The Streaming Giant That's Quietly Reshaping How We Pay for Video

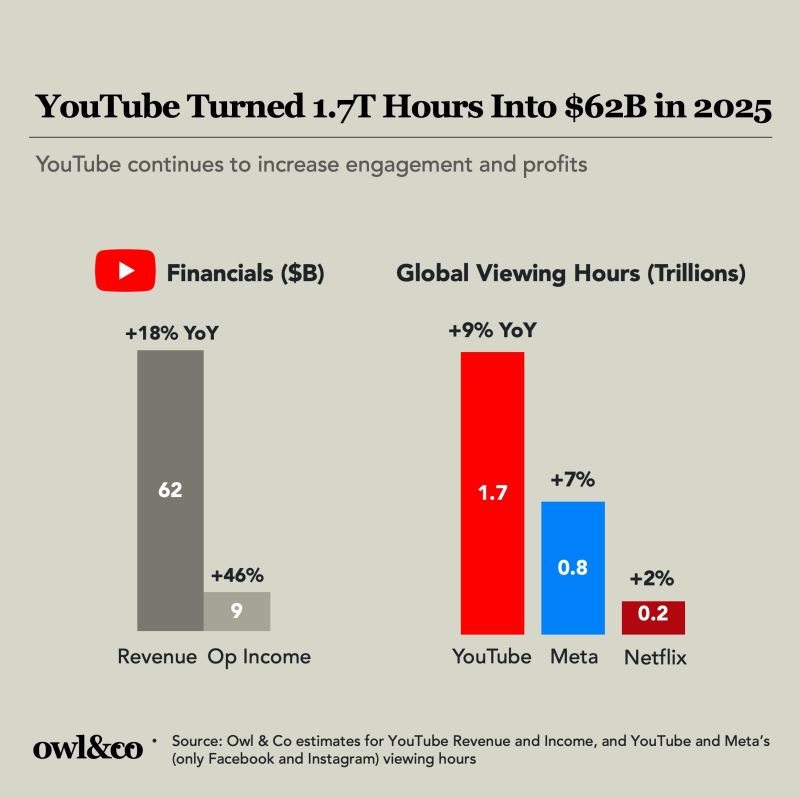

When you think about subscription services, Netflix probably comes to mind first. But here's what most people miss: YouTube is quietly becoming one of the most valuable subscription platforms on the planet. In its latest earnings report, Google revealed that YouTube alone generated $60 billion in annual revenue, with subscriptions hitting a critical milestone of 325 million paying users.

That's not just a number. That's proof that the traditional model of "free video with ads" is fundamentally shifting. And it happened faster than anyone expected.

The context matters here. A decade ago, YouTube was almost exclusively ad-supported. The platform's entire business model revolved around algorithmically targeted advertisements interrupting your videos. But starting in 2018, YouTube Premium launched as a premium tier offering ad-free viewing, offline downloads, and background play. Most analysts thought it would remain a niche product for power users.

Instead, it's become a revenue juggernaut.

In just three months alone (Q4 2025), Google added 25 million net new paying subscribers across YouTube Premium and Google One combined. That's roughly 8 million new subscribers per month, or 267,000 per day. If you extrapolate that growth rate, YouTube is on pace to add over 100 million paying users annually. For context, that's more subscribers than Netflix gained in the same period.

But the real story isn't just about the numbers. It's about what these numbers reveal about consumer behavior, the future of streaming, and how Google is monetizing its most valuable asset in ways that traditional media companies still don't fully understand.

This shift matters because it signals a broader trend across the tech industry: free services are increasingly supplemented by premium tiers. It's the strategy that worked for Spotify, worked for Apple Music, and is now working spectacularly for YouTube. But YouTube has something those competitors don't: a platform with over 2 billion monthly active users generating hundreds of millions of hours of watch time daily.

In this deep dive, we'll examine what's driving this subscription explosion, how YouTube Premium compares to competitors, what it means for creators, and where this entire ecosystem is heading as Google continues to integrate AI into its content discovery and creation tools.

TL; DR

- YouTube's subscription base grew by 25 million users in Q4 alone, reaching 325 million paying subscribers across YouTube Premium and Google One

- The platform pulled in $60 billion in annual revenue, with subscriptions growing stronger while ad revenue slightly missed analyst expectations

- YouTube Premium's $8/month tier is gaining serious traction, particularly among creators and heavy users who want uninterrupted viewing

- YouTube TV is expanding with genre-specific packages, signaling Google's ambition to compete directly with cable alternatives

- AI tools are accelerating adoption, with over 1 million channels using AI creation tools and 20 million consumers engaging with Gemini-powered discovery in December alone

