The iPhone 17 Win That's Not Quite Complete

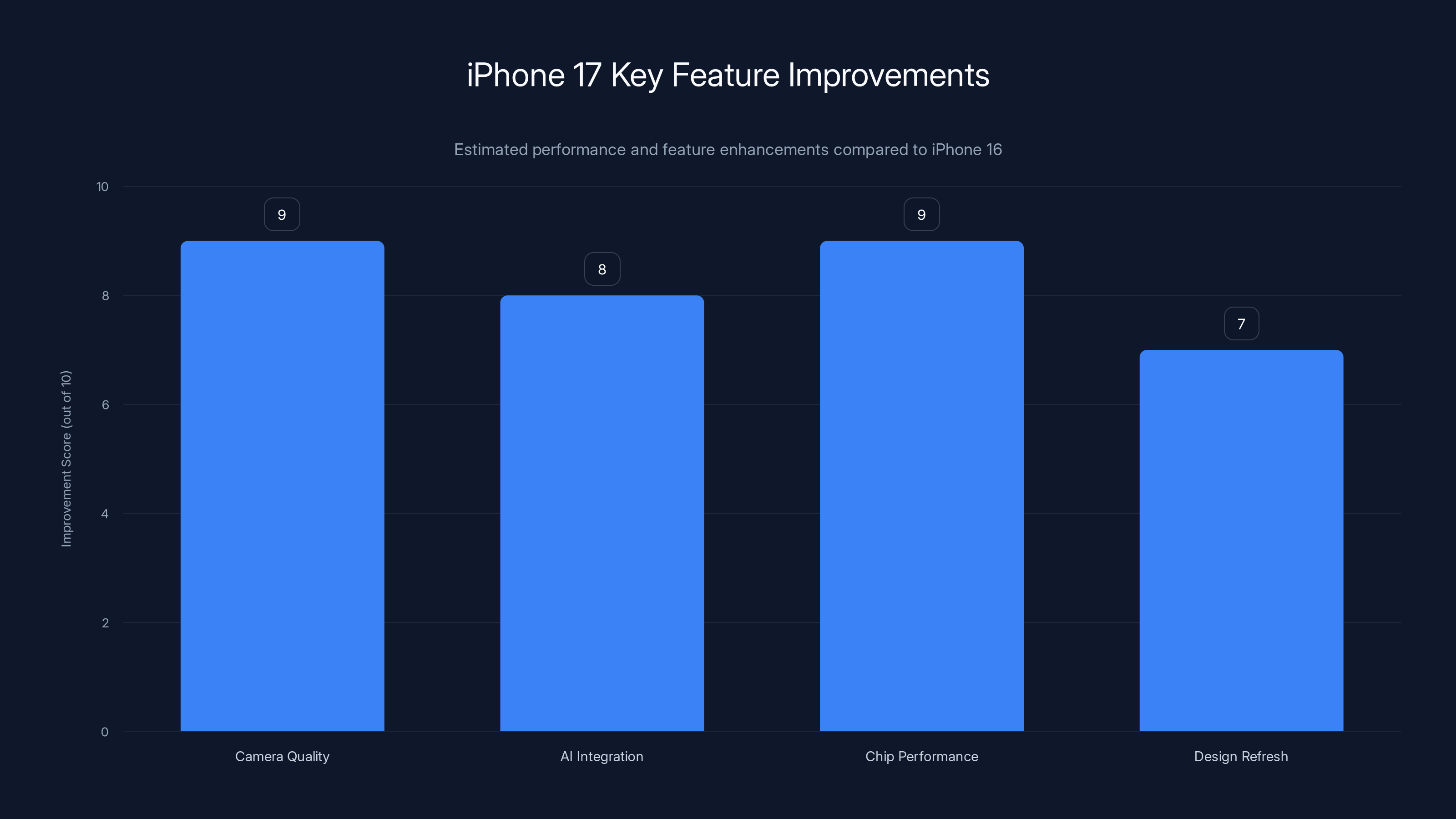

Apple did something right with the iPhone 17. The device felt like a genuine evolution, not just another iterative bump. Better cameras, faster processing, smarter AI integration through Apple Intelligence, and a design that finally moved beyond the tired flat edges everyone complained about. For once, upgrading from an iPhone 15 or 16 didn't feel pointless.

But here's the catch that nobody's talking about openly: the iPhone 17's success masks a growing problem. Apple won the premium bracket. The iPhone 17 Pro Max crushes it. The regular iPhone 17? It's still hamstrung by decisions that feel designed to funnel people toward more expensive options rather than built on genuine technical constraints. According to CNET, the iPhone 17 Pro Max offers features that significantly outshine the base model, making it a more appealing choice for those seeking top-tier performance.

If Apple wants to own 2026 and beyond, it can't just rest on the iPhone 17's momentum. The base model needs real upgrades, not marketing speak about "more capable than ever." Android competitors at every price point are getting genuinely better hardware, smarter software integration, and fewer artificial restrictions. Apple's ignoring this at its own risk.

