YouTube TV's Game-Changing Approach to Streaming Packages

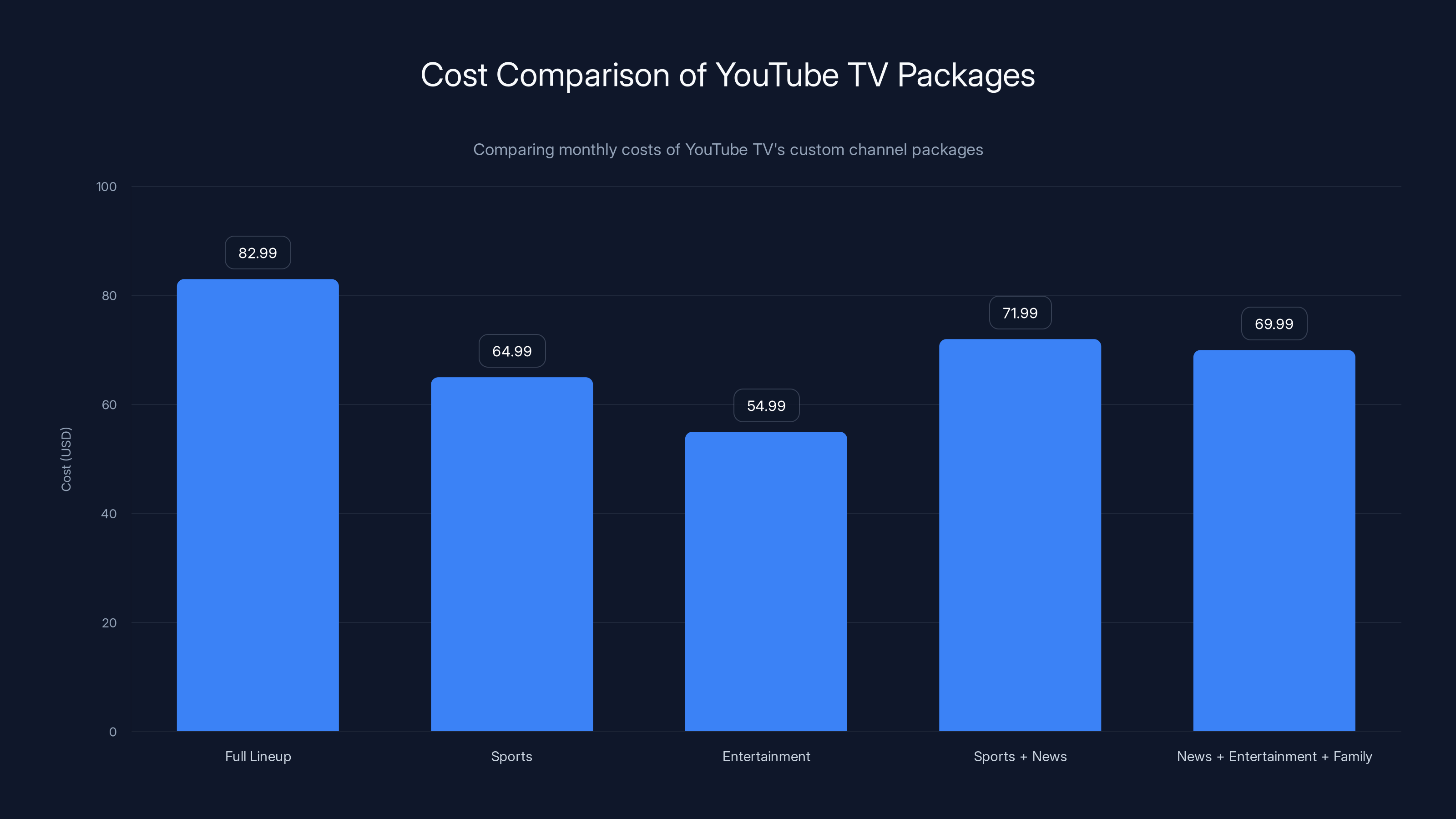

YouTube TV just upended the entire streaming TV landscape. For years, cable-style bundles felt inevitable. You wanted sports? Fine—pay for 300 channels you'd never watch. You just wanted news? Same deal. But last week, YouTube TV announced something genuinely different: the ability to pick exactly what you want, with packages starting at $54.99 per month.

This isn't a minor update. This is a structural shift in how streaming TV works.

