The Subscription Fatigue Crisis That Changed Everything

Remember when cable companies forced you to pay for 200 channels when you really only watched 12? Yeah, that problem never actually went away. It just moved to streaming.

The streaming industry created a monster of its own. Instead of one bloated cable package, you now need five different subscriptions to watch everything you care about. Netflix for shows. Disney+ for Marvel. Paramount+ for football. Max for HBO. Peacock for NBC sports. Your bill hits $80-100 monthly before taxes, and somehow you're spending more than you did on cable.

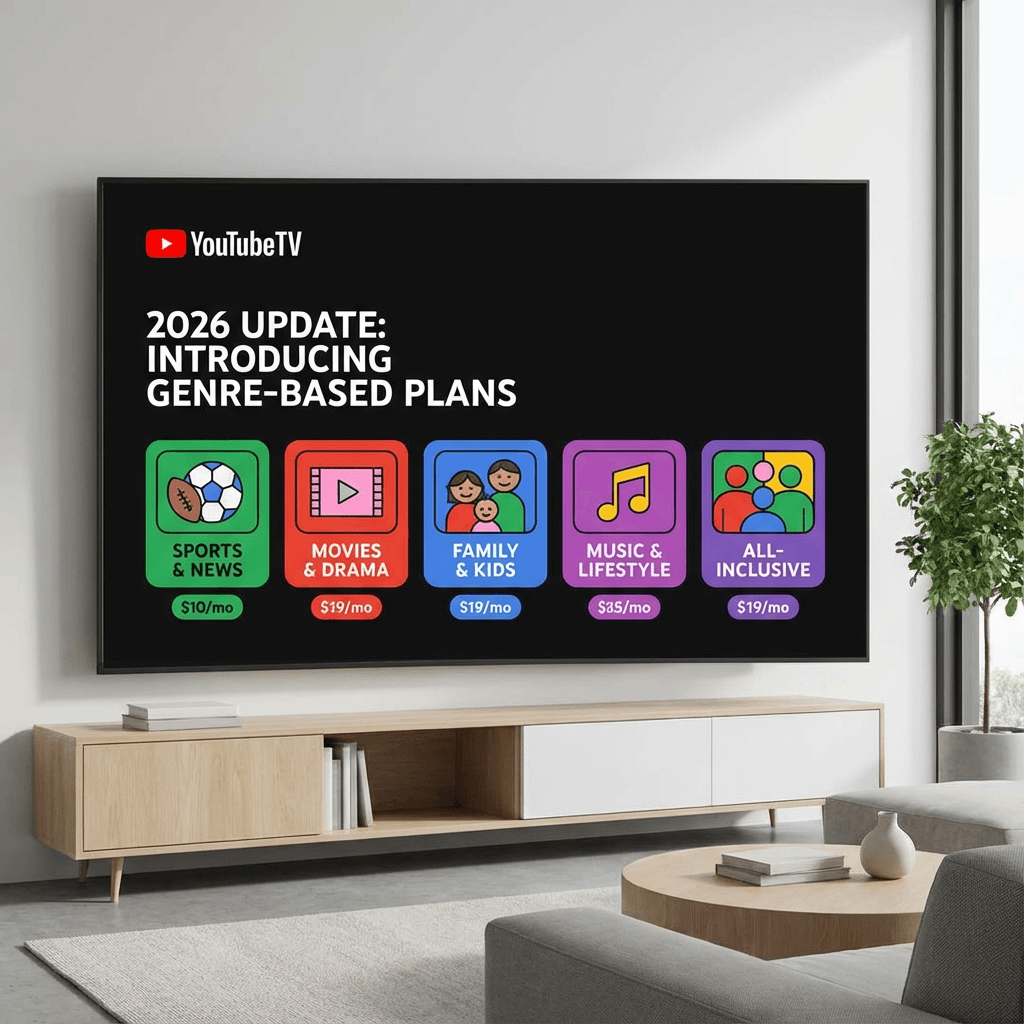

Here's where it gets interesting. YouTube TV just flipped the script. Instead of forcing everyone into the same massive package, the platform introduced genre-specific subscription tiers. Want sports? Buy the sports package. Love movies? Add the entertainment tier. Only interested in news and documentaries? You can do that now. This isn't a minor tweak. It's fundamentally reshaping how streaming subscriptions work.

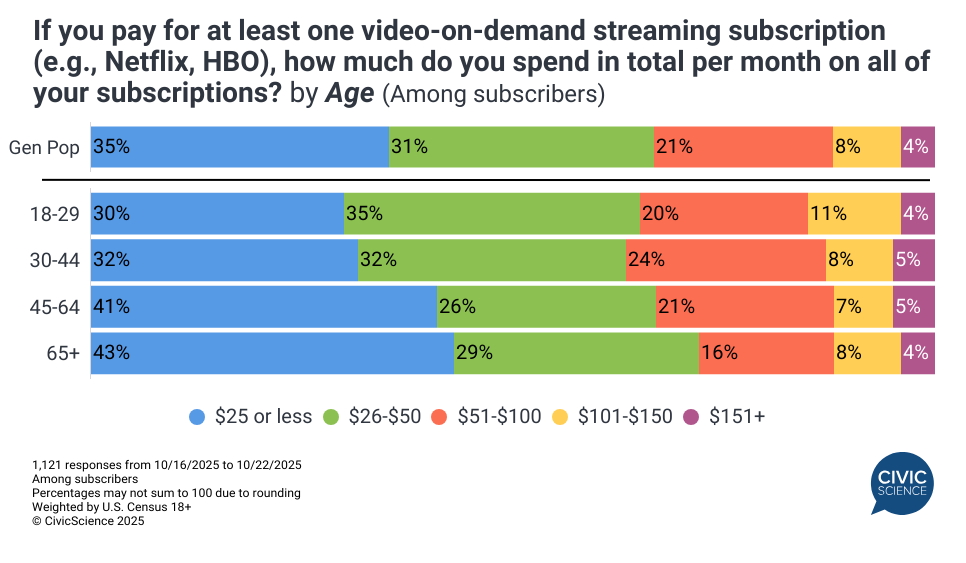

Voters and subscribers have been screaming for this change for years. According to industry research, 67% of streaming subscribers feel they're paying too much for channels they never watch. The major cable companies tried to ignore this feedback for a decade. YouTube TV didn't. They actually listened and built something that addresses the exact problem viewers complained about since the beginning.

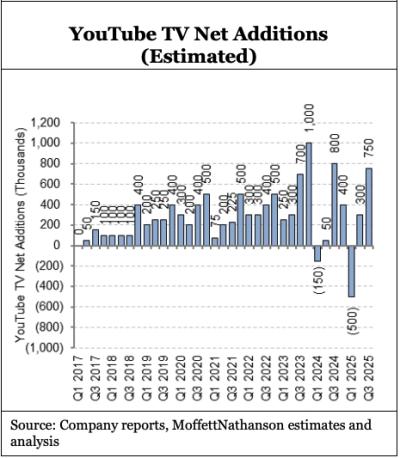

This shift matters because it signals a real market correction. The "throw everything together at maximum price" strategy only works when competition is limited. Once viewers realize they can spend less and get exactly what they want, they leave. YouTube TV recognized this before their subscriber growth flattened completely. They moved fast.

The timing is particularly smart. Streaming is consolidating. People are cutting services, rotating subscriptions monthly, and generally refusing to pay premium prices for content they don't watch. YouTube TV's genre packages tap directly into this frustration. They're essentially saying: "You only want sports? Pay for sports. You only want movies? Pay for movies. Build your own package."

