WP Engine Acquires Big Bite: How Word Press Is Being Consolidated Into Enterprise Publishing

Last year, when I talked to founders at mid-size Word Press agencies, they all said the same thing: the game was changing. Agencies that built custom solutions for media companies were getting picked off by hosting platforms. It wasn't a conspiracy—it was just efficiency. Why hire an agency when the platform itself could build the tools you need?

WP Engine just proved that theory by acquiring Big Bite, a well-respected agency that's spent over a decade building publishing platforms for international newsrooms and media organizations. The deal isn't huge in dollar terms, but the strategic signal is massive. WP Engine is essentially saying: we're done outsourcing our media products. We're building them ourselves, and we're doing it with in-house talent.

This acquisition matters way beyond the companies involved. It reflects a fundamental shift in how Word Press is evolving as a platform. For years, Word Press was positioned as the flexible, extensible option—you built what you needed using agencies and custom plugins. Now, it's becoming more of a packaged solution with built-in publishing tools designed specifically for enterprise media companies.

The implications are significant. Publishers who relied on agency partners for complex editorial workflows now have fewer choices. Agencies that competed with platform vendors are watching their traditional business model get absorbed. And Word Press itself is moving further up-market, trying to compete with more specialized platforms like Contentful and Arc XP.

Let's dig into what this deal means, why WP Engine made this move, and what it signals about the future of Word Press in enterprise publishing.

TL; DR

- Big Bite wasn't just an agency: The company built newsroom platforms, editorial workflows, and custom publishing tools for major international publishers over more than a decade

- WP Engine is ending the agency model: Big Bite's independent services business is shutting down completely. Its entire team moves into WP Engine's engineering organization

- Product development takes priority: This is fundamentally about accelerating WP Engine's own publishing products rather than continuing to offer consulting services

- Enterprise consolidation accelerates: The move reflects how hosting platforms are absorbing capabilities that agencies traditionally provided

- Publishers face reduced options: Organizations that worked with Big Bite as an independent partner now have to work with them through WP Engine, limiting flexibility and potentially increasing costs

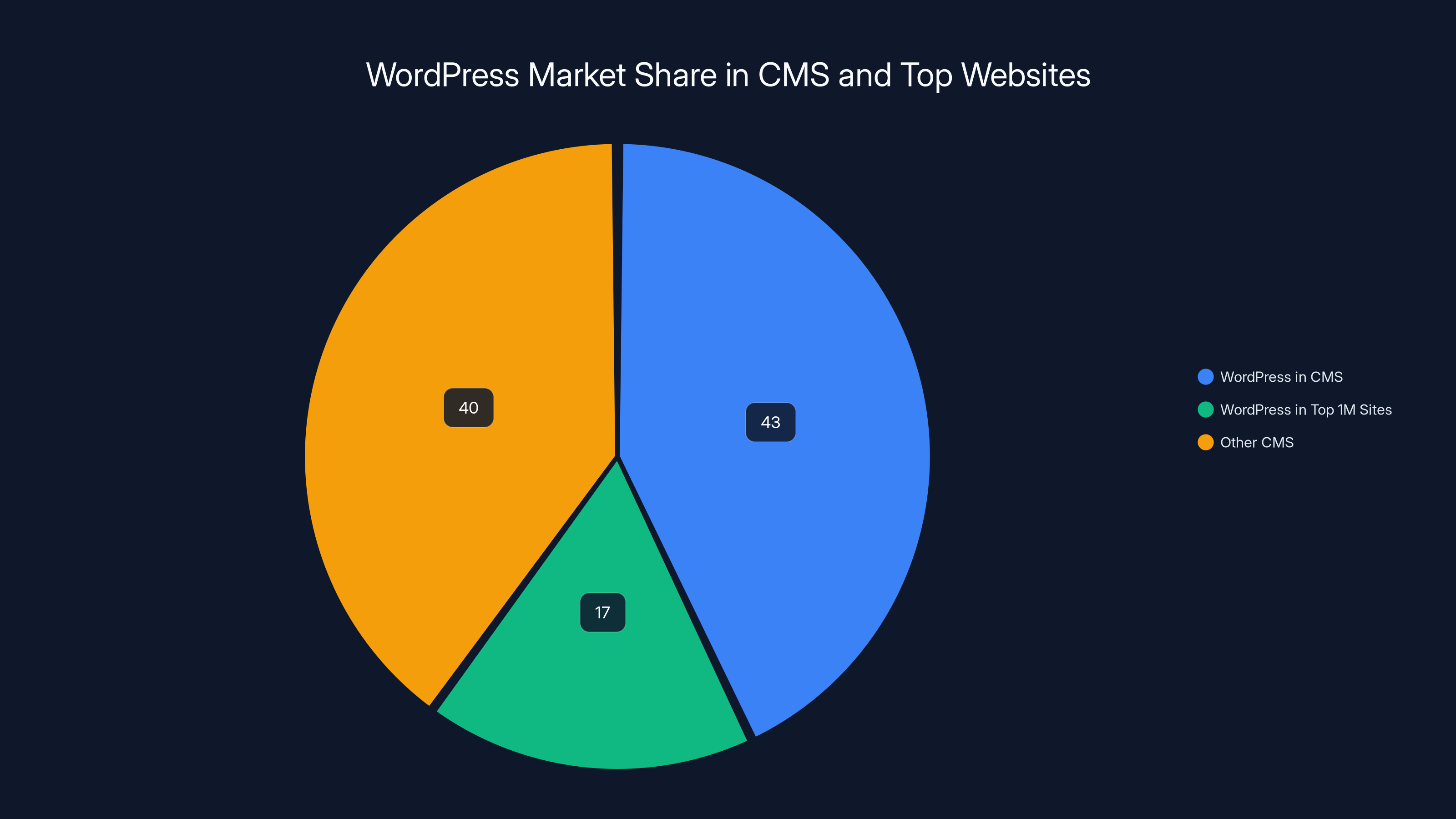

WordPress powers 43% of all websites using a known CMS and 17% of the top 1 million websites, highlighting its significant presence and potential in the enterprise market. Estimated data.

Understanding the Big Bite Acquisition: Why WP Engine Moved Now

WP Engine's acquisition of Big Bite wasn't accidental or opportunistic. It represents a deliberate strategic pivot that's been brewing for several years. The company recognized that to compete for enterprise media contracts, it needed to own the publishing capabilities that clients actually wanted.

Big Bite has worked with some genuinely massive publishers. We're talking international newspaper groups, tech magazines that run complex content operations, and media organizations dealing with thousands of articles, multiple sections, and intricate editorial workflows every single day. The agency didn't just implement Word Press—it built sophisticated systems on top of Word Press to handle the specific challenges of enterprise publishing.

