The Best Budgeting Apps for 2025: Your Complete Guide After Mint's Shutdown

Introduction: Why Budgeting Apps Matter More Than Ever in 2025

The financial landscape has undergone a seismic shift since Intuit's surprise decision to shut down Mint in March 2024. For over a decade, Mint was the gold standard for personal finance tracking—a free, comprehensive tool that helped millions of Americans understand their spending patterns, track their net worth, and work toward their financial goals. That sudden discontinuation left millions of users scrambling for alternatives, forcing a reckoning with the personal finance software market that's fundamentally changed how we think about budgeting tools.

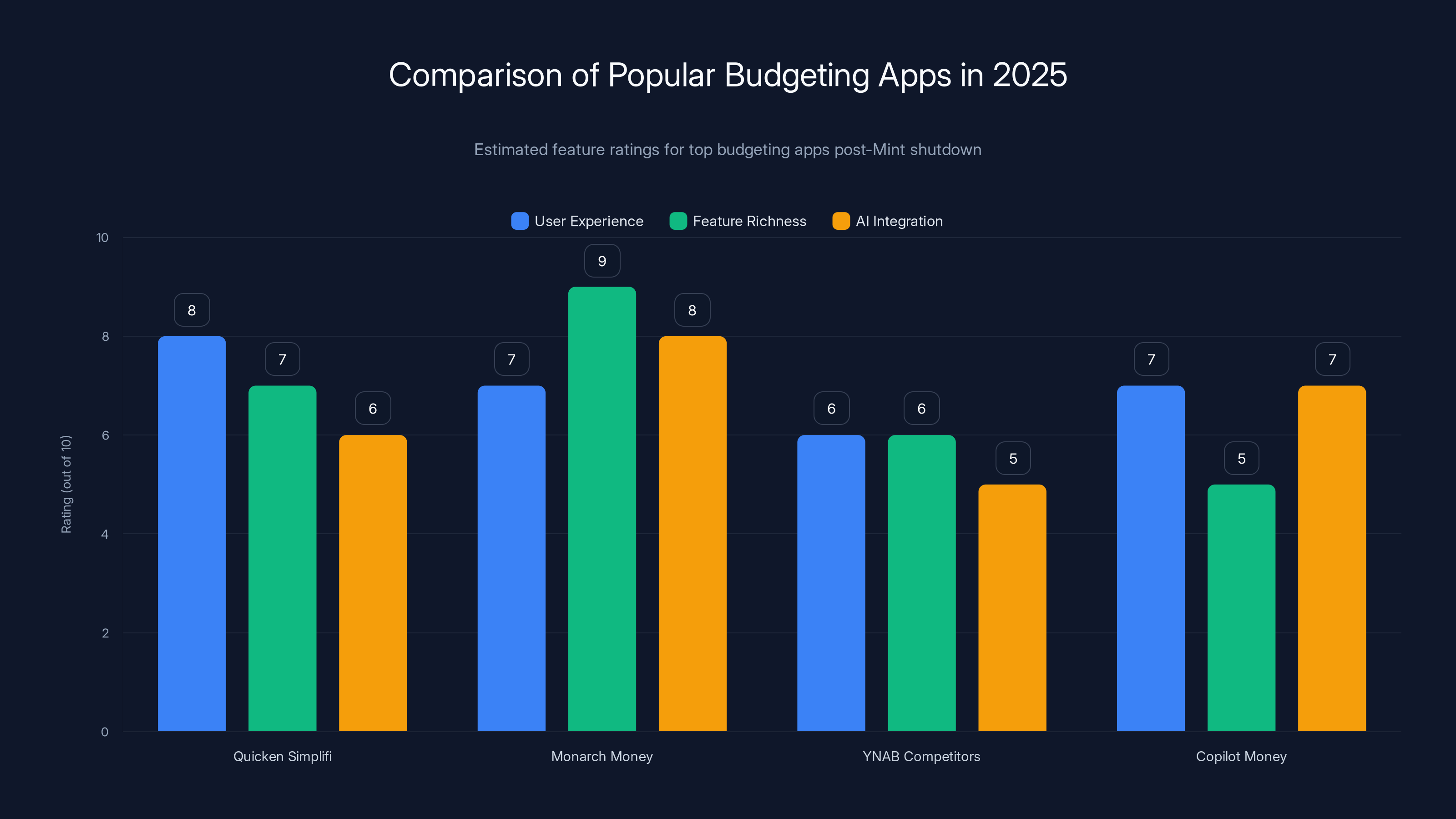

Today's budgeting landscape is more fragmented but also more specialized than ever before. Where Mint offered a one-size-fits-all approach, the current generation of budgeting applications has splintered into multiple categories: premium solutions like Quicken Simplifi that prioritize user experience and simplicity; sophisticated platforms like Monarch Money that cater to power users wanting granular control; free alternatives like YNAB's competitors and Copilot Money for budget-conscious users; and emerging fintech solutions that leverage artificial intelligence to automate categorization and provide predictive insights.

The shift away from Mint didn't happen in a vacuum. The broader financial services industry has experienced transformation driven by open banking standards, improved API infrastructure, and increased regulatory focus on data security. These developments have made it easier for new entrants to build robust budgeting platforms while simultaneously raising the bar for features and functionality. Today's best budgeting apps not only track your spending and income—they provide sophisticated net worth calculations, multi-user collaboration, investment tracking, real estate valuation integration, and increasingly, AI-powered spending insights.

Choosing the right budgeting app in 2025 requires understanding your specific financial situation, technical comfort level, and willingness to invest time in setup and ongoing maintenance. Someone who previously relied on Mint's simplicity might prioritize ease of use and bank connectivity, while a user managing multiple investment accounts and real estate holdings needs robust asset tracking. The stakes are meaningful: research from the National Endowment for Financial Education shows that individuals using budgeting tools save an average of $1,948 annually compared to those who don't track their finances systematically.

This comprehensive guide evaluates the top budgeting solutions available in 2025, examining their strengths, weaknesses, pricing models, and ideal use cases. We've tested multiple platforms extensively, analyzed their feature sets in depth, and compared their performance against specific financial management scenarios. Whether you're a Mint refugee looking for a direct replacement or someone exploring budgeting tools for the first time, this guide provides the context and detailed comparisons you need to make an informed decision.

