How to Watch the Bosch CES 2026 Press Conference Live and What to Expect

If you're following consumer electronics and enterprise technology trends, you've probably heard that CES 2026 is shaping up to be the biggest showcase of AI integration since Chat GPT launched. But here's the thing that gets overlooked: some of the most important announcements won't come from the familiar consumer brands. They'll come from the companies that power those brands.

Bosch is one of those companies, and their CES 2026 presentation is worth your attention, even if you've never heard of them (or thought they only made kitchen appliances). The German multinational is bringing a comprehensive vision of how physical and digital worlds merge, and they're doing it through three massive sectors: automotive, smart home, and manufacturing. This isn't just marketing speak either. These are real technologies that'll likely end up in cars you drive, homes you live in, and factories producing goods you use.

Let me walk you through exactly how to catch their live presentation, what they're actually unveiling, and why this matters beyond just tech industry circles.

How to Watch Bosch's CES 2026 Presentation Live

Let's start with the logistics, because honestly, live streaming information gets buried fast at CES. Bosch is hosting their press conference on Monday, January 5, 2026, at 12 PM ET (that's 9 AM PT for West Coast folks, or 6 PM CET if you're in Central Europe). The livestream is accessible through the official Bosch press page, where they'll have the feed available during the presentation.

If you miss the live broadcast, don't panic. Most companies archive their CES presentations within hours, and Bosch typically does the same. They'll likely upload it to their corporate YouTube channel and media center within a few hours of the presentation ending. But real talk: watching live gives you the actual energy of the event, the immediate Q&A, and the chance to see which announcements the executives emphasize versus which ones they rush through. Those distinctions tell you which projects Bosch is genuinely excited about.

The presentation happens at booth 16203 in the Central Hall of the Las Vegas Convention Center. If you're attending CES in person, you can grab a seat at the press conference itself, but they're usually packed. The livestream is genuinely your best bet for a clear view.

One detail worth noting: some of Bosch's subsidiary press conferences and breakout sessions might happen at different times. Check their full CES schedule on the official website if you want to dive deeper into specific product categories. The main keynote I'm describing is the big umbrella presentation, but they often run specialized sessions for automotive tech, smart home ecosystems, and industrial IoT afterward.

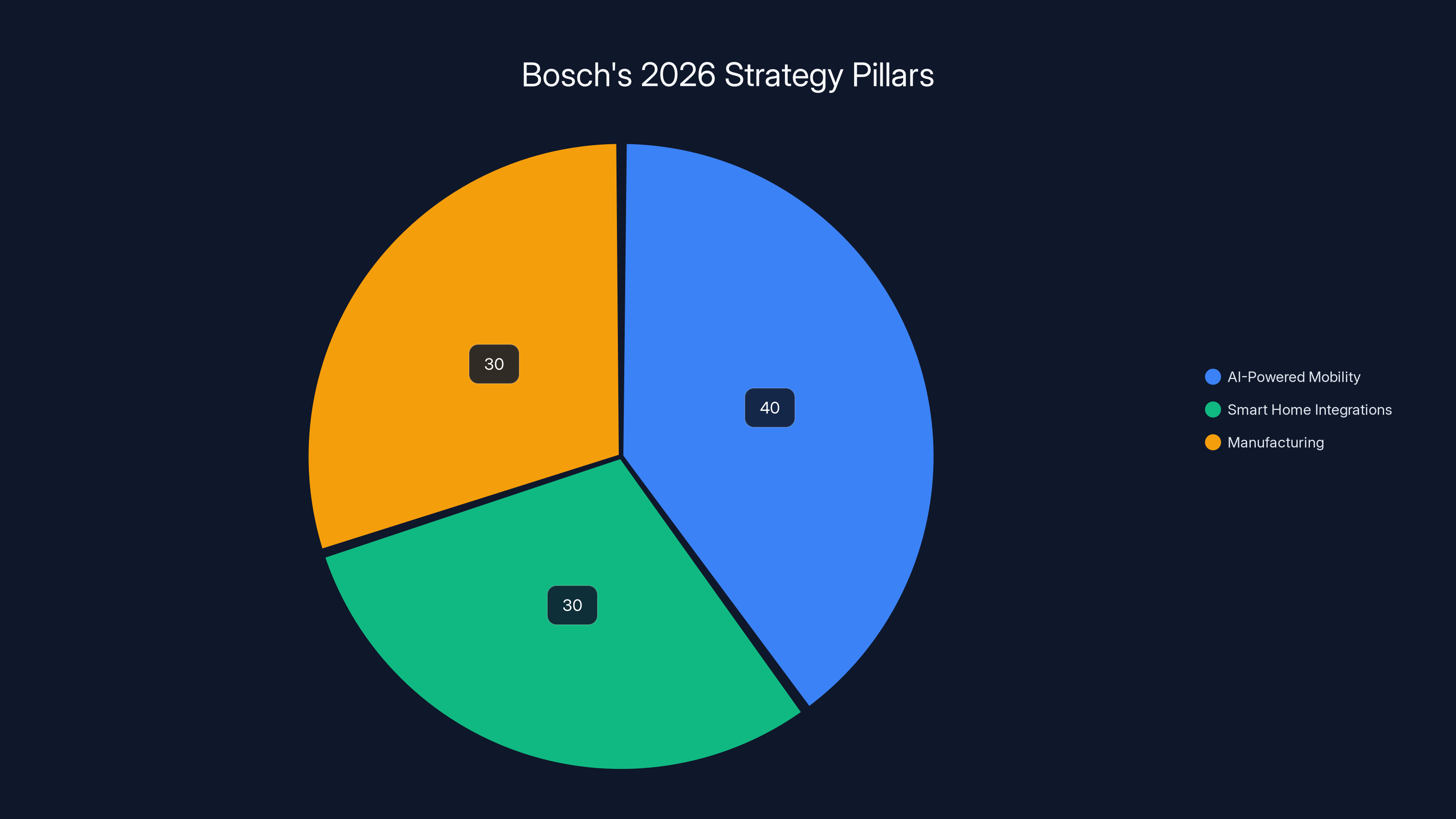

Bosch's 2026 strategy emphasizes AI-powered mobility, smart home integrations, and manufacturing. Estimated data suggests a balanced focus with a slight emphasis on mobility.

Understanding Bosch: Not Your Average Consumer Brand

Before we dive into what they're announcing, let's clear up some confusion about who Bosch actually is. Most people know Bosch through its partnership with Siemens, where you'll see Bosch-branded home appliances like dishwashers, washing machines, and kitchen ventilation systems. That's real, but it's honestly the tip of the iceberg.

