Ultrahuman Ring Pro: The Oura-Killer Wearable [2025]

Something's brewing in the smart ring space, and Oura should probably be paying attention.

Ultrahuman, the Indian health tech company that's been quietly building momentum in the biometric tracking world, just had its next move exposed through an FCC filing. And it's a big one. The company is launching a Ring Pro—a sophisticated smart ring designed to compete directly with Oura's premium offerings.

But here's what makes this interesting: this isn't Ultrahuman's first rodeo with wearables. The company has already built a reputation for detailed metabolic tracking through its M1 band and app ecosystem. Now they're bringing that expertise into the ring form factor, where competition is heating up faster than most people realize.

The leak comes from regulatory filings that always tell the real story before marketing departments do. And what we're seeing suggests Ultrahuman isn't just making another ring—they're positioning themselves as the thinking person's alternative to Oura, with features and an approach that challenges the current market leader's dominance.

Let's dig into what we know, what this means for the smart ring market, and whether Ultrahuman can actually pull off the "Oura-beater" narrative that's already circulating.

TL; DR

- FCC Filing Confirms Launch: Ultrahuman Ring Pro received FCC approval, indicating a real product ready for market

- Direct Oura Competitor: Designed with similar health metrics but potentially different pricing strategy

- Metabolic Focus: Builds on Ultrahuman's existing strength in detailed biometric tracking and AI-powered insights

- Market Timing: Launches when smart ring adoption is accelerating and consumers want more choices

- Feature Parity Challenge: Must match or exceed Oura's established ecosystem and app quality

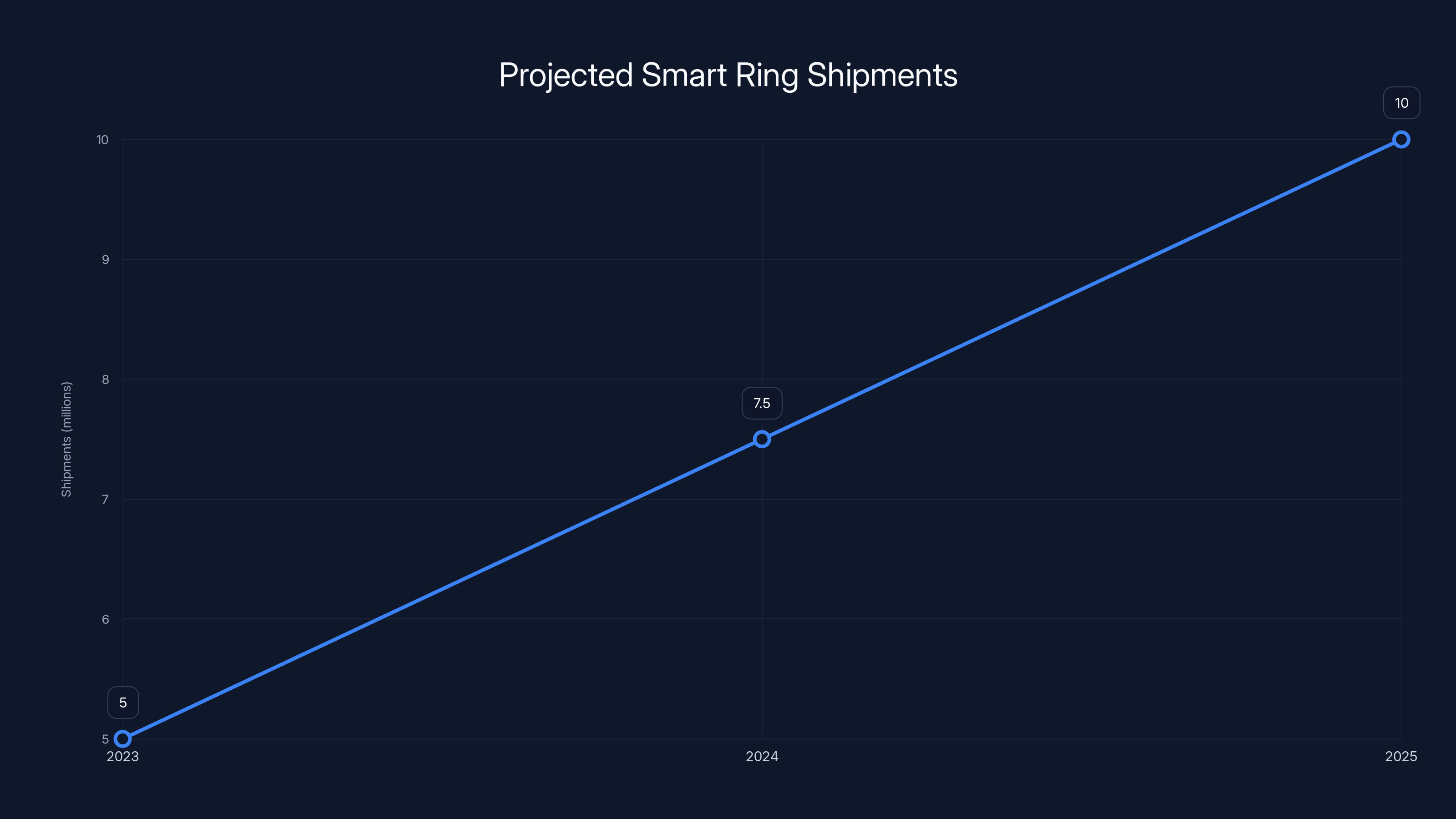

Smart ring shipments are projected to double from 5 million in 2023 to 10 million by 2025, indicating a shift from niche to mainstream adoption. Estimated data.

What Is the Ultrahuman Ring Pro, Exactly?

The Ring Pro is Ultrahuman's answer to a simple question: what if a smart ring prioritized continuous metabolic and health data over everything else?

Unlike some wearables that try to do everything (notifications, payments, fitness tracking), the Ring Pro appears laser-focused on one thing: giving you detailed, actionable health insights based on your biometric data.

Ultrahuman has been in this space since 2021, building a platform specifically designed around metabolic optimization. Their M1 band generated a loyal following by providing glucose monitoring, sleep quality data, and AI-driven recommendations. The Ring Pro takes that DNA and puts it in a form factor that's been proven to work at scale.

What makes this device different from the Oura Ring 4 isn't just the branding. Ultrahuman's approach comes from a company obsessed with metabolic health—how your body actually processes food, stress, and recovery at a granular level. This shapes everything from sensor selection to algorithm design.

The Ring Pro will track the obvious metrics: heart rate, heart rate variability (HRV), sleep architecture, skin temperature, respiratory rate, and movement patterns. But the real value proposition sits in the analysis layer. Ultrahuman's algorithms are trained to show you why your HRV dropped, what sleep stage you're missing, and how to fix it.

Form factor matters too. The Ring Pro appears to use a similar design language to Ultrahuman's existing M1, which means it's probably sleeker and more fashionable than early-generation smart rings. It needs to be—because if you're wearing something on your finger all day, it has to not look like a medical device.

The real differentiator, though? Ultrahuman's AI-powered Hypercise Engine. This system learns your individual metabolism and recommends specific exercises, timing, and intensity based on your real-time biometric data. It's the kind of personalization that Oura doesn't offer out of the box.

How the FCC Leak Actually Works

You might wonder: why are we even talking about an FCC leak? Isn't this supposed to be secret?