This article breaks down exactly how YouTube TV's genre packages work, what they mean for your wallet, how they compare to traditional cable and competing streaming services, and whether this actually represents real value or just a clever repackaging of the same problem.

TL; DR

- YouTube TV launched genre-specific packages allowing subscribers to pick and choose channels rather than paying for everything

- Subscribers save $50-80+ monthly by building custom packages instead of buying the full bundle

- Cable companies ignored this demand for 15+ years, giving YouTube TV a massive competitive advantage

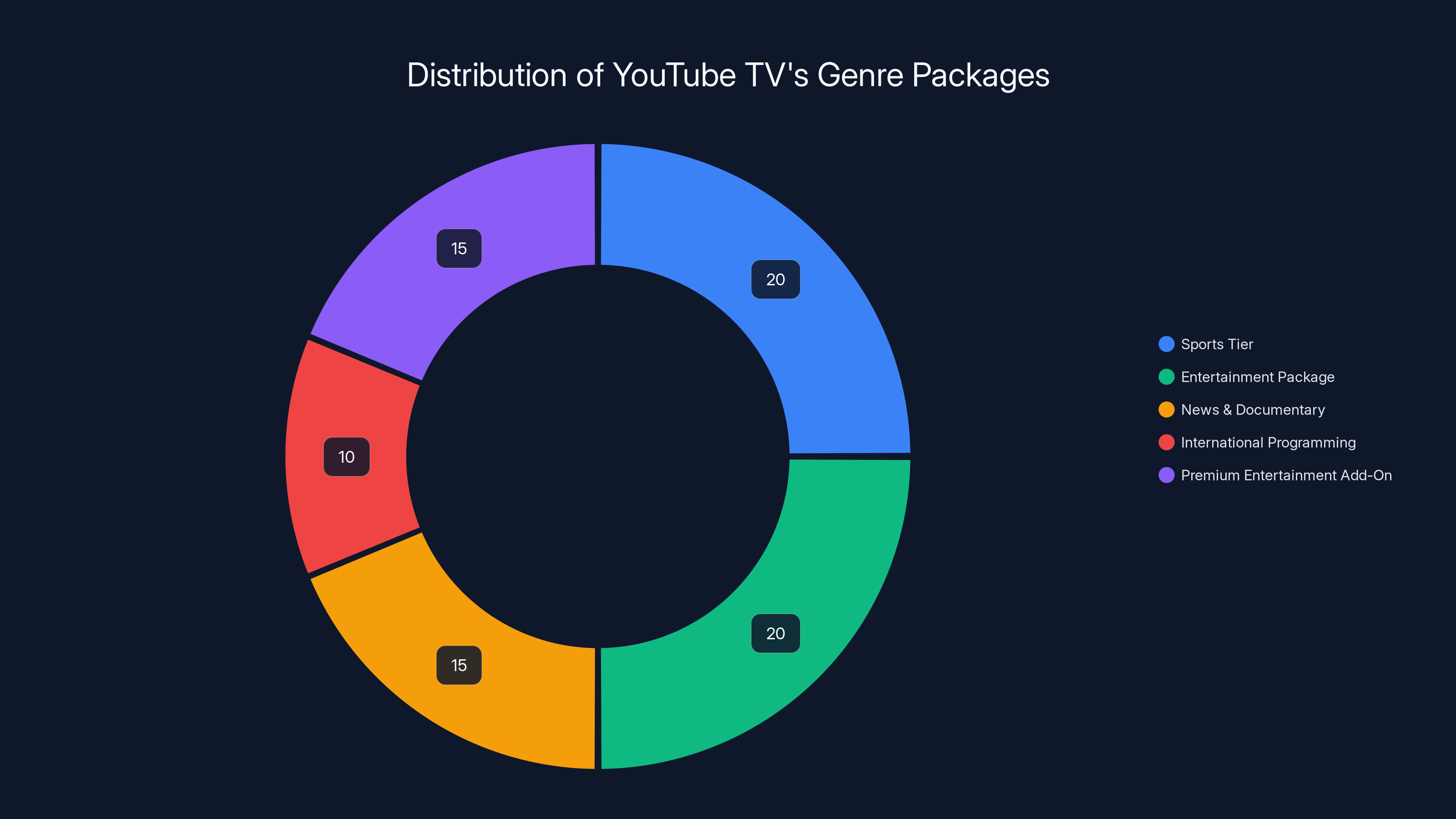

- Five major package tiers include sports, entertainment, news, documentaries, and international content

- The real win isn't the packages themselves, it's forcing the entire industry to rethink the all-or-nothing subscription model

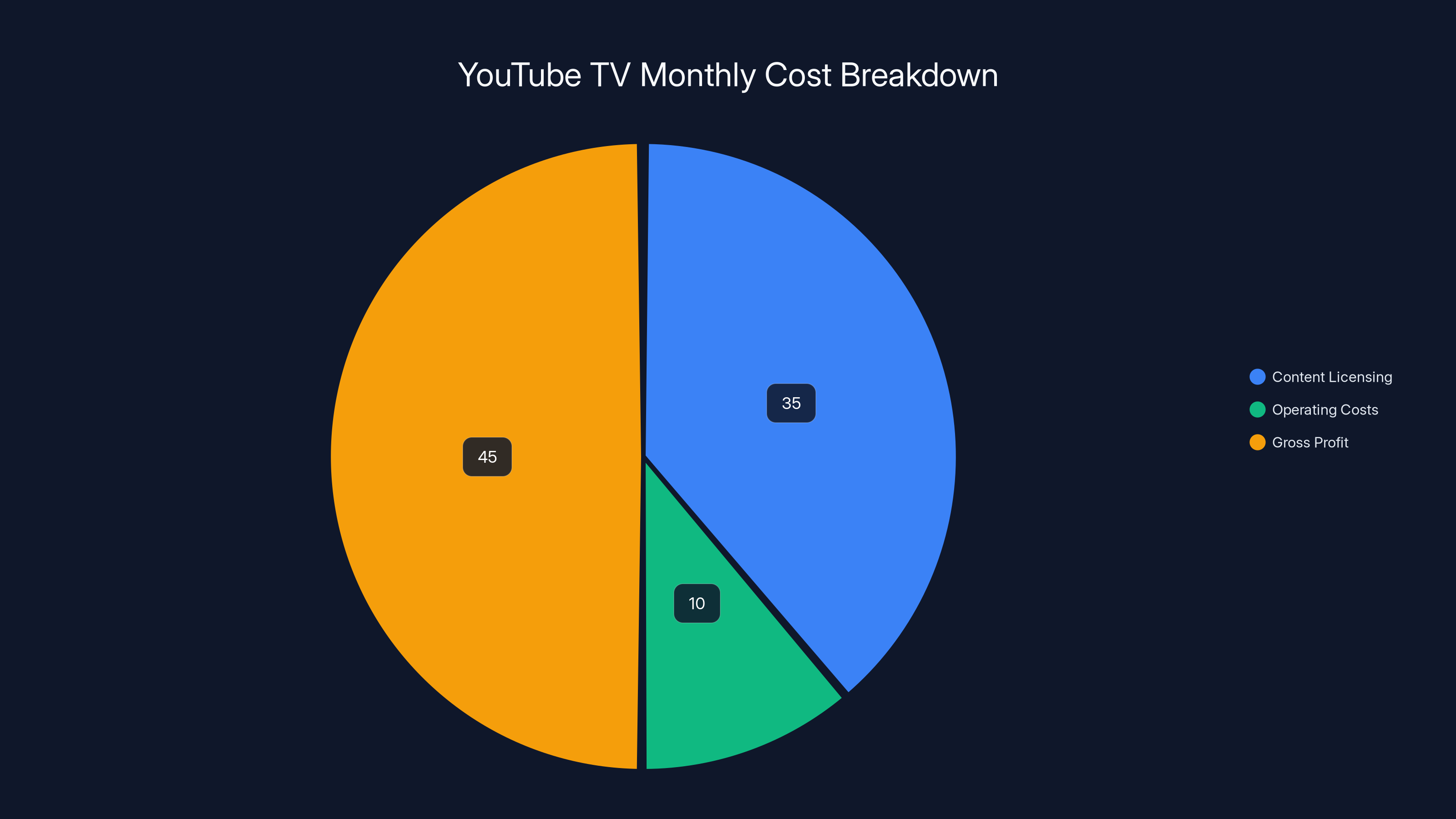

Estimated data shows content licensing and operating costs consume a significant portion of YouTube TV's monthly fee, leaving a narrow gross profit margin.