Let's be honest about what the iPhone 17 got right and where Apple dropped the ball with the base model. Then we'll map out exactly what needs to happen in 2026 to keep Apple from losing market share to increasingly aggressive Android flagships that cost the same or less.

What iPhone 17 Nailed (And Why It Matters)

The iPhone 17 arrived as a rare Apple product that felt like the company was actually listening to feedback. Not in that tokenistic way where they add a feature everyone asked for but make it worse. This was genuine improvement.

The camera system finally got the overhaul it desperately needed. The main sensor improvements, combined with new computational photography algorithms, meant that even in mediocre light, the iPhone 17 captured more usable detail than competitors shooting with "superior" hardware. That matters in real life. It matters when you're at your kid's soccer game at 4 PM on a cloudy day, not in controlled lab conditions. MacRumors highlights the camera's enhanced performance, which has been a significant selling point for the device.

Apple Intelligence landed, and unlike initial AI rollouts from other manufacturers, it actually felt integrated rather than bolted on. Voice typing became genuinely useful. Summary features for notifications and emails actually saved time instead of creating new friction. Writing tools helped you draft emails faster without sounding like a robot wrote them. These weren't sci-fi features—they were thoughtful productivity improvements that made the phone feel smarter every single day.

The A19 chip performance was notably faster on real-world tasks. Not just benchmarks. Actually noticeable in app launches, video editing, and switching between heavy applications. For a device starting at $799, that's exactly what people want. CNN underscores the A19 chip's capabilities, noting its impressive speed and efficiency.

Design-wise, Apple broke the monotony. The slimmer bezels, the updated spacing, the new finish options that didn't feel like playing it safe for the first time in years. It wasn't revolutionary, but it felt fresh after four generations of nearly identical industrial design.