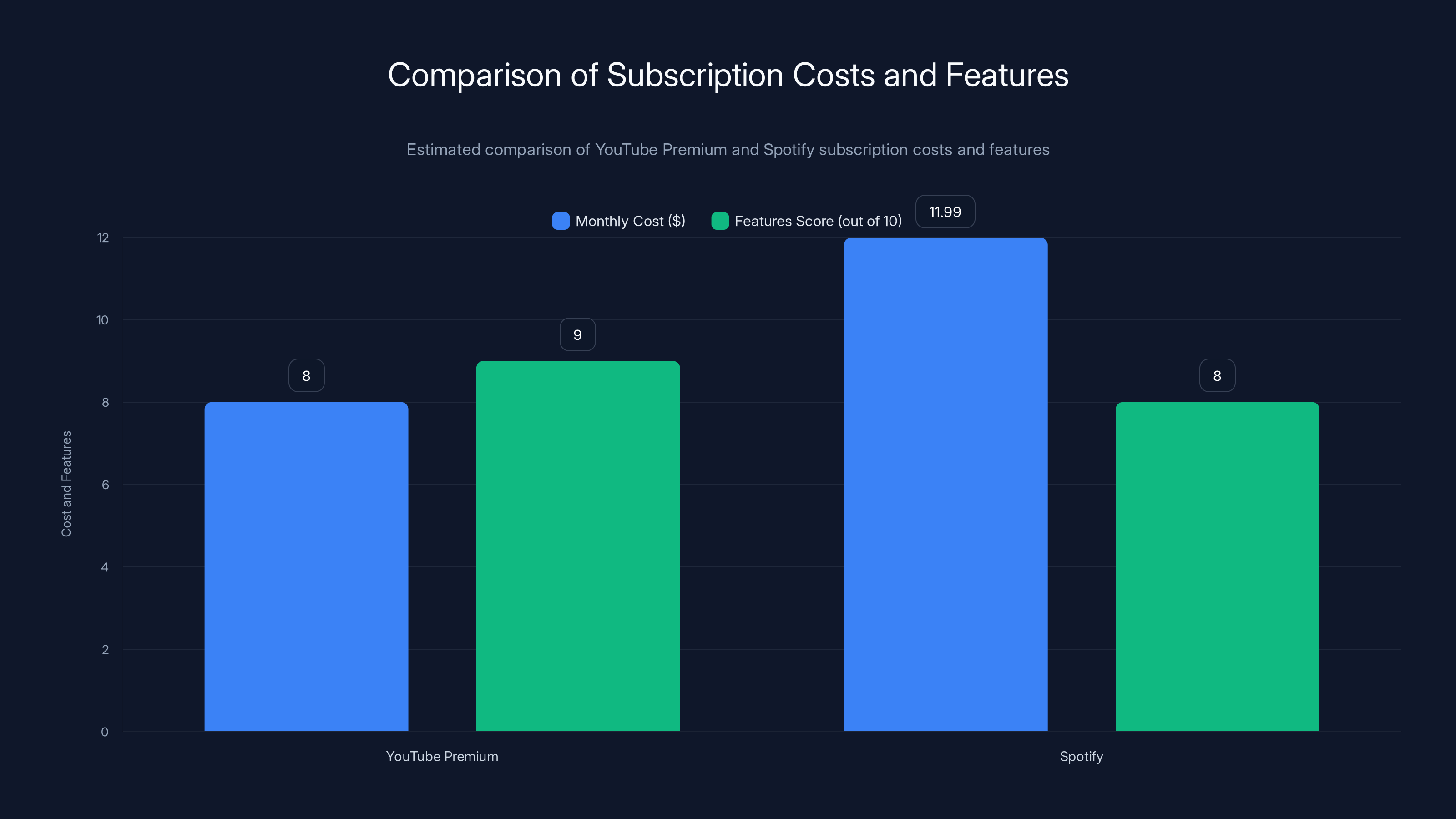

YouTube Premium offers a lower monthly cost and a slightly higher features score compared to Spotify, making it an attractive option for users seeking both video and music streaming. Estimated data.

Understanding YouTube's Subscription Ecosystem

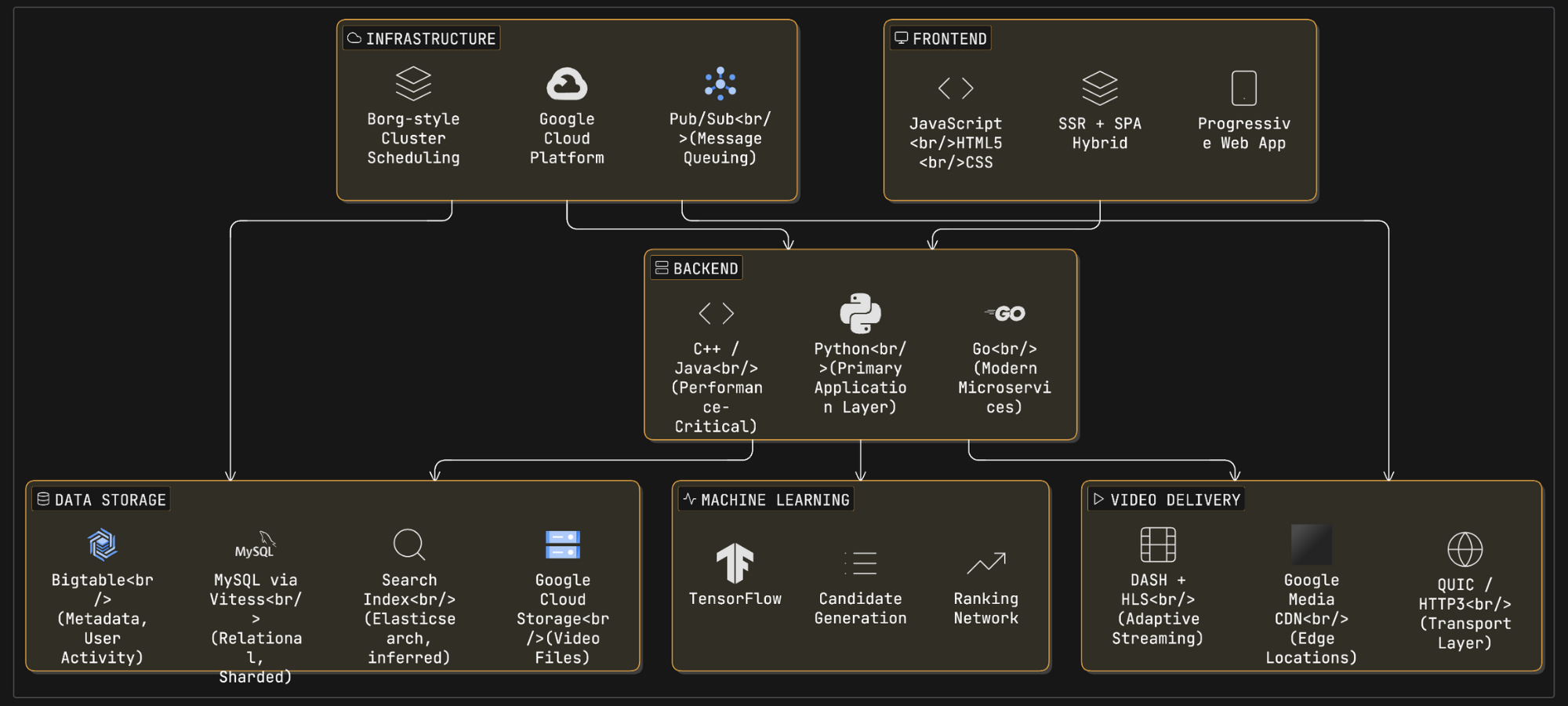

YouTube Premium sits at the center of Google's subscription strategy, but it's not a monolithic product. The platform has actually evolved into a sophisticated multi-tier system with different offerings for different user segments. This is crucial to understand because it reveals how Google is extracting value from different parts of its user base.

The primary YouTube Premium tier costs $8 per month and removes ads across all videos on the platform. This is the product most people think of when they hear "YouTube Premium." But there's more complexity underneath. YouTube Premium includes background play (essential for music listening on mobile), offline downloads (perfect for commuters and travelers), and access to YouTube Music as part of the package.

For many users, this effectively replaces a Spotify subscription, which costs $11.99 per month for the equivalent ad-free tier. From a consumer perspective, YouTube Premium bundling music with video is genuinely compelling. You're getting both ad-free YouTube and ad-free YouTube Music for less than a standalone music service.