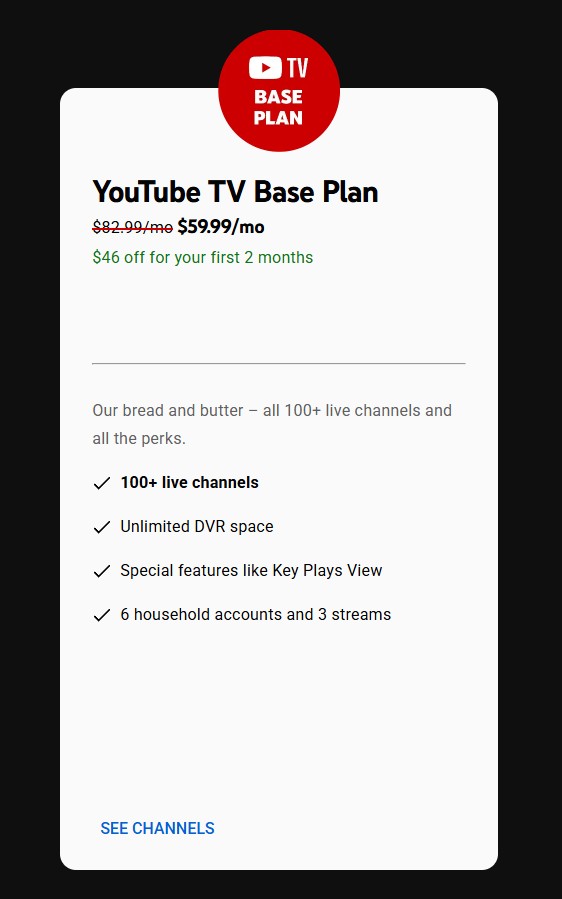

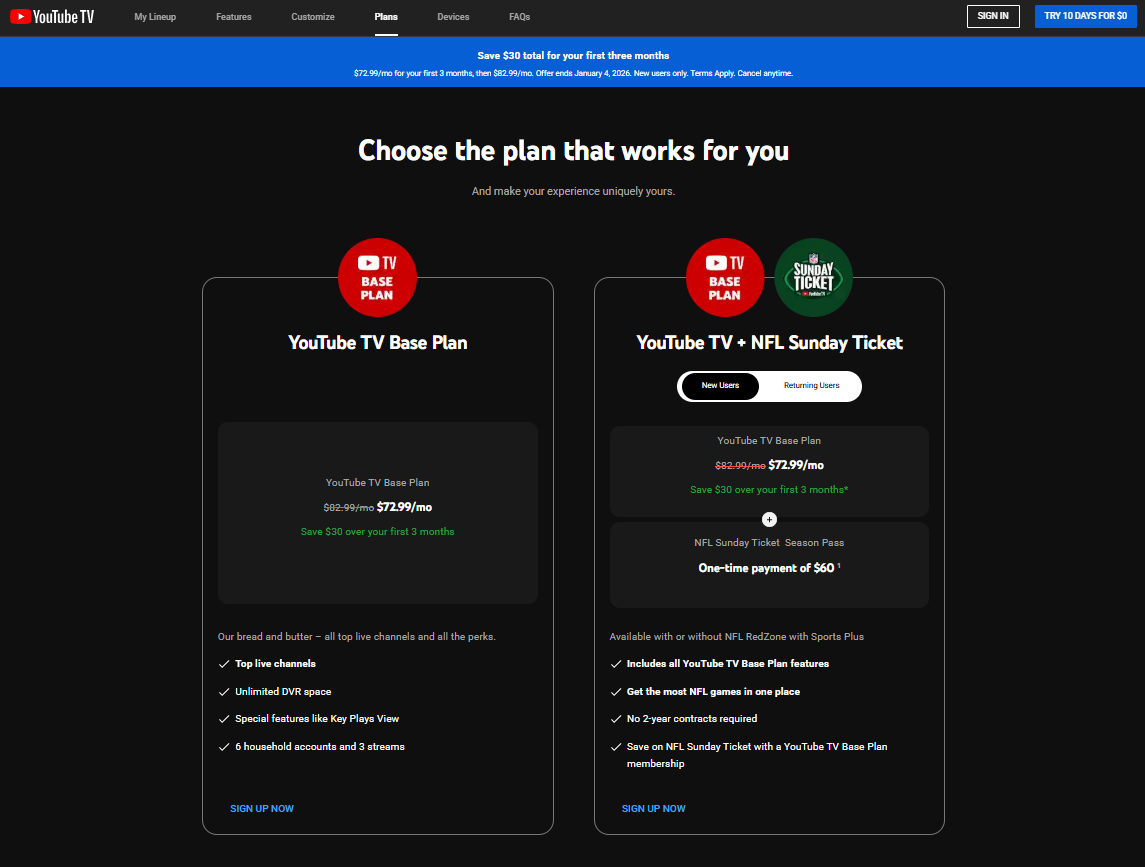

The standard YouTube TV plan costs $82.99 per month. That's been the only option. You get everything, or you get nothing. Now, you can get sports without news, entertainment without family content, or any combination that actually matches how you watch.

The sports package alone costs

Here's what makes this interesting: YouTube isn't lowering prices out of charity. They're responding to something you've probably felt yourself. Streaming bills are out of control. The average household now pays

But this story goes deeper than just pricing. It reveals massive shifts in how media companies think about bundling, cord-cutting, and customer retention. It shows YouTube's willingness to challenge traditional TV economics. And it suggests something bigger: the era of massive, expensive bundles might actually be ending.

Let's break down what YouTube TV is doing, why it matters, and what it means for the future of streaming television.

TL; DR

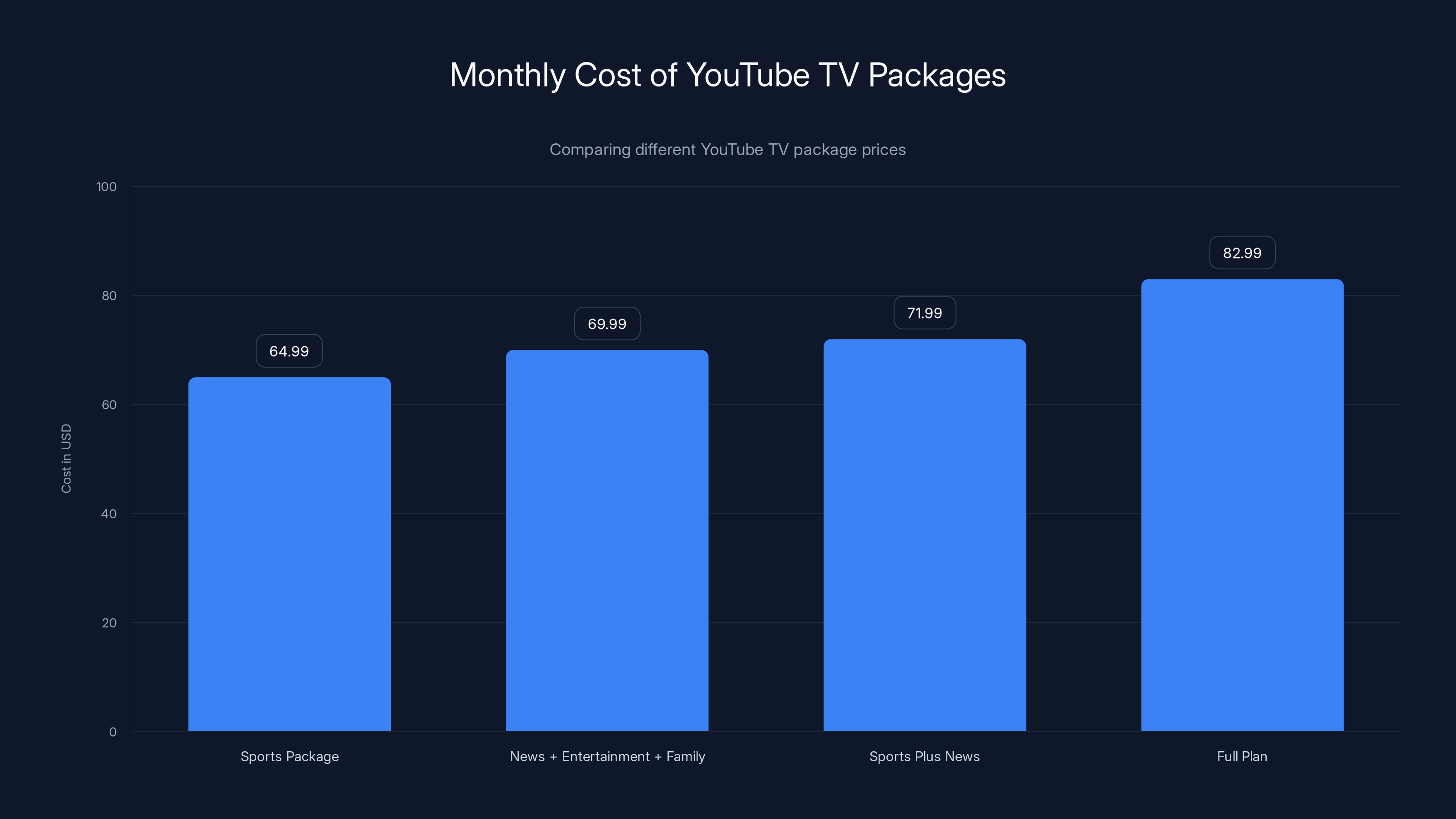

- YouTube TV sports package costs $64.99/month and includes major broadcasters like ESPN, FS1, and NBC Sports Network plus ESPN Unlimited

- Entertainment tier is cheapest at $54.99/month with Comedy Central, Bravo, Paramount, Food Network, HGTV, and similar channels

- News plus entertainment plus family bundle at $69.99/month provides all three content categories in one package

- Standard YouTube TV plan remains $82.99/month for full channel access across all categories

- Custom multiview launching soon allowing subscribers to watch different channel types side-by-side on one screen

- Bottom line: Custom packages undercut the standard plan by 28 monthly, but you lose access to content outside your chosen category