That expertise is exactly what WP Engine needed. Rather than hiring new engineers and hoping they'd figure out publishing at scale, the company brought in an entire team that already understood the problem space deeply. They'd already solved problems like managing content across multiple properties, coordinating editorial workflows across multiple time zones, and optimizing distribution for high-traffic properties.

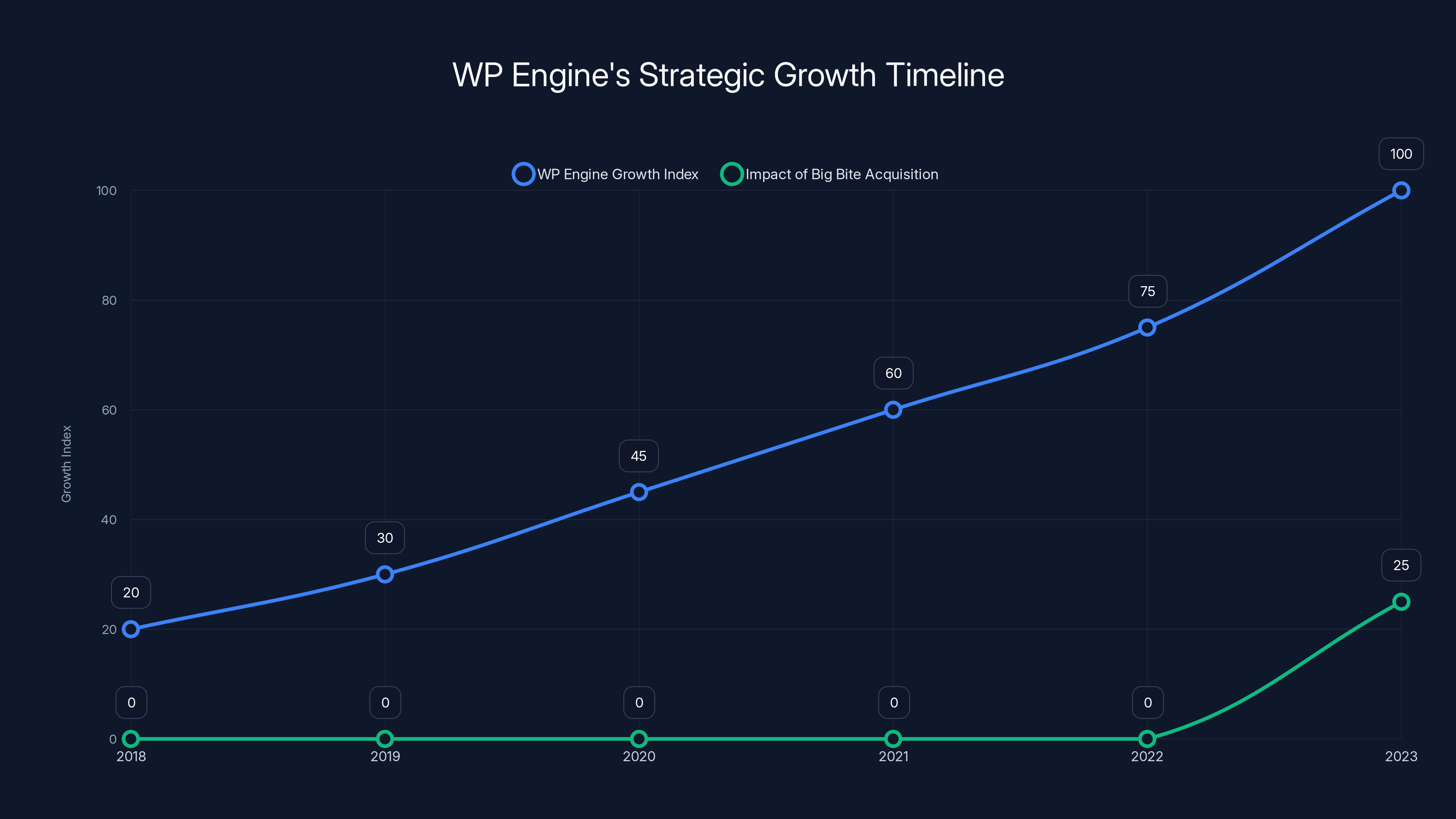

WP Engine CEO Heather Brunner and CTO Ramadass Prabhakar have been pretty explicit about this. The company wants to serve publishers with purpose-built products, not just offer hosting and hope agencies fill the gaps. This acquisition accelerates that strategy by about five years.

The Timing: Why Now, Not Five Years Ago

WP Engine's timing reveals something important about market dynamics. The company has been growing steadily as a Word Press hosting provider, but growth alone wasn't enough. The enterprise market moved toward solutions that did more than just host sites well.

Obsidian, Arc XP, Contentful, Midday—these platforms arrived and immediately captured media companies tired of struggling with Word Press for complex publishing needs. They offered publishing tools built from the ground up, not bolted on top of a general-purpose CMS.

WP Engine couldn't compete on those terms with a pure hosting product. They needed capabilities. Acquiring Big Bite gave them a team that could build competitive publishing products quickly. It's not building from scratch—it's acquiring a running start.

The market also supports this move. Media companies have been consolidating their vendor stacks, looking for platforms that could do more with fewer integrations. WP Engine saw that trend and made a big bet that investing in publishing products would let them capture contracts that would've otherwise gone to more specialized platforms.

WP Engine's acquisition of Big Bite is estimated to accelerate its strategic growth by five years, significantly boosting its capabilities in enterprise media publishing. Estimated data.

What Big Bite Actually Did: The Agency's Publishing Legacy

To understand why WP Engine wanted Big Bite, you need to understand what the agency actually built. Big Bite wasn't a typical Word Press agency that sold custom theme development and plugin customization. It specialized specifically in publishing platforms for organizations running complex content operations at scale.

The agency worked with major newspaper groups—the kind of publishers that run multiple publications, manage hundreds of writers and editors, deal with constant deadlines, and need sophisticated content distribution systems. It also worked with technology magazines and international publishers that had to coordinate across time zones and language variants.

Building for those clients meant solving specific problems that most Word Press agencies never encounter. For instance, imagine you're managing a publication with five different sections, multiple editions (print and digital), and content that needs to be approved through multiple layers of editorial review before publication. Traditional Word Press doesn't handle that workflow well.

Big Bite built systems that did. They created editorial workflows that tracked content through approval processes. They built content organization systems that let editors manage thousands of articles intuitively. They developed distribution tools that could publish content to multiple channels simultaneously. They created integration points with legacy systems that publishers had already invested in.