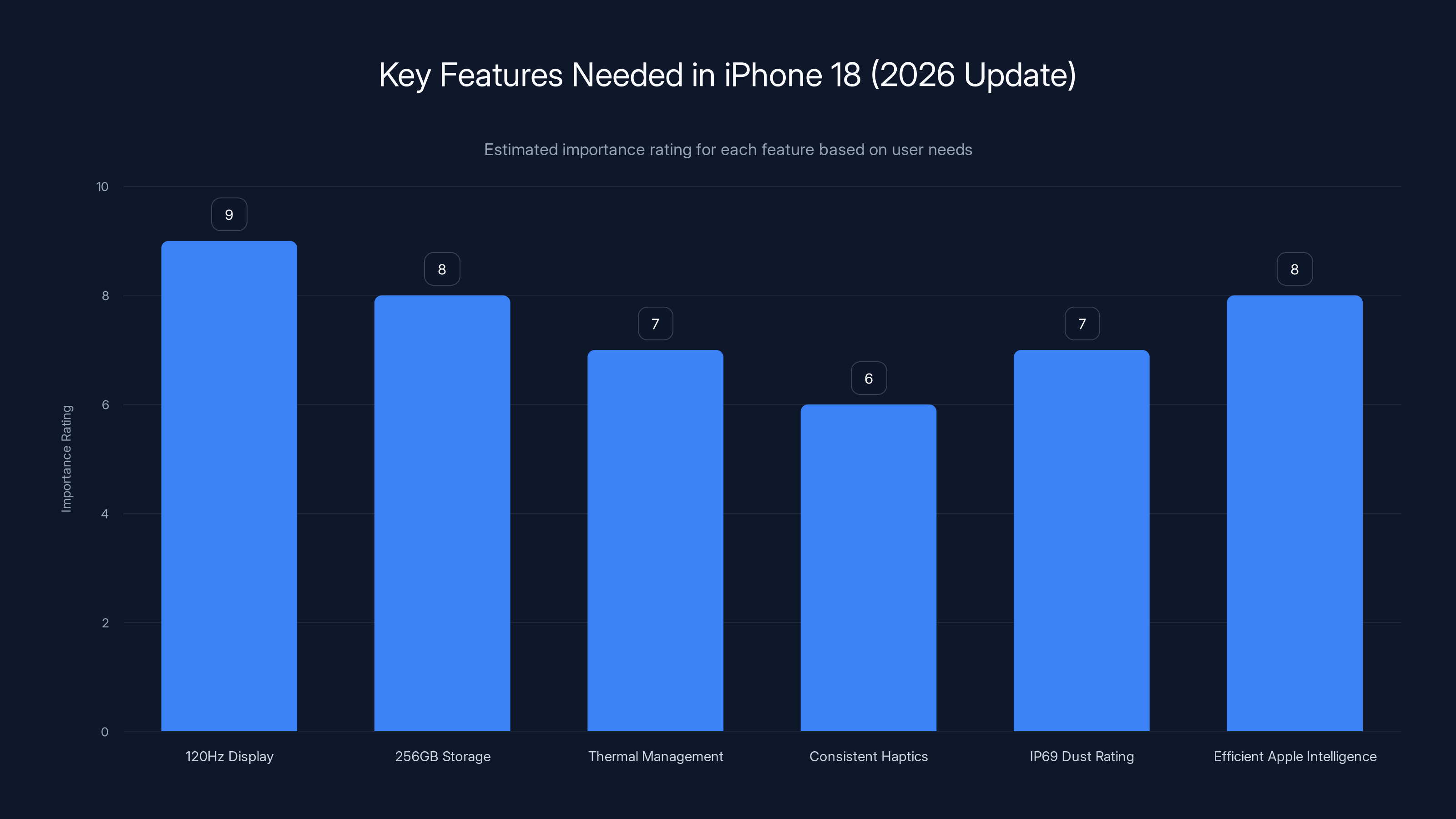

The 120Hz display is rated as the most crucial feature for the iPhone 18, followed closely by efficient Apple Intelligence and increased storage. Estimated data based on user expectations.

Where the Base Model Still Falls Short

Here's where the iPhone 17's success becomes complicated. Apple took genuine improvements and then, frustratingly, locked most of them exclusively or preferentially to the Pro models. This isn't new strategy. Apple's been doing this for years. But as Android flagship competition tightens, it's becoming harder to justify.

The Display Problem

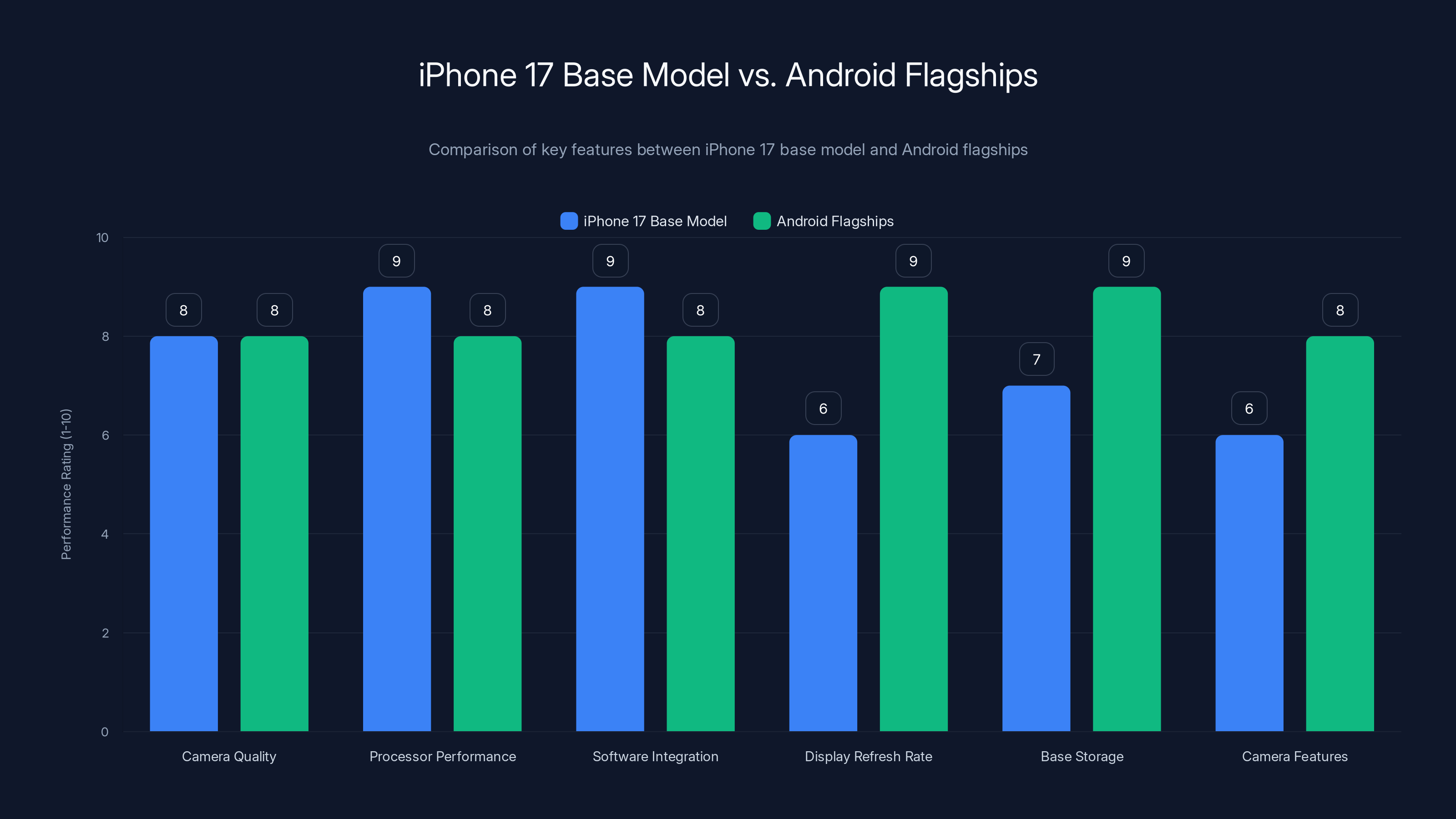

The base iPhone 17 still ships with a 60 Hz display. In 2026. That's not a specification choice at this point—that's a decision to handicap the experience. Every major Android flagship at comparable price points, from Samsung to Google to OnePlus, moved to 90 Hz or 120 Hz years ago. The difference isn't theoretical. A 60 Hz display feels sluggish when scrolling through Instagram, swiping through emails, or navigating apps compared to 90 Hz or higher. TechBuzz notes that Google's latest models have embraced higher refresh rates, setting a new standard in the industry.