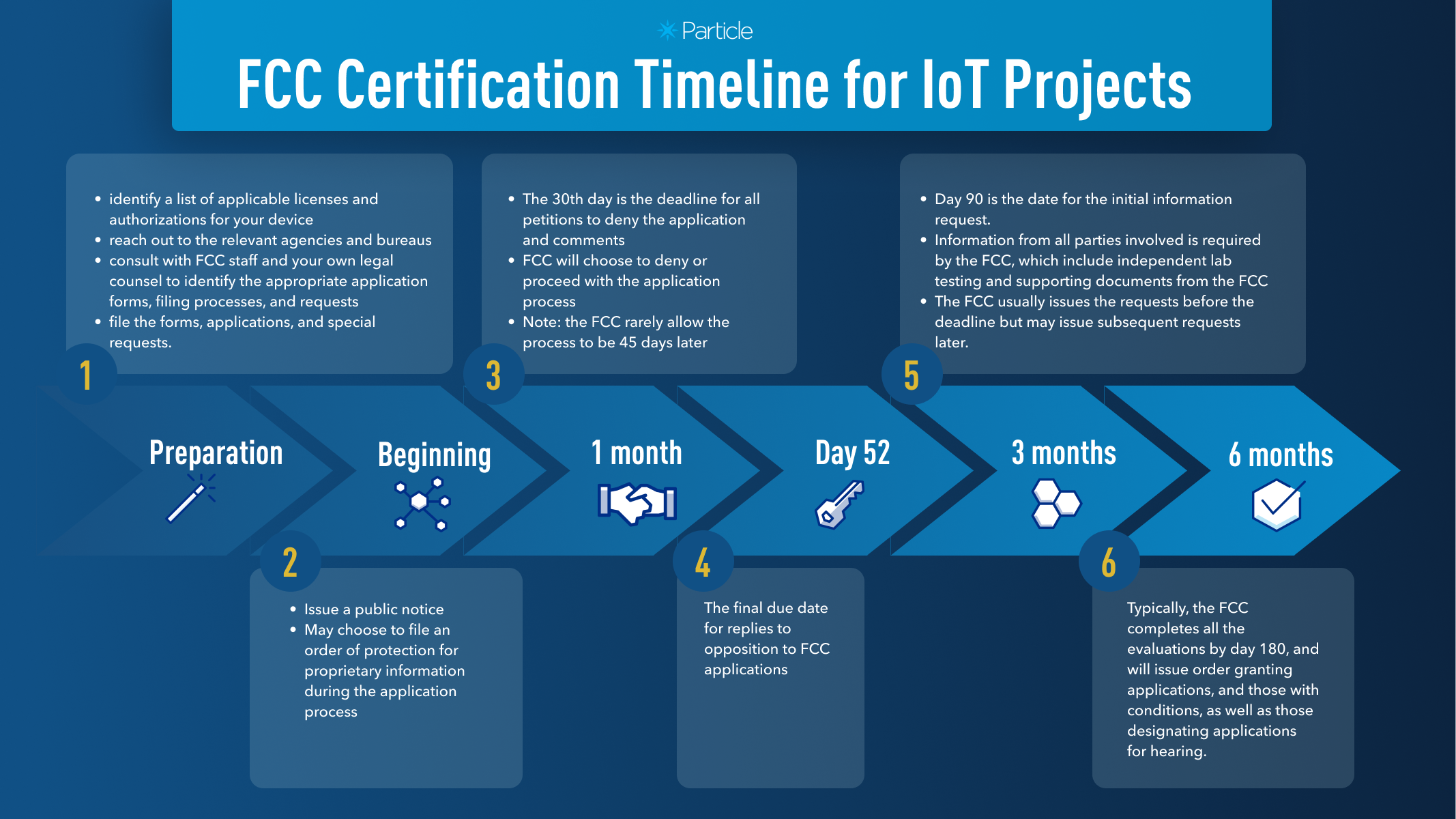

Welcome to the reality of hardware launches. Every electronic device sold in the United States needs FCC approval before hitting consumers. The FCC requires companies to file technical specifications, emissions data, and sometimes photos of the device itself. These filings are public record.

That's how journalists and tech enthusiasts know about new iPhones, Galaxy phones, and smart rings months before official announcements. The FCC filing is essentially a spoiler alert written into law.

For the Ultrahuman Ring Pro, the filing provides several critical pieces of information:

Device Classification and Radio Standards: The specific FCC filing number reveals that the Ring Pro includes wireless connectivity (Bluetooth 5.0 or similar), confirming it will sync with your phone in real-time. This is non-negotiable for modern wearables—you need instant data sync for the AI insights to be useful.

Frequency Bands: The filing shows which radio frequencies the device uses. This tells us whether it supports global connectivity or just specific regions. If Ultrahuman filed broadly across multiple frequency bands, it suggests a global launch strategy, not just India or a single market.

Device Dimensions and Weight: FCC filings often include exact dimensions. This is crucial for a ring—size and weight directly affect comfort and wearability. We're likely looking at something under 5 grams, matching or beating the Oura Ring 4 which weighs around 4 grams.

The timeline matters here. FCC approval is a final gate before manufacturing at scale. If Ultrahuman just received approval, the Ring Pro is probably 4 to 6 weeks from retail shelves. This isn't vaporware or a concept—it's real, manufactured, and ready to ship.

What the filing doesn't tell us are feature details, battery life specifications, or pricing. That's coming in the official announcement. But the FCC data confirms one thing: Ultrahuman is serious about this product, has already manufactured test units, and is ready to go public.

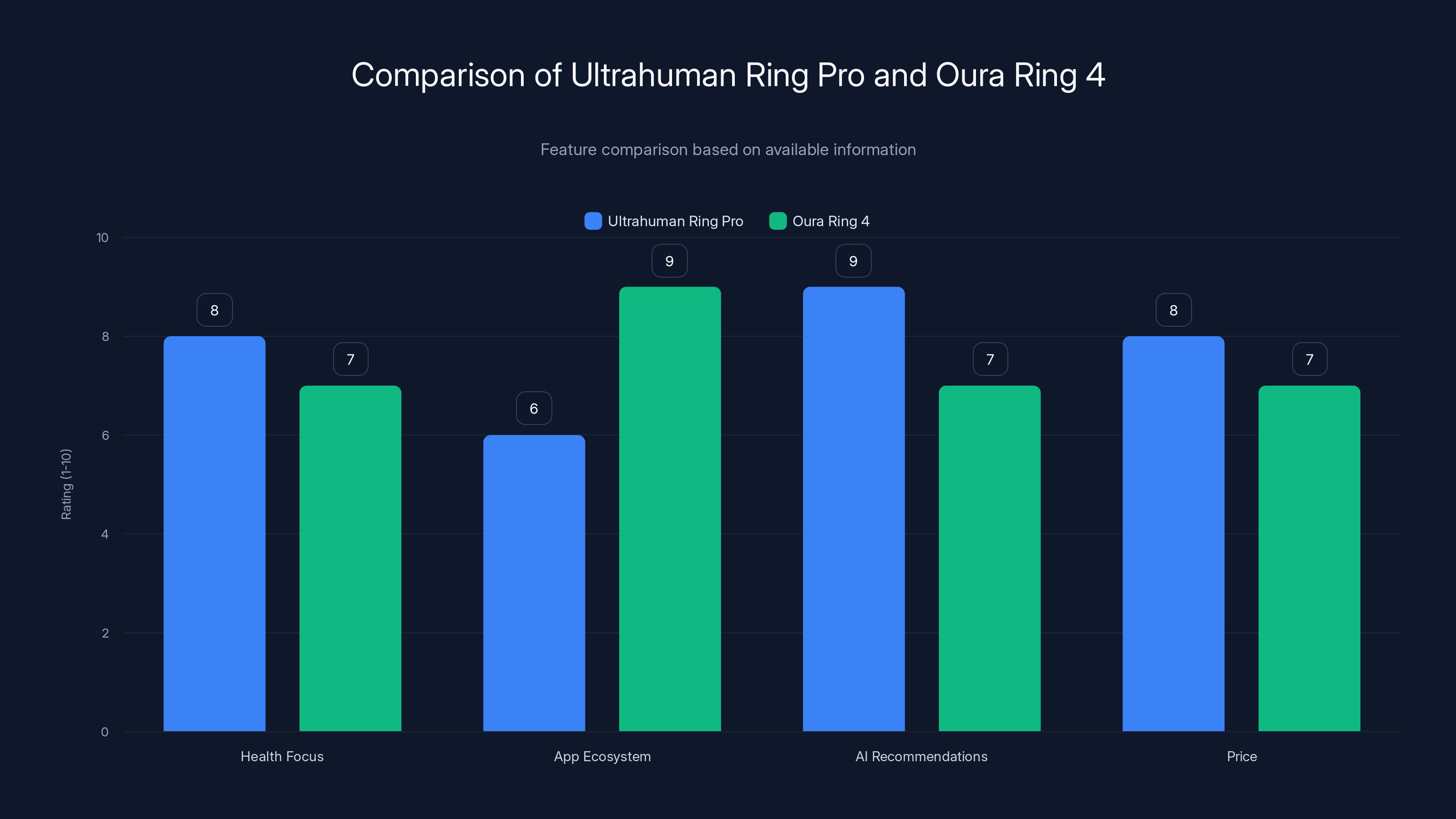

The Ultrahuman Ring Pro excels in AI-driven recommendations and metabolic health focus, while the Oura Ring 4 has a more established app ecosystem. Estimated data based on product descriptions.

