. And that's something the company can't afford right now.

Tesla recently announced a refresh of the Cybertruck for 2025, addressing some build quality issues. But by then, the damage was done. Early buyers became beta testers who got a $60,000+ product with issues that should have been caught before production began. Word of mouth in the automotive industry travels fast. The Cybertruck's reputation is damaged, and that hurts the brand overall.

The Robotaxi Mirage: Promises Versus Reality

Musk has claimed for years that Tesla would launch a robotaxi fleet. The promise gets more concrete every year. By 2023, he was saying robotaxis would be available in 2024. By 2024, he was saying 50% of the US population would have access to robotaxis by end of 2025. As of now? Only a handful of Teslas in Austin and San Francisco are running in "supervised autonomous" mode for limited customers. That's not a robotaxi service. That's a pilot program with extensive caveats.

Here's the thing: robotaxis are probably inevitable eventually. But the timelines matter tremendously. If Tesla can deploy a genuine robotaxi service in 2025-2026, it changes the entire narrative and opens new business models. If it's 2027-2028 or later, or if it requires constant human intervention, then it's not the world-changing innovation Musk keeps promising.

The problem is that Musk's track record on autonomous driving timelines is terrible. In 2015, he promised fully autonomous vehicles within two years. That didn't happen. In 2017, he promised a cross-country driverless trip. That didn't happen in the promised form. In 2021, he promised a rapid deployment of robotaxis. Here we are in 2025, and it's still a limited pilot program.

Investors are buying Tesla stock betting on this future. The current valuation assumes robotaxis launch successfully and generate massive revenues. But the longer Tesla goes without delivering, the more pressure the stock faces. Meanwhile, the core car business is struggling. Eventually, Wall Street gets tired of waiting for future promises.

The other challenge is competition. Waymo, owned by Google, has a genuine robotaxi service operating in San Francisco with impressive performance. Cruise, backed by General Motors and previously owned by Cruise Automation, had a setback after a safety incident but is working on relaunching. Even Apple was rumored to be working on autonomous vehicles (though they stepped back from that focus). Tesla isn't the only company pursuing this vision, and robotaxis don't require Tesla's particular brand of autonomous driving. They just require safe, reliable autonomous driving.

The robotaxi bet is also philosophically interesting. If Tesla succeeds, it means the company pivots from selling cars to operating a service business. That's a completely different business model with different margins, different capital requirements, and different customer relationships. Musk keeps implying this transition is coming, but Tesla is still structured and managed as a car company.

Chevrolet Equinox EV and BYD Seagull offer competitive pricing and high consumer ratings, challenging Tesla's market dominance. Estimated data for ratings.

The Humanoid Robot Fantasy and the Optimus Distraction

Then there's Optimus, Tesla's humanoid robot project. Musk has stated that humanoid robots could eventually be worth more to the company than vehicles. The pitch is that Optimus will eventually perform dangerous jobs, manufacturing tasks, and general labor, creating a massive new revenue stream and potentially solving labor cost issues.

As of early 2025, Optimus can do basic tasks in controlled environments. It's genuinely impressive from an engineering perspective. The robot walks, picks up objects, follows instructions. But it's still slow, requires extensive programming for each task, and isn't close to the autonomous, adaptable general-purpose robot that would be economically useful at scale.

The distraction factor here is massive. Musk and Tesla's engineering team have finite resources. Every person working on Optimus is not working on improving the Model 3, fixing Cybertruck issues, or developing new EV platforms. For a company that's actively losing market share, this is a strategic mistake.

Humanoid robots are a real long-term opportunity, but they're not a 2025 revenue driver. Tesla is not going to sell millions of Optimus robots in the next 2-3 years. It's vapor at this point, and yet it's being discussed as though it's a near-term value driver. It's not. It's a distraction from the fundamental problem: the car business is struggling and needs attention.

The timing of Musk's humanoid robot announcements is revealing. Typically, Tesla announces robotaxi or robot progress when the actual car business looks bad. It works as a narrative reset with enthusiasts and investors. But at some point, the "look at what's coming!" story becomes less believable when the present deteriorates.

