The End of an Era: Phil Spencer Steps Down, Xbox Enters New Chapter

For 38 years, Phil Spencer shaped the trajectory of Xbox. He started as an intern and climbed to the top, becoming the face of Microsoft's gaming division for over a decade. Then, on February 20, 2025, Microsoft announced his retirement. The news sent shockwaves through the gaming community.

Spencer's tenure wasn't without controversy. Under his leadership, Xbox shifted focus away from hardware and toward services. Game Pass exploded from a niche subscription to a pillar of the business. Major acquisitions like Activision Blizzard and Minecraft brought serious IP under the Microsoft umbrella. But there's a problem: the Xbox console business languished.

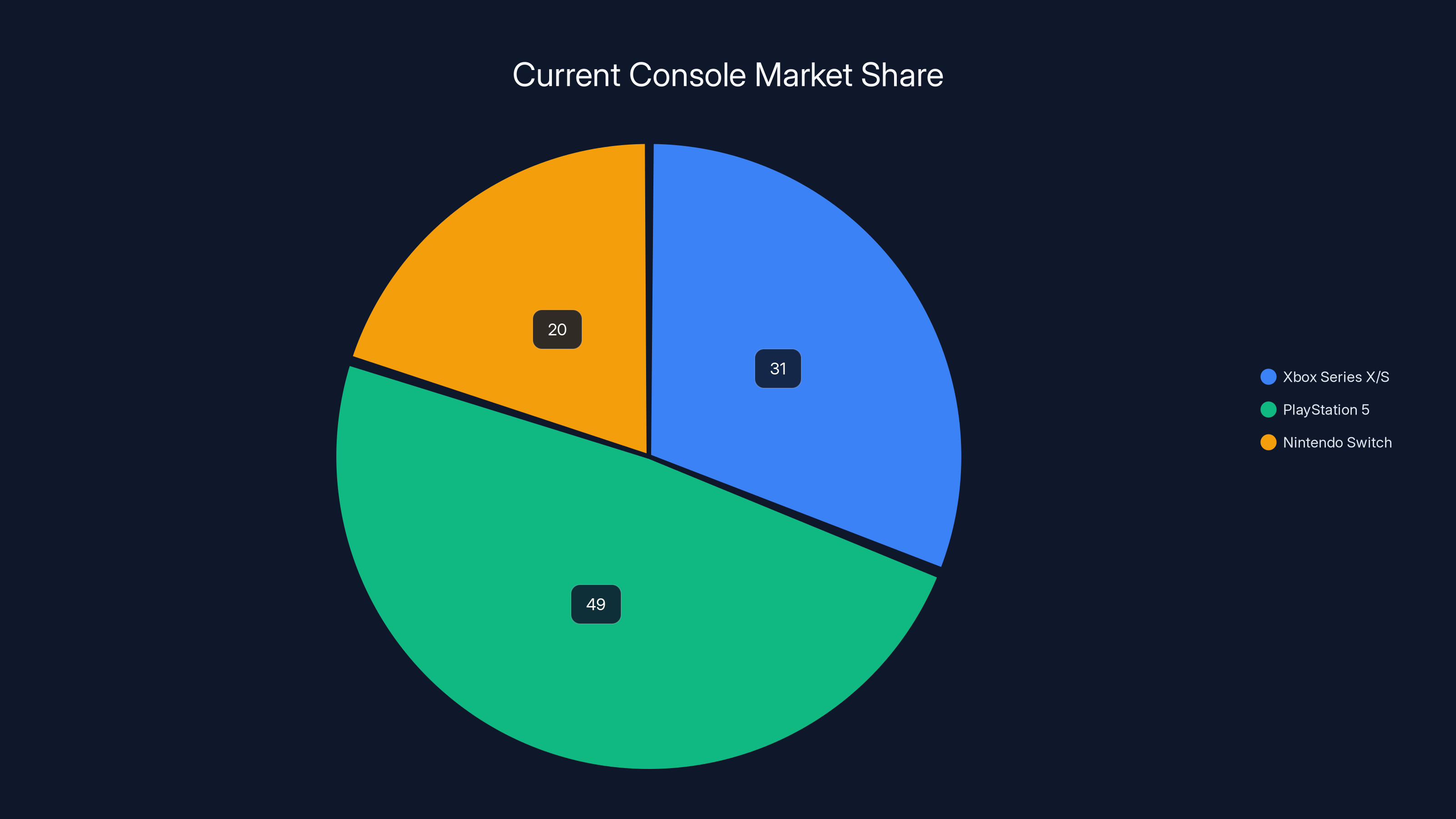

Market share tells the story. Xbox Series X and Series S currently hold roughly 31% of the console market, trailing PlayStation 5 significantly. The price hikes didn't help. Game Pass jumped from

Fans felt abandoned. Console players watched as cloud gaming promises never quite materialized. The Xbox community started asking: Is hardware even a priority anymore?

Enter Asha Sharma, the new Executive Vice President and CEO of Microsoft Gaming. Sharma brings a different pedigree. Before joining Microsoft two years ago, she served as COO of Instacart, where she managed operations at scale. She's never run a gaming company. That might be exactly what Xbox needs.

In her inaugural message to the community, Sharma promised something fans hadn't heard in years: a return to Xbox's roots. But what does that actually mean? And can she deliver?

TL; DR

- Leadership Transition: Phil Spencer retires after 38 years at Microsoft; Asha Sharma becomes new Microsoft Gaming CEO

- Console Revival: New leadership commits to returning focus to Xbox consoles as the foundation of the platform

- AI Commitment: Sharma explicitly promises Xbox won't be "flooded with soulless AI slop," keeping human creativity central

- Market Position: Xbox holds roughly 31% console market share versus PlayStation's dominance; console subscribers have felt neglected

- Cross-Platform Strategy: Xbox still embraces cloud, PC, and mobile, but consoles are no longer an afterthought