Then there's Google One, which bundles YouTube Premium with cloud storage and other Google services like VPN and extra Google Photos storage. Google One starts at

This bundling strategy is brilliant from a business perspective. It allows Google to package YouTube Premium (which some users might not pay $8 for standalone) with cloud storage and services that have genuine value propositions. Suddenly, a user subscribing for storage gets YouTube Premium "for free," and Google gets higher-margin revenue overall.

But the real insight is this: Google isn't primarily selling premium video. It's selling convenience and integration within an ecosystem. A YouTube Premium subscriber isn't just paying to remove ads. They're paying for a seamless experience across music, video, and cloud services. That's far stickier than any single product.

The growth trajectory reveals something else important. Adding 25 million subscribers in three months suggests YouTube Premium isn't some slow-burn niche product anymore. It's mainstream. And mainstream adoption at that scale changes everything about how creators should think about their business models.

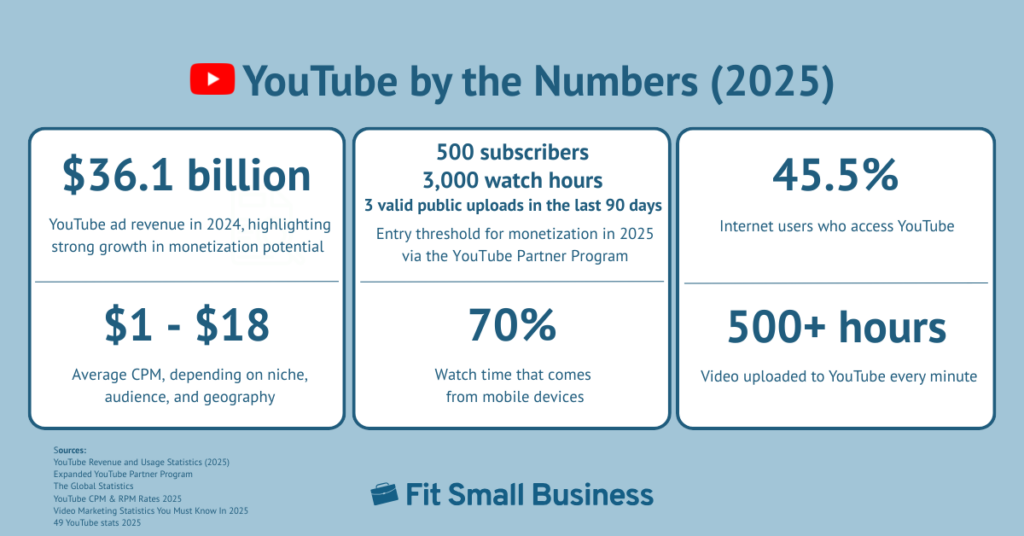

YouTube's actual ad revenue in Q4 was

Why YouTube Premium Actually Works (When It Shouldn't)

Historically, YouTube's biggest strength was also its biggest weakness: it was completely free and ad-supported. This meant anyone with an internet connection could access unlimited high-quality video content with zero friction. The barrier to entry was essentially zero.

Converting a massive base of free users to paying users is theoretically one of the hardest problems in SaaS. The social proof cuts both ways. When most of your friends use something free, paying for it feels wrong, almost foolish. Yet YouTube Premium's growth suggests this isn't actually true at scale.

The primary reason YouTube Premium works is psychological. YouTube became so integral to daily life that removing ads felt worth

This is different from, say, paying for a streaming service where you might watch content a few hours per week. YouTube is ambient. It's background research, music, tutorials, news, and entertainment all in one. Higher usage frequency means higher value perception.

Secondly, YouTube Premium launched at a moment when ad-supported YouTube had become genuinely unpleasant. YouTube's ad algorithm became increasingly aggressive around 2016-2017. Two-minute videos started getting pre-roll ads. Mid-roll ads appeared in longer videos. The ads themselves became longer and less skippable. This wasn't accidental. YouTube was optimizing for ad revenue, which pushed premium adoption as a logical escape hatch.

Third, the competition in music streaming made YouTube Premium's bundle especially compelling. Spotify and Apple Music dominated the music streaming space, but both cost

Fourth, creator support matters more than people realize. Many creators explicitly ask their fans to subscribe to YouTube Premium or use YouTube Music because it results in better revenue sharing. Unlike YouTube Partner Program payouts (which are minuscule), premium subscription revenue actually filters back to creators fairly effectively. This creates a direct feedback loop where fans subscribe to support creators, which then attracts more fans wanting to support their favorite creators.

Finally, there's the viral network effect that few platforms achieve. Once your friends start using YouTube Premium, you notice its benefits more. Someone shows you offline downloads, background play, or ad-free music, and suddenly $8/month seems obvious. Network effects are powerful for any consumer product, but they're especially powerful for media consumption because recommendations from friends drive huge influence.

The Ad Revenue Reality Check

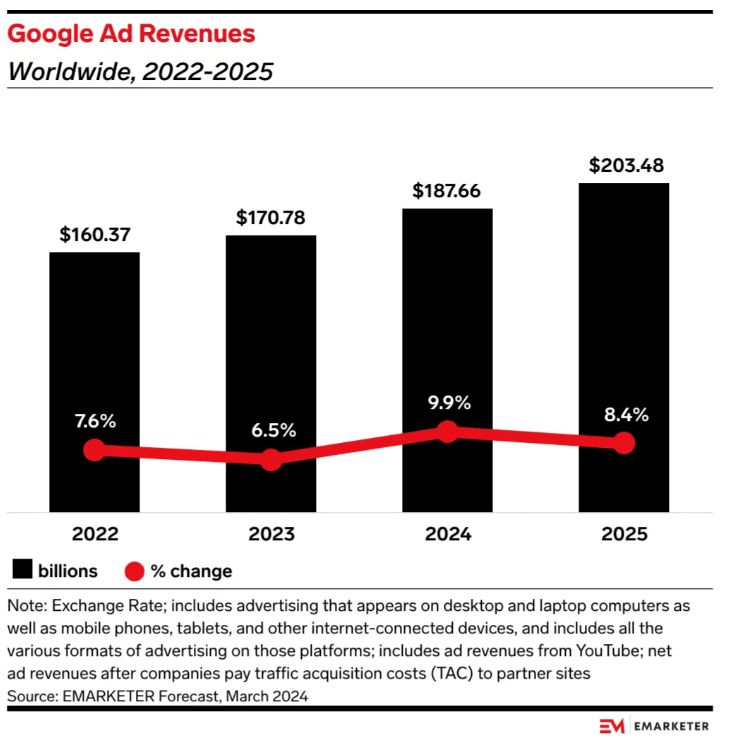

Here's something that didn't get as much attention in the earnings announcement: YouTube's ad revenue actually came in below analyst expectations in Q4. The company reported

This is significant because it reveals an important truth about YouTube's business model. The platform is transitioning away from pure ad dependency. Subscription growth is accelerating, but ad revenue growth is moderating. This is the natural consequence of having a more engaged paid user base that doesn't see ads, combined with natural advertiser budget constraints.