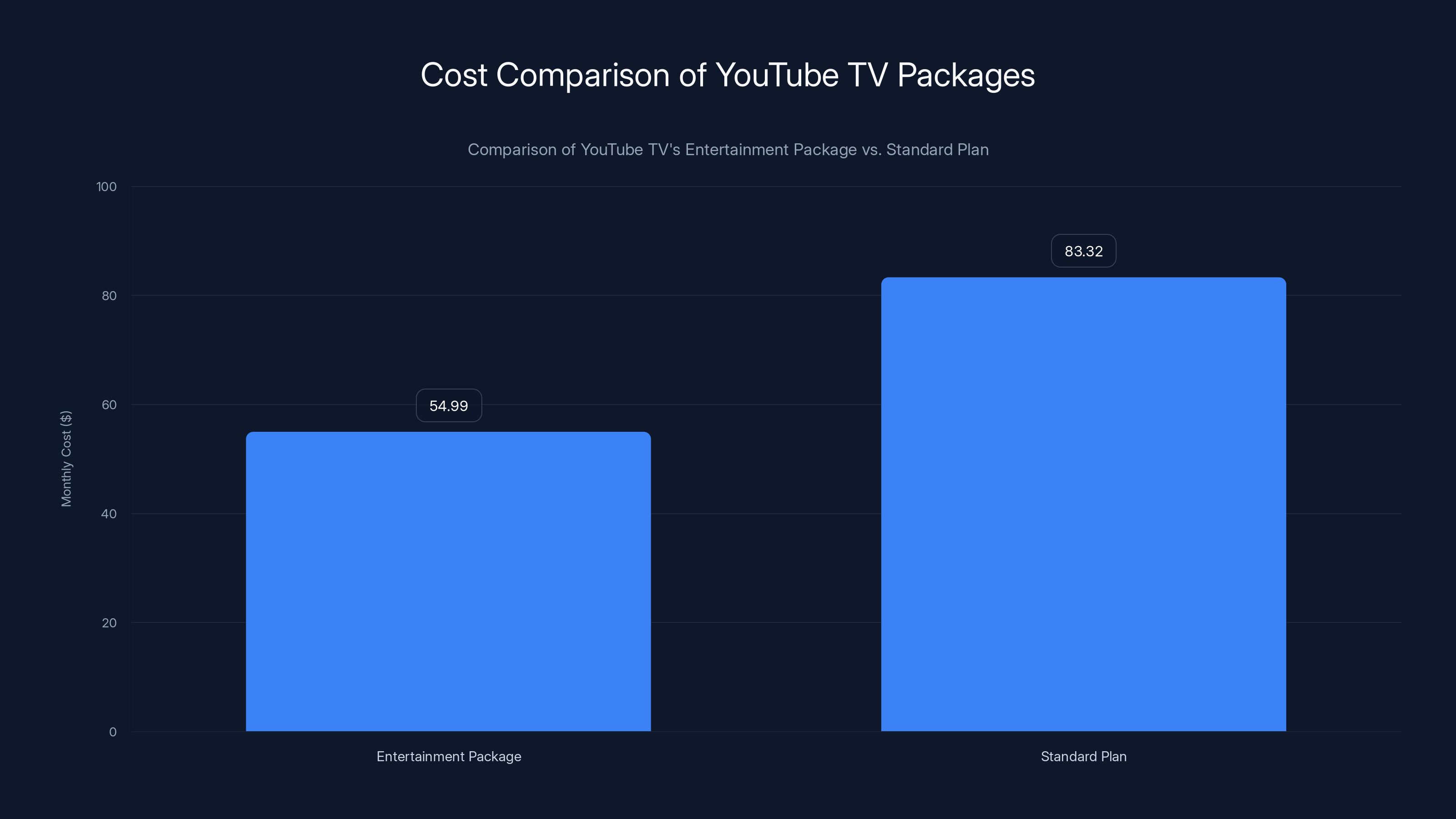

The Entertainment package offers the most savings at $54.99, which is 28% cheaper than the full lineup. Estimated savings vary based on viewing habits.