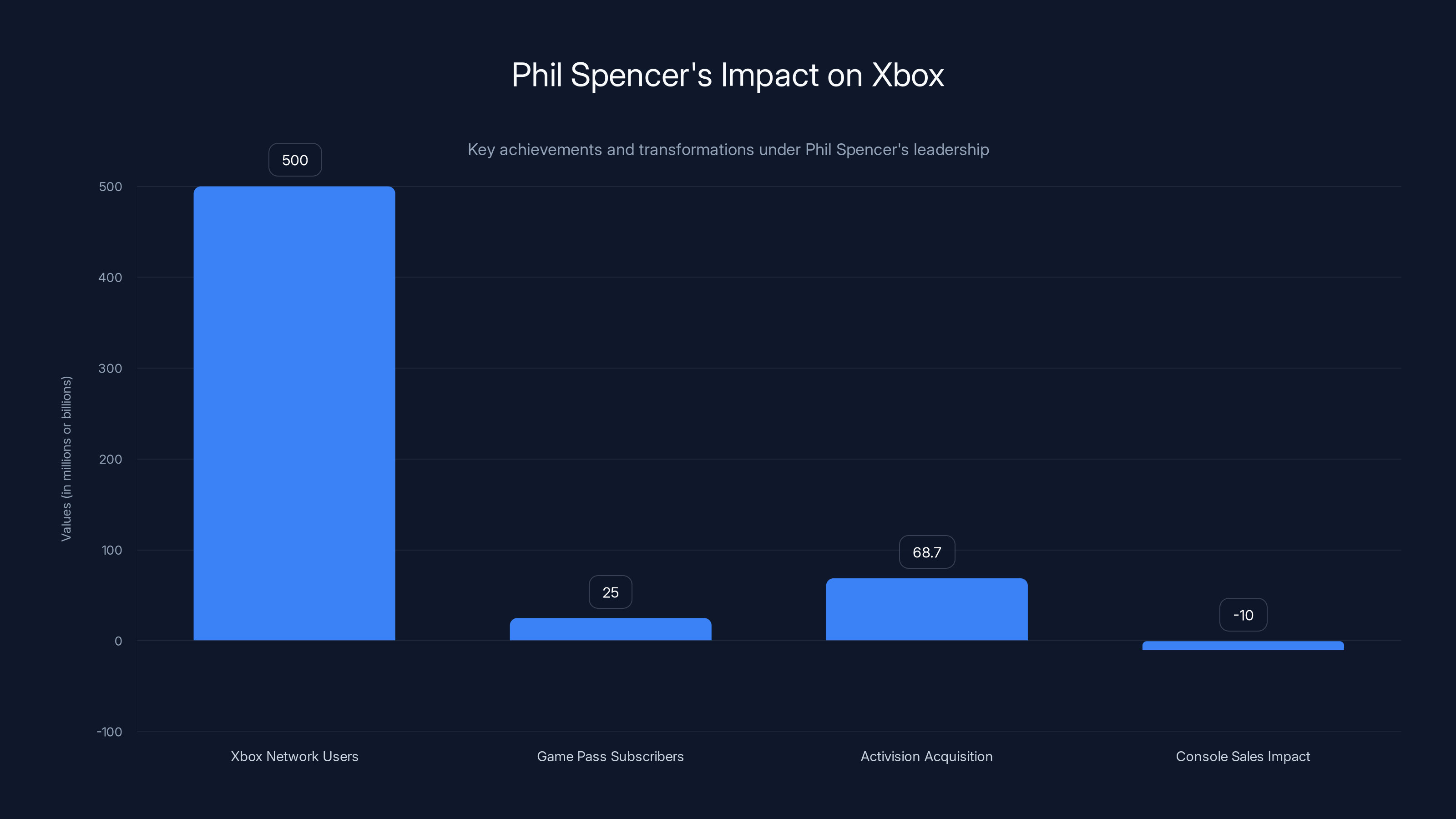

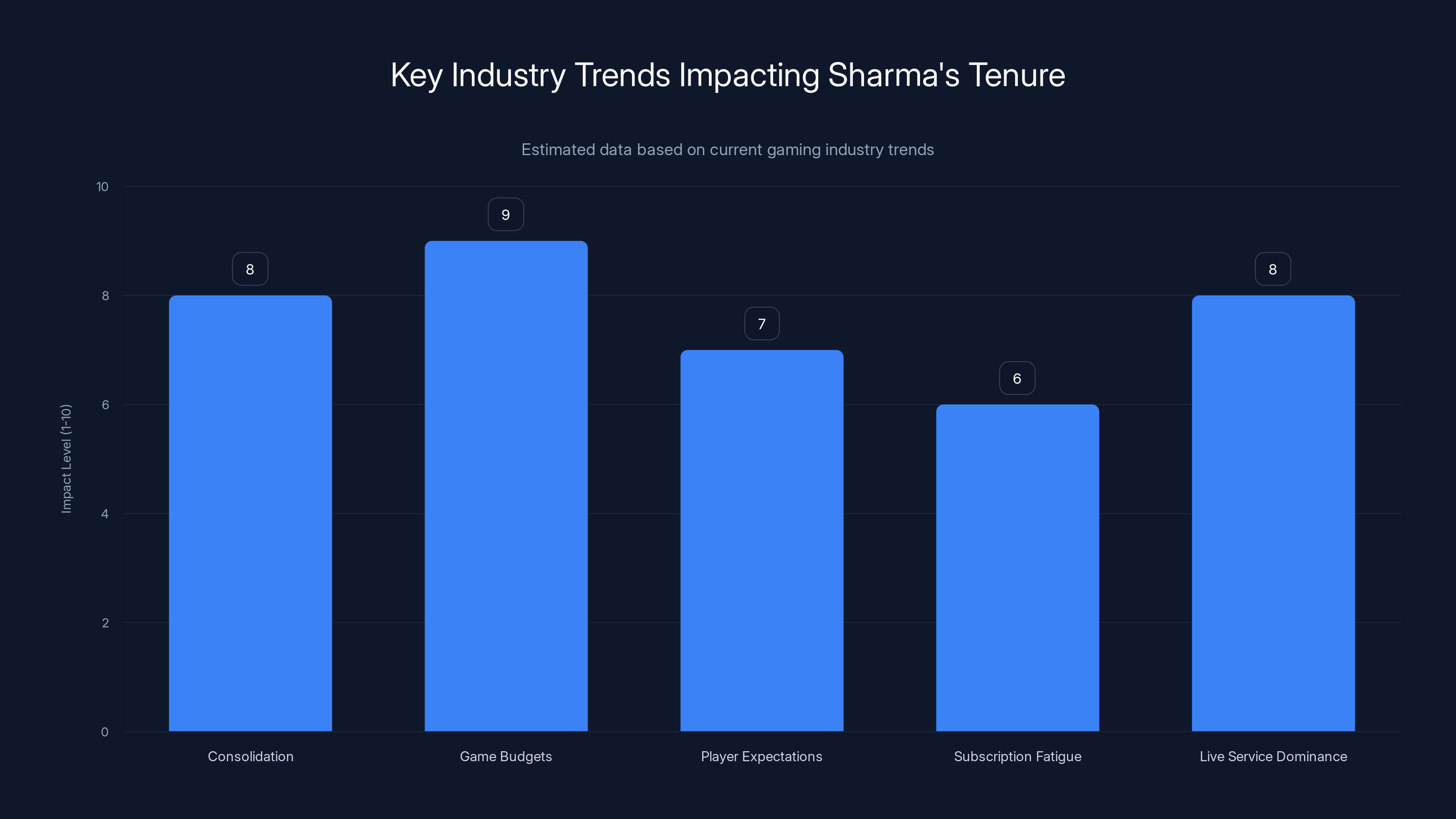

Phil Spencer's tenure saw a balanced focus on growing Game Pass, acquiring major studios, and shifting towards services, despite a decline in console market share. Estimated data.

