The End of an Era: Why Amazon's Cashierless Dream Is Dying

There's something deeply ironic about Amazon's announcement to close every single Amazon Go and Amazon Fresh store. A company that built its empire on disrupting retail just admitted defeat in the physical grocery space. According to NBC Washington, Amazon explained that they "haven't yet created a truly distinctive customer experience with the right economic model."

That's corporate-speak for: we tried. It didn't work. We're moving on.

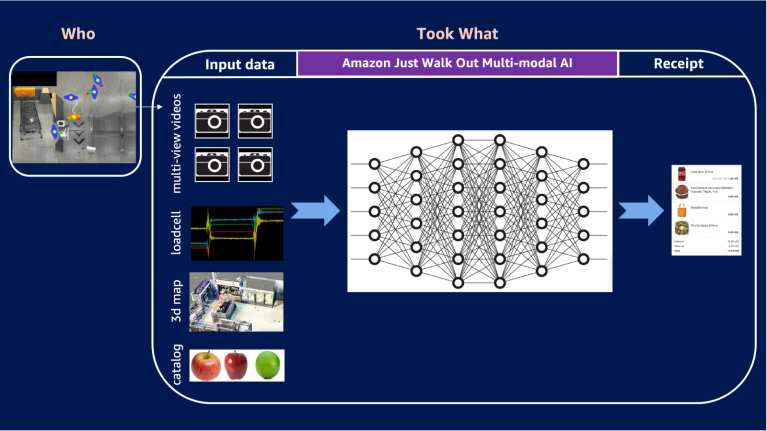

When Jeff Bezos first opened the doors to an Amazon Go store in Seattle back in 2018, it felt like the future. Walk in, grab your stuff, walk out. No checkout line. No scanning items. Just frictionless shopping powered by the same technology that tracks packages across the country. Just Walk Out, they called it. The tech was genuinely impressive. Computer vision, deep learning, sensor networks—the whole nine yards.

But here's the thing. Impressive technology doesn't always translate to a successful business. And for all of Amazon's engineering prowess, they discovered something the grocery industry has known for decades: thin margins, high labor costs, and logistics headaches make the grocery business one of the toughest retail segments to crack.

Understanding Amazon's Grocery Gamble

Amazon's entry into physical grocery wasn't random. It was strategic. After acquiring Whole Foods in 2017 for $13.7 billion, the company had a foothold in premium grocery. But premium doesn't scale. Whole Foods caters to a specific demographic with higher price tolerance. Amazon wanted to reach everyone.

So they built Amazon Go from scratch. Small format. Urban locations. Technology-forward. The pitch was simple: eliminate the friction of checkout, and you eliminate one of shopping's biggest pain points.

The execution, though, proved far more complex than the pitch.

Amazon opened stores in major cities. Seattle, San Francisco, New York, Chicago, London, and eventually, dozens of locations across the US. Each store was a high-tech marvel. Cameras above every shelf. Weight sensors embedded in fixtures. AI analyzing every movement, calculating what was taken, what was put back, what was purchased.

