Why Garmin Watches Cost More Than You Think: A Behind-the-Scenes Look at Extreme Testing [2025]

You're scrolling through smartwatch options. Garmin catches your eye. Then you see the price tag. Six hundred, seven hundred, sometimes over a thousand dollars for what looks like a regular watch. Your first thought? That's insane.

But here's the thing—I got to visit Garmin's headquarters in Kansas, the place they don't usually let journalists into, and I came away understanding exactly why their watches cost what they do. It's not marketing. It's not brand premium. It's engineering that most companies won't bother with.

Garmin doesn't just build smartwatches. They build instruments that work in places where regular devices would fail catastrophically. Deep-sea diving. Arctic expeditions. Combat zones. The kind of environments where your watch either saves your life or gets you killed. That's not hyperbole—it's literally why their testing is so brutal.

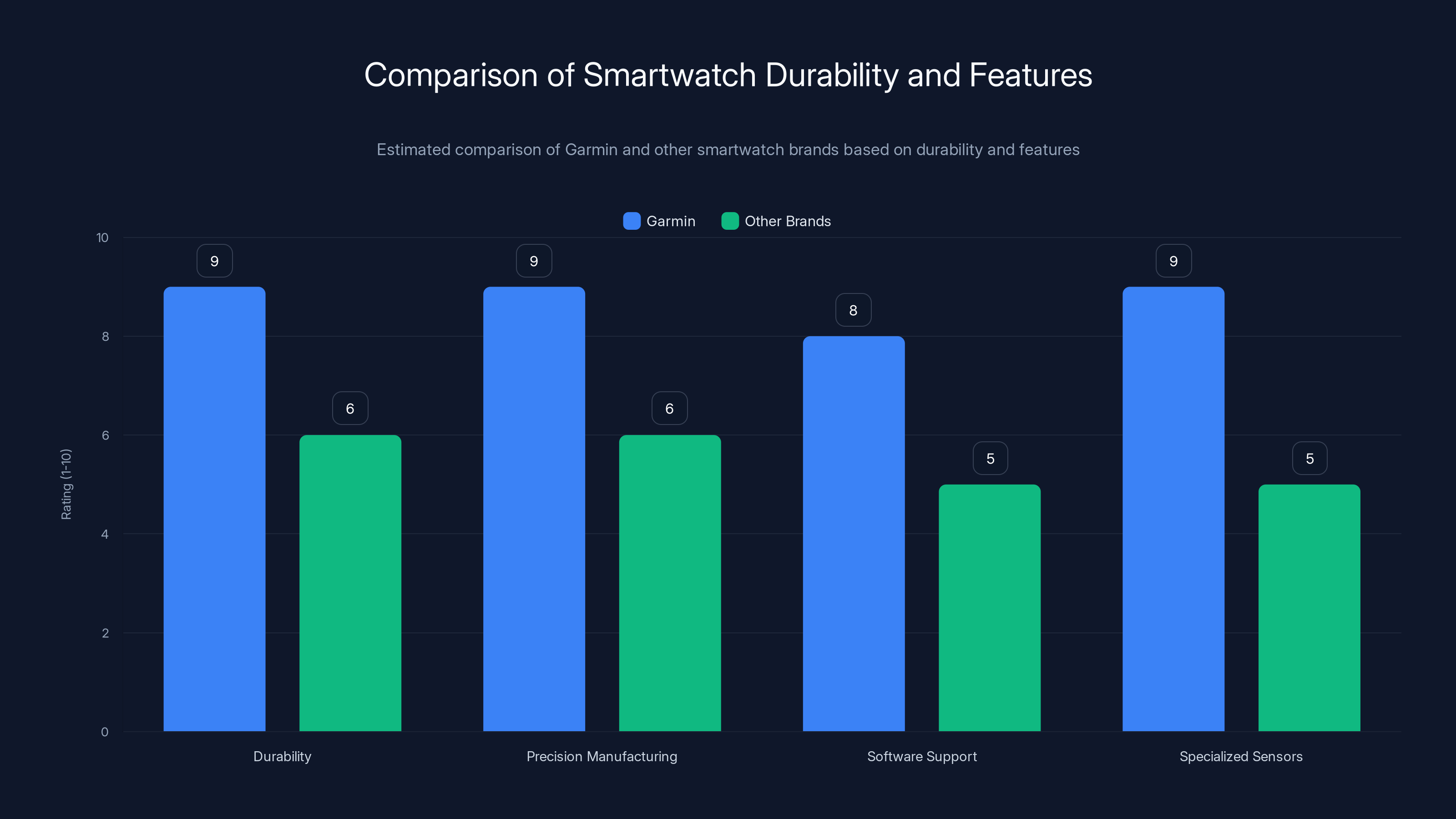

The company spends more on durability testing than most competitors spend on their entire product line. They intentionally destroy watches to make sure the ones that survive are bulletproof. They test in salt water, freshwater, mud, sand, extreme temperatures, and vacuum chambers. They drop them from heights. They pressure them to depths that would crush human bodies. They expose them to radiation, chemicals, and electromagnetic fields.

Somewhere along the way, I realized that the expensive price tag isn't the problem. It's actually the understatement.

The Brutal Reality of Military-Grade Durability Testing

When you walk into Garmin's testing facilities in Kansas, the first thing you notice isn't the fancy equipment. It's the graveyard.

Thousands of watches. Destroyed. Broken. Shattered. Corroded. Some cut in half to examine internal damage. Others blackened by heat or warped beyond recognition. This isn't a failure display—it's the success criterion. Every destroyed watch taught them something critical. Every failure prevented thousands from happening in the field.

The testing protocols are insane. A typical smartwatch might undergo a few days of durability testing. Garmin's watches undergo months. Some individual test sequences last weeks without stopping. We're talking about drop tests from 10 meters onto concrete. Saltwater immersion for 30 days at a time. Thermal cycling where the watch goes from minus 40 degrees Celsius to plus 70 degrees, repeatedly, day after day.

One engineer showed me a watch that had been through the salt-fog chamber—a machine that sprays corrosive saltwater mist continuously to simulate years of coastal exposure in weeks. The watch had been in there for two months. When they pulled it out, the case showed some patina, but the internals? Completely protected. The gaskets held. The sealants worked. No corrosion on the circuitry.

That's not luck. That's obsession.

Garmin tests the glass separately from the case. They test the buttons. They test the bands. They test the charging port—the part that usually dies first on smart devices. They stress-test the battery connector. They verify that after 500 charge cycles, the contact points haven't degraded. Most companies test to 100 cycles and call it good.