The Spencer Legacy: Transformation, Innovation, and Trade-offs

When Phil Spencer took charge of Xbox in 2014, the division was in recovery mode. The Xbox One launch had been a PR disaster. The console came bundled with Kinect, required internet connections, and felt like a media hub nobody asked for. Gamers were furious. Spencer had to rebuild trust from scratch.

He did this through several bold moves. First, he unbundled Kinect and dropped prices. Second, he created Xbox Game Pass, the "Netflix of gaming." Third, he went on an acquisition spree: Bethesda, Activision Blizzard, and others. By the time the Xbox Series X and Series S launched in 2020, Xbox felt relevant again.

The numbers looked impressive on paper. Xbox Network now has over 500 million monthly active users. Game Pass subscribers grew to over 25 million. Spencer orchestrated the largest gaming acquisition in history when Microsoft closed the Activision deal in 2023 for $68.7 billion.

But there's always a catch. Spencer's strategy favored services over hardware. He made Halo Infinite, Forza, and Gears of War available on day one to Game Pass subscribers. Smart business? Sure. But it also meant nobody felt compelled to buy the console to play these games—they could stream them or play on PC.

Console exclusivity died under Spencer. Some saw this as forward-thinking. Others saw it as abandonment.

Game Pass pricing became a flashpoint. The base tier stayed affordable, but the tier with console included went from

Cloud gaming, Spencer's long-term vision, never took off as expected. Internet infrastructure constraints, latency issues, and consumer preference for local hardware made cloud gaming a niche product. Microsoft invested heavily. Returns were modest.

Spencer's final year as CEO was marked by departures and restructuring. In 2023, Microsoft laid off 10,000 employees—including many from the gaming division. Studios were shut down. Several planned games were cancelled. The messaging became confused. Was Xbox doubling down on software? Services? Cloud? Hardware? Nobody seemed to know.

Phil Spencer's leadership led to over 500 million Xbox Network users and 25 million Game Pass subscribers. The $68.7 billion Activision acquisition marked a historic move, though console sales saw a slight decline due to increased focus on services. Estimated data for console sales impact.

Asha Sharma's Vision: "The Return of Xbox"

Asha Sharma's first message was unmistakable: "We will celebrate our roots with a renewed commitment to Xbox, starting with console."

That sentence. It matters.

For years, fans asked: Does Microsoft even care about Xbox consoles anymore? Sharma's answer is yes. But she's careful not to abandon Spencer's legacy entirely. She acknowledges that "gaming now lives across devices." Cloud, PC, and mobile are part of the strategy. But consoles are the foundation.

Here's what we know about Sharma's approach:

1. Console-First Foundation: Sharma explicitly says the Xbox console "connects us to the players and fans who invest in Xbox." This isn't nostalgia. It's recognition that consoles drive engagement and loyalty. They're the entry point for most gamers.

2. Device Agnostic Ecosystem: She isn't retreating from the multi-device strategy. Instead, she's reframing it. Xbox should feel "seamless, instant, and worthy of the communities we serve" across PC, mobile, and cloud. The console isn't the only option—it's the anchor.

3. Content Excellence: Sharma promises that "games are and always will be art, crafted by humans." This is a direct shot at algorithmic, AI-generated slop. She's saying: We're betting on creative human beings making exceptional games, not cutting corners with AI.

4. Efficient Monetization: She won't "chase short-term efficiency." Translation: No aggressive microtransactions. No nickel-and-diming players. No sacrificing experience for engagement metrics.