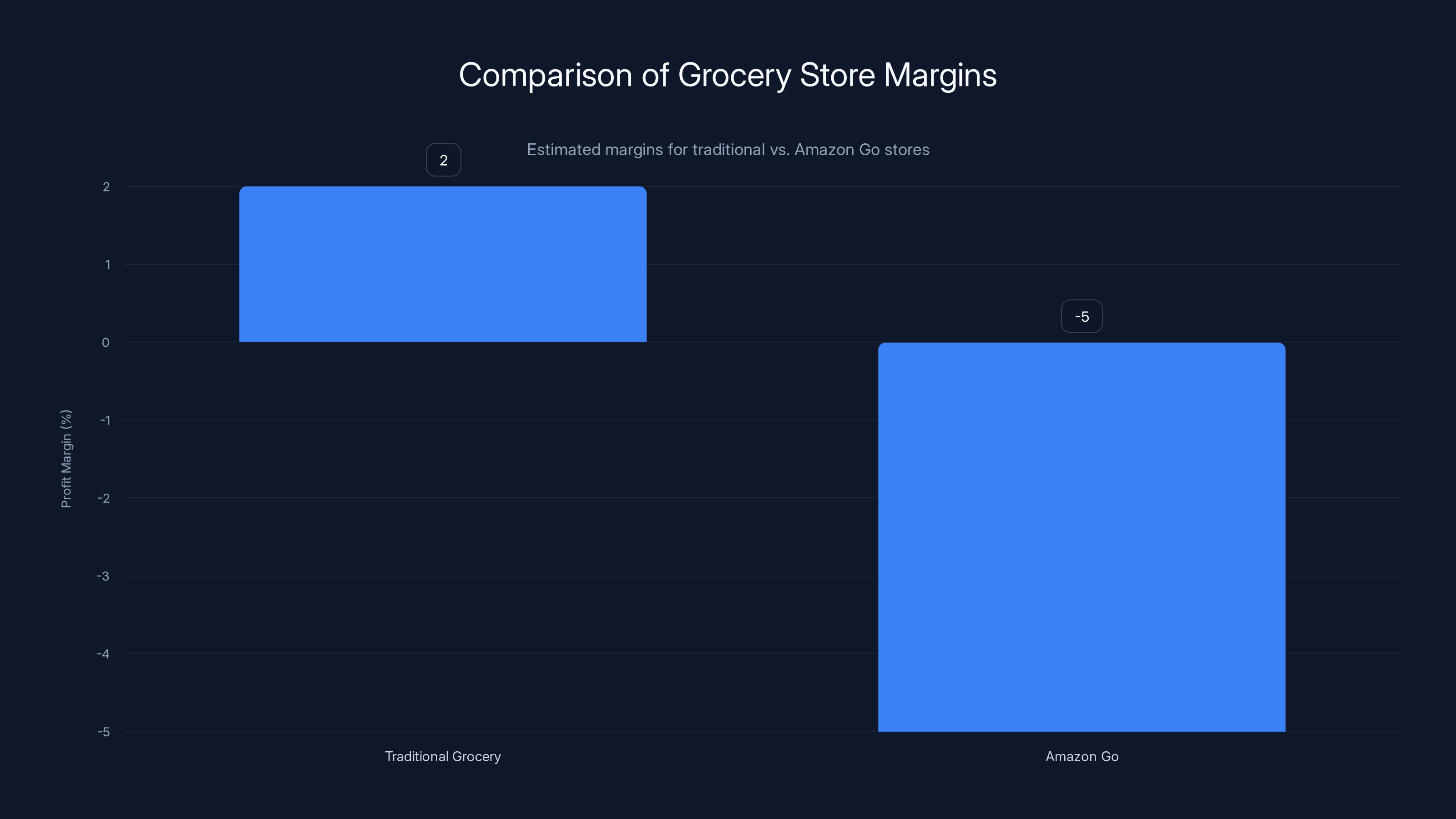

But the economics didn't work. Running a grocery store requires razor-thin margins. Typically, grocery stores operate on 1-3% margins. That means every dollar of revenue comes from cutting costs ruthlessly. Amazon's approach added complexity. Checkout-less technology meant more infrastructure, more maintenance, more specialized staff. The cost per square foot was higher than traditional grocers.

Combine that with the fact that Amazon Go stores were small—typically 1,500 square feet compared to 40,000+ for a traditional supermarket—and you're serving fewer customers across higher per-unit costs. The math simply didn't work.

Amazon is shifting its focus towards Whole Foods and Amazon Now, with less emphasis on Go & Fresh stores. Estimated data based on strategic priorities.

The Amazon Fresh Experiment

Amazon Fresh was supposed to be different. Larger format. Broader selection. A real grocery store, not a convenience concept.

Amazon launched Fresh in 2020, right as the pandemic was creating unprecedented demand for grocery delivery. The timing seemed perfect. People were stuck at home. Online grocery was booming. Amazon had the logistics network, the last-mile delivery capability, the customer relationships.

Fresh stores started opening across Los Angeles, Seattle, San Francisco, and beyond. These were bigger than Go stores. They had produce sections, meat counters, and thousands of SKUs. They looked like actual supermarkets.

For about two years, it seemed plausible. Fresh was expanding. New locations kept opening. There was buzz.

Then growth stalled.

The problem became clear: Amazon was competing against entrenched players with decades of supply chain optimization. Kroger, Safeway, Whole Foods (which Amazon already owned)—these companies had spent generations perfecting the grocery formula. They had relationships with suppliers, distribution networks, and deep local knowledge.

Amazon had technology, but technology can't fix the fundamental economics of grocery. You still need suppliers. You still need warehouses. You still need people to stock shelves, check IDs for alcohol, and handle returns. You still face spoilage, shrinkage, and the brutal reality that your biggest competitor can undercut you on price.