Smart Ring Market: Why Now?

The smart ring space has been dominated by Oura for years. They built the category, educated consumers, and created an ecosystem that works. So why is Ultrahuman entering now?

Because the market is finally ready for competition.

Market Adoption is Accelerating: Statista projects smart ring shipments to exceed 10 million units annually by 2025, up from around 5 million in 2023. This is the hockey stick moment—demand is moving from niche to mainstream.

Consumer Price Sensitivity: Oura Ring prices start at

Health Tech Normalization: Five years ago, wearing a smart ring marked you as a biohacker. Today, it's becoming normalized. Apple Intelligence is bringing AI health analysis to millions of iPhone users. The infrastructure for accepting personalized health recommendations exists now.

Metabolic Health Trend: The fitness industry has shifted from "calories in, calories out" to understanding metabolic health, glucose management, and circadian alignment. This favors Ultrahuman—a company built specifically around metabolic optimization. Oura is more general-purpose health tracking. Ultrahuman's depth in metabolism is becoming increasingly valuable.

Distribution and Partnerships: Ultrahuman has already built distribution networks in India, Southeast Asia, and parts of Europe through their M1 band. They have doctor relationships, corporate wellness partnerships, and retail presence. Launching a premium product into existing channels is far easier than building them from scratch—something Oura took years to accomplish.

There's also competitive psychology at play. When one product dominates a category (Oura and smart rings), the best time to enter isn't when the market is small—it's when the market is proven and growing. Competitors prove demand, normalize the product, and create educated consumers. Ultrahuman is surfing that wave.

Ring Pro vs Oura Ring: Feature Comparison

Let's be direct: on paper, these devices will look similar. Both are smart rings. Both track heart rate, sleep, and activity. Both use machine learning to generate insights.

But the details matter, and they're probably where the differentiation lives.

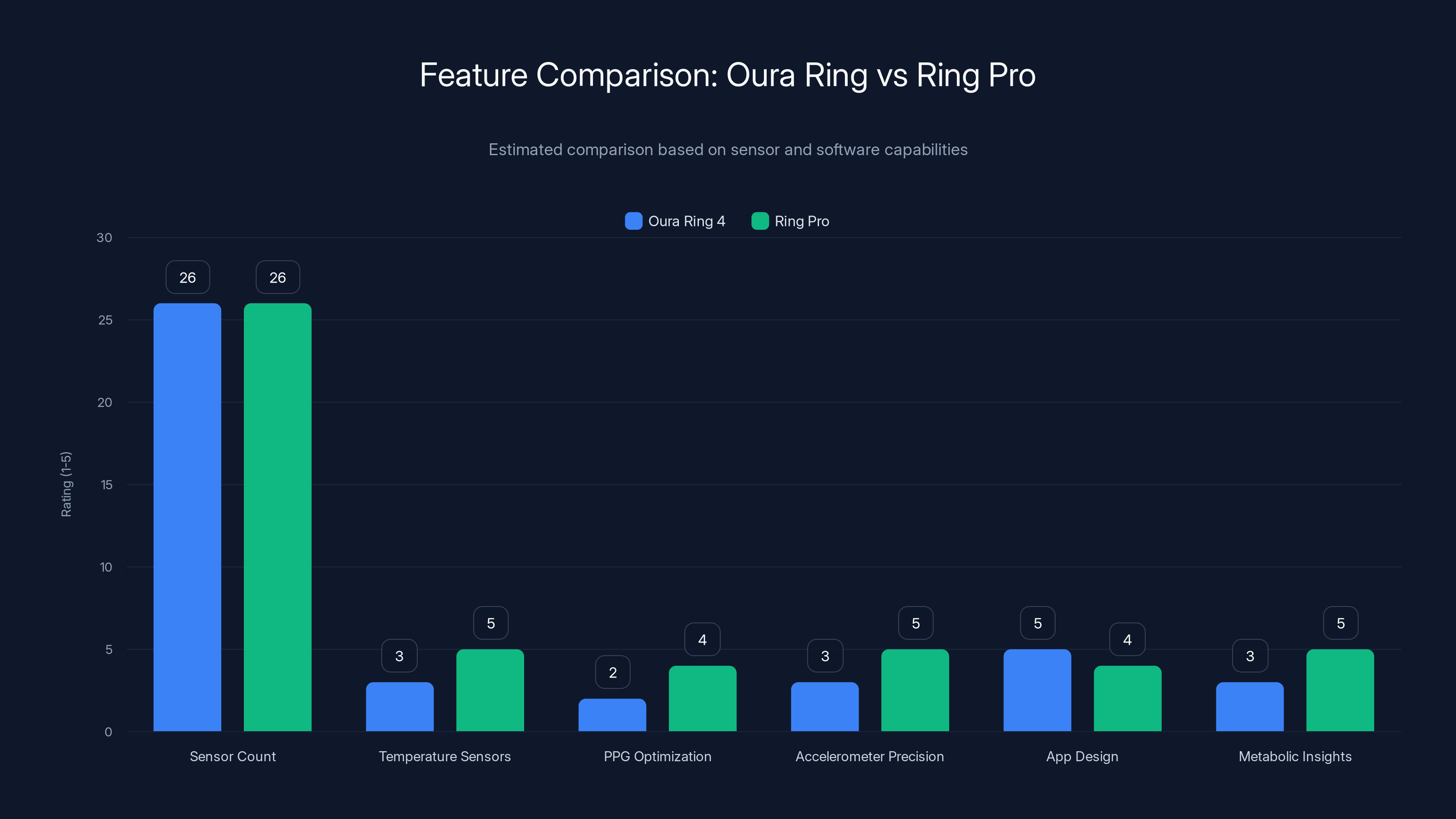

Sensor Architecture

Oura Ring 4 uses 26 sensors including infrared LEDs, temperature sensors, and accelerometers. It's optimized for accurate sleep tracking and general health metrics. The sensor layout is designed for comfort and universal sizing.

Ring Pro likely uses a similar sensor count but with different emphasis. Based on Ultrahuman's M1 design philosophy, expect:

- Advanced temperature sensors: Multiple sensors across the ring surface for better core-body temperature estimation (crucial for metabolic tracking)

- PPG optimization for glucose correlation: Special calibration of the photoplethysmography sensors to pick up glucose-related blood composition changes

- Accelerometer precision: Higher-resolution movement tracking for detailed exercise classification

This isn't necessarily "better" across the board. It's different. Oura optimized for sleep and general wellness. Ultrahuman is optimizing for metabolic precision.

Software and Insights

Here's where Ultrahuman can actually differentiate.

Oura's Strength: The Oura app is beautiful, simple, and provides clear daily recommendations. It's probably the best-designed health app in the category. New features like Oura Labs (experimental features) keep the ecosystem fresh.