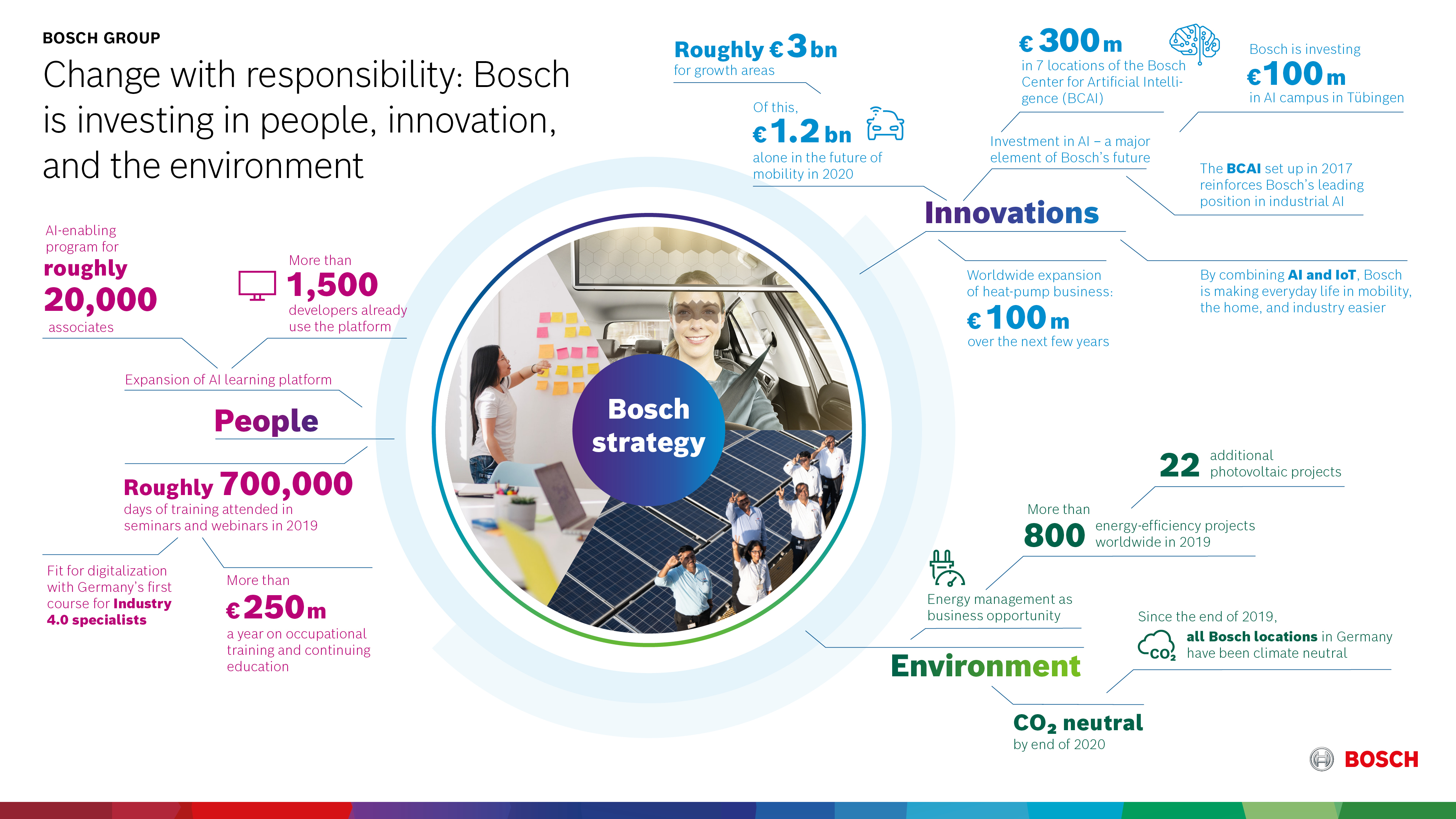

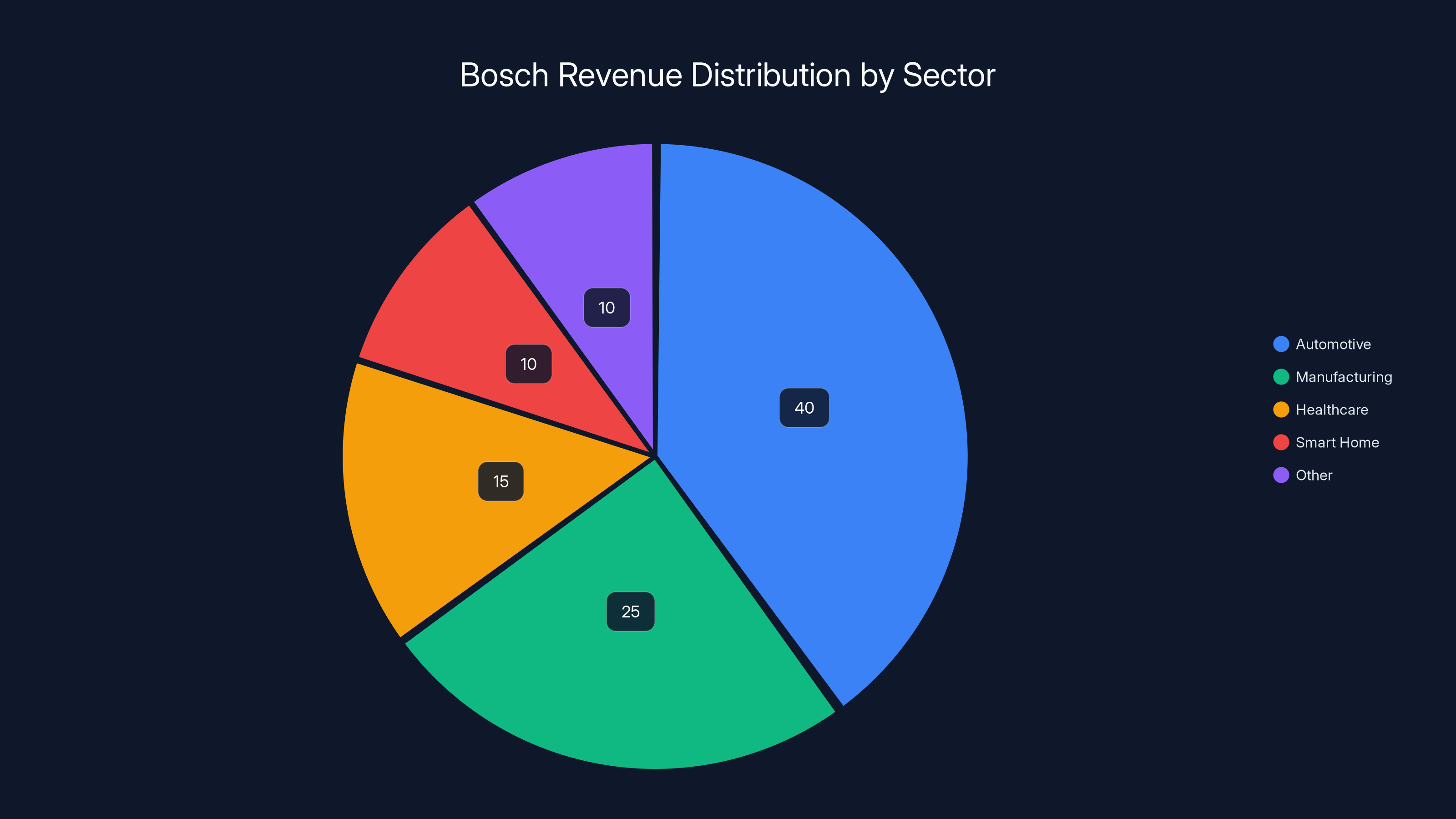

The actual Bosch Group is a sprawling multinational engineering company headquartered in Stuttgart, Germany. They employ over 400,000 people globally and generate revenue in the range of 90 billion euros annually. Their real business is providing underlying technology and engineering solutions to thousands of partner companies across automotive, manufacturing, healthcare, and smart home sectors.

Think of it this way: you probably interact with Bosch technology dozens of times daily without knowing it. The sensors in your car's anti-lock braking system? Often Bosch. The fuel injection system? Bosch tech. Industrial automation equipment in factories? Frequently Bosch. Smart home integrations that talk to your connected devices? Growing Bosch ecosystem.

This matters for understanding CES 2026 because Bosch isn't going to announce a consumer gadget that launches next month on Amazon. Instead, they're announcing technologies that other companies will license, integrate, and eventually bring to market over the next 2-3 years. Their strategy is fundamentally B2B, not B2C.

This B2B-focused approach actually makes their CES presentations more valuable to certain audiences. If you're in automotive engineering, manufacturing, or smart home product development, Bosch's announcements directly affect your roadmap. If you're a consumer interested in future tech, understanding what Bosch is showing tells you what's coming to the cars, homes, and products you'll interact with in 2027-2028.

Bosch's CES 2026 announcements are evenly distributed across automotive cockpit systems, smart home integration, and manufacturing AI, each receiving significant attention.

The Three Pillars of Bosch's 2026 Strategy

Bosch has organized their CES presentation around three interconnected pillars: mobility, smart home integrations, and manufacturing. These aren't separate silos either. The core thesis is that AI, real-time processing, and connected systems are breaking down the barriers between these sectors.

Let me break each down:

Pillar 1: AI-Powered Mobility and the Future Car Cockpit

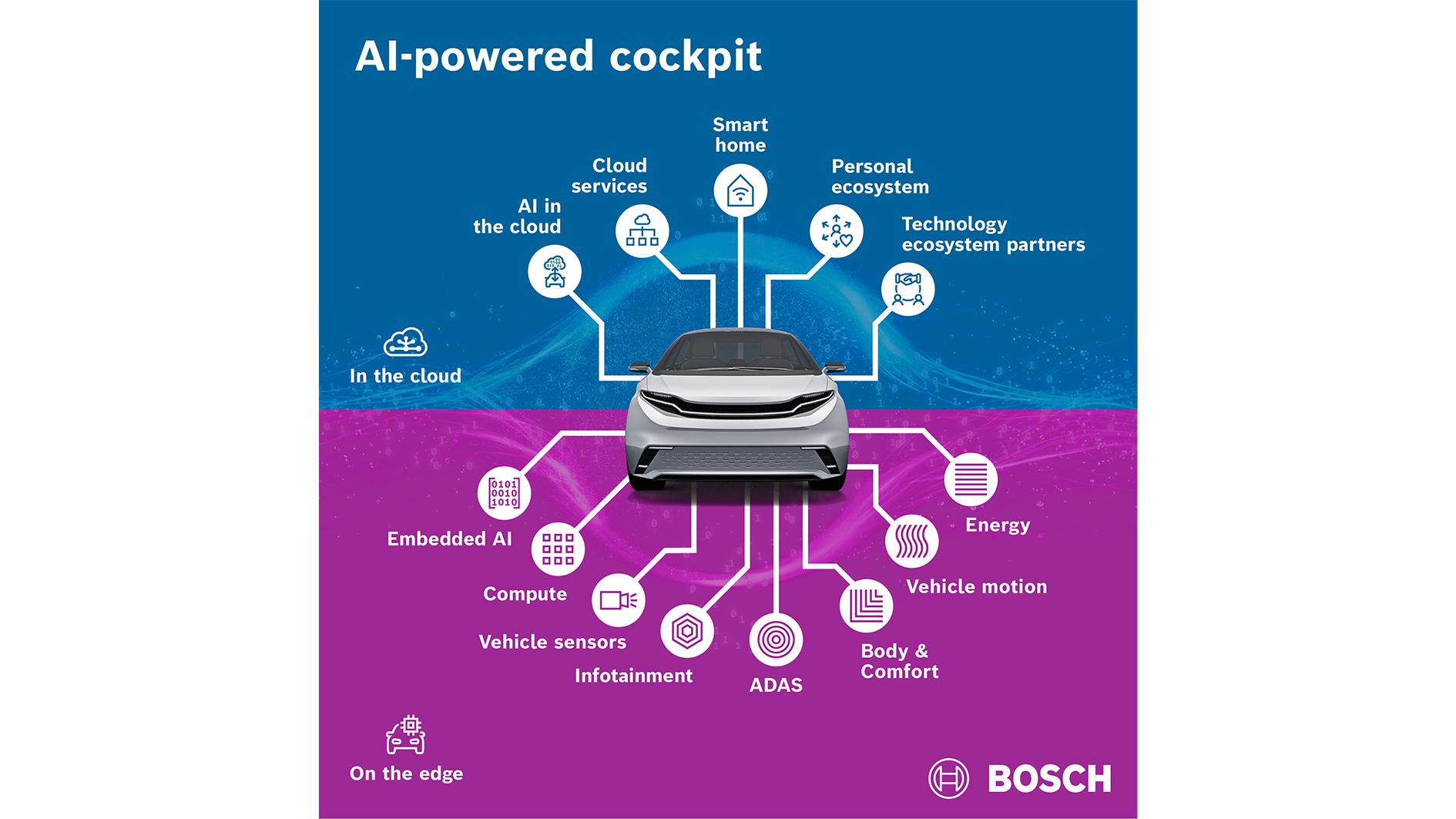

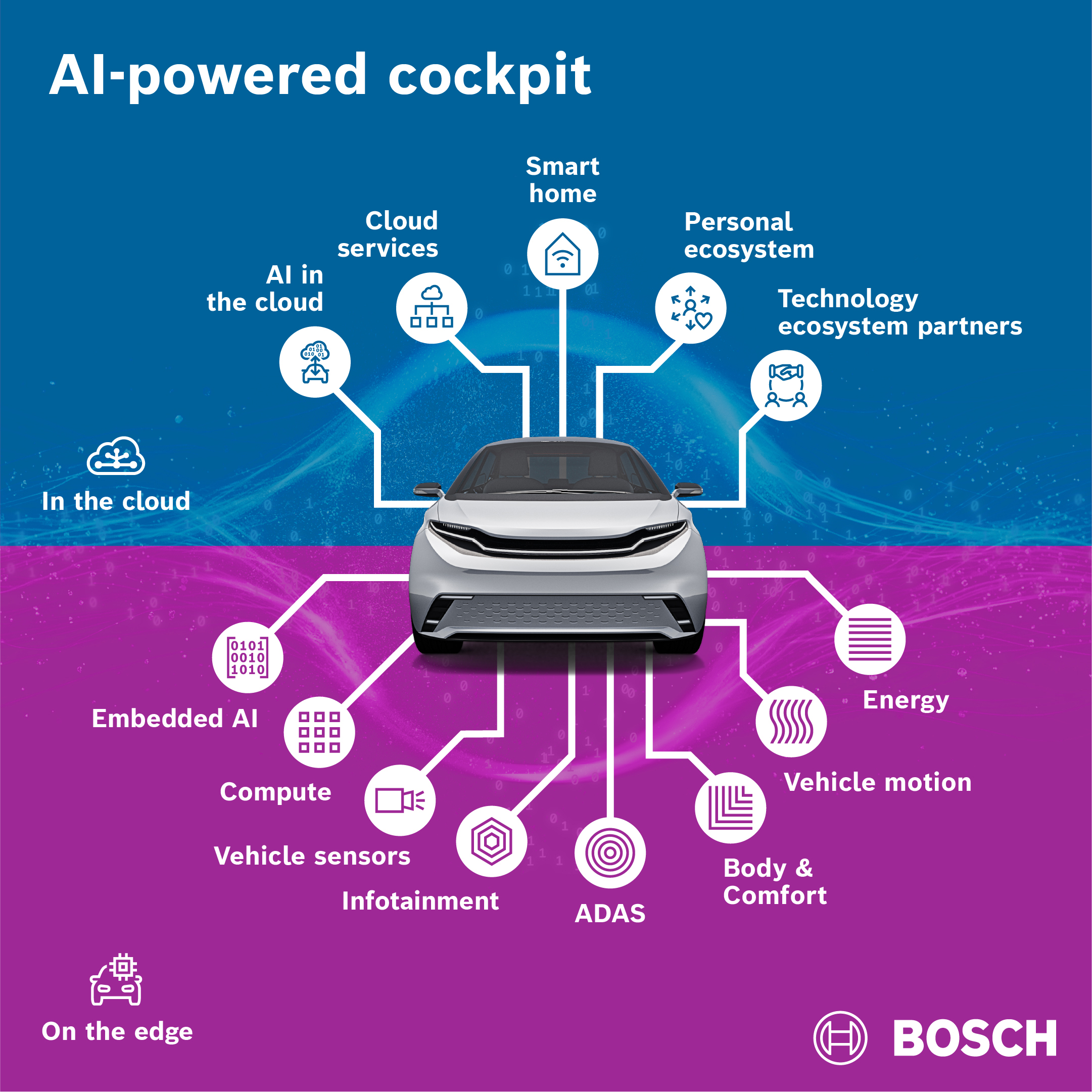

The automotive side is where Bosch is making the boldest claims. They're not building cars; they're building the intelligent systems that go inside cars. Specifically, they're focused on what they're calling "AI in the car" or more precisely, AI-powered cockpit technology.

According to Markus Heyn, a member of the Bosch board, their vision is an "AI-powered cockpit that makes driving more comfortable, intuitive, and safer for all occupants." This isn't just about a fancy infotainment screen, though that's part of it. It's about creating a system that understands driver behavior, anticipates needs, and actively manages vehicle safety features.

Here's what's actually happening under the hood: Bosch's AI cockpit integrates with both Microsoft and NVIDIA technology. On the Microsoft side, the system lets you use voice commands to join Microsoft Teams calls directly from your car. That sounds gimmicky until you consider the actual use case: a salesperson in heavy traffic who needs to join a conference call. The car's system handles it without requiring them to find a safe parking spot or use their phone.

On the NVIDIA side, real-time sensor processing and vision-language models manage everything from object detection to advanced driver assistance systems. NVIDIA's software suites handle the computational heavy lifting for processing streams of data from cameras, radar, and lidar sensors. The AI model interprets what it's seeing and can trigger vehicle responses. Adaptive cruise control activating based on traffic patterns? That's NVIDIA's software layer.

The safety component is genuinely important here. AI-powered cockpits can detect driver drowsiness, monitor attention levels, and intervene before accidents happen. Some early implementations include:

- Attention monitoring that gauges whether driver focus is on the road

- Drowsiness detection that can alert drivers or suggest breaks

- Predictive hazard identification based on road conditions, weather, and traffic patterns

- Adaptive automation levels that adjust what the vehicle handles versus what the driver must handle

Bosch sees this as a fundamental shift in how vehicles handle safety. Instead of just reacting to crashes, AI-powered systems actively prevent them by understanding risk factors in real time.