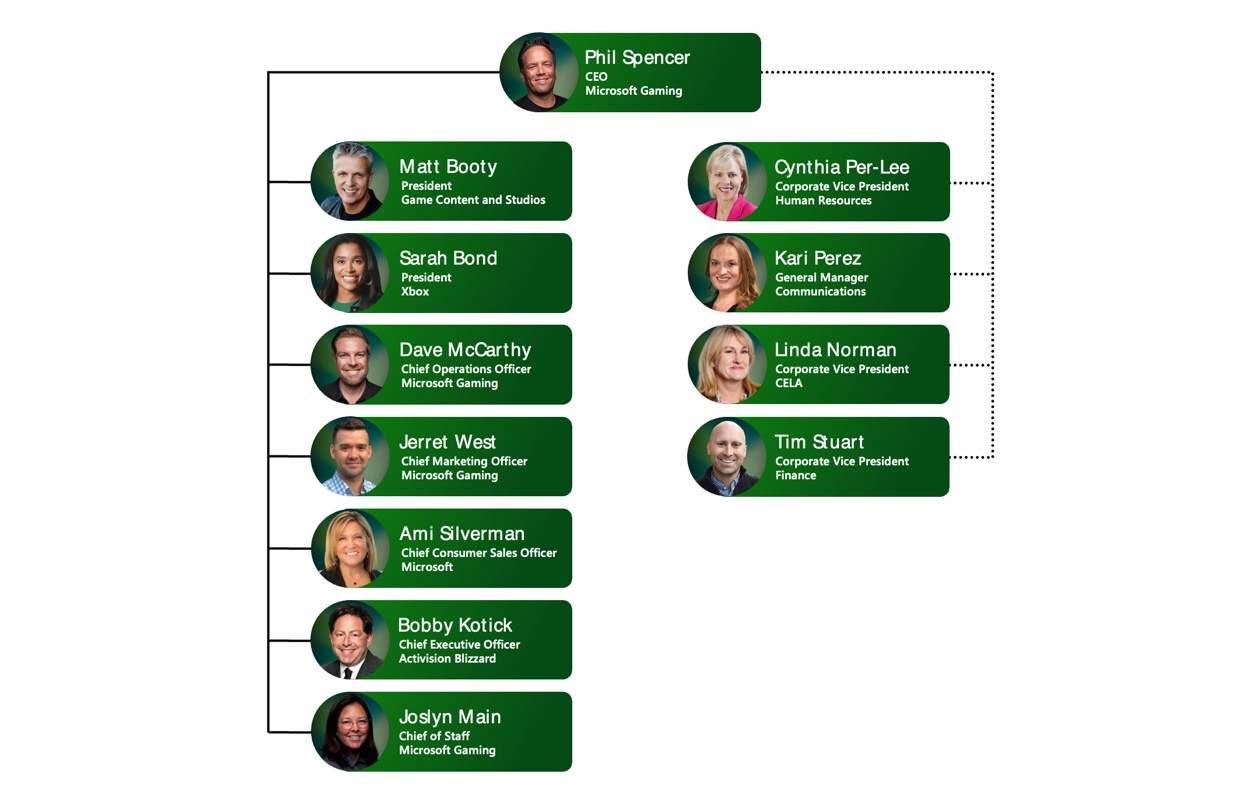

Sharma also mentioned her lieutenant: Matt Booty, Microsoft Games Chief Content Officer. Booty joined Microsoft from Bandcamp and has creative credibility. Having both Sharma (operations and product leadership) and Booty (gaming depth) in leadership positions suggests a balanced approach.

The AI Question: Avoiding Slop, Embracing Tools

The phrase that caught fire was this: "We will not chase short-term efficiency or flood our ecosystem with soulless AI slop."

It's a striking statement in 2025, when every tech company is rushing to integrate AI. But Sharma's commitment reveals something important: the gaming community is skeptical of AI-generated content. They've seen the examples—procedurally generated quest text, AI-voiced NPCs with uncanny intonation, artwork created by algorithms that look technically competent but creatively hollow.

Here's the nuance: Sharma isn't saying AI has no place in gaming. She's saying AI should enhance human creativity, not replace it.

Where AI Can Help in Gaming:

- Game Development Tools: AI can accelerate asset creation, allowing artists to focus on direction and refinement

- Procedural Generation: AI-assisted level generation can create variety while human designers shape the experience

- Accessibility: AI can generate captions, translations, and accessibility features at scale

- Analytics and Community Moderation: AI tools can help manage toxic behavior and understand player sentiment

- Testing and Optimization: AI can identify bugs and performance bottlenecks faster than manual testing

Where AI Backfires:

- Story and Dialogue: Players detect AI-generated narrative. It feels generic and hollow

- Character Design: Procedurally generated NPCs lack personality and emotional depth

- World Building: Algorithmic environments lack intentionality and atmosphere

- Audio Design: AI voice synthesis still sounds artificial in critical moments

Sharma's promise aligns with player sentiment. A recent industry survey found that 61% of gamers are concerned about AI-generated content degrading game quality. Sharma is betting that humans still want human-made experiences.

The risk? If a competitor (say, OpenAI or another studio) releases a hit game powered by AI that's genuinely engaging, Xbox's stance might look quaint. But that hasn't happened yet. For now, Sharma's commitment is a differentiator.

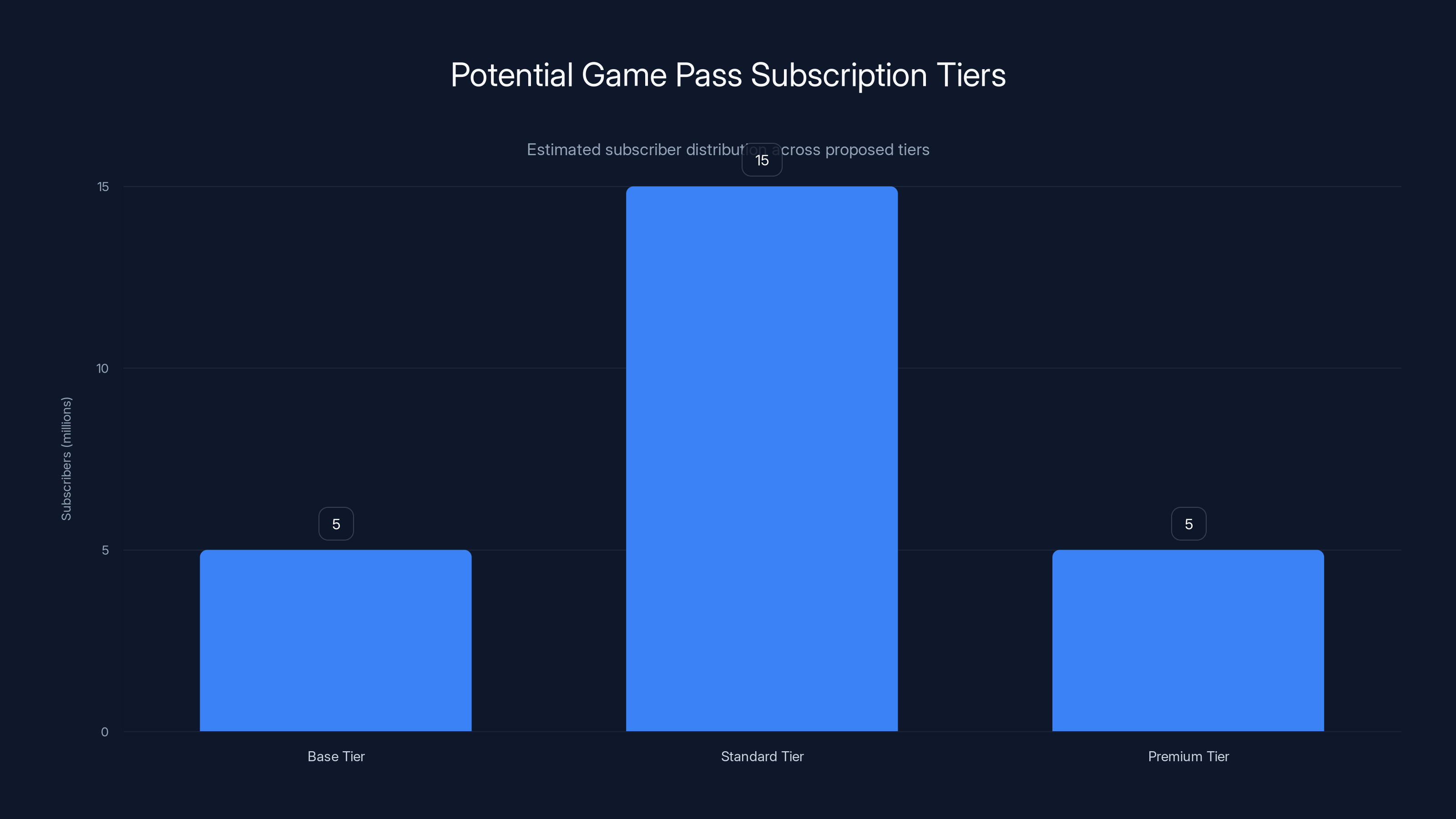

Estimated data suggests a majority of subscribers might opt for the Standard Tier, balancing cost and content access.