For creators, this is meaningful. YouTube is internally signaling that ad-supported revenue may have plateaued. The company is increasingly focused on diversifying revenue through subscriptions, YouTube TV, and eventually AI-powered creation tools that probably carry their own premium pricing.

But here's the nuance: ad revenue still matters enormously. The $11.38 billion in Q4 ad revenue is still massive and still growing year-over-year. The company didn't say it's declining; it just missed analyst expectations. This distinction is crucial for understanding YouTube's actual health.

When you bundle it together, YouTube's total revenue was $60 billion for the full year, up 17% compared to the previous year. That's real growth. That's not a company in decline. It's a company optimizing its revenue mix from pure ads toward a diversified model including subscriptions, commerce, and new product categories.

YouTube Premium pricing varies significantly by market, with India offering the lowest cost at

YouTube Shorts: The Mobile-First Wild Card

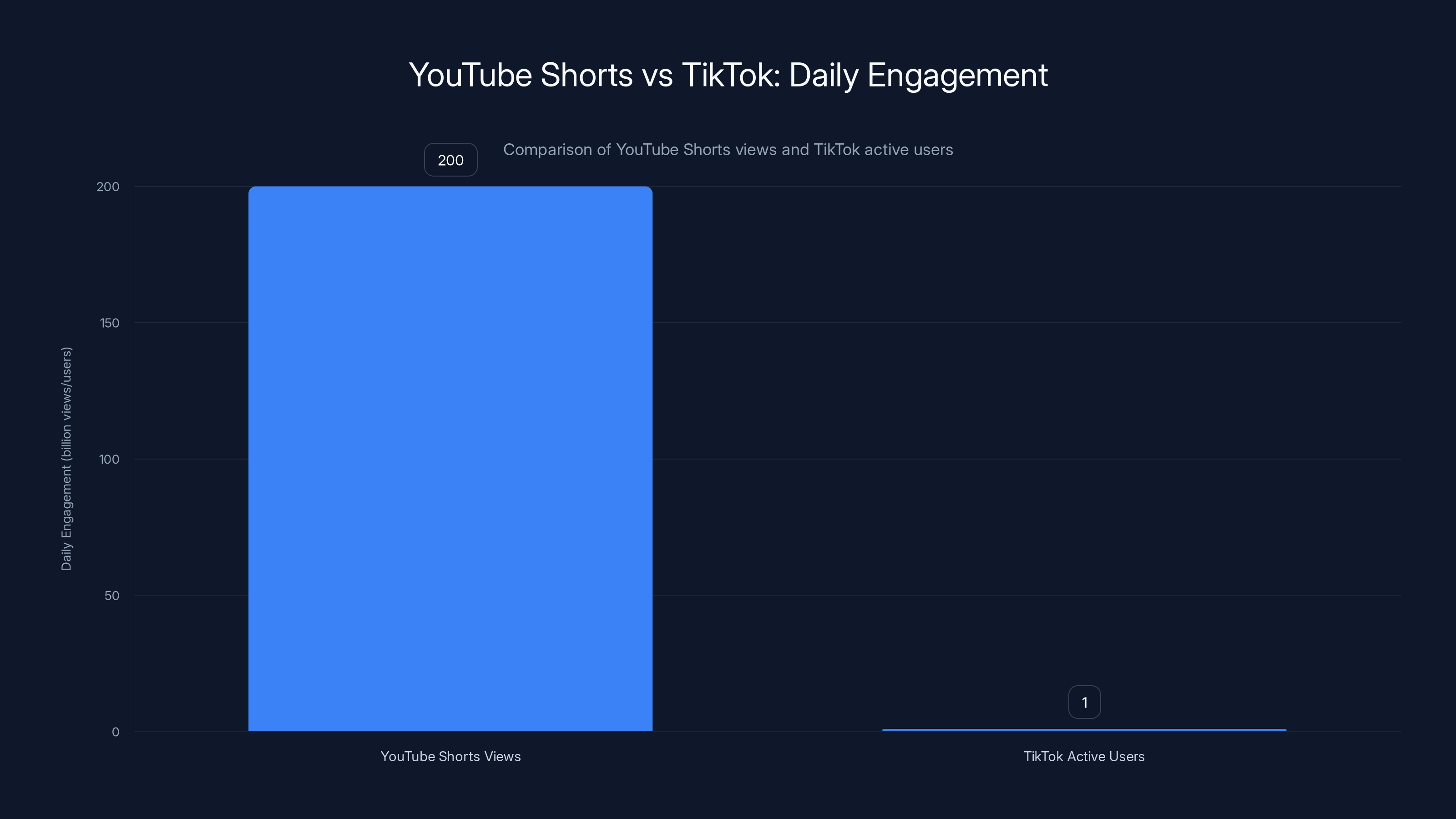

YouTube Shorts reached a significant milestone that deserves more attention: 200 billion average daily views. To put that in context, TikTok's reported daily active user count is around 1 billion people. YouTube Shorts reaching 200 billion daily views means each active user is watching an average of 200 Shorts per day.

Wait. That can't be right. Let me recalculate.

Actually, it likely means that across all YouTube Shorts watch sessions globally, users are collectively accumulating 200 billion views per day. If we estimate conservatively that 500 million people watch Shorts daily, that's 400 views per person per day, which is plausible if you're counting aggregated view metrics rather than unique users.

The key insight here is that Shorts has achieved parity with the previous year while the platform keeps growing. There was no jump. This suggests Shorts has hit a plateau in growth, which is interesting. TikTok's relentless growth has made the short-form video space competitive, and YouTube isn't dominating the way many expected.

But here's what Google highlighted that signals future strategy: "In some countries, ads on short-form video earn more than in-stream ads on a per-hour basis." This is the real story. YouTube discovered that Shorts actually have higher ad yield than traditional long-form videos in certain markets. This is counterintuitive because Shorts are typically 15-60 seconds, while long-form videos are 8-20 minutes.

Higher yield on fewer seconds of video means the ads are either higher CPM (cost per thousand views) or users are watching more Shorts videos, hitting more ads total. Either way, it signals that YouTube can monetize short-form video effectively, which changes the competitive dynamic with TikTok.