Ultrahuman's Edge: The company's Hypercise Engine is built specifically for this. Their algorithms don't just tell you "your sleep was bad" or "your heart rate is elevated." They tell you which specific exercises at what intensity will improve your metabolic flexibility. They correlate your glucose response with food, sleep, and stress.

Ultrahuman's app probably shows you things like:

- Glucose impact of meals: Not just glucose readings (which a CGM provides), but how your specific body responded to specific foods, meals, and timing

- Sleep architecture optimization: Recommended bedroom temperature, wind-down timing, and even supplement timing based on your individual sleep patterns

- Stress-to-performance mapping: How your stress metrics correlate to actual workout performance and recovery

- Circadian phase tracking: Recommendations for light exposure, exercise timing, and meal timing based on your individual circadian rhythm (not the "normal" schedule)

Battery and Form Factor

Oura Ring 4 gets roughly 10 days of battery life. This is a strong point—it means fewer charging cycles and more peace of mind.

The Ring Pro will likely aim for 7-10 days as well, using more efficient sensors and processing. If Ultrahuman manages 10+ days while adding metabolic tracking, that's a significant win.

Size-wise, expect similar dimensions. Both companies understand that a ring needs to be wearable for 24 hours. Anything too chunky gets abandoned.

Data Privacy and Access

This is where Ultrahuman actually has advantages.

Oura syncs data to their cloud for analysis, which enables machine learning but also requires trust in their privacy policies. For EU users, GDPR compliance is strict. For others, it's less clear.

Ultrahuman has positioned themselves as privacy-forward. Their model allows for more on-device processing, meaning fewer data uploads. They're also based in India, not the US or Europe, which (depending on your perspective) either increases or decreases privacy concerns. But for consumers who distrust US tech companies, Ultrahuman's location is actually an asset.

Pricing Strategy: Where Ultrahuman Can Win

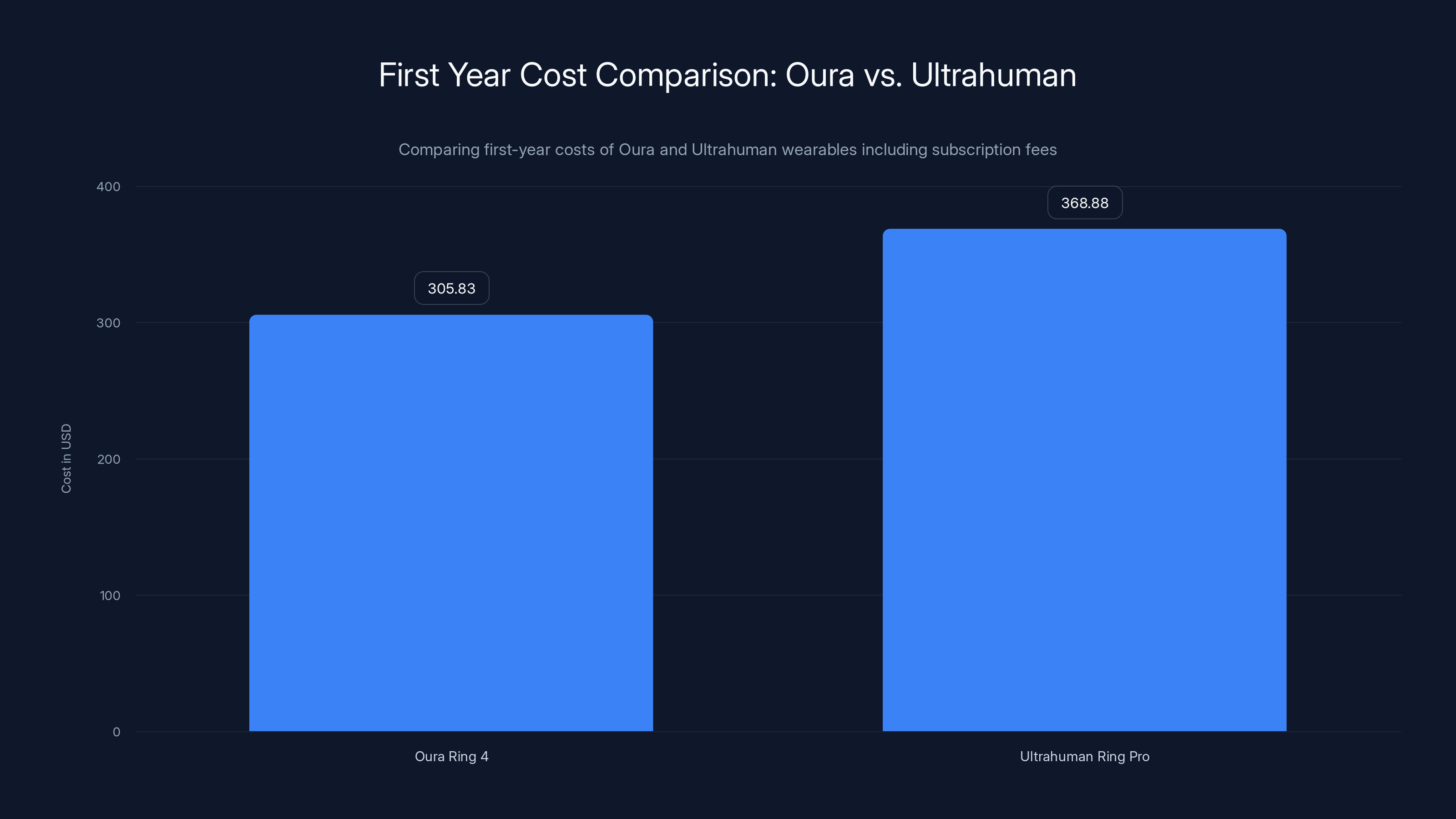

Oura Ring 4 costs $299 for the base model. That's a psychological barrier.

Ultrahuman's rumored pricing: somewhere between

This matters more than people realize. At

But Ultrahuman also has a subscription cost reality. Neither company gives you the full AI insights for free.

Oura Membership:

Ultrahuman Membership (based on M1 pricing): Probably

Here's the strategic calculation:

Oura:

Ultrahuman Ring Pro:

So Ultrahuman would actually be more expensive long-term, even with lower hardware pricing. This means they're betting on two things:

- Perceived AI value is higher: Consumers willing to pay more for better personalized insights

- Lower hardware price drives adoption: Get people in the door at $249, then monetize through subscriptions

This is a reasonable strategy. It mirrors how Peloton, Apple Fitness+, and other companies have tackled the hardware-plus-services market.

Ring Pro excels in metabolic insights and sensor precision, while Oura Ring is strong in app design and general wellness. Estimated data based on feature emphasis.

Technical Specifications: What We Know and What We're Guessing

FCC filings give us some concrete details. Let's separate what's probably accurate from what's educated speculation.

Confirmed or Highly Likely

Wireless Connectivity: Bluetooth 5.0 or 5.3, which enables low-power synchronization with iPhones and Android devices

Processing Power: Modern ARM-based microprocessor, probably similar to what's in the latest Apple Watch chips—enough for on-device machine learning without being overkill

Sensor Complement: At least 15-20 sensors including:

- Photoplethysmography (PPG) LEDs for blood oxygen and heart rate

- Temperature sensors (likely multiple)

- 3-axis accelerometer

- Possibly a gyroscope

- Bioimpedance sensors for body composition estimation

Battery Technology: Likely a custom-shaped lithium-ion battery optimized for the ring form factor, aiming for 7-10 days per charge

Materials: Probably titanium or specialized steel body with sapphire or Gorilla Glass on the sensor face (matching Oura's approach)

Educated Guesses Based on Ultrahuman's Positioning

Proprietary Metabolic Algorithms: Ultrahuman likely filed patents for specific metabolic tracking methods that aren't disclosed in FCC filings but are core to the product

Continuous Glucose Estimation: While not a true CGM (continuous glucose monitor), the Ring Pro might estimate glucose trends from blood composition analysis—a feature Oura doesn't advertise

Multi-Day Prediction Models: Based on Ultrahuman's M1 approach, expect recommendations that aren't just "today's score" but "here's what's coming in the next 3 days based on your patterns"

The Battery Question

One technical detail matters more than most: battery life.