Real Publishing Challenges Big Bite Solved

The specific problems Big Bite tackled reveal why their team is valuable to WP Engine. Consider these scenarios that played out with actual clients:

Multi-property content management: A publisher with five different mastheads needs different teams managing each property, with completely different editorial calendars, design templates, and distribution requirements. But corporate leadership wants a unified dashboard showing performance across all properties. Building that on Word Press requires serious engineering work.

Global content operations: An international publisher produces content in six languages across eight time zones. Different regions have different publishing schedules, different advertiser requirements, and different legal compliance needs. The platform needs to manage all of that without creating silos that prevent knowledge sharing.

Complex approval workflows: A financial publication needs content approved by legal, compliance, and editorial teams before it publishes. Different types of content require different approval chains. The system needs to track approvals, prevent unapproved content from publishing, and alert reviewers when they have pending approvals.

High-traffic performance: Some of Big Bite's clients were getting millions of visitors per month. The publishing platform needed to handle that traffic without degrading, while also handling real-time traffic spikes when breaking news hit.

Legacy system integration: Most enterprise publishers already had subscription systems, analytics platforms, ad servers, and other tools they'd invested years and millions into. The new publishing platform couldn't replace all of that—it had to integrate with it.

Big Bite's team had solved all of these problems, multiple times over, for different clients with different requirements. That institutional knowledge is exactly what WP Engine needed to compete in the enterprise segment.

The Strategic Shift: From Agency Partner to In-House Engineering

WP Engine's decision to shut down Big Bite's independent agency business and move the team into engineering represents a fundamental philosophical shift. The company is no longer interested in having an external partner build publishing solutions. It wants to build them itself.

This is important because it changes the relationship dynamic. When you're working with an independent agency, that agency is motivated to understand your specific requirements and build custom solutions. They have incentive to please you because you're their client.

When an agency becomes part of a vendor, the dynamics shift. The team is now optimized around the vendor's product roadmap, not individual client needs. This can be good—you get features developed for the whole customer base—but it can also be restrictive for clients with unusual requirements.

CTO Ramadass Prabhakar's statement about the acquisition reveals WP Engine's thinking: "Together, we've successfully aligned our capabilities to support some of the world's biggest publishers... we are in a unique position to bring intelligent, purpose-built software solutions to market for agency partners and publishers that will improve how they deliver digital content and optimize workflows."

Notice the language: "purpose-built software solutions." Not consulting, not custom development. Software. Products. Things that WP Engine will build once and sell to many customers.

This is how platforms scale. Instead of taking the same questions from different clients and solving each one uniquely, you solve the problem once in a product and make everyone use your solution. It's more efficient. It's more profitable. But it's less flexible.

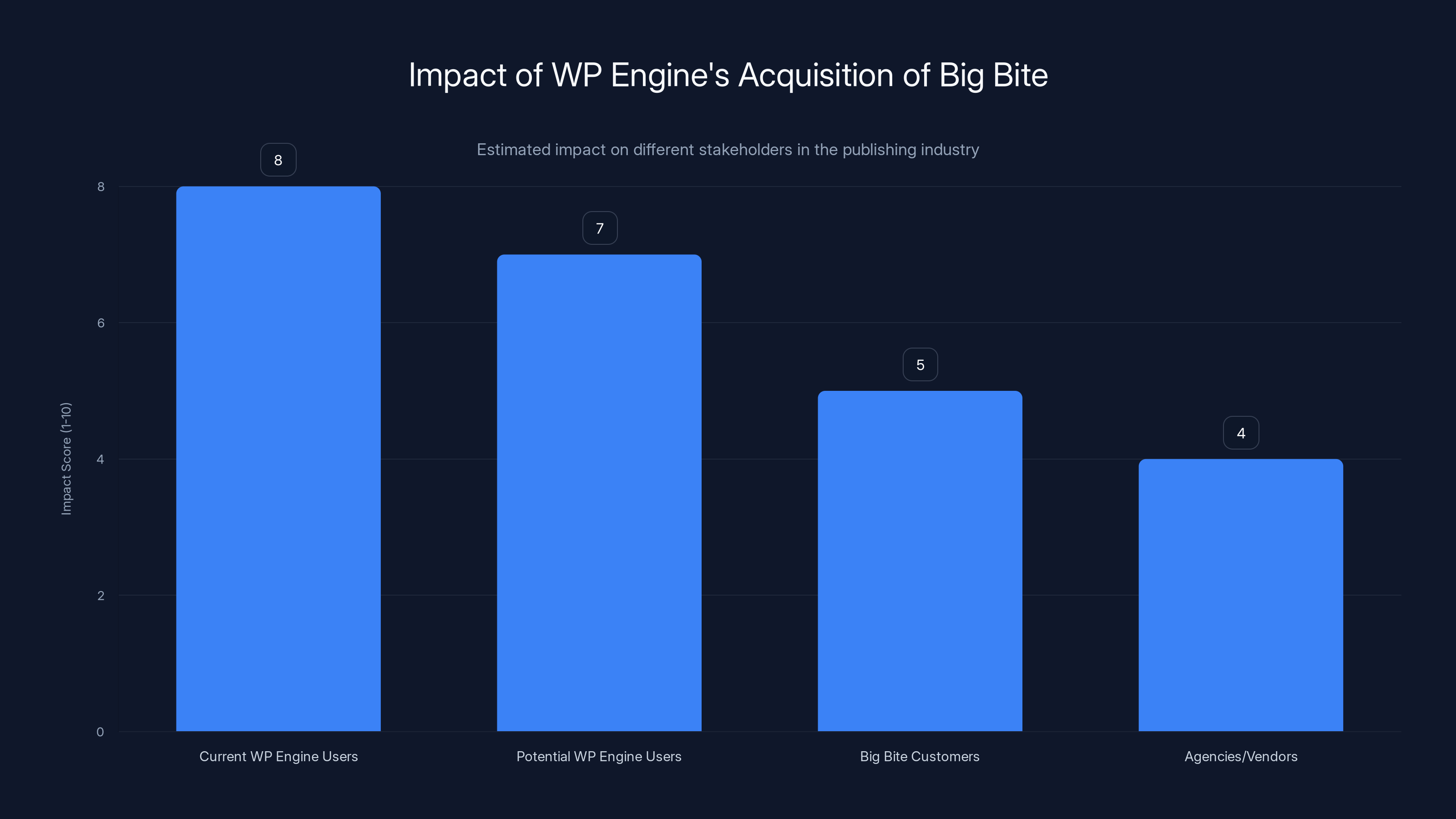

The acquisition is highly beneficial for current WP Engine users, while Big Bite customers and agencies may face challenges. (Estimated data)

The Publisher Perspective: What Changes for Big Bite's Former Clients

ITP Media Group is mentioned prominently in the announcement. They're a big, sophisticated publisher operating across multiple regions and publications. They worked with Big Bite because Big Bite understood their complexity.

