Introduction: The Future of Finance and Real Estate Technology

Each year, TechCrunch's Startup Battlefield competition serves as a crucial indicator of where technology innovation is heading. With thousands of applications filtered down to just 200 finalists competing across specialized categories, the companies selected represent the absolute cutting edge of their respective domains. In 2025, the fintech, real estate, and proptech categories showcase a particularly compelling vision of how artificial intelligence, automation, and data analytics are fundamentally reshaping how we manage money, invest capital, and transact in real estate.

The selection process is notoriously rigorous. TechCrunch's editorial team evaluates not just the current product-market fit or flashy features, but the underlying innovation, the team's execution capability, the size of the addressable market, and the potential for genuine disruption. This means that simply making the Startup Battlefield 200 list is itself a significant validation and a strong signal to investors, customers, and industry observers alike.

What's particularly striking about the 2025 cohort is how comprehensively artificial intelligence has permeated every layer of the financial and real estate technology stack. From document verification and tax optimization to structural design automation and investment analysis, AI isn't just a feature—it's becoming the fundamental operating system powering next-generation financial infrastructure. This represents a significant shift from previous years, where AI was often treated as a bolt-on capability rather than a core architectural component.

Beyond the technology itself, these startups address fundamental pain points that have plagued financial institutions, real estate professionals, and individual consumers for decades. They're tackling inefficiency, accessibility, transparency, and the high cost of professional services. Many are explicitly designed to democratize access to tools and capabilities that were previously available only to institutions with massive budgets and sophisticated operations teams.

Understanding these 14 companies—their business models, their target customers, their technological advantages, and their market positioning—provides valuable insight into the direction of fintech innovation, the acceleration of real estate technology adoption, and the emerging winners in the broader digital transformation of traditional industries. Whether you're an investor evaluating opportunities, an entrepreneur considering your own entry into these spaces, or a business leader evaluating emerging technologies for your organization, this comprehensive guide offers essential context and actionable intelligence.