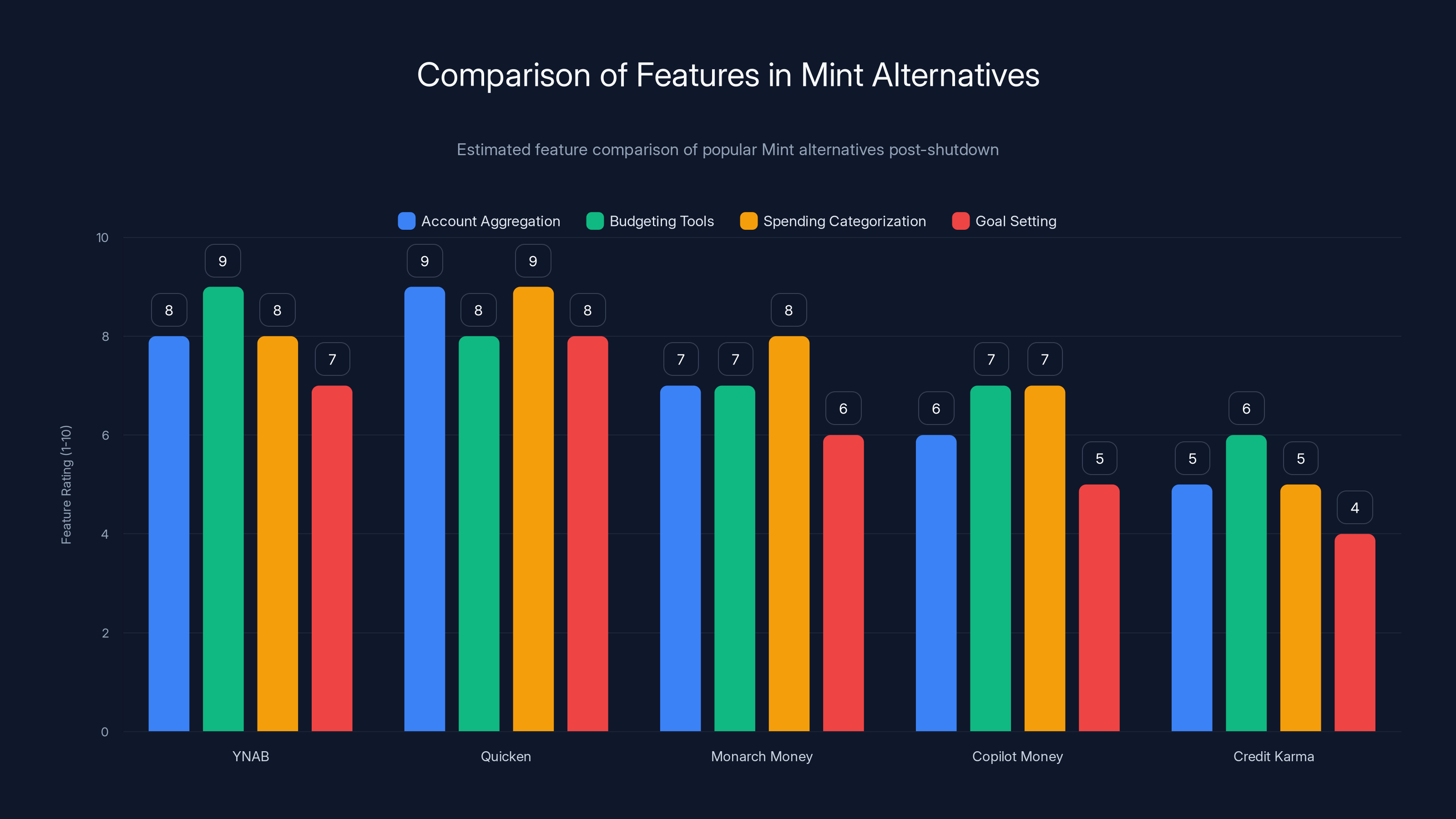

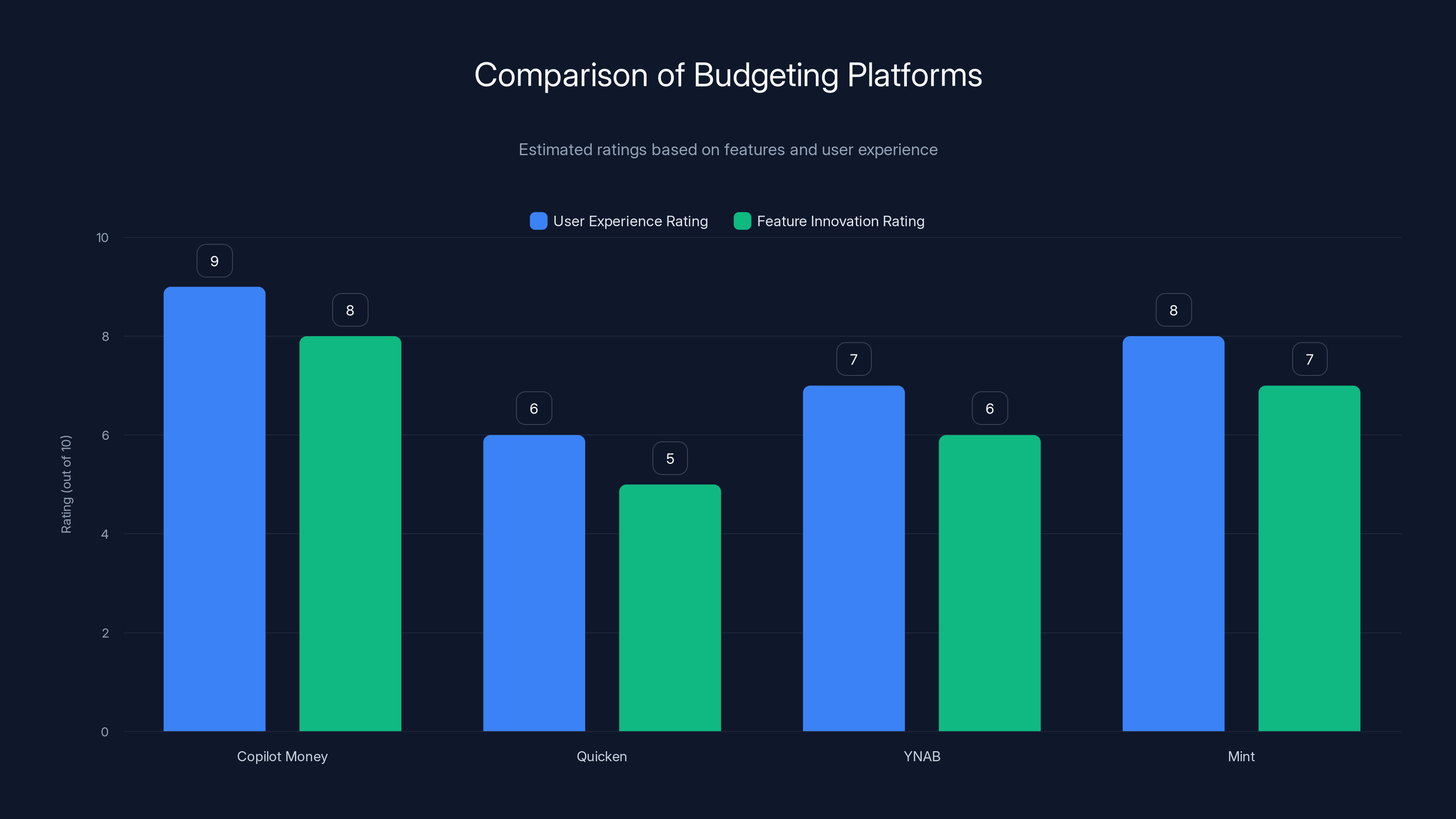

Estimated data suggests YNAB and Quicken offer the most comprehensive features for former Mint users, while Credit Karma lacks in several key areas.

Understanding the Post-Mint Landscape: Why This Matters

The Mint Shutdown and Its Ripple Effects

When Intuit announced the Mint shutdown on November 1, 2023, giving users approximately four months to transition, it created an unexpected crisis for millions of personal finance users. Unlike a gradual deprecation or acquisition where services often continue operating under new ownership, Mint's abrupt discontinuation forced immediate action. Intuit's transition recommendation—moving Mint users to Credit Karma, its other financial platform—proved problematic for many users because Credit Karma was designed with a different purpose and user base in mind.

Credit Karma positions itself primarily as a credit monitoring and credit card recommendation platform. While it includes basic budgeting features, it lacks the comprehensive account aggregation, detailed spending categorization, net worth tracking, and goal-setting functionality that made Mint indispensable to its core user base. For users who had spent years organizing their financial lives around Mint's interface and features, Credit Karma felt like a significant step backward rather than a thoughtful migration path.

This shutdown created a unique market opportunity. Established budgeting platforms like YNAB, Quicken, and Monarch Money suddenly found themselves with millions of prospective customers explicitly looking for Mint replacements. New entrants like Copilot Money and emerging solutions gained attention from users exploring alternatives. The competitive vacuum accelerated innovation, with platforms rapidly rolling out features designed to attract Mint refugees—improved bank connectivity, simplified onboarding, better mobile experiences, and enhanced account aggregation capabilities.

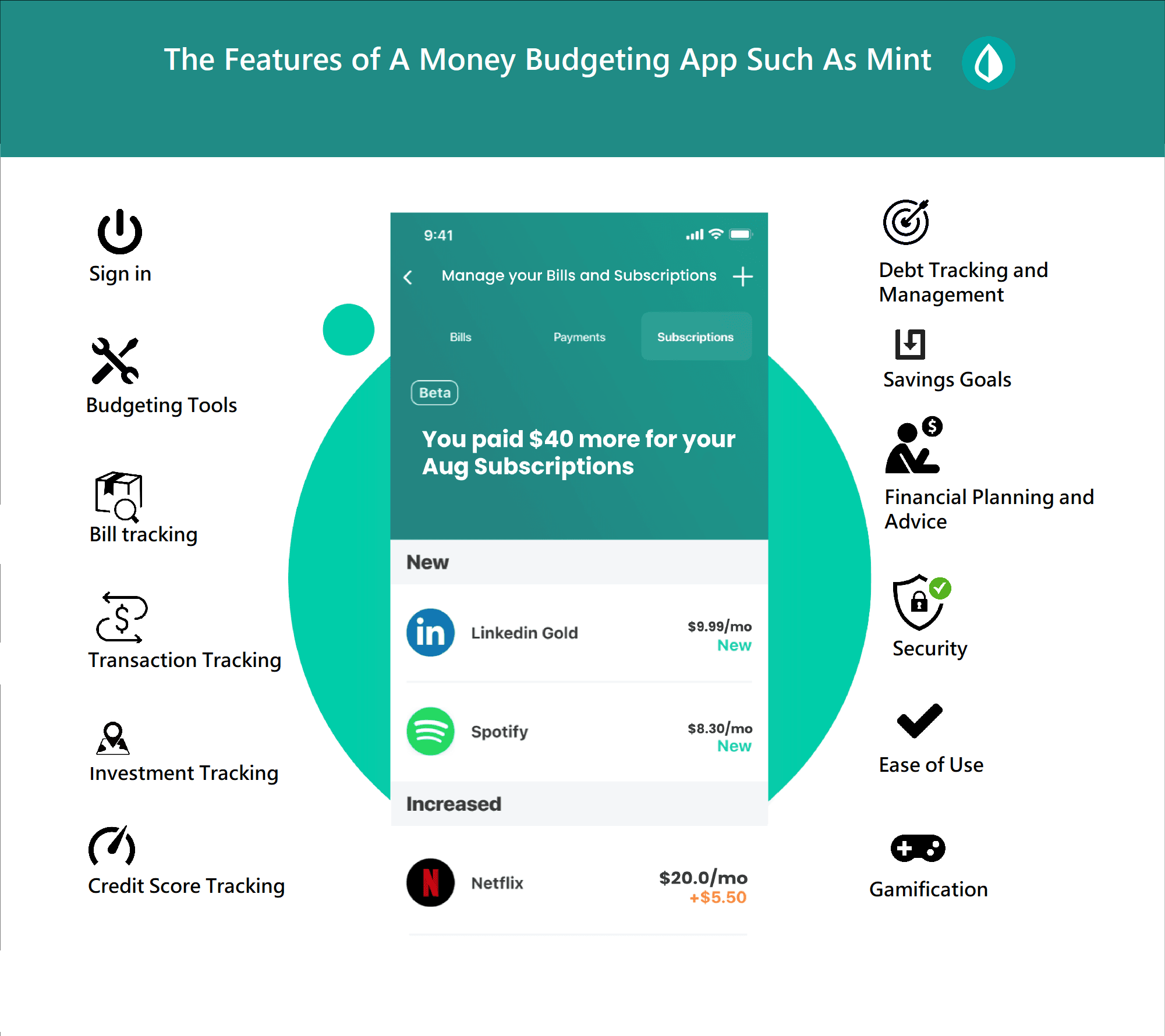

What Made Mint Special (and What You're Looking For in a Replacement)

Mint's durability and popularity stemmed from a compelling combination of factors. First, it was free—genuinely free, with no paid tier, no hidden costs, and no usage limitations. This broad accessibility democratized personal finance management for people across income levels. Second, Mint connected to virtually every U.S. financial institution, aggregating accounts automatically without requiring manual entry. Third, the interface was intuitive enough for casual users while powerful enough for those managing complex financial situations. Fourth, Mint provided holistic financial overview capabilities: you could see your complete net worth, track progress toward goals, understand spending patterns across categories, and project future financial scenarios—all from a single dashboard.

While Mint had limitations—it didn't offer investment portfolio analysis, lacked Zillow integration for home value tracking, and sometimes miscategorized transactions—it established a baseline expectation for what modern budgeting software should provide. Any serious Mint replacement needs to match most of these capabilities while ideally improving on areas where Mint fell short.

The 2025 Budgeting Market Landscape

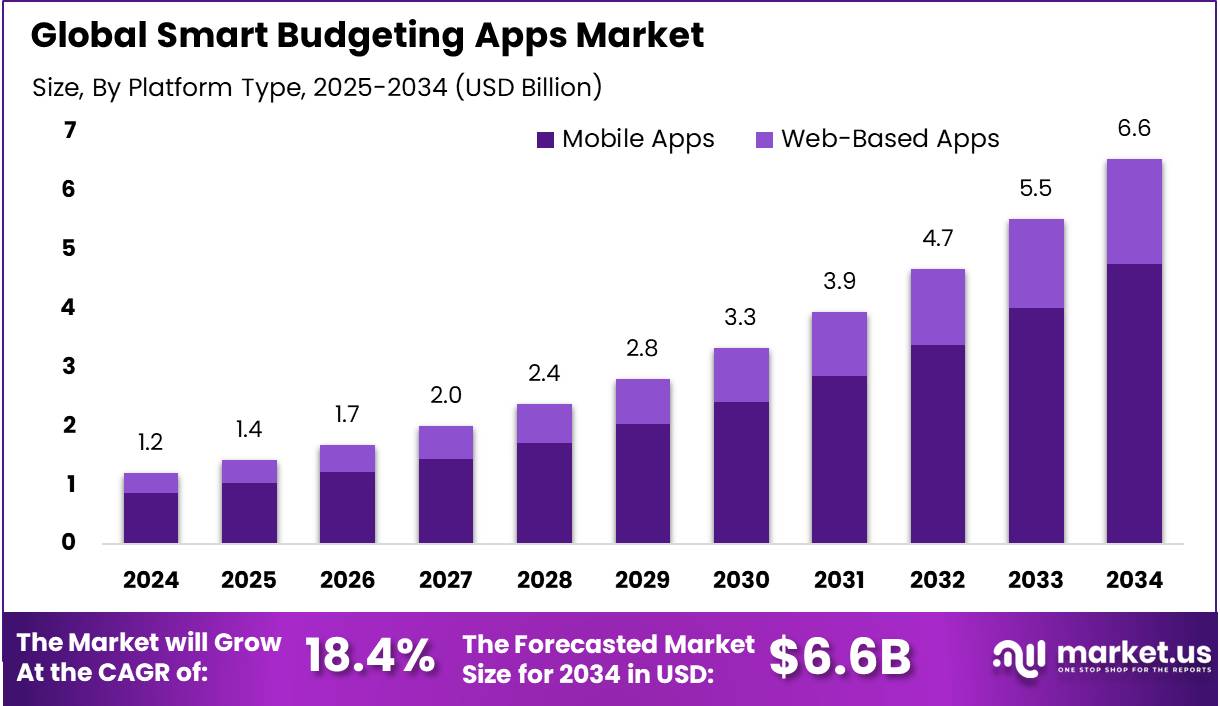

The contemporary budgeting software market has consolidated around several distinct categories, each with different pricing models and target audiences. The premium tier ($150-180/year) includes sophisticated platforms like Quicken Simplifi, Monarch Money, and YNAB, which offer comprehensive features, excellent customer support, and frequent updates. The freemium tier features apps like Nerd Wallet and newer entrants that offer basic budgeting free while charging for premium features. The free tier includes open-source and independent solutions, though fewer truly comprehensive tools remain genuinely free in 2025.

Market research from Statista indicates that personal finance software adoption has increased 37% since 2022, with budgeting apps representing the fastest-growing category within personal finance software. This growth reflects both the Mint void and broader recognition that intentional financial management correlates with better long-term wealth outcomes. Average budgeting app users spend approximately 12-15 minutes weekly on budget management and review, with the time investment paying dividends in improved financial decision-making.