The price premium starts making sense when you realize what you're actually paying for. You're not paying for features. You're paying for the certainty that this watch will work when it matters most. A

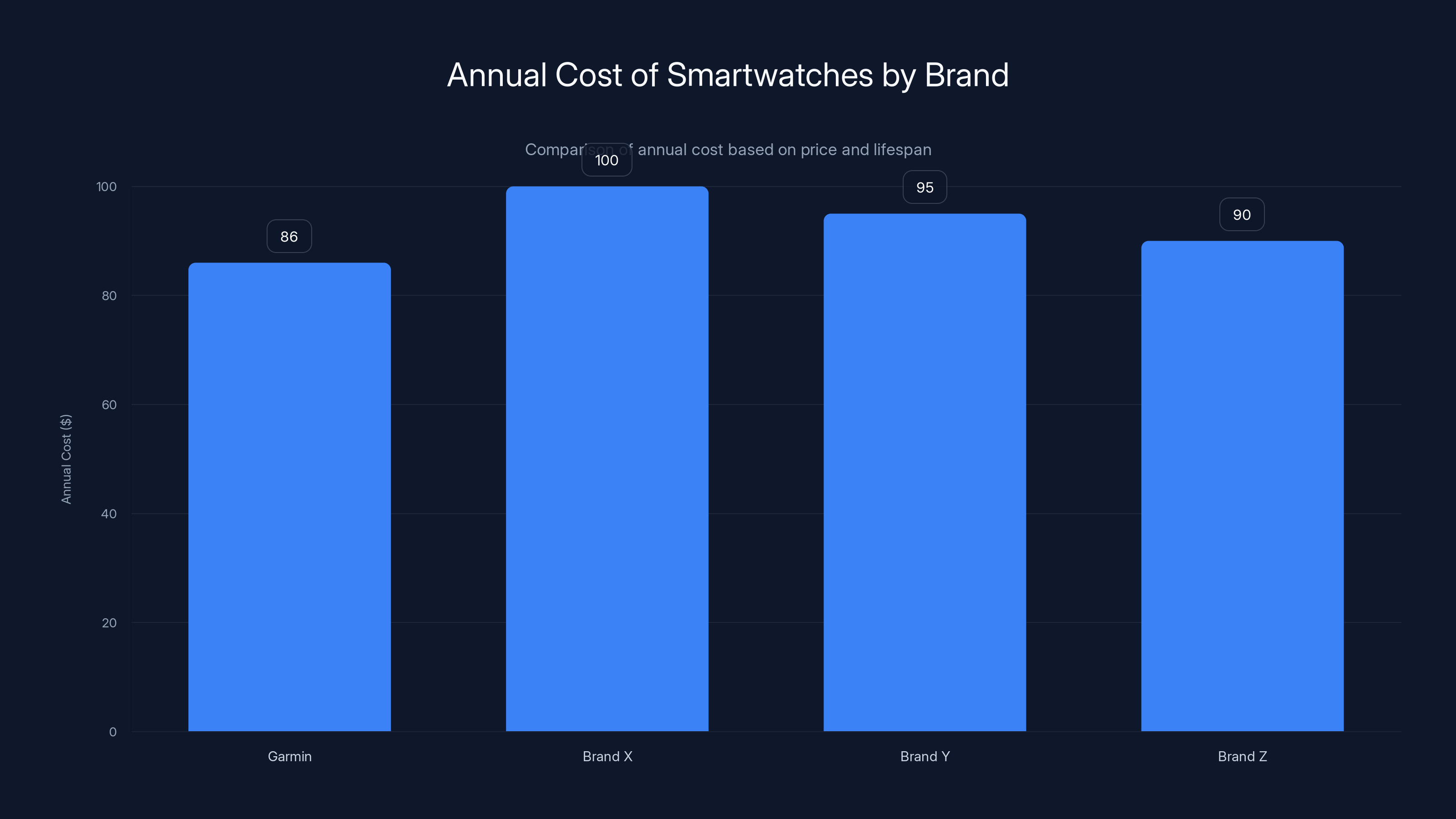

Garmin offers a lower annual cost due to longer lifespan and consistent updates, making it a cost-effective option despite higher initial pricing. Estimated data based on typical market offerings.

The Aerospace-Level Manufacturing Standards

Inside the manufacturing facility, I watched technicians work with tolerances that made me realize we're not talking about a consumer electronics company. We're talking about aerospace-level precision.

Each component undergoes individual inspection. Not sampling. Not random quality checks. Individual units are tested before assembly. The gaskets that seal the watch? They're verified with ultrasonic testing to detect even microscopic flaws. The sapphire crystal covering the display? Each one is inspected under magnification for imperfections that would be invisible to the human eye.

The assembly process itself is partially automated, but the critical connections are done by trained technicians using custom-built jigs and fixtures that ensure perfect alignment every single time. One engineer explained that they've refined the assembly process to the point where variation between units is measured in microns—thousandths of a millimeter.

The circuit boards undergo automated optical inspection before, during, and after soldering. Any defect that would pass through a typical quality check gets caught here. Solder joints are visually inspected under magnification. The potting compound that protects the electronics is applied with precision—too little and you get moisture infiltration, too much and you risk mechanical stress on the components.

Compare this to the typical consumer smartwatch manufacturing process. Most brands assemble in batches and test the finished product. If a certain percentage fails testing, they adjust the yield. Garmin builds to a higher standard from the component level up.

This approach costs more money per unit. It requires more expensive equipment, more skilled labor, more time per watch. But it produces a reliability rate that justifies the premium. And that reliability is what you're actually paying for when you buy a Garmin watch.

