CES 2026: Why EVs Lost to Robotaxis & AI – The Automotive Industry's Dramatic Pivot

Introduction: The Death of the Car Show Dream

For decades, CES (Consumer Electronics Show) held a peculiar dual identity. It was simultaneously the world's largest technology showcase and one of the automobile industry's most important launching pads. Companies like Chevrolet would debut groundbreaking electric vehicles here. BMW, Honda, and Ram would compete for attention with sleek battery-powered concepts. The spectacle was undeniable—color-changing vehicles, shape-shifting vans, flying car prototypes—all vying for headlines and investor enthusiasm.

But something fundamental shifted at CES 2026. The energy, the buzz, the sheer excitement that once surrounded automotive innovation moved elsewhere. Instead of gleaming EV concept cars, the automotive landscape was dominated by something far more abstract: artificial intelligence, autonomous driving systems, and humanoid robots.

Hyundai's keynote presentation embodied this seismic shift perfectly. Rather than showcasing a new affordable electric model or futuristic concept vehicle—the traditional CES playbook—the automaker chose to highlight Boston Dynamics' Atlas robot. Not a new generation. Not an exclusive partnership reveal. Just the same robot the world had already seen multiple times before. The message was unmistakable, though perhaps unintentional: the future isn't about who builds the coolest car anymore. It's about who controls the technology that will power transportation itself.

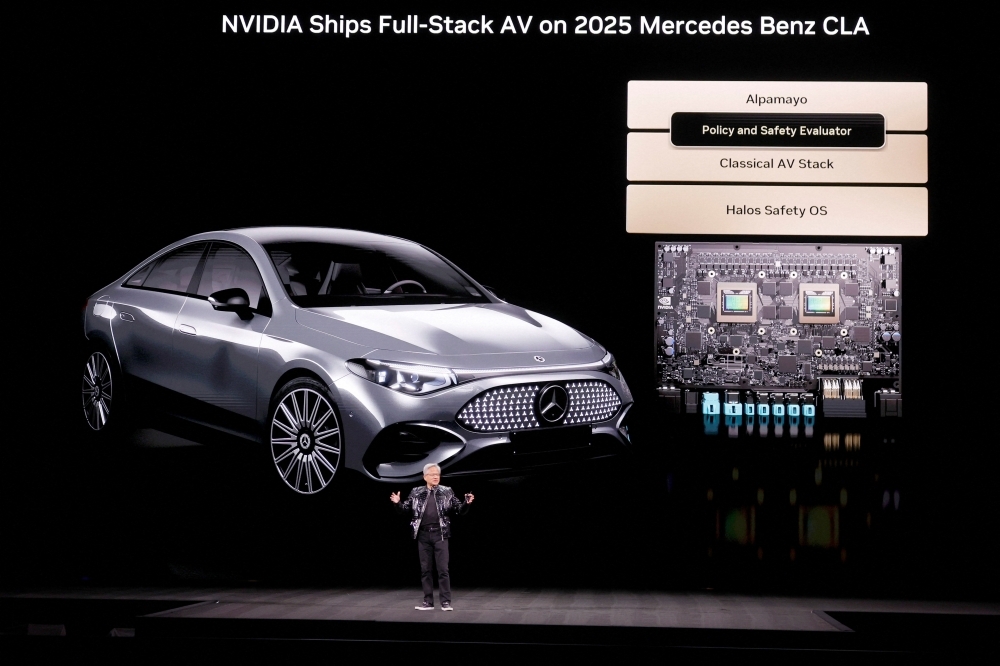

This wasn't an isolated incident. Mercedes announced its Level 2++ driver assistance feature, powered by Nvidia's computing architecture, arriving in US markets later in 2026. Uber showcased its Lucid Gravity robotaxi, signaling the company's continued commitment to autonomous ride-sharing. Nvidia—not a traditional automaker, but the computational backbone of the AI revolution—unveiled an entirely new family of open-source models called Alpamayo, specifically designed to power autonomous driving systems and advanced driver-assistance features.

Meanwhile, the only four-wheeled vehicle to make a significant debut was Sony and Honda's Afeela SUV prototype, with the original Afeela itself still languishing five years into development and years away from actual production. The contrast couldn't have been starker: where innovation once lived, now exists primarily delay and manufactured urgency around software and chips rather than vehicles themselves.

This transformation didn't happen overnight, and it certainly didn't arrive without warning. But CES 2026 crystallized a fundamental realignment in the automotive industry—one driven by economic headwinds, geopolitical uncertainty, and the market's insatiable appetite for AI. To understand how we got here, why this shift matters, and what it means for the future of transportation, we need to examine the convergence of forces that brought us to this inflection point.