The Fintech Revolution: AI-Powered Document Verification

Identifying Fraud Through Intelligent Document Analysis

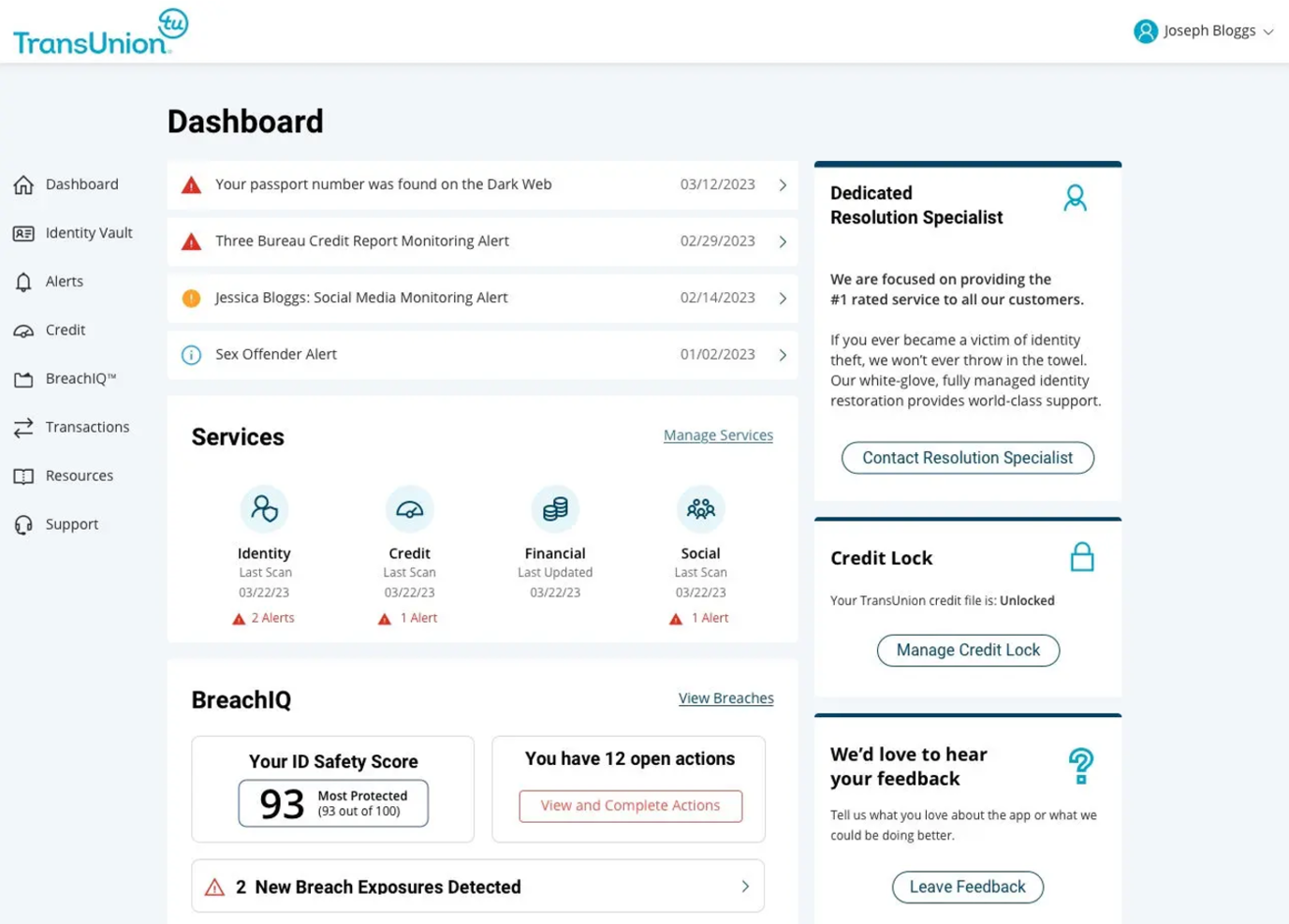

One of the most critical yet underappreciated challenges in modern finance is the verification and authentication of digital documents. Every day, financial institutions process millions of documents—loan applications, identity verification documents, employment letters, bank statements, and tax returns. The fraud risk is substantial: sophisticated document tampering, forgery, and deepfakes represent a growing threat to financial system integrity.