Pillar 2: Smart Home Ecosystems and Connected Living

The smart home sector is fragmented right now. You've got Amazon Alexa, Google Home, Apple Home Kit, and a hundred specialized platforms for thermostats, security systems, and appliances. Bosch's angle is creating a unifying layer that works across these ecosystems instead of competing with them.

Their smart home strategy centers on three concepts: accessibility, automation, and energy efficiency. They're not trying to replace your smart home hub. Instead, they're providing the intelligence layer that helps multiple systems talk to each other and respond to your needs intelligently.

For example, imagine your Bosch-powered smart home system detects that you've left for work. It could automatically:

- Adjust your thermostat to energy-saving mode

- Lower blinds to reduce solar heating

- Lock doors and arm security systems

- Turn off unnecessary lighting

- Prepare your home to maximize efficiency until you return

This happens through AI that understands your patterns. The system learns when you typically leave, how long you're gone, what temperature you prefer when you return, and adjusts accordingly. Over time, the AI gets smarter about predicting your needs.

Bosch is also emphasizing home health and safety monitoring. Their smart home systems can detect falls, irregular movement patterns, or unusual activity. For aging-in-place scenarios, this is crucial. Instead of requiring constant professional monitoring, the system can alert family members or emergency services if something goes wrong.

The energy angle is huge too. European regulations are getting stricter about home energy efficiency, and similar trends are emerging in North America. Bosch's smart home technology helps homes meet increasingly strict building codes while reducing energy costs. For homebuilders and renovators, this is becoming a compliance necessity as much as a convenience feature.

Pillar 3: Manufacturing and Industrial Io T

This is the sector that gets the least coverage at CES, but it's massive. Manufacturing accounts for roughly 10% of global GDP, and Bosch is positioning themselves as the company that makes factories smarter through AI and real-time data processing.

Their industrial Io T (Internet of Things) strategy focuses on what they call "predictive manufacturing." Traditional factories operate on schedules: maintain equipment every X hours, replace parts on a set timeline, schedule production runs based on historical data. This approach leads to unnecessary maintenance (parts replaced before failure), inefficient production scheduling (factories don't run at optimal capacity), and expensive downtime (equipment fails unexpectedly).

Bosch's AI-powered approach inverts this. Sensors continuously monitor equipment health, vibration patterns, temperature, electrical load, and performance metrics. Machine learning models trained on millions of hours of factory data can predict equipment failures before they happen. This enables:

- Predictive maintenance that schedules repairs just before failure, not on a predetermined timeline

- Production optimization that routes jobs through the factory in the most efficient sequence

- Quality control that uses computer vision to catch defects immediately instead of discovering them at the end of production lines

- Energy efficiency that adjusts equipment operation to minimize energy consumption while maintaining output targets

For a factory, this translates directly to ROI. Preventing even one unexpected equipment failure can save $50,000+ in emergency repairs, lost production, and overtime costs. Optimizing production sequences might increase throughput by 5-8% without new equipment. Better quality control reduces scrap and rework by 10-15%.

Bosch sees manufacturing AI as a competitive necessity. Companies that adopt predictive analytics will outpace competitors stuck on preventive maintenance schedules. It's a natural evolution, similar to how cloud computing became non-optional for software companies.

The Technology Stack Behind Bosch's Announcements

Bosch isn't building all of this from scratch. They're strategically partnering with leading AI and computing companies to build their platforms. Understanding these partnerships gives insight into the actual capabilities they're delivering.

Microsoft Integration: Enterprise AI and Cloud Services

Bosch's partnership with Microsoft centers on Azure cloud services and AI model deployment. Microsoft provides the underlying cloud infrastructure that processes data from millions of Bosch sensors globally. When your Bosch car tries to join a Teams call, that's Microsoft's infrastructure handling authentication, audio streaming, and reliability.

Microsoft also contributes AI model capabilities through Azure AI services. These include natural language processing for voice commands, computer vision for analyzing images from cameras, and large language models for understanding complex user intent.

For Bosch's customers, the Microsoft partnership means their systems integrate naturally with Office 365, Microsoft Dynamics, and other enterprise software that businesses already use. If you're managing a fleet of vehicles with Bosch AI cockpits, that data flows into your existing business intelligence systems.

NVIDIA Collaboration: Real-Time Processing and Vision AI

NVIDIA's role is more specialized but equally critical. They provide the compute infrastructure for real-time sensor data processing. A modern vehicle generates terabytes of sensor data annually from cameras, radar, and lidar systems. Processing this data in real time requires serious computational power.

NVIDIA's DRIVE platform provides the hardware (specialized GPUs) and software (real-time processing frameworks) that enables this. For autonomous vehicles and advanced driver assistance systems, NVIDIA's infrastructure is essentially non-negotiable.

Bosch and NVIDIA have been collaborating for years on autonomous vehicle technology. The CES 2026 announcements likely represent the maturation of systems they've been developing together. NVIDIA's software stacks handle the "vision" part of vision-language models, while Bosch's expertise brings the automotive-specific logic.

Bosch's revenue is predominantly driven by the automotive sector, followed by manufacturing and healthcare. Estimated data based on industry insights.