China: Tesla's Second Market Imploding

China represents roughly 25-30% of Tesla's sales historically. The company's Shanghai factory is one of the most efficient EV production facilities in the world. But China is also where Tesla's competitive advantages have completely disappeared.

BYD dominates the Chinese EV market with better product variety, lower prices, and local supply chain advantages. NIO offers luxury EVs with better design and features than Model S/X at similar or lower prices. XPeng focuses on autonomous driving capabilities and younger customers. Li Auto dominates the plug-in hybrid market, which is arguably more practical for long-distance travel in China.

Tesla's market share in China fell from roughly 20% in early 2023 to under 15% by late 2024. Gross margins on Chinese-made vehicles are even thinner than in the US. Competition is fiercer. The government isn't subsidizing EVs anymore, which removes a structural advantage Tesla once enjoyed.

Musk has also faced increasing political friction with the Chinese government. Tesla was accused of data security issues related to vehicle cameras. Chinese policy has gradually become less favorable to foreign EV makers. The government is pushing domestic champions like BYD and NIO, which have political backing and manufacturing subsidies.

The Shanghai factory is still running at high capacity, but that's because Tesla is trying to export to Europe and other markets, not because China demand is surging. The factory is being kept busy to absorb fixed costs, not because there's a demand bonfire.

If Tesla loses China meaningfully—even to 10% market share—the company loses a crucial margin buffer and a significant revenue stream. It also loses the halo of being a global leader. China is where the EV future is being built, and Tesla is increasingly on the sidelines.

Tesla's vehicle deliveries in Q4 2025 dropped by 15.6% compared to Q4 2024, highlighting a significant decline in sales performance.

The Shareholder Vote and the $56 Billion Pay Package

In a peculiar twist, Tesla shareholders just approved a massive new pay package for Elon Musk worth roughly

Let's be direct: these milestones are fantastical. The robot and robotaxi targets require breakthroughs that haven't been demonstrated. The

The optics of approving this package while the core business contracts are terrible. It signals that shareholders and management are more focused on future promises than present reality. It also creates perverse incentives. If Musk's compensation is dependent on hitting these outsized targets, he has motivation to overpromise and maintain the stock price through narrative rather than execution.

This is a classic pattern in tech: when growth slows, leadership makes bigger future promises and ties compensation to them. Shareholders get excited about the narrative. The stock price climbs on promises. Executive compensation vests. The promised future doesn't materialize, and the cycle repeats. The danger is that eventually, the credibility breaks, and the entire structure collapses.

Tesla's situation is precarious in ways that weren't true even 18 months ago. The company is no longer a growth story outrunning any execution criticism. It's a cyclical industrial company with margin compression, competitive threats, and aging products. The valuation model that works for growth companies doesn't apply anymore. But management and shareholders are still operating as though 2019-2022 rules still apply.

The Product Refresh Timing Problem

Tesla's entire sales momentum was supposed to be rebuilt around the refreshed Model 3 and Model Y for 2025. The refreshed Model 3 started production in mid-2025, well behind the original timeline. The refreshed Model Y is coming, but not at scale yet. This timing miss cost Tesla an entire quarter where it could have reset demand narratives.

Here's what should have happened: Tesla finishes the refreshed Model 3 in Q1 2025, launches it in Q2, and creates a demand surge from pent-up interest. Instead, the company had to manage a Q1 2025 where customers were choosing between the old model and waiting for the new one. Many chose to wait. That killed Q1 demand. By Q2, the refreshed model finally shipped, but the sales boost wasn't as dramatic as it could have been because some of the waiting-on-the-fence customers had already moved to competitors.

The design refresh itself is fine—updated styling, cleaner interior, better materials in some areas. But it's not a fundamental reimagining. It's the equivalent of a mid-cycle refresh from a traditional automaker. That's appropriate product planning, but it doesn't cure the underlying demand problem. The model is still 10-15 years old at its core. People who want truly next-generation design and features are going to look elsewhere.