For creators, this is interesting. It means investing in Shorts content might have better return potential in certain regions. But the flat growth quarter-over-quarter also suggests that Shorts are reaching saturation or that users are dividing their attention between Shorts, traditional videos, and other platforms.

The YouTube TV Expansion and Cable Disruption

Google's announcement about YouTube TV expansion is easy to miss in the earnings noise, but it represents a major strategic shift. The company plans to launch "new YouTube TV plans, bringing more choice and flexibility to subscribers with over 10 genre-specific packages."

YouTube TV is YouTube's answer to cable TV. It offers live television through an internet-based service, starting at

The expansion into genre-specific packages is crucial. Instead of forcing users to buy a bundle that includes channels they'll never watch, YouTube is fragmenting YouTube TV into smaller, more focused packages. This is actually a reversal of traditional cable logic.

Cable companies built their business on forcing consumers to buy bundles. Want ESPN? You also need 50 other channels. This worked for decades because it was the only option. But the internet changed that. Now consumers expect à la carte options.

YouTube's new strategy acknowledges this reality. If someone only wants sports channels, Google will sell them a sports package. If someone wants news and documentary channels, there's a package for that. This flexibility could massively expand YouTube TV's addressable market.

Why? Because it eliminates buyer resistance. Instead of

The competitive threat to traditional cable is real. Cable companies have spent decades building networks of content that are now becoming less valuable as distribution shifts to internet-based services. YouTube has the infrastructure (massive server network, 24/7 uptime requirements), the user base (2+ billion monthly active users who already trust the platform), and the financial resources to compete in live television.

For creators, YouTube TV expansion is less directly relevant than YouTube Premium, but it signals that Google's ambitions extend beyond user-generated content into professional media distribution. This could create opportunities for creators to have their content featured in YouTube TV packages, similar to how Netflix licenses content.

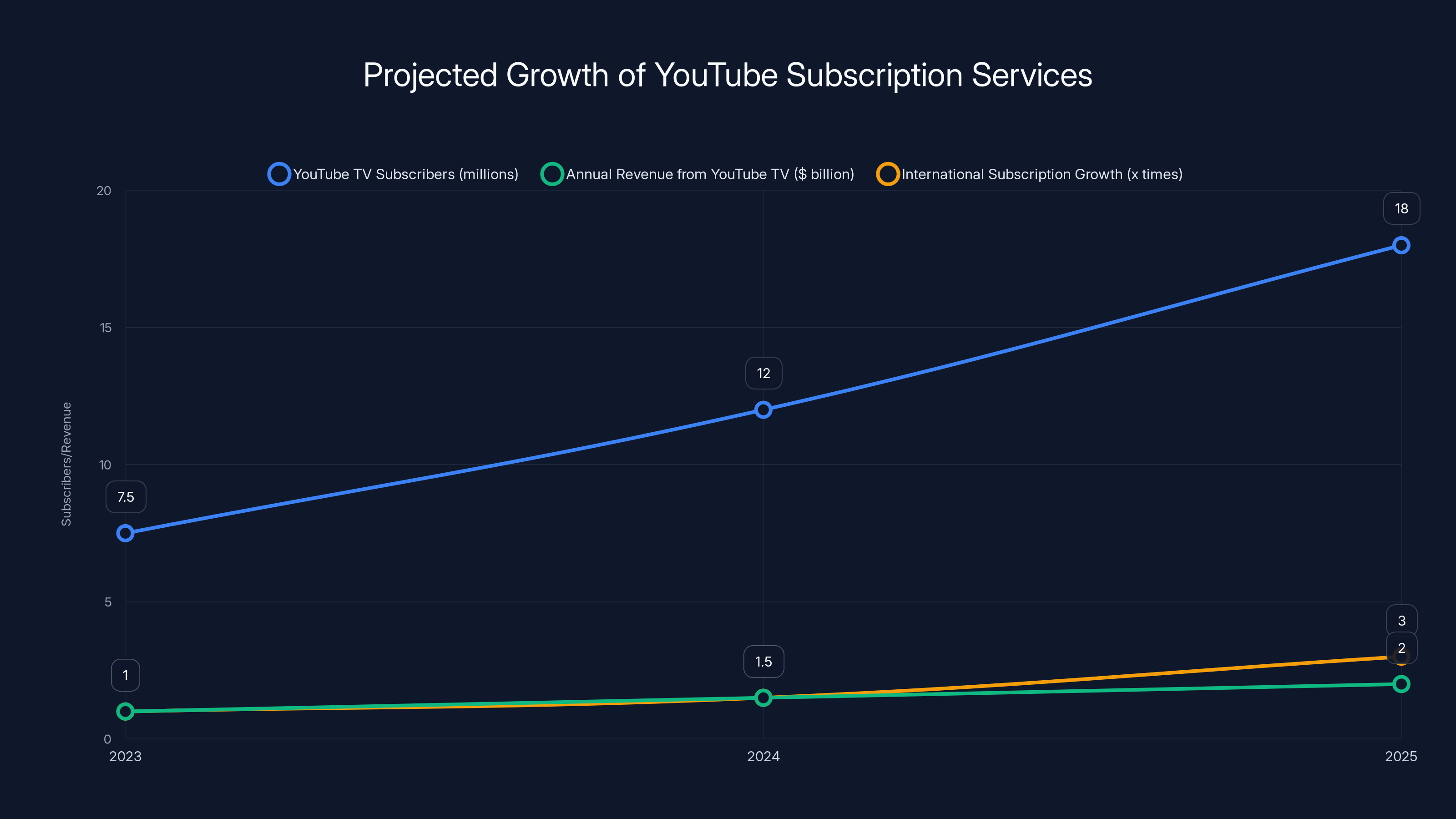

YouTube TV is projected to grow from 7-8 million to 15-20 million subscribers by 2025, potentially generating $1-2 billion annually. International subscriptions could triple with geographic expansion. (Estimated data)

Podcasts as the Next Growth Frontier

Google highlighted an interesting data point that deserves scrutiny: viewers watched 700 million hours of podcasts from their TVs in October. That's a massive number that suggests podcasting has become a serious video format on YouTube.

This is important because podcasting represents a different category than traditional YouTube videos or Shorts. Podcasts are long-form, audio-first content that happens to be distributed on video platforms. They attract audiences that might not be interested in traditional YouTube content like vlogs, gaming, or tutorials.

Google's emphasis on TV viewing of podcasts specifically reveals something about where consumption is happening. Many podcast listeners use YouTube on their TV as a secondary screen while doing other activities. This drives high engagement (700 million hours is extraordinary) while also being relatively hands-off.