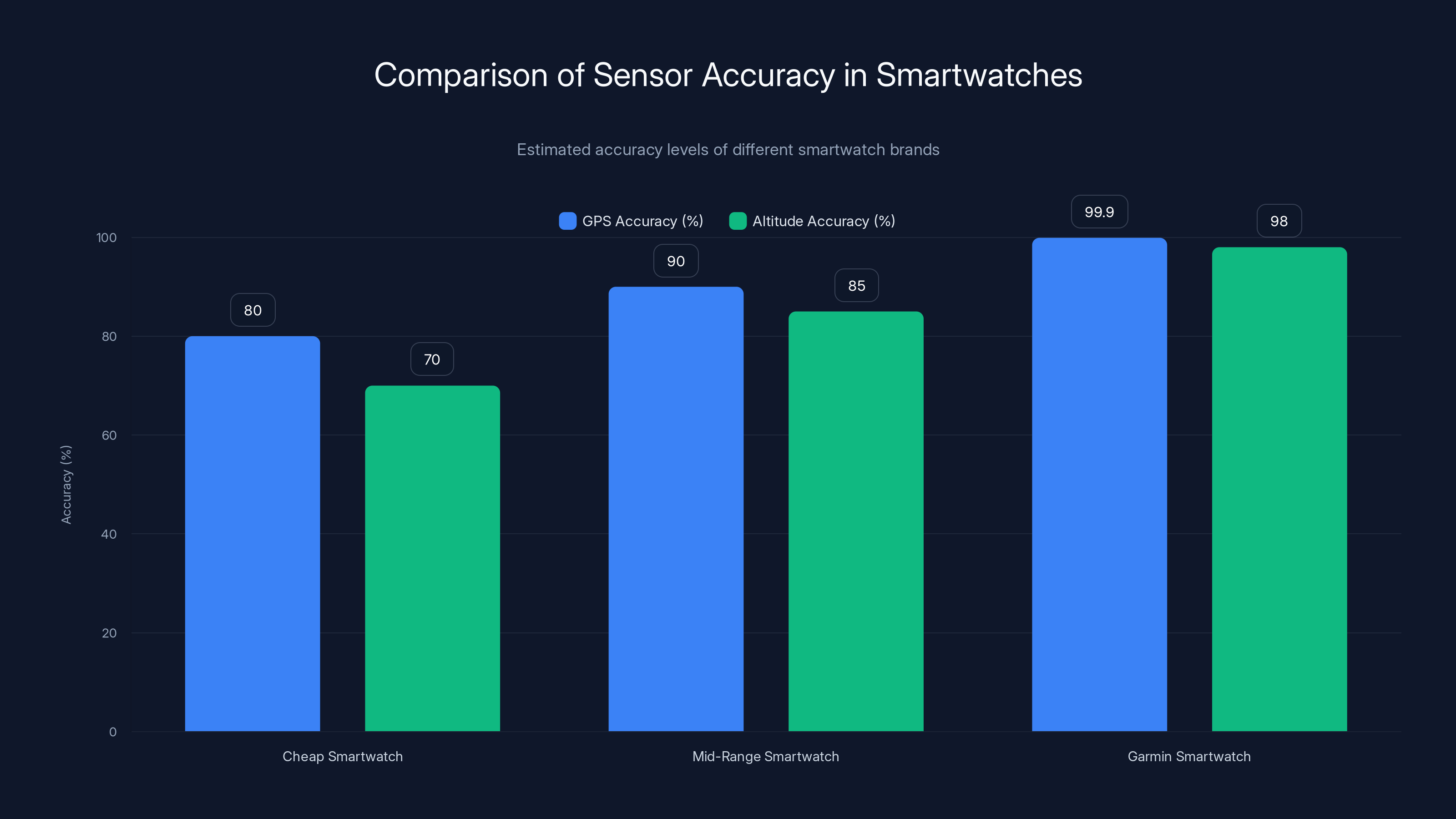

Garmin smartwatches offer superior sensor accuracy, with GPS and altitude accuracy levels significantly higher than cheaper alternatives. Estimated data.

Why Batteries Matter More Than Features

Every smartwatch company claims great battery life. Garmin achieves it through engineering that most competitors won't invest in.

The battery itself is just part of the equation. What matters is power management at every level of the system. Garmin's devices use specialized processors that consume significantly less power than standard smartphone chips. The displays use e-ink technology—passive screens that don't consume power to maintain an image, only to change it. This fundamentally changes the battery math.

But even with efficient components, the real difference is in the software and firmware. Garmin's watches are optimized at a level that most companies never achieve. Every sensor interaction is carefully orchestrated to minimize power draw. The watch doesn't just turn off unused features—it intelligently manages the power state of individual components.

GPS, for example, is a notorious battery killer. Most smartwatches do GPS checks constantly, draining the battery quickly. Garmin's watches can run GPS-based navigation for 20+ hours on a charge because they've engineered smarter acquisition algorithms. The GPS chip turns on less frequently, but stays on longer once activated because it knows how to search efficiently.

Heart rate monitoring is another area where optimization matters. Cheaper watches do constant sampling. Garmin's watches predict when the next useful sample would be and time the monitoring accordingly. This requires more sophisticated algorithms but yields massive battery savings.

The result? A Garmin Epix running a combination of smartwatch functions and GPS navigation can go 11 days on a single charge. Most competitors can't touch half that.

Is that worth the premium? Try going on a week-long hiking trip and realize you don't need to carry a charger. That's when the value becomes obvious.

The Sensor Accuracy That Costs Real Money

Here's something most people don't understand: smartwatch sensors are cheap. A basic accelerometer costs pennies. A basic GPS chip is under

Because bad data is worse than no data.

If your watch tells you that you've run five miles when you actually ran four miles, that's frustrating. But if you're relying on that watch for navigation in the backcountry and the GPS is off by 50 meters, that's potentially life-threatening. If your altitude reading is wrong and you're climbing a mountain in bad weather, wrong elevation data could send you into a dangerous area.

Garmin doesn't just throw sensors into a watch. They calibrate them. They use sensor fusion—combining multiple sources of data to verify accuracy. If GPS, barometric altitude, and accelerometer data conflict, the algorithms figure out which source is corrupted and discard it. They cross-reference everything.

The GPS receivers in Garmin watches are commercial-grade units that cost significantly more than the garbage in cheap smartwatches. They have multiple frequency bands. They support multiple satellite systems: GPS, GLONASS, Galileo, and others. Having multiple systems means your watch can calculate position even if one system is degraded. This is the difference between navigation that works 95% of the time and navigation that works 99.9% of the time.

Altitude sensors in Garmin watches use high-resolution barometric sensors calibrated to detect pressure changes of less than a pascal—a unit of pressure so small that most people have never encountered it in their lives. This allows accurate elevation tracking without constant GPS verification.

The cost difference for this level of sensor accuracy is substantial. But for users who depend on accurate data—trail runners, mountaineers, endurance athletes—this premium isn't luxury. It's necessity.