The margin problem was the same. Fresh stores were bleeding money. Without the path to profitability, they became liabilities. And unlike AWS, which prints money, or advertising, which has become absurdly profitable, grocery stores require operational excellence that takes decades to build.

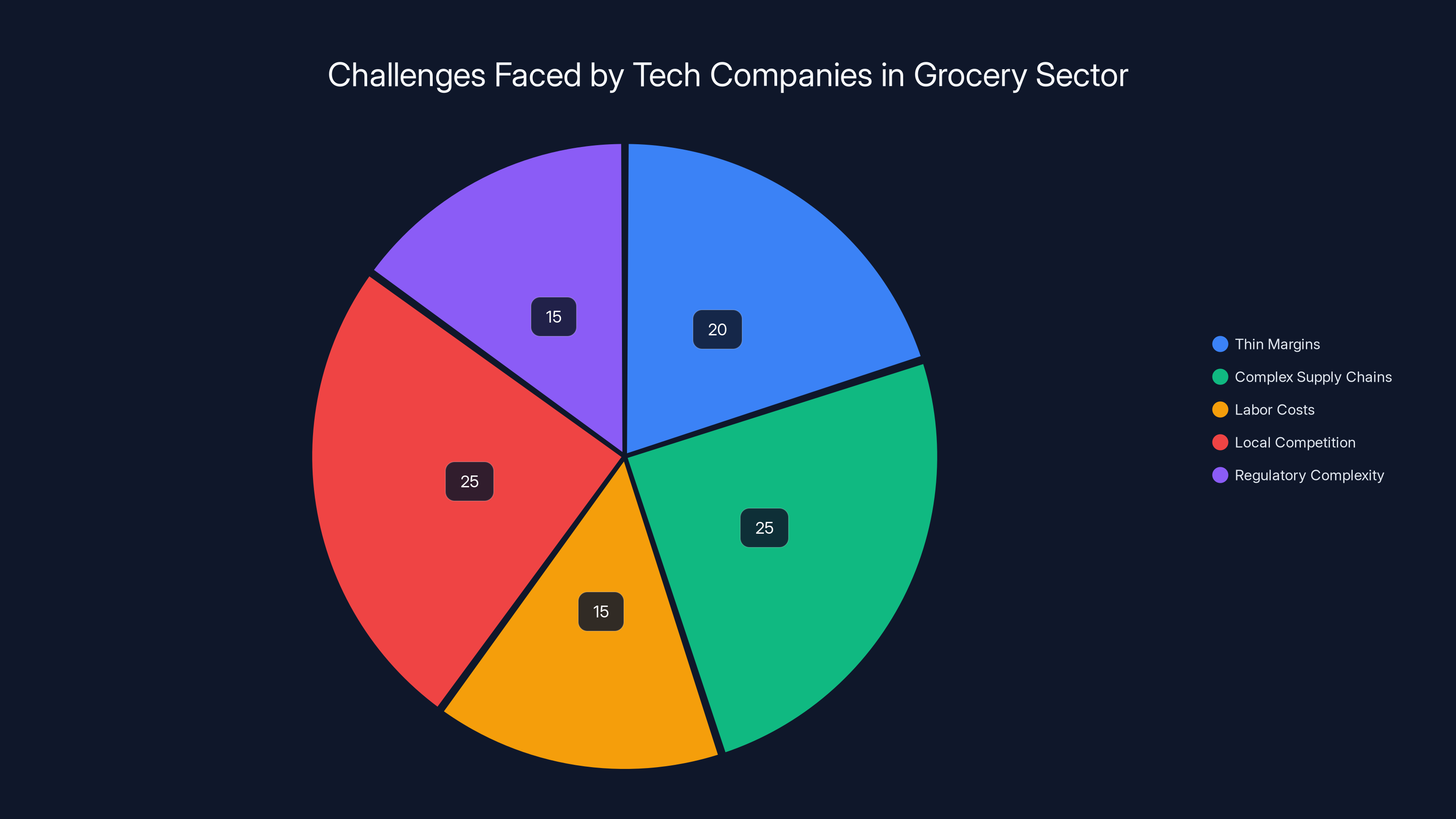

Estimated data shows complex supply chains and local competition as the most significant challenges for tech companies entering the grocery market.