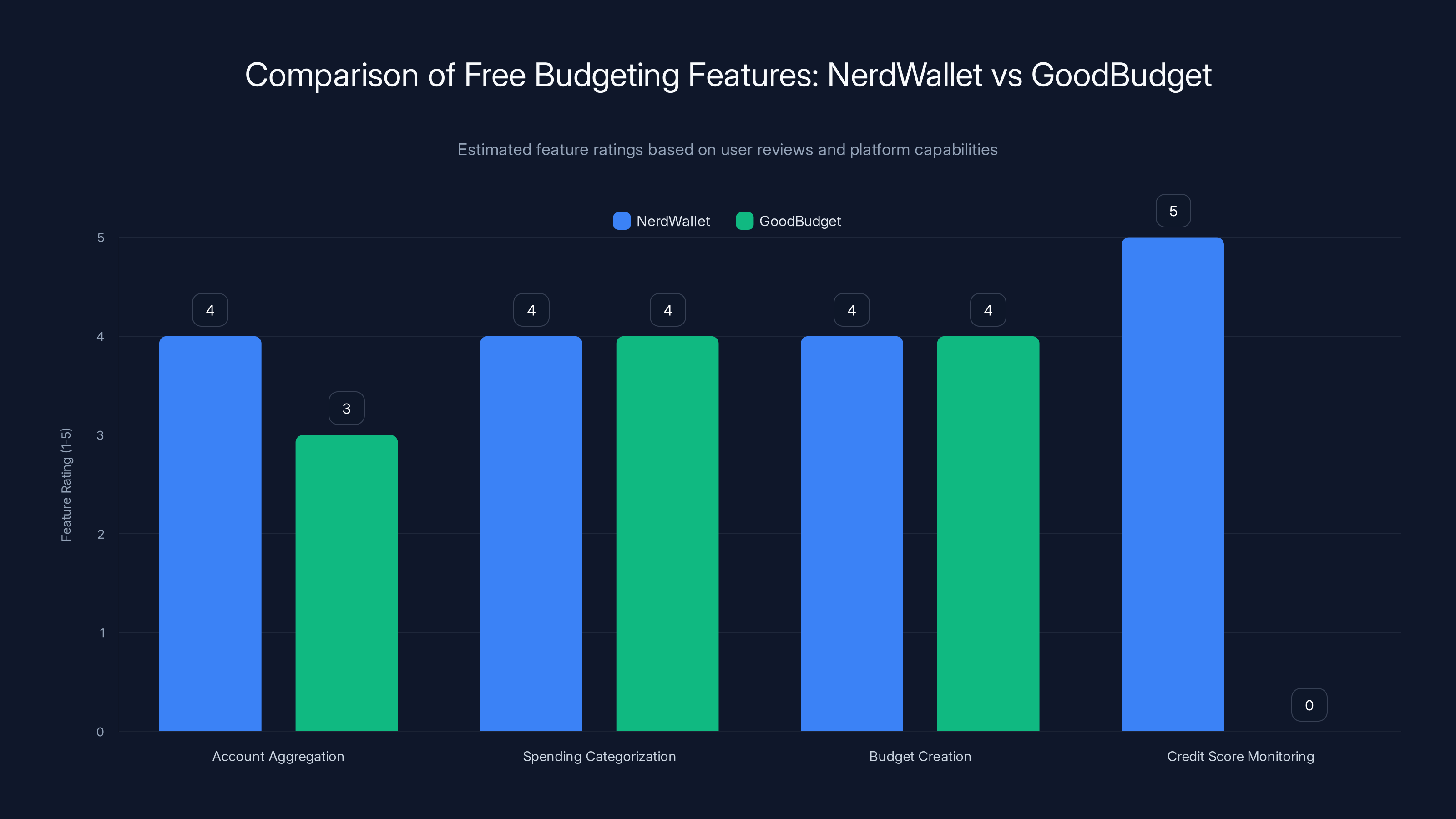

NerdWallet offers superior credit score monitoring compared to GoodBudget, which lacks this feature. Both apps provide strong budgeting capabilities, but NerdWallet's account aggregation is more comprehensive. (Estimated data)

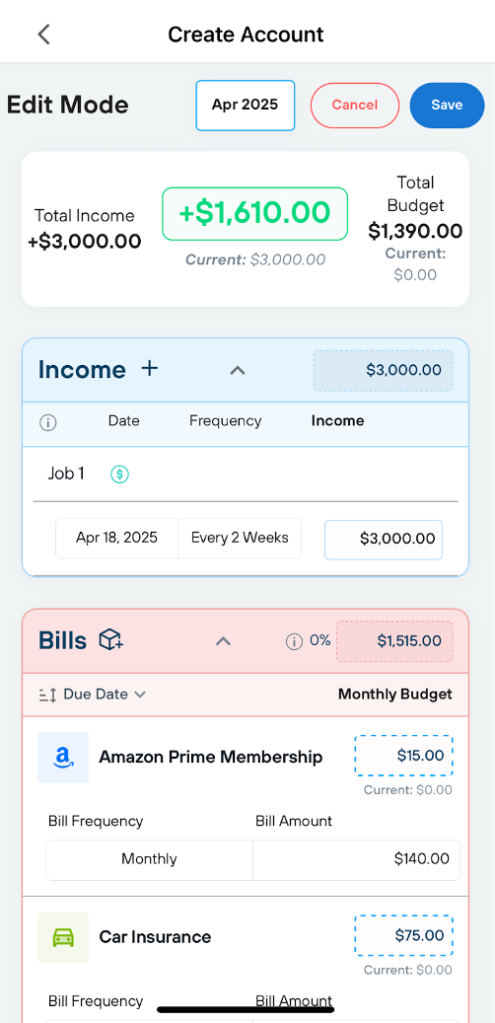

Best Overall Budgeting App: Quicken Simplifi

Why Simplifi Emerges as the Mint Replacement Winner

If your primary goal is finding a Mint replacement that delivers maximum ease of use without sacrificing essential functionality, Quicken Simplifi ranks as the strongest option in 2025. This platform, powered by the legacy of Quicken's 40+ years in personal finance software, deliberately prioritizes simplicity without oversimplifying. The result is an application that captures what made Mint special while improving several areas where Mint disappointed users.

Simplifi's core philosophy centers on reducing friction in financial management. The landing page presents a scrollable dashboard that displays exactly what you need at a glance: account balances, net worth, recent transactions, upcoming bills, spending by category, savings goals progress, and achievement tracking. This "scrolling overview" approach means you're never more than a few seconds from understanding your complete financial picture. The interface uses clean typography, sensible color differentiation, and intuitive iconography that doesn't require a learning curve.

The setup experience proved notably smooth during testing. Connecting to Fidelity accounts—an integration that surprisingly frustrates some other platforms—completed successfully within minutes. The app walked through income verification, identified recurring transactions with impressive accuracy, and suggested category assignments that required minimal manual correction. For users accustomed to Mint's relatively frictionless onboarding, Simplifi delivers comparable ease.

Core Features That Deliver on the Promise

Simplifi's feature set reflects the maturation of personal finance software. Account aggregation connects to major U.S. financial institutions and pulls transaction data automatically. Most bank connections update within hours of transactions posting, allowing near-real-time visibility into your financial activity. The platform supports checking accounts, savings accounts, credit cards, brokerage accounts, loans, and even some international accounts.

Spending categorization uses a hybrid approach: automated categorization gets most transactions right immediately, while you maintain full authority to recategorize anything the system misclassified. Critically, Simplifi allows selective recurring marking—you can mark specific purchases from a merchant as recurring without creating a blanket rule. For example, if you order regularly from Amazon, you can mark your subscribe-and-save orders as recurring while leaving other Amazon purchases flexible. This granularity prevents artificial inflation of fixed expenses.

Budget creation starts with the app suggesting targets based on your six-month spending history. You refine these suggestions into your actual monthly budget by category. Simplifi distinguishes between bills and discretionary spending in its reporting—the "income after bills" metric shows take-home income minus actual bills, giving you a clear picture of available discretionary spending. You can also create one-time budget items for quarterly insurance payments or annual subscriptions, providing a more accurate monthly spending view.

Goal setting enables you to establish and track progress toward specific financial objectives: emergency funds, vacation savings, down payments, debt reduction, or any custom target. Goals display prominence on the dashboard, and Simplifi tracks actual progress versus targets across time. The gamification elements—achievement badges and progress milestones—provide gentle motivation without becoming obnoxious.

The refund tracking feature, unique among platforms tested, lets you mark anticipated refunds when you spot them. This prevents temporarily inflating spending categories when you'll recover the funds through tax returns or merchant refunds. It's a subtle feature that significantly improves accuracy when you're reviewing quarterly financial performance.

Advanced Capabilities for Power Users

While Simplifi prioritizes simplicity, it doesn't abandon sophistication. Net worth tracking aggregates all account balances and assets, automatically calculating your complete net worth and tracking changes over time. However, notably, Simplifi doesn't integrate with Zillow for automatic home value updates—if you own real estate, you'll need to manually enter property valuations quarterly or annually to keep net worth calculations current. This limitation, particularly relevant for homeowners managing substantial assets, represents Simplifi's main weakness compared to Monarch Money.

Recurring transaction identification uses machine learning to detect patterns and automatically mark likely recurring payments. The system learns your payment patterns and continues improving accuracy over time. In our testing, Simplifi correctly identified income recurring patterns better than some competitors, which matters because accurate income detection is foundational for accurate budgeting.

Account sharing represents a feature where Simplifi genuinely outperforms competitors. You can invite your spouse or financial advisor to co-manage your account with full access to accounts and budgets. This capability, surprisingly absent from many platforms, matters enormously for couples engaged in shared financial management or individuals working with professional advisors. Access controls allow you to grant read-only or full editing permissions.

Pricing and Value Proposition

Simplifi operates on a straightforward annual subscription model:

For couples using shared access, the single subscription covers both users—no additional charge for spousal access. For users working with financial advisors, the same applies. This matters financially for households managing finances jointly, essentially providing two user seats for a single subscription cost.

Real-World Performance and Limitations

During extended testing, Simplifi demonstrated reliable performance. Transactions appeared reliably, categorization accuracy improved over time as the system learned your patterns, and the interface remained responsive even when accessing large numbers of transactions. Mobile performance (iOS and Android apps are identical in functionality) matched desktop performance—a notable achievement in cross-platform development.

Limitations exist, primarily around integration. The absent Zillow integration means homeowners can't automatically track real estate values, which Monarch Money and some other platforms support. The inability to connect to Zillow creates friction when you're trying to monitor net worth changes driven by real estate appreciation. For renters or users not concerned with real estate valuation, this limitation is irrelevant; for homeowners managing substantial real estate holdings, it represents a meaningful gap.

Transaction miscategorization occurred occasionally—certain merchants (particularly large retailers with diverse product categories) sometimes posted initially under incorrect categories. The correction process was straightforward, and as you corrected transactions, the system learned your preferences and future similar transactions categorized correctly. No budgeting software achieves 100% accurate categorization; Simplifi's performance fell solidly in the middle range of platforms tested.

Who Should Choose Simplifi

Simplifi excels for users prioritizing straightforward financial management, ease of use, and rapid onboarding. It's ideal for Mint refugees wanting similar simplicity with modest improvements. It's excellent for couples managing joint finances, given the shared account feature. It works well for people with straightforward financial situations—multiple accounts but not complex investment portfolios or real estate holdings. It's appropriate for users at any technical skill level, from complete beginners to finance enthusiasts.

Simplifi may disappoint users with complex asset portfolios requiring detailed investment analysis, those heavily invested in real estate wanting automatic valuation tracking, or users needing highly granular spending rules. For those users, Monarch Money or YNAB might better suit their needs despite greater complexity.

Runner-Up: Monarch Money for Sophisticated Financial Management

Understanding Monarch Money's Positioning

Monarch Money, founded by a former Mint product manager, explicitly targets users willing to invest time learning a platform in exchange for powerful features and granular control. Unlike Simplifi's philosophy of elegant simplicity, Monarch Money embraces complexity, offering capabilities that appeal to users managing sophisticated financial situations or those wanting to optimize their financial management with precision.

The initial impression of Monarch Money can feel overwhelming. The interface is less intuitively organized than Simplifi. Creating and editing expense categories, establishing recurring transaction rules, and configuring automation requires navigation through multiple menus. Mobile app functionality, while complete, sometimes feels cramped compared to the web interface. For users accustomed to Mint's straightforward approach, Monarch Money's learning curve is noticeable. However, once configured, Monarch Money delivers capabilities that justify the initial complexity investment.