Console Hardware: The Forgotten Foundation

Xbox console sales have been sluggish. The Xbox Series X and Series S launched in November 2020 with strong specs and anticipation. But five years in, they've plateaued.

Why? Several reasons:

Lack of Exclusive Content: The biggest games—Starfield, Redfall, Halo Infinite—launched with mixed reviews and modest sales compared to PlayStation exclusives like Spider-Man, God of War, or Final Fantasy VII Remake. Console buyers want reason to pick one system over another. Xbox's exclusive library didn't provide it.

Price Parity with PC: A high-end gaming PC can play the same games as an Xbox Series X, often with better graphics. The console's value proposition weakened as GPU prices fell and PC gaming became more accessible.

Game Pass Dilution: If you can play day-one releases on Game Pass (or PC), why buy the console? This strategy boosted subscriptions but hurt hardware sales. Spencer prioritized subscribers over console units. That's fine for revenue, but console players felt abandoned.

Cross-Platform Development: Most third-party games launch simultaneously on PS5, Xbox, and PC. There's no technical reason to choose one console over another, so brand loyalty becomes everything. PlayStation's marketing and exclusive games gave it an edge.

Sharma's challenge is reviving console appeal without undermining the Game Pass subscription model. She can't just slash Game Pass prices back to $9.99—the economics don't work. But she can ensure the console experience is enhanced, that exclusive games are exceptional, and that the console feels essential to the Xbox ecosystem.

Cross-Platform Strategy: PC, Mobile, and Cloud

Sharma isn't abandoning Spencer's cross-platform vision. She's rebalancing it.

Xbox on PC is thriving. Steam and the Microsoft Store have become critical distribution channels for Xbox games. Game Pass for PC has grown significantly. This segment is healthy and should continue expanding.

Mobile gaming is trickier. Microsoft's mobile strategy has been scattered. They've released some games on Apple App Store and Google Play, but there's no coherent strategy. Sharma likely wants to be more aggressive here, especially in emerging markets where mobile is the primary gaming platform.

Cloud gaming remains a long-term bet. Xbox Cloud Gaming technology is solid, but adoption is slow. Better internet infrastructure, cheaper streaming devices, and lower latency are prerequisites. These are improving, but cloud gaming is still a niche product. Sharma probably won't force it; instead, she'll let it grow organically as infrastructure improves.

The balance is critical. If Sharma prioritizes PC and cloud too much, the console gets neglected again. If she over-focuses on console, she alienates the growing PC and mobile audience. The challenge is threading the needle.

Consolidation and rising game budgets are the most impactful trends for Sharma, with high levels of industry influence. Estimated data based on current observations.

The Competitive Landscape: Can Xbox Compete?

Xbox's position relative to competitors is worth examining.

Against PlayStation: Sony's PlayStation dominates in total revenue, exclusive game quality, and brand perception. PS5 has more exclusives in development than Xbox. Player perception favors PlayStation as the console for "serious" gamers. Reversing this requires multiple hit exclusives in succession—Halo, Starfield, and Redfall didn't achieve that. Sharma needs better exclusive games.

Against Nintendo: Nintendo owns the console market in pure units sold and cultural relevance. The Switch is a phenomenon. Xbox isn't competing directly here—Nintendo serves a different market (casual, family, and portable gaming). But Nintendo's success proves that differentiation, not just specs, wins console wars.

Against PC Gaming: NVIDIA, AMD, and Intel have made gaming PCs more powerful and affordable than ever. The console's technical advantage has eroded. High-end PC gaming now competes directly with consoles, and the PC market is fragmented across multiple vendors and stores. This is Xbox's advantage—Game Pass and Microsoft's ecosystem can unify the experience.

Against Free-to-Play and Mobile: Epic Games, Riot, and miHoYo have built billion-dollar franchises on free-to-play models. Fortnite, League of Legends, and Genshin Impact dwarf Xbox's exclusive portfolio in player engagement. This is where the real competition is. Console and PC games are niche compared to mobile gaming.

Xbox can't compete with Nintendo's brand or PlayStation's exclusive library overnight. But Sharma can compete with the free-to-play space by ensuring Game Pass delivers exceptional value and breadth.

First-Party Games: The Critical Priority

Everything hinges on games.

Xbox's first-party lineup includes studios like 343 Industries (Halo), Playground Games (Forza), Obsidian Entertainment (The Outer Worlds), Bethesda Softworks (The Elder Scrolls, Fallout), and others.

On paper, this looks robust. In practice, execution has been inconsistent. Halo Infinite launched incomplete and received heavy criticism. Starfield was ambitious but polarized fans. Redfall was widely panned. Meanwhile, Sony delivered Spider-Man: Miles Morales, God of War Ragnarök, and Final Fantasy VII Rebirth—each a critical and commercial hit.

Sharma's challenge: she needs multiple hit exclusives within 18-24 months. Not just good games—exceptional ones that make console owners feel their choice was justified. This is where Booty's role as Chief Content Officer becomes crucial. He needs to oversee a creative renaissance across Xbox's studios.

Potential upcoming titles:

- Halo: The Master Chief Collection updates and Halo 7 (in development)

- The Elder Scrolls VI (years away, but anticipated)

- Fallout 5 (also far off, but a franchise asset)

- Fable (rebooted, expected soon)

- Avowed from Obsidian (spiritual successor to Pillars of Eternity series)

- South Park: The Stick of Truth 3 (announced, platform TBD)

Many of these are years away. Sharma needs immediate wins.