The Ring Pro needs to hit at least 7 days between charges to be competitive. At 10 days, it wins. If it's under 5 days, it fails—people won't accept that from a wearable ring.

Oura achieves this through:

- Efficient sensors that don't require constant high-power reads

- Smart algorithms that sample data strategically rather than continuously

- Optimized charging—fast enough to minimize friction

Ultrahuman's higher-complexity algorithms (more metabolic analysis) could consume more power. This is the engineering challenge they need to nail.

AI and Machine Learning: Where Ultrahuman's Expertise Shows

Here's what separates a good wearable from a great one: the AI doesn't overthink it. Your data is noise. The AI's job is to find the signal.

Ultrahuman has been building metabolic AI for years. Their M1 band generated insights like:

- "Your glucose spiked 45 minutes after breakfast yesterday. If you switch to protein-first eating tomorrow, it'll be 30% lower"

- "Your HRV dropped 20% on days you slept in—irregular sleep schedule is your biggest recovery killer"

- "You perform best in workouts when your core temperature is 0.5°C elevated. Here's when that naturally happens"

These insights require models trained on thousands of users' metabolic patterns. They're not simple correlation detection. They're causal relationship identification with noise filtering.

How This Shows Up in the Ring Pro:

The device itself is just a sensor package. The Ring Pro's real value is in what happens after the data leaves the ring:

-

Real-time processing: Your phone receives the data and runs local models (on-device ML) for instant feedback. This preserves privacy and enables fast iterations.

-

Cloud training: Anonymized data flows to Ultrahuman's servers, where larger models train continuously to improve recommendations. This is where competitive advantage lives—better models than Oura means better recommendations.

-

Personalization layers: The base models are generic. Then they fine-tune on your individual pattern—your unique metabolism, sleep preference, stress response. Two people with identical HRV readings might get completely different recommendations because their baselines are different.

-

Predictive interventions: Instead of reactive ("you didn't sleep well"), the AI becomes predictive ("based on your calendar this week and current stress markers, here's what will help you prevent poor sleep").

The Hypercise Engine: Ultrahuman's Secret Sauce

This is the feature that could actually differentiate the Ring Pro from Oura.

Hypercise isn't a fixed algorithm. It's a recommendation system that adapts workout suggestions based on:

-

Your current metabolic state: If your HRV is low and glucose variability is high, you get recovery-focused recommendations. If you're in a good state, you get intensity recommendations.

-

Your individual glucose response to exercise: Some people are glucose-sensitive (blood sugar crashes hard after intense exercise). Others stabilize it. The Hypercise system learns your pattern and recommends workout timing accordingly.

-

Your circadian phase: Exercise timing matters. Morning sprints might work for one person's biology but destroy another's. Hypercise customizes.

-

Your stress recovery curve: How fast do you bounce back from hard workouts? The algorithm learns this and spaces recommendations accordingly.

Oura doesn't have anything equivalent. Oura tells you "your readiness is 76%"—which is useful context. But Hypercise tells you "do 20 minutes of zone 2 cardio at 6 PM because your glucose responsiveness is elevated and your core temp peaks at that time."

That level of specificity could be a real differentiator. Or it could be hype. We'll know once people start using it.

Integration with Ecosystem: The Real Challenge

Let's be honest: building a good ring is hard. Building a good ring that integrates with everything else is much harder.

Oura has massive advantages here. They've spent years integrating with:

- Apple Health: Your Oura data syncs to Apple Health, where it feeds Apple's Fitness and health apps

- Google Fit: Same story for Android users

- Third-party apps: Oura data flows to Strava, WHOOP, My Fitness Pal, and dozens of other apps

- Health research: Researchers can access (with consent) Oura data for studies

Ultrahuman has smaller integrations established. They'll need to expand rapidly:

What's Probably Coming:

- Apple Health integration (mandatory for iOS users)

- Google Fit integration (mandatory for Android users)

- Strava integration for fitness tracking

- Possibly integrations with major health apps

What's Uncertain:

- Integration with corporate wellness platforms (where Oura has real traction)

- Research partnerships (Oura has Stanford, Mayo Clinic, and others working with their data)

- Third-party coaching app integrations

This isn't a dealbreaker—new products can build these partnerships. But it's a gap Ultrahuman starts with that Oura doesn't.

Ultrahuman Ring Pro, despite lower hardware cost, ends up being more expensive in the first year due to higher subscription fees. Estimated data for Ultrahuman subscription.

Market Positioning: Going After Oura's Blind Spots

Every market leader has blind spots. Oura's are:

Price Insensitivity: Oura users tend to be wealthy. They're not price-shopping. This creates an opportunity for Ultrahuman to target the $150-250 segment who want a premium experience at a non-luxury price.

Metabolic Focus Gap: Oura is general health. Ultrahuman is metabolic optimization. If you're interested in glucose management, circadian optimization, and personalized nutrition, Ultrahuman's depth could be more valuable.

Privacy Positioning: Ultrahuman can position themselves as the "privacy-first" alternative. Whether accurate or not, if they communicate this effectively, it appeals to privacy-conscious consumers (a growing segment).

AI Sophistication: Ultrahuman's AI narrative is stronger than Oura's. Oura focuses on sleep and readiness. Ultrahuman focuses on predictive, personalized coaching. That's a more compelling narrative in 2025.

Geographic Expansion: Ultrahuman started in India. They can dominate that market (where Oura has lower penetration) while expanding westward. They don't need to beat Oura globally immediately—they need to own key regions.

The strategic play isn't "dethrone Oura." It's "become the alternative that appeals to metabolically-obsessed, privacy-conscious, budget-minded early adopters." Nail that segment, scale slowly, and eventually you have enough market share to negotiate with healthcare companies and corporate wellness platforms.

Manufacturing and Supply Chain Reality

Here's a consideration most tech enthusiasts miss: actually making these things.

Smart rings are harder to manufacture than you'd think. The form factors are small, tolerances are tight, and calibration is crucial. One percent variation in sensor placement changes the accuracy significantly.

Oura has years of manufacturing experience. Ultrahuman's M1 band proved they can handle complex wearable production. But scaling ring production to significant volumes? That's a different game.

The Real Timeline:

FCC approval means they've probably manufactured test batches. They've qualified a manufacturing partner (likely in China or Taiwan, following the standard playbook). First production runs are probably underway.

Based on typical hardware launch windows:

- Month 1: Official announcement (probably Q2 2025)

- Months 2-3: Pre-orders open

- Months 4-5: Early shipments to first-wave customers

- Months 6+: Broader availability and stock normalization

If Ultrahuman executes well on manufacturing, this is a non-story. If they have supply chain hiccups (like every hardware company does), it becomes a problem. First impressions matter in wearables—ship delayed and people lose enthusiasm.

Competitive Threat Level: Real or Overblown?

Let's assess whether Ultrahuman Ring Pro is genuinely threatening to Oura or just another competitor.

Factors That Make It a Real Threat:

-

Metabolic focus: There's a real market segment obsessed with glucose, circadian rhythms, and personalized optimization. Ultrahuman owns this narrative.

-

Price positioning: At

299, they're positioned just right—premium but not luxury. -

Proven experience: Ultrahuman's M1 band already generated loyal users. Those users will likely try the ring.

-

AI differentiation: If Hypercise actually delivers on its promises, it's materially different from Oura's offering.

-

Timing: Smart rings are reaching mainstream adoption. Ultrahuman enters when the category is proven and growing.