What YouTube TV's Genre Packages Actually Are

Let's get specific about what YouTube TV rolled out. This isn't a complete overhaul of their service. It's a strategic restructuring of how their core offering works.

YouTube TV traditionally offered one main package with roughly 85-100 channels. Everyone paid the same price. Everyone got the same channels. If you didn't watch 70 of those channels, too bad. You were still paying for them.

The new model breaks this into five distinct tiers, each focused on a specific content category. Think of it like building your own à la carte menu instead of ordering the full prix fixe dinner.

The Sports Tier includes ESPN, ESPN2, NFL Network, NBA TV, NHL Network, MLB. TV, Pac-12, and regional sports channels depending on your location. This tier appeals directly to the "I watch sports 80% of the time and don't care about reality TV" crowd.

The Entertainment Package stacks together AMC, HGTV, Food Network, Bravo, FX, and similar lifestyle and drama-focused networks. This is for people who actually watch scripted dramas and entertainment content regularly.

News and Documentary Content bundles CNN, MSNBC, Fox News, BBC America, Discovery Channel, National Geographic, and Smithsonian. For viewers who prefer factual content and current events.

International Programming includes channels focused on Spanish-language content, international news, and regional channels depending on your market. This directly addresses underserved communities that cable largely ignored.

The Premium Entertainment Add-On layers in premium channels like HBO Max integration, Showtime, Starz, and similar premium networks for people who want the broadest possible entertainment selection.

The genius here is flexibility. You can subscribe to Sports + News for $40-50 monthly. Or Entertainment + International for a different price point. Or all five for the full package price, which is competitive with their old all-in pricing.

This model directly copied what Hulu tried with its marketing, but YouTube TV actually executed it cleanly. Cable companies mentioned "customization" for years without actually enabling it. YouTube TV shipped real functionality.

The infrastructure change is also significant. YouTube had to redesign their entire channel guide interface to let users toggle tiers on and off. They rebuilt recommendation algorithms to work across subscribed tiers only. They reworked billing systems to handle partial subscriptions. This was a ground-up engineering project, not a marketing rebrand.

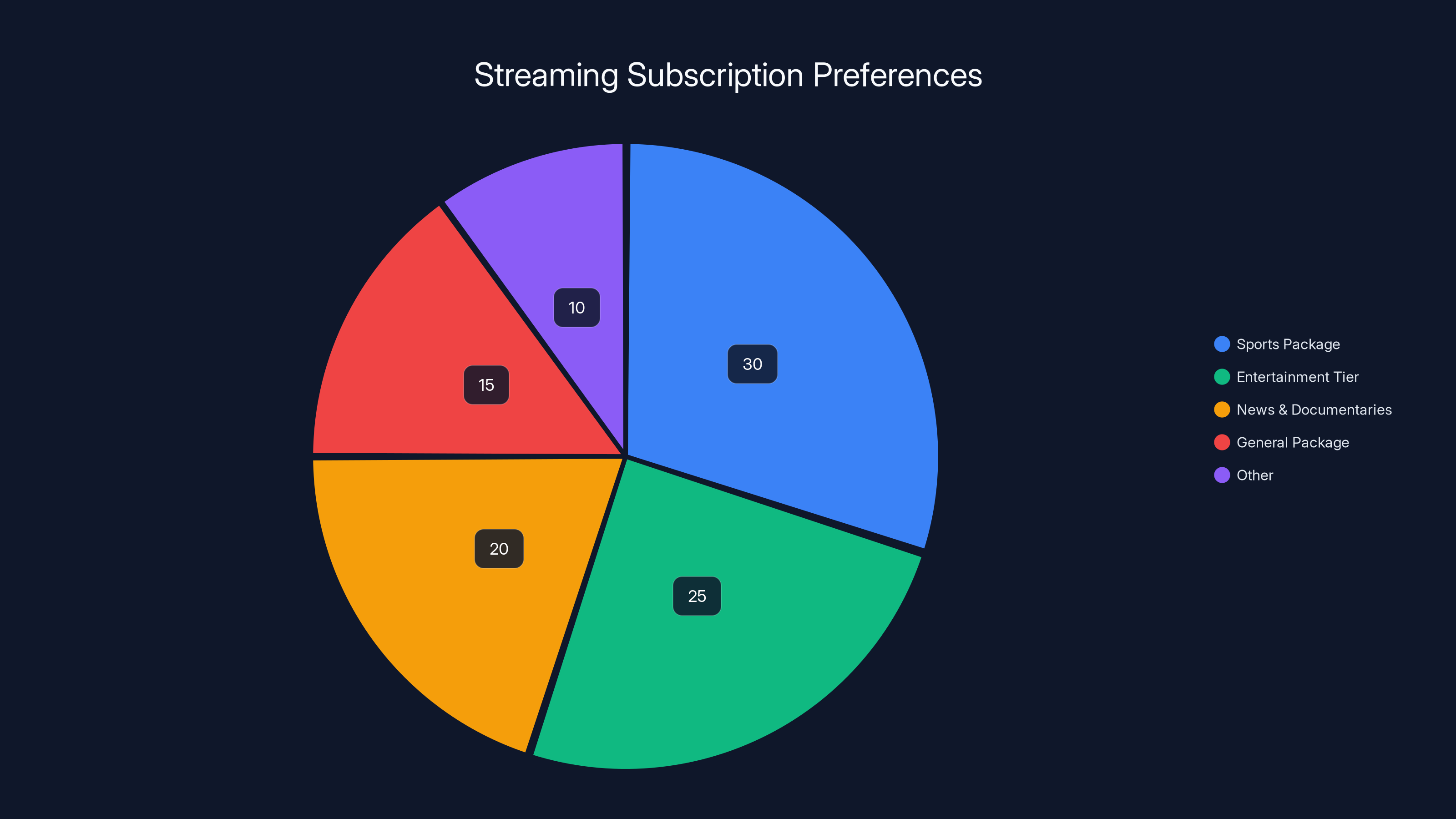

Estimated data shows a balanced distribution of channels across YouTube TV's genre packages, offering flexibility and targeted content for diverse viewer preferences.

Why Cable Forced This Exact Problem for Decades

Understanding YouTube TV's move requires understanding why cable companies created this mess in the first place.

When cable television launched in the 1970s and 1980s, bundling made economic sense. Distributing video content required massive infrastructure investment. Building the network, laying cables, running servers. The costs were enormous. The only way to make the math work was bundling. If you packed 100 channels into one package, you could spread infrastructure costs across all of them. If you offered 100 separate channels at individual prices, the math collapsed.

But here's what happened next: bundling became a profit machine, not just an economic necessity.

Cable companies realized they could force people to pay for ESPN even if they never watched sports. They could include premium movie channels most subscribers never accessed. They could add niche channels with zero viewership because technically, it gave subscribers "choice." The bundling created artificial value inflation. Nobody would pay $20/month for a single channel. But bundled into a 100-channel package? Suddenly that channel doesn't seem unreasonable.