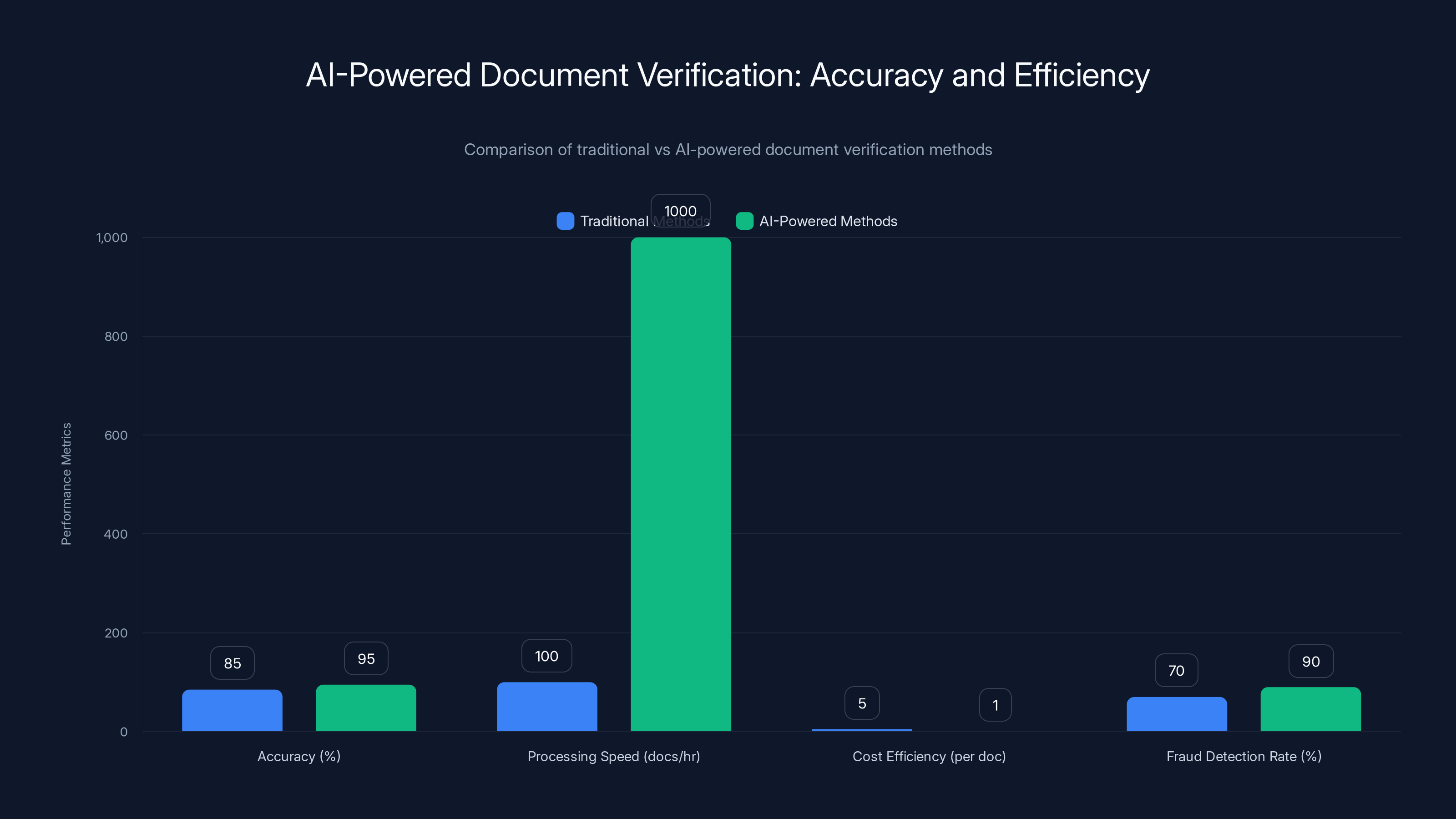

The first company in our analysis has developed an AI-powered solution specifically designed to detect fraud in digital documents with remarkable accuracy. Rather than relying on traditional rule-based systems or manual review, this platform leverages advanced machine learning models trained on millions of legitimate and fraudulent documents to identify tampering, forgery, and other anomalies with precision that exceeds human reviewers.

What makes this particularly compelling is the application context. Financial institutions and lending companies spend enormous resources on document verification—it's a critical component of know-your-customer (KYC) processes, loan underwriting, and fraud prevention. Traditional approaches involve manual review by trained specialists, which is expensive, slow, and prone to human error. The company's solution promises to automate this process entirely while actually improving accuracy and reducing false positives that frustrate legitimate customers.

The business model implications are significant. Rather than charging per transaction (which creates perverse incentives and becomes expensive at scale), the platform offers institutional licensing that allows financial firms to embed verification capabilities directly into their existing workflows. This means faster document processing, reduced manual review costs, and substantially improved fraud detection rates—often resulting in 30-40% reduction in processing time while simultaneously improving accuracy.

The market opportunity is substantial. With trillions of dollars in lending volume annually, even small percentage improvements in fraud detection or processing speed translate to hundreds of millions in value. Moreover, regulatory pressure continues to increase KYC and anti-money laundering (AML) requirements, making sophisticated verification tools increasingly essential rather than optional.

Why This Matters for Financial Institution Infrastructure

The significance of document verification extends beyond simple fraud prevention. Financial institutions are under increasing regulatory scrutiny regarding their ability to verify customer identities and source of funds. Regulators in jurisdictions worldwide have implemented stricter KYC requirements following high-profile money laundering scandals and anti-terrorism financing concerns.

Traditional document verification involves significant manual overhead: trained specialists must examine documents, look for security features, verify authenticity with issuing authorities, and document their findings. This process is labor-intensive, creating bottlenecks that slow loan approvals and customer onboarding. Moreover, the quality of review varies based on reviewer training, fatigue, and expertise.

An AI-powered solution that can consistently apply sophisticated fraud detection logic at machine speed represents a genuine step-change in capability. The system can simultaneously evaluate multiple document properties—ink consistency, pixel-level manipulations, metadata integrity, and signature verification—across thousands of documents per day with minimal human intervention.

For customers, this means dramatically faster loan approvals. A mortgage application that previously took 5-7 days for document verification might be completed in hours. For lending platforms and fintech companies with high volume and thin margins, this speed and cost advantage directly impacts profitability and competitive positioning.

