Introduction: The End of Tesla's EV Dominance

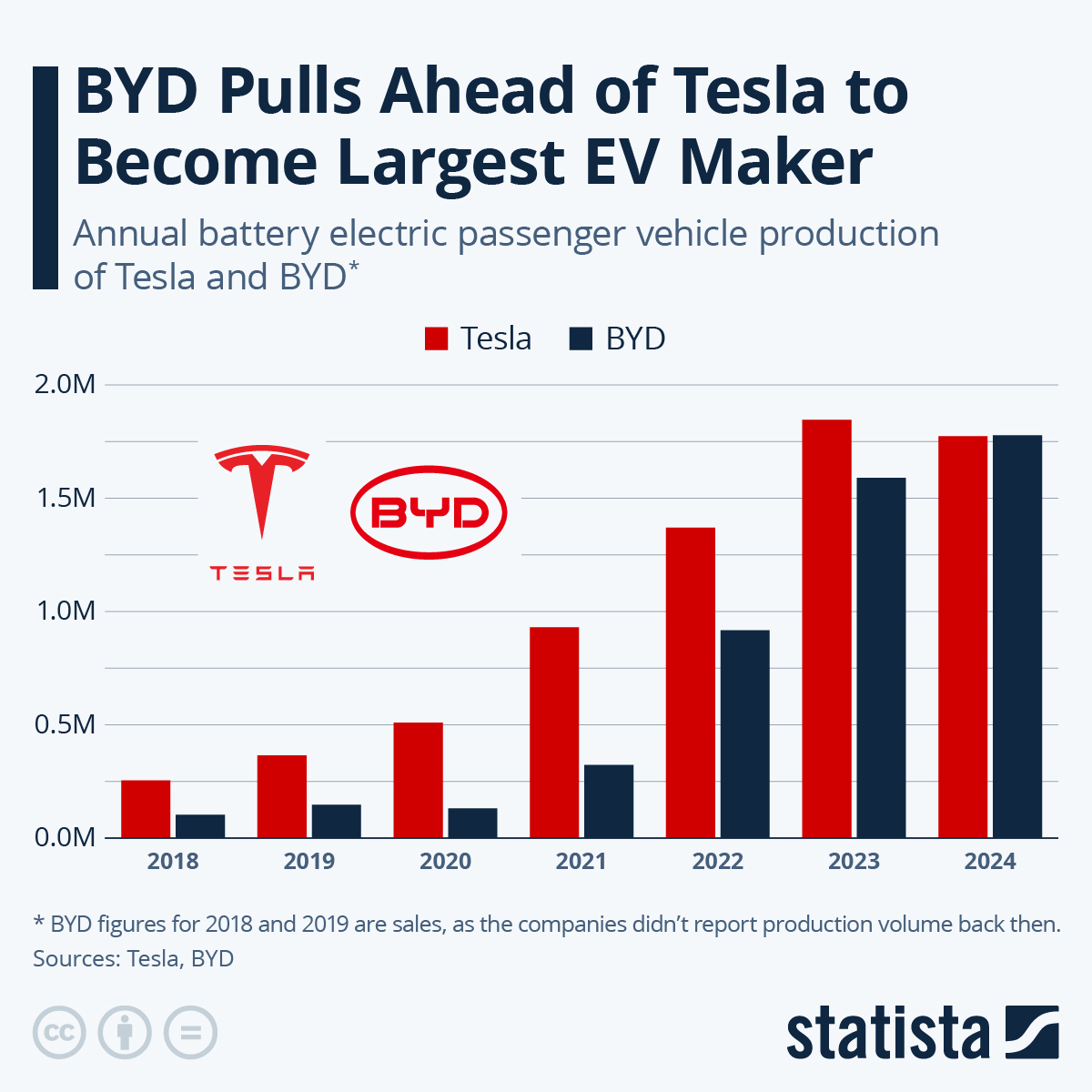

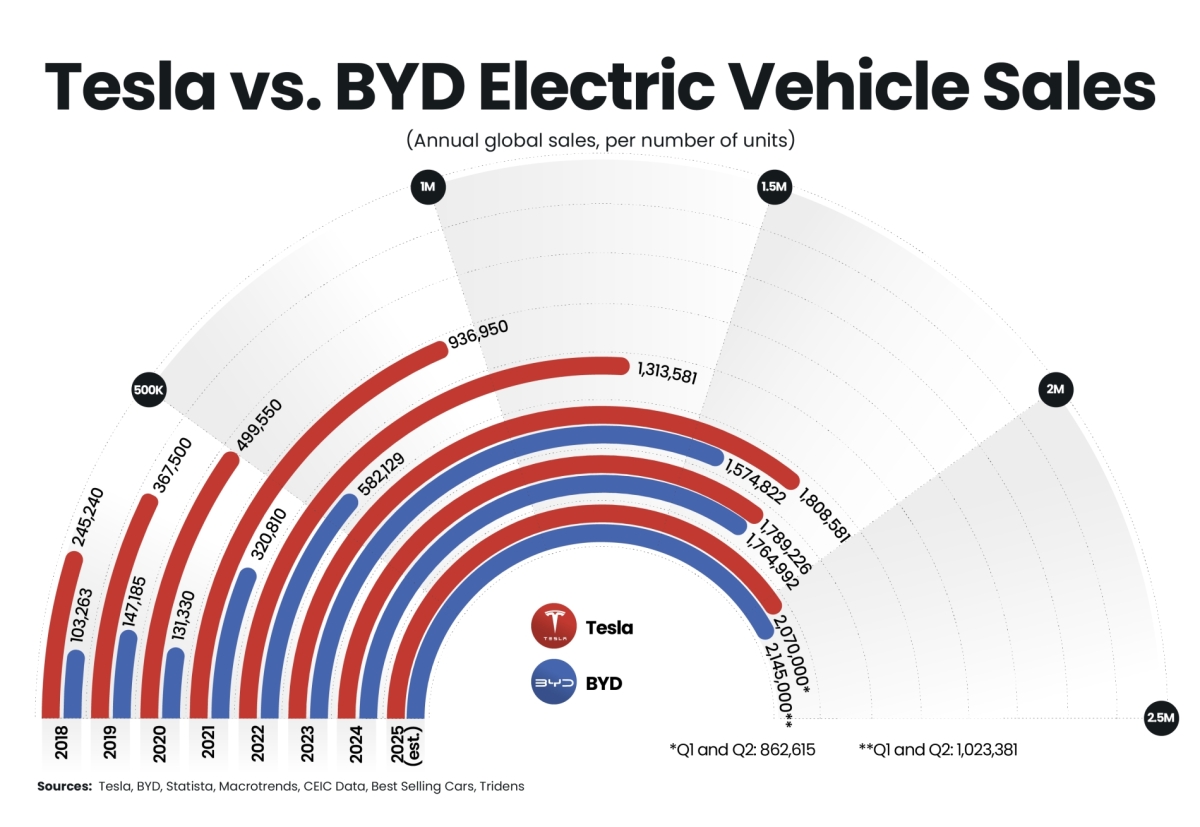

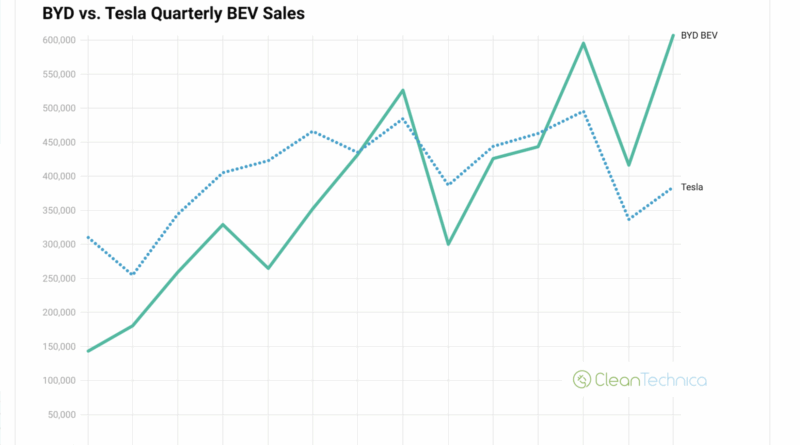

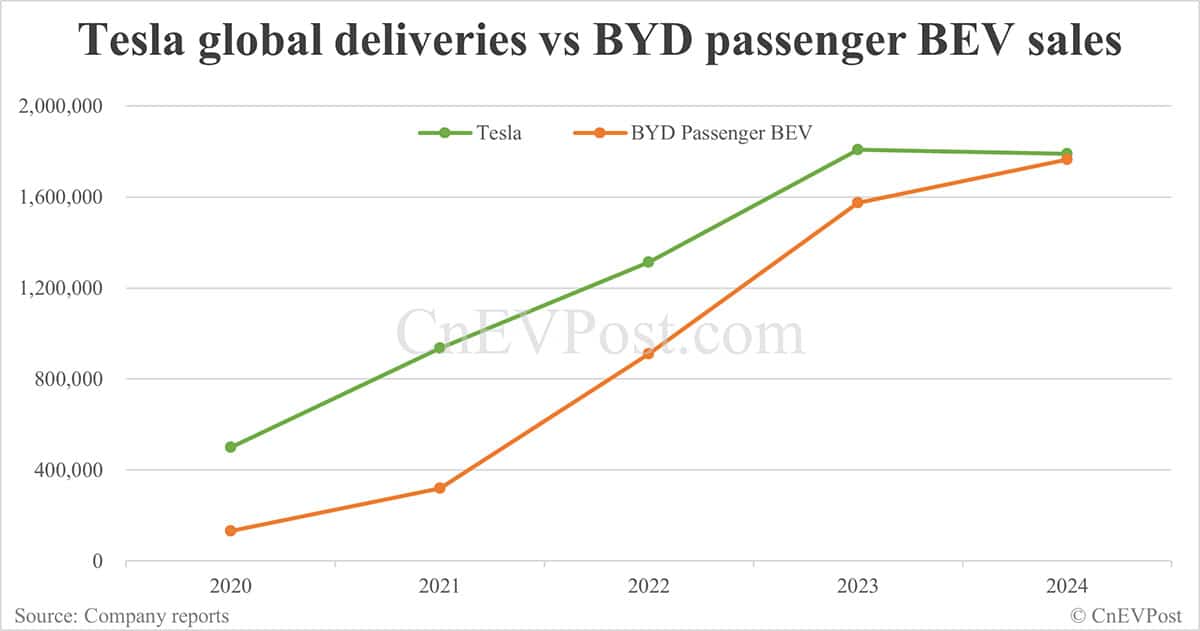

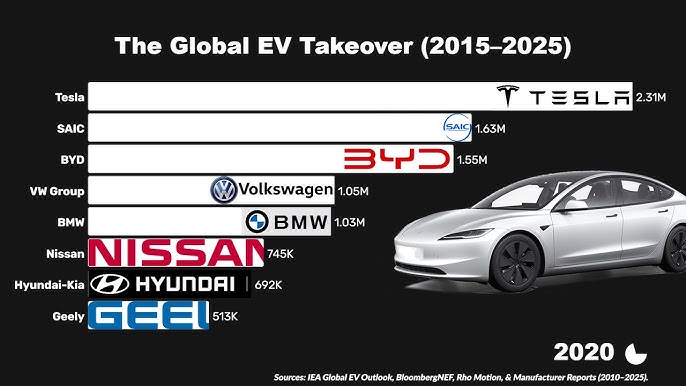

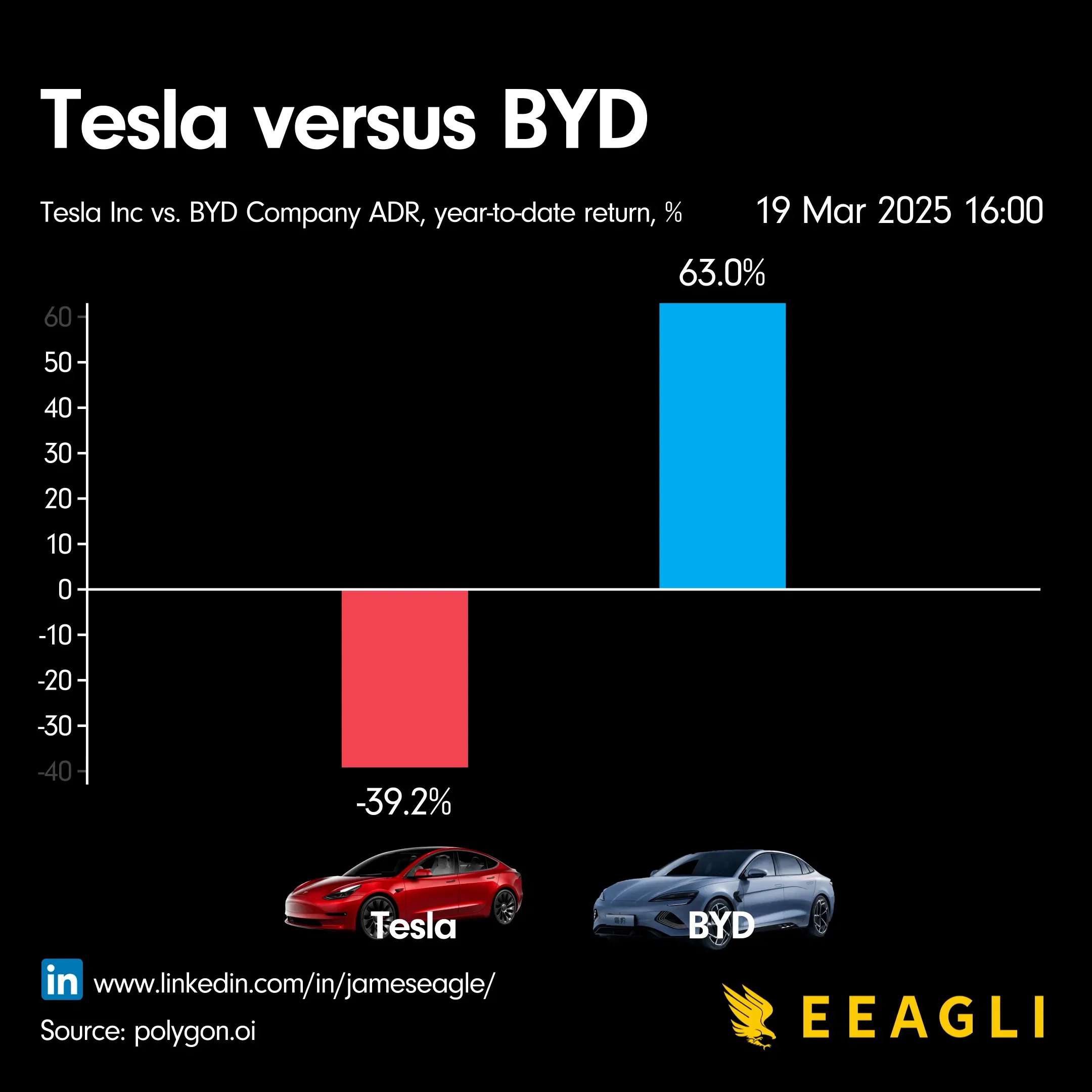

For over a decade, Tesla stood as the undisputed king of electric vehicle manufacturing. The company that transformed the automotive industry from a skeptical observer into an EV-obsessed competitor has experienced a historic shift in market positioning. In 2025, Tesla delivered 1.63 million vehicles globally—a 9% decline from 2024's 1.79 million units—marking the second consecutive year of sales contraction. More significantly, this decline represents not merely a numerical setback but a fundamental restructuring of the global EV landscape as reported by The New York Times.

