The Atari Hotel Las Vegas Dream Died: Here's the Full Story

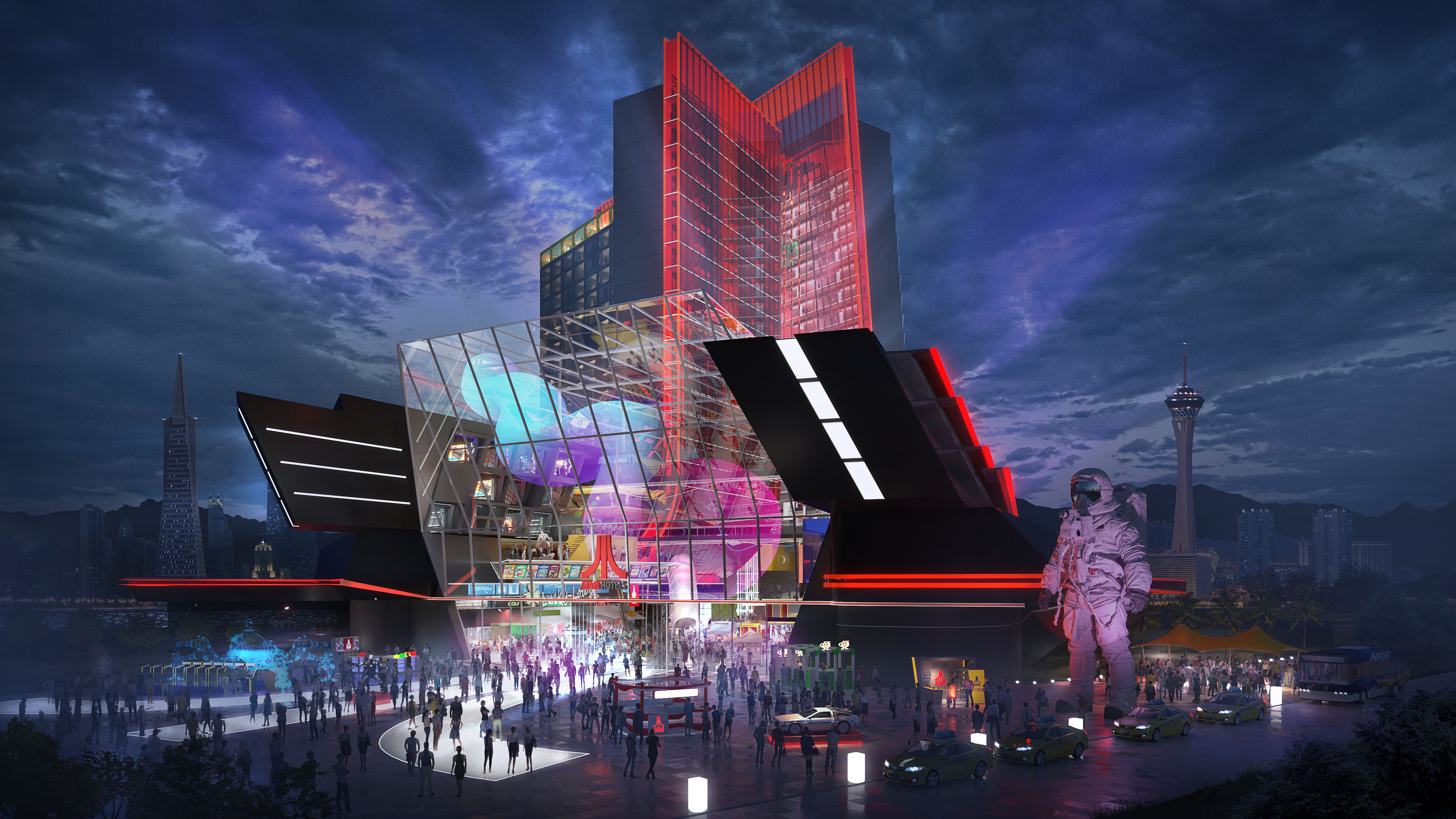

Back in 2020, when the world was still coming to grips with a pandemic that nobody understood, Atari announced something genuinely exciting. The company—the legendary maker of home gaming systems and arcade cabinets that defined childhoods for millions—was planning to build hotels. Not just one. Eight of them. Across eight major American cities.

Las Vegas was supposed to be one of them. Austin, Chicago, Denver, San Francisco, San Jose, and Seattle were on the list too. The concept seemed perfect. Gaming enthusiasts would have a place to stay that wasn't just a generic casino resort, but something specifically designed for them. A destination where the entire experience centered on vintage arcade games, modern gaming, and the culture that surrounded it all.

But here's where the story gets disappointing, and honestly, it's worth understanding because it tells us something important about why ambitious hospitality projects fail. The Las Vegas location never happened. The company quietly shelved those plans, focusing instead on a single property in Phoenix, Arizona. According to the Las Vegas Sun, the decision was influenced by the high costs and regulatory complexities associated with building in Las Vegas.

This isn't just about one failed hotel deal. It's a case study in how grand visions intersect with financial reality, how a company tries to pivot when the original plan doesn't work out, and what happens when you announce major projects during a global crisis without having all your funding locked down.

Let's break down what actually happened, why it matters, and what the current state of the Atari Hotels project really looks like in 2025.