Factors That Limit the Threat:

-

Oura's moat: Brand awareness, user base, ecosystem integration—these compound over time. Switching costs are real.

-

Trust and data history: Oura users have years of historical data in the app. Starting over with Ultrahuman means losing that context.

-

Marketing budget: Oura has significantly more marketing reach. Ultrahuman is under-the-radar currently.

-

Research credibility: Oura's partnerships with major health research institutions give it credibility Ultrahuman needs to build.

-

App maturity: Oura's app is beautifully designed. Ultrahuman's will need to match that quality.

Realistic Assessment:

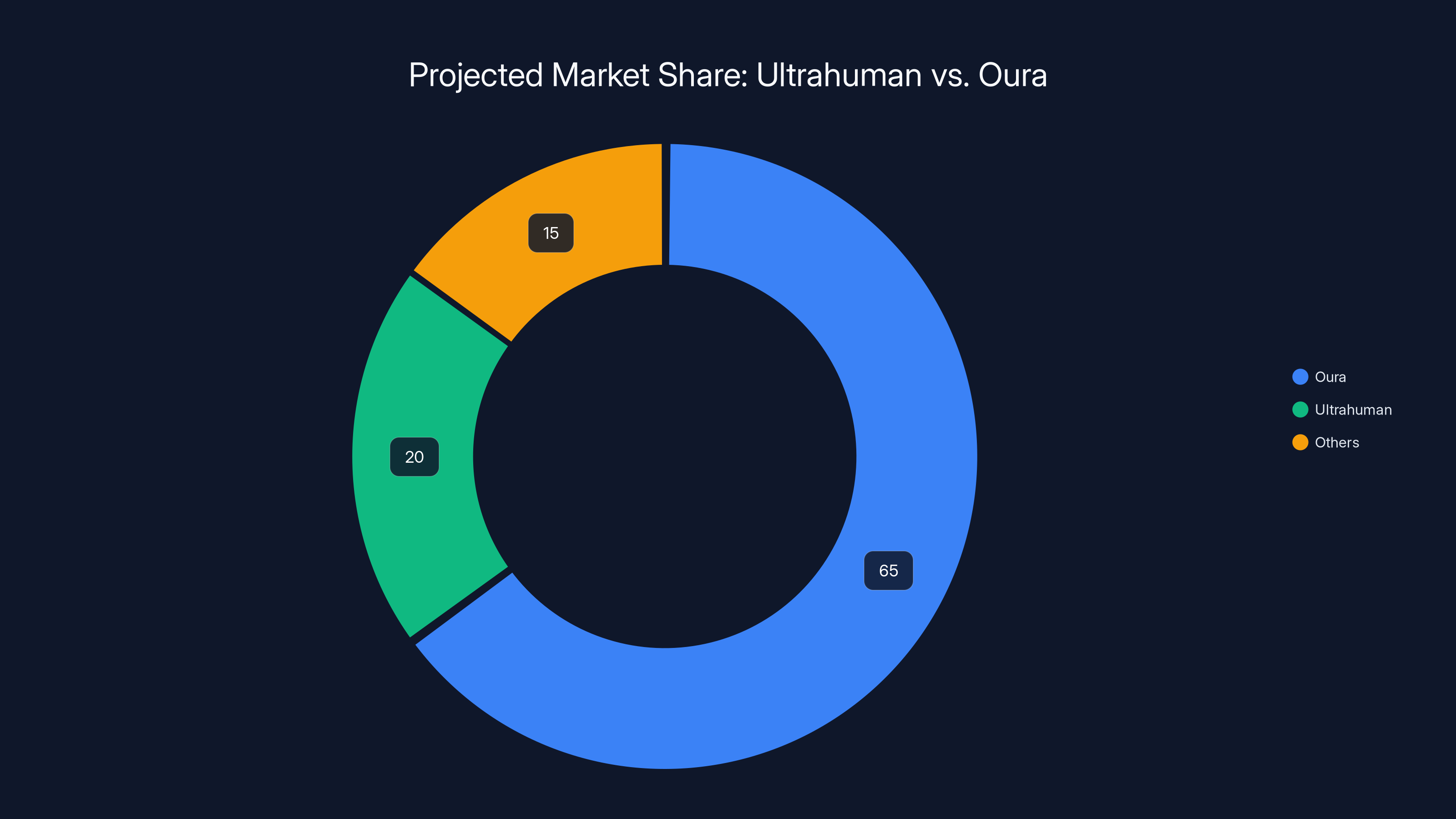

Ultrahuman won't dethrone Oura. But they could capture 15-25% market share in the next 3 years. That's enough to be viable, sustainable, and profitable. It's also enough to force Oura to innovate faster and potentially lower prices—which benefits consumers.

This is healthy competition, not an existential threat to either company.

Estimated data suggests Ultrahuman could capture 20% of the market, challenging Oura's dominance but not threatening its leadership. Estimated data.

What We're Waiting to See

The FCC filing confirms the Ring Pro is real. But several critical questions remain unanswered until the official launch:

Battery Life Verification

Claimed vs actual battery life is different. We need real-world testing in multiple scenarios (active people vs sedentary, sleep tracking depth, background app refresh). Oura delivers on its 10-day claim. Will Ultrahuman?

Algorithm Accuracy

The Hypercise engine and metabolic algorithms sound compelling in marketing materials. But do they actually improve outcomes? Do people actually get better results from Hypercise recommendations than from generic advice? This needs independent testing.

App Quality

This is where most competitor products fall short. The hardware is table stakes. The software is the differentiator. Ultrahuman's app needs to be at least 90% as polished as Oura's, or users will get frustrated with janky interfaces and slow syncing.

Support and Reliability

When something breaks (a ring stops syncing, battery fails early, or software glitches), does Ultrahuman have a support infrastructure? Oura's support is solid. Ultrahuman needs to match it.

Privacy Claims Verification

If Ultrahuman markets itself as "privacy-first," independent security researchers need to verify that claim. Marketing privacy is easy. Actually implementing it is hard. Expect scrutiny.

Market Expansion Timeline

Ultrahuman is India-first. When do they hit Europe, Australia, and North America at scale? Soft launches are fine, but real market penetration requires strong logistics and customer service infrastructure in each region.

The Broader Context: Wearables Fragmenting

The Ultrahuman Ring Pro isn't just about competing with Oura. It's part of a larger pattern in the wearables market: fragmentation around specific use cases.

For years, the wearables market looked like this:

- Fitness focus: Garmin, Fitbit, Apple Watch dominate

- Sleep focus: Oura dominates

- Prestige: Apple Watch dominates

Now it's fracturing:

- Glucose management: Continuous glucose monitor users like Free Style Libre, Dexcom, and consumer devices

- Sleep optimization: Oura, but also WHOOP's niche positioning

- Training load: WHOOP focuses on this relentlessly

- Metabolic health: Ultrahuman is targeting this explicitly

- Fashion/status: Multiple players making luxury smart rings

Ultrahuman is betting that "metabolic health" becomes a major category, the way "fitness tracking" became a category. That's not crazy—metabolic dysfunction affects a huge population, and personalized recommendations around it are genuinely valuable.

If they nail the positioning, they don't need to beat Oura. They need to own "metabolic optimization," and let everyone else fight for "general health."

Recommendations: Should You Wait or Buy Oura Now?

If you've been on the fence about a smart ring, here's my honest take:

Buy Oura Ring 4 NOW if:

- You want a proven product with years of data collection

- You don't specifically care about metabolic depth

- You want the best-designed app in the category

- You want to sync seamlessly with everything (Apple Health, third-party apps, etc.)

- You value research credibility (Oura has studies backing their metrics)

Wait for Ultrahuman Ring Pro if:

- You're obsessed with glucose management and metabolic optimization

- You're willing to be an early adopter of newer technology

- You prefer the metabolic-focused positioning over general health tracking

- You want to see real-world performance and user reviews before committing

- You're price-sensitive (299)

Don't wait if you need a ring now. Both will be good devices. Oura's advantage is established. Ultrahuman's advantage is potential. The best wearable is the one you'll actually wear and use—not the one with theoretically superior specs.