Tesla also has a bigger problem: it doesn't have enough new models coming. The Roadster (sports car) is late. The Semi (commercial truck) is shipping in tiny volumes. The Model 2 (cheaper vehicle) has been promised repeatedly but hasn't shipped. The product pipeline is thin. In a competitive market, you need new vehicles regularly to keep customers engaged and interested. Tesla is running on fumes here.

Meanwhile, traditional automakers are launching a fresh EV every 6-12 months in many segments. Volkswagen is launching the Scout brand specifically to compete with Tesla across multiple segments. General Motors is committing $35 billion to EV and autonomous vehicle development. Ford is expanding EV lineup dramatically. The product development gap is real and widening.

The removal of the

Supply Chain and Manufacturing Challenges

Tesla's vaunted manufacturing edge has evaporated. The company's Fremont plant, where Model S, X, and Cybertruck are made, has had quality and production issues. The Gigafactory in Austin, where Model Y is produced, is operating below capacity due to early-stage ramp challenges. Shanghai is running at high volume but not selling what it produces domestically.

The battery supply situation is particularly interesting. Tesla used to have a major advantage because it invested early in battery cell manufacturing. Now, every major automaker is building batteries in-house or partnering with battery suppliers. The advantage Tesla had from partnerships with Panasonic is less meaningful when everyone can access similar battery technology.

Supply chain costs for raw materials haven't declined proportionally to what Tesla expected. Lithium, cobalt, nickel, and other battery materials are still relatively expensive. Tesla's cost structure for a finished battery pack hasn't improved as much as the industry hoped. That means gross margins stay compressed even with efficiency improvements.

One specific problem: Tesla's 4680 battery cell, which was supposed to be a major cost and performance breakthrough, has been delayed repeatedly. These cells would reduce cost per kilowatt-hour, improve energy density, and streamline production. They're still not at production scale. Every quarter of delay costs Tesla competitive advantage.

The company's manufacturing strategy of pursuing full vertical integration (making batteries, motors, everything in-house) made sense when suppliers were slow. Now that battery suppliers like CATL, BYD, and Panasonic can deliver exactly what you need, the vertical integration cost premium isn't worth it. Tesla is locked into this strategy, though, because they've built factories and can't pivot quickly.

What Comes Next: The Path Forward Is Murky

So where does Tesla go from here? The company needs to fix several things simultaneously, and they all compete for resources and attention.

First, Tesla needs to stabilize the core car business. That means improving product quality on Model 3 and Model Y, developing genuinely new models, and fixing margin compression. This is boring work. It doesn't excite investors or Elon Musk. But it's necessary. Without a healthy core business, everything else is fantasy.

Second, Tesla needs to be more realistic about timelines for robotaxis and robots. If the company can deploy supervised autonomous vehicles in more cities during 2025-2026, that's a win. If it can get to Level 4 autonomy (limited self-driving in defined environments) within three years, that's a positive development. But saying "50% of Americans will have access to robotaxis by end of 2025" when only a few hundred in two cities do now? That's not credible. It damages trust.

Third, the company needs to address the brand damage. Tesla's image among consumers has deteriorated. This isn't something that can be fixed with a press release. It requires time and a perception that the company is refocusing on customers and products. Musk stepping back from visible political involvement would help tremendously.

Fourth, Tesla needs to prove it can still innovate at the product level. The Model 3 refresh is a start, but it's not sufficient. The company should be working on next-generation platforms with revolutionary design and features. Instead, it's pouring resources into robotaxis and humanoid robots that don't exist yet.

The reality is that Tesla is at an inflection point. For the past decade, the company could afford to overpromise because the EV industry was so new and competitive pressure was minimal. Now both conditions have reversed. The market is mature. Competition is fierce. And Tesla is struggling to keep up with established automakers on product quality, design, and customer service.

The stock is priced for near-perfect execution on moonshot bets (robotaxis, robots) while the core business deteriorates. That's an unstable equilibrium. Either Tesla needs to deliver on those bets faster than people expect, or the stock price needs to adjust downward. There's no middle ground where the company keeps the valuation and slowly works on solving car business problems.