Monarch Money's founding story matters context-wise. The platform's creator, while at Mint, understood what users wanted from that platform and recognized opportunities for enhancement. Monarch Money implements lessons learned from Mint's design while incorporating capabilities Mint never offered. The result is a platform that feels like "Mint 2.0"—what Mint might have evolved into with unrestricted development resources and willingness to embrace more sophisticated users.

Advanced Features for Financial Complexity

Monarch Money's strongest differentiator is its balance sheet budgeting approach. Unlike other platforms treating budgets as simple spending limits, Monarch Money generates comprehensive balance sheets showing budgets and actual spending by category. This gives users clear visibility into exactly how much they're spending relative to targets, with variance analysis built into the interface. For users managing complex financial situations with multiple income streams, irregular expenses, and specific financial goals, this approach provides the visibility that drives informed decision-making.

Sophisticated recurring transaction rules represent another area where Monarch Money excels. You can mark recurring transactions not just by merchant, but by combination of parameters. For example, when a specific Amazon purchase amount appears (like those

Forecast functionality allows projecting future financial scenarios by year or month. You can see anticipated spending, income, and net worth changes based on current patterns and configured recurring transactions. This forward-looking perspective helps with planning and identifying whether current spending patterns support your financial goals. Many people manage finances reactively, discovering problems only when balances get low; Monarch Money's forecasting enables proactive management.

Detailed reporting capabilities represent a recent addition that substantially enhanced Monarch Money's value. The reporting interface lets you create custom graphs based on accounts, categories, tags, time periods, and other parameters. You can visualize spending trends, analyze category changes over time, compare months or years, and export reports. This goes far beyond basic spending summaries, enabling genuine financial analysis.

Real estate and vehicle valuation tracking addresses a significant gap in many budget platforms. Monarch Money integrates with Zillow for automatic home value updates and can track vehicle values, automatically updating both in your net worth calculation. For homeowners and car owners, this means net worth tracking reflects real asset value changes without manual updates.

Weaknesses and Drawbacks

Monarch Money's complexity represents both strength and weakness. The mobile app, while feature-complete, doesn't match the simplicity of Simplifi's mobile experience. Fine-tuning configurations—categorization rules, recurring transaction settings, budget parameters—works better on the web app. Users expecting straightforward setup like Simplifi or Mint will face friction.

During testing, Monarch Money's income detection required manual correction. The system didn't automatically identify my regular income accurately, necessitating manual editing. While subsequent income deposits seemed to register correctly, the initial setup friction was noticeable. Other platforms handled income detection more smoothly.

Another quirk: Monarch Money lacks explicit bill vs. subscription differentiation. While you can categorize transactions into different categories (making bills and subscriptions separable analytically), the system doesn't maintain this distinction in the way Simplifi does with its "income after bills" metric. This is a minor limitation but worth noting for users wanting specific bill isolation.

Pricing and Value Proposition

Monarch Money costs

Monarch Money doesn't offer free tier options, unlike some competitors. However, a free trial lets you experience the full feature set before committing financially.

Who Should Choose Monarch Money

Monarch Money suits users managing sophisticated financial situations: multiple income streams, complex expense patterns, substantial investments, and real estate holdings. It's ideal for users willing to invest setup time in exchange for powerful analytical capabilities. It appeals to finance enthusiasts and people optimizing their financial management with precision. It works well for users who found Mint limiting and wanted more granular control and analysis.

Monarch Money doesn't suit users prioritizing simplicity, those uncomfortable with more complex interfaces, or people wanting quick-start minimal configuration. It may overwhelm casual budgeters while rewarding engaged financial managers.

Monarch Money offers the lowest annual cost at

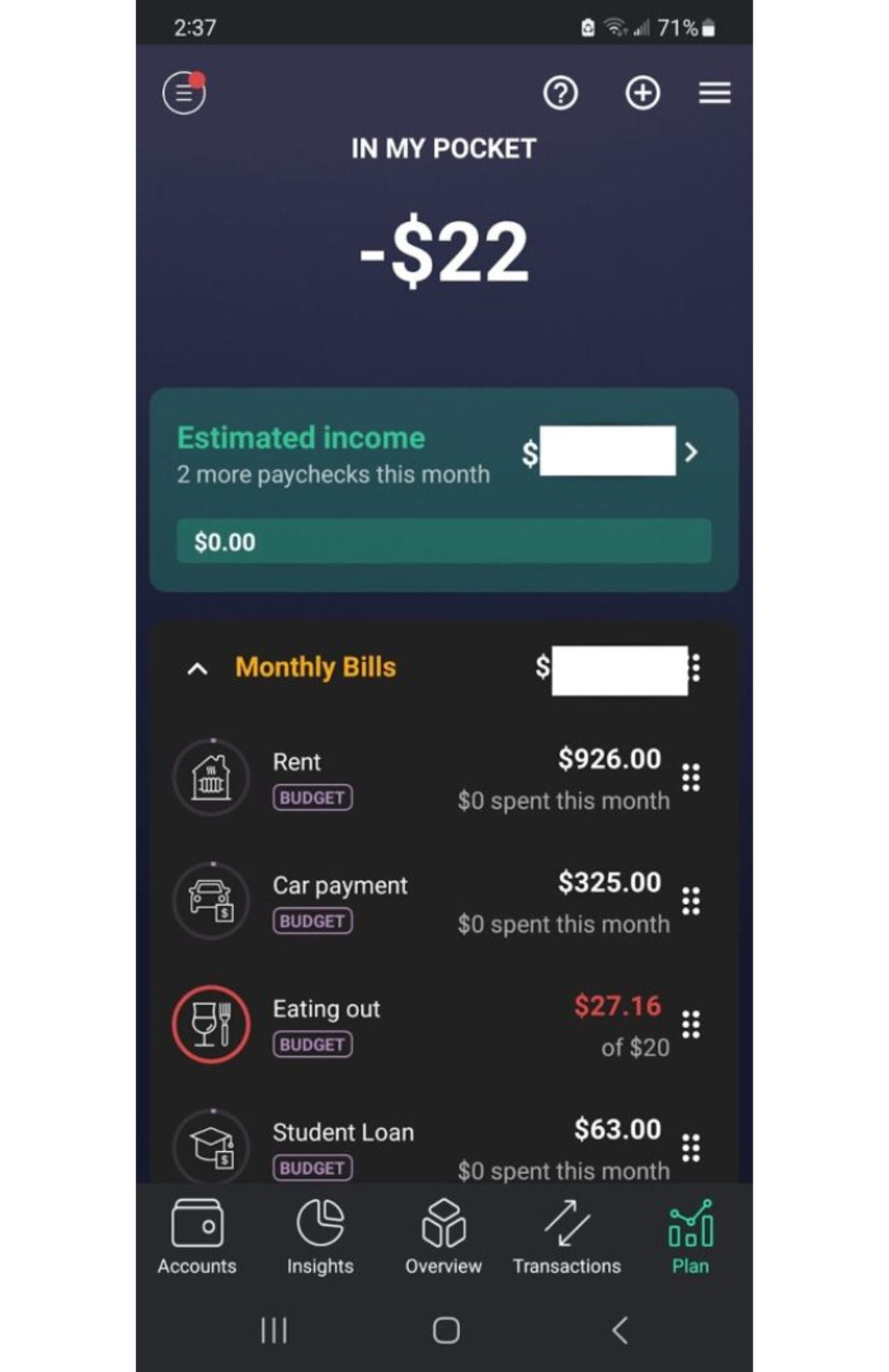

Best Free Budgeting App: Nerd Wallet and Good Budget Comparison

The Free vs. Paid Calculation

After Mint's shutdown, the question of free budgeting solutions became paramount. Many users had grown accustomed to unlimited free access and hesitated committing to paid subscriptions without testing alternatives. The free budgeting app market in 2025 consists of several viable options, though none match the comprehensiveness of Mint or paid alternatives like Simplifi and Monarch Money.

Nerd Wallet's free budgeting offering has expanded significantly since Mint's discontinuation. The platform provides core budgeting functionality—account aggregation, spending categorization, budget creation, and basic financial tracking—completely free. Nerd Wallet monetizes through premium features and financial product recommendations rather than subscription fees. While the free tier has limitations compared to premium versions of other platforms, it provides legitimate value for budget-conscious users.

Nerd Wallet's Free Budgeting Features

Nerd Wallet's free tier includes automatic account aggregation for checking, savings, credit card, and loan accounts. Transactions populate automatically, and the platform provides basic categorization with manual correction options. The dashboard shows account summary, spending by category, and recent transactions. Budget creation is supported: you establish monthly spending targets by category and monitor progress against these targets.

Credit score monitoring represents a valuable addition that sets Nerd Wallet apart from many pure budgeting apps. As you track spending and manage accounts, Nerd Wallet monitors your credit score (with a free monthly update) and provides insights into factors affecting your credit health. For users who want budgeting alongside credit management, this integrated approach eliminates tool switching.

However, Nerd Wallet's free tier has meaningful limitations. Advanced features—detailed net worth calculations, goal tracking, forecast capabilities, multiple user access, and mobile app features—require Nerd Wallet Premium (

Good Budget: Envelope-Based Free Alternative

Good Budget represents a fundamentally different approach to budgeting, employing the envelope system (also called zero-based budgeting). Rather than tracking actual spending against categories, you allocate your income into virtual "envelopes" representing different spending categories. When you spend from an envelope, the balance decreases. This approach forces deliberate allocation of every dollar of income and creates accountability through envelope depletion.

Good Budget's free tier provides unlimited account management, unlimited envelope creation, and full mobile app access (iOS and Android). The system syncs across devices, so your desktop allocation appears on your phone in real-time. The approach appeals to people who find traditional budgeting abstract; the envelope metaphor provides tangible mental model for spending management.

The envelope system differs fundamentally from transaction-tracking platforms like Simplifi and Monarch Money. Rather than categorizing actual spending, you're working with planned allocations. This suits certain personality types—people who respond to concrete constraints and explicit allocation—while potentially frustrating those who prefer analyzing actual spending patterns.

Good Budget's free tier has limitations: limited reporting features, no automatic transaction import from some financial institutions (though you can connect accounts manually), and basic mobile interface compared to premium versions. The paid tier (

Pros and Cons of Free Solutions

Advantages of free budgeting apps include zero financial commitment, allowing testing multiple platforms before deciding. They suit budget-conscious users and those new to budgeting wanting to develop the habit before investing financially. Free apps create no pressure to justify subscription costs, which can be psychologically valuable for people uncertain whether they'll maintain budgeting discipline.

Disadvantages include limited feature sets compared to paid alternatives. Nerd Wallet's free tier lacks comprehensive net worth tracking, goal management, and forecast capabilities. Both free options have less frequent updates and fewer development resources than subscription-funded platforms. Premium features often provide meaningful value—net worth tracking, detailed reporting, goal progress visualization—that you'll miss if staying entirely within free tiers. The temptation to upgrade to premium versions, each with separate subscription costs, can eventually exceed what you'd pay for single comprehensive platform.