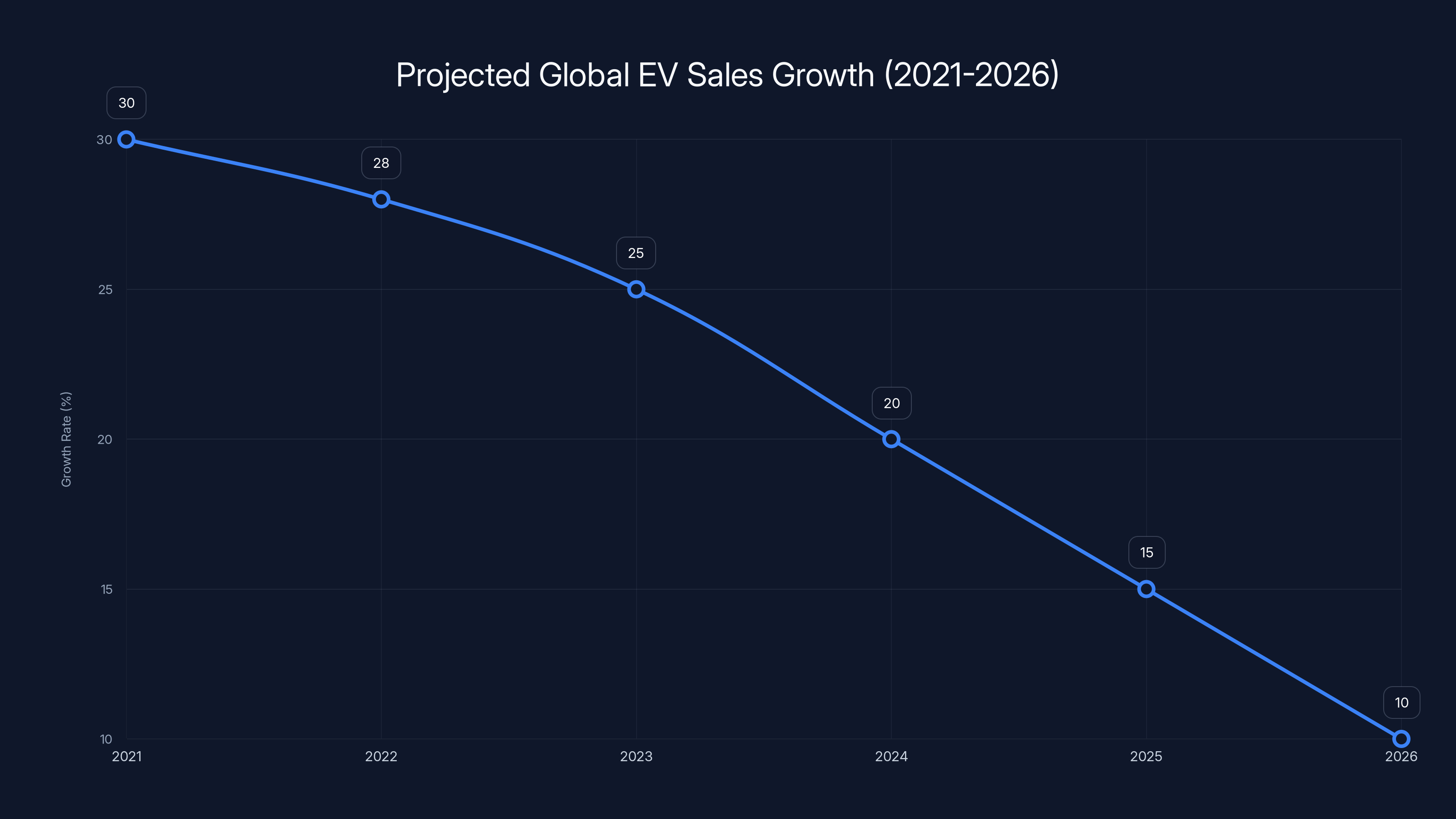

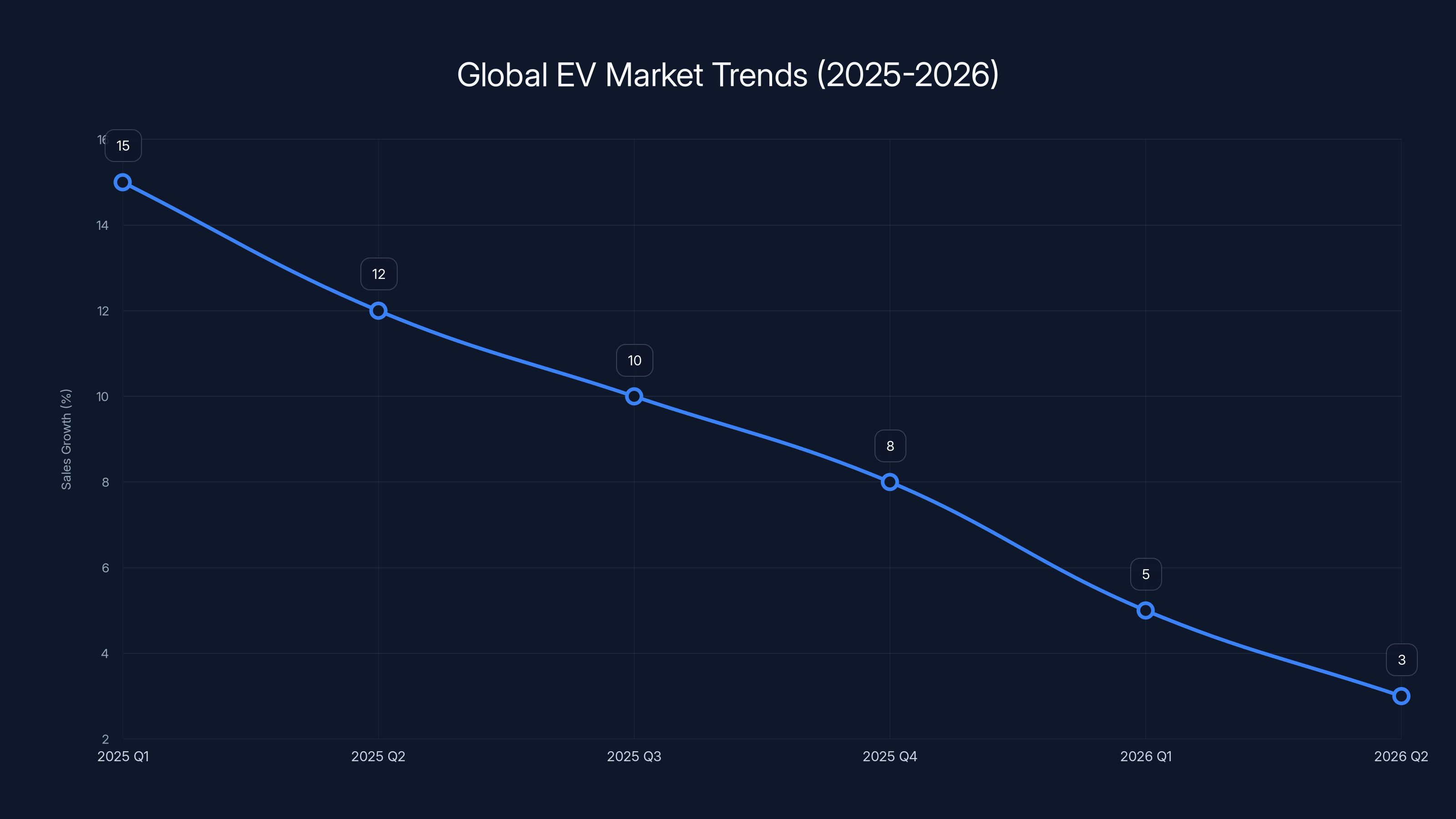

The global EV sales growth is projected to slow significantly by 2026, with a decline from 30% in 2021 to an estimated 10% in 2026. This trend reflects structural challenges and policy shifts, particularly in major markets like China and Europe.

The EV Market's Reality Check: Why Growth Is Slowing

Global EV Sales Momentum Decelerating

The electric vehicle revolution that seemed inevitable just two years ago has hit significant turbulence. Projections for 2026 now anticipate significantly slower growth in global EV sales compared to the preceding five years. This deceleration represents more than just a temporary market correction—it reflects structural challenges that automakers are struggling to address.

The data tells a sobering story. In major markets worldwide, the EV growth trajectory that seemed unstoppable is flattening. China, once the engine of global EV expansion, is winding down its aggressive subsidy programs. The Chinese government's shift away from direct consumer incentives reflects both fiscal constraints and a confidence (perhaps overconfident) that the market has matured enough to sustain itself without artificial stimulation. This change has profound implications because China accounts for roughly 60% of global EV sales. When growth slows there, it reverberates throughout the entire worldwide ecosystem.

Europe faces its own contradictions. The continent committed to an aggressive phase-out of internal combustion engine vehicles, implementing strict emissions regulations that theoretically forced manufacturers toward electrification. Yet European policymakers are now wavering on these timelines, facing pressure from domestic manufacturers struggling with the costs of retooling factories and from voters concerned about purchasing power and job losses in traditional automotive sectors. The European Union's commitment to its 2035 ban on new combustion engine sales, once treated as ironclad, now feels increasingly negotiable.

Meanwhile, the United States—historically the most important automotive market and a crucial proving ground for new technologies—is moving in the opposite direction. The Biden administration's aggressive push to accelerate EV adoption through tax credits, charging infrastructure investment, and regulatory pressure represented the most ambitious government intervention in automotive markets in decades. However, the incoming administration is unwinding much of this policy infrastructure. Tax credits are being reconsidered. Regulatory timelines are being extended. The policy tailwind that was propelling EV adoption is becoming a headwind.

Manufacturing Cost Challenges and Trade Uncertainty

Under these demand headwinds, manufacturers face escalating unit economics. The manufacturing costs associated with battery production haven't declined as rapidly as once anticipated. While battery chemistry has improved and production volumes have increased, the gains haven't been sufficient to offset other rising costs. Raw material prices for lithium, cobalt, and nickel remain volatile. Supply chain disruptions continue to plague manufacturers. Semiconductor shortages, while improving, still create bottlenecks for advanced driver-assistance systems and infotainment platforms.

Simultaneously, global trade tensions have created profound uncertainty. Tariff regimes are shifting. Geopolitical relationships are becoming increasingly transactional. Manufacturers that built supply chains optimized for a pre-2023 world of predictable, rules-based international commerce are now managing constant recalculation. The cost of manufacturing in one country and selling in another has become less predictable, making long-term capital investment decisions extraordinarily difficult.

These manufacturing cost pressures combine with softening demand to create a profitability squeeze. Automakers that ramped up EV production capacity are now operating below optimal utilization rates. Fixed costs are being spread across fewer units. Profit margins on electric vehicles, which never achieved the density of traditional combustion vehicles, are eroding further. In this environment, committing billions to new EV platforms, battery facilities, or advanced driver-assistance systems requires not just technological confidence but genuine faith in long-term demand.

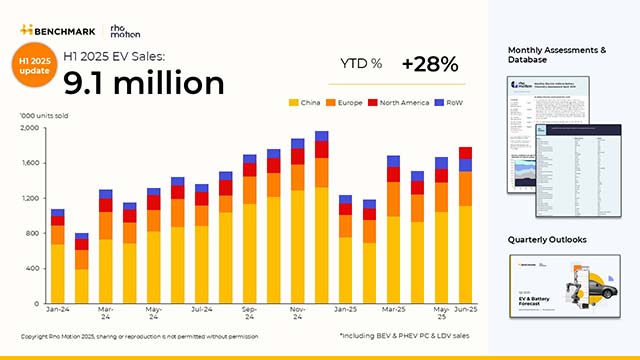

Global EV sales growth has decelerated from 15% in early 2025 to an estimated 3% by mid-2026 due to policy changes and market uncertainties.

The Hybrid Resurrection: A Strategic Retreat

Hybrids as the Pragmatic Middle Ground

Confronted with these realities, automotive manufacturers across the industry are recalibrating their strategies. Rather than full electrification, many are pivoting toward hybrid architectures—vehicles that combine internal combustion engines with electric motors and batteries. This shift represents a fundamental strategic retreat from the "all-electric future" narrative that dominated boardrooms and investor presentations just 18 months ago.

Hybrids offer several compelling advantages in this new environment. They solve the range anxiety problem that continues to plague pure electric vehicles for many consumers. A consumer who drives 50 miles daily can operate in electric mode most of the time, enjoying the efficiency and smoothness of electric propulsion, while maintaining the security blanket of an internal combustion engine for longer trips or when charging infrastructure is unavailable. Manufacturing hybrids requires less fundamental retooling than pure electrics. Factories can often add hybrid capability to existing production lines with capital investments measured in millions rather than billions.

For automakers, hybrids represent a way to meet emissions regulations while maintaining higher profit margins than pure electric vehicles. They satisfy regulatory requirements in markets like Europe and California without the manufacturing cost penalties and demand uncertainty of full electrification. Hybrids are the automotive industry's way of hedging its bets—maintaining a path toward emissions reduction while preserving the option to retreat to combustion engines if the EV transition stalls further.

This pivot is profound because it suggests that even manufacturers with significant EV momentum believe the market's transition to electrification will be slower and messier than previously projected. It's an implicit admission that the "tipping point" toward universal EV adoption hasn't arrived and might not arrive for a decade or more.

Extended-Range EVs: The Compromise Vehicle

Another manifestation of this strategic recalibration is the growing emphasis on extended-range electric vehicles (EREVs or REx vehicles)—primarily electric vehicles that carry a small internal combustion engine or generator for emergency power when battery charge depletes. These vehicles offer genuine electric range for daily driving (typically 50-150 miles) while eliminating range anxiety through onboard combustion backup.

EREVs represent a manufacturing compromise. They're more complex than pure electrics, requiring integration of two completely different propulsion systems. They're more expensive than pure combustion vehicles. They generate more emissions than pure electrics. Yet from a market perspective, they might actually satisfy consumer needs better than either pure option. A consumer gets most of the benefits of electric driving with few of the perceived drawbacks of battery electric vehicles.

The strategic emphasis on hybrids and EREVs signals that manufacturers have lost confidence in the speed of EV adoption. This lack of confidence, in turn, makes massive capital investment in EV-specific production capacity appear reckless. Why build a $2 billion factory optimized for battery electric vehicles when you're uncertain about demand and when you could adapt existing combustion facilities to produce hybrids at a fraction of that investment?

The AI Takeover: Why Technology Now Matters More Than Vehicles

Why Wall Street Demands an AI Strategy

While the EV market stumbled, artificial intelligence captured the world's attention with unprecedented velocity. The launch of advanced generative AI models, the race between technology giants to establish dominance in this emerging space, and the seemingly limitless applications of AI in every industry created a new kind of market mania. Investors became convinced that AI represented not just a new technology but a fundamental restructuring of economic value creation.

For automotive companies, this created a peculiar and somewhat absurd dilemma. The automotive industry generates enormous revenue and manages complex global operations, yet it's increasingly viewed by technology-focused investors and financial analysts as "old tech." To be taken seriously by Wall Street—to maintain stock valuations that reflect growth potential rather than mature-industry reality—automotive companies felt compelled to develop visible AI credentials. This necessity transcended actual technological readiness or market relevance. Companies needed to appear to be AI companies, not just vehicle manufacturers adapting AI to their products.

This is why Hyundai's decision to devote significant keynote time to Boston Dynamics' humanoid robot makes sense from an investor relations perspective, even if it makes little sense from an automotive development perspective. A humanoid robot—a technology years away from practical commercial deployment, with unclear product-market fit—generates headlines, investor excitement, and positioning as a forward-thinking company. It positions the company not as a traditional automaker slowly adapting to technology change, but as an AI pioneer positioning itself for the next decade's opportunities.

Similarly, Mercedes' emphasis on Nvidia-powered driver assistance, Uber's commitment to autonomous robotaxis, and Nvidia's Alpamayo model announcements all reflect this reality: the market values the companies building the brains of the future more than the companies building the vehicles themselves. This is historically unprecedented. General Motors is vastly larger than Nvidia by revenue, yet investors often value Nvidia more highly. Tesla's valuation is predicated more on perceived AI leadership than on current automotive profitability. The market has reassigned dominance.

Autonomous Driving as the Marquee AI Application

With this context, autonomous driving represents the perfect intersection of genuine technological progress, massive market potential, and abstract AI hype. Unlike many AI applications, which remain confined to software and digital services, autonomous driving technology involves physical robots that operate in real-world environments, making high-stakes decisions. It's AI with consequences, which generates both genuine safety and regulatory interest and perfect marketing optics.