What happens to ITP Media Group and other big publishers who relied on Big Bite? They now have a different relationship with their technology partner. Instead of hiring an agency that serves multiple hosting platforms, they're now working with the hosting platform's own engineering organization.

On one hand, this could be beneficial. WP Engine's engineering team is larger than Big Bite's was. They have more resources to invest in features. They can incorporate Big Bite's solutions into their core product, making them available to all customers rather than just those who hire Big Bite specifically.

On the other hand, publishers lose some flexibility. They can't shop around. If WP Engine's publishing products don't quite fit their needs, they can't hire Big Bite to fix it—Big Bite no longer exists as an independent entity. They have to work with WP Engine's support organization and follow WP Engine's product roadmap.

There's also the consolidation risk. If you're running a major media operation, vendor concentration is a real concern. The more of your technology stack that depends on one vendor, the more leverage that vendor has. They can raise prices, they can slow down feature development, they can make changes that don't serve your interests.

The Integration Challenge Ahead

Moving Big Bite's entire team into WP Engine's engineering organization sounds straightforward until you think about it actually happening. Big Bite was an agency with agency culture—client-focused, flexible, responsive to specific needs. WP Engine is a hosting company with platform culture—focused on standardization, scalability, and product efficiency.

These cultures don't merge smoothly. The Big Bite team will be working in a different context, building products on a different timeline, answering to different stakeholders. Some team members will adapt well. Some will probably leave. There will be friction.

The integration also has to solve a hard problem: how do you convert agency expertise into product capabilities? When Big Bite was an agency, their engineers solved problems by understanding a client's specific context deeply and building custom solutions. As part of WP Engine, they need to identify the patterns across all clients and build generalizable features.

That's a different skill set. Not everyone who's great at custom development is great at product development. WP Engine will need to invest in helping the team understand this transition, or risk losing some of their most valuable people.

How This Fits WP Engine's Bigger Strategy

The Big Bite acquisition didn't happen in isolation. It's part of a deliberate strategy to move WP Engine upmarket and increase enterprise adoption. Let's look at what else the company is doing.

WP Engine has been investing heavily in platform infrastructure—making Word Press more performant, more secure, and more suitable for high-traffic operations. They've been building integrations with enterprise tools that publishers rely on. They've been adding features that appeal to larger organizations rather than just agencies and small sites.

The company has also been investing in sales and marketing capabilities to reach enterprise buyers. Big Bite's relationships with major publishers are valuable assets that help WP Engine get in the door with new enterprise prospects.

What's interesting is that WP Engine is making this push while the broader Word Press ecosystem is somewhat fragmented. Some people argue Word Press isn't suitable for enterprise publishing anymore. Others point to Word Press's flexibility and maturity as advantages. WP Engine is betting that with the right investments, Word Press can compete effectively in the enterprise segment.

That's a reasonable bet. Word Press powers more than 40% of all websites, including many major publishers. It has a massive ecosystem of developers, plugins, and integrations. Word Press.com, Automattic's hosting platform, has shown that you can run sophisticated publishing operations on Word Press at significant scale.

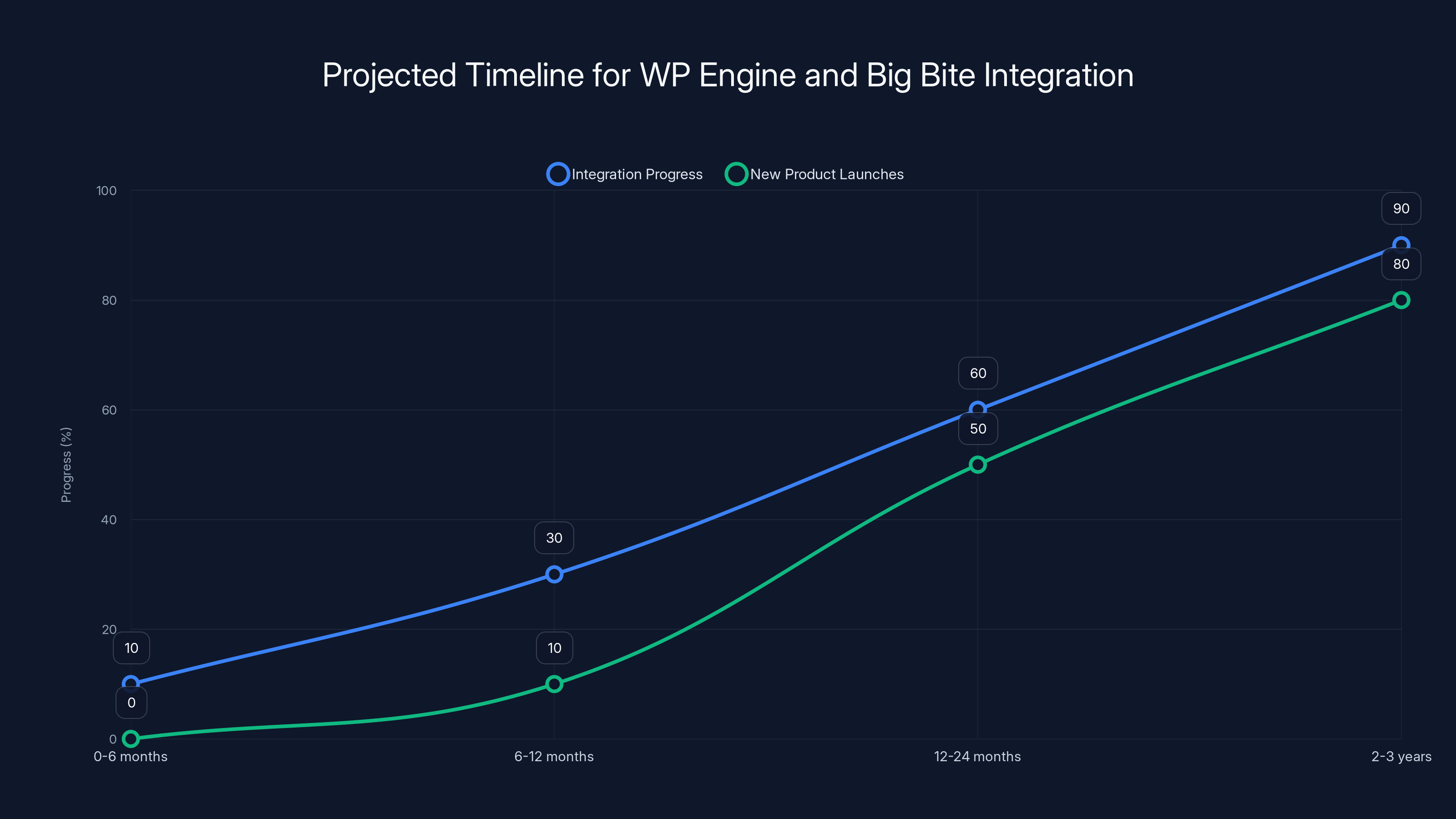

WP Engine's integration with Big Bite is expected to progress steadily, with significant new product launches anticipated within 12-24 months. Estimated data.