Understanding YouTube TV's Traditional Bundle Model

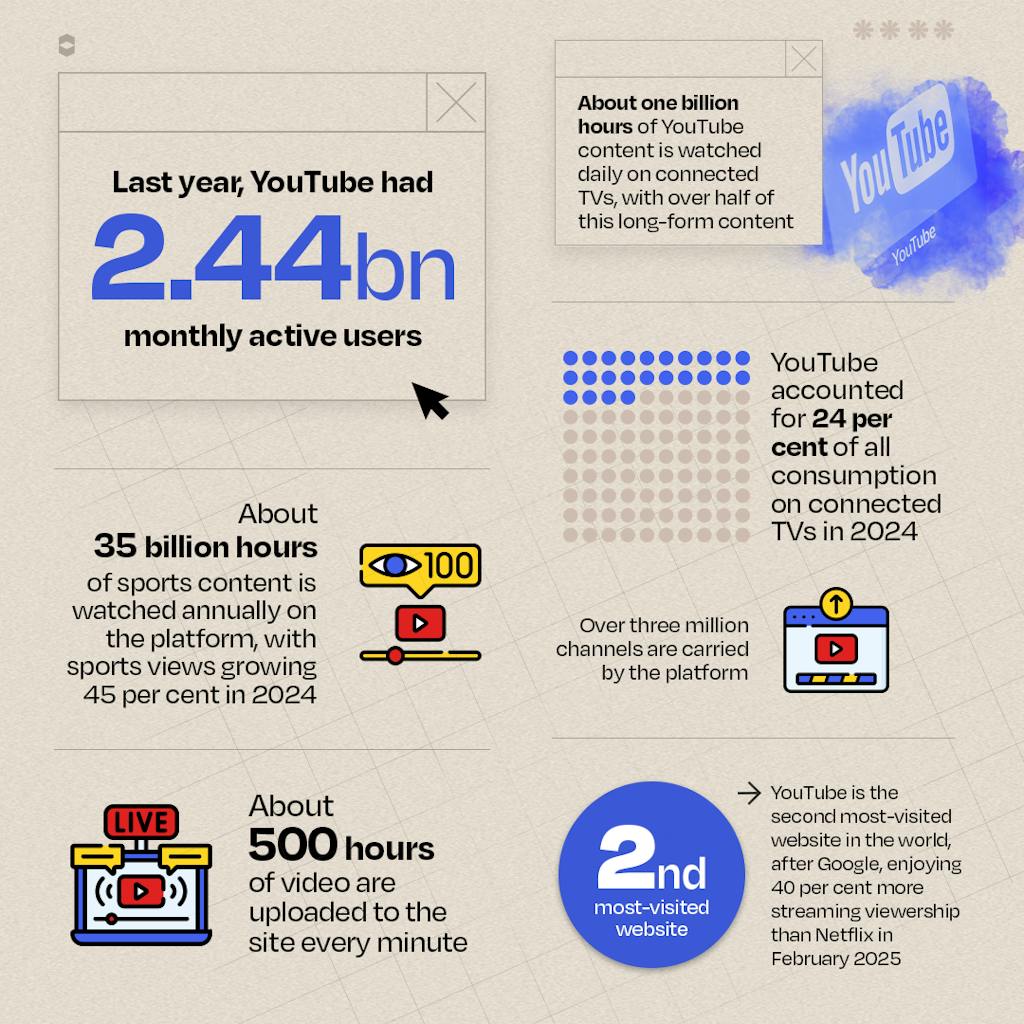

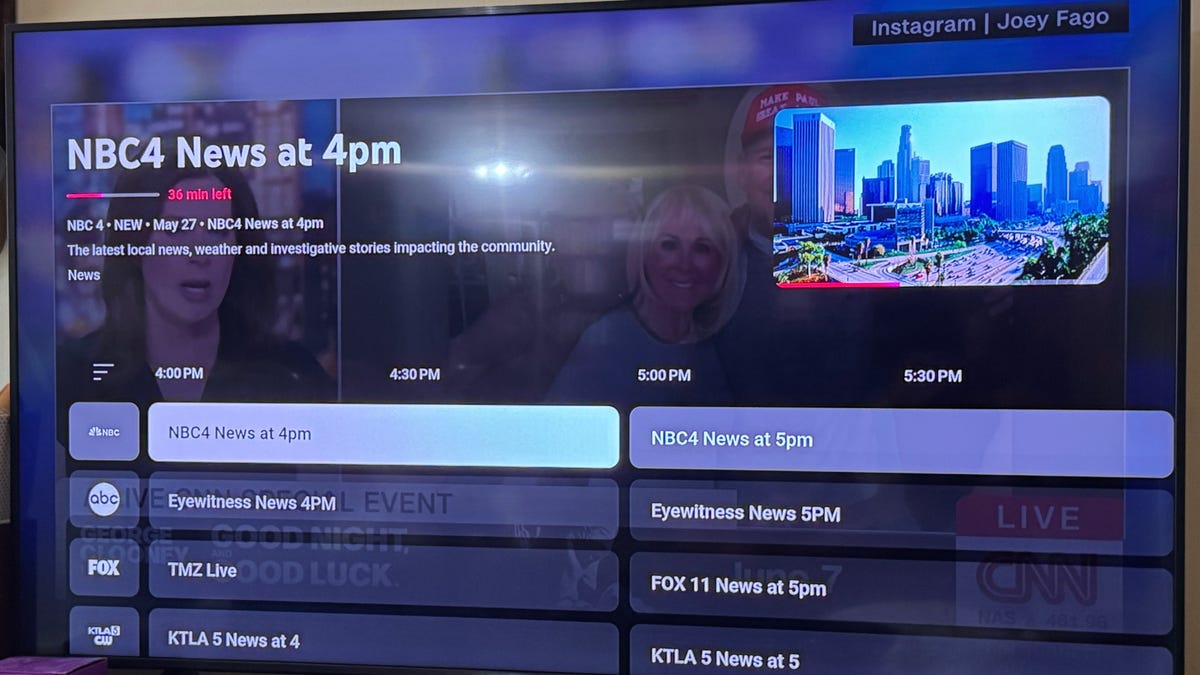

Before diving into the new packages, you need to understand what YouTube TV was before this announcement. YouTube TV launched in 2017 as Google's answer to cable TV. Instead of a satellite dish or cable box, you'd get television channels through an internet connection.

The pitch was simple: the best of cable TV without the cable company's terrible customer service and price increases. YouTube TV included major broadcast networks like ABC, NBC, CBS, and Fox. It added cable mainstays like ESPN, CNN, HGTV, Food Network, Bravo, Comedy Central, and dozens of others. For most people, it covered everything they watched on traditional TV.

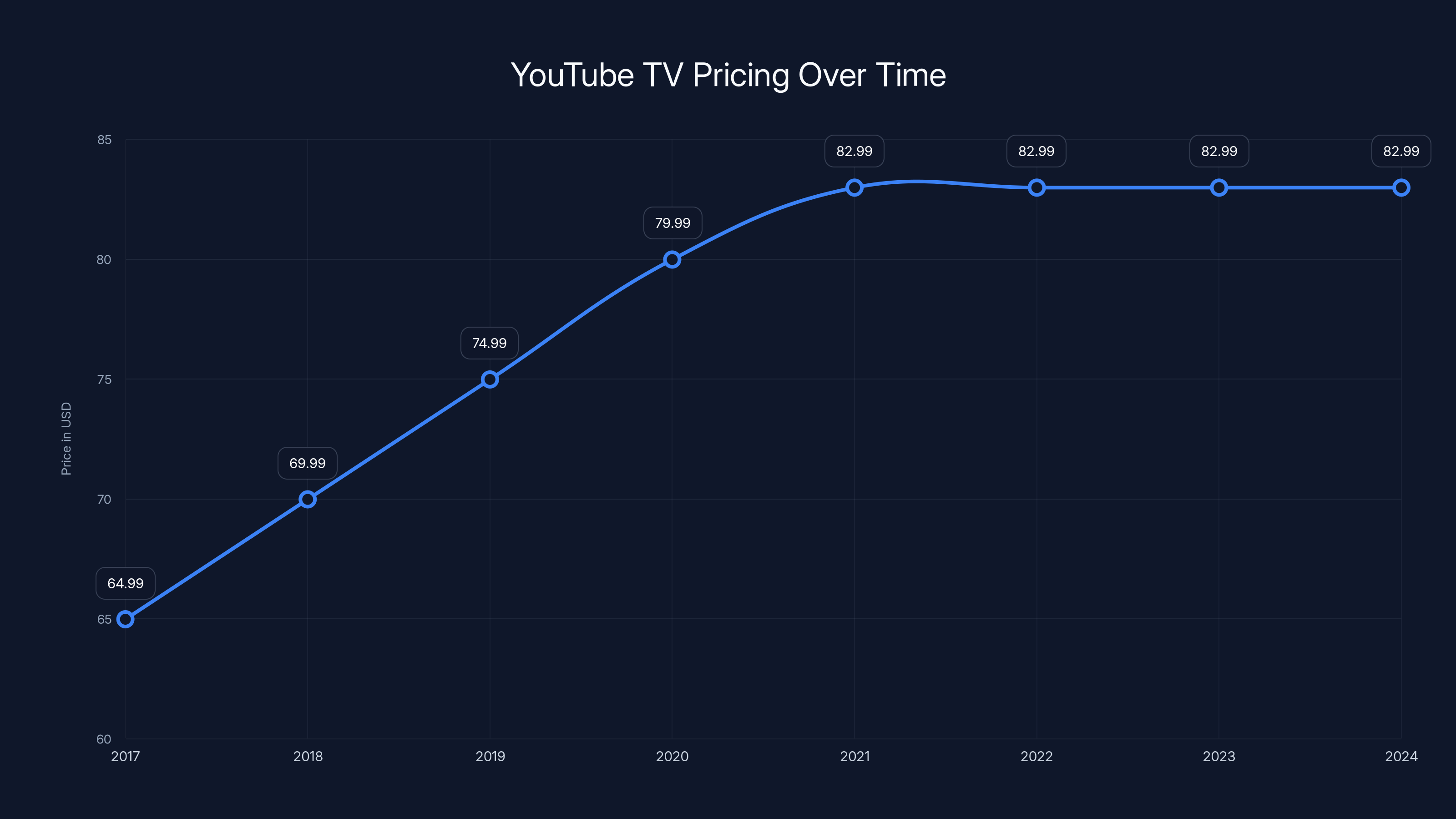

YouTube TV's pricing started at

The problem: most users never wanted all those channels. Sports fans didn't need Food Network. News watchers didn't need Comedy Central. The bundling approach worked great for YouTube TV's bottom line. It forced people to pay for content they'd never use. But it created frustration that eventually leads to cancellations.

YouTube TV also started raising prices aggressively. This became a pattern. Every year or so, they'd add five dollars. Users tolerated it because the alternative was traditional cable, which was worse. But tolerance erodes. At some point, people decide to cut the cord entirely.

That's the environment YouTube TV was operating in. More expensive bundles than ever. More people cutting subscriptions. More competition from niche services like Apple TV Plus, Max, and Paramount Plus that charged less for specific content. Something had to give.

The Sports Package: $64.99/Month Deep Dive

YouTube TV's sports package is the most interesting of the four offerings. It costs $64.99 per month and focuses entirely on live sports broadcasting.

What channels are included? FS1 (Fox Sports 1), NBC Sports Network, ESPN, and ESPN Unlimited. Those are the three major sports broadcasters in America, covering NFL, NBA, NHL, MLB, college sports, tennis, golf, and more.

Wait, but what about regional sports networks? What about niche sports like golf-only channels or soccer streaming? The sports package doesn't include those. You get the major networks. You don't get everything.

Here's the financial math: ESPN alone costs distributors about

So when YouTube prices the sports bundle at $64.99, they're covering network costs, infrastructure, customer service, payment processing, and still taking a margin. It's not wildly profitable, but it's sustainable.

Why would a sports fan choose this over the

But here's the catch nobody's discussing: most people don't watch only sports. The football fan also watches some news. The basketball viewer also checks out reality TV. By forcing people into single-category packages, YouTube might be leaving money on the table with cannibalization.

That's probably why YouTube is offering combination packages too. They're hedging against this exact scenario.

YouTube TV's pricing has steadily increased from

The Entertainment Package: $54.99/Month Analysis

The entertainment tier is YouTube TV's most aggressive offer. At $54.99 monthly, it's the cheapest package by far. And it's designed for a specific audience: people who don't care about sports or serious news.