The Broader EV Market: Winners and Losers Emerging

Tesla's struggles reveal a lot about the EV market overall. The race isn't over. In fact, it's just beginning to sort real winners from vaporware and marketing hype.

Winners so far: Traditional automakers who took EVs seriously and invested in real manufacturing. Volkswagen, BMW, Mercedes-Benz, Ford, and General Motors all have credible EV products shipping at volume. They have dealer networks, service infrastructure, and warranty support. They have the balance sheets to weather margin compression while ramping EV production. Some have margins on EVs that rival traditional gas cars.

Also winning: Battery suppliers who own manufacturing at scale. CATL, BYD, Panasonic, LG, and SK Innovation are all seeing massive demand and pricing power. The limiting factor for EV growth is battery availability, not vehicle design or customer demand. Whoever controls batteries controls the industry.

Losers: Startups that promised $30,000 EVs and went bankrupt (Fisker, Lordstown Motors, Nikola). Companies that promised delivery timelines they couldn't meet. Luxury EV makers who assumed customers would pay premium prices for being different (Lucid is struggling).

Also struggling: Tesla, which built its entire identity on being different and now faces a market where different isn't enough. When you're competing on price against companies with better manufacturing scale and lower cost structures, being cool doesn't compensate.

The EV industry is maturing into something resembling the traditional car industry: a handful of global players with significant market share, lots of regional players, some niche brands, and constant pressure on margins. Tesla thought it would escape that fate by being a tech company instead of a car company. Turns out, EVs are still cars, and cars are a commodity business. The only way Tesla stays differentiated is through autonomous driving or robotaxis. Everything else is just a car.

Lessons for Investors and the Broader Tech Industry

Tesla's situation offers some hard lessons for tech investors and entrepreneurs. First, being first doesn't guarantee lasting dominance. Tesla had a five-year head start in EVs. That's gone now. Competitors caught up and in some areas surpassed Tesla.

Second, valuation eventually has to match reality. For years, Tesla traded on future promises. Every failure or delay was forgiven because "wait for the robotaxis." That works when the company is growing. It doesn't work when growth reverses. Once you're declining, you're a cyclical industrial stock, and cyclical stocks don't trade at 60x earnings.

Third, CEO personality and public behavior matter. Elon Musk was an asset to Tesla for years—the visionary founder who believed in EVs when nobody else did. Now he's a liability—a distraction from the core business and a polarizing figure that alienates customers. At some point, successful companies need boring, focused leadership. Tesla needs that now.

Fourth, it's hard to compete on innovation when you have to also compete on execution. Tesla tried to do both—innovative products and efficient production. That's incredibly hard. Traditional automakers accept good-enough innovation and focus on execution. Tesla thought it could out-execute them on both dimensions. That assumption was wrong.

Fifth, sustainability requires reinvention every 5-10 years. Tesla's vehicle-selling model was revolutionary in 2010. It's mature now. The company needs an entirely new business model to grow from here. Robotaxis could be it. But building a new business while the core business contracts is almost impossible. Usually, you have to sacrifice growth in the mature business to fund the new one. Tesla isn't willing to do that yet.

The Real Numbers Behind the Narrative

Let's do the math on Tesla's current situation to make it concrete. The company sold 1.636 million vehicles in 2025 at an average selling price of roughly

With gross margins around 15%, that's

Tesla's market cap is roughly $850 billion (as of early 2025, fluctuating significantly). Dividing market cap by net income gives you a P/E ratio of roughly 300. That's not a typo. Three hundred times earnings. For context, Apple trades at 30-35x earnings. Microsoft at 40-45x. Nvidia at 60-70x. Only the hottest growth stocks hit 100x+.

That 300x P/E assumes investors are betting the company will grow net income 5-10x in the next decade. That's possible if robotaxis work and capture a massive share of transportation. But it's a big assumption. If robotaxis don't materialize as promised, and the car business stays flat to down, the stock is 80-90% overvalued.

