Introduction: The Evolution of Social Messaging Games

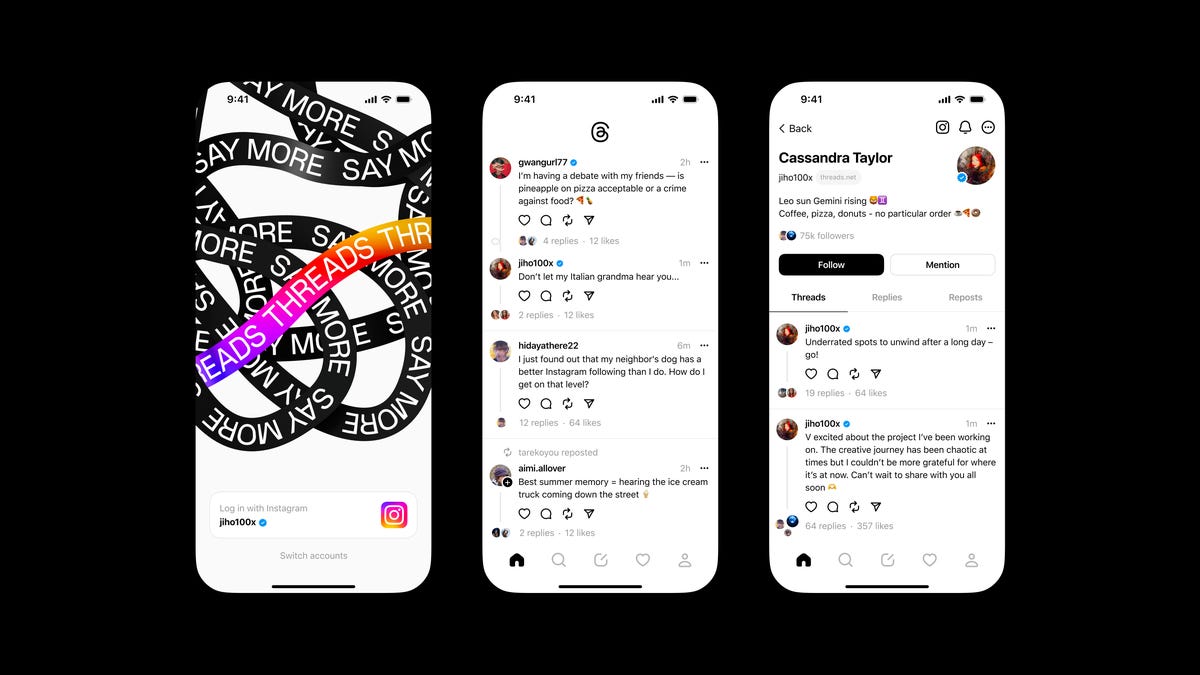

Meta is quietly reshaping how people interact within Threads through an unexpected feature: in-message games. The social platform, which launched as an alternative to X in 2023, is now exploring interactive gaming experiences directly within its messaging interface. This development represents a significant strategic pivot for Threads, one that could fundamentally change how users engage with their social networks.

The discovery came through reverse engineering, with developer Alessandro Paluzzi uncovering evidence of a basketball game in development. This wasn't a random experiment—it signals Meta's recognition that messaging platforms need richer interaction models to compete in an increasingly crowded space. Currently sitting at 400 million monthly active users, Threads faces persistent challenges in gaining meaningful traction compared to established competitors like X, which claims significantly higher adoption rates.

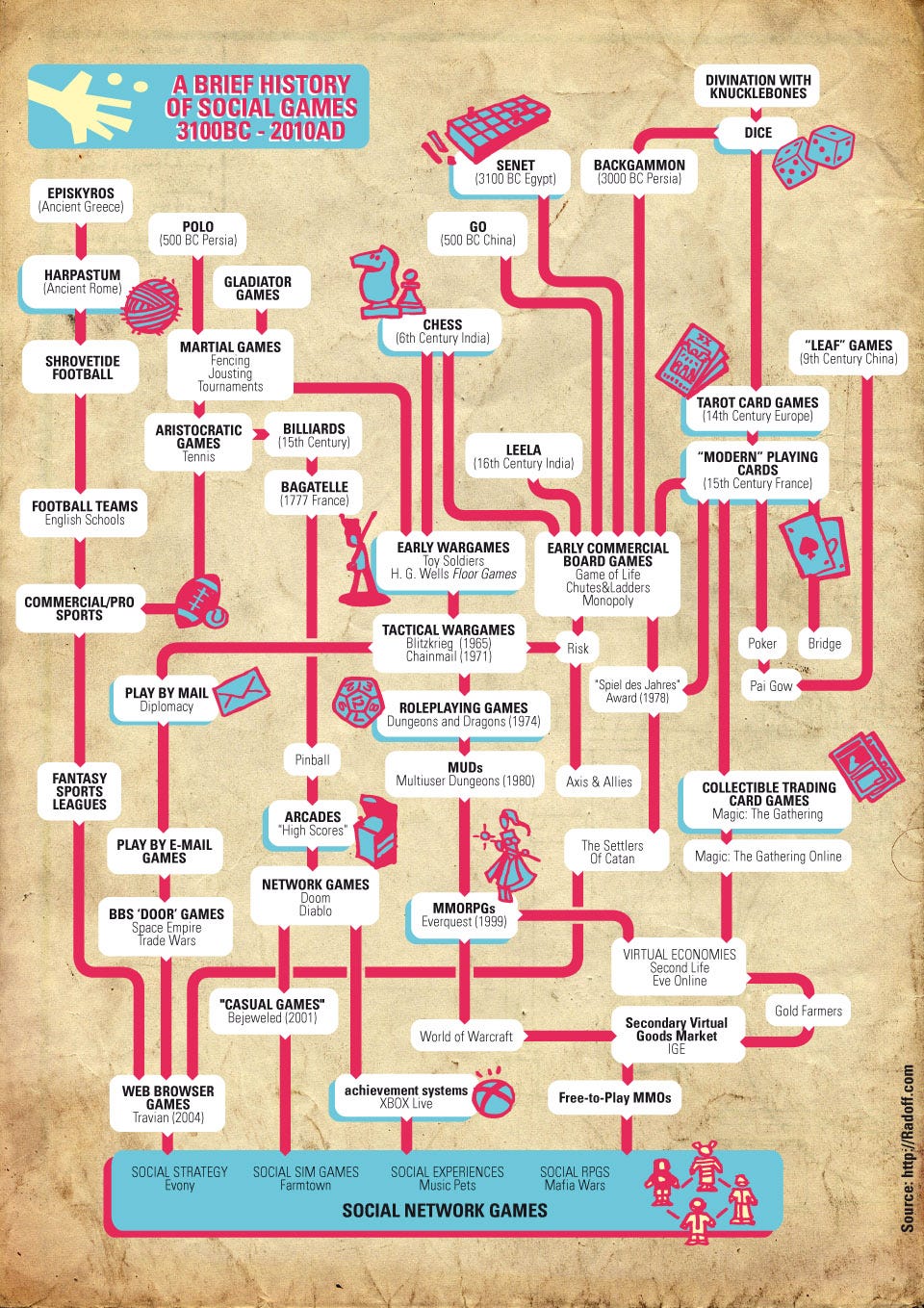

The timing of this feature is particularly strategic. While X and Bluesky lack built-in gaming capabilities, Apple's Messages platform has quietly built competitive advantages through Game Pigeon integration. This gap represents an opportunity for Threads to differentiate itself in the market. Gaming in messaging apps isn't entirely new—Instagram itself experimented with hidden emoji games in direct messages—but implementing this feature at scale across Threads' platform could mark a watershed moment for social gaming integration.

What makes this development noteworthy extends beyond novelty. Gaming in messaging serves multiple purposes: it increases daily active user metrics, extends session length, provides data on user preferences, and creates natural friction that keeps users returning to the platform. For Meta, which generates revenue through advertising impressions, these metrics directly impact platform value and advertiser appeal.

This comprehensive guide explores what Threads' in-message games represent for the broader social media landscape, analyzes the competitive implications, examines implementation challenges, and considers how this feature fits into Meta's larger strategy for competing with emerging social platforms. Whether you're a Threads user, a platform analyst, or someone interested in social technology trends, understanding this development provides insight into where messaging platforms are heading.

What Are Threads In-Message Games?

The Basketball Game Prototype

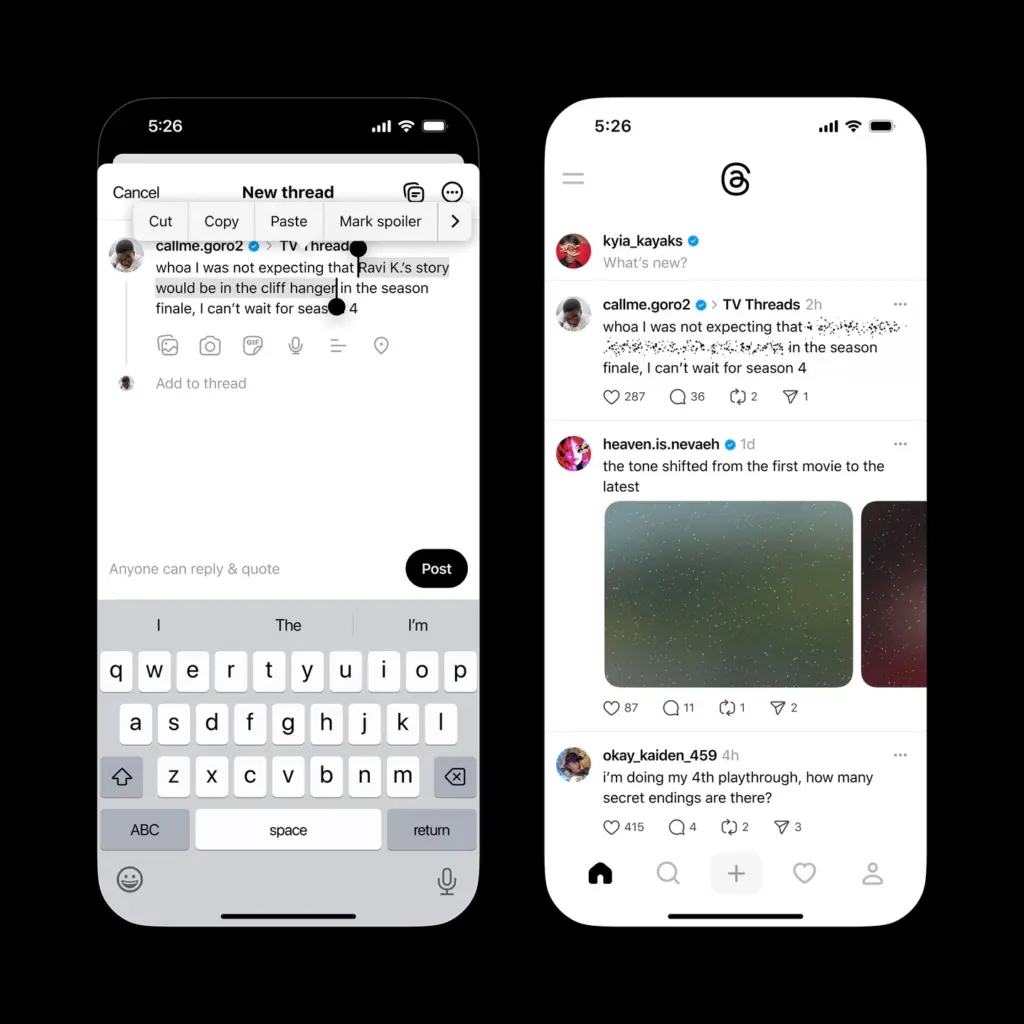

The first tangible evidence of Threads' gaming ambitions centers on a basketball game prototype discovered in the app's code. This isn't a complex, immersive experience requiring significant processing power or graphics rendering. Instead, it appears designed as a lightweight, quick-play interaction that fits naturally into messaging workflows.