What's included? Comedy Central, Bravo, Paramount, Food Network, HGTV, Freeform, E!, IFC, and a handful of others. These are entertainment, lifestyle, and reality TV channels.

That's 34% cheaper than YouTube TV's standard plan. For budget-conscious subscribers, that's compelling. If you're watching The Real Housewives, The Great British Bake Off, and home renovation shows, this covers your needs.

Who's the actual customer for this tier? Younger viewers without cable subscriptions. People in apartments who want entertainment but don't care about comprehensive news coverage. Retirees who love Food Network and HGTV more than they care about ESPN.

YouTube's betting that enough people fit this profile to make the entertainment package viable. And they're probably right. Entertainment and lifestyle content has huge viewership. Bravo alone reaches millions. Food Network consistently ranks in the top 20 cable channels.

The bundle makes sense from YouTube's perspective too. They're offering channels that cost relatively less in licensing fees. Comedy Central and Bravo are cheaper to license than ESPN. Food Network costs less than Fox Sports 1. By bundling lower-cost channels together, YouTube can undercut the standard plan's price while still maintaining margins.

One smart element: this package is designed to pull cord-cutters from pure streaming services. Someone watching Netflix and Hulu for entertainment isn't getting live linear content. They're getting on-demand streaming. YouTube TV's entertainment package offers live broadcasts of these shows as they air, plus on-demand through YouTube TV's cloud DVR. That's a different value proposition.

The News Plus Entertainment Plus Family Package: $69.99/Month

This is arguably the smartest package YouTube TV offers. At

What does it contain? Everything from the entertainment package plus news networks like CNBC, Fox News, MSNBC, CNN, C-SPAN, Bloomberg, and Fox Business. Plus family channels including Disney Channel, Nickelodeon, National Geographic Kids, Cartoon Network, PBS Kids, Smithsonian, Discovery Kids, and more.

That's a lot of content for $69.99. More than three content categories. Three demographics in one household—maybe kids, their parent, and a news-consuming adult.

Here's why this package is genius: it targets families. Modern families don't fit neatly into single-category consumption anymore. Parents watch news. They watch some entertainment. Kids watch family content. The old YouTube TV model forced them to pay for everything. This package lets them get the stuff they actually use and skip the sports they don't.

For a family household,

The family channel lineup is particularly interesting. Disney Channel, Nickelodeon, and Cartoon Network are the dominant sources of children's content on linear TV. YouTube recognizes that parents still value these channels for their kids, especially for younger children under 10 who benefit from curated, kid-appropriate content.

The news component reflects something important: news consumption hasn't moved entirely to streaming yet. Millions of Americans still prefer watching news networks like CNN or Fox News on their cable box (or now, streaming platform) rather than only relying on streaming or social media. By bundling news with entertainment and family, YouTube acknowledges that different household members have different needs.

The Sports Plus News Package: $71.99/Month Combination

The second combination package targets households where different people want different things. One person's a sports fan. Another wants news. They live together. Neither wants to pay $82.99 for everything.

At

What's included? All the sports channels from the sports package plus all the news networks from the other bundle. But no entertainment or family channels.

This package is explicitly designed for households with specific viewing patterns. Think of a couple where he's into sports and she's into news. Or a family where the parents want news coverage and the teenager wants to watch sports.

The pricing makes sense from a segmentation standpoint. YouTube's essentially saying: if you need two category types, you pay for two category types, but you don't pay for everything. It's more granular pricing.

One thing that's notable: there's no sports plus entertainment package, and no sports plus family package. YouTube's conscious choices here reveal their thinking. Sports and family content rarely overlap in viewership (children watch different sports than adults). Sports and entertainment are more complementary, but apparently, YouTube data suggests not enough households want exactly that combination to justify marketing it.

They're keeping the package offerings relatively simple: four options. One of each category, and two major combination packages. This avoids analysis paralysis while still offering real choice.

The Sports Plus News package offers a middle ground at

The Standard Plan Remains at $82.99/Month

YouTube TV's not eliminating the full plan. It stays at $82.99 monthly and includes everything: all sports, all news, all entertainment, all family content.

Why keep it? Because some people want everything. Some households have diverse viewing across all categories. Some people don't want to think about package choices and just want the full lineup.

There's also a psychological element. By keeping the standard plan, YouTube creates a reference point. The custom packages are explicitly positioned as "cheaper alternatives." Without the $82.99 option, the custom packages are just prices. With it, they feel like savings.

The standard plan also captures premium customers. Some people will gladly pay $82.99 to not think about it. Some households have such diverse viewing that they actually need everything. And some users simply prefer simplicity to choice.

From a business perspective, YouTube's keeping the standard plan as a high-value option. It's likely where their highest-engagement users stay. People who watch across multiple categories multiple hours daily probably aren't downgrading to a single-category package.

This pricing strategy actually mirrors what Max (formerly HBO Max) and Paramount Plus do. They offer cheaper ad-supported tiers alongside full-price ad-free options. YouTube TV's doing something similar with category options alongside the full plan. Different options for different customers.

How Custom Multiview Changes the Game

Here's where YouTube TV gets clever beyond just pricing. They're launching custom multiview, a feature that lets subscribers watch different types of content simultaneously on split screens.

Imagine this: you're at a dinner party. One person wants to watch the Chiefs game. Someone else wants CNN. A third person wants to check if their show is on. Traditional YouTube TV, you'd need three different devices or one person missing their content.

With custom multiview, you can watch all three simultaneously on different quadrants of one screen. It's not revolutionary technology—cable companies had picture-in-picture decades ago—but it's a smart addition for the bundled, package-based approach YouTube's introducing.

Why does this matter for packages? It makes the custom packages more functional. If you have a sports package, you might occasionally want to glance at news or entertainment. Multiview lets you do that without actually subscribing to those packages. It's a quality-of-life feature that makes limited packages feel less limiting.

YouTube's banking on the fact that people will tolerate package limitations if they have tools to work around them occasionally. Multiview is that workaround.

The technical implementation is interesting too. YouTube's had to negotiate rights with networks to allow simultaneous streaming across multiple feeds. That's not as simple as it sounds. Licensing agreements typically specify how many simultaneous streams a user can have. Multiview effectively creates multiple simultaneous streams. YouTube presumably secured permission for this, which required conversations with studios and networks.

The Strategic Reasoning Behind Package Customization

Why is YouTube TV doing this now? The answer involves multiple factors converging simultaneously.

First, cord-cutting accelerated dramatically. From 2019 to 2024, millions of Americans dropped cable TV entirely. YouTube TV benefited initially because they offered cable channels without the cable company. But as cord-cutting deepened, they faced a different problem: competition from niche streaming services.

If you only want to watch sports, why pay YouTube TV $82.99 when you can subscribe to NFL Plus, NBA League Pass, MLB.tv, and ESPN Plus for less combined? If you only want news, CNN Plus exists. MSNBC offers streaming. If you want entertainment, Netflix and Hulu are cheaper.

YouTube was losing people not to traditional cable but to specialized services. The full bundle wasn't competitive against best-of-breed alternatives. Custom packages address this directly.

Second, streaming economics shifted. When YouTube TV started, streaming infrastructure was expensive. Offering multiple package tiers meant maintaining multiple separate feeds, licensing negotiations, and technical complexity. The economics didn't work.

But technology improved. Cloud computing became cheaper. Streaming optimization advanced. Now YouTube can offer multiple package configurations without proportionally increasing costs.

Third, customer research probably showed what every streaming service has discovered: most people only use 4-5 channels regularly. They subscribe for the full selection, watch the same handful repeatedly, and resent paying for everything else.

YouTube realized they could increase customer lifetime value by reducing churn. Someone canceling their

YouTube TV offers competitive pricing at

Comparison with Traditional Cable and Competitors

How do YouTube TV's packages compare to cable, traditional broadcast TV, and other streaming competitors?