That's not to say Tesla will crash. Market sentiment can sustain high valuations longer than logic suggests. But it does mean the risk/reward ratio is terrible for new buyers at current prices. You're paying

For comparison, traditional automakers:

The valuation gap is enormous. Tesla would need to become 50-100x more profitable just to justify a 5-10x premium for being a better-managed company. That's theoretically possible but requires near-flawless execution and breakthrough innovation.

What Wall Street Got Wrong (And Continues to Get Wrong)

Wall Street's Tesla analysis has been consistently disconnected from reality, and that pattern hasn't changed. Analysts have been predicting Tesla to "grow into its valuation" for five years. The company has grown revenues but not earnings. Margins have compressed. Market share has fallen. And yet analyst price targets remain high, earnings estimates remain bullish, and the consensus narrative remains "just wait for robotaxis."

This is partly because Tesla still commands a premium among certain investor classes. Growth investors like the narrative. Energy storage investors see a potential new business. Tech investors want to own the "future of transportation." Even value investors have warmed to Tesla because the stock is cheaper now (at "only" 300x earnings) than it was at 500x earnings.

But honest analysis would suggest Tesla is a company in transition with an unstable business model and a stock price completely disconnected from current earnings. That's not a problem if the transition works. It's a massive problem if it doesn't.

The sell-side hasn't adjusted because Tesla is too important to the market narrative. If analysts downgrade Tesla significantly, it means the entire EV future narrative gets re-evaluated. That's messy. It's easier to keep saying "hold" and "buy the dip" while quietly acknowledging the company is struggling.

The buy-side (institutional investors) keeps buying because Tesla has enormous inflows due to index funds and ESG mandates. People are buying Tesla for its index weighting, not because they believe in the investment thesis. That creates a perpetual bid under the stock, even as fundamentals deteriorate.

This will eventually break. Once the market realizes robotaxis aren't coming as quickly as promised, and the car business isn't recovering, valuations will reset. That could be in 2025, 2026, or later. But it's inevitable unless Tesla executes flawlessly on its promise of future breakthroughs.

The Closing Bell: Tesla at a Critical Moment

Tesla's Q4 2025 sales miss wasn't a surprise. It was the inevitable result of structural market changes, competitive pressure, brand damage, and questionable leadership focus. The company built a decade of success on being right when everyone else was wrong about EVs. Now that everyone's right about EVs, Tesla's differentiation has evaporated.

The next 18-24 months will determine whether Tesla can adapt and innovate, or whether it becomes a mid-tier automotive company competing on price and execution like everyone else. Musk's promises about robotaxis and humanoid robots will either materialize or fade. The core car business will either stabilize or deteriorate further. The brand damage will either heal or worsen.

Most likely scenario: Tesla muddles through. It stabilizes EV sales at a lower level, maintains margins around 15-18%, continues making profits but not "revolutionary" profits. The robotaxi initiative shows progress but doesn't launch at meaningful scale until 2027 or later. The humanoid robot stays in research phases. The stock price oscillates based on narrative cycles, but structural valuation compression happens gradually.

Bullish scenario: Robotaxis launch faster than expected. Level 4-5 autonomous driving works. Musk's 50% US coverage claim becomes true by late 2026. A whole new transportation ecosystem emerges around Teslas as service vehicles. The stock price doubles or triples because the business model fundamentally shifts.

Bearish scenario: Robotaxis don't materialize as promised. The car business continues contracting. Competitors capture more market share. Margins compress further. The stock valuation resets from 300x earnings to 50-100x earnings, representing a 60-80% decline. Tesla becomes a normal automotive company with a great historical story but limited future.

For investors, the thesis is clear: You're not paying for Tesla's current business. You're paying for options on robotaxis and humanoid robots. If you believe in those bets, the stock is worth holding. If you don't, it's overpriced at current levels. But the one thing you shouldn't do is think Tesla's current $850 billion valuation is justified by the business it runs today. It's not even close.