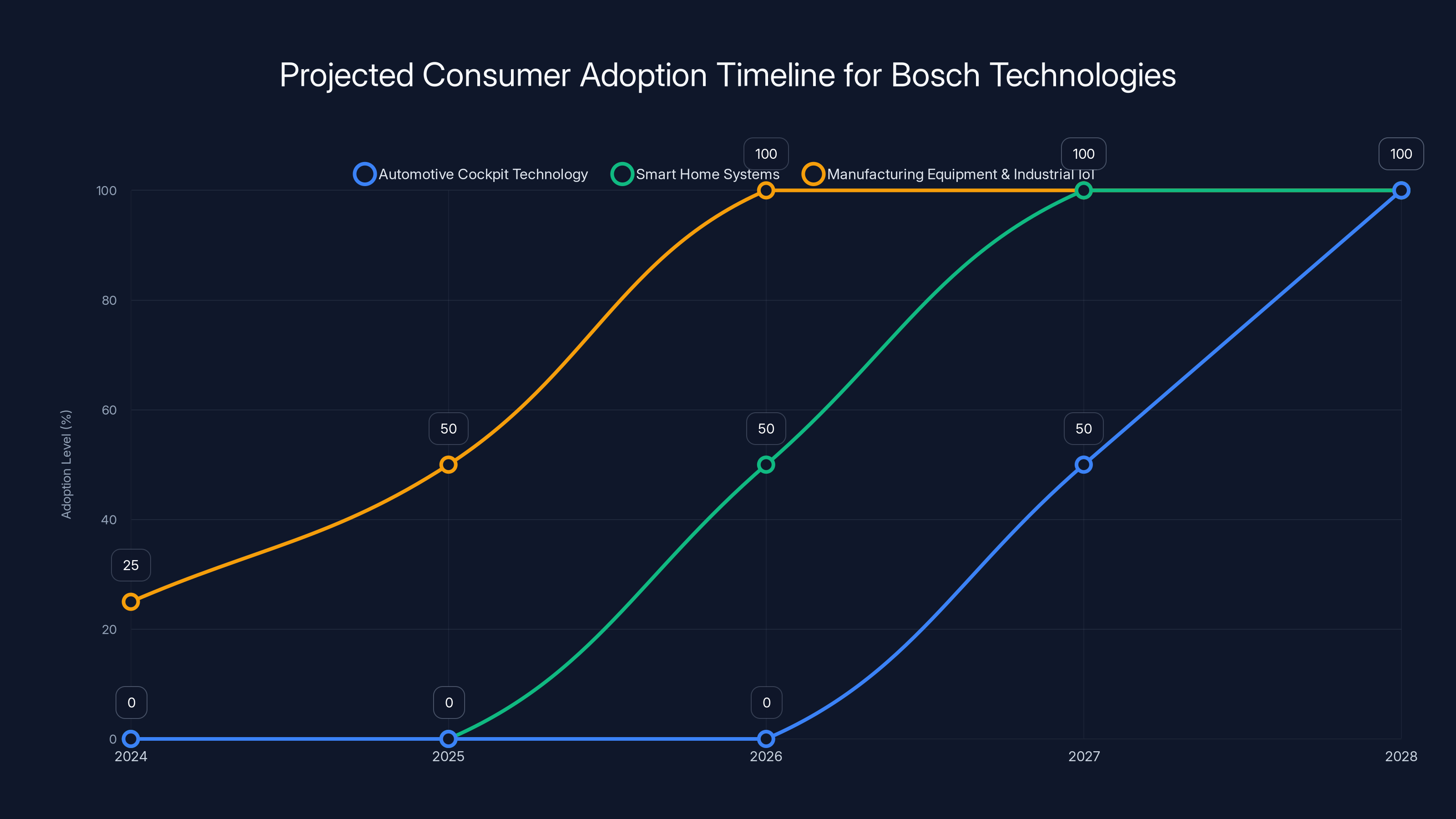

Timeline: When Will These Technologies Actually Reach Consumers?

One of the most common questions about CES announcements is timing. When can you actually buy these things? The answer with Bosch is: it's complicated and depends on the sector.

Automotive cockpit technology: Likely 2027-2028 for mainstream adoption. Bosch typically licenses their automotive technology to major OEMs (Original Equipment Manufacturers) like BMW, Daimler, Volkswagen, and others. Once licensing agreements are finalized (which takes 12-18 months), OEMs integrate the technology into their vehicle platforms. Production vehicles with Bosch AI cockpits could hit the market in late 2027 or early 2028. High-end vehicles (think Mercedes, BMW) might get it earlier in 2027.

Smart home systems: Faster adoption, probably 2026-2027. Smart home technology moves quicker because it doesn't require the extensive safety certification that automotive systems do. Bosch's smart home products already exist in some markets. CES 2026 announcements likely represent new capabilities or expanded availability rather than entirely new products.

Manufacturing equipment and industrial Io T: Immediate adoption through 2026-2027. Factories can implement this technology immediately once contracts are signed. Industrial decision-making moves faster than consumer markets because ROI is concrete and quantifiable. Expect to see early adopters implementing Bosch predictive manufacturing systems within 6-12 months of the CES announcement.

The key insight: Bosch works in industrial timescales, not consumer timescales. They're not building hype for something launching next month. They're signaling the direction of their multi-year product roadmap.

What Makes Bosch's Approach Different From Competitors

Bosch isn't alone in pursuing AI-powered automotive cockpits, smart home systems, or industrial Io T. Tesla, Google, Amazon, and traditional automakers are all working in these spaces. What differentiates Bosch?

Depth of expertise across multiple sectors: Tesla focuses primarily on vehicles. Amazon focuses on consumer devices and smart homes. Bosch operates across all three sectors simultaneously. This creates unique opportunities for integration. An AI cockpit system that learns your home's energy patterns? That's possible because Bosch understands both automotive and smart home domains.

B2B relationships and OEM partnerships: Bosch has decades-long relationships with every major automotive manufacturer, appliance maker, and industrial equipment producer globally. When they announce technology, it doesn't have to go through consumer marketing. They can license it directly to companies that bring it to market under their own brands. This is less visible to consumers but more powerful commercially.

Manufacturing and supply chain integration: Unlike software-first companies, Bosch actually manufactures products at massive scale. They understand supply chain constraints, production scaling, and cost optimization. When they announce something, they're usually confident they can actually manufacture it at the volumes required.

Regulatory expertise: Bosch navigates automotive regulations globally. They understand NHTSA requirements in the US, EU regulations in Europe, and emerging standards in China. When they design safety-critical systems like AI cockpits, they're already thinking about compliance. That regulatory expertise is often overlooked but absolutely critical for adoption.