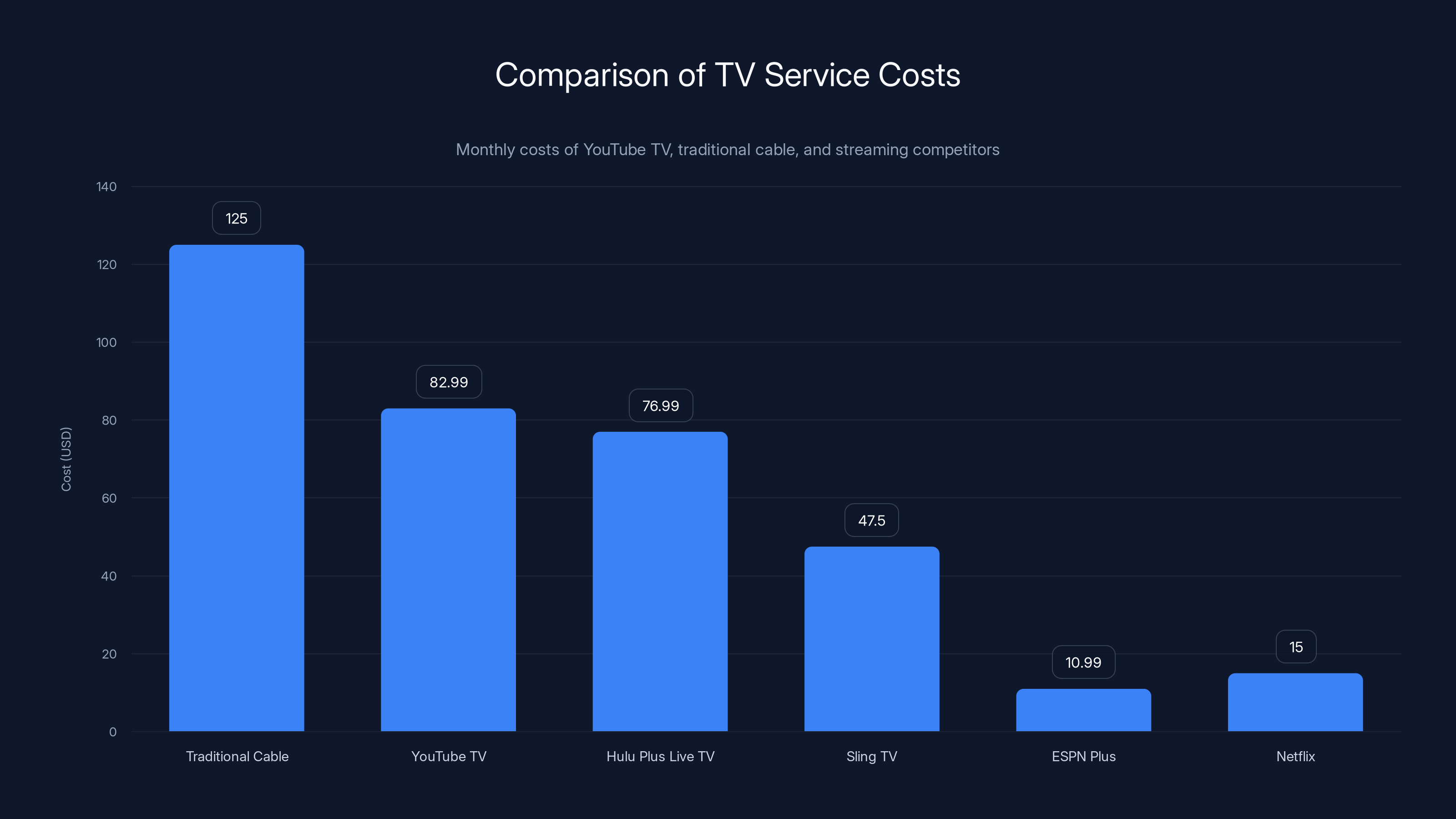

Traditional cable costs

But here's what cable offers that YouTube TV doesn't: local channels in all markets, guaranteed cloud DVR storage, simultaneous streaming on multiple devices in all packages. YouTube TV has these features in the full plan, but custom packages might have limitations.

Compete against specialty services: ESPN Plus is

That's the key differentiation: YouTube TV offers linear television. Most streaming services offer on-demand. Those are different experiences. Linear TV has scheduled programming, live sports, and the social aspect of watching something together in real time. On-demand means you watch whenever. They're not direct competitors despite appearing to serve similar needs.

Versus other streaming TV services like Hulu Plus Live TV or Sling TV: Hulu Plus Live TV costs

Implications for the Future of Streaming Television

This move signals something significant about streaming TV's future. The "all-you-can-watch" model that dominated early streaming (Netflix with movies and shows, YouTube TV with channels) is fragmenting.

We're moving toward componentized television. You build your own experience from available pieces. This mirrors what happened in technology more broadly. In the 1990s, computers came as bundled packages. Now you build custom rigs from components. Smartphones were monolithic. Now you use modular apps. Television is following the same trajectory.

This creates opportunities and challenges. For YouTube TV, custom packages increase price flexibility but create support complexity. For subscribers, it's empowering until you realize you need something in a different package and face an upgrade decision.

The trend likely continues. We'll probably see more granular options. Maybe next year, YouTube TV offers sports without ESPN or entertainment without Comedy Central. Maybe they license specific sports packages separately. Each step increases choice and decreases total cost of ownership.

Streamers like Netflix and Max will probably follow. Netflix already has ad-supported tiers. Expect category-specific pricing next—pay for movies, not shows, or vice versa. Max might offer premium sports packages separately from their main service.

The long-term outcome is lower prices for targeted audiences and higher complexity. Some people will find their perfect package at lower cost. Others will end up subscribing to multiple services anyway and spend more overall through complexity.

Implementation Details and Rollout Timeline

YouTube TV announced these packages would start rolling out during the week of the announcement. That means staggered availability across the US.

Initially, the packages are available to new subscribers. Existing YouTube TV subscribers can keep their current plan or switch to a custom package. But the rollout is gradual—not everyone gets access immediately.

This phased approach is intentional. YouTube doesn't want to overwhelm customer service with package questions. They don't want to crash the system. They're testing how many people choose each package, what technical issues emerge, and how support handles transitions.

The customer experience will matter significantly. If switching packages is easy, people try different options. If it's complicated, they stick with their current plan. YouTube's betting that simplicity here drives adoption.

From a technical standpoint, YouTube TV's backend had to be completely redesigned to support package customization. Billing systems needed modification. Streaming infrastructure had to route different channels to different subscribers. Content rights verification had to account for package types. It's not a trivial implementation.

The multiview feature mentioned earlier is separate but related. It's launching around the same time as packages but probably not available day one everywhere. YouTube will likely expand multiview gradually as they ensure it works reliably.