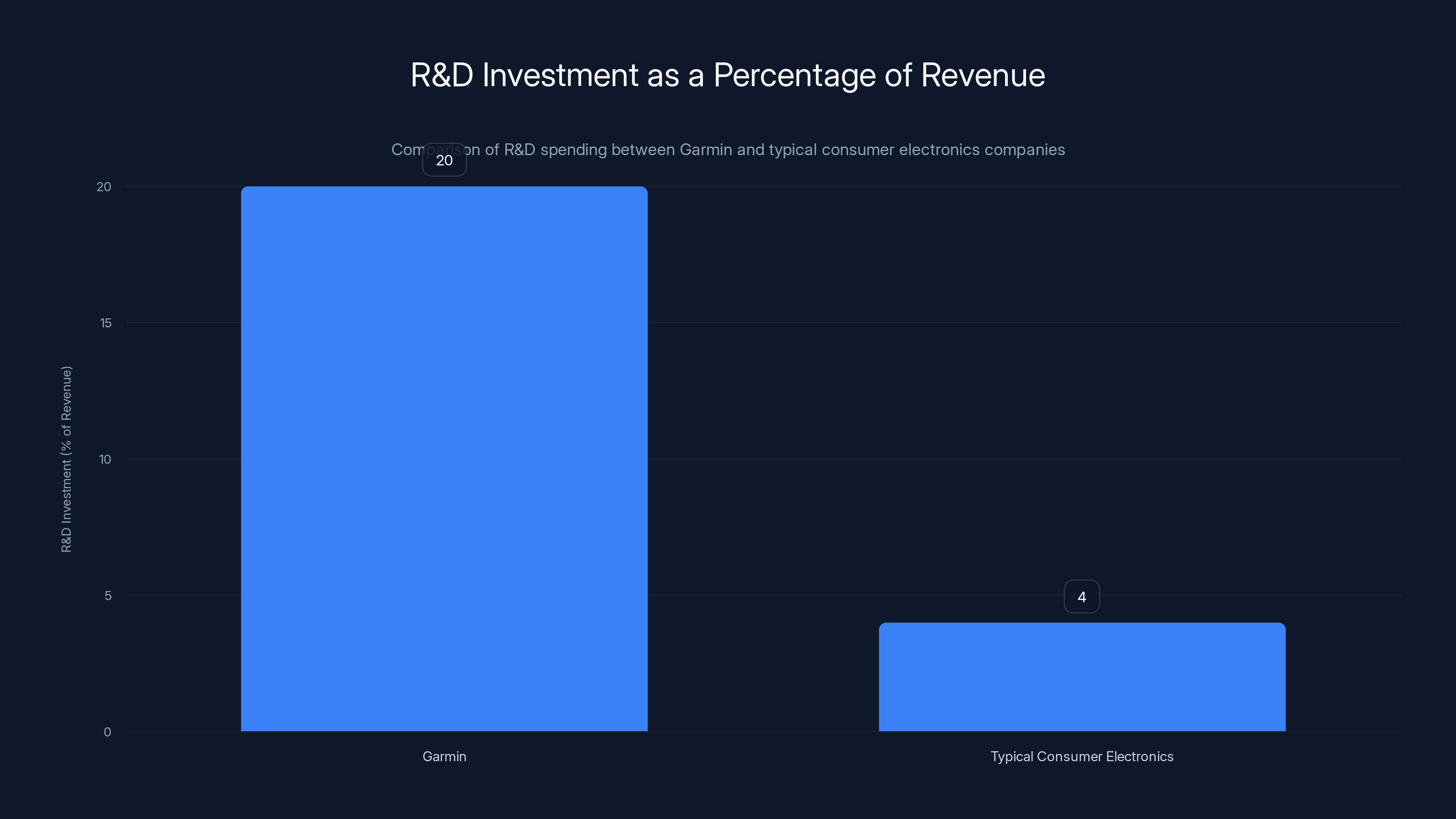

Garmin invests significantly more in R&D compared to typical consumer electronics companies, with over 20% of revenue allocated to research, compared to the industry average of 3-5%.

The Software Stack That Justifies the Price

Hardware gets the attention, but software is what transforms hardware into a functional product. Garmin's software development investment dwarfs what you'd expect from looking at the user interface.

The operating system running inside a Garmin watch is built from scratch, not licensed from an external vendor. This gives Garmin total control over power consumption, responsiveness, and reliability. Every line of code is written with the assumption that power matters more than flashy animations.

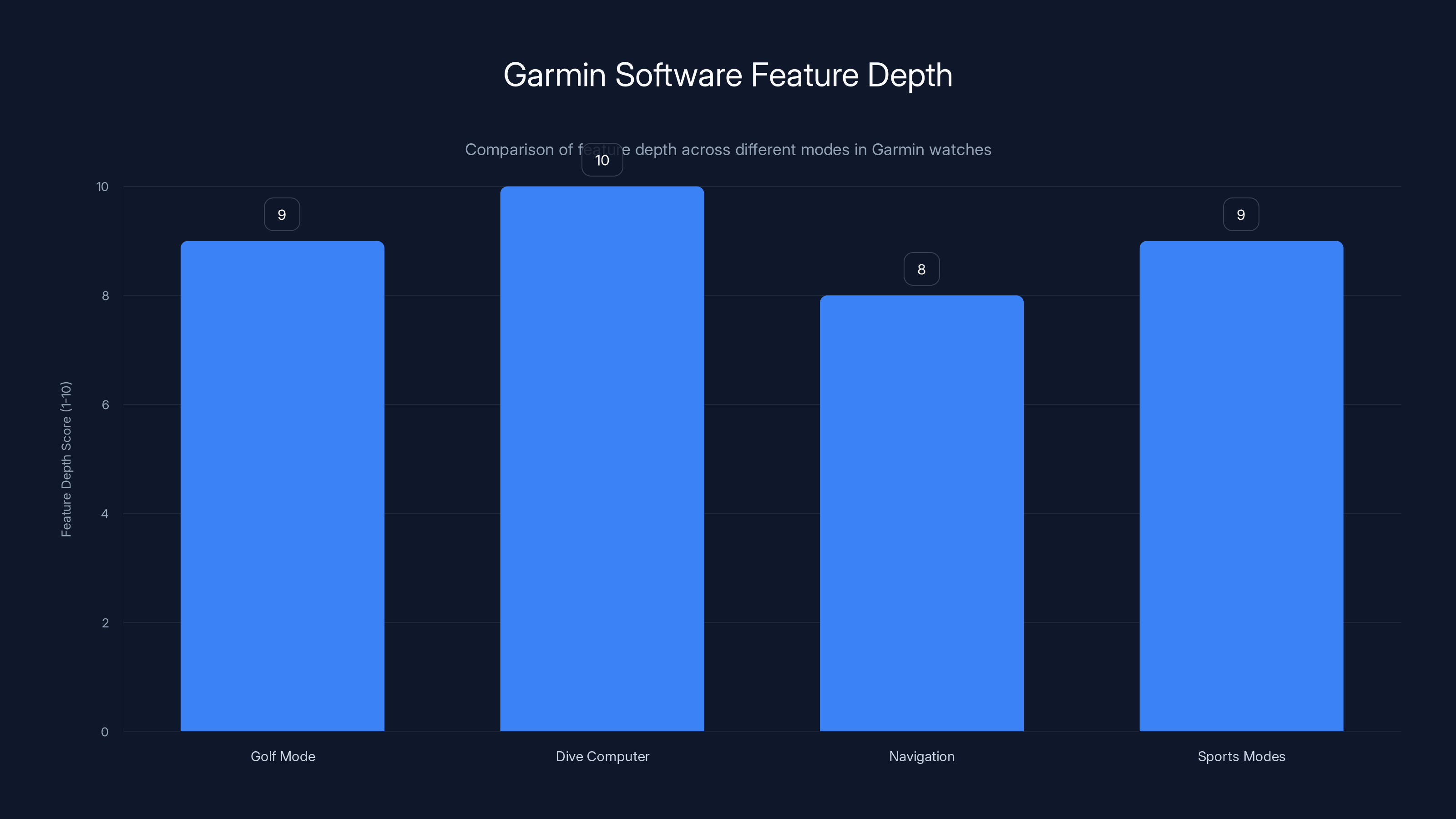

The apps available on Garmin watches go deep. Not the shallow "check your email" integration of other platforms. We're talking about full-featured navigation applications, dive computers, golf course mapping, ski slope tracking, and specialized sports modes for over 100 different activities. Each mode is specifically optimized for its use case.