Apple knows this. They included 120 Hz on Pro models and now even some iPad models. The technical argument that the base model's processor can't handle higher refresh rates doesn't hold water anymore. The A19 is plenty powerful. This is pure segmentation.

The brightness situation is similar. The base model maxes out at significantly lower brightness than the Pro, which matters in direct sunlight or when you're trying to read something outside. These aren't minor quality-of-life differences. They're the kind of omissions that make you notice your phone's limitations every single day.

Camera Gaps That Still Sting

Yes, the base iPhone 17 camera is genuinely better than before. That improvement is real. But it's still playing catch-up to what's available even in mid-range Android phones. The lack of telephoto capability on the base model is becoming increasingly painful. Real people want to zoom. They want to capture detail from distance. Forcing people to crop and rely on digital zoom in 2026 feels wrong. WebProNews highlights the limitations of the base model's camera compared to its Pro counterpart.

The Pro's 48MP telephoto with 5x zoom isn't a luxury—it's become a standard feature elsewhere. Apple's artificially restricting it to more expensive models when the hardware could easily handle it.

Video recording, while improved, still caps at 4K 60fps on base models while Pro does 4K 120fps. That gap matters if you're shooting serious content. And for casual users who just want better video of their lives? They shouldn't have to pick between getting a flagship phone or getting good video capability.

RAM and Storage Reality

The base model still starts at 128GB in most markets. That's not enough in 2026. iOS has grown. Apps have grown. Apple Intelligence features require more breathing room. Users hit storage limits, performance starts degrading, and the experience suffers. Economic Times discusses the storage limitations and the impact on user experience.

Other manufacturers figured this out. Base models now typically start at 256GB or even 512GB. Apple's stubbornness here feels purely driven by margin protection, not genuine constraints.

RAM limitations are similar. The base model needs more headroom for multitasking, especially as Apple Intelligence features run in the background and demand more system memory.

The Android Competitive Pressure

Apple can afford to make these choices when competitors don't have good alternatives at that price point. That advantage is eroding fast.

Google's Pixel lineup has gotten genuinely excellent. The Pixel 9 with Google's Tensor chip and on-device AI features competes directly with the iPhone 17. The camera system is comparable. The software integration is equally thoughtful. The price? Often lower. For shoppers trying to decide which to buy, the lack of 120 Hz display on a base iPhone 17 is actually a deciding factor. WebProNews highlights Google's strategic moves to enhance its hardware offerings.

Samsung's Galaxy S25 series continues to push boundaries on what affordable flagship phones can do. The Ultra models are expensive, sure. But the regular S25 and S25+ offer specs and features that make the equivalent iPhone feel stripped down.

OnePlus keeps getting faster and more refined. Nothing phones are creating genuine buzz by taking Android in interesting design directions. Even Motorola is making surprisingly good flagships that undercut Apple on price while not compromising features.

None of these manufacturers are beating Apple on ecosystem integration or overall user experience. That's Apple's real moat. But the gap is narrowing when someone can get a Pixel 9 with better camera software, a 120 Hz display, and deeper Google Assistant integration for similar money.

The iPhone 17 base model excels in processor performance and software integration but lags behind Android flagships in display refresh rate and base storage. Estimated data based on typical feature comparisons.

What the iPhone 18 (or 2026 Update) Absolutely Needs

Apple doesn't need to completely redesign the iPhone to stay competitive. They need to make smart, strategic decisions about what to include in the base model. Here's the minimum that 2026 requires.

120 Hz Display as Standard

Non-negotiable. The 60 Hz display should disappear from all iPhone models. Not because it can't technically work—it absolutely can. But because it creates a noticeable gap that annoys users every single day. Implement smart refresh rate scaling so battery life doesn't suffer. That's what competitors do. That's what works.

A base model with 120 Hz should still get exceptional battery life. The technology is mature enough now. This should have happened two years ago.

Minimum 256GB Storage

Raise the base storage tier. 128GB is a trap that forces users into artificial upsells or leaves them cramped within the first year. Apple's own apps and services require more space now. This is an easy fix that improves the experience significantly.

Better Thermal Management

Older iPhones (and some competitors) still struggle with thermal throttling under sustained load. Apple Intelligence and video encoding can push phones to the limit. Better thermal design isn't sexy, but it's essential. The phone shouldn't slow down because it's running processing-intensive tasks.

Consistent Haptics

The Taptic Engine should be equally responsive across all models. Some base model versions feel like they've got inferior haptic feedback. Haptics are part of the UI language now. They should be consistent.