Mercedes' Level 2++ announcement—building on Nvidia's automotive computing platform—represents incremental progress in driver assistance that has been ongoing for nearly a decade. Lane-keeping assist, adaptive cruise control, and automatic emergency braking have been steadily advancing. Level 2++ simply extends these capabilities further, creating a system that can handle increasingly diverse driving scenarios without driver intervention. It's genuine technological progress, but it's also evolutionary rather than revolutionary.

Yet Mercedes chose to frame this advancement as a major CES announcement, generating headlines and media coverage far exceeding what the technical achievement alone would warrant. Why? Because autonomous driving is the AI narrative that resonates most powerfully with investors and the technology press. It suggests that the future of mobility will be defined not by the elegance of mechanical engineering or battery technology, but by the sophistication of artificial intelligence directing mechanical and electrical systems.

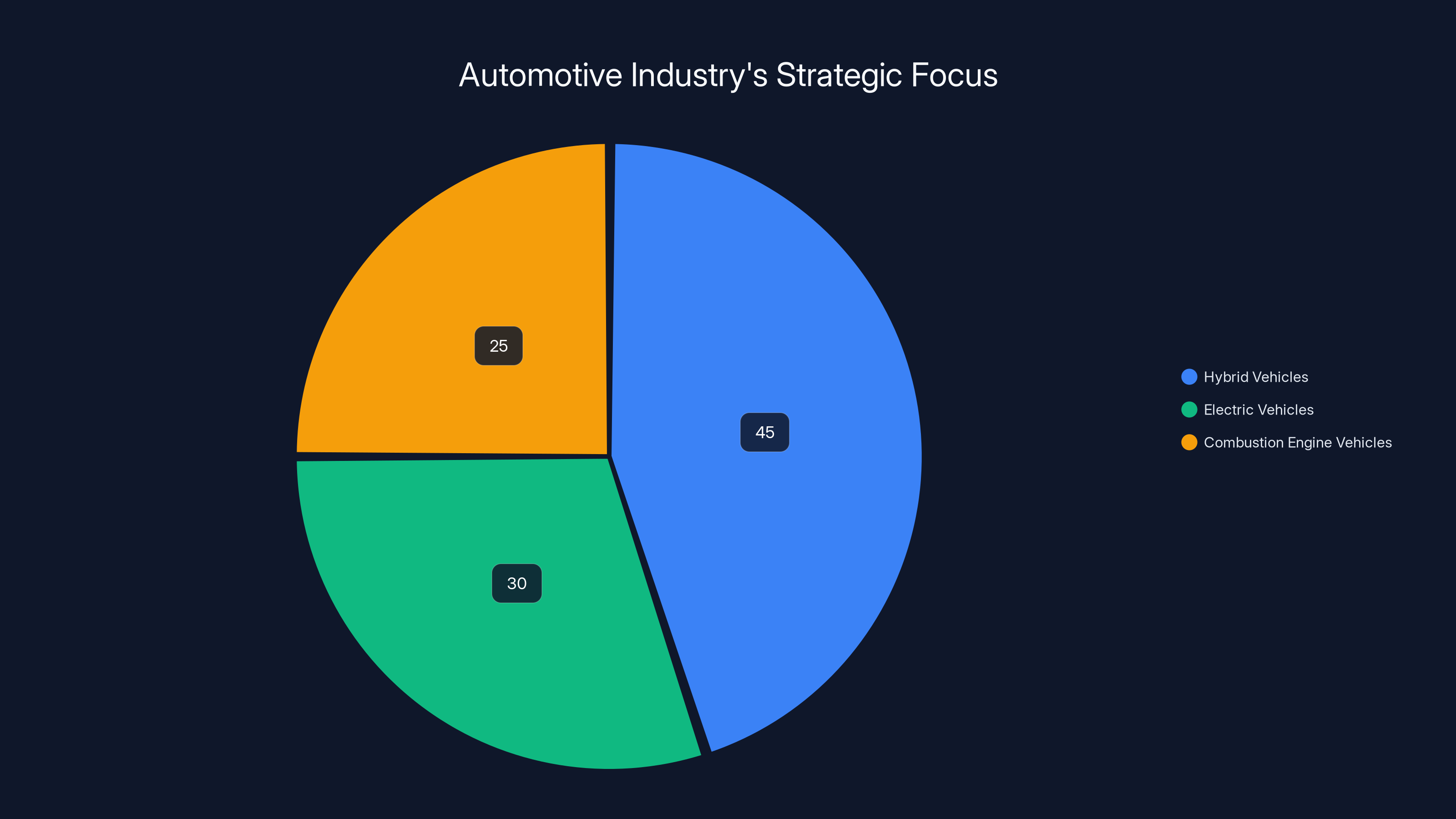

Estimated data suggests a significant focus on hybrid vehicles, reflecting a strategic retreat from full electrification due to market and infrastructure challenges.

Robotaxis and the Autonomous Future Narrative

Uber's Lucid Gravity: Embodying the Robotaxi Dream

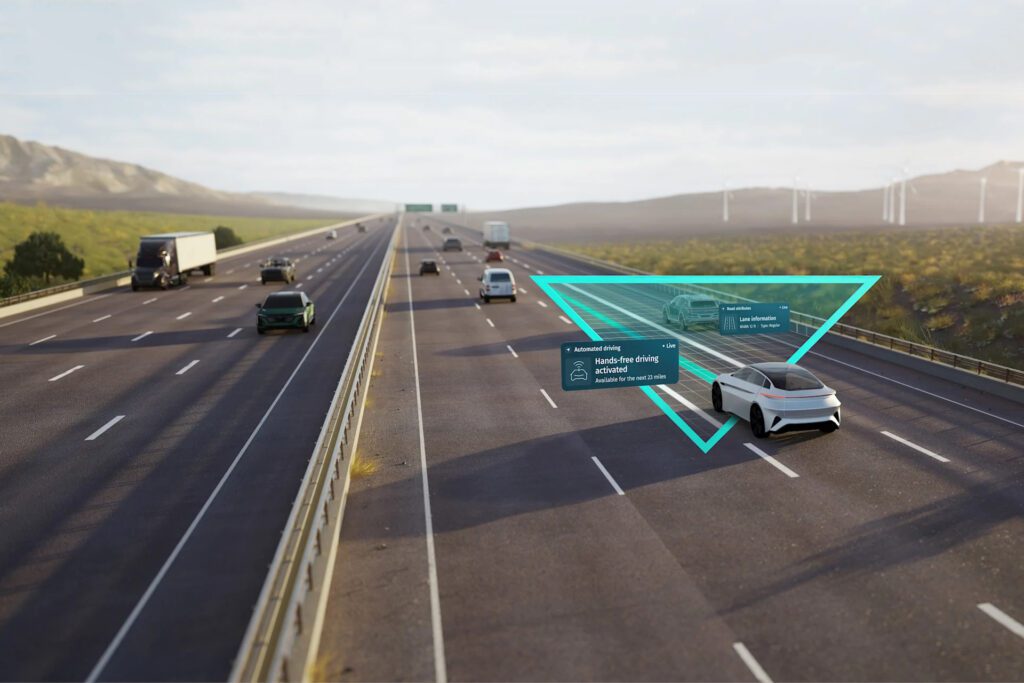

Uber's presence at CES with its Lucid Gravity robotaxi exemplifies how the industry's imagination has shifted. The Lucid Gravity is a compelling vehicle—a high-end SUV combining luxury positioning with advanced autonomous driving capabilities. But its significance isn't its performance as a vehicle. Its significance is its positioning as proof of concept for a future where autonomous robotaxis supplant personal vehicle ownership.

This narrative—the idea that autonomous vehicles will eliminate the need for personal car ownership, that transportation will be provided on-demand through a fleet of robotaxis—has become central to how the automotive industry and technology companies discuss the future. It's intoxicating to investors because it implies a complete restructuring of the transportation market, with enormous opportunities for companies that can establish dominance in autonomous mobility platforms.

The robotaxi narrative also explains why personal vehicle advancement has become secondary. If the future is autonomous robotaxis, then optimizing a vehicle for driver experience (acceleration, handling, comfort when operated manually) becomes less important than optimizing it for fleet economics and autonomous driving performance. The Lucid Gravity isn't designed to be driven by people who enjoy driving—it's designed to be driven by nobody, carrying passengers who don't need to pay attention.

This narrative shift, while still speculative, has profound implications for how companies allocate capital and how they justify their strategies to investors. A company investing in autonomous mobility platforms can claim transformative potential. A company optimizing battery chemistry or improving charging infrastructure is engaged in necessary but ultimately incremental work.

Regulatory Pathways for Autonomous Vehicles

A crucial reality undergirding the robotaxi enthusiasm is that regulatory pathways for autonomous vehicles have begun to solidify in certain jurisdictions. California, Arizona, and several other US states have developed permitting frameworks that allow companies to test autonomous vehicles on public roads with varying levels of human supervision. This regulatory progress creates genuine optionality for companies developing autonomous technology.

However, it's crucial to distinguish between regulatory permission and commercial viability. A company can legally deploy autonomous vehicles in a specific jurisdiction and still face enormous challenges achieving profitability or demonstrating consumer demand. The regulatory framework removes one barrier, but many remain.

Yet from an investor and corporate communication perspective, regulatory progress enables a powerful narrative: "We have permission to operate autonomously in X jurisdiction, therefore the technology is real, therefore we are positioned to capture the robotaxi market." This narrative progression simplifies what remains an extraordinarily complex technical and commercial challenge into something that sounds like an inevitable future.