Take golf mode. A Garmin golf watch doesn't just show you the yardage. It tracks every shot, analyzes your swing patterns, maps hazards on the course, and stores historical data about your performance on specific holes. Over time, the watch learns your tendencies and can predict what club you might need based on past performance.

Dive computer mode is even more sophisticated. The watch tracks depth, time, nitrogen loading, and automatically calculates decompression requirements. Get this wrong and a diver can get the bends. Garmin's dive computer software has been battle-tested by thousands of professional divers in conditions where failure isn't an option.

The navigation engine handles turn-by-turn directions on a tiny screen without becoming confusing. The routing algorithms are sophisticated enough to understand that different sports have different routing priorities. A running route needs to avoid highways. A cycling route can use them. A hiking route should minimize steep sections if possible but can handle them if necessary.

This level of software sophistication costs massive development resources. Garmin has hundreds of developers working on watch software alone. That's not cheap. And that cost gets reflected in the final product price.

Materials Science and the Hunt for Durability

Most smartwatches use commodity materials because they're cheap and good enough. Garmin researches materials like they're developing equipment for space missions.

The cases can be titanium, which is more expensive and harder to machine than stainless steel, but lighter and more resistant to corrosion. Or composite materials that are even more specialized. Garmin doesn't choose materials based on cost. They choose based on application requirements.

For watches designed for extreme water sports, they use specific titanium alloys that have been tested to withstand crushing pressure at depth. For watches meant for construction workers, they use materials that resist impacts and abrasion. For watches meant for desert environments, they use coatings that resist sand damage and UV degradation.

The display technology varies by use case. Devices designed for bright outdoor use get always-on displays that are readable in direct sunlight. Devices for night activities use transflective technology that still works in darkness. This requires different material choices and different manufacturing processes.

The bands aren't just rubber. Garmin tests different elastomer compounds for durability, resistance to sweat, and long-term flexibility. Cheap bands get stiff and crack after a year or two. Garmin bands are still flexible after five years of daily wear.

The charging port is where cheap watches usually fail first. Moisture gets in, corrosion starts, and suddenly the watch won't charge. Garmin's solution is proprietary contact design with specific metal alloys and coatings that resist oxidation. The connector is sealed in a way that prevents liquid entry even when submerged.

Every material choice reflects research and testing. Every material choice costs money. But the result is a watch that survives conditions where normal devices would fail within months.

Garmin watches score higher in durability, precision manufacturing, software support, and specialized sensors compared to other brands. Estimated data based on typical industry standards.

The Warranty and Support Cost Structure

When you buy a Garmin watch, you're not just buying the hardware. You're buying into a support structure that most companies won't offer.

Garmin's warranty coverage is more generous than industry standard. More importantly, they actually honor it. If your watch breaks within the warranty period—for almost any reason—they'll replace it or repair it without much hassle. This isn't cheap from a business perspective. It requires maintaining a repair facility, training technicians, stocking replacement parts, and eating the cost of defects.

The cost structure reflects this. A company that plans for 3% warranty claims has radically different economics than a company that plans for 0.5% warranty claims. Garmin's low failure rate means their warranty costs are reasonable even though they're generous.

Beyond warranty, Garmin maintains support for devices for years after release. Software updates continue rolling out. New features get added. Bugs get fixed. The company treats watches released five years ago as products still worth supporting. Most competitors drop support after 12-18 months.

This long-term support model costs money. But it also explains why a Garmin watch maintains value longer than competitors' devices. An old Garmin isn't obsolete because it still receives updates. An old Apple Watch is already getting phased out of the ecosystem.

There's also the community aspect. Garmin maintains forums, documentation, and training resources. You can get support through the website, through community forums, or through authorized retailers. This customer service infrastructure costs money to maintain.

The Research and Development Investment

Garmin spends an enormous percentage of revenue on research and development. More than 20% of revenue goes into R&D. For comparison, most consumer electronics companies spend 3-5%.

That money goes toward exploring new sensor technologies, developing new algorithms, improving manufacturing processes, and pushing into adjacent markets. Some of that R&D ultimately fails—projects get canceled because they don't pan out. That failure cost still gets amortized across the successful products.

Garmin invests heavily in GPS technology research even though they could just buy GPS chips from suppliers. They invest because they want to understand the technology deeply enough to optimize it beyond what standard implementations offer. They research battery chemistry and optimization techniques. They study material science. They explore new display technologies.

This investment mindset explains why Garmin watches sometimes have features or capabilities that seem impossible for the price. They achieved that through years of research and optimization that competitors haven't matched.

The research also flows backward to inform manufacturing decisions. Process improvements discovered through R&D get implemented in the factory. Engineering solutions developed for new products sometimes get retrofitted to improve older models.