When Atari Announced the Hotel Empire

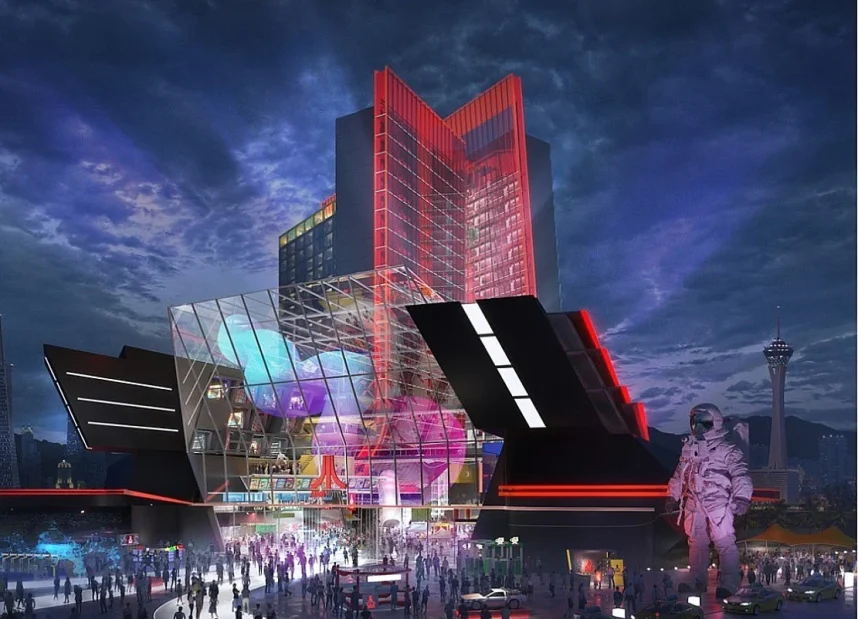

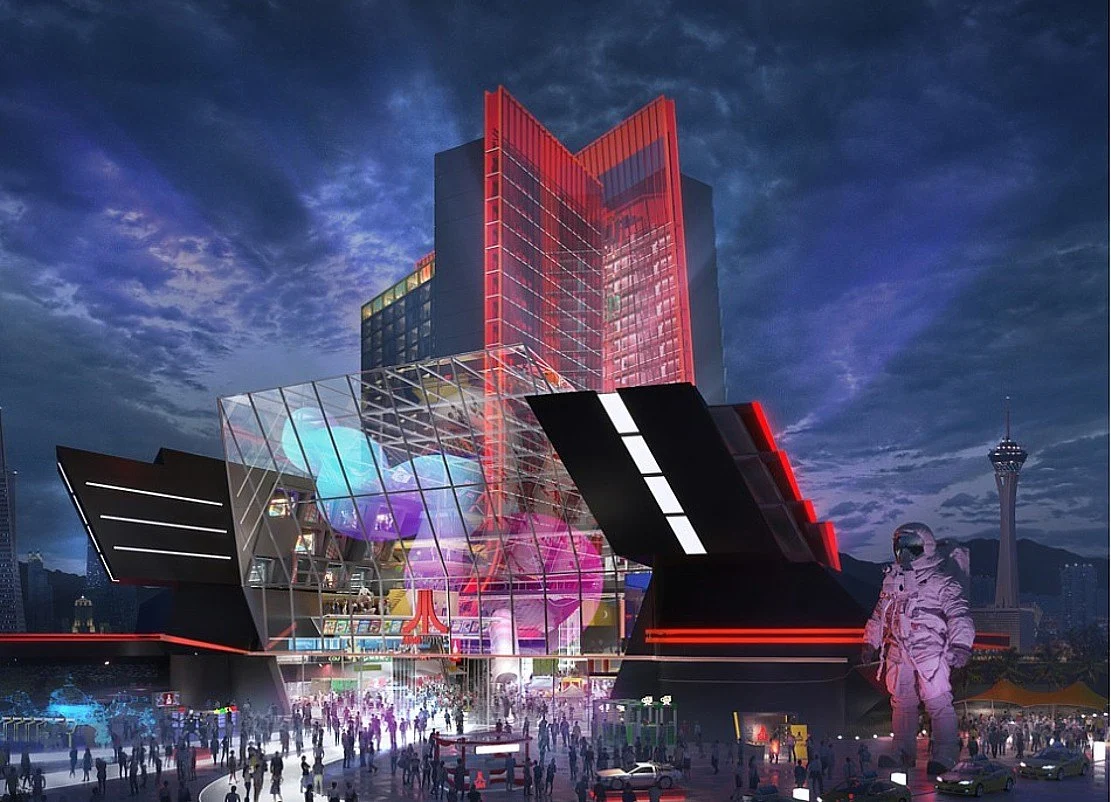

The announcement came in September 2019, just months before COVID-19 shut down the world. Atari, under the leadership of executives who saw an opportunity in gaming nostalgia, unveiled plans for a chain of hotels that would celebrate gaming culture. The concept art looked sleek. The marketing materials promised an experience where guests could play thousands of games, both classic arcade titles and modern releases.

Las Vegas made sense as a target market. The city thrives on themed experiences and destination tourism. People travel there specifically for unique attractions. A gaming-themed hotel could have captured multiple audiences: hardcore retro gaming enthusiasts, casual players who grew up with Atari, and general tourists looking for something different from the typical casino resort experience.

The company pitched eight locations for specific reasons. These weren't random cities. Austin has a tech scene and gaming culture. Chicago is a major Midwestern hub. Denver appeals to younger demographics. San Francisco and San Jose are in the heart of Silicon Valley. Seattle has a strong gaming community anchored by companies like Valve and Amazon Game Studios. Las Vegas, of course, is the ultimate destination resort city.

Each location represented a different market demographic. The strategy looked reasonable on paper. Build in tech hubs and gaming centers, then leverage those successes to expand elsewhere. It's the standard playbook for hospitality expansion: prove the concept works in key markets, then scale.

But here's the thing about grand announcements during uncertain times: they often look better in press releases than they do when actual money needs to change hands.

Estimated data shows that the initial construction and gaming amenities cost for a 150-room gaming hotel can reach up to