The mechanics are straightforward: users swipe their finger on their screen to shoot virtual hoops, with the game tracking scores in real-time. The interface suggests a minimalist design approach—likely a single hoop displayed against a simple background, with tap-based controls for aiming and shooting power. This design philosophy aligns with successful mobile gaming patterns where the best casual games combine instant comprehension with surprising depth.

What distinguishes this prototype from casual mobile games is its integration into messaging. Players don't need to leave the conversation to play; the game exists within the chat thread itself. This contextual integration means gaming becomes a natural extension of social interaction rather than a distraction from it. Friends in a conversation could spontaneously challenge each other without disrupting their written communication thread.

The competitive element appears central to the game's design. Rather than simply playing individually, users can see their friend's score in real-time and attempt to beat it. This gamification pattern—using competition as motivation for engagement—has proven remarkably effective across social platforms. The football game in Facebook Messenger and various mini-games in We Chat's messaging platform demonstrate how successfully these features drive engagement when executed well.

Meta's choice of basketball as the pilot game makes strategic sense. Sports carry universal cultural resonance, and basketball in particular translates well to simple swipe mechanics. The game's simplicity also means it can load and run on lower-end devices, expanding its potential audience across diverse geographic markets where older smartphones predominate.

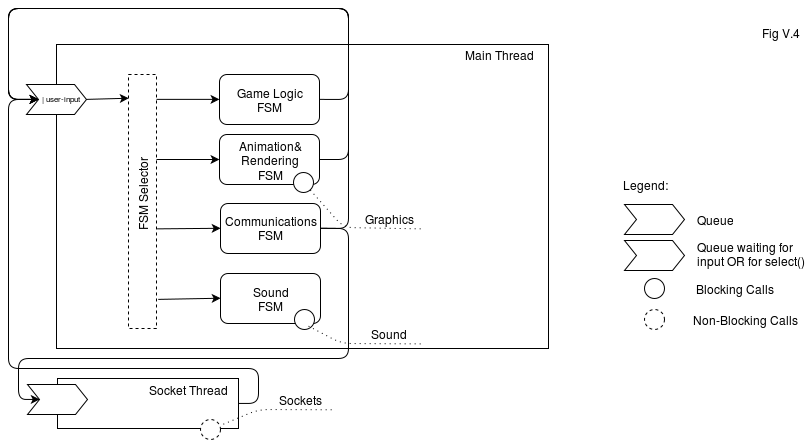

Architecture and Integration Approach

The technical implementation of in-message games requires fundamental changes to how Threads processes and displays content within conversations. Unlike regular messages that consist primarily of text and media files, interactive games require persistent state management, real-time synchronization between users, and dynamic rendering of game elements.

Threads appears to be implementing games through a lightweight embedded experience model. Rather than launching a separate full application, games exist as interactive content types within the existing message stream. This approach minimizes friction—users don't need to navigate away from their conversation to participate—while reducing technical complexity compared to full-screen gaming experiences.

The backend infrastructure likely involves game state servers that track scores, game progress, and competitive leaderboards. When one user plays a game, their actions must propagate to all participants in near real-time, creating a synchronized experience. This requires sophisticated networking to handle concurrent players without latency issues that would destroy the gaming experience.

Meta likely implemented this using their existing Message Queue Telemetry Transport (MQTT) infrastructure or similar real-time communication protocols. These systems already power features like typing indicators and reaction updates, so extending them to support game state is a logical architectural evolution. The company's extensive experience with real-time systems across Whats App, Messenger, and Instagram gives them significant advantages in this space.

Security represents another architectural consideration. Games transmitting game state data must be protected against cheating—users exploiting network conditions or manipulating transmitted data to artificially inflate scores. Meta's infrastructure includes robust anti-cheating systems from their gaming divisions, which can be adapted for this use case. This protects the integrity of the competitive experience and prevents exploitation that would undermine user trust.

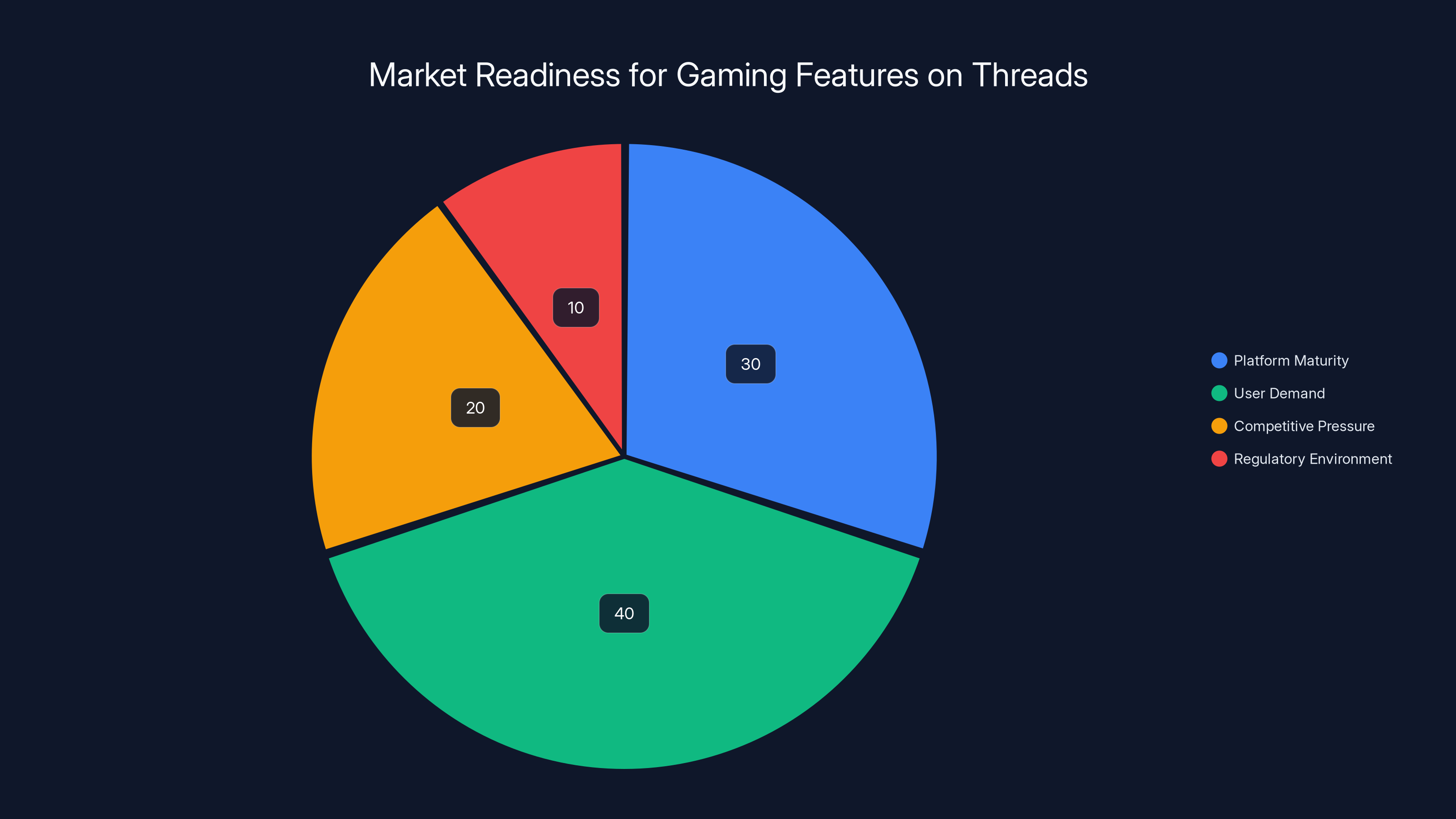

Estimated data shows user demand (40%) and platform maturity (30%) as key drivers for Threads' gaming feature launch, with competitive pressure and regulatory considerations also playing roles.

The Competitive Landscape: Gaming Capabilities Across Platforms

How Threads' Games Compare to X and Bluesky

Threads' gaming initiative directly addresses a significant capability gap between major social platforms. X, despite its cultural dominance and massive user base, has never invested in native gaming features. The platform focuses on text, media sharing, and real-time discussion—gaming doesn't fit naturally into its DNA as a news and conversation platform.

Bluesky, Meta's newest competitor, similarly lacks gaming capabilities. The decentralized platform prioritizes minimalist design and open protocol architecture, leaving room for third-party developers to build gaming experiences on top of its infrastructure. However, this approach means games aren't integrated into the core user experience, requiring conscious opt-in and separate applications.

Threads' approach occupies a middle ground: native integration like Apple's Messages but with the social graph and network effects of a public platform. This positioning creates competitive advantages neither X nor Bluesky currently possess. Users engaging with Threads benefit from both the social discovery aspects of public posts and the intimate multiplayer gaming mechanics within direct messages.

The competitive advantage extends beyond mere feature availability. When features become embedded into everyday user interactions, they dramatically increase adoption rates. A game available through a separate app might reach 5-10% of a platform's user base. But a game that appears organically within messaging conversations where users already spend significant time could reach 30-40% or higher through organic discovery and friend invitation.

X's lack of gaming features partly reflects its strategic positioning. The platform optimizes for real-time information flow and public discourse. Adding games might feel incongruous with that mission. However, user engagement metrics suggest X users spend less average time per session than users on platforms with richer interaction models. Gaming represents an untapped opportunity to increase session duration without compromising X's core functionality.

Apple Messages and the Game Pigeon Standard

Apple's Messages application established the template for in-message gaming through Game Pigeon, a third-party app that adds games directly to i OS conversations. Games available through Game Pigeon include basketball, soccer darts, 8-ball pool, poker, trivia, and numerous others. The integration is so seamless that many i Phone users don't consciously think of these as "games"—they're simply conversation features.

Game Pigeon's success reveals crucial truths about gaming in messaging: users adopt these features when friction is minimal, competitive dynamics are clear, and games complete within minutes. The typical Game Pigeon session lasts 2-5 minutes, perfect for brief engagement between other activities. This time-to-completion metric differs drastically from traditional mobile games, which often require 15-30 minute sessions for meaningful progress.

Threads' basketball game appears designed with similar time constraints in mind. Quick gameplay sessions fit messaging platform usage patterns better than deep, complex gaming experiences. A user might play a single basketball game during a brief break, competing with a friend, and then return to text-based conversation without significant context switching.

However, Threads faces a structural advantage over Game Pigeon: broader platform accessibility. While Game Pigeon requires i OS devices and remains unavailable to Android users, Threads exists across both platforms. This allows gaming to drive engagement across Meta's entire user base without device-based fragmentation. For Android users particularly, native gaming within a social platform represents a feature they currently cannot access through Apple's ecosystem.