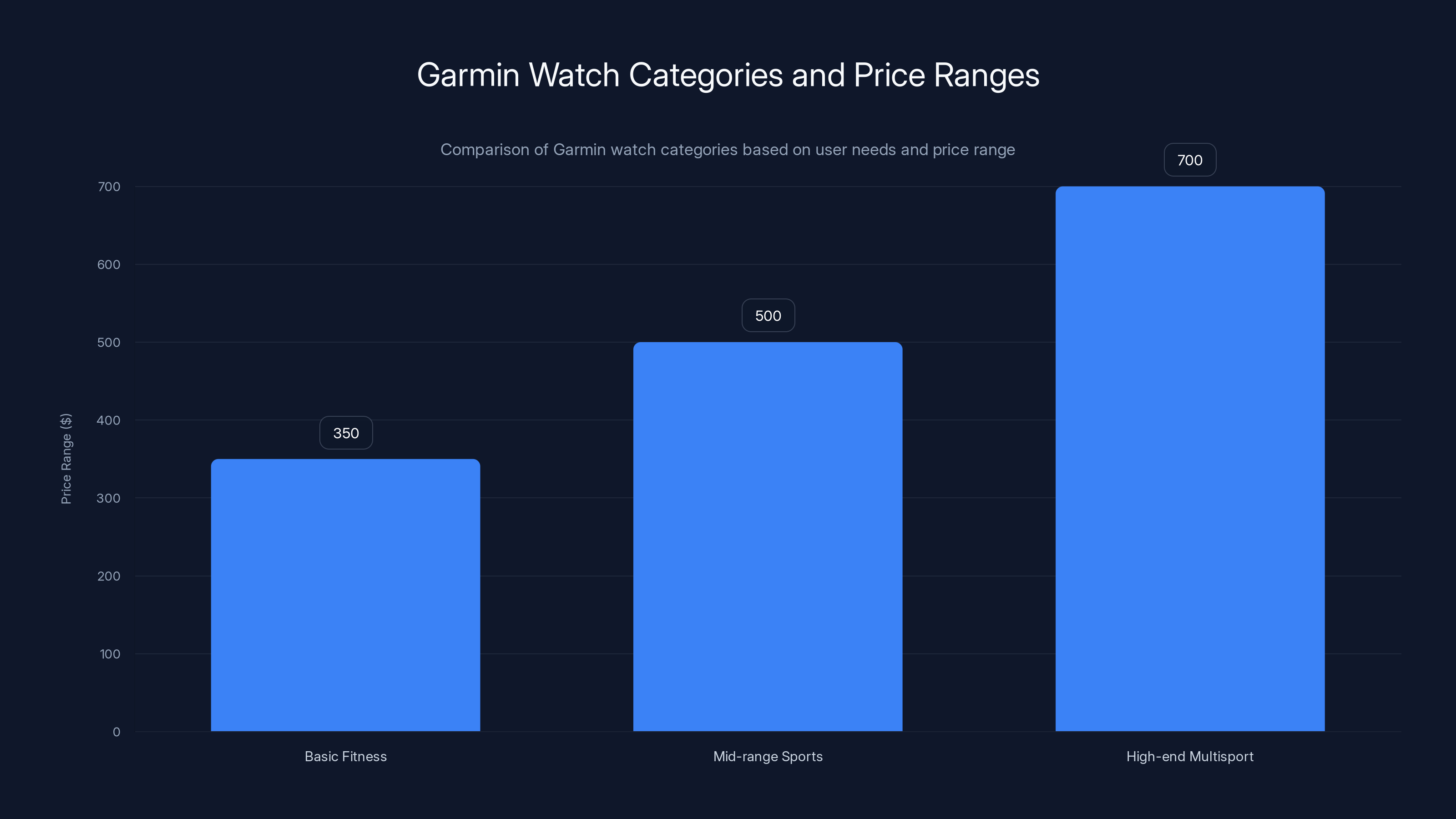

Garmin watches are priced according to their specialized features and user needs, ranging from

The Supply Chain Complexity That Adds Cost

Building a smartwatch seems simple until you realize the supply chain nightmare involved.

Garmin doesn't manufacture most of the components inside their watches. They source from specialists. But unlike companies that accept whatever components suppliers want to sell them, Garmin specifies exactly what they want and works with suppliers to achieve it.

The display panels are custom orders optimized for specific performance criteria. The processors are often semi-custom chips. The sensors are sourced from multiple suppliers for redundancy and to ensure quality consistency. The potting materials are formulated specifically for Garmin applications.

This approach costs more than just buying standard components. But it gives Garmin control over quality that other companies can't achieve. When something goes wrong, Garmin can trace it back to a specific supplier and work with them to fix it. This responsiveness matters when reliability is the core value proposition.

The supply chain also reflects sustainability considerations. Garmin sources from suppliers who meet their environmental and labor standards. That costs more money than sourcing from the cheapest possible supplier in a country with minimal regulations.

The logistics of getting components, assembling watches, testing them, and shipping them to distribution centers across the globe adds complexity. Unlike phone manufacturers that ship millions of units and spread logistics costs across huge volumes, smartwatch manufacturers deal with smaller numbers. Garmin's logistics costs per unit are higher than a phone manufacturer's would be.

Why the Price Won't Come Down

Here's the uncomfortable truth: Garmin's watches probably won't get significantly cheaper, and that's not a problem.

The price is a function of deliberate choices about durability, reliability, and support. Lowering the price would require compromising one of those factors. Garmin could use cheaper materials. Could skip some testing. Could reduce the software development investment. Could shorten the support timeline. All of that would bring the price down.

But it would also reduce the core value proposition. The reason someone buys a Garmin watch instead of a competitor's device is because they believe it will last longer, work more reliably, and be supported for years. If Garmin competed on price, they'd have to sacrifice those differentiators.

This is actually a smart business strategy. Garmin has positioned itself in the premium segment where price matters less than value. They're not trying to be the cheapest. They're trying to be the best. And they're willing to charge what that actually costs.

The market validates this approach. Garmin's market share in certain segments—particularly in sports watches and adventure watches—is enormous despite higher prices. People buy them because they trust the durability and reliability.

Garmin's software excels in feature depth, particularly in dive computer mode, which scores a perfect 10 due to its critical safety features. (Estimated data)

The Competitive Landscape and How Garmin Differentiates

Garmin isn't the only smartwatch manufacturer. Apple, Samsung, Fitbit, and others compete in the space. So why do customers choose Garmin despite higher prices?

The answer is specialization. Garmin isn't trying to be everything to everyone. Their watches aren't the best for checking email or reading messages. Their interfaces aren't as flashy as Apple's. Their smartwatch ecosystem isn't as integrated with a phone OS.

What they excel at is being the best tool for active people who actually use their watches for navigation, fitness tracking, and data collection. A runner doesn't care about email notifications. They care about accurate pace tracking. A mountaineer doesn't care about app variety. They care about accurate altitude and reliable navigation. A diver doesn't care about integration with their phone. They care about accurate depth tracking and reliable decompression calculation.

Garmin's watches are optimized for these use cases. And that optimization costs money. But for the people who actually need it, it's worth every penny.

Apple Watch excels at being a second screen for your iPhone. It's slick, it's integrated, it's easy to use. But it's not built for the same purposes as a Garmin watch. If you're serious about running, cycling, or diving, you'll eventually recognize that the Apple Watch is a compromise that doesn't quite work for your needs.

This positioning allows Garmin to maintain premium pricing without competing directly with other manufacturers on the same basis. They're not competing for the general consumer market. They're competing to be the best choice for athletes and adventurers who take their equipment seriously.

The Real Cost of Planned Obsolescence (That Garmin Avoids)

Most consumer electronics operate on a planned obsolescence model. Devices are designed to fail or become unsupported after 3-5 years. This drives repeat purchases and keeps revenue flowing.

Garmin doesn't follow this model. Watches released 10 years ago still receive occasional software updates. The hardware doesn't degrade prematurely. The battery can be replaced. The band can be replaced. The watch can be repaired instead of discarded.