This worked because cable had limited competition. In the 1990s and 2000s, if you wanted TV, you had cable, satellite, or nothing. That oligopoly meant customers had zero leverage. Cable companies could raise prices 5-8% annually. They could add channels people didn't want. They could bundle aggressively because where else would you go?

The bundling strategy also served another purpose: it protected niche channels that couldn't survive on individual merit. A channel with 50,000 viewers couldn't justify $0.50/month per subscriber if people opted in individually. But bundled into a package where 5 million people pay for 100 channels? That channel survives because people can't opt out of it.

Broadcasters loved this system. Niche networks that should have died in the 1990s stayed alive because bundling subsidized them. Cable companies loved it because bundling maximized revenue. The only people who got screwed were subscribers.

Streaming services inherited this exact mindset. Netflix started with unlimited options for a fixed price, which was a different model. But once Netflix established itself, every other service launched with the full-package approach. Disney+ forced you to buy all of Disney's content. Paramount+ bundled everything CBS, MTV, Comedy Central, and Viacom CBS owned. Apple TV+ offered a thin catalog but at premium pricing for limited content.

They tried to recreate cable's bundling advantage in a digital world. And for a few years, it worked. Subscribers spread payments across multiple services because the individual services offered enough value.

But the model broke down around 2022-2023. The magic number where people subscribe to more than 3-4 services wasn't "I found perfect variety." It was "I'm spending too much and cutting services." That's when YouTube TV moved first.

How the Pricing Actually Works (And Whether It Saves Money)

This is where the rubber meets the road. Genre packages only matter if they actually save money. Let's get into the actual numbers.

YouTube TV's Pricing Structure (2025)

The full bundle still exists. It's around

But here's where things get interesting. Individual tiers run approximately $25-35 per tier depending on content depth. The sports package is typically on the higher end because sports content commands premium pricing. Entertainment and news packages sit in the middle. International packages vary by region.

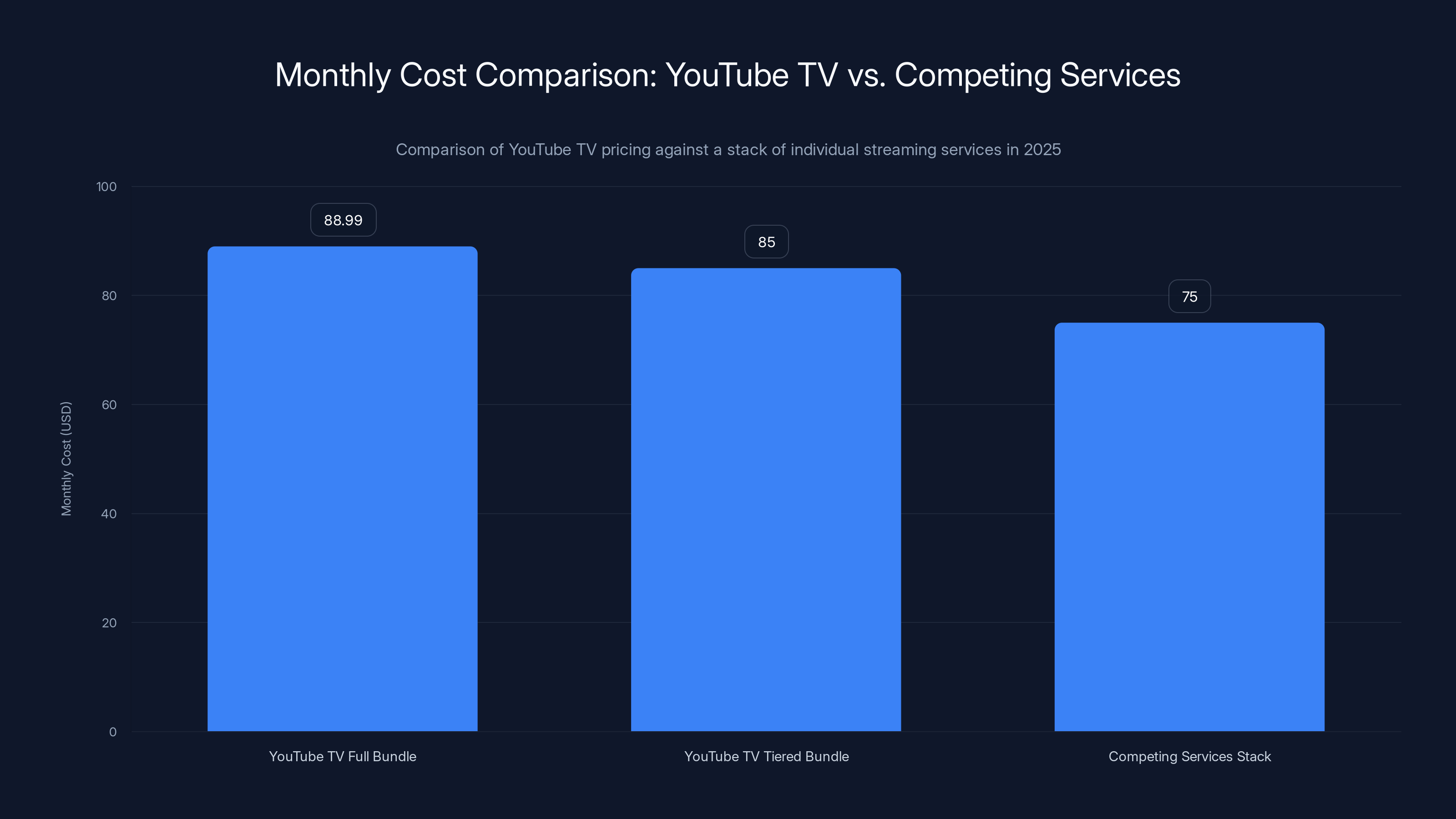

Math example: If you subscribe to Sports + Entertainment + News, you're looking at roughly $80-90/month depending on regional variations and current promotions. That's cheaper than the full bundle but offers 60-70% of the channels most viewers actually watch.

Compare that to building a competing service stack:

- ESPN+: $11.99/month (sports core)

- Hulu: $8.99/month (basic entertainment)

- Netflix: $15.49/month (entertainment content)

- Max (HBO Max): $15.99/month (premium entertainment)

- Paramount+: $7.99/month (entertainment/sports)

- Total: $59.45/month for five services

But here's the catch. That

So the actual value proposition is: Pay

The convenience factor is substantial. YouTube TV's interface is purpose-built for cord cutters. Every service I mentioned has different UI logic. Netflix organizes by genre algorithms. Hulu organizes by network. ESPN+ organizes by sport. Switching between them is friction.

YouTube TV also includes significant DVR functionality (typically 500 hours of cloud storage) and the ability to stream on multiple devices simultaneously. Most competitors charge extra for these features or have limitations.

Regional pricing variations matter too. YouTube TV's packages adjust for regional sports availability. Someone in Los Angeles with regional Lakers/Dodgers access pays differently than someone in Austin. That regional specificity is something cable companies charged blanket rates for. YouTube TV actually made it work technically.