The Technology That Looked Promising But Didn't Scale

The Just Walk Out technology deserves its own analysis because it was genuinely innovative. The engineering was solid. The user experience was frictionless. In a sterile lab environment, it was perfect.

But retail isn't sterile. It's messy.

The technology had to contend with:

Human behavior complexity. People don't behave like robots. They pick up items, put them back, move things around. Someone grabs a can of soup, reads the label, puts it back on the wrong shelf. Another person swaps items between bags. A group of friends shares an item back and forth. The cameras and sensors had to track all of this in real-time, instantly determining who owns what.

Scale challenges. The technology worked fine in small spaces with 100-200 customers per day. But grocery stores serve thousands of customers daily. Managing that volume with computer vision and AI created exponential complexity. The error rates increased as transactions increased.

False positives and negatives. Early adopters reported being charged for items they didn't take. Or not being charged for items they did. Amazon's algorithm wasn't perfect. When you're working with 1-3% margins, even small error rates become expensive.

Staff overhead. Cashierless doesn't mean staffless. Stores still needed employees to stock shelves, manage returns, handle edge cases when the system failed. The labor costs didn't drop as much as the concept suggested.

The irony is that Amazon's Just Walk Out technology found success elsewhere. It's currently deployed in hospital cafeterias, sports arenas, and Amazon's own warehouse break rooms. In those controlled environments, with lower transaction volumes and pre-screened users, it works great. Amazon is even licensing the technology to third parties.

But for mainstream grocery? It proved too complex, too error-prone, and not cost-effective enough to justify the investment.

Why Whole Foods Became the Winning Strategy

Here's what Amazon discovered: they already owned the answer.

Whole Foods Market operates in 42 states with over 500 stores. It has established supply chains, loyal customers, and a premium positioning that commands higher margins. More importantly, it works. Whole Foods is profitable. It has operational sophistication that took Whole Foods (the company before Amazon acquired it) decades to build.

So instead of building from scratch with Go and Fresh, Amazon is investing in Whole Foods expansion. They announced plans to open more than 100 new Whole Foods Market stores over the next few years.

This is a completely different strategy. Amazon isn't trying to disrupt Whole Foods. It's trying to grow it. The company is using its capital and logistics network to accelerate expansion, but the core formula remains: premium grocery, curated selection, higher margins, and established operational playbook.

Some Go and Fresh locations are being converted to Whole Foods stores. This is actually brilliant. They're repurposing real estate they've already leased or own, transferring the customer base from a failing concept to a working one.

Whole Foods' advantages are exactly what Go and Fresh lacked:

Established brand loyalty. Whole Foods customers love the brand. They're willing to pay premium prices for perceived quality and values alignment. This dramatically improves margins.

Proven supply chain. Whole Foods has relationships with suppliers, known sourcing practices, and established distribution patterns. This reduces operational risk.

Operational excellence. Whole Foods employees know how to run a grocery store. They have processes, training programs, and expertise. Amazon can leverage this instead of reinventing everything.

Higher margins. Premium positioning means better margins than mass-market grocery. This is the fundamental shift—Amazon stopped trying to compete on price and scale, and instead focused on the more profitable segment.

Traditional grocery stores typically operate on slim margins of 1-3%, while Amazon Go's high-tech approach results in estimated negative margins due to increased costs (Estimated data).

Amazon Now: The Delivery Pivot

Alongside the Whole Foods expansion, Amazon is doubling down on grocery delivery through two channels: Whole Foods delivery and a new service called Amazon Now.

Amazon Now is the company's answer to Door Dash and Instacart. It promises 30-minute-or-less delivery for groceries and household items. It's a direct assault on the fast-delivery market that's become incredibly competitive.

The logic is sound. People don't necessarily want to visit a grocery store—they want groceries. Delivery solves that. Amazon has the logistics infrastructure (Prime members, distribution network, last-mile capability) that makes delivery economically viable at scale.

Whole Foods + delivery is actually a potent combination. Whole Foods has the products customers want. Amazon Now has the delivery speed. Combined, they offer something neither competitor could easily match.

This is also where Amazon's other advantages shine:

Prime membership leverage. Amazon can integrate Whole Foods delivery into Prime, making it a membership benefit. This drives adoption and improves unit economics.

Logistics network. Amazon operates the most sophisticated logistics network in the world. They can deliver groceries faster and cheaper than any competitor because they already have the infrastructure.

Data and personalization. Amazon knows what you buy. They can personalize recommendations, predict demand, and optimize delivery routes in ways traditional grocers can't.