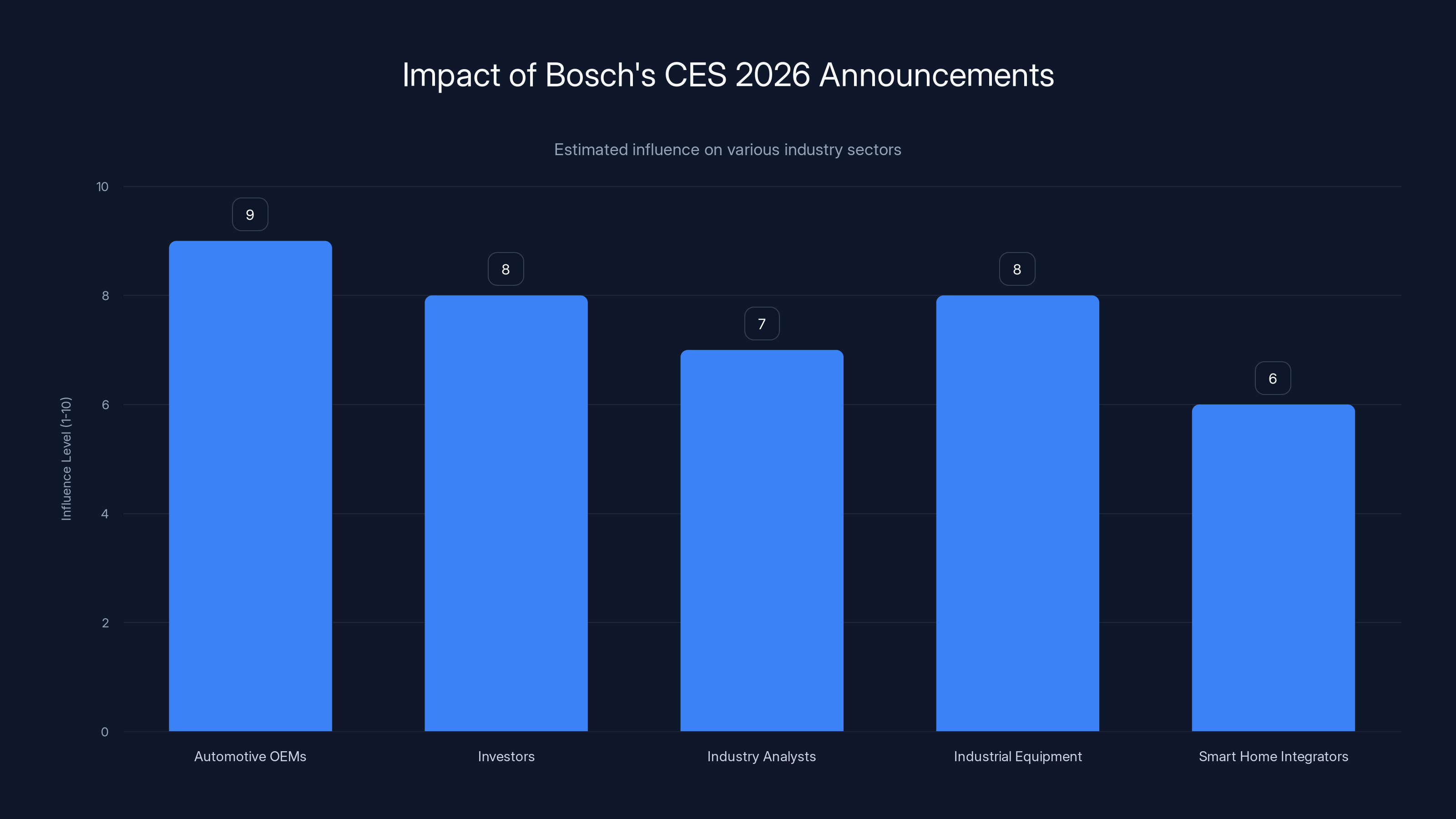

Bosch's CES 2026 announcements are projected to have the highest influence on automotive OEMs and industrial equipment manufacturers, signaling a shift towards AI integration. (Estimated data)

The Competitive Landscape: Who Else Is Doing This?

To understand Bosch's significance, it's worth considering their actual competition:

Tesla: Leading in autonomous driving and vehicle automation but focused on their own vehicles. They're not licensing cockpit technology to other manufacturers, at least not yet.

Traditional OEMs (Volkswagen, BMW, Mercedes): Building their own AI cockpit systems in-house. Volkswagen, for instance, is developing their own software platform rather than licensing from suppliers like Bosch. This creates complexity and delays.

Google and Qualcomm: Developing automotive platforms and competing for the infotainment and connectivity layer. Google's Android Automotive is becoming more prevalent in new vehicles.

Smaller startups (Waymo, Aurora, Cruise): Focused specifically on autonomous driving technology, not the full cockpit experience.

Bosch's advantage is they're the only company simultaneously strong in automotive, smart home, industrial Io T, and cloud infrastructure partnerships. They're the only supplier that can provide a unified platform across multiple sectors.

Why CES 2026 Matters Beyond Press Coverage

CES is ostensibly a consumer electronics show, but it's evolved into something more nuanced. For companies like Bosch, CES is a stage to influence manufacturers, investors, and industry analysts simultaneously. When Bosch announces their AI cockpit strategy at CES, they're not marketing to consumers. They're signaling to automotive OEMs that this technology is ready for licensing. They're showing investors that their AI investments are paying off. They're setting expectations with analysts who cover the industry.

For automotive engineers and product managers at companies like Volkswagen, BMW, and Daimler, Bosch's CES 2026 announcement likely triggers strategic conversations: Do we license this technology or continue building our own? The answers to those questions ripple through entire organizations.

For industrial equipment manufacturers, the manufacturing AI announcement has similar weight. It's a signal that predictive maintenance and AI-powered optimization are moving from experimental to standard. Companies that don't adopt these technologies within 2-3 years risk falling behind competitors who do.

For smart home integrators and builders, Bosch's expanded platform capabilities mean they have new options for meeting energy efficiency requirements and providing premium features to customers.

Bosch's automotive cockpit technology is expected to reach mainstream adoption by 2028, while smart home systems and industrial IoT will see faster integration by 2026-2027. Estimated data based on industry trends.

The Broader Theme: Bridging Physical and Digital

Bosch's overall positioning at CES 2026 centers on a simple but powerful theme: bridging the gap between physical and digital worlds. In the car, this means digital systems that understand and optimize physical driving. In the home, it's digital controls that enhance physical comfort and safety. In the factory, it's digital intelligence that optimizes physical production.

This framing matters because it reflects a fundamental shift in technology. For decades, physical and digital were separate domains. You had mechanical systems (cars, factories, homes) and digital systems (computers, software). They interacted but didn't truly merge.

Now, with AI, real-time sensors, and cloud computing, these worlds are fusing. The line between physical and digital is dissolving. An AI system that controls your home's temperature based on weather patterns and your preferences is neither purely physical nor purely digital. It's both, simultaneously.

Bosch is positioning themselves as the company that understands both domains deeply and can build the integration layer. Whether they succeed depends on execution, partner adoption, and regulatory environment. But the vision they're articulating at CES 2026 represents a genuine strategic insight about where technology is headed.

Key Takeaways from Bosch's CES 2026 Announcements

For consumers: Technologies you interact with 2-3 years from now are likely being announced at CES 2026. Bosch's announcements signal what's coming in the next generation of vehicles, smart homes, and connected devices.