Tesla taught the world that EVs were the future. Now the world is learning what Tesla learned: being right about the future doesn't guarantee you'll win in the future. Execution, products, brand trust, and real innovation matter more than vision. Tesla has had a rough 12 months, and the challenges ahead are real. The question isn't whether Tesla will survive—it will. The question is whether it will thrive or merely survive.

FAQ

What does Tesla's Q4 2025 sales decline mean for the EV market overall?

Tesla's decline signals that the EV market is maturing and competition is fierce. However, it doesn't mean EVs are losing momentum globally. Instead, it means Tesla's market share is compressing as traditional automakers launch credible EV competitors. The EV market is growing overall, but growth is distributed among more players now rather than concentrated at Tesla. This is actually healthy for the industry—it means consumer choice is expanding and price competition is driving adoption.

How did the federal EV tax credit expiration affect Tesla's sales?

The expiration or reduction of the federal EV tax credit removed approximately

Why is the Cybertruck considered a failure when it's still being produced?

The Cybertruck isn't a failure because production stopped—it's failing expectations on multiple dimensions. Musk promised 500,000 units per year by 2025. Tesla delivered roughly 11,642 in Q4, putting the full-year total at 50,000-60,000. The vehicle was promised at

What role did Elon Musk's political activities play in Tesla's sales decline?

Musk's political involvement and controversial social media activity likely contributed to Tesla sales decline, particularly in left-leaning markets like California, New York, and parts of Europe. While we can't quantify the exact impact, market research from mid-2024 showed increased consumer focus on "brand values" when choosing EVs, with Tesla's perceived alignment shifting away from environmental and progressive values. For a company built in California's tech culture and dependent on early-adopter customers who typically have progressive values, the brand damage from Musk's visibility as a controversial political figure is material and measurable through customer sentiment tracking. The damage isn't catastrophic, but it's persistent and difficult to reverse quickly.

Are Tesla's promises about robotaxis and humanoid robots credible given the sales miss?

Tesla's promises about robotaxis and humanoid robots should be evaluated independently from current sales performance. The sales miss reflects present market dynamics (competition, tax credits, brand perception). The robotaxi and robot promises depend on autonomous driving and AI breakthroughs that are genuinely uncertain. Musk's track record on autonomous driving timelines is poor—he's missed previous targets by 2-5 years. That said, the underlying technologies are advancing, and a robotaxi service could eventually work. The credibility issue is timing: investors should assume these products launch 2-3 years later than Musk promises, not on his projected timeline.

Could Tesla's cheaper Model 3 and Model Y variants reverse the sales decline?

The cheaper variants are helping at the margin but haven't reversed the decline because they compress margins further while not meaningfully increasing volume. A cheaper Model Y attracts some additional buyers, but many of those are defectors from higher-trim variants or potential buyers who would have purchased anyway. The new affordable variants are competing with competitors' products on price, where Tesla doesn't have a cost advantage. Traditional automakers can undercut or match Tesla's prices while maintaining reasonable margins because they have lower overall cost structures. Tesla's path forward isn't to compete on price in a commoditized market—it's to innovate on features, design, and technology where it can command premium pricing. The cheaper variants are survival moves, not growth strategies.

What would need to change for Tesla to return to growth?

Tesla's return to growth requires three things: (1) Stabilization of the core car business through new product launches, quality improvements, and brand rehabilitation. This requires 12-24 months minimum. (2) Meaningful progress on autonomous driving, demonstrated through wider robotaxi availability or Level 3-4 autonomous capability in regular vehicles. (3) Resolution of the margin compression issue through manufacturing improvements, cost reduction, or price increase opportunity from new products or services. All three simultaneously is unlikely. Tesla will probably choose to focus on one while the others drift. That choice will determine the company's trajectory over the next 3-5 years.

How does Tesla's situation compare to traditional automakers during transition periods?