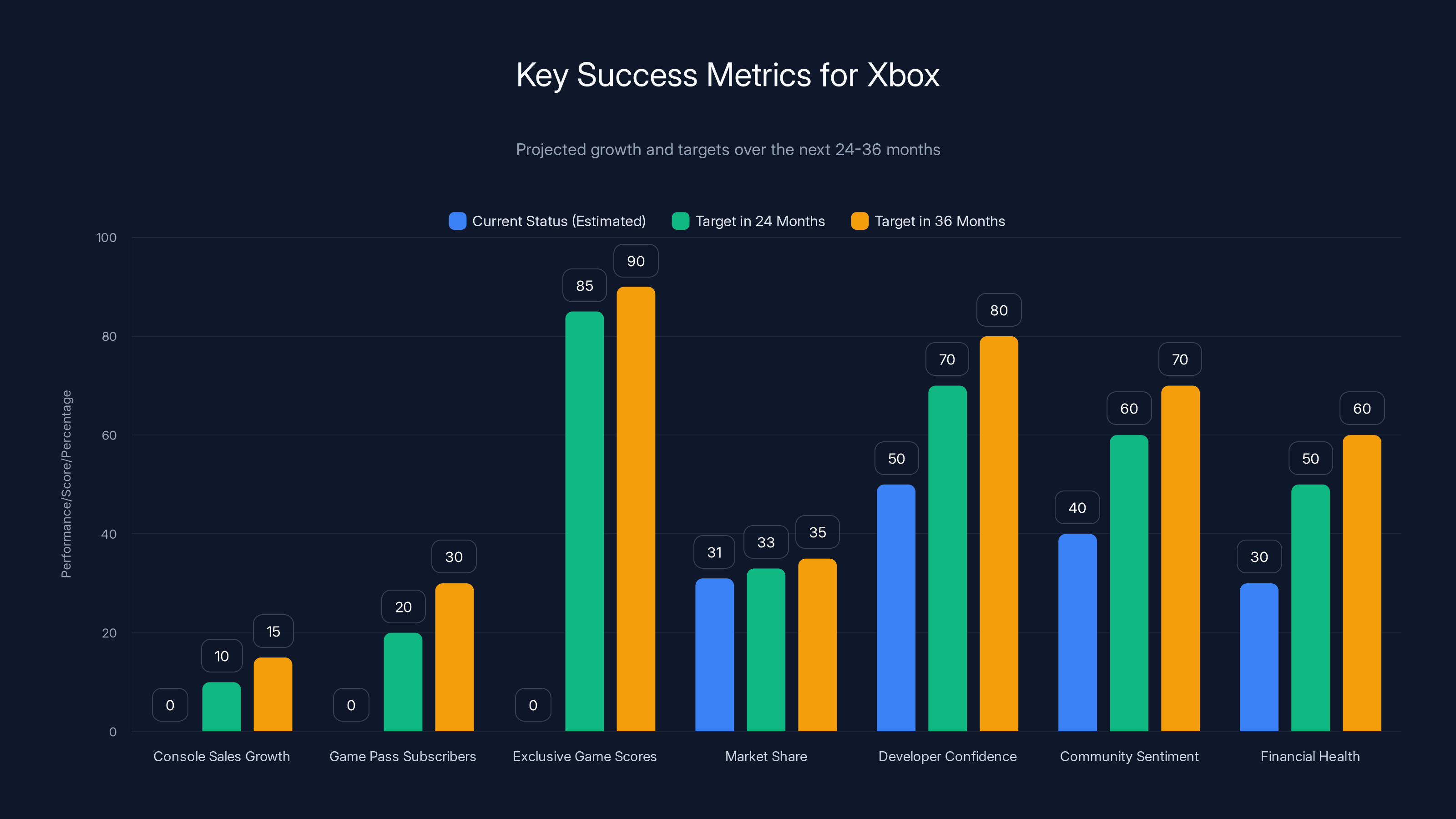

This bar chart illustrates the projected growth targets for Xbox across various success metrics over the next 24 to 36 months. Estimated data shows current status and ambitious targets for future growth.

Game Pass Recalibration: Subscriber Value Equation

Game Pass has been both Xbox's greatest asset and a strategic dilemma.

At its peak, Game Pass represented unbeatable value: hundreds of games, many day-one releases, for $10-20 per month. No competitor matched it. Subscribers grew rapidly.

But Spencer's pricing hikes created resentment. The economics are brutal. High-quality games cost

Xbox's gaming division loses money or barely breaks even, according to various analyst reports. The subscription model doesn't guarantee profitability when you're paying for major AAA games to be included day one.

Sharma has a few options:

Option 1: Tier Aggressively: Expand the tier system. Base tier (free or

Option 2: Selective Day-One Releases: Not every game needs day-one access. Only flagship exclusives. Third-party games come 6-12 months after launch. This reduces costs while preserving prestige.

Option 3: Aggressive Third-Party Partnerships: Licensing deals where popular franchises come to Game Pass in exchange for promotional support. This spreads development costs.

Option 4: Focus on Quality, Not Quantity: Cull the library of weak games, focus on showcase titles, and market the hell out of them. Positioning matters—Netflix has fewer titles than competitors but dominates mindshare.

Sharma's first moves will signal which direction she's taking. Her stated commitment to content quality (not chasing short-term efficiency) suggests she won't go the aggressive monetization route—at least not publicly.

AI in Development: Tools, Not Content Replacement

While Sharma rejected "soulless AI slop," she'll likely embrace AI as a development tool.

Studios like Creativity Storm are already testing AI-assisted asset generation—concept art, backgrounds, UI elements. Tools like Midjourney and Adobe Firefly reduce production time. For a $200 million game, saving months on asset creation with AI-assisted workflows translates to real cost savings.

Similarly, GitHub Copilot and similar AI coding assistants are becoming standard in game development studios. They accelerate coding, catch bugs, and reduce boilerplate. This is uncontroversial—nobody objects to developers using better tools.

Where Sharma draws the line is creative direction. AI shouldn't write the story. AI shouldn't design the antagonist. AI shouldn't decide how the game feels. Those are human decisions.

This distinction matters because it signals respect for the craft. Game development is art plus engineering. Using AI to optimize the engineering while preserving the art makes sense. Sharma's statement reflects this balanced view.

However, if Anthropic, OpenAI, or DeepMind create AI systems that can generate compelling interactive narratives, Sharma's stance might shift. The gaming industry doesn't resist innovation—it embraces it when it works.

Xbox Series X/S holds 31% of the console market, trailing behind PlayStation 5's 49% share. Estimated data.

The Organizational Shake-Up: Who's in Charge?

Sharma's appointment isn't just about vision—it's about execution. She's brought in or elevated key lieutenants.

Matt Booty becomes even more critical. As Chief Content Officer, he oversees all game development studios and creative direction. This is the role that determines if Xbox gets hit games. Booty's track record at Microsoft is solid—he's championed exclusive development and portfolio strategy. Under Sharma's leadership, he has more autonomy to green-light projects and take creative risks.