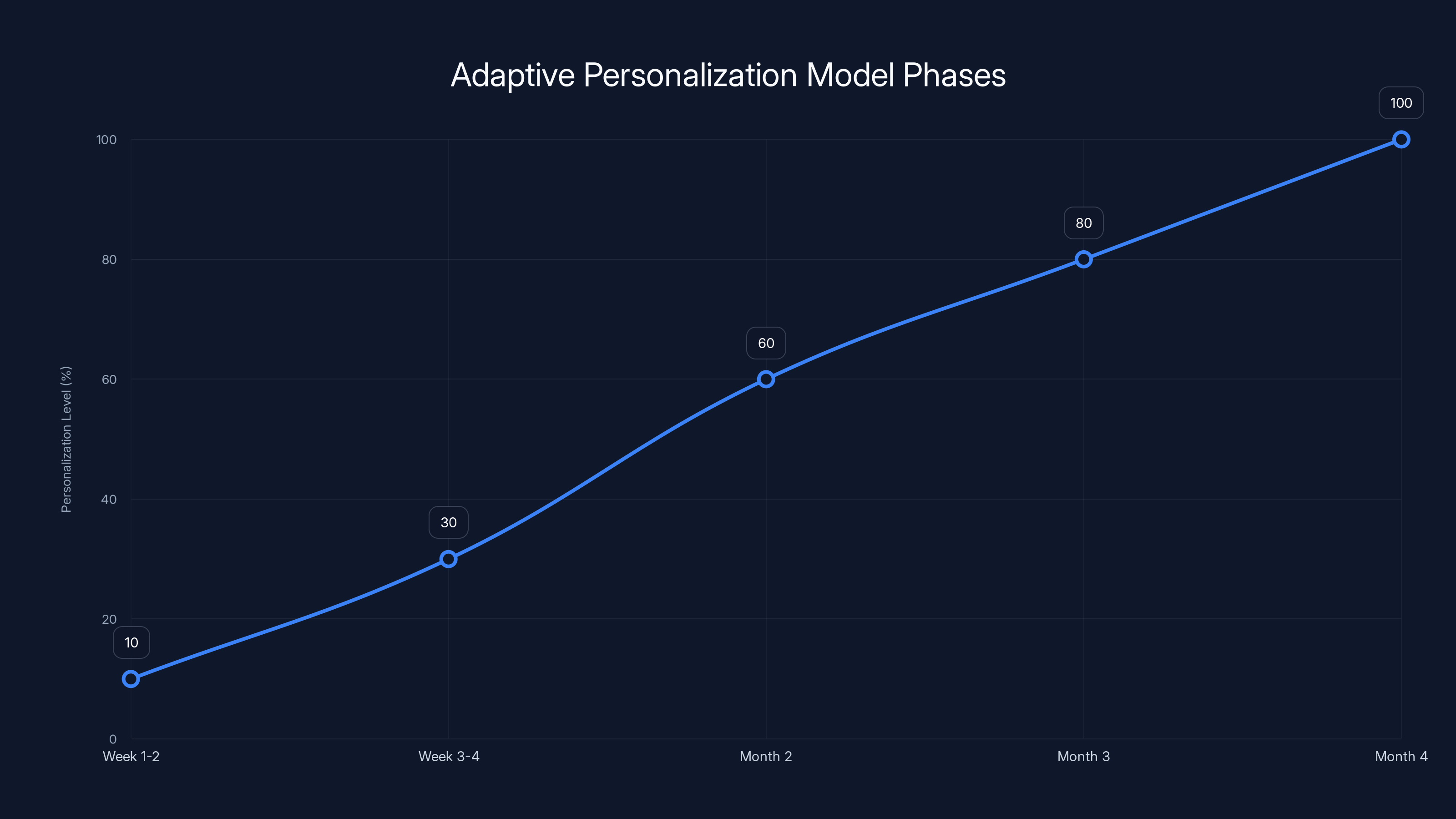

Ultrahuman's AI personalization increases significantly over time, starting with baseline data collection and evolving into predictive modeling. Estimated data.

Global Availability and Rollout Strategy

Ultrahuman's biggest challenge isn't the Ring Pro itself—it's getting it into people's hands globally.

Oura has advantages here. They ship to dozens of countries, have established supply chains, and can handle multi-currency transactions easily. Ultrahuman's M1 band is available globally, but penetration is lower.

Likely rollout strategy:

-

India and Southeast Asia first: Home market advantage, existing infrastructure, known customer base from M1 band

-

Europe second: Higher health-consciousness, strong willingness to pay for optimization, GDPR-friendly positioning appeals to Europeans

-

North America third: Most competitive, highest customer acquisition cost, but biggest total market

-

Australia/NZ and rest of world: Gradual expansion

This isn't lazy—it's smart. Dominate adjacent markets first, build momentum, then attack the fortress.

The risk? Oura uses the time to drop prices, improve their app, or launch Oura Ring 5 with better features. But Ultrahuman's staggered rollout also means less pressure on their support and logistics infrastructure.

The AI/Personalization Edge: A Deeper Look

I want to spend more time here because this is where Ultrahuman genuinely differentiates.

Most wearables use generic algorithms. They measure your heart rate, apply a standardized formula, and show you a number. The number is based on population averages, not your individual biology.

Ultrahuman's approach is different. They're building adaptive personalization models.

Here's how it would work with the Ring Pro:

Week 1-2: You wear the ring. Ultrahuman collects baseline data. The AI learns:

- Your resting heart rate

- Your normal sleep patterns

- Your stress response profile

- Your exercise recovery speed

- Your circadian rhythm

This is the calibration phase. Nothing special happens yet—you're just being measured.

Week 3-4: The algorithms shift into personalization mode. Now Ultrahuman knows your baseline, so they can identify meaningful deviations:

- "Your HRV is 8 points below your personal normal—something's off"

- "Your sleep tonight is 40 minutes shorter than your baseline—recommend recovery focus"

- "Your glucose spiked faster than your typical response to similar meals"

Month 2 onward: Predictive models activate. Instead of reacting to what happened, the AI predicts what will happen:

- "Based on your calendar and current stress load, predict poor sleep the next 3 nights—here's what helps you most"

- "Your workout performance drops when you sleep less than 7 hours and exercise intensity exceeds 75% max HR—upcoming schedule violates this, recommend adjustment"

- "Your circadian rhythm is shifting 20 minutes later this week—recommend gradually shifting meal and sleep timing"

This is the value proposition. Not better sensors (Oura and Ultrahuman have similar hardware quality). Not more data (they both track the same basic metrics). The difference is in the algorithm sophistication and personalization depth.

Oura's advantage is their app presentation and ease of use. Ultrahuman's advantage is their algorithmic depth and prediction capability.

For someone who wants recommendations, Ultrahuman is compelling. For someone who just wants to see their sleep score and ring health, Oura's simplicity wins.

Metabolic Health Market Timing: Why This Matters

Ultrahuman's timing is interesting because metabolic health is becoming a major health category.

For decades, health advice was binary: eat less, move more. But research over the last 5-10 years shows this is overly simplistic. What matters is metabolic health—how efficiently your body processes glucose, responds to stress, recovers from exercise, and maintains circadian alignment.

Why this trend matters for Ring Pro:

The CDC estimates 56% of American adults have metabolic dysfunction. That's not just overweight people—it includes many who look "normal" but have dysregulated glucose, poor circadian rhythm, or abnormal stress response.

For this massive population, generic health advice doesn't work. You need personalized metabolic recommendations.

Oura can report your sleep and readiness. Ultrahuman is positioning to say: "Based on your specific metabolism, here's what will actually work for you."