The reason Google is highlighting this is because podcasts represent expansion into a new content category that has its own ecosystem and creator base. Podcasters have historically published on specialized platforms like Spotify, Apple Podcasts, and dedicated podcast apps. But YouTube's push into podcasts means the platform is converging all long-form content into one place.

For podcasters, this creates an interesting opportunity. Instead of being locked into Spotify or Apple Podcasts, creators can now publish directly to YouTube and reach the platform's 2+ billion users. Some podcasters are already doing this, publishing their audio content as simple video (sometimes with static images or transcript crawls).

Google's infrastructure advantages make YouTube an increasingly attractive podcasting platform. The company has the server capacity to handle massive amounts of audio-video data. It has the recommendation algorithm to surface podcast content to relevant audiences. And it has the monetization infrastructure to pay creators fairly through the Partner Program or subscription revenue sharing.

AI Tools: The Invisible Monetization Engine

Here's what might be the most important stat that barely made a dent in the earnings coverage: Over 1 million channels are using YouTube's AI creation tools. And in December alone, 20 million consumers used Gemini-powered content discovery tools.

These numbers are important because they signal that AI isn't just coming to YouTube. It's already deeply embedded and being used at scale. When a creator uses YouTube's AI generation features to automatically create video descriptions, captions, or even entire video segments, they're becoming dependent on Google's AI infrastructure. When users interact with Gemini-powered recommendation systems, they're training Google's model on what content they find valuable.

This is the kind of data that feeds competitive advantages. YouTube's AI models learn from billions of hours of user behavior, creator preferences, and content performance data. This feedback loop makes YouTube's recommendation system better at understanding what content works, what resonates with audiences, and what should be promoted.

But there's also a monetization angle that Google probably hasn't even fully activated yet. As these AI tools become more sophisticated and more creators become dependent on them, Google can introduce premium tiers for advanced AI features. Imagine a creator paying $20/month for advanced AI tools that automatically generate video thumbnails, optimize metadata, create shorts from long-form videos, or even generate entire video concepts based on channel performance.

Spotify does this with its Creator Tools. Apple does this with Apple Music for Artists. YouTube will eventually do this with AI. And when creators are paying monthly for advanced AI features, that's recurring revenue from a creator base that's almost entirely free today.

The 20 million Gemini users in December is a different metric, but equally important. These are consumers using AI-powered content discovery. YouTube is essentially asking Gemini "what should I watch?" and the AI recommends videos. This is more sophisticated than YouTube's traditional recommendation algorithm because it can understand context, preferences, and even mood.

YouTube Premium is experiencing rapid growth, adding approximately 25 million subscribers in Q4 2025 alone. Estimated data suggests continued growth into 2026.

Competitive Landscape: How YouTube Premium Stacks Up

To understand why YouTube's subscription growth is so impressive, you need to see it in context of other video streaming services. Netflix, for comparison, has roughly 300+ million subscribers globally but has been growing much slower in recent years (single-digit percentage growth quarterly). YouTube just added 25 million subscribers in three months while already having a massive installed base.

Netflix's growth is slowing because it's hitting saturation in developed markets. YouTube's growth is accelerating because subscription adoption on the platform is still in early innings despite YouTube being 20 years old. This is the difference between a dedicated subscription service (Netflix) and a platform that added subscription as an afterthought (YouTube).

TikTok doesn't have a direct comparable paid tier, though the company has explored various monetization options like TikTok Shop and creator fund payments. But TikTok doesn't offer ad-free viewing because the platform's algorithm benefits from user engagement signals that ads generate.

Disney Plus, HBO Max, and other premium video services are all facing subscriber growth challenges and increasing competition. YouTube Premium isn't facing these same headwinds because the value proposition is fundamentally different. You're not paying for exclusive content. You're paying to improve your experience on a platform you were already using daily.

Spotify, as mentioned, is probably YouTube Premium's closest direct competitor in terms of music streaming, but YouTube's $8/month bundled offer is hard to beat. Spotify is focused purely on music; YouTube Premium gives you both music and video.

Apple Music is another direct competitor, but similarly, it's music-only. Apple does bundle it with other services in Apple One, which ranges from

What This Means for Creators' Revenue Strategies

For content creators, YouTube's subscription growth has profound implications for how they should monetize their channels. The traditional YouTube monetization stack has three main components:

- Ad revenue from the YouTube Partner Program (revenue share on ads shown in your videos)

- Channel membership (your own paid subscription tier offered directly to your audience)

- YouTube Premium revenue (share of subscription fees based on watch time from Premium members)

The Q4 earnings report essentially signals that component three (YouTube Premium revenue) is becoming increasingly important. As more viewers subscribe to YouTube Premium, more creators benefit from that revenue pool. This shifts the incentive structure.

Previously, a creator's incentive was to maximize watch time with ads, which meant friction and interruption. Now, creators benefit from maximizing watch time period, regardless of whether users see ads. This is actually more aligned with viewer interests.

Channel memberships have proven to be incredibly lucrative for some creators but remain difficult for most to activate. Membership revenue is highly dependent on a creator having a loyal, engaged audience willing to pay monthly. Top creators like Mr Beast or Dude Perfect can command high channel membership rates, but most channels struggle to get even 1% of their audience to join memberships.

This creates an opportunity for creators who aren't hitting membership targets to benefit from YouTube Premium growth instead. Every viewer on your channel that has YouTube Premium essentially becomes a revenue source without any action on your part. You don't need to ask them to join, create special content, or do anything different. They just watch, and you benefit.

Over time, I'd expect creators to increasingly deprioritize ad-friendly content strategies and instead focus on building engaged, loyal audiences. The math works better that way in a subscription-heavy YouTube.

YouTube Shorts achieves 200 billion daily views, vastly surpassing TikTok's 1 billion daily active users, highlighting Shorts' massive engagement (Estimated data).

The Integration Advantage: Google's Ecosystem Play

One aspect of YouTube's subscription strategy that's often overlooked is how it integrates with Google's broader ecosystem. When someone subscribes to YouTube Premium, they're also more likely to subscribe to Google One (which bundles premium storage, VPN, and other services). When someone subscribes to Google One, they're more likely to use Google's other services more heavily.

This ecosystem lock-in is powerful. A user who has YouTube Premium, Google One, and Google Play Pass (Google's app subscription service) is deeply integrated into Google's ecosystem. Switching away from YouTube becomes harder when you lose all those benefits.