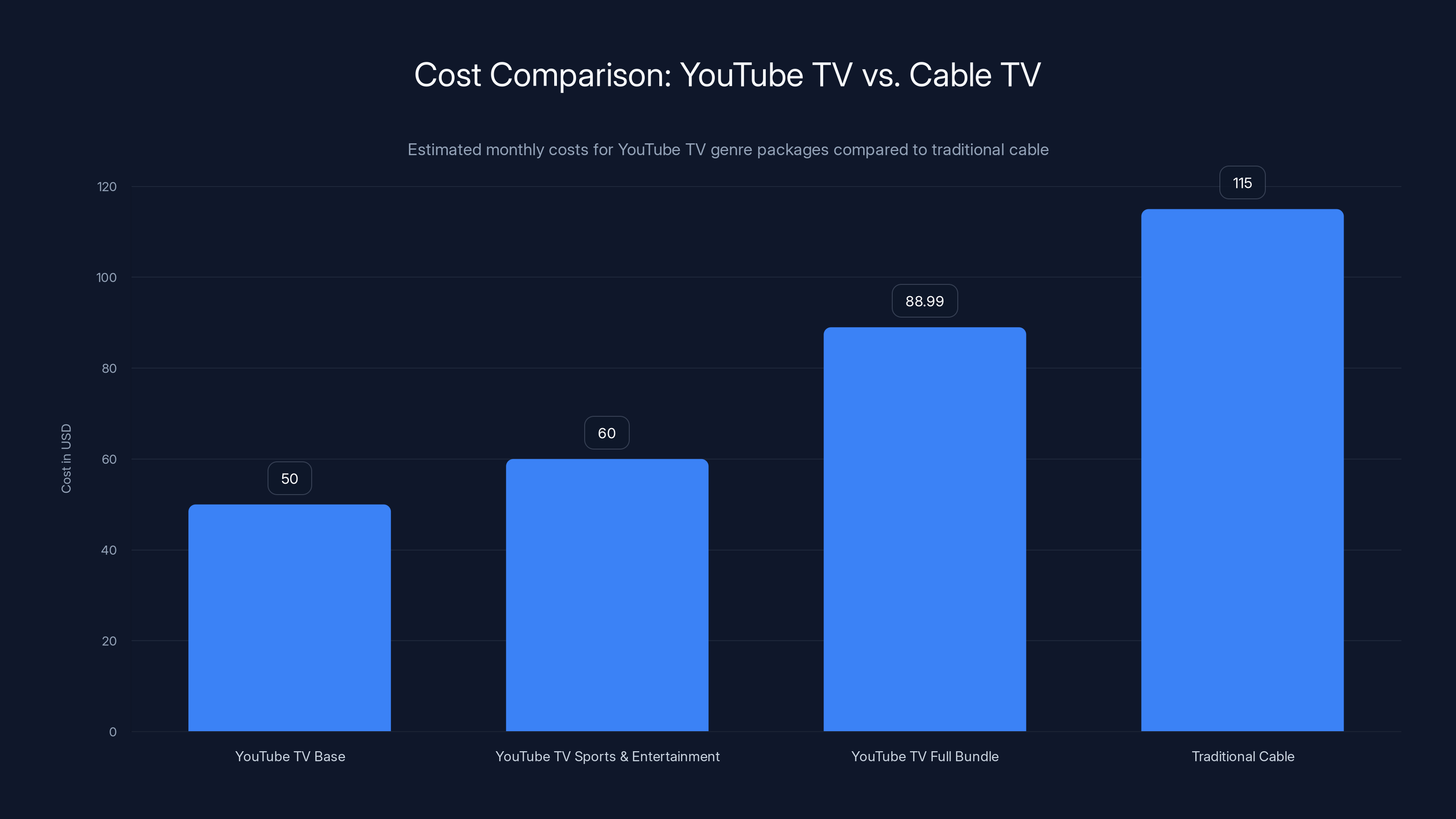

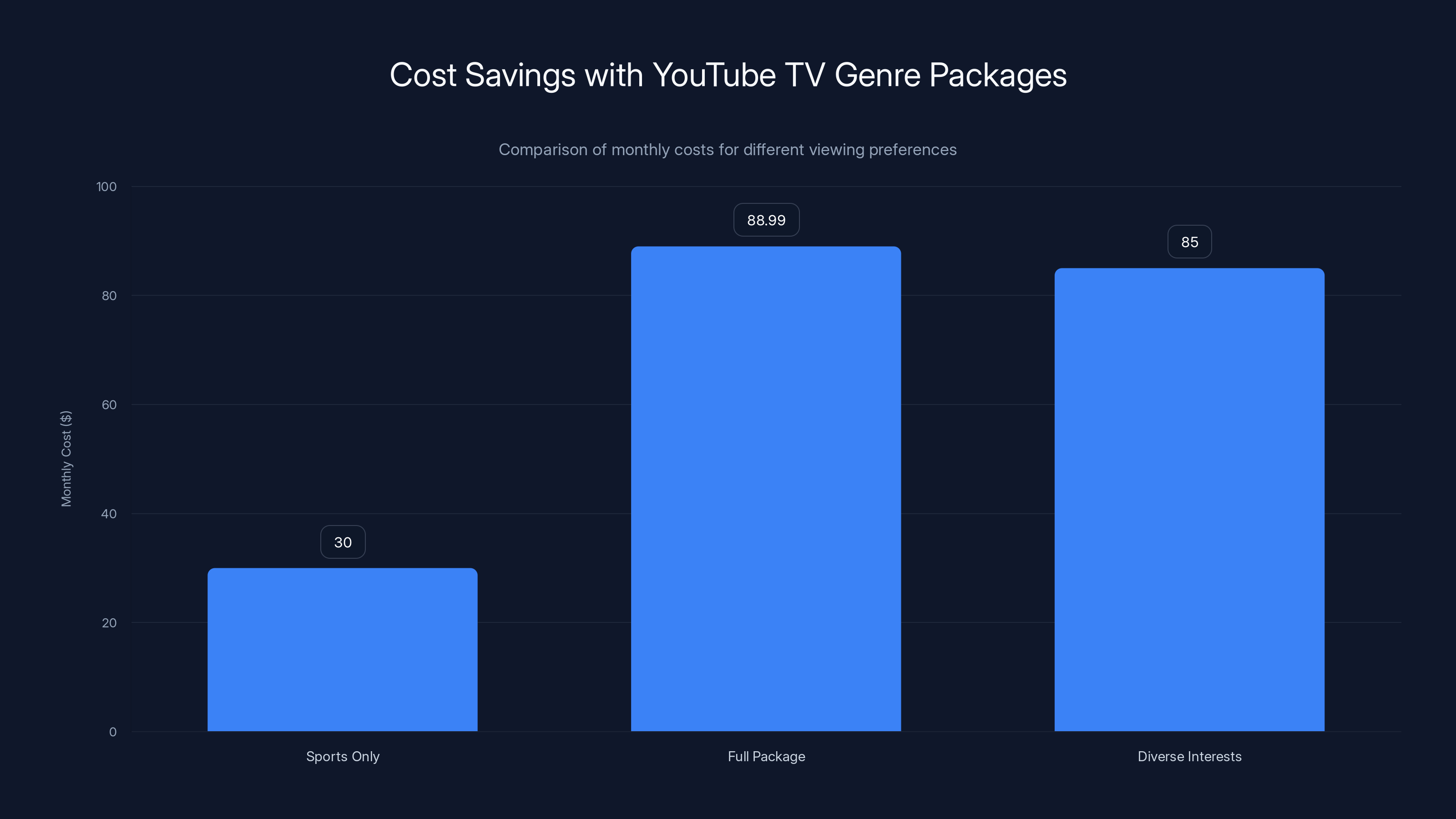

YouTube TV offers significant savings compared to traditional cable, with genre-specific packages reducing costs by up to 65% for targeted viewing preferences. Estimated data.

The Competitor Response: How Other Streaming Services Are Reacting

YouTube TV didn't invent genre packages. They just executed better than competitors. Here's what the broader industry is doing.