The COVID-19 Timing Disaster

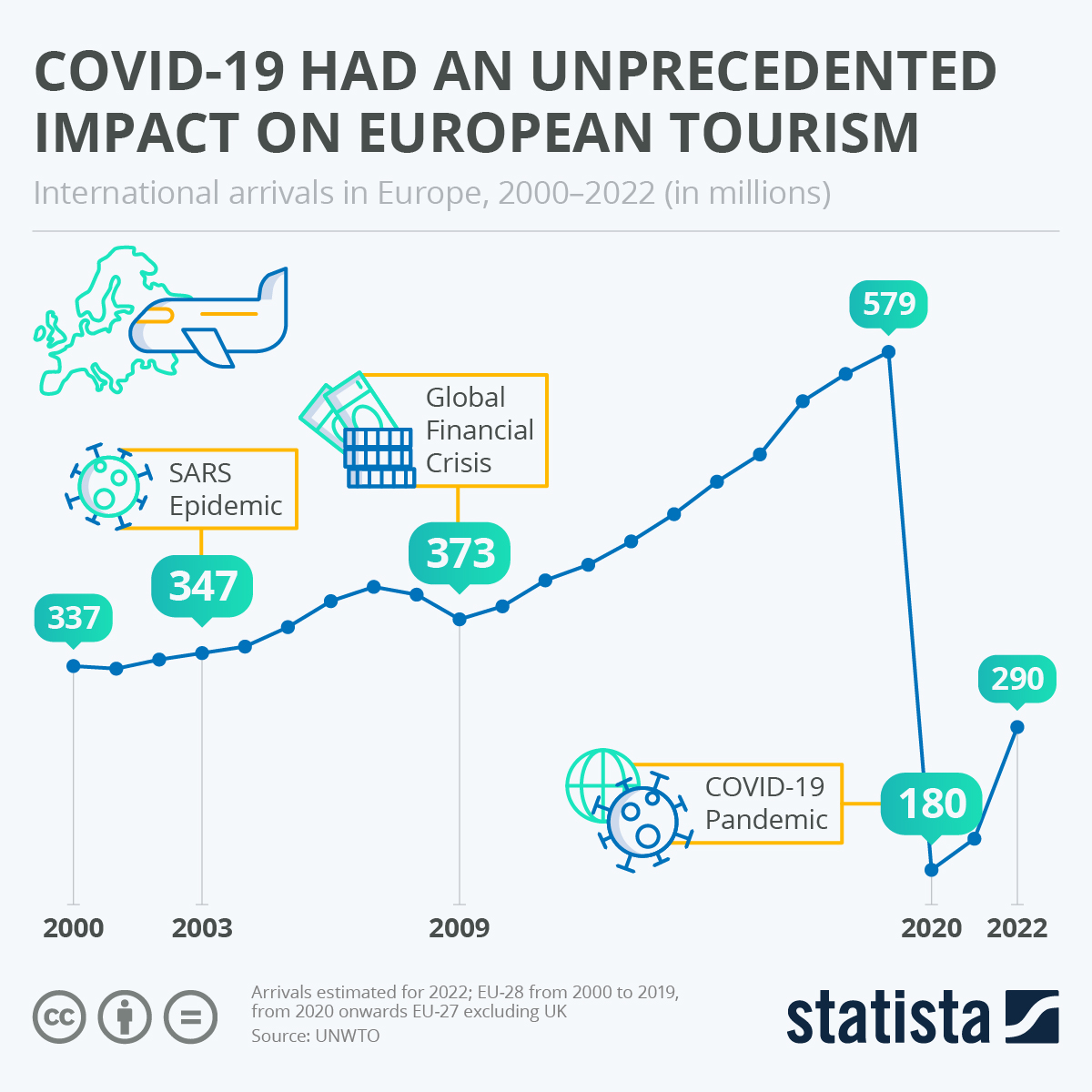

The pandemic's impact on hospitality can't be overstated. Hotels, restaurants, casinos, and attractions faced existential threats. Occupancy rates plummeted. Consumer confidence evaporated. The travel industry essentially froze.

For a completely new concept hotel with zero operational history, the timing couldn't have been worse. Atari was essentially asking investors to back a hospitality venture right as the industry was collapsing. Banks that might have financed hotel construction were instead focused on survival. Private equity firms that invest in hospitality projects were extremely risk-averse.

More importantly, the company faced an immediate problem: delayed construction timelines. The original plan called for the Phoenix property to break ground in 2020. That didn't happen. Pandemic-related supply chain disruptions, labor shortages, and financing delays pushed everything back.

By 2021 and 2022, when the hospitality industry started recovering, other challenges had emerged. Construction costs skyrocketed. Labor was scarce. The financial projections that looked reasonable in 2019 suddenly seemed optimistic. Real estate development is like that: conditions change faster than anyone anticipates.

The domino effect began. The company couldn't maintain momentum on multiple projects simultaneously. Focus became necessary. Instead of pushing forward on eight locations, Atari had to consolidate.

Why Las Vegas Got Cut First

Las Vegas might seem like the obvious choice for a hotel project, but actually, it's one of the hardest markets to enter for a new operator. The city's dominant players (MGM Resorts, Caesars, Wynn, The Venetian) have enormous advantages: established relationships with gaming regulators, existing infrastructure, loyal customers, and massive capital reserves.

Building a new hotel-casino on the Strip requires navigating complex zoning, gaming licenses, and regulatory approval. It's not impossible, but it's expensive and time-consuming. Off-Strip properties face competition from established properties and lower foot traffic.

Phoenix, by contrast, represented a cleaner opportunity. It's a growing market without the incumbency challenges of Las Vegas. Real estate is cheaper. The regulatory environment is more straightforward. Building a boutique hotel in Phoenix doesn't require the same capital investment as a major Las Vegas property.

When Atari ran the numbers and realized the Las Vegas project wasn't financially viable in the current environment, the decision became straightforward. Cut the location that required the most capital and faced the most regulatory complexity. Focus on the location where success was most achievable with available resources, as noted by the Las Vegas Sun.

It's not a glamorous story. It's not a scandal. It's just the reality of how business decisions get made when initial plans don't survive contact with reality.

Atari initially planned eight hotels, with one each in Las Vegas and Phoenix, and six in other cities. Estimated data based on narrative.