The Competitive Landscape: Who Else Is Building For Enterprise Publishers

To understand why WP Engine made this move, it helps to see who they're competing against. The enterprise publishing platform market is surprisingly competitive, and it's getting more so.

Contentful is a headless CMS that's been aggressively targeting media companies. It promises more flexibility than traditional Word Press because it doesn't bundle presentation with content management. Publications like Tech Crunch (well, before it was acquired) and others use Contentful.

Arc XP, built by the Washington Post, is a suite of publishing tools purpose-built for media companies. It includes content management, paywalls, metering, recommendation engines, and analytics. Because it's built by a publisher for publishers, it deeply understands publishing problems.

Obsidian is another player focused specifically on publishing platforms. There's also Ghost, which is opinionated about content publishing but much simpler than something like Arc XP.

Then there are the legacy players like Vignette and Interwoven that have been serving enterprise publishers for decades. They're declining in relevance but still have tons of installed base.

WP Engine looked at this competitive landscape and realized something important: Word Press wasn't losing to these platforms because Word Press was bad. It was losing because WP Engine wasn't providing the publishing-specific tools that publishers needed. By acquiring Big Bite, WP Engine is saying: we're going to fix that.

Comparative Advantages WP Engine Gains

Acquiring Big Bite gives WP Engine several competitive advantages:

Proven expertise in publishing problems: The Big Bite team has solved these problems for sophisticated clients. They don't have to guess what publishers need—they know.

Existing relationships with major publishers: ITP Media Group and others who worked with Big Bite are more likely to consider WP Engine's solutions because they already have trust in parts of the team.

A running start on product development: Rather than starting from zero, WP Engine is getting a team that has built publishing platforms that actually work for real clients.

Credibility in the publishing vertical: Publishers are going to listen to someone who has shipped publishing software at scale. It's harder to dismiss when the team has real production experience.

Faster feature development: Even if WP Engine could hire great engineers from scratch, onboarding and getting them productive would take a year or more. Acquiring a team that already understands the product space is faster.

The Agency Industry Response: What This Means for Word Press Agencies

The Big Bite acquisition sends a specific message to the Word Press agency industry: the rules are changing. Platforms are consolidating capabilities that agencies traditionally provided. If you're an agency competing in areas where the platform itself is also building, you're going to lose.

This has been happening for years. Automattic (Word Press.com) started building site building tools that competed with agencies doing custom Word Press work. Shopify absorbed a bunch of agencies that built custom Shopify stores. It's a known pattern.

But it's accelerating in the Word Press space because the market is consolidating. Smaller Word Press hosts are either dying or being acquired. Larger hosts like WP Engine, Kinsta, and others are building out product capabilities to compete more effectively for enterprise business.

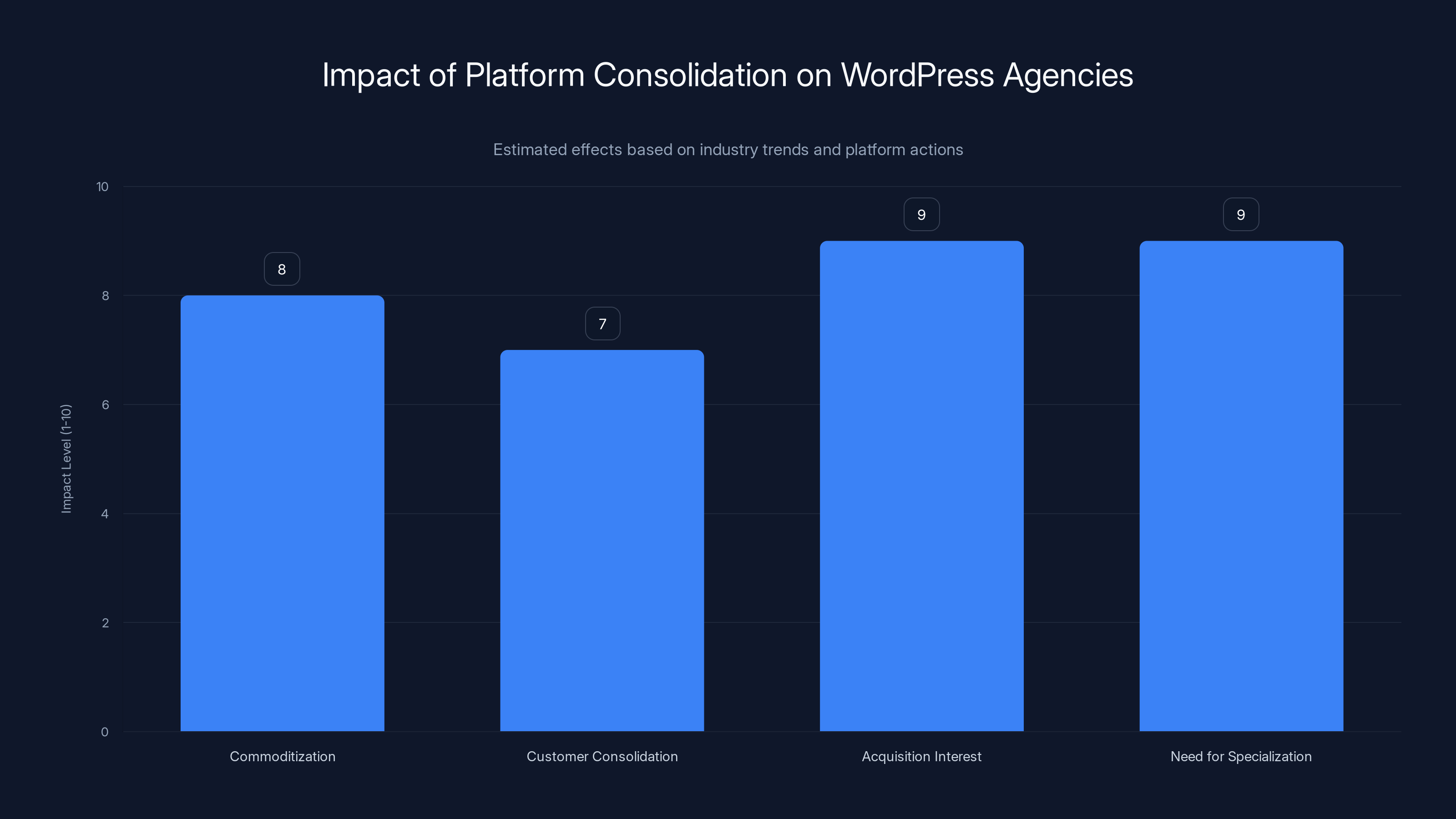

For agencies, this means a few things:

Commoditization of routine work: If the platform itself can do something reasonably well, agencies can't charge premium prices for it anymore. You need to move up-market or specialize.