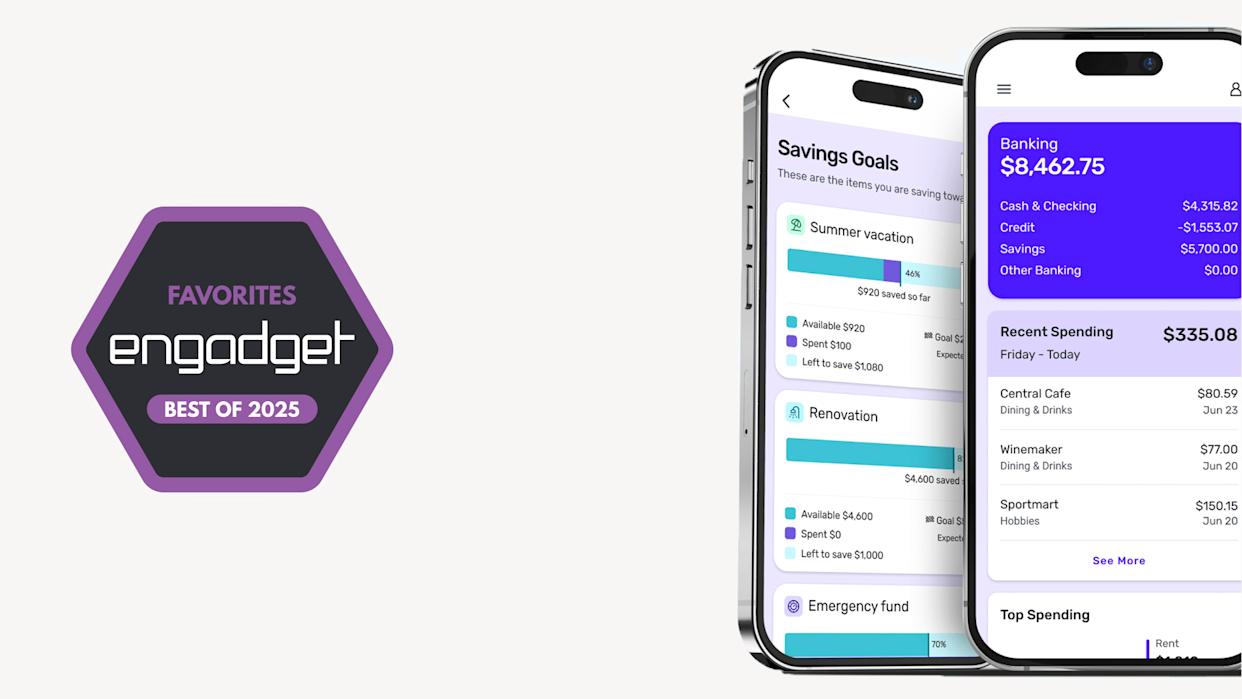

Best Up-and-Coming Solution: Copilot Money

Understanding Copilot's Market Position

Copilot Money emerged in 2023 as a fintech-native budgeting platform designed specifically for the modern user experience. Unlike legacy platforms like Quicken that evolved from desktop software, or YNAB (You Need A Budget) that built on the envelope philosophy, Copilot Money constructed from the ground up as a mobile-first, cloud-native platform leveraging modern architecture.

The platform targets millennial and Gen Z users who've grown up with modern consumer apps and expect comparable design and functionality from financial software. Copilot Money's interface reflects current design trends: clean typography, generous whitespace, intuitive navigation, and mobile-optimized layouts. Using Copilot Money feels like using contemporary consumer apps, not legacy financial software.

Copilot Money's founding philosophy emphasizes making financial management accessible and engaging for users who might otherwise avoid budgeting altogether. Rather than targeting power users or financial optimization enthusiasts, Copilot Money builds for people who find traditional budgeting boring or intimidating. Gamification, visual feedback, and simplified workflows replace dense dashboards and complex menus.

Core Features and Innovation

AI-powered spending insights represent Copilot Money's signature innovation. The platform analyzes your spending patterns and automatically identifies optimization opportunities: redundant subscriptions you've forgotten about, spending trends you might not notice, seasonal variations in different categories, and areas where actual spending significantly exceeds budget targets. These insights appear as suggestions and alerts, prompting you to consider changes without imposing them.

Simplified budget creation builds on consumer app principles. Rather than presenting complex budget worksheets, Copilot Money guides you through simple questions about your income and major expenses. It suggests targets based on the 50/30/20 rule (50% needs, 30% wants, 20% savings) or other frameworks, then lets you customize. The process typically completes in minutes rather than hours.

Real-time alerts notify you when you're approaching budget limits in categories or when unexpected spending occurs. These alerts use smart algorithms to avoid alert fatigue—rather than notifying you every time you exceed a small threshold, they trigger on meaningful deviations, giving you useful signals without overwhelming notification volume.

Subscriptions management identifies recurring charges and helps you evaluate whether subscriptions are worth maintaining. The platform categorizes subscriptions separately from other spending, shows annual cost totals, and even lets you cancel certain subscriptions directly through the app. For typical households with 5-10 active subscriptions, this feature often identifies $50-200 monthly in redundant or forgotten subscriptions.

Zillow integration provides automatic home value tracking for homeowners. If you own real estate, Copilot Money displays your Zillow estimate and incorporates this into net worth calculations. The integration updates periodically, showing how real estate value changes affect your overall financial position.

Strengths and Current Limitations

Copilot Money excels at engagement and motivation. The interface makes financial management feel less like a chore and more like an app you're happy to open. The AI insights provide genuine value, often highlighting spending patterns and opportunities users wouldn't notice manually.

However, Copilot Money has limitations that prevent full recommendation as a primary budgeting platform for all users. Investment account support remains limited—you can connect brokerage accounts for viewing balances but not for detailed portfolio analysis or investment tracking. Users with significant investment portfolios may feel the platform inadequately addresses this aspect of their financial lives.

Mobile-only focus (while appropriate for target demographic) means the web experience lags behind the app experience. Power users who prefer desktop management may find limitations. Limited account sharing means couples managing finances jointly have fewer options than with Simplifi (which supports full shared account management).

Multi-currency support remains minimal, limiting usefulness for international users or those managing accounts in multiple currencies. The platform is decidedly U.S.-focused, which is appropriate for its initial market but may limit future growth.

During testing, Copilot Money demonstrated solid performance for its intended use case—people wanting simplified, engaging budgeting—but felt limiting for users managing complexity beyond straightforward U.S. personal finances.

Pricing Model and Value

Copilot Money operates on a freemium model: basic budgeting, account connection, and spending tracking are free. Premium features (

For the target demographic—younger users, first-time budgeters, people wanting simplicity—the value proposition is strong. The free tier often provides sufficient functionality, and premium pricing is accessible.

Who Should Choose Copilot Money

Copilot Money suits younger users, first-time budgeters, and people overwhelmed by traditional budgeting software complexity. It's excellent for those wanting mobile-first experience, strong spending insights, and subscription management. It appeals to users who find traditional budgeting boring and want an app that makes financial management engaging.

Copilot Money may disappoint users with complex investment portfolios, international finance needs, or preferences for desktop-first experience. Users wanting full account sharing capability might prefer Simplifi.

Copilot Money scores high on user experience and feature innovation, appealing to younger users with its modern design and AI-powered insights. Estimated data.

YNAB (You Need A Budget): The Envelope Philosophy

Understanding YNAB's Approach

YNAB (You Need A Budget) represents one of the oldest continuously developed budgeting platforms, having started as a spreadsheet system in 2003 and evolved into sophisticated web and mobile applications. Unlike platforms treating budgeting as spending analysis, YNAB centers on the envelope system philosophy: allocate every dollar of income to a specific purpose before spending it.

This zero-based budgeting approach fundamentally differs from tracking-based systems. Rather than spending freely then categorizing expenses, you decide in advance how much you'll spend in each category, fund those categories with available money, and spend within allocated amounts. The psychology differs significantly: you're making intentional allocation decisions rather than reacting to realized spending.

YNAB's four rules formalize this philosophy: 1) Give Every Dollar a Job (allocate all income before spending), 2) Embrace Your True Expenses (plan for periodic expenses like insurance by saving monthly), 3) Roll With the Punches (adjust budgets as circumstances change), 4) Live on Last Month's Income (advanced practice where you spend from previous month's earnings, building buffer).

Core Features and Philosophy

YNAB's account aggregation connects to financial institutions, importing transactions automatically. However, the key workflow differs from other platforms: imported transactions don't automatically categorize. Instead, you manually assign each transaction to a budgeted category, making conscious decisions about allocation. This manual assignment is intentional—YNAB believes engagement with each spending decision reinforces the budgeting discipline.

Category management in YNAB supports master categories and subcategories, enabling hierarchical organization. You might have a "Home" master category containing "Groceries," "Utilities," "Maintenance," and "Furniture" subcategories. This structure supports both simplicity (view spending at master category level) and detail (drill into individual subcategories).

Goal setting in YNAB integrates into budget categories. You can set goals for categories (like "save $500 monthly for emergency fund") and YNAB tracks progress, suggesting how much to allocate monthly to reach targets. This connects budgeting and goal progress, keeping both visible and actionable.

Reporting and insights show spending trends over time, compare months or years, and analyze category spending. YNAB's reports are simpler than Monarch Money's but sufficient for most users to understand their financial patterns.

Mobile experience is comprehensive—you can manage the full YNAB experience on phone or tablet, including transactions, categories, budgets, and goals. The mobile app is native (not web-based), providing responsive, smooth experience.

Strengths of the YNAB Philosophy

YNAB's envelope system and manual assignment create psychological engagement with spending. Research in behavioral economics shows that manual allocation decisions create stronger behavior change than passive spending analysis. Users engaging with YNAB report greater awareness of spending patterns and stronger discipline maintaining budgets.

The zero-based budgeting approach forces clarity about values and priorities. When you allocate every dollar intentionally, you make explicit trade-offs. Choosing to allocate $300 to dining out means allocating less to entertainment or savings. This visibility into priorities, often obscured in traditional budgeting, drives value-aligned spending.

YNAB's community is renowned for engagement and support. The platform offers extensive educational resources, and users often cite community forums and accountability support as meaningful parts of the YNAB experience. This community factor differentiates YNAB from purely transaction-tracking platforms.

Weaknesses and Considerations

YNAB's pricing represents its primary weakness. At

The manual assignment workflow, philosophically intentional, creates friction compared to mostly-automatic categorization in competitors. While automation isn't a universal good (manual engagement has value), users accustomed to automatic categorization may find YNAB's approach tedious. Syncing across devices sometimes lags, particularly with mobile apps, which can be frustrating when managing time-sensitive transactions.

YNAB lacks some features competitors offer: no explicit net worth tracking (though account balances appear), no investment portfolio analysis, and no real estate integration. For simple budgeting and envelope management, these aren't critical, but users wanting comprehensive financial management may find YNAB limiting.

Who Should Choose YNAB

YNAB suits people committed to behavioral change around spending, those wanting accountability and community support, and users convinced that explicit allocation discipline creates better financial outcomes. It works well for people with variable income (freelancers, commission-based earners) for whom zero-based budgeting provides clearer clarity. It appeals to people who've struggled with budgeting discipline and want structure that YNAB's philosophy provides.

YNAB may frustrate users wanting automation and simplicity, those managing complex finances requiring detailed analysis, and cost-conscious buyers. For pure transaction analysis, competing platforms provide similar or better functionality at lower cost.

Account Integration and Bank Connection Quality

The Critical Importance of Bank Connectivity

Among the most frustrating aspects of the Mint shutdown was how taken-for-granted Mint's bank connectivity seemed until it disappeared. Mint connected to virtually every U.S. financial institution and updated transactions with minimal delay. Users expected automatic account connection as a baseline feature, not recognizing how difficult achieving reliable bank integration actually is.

Bank connectivity powers modern budgeting applications. Without it, manual transaction entry creates friction that most users won't tolerate. The quality of bank connections—reliability, speed of updates, breadth of supported institutions, and accuracy of transaction data—directly impacts whether users maintain budgeting discipline.

Unfortunately, bank connectivity has become more difficult since Mint's peak. Banks have tightened API access, increased security requirements, and sometimes actively discouraged third-party connections. Open Banking standards that promise to simplify bank API connections have advanced slowly in the United States compared to Europe. This creates a landscape where some platforms connect reliably to major banks while struggling with smaller institutions, and users may need to manually add certain accounts despite automated connections being available for others.

How Different Platforms Approach Integration

Most platforms use aggregators like Plaid or Open Integration, which maintain relationships with thousands of financial institutions and provide unified APIs to multiple clients. This approach allows platforms to support broad institution coverage without maintaining individual bank relationships. However, aggregator reliance creates latency and occasional synchronization issues—changes at the aggregator level impact all dependent platforms.

Simplifi's account aggregation impressed during testing, particularly with Fidelity connections, which sometimes frustrate other platforms. The app imported account data smoothly and updates appeared within hours. Credit card transactions synced reliably. Investment account balances integrated without special configuration. This performance suggests thoughtful integration implementation.

Monarch Money performed similarly well for standard accounts (checking, savings, credit cards) but occasionally required manual intervention when adding certain institutions. The onboarding process was smooth, but occasional instances required re-authenticating or addressing connection issues that similar attempts with Simplifi didn't encounter. These instances were exceptions rather than rules, but they indicated slightly less polished integration management.