The Phoenix Property: Still Moving Forward (Sort Of)

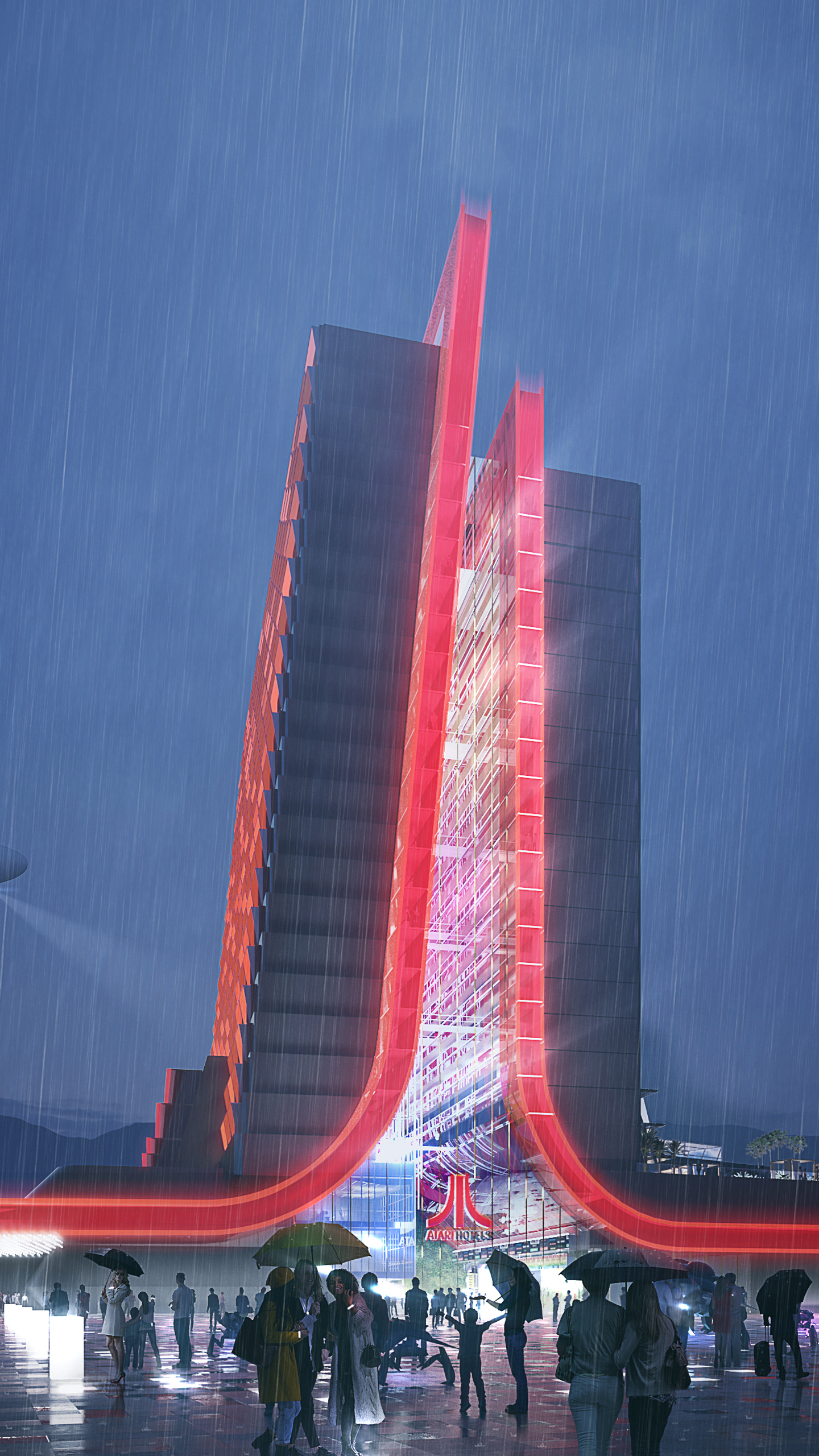

So what's actually happening with the Phoenix Atari Hotel? As of late 2024, the company is still pursuing it. Construction was expected to begin sometime in 2024, with an opening targeted for 2028.