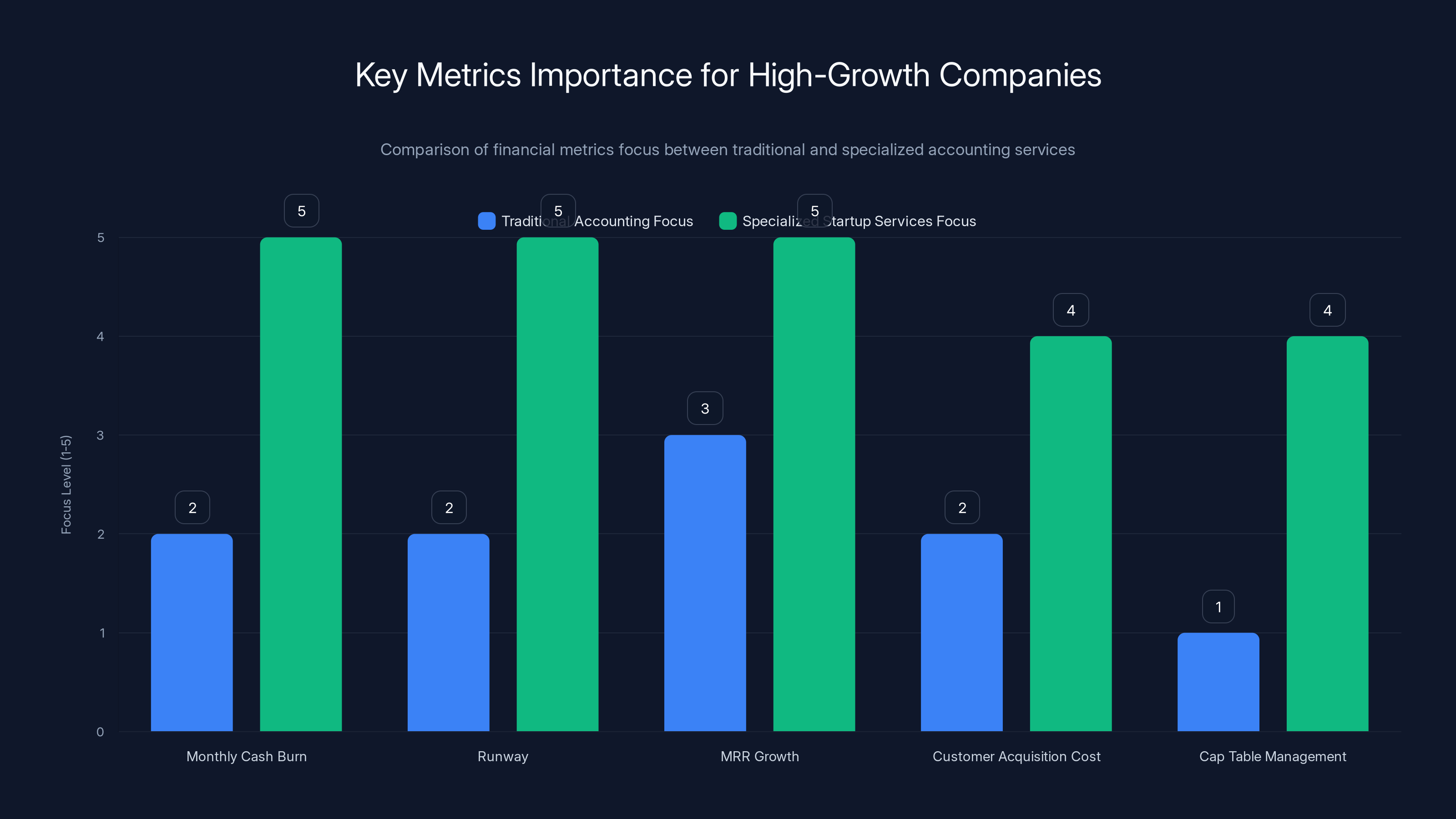

Specialized accounting services for startups place a significantly higher focus on key metrics like cash burn and runway compared to traditional accounting firms. Estimated data based on typical service offerings.

Financial Management for High-Growth Companies

Specialized Accounting for the Startup Ecosystem

While traditional accounting and CFO services are commoditized and widely available, high-growth technology companies face a unique set of financial management challenges that generalist providers often struggle to address effectively. These companies care deeply about specific metrics—burn rate, runway, unit economics, customer acquisition cost, lifetime value, and cap table management—that are often afterthoughts for traditional accounting firms focused on tax compliance and standard financial reporting.