Nerd Wallet's free tier integration works adequately for basic accounts but occasionally misses newer or smaller financial institutions. Users often report needing to manually add certain accounts that don't appear in the automated connection list. This isn't a critical issue for users with accounts at major institutions but creates friction for those using smaller banks or credit unions.

Copilot Money's bank connections work well for major institutions but are less comprehensive for smaller ones. The focus on mainstream users means extensive support for JPMorgan Chase, Bank of America, Wells Fargo, and similar large institutions, but less depth in smaller bank support.

Speed and Accuracy of Transaction Updates

Transaction update speed varies meaningfully across platforms. Simplifi typically reflects transactions within 4-12 hours of posting. Monarch Money similarly provides fast updates. YNAB's manual assignment means real-time import isn't as critical—you assign transactions when you notice them. Copilot Money and free-tier Nerd Wallet occasionally lag in updates, particularly for credit card transactions (which banks often delay reporting).

Accuracy of bank data also varies. Most platforms receive transaction data directly from institutions, so accuracy issues typically arise in categorization rather than core data. Transaction merchant names sometimes appear cryptically (especially from credit card processors), requiring users to identify what the merchant actually was. Platforms handling this confusion differently, with some fuzzy-matching merchant names to readable formats better than others.

Recommendations for Bank Connectivity Evaluation

When choosing a budgeting platform, test bank connectivity directly with your actual accounts before committing. Most platforms offer trials—connect your primary accounts and verify they sync reliably and with acceptable speed. Check whether less common accounts (credit unions, regional banks, investment accounts) connect smoothly. Ask yourself whether you'd be comfortable manually adding accounts that won't auto-connect, or whether you'd abandon the platform if certain accounts aren't supported.

Estimated data shows Monarch Money leading in feature richness, while Quicken Simplifi excels in user experience. AI integration varies across apps.

Mobile Apps vs. Web Platforms: Where the Real Action Happens

The Mobile-First Reality

The personal finance software landscape has fundamentally shifted toward mobile during the period since Mint's shutdown. Where Mint offered web as the primary experience with mobile as secondary, modern platforms increasingly build mobile-first, with web serving as a power-user secondary interface.

This shift reflects broader consumer behavior: most financial management interactions now happen on phones. Recording expenses immediately after purchases, checking remaining budget before spending, reviewing financial progress during downtime—these activities happen more naturally on mobile than requiring desktop access.

How Platforms Handle Mobile

Simplifi's mobile experience matches its desktop experience in functionality. iOS and Android apps provide access to all features: account management, transaction review, budget management, goal tracking, and settings. The app is native (not web-based), providing smooth, responsive experience. However, detailed configuration (like complex recurring transaction rules) works better on desktop.

Monarch Money's mobile app provides comprehensive functionality but feels slightly cramped compared to desktop. Advanced features like detailed forecasting and custom reporting are available on web primarily. The mobile experience is complete but doesn't feel optimally designed for mobile interaction—more like a mobile wrapper around a web application.

YNAB's mobile app is genuinely native and comprehensive. The experience feels built for mobile users, not adapted from web. Key workflows work smoothly on phone, including transaction assignment, budget management, and goal tracking.

Copilot Money embraces mobile-first fully. The app provides the primary experience, with web available but secondary. This approach makes sense for Copilot Money's demographic—younger users living on phones—but means users preferring desktop-first interaction will feel limited.

Practical Implications

For most users, mobile app quality matters more than web platform polish. If you're checking budget on phone while shopping, or reviewing spending during downtime, mobile experience directly impacts whether you maintain budgeting engagement. A platform with mediocre desktop but excellent mobile outperforms one with beautiful desktop but clunky mobile.

Weigh mobile app design quality as a primary evaluation criterion. Try the app with your actual accounts during trial periods. Notice whether the experience feels native and responsive or slow and clunky. Evaluate whether key actions (adding transactions, checking budget, reviewing spending) are intuitive or require multiple taps and navigation.

Comparing Spending Categorization Accuracy

The Categorization Challenge

Automatic spending categorization seems like it should be solved by now. In 2025, with years of machine learning advancement and massive amounts of historical transaction data, platforms should achieve near-perfect categorization accuracy. In reality, categorization remains imperfect—a consistent source of friction across all platforms.

The challenge stems from merchant naming and complexity in retail categories. When you purchase from Target, the transaction might show as "TARGET 12345" with no indication whether you bought groceries, clothing, household items, or all three. Visa and Mastercard provide no product-level details in standard transaction data. Platforms have no way to know, without additional intelligence, what you actually purchased at Target.

Machine learning helps: platforms analyze your purchasing patterns over time and use context clues (time of day, frequency, historical patterns) to make educated guesses. A

Platform Performance Variations

During testing, categorization accuracy varied meaningfully. Quicken Simplifi demonstrated above-average categorization accuracy, particularly for regular transactions at major retailers. The platform's machine learning seemed to have learned my patterns—repeated transactions at the same merchants usually categorized correctly without manual correction required.

Monarch Money similarly performed well, with particular strength in distinguishing subcategories. When you've configured rules that certain Amazon transactions of specific amounts are baby supplies, Monarch Money remembers and applies these rules consistently. This requires initial setup effort but rewards it with excellent subsequent accuracy.

YNAB's manual assignment approach eliminates categorization errors by making them intentional—you decide the category—but creates workflow friction. Once you've assigned categories a few times for repeat merchants, you might question whether the manual discipline actually produces better financial understanding or just busy work.

Copilot Money's categorization felt less accurate than paid alternatives, occasionally miscategorizing restaurant expenses or confusing general retail spending. The platform seemed to cast wider nets (marking things simply as "shopping" rather than distinguishing clothing, groceries, household items), which simplifies the interface but reduces analytical granularity.

Practical Implications

No platform achieves perfect categorization. Budget for 5-10 minutes monthly reviewing and correcting miscategorized transactions. This isn't a platform failure—it's recognition of the inherent difficulty in categorizing without product-level transaction data. Platforms that make correction easy (clear UI, ability to create rules from corrections) minimize the friction this creates.

If perfect categorization matters enormously for your use case, YNAB's manual assignment approach guarantees accuracy but requires more ongoing effort. For most users, acceptable accuracy with occasional corrections represents the practical reality across platforms.

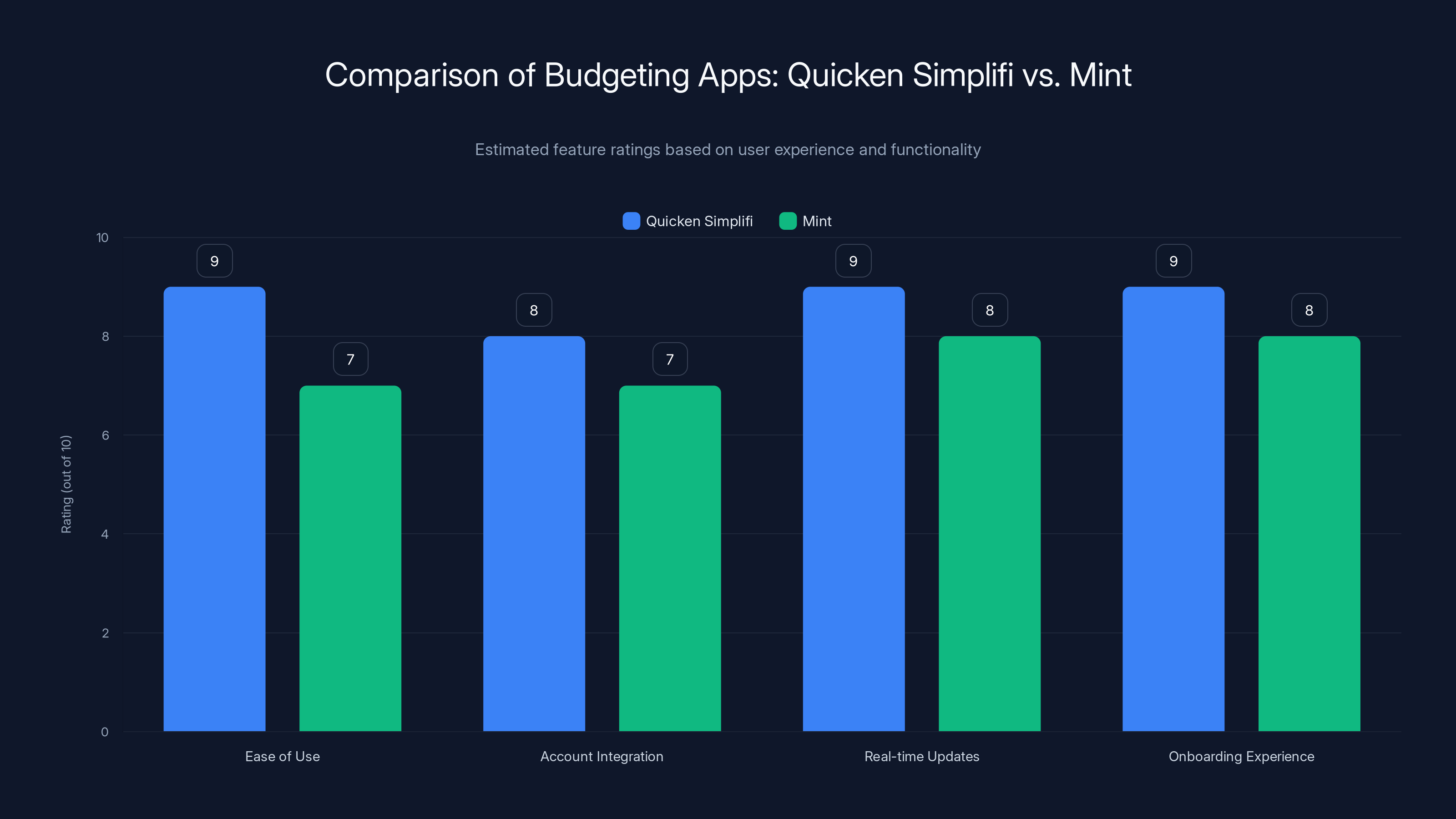

Quicken Simplifi outperforms Mint in ease of use, account integration, and onboarding experience, making it a strong Mint replacement. (Estimated data)

Net Worth Tracking: Beyond Budgeting

Why Net Worth Matters

Budgeting and net worth tracking are complementary but different financial management activities. Budgeting focuses on cash flow: tracking income and expenses over time to ensure you're spending within your means. Net worth tracking focuses on balance sheet health: aggregating assets and liabilities to understand your overall financial position and changes over time.

Net worth trends matter because they reveal whether your financial management is working. If you're budgeting successfully but net worth declines, something's wrong (perhaps you're spending down savings faster than earning). If net worth increases while you maintain lifestyle spending, you're genuinely building wealth. This connection between budgeting activity and net worth outcomes provides a crucial feedback loop.

Platform Net Worth Capabilities

Quicken Simplifi provides basic net worth calculation: adding all account balances minus liabilities. The dashboard displays your current net worth and trends over time. However, real estate values must be entered manually—without Zillow integration, homeowners must update property valuations periodically. This creates incomplete net worth tracking for homeowners if you forget to update real estate values regularly.

Monarch Money's net worth tracking includes automatic real estate and vehicle valuation through Zillow integration and automatic vehicle value tracking. For homeowners managing substantial assets, this integration meaningfully improves net worth tracking accuracy. You can visualize how real estate appreciation contributes to wealth building without manual updates.

YNAB doesn't explicitly track net worth in the way other platforms do, though account balance aggregation provides related information. For YNAB users focused on budgeting and behavioral change, this limitation may not matter. But for those wanting to track overall financial progress, YNAB falls short.

Copilot Money provides net worth calculations with Zillow integration, giving homeowners accurate real estate value incorporation without manual effort.

Nerd Wallet's free tier offers limited net worth tracking; premium version provides more comprehensive capabilities.

Real Estate Integration: The Zillow Question

Zillow integration has become a meaningful differentiator. As home prices have appreciated significantly in many markets, real estate often represents the largest component of net worth. Automatic valuation updates reflect this importance without requiring quarterly value estimations.