That's a market timing advantage. Metabolic health education is finally reaching mainstream consciousness. Ultrahuman has positioned themselves as the company that operationalizes it.

Potential Deal-Breakers and Concerns

Let me be the skeptic here. Some things could make the Ring Pro fail:

Software Quality Issues: If the app crashes, syncs slowly, or has bugs, people will bail to Oura. Ultrahuman's M1 app is solid but not flawless. The Ring Pro app needs to be better.

Limited Integration: If Ring Pro only works well with Ultrahuman's ecosystem and doesn't integrate with Apple Health, Google Fit, and major apps, it becomes a data silo. That's a deal-breaker for many users.

Overpromised AI: If Hypercise recommendations are vague, generic, or wrong, the marketing falls apart. "We have better AI" only works if you actually do.

Subscription Fatigue: If the subscription is too expensive or requires unlocking basic features, people will stay with Oura's better value proposition.

Support and QA Issues: Early wearables often have high defect rates. If Ring Pro has reliability issues, word spreads fast and kills adoption.

Market Confusion: If consumers don't understand why they'd choose Ultrahuman over Oura, no amount of specs matter. The marketing narrative has to be crystal clear.

Battery Reality vs Claims: Like many consumer electronics, real-world battery life often underperforms claimed specs. If the Ring Pro gets 5 days instead of 10, that's a failure.

These aren't reasons not to launch—they're execution risks. All new products face them. How well Ultrahuman navigates them determines success.

The Verdict: Real Disruption or Another Competitor?

Let me be direct: Ultrahuman Ring Pro is a credible competitive product. It's not vaporware—the FCC filing proves it exists and is ready to launch.

Will it "beat" Oura? Probably not in total market share. Oura has too much momentum, too established an ecosystem, and too strong a brand.

Will it matter? Absolutely. Here's why:

For consumers: You finally have a choice. Oura's dominance meant they could set prices, move slowly on features, and relax on innovation. Real competition fixes that. Expect Oura to improve faster, possibly lower prices, and definitely add more metabolic features.

For the market: Smart rings are no longer a single-player game. That legitimizes the entire category and attracts more manufacturers, more investment, more innovation.

For Ultrahuman: This is their moment. Execute well, and they become a sustainable, profitable business. Mess it up, and they become a cautionary tale about good ideas with poor execution.

The Ring Pro represents the natural evolution of wearable technology. After years of Oura dominance, we're entering the "choice and competition" phase. That's healthy.

I'd expect to see reviews and real user data by Q3 2025. That's when the true competitive battle gets decided—not on specs, but on actual experience.

FAQ

What is the Ultrahuman Ring Pro?

The Ultrahuman Ring Pro is a smart ring being launched by Ultrahuman, an Indian health tech company. It's designed to track biometric data like heart rate, sleep patterns, temperature, and movement, with a focus on metabolic health optimization. The Ring Pro competes directly with the Oura Ring, offering similar hardware but with Ultrahuman's proprietary AI algorithms for personalized metabolic recommendations.

How did the FCC leak reveal the Ring Pro?

Every wireless device sold in the United States requires Federal Communications Commission approval before launch. The FCC publishes these filings publicly, which includes device specifications, test reports, and photos. Ultrahuman's Ring Pro FCC filing became public, revealing the product's existence and technical details months before the official announcement. This is standard practice in the tech industry—journalists and enthusiasts monitor FCC filings to find unreleased products.

What are the key differences between Ring Pro and Oura Ring 4?

Both devices track similar metrics (heart rate, sleep, temperature, movement), but they emphasize different aspects. The Oura Ring 4 focuses on general health, sleep quality, and readiness scores. The Ultrahuman Ring Pro emphasizes metabolic health, glucose correlation, and personalized coaching through the Hypercise Engine. Oura has a more established app ecosystem and third-party integrations, while Ultrahuman promises more sophisticated AI-driven recommendations. The Ring Pro will likely cost

How does the Hypercise Engine work?

The Hypercise Engine is Ultrahuman's AI system that provides personalized exercise and lifestyle recommendations based on your real-time biometric data. Instead of generic recommendations, it learns your individual metabolism, glucose response patterns, circadian rhythm, and recovery profile. It then recommends specific exercises at specific times, adjusted to your personal biology. For example, instead of "do cardio," it might say "do 20 minutes of zone 2 cardio at 6 PM because your glucose responsiveness is elevated at that time."

What is the expected price of the Ring Pro?

While not officially confirmed, the Ring Pro is expected to be priced between

When will the Ring Pro be available?

Based on the FCC approval timeline, the Ring Pro is expected to launch in Q2 2025, with pre-orders likely opening shortly after the official announcement. Initial availability will probably be in Ultrahuman's core markets (India and Southeast Asia) before expanding to Europe and North America over the following months. Full global availability may take 6-12 months from initial launch.

Is the Ring Pro better than Oura Ring 4?

"Better" depends on your priorities. If you want the most established product with the best app design, strongest third-party integrations, and research credibility, the Oura Ring 4 is the safer choice. If you're specifically interested in metabolic health optimization, personalized AI coaching, and willing to take a chance on newer technology with lower price, the Ring Pro could be better for you. Both will track your health effectively—the difference is in depth of metabolic insights versus general health tracking.

How does the Ring Pro integrate with other apps?

Ultrahuman has confirmed Apple Health and Google Fit integration for the Ring Pro, which allows your health data to sync with thousands of third-party apps. However, deep integrations with specific fitness apps (like Strava, My Fitness Pal, or WHOOP) will likely come after launch. Oura has more established integrations currently, but Ultrahuman will probably add these over time as demand grows.

What is Ultrahuman's company background?

Ultrahuman is a health tech startup founded in 2021, based in India with operations in multiple countries. The company is known for the M1 band, a wearable designed for metabolic health tracking. They've built a user base interested in biohacking, metabolic optimization, and personalized health insights. The Ring Pro represents their expansion into a new form factor while leveraging their core expertise in metabolic health AI and algorithms.

Should I wait for the Ring Pro or buy Oura Ring 4 now?

Buy Oura Ring 4 now if you want a proven product with years of reliability, established ecosystem integration, and proven results. Wait for Ring Pro if you specifically want metabolic health focus, prefer to see real-world reviews before committing, or want to evaluate the $50 price difference. The best wearable is the one you'll actually wear consistently—both are excellent devices, so choose based on your priorities (general health vs metabolic optimization) and comfort with being an early adopter of newer technology.

The Ultrahuman Ring Pro isn't just a new product—it's a signal that the smart ring market is maturing beyond Oura's dominance. Competition is coming. That's good news for consumers, disruptive news for Oura, and validate for Ultrahuman's vision that metabolic health is becoming the next frontier in personalized wellness.

The ring wars are just beginning.

Key Takeaways

- FCC filing confirms Ultrahuman Ring Pro is a real product launching Q2 2025, not vaporware

- Metabolic health focus differentiates Ring Pro from Oura's general health approach, targeting a growing market segment

- Expected 299, though subscriptions may offset hardware savings

- Smart ring market growing 87% annually—timing enables Ultrahuman to capture 15-25% share rather than compete head-to-head

- AI-powered Hypercise Engine for personalized exercise recommendations is the real differentiator, pending execution quality

Related Articles

- Wearable Technology & Health Tech: A Senior Reviewer's Complete Guide [2025]

- Best Fitbit Fitness Trackers & Smartwatches [2026]

- RingConn Gen 2 Smart Ring: Best Oura Alternative at Lowest Price [2025]

- Samsung Fitness Trackers: Best Deals & Models for 2025

- Apple Watch Series 11: Complete Guide, Features & Best Deals [2025]

- Running Watch vs Smartphone: Which Is Better for Runners [2025]

![Ultrahuman Ring Pro: The Oura-Killer Wearable [2025]](https://tryrunable.com/blog/ultrahuman-ring-pro-the-oura-killer-wearable-2025/image-1-1771241906187.jpg)