Nvidia's AI Infrastructure Dominance: The Real Winner

Alpamayo Models: Powering the Autonomous Future

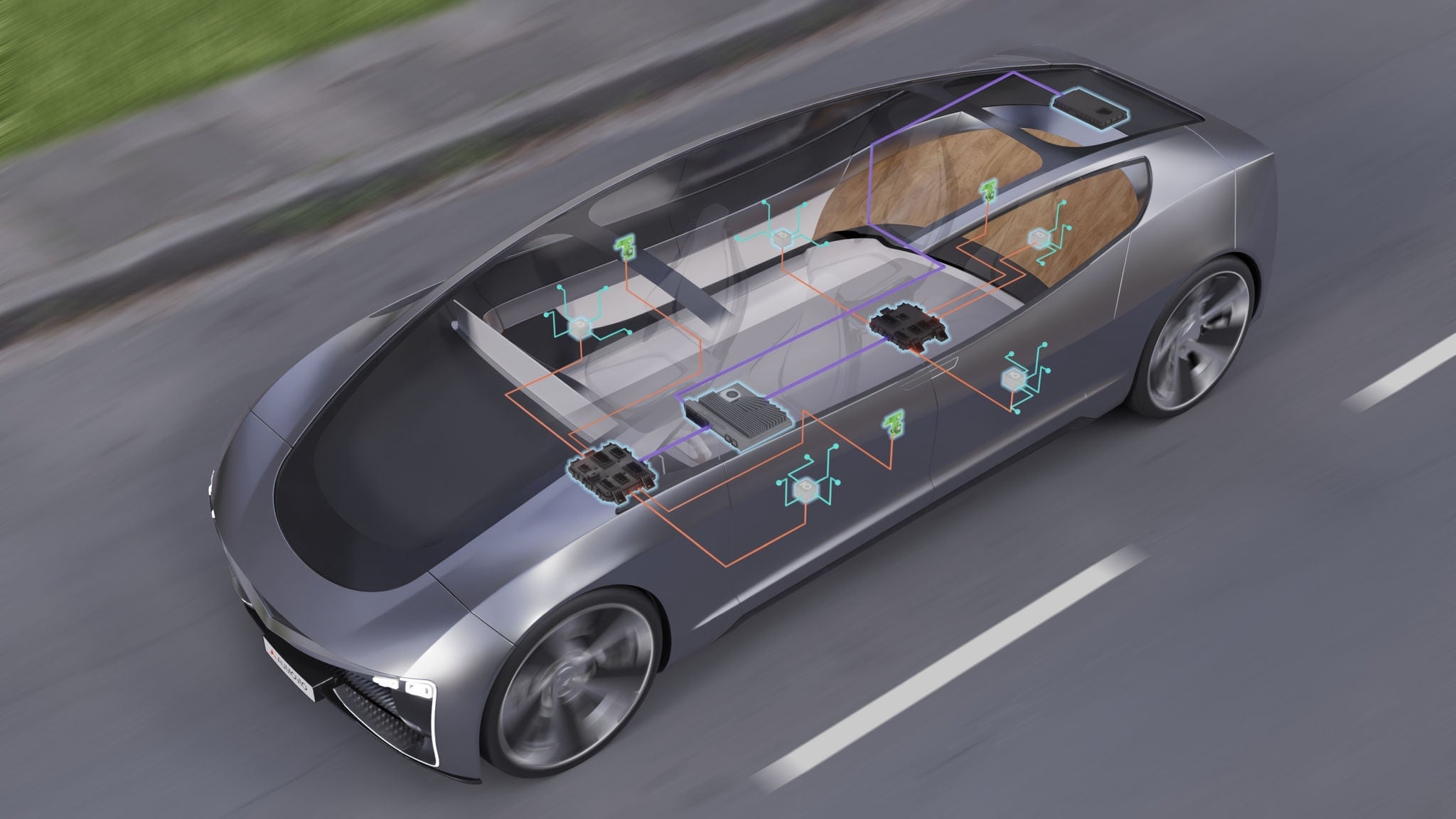

Nvidia's announcement of its Alpamayo family of open-source models deserves special attention because it reveals where the industry's real power dynamics are shifting. Nvidia, which began as a graphics card manufacturer, has positioned itself as the essential computational infrastructure powering autonomous driving systems. The company's CUDA architecture, specialized AI accelerators, and comprehensive software ecosystem have made it nearly impossible for automotive companies to develop serious autonomous driving capabilities without relying on Nvidia's technology.

The Alpamayo announcement reflects Nvidia's strategy to deepen this dependence. By developing and open-sourcing models specifically optimized for autonomous driving and driver assistance, Nvidia shifts from being a hardware infrastructure provider to being an integrated software-and-hardware partner. Automotive companies that want to compete in autonomous driving find themselves adopting Nvidia's entire stack: processors, software frameworks, AI models, and development tools.

This concentration of power in Nvidia's hands explains something crucial about the AI-ification of CES 2026: Nvidia, not any automotive manufacturer, controls the foundational technology enabling autonomous vehicles. From Nvidia's perspective, it doesn't matter whether individual automakers succeed with electric vehicles or hybrids. Nvidia's profits come from the chips, software, and models powering whatever vehicles get manufactured. Automotive competition becomes secondary to Nvidia's market dominance in AI infrastructure.

The Economics of AI Infrastructure Vs. Vehicle Manufacturing

This matters profoundly for understanding capital allocation decisions across the industry. Manufacturing vehicles is capital-intensive, operationally complex, geographically distributed, and subject to intense price competition. Building AI infrastructure and software is capital-intensive in different ways (massive data centers, world-class engineering talent, research and development) but offers substantially higher profit margins and greater scaling potential. Each additional customer using an AI infrastructure platform adds incremental value with minimal additional cost.

Automakers face a strategic choice: continue trying to compete with each other through vehicle design and manufacturing excellence, or increasingly adopt third-party AI platforms (Nvidia, Google, Amazon AWS, or others) that handle the computational complexity while the automakers focus on vehicle integration and customer relationships. The former requires building and maintaining expensive, complex expertise. The latter reduces differentiation but also reduces risk and capital intensity.

Nvidia's CES presence, with its Alpamayo announcements, represents an effort to accelerate this outsourcing. By demonstrating that Nvidia models can power effective autonomous driving systems, Nvidia reduces the perceived need for automotive companies to build in-house autonomous driving capabilities. Why spend billions developing your own self-driving technology when you can license Nvidia's?

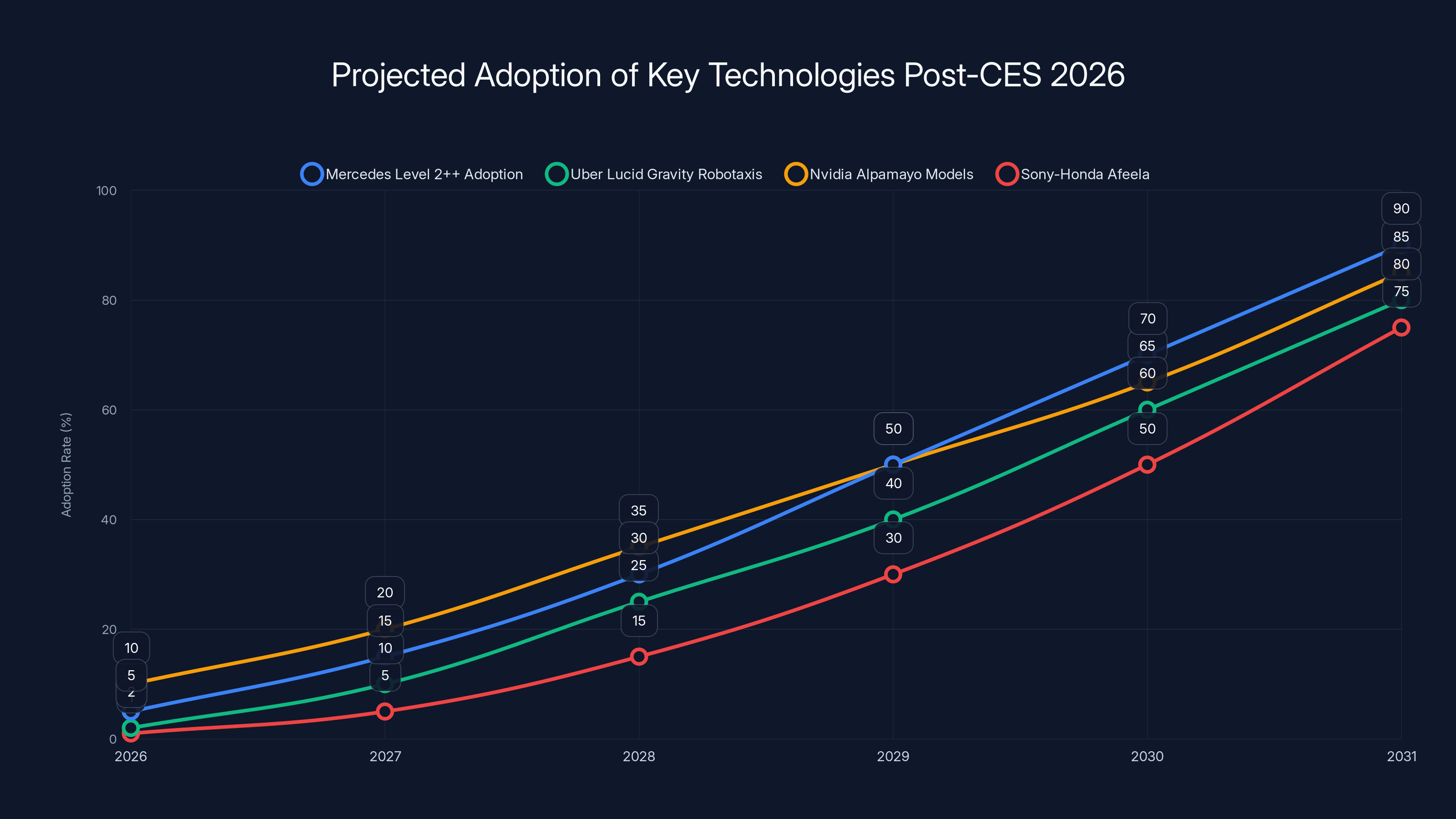

Estimated data suggests significant growth in adoption of technologies announced at CES 2026 by 2031, with Mercedes' Level 2++ and Nvidia's Alpamayo models leading the way.

Boston Dynamics' Atlas: The Humanoid Robot Hype Cycle

Why Automakers Suddenly Care About Robots That Don't Drive

Perhaps the most bewildering element of CES 2026's automotive coverage was the emphasis on humanoid robots, culminating in Hyundai's keynote celebration of Boston Dynamics' Atlas. For a company primarily known for manufacturing vehicles, the decision to highlight a robot that doesn't drive, doesn't have obvious applications in transportation, and has been under development in various forms for over a decade requires explanation.

The answer lies in perception management and market positioning. Humanoid robots capture public imagination in ways that incremental improvements to driver-assistance systems don't. A humanoid robot solving complex physical tasks evokes science fiction imagery and suggests a company thinking about far-future possibilities. It positions Hyundai not as a manufacturer trying to adapt to electric vehicles and autonomous driving (a reactive posture) but as a forward-thinking technology company exploring the next technological frontier.

Boston Dynamics itself is owned by Hyundai's parent company, Hyundai Motor Group. Showcasing the robot effectively showcases Hyundai's ownership of cutting-edge robotics capabilities. It suggests that when humanoid robots do achieve commercial viability—perhaps in manufacturing, logistics, or other industrial applications—Hyundai will be positioned as a leader. It's strategic brand positioning disguised as technology announcement.