Cross-selling. Whole Foods delivery can be bundled with other Amazon services. Order groceries, get a book, grab some electronics—all in one transaction.

The Supercenter Concept: What's Actually Happening

Amazon mentioned plans for new physical locations called "supercenters" that would combine groceries, household items, and general merchandise. The CEO's sarcastically called this "just a supermarket," but it's actually more interesting than that.

What Amazon is describing sounds like Walmart. But it's not quite the same thing. A true Amazon supercenter would likely combine:

Whole Foods grocery selection. Premium products, curated sourcing, strong margins.

Amazon general merchandise. The stuff Amazon sells online—electronics, home goods, clothing. Think of it as a physical extension of Amazon.com.

Amazon services. Returns, customer service, device support. A place where Prime members can handle everything Amazon-related.

Fulfillment capabilities. A location that functions as both retail and mini-warehouse, enabling same-day or next-day delivery for nearby customers.

This isn't Amazon admitting that supermarkets are just supermarkets. It's Amazon recognizing that the future of retail is hybrid: part physical, part digital, part fulfillment center.

The challenge is that supercenters are incredibly capital-intensive. Building one is expensive. Managing one requires operational sophistication. And the margins are thin unless you can drive significant traffic.

Amazon is approaching this carefully. Rather than rushing out 500 supercenters, they'll probably test concepts, learn what works, and scale slowly. That's the Amazon playbook: experiment, measure, scale what works.

The 'Just Walk Out' technology faced significant challenges in scaling for mainstream grocery due to human behavior complexity, scale challenges, and error rates, making it less cost-effective. Estimated data.

Why Grocery Has Always Been Brutal for Tech Companies

Amazon's struggles in grocery aren't unique. This is a pattern that repeats.

Tech companies keep trying to disrupt grocery because it's a huge market. Americans spend over $1 trillion annually on food. That's a massive TAM. But the reason nobody's successfully disrupted it at scale is because the economics are awful.

Grocery operates on thin margins because it's a competitive, commoditized market. Customers are price-sensitive. Switching costs are low. Walmart or Kroger can undercut you on price. You can't win on price without massive scale and operational efficiency that takes decades to build.

Supply chains are complex. Food is perishable. Spoilage is a constant problem. You need sophisticated logistics, temperature control, and inventory management. A single miscalculation costs money. Tech companies often underestimate this complexity.

Labor costs are sticky. You need people. To stock shelves, to manage returns, to handle edge cases. Labor doesn't get cheaper. Tech can't fully automate grocery store operations without significantly degrading the customer experience.

Local competition is fierce. Supermarkets are local businesses operating in local markets. They have relationships with local suppliers, understand local preferences, and have local brand loyalty. National companies have to compete in thousands of local markets simultaneously, which is incredibly difficult.

Regulatory complexity. Food safety, alcohol regulations, pricing laws—grocers operate in a complex regulatory environment. Tech companies often underestimate regulatory compliance costs.

When you combine all of this, you realize that grocery success requires:

- Decades of operational expertise

- Established supplier relationships

- Deep local knowledge in hundreds of markets

- Efficient supply chains

- Lean operations and cost discipline

- Brand loyalty in local markets

These aren't things you can buy or build quickly. Amazon has money and technology, but it doesn't have decades of grocery operational expertise. And you can't fake that.

The Lessons Amazon Learned (and the Broader Industry Should Learn)

Amazon's pivot away from physical grocery stores tells us several things:

First, technology isn't everything. Amazon is arguably the most sophisticated tech company operating logistics at scale. Yet they couldn't make checkout-less grocery work at scale. This suggests that no amount of engineering will solve the fundamental economics of low-margin retail. If Amazon can't make it work, it's probably not possible.

Second, not every market wants disruption. Customers actually like grocery stores. They like browsing, touching produce, checking expiration dates, comparing prices. The friction that Amazon identified—checkout lines—isn't actually the main pain point for grocery shopping. People have bigger complaints: prices, selection, store hours, parking.

Third, owning something better is better than building something new. Amazon already owned Whole Foods. Instead of trying to create a new grocery concept, they're investing in the one they own. This is the smarter move. Whole Foods already has everything Amazon spent billions trying to replicate.

Fourth, delivery is the real opportunity. The successful moves are Whole Foods delivery and Amazon Now. These leverage Amazon's core strength—logistics—rather than trying to reinvent retail. Customers want groceries delivered conveniently. Amazon can do that better than anyone.