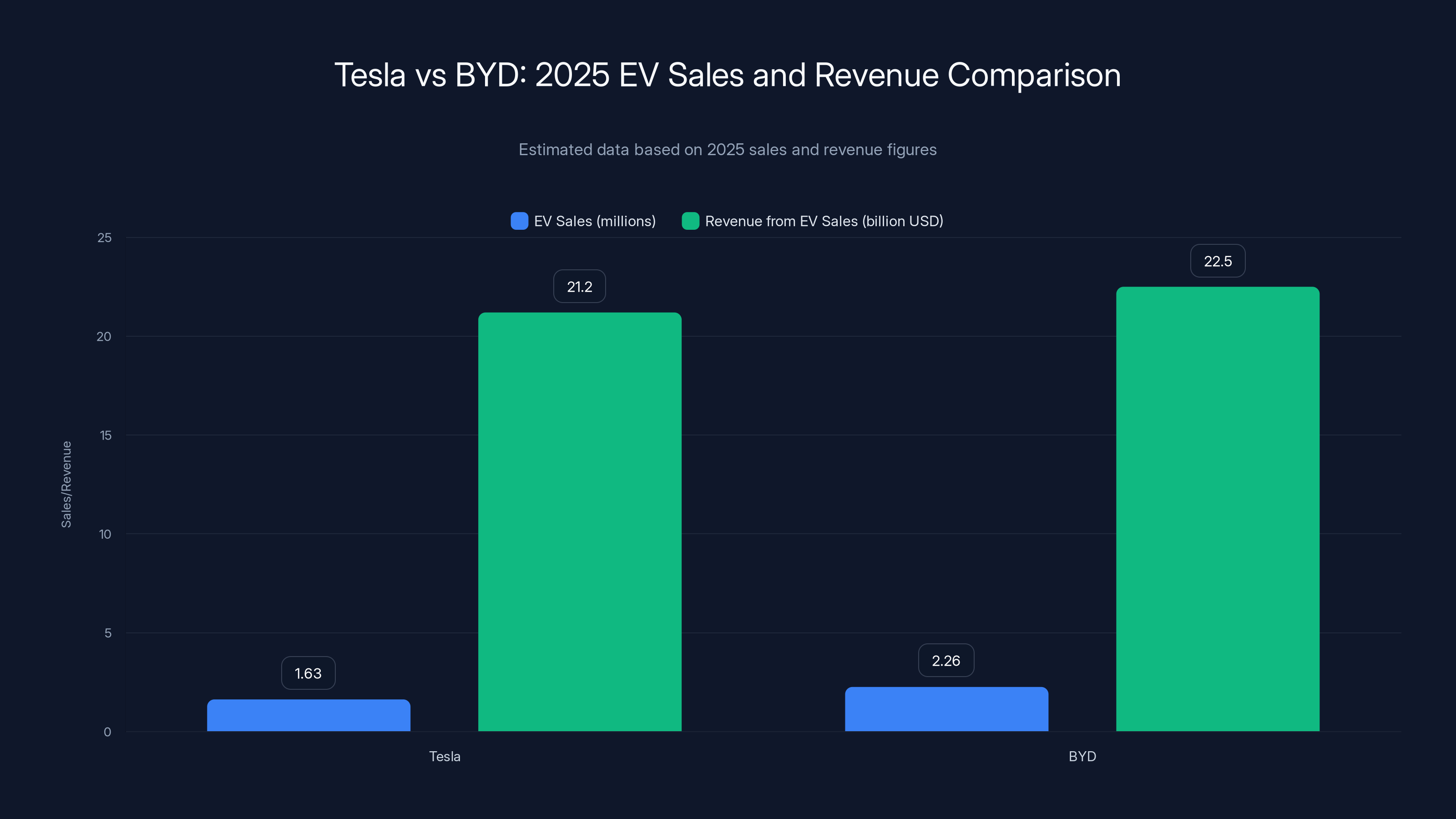

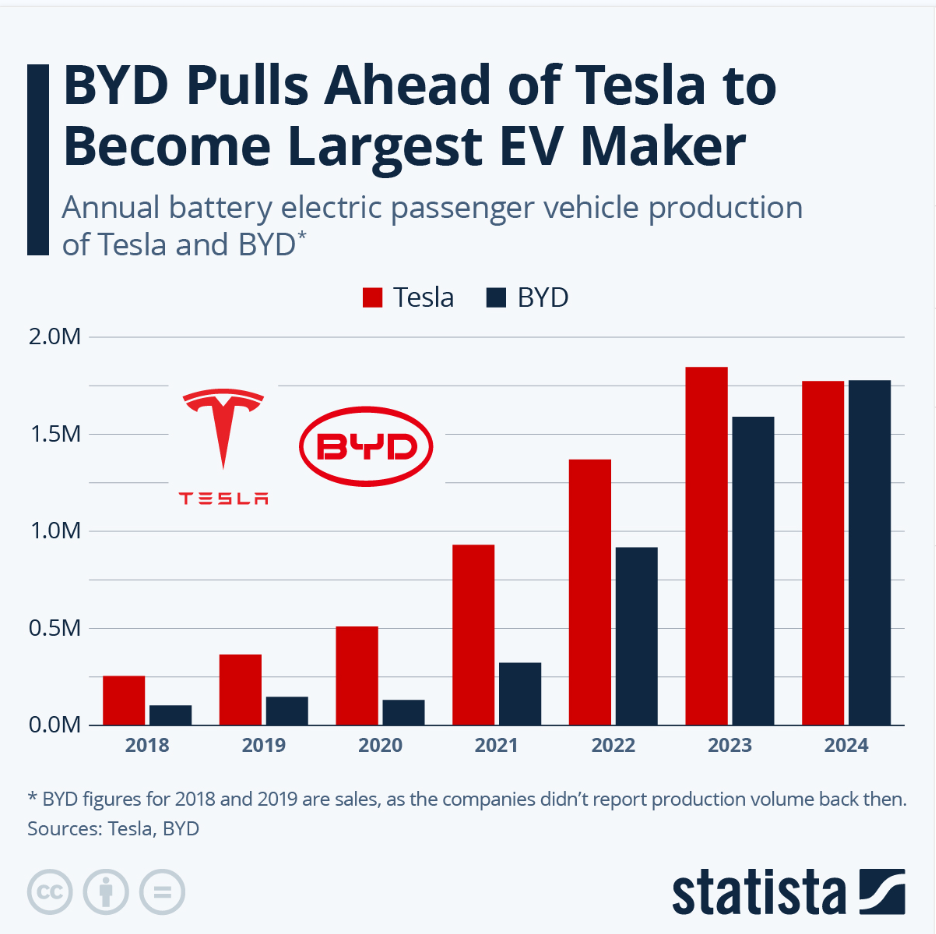

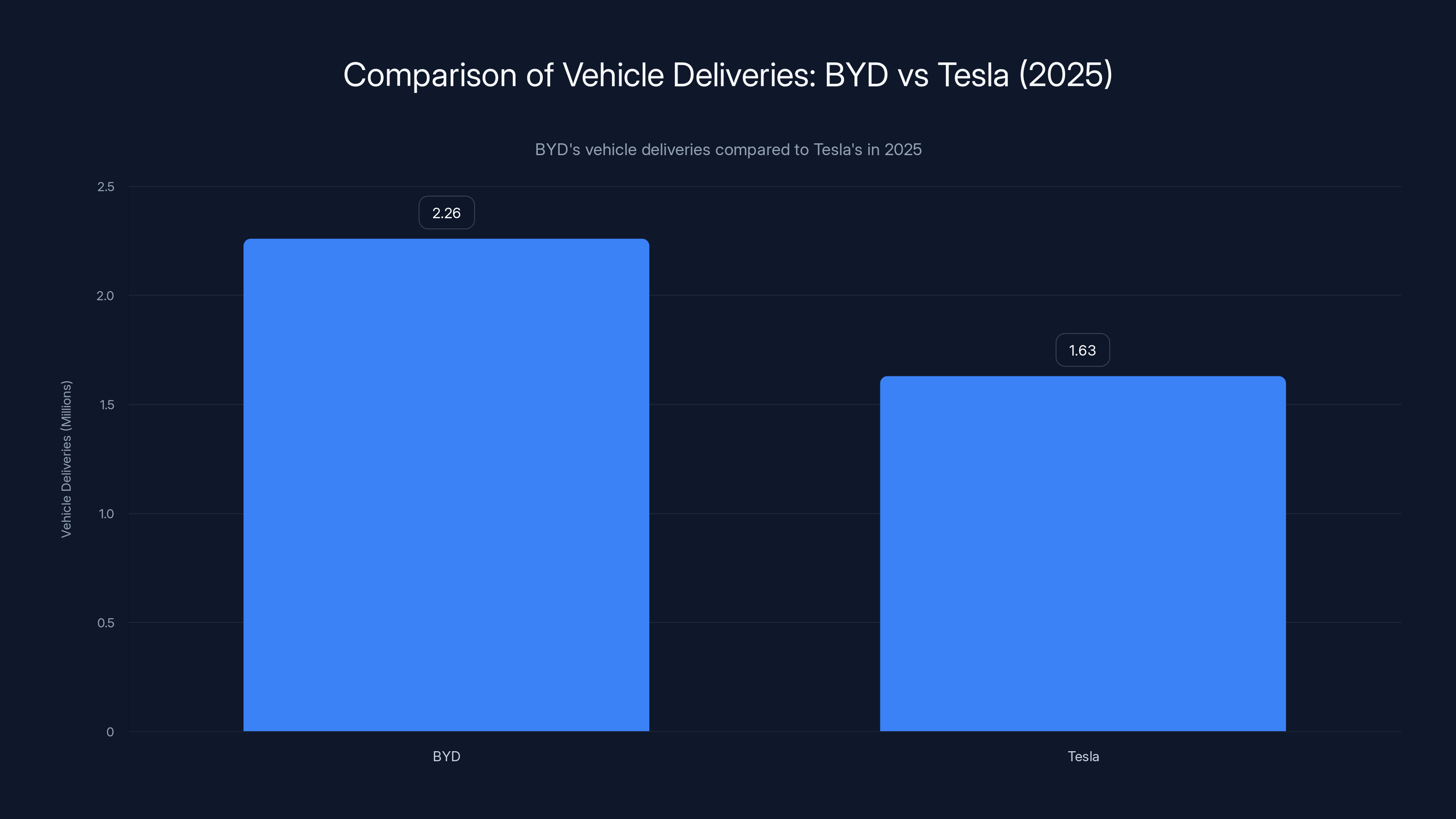

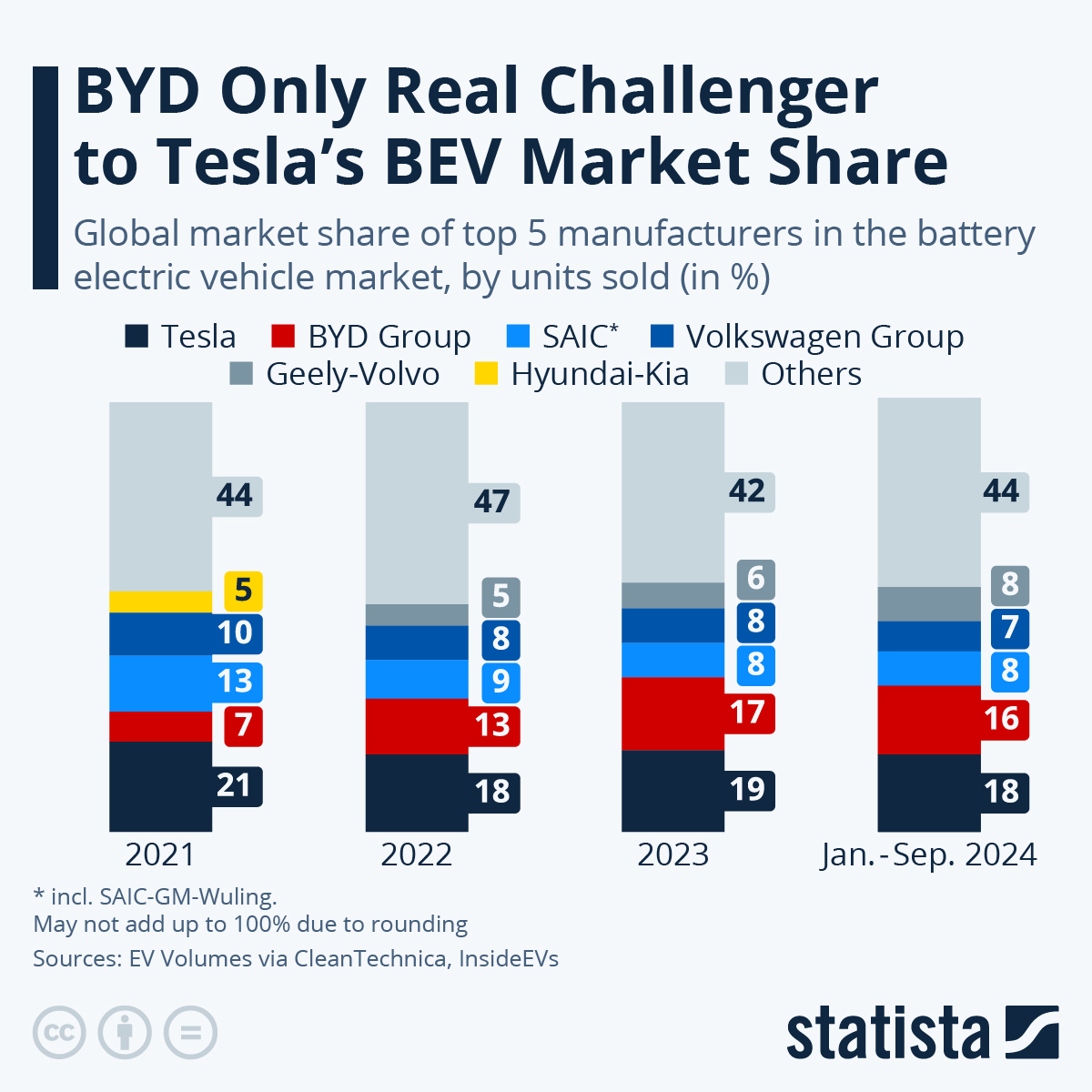

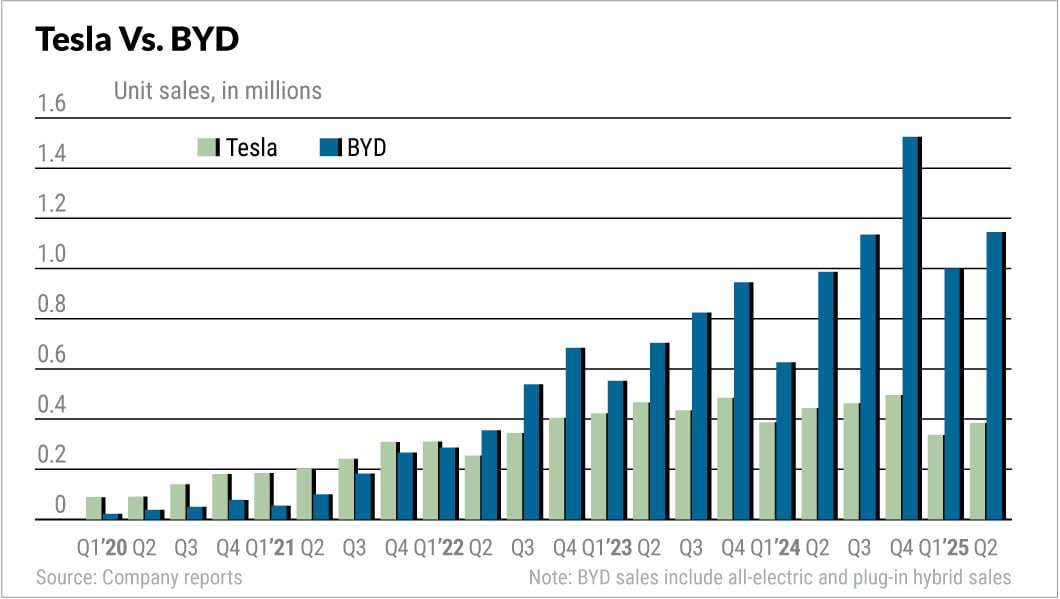

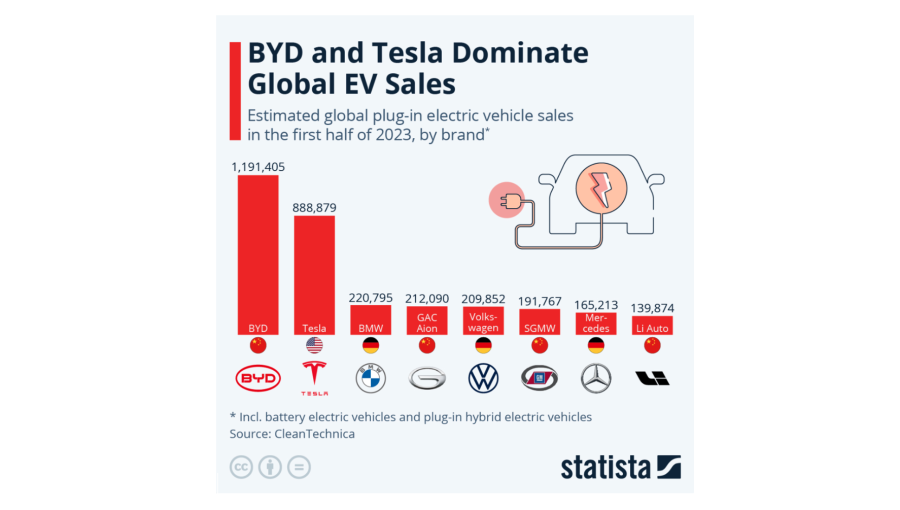

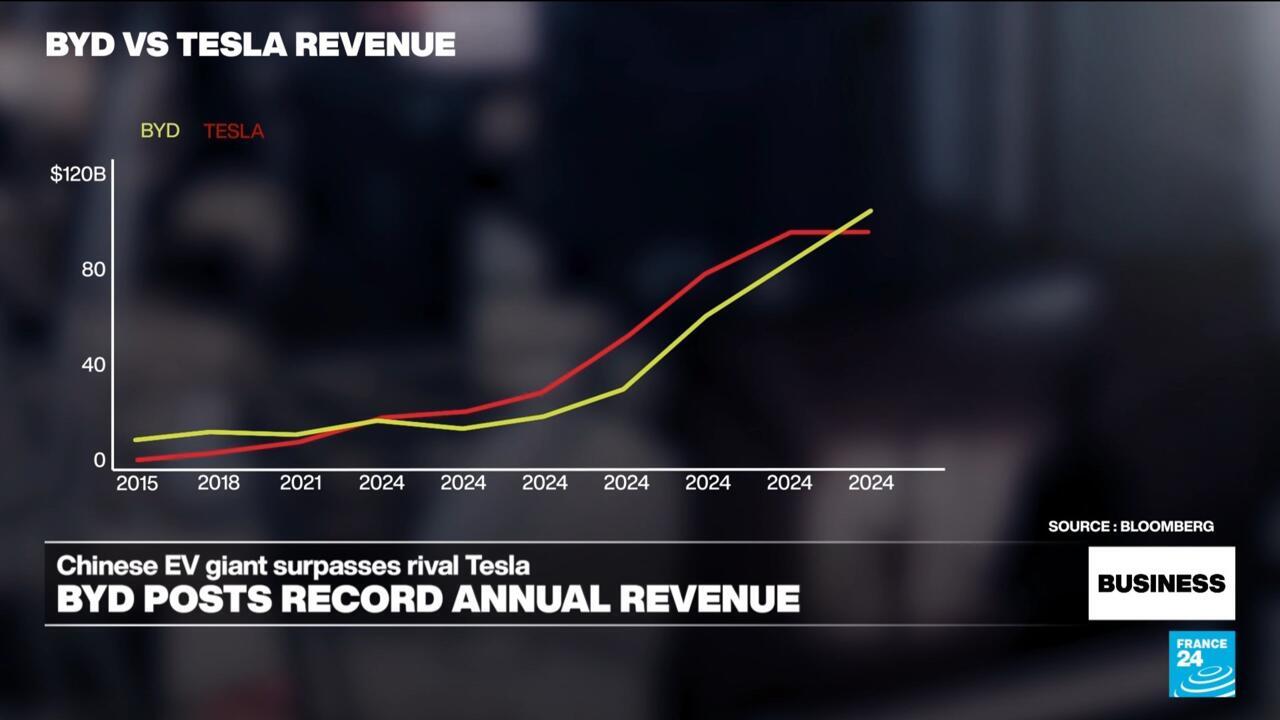

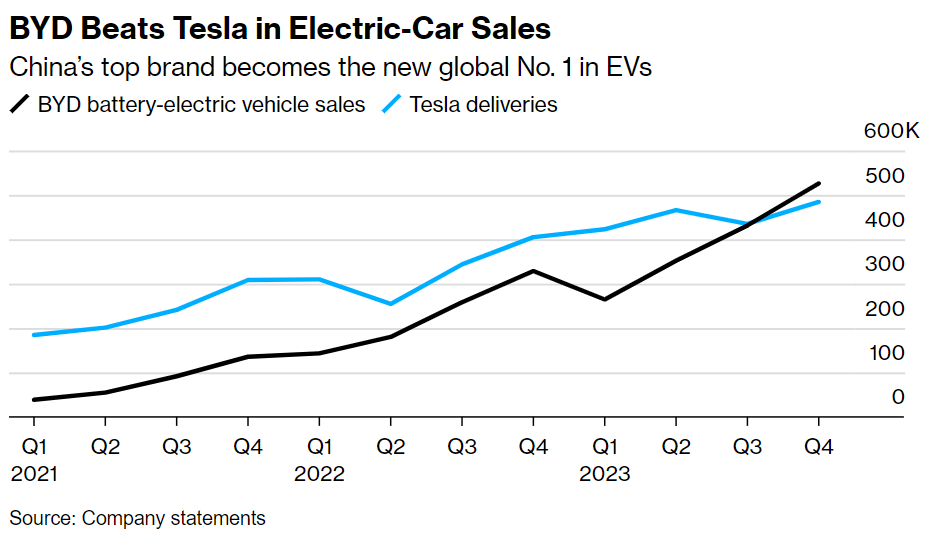

The number that deserves the most attention: BYD, the Chinese automotive manufacturer, delivered 2.26 million electric vehicles in 2025, formally dethroning Tesla as the world's largest EV producer by volume. This isn't a marginal difference or a temporary fluctuation. BYD's lead represents a 39% higher annual output compared to Tesla, signifying a structural shift in manufacturing capacity, market strategy, and consumer preference.