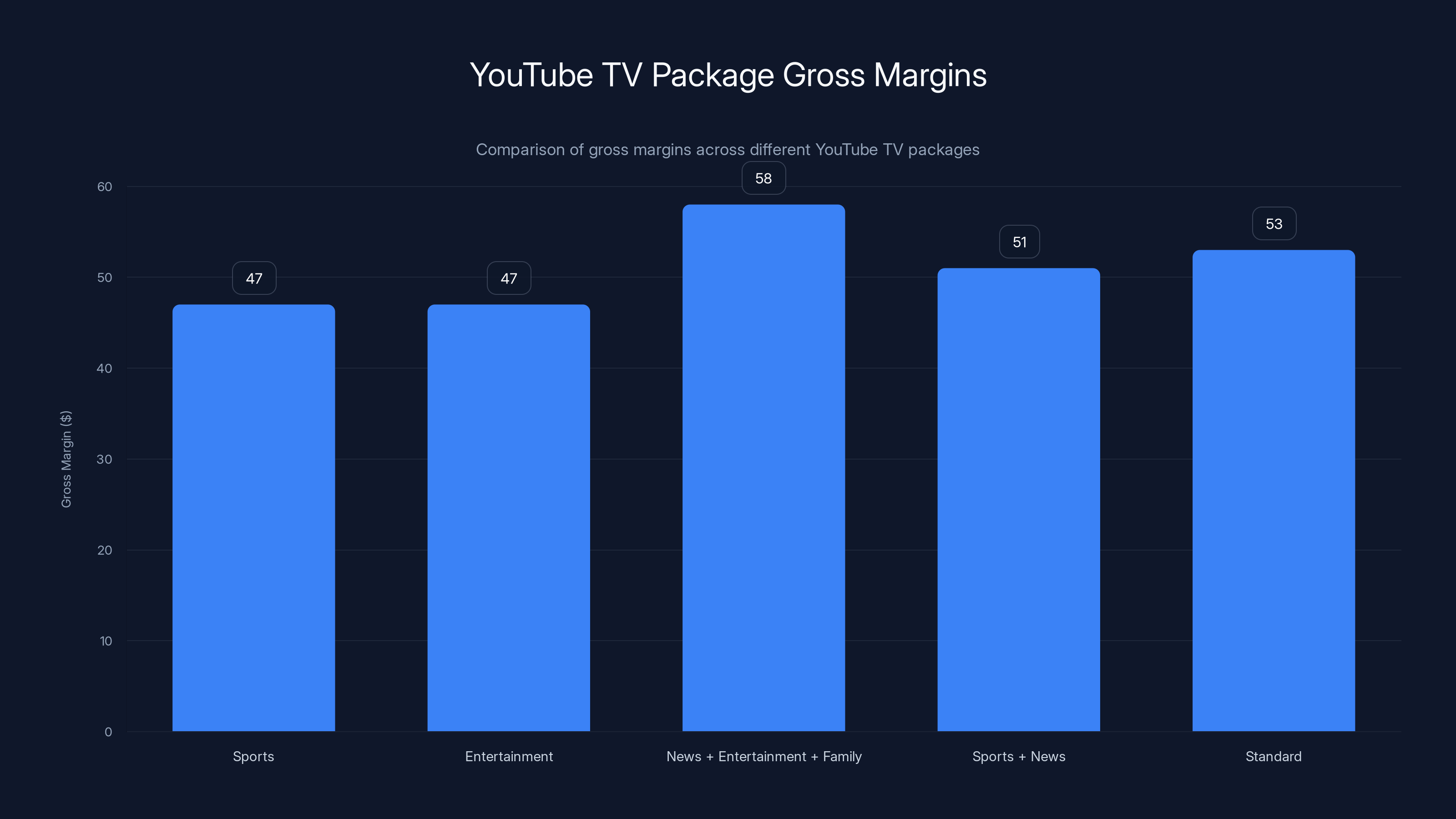

YouTube TV maintains a consistent gross margin of approximately 70-75% across all packages, focusing on optimizing lifetime value rather than maximizing short-term profits.

The Economics Behind Package Pricing

Understanding the economics reveals why YouTube priced each package the way they did.

Content licensing costs vary dramatically by category. Sports channels are expensive. ESPN costs distributors the most of any TV channel—around

News channels are cheaper. MSNBC costs roughly

Entertainment and family channels are cheapest. Comedy Central, Bravo, Paramount, Food Network, HGTV together might be

So YouTube's wholesale costs for each package roughly:

Sports Package: ~

With these rough costs, the pricing margins are:

Sports:

Notice something? YouTube's targeting roughly 70-75% gross margins on all packages. They're not trying to maximize short-term profit on specific tiers. They're trying to optimize lifetime value and churn rate.

That

Customer Scenarios and Real-World Adoption

Let's think through actual customer scenarios and how they'd respond.

Scenario 1: Sports-Obsessed Single Watches games 4-5 hours daily. Rarely watches news or entertainment. Currently pays

Scenario 2: News-Focused Retiree Watches news networks 6-8 hours daily. No interest in sports. Watches some entertainment. Currently pays

Scenario 3: Family of Four Parent 1 watches sports. Parent 2 watches news and entertainment. Kids watch family channels. Currently pays

Scenario 4: Casual Observer Watches maybe 10 hours of content monthly across all categories. Currently pays

Scenario 5: Streaming Optimizer Currently uses Netflix, Disney Plus, Hulu, and YouTube TV standard plan. Considering cutting YouTube TV entirely. Custom packages make YouTube TV cheaper, but still expensive compared to specialty options. Might downgrade to sports package and supplement with ESPN Plus, keeping overall costs lower. Moderate probability adoption, high probability of churn if packages aren't compelling.

YouTube's modeling probably includes these scenarios. They're betting that categories 1-3 represent enough of their subscriber base to offset some churn in category 5.

Licensing Negotiations and Network Agreements

One thing nobody discusses: how did YouTube TV convince networks to support these custom packages?

Networks like ESPN, CNN, and Paramount care about distribution. More distribution means more advertising revenue (for ad-supported channels) and more subscriber revenue. But they also care about how channels are bundled. ESPN doesn't want to be in a "premium" sports package that only hardcore fans get. Fox News doesn't want to be bundled with entertainment channels in a way that looks cheap.

YouTube TV had to negotiate with each network, probably offering guarantees: "We'll maintain minimum subscriber counts." Or: "We're packaging you this way, guaranteeing at least X million views." Or: "Your channel gets this positioning in our interface."

For newer networks and smaller channels, being in an affordable package probably looked great. For premium networks like ESPN, accepting package customization meant accepting reduced distribution in some scenarios. YouTube likely offered better per-subscriber rates or promotional support to make it worth it.

This is complex negotiation happening mostly invisibly. But the willingness of networks to support these packages suggests the economics work for everyone. YouTube gets flexibility. Networks maintain distribution. Subscribers get choices.

The Entertainment Package is 34% cheaper than the Standard Plan, making it an attractive option for budget-conscious viewers. Estimated data for the Standard Plan cost.

Limitations and Potential Drawbacks of Customization

Custom packages aren't perfect. There are real drawbacks worth considering.

Content Restrictions: You can't legally stream sports content if you're not subscribed to the sports package. This matters when friends come over or you change viewing habits. Temporary needs become expensive upgrades.

Feature Parity: It's unclear whether all packages include full cloud DVR storage, simultaneous streams on multiple devices, or 4K streaming. YouTube probably restricts some features to more expensive tiers. Limited information early on creates confusion.

Long-term Cost: Some households will end up paying more as they realize their viewing spans multiple categories. That couple splitting sports and news? They're paying $71.99. Add family channels later? They'll upgrade.

Complexity: Choosing between four options seems simple. But when you move, change jobs, or have life circumstances shift, you'll reassess. That's friction. Simpler to just keep one plan.

Network Concerns: Some networks fear being in "cheap" packages. Comedy Central and Bravo in a $54.99 bundle might feel devalued to their content creators and producers. This could eventually affect content quality or willingness to provide exclusive content.

Licensing Costs: More package options mean more licensing negotiations and contract management. As YouTube adds packages, negotiations become more complex, potentially increasing administrative costs and reducing flexibility.

Predictions for YouTube TV's Next Steps

If custom packages succeed, expect YouTube TV to refine them. Within 12 months, watch for:

Premium Sports Packages: Premium tier with NFL, exclusive sports content, and premium games. Cost maybe $99.99 monthly.

Network-Specific Options: Choose specific sports leagues separately. Want just NFL? Just NBA? Just MLB? Maybe available individually at lower costs.