Tesla's situation is actually worse than traditional automakers' transitions. Ford, GM, and others had massive cash reserves and diverse product portfolios to fund EV transitions while maintaining profitability in gas vehicles. Tesla has a single product line and limited financial cushion. Traditional automakers could afford to take a few years of margin compression on EVs while their core gas business funded operations. Tesla can't—it's fully dependent on EV sales profitability. Additionally, traditional automakers had dealer networks and service infrastructure to support the transition. Tesla had to build those from scratch and is still working on it. The transition Tesla is attempting (becoming a car company that also owns robotaxi and robot businesses) is harder than the transition traditional automakers are attempting (selling EVs in addition to gas vehicles).

What's the downside scenario for Tesla's stock price?

In a downside scenario where robotaxis don't materialize as promised and the car business stays flat to down, Tesla's P/E ratio compresses from 300x to 50-100x earnings, representing a 60-80% stock price decline. That would bring valuation more in line with other automotive companies. The company would still be profitable and functional, but the "revolutionary growth stock" narrative would be dead. Shareholders who bought above $250/share would face significant losses. The downside risk is real because Tesla's valuation has minimal margin of safety. A few quarters of worse-than-expected results could trigger sharp multiple compression.

TL; DR

- Tesla Q4 2025 collapsed: 418,227 deliveries, down 15.6% YoY, missing analyst expectations by ~4,600 units

- Full-year decline: 1.636 million vehicles sold (8.5% YoY drop), marking the second straight year of declining sales

- Cybertruck flatlined: Only 11,642 "other" vehicles delivered in Q4, down 50.7% YoY, signaling complete failure of the polarizing truck

- Margin compression severe: Gross margins fell from 30% (2022) to 14-15%, eliminating pricing power and profit cushion

- Tax credit cliff killed demand: Federal EV tax credit expiration ($7,500) removed pricing flexibility exactly when competition intensified

- Competition flooded the market: Chevrolet Equinox EV ($35K), Ford Mustang Mach-E, and Chinese competitors (BYD, NIO, XPeng) undercut Tesla on price and matched on features

- Brand damage real: Elon Musk's political activity and controversial statements alienated traditional EV buyers in left-leaning markets, measurable through sentiment tracking

- Robotaxi promises undelivered: Despite Musk's 2025 targets, only supervised autonomous vehicles operate in Austin and San Francisco with safety drivers required

- Humanoid robot distraction: Optimus development diverts resources from core car business problems while remaining 3-5 years from commercial viability

- Valuation is speculative: P/E ratio of ~300x requires near-perfect execution on robotaxis and robots; current earnings justify only 30-50x multiple

- Bottom line: Tesla's Q4 miss wasn't a surprise—it was inevitable as competition matured, incentives expired, and product pipeline aged. The next 18 months determine if Tesla adapts or becomes a mid-tier automaker competing on price.

Key Takeaways

- Tesla Q4 2025 deliveries fell 15.6% YoY to 418,227 units, missing analyst targets and marking second consecutive year of sales decline

- Gross margins collapsed from 30% (2022) to 14-15% (2025), eliminating pricing power and forcing volume strategy that's not delivering

- Federal EV tax credit expiration removed $7,500 from Tesla's effective pricing at exact moment when competition from Chevy, Ford, VW intensified

- Cybertruck sales flatlined with only 11,642 deliveries in Q4 2025 (down 50.7% YoY), failing to meet production promises or pricing targets

- BYD, Chinese competitors, and traditional automakers captured market share with lower-priced alternatives and superior execution on quality and reliability

- Brand damage from Elon Musk's political activities and controversial social media presence measurably alienated Tesla's core left-leaning customer base

- Robotaxi and humanoid robot promises remain undelivered, yet drive stock valuation at 300x earnings—unsustainable if timelines slip further

- Tesla's Q4 miss represents structural market shift from monopoly advantage to commoditized competition, requiring fundamentally different strategy

![Tesla Q4 2025 Sales Collapse: Why the EV Leader Lost Its Edge [2025]](https://tryrunable.com/blog/tesla-q4-2025-sales-collapse-why-the-ev-leader-lost-its-edge/image-1-1767366614989.jpg)