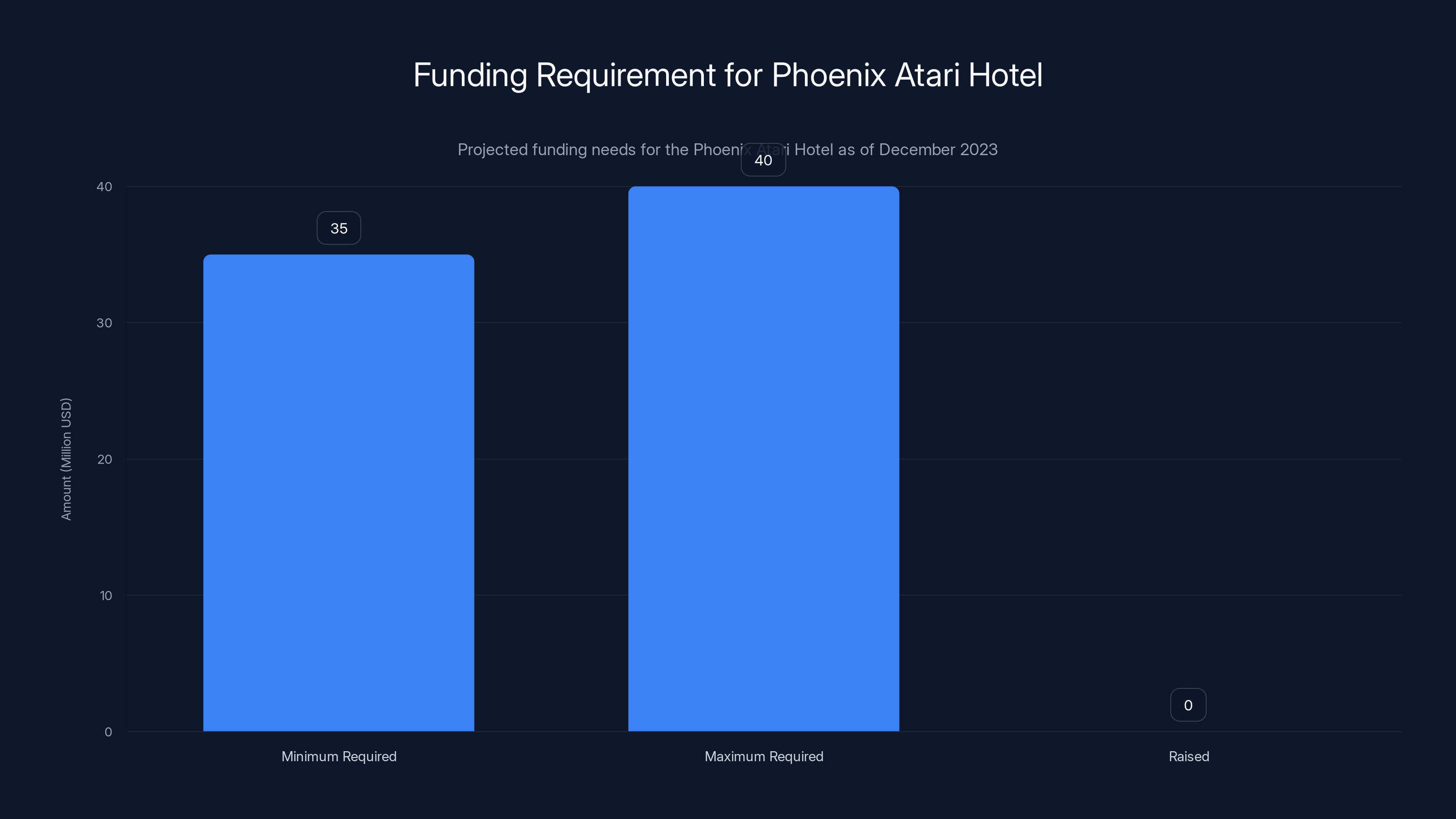

But here's the catch: Atari still needs to raise

Funding is the real constraint here. Atari isn't a hotel company. It's a gaming and entertainment company trying to diversify into hospitality. That means investors need to believe in the concept and in Atari's ability to execute it. Unproven concepts from companies without hospitality experience require higher returns to justify the risk. That means higher costs of capital.

The Phoenix location is planned for roughly 150 rooms, according to available details. That's smaller than major casino resorts, but not tiny. A 150-room boutique property with gaming amenities could work in Phoenix's market. But financing still needs to come through, as highlighted by CoStar.

What Happened to the Other Cities?

Austin, Chicago, Denver, San Francisco, San Jose, and Seattle were all supposed to get Atari Hotels. None of them have seen significant progress.

According to the company's website FAQ, "Additional sites, including Denver, are being explored under separate development and licensing agreements." That's corporate speak for "we're not actively building these right now, but we haven't completely closed the door either."

What does that actually mean? Probably that Atari has licensing agreements or partnerships in place with developers in these cities, but nothing is under active development. The agreements might include funding triggers or performance conditions that would activate if the Phoenix property succeeds.

It's a smart strategy, actually. The company maintains optionality without burning capital. If the Phoenix location proves the concept works and attracts enough guests to justify expansion, existing agreements could enable rapid scaling. If it doesn't work, the company hasn't wasted tens of millions on multiple properties that can't generate returns.

But for consumers or investors who thought major properties in Austin, Chicago, and Seattle were imminent? That door has essentially closed for now. Atari effectively went from "we're building eight hotels" to "we're building one, and maybe we'll build others later."

The Broader Hospitality Context: Why Gaming Hotels Are Hard

Atari's experience with the hotel project reflects broader challenges in the hospitality industry. Themed hotels face unique pressures.

First, themes need to sustain repeat visits. A gaming-themed hotel can't rely solely on novelty. Guests need reasons to come back. That means constantly updating games, adding new attractions, and maintaining the property. Older casino hotels can coast on their reputation and location. A new themed property needs to earn its loyalty.

Second, capital costs are enormous. A mid-range hotel costs

That capital needs to generate returns. A 150-room property with 80% occupancy at

Third, gaming is regulated heavily. Any property that wants to offer gaming (beyond casual penny-slot machines) needs licenses. Different states have different rules. Gaming revenue is taxed heavily. This adds complexity and cost that a standard hotel doesn't face.

Atari needs to raise between

Why Atari Still Pursued This

Despite the challenges, it makes sense that Atari pursued this concept. The company owns iconic intellectual property. Decades of nostalgia surround the Atari brand. There's genuine demand from enthusiasts who want immersive gaming experiences.

Think about how successful immersive entertainment venues have become. Escape rooms, themed restaurants, experiential attractions like the Museum of Ice Cream and Area 15 in Las Vegas. Consumers will travel and pay premium prices for experiences that go beyond typical hospitality.

A well-executed gaming hotel could have captured that demand. Guests would stay because of the themed experience, not just because they needed a place to sleep. That premium positioning would support higher room rates and additional revenue streams.

The concept wasn't flawed. The execution timing, financing, and market conditions were challenging.

Construction Delays and the 2028 Timeline

The current plan targets 2028 for the Phoenix property opening. That's four years away from late 2024. Why so far in the future?

Hotel construction is slow. Even with financing in place and permits approved, constructing a 150-room hotel with complex gaming and entertainment amenities typically takes two to three years. Atari likely needs another year to finalize funding and secure permits. That gets you to 2026 or early 2027 for groundbreaking, with 2028 opening being realistic.

But that's assuming everything goes smoothly. Supply chain issues could cause delays. Design changes could add time. Regulatory reviews could take longer than expected. Every major construction project seems to slip.

A 2028 opening means the project is still five years away from reality. That's a long time in the gaming and hospitality industries. Technology evolves. Market preferences shift. Consumer behavior after a major pandemic changes. By 2028, the gaming landscape could look very different than today.

The Funding Question: Can Atari Raise $35-40 Million?

This is the real question. Atari isn't a company with massive balance sheet capital or unlimited access to credit. The company has gone through various ownership changes and restructurings over the decades.