Hulu's Approach

Hulu offers multiple tier pricing based on ad load and content library breadth, but not genre-specific customization. You get either "basic with ads," "basic ad-free," or the full premium experience. There's no way to pay less for fewer channels. You either get all Hulu content or you don't.

Hulu's parent company, Disney, explicitly resisted à la carte offerings because it would cannibalize their other services (Disney+, ESPN+). Disney's strategy is bundling all three services together at a discount, which is the opposite of YouTube TV's approach. Disney wants you buying all three. YouTube TV wants you buying only what you need.

Paramount+'s Response

Paramount+ launched with all content in one package. More recently, they introduced a Paramount+ with Showtime bundle, which is another tier but not genre-specific. You're still getting most content regardless of tier. Paramount hasn't announced category-based subscriptions, likely because their library is smaller than YouTube TV's channel offering.

Peacock's Model

Peacock offers free (with ads), paid basic, and premium tiers based on content depth and ad load. They haven't moved toward genre packages either. NBC/Comcast's approach is different from YouTube because they own less content diversity across genres.

Max (formerly HBO Max)

Max operates as a premium offering but recently merged with Discovery content, giving them more genre breadth. They've tested tiering but not genre-specific packages. Warner Bros. Discovery wants to maximize revenue from their premium positioning rather than compete on price flexibility.

Cable Companies' Reaction

This is the wildest part. Traditional cable companies like Comcast, Charter, and AT&T haven't meaningfully responded with genre packages. They've launched streaming services (Peacock, Hulu, Max) but haven't restructured traditional cable packaging. Cable TV is still "buy the 100-channel package or nothing." They're essentially ceding the bundling-efficiency argument to streaming and competing on different variables like sports exclusivity.

The competitive landscape is fascinating because YouTube TV moved into territory that should logically benefit every other service. Yet most haven't followed. That suggests either YouTube TV's genre package infrastructure is more complex than it appears, or other services have internal politics preventing the move. Likely both.

Why This Solves Cable's Central Problem (But Not Completely)

Let's be precise about what YouTube TV's genre packages actually solve and what they don't.

The Problem It Solves: Unwanted Channel Bloat

Cable's biggest complaint was force-bundling. If you wanted ESPN, you paid for 100 channels. YouTube TV's genre packages eliminate that for anyone willing to skip content categories. Want only sports and news? Skip entertainment and international channels. That's real choice.

For a specific subscriber—someone who watches exclusively sports, never watches movies, avoids scripted drama—YouTube TV's sports package could drop their bill from

The problem becomes different for viewers with diverse interests. Someone who watches sports, loves movies, needs news, and enjoys documentaries still needs 4 tiers, landing around

What It Doesn't Solve: The Fundamental Economics of Content Distribution

Here's the hard truth. Bundling exists because it's economically efficient. Sports channels cost money. Movie networks cost money. News organizations cost money. When you spread those costs across everyone, the per-user cost decreases.

If YouTube TV's true cost to distribute a tier is

But if the economics don't work (which they might not, long-term), YouTube TV will eventually need to raise prices or reduce channel offerings. The genre packages solve the customer-experience problem. They don't solve the fundamental tension between what content costs and what people want to pay.

What It Doesn't Solve: The Content Licensing Problem

Networks license content to distributors (cable companies, streaming services) with bundling requirements built into contracts. ESPN doesn't want to be available only to sports fans who don't watch entertainment. They want maximum distribution. If YouTube TV's genre packages fragment the audience too much, networks might demand higher per-tier licensing fees or refuse licensing altogether.

This is where YouTube's negotiating power matters. YouTube is massive. They can probably negotiate favorable licensing terms because they drive meaningful volume to networks. Smaller streaming services can't.

What It Does Solve Better Than Anyone Expected: The Decision Fatigue Problem

Maybe the biggest value isn't the savings. It's the interface simplification. Choosing between five streaming services is exhausting. Each has different UI, different search logic, different recommendation algorithms. YouTube TV's genre packages offer meaningful categories without the switching cost of five separate apps.

YouTube TV's full bundle is slightly more expensive than a competing service stack, but it offers a unified interface and comprehensive content. Estimated data for tiered bundle.

The Real Winners: Niche Networks and International Content

Here's a group that benefits massively from genre packages that nobody discusses: niche networks and international broadcasters.

Traditional bundling let niche networks survive because they were subsidized by premium channels people actually wanted. You paid for ESPN, got Food Network included. But in an à la carte world, Food Network dies because people wouldn't pay $5/month for it individually.

Genre packages solve this by creating a middle ground. Food Network survives as part of the "entertainment package" because people buying that package do want it (they're not forced into it). It's not à la carte death, but it's not pure bundling either.

International content has been marginalized in English-language streaming for years. YouTube TV's international package signals commitment to Spanish-language, Asian, and other regional content in a way competitors haven't. This opens real possibilities for networks that have traditionally needed cable's bundling to survive.

For Spanish-language broadcasters specifically, YouTube TV's international package is significant. Cable companies offered Spanish channels but often treated them as premium add-ons charged at high rates. YouTube TV's approach treats them as a native tier, removing the stigma of "premium Spanish package" and making them part of the standard service menu.

Technical Infrastructure: How YouTube Actually Built This

People don't usually think about the engineering complexity of something like genre packages. It's actually enormous.

The Channel Guide Problem

YouTube TV's interface shows you the channels available in your subscription tier in real-time. Building this is straightforward if everyone gets the same channels. It's complex when different tiers show different channels.

You need database-level filtering that identifies which channels a user has access to, then populates the guide accordingly. That sounds simple until you realize users might have multiple tiers, some expiring, some paused, some pending activation. The logic compounds quickly.

The Recommendation Engine

YouTube TV's recommendations learn from your watching and suggest similar content. But if a user doesn't have a tier that includes recommended content, the recommendations fail. The system now needs to be tier-aware. It recommends movies if the user has the entertainment tier, sports if they have the sports tier. That's straightforward logic but complicated implementation across millions of simultaneous users.

Billing System Complexity

Handling multiple tiers with different prices, potentially different billing cycles, promotional codes applicable to specific tiers, pausing specific tiers, upgrading, downgrading. This is where the real complexity lives. A cable billing system handles one thing: does the user have cable? YouTube TV's now handles dozens of permutations.

Content Licensing Infrastructure

Networks need to know which tier their content appears in. Contracts specify this. YouTube had to rebuild backend systems to tie content to tiers, ensure licensing compliance, and prevent users from accessing content they don't have rights to.

Authentication and Stream Management

Multiple simultaneous streams across devices, tier-based stream limits, regional content restrictions for sports (blackout rules are complex), VPN detection to prevent unauthorized access. These are independently complex problems that needed updating for a tier-based system.

None of this is impossible. But it's substantial engineering work, which explains why competitors haven't immediately copied YouTube TV. It's easier to launch a new streaming service with one tier than restructure an existing service's entire infrastructure.

Estimated data shows a diverse preference for subscription packages, with sports and entertainment being the most popular. This reflects the need for customizable streaming options.

International Expansion and Regional Variations

YouTube TV started in the United States. Genre packages are currently rolling out primarily in US markets, though that's expanding.

International expansion is fascinating because broadcast regulations differ globally. The European Union's regulations on content licensing are stricter than the US. UK broadcasting rules are different again. Canadian content requirements are unique.

When YouTube TV expands genre packages to these markets, they can't simply copy the US model. A "news package" that works in the US (CNN, MSNBC, Fox News, BBC America) doesn't work in the UK (where different networks dominate). They need to build region-specific tiers that reflect local content ecosystems.

This is actually an advantage for YouTube TV. They're forcing themselves to understand regional content preferences at a granular level. That knowledge is valuable for competing against regional incumbents.