Studio Leadership: How Sharma manages the studio heads under Booty will be telling. Does she replace underperforming leaders? Does she empower creative vision? Does she inject more capital into R&D? These decisions cascade throughout the organization.

Community Management: Sharma also needs to rebuild trust with fans. Spencer's tenure ended with layoffs, cancellations, and confusion. Sharma's first months should involve town halls, transparent communication, and demonstrated commitment to Xbox players.

Organizationally, Sharma is inheriting a complex structure:

- Xbox hardware and OS team

- Xbox Network and services infrastructure

- Game Pass operations and partnerships

- First-party game studios (multiple, spread globally)

- Third-party publishing and licensing

- Hardware manufacturing (contracted to external partners like Flextronics)

Coordinating these groups under one vision is non-trivial. Spencer had years to align them. Sharma needs to move faster.

Market Trends Sharma Must Navigate

Sharma isn't taking over in a vacuum. Several industry trends will shape her tenure.

Consolidation Continues: Microsoft's Activision acquisition is done, but regulatory scrutiny remains high. Sony is trying to buy Embracer Group studios. Japan's Sony and Nintendo will likely remain independent. The consolidation trend favors large companies with capital. Sharma has that. She can outbid competitors for studios and IP.

Game Budgets Are Exploding: Ubisoft's recent releases cost

Player Expectations Are Rising: Graphics, performance, story quality, and technical stability are baseline. Anything less and players move on. The bar for "good enough" has shifted dramatically upward.

Subscription Fatigue: Consumers are tired of juggling multiple subscriptions—Netflix, Hulu, Disney+, Game Pass, PlayStation Plus, etc. Sharma might see subscriber growth slow unless she adds exceptional value.

Live Service Dominance: Fortnite, Overwatch 2, Final Fantasy XIV, and others generate enormous ongoing revenue. Single-player, story-driven games are still valuable, but live service components are becoming expected.

Geopolitical Tensions: China regulations, US-China tech competition, and international IP disputes will affect Microsoft's global strategy. Sharma needs to navigate these carefully.

What Sharma Needs to Do in Year One

If I were advising Sharma, here's the playbook for 2025:

-

Announce Major Exclusives: Showcase at least three high-profile games coming within 24 months. Rebuild excitement.

-

Stabilize Game Pass: Clarify the pricing tier structure. Communicate why subscriptions cost what they do. Emphasize value, not nickel-and-diming.

-

Celebrate Xbox Culture: Create content celebrating independent game developers on Xbox. Highlight indie hits like Stardew Valley and Hollow Knight. Show that Xbox cares about diversity, not just blockbusters.

-

Invest in Developer Relations: Make it easier for indie and mid-tier studios to publish on Xbox. Provide tools, funding, and promotion. Build goodwill.

-

Refresh Hardware Marketing: If there's a mid-gen console refresh coming, market it as a return to hardware excellence, not a cost-cutting measure.

-

Lay Out a 3-Year Roadmap: Games are years in development. Show players what's coming 2025-2028. Transparency builds trust.

-

Address the AI Question Head-On: Publish guidelines on how Xbox studios can use AI ethically. Lead the conversation instead of being reactive.

-

Engage Community Leaders: Listen to content creators, streamers, and fan communities. Show that their feedback matters.

These aren't revolutionary—they're basic CEO moves. But doing them well would signal a sharp course correction from Spencer's cloud-first, services-focused strategy.

The Renegade Spirit: What Does It Mean?

Sharma ended her message with: "I want to return to the renegade spirit that built Xbox in the first place."

What is this renegade spirit?

When Xbox launched in 2001, it was the upstart. Steve Ballmer and Microsoft were taking on Sony's established PlayStation and Nintendo's dominance. The original Xbox had no exclusives initially. It succeeded on raw power, online multiplayer (Halo: Combat Evolved), and guts. It was a direct challenge to the gaming establishment.

The Xbox 360 doubled down. It launched before PS3, had killer games (Halo 3, Gears of War, Bioshock), and pioneered online gaming at scale. Xbox Live was revolutionary. The 360 became the console of choice for a generation of gamers.

Then things changed. Spencer's vision was more corporate, more services-focused, less about raw gaming passion.

Sharma's "renegade spirit" probably means:

- Risk-taking on Games: Funding bold, unconventional projects alongside blockbusters

- Player-First Decisions: Prioritizing player experience over shareholder optics

- Innovation in Distribution: Finding new ways to reach gamers (not just traditional console sales)

- Authentic Community Engagement: Real conversations with players, not corporate PR

It's an aspirational framing. Whether Sharma can embody it depends on execution.

Looking Forward: What Success Looks Like

Success for Sharma would be measured by:

-

Console Sales Recovery: Xbox console unit sales growing year-over-year. This hasn't happened consistently in recent years.

-

Game Pass Growth and Stability: Subscriber numbers growing without relying on aggressive price hikes. Retention metrics improving.

-

Critical Game Releases: At least two major exclusive games shipping that score 85+ on Metacritic and sell millions of copies.

-

Market Share Gains: Xbox holding steady or growing its 31% console market share versus PlayStation's decline or stagnation.

-

Developer Confidence: Top indie and mid-tier studios wanting to launch games on Xbox because the support and marketing are top-notch.

-

Community Sentiment: Fan forums shifting from skepticism to optimism. This is measurable through sentiment analysis and community discourse.

-

Financial Health: Xbox gaming division moving toward profitability without aggressive monetization tactics that harm players.

Achieving these metrics in 24 months is ambitious but possible. Achieving them in 36 months is more realistic.

Potential Pitfalls and Risks

Sharma could fail in several ways:

Risk 1: Game Delays: If major exclusives slip further into 2026 or later, momentum dies. Players get impatient.

Risk 2: Missed Growth Opportunity: If she plays it safe and doesn't take creative risks, Xbox remains in PlayStation's shadow.

Risk 3: Subscription Model Breaks: If Game Pass subscriber growth flatlines or declines, the entire strategy unravels. She can't cut content without backlash.

Risk 4: Integration Chaos: If Activision Blizzard studios don't mesh well with existing Xbox culture, combined output suffers. This is a real integration challenge.

Risk 5: Hardware Refresh Missteps: If Xbox refreshes hardware and it's perceived as expensive or incremental, it fails to revitalize the market.

Risk 6: Community Skepticism: If gamers don't believe Sharma is serious about change, they won't give her time. Rebuilding trust is harder than building it initially.

The odds aren't against her, but execution is hard.

FAQ

Who is Asha Sharma and what's her background?