But the deeper logic is more interesting: by emphasizing robotics, Hyundai positions itself alongside Nvidia, Tesla, and other companies framing the future in terms of artificial intelligence and autonomous systems rather than in terms of automotive engineering. It signals that Hyundai understands the future isn't about making better vehicles—it's about understanding how intelligence (artificial or applied robotically) will reshape entire industries.

The Misalignment Between Humanoid Robots and Transportation

Yet this emphasis on humanoid robots represents a fundamental misalignment between what's technically exciting and what's commercially relevant to transportation. A humanoid robot's value lies in its ability to substitute for human labor in diverse environments—manufacturing, construction, hazardous material handling, healthcare. Its relationship to vehicle manufacturing or autonomous transportation is tenuous at best.

A robotaxi doesn't need humanoid characteristics. It needs wheels, computing power, sensors, and autonomy. A manufacturing facility that uses humanoid robots in some processes doesn't thereby become better at manufacturing vehicles. The enthusiasm for humanoid robots reflects the broader technology industry's infatuation with robotics and AI for their own sake, not because they solve specific, pressing problems in transportation.

Yet from a corporate communication perspective, humanoid robots accomplish something crucial: they make a company seem futuristic, visionary, and positioned for disruption. Investors reward this positioning with higher valuations, employees want to work for such companies, and the media covers them more extensively. The humanoid robot enthusiasm at CES 2026 says more about investor psychology and corporate brand management than about technological trajectories in transportation.

The Sony-Honda Afeela: Ambition Deferred

A Concept Car That Forgot to Become a Real Car

Among the automotive announcements at CES 2026, the Sony-Honda partnership deserves examination as a case study in how even collaborations between technology and automotive giants can struggle with execution. Sony and Honda introduced the Afeela SUV prototype, representing the original Afeela concept's evolution toward production. The original Afeela was unveiled five years prior—an eternity in automotive development cycles.

Five years after the initial announcement, the Afeela remains a prototype, still years away from actual production and customer delivery. What should have been a success story—a collaboration between a technology powerhouse (Sony) and an automotive innovator (Honda)—has instead become emblematic of the challenges in executing ambitious vehicle programs in the current environment.

The Afeela's slow progression reflects multiple challenges: the difficulty of integrating advanced autonomous driving capabilities into a production vehicle, the complexity of homologating and certifying autonomous systems across different jurisdictions, the manufacturing challenges of implementing novel architectures at scale, and the broader uncertainty about market demand for high-technology vehicles in an economic environment where consumers increasingly prioritize affordability and practicality.

Yet Sony-Honda chose to showcase the Afeela prototype at CES, generating headlines about a "new" model that is functionally identical to what was shown years prior. This suggests that even companies with strong track records of innovation and execution are struggling to advance beyond prototype and demonstration phases in autonomous vehicle development.

The Five-Year Prototype Trap

The Afeela's extended development timeline reveals something crucial about cutting-edge automotive technology: demonstrations and prototypes are far easier than production-ready vehicles. A prototype can have numerous compromises—limited range, expensive-to-manufacture components, reliability issues that are acceptable in controlled testing but not in consumer service. Moving from prototype to production-ready vehicle requires solving thousands of engineering details, optimizing manufacturing, establishing supply chains, building quality control systems, and certifying systems for safety and regulatory compliance.

For autonomous vehicles specifically, the development challenge is compounded by the need to accumulate billions of miles of real-world driving data, demonstrate safety equivalent to human drivers across diverse environments and weather conditions, and satisfy regulators with increasingly sophisticated safety requirements. No company has yet compressed this process into less than five to seven years for a novel architecture.

The Afeela's slow progression suggests that Sony and Honda may have underestimated these challenges. Or they may have accurately estimated them and are proceeding at an appropriately cautious pace. Either way, the message is clear: even the world's most capable technology and automotive companies are finding that the gap between prototype and production is measured in years, not months.

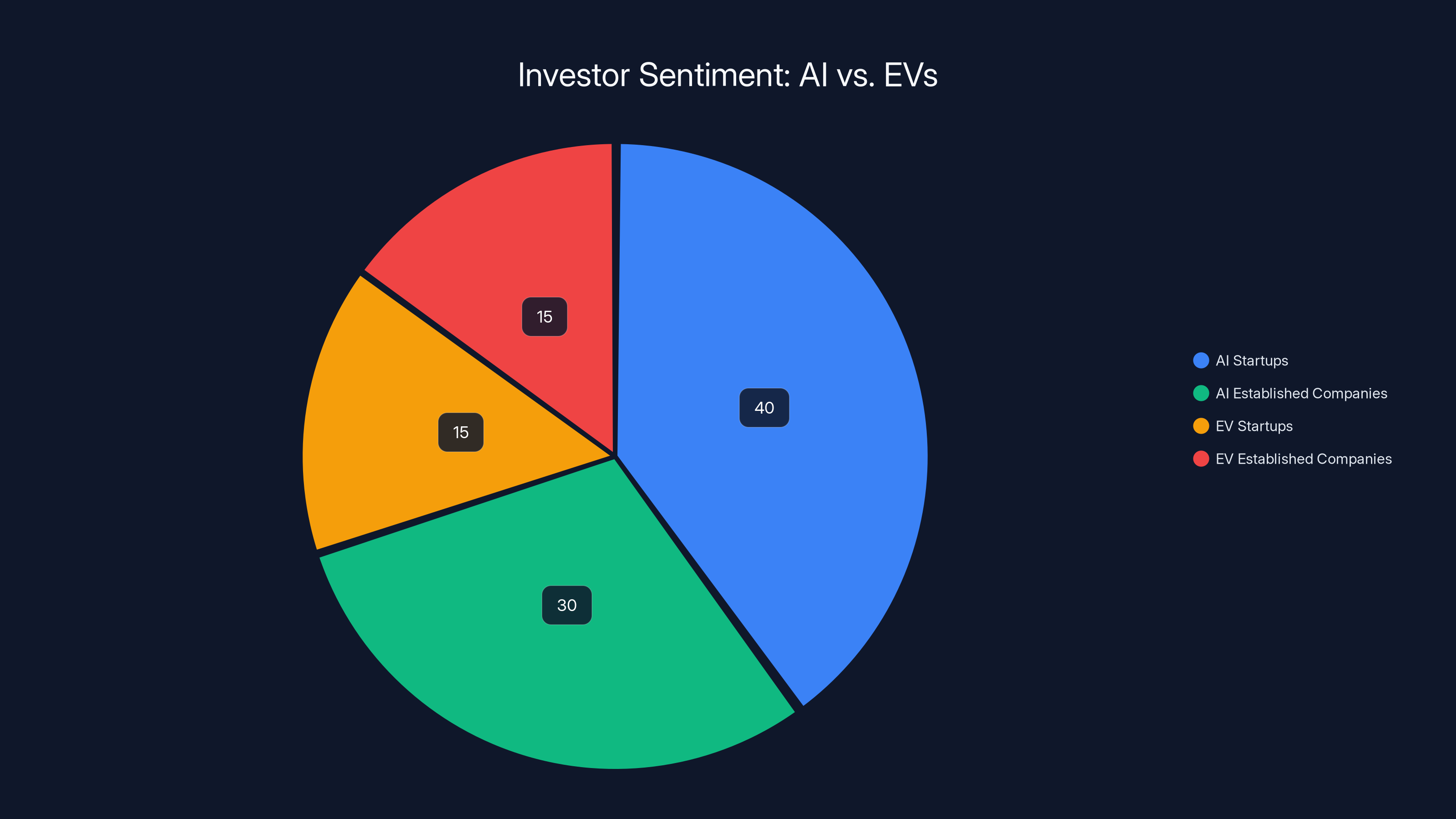

Investors allocate more capital to AI startups and established AI companies due to perceived limitless market opportunities, while EV companies receive less due to market commoditization. (Estimated data)

Market Psychology: Why AI Excites Investors More Than EVs

The Maturation Narrative and Investor Sentiment

A crucial component of understanding CES 2026's pivot from EVs to AI lies in investor psychology and valuation frameworks. Electric vehicles, while still growing globally, have transitioned in investor perception from revolutionary technology to incremental engineering improvement. The first generation of consumer EVs—Tesla Model S, Nissan Leaf, Chevy Bolt—seemed revolutionary. But consumers and investors now understand that EVs are fundamentally vehicles with different propulsion systems. The problems they solve (emissions, fuel efficiency) are important but not novel. The problems they create (range limitations, charging infrastructure gaps, battery costs) are well-understood.

In contrast, artificial intelligence in autonomous driving and robotics still occupies the realm of apparent possibility. The technology is advancing rapidly, the applications seem transformative, and the market opportunities appear nearly limitless. An investor who hears about incremental improvements in battery chemistry or EV charging speeds might think "that's nice, but the market is still uncertain." But an investor who hears about autonomous vehicles and AI-powered robotics thinks "that's the future, and whoever dominates this space will capture enormous value."

This perception gap translates directly into capital allocation. Investors are willing to fund AI companies at high valuations based on speculative future outcomes. They're more skeptical of EV companies, even established ones with proven technology, because the market is perceived as increasingly commoditized and competitive. A startup with a hypothesis about using large language models for autonomous vehicle planning can raise hundreds of millions. An established automaker trying to reduce EV production costs might struggle to communicate why incremental margin improvements justify capital expenditure.

The industry's shift toward emphasizing AI isn't purely organic—it reflects investor pressure on management teams to frame their strategies in terms that resonate with technology-focused investors and analysts. Companies that want high valuations must be AI companies, not vehicle manufacturers. This imperative fundamentally changes corporate communication and, ultimately, capital allocation decisions.

The Visibility Problem for Traditional Automotive Progress

There's also an element of visibility at work. Autonomous driving, AI models, and robotics are exciting to discuss in conferences and media coverage. They inspire imagination and generate headlines. Improvements in battery energy density, advances in thermal management, or optimization of manufacturing processes are important but unglamorous. A CEO discussing "we improved our cell energy density by 8% through novel cathode chemistry" doesn't capture media attention. A CEO discussing "we're using large language models to power the next generation of autonomous vehicles" dominates the news cycle.

For publicly traded automotive companies, media attention and investor enthusiasm directly impact stock price. A CEO's primary obligation is to shareholders, and strategies that improve long-term profitability but generate limited media excitement are less attractive than strategies generating headlines and investor enthusiasm, even if their long-term commercial viability is uncertain.