For professionals in automotive, smart home, or manufacturing: Bosch's announcements should directly influence your technology roadmap. These aren't theoretical explorations. These are production-ready technologies becoming available for licensing and integration.

For investors: Bosch's AI investments are yielding tangible products and revenue opportunities. Their partnerships with Microsoft and NVIDIA are working. Their B2B model positions them to capture value across multiple industries.

For industry analysts: The real story isn't Bosch alone. It's the maturation of AI across multiple sectors simultaneously. When a traditional manufacturing company like Bosch can announce credible AI products in automotive, smart home, and industrial applications, it signals mainstream adoption. The AI hype phase is over. The deployment phase is here.

How to Stay Updated Beyond the January 5 Presentation

If you want to follow Bosch's CES announcements in detail, here's the best approach:

Watch the live presentation on January 5 at 12 PM ET. This gives you the context and emphasis that the Bosch team prioritizes.

Check their press releases following the event. Bosch typically publishes detailed press releases for each major announcement within 24-48 hours of the presentation. These provide technical specs and timelines.

Review their booth materials at CES. Physical press kits and booth demos often contain details not mentioned in the main presentation. If you're attending CES in person, spending 30-45 minutes at their booth (16203, Central Hall) is worthwhile.

Follow technology analyst coverage in the days following the presentation. Companies like Gartner and IDC will publish analysis about what Bosch's announcements mean for their respective sectors. These analyses often provide valuable context about competitive positioning and market impact.

Subscribe to Bosch's media newsletter if you want ongoing coverage. They distribute regular updates about new technology deployments and partnerships. This gives you visibility into which automakers are actually licensing their cockpit technology, for instance.

FAQ

What time does the Bosch CES 2026 press conference start?

The Bosch press conference is scheduled for Monday, January 5, 2026, at 12 PM ET (9 AM PT). The livestream is available through the official Bosch press page, and the presentation takes place at booth 16203 in the Central Hall of the Las Vegas Convention Center.

Can I watch the Bosch CES 2026 presentation online if I can't attend in person?

Yes, absolutely. The presentation is livestreamed through the official Bosch press page during the event. If you miss the live broadcast, Bosch typically archives presentations within hours, usually on their corporate YouTube channel or media center. The livestream is often your best option for a clear view, even if you're attending CES, since the press conference venues are typically packed.

What is Bosch actually announcing at CES 2026?

Bosch is announcing AI-powered technologies across three major sectors: automotive cockpit systems that integrate with Microsoft Teams and NVIDIA real-time processing, smart home ecosystem integrations focused on energy efficiency and health monitoring, and manufacturing AI for predictive maintenance and production optimization. These aren't consumer products launching tomorrow—they're technologies being licensed to partners for integration into vehicles, homes, and industrial equipment over the next 2-3 years.

Why does Bosch's CES presentation matter if they don't sell directly to consumers?

Bosch's B2B model means their announcements influence manufacturers, investors, and industry analysts simultaneously. When Bosch announces AI cockpit technology at CES, automotive OEMs like BMW, Volkswagen, and Mercedes use that information to make strategic licensing decisions. The technology eventually reaches consumers through vehicles and products made by these partners, but the immediate impact is on manufacturing and business strategy, not consumer purchasing.

When will Bosch AI cockpit technology actually be available in vehicles?

Expect the first production vehicles with Bosch AI cockpits in late 2027 or 2028, starting with premium brands like Mercedes and BMW. The timeline depends on licensing agreements (12-18 months), OEM integration (12-18 months), safety certification (6-12 months), and production ramp-up. Industrial Io T and smart home implementations will come faster, likely 2026-2027, because they require less regulatory approval than automotive safety systems.

How does Bosch's strategy compare to competitors like Tesla or Google?

Bosch's main advantage is depth across multiple sectors simultaneously. Tesla dominates autonomous driving but only for their own vehicles. Google leads in software platforms but isn't manufacturing at scale. Traditional automakers build their own systems but lack Bosch's expertise in smart home and industrial Io T. Bosch is unique in being strong across automotive, smart home, industrial, and cloud partnerships, enabling integration opportunities that competitors can't replicate.

What are the actual technical capabilities of Bosch's AI cockpit system?

The system integrates Microsoft Teams voice integration for calls (handled through Azure cloud infrastructure), NVIDIA real-time sensor processing for autonomous functions, attention and drowsiness monitoring, predictive hazard identification, and adaptive automation levels that adjust what the vehicle handles versus what the driver controls. It's designed to make driving safer and more comfortable while maintaining driver control and safety as core principles.

Is Bosch's manufacturing AI something small factories can use, or only large enterprises?

Bosch targets both, but their CES 2026 announcements focus primarily on large-scale manufacturing operations where ROI is substantial. However, they're gradually developing scaled-down versions for mid-size operations. The core predictive maintenance concepts apply at any scale, but the implementation approach differs. Small manufacturers typically see value starting around 20-30 pieces of equipment with real-time monitoring.

How do I get access to Bosch's smart home technology if I want to upgrade my home?

Bosch's smart home systems are available through various channels depending on your region. In some markets, they're integrated into new home construction. In others, they're available as retrofit systems through smart home installers. Their CES 2026 announcements likely detail expanded availability and new capabilities. Check the Bosch official website or contact a local smart home integrator for specific options in your area after the CES presentation.

What should automotive engineers focus on regarding Bosch's cockpit technology?

If you work in automotive engineering, understand that Bosch's licensing model will likely become a standard offering from major Tier-1 suppliers within 2-3 years. You should evaluate whether licensing their cockpit platform makes sense versus continuing in-house development. Consider integration timelines, cost comparisons, and competitive differentiation opportunities. Early adopters will have advantages in time-to-market and feature completeness.

How is Bosch addressing data privacy and security in these AI systems?

Bosch hasn't detailed specific security measures in available information, but automotive and smart home systems handling personal data face increasing regulatory scrutiny. GDPR in Europe, data localization requirements in various countries, and vehicle cybersecurity regulations all apply. Their Microsoft partnership likely incorporates Azure's security infrastructure. Expect detailed security documentation once licensing agreements are finalized with OEMs.

Related Articles

- Sony Honda Afeela CES 2026 Press Conference: Complete Watch Guide [2025]

- Tech Resolutions for 2026: 7 Ways to Upgrade Your Life [2025]

- Amazon Echo Dot Smart Home Setup Guide [2025]

- The Night Before Tech Christmas: AI's Arrival [2025]

- [2025] Humanoid Robots in Industrial Settings: Transforming Efficiency