Consolidation of customers: As platforms absorb capabilities, fewer customers need agency services for those capabilities. The market size shrinks for agencies.

Acquisition interest from platforms: Platforms are actively looking for agencies with specialized expertise or valuable customer relationships. If you have something valuable, you're a buyout candidate.

Need for specialization: Agencies that can't differentiate themselves from the platform itself are in trouble. Agencies that specialize in specific verticals, specific problems, or specific client types have better prospects.

Some Word Press agencies will see the Big Bite acquisition as a threat. Others will see it as proof that there's still value in specialized agencies—otherwise why would WP Engine pay to acquire one?

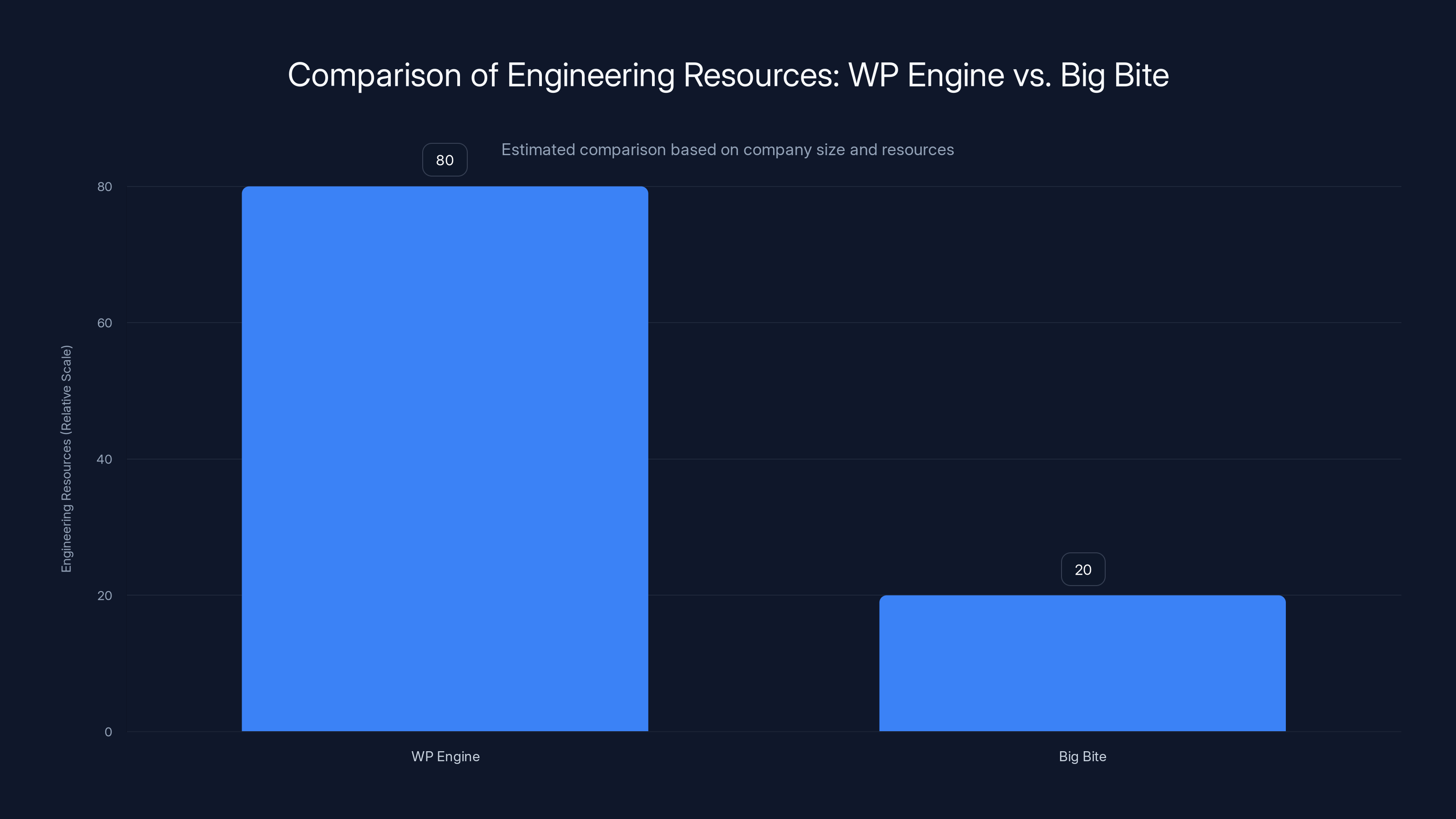

WP Engine has significantly more engineering resources compared to Big Bite, which could lead to more robust feature development. (Estimated data)

The Customer Consolidation Trend: Fewer Choices, More Vendor Power

This acquisition is part of a larger trend in technology that's worth understanding: consolidation of the vendor stack. Organizations are moving away from best-of-breed combinations and toward consolidated vendors that provide multiple capabilities.

For publishers, this trend creates a difficult dilemma. On one hand, consolidation reduces complexity. You have fewer vendors to manage, fewer integrations to maintain, fewer contracts to renegotiate. Your team understands the platform better because they're only learning one.

On the other hand, consolidation increases vendor power. When you depend on one vendor for hosting, publishing tools, analytics, and reporting, that vendor can raise prices or change terms because switching costs are too high.

This is the core tension in the Big Bite acquisition. For WP Engine's business, consolidating publishing expertise in-house makes sense. For publishers, having fewer alternatives to their existing vendor is problematic.

Historically, this has gone badly. News organizations have had painful experiences consolidating their technology stacks around single vendors, only to find themselves locked in or facing conditions they didn't like. The more you consolidate, the more leverage the vendor has.

Publishers thinking about moving to WP Engine or deepening their relationship with WP Engine should understand this dynamic. The convenience of consolidated tools comes with the cost of increased vendor dependence.

Technical Integration: How Big Bite's Work Becomes WP Engine Products

Here's the interesting technical challenge: how does WP Engine actually integrate Big Bite's work into their platform?

Big Bite built custom solutions for specific clients. Those solutions lived in the Big Bite codebase, specific to those clients' requirements. Some elements were probably general enough to be useful across multiple clients. Some were probably very specific to a client's particular workflow.