This creates a perverse incentive structure where companies may emphasize speculative AI projects over proven, profitable automotive engineering. The humanoid robot announcements, the autonomous vehicle demonstrations, the AI model releases—all serve marketing and investor relations functions more effectively than they serve actual customer transportation needs.

CES 2026 as Symptom of Broader Industry Anxiety

Economic Headwinds and Strategic Uncertainty

Underlying CES 2026's transformation is a deeper layer of industry anxiety and strategic uncertainty. The automotive industry faces genuine headwinds that no amount of AI enthusiasm can entirely obscure. Global trade tensions create manufacturing uncertainty. Cost pressures persist. EV demand is proving more uncertain than previously projected. The transition to autonomous driving, while inevitable in some form, remains uncertain in timing and scope.

When industries face genuine uncertainty about their futures, strategic behavior becomes increasingly defensive and speculative. Companies can't confidently commit billions to specific technological pathways because the outcomes are uncertain. Instead, they hedge their bets: invest in EVs, hybrids, and extended-range vehicles simultaneously. Announce autonomous driving programs, AI partnerships, and robotics initiatives. Maintain optionality while projecting confidence.

This defensive posture explains why CES 2026 felt so different from CES 2015. A decade ago, the automotive industry was moving toward a clear vision: electrification of personal vehicles powered by increasingly sophisticated battery technology. Now the industry is fractured between multiple possible futures: autonomous robotaxis replacing personal vehicles, hybrids extending the life of combustion-powered vehicles, electric vehicles continuing their gradual expansion, hydrogen fuel cells potentially emerging as a surprise winner, and AI-powered driver assistance potentially making personal vehicle ownership more attractive despite congestion and parking challenges.

With multiple possible futures and enormous capital required to commit to any single pathway, companies increasingly choose to appear positioned for all futures. This leads to announcements like Hyundai's Boston Dynamics robot—it doesn't commit the company to any particular vehicle architecture, but it positions Hyundai as a technology leader regardless of which future actually emerges.

The Role of Geopolitical Uncertainty

Geopolitical factors are also crucial here. The rise of China as an EV manufacturing powerhouse, combined with increased US protectionism and shifting alliances, creates genuine uncertainty about global automotive markets. A US-based automaker cannot confidently expand EV manufacturing in China (geopolitical risk). Cannot rely on Chinese battery supplies (strategic vulnerability). Cannot assume traditional manufacturing locations in Europe or North America remain optimal (trade policy uncertainty).

This uncertainty makes long-term strategic bets on specific vehicle architectures or manufacturing locations extremely risky. Companies respond by moving slowly, hedging, and emphasizing AI and software capabilities (which are geography-agnostic and less vulnerable to trade policy shifts) over physical manufacturing.

CES 2026's emphasis on AI, autonomous driving, and robotics—relatively geography-agnostic technological capabilities—reflects this geopolitical reality. A company announcing advanced autonomous driving capabilities doesn't have to explain where it will manufacture vehicles or how tariffs might impact profitability. A company announcing a major EV manufacturing expansion now has to address multiple geopolitical uncertainties simultaneously.

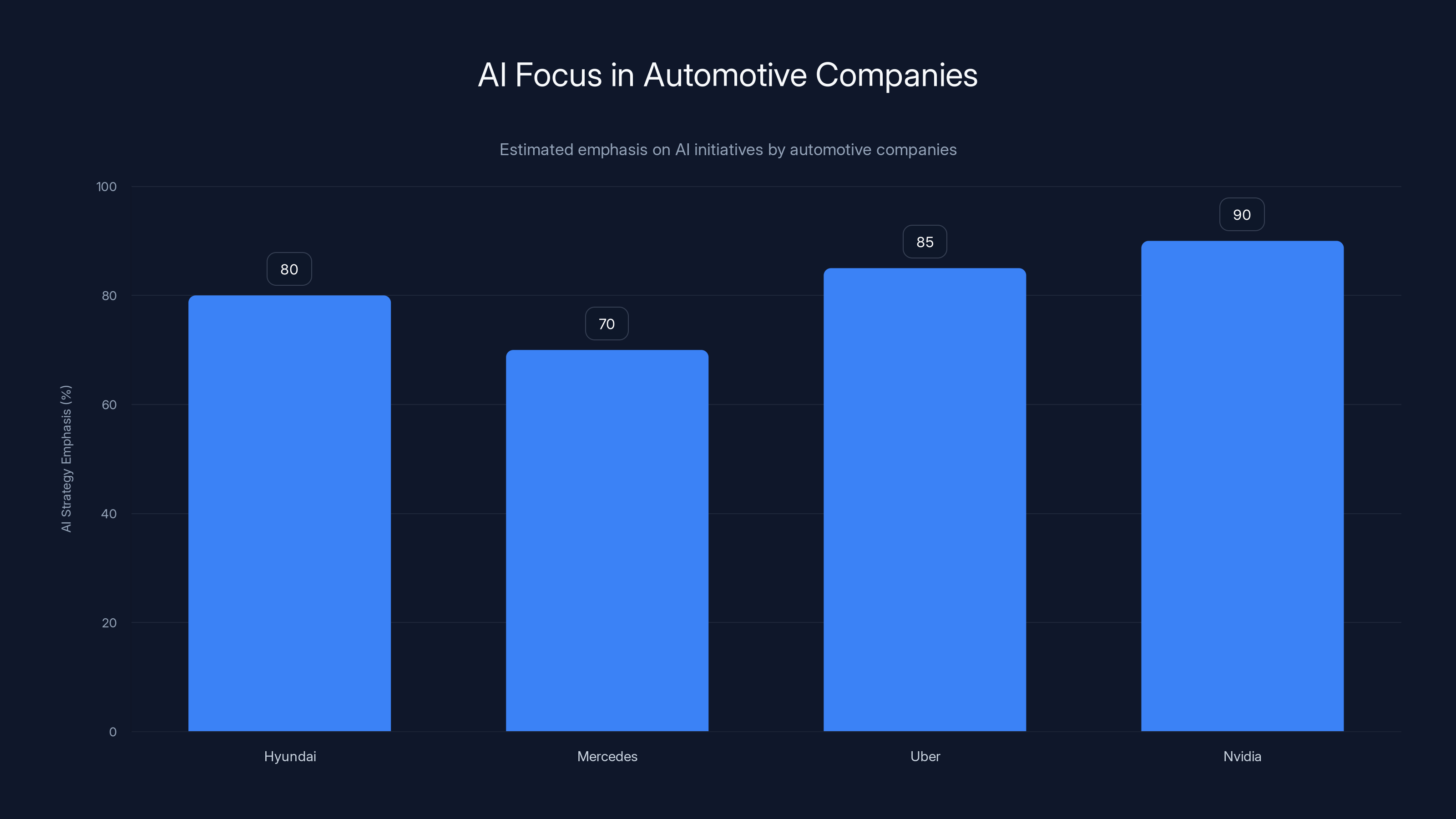

Automotive companies are increasingly emphasizing AI strategies to appeal to investors, with Hyundai and Uber leading in AI focus. Estimated data.

What CES 2026 Reveals About the Automotive Industry's Trajectory

The Stratification of Automotive Competition

CES 2026 suggests that automotive competition is becoming increasingly stratified. At one level, there's the question of who builds vehicles people actually want to drive and own—a competition that remains fierce but increasingly seems like a commodity business where competition revolves around price, reliability, and design. At another level, there's competition over who controls the foundational technologies—AI infrastructure, autonomous driving platforms, battery technology, manufacturing processes—that will underpin the vehicles of the future.

Traditional automotive companies like Mercedes, Hyundai, and Honda are attempting to compete at both levels simultaneously. They're trying to remain competitive in the vehicle business while also positioning themselves as technology leaders. This dual competition is extraordinarily difficult. It requires both manufacturing excellence and cutting-edge research and development. It requires maintaining existing profitable businesses while simultaneously investing in speculative technologies that may not generate revenue for years or decades.

Meanwhile, technology companies like Nvidia are focusing exclusively on the foundational technology level. They're not trying to build vehicles. They're building the computational infrastructure and AI models that all vehicles will eventually depend on. From a business perspective, this is far more attractive. Higher margins, greater scaling potential, and less direct competition.

Some companies—notably Tesla—are attempting a different approach: starting with vehicles but using them as platforms for capturing data about autonomous driving and using that data to train AI models. Other companies—potentially Waymo and other autonomous driving specialists—are developing autonomous driving technology independently of traditional automakers, positioning themselves as platform providers or robotaxi operators rather than vehicle manufacturers.

The Decline of the Vehicle-Centric Automotive Industry

What CES 2026 demonstrates is the decline of the vehicle-centric automotive industry. For a century, automotive competition centered on the vehicle itself: its engineering, its styling, its performance, its reliability. The best companies built the best vehicles, and consumers chose vehicles based on their merits.

Increasingly, automotive competition is shifting to the layers around the vehicle: the software that operates it, the AI systems that navigate it, the platforms that coordinate and manage it, the data streams that improve it. In this new competitive landscape, the vehicle itself becomes almost incidental—a physical platform for deploying software and AI systems that represent the actual competitive battleground.

This shift has enormous implications. It means that companies that are best at software and AI—technology companies—have structural advantages over companies that are best at mechanical engineering and manufacturing—traditional automakers. It means that profitable competition increasingly happens at the platform and infrastructure level rather than at the vehicle level. It means that consumers' experience of transportation is increasingly mediated by software and AI rather than by mechanical systems.

CES 2026's emphasis on autonomous driving, AI models, and platform technologies reflects this fundamental shift. The conference is no longer primarily about celebrating vehicles. It's about celebrating the technological infrastructure that vehicles are becoming increasingly dependent on.

Looking Forward: What Comes After CES 2026

The Next Five Years: Prototypes Becoming Products

The announcements made at CES 2026—Mercedes' Level 2++ driver assistance, Uber's Lucid Gravity robotaxi, Nvidia's Alpamayo models, Sony-Honda's Afeela prototype—represent commitments that will be evaluated over the coming five years. By 2031, will Level 2++ driver assistance be standard across Mercedes' lineup and genuinely helpful to drivers? Will Uber's Lucid Gravity robotaxis be operating profitably in multiple cities? Will Alpamayo models have enabled a new generation of autonomous driving breakthroughs? Will the Afeela finally be in customer hands?

Historically, the answer is mixed. Some announced technologies prove transformative. Others fade as technical challenges prove more difficult than anticipated or as market demand fails to materialize. The autonomous driving field has dozens of examples of both. Some companies have steadily advanced autonomous capabilities over years. Others invested billions and eventually abandoned the effort.