Fifth, focus beats diversification. Amazon's core business (e-commerce, AWS, advertising) are incredibly profitable. Grocery was a distraction. Focusing resources on things Amazon dominates (delivery, technology, scale) is smarter than trying to compete in categories where Amazon has no advantage.

Whole Foods excels in brand loyalty, supply chain efficiency, operational excellence, and profit margins compared to Amazon Go and Fresh. Estimated data.

What Happens to All Those Go and Fresh Stores?

Amazon has committed to helping employees at closed stores find other positions within the company. This is good PR, but the reality is that many of those jobs will disappear. Retail work—stocking shelves, managing customer service—isn't easily redeployed to other parts of Amazon.

Some Go locations will become Whole Foods stores. Real estate that's already been leased or purchased gets repurposed. Customers might not notice much change, except that they'll now encounter checkout-less technology only at certain Whole Foods locations (Amazon is selectively deploying Just Walk Out in some Whole Foods stores).

Other locations will simply close. Leases will be terminated or transferred. It's expensive to exit, but continuing to operate stores losing money is more expensive.

The real estate that Amazon owns outright becomes an asset. Maybe they convert it to fulfillment space. Maybe they hold it for the supercenter concept. Maybe they sell it. Amazon has options because they have capital.

The Just Walk Out Technology Survives Elsewhere

One of the more interesting outcomes is that Just Walk Out technology isn't disappearing. It's just finding different applications.

Amazon is licensing the technology to third parties. You'll see it in:

-

Hospital cafeterias. Doctors and nurses can grab meals during shifts without going through checkout. Hospitals love this because it reduces break room congestion and increases meals served.

-

Sports arenas and venues. Fans can grab snacks and drinks without waiting in long concession lines. Higher volume, less friction, better experience.

-

Corporate office break rooms. Amazon's deploying it in their own warehouses. Employees grab meals without checkout delays. The company gets data on consumption patterns.

-

University dining. Some colleges are testing the technology in campus dining facilities.

-

Airport lounges. Premium lounges can offer grab-and-go without checkout.

In these constrained environments, Just Walk Out works great. The technology is proven. The ROI is clear. Customers love it. Amazon can monetize the technology without having to operate grocery stores.

This is actually the smarter play. Rather than trying to use technology to disrupt the grocery industry, Amazon's licensing it to places where checkout-less shopping genuinely solves a real problem. That's much more defensible than trying to out-grocery the grocers.

What This Means for Amazon's Competitive Position

Does Amazon's retreat from Go and Fresh suggest weakness? Not really.

Look at the bigger picture:

- Amazon controls Whole Foods, the premium grocery brand.

- Amazon is expanding Whole Foods aggressively.

- Amazon is launching fast delivery through Amazon Now.

- Amazon's logistics network is unmatched.

- Amazon's not trying to compete on price; they're focusing on convenience and premium positioning.

This is actually smart strategy. Amazon realized they can't beat Kroger or Walmart at their game (low-cost grocery). So they're not playing that game. They're playing a different game: premium grocery + fast delivery, which plays to Amazon's strengths.

The question isn't "did Amazon fail at grocery?" The question is "did Amazon learn from Go and Fresh to make better decisions with Whole Foods and Amazon Now?" And the answer seems to be yes.

The Broader Implication for Retail Innovation

Amazon's pivot has implications beyond grocery.

It suggests that technology-first approaches to retail disruption have limits. You can't just apply technology to an industry and expect it to revolutionize it. Industries develop the way they do because those forms are optimized for the underlying economics.

Retail is heavily shaped by:

- Real estate costs

- Labor costs

- Customer behavior

- Supply chain logistics

- Regulatory environment

- Competitive dynamics

- Margin structures

You can't engineer your way around all of that. Sometimes, the best approach is to work with the industry as it exists (like Amazon's doing with Whole Foods expansion) rather than trying to completely reimagine it.

This doesn't mean retail innovation is dead. It means innovation has to be grounded in economic reality. Amazon's success with Prime and their logistics network wasn't because they invented new technology. It was because they applied existing technology to solve real customer problems in a way that's economically viable.

Looking Ahead: What's Next for Amazon in Grocery

Amazon's not abandoning grocery. They're just being smarter about it.

Expect to see:

Whole Foods expansion. 100+ new stores over the next few years. These will be in strategic locations, likely focusing on affluent areas where Whole Foods' premium positioning makes sense.