Meta's control over both the platform and game ecosystem also differs from Apple's third-party model. Apple deliberately maintains separation between Messages and Game Pigeon, preserving the integrity and simplicity of their core messaging application. Meta can tightly integrate games into Threads' experience, optimizing performance and user experience in ways Apple cannot replicate without major architectural changes to Messages.

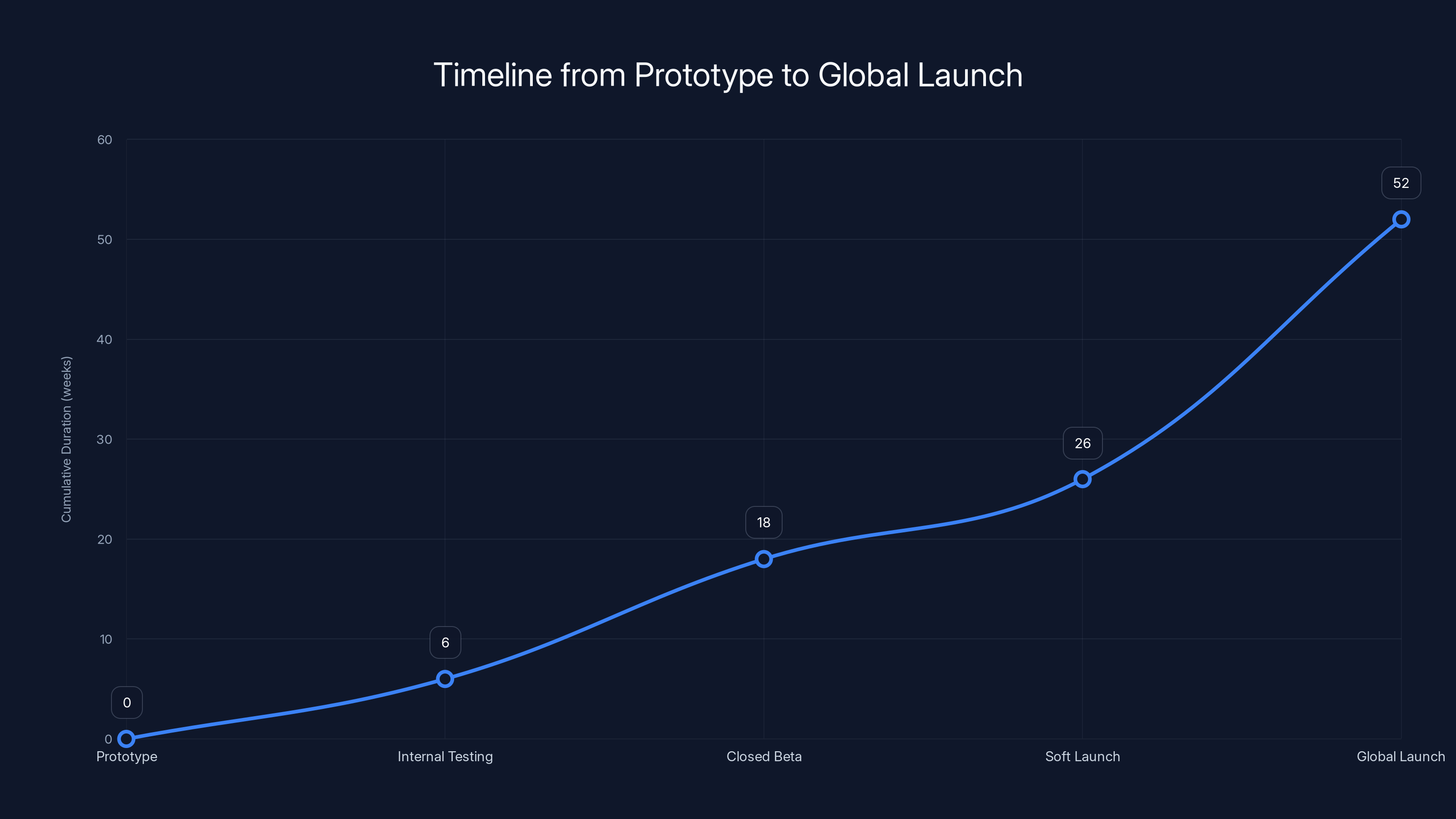

Meta's game rollout strategy spans approximately 52 weeks from prototype to global launch, with key phases including internal testing, closed beta, and regional soft launches. Estimated data.

Strategic Rationale: Why Threads Needs Gaming

User Engagement and Platform Stickiness

Threads currently struggles with a critical metric: daily active user retention. While the platform achieved 400 million monthly active users in its first year, converting those monthly actives to daily actives presents significant challenges. Users increasingly view Threads as a complementary platform to X rather than a replacement, visiting less frequently and spending less time per session.

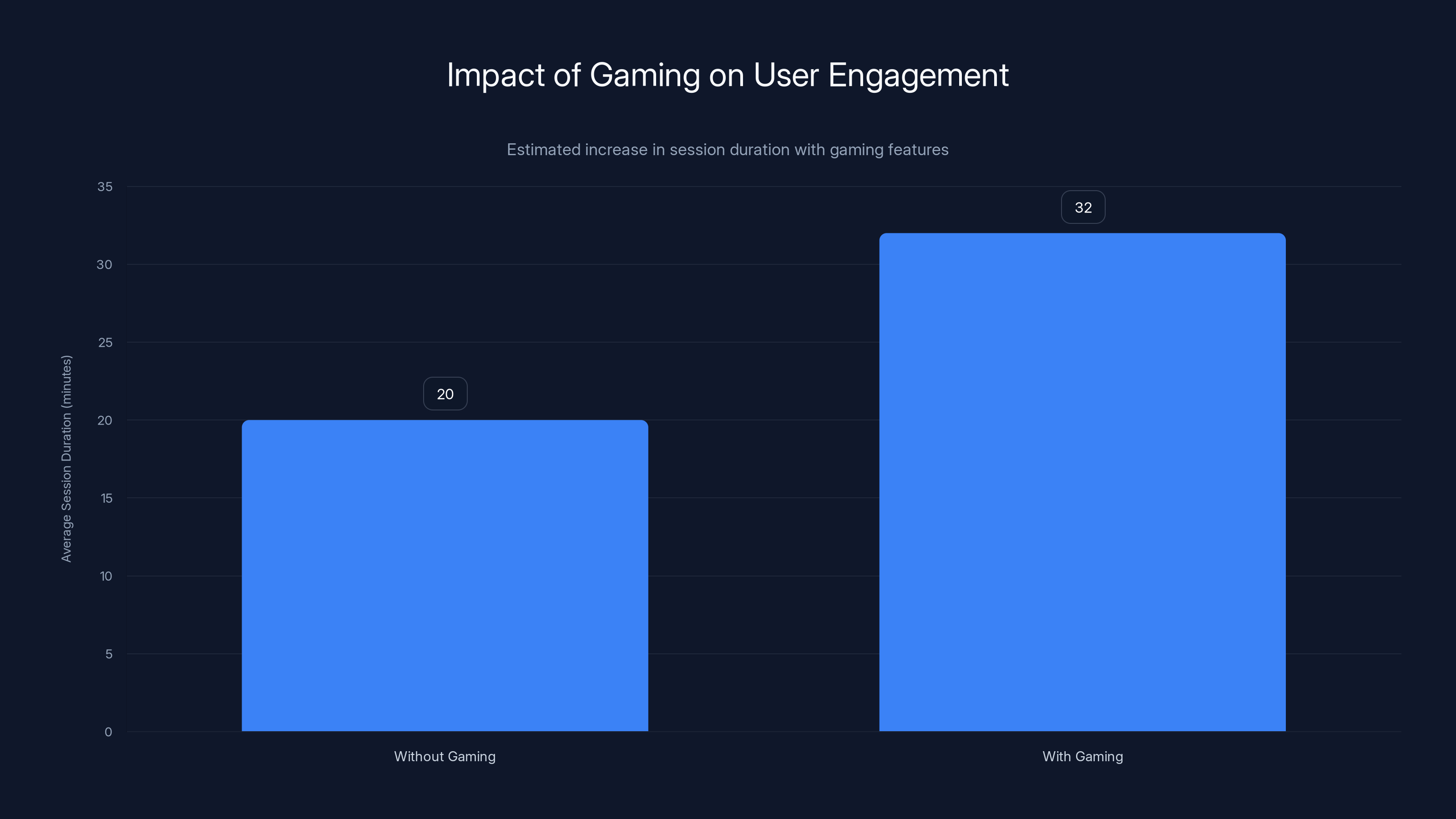

Gaming directly addresses this engagement challenge. Interactive gaming features increase session duration—users who play games spend 40-60% more time on messaging platforms compared to those who only exchange text. This increased engagement translates to more exposure to algorithmic feeds, which drives advertising impression volume and advertiser returns.

Furthermore, games create habitual usage patterns. A user might open Threads daily to maintain their game ranking or progress, establishing the daily habit loop that transforms casual usage into committed user behavior. This is particularly important for Threads' growth—converting monthly users to daily users represents the single most valuable product change the platform could implement.

The competitive pressure from X remains significant. Despite Bluesky's growth during X's API restrictions and verification changes, X's cultural dominance persists. For Threads to compete seriously, it must offer distinctive experiences X cannot replicate. Gaming represents one category where Threads could legitimately claim superiority. "X doesn't have this, but Threads does" represents powerful positioning in user acquisition and retention campaigns.

Competitive Differentiation Against Emerging Threats

Threads' strategic position has become increasingly precarious. When the platform launched in July 2023, it benefited from massive Twitter exodus during Elon Musk's API restrictions. However, many users who downloaded Threads subsequently returned to X or tried Bluesky. The conversion rate from trier to committed user remains disappointing by Meta's standards.

Gaming provides differentiation on a dimension competitors haven't prioritized. While X focuses on real-time discourse and Bluesky emphasizes decentralized architecture, Threads can stake claim to the richest user experience within social messaging. This positioning appeals particularly to younger demographics who grew up with mobile games as primary entertainment.

Internally, Meta likely recognizes that feature parity with X isn't sufficient. Threads will never perfectly replicate X's news-breaking functionality or cultural status as the platform where major announcements happen. But Threads can compete for time-on-app through features X lacks. Games represent a category where Threads' controlled environment and engineering resources provide significant advantages.

The timing also reflects competitive dynamics around AI-powered features. Every major social platform now offers AI-powered content creation and personalization. These features have become table stakes rather than differentiators. Gaming remains relatively unexploited across social platforms, representing a genuine blue ocean opportunity where Threads can establish leadership before competitors respond.