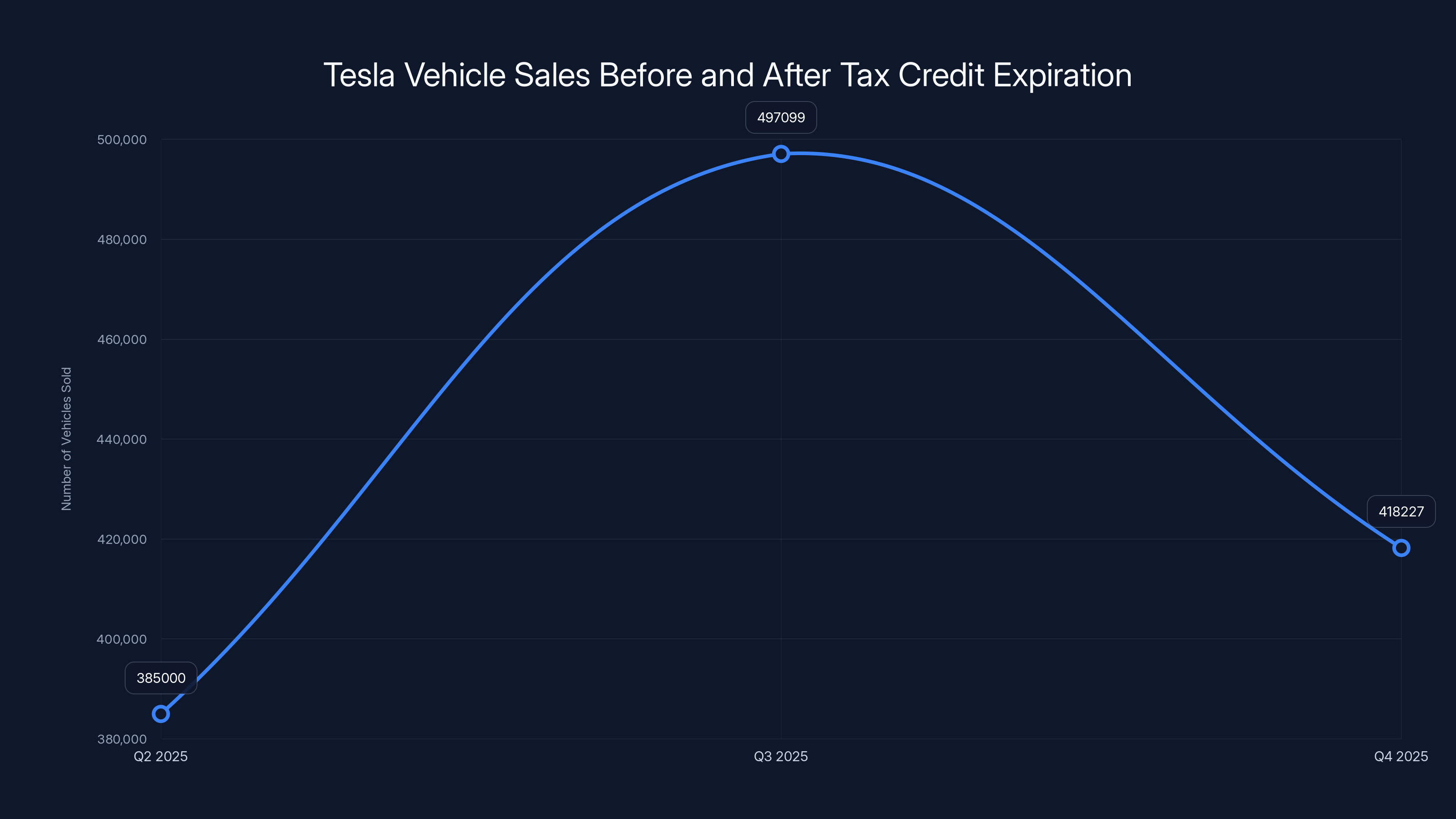

What makes this transition particularly significant is the constellation of factors that contributed to it. The elimination of the $7,500 U.S. federal tax credit created unprecedented pricing pressure on Tesla's core markets. Fourth-quarter sales plummeted to 418,227 vehicles—a devastating 15.6% decline from Q4 2024—as the company struggled to maintain momentum following record Q3 deliveries of 497,099 vehicles that were driven by consumers rushing to purchase vehicles before the tax incentive disappeared according to Kelley Blue Book.

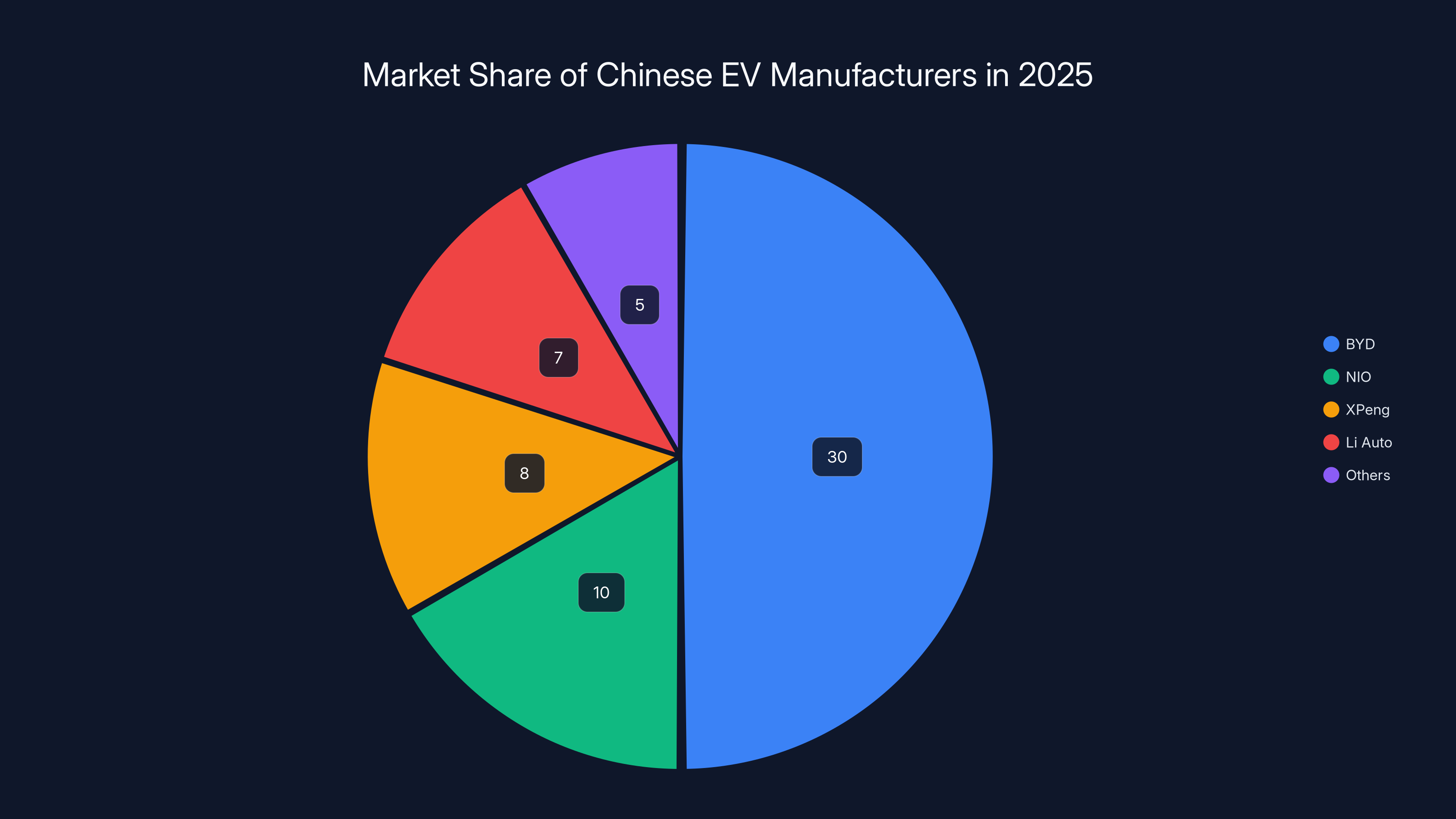

Beyond the immediate policy impacts, Tesla faces an increasingly fragmented competitive landscape. Chinese automakers, particularly BYD, have demonstrated superior manufacturing efficiency, lower cost structures, and aggressive pricing strategies. Competitors like NIO, XPeng, and Li Auto have captured significant market share in China and are positioning themselves for international expansion as noted by Mexico Business News. Simultaneously, traditional automakers including Volkswagen, BMW, and Mercedes-Benz have accelerated their EV production timelines, introducing increasingly competitive models at various price points.

For investors and industry observers, Tesla's sales decline raises fundamental questions about the company's strategic direction. CEO Elon Musk has publicly pivoted the company's focus toward artificial intelligence and robotics, positioning autonomous vehicles and humanoid robots as the company's future revenue sources. Yet the present reality remains clear: Tesla generated

This comprehensive analysis examines Tesla's sales decline through multiple analytical lenses. We'll explore the immediate policy drivers that accelerated the downturn, analyze the competitive dynamics reshaping the global EV market, investigate Tesla's strategic pivot toward AI and robotics, and assess what this transformation means for the broader automotive industry's future. The story of Tesla's decline is simultaneously a story of the global EV market's maturation, the rise of Chinese manufacturing excellence, and the beginning of the post-Tesla era in electric vehicles.

The Collapse of Tesla's Federal Support System

Understanding the $7,500 Tax Credit's Impact

The U.S. federal tax credit for electric vehicles served as a crucial market-shaping mechanism for nearly 15 years. This

Tesla's fourth-quarter collapse directly correlates with the credit's elimination. The company sold 497,099 vehicles in Q3 2025—a staggering 29% increase from Q2—as consumers accelerated purchases to claim the credit before its expiration. This represented artificial demand acceleration rather than organic market growth. When the credit disappeared between Q3 and Q4, Tesla faced a demand cliff. Fourth-quarter sales of 418,227 vehicles represented a 15.6% quarter-over-quarter decline, with the post-credit environment proving substantially less favorable to vehicle sales as reported by Reuters.

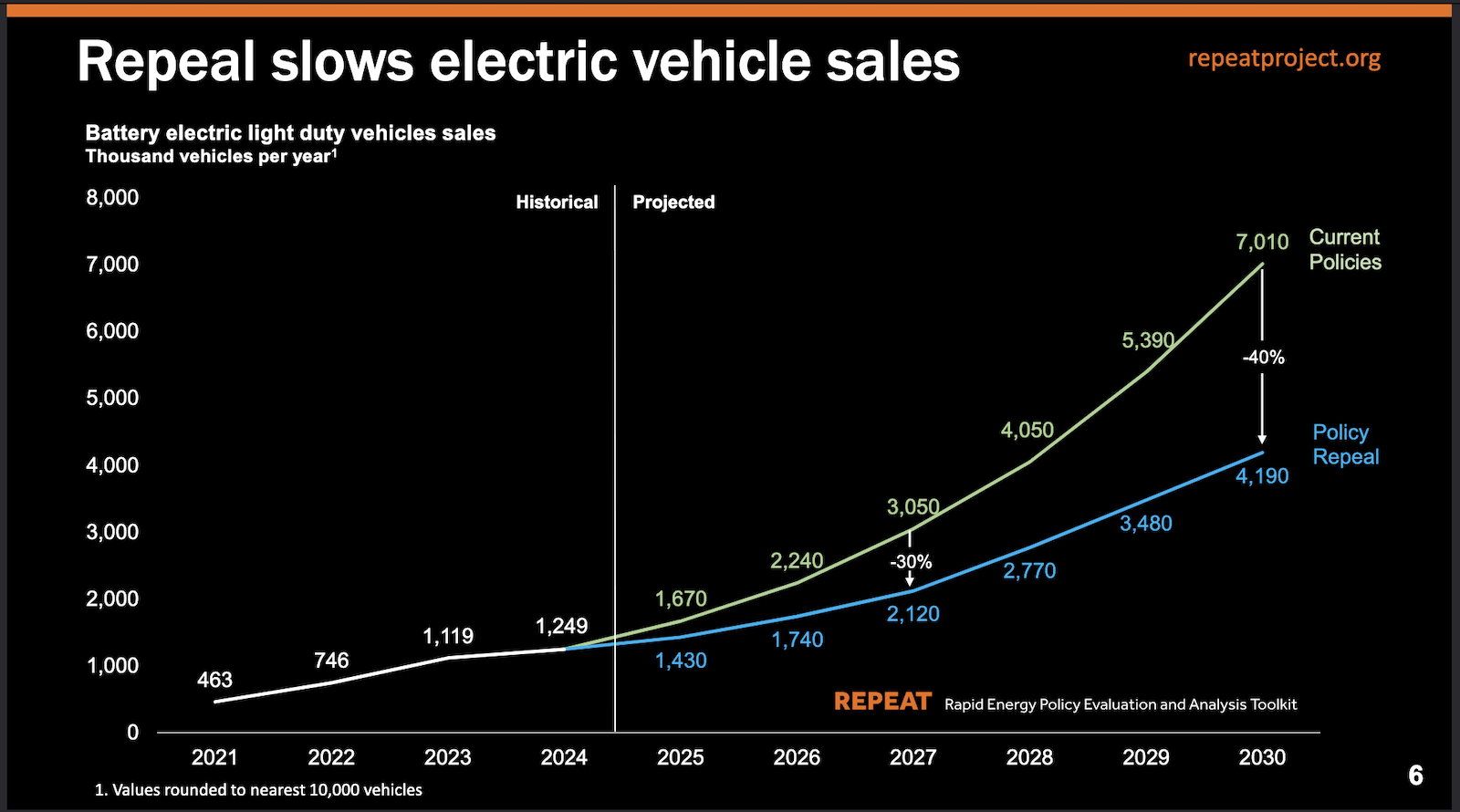

The tax credit's impact extended beyond simple consumer incentive mechanics. It represented a symbolic statement about government support for EV adoption. Its removal signaled to market participants that the "easy" phase of EV market development—characterized by government subsidies and policy tailwinds—was concluding. Moving forward, EV adoption would increasingly depend on vehicle value proposition, manufacturing efficiency, and competitive pricing rather than government financial support.