Similarly, YouTube Premium integrates with YouTube Music, creating a music ecosystem that competes with Spotify, Apple Music, and Amazon Music. For users who care about both music and video, YouTube's bundle is genuinely compelling.

Google's AI strategy also integrates here. When Gemini becomes a more prominent part of YouTube's content discovery (which the company is clearly pushing based on the 20 million December users stat), users who subscribe to YouTube Premium get better AI recommendations. This improves satisfaction and retention.

This ecosystem approach is fundamentally different from Netflix's strategy, which remains siloed as a pure video streaming service. Netflix is trying to expand into gaming and live events, but these feel bolted-on rather than integrated. YouTube's subscription growth benefits from the fact that it's part of something bigger.

International Growth and Currency Dynamics

One important context that didn't make the earnings report headlines: YouTube's subscription growth is happening globally, but currency fluctuations matter. In markets where the US dollar strengthened significantly in 2024-2025 (like India, Brazil, and Southeast Asia), YouTube's dollar-denominated revenue numbers look better even if local currency subscriptions are flat.

However, this also creates an opportunity. YouTube Premium's pricing varies by market. In India, YouTube Premium costs around 139 rupees per month (about

For YouTube's Q4 growth story, a significant portion of those 25 million new subscribers likely came from international markets where population size is larger. India has 1.4+ billion people. Even if YouTube Prime penetrates just 1-2% of the Indian market, that's millions of new subscribers. Brazil, Mexico, Indonesia, and other large emerging markets are likely major contributors to subscription growth.

This creates an interesting dynamic for competition. Netflix has struggled in emerging markets with piracy and willingness to pay. YouTube's freemium model with a low-cost premium tier is more suited to these markets. Free YouTube remains available to everyone; those who want premium pay what's affordable in their local market. This is inherently more accessible than Netflix's $6.99+ pricing floor.

Future Outlook: What's Next for YouTube's Subscription Strategy

Based on the earnings report and current trends, several developments seem likely over the next 1-2 years:

1. AI Premium Tiers: YouTube will almost certainly introduce advanced AI features as a premium tier, possibly separate from YouTube Premium or bundled with YouTube Premium Plus. Creators will pay for advanced AI generation, editing, and analytics tools.

2. YouTube TV Expansion: Genre-specific packages will launch and likely succeed in converting cable viewers. This could drive YouTube TV from 7-8 million to 15-20 million subscribers, representing a $1-2 billion annual revenue opportunity.

3. Creator Revenue Adjustments: As subscription becomes more important, YouTube will likely adjust how it distributes revenue to creators, emphasizing engagement time over ad CTR. This benefits long-form content creators but may challenge short-form creators.

4. International Subscription Growth: Subscription penetration in emerging markets remains extremely low. YouTube could grow subscriptions 2-3x just from geographic expansion without changing pricing or product.

5. Music Integration: YouTube Music might become more seamlessly integrated with YouTube Premium, potentially cannibalizing some Spotify and Apple Music subscribers in the process.

6. Podcast Dominance: Podcasts could become a major YouTube content category with dedicated discovery surfaces, potentially rivaling Spotify for podcasting.

The Creator Economy Implications

For the broader creator economy, YouTube's subscription success matters profoundly. The platform employs over 2 million creators (people who claim YouTube as a primary or significant income source). YouTube's subscription growth means the total value distributed to creators through YouTube Premium revenue sharing is growing rapidly.

When you combine YouTube Premium revenue with ad revenue, channel memberships, Super Chat/Super Likes, and YouTube Shop capabilities, a successful creator on YouTube has multiple revenue streams that feed off each other. A creator who relies solely on ad revenue is leaving massive money on the table.

But this also creates pressure. Creators need to optimize for multiple metrics simultaneously: watch time (for ad and premium revenue), engagement (for algorithmic promotion and memberships), and quality (to maintain audience loyalty). This is harder than optimizing for a single metric.

The winners in this new environment will be creators who understand their audience deeply and can create content that drives multiple forms of monetization simultaneously. A creator who makes content that people watch completely, engage with in comments, feel compelled to support through memberships, and want to watch multiple times per month will maximize revenue. Creators who make content optimized for ad clicks but poor overall engagement will fall behind.

Comparison with Traditional Media Models

YouTube's subscription growth is worth comparing to traditional media company subscription models. Cable networks operate on a model where content producers get paid by cable distributors (who then get paid by subscribers). Netflix operates on a pure DTC (direct-to-consumer) subscription model where Netflix pays for content directly.

YouTube operates on a hybrid model. Some creators are getting paid through YouTube's revenue sharing. Others are getting paid by YouTube to create exclusive content or fund production. Still others are building their own audience and leveraging YouTube as a distribution platform while monetizing elsewhere.

This flexibility is YouTube's advantage. The platform doesn't need to own all the content. It doesn't need exclusive deals with top creators. It can let creators compete on merit, and the algorithm will surface the best content to the right audiences. This is more efficient than traditional media's approach.

For traditional media companies, YouTube's success poses a threat. As creators and audiences migrate to YouTube, traditional cable and streaming services lose relevance. Some traditional media companies are trying to adapt by creating YouTube channels, but they often struggle because they're still thinking in broadcast terms rather than understanding how YouTube's algorithmic discovery works.

Challenges and Limitations

It's worth acknowledging what YouTube Premium doesn't solve. The service still faces real competition from free alternatives. TikTok, for instance, offers ad-free content for free (though with a limited creator ecosystem). Instagram Reels is also ad-free content from your followed creators.

YouTube Premium works because the service provides genuine value beyond ad removal (background play, offline downloads, YouTube Music). But as competition increases, maintaining premium pricing power becomes harder.

There's also the question of saturation. At some point, YouTube's 2 billion monthly active users will have converted as many as reasonably possible to premium. Maybe that's at 500 million subscribers. Maybe it's 1 billion. But there's definitely a ceiling.

Regulatory pressures also loom. Antitrust authorities in the EU and potentially the US are scrutinizing whether Google's dominance in both video distribution and advertising is anticompetitive. Forced divestiture or restrictions on bundling could impact YouTube's subscription strategy.

Finally, there's execution risk. YouTube's AI expansion, YouTube TV market entry, and Podcast ambitions all require execution excellence. The company has resources, but large organizations often struggle with new initiatives that don't fit existing core business logic.

FAQ

What is YouTube Premium and how does it differ from YouTube Music?

YouTube Premium is a subscription service that costs

How does YouTube Premium revenue get distributed to creators?