Raising

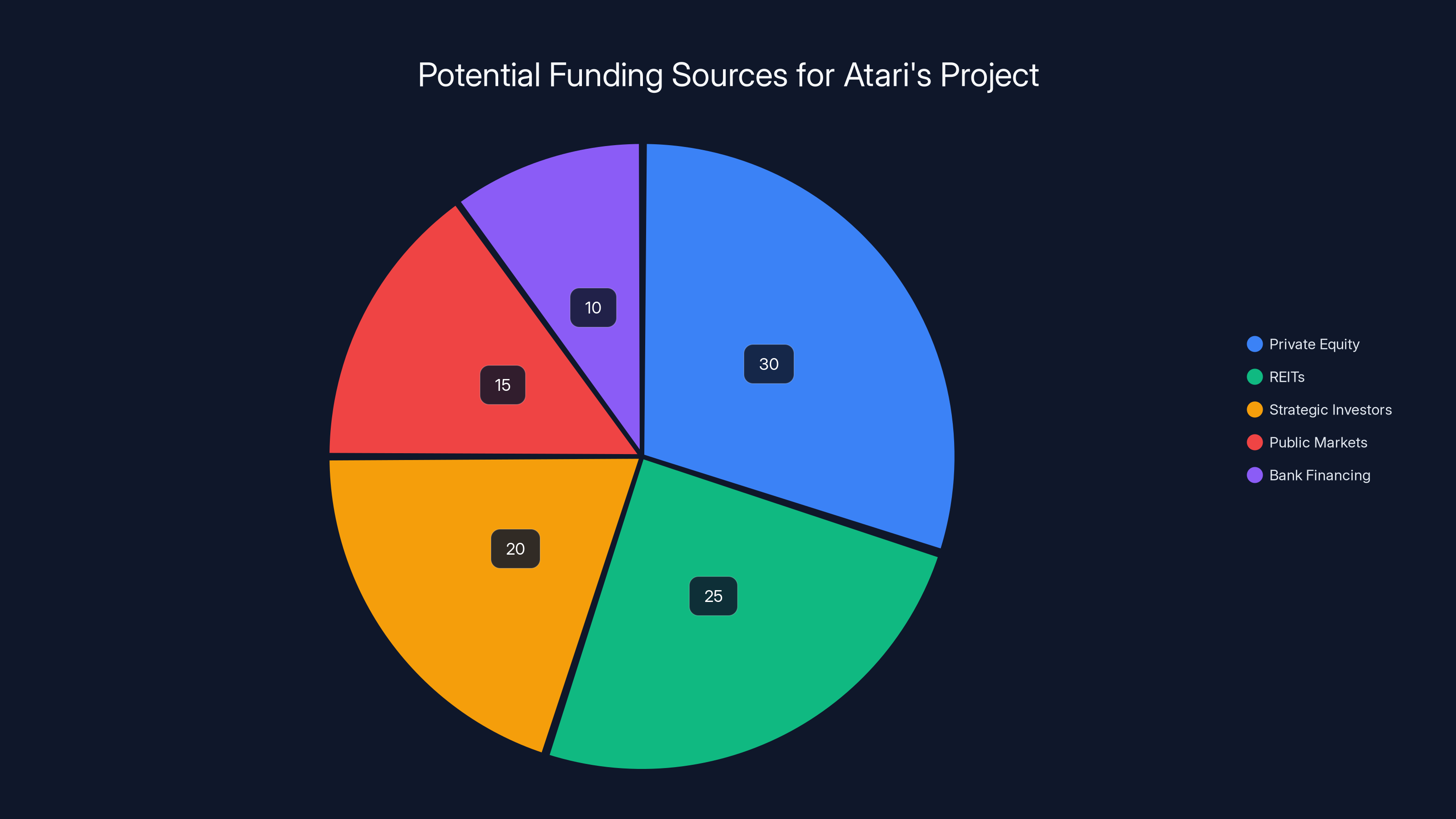

Where might the money come from? A few possibilities:

Private equity firms that specialize in hospitality could be interested. They have experience evaluating hotel projects and understanding the returns. But they'll want preferred returns and board seats, meaning Atari loses some control.

REITs (Real Estate Investment Trusts) that focus on hospitality or entertainment properties could invest. They need steady cash flows from properties, and an Atari hotel could fit their portfolios.

Strategic investors in gaming or hospitality could partner with Atari. A company like Draft Kings, Fa Ze Clan, or an esports organization might see synergy. But that hasn't been announced.

Public markets could be an option if Atari decided to raise capital through an offering. But the company isn't public, so that route seems unlikely.

Meanwhile, traditional bank financing is harder because the company lacks hospitality track record. Banks want collateral and cash flow history. A startup hotel project doesn't have either.

The funding challenge is real. It's the biggest obstacle to the Phoenix property actually getting built, as noted by Las Vegas Sun.

Estimated data suggests private equity and REITs are the most viable funding sources for Atari's $35-40 million project, followed by strategic investors.

What the Las Vegas Cancellation Says About the Industry

Atari's experience reflects broader trends in hospitality development. Major new hotel projects are increasingly difficult to finance and execute. Construction costs have risen dramatically. Labor is scarce. Consumer preferences are shifting.

Many proposed hotels never break ground. Projects get announced, then quietly shelved when funding doesn't materialize or market conditions shift. The Atari hotels situation is notable because the company was honest about it, but it's far from unique.

Smaller boutique properties, focused experiences, and partnerships with established operators are replacing the ambitious expansion plans of previous decades. Companies are learning that building the perfect hospitality experience is harder than it sounds.

For Las Vegas specifically, the decision means one fewer themed property entering the market. The city's hotel landscape remains dominated by traditional casino resorts and established brands. Alternative concepts struggle to find their niche.

The Gaming Hotel Niche and Its Challenges

Even as gaming grows in cultural relevance, translating that into a hospitality business model remains difficult. Several factors complicate it:

Audience Definition: Who exactly is the target guest? Hardcore retro gaming enthusiasts are a smaller market than it might seem. Casual gamers might enjoy gaming elements but prioritize comfort and amenities over themed experiences. Families might want gaming options but expect family-friendly environments.

Content Pacing: Gaming enthusiasts quickly tire of the same games. A property needs constant updates and new content. That's expensive and requires ongoing expertise.

Competition from Home Gaming: Why visit a hotel to play games when you can play the same games at home on superior hardware? The experience needs to offer something you can't get at home.

Regulatory Complexity: Offering actual gambling or even simulators with gaming elements triggers regulations. Different states and municipalities have different rules.

These challenges aren't insurmountable, but they require capital, expertise, and smart execution.

Comparing to Other Themed Hotels

A few comparable properties offer lessons:

The Nintendo experience locations in Japan proved you can build successful gaming-themed attractions. But those were seasonal events and exhibitions, not hotels. Different model entirely.

Esports arenas and gaming lounges have proliferated, but they operate differently than hotels. They focus on the entertainment experience without the hotel operations complexity.