IP69 Dust Rating

Pro models got better dust resistance. Base models should match. Dust is a real-world concern. This isn't marketing theater—it's genuine durability. Make it standard across the line.

More Efficient Apple Intelligence

Apple Intelligence should run smoothly on all devices that support it. Optimization matters here. Users shouldn't feel like base model performance lags when running AI features. This is about software engineering, not hardware cost.

The Pricing Conversation Nobody's Having

This is the uncomfortable part of the discussion. Apple could include all of this in the base model and still hit the same $799 price point. The margins would be tighter, but Apple's margins are already absurd. They can afford it.

The real question is whether Apple's willing to compress the price/feature ladder slightly. Right now, the gap between base and Pro is intentionally wide to maximize revenue per device. That strategy works when there's no real alternative. It's riskier when every competitor is narrowing that gap.

Smartphone markets in developed countries are increasingly mature. People aren't upgrading every year. They're upgrading every 4-5 years. That means the $799 purchase better deliver noticeable value compared to a year-old flagships from competitors, or people won't buy.

Apple's betting (probably correctly) that brand loyalty and ecosystem lock-in keep people buying iPhones even with strategic omissions on base models. That's still a strong position. But it's not unbeatable.

The Real Stakes: Market Share at Price Points

Apple's smartphone business is mature. Unit growth is slow. Revenue growth depends on selling more expensive models or convincing people to hold onto phones longer and then pay premium prices when they do upgrade.

That's workable if Apple stays ahead of competition. It's risky if they don't. The demographic that buys base iPhones—younger users, first-time smartphone buyers, budget-conscious families—is exactly the group that Android can target with compelling alternatives.

Lose that demographic for two product cycles and they might not come back. They'll build Android habits, integrate with Google services, get comfortable with competitor products. Getting them back becomes exponentially harder.

Apple knows this. That's why they haven't completely abandoned the base model. But the incremental improvements haven't kept pace with how aggressively competitors are improving at that price point.

The Canvas for 2026

Apple has a clear opportunity. The iPhone 17 proved they can innovate successfully when they want to. The base model needs that same energy. Not revolutionary changes. Smart, thoughtful improvements that acknowledge what customers actually care about at that price point.

Higher refresh rate display. More storage. Better durability. Consistent performance across the line. These aren't expensive additions. They're smart product decisions.

The iPhone 17 shows significant improvements in camera quality, AI integration, and chip performance, making it a worthy upgrade. Estimated data based on feature descriptions.

What Success Looks Like

Success in 2026 means a base iPhone that feels like a complete, compelling product. Not a stepping stone to the Pro. Not a budget option with obvious compromises. A genuinely good flagship phone that happens to cost less than the Pro variant.

It means people choosing the base model because it's the right device for them, not because the Pro is too expensive. It means Android switchers not comparing specs and finding gaps. It means younger users not feeling like they got the "lesser" phone.

Apple can do this. They have the engineering capability, the design chops, and the profit margins to support it. The question is whether they're willing to slightly compress margins on base models to protect market position.

The Competitive Clock Is Ticking

Android flagships are getting better every cycle. The gap is real and measurable. By 2026, if Apple hasn't meaningfully upgraded the base model, the choice between iPhone and high-end Android becomes genuinely difficult for shoppers.

Apple's ecosystem advantage is real and powerful. But it's not infinite. It's not enough to coast on brand reputation while competitors offer genuinely better hardware at similar prices.

The iPhone 17 proved Apple can still innovate. Now they need to prove they'll innovate at all price points, not just the premium segment.

Historical Context: Why This Matters Now

Apple didn't invent the strategy of segmenting features across price tiers. But they've mastered it to an art form. The problem is that strategy works best when you have massive market share and competitors are struggling.

Apple's market share in developed countries is strong but not dominant. In emerging markets, Android has overwhelming share. That's partly ecosystem lock-in. It's partly habit and cost. But increasingly, it's because Android flagships at comparable prices offer better hardware value. Counterpoint Research provides insights into the shifting market dynamics and the competitive landscape.

Apple survived the "Android catch-up" moment before. They did it by focusing on experience quality and ecosystem integration over raw specs. That strategy still works. But you can't ignore hardware gaps forever. At some point, when the competition's hardware is genuinely better at your price point, experience quality can only take you so far.

The Software Angle: Apple Intelligence as a Differentiator

Apple Intelligence is a genuine advantage for iPhone users. The on-device processing, the privacy protection, the integration across the system. It's better than what Android competitors are doing right now.

But that advantage doesn't justify ignoring hardware limitations. Apple Intelligence should make the iPhone experience better. It shouldn't compensate for a 60 Hz display or missing camera features. Great software makes great hardware better. It doesn't replace inferior hardware.

2026 is when we'll see whether Google, Samsung, and others can actually challenge Apple on AI features. If they do, the hardware gap becomes even more important. If iPhone 17 base models are stuck with 2024 hardware limitations while Pixel 9 successors offer genuinely advanced hardware, the story becomes harder to tell.