Simplifi's lack of Zillow integration is its most significant weakness relative to competitors. For homeowners, this means choosing between: 1) accepting incomplete net worth tracking, 2) manually updating values periodically (tedious and easy to neglect), or 3) choosing a competing platform with automatic integration.

For renters or users unconcerned with real estate valuation, Simplifi's limitation is irrelevant. But for homeowners, it's worth considering whether this gap matters for your situation.

Pricing Models and Total Cost of Ownership

Breaking Down the Financial Commitment

Budgeting app pricing has become more complex since Mint's free era. Most platforms use annual subscription models, some support monthly-to-month billing (usually at higher per-month cost), and a few maintain free or freemium options. Evaluating true cost requires accounting for annual commitments, potential upgrades, and what you're actually using.

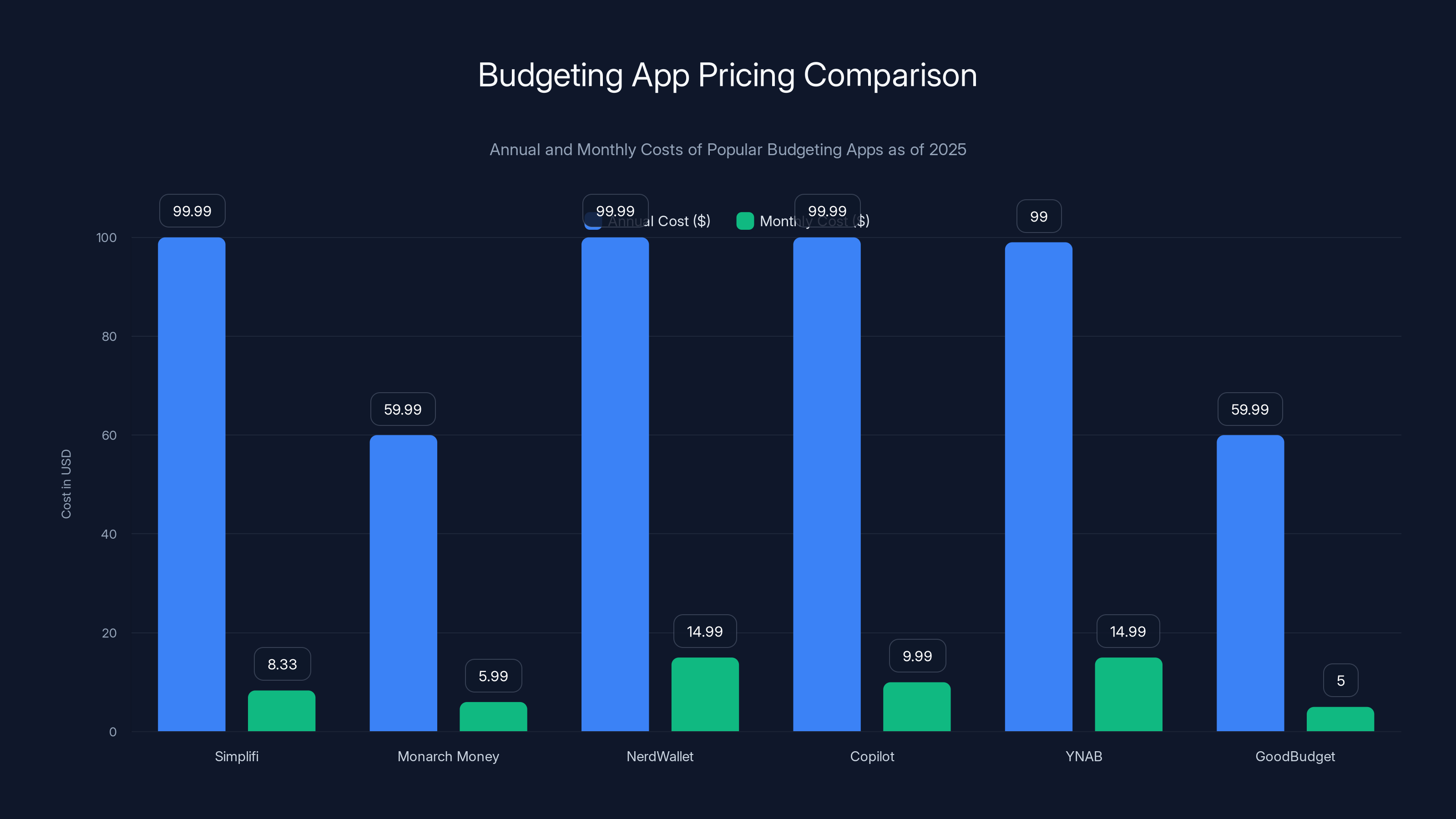

Detailed Pricing Comparison

| Platform | Annual Cost | Monthly Cost | Free Tier | Key Paid Features |

|---|---|---|---|---|

| Simplifi | $99.99 | $8.33 | No | All features |

| Monarch Money | $59.99 | $5.99 | No | Balance sheet budgeting, forecasting, reporting |

| Nerd Wallet | $99.99 | Premium $14.99 | Basic budgeting | Detailed insights, portfolio analysis |

| Copilot | $99.99 | Premium $9.99 | Basic budgeting | AI insights, advanced features |

| YNAB | $99 | $14.99 | Limited trial | All features |

| Good Budget | Free option | $59.99 premium | Basic envelope budgeting | Automatic import, advanced reporting |

Important context: All prices are current as of 2025, but platforms adjust pricing regularly. Before committing, verify current pricing on official websites.

Simplifi's

Monarch Money's $59.99 annual cost seems particularly attractive, positioning as lowest-cost serious platform. However, this aggressive pricing reflects their market positioning as Mint replacement for budget-conscious users willing to deal with greater complexity.

YNAB's **

Evaluating Cost vs. Value

When evaluating pricing, consider: What will you actually use? A platform with impressive features you never access isn't better value than simpler tool you use consistently. What's the switching cost? If you heavily configure a platform with months of transaction history, switching later costs time in reconfiguration and data consolidation. Does the platform support shared account management (valuable for couples)? This multiplies the per-user cost and might justify premium pricing.

As a crude benchmark: if using a budgeting app leads to identifying and eliminating

Advanced Features Comparison: Investment Tracking, Goals, and Forecasting

Investment Account Integration

While budgeting primarily focuses on cash flow, many users want comprehensive financial management including investment accounts. Integration quality varies significantly across platforms.

Simplifi connects to most major brokerage accounts and displays balances. However, detailed portfolio analysis—holdings breakdown, performance tracking, asset allocation—isn't available. You can see "Fidelity Account: $47,500" but not "50% stocks, 30% bonds, 20% cash" allocation. For users wanting to monitor overall account balances as part of net worth, this works. For those wanting detailed investment analysis, it's insufficient.

Monarch Money similarly displays investment account balances but doesn't provide deep portfolio analysis. However, the asset tracking (including vehicles and real estate) integrated with Zillow works well for net worth composition.

YNAB doesn't focus on investment tracking beyond account balance aggregation. The philosophy centers on budgeting and behavioral change rather than portfolio management.

Nerd Wallet's premium tier includes some investment tracking features, and their platform includes financial product recommendations (stocks, funds) relevant to investment-focused users. However, their strength is credit monitoring and cash budgeting rather than investment portfolio analysis.

For detailed investment management, none of these general budgeting platforms compete with dedicated investment tracking apps like Personal Capital or Empower. If investment portfolio analysis is critical for your needs, consider specialized platforms as supplement to budgeting apps.

Goal Setting and Progress Tracking

Goal-setting features help connect budgeting discipline with aspirational outcomes. Saving $200/month toward an emergency fund is more motivating when you see progress visualization on the dashboard.

Simplifi's goal tracking displays progress toward targets with visual indicators. Goals appear on the dashboard, keeping them visible and top-of-mind. You can create goals for any purpose, and the app tracks accumulation toward targets.

Monarch Money's goal functionality integrates into budgeting: when you set a goal for a budget category, Monarch Money suggests monthly allocation needed to achieve your target timeframe. This integration provides clear guidance: "To save

YNAB builds goals into category budgeting. You set targets and the app shows progress, but the approach feels less emphasized than dedicated goal-tracking platforms.

Copilot Money's goal tracking is basic but functional—less emphasis on goal visualization than some competitors.

For goal-focused financial management, Simplifi and Monarch Money provide meaningful motivation through progress visualization. If goals are central to your financial management approach, these platforms serve you better than others.

Forecasting and Projection Capabilities

Forecasting answers "where will I be financially if current patterns continue?" questions. This forward-looking perspective helps identify problems before they materialize.

Monarch Money's forecasting stands out: you can project financial scenarios by month or year, seeing anticipated net worth changes, spending patterns, and income variations. This enables powerful "what-if" analysis: "If I reduce dining-out spending by 50%, how much faster would I reach my emergency fund goal?"

Simplifi and YNAB lack explicit forecasting features, though both provide spending trend visualization. Copilot Money's insights include some forward-looking analysis but not comprehensive forecasting.

For detailed financial planning, Monarch Money's forecasting capability provides genuine value. Users serious about optimizing financial outcomes benefit from this capability.

Security, Privacy, and Data Protection

Why Security Matters in Financial Software

Budgeting apps aggregate your complete financial picture: account balances, transaction history, income, spending patterns. This concentration of sensitive financial data creates security responsibility. A breach could expose not just account numbers (which banks protect anyway) but comprehensive financial patterns revealing income, spending, and asset information.

How Platforms Protect Data

All major platforms use encryption for data in transit (SSL/TLS) and at rest. Multi-factor authentication is standard across platforms, and you should enable it. Connections use OAuth or similar protocols that don't require sharing banking passwords—apps receive access tokens that limit permissions and can be revoked.

Simplifi uses industry-standard encryption and security practices. The platform doesn't store banking passwords (connections use secure API tokens). Multi-factor authentication is available. The platform's long history and large user base suggest security is taken seriously, though no system is perfectly secure.

Monarch Money, as a newer platform, has security-first design principles. The app uses modern encryption, API security, and access control patterns. However, "newer" sometimes means less battle-tested—Simplifi's decades of financial software history might provide more security comfort to some users.

All platforms undergo security audits and typically publish security practices on their websites. Before choosing a platform, review their security documentation and privacy policies. Pay particular attention to: Do they store banking passwords (they shouldn't)? How is data encrypted? What's their data breach response plan? What information do they share with third parties?

Privacy Considerations

Beyond security, privacy questions matter: What do platforms do with your data? Do they use your spending patterns for their own financial product recommendations (common)? Do they share data with third parties (beyond what's necessary for basic operations)? Do you own your data if you leave the platform?

Simplifi's privacy practices are relatively transparent: Intuit (parent company) uses aggregated, anonymized data for financial insights but claims not to share individual user data with third parties. However, you're trusting Intuit, a large financial services company, with comprehensive financial data.

Monarch Money publishes detailed privacy policies and their newer platform was built with data minimization principles. However, as a smaller company with growth ambitions, venture investment, and acquisition pressures, long-term data practices are less certain.

YNAB's founder-led, mission-driven positioning suggests privacy-focused practices, but verify their privacy policies yourself rather than relying on positioning.

For privacy-conscious users, reviewing platform privacy policies and comparing practices directly is more reliable than platform positioning. No platform is perfectly privacy-protecting when offering services involving financial data aggregation.

Making the Final Decision: A Decision Framework

Key Evaluation Questions

Choosing among budgeting platforms requires balancing multiple factors. These questions help clarify which platform fits best:

1. What's your primary use case? Are you focused on simple spending tracking, comprehensive net worth management, detailed investment analysis, or behavioral change around spending? Different platforms excel at different objectives. Simplifi works for straightforward budgeting; Monarch Money suits complex finances; YNAB drives behavioral change; Copilot Money engages casual budgeters.

2. How complex is your financial situation? Do you have straightforward checking/savings/credit cards, or do you manage multiple investment accounts, real estate, side business income? Platform features should match your financial complexity. Straightforward situations work with any platform; complex finances need robust asset tracking and categorization.

3. Are you budgeting alone or with a partner? If jointly managing finances, shared account access matters. Simplifi's strong shared account capability sets it apart. Other platforms have limitations that might frustrate couples.