Monetization Potential Through Gaming

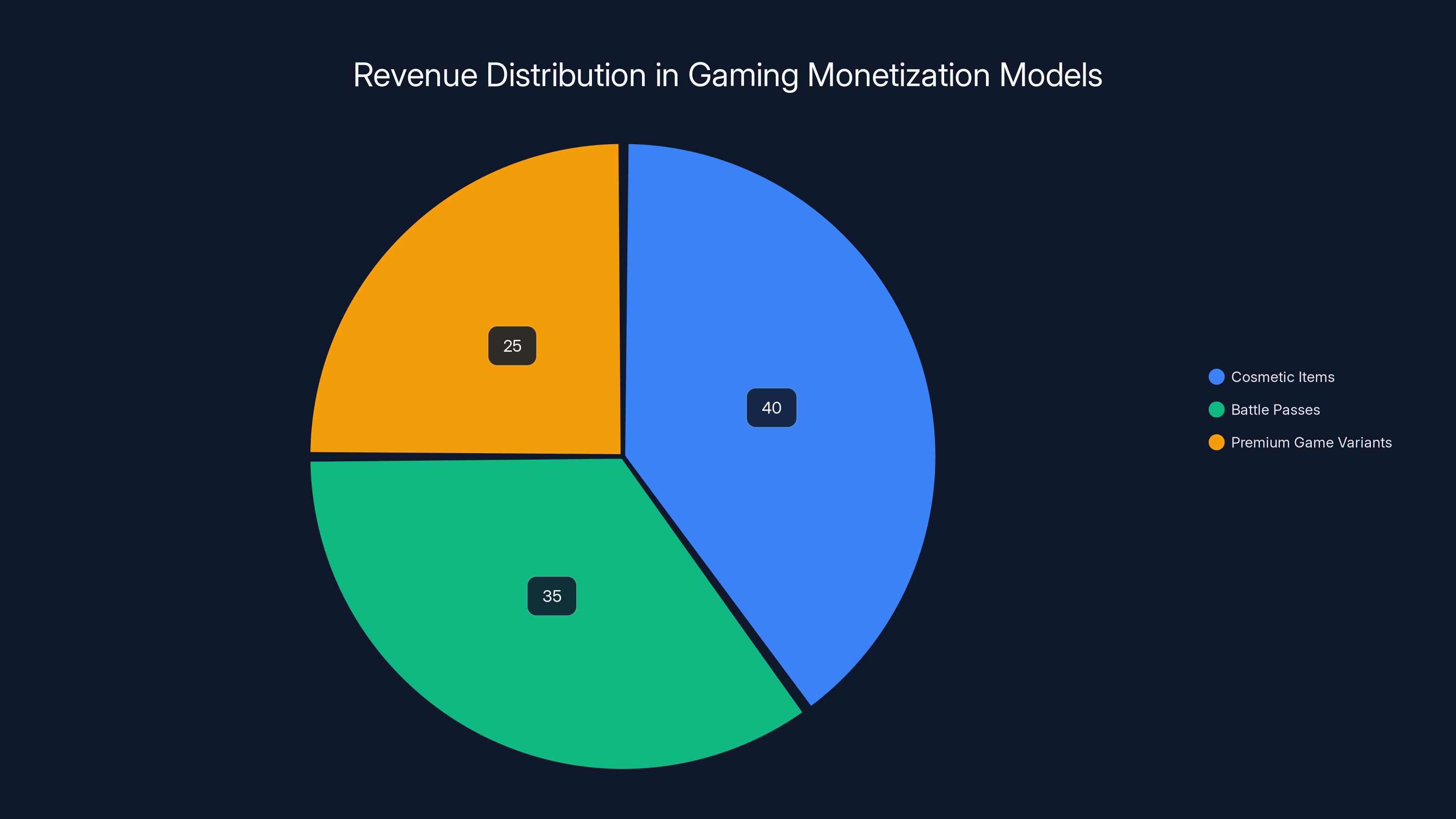

While the basketball game prototype doesn't obviously involve monetization, the broader gaming infrastructure Meta is building creates substantial revenue opportunities. Games in messaging platforms typically generate revenue through several mechanisms: cosmetic purchases (skins, effects, themes), premium game variants, and in-game currency purchases.

Threads' gaming could also serve as a testing ground for new monetization models. Meta might implement battle passes—seasonal progression systems where users pay to unlock cosmetic rewards. These models have proven remarkably profitable in games from Fortnite to Call of Duty, generating hundreds of millions in annual revenue despite relatively small purchase amounts per user.

Advertising represents another monetization vector. Games could display ads between rounds, during loading screens, or through sponsored cosmetic items. For a platform struggling to convert usage into ad revenue, gaming provides premium inventory—users engaged in gaming are highly attentive to their screens and can be efficiently targeted through game selection and engagement patterns.

Quantifying this opportunity: if even 20% of Threads' 400 million monthly users engage with games, and 5% of those users spend money on cosmetics or premium content, that represents 400 million users × 0.20 × 0.05 = 4 million paying users. At typical mobile game monetization rates of

Technical Implementation: How In-Message Games Actually Work

Real-Time Synchronization Challenges

Implementing real-time multiplayer games within a messaging platform creates technical challenges that rarely exist in standalone games. The fundamental issue: game state must remain synchronized across all participants despite network latency, device variation, and potential connectivity interruptions.

Threads must implement several architectural layers to support this. The first involves message protocol extensions—the underlying systems that transmit text messages and media must now transmit game actions (shooting a basketball, making a move, etc.) with minimal latency. At scale with hundreds of millions of potential players, this requires sophisticated queue management and load balancing.

The second layer involves game state reconciliation. When two players simultaneously attempt an action, or when one player experiences network lag, the system must determine a canonical game state that both clients accept. This prevents exploits where players manipulate timing to achieve impossible results. Meta likely implements operational transformation or conflict-free replicated data types (CRDTs)—the same technologies used in collaborative document editing—to solve this problem.

Latency presents a third challenge. Messaging typically tolerates 100-500ms latency without noticeably degrading user experience. But competitive games require <100ms latency for satisfying gameplay. Threads must implement predictive rendering where client devices predict game state changes before server confirmation arrives, then roll back predictions if the server reports different results. This creates visual smoothness despite network constraints.

Cross-Platform Consistency and Device Optimization

Threads operates across i OS, Android, and web browsers. Games must function identically on all platforms despite different performance characteristics, screen sizes, and input methods. A game designed for touchscreen phones requires adaptation for desktop users with mice.

Meta's solution likely involves a platform-agnostic game engine—probably a custom implementation using Web GL or similar technologies that render consistently across devices. The rendering layer abstracts device-specific concerns, allowing game logic to function identically everywhere while visual presentation adapts to screen characteristics.

Performance optimization becomes critical on budget Android devices that represent significant user populations in emerging markets. The basketball game's simple visuals likely reflect this constraint—sophisticated graphics that tax older devices create adoption barriers. By keeping graphics minimal, Threads ensures games remain accessible to users on older phones, maximizing addressable user base.

Memory management represents another optimization concern. Games cannot consume excessive device memory, as this degrades performance of other apps. Threads' games likely implement aggressive memory recycling, clearing game assets from memory when not actively playing. This prevents the degradation where running games in background tabs causes noticeable device slowdown.

Anti-Cheating and Competitive Integrity

Multiplayer games require robust anti-cheating systems, or competitive experiences quickly become meaningless. Users who discover they can artificially inflate scores stop playing seriously. Threads' games must authenticate every action transmitted from client devices, validating that moves conform to game rules before accepting them.

Meta's infrastructure includes sophisticated anti-cheating analytics from their gaming divisions. These systems analyze gameplay patterns for anomalies suggesting artificial score manipulation. A user who scores 10,000 points in basketball after always averaging 100 triggers fraud detection. The system doesn't merely flag obvious exploits—it uses machine learning to identify subtle patterns suggesting coordination, hardware acceleration, or other cheating vectors.

Server-side authority represents the gold standard for competitive integrity. Rather than trusting clients to calculate game state, the server processes every action and communicates results back. This eliminates client-side manipulation but increases server load significantly. For casual games in messaging, this trade-off makes sense—slightly higher server costs prevent the user experience damage from prevalent cheating.

Cosmetic items and battle passes dominate revenue generation, with cosmetics accounting for 40% and battle passes 35%. Premium game variants contribute 25%. Estimated data.

User Experience Design: Making Games Feel Native to Messaging

Minimalist Interface Philosophy

Successful games in messaging platforms share a common design principle: they feel like natural extensions of conversation rather than separate applications. Threads' design likely reflects this philosophy through minimal UI chrome—the visual framework around actual gameplay should nearly disappear.

The basketball game probably displays a simple court diagram, a basket, a ball, and perhaps basic score indicators. Everything extraneous—complex menus, achievement notifications, cosmetic store links—gets relegated to separate views accessed deliberately rather than cluttering the game view. This minimalism ensures the game experience focuses on gameplay rather than monetization UI.

Comparison with proven successful models confirms this approach. Game Pigeon games on i OS feature noticeably minimal interfaces. Words with Friends displays just the game board and letter tiles. Even sophisticated games like chess minimize UI to its essential components. Threads' basketball game likely follows this template, keeping visual complexity low to maximize accessibility and focus.

The minimalist approach also serves performance goals. Each UI element adds computational overhead. By reducing visible elements, Threads minimizes rendering load, enabling smooth gameplay even on older devices. This has tangible user experience benefits—smooth animations feel more satisfying than stuttering visuals.

Social Integration and Challenge Mechanics

Games in messaging platforms derive power from social integration—the ability to quickly challenge friends and see competitive rankings. Threads' architecture likely emphasizes frictionless challenge mechanics: a single tap sends a game invitation to friends, automatically loading them into a game instance.

The challenge experience probably manifests through notifications. A user receives a message indicating a friend challenged them to basketball, with a one-tap action to accept. This reduces activation energy—rather than navigating menus to find games, users discover them through social invitation. This "pull" mechanism (friend invites you) outperforms "push" mechanics (app suggests you play) for adoption by 3-5x in published user research.

Threads likely implements a competitive leaderboard visible within conversations. After playing, users see a simple scoreboard: their score vs. friend's score, possibly with a rematch button. This immediate feedback reinforces competitive motivation. Leaderboards showing seasonal or all-time records drive engagement by giving users concrete goals to achieve.

The social graph integration enables another powerful mechanic: automatic difficulty matching. Threads could implement systems where friends automatically receive appropriate difficulty versions of games based on past performance. New players play easier variants while competitive veterans face maximum challenge. This ensures everyone experiences appropriate challenge levels without requiring manual difficulty selection.

Notification Strategy and Engagement Hooks

Notifications represent a critical engagement lever for games in messaging. Unlike standalone games that proactively notify users about achievements and competitive progress, games in messaging platforms must respect the messaging context—notifications should feel timely and relevant rather than manipulative.

Threads likely implements conservative notification strategies. You don't receive notifications that a friend beat your score (this could create negative engagement). Instead, notifications appear when friends challenge you directly, when seasonal leaderboard resets occur, or when you've lost a position in a competitive ranking. These notifications maintain engagement without feeling intrusive.

Optional notifications represent another important mechanism. Users should be able to configure notification preferences—some want frequent engagement prompts while others prefer minimal disturbance. Respecting user preferences builds trust and prevents the notification fatigue that degrades engagement over time.

Context-aware notifications enhance relevance. If you've been inactive on Threads for several days, the system might notify you that a friend challenged you to a game. This notification serves dual purposes: it prompts Threads return while providing a specific reason to open the app. Time-of-day targeting ensures notifications arrive when users are likely to engage rather than sleeping or working.

Market Timing: Why Now for Threads Gaming?