Traditional casino resorts with gaming focus remain profitable because they can leverage gaming revenue (actual gambling) alongside hospitality. That's much harder for a non-gaming property.

VR arcades and immersive entertainment venues show there's demand for gaming experiences. But scaling that into a full hotel property is a different challenge.

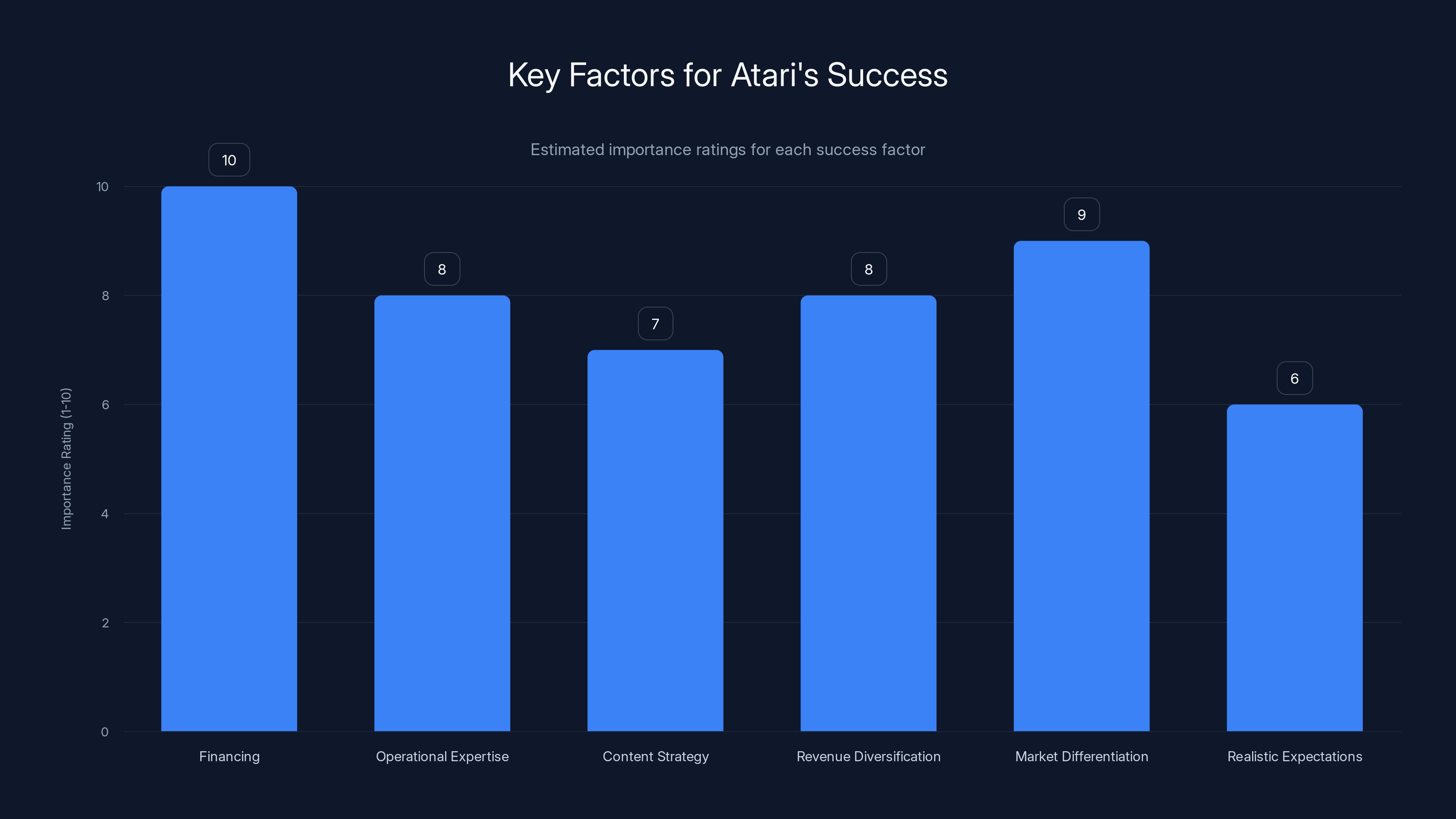

Financing is the most critical factor for Atari's success, followed closely by market differentiation and operational expertise. Estimated data.

What Atari Needs to Actually Succeed

For the Phoenix property to happen and eventually expand, Atari needs to solve several problems:

Financing: The company must raise the promised $35-40 million. This is table stakes. Without it, nothing else happens.

Operational Expertise: Atari needs to hire or partner with experienced hotel operators who understand how to run a property profitably. The company can't rely solely on brand and gaming IP.

Content Strategy: Atari needs a clear plan for how it will continuously update and refresh gaming content. Stale games drive guests away.

Revenue Diversification: The property needs multiple revenue streams: room rates, food and beverage, gaming, events, merchandise. Relying too heavily on one category is risky.

Market Differentiation: The hotel needs to offer something genuinely better than competitors, not just themed differently. That means superior service, unique amenities, and genuine value.

Realistic Expectations: Atari needs to understand that a 150-room property in Phoenix isn't going to become a billion-dollar asset. It's a niche offering serving a specific market. Setting reasonable return expectations helps attract patient capital.

The Future: Will More Atari Hotels Actually Get Built?

Honestly? It depends on whether the Phoenix property succeeds. If it achieves positive cash flow, attracts strong occupancy, and generates the projected returns, then yes, the company can revisit Las Vegas and other cities.

If the Phoenix property underperforms, the company will likely restructure or sell. That's how these things usually work.

The optimistic scenario: Phoenix opens in 2028 or 2029, exceeds expectations, and becomes a profitable platform for expansion. The company then activates the dormant licensing agreements in other cities.

The pessimistic scenario: Phoenix takes longer and costs more than projected, doesn't reach expected occupancy, and Atari uses it as a learning experience before moving on to other ventures.

The realistic scenario is probably somewhere in between. The property opens, it's moderately successful, and Atari may or may not pursue additional locations depending on performance and market conditions.

Lessons for Would-Be Hotel Developers

Atari's experience offers concrete lessons for anyone thinking about developing hotels:

Secure Financing Before Announcing: Announcing projects before financing is locked down creates pressure and expectations that can backfire. Better to announce after securing commitments.