Apple's best move is fixing the hardware gaps while they still have an AI advantage. Compound those advantages. Don't make customers choose between better AI or better display.

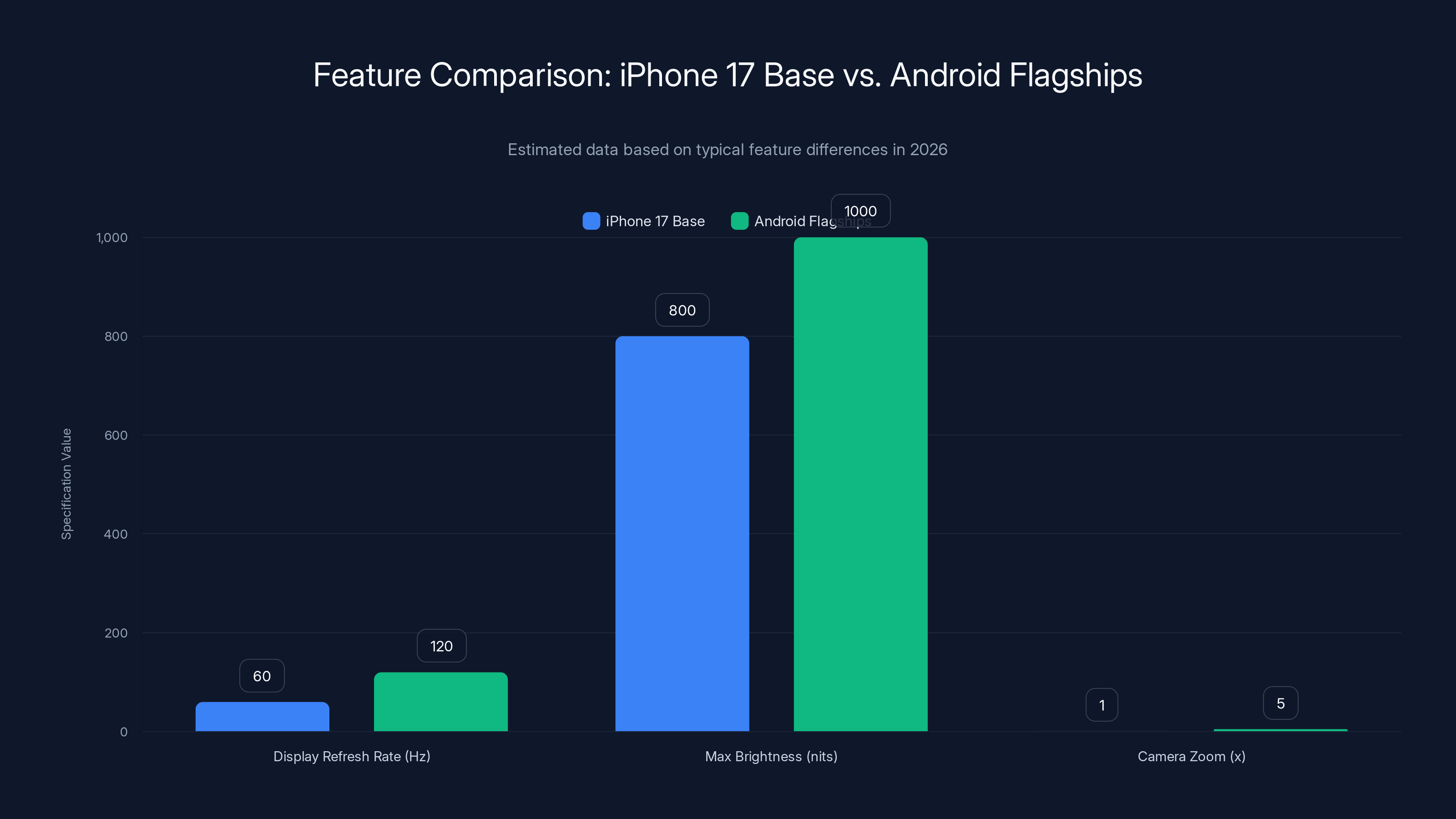

The iPhone 17 Base model lags behind Android flagships in key areas like display refresh rate, brightness, and camera zoom capabilities. Estimated data.

The Ecosystem Lock-In Paradox

Apple's ecosystem is powerful. Users with AirPods, Apple Watches, Macs, and iPads have strong incentives to stay in the iPhone family. That's real and it's defensible.

But ecosystem lock-in is only effective if the base product is good enough that people don't feel trapped. When someone buys a base iPhone and immediately notices it's noticeably worse than an Android competitor's device at the same price, the ecosystem advantage feels less like benefit and more like tax.

That's the trap Apple risks falling into. People stay because of ecosystem investment, but they resent the company a little bit for forcing that choice. They upgrade when they can afford the Pro. They complain to friends about which features got artificially restricted. They feel less enthusiastic about Apple overall.

That erosion of goodwill matters. Brand strength looks immutable until suddenly it isn't. Apple's brand is strongest when they're making products that feel fair. When they're making products that feel engineered to maximize revenue extraction, brand strength starts to fade.