The coming years will separate genuine technological progress from hype-driven announcements. Companies that made ambitious AI and autonomous driving commitments at CES 2026 will need to demonstrate concrete progress. Regulatory approval will accumulate (or fail to). Commercial deployments will succeed or fail. Consumers will adopt or reject autonomous features.

The Unresolved Questions About Transportation's Future

Despite all the excitement about autonomous driving and AI at CES 2026, fundamental questions about transportation's future remain unresolved. Will autonomous vehicles primarily emerge as robotaxis eliminating personal vehicle ownership, or will they primarily function as advanced driver assistance systems in privately owned vehicles? Will battery electric vehicles dominate the future, or will hybrids and extended-range vehicles prove more aligned with consumer preferences and economic constraints?

Will the computational requirements of autonomous driving force vehicles to remain perpetually connected to cloud-based AI systems, or will on-vehicle AI become sophisticated enough to handle most decisions locally? Who will ultimately control autonomous vehicle platforms—technology companies, automotive manufacturers, or new companies built specifically for robotaxi operations? How will urban planning and infrastructure adapt to autonomous vehicles?

These questions lack clear answers. CES 2026 showcased companies' current hypotheses about these questions, but time will determine which hypotheses prove correct.

The Likely Near-Term Outcome: Gradual, Unglamorous Progress

While CES 2026 emphasized dramatic possibilities—humanoid robots, autonomous robotaxis, AI-powered vehicles—the most likely near-term outcome is far more prosaic. Over the next five years, automotive technology will likely advance gradually and somewhat unglamorous. Batteries will improve incrementally. Driver assistance systems will expand their capabilities, allowing more hands-free driving in more conditions. Electric vehicles will capture an increasing share of the market, but not explosively. Hybrids will flourish as manufacturers hedge their bets. Autonomous vehicles will continue operating in limited conditions—highway driving, robotaxi services in specific geographies—but won't achieve the universality that advocates project.

Meanwhile, AI will become increasingly embedded in vehicle software, but this embedding will happen invisibly, without the fanfare of CES announcements. A manufacturer won't announce "we're using transformer-based neural networks to improve our weather prediction for adaptive lighting"—the improvement will simply appear in the vehicle.

This gradual progress won't generate headlines or excite investors. It won't be celebrated at future CES conferences. It will, however, be where most of the actual progress toward safer, more efficient, more autonomous transportation happens. The unglamorous engineering work of moving from prototype to production, from demonstrations to deployed systems, from laboratory conditions to real-world conditions—this is where futures are built.

CES 2026 celebrated the exciting, speculative frontier of automotive technology. The actual future will be determined by the millions of engineering decisions that no one celebrates at conferences.

The Broader Technology Landscape: Why This Shift Isn't Really About Cars

AI as the Central Narrative of 2026

To fully understand CES 2026's transformation, it's important to recognize that the shift from EVs to AI isn't really about vehicles at all. It's about the ascendancy of artificial intelligence as the central narrative of the technology industry in 2026. Automotive is just one arena where this broader narrative is playing out.

Investors, analysts, and technology leaders have become convinced that AI represents a fundamental restructuring of economic value creation. Every industry, every company, every function is being re-examined through the lens of "how will AI transform this?" Companies that can credibly position themselves as AI-first are attracting capital, talent, and investor enthusiasm. Companies that are perceived as traditional or analog are viewed skeptically.

For automotive companies, this has created a perception problem: they're seen as traditional manufacturing companies, not technology companies. To overcome this perception and attract investor enthusiasm, they're increasingly positioning themselves as AI and autonomous driving companies. The vehicle is almost incidental to the narrative—it's the platform through which they demonstrate AI capabilities.

This broader narrative shift explains phenomena that seem odd when examined narrowly—why would Hyundai spend keynote time on humanoid robots with no clear connection to vehicles? Why would Nvidia announce autonomous driving models as a way of deepening its role in automotive? Why would Sony-Honda still be showing a prototype years from production?

The answer is that all these announcements are primarily directed at investors, analysts, and technology enthusiasts who are evaluating companies based on their perceived AI leadership and positioning for future technology disruption. The actual vehicles and their technical merits are secondary.

The Danger of Narrative Capture

This narrative dominance of AI creates a genuine danger: companies may allocate capital toward speculative AI and autonomous driving projects that generate headlines but limited near-term commercial value, while underinvesting in more prosaic but more immediately profitable improvements to existing products. A manufacturer might reduce investment in battery cost reduction or manufacturing efficiency in order to fund autonomous driving research that won't reach consumers for a decade.

This isn't inevitable—well-managed companies balance excitement about future possibilities with commitment to near-term business success. But the investor and media pressure toward AI narratives creates continuous temptation toward this misallocation of resources.

Industry Consolidation and Strategic Positioning

The Advantages of Scale in AI and Autonomous Driving

One consequence of the shift toward AI and autonomous driving is that both these domains favor very large companies and very well-funded startups. Developing autonomous driving technology requires massive investment in research, data collection, testing, and regulatory navigation. Developing AI infrastructure requires enormous computational resources and cutting-edge talent. These are fundamentally expensive endeavors.

This creates pressure toward consolidation. Smaller automotive companies without sufficient capital to fund autonomous driving and AI research independently must either merge with larger companies, enter into partnerships where larger companies provide the technology, or focus on vehicle development while licensing autonomous capabilities from specialized technology companies.

The announcements at CES 2026 reflect these dynamics. Mercedes partnering with Nvidia for autonomous driving capability. Uber using Lucid vehicles for robotaxi deployment. Sony and Honda collaborating on autonomous vehicles. These partnerships represent strategies for accessing cutting-edge technology without entirely building it in-house.

Over the next decade, we're likely to see continued consolidation in the automotive industry, with medium-sized manufacturers being absorbed into larger groups that can justify the research and development investments required for autonomous and AI capabilities.

The Role of Regulatory Frameworks

Safety Standards and Autonomous Vehicle Certification

While CES celebrations and corporate announcements focus on technological possibilities, regulatory frameworks will increasingly determine what actually reaches consumers. Governments worldwide are developing safety standards, testing protocols, and certification requirements for autonomous vehicles. These regulatory frameworks move far more slowly than technology development.

A company can develop autonomous driving technology far faster than regulators can establish standards for certification. This creates a bottleneck where technically capable vehicles can't be widely deployed until regulators approve them. Companies announcing autonomous driving capabilities at CES may face multi-year delays in actual deployment as regulatory processes work through their complex procedures.

California's regulatory framework for autonomous vehicles, while more progressive than many jurisdictions, still imposes significant requirements. Other jurisdictions—the federal government, the European Union, China—are developing their own, often conflicting regulatory approaches. A company that meets California's requirements might not meet federal requirements or European standards. This fragmented regulatory landscape creates uncertainty that no amount of technological enthusiasm can overcome.

CES 2026 celebration of autonomous driving largely ignored the regulatory challenges that will ultimately determine deployment timelines. This represents a form of selective emphasis common at technology conferences—celebrate the exciting technology, minimize discussion of boring regulatory processes that will ultimately govern commercialization.

Comparing CES 2026 with Historical Precedent

The 2010-2015 Electric Vehicle Push

To properly understand the significance of CES 2026's pivot away from EVs, it's useful to examine the early 2010s when electric vehicles were emerging as a transformative technology. Companies like Tesla, with the Roadster and subsequent Model S, demonstrated that electric vehicles could be exciting and desirable. Nissan, with the Leaf, demonstrated mass-market appeal. Established manufacturers like General Motors and BMW invested billions in EV development.

During this period, CES conferences celebrated electric vehicle announcements with genuine enthusiasm. The technology seemed to promise not just environmental benefits but also driving experience advantages: instant torque, smooth acceleration, reduced mechanical complexity. The narrative of an impending electric revolution was plausible and gaining momentum.

Over the course of a decade, this enthusiasm moderated as the realities of EV manufacturing, infrastructure requirements, and consumer preferences became clearer. The technology didn't fail—electric vehicles continued improving and gaining market share. But the assumption of rapid, total transformation of the global automotive fleet proved wrong. The progress has been gradual and geographically uneven.

Currently, we may be in the early stages of a similar arc with autonomous driving and AI. The technology is advancing, the announcements are exciting, the narrative of transformative change is compelling. Yet history suggests that the actual deployment timeline will be longer and more complex than current enthusiasm implies.

Future CES Conferences: Predictions and Implications

Will EVs Ever Return to CES Prominence?

A natural question is whether CES will ever return to being a major venue for automobile announcements, or whether this shift to AI and robotics is permanent. The answer likely depends on developments in the EV market, autonomous driving deployment, and broader technology narratives.

If EV adoption accelerates as regulatory push and manufacturing scale improvements drive costs down substantially, EVs might return to prominence. A genuinely revolutionary battery technology—one that doubled range while halving costs, for example—would certainly merit CES coverage. If autonomous vehicles begin deploying at scale and demonstrating genuine benefits, that technology could become central to automotive discussions regardless of EV status.

But given the industry's current mood and investor psychology, it seems likely that CES will remain primarily focused on autonomous driving, AI, and robotics rather than on incremental EV improvements. The technology industry and investor community have moved on from viewing electrification as the central automotive narrative. Unless something dramatic changes, that shift will likely persist.

Conclusion: The Automotive Industry at an Inflection Point

CES 2026 was a conference at an inflection point. The automotive industry, facing genuine uncertainty about demand for electric vehicles, geopolitical complexity, manufacturing cost challenges, and investor pressure to appear positioned for an AI-driven future, made a collective decision to emphasize artificial intelligence, autonomous driving, and robotics over the incremental progress of electric vehicle technology.

This shift is not irrational. It reflects real technological progress, genuine market potential, and investor enthusiasm that translates into capital availability. Companies announcing autonomous driving capabilities or AI partnerships attract investment and talent more easily than companies announcing battery improvements or charging infrastructure expansion.

Yet the shift also involves a form of narrative capture where companies emphasize the exciting, speculative future while downplaying the challenging, complex, and unglamorous present. Humanoid robots capturing headlines despite lacking clear applications to transportation. Autonomous robotaxis celebrated despite remaining years away from significant deployment. AI models announced as revolutionary despite their incremental advancement from existing systems.

The automotive industry's future will ultimately be determined not by what companies announce at CES but by the millions of engineering decisions, regulatory developments, and consumer preference shifts that unfold over the next decade. The predictions made at CES 2026 will be tested against reality. Some will prove prescient. Others will prove embarrassingly wrong.

What's clear is that the era of the car show—where CES served as the world's most important venue for automotive announcements—has definitively ended. The era of the AI conference with automotive applications has clearly begun. Whether this represents a temporary narrative shift or a fundamental restructuring of automotive competition will become apparent only over time.