Understand Your Market: Las Vegas, Austin, and other cities aren't equally viable for every concept. Run the numbers carefully before committing.

Account for Timeline Creep: Projects almost always take longer than expected. Build in buffer time and contingency planning.

Partner With Experienced Operators: If you're new to hospitality, bring in operators who understand the business. The Atari brand is valuable, but it doesn't replace hospitality expertise.

Start With One Property: Prove the concept works at scale before expanding. Build momentum and track record before making major capital commitments.

Be Flexible: When original plans don't work, be willing to adjust. Atari correctly recognized Las Vegas wasn't viable and shifted focus to Phoenix.

The Broader Context: Gaming as an Industry

While the Atari hotels project faces challenges, the gaming industry itself continues to grow. Esports is mainstream. Game streaming is enormous. Mobile gaming reaches billions. Console and PC gaming remain strong.

There's genuine demand for gaming experiences and gaming-centered culture. Hotels that successfully tap into that demand could succeed. But it requires more than just putting arcade cabinets in a lobby and calling it "gaming-themed."

Successful themed properties create immersive experiences where every element reinforces the theme. They offer content and experiences guests can't get elsewhere. They execute at high quality. They maintain relevance as trends evolve.

Atari has the brand. It needs the execution.

Why This Matters Beyond Gaming

The Atari hotel situation matters because it illustrates how grand visions often encounter reality. Companies announce ambitious plans, but financing, regulations, market conditions, and execution complexity derail them.

For consumers, it means being skeptical when companies announce multiple future properties. One property in construction is more credible than eight announced projects. For investors, it's a reminder that even well-known brands struggle with diversification into unfamiliar industries.

For Las Vegas, it means the gaming-themed hotel concept didn't gain traction there (yet). The city's hotel market remains dominated by traditional players.

Conclusion: The Dream Lives On, But Differently

The Atari Hotels concept isn't dead. It's just much smaller than originally planned. From eight announced locations, the company has narrowed focus to one: Phoenix.

That's not necessarily a failure. Sometimes the best path forward involves learning from experience and adjusting plans. Atari chose the realistic option: build one property, prove the concept, then expand if successful.

The Las Vegas location getting cut was inevitable. It required too much capital, faced too much regulatory complexity, and competed against entrenched players. Phoenix represents a smarter beachhead.

Will the Phoenix property actually open in 2028? That depends on securing funding and executing well. Will Atari eventually build hotels in Las Vegas and other cities? Only if Phoenix succeeds.

For now, the Atari hotel dream remains a work in progress. The announcement in 2020 promised eight properties by the early 2020s. The reality is one property, hopefully opening in 2028, with uncertain prospects for expansion.

It's a reminder that even great brands with decades of equity face challenges entering new industries. The Atari name carries weight, but it doesn't guarantee hospitality success. Execution matters more than brand recognition. Capital constraints matter more than ambition.

The story isn't over. But it looks very different from what was promised back in 2020.

FAQ

What happened to the Atari hotel in Las Vegas?

Atari cancelled its plans to build a hotel in Las Vegas as of 2024. The company originally announced eight hotel locations in 2020, including Las Vegas, but determined that the Las Vegas project wasn't financially viable given construction costs, real estate complexity, and regulatory requirements. The company chose instead to focus its resources on building a single property in Phoenix, Arizona.

Why did Atari abandon the Las Vegas location?

The Las Vegas project faced several challenges that made it impractical to pursue alongside other planned properties. The city's established competitors (MGM Resorts, Caesars, Wynn, and others) dominate the market, requiring significant capital to compete. Additionally, the pandemic disrupted financing and construction timelines, forcing Atari to prioritize. Las Vegas demanded the most capital investment while Phoenix offered cleaner economics and simpler regulatory requirements.

Is the Phoenix Atari Hotel actually being built?

Atari is pursuing the Phoenix property, but it's still in the financing and planning stages as of late 2024. The company announced it needs to raise

When will the Phoenix Atari Hotel open?

Atari's current timeline targets 2028 for the Phoenix property's opening. The project is planned to be a 150-room boutique hotel with gaming, entertainment, and food and beverage amenities. However, construction timelines for major hospitality projects frequently slip, so 2028 should be considered a target rather than a guarantee.

What cities were originally planned for Atari Hotels?

Atari announced plans for eight hotels in 2020: Las Vegas, Phoenix (which remains the focus), Austin, Chicago, Denver, San Francisco, San Jose, and Seattle. Of these eight announced locations, only Phoenix is actively being pursued. The company's website notes that other sites are being explored under separate development agreements, but none are currently in active construction or development.

Why is it hard to build a gaming-themed hotel?

Gaming-themed hotels face several challenges. First, they require enormous capital investment (typically

Key Takeaways

- Atari cancelled its Las Vegas hotel project in 2024, consolidating from eight announced cities to a single Phoenix property

- COVID-19 pandemic timing, construction cost inflation, and financing challenges forced the company to prioritize geographic focus

- Las Vegas presented the highest capital requirements and strongest incumbent competition, making it the obvious cut

- Phoenix remains in development with a targeted 2028 opening, pending $35-40 million in funding still being raised

- Gaming-themed hotels face unique challenges including content pacing, regulatory complexity, and capital intensity that limit their feasibility

- The experience demonstrates that brand recognition alone doesn't guarantee success in unfamiliar industries like hospitality

Related Articles

- 7 Best Board Games to Survive January 2025: Expert Picks

- The Games We Actually Played in 2025 Beyond the Hype [2025]

- OneXSugar Wallet: The Foldable Retro Handheld Gaming Device [2025]

- Commodore 64 Ultimate Review: Is This Retro Remake Worth It? [2025]

- Epilogue's SN Operator: Turn Your PC Into a Super Nintendo [2025]

- Retroid Pocket 6: PS2 Gaming on a Handheld Device [2025]

![Atari Hotel Las Vegas Cancelled: What Went Wrong [2025]](https://tryrunable.com/blog/atari-hotel-las-vegas-cancelled-what-went-wrong-2025/image-1-1768687511255.jpg)