Canadian Expansion

Canada has Canadian content quotas for video services. Any streaming provider offering content in Canada must ensure a percentage of that content is Canadian-produced. YouTube TV's genre packages let them structure tiers that meet quota requirements while maintaining user choice. This is genuinely helpful to their expansion there.

UK and European Markets

UK and EU consumers are used to different content ecosystems. BBC content dominates UK viewing. French consumers expect French networks. Spanish consumers expect Spanish networks. YouTube TV's international tier specifically addresses this.

The catch: operating YouTube TV internationally is expensive. Content licensing costs multiply by region. Infrastructure costs increase. YouTube TV's current model of modest subscription fees might not be sustainable everywhere. Some markets might require premium pricing.

Generational Viewing Habits and How They Drive the Package Redesign

YouTube TV's genre packages are partly a response to generational content consumption differences that have become impossible to ignore.

Gen Z Viewing Patterns

Generational viewers (under 25) basically don't watch traditional TV at all. They watch YouTube, TikTok, streaming shows, and clips. "Sitting down for appointment television" isn't in their playbook. This generation has never paid for traditional cable.

YouTube TV isn't trying to win Gen Z with genre packages. They're trying to win their parents and grandparents who cut cable and want to feel like they're making a conscious choice. Genre packages are a psychological win more than an economic one for this group.

Millennial Viewing Patterns

Millennials (roughly ages 28-43) are cord-cutters or cord-nevers who actually do watch TV but selectively. They'll watch specific shows, sports, or news. They're less likely to have "TV on all the time" as background. Genre packages appeal to them because bundling is annoying.

This is the primary audience YouTube TV's redesign targets: people with specific viewing preferences who refuse to pay for filler content.

Gen X and Boomer Viewing Patterns

Older viewers (44+) skew toward news, sports, and movies. They're the audience most likely to want a sports package or news package without wasting money on entertainment they don't watch.

Intriguingly, they're also the demographic most likely to stick with cable despite its problems. They're most attached to traditional TV experiences. But YouTube TV's genre packages let them maintain traditional viewing with lower costs. This is particularly powerful in the US market where cord-cutting has plateaued.

The Sports Audience

This deserves its own mention. Sports fans represent a specific demographic: they'll pay premium prices for sports access because sports is non-negotiable. Cable knew this. YouTube TV definitely knows this. The sports package is where YouTube TV can charge premium pricing while still being cheaper than full cable.

The sports-only subscriber is extremely valuable because they're price-insensitive and committed. They'll pay $35-40/month for their tier and stick around because they have no alternatives.

YouTube TV's genre packages can significantly reduce costs for targeted viewers, offering up to 65% savings for sports-only subscribers. However, those with diverse interests see minimal savings. Estimated data.

Advertising and How It Changes With Genre Packages

One variable nobody discusses: advertising. YouTube TV's genre packages create new advertising possibilities that change the revenue equation.

Targeted Advertising Advantages

When YouTube TV knows a user is subscribed to the sports package only, they know the user watches sports. They can sell premium advertising to sports-adjacent businesses: sportsbooks, athletic equipment companies, sports bars, fitness services.

A user with only the entertainment package? Advertisers selling movies, streaming services, entertainment tickets. This allows YouTube TV to charge premium CPMs (cost per thousand impressions) because they're offering genuinely targeted audiences to advertisers.

Cable never leveraged this advantage because they didn't have user-level granularity. They knew which programs aired when, not who was actually watching them. YouTube TV has both.

Ad-Supported Tier Opportunities

YouTube TV operates an ad-free model (you pay a monthly fee, get no ads). But genre packages create opportunity for an ad-supported version of specific tiers. Netflix proved ad-supported tiers can be profitable.

Imagine YouTube TV offering a sports package with ads at

This hasn't launched yet, but it's inevitable. Genre packages enable targeted ad-supported tiers in ways the old all-in-one model didn't.

The Profitability Question: Does YouTube TV Actually Make Money?

Here's the uncomfortable reality: YouTube TV's profitability is genuinely unclear.

YouTube TV operates as a loss leader for Google. It drives engagement, data, advertising across the Google ecosystem, and helps promote YouTube. But YouTube TV's own subscription revenue probably doesn't justify its content licensing costs.

The math is brutal. Content licensing fees run

But networks constantly negotiate licensing fee increases. Sports content is getting more expensive. YouTube TV's margins are probably tightening, not expanding.

Genre packages potentially improve this situation in two ways:

First: Customer Segmentation

Some users would drop the service entirely rather than pay full price. Genre packages let YouTube TV capture them at lower price points. A customer paying $32/month for sports-only is better than no customer at all. That revenue, minus the lower licensing costs (sports packages need fewer content licenses), might still be profitable.

Second: Selective Upselling

A customer starts with a sports package. Over time, they add entertainment. Then news. Eventually they're close to full pricing. This gradual upsell might work better than forcing everyone to buy everything upfront.

But here's the risk: if users optimize too hard ("I'll only buy sports and never upsell"), YouTube TV's already-thin margins evaporate completely.

YouTube can sustain losing money on YouTube TV if it matters strategically. Losing

Genre packages are likely YouTube's best bet at achieving it. They're not a miracle. But they're the smartest move they've made on this service.

Content Exclusivity and What It Means for Package Value

Sporting events are where content exclusivity becomes genuinely important.

The Football Problem

NFL games air on multiple networks: NFL games on CBS, FOX, NBC, and cable networks like ESPN. No single streaming service has all NFL content. You need cable for Sunday Ticket exclusives. You need Prime Video for Thursday Night Football. You need YouTube TV for some games but not all.

This fragmentation means YouTube TV's sports package doesn't actually give you "all football." You're getting most games, but not all. That's a real limitation that's hard to advertise.

NBA and NHL Considerations

Basketball and hockey are slightly better consolidated. Most games air on traditional networks that YouTube TV includes. But playoffs and specific matchups might be exclusive to cable or specific apps.

Baseball's Unique Model

MLB. TV exists as a streaming service specifically for baseball. YouTube TV includes it, but it comes with blackout restrictions (you can't watch local teams in some cases). This is absurdly antiquated, but it's how broadcast agreements work.

International Sports

Soccer (football internationally) is the most fragmented. Premier League matches air on multiple platforms in the US. Champions League is somewhere else. This is why YouTube TV's international package is valuable—it's attempting to consolidate what cable fragmented.

Exclusivity is a double-edged sword for YouTube TV. Exclusive content drives subscriptions. But it's expensive to acquire. YouTube TV probably can't outbid Amazon Prime Video or ESPN+ for major exclusive deals. So they're competing on consolidation, not on unique content.

Future Trends: Where Streaming TV Is Heading

Genre packages are a step. But they're not the final form of streaming TV.

True À la Carte Subscriptions

Eventually, streaming services will offer true per-channel subscriptions. You want HBO?

But it breaks the financial model for niche content. Channels that survive because of bundling die in pure à la carte. Networks don't want this. Streaming services don't want this (it lowers revenue). Only customers want this. So we'll see partial movement toward it, but not full conversion.

Advertising-Supported Tiers Will Dominate

Profitability pressure is massive. Expect every service to launch lower-price ad-supported tiers for each genre package. Sports with ads:

Consolidation and Bundling by Large Tech Companies

The irony: we'll escape cable bundling by accepting tech company bundling. Google bundles YouTube TV with YouTube Music and YouTube Premium. Apple bundles Apple TV+ with Apple Music and iCloud. Microsoft bundles Game Pass with other services.

This is just bundling with tech company flavor. Different structure, similar result.