Amazon Now scaling. Expect aggressive expansion of 30-minute delivery, especially in dense urban areas where last-mile logistics are most efficient. This is where Amazon can compete on speed and convenience.

Selective Just Walk Out deployment. Amazon won't abandon the technology. Expect to see it in some Whole Foods locations, particularly in tech-forward urban areas where it aligns with brand positioning.

Supercenter testing. Amazon will probably test the supercenter concept in one or two markets. They'll gather data, learn what works, and decide whether to scale it. This is the Amazon way.

International expansion. Whole Foods presence outside the US is limited. Amazon might expand the brand internationally, leveraging their global logistics network.

The through-line is that Amazon is shifting from "disrupt with technology" to "dominate with economics." They own Whole Foods. They have logistics that nobody else has. They have customer data and relationships that nobody else has. They're leveraging those assets instead of trying to build new ones.

The Human Element: What About Workers?

One last thing worth addressing: what happens to the people who worked at Go and Fresh stores?

Amazon has committed to helping them find positions elsewhere in the company. That's admirable, but it's not a complete solution. Many of those jobs can't easily transfer to Amazon's other operations. A grocery store associate stocking shelves doesn't necessarily have skills that translate to warehouse work or corporate roles.

In practice, some employees will find other work within Amazon. Others will lose their jobs, or at least face the disruption of job searching. A few might transition to Whole Foods stores if those are opening in their area.

This is the real cost of retail innovation. Technology and capital can be redirected. Real estate can be repurposed. But people require real support and transition assistance. Amazon's probably doing better than many companies would, but it's still a significant human cost.

It's worth keeping in mind that behind every failed retail experiment is a set of real people whose employment situation just became uncertain. That doesn't mean Amazon made the wrong decision—they had to exit unprofitable businesses—but it's the element of this story that often gets overlooked in discussions of "what Amazon learned."

Conclusion: Why This Matters Beyond Amazon

Amazon's exit from Go and Fresh tells us something important about the future of retail, technology, and business strategy in general.

It shows that even companies with essentially unlimited capital and world-class engineering can't overcome fundamental economic constraints in certain industries. Grocery is hard not because of technology or innovation, but because of margins, logistics, competition, and customer behavior.

Amazon's pivot to Whole Foods and delivery suggests a maturation in their thinking. Instead of trying to disrupt an entire industry, they're leveraging their existing assets more effectively. That's not failure. That's smart strategy.

For everyone else, the lesson is clear: not every industry is waiting to be disrupted by technology. Some industries have the form they do because that form makes economic sense. If you're going to innovate in those spaces, you need to work with the economics, not against them.

Amazon will still be a major player in grocery. But they'll do it by owning Whole Foods, delivering groceries fast, and occasionally using clever technology where it makes sense. That's not as romantic as a vision of checkout-less stores revolutionizing retail, but it's probably a lot more profitable.

And in the end, that's what matters.

FAQ

Why is Amazon closing all Amazon Go and Fresh stores?

Amazon determined that despite impressive technology, the Go and Fresh store formats didn't create an economic model sustainable for large-scale expansion. The company found that thin grocery margins (1-3% industry standard) combined with high infrastructure costs for cashierless technology made profitability challenging. Amazon prioritized resources toward formats that work better: Whole Foods (which already operates profitably) and delivery services like Amazon Now, which leverage Amazon's superior logistics network.

What technology was Amazon using in Go and Fresh stores?

Amazon deployed "Just Walk Out" technology that used computer vision cameras, weight sensors in shelf fixtures, and AI algorithms to track items customers picked up and automatically charge them. Shoppers entered using their phone or Amazon account, grabbed items, and left without interacting with a checkout counter. While impressive in concept, the technology proved too complex to operate reliably at scale, with challenges including tracking customer behavior accurately, managing error rates, and justifying the infrastructure costs against thin profit margins.

Are Amazon Go and Fresh stores completely disappearing?

Not entirely. Some Go and Fresh locations are being converted into Whole Foods Market stores, repurposing the physical footprint for Amazon's premium grocery brand. However, the Go and Fresh banners as distinct retail concepts are being discontinued. The Just Walk Out technology survives in other applications like hospital cafeterias, sports arenas, and Amazon warehouse break rooms, but its application to mainstream grocery has been abandoned.

What's Amazon Now and how does it differ from Whole Foods delivery?