Market Response and Competitive Disadvantage

Tesla's pricing challenges intensified in the post-credit environment. The company had already implemented multiple price reductions throughout 2024 and early 2025, attempting to maintain volume despite increasing competition. Without the federal tax credit backstop, Tesla's vehicles became substantially more expensive relative to competing offerings from traditional automakers now aggressively launching their own EV lineups as noted by Foley & Lardner LLP.

Competing vehicles suddenly appeared more attractive on a total-cost-of-ownership basis. A Chevrolet Equinox EV, priced at approximately $35,000, competed directly with Tesla's Model 3 without requiring consumers to wait for tax credits or navigate complex eligibility requirements. Volkswagen's ID. Buzz, Hyundai's Ioniq 5, and Kia's EV9 offered premium features at competitive price points. The incentive structure that had allowed Tesla to maintain price premiums for years evaporated virtually overnight.

Geographic impacts proved particularly severe. Regions with strong EV incentive programs—such as California with its state-level rebates—remained more favorable to Tesla. However, regions lacking supplementary state incentives experienced immediate demand destruction. Buyers in states without state-level EV support found competing vehicles from established manufacturers suddenly more economically rational choices.

Long-Term Implications for EV Market Dynamics

The credit's elimination fundamentally altered EV market economics. Historical analysis suggests that EV penetration rates increase dramatically in markets with purchase incentives and decrease substantially when incentives disappear. The removal of the federal credit reversed years of market-building momentum in the United States, potentially delaying broader EV adoption timelines.

For Tesla specifically, the loss of the credit created an additional disadvantage relative to traditional automakers. Those established manufacturers could absorb margin pressure through profits from their profitable internal combustion engine businesses. Tesla, dependent almost entirely on EV revenue, faced pressure to reduce vehicle profitability rather than cross-subsidize from other divisions. This dynamic forced Tesla into a dilemma: maintain prices and lose volume, or reduce prices and compress margins as analyzed by Carbon Credits.

In 2025, BYD surpassed Tesla in EV sales with a 39% volume advantage, delivering 2.26 million vehicles compared to Tesla's 1.63 million. Revenue from EV sales was comparable, highlighting BYD's competitive pricing and cost structure.

BYD's Ascent: The Chinese Manufacturing Revolution

BYD's 2.26 Million Vehicle Achievement

BYD's delivery of 2.26 million electric vehicles in 2025 represents more than a sales figure—it demonstrates the scaled manufacturing capacity of Chinese automotive production. To contextualize this achievement: BYD's 2025 output exceeds Tesla's total global vehicle deliveries by 39%. The company manufactures more vehicles in a single year than many traditional automakers produce across their entire vehicle lineup as reported by CNBC.

BYD's manufacturing expansion has progressed with remarkable velocity. The company operates multiple mega-factories, each capable of producing over 1 million vehicles annually. Unlike Tesla, which maintains concentrated manufacturing in a limited number of global facilities, BYD has distributed production across numerous Chinese locations, reducing supply chain vulnerability and optimizing for regional market demands. This manufacturing decentralization strategy provides flexibility that Tesla's more concentrated approach cannot match.

The scale economics of BYD's operation create structural cost advantages. Manufacturing 2.26 million vehicles annually allows BYD to negotiate superior component pricing, optimize production processes through extensive volume learning curves, and distribute fixed costs across an enormous revenue base. A 1% improvement in manufacturing efficiency across 2.26 million vehicles generates substantially greater absolute cost savings than the same improvement applied to Tesla's 1.63 million vehicles.

BYD's Vertical Integration and Battery Dominance

BYD's competitive moat extends beyond manufacturing scale into vertical integration across the EV supply chain. The company manufactures its own batteries—a critical component that represents 30-40% of an EV's material cost. In 2025, BYD produced approximately 700+ gigawatt-hours of battery capacity annually, making it the world's largest EV battery manufacturer by a substantial margin. This vertical integration allows BYD to:

- Reduce battery costs through direct manufacturing rather than purchasing from third-party suppliers

- Control supply chain timing and availability, avoiding battery shortages that periodically constrain competitors

- Optimize battery specifications for specific vehicle platforms rather than adapting vehicles to available battery configurations

- Capture supply chain margins that competitors must pay to external battery manufacturers

BYD's Battery and Electric Vehicle (BEV) division operates as a profit center, generating revenue from both internal vehicle manufacturing and external battery sales to other automakers. This dual revenue stream creates different economics than Tesla's approach, where battery manufacturing directly supports vehicle production.

Price Competitiveness and Market Positioning

BYD's manufacturing efficiency translates into aggressive pricing strategies that Tesla cannot match profitably. A BYD Qin model, positioned as a family sedan with hybrid-electric capability, sells for approximately 150,000 Chinese yuan (roughly

These price advantages represent real manufacturing and operational efficiency rather than unsustainable margin compression. BYD achieves profitability at price points Tesla cannot reach without substantial margin destruction. This structural cost advantage creates a scenario where Tesla cannot compete on price without severely impacting profitability.

BYD's pricing strategy has evolved beyond pure cost competition. The company now offers multiple brands and vehicle tiers, serving diverse market segments. The Qin line addresses mass-market buyers, BYD Song targets premium market segments, and Yuan Plus models compete in the crossover category. This brand architecture allows BYD to capture market share across numerous price points simultaneously.

Geographic Market Dominance

BYD's volume advantage concentrates heavily in China, where the company captured approximately 40-45% of the EV market in 2025. China's automotive market represents the world's largest, with annual sales exceeding 25 million vehicles. Dominating the Chinese EV segment provides access to a massive and growing customer base.

Beyond China, BYD has begun international expansion into Southeast Asia, Australia, and selected European markets. While international sales represent a smaller percentage of BYD's total volume, the company is systematically building distribution networks and brand recognition in priority markets. This international expansion trajectory suggests that BYD's competitive challenge to Tesla will intensify globally, not remain concentrated in China as highlighted by Fortune Business Insights.

Tesla's vehicle sales surged by 29% in Q3 2025 due to the $7,500 tax credit, but dropped by 15.6% in Q4 after the credit expired, highlighting its significant impact on demand.

The Broader Competitive Landscape: More Than Just BYD

China's EV Manufacturer Ecosystem

BYD's ascendance overshadows an equally significant development: multiple Chinese automakers have achieved substantial scale and technological sophistication. NIO, founded in 2014, has emerged as a premium EV manufacturer, competing directly with Tesla in the luxury segment. XPeng has positioned itself as a technology-focused brand, emphasizing autonomous driving capabilities and innovative features. Li Auto has pioneered the extended-range electric vehicle (EREV) segment, positioning batteries not as the primary power source but as range extenders.

Together, Chinese EV manufacturers captured approximately 60% of China's EV market in 2025. This market concentration reflects not temporary competitive advantage but structural shifts in automotive manufacturing. Chinese manufacturers benefit from:

- Government support including manufacturing subsidies, research funding, and preferential regulatory treatment

- Access to capital through both state-owned enterprises and venture financing

- Domestic market scale providing enormous profit pools to reinvest in development

- Supply chain coordination with Chinese battery manufacturers, semiconductor suppliers, and component makers

- Technology transfer facilitated through joint ventures and government-supported technology initiatives

These structural advantages accumulate over time, creating self-reinforcing competitive dominance. As Chinese manufacturers achieve greater scale, they generate higher profitability, enabling greater investment in technology and manufacturing infrastructure, further widening competitive advantages as discussed by Barron's.

Traditional Automakers' EV Acceleration

While Chinese manufacturers capture volume, traditional automotive incumbents have dramatically accelerated EV production and introduced competitive models. Volkswagen has committed to aggressive EV production expansion, targeting 50% of sales from electric vehicles by 2030. BMW has launched the i 4, i X, and i 7 models, positioning electric vehicles across its lineup. Mercedes-Benz has introduced the EQE, EQS, and EQG models, competing across multiple market segments.

These traditional automakers possess critical advantages Tesla lacked in its early years: established dealer networks, brand recognition, manufacturing expertise, and financial resources. A consumer evaluating a $50,000 luxury sedan now chooses between Tesla's Model S and Mercedes' EQS, with the Mercedes option offering prestige, established service networks, and heritage brand reputation.

The competitive threat from traditional automakers intensifies as their EV production scales. Manufacturing efficiency improvements will compress pricing. Model proliferation across price points will capture market segments Tesla cannot address with limited product variety. Dealer networks will provide service and support capabilities that Tesla has struggled to develop at comparable scale.

Emerging Competitors in Underserved Segments

Beyond BYD and traditional automakers, specialized EV manufacturers are capturing specific market segments. Rivian has focused on electric trucks and SUVs, segments Tesla addressed only with the Cybertruck. Lucid has positioned itself as an ultra-premium manufacturer, competing with high-end Tesla models through superior performance specifications. Polaris has introduced affordable electric vehicles targeting mass-market buyers in underserved price segments.

Each competitor has identified specific market gaps and built product and marketing strategies to exploit them. This fragmentation of the EV market creates an environment where no single manufacturer can achieve the dominant position Tesla once held. Instead, the market has matured into a competitive ecosystem where multiple strong competitors occupy distinct market positions.

Tesla's Strategic Pivot: From EVs to AI and Robotics

Musk's "Master Plan IV" and Sustainable Abundance

Elon Musk has openly acknowledged Tesla's strategic shift away from vehicle manufacturing as the company's primary focus. The recently articulated "Master Plan IV" repositions Tesla as a technology company pursuing "sustainable abundance" through interconnected products spanning transportation, energy, storage, and robotics. This strategic pivot represents either a visionary recognition of emerging opportunities or a troubling departure from the company's core competency—interpretations differ sharply among investors and industry observers.

The Master Plan IV outlines a vision where Tesla's future value derives not from manufacturing vehicles but from:

- Autonomous vehicle technology enabling vehicles to operate without human drivers, fundamentally transforming transportation economics

- Humanoid robots performing tasks currently executed by humans, addressing labor shortages and creating new economic value

- Energy products including solar generation and battery storage, enabling decentralized energy systems

- Integrated transportation networks combining autonomous vehicles with AI-managed logistics and ride-sharing services

This vision presumes that autonomous vehicle technology will achieve Level 5 autonomy—complete automation requiring no human intervention—within a defined timeframe. Once achieved, the economics would shift dramatically. A vehicle owned by an individual that sits idle 95% of the time would transform into a productive asset generating revenue through autonomous ride-sharing. The value creation would be enormous, supporting valuations and margins far exceeding traditional vehicle manufacturing.

The Robotics Bet: Optimus and Future Manufacturing

Tesla's humanoid robot program, branded "Optimus," represents the company's most ambitious long-term project. The company envisions robots performing manufacturing tasks, logistics operations, and service-oriented work currently executed by human employees. Successfully developing cost-effective humanoid robots would represent one of the most significant technological achievements in human history and would generate enormous economic value.

Tesla has stated aspirational targets for Optimus production, suggesting the robot could eventually become one of the company's most valuable products. A humanoid robot capable of performing complex tasks at a cost below $25,000 would create an enormous market opportunity. Manufacturing facilities could operate with robotic labor, service industries could deploy robots for dangerous or unpleasant tasks, and logistics operations could be entirely automated.

However, the timeline between aspiration and realization remains uncertain. Humanoid robotics has proven exceptionally challenging despite decades of research. Balancing bipedal locomotion, achieving dexterous manipulation, developing complex problem-solving capabilities, and creating economically viable manufacturing all present substantial technical hurdles. Tesla's Optimus program is in early stages, with no production timeline for commercial availability.

The Contradiction: Present Revenue vs. Future Vision

Tesla's strategic pivot creates an internal contradiction that shapes current business performance. The company is attempting to maintain its EV business while simultaneously deprioritizing it relative to speculative future ventures. This divided focus manifests in several ways:

- Capital allocation directed toward AI and robotics development rather than manufacturing capacity expansion

- Management attention consumed by autonomous vehicle development and robotics projects

- Innovation cycles extended as engineering resources are shared across multiple concurrent initiatives

- Product development slowed as the company addresses robotics and AI challenges alongside vehicle engineering

Competitors unencumbered by this divided focus can concentrate entirely on vehicle manufacturing excellence. BYD, NIO, and traditional automakers allocate maximum resources to their core competency without distraction from speculative future ventures. This focus advantage becomes evident in manufacturing efficiency, product development cycles, and competitive responsiveness.

Further, Tesla's public communication of future ambitions creates investor expectations that increasingly diverge from present financial reality. The stock market assigns substantial value to the company's speculative AI and robotics businesses, even though these ventures currently generate zero revenue. Should these projects fail to materialize, value destruction would be severe.