4. How technical are you? Are you comfortable with more complex interfaces and configurations, or do you prefer simplicity? Monarch Money appeals to tech-comfortable users; Simplifi and Copilot Money prioritize simplicity.

5. How engaged will you be with the platform? Will you spend time configuring details and optimizing, or do you want quick setup and minimal ongoing management? YNAB and Monarch Money reward engagement; Simplifi minimizes required engagement.

6. What's your budget sensitivity? Are you cost-focused, or is feature set more important? Free and freemium options exist; premium platforms cost

Decision Matrix Approach

Create a simple decision matrix: list your key requirements (shared access, real estate integration, simplicity, investment tracking, etc.) and score platforms against each criterion on 1-5 scale. Weight criteria by importance to your situation. Calculate weighted scores. This systematic approach prevents getting distracted by individual features and maintains focus on overall fit.

For example:

- Simplicity (weight: 5): Simplifi (5), Monarch (3), YNAB (4), Copilot (5)

- Real Estate Integration (weight: 4): Simplifi (1), Monarch (5), YNAB (1), Copilot (4)

- Shared Access (weight: 5): Simplifi (5), Monarch (2), YNAB (2), Copilot (2)

- Cost (weight: 3): Simplifi (4), Monarch (5), YNAB (3), Copilot (4)

- Mobile Experience (weight: 3): Simplifi (4), Monarch (3), YNAB (5), Copilot (5)

Weighted scores would show which platform best aligns with your priorities.

The Trial Approach

Before committing financially, use trial periods to test your top 2-3 candidates. Connect your actual accounts, go through setup, and spend time using the platforms daily for their trial periods. Most platforms offer 30-day free trials—use this time to simulate real usage.

During trial periods, pay attention to: How natural does the onboarding feel? Are you creating transactions, or is automation handling it? How often does bank connection sync? Are transactions categorized correctly? Is the mobile experience responsive and intuitive? Do you find yourself opening the app regularly, or does it feel like a chore?

Your emotional response to using the platform matters. If you're not engaging with a budgeting app, even if it's feature-complete, it won't drive behavior change. The best platform is the one you'll actually use consistently.

Alternative Approaches: When Traditional Budgeting Apps Aren't Enough

Spreadsheet-Based Budgeting

Despite sophisticated budgeting apps, some users prefer spreadsheet-based approaches. Spreadsheets provide ultimate control and customization, require no reliance on third-party companies, and eliminate security concerns around bank connectivity. Users comfortable with spreadsheets can create custom systems matching their exact needs.

However, spreadsheet budgeting requires substantial manual data entry, lacks automated bank connectivity, and won't sync across devices (or requires manual synchronization). For people with the discipline and technical skill to maintain spreadsheet systems, this approach works. For most people, the manual overhead makes spreadsheets impractical for sustained budgeting.

Financial Advisory Services

For people with complex finances, substantial assets, or significant planning needs, financial advisors and planners provide personalized guidance that budgeting apps can't match. An advisor helps determine whether your financial management strategy aligns with your goals, optimizes tax planning, and adjusts strategies as circumstances change.

Budgeting apps and financial advice aren't mutually exclusive—in fact, they're complementary. An advisor might recommend using a specific budgeting app to maintain cash flow awareness while the advisor handles investment and tax planning. Many financial advisors recommend clients maintain budgeting discipline as part of comprehensive financial management.

Industry Trends and Future Directions

AI-Powered Financial Management

Artificial intelligence increasingly influences budgeting software. Rather than static categories and rules, AI-driven platforms provide dynamic spending insights, predictive alerts, and behavioral recommendations. Copilot Money's AI insights represent early-stage evolution of this trend.

Expect future development to include: better transaction categorization using machine learning, predictive spending analysis ("You typically spend

The risk: as AI becomes more sophisticated at analyzing spending, users might feel uncomfortable with algorithmic spending suggestions. Privacy concerns may intensify. But the benefits—better categorization, smarter insights, reduced manual configuration—suggest AI integration will continue accelerating.

Open Banking and API Standards

Open Banking standards, common in Europe and gradually advancing in the U.S., promise to simplify bank connectivity and reduce dependency on intermediaries like Plaid. As these standards mature, budgeting apps may provide more direct bank connections, potentially improving reliability and reducing transaction update delays.

However, U.S. banking regulations remain less progressive than international standards, so widespread Open Banking adoption in the U.S. will take years. For now, intermediary aggregators remain necessary for most platforms.

Consolidation and Specialization

The budgeting app market appears headed toward consolidation around a few major platforms while specialized alternatives target specific niches. Intuit owns multiple financial products and might eventually consolidate around Quicken for comprehensive personal finance. Larger fintech companies may acquire successful platforms, integrating them into larger suites.

This consolidation creates risk: less competition might slow innovation and reduce user choice. It also creates opportunity: acquisition could provide acquired platforms resources for accelerated development.

Runable: An Alternative Perspective on Financial Automation

Beyond Traditional Budgeting

While traditional budgeting apps focus on tracking and analyzing spending, modern productivity platforms like Runable take different approaches to financial management. Rather than spending analysis, Runable emphasizes automated financial workflows and intelligent reporting through AI-powered automation capabilities.

For example, instead of manually compiling monthly financial reports or expense breakdowns, teams using Runable's automated document generation and workflow automation features can create sophisticated financial dashboards, expense reports, and budget summaries with minimal manual effort. At $9/month, Runable positions itself as a cost-effective alternative for teams needing to automate financial documentation and reporting processes.

While Runable doesn't directly compete with platforms like Simplifi for personal budgeting, its AI agents for document generation and workflow automation address gaps some users identify: the tedious process of creating reports, compiling financial data, and sharing insights with teams. For users already using traditional budgeting platforms, Runable could supplement by automating the reporting and documentation that follows budget analysis.

For individuals managing team or household finances at scale—creating regular financial updates, generating reports for planning, or maintaining comprehensive financial documentation—Runable's automation capabilities provide efficient alternatives to manual creation or complex spreadsheet-based approaches.

FAQ

What happened to Mint, and why did it shut down?

Intuit, Mint's parent company, shut down the service in March 2024, recommending users transition to Credit Karma. The exact reasons weren't fully disclosed, but the decision reflected Intuit's strategic decision to consolidate personal finance tools and allocate resources to other priorities. This left millions of users needing to find alternative budgeting solutions, which created the current competitive landscape.

What's the difference between budgeting and net worth tracking?

Budgeting focuses on cash flow management: tracking income and expenses over time to ensure spending stays within targets. Net worth tracking focuses on balance sheet health: aggregating assets and liabilities to determine overall financial position. Both matter for comprehensive financial management, but they address different questions—budgeting answers "am I spending appropriately?" while net worth answers "am I building wealth?" Many platforms include both, though some (like YNAB) emphasize budgeting while others (like Monarch Money) incorporate substantial net worth tracking.

Is free budgeting sufficient, or do paid apps provide meaningful additional value?

Free budgeting apps like Nerd Wallet provide legitimate core functionality—account aggregation, spending categorization, basic budgeting—that works for straightforward financial situations. However, paid apps typically offer features free tiers omit: comprehensive net worth tracking, detailed goal tracking, forecast capabilities, and real estate integration. Whether these features provide value depends on your financial complexity. Simple situations work fine with free apps; complex finances benefit from paid platform sophistication. Consider that annual costs (typically $60-100) often return ROI through identified spending improvements or better financial planning.

How important is bank connectivity quality when choosing a budgeting app?

Bank connectivity quality is critically important. Without reliable, fast account synchronization, you're relegated to manual transaction entry, which most people won't maintain long-term. Test connectivity with your actual accounts during trial periods before committing. Verify that all your financial institutions connect automatically, or understand which accounts require manual entry and whether you can tolerate that friction. Poor connectivity is a platform dealbreaker despite other features.

Can budgeting apps replace financial advisors or investment management platforms?

Budgeting apps and financial advisory services serve different purposes. Budgeting apps optimize cash flow management and spending awareness. Financial advisors optimize investment strategy, tax planning, and comprehensive financial planning. For most people, these are complementary rather than competing. A financial advisor might recommend using a budgeting app to maintain spending awareness while the advisor handles investment decisions. Investment management platforms specialize in portfolio analysis that budgeting apps typically don't provide. Use budgeting apps for budgeting, consider advisors for investment and tax planning, and invest in investment management platforms only if you have substantial portfolios requiring detailed analysis.

How much time should budgeting actually require?

This depends on your approach and financial complexity. Platforms emphasizing automation (like Simplifi and Copilot Money) require minimal time—perhaps 10-15 minutes weekly reviewing transactions and checking budget progress. Platforms emphasizing intentional allocation (like YNAB) might require 20-30 minutes weekly as you assign categories and refine budgets. Complex financial situations need more time than simple ones. The goal isn't identifying "correct" time investment but finding whether you'll actually engage. Choose platforms matching your realistic capacity—an ideal app you abandon is worse than a simple app you use consistently.

Should couples share a single budgeting account or maintain separate accounts?

This depends on your financial structure and relationship preferences. Couples with fully joint finances (shared checking accounts, combined budgets) benefit from single shared accounts, particularly platforms like Simplifi that support true shared access. Couples maintaining separate finances or preferring financial independence might maintain individual accounts and manually share summaries. Couples with hybrid structures (shared household expenses, separate personal spending) might benefit from separate accounts that both parties review during regular financial check-ins. The important factor is whether the structure supports your decision-making process and relationship dynamics—there's no single correct answer.

What should you prioritize when choosing among multiple budgeting app options?

Prioritize in this order: 1) Matching your actual financial complexity (don't pay for features you won't use, but ensure the app handles your situation), 2) Quality of bank connectivity (fundamental to sustained usage), 3) Interface and experience quality (you won't use apps you dislike), 4) Shared account management (if budgeting with partners), 5) Specific feature availability (like real estate integration if homeowners), 6) Pricing (among options that meet above criteria). Avoid choosing platforms primarily on features you think you "should" use but realistically won't, and avoid being lured by the "most powerful" option if complexity would prevent consistent engagement.

Conclusion: Finding Your Financial Management Solution

The post-Mint landscape offers more choices than ever, but also more fragmentation. There's no single "best" budgeting app—only the best app for your specific situation, financial complexity, and preferences. Quicken Simplifi serves Mint refugees wanting similar simplicity with modest improvements. Monarch Money appeals to power users wanting granular control and sophisticated analysis. YNAB drives behavioral change through envelope philosophy. Copilot Money engages casual budgeters with contemporary design. Free alternatives accommodate budget-conscious users willing to accept limitations.

The shared pattern across successful platforms: they focus on sustainable engagement. The most powerful budgeting app abandoned after three months provides zero value. Platforms succeeding in 2025 do so because users actually engage consistently—whether through simplicity reducing friction, powerful features appealing to optimization enthusiasts, community providing support, or design creating engagement.

Your path forward: identify your actual needs and financial complexity, test 2-3 candidate platforms using their trial periods, and choose based on which one you'd realistically use consistently. Don't agonize endlessly—budgeting app selection matters far less than actually budgeting. A 70% solution you use consistently outperforms a 95% solution you abandon.

The good news: the 2025 budgeting app market offers legitimate quality across multiple platforms. Whether you choose Simplifi's simplicity, Monarch Money's sophistication, YNAB's behavioral philosophy, or free alternatives' accessibility, you'll find tools capable of improving your financial management. The transition away from Mint, while initially frustrating, has created competitive innovation that benefits anyone serious about managing their finances intentionally. Pick a platform, commit to consistent engagement, and discover what most budgeting app users find: awareness drives improvement, and improvement compounds into significantly better financial outcomes.

Key Takeaways

- Mint's 2024 shutdown created significant market opportunity and drove innovation in budgeting platforms

- Quicken Simplifi offers best balance of simplicity and features for most users, with $99.99 annual pricing

- Monarch Money provides sophisticated features for complex finances with aggressive $59.99 annual pricing

- YNAB's envelope-based philosophy drives behavioral change through intentional allocation approach

- Bank connectivity quality and mobile experience are critical evaluation factors for sustained usage

- Real estate integration through Zillow differentiates platforms for homeowners managing substantial assets