WP Engine now needs to analyze that codebase and figure out what parts should become core WP Engine product features. What patterns emerged across multiple clients? What problems came up repeatedly? Which solutions are general enough to serve multiple publishers?

Then comes the harder part: cleaning that code up, generalizing it, making it production-ready for WP Engine's standards and infrastructure. Code that worked perfectly for one client might not scale to hundreds. Code that was customized for a specific client's workflow might need to be made more configurable.

This integration work could take a year or more. WP Engine probably has a roadmap already—they didn't acquire Big Bite without thinking through what they'd do with the code. But executing that roadmap while keeping the team productive and motivated is genuinely hard.

The team will be learning WP Engine's development practices, codebases, testing standards, and infrastructure. Some of their code will be rewritten. Some might be thrown away because WP Engine already solved the problem differently. It's like joining a company and discovering that the elegant solution you spent months building already exists as a core feature that you just didn't know about.

Platform consolidation is significantly impacting WordPress agencies, with high levels of commoditization and acquisition interest. Specialization is crucial for survival. (Estimated data)

The Enterprise Publishing Market: Is Word Press Ready

Underlying all of this is a fundamental question: is Word Press really suitable for enterprise publishing at scale? Different people have different answers.

The Word Press advocates point out that Word Press powers major media operations successfully. The Word Press VIP platform serves major publishers. Word Press has been battle-tested on high-traffic operations. With the right hosting and the right plugins, Word Press can do sophisticated publishing work.

The skeptics point out that Word Press was originally designed as a blogging platform. It's been extended to handle publishing workflows, but it's still fundamentally a general-purpose CMS. Specialized platforms like Arc XP are purpose-built for publishing and thus understand publishing problems more deeply.

The pragmatists say it depends on the specific requirements. Word Press can absolutely handle enterprise publishing if you have the right team building on it. But it requires significant engineering effort. Specialized platforms come with more of that work already done.

WP Engine's position is clear: they believe Word Press can compete. They're betting billions that publishers will choose Word Press hosting with purpose-built publishing tools over specialized platforms. The Big Bite acquisition is them putting money where their mouth is.

It's a reasonable bet. Word Press's ecosystem is massive. The developer community is huge. The flexibility is genuine. If WP Engine can build publishing tools that work well and integrate cleanly, they have a shot.

But it's also a difficult bet. Specialized platforms have significant advantages in product maturity and engineering focus. Arc XP, for instance, has the Washington Post's entire publishing operation driving its product development. That's a huge advantage.

Market Signals: What Other Platforms Are Likely To Do

If you run a competing platform, the Big Bite acquisition sends a clear message. WP Engine just demonstrated that acquiring agency talent is faster and more effective than building product capabilities from scratch.

Expect other platforms to follow this playbook. Kinsta might acquire an agency. Pantheon might acquire publishing specialists. Shopify might acquire e-commerce agencies. It's a proven strategy: identify a vertical you want to own, acquire the team that already understands that vertical deeply, integrate them into your product organization, and let them drive product development.

For agencies, this creates a market dynamic where acquisition offers become more likely. If you have valuable expertise and a profitable business, you're an acquisition target. That can be good or bad depending on the offer and whether you want to exit.

For customers, this creates a market where platform consolidation accelerates. Every acquisition of an agency by a platform reduces the number of independent vendors and increases platform power.

It's a natural evolutionary pattern. Platforms start by providing basic services. Agencies build specialized solutions on top. Eventually, platforms acquire the agencies and integrate their capabilities. The market consolidates. Power centralizes.

The Path Forward: What To Expect Next

So what happens next with WP Engine, Big Bite, and the broader Word Press ecosystem?

In the next 6-12 months: WP Engine will work on integrating the Big Bite team. Some team members will probably leave—acquiring teams always results in some attrition. WP Engine will start planning which Big Bite solutions should become core platform features. They'll probably announce some new publishing-focused products.

In 12-24 months: New WP Engine publishing products will start launching. These will be targeted at enterprise publishers and will incorporate Big Bite's expertise. Existing customers will see the integration results as new features. New customers will be pitched on WP Engine's publishing capabilities.

In 2-3 years: WP Engine will either have successfully used Big Bite's expertise to become more competitive in enterprise publishing, or they'll have struggled with the integration and decided they picked the wrong team. Most acquisitions go reasonably well—most. Some don't.

For publishers considering WP Engine or any platform, this is relevant context. WP Engine is betting on becoming more competitive in publishing. That could work out well. Or it could mean the company is distracted with integration work while competitors move faster.

Implications For Your Organization: Practical Considerations

If you're a publisher evaluating platforms, the Big Bite acquisition should factor into your thinking:

If you're already on WP Engine: This is generally good news. You're getting access to publishing expertise that can drive better products. The integration will probably cause some disruption, but ultimately you should benefit from faster feature development and better publishing tools.

If you were considering WP Engine: You now know they're serious about publishing. They're investing real resources into competing in that space. This increases your confidence that WP Engine will continue investing in publishing features. It also signals that WP Engine has capital for acquisitions, which is generally a positive sign about the company's financial health.

If you use Big Bite or were considering hiring them: Your situation is more complex. If you're an existing Big Bite customer, expect integration and potentially some organizational changes. If you were considering hiring Big Bite, you now need to work with them through WP Engine, which changes the relationship dynamic.

If you're an agency or vendor in the publishing space: This is a signal that consolidation is accelerating. You should be thinking about how to compete against increasingly powerful platforms that are absorbing more capabilities in-house.

Zooming Out: The Bigger Picture of Platform Evolution

The Big Bite acquisition is one move in a much larger game. The software industry has been on a consolidation trajectory for decades. Platforms accumulate capabilities, agencies get acquired, vendor choice decreases, and markets consolidate around fewer, larger players.

Word Press itself is interesting because it's remained relatively open and modular through this consolidation. You can still use Word Press.org for free, you can still plug in capabilities from different vendors, you can still build custom solutions. That openness is partially why Word Press has stayed relevant while other platforms have faded.

But there's a risk. As platforms like WP Engine become more sophisticated and more powerful, they might be tempted to lock customers in more tightly. They might move toward proprietary features that only work with WP Engine. They might start charging for things that used to be free.

Word Press's strength has always been its ecosystem—the fact that so many different vendors can build on it. As that ecosystem consolidates, Word Press itself becomes less of an open platform and more of a vendor lock-in situation.

This isn't necessarily bad. Consolidation has benefits—fewer vendors to manage, simpler stacks, faster product development. But it does shift power dynamics in ways worth understanding.

FAQ

What exactly is the Big Bite acquisition?