This approach seems bad for business—if people keep their watches for 10 years instead of buying a new one every 3 years, revenue shrinks. But it's actually a powerful competitive advantage.

First, it builds customer loyalty. If you own a Garmin watch that you've used for five years and it's still being supported and receiving updates, you're going to buy another Garmin watch. You've already invested in the ecosystem. You trust the product. Repeat customers are more valuable than new customers because they require less marketing spend.

Second, it builds brand reputation. Word-of-mouth is powerful. When your watch from five years ago is still working perfectly and still being updated, you tell people about it. That reputation attracts new customers despite higher prices.

Third, it reduces the pressure to innovate constantly. Garmin can take a long-term view of development. They don't need a revolutionary new feature every year to get people to upgrade. They can focus on refinement and optimization over time.

The avoided planned obsolescence is part of what justifies the premium price. You're not just paying for the hardware and software. You're paying for a product philosophy that respects your investment and keeps working for years.

The Real World: What Happens When a Garmin Fails

I asked the engineers what happens when a Garmin watch actually breaks. The answer is revealing.

First, failure is rare. Garmin's return rate for defective products is less than 1%. That's industry-leading. But when failures do happen, the company has procedures to learn from them.

Every failed watch that comes back gets analyzed. The failure is classified. The root cause is investigated. If it's a manufacturing defect, the production line gets adjusted. If it's a design issue, engineering documents it and considers whether to address it in future versions. If it's component failure from a supplier, that supplier relationship gets reviewed.

This failure analysis culture costs money. It requires trained technicians to disassemble failed products and investigate causes. It requires documentation and communication between the field and the factory. Most companies skip this step and just replace the defective unit.

Garmin doesn't. Every failure is a data point that informs future improvements. This discipline means that the same defect doesn't happen twice. The failure rate goes down over time. Reliability improves with each generation.

This is part of the hidden cost of premium quality. It's not just the expensive components or the meticulous manufacturing. It's the continuous feedback loop that means the next generation will be even better.

Rethinking Value in the Smartwatch Market

After visiting Garmin's facilities and understanding what goes into their products, I came away with a different perspective on pricing.

We live in a market where the cheapest option is usually considered the best deal. But that calculation ignores durability, reliability, and longevity. It ignores the cost of replacing a watch every two years. It ignores the frustration of features that don't work when you actually need them.

A

Beyond the math, there's the reliability factor. If you're relying on your watch for navigation, fitness tracking, or health monitoring, you need to know it will work when it matters. You can't afford failures. You can't afford inaccuracy. You can't afford a device that becomes unsupported when you still need it.

This is why Garmin maintains premium pricing. They're not charging for features. They're charging for reliability. They're charging for durability. They're charging for the certainty that your investment will continue working for years.

Once you understand that, the price premium stops feeling like an overcharge and starts feeling like a reasonable cost for actual quality.

The Future: Where Garmin is Heading

The testing labs aren't just focused on today's watches. They're testing the future.

Garmin is investing in new sensor technologies that will provide even more accurate data. They're exploring advanced battery chemistries that could extend battery life even further. They're researching new materials that are lighter, stronger, and more durable.

They're also expanding into new markets. Health monitoring. Mental health tracking. Advanced biometric measurement. All of these require the same investment in testing and reliability that has defined Garmin so far.

The price of future Garmin watches probably won't drop. They'll maintain the premium positioning. But what you get for that premium will keep improving. Better sensors. Better battery life. Better software. Better durability. The expensive development process will produce better products over time.

This is the opposite of the typical consumer electronics industry where products get cheaper and worse. Garmin is proving that you can build premium products, charge premium prices, and actually deliver value that justifies the cost. It's not easy. It requires obsessive attention to detail, massive R&D investment, and a willingness to say no to shortcuts.

But the watches in those testing labs, getting destroyed repeatedly to ensure reliability, are proof that it works. The people wearing Garmin watches in the real world—mountaineers, divers, ultramarathon runners—understand this intuitively. They're not paying for a fashion statement. They're investing in reliability they can trust with their lives.

TL; DR

- Durability testing is extreme: Garmin intentionally destroys watches through months of salt water, thermal cycling, pressure testing, and impact testing to ensure reliability before devices reach consumers.

- Manufacturing precision rivals aerospace standards: Components undergo individual inspection, assembly happens with micron-level tolerances, and quality checks occur before, during, and after every production step.

- Long-term software support costs real money: Garmin continues updating watches for 5+ years after release, while competitors drop support after 12-18 months, requiring ongoing development investment.

- Sensor accuracy is specialized and expensive: Multi-system GPS, high-resolution barometric sensors, and fusion algorithms provide accuracy that matters for navigation and health monitoring in critical situations.

- The cost-per-year math favors premium watches: A 86/year) often beats a100/year) when you factor in lifespan and support.

- Bottom Line: Garmin's premium pricing reflects genuine engineering investment, not brand inflation. The expensive development process produces watches that outlast and outperform competitors by measurable margins.

FAQ

Why are Garmin watches so expensive compared to other smartwatches?

Garmin watches cost more because the company invests extensively in durability testing, precision manufacturing, long-term software support, and specialized sensors that most competitors skip. A Garmin watch undergoes months of testing designed to intentionally find and prevent failures. The manufacturing uses aerospace-level tolerances. The software receives updates for years after release. These investments cost significantly more money per unit than competitors spend, and Garmin passes that cost to consumers in the form of higher prices.

What testing do Garmin watches actually go through?

Garmin watches undergo extreme testing including saltwater immersion for 30+ days, thermal cycling between minus 40 and plus 70 degrees Celsius repeated 50 times, pressure testing to simulate deep-water conditions, drop tests from 10 meters onto concrete, radiation exposure, chemical exposure, and electromagnetic field testing. Individual components like gaskets, buttons, charging ports, and solder joints are tested separately before assembly. This testing regime lasts months for each watch model and sometimes longer.

Is a Garmin watch worth the premium price?

For the intended users—athletes, adventurers, and people who depend on reliable navigation or health monitoring—Garmin watches typically justify their premium through longer lifespan, better durability, more accurate sensors, and longer software support. When you calculate total cost of ownership over 5-7 years and account for replacement cycles, a premium Garmin often costs less per year than cheaper alternatives. For casual users who don't need the specialized features, cheaper alternatives might provide adequate value.

How long do Garmin watches typically last?

Garmin watches are designed to last 7-10 years with normal use, and many continue operating well beyond that timeframe. Unlike competitors' devices that become obsolete after 3-5 years when software support ends, Garmin watches receive updates throughout their lifespan. The hardware durability and repairability (batteries and bands can be replaced) further extend usable life. In practice, people often use Garmin watches for a decade or longer without major issues.