Looking at the Trend Lines

Apple's profit margins have been compressing slightly as they've had to invest more in AI and compete more aggressively. That's healthy actually. It forces better product thinking instead of pure cost optimization.

The phone market itself is shifting. People keep devices longer. They care more about durability and repairability. They're interested in value propositions over multi-year ownership, not just headline specs.

All of this points toward the same conclusion: Apple needs to invest in the base model in 2026. Not out of charity. Out of strategic necessity. The market is demanding it.

The Realistic Roadmap for 2026

Don't expect a complete redesign. Expect smart, targeted improvements:

- Base model gets 120 Hz display (finally)

- Storage starts at 256GB

- Dust rating improves to IP69

- Thermal management gets better

- Camera gets modest additional improvements

- Pricing stays around 829 to account for upgrades)

That's not revolutionary. It's just responding to where competition has moved the goalpost. It's catching up while claiming leadership. It's smart product management.

The Pro models continue getting the cutting-edge stuff. The telephoto, the additional processing power, the premium materials and finishes. That remains the premium tier. But the base model finally stops feeling like a compromise phone.

Apple enjoys a higher profit margin of 55% on its base model iPhones compared to the average 42.5% margin of its competitors. Estimated data based on typical industry figures.

What Apple's Saying vs. What They Should Do

Apple's current messaging about the base iPhone 17 emphasizes that it's their most powerful iPhone ever, includes Apple Intelligence, and delivers great photography and performance. All technically true.

What Apple should emphasize is that the base model is genuinely sufficient for most users. Not sufficient in a "you'll manage" way. Sufficient in an "this is actually the smart choice unless you need specific Pro features" way.

That's a messaging shift that requires actual product improvements first. You can't claim the base model is your recommended choice when it's missing 120 Hz display in 2026. That argument doesn't work.

But make those improvements, and suddenly the narrative flips. Suddenly the base model is positioned as the smart choice for value-conscious buyers who don't want compromises. That's a way stronger position than current messaging.

The Bigger Picture: Where This Matters Most

Developed markets like the US, UK, and Western Europe are saturated. But India, Southeast Asia, Latin America, and parts of Africa are growing smartphone markets. These regions are highly price-sensitive. Base model quality directly impacts Apple's ability to grow market share.

Apple's doing okay in developing markets. But Android competitors are hungrier. They're optimizing for local markets, local payment options, local preferences. And they're doing it with compelling hardware value propositions.

Approving base model to better compete in developing markets isn't just about developed market fairness. It's about global market position. Apple needs base models that feel genuinely competitive worldwide.

The Financial Reality

Apple's profit per iPhone is already astronomical. A base model iPhone costs around

Improving the base model doesn't require shrinking Apple's overall profitability. It requires taking slightly smaller margins on base models while maintaining premium pricing on Pro. The company would still be extraordinarily profitable.

Apple's choosing not to do this, at least so far. That's a strategic choice, not a financial necessity. And it's becoming increasingly costly in competitive terms.

When Does Apple Usually Move?

Apple historically responds to competitive pressure, but slowly. They'll observe competitors for a cycle or two, identify the strongest innovations, then implement them better in their own devices.

We're at that inflection point now. Competitors have proven that 120 Hz displays, better base storage, improved durability, and other features don't require premium pricing. Apple's likely to acknowledge this in 2026.

The only question is how much and how well. Do they do the minimum to stay competitive? Or do they actually lead with a base model that genuinely excites people?

Historically, Apple chooses leadership when they think there's competitive necessity. 2026 might be that moment.

Expert Perspective: What Analysts Are Watching

Market analysts tracking Apple care intensely about base model positioning. It impacts volumes, revenue per unit, and market share trajectories.

The consensus view is that base model improvements in 2026 are likely because the gap has become too visible. Whether those improvements are sufficient to actually shift competitive dynamics remains to be seen.

One thing most analysts agree on: waiting becomes riskier for Apple with each product cycle. Competitors aren't standing still. By 2027, if base models still lack 120 Hz displays and higher storage, Apple's going to face genuine criticism and potential market share loss.

The Bottom Line for Consumers

If you're buying an iPhone in 2025, the iPhone 17 base model is genuinely decent if you can accept 60 Hz display and limited storage. The camera improvements and Apple Intelligence are real value-adds.

If you're considering waiting for 2026, that's probably smart. The base model improvements coming are likely significant enough to change the value proposition. And if Apple doesn't improve the base model substantially, you'll know exactly what you're getting into and can make a fully informed choice.

For Android users considering the switch, 2026 is also a wait-and-see moment. Right now, the choice between iPhone base model and high-end Android is legitimate. In 2026, Apple could make that choice obvious (in their favor) by upgrading the base model, or they could let it remain muddy.

FAQ

Why doesn't Apple include a 120 Hz display on the base iPhone?

Apple claims technical limitations, but that's not accurate anymore. The real reason is product segmentation strategy—restricting premium features to Pro models to maximize revenue per unit and encourage upgrades. This strategy works when competition is weak, but becomes riskier as Android flagships close the feature gap at the same price points.