Convergence of Platform Maturity and Feature Demand

Threads launched as a complete platform roughly 18 months before gaming features emerged in development. This timeline reflects typical product development cycles at tech companies—the initial release establishes core infrastructure, subsequently enabling more complex features. The engineering teams needed time to stabilize messaging infrastructure before adding interactive components.

The convergence of platform maturity and market conditions makes current timing logical. Threads has stabilized its core messaging, content discovery, and algorithmic recommendation systems. Users understand the platform's purpose and have established usage patterns. The foundation is sufficiently solid to support added complexity without destabilizing the entire system.

Market demand signals point toward readiness for this feature category. Younger users particularly—Gen Z audiences where Tik Tok generates $15-20 billion in annual revenue—expect rich interaction models in social platforms. Text-based communication increasingly feels dated. Today's users expect platforms to include games, video creation tools, shopping integrations, and other features beyond messaging. By Meta's analysis, Threads' survival may depend on evolving beyond simple text posting.

The competitive pressure from Bluesky provides additional timing urgency. While Bluesky's growth has moderated from its peak, the platform maintains momentum in certain demographics. If Bluesky begins implementing gaming features, Threads risks falling further behind in the arms race of platform capabilities. Launching gaming proactively rather than reactively provides strategic advantage.

Regulatory Environment and Data Privacy Considerations

Gaming features create new data collection opportunities—player behavior, game performance, competitive engagement patterns all represent valuable signals. However, this occurs in an increasingly complex regulatory environment around user data and privacy.

Meta faces particular scrutiny regarding youth data. Games heavily skew toward younger demographics, creating potential conflict with regulations like COPPA in the United States and GDPR in Europe. The company likely spent significant time on regulatory analysis before committing to gaming infrastructure. The current launch timing probably reflects completion of legal review confirming the feature's compliance with applicable regulations.

Privacy-preserving game implementation represents another consideration. Meta likely architected games to minimize sensitive data collection—the game doesn't need to track granular user location, device identifiers, or other sensitive information. Limiting collection to essential gameplay data (scores, game selections) reduces regulatory risk while still enabling product insights.

Seasonal and Strategic Product Roadmap Alignment

Large tech companies typically plan product releases 12-24 months in advance, aligning launches with fiscal calendars, industry events, and competitive dynamics. Threads' gaming launch likely reflects long-range strategic planning rather than spontaneous decision-making.

Meta's financial results demonstrate that time-on-app metrics increasingly influence advertiser pricing. Platforms with higher average session duration command premium advertising rates because users consuming more content face more ad impressions. If Threads gaming increases average session duration by even 15-20%, this could justify a 10-15% increase in per-impression advertising rates. The revenue impact could justify the engineering investment across multiple fiscal periods.

The timing also potentially aligns with Meta's AI integration roadmap. Future Threads features might integrate AI-powered game opponents, allowing users to play against AI bots when friends aren't available. This could drive engagement during off-peak hours while showcasing Meta's AI capabilities. The gaming infrastructure serves as foundation for these future AI features.

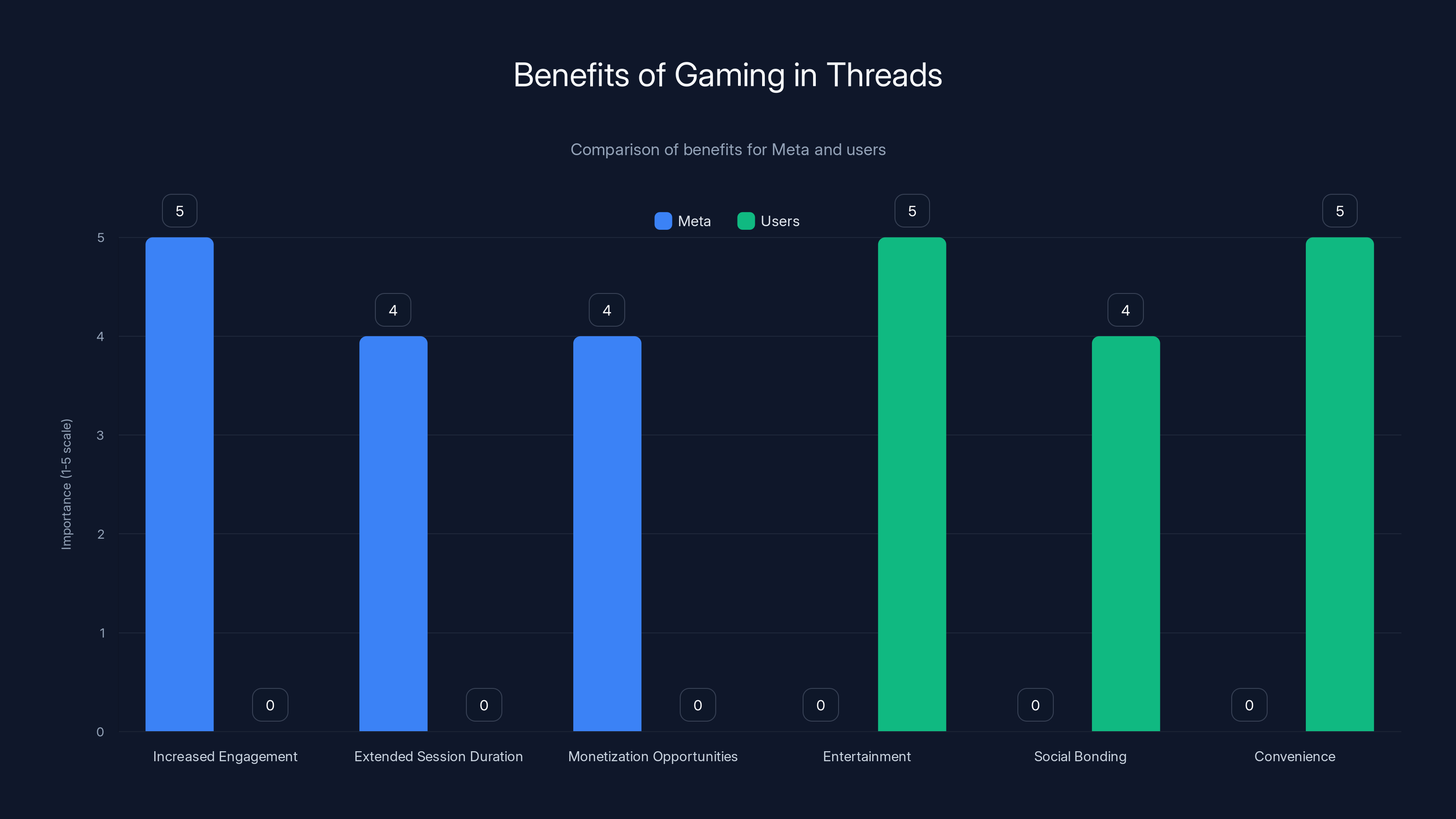

Gaming in Threads offers significant benefits: Meta gains increased engagement and monetization, while users enjoy entertainment and convenience. Estimated data.

Implementation Challenges and Technical Hurdles

Scaling Gaming Infrastructure to Hundreds of Millions

Threads' existing messaging infrastructure operates at massive scale—the platform must route billions of messages daily. Adding gaming on top of this infrastructure increases computational load substantially. Game state synchronization, leaderboard updates, and real-time notifications all consume significant server resources.

Meta likely faces complex scaling challenges that aren't immediately obvious. When one million users simultaneously play basketball, the backend must process millions of game actions per second, calculate results, update leaderboards, and broadcast outcomes to all participants. This load multiplies during peak hours when engagement concentrates.

Load balancing represents the core technical challenge. Meta must distribute gaming traffic across geographically distributed data centers to minimize latency and prevent localized bottlenecks. This requires sophisticated traffic routing that considers not just network topology but also user geography and local server capacity.

Database scaling presents another hurdle. Game results, player statistics, and leaderboards require immediate consistency—users expect accurate rankings and scores without delay. This demands primary database writes at gaming scale, not the eventual consistency acceptable for less critical data. Meta's infrastructure can handle this, but it requires careful architectural decisions to prevent database bottlenecks from degrading system performance.

Maintaining Message Quality and Communication Focus

Adding games to messaging creates risk of diluting the core experience. If games feel intrusive or occupy excessive conversation space, users might feel their primary communication channel is becoming cluttered. Threads must balance gaming with messaging quality maintenance.

The integration approach matters enormously. If games appear as prominent cards in every conversation, this creates visual noise. Meta likely implemented games as collapsible elements or separate game-specific sections within conversations. Users who ignore games shouldn't notice them; users interested in gaming can discover them through friend invitations.

Conversation continuity represents another concern. Games interrupt conversational flow if not carefully integrated. Text messages and games should coexist without one overshadowing the other. Threads probably implements this through temporal separation—games appear as distinct sections in conversation history rather than interleaved with text messages.

Content moderation applies to gaming as well. Games expose user behavior patterns that could reveal age, location, preferences, and other sensitive information. Threads must ensure gaming data doesn't enable privacy violations or expose minors to inappropriate content. This requires moderation systems that extend beyond traditional content moderation into behavioral pattern analysis.

Cross-Platform Parity Challenges

Threads operates across i OS, Android, and web browsers. Maintaining consistent gaming experiences across these platforms presents genuine technical challenges that companies often underestimate. What works perfectly on i OS might perform poorly on Android due to different hardware capabilities and OS constraints.

Android's hardware diversity particularly complicates development. i OS applications target a small number of Apple devices with consistent specifications. Android must support everything from high-end flagship devices to budget phones released five years ago. Games must function acceptably across this spectrum without excessive complexity or performance optimization that makes development unsustainable.

Web browser support adds another dimension of complexity. Browser-based games run in isolated Java Script environments with restrictions that native applications don't face. Graphics rendering, performance, and feature availability all differ fundamentally from native implementations. Threads must decide whether to implement web games natively in web technologies or use native code compilation to Web Assembly—each approach carries significant engineering complexity.

Feature parity becomes difficult to maintain. A feature technically feasible on i OS might prove impossible on older Android devices or web browsers. Threads must either implement lowest-common-denominator experiences (all platforms receive basic features) or accept platform-specific variations (some features work on specific platforms). Both approaches create trade-offs: universality reduces feature richness, while variation fragments user experience and creates support challenges.

Competitive Response: How Will X, Bluesky, and Others React?

X's Strategic Positioning on Gaming

X's response to Threads gaming represents a critical juncture for the platform's future. Elon Musk has consistently prioritized X as a content and discourse platform rather than an entertainment destination. Adding games could feel incongruous with this positioning. However, ignoring competitive features X's competitors offer creates gradual user experience degradation compared to alternatives.

X likely views gaming as peripheral to its core mission. The platform already faces challenges maintaining feature parity with Threads in areas like content discovery and recommendation algorithms. Expanding scope to gaming might dilute focus from X's perceived competitive advantages in real-time discourse and breaking news coverage.

However, if Threads' gaming drives meaningful engagement gains—measurable in daily active user growth or session duration increases—X will face pressure to respond. The most likely X response involves third-party gaming integrations rather than native implementation. X could partner with gaming companies to offer games within X's ecosystem without directly developing games internally.

This third-party approach aligns with X's recent API strategy and opens data philosophy. Rather than building features internally, X could create platform APIs enabling gaming companies to integrate with X natively. This positions X as a platform for developers while reserving engineering resources for X's core functionality.