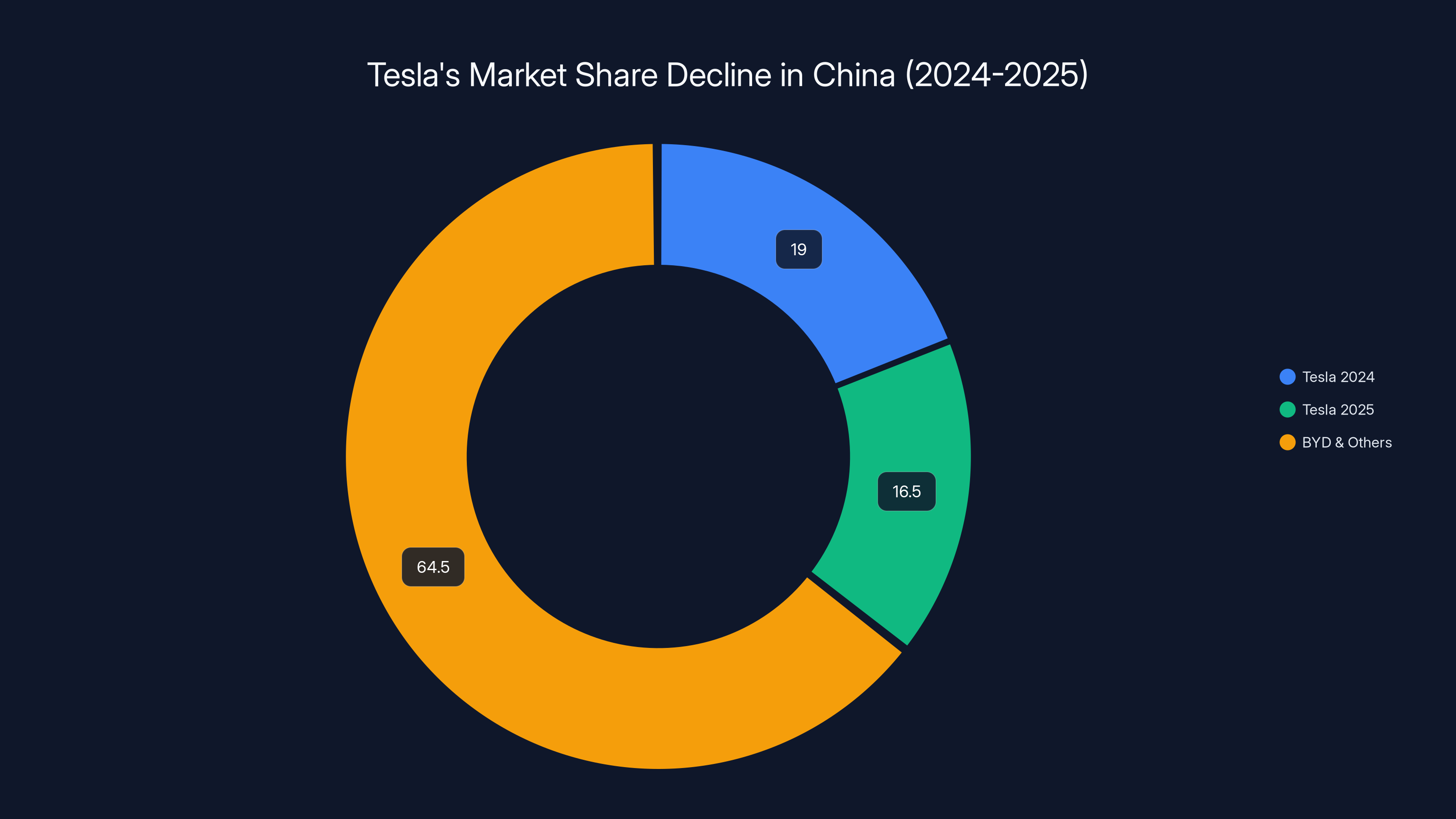

Tesla's market share in China decreased from 19% in 2024 to approximately 16.5% in 2025, while competitors like BYD gained ground. Estimated data based on market trends.

Regional Market Analysis: Where Tesla Lost Ground

China: The Market Tesla Can No Longer Defend

China represents the world's largest EV market by volume, with annual sales exceeding 9 million electric vehicles in 2025. Tesla's position in China has deteriorated dramatically. In 2024, Tesla controlled approximately 19% of China's EV market. By 2025, this share had compressed to approximately 16-17%, reflecting both BYD's aggressive expansion and aggressive pricing strategies by other competitors as reported by Deutsche Welle.

BYD's domination of the Chinese market creates a structural barrier to Tesla's growth. As BYD's volume increases, the company's cost advantages compound, enabling more aggressive pricing that Tesla cannot match profitably. Simultaneously, BYD's established relationships with Chinese consumers, retailers, and supply chain partners create network effects favoring continued market share accumulation.

Geopolitical considerations compound Tesla's China challenges. Growing U.S.-China tensions have created regulatory uncertainty for American companies operating in China. Tesla's Shanghai manufacturing facility—crucial for serving both the Chinese market and exporting to other regions—faces potential policy risks. Chinese regulators could prioritize domestic manufacturers in procurement decisions or implement policy changes disadvantaging foreign competitors.

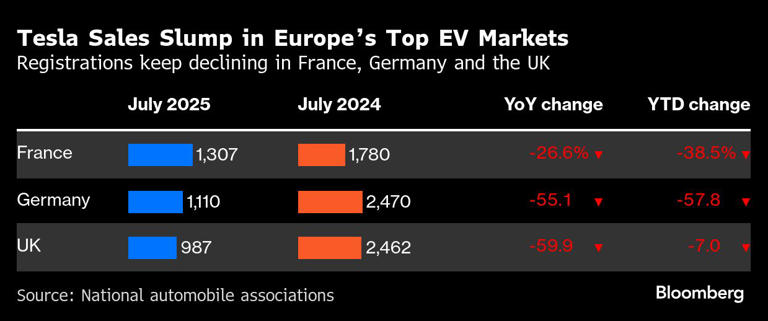

Europe: Facing Entrenched Traditional Competitors

Europe's EV market, historically receptive to Tesla, has increasingly shifted toward traditional automakers' EV offerings. Volkswagen's ID series, BMW's i 4, and Mercedes' EQE compete effectively on price, features, and brand prestige. Tesla's European sales declined approximately 12-15% in 2025 as traditional automakers increased EV production and captured market share through established distribution networks.

Europe's charging infrastructure, expanding rapidly, reduces Tesla's historical advantage in Supercharger network access. Third-party fast-charging networks like Ionity, EVgo, and Tesla's own network expansion have made charging infrastructure increasingly competitive. Consumers no longer require Tesla vehicles to access reliable charging—a crucial consideration in Europe's geographically compact countries with limited driving distances.

Regulatory developments also challenged Tesla's European position. The EU's push toward unified charging standards and mandates for standardized connectors reduced Tesla's differentiation advantage. European emissions regulations increasingly favored traditional automakers positioned to distribute EV volume across their existing networks rather than startups concentrating entirely on electric vehicles.

North America: Maintaining Share Through Volume Pressure

Tesla maintains its strongest position in North America, where its brand recognition remains formidable and charging infrastructure advantage persists. However, competitive pressure intensifies as traditional automakers introduce competitive models. Chevrolet's Equinox EV and Silverado EV, Ford's F-150 Lightning, and Rivian's R1T and R1S compete effectively in Tesla's core market segments.

The federal tax credit's elimination particularly impacted North American market dynamics, as the region represents Tesla's largest revenue source. When the credit disappeared, Tesla's pricing advantage evaporated, forcing the company to compete on vehicle attributes rather than total cost of ownership metrics favoring Tesla's vehicles.

Tesla's North American dealer situation creates structural challenges as well. The company's direct-to-consumer sales model works effectively in concentrated urban markets but proves less effective in distributed suburban and rural areas where traditional dealer networks provide service and sales convenience. As Tesla expands geographic coverage, it increasingly requires service infrastructure comparable to traditional dealers, reducing the cost advantages of direct distribution.

Manufacturing Efficiency: The Cost Disadvantage Game

Tesla's Manufacturing Economics

Tesla's manufacturing facilities achieve impressive efficiency metrics compared to traditional automakers. The company operates with remarkably lean workforces and emphasizes automation extensively. However, Tesla's manufacturing efficiency, while impressive, has not translated into cost advantages sufficient to maintain profitability at competitive market prices.

Tesla's Gigafactories, designed as massive integrated facilities combining battery manufacturing with vehicle assembly, were conceptually superior to traditional distributed manufacturing. In practice, however, these mega-factories face integration challenges, workforce training demands, and production ramp-up delays that have constrained efficiency gains. The Shanghai Gigafactory requires approximately 2.5 labor hours per vehicle to manufacture, compared to industry benchmarks ranging from 2.0-2.2 hours at optimized traditional manufacturing facilities.

Further, Tesla's manufacturing economics are constrained by limited product variety. Manufacturing a single platform (the Model 3) with limited variants enables greater efficiency than manufacturing diverse platforms. However, this concentrated approach limits addressable market size. Traditional manufacturers benefit from diverse product portfolios serving multiple market segments with shared platform architectures enabling economies of scope.

BYD's Cost Structure Advantage

BYD achieves manufacturing economics superior to Tesla through multiple mechanisms. First, labor costs in China average substantially below U.S. labor costs. While BYD compensates employees competitively within Chinese markets, absolute wage levels remain lower than comparable U.S. facilities. This cost advantage compounds across BYD's massive manufacturing footprint, generating meaningful absolute cost advantages.

Second, BYD's vertical integration into battery manufacturing generates substantial cost savings. Internal battery manufacturing costs approximately

Third, BYD benefits from supply chain coordination advantages within China's automotive ecosystem. Component suppliers cluster in specific regions, reducing logistics costs and enabling just-in-time delivery systems more effectively than geographically dispersed suppliers serving Tesla. These supply chain coordination advantages reduce inventory carrying costs, minimize logistics expenses, and improve production flexibility.

Fourth, BYD leverages government support through manufacturing subsidies, research funding, and preferential regulatory treatment unavailable to Tesla. While quantifying these advantages precisely proves difficult, their cumulative impact on BYD's cost structure is substantial.

Traditional Automakers' Manufacturing Efficiency

Traditional automakers possess enormous manufacturing infrastructure developed over decades. Volkswagen operates manufacturing facilities across multiple continents with massive production capacity. Toyota's manufacturing systems, developed through decades of lean manufacturing philosophy, achieve efficiency metrics among the world's best. These established manufacturers can apply existing manufacturing expertise to EV production, achieving efficiency improvements more rapidly than startups developing manufacturing processes from scratch.

As traditional automakers expand EV production, their cost structures improve through manufacturing learning curves. A manufacturer reaching 5 million annual EV production across diverse facilities will achieve cost structures substantially below manufacturers producing lower volumes. This dynamic suggests that over time, as EV production becomes a larger percentage of traditional automakers' total output, their cost structures will improve to competitive levels.

In 2025, BYD delivered 2.26 million vehicles, surpassing Tesla's 1.63 million by 39%, showcasing BYD's manufacturing prowess.

The Fourth-Quarter Collapse: Understanding the Magnitude

Q4 2025 Delivery Failure Analysis

Tesla's fourth-quarter performance represents one of the company's most disappointing periods since achieving large-scale production. Fourth-quarter deliveries of 418,227 vehicles declined 15.6% quarter-over-quarter compared to Q3's 418,277 vehicles. Wait—this comparison reveals a critical detail: Q4 and Q3 deliveries were virtually identical in absolute volume, despite Q3 representing the record-breaking 497,099 vehicle quarter.

This pattern indicates severe demand destruction rather than temporary quarter-to-quarter fluctuation. Q3 represented an extraordinary quarter driven by tax credit deadline effects, not a sustainable business level. Q4's return to Q3 levels, despite elimination of the tax credit incentive, suggests the underlying business operated at a substantially lower production rate than Q3, with tax credit urgency entirely responsible for Q3's extraordinary performance.

Year-over-year comparison proves even more damaging. Fourth-quarter 2024 deliveries totaled 495,570 vehicles. Fourth-quarter 2025 at 418,227 represents a 15.6% year-over-year decline, indicating that Tesla's demand destruction extended beyond tax credit elimination into broader competitive displacement.

Analyst Expectations vs. Actual Results

The magnitude of Tesla's Q4 miss relative to analyst expectations deserves emphasis. Wall Street analysts, based on Q3's record deliveries and Tesla's historical performance patterns, had estimated Q4 deliveries in the 485,000-500,000 vehicle range. Tesla's delivery of 418,227 vehicles fell approximately 15-17% below these consensus estimates, representing a substantial miss.

When Tesla reported the Q4 figures, equity markets responded immediately with a 2%+ stock price decline. This market reaction reflects investor disappointment but understates the full significance. The Q4 miss represents not merely a single quarter's underperformance but evidence that Tesla's underlying business has deteriorated more severely than investors anticipated.

Competitive Displacement During the Crisis

During the Q4 2025 period when Tesla struggled, competitors aggressively captured market share. BYD increased production and captured incremental market volume. Traditional automakers introduced new models and expanded production of existing EV platforms. Chinese competitors focused on market penetration. The period of Tesla's weakness became a window of opportunity for competitors to establish stronger market positions.

This dynamic creates path-dependent outcomes. Consumers who purchased competitive vehicles during Tesla's crisis may develop brand loyalty or satisfaction that reduces likelihood of switching to Tesla subsequently. Market share lost during weakness proves difficult to recover once competition establishes stronger market positions and consumer relationships deepen.