Ad Versus Ad-Free Tiers: Following Max and Paramount Plus, YouTube TV will probably offer cheaper ad-supported versions of packages alongside ad-free options.

Family Controls: Tools letting families manage what each member can watch from specific packages. Right now, you subscribe to a package—everyone gets everything in that package. Better granularity coming.

Integration with YouTube Streaming: YouTube's core business is YouTube streaming and YouTube Music. Watch for packages bundling YouTube TV with YouTube Premium or YouTube Music, creating integrated entertainment ecosystems.

How Other Streamers Will Respond

YouTube TV's not operating in isolation. Competitors will adapt.

Hulu Plus Live TV ($76.99) will probably introduce package options within a year, matching YouTube's strategy. Their existing customer base expects it.

Sling TV already offers different packages (Entertainment or Sports). They might expand this further, creating more granular options.

Max and Paramount Plus will probably offer sports-specific tiers. Max might introduce a sports package (they have HBO Sports content). Paramount Plus might separate CBS All Access (their broadcast channel offering) from their streaming content.

Specialty streamers like ESPN Plus, Apple TV Plus, and MLS Season Pass are already category-specific. Watch them create packages combining several options at discounts.

The industry is bifurcating. Some services will go full niche (ESPN Plus is sports only). Others will remain broad but add more granular customization (YouTube TV's approach). Fewer will maintain all-encompassing bundles.

The Environmental and Sustainability Angle

This might seem tangential, but streaming infrastructure is energy-intensive. The more fragmented and specialized services become, the more total energy used across the ecosystem.

One YouTube TV instance using 100 channels is more efficient than a user splitting their viewing across YouTube TV's sports package, Netflix, Disney Plus, and a specialty service. But one YouTube TV sports package user is less efficient than a traditional cable bundle because infrastructure isn't consolidated.

YouTube's probably not prioritizing this in their calculations, but it's worth noting. Customization creates convenience at an environmental cost.

The Global Implications

These packages are US-focused initially. But YouTube TV's parent company Google operates globally. If this strategy succeeds in the US, expect international rollout.

Europe has different broadcasting rights, different sports popularity (soccer dominates), and different regulatory approaches. Middle East, India, and Asia have vastly different content preferences and infrastructure.

YouTube would need to completely rethink packages for each region. A sports package in India might be cricket and soccer-focused. A European sports package might be entirely different. Family content requirements vary dramatically.

But the principle—customizable, price-differentiated packages—works globally. Don't be surprised when YouTube TV's strategy arrives in your region in the next 2-3 years.

Conclusion: The End of One-Size-Fits-All Streaming

YouTube TV's custom packages represent a fundamental shift in streaming television. For six years, YouTube offered one plan at one price. Most streamers still do. But the era of monolithic bundles is ending.

What YouTube's done is honest and smart. They recognized that most people don't want everything. They'd rather have exactly what they need at lower cost. So they're offering that.

Yes, some households will spend more by upgrading between packages. Yes, the complexity introduces friction. Yes, networks will worry about perception. But the fundamental economics are sound.

For individuals and families whose viewing neatly fits one or two categories, these packages represent real savings. That

YouTube's also positioning themselves differently in a crowded market. They can't out-content Netflix or Max. They can't compete with specialty services on focus. But they can compete on flexibility and price. This move does that.

The real question isn't whether YouTube TV's packages work. They probably do. The question is whether this accelerates or slows overall streaming adoption. More choices at lower prices might slow cord-cutting. Fewer people need everything, so fewer people justify streaming TV subscriptions.

But that's speculation. What we know: YouTube TV is offering less for less money. For the right person, that's genuinely valuable.

The future of streaming television isn't more services. It's more choice within services. YouTube just made that future real.

FAQ

What are YouTube TV's custom channel packages?

YouTube TV's custom packages let subscribers pay for only the content categories they watch instead of paying

How much money can I save with YouTube TV's custom packages?

Savings depend on your viewing habits. The entertainment package saves the most at

Which YouTube TV package should I choose?

Choosing depends on your primary viewing category. Sports fans should choose the sports package (

Does YouTube TV offer different channels in each package?

Yes, each package includes specific networks while excluding others. The sports package includes ESPN, FS1, NBC Sports Network, and ESPN Unlimited, but no entertainment or news channels. The entertainment package includes Comedy Central, Bravo, Food Network, and HGTV but excludes sports. Package-specific exclusions are intentional—you're paying for what you watch, not for everything.

Can I switch between YouTube TV packages whenever I want?

Yes, you can change packages as needed, similar to upgrading streaming tiers on Netflix or Hulu. The transition typically takes effect on your next billing cycle. However, frequently switching between packages creates billing complexity. Plan to stay on your chosen package for at least a few months to avoid unnecessary changes.

What is YouTube TV's standard plan that costs $82.99?

The $82.99 standard plan includes all channels from all packages: sports networks, news networks, entertainment channels, and family content. It's essentially the complete YouTube TV lineup available before custom packages launched. This plan works for people who watch across multiple categories and prefer simplicity over optimizing for specific content.

Does YouTube TV offer a free trial for custom packages?

YouTube TV typically offers a limited free trial for new subscribers (usually 3-7 days). This trial likely applies to whichever package you choose, not to all packages. Existing subscribers switching to custom packages don't receive additional free trial periods. Check YouTube TV's current promotions for trial availability.

What is YouTube TV's custom multiview feature?

Custom multiview allows you to watch up to four different channels simultaneously on split screens. Instead of choosing between a sports game and news broadcast, you can display both plus two other channels at once. This feature is launching around the same time as custom packages and works across all package types, letting you monitor content from different categories without maintaining separate subscriptions.

How does YouTube TV's sports package compare to ESPN Plus or other specialty apps?

YouTube TV's sports package offers linear television (scheduled broadcasts of games as they happen) with major broadcasters like ESPN, FS1, and NBC Sports Network. ESPN Plus is a streaming app offering primarily on-demand content at $10.99 monthly. YouTube TV's package is better for watching live games in real time. ESPN Plus is better for specialty content and flexibility. Many users subscribe to both since they serve different needs.

Will YouTube TV add more packages in the future?

Probably. If custom packages succeed, YouTube will likely introduce premium sports packages with exclusive content, network-specific options (like NFL-only packages), and ad-supported versions at lower costs. Watch for announcements about expanded package options within 12-18 months of the initial rollout.

Use Case: Create comparison reports and pricing analysis spreadsheets automatically for your streaming service subscription decisions—let AI handle the data aggregation while you focus on which package fits your budget.

Try Runable For FreeKey Takeaways

- YouTube TV introduced four customizable packages: sports (54.99), sports + news (69.99)

- Custom packages save subscribers 28 monthly compared to the $82.99 standard all-inclusive plan

- The entertainment tier offers maximum savings at 34% cheaper, making it attractive for viewers unconcerned with sports

- Network licensing costs vary 3-4x between categories, with sports networks costing 3-5 monthly

- YouTube's strategy reflects broader industry shift toward componentized streaming as cord-cutting accelerates and customer retention becomes critical

- Custom multiview feature launching alongside packages lets subscribers watch four channels simultaneously, reducing the pain of package limitations

Related Articles

- YouTube TV $80 Discount: How to Get It Before 2025 Ends

- HBO Max UK Launch Date, Pricing & How It Compares to Netflix [2025]

- Watch Ski Jumping Winter Olympics 2026 Free Live Streams [2025]

- HBO Max UK & Ireland Launch [2025]: Complete Guide & Pricing

- HBO Max UK Launch 2025: Everything You Need to Know [2025]

- How to Watch Super Bowl LX 2026 Free Stream Online [2025]

![YouTube TV Custom Channel Packages & Pricing Guide [2025]](https://tryrunable.com/blog/youtube-tv-custom-channel-packages-pricing-guide-2025/image-1-1770651378769.jpg)