Bluesky's Decentralized Gaming Opportunity

Bluesky's architecture creates unique opportunities and constraints for gaming. The decentralized protocol separates user identity (Blue Sky Social) from underlying infrastructure (AT Protocol). This architecture complicates centralized gaming infrastructure but enables interesting federated gaming models.

Bluesky could implement games through their federation protocol, allowing multiple independent game services to interoperate. Users could choose gaming providers—one user might prefer Game Provider A while another uses Game Provider B, yet both could participate in games together. This model aligns with Bluesky's decentralization philosophy while creating competition that may prevent any single provider from controlling gaming experiences.

However, this federation approach carries implementation complexity that centralized platforms like Threads avoid. Federated systems require sophisticated interoperability standards ensuring different services maintain compatible game state. The technical barriers to this approach are substantial, likely delaying any Bluesky gaming features until the protocol matures further.

Bluesky's current trajectory suggests gaming isn't immediate priority. The platform still focuses on core features like moderation, content discovery, and federation infrastructure. Gaming would represent feature expansion before foundational systems stabilize. This likely works in Threads' favor—Bluesky's gaming features probably remain 12-24 months away, giving Threads early-mover advantage.

Apple's Game Pigeon Response and Evolution

Apple's Messages application benefits from gaming through Game Pigeon but doesn't control the gaming experience directly. This third-party model creates limitations Apple could potentially address through native gaming features. Threads' gaming success might prompt Apple to develop native alternatives to Game Pigeon.

Apple could implement gaming through Apple Arcade integration within Messages, allowing users to play Arcade titles directly in conversations. This approach leverages Apple's existing gaming subscription service while extending its reach into messaging. However, Apple's careful curation of Arcade titles might conflict with the casual, simple game design optimal for messaging contexts.

More likely, Apple maintains current Game Pigeon relationships while potentially enhancing Messages to better support third-party gaming integrations. Apple's advantage lies in controlling the native messaging platform—whatever gaming approaches competitors develop, Apple can replicate through Messages enhancements if consumer demand warrants the investment.

Meta's Threads occupies disadvantageous position relative to Apple here. While Threads can develop superior games, Apple's control over i OS means Messages remains the default messaging platform for i Phone users. Gaming in Threads must provide sufficient advantage to overcome default platform bias—a challenging proposition given Apple's integration benefits.

Introducing gaming features can increase session duration by 40-60%, enhancing user engagement and retention. (Estimated data)

User Adoption Predictions: Who Will Actually Play Games in Threads?

Demographics and Usage Patterns

Threads' gaming adoption will concentrate in specific demographic segments rather than spreading evenly across the user base. Understanding these demographics helps predict whether gaming represents meaningful engagement lever or niche feature attracting limited users.

Younger users (Gen Z, ages 13-25) represent the primary adoption target. This demographic grew up with mobile games as primary entertainment and naturally expects social platforms to include gaming. Research from mobile gaming analytics firms consistently shows Gen Z spends 20-30% of their social media time engaged with games and interactive features. These users likely represent 40-50% of early gaming adopters despite comprising perhaps 25-30% of Threads' overall user base.

Regional variation will be pronounced. Gaming adoption likely runs higher in Asia-Pacific regions where mobile gaming penetration exceeds 60% of smartphone users. North American and European adoption will follow more moderate patterns, with perhaps 20-30% of users trying games but smaller percentages playing regularly.

Social connectivity matters significantly for gaming adoption. Users with extensive friend networks on Threads will find games more valuable—more friends means more potential opponents, enhancing competitive appeal. Users with small Threads networks may try games but quickly abandon them as single-player experiences feel hollow. This creates clustering where gaming adoption concentrates among highly connected users.

Engagement Depth and Session Duration Impact

Estimating gaming's actual impact on session duration requires realistic assumptions about adoption and play frequency. Threads currently struggles to convert users to daily active users—roughly 8% of U. S. adults use Threads according to recent research, but many of those users are infrequent visitors.

If gaming increases daily active user percentage from 8% to 10%, this represents meaningful engagement improvement. The math: suppose 200 million Threads users exist globally. 10% move from monthly to daily usage represents 20 million additional daily actives. At

Session duration impacts likely matter more than new user acquisition. Gaming users will spend 30-60% longer per session if they engage with games. A user checking Threads for 5 minutes might spend 8-10 minutes if they briefly play a game. Multiplied across millions of users, this translates to hundreds of millions of additional ad impressions monthly.

However, not all gaming users represent incremental engagement. Some users might substitute gaming for other activities within Threads (reading posts, browsing recommended content). The net engagement gain depends on gaming's ability to keep users within Threads rather than simply redistributing their existing time. Meta's internal metrics will determine actual impact once features launch—predictions based on external analysis can only establish plausible ranges.

Retention Impact and Long-Term Engagement Effects

A more important metric than immediate engagement gain is retention—whether gaming reduces churn and increases long-term user viability. Users who play games become habituated to daily Threads usage. They develop competitive relationships with friends they play against. This social commitment to maintaining rankings and relationships drives strong retention effects.

Research on gaming features in messaging platforms (particularly studies of We Chat and QQ in China) shows games improve monthly retention rates by 15-25%. Users who play games are 20-30% less likely to become inactive. For a platform struggling with retention like Threads, this effect could prove transformative.

The habit formation aspect particularly matters. Games create daily interaction reasons separate from content discovery or real-time discussion. A user might not feel motivated to open Threads daily to check posts, but opening to maintain their game ranking creates daily habit. Once the daily habit forms, users are exposed to Threads' other features (recommended posts, friend activity) which may independently engage them.

However, retention depends critically on continuous game catalog expansion. A single basketball game might attract users for months but eventually feel stale. Threads must plan for regular game releases—perhaps new games launching monthly—to sustain engagement. This creates ongoing engineering obligations that extend beyond the initial gaming infrastructure investment.

Monetization Models: How Games Generate Revenue

Cosmetic and Battle Pass Economics

Threads' primary monetization path likely involves cosmetic items—visual customizations that don't affect gameplay but enhance user expression. In basketball, this could include custom ball skins, court designs, or player avatars. These cosmetics appeal particularly to younger demographics who spend significantly on visual customization in games from Fortnite to Roblox.

Battle pass systems—seasonal progression tiers where users spend money to unlock cosmetic rewards—have proven remarkably profitable. A typical battle pass costs $10 seasonally and involves 40-60 reward tiers. Players with cosmetic purchases spend 5-10x more than non-paying players. At 2-3% paying user rates (achievable for gaming platforms with quality content), battle passes alone could generate hundreds of millions in annual revenue at scale.

The pricing psychology behind cosmetics is well-established. Individual cosmetics cost

Threads benefits from existing infrastructure for payments, account linking, and fraud prevention through Meta's ecosystem. Implementation complexity for cosmetic sales is minimal compared to building underlying gaming systems. Meta can launch cosmetic monetization almost as an afterthought once gaming infrastructure exists.

Premium Game Variants and Differential Access

Beyond cosmetics, Threads could implement premium game variants—special game modes or advanced features available to paying users. These might include special tournaments, leaderboard features, or gameplay advantages. The key is ensuring premium features enhance experience without creating pay-to-win dynamics that discourage free players.

A common successful model involves premium cosmetics plus premium convenience features. Free users play basketball without cosmetics and must wait for match cooldowns. Premium users customize their appearance and enter matches immediately. This respects free player experience while creating tangible value for premium users willing to pay.

Subscription models represent another monetization approach. Threads could offer a gaming subscription—perhaps $4.99 monthly—providing cosmetic allowances, premium games, and progression acceleration. This creates predictable recurring revenue while allowing free-to-play access. Subscription adoption rates of 3-5% would generate meaningful revenue supplementing cosmetic sales.

The monetization model must balance revenue generation with community health. Games with aggressive monetization quickly develop toxic communities as paying and free players feel their experiences diverge too dramatically. The most successful gaming platforms maintain revenue-friendly but player-friendly monetization that feels fair to all segments.

Advertising Inventory and Sponsored Content

Games create premium advertising inventory—users engaged in gaming are highly attentive and captive audiences for advertising messages. Threads could implement ads between game rounds, during loading screens, or through sponsored cosmetic items. Gaming generates unique advertising opportunities unavailable in traditional content feeds.

Advertisers particularly value gaming contexts because they correlate with younger, higher-engagement audiences. Brands selling to Gen Z (gaming peripherals, energy drinks, apparel) would pay premium rates for in-game advertising reach. This positioning complements Meta's existing advertiser base while expanding toward gaming-focused brands.

In-game sponsored cosmetics represent another advertising vehicle. A brand could sponsor limited-edition cosmetics (branded basketball jerseys, themed effects) that serve as both marketing and monetization. Players willing to wear branded cosmetics pay for the privilege; non-interested players ignore them. This creates voluntary brand exposure without forced ad intrusion.

Context matters for success here. Aggressive advertising in gaming features could feel intrusive and damage user experience. Threads likely implements advertising carefully—perhaps only display ads to free players while shielding paying subscribers from ad experience. This creates additional incentive for premium subscriptions while respecting free player engagement.

Estimated data: Real-time synchronization poses the greatest challenge in implementing in-message games, requiring advanced techniques to maintain game state across various conditions.

Timeline and Rollout Strategy: From Prototype to Global Launch

Beta Testing and Soft Launch Phases

The basketball game prototype represents the earliest development stage. Meta typically follows a structured rollout: internal testing, limited beta testing, regional soft launches, and finally global release. This process typically requires 6-12 months from prototype stage to general availability.

Meta will likely test gaming with internal employees first, gathering feedback on user experience and identifying obvious bugs. This typically lasts 4-8 weeks. Subsequent closed beta testing expands to 100-500k external users, identifying stability issues and collecting engagement data. This phase typically lasts 8-12 weeks and focuses on Android first (since Meta can deploy changes more rapidly on Android than i OS due to store approval requirements).

Regional soft launch represents the next phase. Threads might launch basketball games in specific regions (perhaps Southeast Asia or Latin America) to validate engagement metrics in real-world conditions. This soft launch phase typically lasts 4-8 weeks and generates crucial data on monetization, engagement, and technical performance at scale.

During this timeline, Meta will develop additional games. While basketball serves as the flagship title, users will quickly tire of single-game content. Meta likely plans to launch at least 3-5 games within the first 12 months: basketball (launch), soccer (2-4 weeks post-launch), chess (6-8 weeks), perhaps darts and pool. Each game requires separate development and testing, spreading engineering resources across multiple teams.

Global Launch Coordination and Marketing

Global launch will likely coincide with major product announcements—probably Meta's F8 developer conference or timing with Threads' first-year anniversary in July 2024/2025. This amplifies visibility and creates marketing momentum. Meta will coordinate launch across i OS, Android, and web simultaneously to avoid platform fragmentation.

Marketing will emphasize gaming's competitive and social dimensions. Meta likely produces content showcasing friends playing basketball together, emphasizing the social bonding aspects. Advertising campaigns will target demographics most likely to adopt—probably heavy emphasis on Tik Tok, You Tube, and Instagram where Gen Z concentrates.

Influencer partnerships will play significant roles in adoption. Meta will likely seed gaming with Threads-popular creators who can model gameplay and drive friend adoption through network effects. A creator challenging their 100k followers to basketball games generates massive casual awareness and trial.