For now, CES 2026 stands as a snapshot of an industry uncertain about its future, attempting to position itself for multiple possible outcomes, and choosing to emphasize artificial intelligence and autonomous systems as the arena where the future of transportation will be decided. Whether that emphasis proves justified or misguided, history alone will determine.

FAQ

What is the significance of CES 2026 shifting from EVs to AI and autonomous driving?

CES 2026 marked a fundamental shift in how the automotive industry views its future, moving away from celebrating incremental electric vehicle improvements toward emphasizing artificial intelligence, autonomous driving systems, and robotics. This reflects genuine technological progress in autonomous systems, investor pressure on companies to demonstrate AI capabilities, and the automotive industry's uncertainty about near-term EV demand growth. The shift signals that companies believe competitive advantage will increasingly come from software, AI, and autonomous capabilities rather than from traditional vehicle engineering and manufacturing excellence.

How has the global EV market changed since 2025?

Global EV sales growth has significantly decelerated compared to previous years, with multiple headwinds converging simultaneously. China, which accounts for roughly 60% of global EV sales, is winding down subsidies that previously stimulated demand. Europe is reconsidering its aggressive timelines for phasing out combustion engines. The United States is reversing many of the policy incentives that had supported EV adoption. Additionally, manufacturing costs for EV batteries haven't declined as rapidly as previously projected, while supply chain uncertainties persist. This combination has led manufacturers to hedge their bets through hybrid and extended-range EV strategies alongside pure electric vehicles.

Why did Hyundai emphasize humanoid robots at CES instead of showcasing new vehicles?

Hyundai's decision to highlight Boston Dynamics' Atlas robot served multiple strategic objectives. From an investor relations perspective, it positioned Hyundai as a forward-thinking technology company rather than a traditional manufacturer. It signaled the company's capabilities in cutting-edge robotics and AI, areas that investors currently view as more important than incremental vehicle improvements. The announcement also leveraged Hyundai Motor Group's ownership of Boston Dynamics to demonstrate technological leadership. Additionally, humanoid robots generate significantly more media attention and investor enthusiasm than traditional automotive announcements, making them valuable for corporate positioning regardless of their immediate relevance to transportation.

What does "Level 2++" driver assistance mean?

Level 2++ refers to a driver assistance system that extends beyond traditional Level 2 autonomy (lane-keeping, adaptive cruise control) to handle more complex driving scenarios with less human intervention required. The "+" designation isn't a formal SAE standard but rather manufacturer terminology indicating capabilities approaching but not quite reaching Level 3 autonomy (where the system handles driving responsibilities in defined conditions while the driver remains available to take control when needed). Level 2++ systems developed by companies like Mercedes using Nvidia computing platforms can handle highway driving with minimal driver intervention, maintaining lane position, managing speed relative to traffic, and executing lane changes with driver monitoring rather than driver operation.

How do autonomous robotaxis differ from self-driving vehicles for personal use?

Autonomous robotaxis and self-driving vehicles represent fundamentally different deployment models. Robotaxis are purpose-built for ride-sharing services, operated by centralized companies like Uber, with vehicles managed as fleets rather than individually owned. They optimize for fleet economics and passenger experience rather than driver experience. Self-driving capabilities in personally owned vehicles, by contrast, need to accommodate diverse driver preferences, maintain backward compatibility with manual driving, and satisfy individual consumer expectations. The Lucid Gravity robotaxi that Uber displayed at CES is designed specifically for autonomous ride-sharing, not for personal vehicle ownership, which determines its design, control systems, and operational characteristics.

Why is Nvidia's role in autonomous driving becoming increasingly important?

Nvidia has positioned itself as the essential computational infrastructure enabling autonomous driving development across the automotive industry. The company's specialized AI accelerators, CUDA software architecture, and development tools have made it nearly impossible for automotive companies to develop serious autonomous driving capabilities without relying on Nvidia's technology stack. Nvidia's announcement of the Alpamayo family of autonomous driving-specific AI models deepens this dependence by extending Nvidia's role from hardware infrastructure provider to integrated software-and-hardware partner. This consolidation of power in Nvidia's hands means the company profits from autonomous driving deployment regardless of which vehicle manufacturer succeeds, creating an incentive structure aligned with autonomous driving proliferation.

What explains the five-year development timeline for the Sony-Honda Afeela to progress from concept to near-production?

The Afeela's extended development timeline, with the original concept unveiled five years prior to CES 2026 and production still years away, reflects the genuine complexity of bringing advanced autonomous vehicles to production. Companies typically underestimate the engineering challenges involved in transitioning from working prototypes to production-ready vehicles. Prototypes can incorporate expensive, hand-crafted components and operate under controlled conditions with extensive human oversight. Production vehicles require cost optimization, manufacturing process development, supply chain establishment, regulatory certification, and demonstrated reliability across diverse real-world conditions. For autonomous vehicles specifically, companies must also accumulate billions of miles of real-world testing data and satisfy regulators with increasingly sophisticated safety requirements, compressing this process into less than five to seven years proves extraordinarily difficult even for well-resourced companies like Sony and Honda.

How does geographic variation in EV policy affect global vehicle development strategies?

Geographic variation in EV policy creates profound strategic complexity for global automakers. A strategy that makes sense in Europe with its strict emissions regulations and EV subsidies may not work in markets with weaker EV support or regions increasing tariffs on imported vehicles. China's subsidy reduction affects companies differently than Europe's policy shifts. US policy volatility under changing administrations creates uncertainty for companies trying to commit billions to EV manufacturing capacity. This geographic complexity encourages manufacturers to develop hybrid strategies—maintaining combustion, hybrid, extended-range, and pure electric options for different markets rather than betting entirely on electrification. It also encourages greater emphasis on software, AI, and autonomous capabilities, which are more geography-agnostic than physical vehicle manufacturing infrastructure.

What does the shift from EVs to AI reveal about investor psychology and capital allocation?

The shift reflects investor conviction that artificial intelligence represents a more transformative opportunity than incremental improvements in battery technology or vehicle design. Companies positioned as AI-first attract investment at higher valuations than companies viewed as traditional manufacturers gradually adopting AI. This perception gap translates directly into capital allocation pressure—executives seeking to maintain stock valuations and attract investment feel compelled to emphasize AI and autonomous capabilities in corporate strategy regardless of near-term commercial viability. This creates potential misallocation where speculative AI projects receive funding while more immediately profitable improvements to existing products are underfunded. The phenomenon reveals how investor perception and valuation frameworks drive actual corporate strategy and capital allocation, often disconnected from immediate market realities.

What regulatory pathways currently exist for autonomous vehicles?

Several US states including California, Arizona, and Nevada have developed permitting frameworks allowing companies to test autonomous vehicles on public roads with varying levels of human oversight and liability assumptions. The federal government and individual states have begun developing safety standards and testing protocols. The European Union is developing autonomous vehicle regulations through its regulatory bodies. China has created special economic zones where autonomous vehicle testing is permitted. However, these regulatory frameworks are evolving rapidly, remain inconsistent across jurisdictions, and have not yet established clear pathways for widespread commercial deployment of fully autonomous vehicles. Regulatory approval of autonomous technologies moves far more slowly than technology development, creating bottlenecks where technically capable systems cannot be deployed until regulatory frameworks catch up. This regulatory uncertainty significantly impacts deployment timelines that companies announce at CES.

Will CES ever return to being primarily an automotive show, or is the shift to AI permanent?

The shift toward AI appears likely to be durable rather than temporary, though CES may eventually return to emphasizing vehicles when sufficiently transformative developments occur. If autonomous vehicles begin deploying at scale with genuine consumer benefits, they could become central to automotive discussions regardless of EV status. If battery technology undergoes revolutionary improvements—doubling range while halving costs—that could merit major CES coverage. However, given current investor psychology, technology industry focus on AI, and the automotive industry's mood, emphasis on autonomous driving and AI over incremental EV improvements will likely persist unless significant market developments shift these narratives. CES has essentially transitioned from being "the world's biggest car show" to being "a major technology conference where automobiles are one application domain among many," a shift that reflects broader restructuring of how technology industries view automotive innovation.

Key Takeaways

- CES 2026 marked a definitive pivot: The conference shifted from celebrating electric vehicle innovation to emphasizing autonomous driving, AI systems, and robotics as the future of transportation.

- EV market headwinds are significant: Global EV sales growth is decelerating due to subsidy reductions in China, policy wavering in Europe, and policy reversals in the US, forcing manufacturers to hedge with hybrid and extended-range vehicles.

- Manufacturing costs remain problematic: Battery production costs haven't declined as rapidly as anticipated, while supply chain uncertainties and geopolitical trade tensions create additional cost pressures.

- Wall Street demands AI positioning: Companies facing investor skepticism about EV market saturation are emphasizing AI and autonomous capabilities to attract investment and maintain stock valuations, even when near-term commercial viability remains unclear.

- Nvidia emerges as the real winner: Rather than traditional automakers, Nvidia and companies controlling autonomous driving infrastructure are capturing disproportionate value by providing essential computational and software platforms.

- Humanoid robots are about optics, not transportation: Announcements like Hyundai's Boston Dynamics robot serve investor relations functions more than they address actual vehicle transportation needs.

- Regulatory frameworks will govern deployment: Despite technological enthusiasm, actual autonomous vehicle and AI system deployment will be constrained by regulatory approval processes that move far more slowly than technology development.

- The stratification of automotive competition: Automotive is becoming two distinct competitions—vehicle manufacturing (increasingly commoditized) and foundational technology (increasingly profitable and concentrated).

- Near-term progress will be unglamorous: While CES celebrates dramatic possibilities, actual advancement in transportation over the next five years will likely involve gradual battery improvements, expanding driver assistance capabilities, and careful autonomous vehicle deployments in limited conditions.

- The narrative has shifted permanently: Even if autonomous driving deployment slows or EV growth accelerates, CES and investor focus are unlikely to return to celebrating traditional automotive progress—AI and autonomous systems have become the central narrative.

Related Articles

- Home Robots in 2026: Why Specialized Bots Beat the Robot Butler Dream [2026]

- AI Companion Robots and Pets: The Real-World Shift [2025]

- CES 2026: Every Major Tech Announcement & What It Means [2026]

- The Wildest Tech at CES 2026: From AI Pandas to Holographic Anime [2026]

- Wi-Fi 8 is Coming in 2026 (And You Probably Aren't Ready) [2025]

- ASUS Zenbook Duo 2026: The Dual-Screen Laptop Redesign [2025]