Live Sports Streaming Wars Will Intensify

Sports is where the real margins are. Expect increasing competition from tech companies (Amazon, Apple, Microsoft, ESPN) for exclusive streaming rights. YouTube TV will likely lose some sports exclusivity. This will hurt their sports package value unless they maintain deep discount pricing.

AI-Powered Personalized Packages

Ten years from now, expect algorithmic recommendation of package combinations based on watching history. You don't choose genres. The algorithm chooses for you. "Based on your watching, we think you'll want Sports + Entertainment. Cost: $65/month." This removes friction from decision-making while optimizing YouTube TV's revenue.

FAQ

What are YouTube TV genre packages?

YouTube TV genre packages are subscription tiers organized around content categories like sports, entertainment, news, documentaries, and international content. Instead of forcing subscribers to pay for a full channel bundle, users can choose which content categories they want to subscribe to, allowing for customized packages at different price points.

How much do YouTube TV genre packages cost?

Pricing varies by tier and region, but typically individual genre packages range from

How do YouTube TV genre packages compare to cable TV?

YouTube TV's genre packages offer significant savings compared to traditional cable, which averages $110-120/month and forces bundling of unwanted channels. YouTube TV's base package is 43% cheaper than cable, and genre-specific packages can reduce costs by 65% for viewers with narrow interests. However, cable still offers some sports exclusives (NFL Sunday Ticket) and may have better HD availability in some regions.

Can I switch between YouTube TV genre packages?

Yes. Subscribers can add or remove individual genre packages at any time through their account settings. This flexibility allows you to temporarily add the sports package during football season, then remove it when the season ends. Changes typically take effect immediately or at the start of the next billing cycle depending on your plan.

Which streaming services have similar package offerings to YouTube TV?

Hulu offers tiered pricing based on ad load and library depth but not genre-specific customization. Max offers premium tiers but not genre packages. Paramount+ bundles all content together with a premium tier option. YouTube TV is currently the only major service offering true genre-based package selection, though others may follow this model.

Does YouTube TV have sports content in every genre package tier?

No. Sports content is concentrated in YouTube TV's dedicated sports package, which includes ESPN, NFL Network, NBA TV, MLB. TV, and regional sports channels. Some sports-related content may appear in other tiers (like news coverage of sports), but live games and sports-specific programming requires the sports package subscription.

What channels are included in each YouTube TV genre package?

The sports package includes ESPN, ESPN2, NFL Network, NBA TV, NHL Network, MLB. TV, and regional sports networks. Entertainment includes AMC, HGTV, Food Network, Bravo, and FX. News includes CNN, MSNBC, Fox News, and BBC America. Documentary includes Discovery Channel, National Geographic, and Smithsonian. International content varies by region but includes Spanish-language networks and regional channels.

Is YouTube TV available internationally with genre packages?

YouTube TV's genre package rollout is currently limited primarily to the United States. International availability is expanding gradually, but complete global rollout of genre packages is still in progress. Regional versions adapted to local content ecosystems are launching in select markets including Canada and the UK.

How do I choose which YouTube TV genre packages I need?

Analyze your actual viewing habits over a typical month. Track which channels and types of content you actively watch versus channels you pay for but never access. Most subscribers find that 2-3 genre packages cover 80-90% of their watching. Start with the packages matching your primary interests, then add additional packages as needed rather than purchasing everything upfront.

Can you get an ad-supported version of YouTube TV genre packages?

Currently, YouTube TV operates only as an ad-free, paid subscription service across all genre packages. However, the company has not ruled out introducing ad-supported tiers at lower price points in the future, similar to Netflix's ad-supported option and Hulu's tiered offerings.

The Bigger Picture: What This Means for the Streaming Industry

YouTube TV's genre packages matter beyond YouTube TV subscribers. They're a signal to the entire industry that the all-or-nothing bundling strategy is dead. This had to happen eventually.

Cable companies held out for 40 years because they had no competition. Streaming companies held out for 10 years because they were still in growth mode. But growth stops. Churn increases. Pricing power decreases. Eventually, companies need to ask: "What if we offered what customers actually want instead of what maximizes short-term revenue?"

YouTube TV's answer is genre packages. They're not perfect. They don't solve the underlying economics of content distribution. But they're a genuine acknowledgment that forced bundling was always the worst part of cable.

The real impact isn't whether genre packages become universal (they will). It's that they signal the beginning of the end for bundling-as-default thinking. Competitors will follow. Pricing will get more transparent. Customer choice will become a legitimate competitive advantage.

This is boring-sounding stuff, but it matters. Every subscriber choosing their own package instead of accepting what the service dictates is a small victory for common sense. Every dollar saved by paying only for what you watch is money back in people's pockets.

YouTube TV might not be the ultimate winner in streaming wars. But they're the company that decided customer preferences matter more than maximizing revenue per subscriber. That's more significant than any individual feature.

The streaming wars aren't over. But the "bundle everything and hope customers don't notice" era is finished. YouTube TV killed it. Everything else has to adapt.

Conclusion: The End of Cable's Bundling Nightmare

YouTube TV's genre packages are solving a problem cable created 40 years ago and refused to fix for four decades. That's the headline. Everything else is details.

The details matter, though. We've covered what the packages are, how they work, what they cost, why competitors haven't followed, what the technical complexity looks like, and where the industry heads next. But the core truth remains: YouTube TV looked at cable's biggest failure and fixed it.

This won't save YouTube TV if the content economics don't work. Margins matter. Growth matters. Profitability matters. But from a customer experience perspective, genre packages are the right move. They acknowledge that people have different needs, different budgets, and different viewing preferences. Instead of forcing everyone into the same box, YouTube TV opened the box.

Will this become the industry standard? Almost certainly. Netflix will experiment with genre packages. Hulu will probably follow. Cable companies might even grudgingly implement it. But YouTube TV moved first with actual execution, not just promises.

If you're currently paying $80-100+ monthly for cable or multiple streaming services, YouTube TV's genre packages are worth evaluating. You might not save money. But you might not feel like you're subsidizing channels you never watch. That's worth something.

The future of streaming isn't about who has the most exclusive content. It's about who respects that customers know what they want better than algorithms or marketers do. YouTube TV made that bet with genre packages. Early returns suggest it's the right call.

For the first time in the history of television distribution, the choice is genuinely yours.

Key Takeaways

- YouTube TV's genre packages let subscribers choose channels by category instead of buying everything, solving cable's primary complaint for 40+ years

- Sports-only subscribers save 65% monthly while entertainment+news combinations save 5-10%, making value dependent on actual viewing habits

- Competitors like Hulu, Paramount+, and Max haven't adopted genre packages despite clear customer demand, likely due to engineering complexity or corporate strategy

- Genre packages signal the beginning of the end for bundling-as-default thinking across the entire streaming and cable industry

- The real impact on profitability depends on whether YouTube TV can maintain margins while capturing price-sensitive subscribers, an unresolved question

Related Articles

- YouTube TV Custom Multiview and Channel Packages: Everything You Need to Know [2025]

- YouTube TV's Customizable Multiview: Complete Guide [2025]

- Disney+ and Hulu Bundle Deal: Complete Guide to Streaming Savings [2025]

- HBO Max Promo Codes & Deals: Save Up to 50% [2025]

- Marseille vs Liverpool Champions League 2025/26: Complete Watch Guide

- NBA League Pass Premium 2025: Complete Streaming Guide [2025]

![YouTube TV Genre Packages: How Flexible Subscriptions Are Solving Cable's Biggest Problem [2025]](https://tryrunable.com/blog/youtube-tv-genre-packages-how-flexible-subscriptions-are-sol/image-1-1769103778825.jpg)