Asha Sharma is the new Executive Vice President and CEO of Microsoft Gaming, replacing retiring Phil Spencer. Before joining Microsoft two years ago, she served as Chief Operating Officer at Instacart, where she managed operations and scaling challenges. While she doesn't have extensive gaming industry experience, her operational expertise and product leadership background position her to drive organizational improvements and refocus Xbox's strategy on core gaming audiences.

What did Phil Spencer accomplish as Xbox CEO?

Phil Spencer led Xbox for over a decade and oversaw significant transformations, including the creation of Game Pass (which grew to 25+ million subscribers), major acquisitions of Minecraft and Activision Blizzard, and the strategic pivot toward services and cloud gaming. However, his tenure also saw declining console market share, controversial price increases, and player frustration with perceived neglect of hardware in favor of subscription services and cloud infrastructure.

Why is Asha Sharma focusing on console gaming again?

Sharma is refocusing on console gaming because market data and player sentiment show that consoles remain critical to the gaming ecosystem. While Xbox console sales have lagged, consoles still drive engagement, loyalty, and serve as anchors for hardware-based gaming experiences that cloud and streaming cannot yet fully replicate due to latency, infrastructure limitations, and player preference for local hardware.

What does Sharma mean by "no soulless AI slop"?

Sharma's commitment against "soulless AI slop" signals that Xbox games will prioritize human creativity in storytelling, character design, and world-building rather than relying on algorithmic generation. While AI tools may assist with asset creation and development workflows, the creative vision and emotional core of games will remain human-driven. This positions Xbox against competitors that might cut costs by using AI-generated narratives or generic procedural content.

How does Xbox's 31% market share compare to competitors?

Xbox currently holds approximately 31% of the console market, significantly trailing PlayStation 5, which dominates with around 52% market share. Nintendo Switch captures the remainder with strong position in casual and portable gaming. This competitive gap is why Sharma's console-refocusing strategy is urgent—Xbox needs to win back players and build hardware momentum.

What is Game Pass and why is it important to Sharma's strategy?

Game Pass is Microsoft's subscription service offering hundreds of games, including day-one releases of major exclusives, for $15-30 per month depending on tier. It's central to Sharma's strategy because it provides recurring revenue, builds subscriber loyalty, and offers exceptional value that competitors struggle to match. However, the service's profitability remains questioned, and pricing increases have created subscriber backlash that Sharma must balance.

How does Sharma's leadership differ from Spencer's strategy?

Spencer prioritized cloud gaming, cross-device experiences, and subscription services as the future of gaming, sometimes at the expense of console focus. Sharma is rebalancing by anchoring the strategy on console excellence while maintaining cloud and PC as complementary platforms. She's also emphasizing human creativity over cost-cutting efficiency, signaling a cultural shift toward quality-first game development rather than volume-first service expansion.

What games are coming to Xbox under Sharma's leadership?

While specific release dates haven't been announced, Xbox has several major titles in development, including new entries in franchises like Halo, Forza, and The Elder Scrolls series, as well as new projects from studios like Obsidian Entertainment. Sharma has indicated these titles will be prioritized, and success hinges on critical reception and commercial performance of these exclusives within 18-24 months.

Conclusion: A Pivotal Moment for Gaming's Three-Way Console Battle

Phil Spencer's retirement marks the end of an era. He transformed Xbox from a struggling console manufacturer into a services giant worth billions. Game Pass became a template that competitors scrambled to replicate. The Activision acquisition brought intellectual property gold. By the numbers, Spencer's tenure was successful.

But perception matters in gaming. The community felt abandoned. Console players watched as cloud gaming promises went unfulfilled. Game Pass price hikes stung. Exclusive games lagged behind PlayStation's quality. The magic was gone.

Asha Sharma's appointment signals a course correction. Not a rejection of Spencer's work, but a rebalancing. She's saying: "We still value everything you built. But we're going to double down on what made Xbox special: great games, hardware excellence, and respect for players."

This is harder than it sounds. Rebuilding console market share requires multiple hit games in succession—something even dominant players struggle with. Game Pass's profitability remains murky, and adjusting pricing without alienating subscribers is a tightrope. AI's role in game development will test her principles as budgets rise and efficiency pressures mount.

But Sharma has advantages Spencer lacked at the end of his tenure. She's a fresh voice without baggage from failed initiatives. She has a supportive executive team in Matt Booty and others. Microsoft's financial resources are unlimited. The gaming community is willing to give her a chance—they're desperate for Xbox to succeed because competition is good for the industry.

The next 18 months are critical. If Sharma delivers a few exceptional exclusive games, stabilizes Game Pass, and articulates a clear vision for Xbox's future, the community will rally. If she stumbles on game quality or seems to abandon her promises, skepticism will harden into apathy.

The renegade spirit isn't abstract. It's building games that matter, marketing them with authenticity, and respecting players enough to tell them the truth when things don't work. Sharma seems to understand this. Whether she can execute on this understanding at the scale required by Microsoft's gaming division remains the open question.

One thing's certain: The console wars just got interesting again.

Key Takeaways

- Phil Spencer's 38-year tenure at Microsoft ended with his retirement, transitioning leadership to Asha Sharma, a former Instacart COO with strong operational expertise

- Sharma commits to refocusing Xbox strategy on console hardware as the foundation while maintaining cross-platform PC and cloud presence

- Xbox explicitly rejects AI-generated game content in favor of human creativity, positioning the brand against algorithmic shortcuts and generic experiences

- Xbox's 31% console market share trails PlayStation's 52%, requiring immediate delivery of exclusive games to regain competitive ground

- Game Pass pricing stability and subscriber value will determine Xbox's financial health, requiring careful balance between monetization and player retention

Related Articles

- Asha Sharma's Xbox Vision: What Her First Memo Reveals About Gaming's Future [2025]

- Xbox Leadership Shakeup: Phil Spencer's Retirement and What's Next [2025]

- Phil Spencer Leaves Microsoft: Xbox's Biggest Leadership Shift [2025]

- Ubisoft Layoffs at Splinter Cell Studio: What It Means for Gaming [2025]

- Replaced Delayed Again: What We Know About Sad Cat Studios' Cyberpunk Platformer [2025]

- Why Final Fantasy is Shifting to PC as Lead Platform [2025]

![Xbox's New Era: AI Strategy, Console Revival, and Gaming's Future [2025]](https://tryrunable.com/blog/xbox-s-new-era-ai-strategy-console-revival-and-gaming-s-futu/image-1-1771637767883.png)