WP Engine has acquired Big Bite, a digital agency that specialized in building publishing platforms and editorial workflows for international publishers and media organizations over more than a decade. The acquisition consolidates Big Bite's entire team into WP Engine's engineering organization, ending Big Bite's operations as an independent agency. This marks a strategic shift for WP Engine to develop publishing products in-house rather than through external agency partnerships.

Why did WP Engine buy Big Bite instead of hiring engineers directly?

Acquisitions are faster and more effective than direct hiring for specialized expertise. Big Bite's team didn't just have engineering skills—they had institutional knowledge about enterprise publishing workflows, existing relationships with major publishers, experience solving specific publishing problems, and proven track records shipping publishing systems that worked at scale. Hiring engineers from scratch would have taken years to build that same institutional knowledge.

What happens to Big Bite's current clients?

Big Bite's independent agency operations are shutting down completely. Current clients are transitioning to working directly with WP Engine's engineering organization. This changes the relationship dynamic—they're no longer working with an independent agency, they're now working with the hosting platform's internal team. The team members should remain largely the same, but the organizational structure and service model are changing significantly.

Does this mean Word Press is getting better at publishing?

Potentially, yes. WP Engine is explicitly investing in publishing-specific capabilities by consolidating Big Bite's expertise. However, this also means WP Engine is centralizing publishing tools rather than maintaining them as flexible, modular solutions. Publishers will get better tools, but those tools will be integrated into WP Engine's platform, not available as standalone products.

Should I be concerned about vendor lock-in?

This is a legitimate concern. As platforms like WP Engine absorb more capabilities in-house, they increase their lock-in power. Publishers who use WP Engine's hosting plus WP Engine's publishing tools have fewer incentives to switch to competitors. This concentration of power benefits the vendor but can be problematic for customers. It's worth evaluating how dependent your organization would become on any single platform.

Is Word Press still competitive with specialized publishing platforms?

It depends on your specific requirements. Word Press can handle enterprise publishing if you have the right tools, hosting, and engineering support. Specialized platforms like Arc XP have some advantages in purpose-built features and product maturity. The competitive landscape is tightening—WP Engine's acquisition of Big Bite is partly about closing the gap, but specialized platforms continue to invest aggressively.

What does this mean for the Word Press agency business?

It accelerates a long-term trend toward consolidation. Platforms are absorbing capabilities that agencies traditionally provided. Agencies will need to specialize more aggressively to compete—either by focusing on specific verticals, specific problem domains, or specific client sizes that don't interest platform vendors. Agencies with valuable expertise or relationships should expect more acquisition interest from platforms.

Will WP Engine's products be available to customers outside of WP Engine hosting?

That depends on WP Engine's business strategy, which hasn't been fully spelled out. Some acquired capabilities might be offered as standalone products or plugins. Others will probably remain exclusive to WP Engine's hosting platform. WP Engine will likely use exclusive features as a competitive advantage to drive customers toward their hosting platform.

How long will the integration take?

Major integrations of this type typically take 12-24 months to complete. WP Engine needs to analyze Big Bite's codebase, identify generalizable solutions, clean up and generalize the code, integrate it into WP Engine's systems, and ship new products. During this period, expect some disruption, possible team member departures, and a focus on engineering over new feature announcements.

What should publishers do if they're considering WP Engine?

Understand that WP Engine is actively investing in publishing capabilities through this acquisition. This is a positive signal about commitment to the publishing vertical. However, you're also consolidating vendor risk—you're becoming more dependent on a single platform. Evaluate whether the benefits of consolidated publishing tools outweigh the risks of increased vendor dependence, and ensure WP Engine's product roadmap aligns with your publishing requirements.

Conclusion: The Future Is Consolidating

The Big Bite acquisition is significant because it's not an outlier—it's a data point in a clear trend. Platforms are consolidating, vendor choice is decreasing, and power is centralizing in larger players.

For WP Engine, this acquisition is a smart bet. The company identified a gap in its product offerings (sophisticated publishing tools), identified the best team already solving those problems (Big Bite), and paid to bring that team in-house. It's a proven strategy.

For publishers, the acquisition offers both opportunities and risks. You get access to better publishing tools, faster feature development, and more sophisticated platforms. You also get increased vendor dependence, fewer alternatives if you want to switch, and less ability to negotiate custom solutions.

For Word Press agencies, the acquisition is a reminder that the industry is changing. Platforms are absorbing capabilities that agencies traditionally provided. Agencies that can't differentiate themselves from the platforms themselves will struggle. Those that specialize deeply in specific verticals or problems will thrive.

The bigger picture is that software is consolidating. This is partly driven by technology—it's easier and more efficient to offer consolidated solutions than modular ones. It's partly driven by economics—larger platforms have more power than smaller ones. It's partly driven by customer preferences—organizations often prefer to minimize vendor count.

Word Press itself remains relatively open, which is one reason it's stayed competitive. But as platforms like WP Engine become more sophisticated and more capable, the Word Press ecosystem might consolidate in ways that reduce that openness.

None of this is necessarily bad. Consolidation has real benefits. But it's worth understanding what's happening and making conscious choices about vendor dependence and lock-in risks.

If you're a publisher, understand that your platform choices increasingly matter. The platform you choose will drive your product capabilities, feature development speed, and vendor power dynamics.

If you're an agency, recognize that consolidation is accelerating. Differentiation and specialization are becoming more critical. Commoditized services will face increasing pressure from platforms.

If you're someone building products on Word Press, pay attention to how platforms are evolving. The Word Press of five years from now might be significantly different from the Word Press of today, especially as platforms like WP Engine consolidate capabilities.

The Big Bite acquisition isn't the most dramatic technology acquisition ever announced. But for those paying attention to trends in publishing platforms, hosting companies, and the Word Press ecosystem, it signals important things about how the industry is evolving. Keep watching this space.

Key Takeaways

- WP Engine acquired Big Bite to move publishing expertise in-house, ending the agency's independent operations and shifting toward product-based development

- The acquisition signals platform consolidation accelerating across the WordPress ecosystem, with vendors absorbing capabilities agencies traditionally provided

- Publishers face a trade-off: consolidated tools increase efficiency but also increase vendor lock-in risk and reduce alternative options

- The acquisition gives WP Engine credibility in enterprise publishing and a team with proven expertise solving real publishing problems at scale

- Agencies must increasingly specialize or become acquisition targets as platforms absorb general capabilities and move up-market

![WP Engine Acquires Big Bite: WordPress Consolidation Reshapes Enterprise Publishing [2025]](https://tryrunable.com/blog/wp-engine-acquires-big-bite-wordpress-consolidation-reshapes/image-1-1768417926040.jpg)