The second company in our analysis recognized this gap and built a specialized fractional CFO and accounting services platform specifically designed for startups and high-growth tech companies. Rather than treating all businesses the same, this platform tailors its financial metrics, reporting frameworks, and advisory services to the unique needs of venture-backed companies.

Where traditional accounting firms might provide monthly P&L statements and annual tax returns, this platform delivers dashboards tracking the metrics that actually matter to startup founders and investors: monthly cash burn, estimated runway, MRR (monthly recurring revenue) growth trends, customer acquisition economics, and equity cap table management. The team understands venture funding dynamics, option pool implications, and investor reporting requirements—they speak the language of the startup ecosystem rather than forcing startups to conform to a one-size-fits-all accounting model.

The value proposition extends beyond pure financial reporting. The platform positions itself as a fractional CFO service, providing strategic financial advice alongside bookkeeping and compliance. This might include guidance on fundraising timing, recommendations on expense management during growth phases, analysis of pricing strategies' financial implications, or strategic planning around equity compensation structures.

The business model typically involves tiered pricing based on company stage and financial complexity. Early-stage startups might pay

The Investor Reporting Imperative

High-growth companies with venture investors face a critical requirement: comprehensive, timely, and sophisticated financial reporting tailored to investor needs. Investors need transparency into company financial health, progress toward key metrics, runway, and potential funding needs. Poor financial reporting creates friction, erodes investor confidence, and can complicate future fundraising rounds.

Traditional accounting tools like QuickBooks or Wave were designed for small business accounting, not for tracking the specific metrics venture-backed companies care about. Building custom financial reporting often falls to stretched finance teams or requires engaging specialized consultants at high cost.

A modern financial services platform designed for startups can embed investor reporting directly into standard financial workflows. Rather than spending hours compiling data from multiple sources and building custom reports, founders can access investor-ready reports with a few clicks. This includes:

AI-powered document verification significantly improves accuracy, speed, and cost efficiency compared to traditional methods, with a higher fraud detection rate. Estimated data.

Key Takeaways

- TechCrunch Disrupt Startup Battlefield 2025 selected 14 fintech and proptech companies representing the cutting edge of financial and real estate technology innovation

- AI has become the fundamental operating system powering next-generation financial infrastructure, not merely a feature or add-on

- Document verification, tax optimization, and investment analysis automation are democratizing institutional-quality tools for broader markets

- Specialized financial services platforms for startups address critical gaps that generalist providers fail to solve effectively

- Real estate technology is being transformed by AI-powered property analysis, architectural design automation, and commission-rebate business models

- These companies address decades-old inefficiencies in finance and real estate, creating substantial opportunities for market disruption and value creation

Related Articles

- AI and the Death of the 2021 Sales Process: A Modern Framework

- [2025] Runway's Breakthrough in AI: Launching the GWM-1 World Model and Upgrading Gen 4.5

- [2025] The Rise of Super Apps: Crypto Payments & Encrypted Chat

- [2025] Empromptu Raises $2M to Revolutionize AI Apps

FAQ

What is 14 Fintech & PropTech Startups from TechCrunch Disrupt 2025: Complete Guide?

Each year, TechCrunch's Startup Battlefield competition serves as a crucial indicator of where technology innovation is heading

What does introduction: the future of finance and real estate technology mean?

With thousands of applications filtered down to just 200 finalists competing across specialized categories, the companies selected represent the absolute cutting edge of their respective domains

Why is 14 Fintech & PropTech Startups from TechCrunch Disrupt 2025: Complete Guide important in 2025?

The selection process is notoriously rigorous

How can I get started with 14 Fintech & PropTech Startups from TechCrunch Disrupt 2025: Complete Guide?

TechCrunch's editorial team evaluates not just the current product-market fit or flashy features, but the underlying innovation, the team's execution capability, the size of the addressable market, and the potential for genuine disruption

What are the key benefits of 14 Fintech & PropTech Startups from TechCrunch Disrupt 2025: Complete Guide?

This means that simply making the Startup Battlefield 200 list is itself a significant validation and a strong signal to investors, customers, and industry observers alike

What challenges should I expect?

What's particularly striking about the 2025 cohort is how comprehensively artificial intelligence has permeated every layer of the financial and real estate technology stack