Financial Implications: Profitability Under Pressure

Revenue Impact of Volume Decline

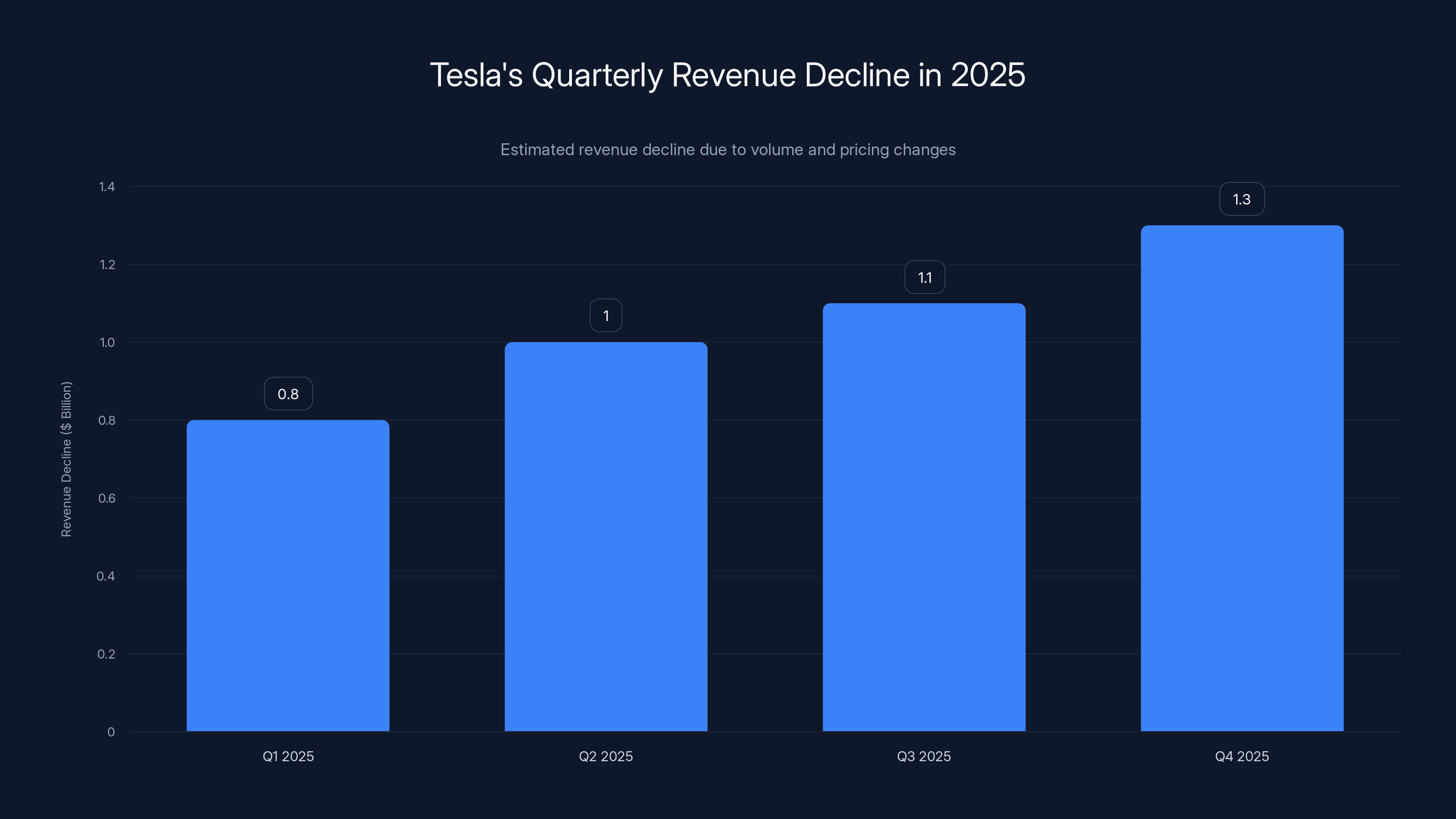

Tesla's 9% annual volume decline directly translates into revenue pressure. If average selling price remained constant at approximately

Quarterly revenue breakdown reveals the severity: Q4 2025 revenue declined approximately 8-10% year-over-year despite inflationary pressures that typically increase prices. In absolute terms, this represented a revenue decline of approximately $1.2-1.4 billion in a single quarter.

Profitability Compression and Margin Erosion

Beyond revenue pressure, Tesla's profitability compressed as the company implemented aggressive pricing to maintain volume. The traditional pricing model—maintain prices while volume declines—would have been catastrophic for company survival. Instead, Tesla reduced prices, attempting to stimulate demand while accepting lower per-unit profitability.

This margin compression creates a destructive spiral. As prices decline, profitability per vehicle decreases, forcing reduction in costs or acceptance of lower returns on capital. Tesla's cost structure, built to support higher historical prices, became uneconomical at lower price points. The company faced pressure to reduce manufacturing costs, engineer simplification, or accept margin compression across the board.

Capital Allocation Pressures

Reduced profitability constrains Tesla's capital allocation flexibility. The company had historically allocated substantial capital toward Gigafactory expansion, autonomous vehicle development, and robotics research. Reduced profitability necessitates more disciplined capital allocation or increased borrowing to fund ambitious growth projects.

Capital constraints prove particularly problematic for Tesla's speculative ventures. Autonomous vehicle development and robotics research consume enormous capital without generating near-term revenue. When profitability contracts, funding these long-term initiatives becomes more difficult without increasing debt or reducing shareholder capital returns.

In 2025, Chinese EV manufacturers are projected to hold a significant share of China's EV market, with BYD leading at 30%. Estimated data.

Policy and Regulatory Landscape: The Credit Elimination Context

Federal Tax Credit History and Mechanics

The $7,500 U.S. federal EV tax credit, enacted through the American Recovery and Reinvestment Act of 2009, represented America's primary mechanism for stimulating EV adoption. The credit applied to the first 200,000 vehicles per manufacturer, after which the credit phased out over the following two years. Tesla, as the first manufacturer to reach the 200,000-vehicle threshold, had its credit phase out entirely by July 2019.

However, the Inflation Reduction Act, enacted in 2022, substantially restructured the EV credit. The new framework eliminated the per-manufacturer cap and instead focused on vehicle price caps, domestic manufacturing requirements, and battery component sourcing. Critically, for Tesla, the domestic manufacturing requirement and battery sourcing mandates meant that many Tesla vehicles didn't qualify for the credit despite the company's U.S. manufacturing operations.

The elimination of the federal credit for Tesla vehicles (while other manufacturers like General Motors and Hyundai benefited from expanded credit availability) created a significant competitive disadvantage. Consumers comparing a Tesla Model 3 to a Chevrolet Equinox EV suddenly found the Chevy more affordable when factoring in available credits, fundamentally altering purchase economics.

State and Regional Incentive Variations

While the federal credit disappeared, numerous states maintained their own EV incentive programs. California, historically Tesla's largest market, offers up to $7,500 in state-level rebates for qualifying EV purchases. However, even state incentives proved insufficient to fully offset federal credit elimination. The combination of federal and state incentives available to competitors exceeded what Tesla could access in most markets.

Regional variation in incentive availability created uneven competitive landscapes. In states with generous EV incentives, Tesla maintained stronger competitive positions. In states lacking state-level incentives, competitive pressure intensified substantially. This regional variation complicated Tesla's national pricing strategy, requiring different price points in different states to maintain competitiveness.

International Subsidy Environments

Outside the United States, various international markets maintained or expanded EV subsidy programs. China continued supporting domestic EV manufacturers through manufacturing subsidies and preferential policy treatment. European countries maintained purchase incentives for EV buyers, ranging from €3,000-€9,000 per vehicle depending on country and vehicle class. These international incentives supported demand in Europe and China, enabling competitors to maintain volume despite Tesla's challenges.

The divergence between U.S. subsidy elimination and international subsidy continuation created advantage for competitors with stronger international positions. BYD, with dominant market position in China, benefited from Chinese subsidy support. European manufacturers benefited from European incentive programs. Tesla, with concentrated North American focus, faced incentive disadvantage precisely in its largest market.

The Cybertruck Situation: A Strategic Bet Under Scrutiny

Production Ramp Challenges

The Cybertruck represents Tesla's most ambitious product launch in years: an electric pickup truck with distinctive angular design and advanced materials. Production ramp has progressed substantially slower than originally projected. Tesla delivered approximately 50,850 Cybertrucks in 2025, a meaningful number but far below production capacity and substantially below company aspirations.

The Cybertruck's complex manufacturing process, featuring stainless steel exoskeleton construction and novel assembly techniques, has created production bottlenecks. Traditional vehicle manufacturing processes, refined over decades, don't readily apply to the Cybertruck's unique design. Tesla has invested enormous engineering effort in solving manufacturing challenges, but the ramp timeline has extended well beyond original projections.

Delay in Cybertruck production creates several problems. First, capital invested in Cybertruck manufacturing facilities generates lower-than-expected returns as production volume remains constrained. Second, Cybertruck represents a new revenue stream that was supposed to partially offset Model 3/Model Y maturation. Third, extended ramp timelines delay the company's diversification away from concentrated Model 3/Y production.

Market Reception and Competitive Response

The Cybertruck has generated significant market interest, with early adopters expressing enthusiasm for its novel design and technology. However, the unconventional angular design creates strong divergence in consumer preferences: enthusiasts love it; skeptics find it impractical and aesthetically questionable. This polarized reception limits addressable market compared to conventional pickup truck designs.

Competitors have responded with conventional EV trucks: Ford's F-150 Lightning and upcoming Silverado EV pursue traditional pickup truck aesthetics, which may appeal to broader market segments. Rivian's R1T, launched earlier than Cybertruck, has established market position in the electric truck category before Tesla's volume production.

Financial Expectations and Reality

Tesla had publicly suggested that Cybertruck would become a significant profit driver, potentially rivaling Model 3 in contribution. These projections presume high-volume production at favorable margins. Current production constraints and pricing challenges suggest these optimistic scenarios may not materialize. The Cybertruck, rather than becoming a profit engine, may continue representing capital and engineering investment with uncertain returns.

The Cybertruck's disappointing ramp has implications beyond the truck itself. It suggests Tesla's manufacturing capabilities face constraints in scaling new platforms. If Tesla struggles to reach Cybertruck volume targets, skepticism intensifies regarding other new platforms like the rumored $25,000 vehicle or futuristic next-generation platform.

Tesla's revenue decline accelerated throughout 2025, with Q4 experiencing the highest drop of approximately $1.3 billion due to volume and pricing pressures. Estimated data.

Investor Sentiment and Market Reactions

Stock Price Performance and Valuation Questions

Tesla's stock experienced meaningful volatility in response to the 2025 sales decline announcement. The stock dropped approximately 2% in immediate market reaction to the Q4 delivery figures. Over the broader period surrounding the sales decline, Tesla shares declined approximately 8-12%, reflecting broader investor disappointment with the company's growth trajectory.

Tesla's valuation remains substantially elevated relative to traditional automakers despite declining growth. The company trades at enterprise value-to-revenue multiples substantially exceeding Ford, General Motors, or Volkswagen. This valuation premium presumes that Tesla's future AI and robotics ventures will generate enormous value. Should these speculative ventures fail to materialize within investors' expected timeframes, dramatic valuation compression could occur.

Analyst Downgrades and Target Revisions

Numerous equity analysts downgraded Tesla following the 2025 sales results. Morgan Stanley revised its outlook, citing heightened competitive pressure and declining growth visibility. Goldman Sachs reduced its price target, emphasizing that consensus had become too optimistic about Tesla's ability to defend market share. These analyst revisions reflect growing acceptance that Tesla's dominance-based growth narrative has shifted to a competitive competition narrative.

Price targets across the analyst community compressed meaningfully. Where analysts had previously projected

Institutional Investor Repositioning

Institutional investors began repositioning portfolios away from Tesla concentration and toward broader diversified automotive exposure. Some institutions maintained Tesla positions but reduced position sizes or hedged exposure through options strategies. This institutional repositioning created incremental selling pressure during periods of market weakness.

The institutional repositioning reflects changing narrative around Tesla. The company has transitioned from a "growth at all costs" profile supported by investors seeking exposure to EV industry transformation, to a more traditional automotive company profile subject to cyclical industry dynamics and intense competition. This narrative shift carries significant implications for how Tesla is valued and what investor constituencies hold the stock.

What's Next: Tesla's Path Forward

Strategic Options and Decision Points

Tesla faces several strategic choices that will determine its competitive trajectory. First, the company must decide how aggressively to defend market share through pricing versus maintain profitability through disciplined pricing. This decision involves tradeoffs with no perfect solution: aggressive pricing preserves volume but destroys profitability; disciplined pricing maintains margins but risks volume destruction.

Second, Tesla must determine its investment priorities across competing initiatives. The company cannot simultaneously maximize capital investment in manufacturing capacity, autonomous vehicle development, and robotics research while maintaining shareholder returns. More disciplined capital allocation will require difficult prioritization decisions.

Third, Tesla must address its product portfolio gaps. The company's limited product diversity—concentrated on Model 3 and Model Y—leaves addressable market segments to competitors. A $25,000 vehicle would address mass-market segments currently dominated by BYD and traditional automakers. A three-row SUV would compete directly with traditional platforms Tesla currently cannot address. Expanding product diversity requires capital investment and manufacturing complexity that current operations may not easily accommodate.