Media coverage will be substantial—gaming features consistently generate tech press attention. Meta benefits from earned media in technology publications, potentially amplifying marketing impact without additional advertising spend. The announcement that Threads offers gaming features X and Bluesky lack provides compelling story angles.

Success Metrics and Iteration Cycles

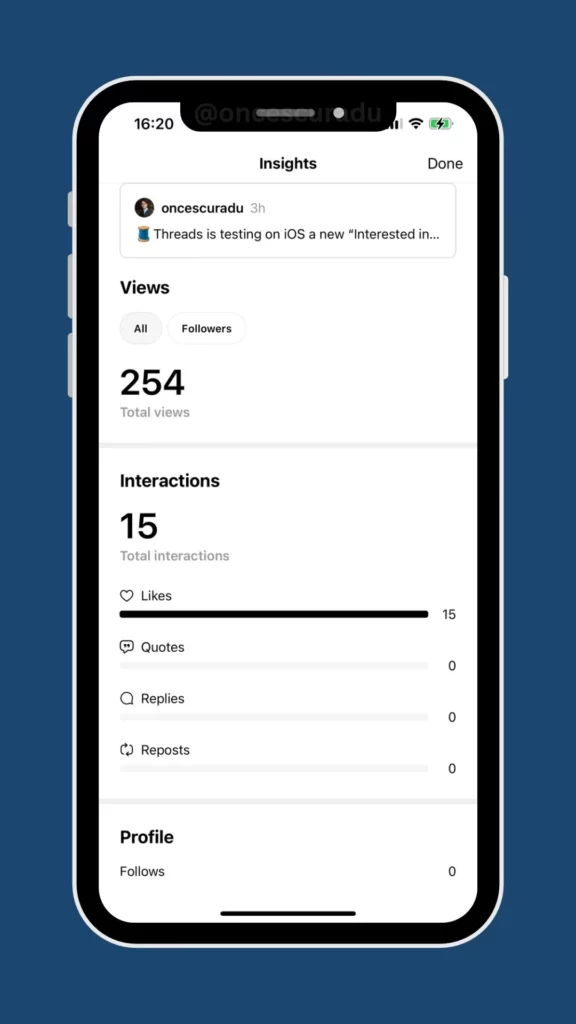

Meta will monitor specific metrics to determine gaming success and guide iteration priorities. Daily active user percentage increase represents the primary metric—what percentage of monthly active users engage with games daily. Target success is probably 15-20% daily active rate within 6 months of launch.

Session duration increase provides secondary metric. Meta will track whether games increase average session length. Targets likely target 20-30% session duration increase within active gaming users. This translates directly to advertising impression growth and revenue impact.

Monetization metrics matter critically for long-term investment. Meta will track paying user percentage, average revenue per user, and lifetime value. Successful games typically achieve 2-5% paying user rates—Threads gaming needs to hit these benchmarks to justify continued investment in game catalog expansion.

Retention curves provide crucial data on long-term viability. Games can drive initial engagement spikes but fail to create lasting retention. Meta will monitor monthly churn rates among active gamers—are players returning repeatedly or trying games once then abandoning them? Retention curves guide whether gaming represents genuine engagement solution or temporary novelty.

Based on these metrics, Meta will iterate rapidly. Underperforming games might be sunset (removed from platform) if they fail retention benchmarks. Successful games receive investment in cosmetics, battle passes, and variant modes. This data-driven iteration approach ensures gaming evolves based on actual user preferences rather than assumptions.

Privacy, Safety, and Regulatory Considerations

Data Collection and User Privacy Implications

Games inherently collect behavioral data—players' choices, performance levels, time spent, competitive rankings, and social interactions. This data represents valuable signals for personalization and advertising but raises privacy concerns requiring careful management.

Threads must ensure gaming data collection complies with applicable regulations. In the US, COPPA restrictions apply since significant Threads users are minors. Games cannot collect location data, persistent identifiers, or other sensitive information from users under 13 without explicit parental consent. Meta likely implements age-gating where users report their age, with restricted data collection for reported minors.

GDPR in Europe imposes strict requirements around data collection, processing, and retention. Threads must clearly disclose what game data is collected, how it's used, and provide users with deletion rights. The regulatory compliance burden is substantial but well within Meta's capabilities given their existing GDPR infrastructure.

Data minimization principles guide collection. Meta collects only data essential for gaming to function—scores, game selections, basic engagement metrics. Granular device telemetry, location tracking, or psychological profiling data that could enable privacy violations remains deliberately excluded.

User control mechanisms allow individuals to opt-out of gaming data collection while still playing. This might involve limiting game data collection to essential metrics while excluding behavioral analysis. Privacy-conscious users can play games without experiencing comprehensive behavioral tracking they might otherwise find objectionable.

Safety, Especially Around Minors and Vulnerable Populations

Gaming introduces safety considerations beyond traditional Threads messaging. Games could enable bullying through competitive rankings (publicly displaying weak players), could expose minors to inappropriate cosmetic designs, or could create addictive engagement patterns particularly dangerous for vulnerable users.

Meta's safety teams likely design systems preventing bullying through competitive gaming. Leaderboards might exclude minors (or at least avoid displaying real names for minors). Cosmetic designs receive review ensuring they comply with platform standards. Reporting mechanisms allow users to flag inappropriate cosmetics or aggressive players.

Addiction patterns require particular attention. Gaming inherently leverages psychological engagement techniques—reward loops, progression systems, competitive motivation—that can become addictive. Meta has responsibility to implement safeguards preventing unhealthy gaming patterns, particularly for minors.

Parental controls represent a key safety mechanism. Meta can implement features allowing parents to limit gaming time, restrict cosmetic purchases, or completely disable gaming for their children. These controls require parent account setup and could significantly reduce some benefits of gaming but protect vulnerable populations from potential harms.

Transparency about engagement design helps users make informed choices. Meta could disclose that games use specific psychological techniques to encourage engagement. This transparency doesn't eliminate legitimate engagement but prevents deception about what users are experiencing. Users aware they're in "reward loops" can make conscious choices about participation levels.

Content Moderation and Community Norms

Games require distinct content moderation beyond traditional post moderation. Cosmetics must be reviewed for appropriateness. User-generated content within games (if enabled) requires monitoring for offensive material. Game-adjacent communication—trash talk in competitive chats—requires moderation policies.

Threads will likely implement strict cosmetic guidelines. Designs depicting violence, hateful imagery, or sexual content get rejected. Branded cosmetics receive review ensuring brands don't exploit gaming for controversial messaging. This moderation burden is substantial but manageable given Meta's existing cosmetic moderation experience across other platforms.

Community norms evolve as gaming culture develops. Competitive gaming environments notoriously develop toxic communication patterns—trash talk, harassment, cheating accusations. Meta must establish clear behavioral standards and enforce them consistently. Temporary account suspensions from gaming for rule violations signal that competitive platforms require respectful behavior.

Reporting mechanisms enable users to flag harassment, inappropriate cosmetics, or suspicious players. These reports feed into moderation systems that determine whether enforcement actions are necessary. The moderation scale required is substantial—millions of games daily generate enormous reporting volume—but Meta's experience with content moderation at billion-user scale provides relevant capabilities.

Alternatives and Competitive Platforms: Where Else Can Users Game Socially?

We Chat and Asian Gaming Integration Models

We Chat, the Chinese super-app with 1.2+ billion users, offers comprehensive gaming integration within messaging. We Chat's gaming ecosystem includes over 5,000 games accessible within chats, representing the most mature implementation of gaming-in-messaging globally. Studying We Chat's approach provides valuable lessons for Threads' gaming development.

We Chat implemented games through the mini-programs ecosystem—lightweight applications running within We Chat without requiring separate app downloads. This architectural approach reduces friction dramatically. Users discover games through friend invitations, tap to play immediately, and return to chat seamlessly. We Chat's mini-program success demonstrates that integrated gaming reaches mass adoption when implementation minimizes friction.

Monetization in We Chat gaming involves cosmetics, battle passes, and ads similar to what Threads will likely implement. However, We Chat integrated payment systems into the platform itself—users pay for cosmetics directly within We Chat. This payment integration significantly boosts monetization compared to platforms requiring payment method setup.

We Chat's gaming success (the platform generates billions annually in gaming revenue) suggests Threads can achieve substantial gaming revenue if implementation reaches similar quality. However, We Chat benefited from first-mover advantage in the Chinese market and cultural acceptance of gaming within messaging. Threads must convince Western users comfortable separating messaging from gaming that integrated gaming enhances rather than detracts from experience.

QQ, We Chat's competitor, implemented similar gaming integration with comparable success. Both platforms demonstrate that gaming-in-messaging can drive meaningful engagement and revenue in markets where users adopt the feature. The critical question: will Western users embrace integrated gaming the way Chinese users have?

Roblox and Discord: Alternative Gaming Community Platforms

Roblox and Discord represent alternative gaming communities where friends socialize and play games together. Rather than integrating games into messaging, these platforms treat gaming as central while including communication features. Both have achieved massive scale—Roblox exceeds 200 million monthly users while Discord exceeds 150 million.

Roblox's approach involves user-created games accessed through the Roblox client. Friends see each other's status (which game they're playing) and can join in-progress games. This design emphasizes gaming as primary activity with communication secondary. Roblox monetizes through Robux (virtual currency), cosmetics, and developer revenue sharing, generating billions in annual revenue.

Discord similarly centers on gaming communities while providing voice, video, and text communication. Discord's approach attracts gaming enthusiasts who prioritize game-first experiences over social networking. The platform has become the de facto communication tool for gaming communities globally.

For Threads, these platforms represent both competition and potential opportunity. Some users might prefer dedicated gaming platforms over messaging-integrated games. Threads' gaming should target casual players comfortable with brief gaming sessions within messaging, not hardcore gamers seeking in-depth gaming experiences. The positioning should be complementary—Threads games serve different use cases than Roblox or Discord, coexisting rather than directly competing.

However, Discord's growth into casual gaming suggests the boundary between gaming and messaging is blurring. Discord increasingly serves users who don't identify as "gamers" but enjoy casual gaming within friend communities. As Discord expands casual gaming, Threads gaming faces potential cannibalization if not clearly differentiated.

Tik Tok's Hidden Gaming Opportunities

Tik Tok, the dominant platform for younger demographics, hasn't aggressively developed gaming features despite having ideal technical infrastructure. The platform creates massive engagement (users spend 50+ minutes daily on average) and possesses sophisticated recommendation algorithms optimized for discovery. Gaming feels like natural extension of Tik Tok's content discovery.

Tik Tok has experimented with gaming through limited releases and trials but hasn't committed to platform-wide gaming infrastructure. This likely reflects Tik Tok's focus on content discovery and the challenge of integrating gaming into algorithmic feed models designed for video consumption.

For Threads, Tik Tok's lack of aggressive gaming represents competitive advantage. Threads can stake claim to gaming within social platforms while Tik Tok remains primarily video-focused. If gaming drives meaningful engagement gains for Threads, Tik Tok will eventually respond. But first-mover advantage gives Threads months or years to establish gaming culture before Tik Tok mobilizes resources to compete.