YouTube Premium revenue is distributed to creators based on how much watch time their content receives from YouTube Premium subscribers. When a Premium member watches your video, you earn a portion of the subscription fees proportional to that viewing. This is separate from ad revenue (which you earn when ads appear) and channel membership revenue (which comes from viewers paying for a creator's specific channel membership). The exact distribution algorithm isn't disclosed, but it rewards creators with higher total watch time, regardless of whether viewers see ads.

Why is YouTube's subscription growth outpacing Netflix and other streaming platforms?

YouTube's subscription growth is outpacing traditional streaming services because the platform has a massive free user base (2+ billion monthly active users) and is converting a portion to paid, whereas Netflix started as a paid-only service and is now hitting saturation. Additionally, YouTube Premium's value proposition is different from Netflix's: you're not paying for exclusive content but rather for an improved experience on a platform you already use daily. The bundling with YouTube Music, background play, and offline downloads makes the $8/month price point extremely compelling compared to separate music and video subscriptions. Finally, YouTube's global pricing strategy (adjusted for local markets) allows for higher penetration in emerging markets where Netflix's pricing feels expensive.

What does YouTube's focus on subscriptions mean for creators who depend on ad revenue?

The shift toward subscriptions is both opportunity and risk for creators. The opportunity is that YouTube Premium revenue (distributed to creators based on watch time) supplements and eventually could exceed ad revenue as the Premium subscriber base grows. The risk is that if YouTube deprioritizes ad optimization (which seems likely), ad CPM rates could decline, and creators who haven't diversified their monetization might see income decrease. The smart approach for creators is to optimize for overall watch time and audience engagement (which benefits both ads and premium revenue), while also exploring channel memberships and other direct monetization where relevant.

How does YouTube Premium's $8/month pricing strategy compare to competitors?

At

What is YouTube TV and how does it compete with traditional cable?

YouTube TV is YouTube's live television service that offers over 100 channels including news, sports, entertainment, and premium networks, starting at

How are AI tools being integrated into YouTube and what does this mean for creators?

YouTube is integrating AI across multiple areas: AI-powered content recommendations (Gemini-powered discovery reaching 20 million users in December), AI creation tools (over 1 million channels using these tools to generate descriptions, captions, and potentially full video content), and AI-powered analytics for creators. This integration means creators can increasingly automate routine content optimization tasks while AI handles discovery and recommendation on the viewer side. The opportunity for creators is to master these tools early while they're free or low-cost; the risk is that over-reliance on AI-generated content could lead to diminishing returns as algorithmic saturation increases. Expect YouTube to introduce premium AI tiers that charge creators for advanced features in the coming years.

Will YouTube Premium ever include exclusive content like Netflix?

Based on YouTube's strategy and earnings commentary, exclusive content (in Netflix's sense) is unlikely to be a primary focus for YouTube Premium. Google's advantage is the platform's open nature, where diverse creators compete on merit rather than exclusive deals. However, YouTube could offer exclusive premium perks like earlier release dates, special content from top creators, or creator-specific exclusive series without fundamentally changing the model. The economics don't favor YouTube acquiring massive exclusive content libraries the way Netflix did, since YouTube's value comes from algorithmic discovery of diverse content rather than premium production value.

How much of YouTube's growth is coming from international markets versus developed markets?

While Google doesn't break down growth by geography in its earnings reports, the math suggests a significant portion of the 25 million new subscribers in Q4 came from emerging markets. India alone has 1.4+ billion people, and even 1-2% YouTube Premium penetration represents millions of subscribers. Southeast Asia, Brazil, Mexico, and Africa have similar dynamics. However, developed markets (US, Europe, Canada) likely contribute higher revenue per subscriber due to higher prices. The strategic implication is that YouTube's near-term subscriber growth will come from emerging markets, but revenue growth will be more balanced as mix shifts toward higher-ARPU developed markets.

The Bigger Picture: Why YouTube's Subscription Success Matters Beyond Earnings

YouTube's subscription growth isn't just important as a financial metric for Google's earnings. It signals a fundamental shift in how video content is consumed and monetized in the post-internet era. For decades, the assumption was that video on the internet would always be ad-supported and free because distribution was cheap and advertising was efficient.

YouTube's success in converting hundreds of millions of free users to paying subscribers proves that assumption wrong. People will pay for convenience, better experience, and integration with services they value. This has implications for every platform, every media company, and every content creator.

For YouTube's creator ecosystem, subscription growth means new revenue opportunities and changing incentive structures. For consumers, it means better experiences but also more fragmented subscriptions. For traditional media companies trying to compete with YouTube, it means understanding that bundling, pricing flexibility, and integration matter more than exclusive content.

The next few years will be critical. YouTube TV's expansion with genre-specific packages could reshape the cable landscape. AI integration into content creation and discovery could fundamentally change how creators optimize their work. International market penetration could add hundreds of millions of new premium subscribers. And as YouTube's subscription base grows, the leverage the company has in negotiations with creators, advertisers, and content producers will only increase.

What seems certain is this: the era of YouTube as primarily an ad-supported platform is ending. The next era is one where subscriptions, AI, and integration across Google's ecosystem drive growth and profitability. Understanding this shift is essential for anyone creating content, advertising, or building on the platform.

Key Takeaways

- YouTube's 325 million paying subscribers across Premium and Google One grew 25 million in Q4 alone, outpacing Netflix's growth rate and signaling mainstream adoption

- The platform's $60 billion annual revenue reflects a strategic shift from pure advertising toward diversified monetization through subscriptions, YouTube TV, and AI tools

- YouTube Premium's $8/month bundle (including YouTube Music) undercuts Spotify and Apple Music individually, making it the most compelling video-plus-music subscription economically

- AI integration is accelerating with 1M+ channels using creation tools and 20M users engaging with Gemini-powered discovery, signaling future premium monetization opportunities

- YouTube TV's expansion into genre-specific packages positions Google to capture cord-cutters and cable subscribers by offering flexibility traditional cable companies refuse to provide

Related Articles

- Apple's Patreon Subscription Billing Mandate: What Creators Need to Know [2025]

- Crunchyroll Price Hike 2025: What Changed & Why Anime Fans Matter [2025]

- Disney's Unified Hulu and Disney+ App: Late 2026 Launch and Price Hike [2025]

- UpScrolled Hits 2.5M Users: How This TikTok Alternative Exploded [2025]

- TikTok Outages 2025: Infrastructure Issues, Recovery & Platform Reliability

- A Knight of the Seven Kingdoms Episode 4 HBO Max Release Date [2025]

![YouTube's $60B Revenue Dominance: Inside Google's Subscription Strategy [2025]](https://tryrunable.com/blog/youtube-s-60b-revenue-dominance-inside-google-s-subscription/image-1-1770296872806.jpg)