Manufacturing Strategy Recalibration

Tesla's manufacturing strategy, predicated on gigantic integrated facilities combining battery and vehicle manufacturing, has not delivered the cost advantages originally envisioned. A strategic pivot toward more distributed manufacturing or partnership with suppliers might prove more economically rational. Alternatively, Tesla could accept that its manufacturing strategy requires higher capital intensity to achieve cost parity with competitors.

The company's current Gigafactory portfolio—operating at varying utilization rates—suggests potential overcapacity relative to current and near-term demand. Idle manufacturing capacity represents capital inefficiently deployed. Tesla must either:

- Drive volume increases through aggressive pricing and new product introduction

- Reduce manufacturing footprint through consolidation or closure of underutilized facilities

- Diversify manufacturing beyond vehicles into robots, energy storage, or other products

Each option involves significant financial and strategic implications.

Competitive Response Requirements

To remain competitive, Tesla must accelerate product development timelines and improve manufacturing efficiency. The company's current trajectory suggests that without meaningful operational changes, competitive position will continue eroding. BYD will continue gaining volume advantages, traditional automakers will expand EV market share, and Tesla's position will contract further.

Competitive response might include:

- Aggressive price reduction below current levels to maintain volume, accepting lower margins

- Product diversification through introduction of new platforms and price points

- Manufacturing transformation through process innovation or partnership strategies

- Technology differentiation through autonomous vehicle and robotics capabilities if they achieve commercial viability

- Service and experience enhancement to defend premium positioning despite competitive price pressure

Global Automotive Industry Transformation

The Shift from U.S.-Based Leadership to Global Competition

Tesla's sales decline marks a historic transition in automotive industry leadership. For the 20th century, American automakers dominated global markets. In the 21st century, Japanese manufacturers (Toyota, Honda, Nissan) competed effectively, and European manufacturers (Volkswagen, BMW) maintained strong positions. Chinese automakers, previously relegated to domestic markets, have emerged as globally competitive forces.

BYD's dominance of global EV production represents this transition's culmination. The company manufactures more vehicles than any American automotive company and does so at cost structures American manufacturers cannot match. This shift reflects broader global economic transformation where manufacturing prowess has migrated toward Asia.

EV Market Maturation and Competitive Dynamics

The EV market has matured from a niche category dominated by single players into a mainstream industry with diverse competitors. This maturation creates fundamentally different competitive dynamics. When Tesla was the only serious EV manufacturer, competitive advantage derived from technology, brand, and first-mover positioning. As the market matures, competitive advantage derives increasingly from manufacturing efficiency, cost structure, product diversity, and capital access—areas where traditional automakers and large Chinese manufacturers excel.

Market maturation also reduces subsidy dependency. Early EV adoption required government support to offset higher vehicle costs. Mature markets operate on economic fundamentals: EVs must achieve cost parity with comparable internal combustion vehicles through manufacturing efficiency and scale rather than subsidies. This transition advantages manufacturers with superior cost structures.

The Energy Transition and Beyond

Beyond vehicle sales, the EV market's evolution connects to broader energy transition dynamics. Battery manufacturing, electricity generation, and grid management all intertwine with vehicle electrification. China's dominance in battery manufacturing extends beyond automotive applications into stationary energy storage, grid balancing, and renewable energy integration. This broader energy ecosystem advantage extends China's competitive position beyond automobiles.

International energy security concerns increasingly shape EV market dynamics. Nations seeking to reduce dependence on imported oil and foreign energy sources prioritize domestic EV manufacturing and battery production. This creates policy tailwinds for national champions like BYD while potentially creating headwinds for foreign competitors in some markets.

Industry Lessons and Precedents

Smartphone Industry Parallel

The smartphone industry provides an instructive historical parallel. Apple dominated early smartphone markets with premium positioning and technological differentiation. As the market matured, numerous competitors emerged offering similar capabilities at lower prices. Apple maintained market leadership through brand positioning and premium pricing but lost volume market share to competitors offering greater affordability.

Tesla's position bears resemblance to Apple circa 2012-2014, when competition intensified and market share concentration decreased. Like Apple, Tesla possesses strong brand and technology differentiation. Like Apple, Tesla maintains some cost structure disadvantage to high-volume manufacturers. The question remains: does Tesla follow Apple's successful path of premium positioning and selective market share loss, or does it face more existential challenges?

The Personal Computer Industry Lesson

The personal computer industry offers a more cautionary precedent. IBM dominated early PC markets through premium positioning and brand trust. As the market matured, Dell and Compaq offered competitive products at lower prices through superior supply chain management. IBM gradually lost market dominance and eventually exited the PC business entirely, refocusing on higher-margin services and enterprise computing.

Would Tesla follow Apple's path or IBM's path? The answer likely depends on whether Tesla successfully develops autonomous vehicle and robotics capabilities that justify premium valuation. If Tesla remains primarily a vehicle manufacturer, its trajectory may resemble IBM's path. If Tesla successfully transitions to AI and robotics, it may achieve Apple-like premium positioning in a different market.

Conclusion: Navigating the Post-Tesla Era

Tesla's 9% annual sales decline and loss of global EV leadership position represent far more than a single company's competitive setback. The results reflect a historic transition in automotive industry structure, the maturation of the EV market from niche to mainstream, and the emergence of Chinese manufacturing capabilities as globally dominant forces.

The immediate financial impacts prove manageable: Tesla remains profitable despite margin compression, and the company maintains substantial cash reserves and unencumbered assets. The strategic implications prove more significant. Tesla's ability to maintain competitive position will depend on successfully executing multiple simultaneous challenges: defending market share against increasingly capable competitors, accelerating autonomous vehicle and robotics development, diversifying product offerings across price points, and improving manufacturing efficiency to competitive levels.

For Tesla investors, the inflection point is unmistakable. The company has transitioned from consistent growth and margin expansion to growth challenges and margin compression. Depending on autonomous vehicle and robotics development for valuation support introduces substantial execution risk. Should these ambitious projects fail to materialize within investors' expected timeframes, severe valuation compression could occur.

For the broader automotive industry, Tesla's setback removes the existential threat that Tesla represented to traditional automakers. The industry can now focus on evolutionary competition rather than responding to disruptive innovation. Traditional automakers maintain cost structure advantages, manufacturing expertise, and capital resources. As EV production increases as a percentage of their total output, these traditional manufacturers' EV cost structures will improve, further narrowing Tesla's competitive advantage.

For global energy transition efforts, Tesla's challenges highlight both progress and remaining obstacles. The transition toward electrified transportation continues unabated—total EV sales in 2025 exceeded 14 million vehicles globally, representing approximately 16% of total passenger vehicle sales. This represents remarkable progress toward a decarbonized transportation system. However, the shift from Tesla dominance to BYD leadership introduces geopolitical complexity, as energy security concerns become entangled with automotive competition.

The post-Tesla era of global EV leadership will prove more competitive, distributed, and complex than the early years of Tesla's dominance. Multiple powerful competitors will occupy distinct market positions. Manufacturing scale and cost structure will matter more than technological differentiation. Governments will play crucial roles in shaping markets through policy and incentives. Energy security and geopolitical considerations will influence competition.

Tesla's path forward remains uncertain. The company possesses the brand, talent, and capital to remain a significant automotive manufacturer. Whether it regains market leadership, stabilizes at sustainable competitive positions, or continues erosion depends entirely on execution of strategic initiatives that remain speculative. For now, 2025 marks the clear inflection point where Tesla transitioned from dominant market leader to challenged incumbent facing determined competition from multiple directions.

The electric vehicle revolution that Tesla catalyzed continues advancing. The dominance that Tesla achieved through innovation and operational excellence has passed to competitors with superior cost structures and manufacturing capabilities. This outcome—while potentially disappointing to Tesla investors—confirms that the fundamental transition toward electric transportation continues successfully. The vehicle revolution remains intact; only the vehicle revolutionary's dominance has diminished.

FAQ

What caused Tesla's 9% sales decline in 2025?

Tesla's sales decline resulted from multiple compounding factors: the elimination of the $7,500 federal EV tax credit created pricing pressure, intensifying competition from BYD and traditional automakers reduced market share, and fourth-quarter demand collapsed after the tax credit deadline passed. The company delivered only 418,227 vehicles in Q4 2025, a 15.6% decline from Q4 2024, demonstrating severe demand destruction beyond policy impacts.

How did BYD surpass Tesla as the global EV leader?

BYD delivered 2.26 million electric vehicles in 2025 compared to Tesla's 1.63 million, giving BYD a 39% volume advantage. BYD achieved this through vertical integration into battery manufacturing (reducing costs), lower labor costs in China, government support, and aggressive pricing strategies that Tesla cannot match profitably. BYD's distributed manufacturing across multiple mega-factories also provides advantages over Tesla's more concentrated facility structure.

What are the implications of losing federal EV tax credits?

The elimination of the $7,500 federal tax credit increased effective vehicle prices by 16-18% for Tesla customers, while competitors like General Motors and Hyundai accessed expanded credits under restructured Inflation Reduction Act provisions. This policy shift destroyed approximately 15-20% of Tesla's fourth-quarter demand and compressed margins across remaining sales as the company implemented price reductions to maintain volume.

How does Tesla's financial performance compare to BYD's?

Tesla generated approximately

What is Tesla's strategic pivot toward AI and robotics?

CEO Elon Musk repositioned Tesla toward autonomous vehicles and humanoid robots through "Master Plan IV," emphasizing "sustainable abundance" across transportation, energy, and robotics. The company envisions future value creation through autonomous ride-sharing networks and commercial robotics rather than traditional vehicle manufacturing. However, these ventures remain largely speculative with no meaningful current revenue contribution, while EV sales continue driving 75%+ of revenue.

Which regions experienced the most severe competitive pressure on Tesla?

China proved most challenging, where Tesla's market share compressed to 16-17% from 19% as BYD and competitors expanded aggressively. Europe faced intense traditional automaker competition from Volkswagen, BMW, and Mercedes-Benz expanding EV lineups. North America remained relatively stronger for Tesla but saw intensifying competition from Ford, Chevrolet, and Rivian in truck segments and price-sensitive categories.

Can Tesla recover market leadership from BYD?

Recovery of market leadership would require simultaneous achievement of multiple difficult objectives: manufacturing cost structure improvement to BYD-competitive levels, product portfolio expansion into mass-market segments, acceleration of autonomous vehicle deployment to generate substantial revenue, and competitive pricing sustainability. While not impossible, the trajectory suggests continued market share erosion unless Tesla executes flawlessly across all dimensions simultaneously.

How will traditional automakers impact the EV market going forward?

Traditional automakers possess advantages in manufacturing efficiency, cost structures, dealer networks, and capital resources. As EV production increases as a percentage of their total output, their per-unit EV costs will decline through manufacturing learning curves and fixed-cost distribution. By 2030, traditional automakers' EV cost structures will likely match or exceed Tesla's, fundamentally altering competitive dynamics and reducing Tesla's cost structure differentiation advantage.

What does Tesla's decline mean for EV adoption overall?

Tesla's setback does not threaten overall EV adoption—global EV sales exceeded 14 million vehicles in 2025, representing 16% of total passenger vehicle sales and continuing rapid growth trends. The market shift reflects that EV adoption is becoming mainstream and competitive rather than dominated by single players. From a climate and energy transition perspective, Tesla's decline proves irrelevant; the transportation transformation continues regardless of which manufacturers lead.

What investor risks does Tesla's performance create?

Investor risks include valuation compression if autonomous vehicles and robotics fail to achieve commercial viability within expected timeframes, continued market share erosion if manufacturing efficiency doesn't improve, profitability pressure from competitive pricing, and strategic uncertainty regarding capital allocation between speculative ventures and core automotive business. Tesla's valuation premium presumes successful execution of ambitious long-term projects with substantial execution risk.

Key Takeaways

- Tesla's 9% annual sales decline and second consecutive year of contraction signals fundamental market structure change, not temporary setback

- BYD's 2.26M vehicle deliveries exceed Tesla by 39%, driven by superior manufacturing efficiency, vertical battery integration, and aggressive pricing strategies

- Federal EV tax credit elimination created 15-20% Q4 demand destruction and compressed Tesla's competitive advantage in North American market

- Chinese manufacturers' structural cost advantages and economies of scale appear sustainable and may widen over time as production scales further

- Tesla's strategic pivot toward autonomous vehicles and robotics creates execution risk, as company remains dependent on EV sales for 75%+ of revenue

- Traditional automakers' EV cost structures will improve dramatically as electric vehicles represent larger portion of total production, narrowing Tesla's competitive advantages

- Market has matured from niche EV category dominated by single innovator to mainstream competitive automotive segment with multiple capable competitors

- Geographic competition patterns vary significantly, with China overwhelmingly favorable to BYD, Europe competitive with traditional automakers, North America more favorable to Tesla but eroding

- Tesla's profitability faces compression from pricing pressure and margin erosion as company attempts to maintain volume against determined competitors

- EV adoption and transportation electrification continue accelerating regardless of Tesla's market position decline, indicating successful transition toward sustainable transportation