Amazon Now is Amazon's fast-delivery service promising 30-minute-or-less delivery for groceries and household items, designed to compete with Door Dash and Instacart. Whole Foods delivery offers a similar service but specifically features Whole Foods products. Both leverage Amazon's logistics infrastructure, but Amazon Now is broader in scope, while Whole Foods delivery provides access to a specific premium grocery brand that Amazon owns.

Why is Amazon focusing on Whole Foods instead of continuing Go and Fresh expansion?

Whole Foods represents a vastly more sophisticated asset than Go or Fresh. It operates 500+ stores in 42 states with established supply chains, loyal customer base, proven profitability, and decades of operational expertise. Rather than building grocery operational knowledge from scratch with Go and Fresh, Amazon recognized it was smarter to invest in accelerating an already-successful brand. This approach plays to Amazon's strength (capital and logistics) while leveraging operational excellence they already own, rather than trying to out-execute entrenched competitors in a low-margin business.

What happens to Just Walk Out technology if Amazon isn't using it in stores anymore?

Just Walk Out technology is being successfully deployed and licensed to third-party operators. Amazon installed it in hospital cafeterias, sports arena concession areas, university dining facilities, and Amazon warehouse break rooms. The technology works well in controlled environments with moderate transaction volumes and pre-screened users. Rather than abandoning it, Amazon is monetizing the technology through licensing while focusing grocery operations on formats better suited to retail economics.

How many stores is Amazon closing, and what's the timeline?

Amazon didn't specify exact closure numbers for Go and Fresh stores in initial announcements, but media reports indicated there were roughly 600 combined locations at peak. The closures are happening progressively, with Amazon working to transition affected employees to other positions within the company. Some locations are being converted to Whole Foods, while others are being closed outright. The timeline appears to be gradual rather than sudden, allowing time for lease termination negotiations and staff transitions.

Will Amazon reopen any Go or Fresh stores in the future?

Amazon hasn't ruled out future physical grocery concepts, but Go and Fresh in their original form are done. The company mentioned plans for new store concepts including "supercenters" combining groceries, household goods, and general merchandise. However, these appear to be future experiments rather than imminent launches. Amazon's focus is clearly on Whole Foods expansion and delivery rather than launching new cashierless store formats in the near term.

How does this affect Amazon Prime members?

Amazon Prime members actually benefit from this shift. Whole Foods delivery is a Prime membership benefit that's becoming more widely available. Amazon Now, Amazon's fast-delivery service, is also integrated with Prime. Rather than losing grocery benefits, Prime members are gaining better grocery delivery options through Whole Foods and faster delivery through Amazon Now. The convenience of not visiting physical Go or Fresh stores is traded for the convenience of faster delivery, which is arguably a better value proposition for many customers.

What does Amazon's grocery retreat mean for retail innovation?

Amazon's pivot suggests that technology alone doesn't disrupt industries with fundamental economic constraints. Grocery's thin margins, complex logistics, and entrenched competition create barriers that engineering can't overcome. The lesson is that successful retail innovation requires working with economic realities, not against them. Amazon's shift toward owning profitable grocery brands (Whole Foods) and leveraging logistics advantages (delivery) reflects mature thinking about where innovation can actually create value in the grocery sector.

Key Takeaways

- Amazon is closing all Amazon Go and Amazon Fresh stores, converting some to Whole Foods locations while shifting focus to delivery and Whole Foods expansion

- Grocery operates on razor-thin 1-3% margins, making technology infrastructure costs unsustainable for checkout-less retail at scale

- Just Walk Out technology works in controlled environments (hospitals, arenas, break rooms) but proved too complex for mainstream grocery operations

- Amazon's pivot to owning and expanding Whole Foods (already profitable) rather than building new grocery formats demonstrates smarter capital allocation strategy

- Amazon Now (30-minute delivery) and Whole Foods delivery represent Amazon's winning strategy: leveraging logistics advantages rather than trying to reinvent retail operations

- Even companies with unlimited capital and world-class engineering can't overcome fundamental economic constraints in certain industries

- Grocery retail success requires decades of operational expertise, local relationships, and supply chain optimization that can't be engineered or bought quickly

![Amazon Go & Fresh Closures: Why Amazon is Ditching Cashierless Retail [2025]](https://tryrunable.com/blog/amazon-go-fresh-closures-why-amazon-is-ditching-cashierless-/image-1-1769539249836.jpg)