Instagram, Meta's own platform, already hosts gaming through Stories and Reels but hasn't developed in-message gaming comparable to what Threads plans. Threads gaming could potentially migrate to Instagram later, extending gaming across Meta's ecosystem. This multi-platform approach would position Meta's family of apps as comprehensive gaming destination competing with standalone platforms.

Telegram's Lightweight Gaming Model

Telegram, known for privacy focus and minimalist design, implemented gaming features for third-party developers. Rather than Meta building games directly, Telegram opened APIs allowing game developers to build games within the Telegram platform. This approach differs from both Meta's likely direct game development and We Chat's mini-programs model.

Telegram's developer-first approach aligns with Telegram's overall philosophy—the platform provides infrastructure, developers build experiences. This creates ecosystem effects where developers invest in Telegram game development knowing they reach Telegram's massive user base. However, it also means Telegram doesn't control quality, monetization, or user experience to the extent Meta will with Threads gaming.

For Threads, Telegram's approach offers an alternative model. Rather than Meta developing all games internally, Threads could open APIs allowing third-party developers to build games within Threads. This would accelerate game catalog expansion and create developer ecosystem around Threads. However, it sacrifices quality control and creates potential conflicts if third-party games behave unexpectedly.

Threads likely pursues hybrid approach: Meta develops flagship games (basketball, soccer, etc.) while opening APIs for third-party developers to build additional games. This balances quality control with ecosystem benefits, similar to successful app store models.

Future Evolution: Gaming Beyond Simple Casual Games

AI-Powered Opponents and Adaptive Difficulty

The gaming infrastructure Threads builds creates foundation for AI integration. Rather than requiring human opponents always available, Threads could implement AI opponents trained to provide appropriate challenge levels. Machine learning systems can personalize difficulty—new players face easier AI while veterans challenge progressively harder AI opponents.

Meta's investments in AI research position the company well to implement sophisticated game AI. Systems trained on millions of game sessions can predict player skill levels and adjust AI difficulty dynamically. This ensures all players experience appropriate challenge regardless of skill level—a core engagement driver.

AI opponents address the single biggest limitation of competitive gaming in messaging: availability. A friend might not be available when you want to play, but AI never sleeps. Ensuring players always have opponents available keeps them engaged with gaming experiences rather than abandoning games due to lack of opponents.

Over time, AI could generate entirely new game variants or even create personalized games optimized for individual players. Machine learning could analyze what types of games specific users engage with and create similar variants. This personalization capability creates engagement far beyond static game catalogs.

Cross-Platform Gaming and Ecosystem Integration

Threads gaming could eventually integrate across Meta's ecosystem—the same basketball game accessible on Instagram, Whats App, and Messenger. This ecosystem integration creates network effects where games drive traffic across Meta platforms while allowing users to maintain competitive rankings regardless of platform.

Cross-platform integration requires sophisticated backend infrastructure—unified user identities, synchronized game state across platforms, consistent cosmetics and progression systems. Meta's infrastructure can support this given their existing ecosystem integration across properties, but implementation remains complex.

The benefits justify the complexity. A game accessible across five Meta platforms reaches vastly larger audience than a single-platform game. Competitive leaderboards spanning all platforms create higher-stakes competition as larger player pools create steeper competition for top rankings. This intensifies engagement motivation.

Advanced Features: Tournaments, Betting, and Esports Integration

As gaming matures, Threads could develop advanced competitive features: tournaments, seasonal competitions, and esports integration. Meta could implement systems where top players compete in organized tournaments with monetary prizes (subject to regulatory approval).

Tournament infrastructure requires sophisticated matchmaking, bracket management, and prize distribution systems. Building these systems represents substantial engineering effort, likely only worth attempting after casual gaming proves successful and achieves sufficient scale.

Betting represents another potential feature, though one that requires careful regulatory analysis. Platforms allowing users to wager money on gaming outcomes face strict gambling regulations. However, cosmetic-based betting (risking cosmetics rather than money) could offer competitive excitement while avoiding regulatory complexity.

Esports integration could position Threads as hosting platform for professional gaming competitions. Rather than just casual play, professional players could compete within Threads for prize money and sponsorship opportunities. This elevated competitive structure would showcase gaming on the platform and drive mainstream attention.

Conclusion: The Bigger Picture of Threads' Gaming Strategy

Threads' in-message gaming represents far more than a novelty feature. Gaming serves as critical component of Meta's broader strategy to establish Threads as viable competitor to X and emerging platforms like Bluesky. In an increasingly crowded social media landscape, Threads must differentiate through distinctive experiences that competitors cannot easily replicate.

Gaming achieves this differentiation while addressing Threads' most pressing weakness: user engagement. The platform achieved impressive monthly active user numbers through viral distribution in its launch period, but converting monthly actives to daily actives has proven difficult. Gaming provides concrete mechanism to increase daily engagement through habit formation and competitive motivation.

The technical implementation challenges are substantial but well within Meta's capabilities. The company's infrastructure expertise, scale experience, and engineering resources far exceed most competitors. The primary risk isn't technical failure but rather market adoption—whether Western users embrace integrated gaming in messaging the way Asian users have in We Chat and QQ.

Competitive positioning strongly favors Threads here. X shows no indication of developing gaming capabilities, Bluesky's decentralized architecture complicates gaming implementation, and other competitors lack infrastructure at Threads' scale. If Threads executes gaming well and achieves meaningful adoption, the feature could provide sustained competitive advantage lasting months or years before competitors respond.

Monetization potential justifies the investment. Even modest gaming adoption (20% of monthly actives trying games, 3% becoming paying users) generates hundreds of millions in annual incremental revenue. This makes gaming one of the highest-ROI product initiatives Meta could undertake given the engineering cost involved.

Looking forward, gaming's success depends on several critical factors. First, game quality must be high—polished experiences that feel fun and fair. Poor games damage platform perception and create negative first experiences that discourage future gaming engagement. Second, consistent game catalog expansion must occur—single games feel stale within months. Regular new game releases keep the experience feeling fresh. Third, community management must maintain healthy gaming environments—toxic experiences drive away casual players who represent the largest potential audience.

If Threads executes gaming well across these dimensions, the feature could become transformative for platform trajectory. Daily active users could increase 20-30%, session duration could extend by 30-50%, and monetization could improve as gaming revenue supplements existing ad revenue. Combined, these improvements could finally give Threads the engagement metrics necessary to compete credibly with established platforms.

For users, Threads gaming offers genuine value. The ability to play casual games with friends without leaving the messaging conversation provides convenience and natural social integration. For competitive players, the opportunity to establish rankings and dominate friends provides satisfying gameplay loop. Even for users indifferent to gaming, the feature's existence might increase their Threads usage as they're exposed to friends' gaming activities and feel social pressure to participate.

The meta-question underlying this analysis: is gaming in messaging an essential feature for modern social platforms, or a distraction from core functionality? Data from successful platforms like We Chat suggests gaming can become essential, driving meaningful engagement gains. However, Western user preferences might differ from Asian patterns. Only time and actual user adoption will definitively answer whether gaming represents Threads' path to competitive viability or an interesting experiment that fails to drive meaningful engagement.

Regardless of ultimate success or failure, Threads' gaming initiative signals Meta's recognition that social platforms must evolve beyond simple content sharing. The next generation of social platforms will be rich, interactive environments combining communication, content discovery, commerce, and gaming. Whether through Threads, other Meta properties, or emerging competitors, this evolution appears inevitable. Threads is simply placing its bet that gaming will be part of the winning formula.

FAQ

What is Threads in-message gaming?

Threads in-message gaming is a feature Meta is developing that allows users to play interactive games directly within Threads conversations. The first discovered prototype is a basketball game where users swipe to shoot virtual hoops and compete with friends for high scores. Unlike standalone gaming apps, these games integrate seamlessly into messaging, with scores and competitive results displayed within the chat conversation. The feature aims to increase user engagement and session duration by providing entertainment experiences without leaving the messaging interface.

How does the Threads basketball game work?

The basketball game prototype users swipe their finger on the screen to shoot virtual hoops, attempting to score as many baskets as possible. The game appears to track scores in real-time and allows users to challenge friends to see who can achieve higher scores. The competitive element is central to the design—friends can see each other's results and immediately rematch to try beating their opponent's score. The mechanics are intentionally simple and quick-play, designed to complete within minutes so gaming doesn't disrupt messaging flow.

What are the benefits of gaming in Threads?

Gaming in Threads offers multiple benefits for both Meta and users. For Meta, games increase daily active user metrics, extend session duration, and create additional monetization opportunities through cosmetics and premium features. For users, games provide entertainment and social bonding with friends through competition. Casual gaming within messaging offers convenience—users can play without downloading separate apps or leaving their conversations. The feature also differentiates Threads from competitors like X and Bluesky, which lack native gaming integration, making Threads a more feature-rich alternative for users seeking richer social experiences.

When will Threads gaming launch publicly?

The basketball game is currently an internal prototype with no official launch timeline confirmed. However, based on Meta's typical development cycles, games could reach public testing within 2-3 months and global rollout within 6-12 months. Meta typically follows a pattern of internal testing, limited beta testing (initially on Android), regional soft launches, and finally global release. The company will likely announce gaming formally during major events like Meta's F8 developer conference, though this remains speculation without official confirmation.

How will Threads gaming be monetized?

Threads gaming will likely generate revenue through multiple mechanisms. The primary approach probably involves cosmetic purchases—visual customizations like unique ball skins, court designs, or player avatars that don't affect gameplay but enhance user expression. Battle pass systems, where users pay seasonally to unlock cosmetic rewards through gameplay progression, represent another major revenue vector. Advertisements between game rounds and within games could also generate advertising revenue. Premium game variants or subscription models might provide additional monetization, though these must balance revenue generation with maintaining healthy free-to-play experiences.

How does Threads gaming compare to gaming in other messaging platforms?

Threads gaming is most directly comparable to We Chat and QQ's integrated gaming ecosystems, which have achieved massive scale and revenue. However, both We Chat and QQ launched gaming in markets where users culturally embraced integrated gaming more readily than Western users typically have. Apple's Messages platform offers gaming through Game Pigeon, a third-party app, showing another model where games integrate into messaging without being fully native. X and Bluesky currently lack integrated gaming, giving Threads potential competitive advantage. Telegram allows third-party developers to create games within its platform rather than developing first-party games like Threads plans to do.

Will Threads gaming be available on all devices and platforms?

Meta's engineering goal will be achieving cross-platform parity, but this requires careful optimization. Games must function on i OS, Android (with highly variable hardware), and web browsers. Older Android devices present particular challenges, as games must function acceptably on older phones or alienate users in emerging markets that represent significant portions of Threads' user base. Meta will likely implement scalable graphics and performance optimization to ensure games work across device spectrum, though some platform-specific differences may persist due to technical constraints.

What happens if Threads gaming doesn't drive the engagement improvements Meta expects?

If gaming fails to meaningfully increase daily actives or session duration, Meta could reduce gaming investment or sunset underperforming features. However, even if specific games fail to drive universal engagement, gaming as a category might still provide value to specific user segments. Meta might maintain gaming as a niche feature for users who engage with it while deprioritizing expansion of the gaming catalog. The investment is substantial but not so large that unsuccessful execution would threaten Threads' overall viability—the platform has other engagement levers being pursued simultaneously.

How will Threads prevent cheating and maintain competitive integrity?