What makes Garmin sensors more accurate than competitors?

Garmin uses commercial-grade sensors, sensor fusion algorithms, and multi-system redundancy (GPS, GLONASS, Galileo) to ensure accuracy. For GPS, having multiple satellite systems means the watch can maintain position accuracy even if one system is partially degraded. For altitude, Garmin uses high-resolution barometric sensors calibrated to detect pressure changes of less than one pascal. The algorithms combine multiple data sources and intelligently discard corrupted data, ensuring the most accurate reading possible.

Does Garmin really spend more on R&D than other smartwatch companies?

Yes. Garmin spends more than 20% of revenue on research and development, compared to 3-5% for most consumer electronics companies. This investment goes into sensor research, battery optimization, software development, manufacturing process improvement, and exploring new technologies. Some R&D projects fail and get canceled. That failure cost still gets amortized across successful products, contributing to higher prices.

Why does Garmin continue supporting old watches with software updates?

Garmin's long-term support strategy builds customer loyalty and brand reputation. Customers who own a Garmin watch for 5-7 years and see it continuing to receive updates and new features are highly likely to buy another Garmin watch. This reduces customer acquisition costs and builds word-of-mouth reputation. Additionally, supporting devices longer requires less pressure to innovate revolutionary features annually, allowing the company to focus on refinement and optimization.

How does Garmin's warranty compare to other smartwatch makers?

Garmin offers more generous warranty coverage than most competitors and actually honors it without extensive qualification. The company maintains repair facilities, trains technicians, and stocks replacement parts to handle warranty claims. This is possible because Garmin's low failure rate (under 1% return rate) means warranty costs stay reasonable despite the generous terms. Most competitors operate on higher failure rates and offer minimal warranty coverage.

Can a Garmin watch be repaired if it breaks?

Yes. Garmin offers repair services for watches outside the warranty period. Batteries can be replaced by technicians. Bands can be replaced (and are often available separately). Many components are repairable rather than requiring complete replacement. This repairability extends the useful life of the device and contributes to the lower total cost of ownership compared to devices that must be replaced when any component fails.

Choosing the Right Garmin Watch for Your Needs

Garmin's product line spans from basic fitness trackers to specialized instruments for diving, aviation, and mountaineering. Understanding which category fits your needs helps justify the investment.

If you're a casual fitness enthusiast tracking daily steps and general workouts, a basic Garmin smartwatch ($300-400 range) provides excellent value over competitors' devices. The battery lasts weeks instead of days. The durability is overkill for your use case, but that reliability means the device just works without hassle.

If you're a serious athlete—runner, cyclist, triathlete—a mid-range sports watch ($400-600) becomes essential. The advanced training metrics, structured workout plans, and detailed performance analysis start justifying the premium. You're paying for features you'll actually use.

If you're an adventurer—mountaineer, backcountry skier, or off-trail explorer—a high-end multisport watch ($600-800+) isn't a luxury. It's insurance. The reliable navigation, accurate altitude tracking, and proven durability in extreme conditions matter for your safety. In this case, the premium pricing is almost irrelevant compared to the value of reliable equipment.

The key insight is that Garmin watches aren't overpriced. They're appropriately priced for devices that actually deliver the value they promise. Once you understand the engineering investment, the testing rigor, and the long-term support, the premium becomes reasonable.

The Philosophy Behind Premium Pricing

Visiting Garmin's testing facilities revealed something important about how they think about pricing. The company isn't trying to maximize short-term profit by charging whatever the market will bear. They're trying to build products so good that customers remain loyal for decades.

This is a fundamentally different business philosophy than most consumer electronics companies operate under. Most companies want customers to upgrade frequently because that's how they maximize revenue. Garmin wants customers to hold onto their watches for years because that builds trust and reputation.

It's a long-term strategy that only works if the products actually deliver on the promise of durability and reliability. You can't charge premium prices for mediocre products. The products have to be genuinely better. And Garmin's product actually is better, which is why they can maintain this pricing strategy.

This philosophy extends to decisions that might seem short-sighted for maximizing revenue. Repairing old watches instead of forcing upgrades. Supporting devices past their expected lifecycle. Investing in R&D to improve products that already work well. These decisions cost money and reduce short-term profit.

But they build a brand that people trust enough to spend $600-800 on a watch. That's the real value Garmin is selling, and that's why the price premium is justified.

Why This Matters Beyond Smartwatches

Garmin's approach to product development and pricing offers lessons that extend far beyond the smartwatch market.

In an era where planned obsolescence is the business norm and devices are designed to fail after a few years, Garmin proves that there's a market for products built to last. Consumers are willing to pay more for durability, reliability, and long-term support. They're willing to invest in quality over disposability.

This has implications for sustainability. If every smartwatch lasted 7 years instead of 2 years, and was supported the entire time instead of abandoned after 18 months, we'd dramatically reduce electronic waste and resource consumption. Garmin demonstrates that this approach is economically viable.

It also has implications for the broader technology industry. The race to the bottom on price and the associated corner-cutting on durability isn't inevitable. It's a choice companies make. Garmin shows that you can choose differently and still succeed commercially.

The expensive testing labs in Kansas aren't just protecting customer safety. They're proving that quality engineering and premium pricing can coexist in a competitive market. That matters.

Key Takeaways

- Garmin watches undergo months of intentional destruction testing including saltwater immersion, thermal cycling, pressure testing, and drop tests that competitors skip entirely

- Manufacturing uses aerospace-level precision with component-level quality inspection, assembly tolerances measured in microns, and individual verification before integration

- Garmin invests 20%+ of revenue in R&D versus 3-5% for competitors, funding sensor research, software development, and manufacturing optimization that extends product lifespan significantly

- Long-term software support and hardware repairability mean Garmin watches typically last 7-10 years while competitors become obsolete after 2-3 years, reducing actual cost per year of ownership

- Premium pricing reflects genuine engineering investment, not brand inflation: durable materials, commercial-grade sensors, sophisticated algorithms, and customer support infrastructure all cost real money

Related Articles

- Best GPS Running Watches for Every Budget [2026]

- Asus Zenbook Duo 2026 Review: Dual-Screen Performance [2026]

- How Cloud Storage Transforms Sports Content Strategy: Wasabi & Liverpool FC [2025]

- Windows 11 Xbox App on Arm PCs: Everything You Need to Know [2025]

- Garmin tactix 8 Cerakote Coating: Ultimate Durability Guide [2025]

- Polar Grit X2 Review: Rugged Features at a Lower Price [2025]

![Why Garmin Watches Cost So Much: Inside Their Brutal Testing Labs [2025]](https://tryrunable.com/blog/why-garmin-watches-cost-so-much-inside-their-brutal-testing-/image-1-1769481500113.jpg)