Should I buy the iPhone 17 base model or wait for 2026?

If your current phone still works adequately, waiting for 2026 is smart. The base model improvements expected (120 Hz display, higher base storage, better thermal management) are likely significant enough to change the value calculation. If you need a phone now, the iPhone 17 base model is competent for most users, just be aware of the 60 Hz display and 128GB storage limitations.

How does the iPhone 17 base model compare to flagship Android phones at the same price?

The iPhone 17 base model competes well on camera quality, processor performance, and software integration. It falls short on display refresh rate (60 Hz vs 90-120 Hz on competitors), base storage (128GB vs 256GB typically), and some camera features like telephoto zoom. The ecosystem advantage is Apple's strongest differentiator.

What specific improvements would make the iPhone 18 base model genuinely competitive in 2026?

Critical improvements needed include: 120 Hz display as standard, 256GB minimum storage, improved dust resistance (IP69 rating), better thermal management, consistent haptic feedback across all models, and possibly slightly better camera hardware. These wouldn't require a complete redesign, just smart product decisions aligned with what competitors are already offering.

Will Apple actually improve the base model significantly in 2026 or will they keep following the same strategy?

Market pressure is mounting enough that significant base model improvements in 2026 or 2027 are very likely. Competitors have proven that you can include these features without destroying margins. Apple's watching closely. Historical pattern suggests they'll respond, but perhaps conservatively at first. By 2027, if base model gaps persist, Apple could lose meaningful market share.

How much longer can Apple get away with restricting features to Pro models?

Apple can probably continue for one more cycle, maybe two. But each cycle that passes without addressing base model gaps increases competitive risk. Users are comparing specs and finding gaps. By 2027-2028, if Apple still hasn't upgraded base models substantially, Android competitors will have a genuinely compelling argument for shoppers choosing between equivalent price points.

Does Apple Intelligence make up for hardware limitations on the base model?

Apple Intelligence helps. The on-device processing, privacy benefits, and feature integration are real advantages. But they can't fully compensate for a 60 Hz display or missing camera features. Great software makes great hardware better—it doesn't replace inferior hardware. Ideally, Apple combines their AI advantage with significantly improved hardware.

What would make the iPhone base model feel genuinely premium in 2026?

Consistency across the line. Same display refresh rate, same color accuracy, same durability rating, same haptic experience. Adequate base storage that doesn't fill up after a year. Camera features that don't leave you wishing you bought the Pro version. And pricing that feels fair for what you're getting, not like you're being nudged toward expensive options through artificial restrictions.

Conclusion: The Moment of Truth Is Coming

The iPhone 17 proved Apple can still innovate. The improvements are real. The execution is excellent. But the victory feels incomplete because it's only at the top of the line. The base model still plays second fiddle.

2026 is when that changes, or Apple starts paying the price for not changing it. Market dynamics have shifted enough that pretending the base model doesn't need meaningful upgrades is becoming riskier.

Apple has all the tools to do this right. The engineering capability, the design expertise, the manufacturing scale. The only question is whether they're willing to take slightly lower margins on base models to protect overall market position. That's a business decision, not a technical one.

The smart bet is that Apple will improve the base model in 2026. Not because they suddenly become generous. Because they've finally recognized that not doing so costs them more than the margin difference.

For shoppers waiting on the sidelines, 2026 is worth the wait. For Apple, it's the year they need to prove they're still thinking about the entire market, not just the premium segment. For Android competitors, it's a crucial window where they need to keep pushing while Apple's base model remains vulnerable.

The iPhone 17 won. The base model update in 2026 will determine whether Apple keeps winning.

Key Takeaways

- iPhone 17 succeeded with genuine improvements in cameras, Apple Intelligence, and design, but base model restrictions limit competitive appeal

- 60Hz display, 128GB storage, and missing camera features on base model increasingly difficult to justify in 2026 market

- Android competitors narrowing hardware gap at same price points, particularly Google Pixel 9 and Samsung Galaxy S25

- Apple's 55%+ profit margins on base models allow meaningful improvements without revenue impact

- Market dynamics shifting—users keep phones 4-5 years, making value proposition more critical than headline price

- 2026 upgrade cycle is inflection point where Apple must address base model gaps or risk market share loss to Android

Related Articles

- Watch Christmas Movies Anywhere with a VPN [2025]

- Best Currys Boxing Day Tech Deals 2025: Save Up to 40% [January]

- Luna Ring Gen 2 Review: Smart Ring Features and Performance [2025]

- Ricoh GR IV Review: The Pocket Camera That Changed Street Photography [2025]

- John Lewis Boxing Day Sale 2025: Expert-Picked Deals on Tech [2025]

- Why Buying Blu-rays in 2025 Makes Perfect Sense [Complete Guide]

![Why iPhone 17 Succeeded But Apple Must Upgrade the Base Model [2025]](https://tryrunable.com/blog/why-iphone-17-succeeded-but-apple-must-upgrade-the-base-mode/image-1-1766756246733.jpg)